Deck 10: Applications of Fair Value to Non-Current Assets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

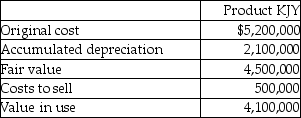

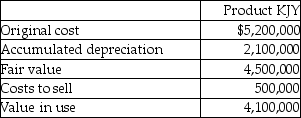

سؤال

سؤال

سؤال

سؤال

سؤال

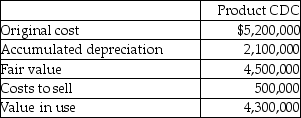

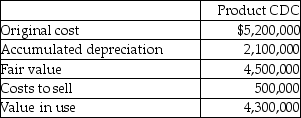

سؤال

سؤال

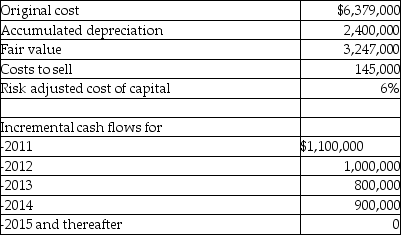

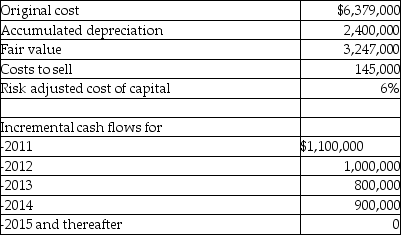

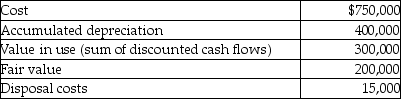

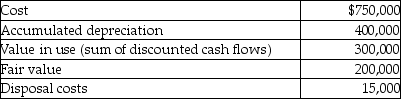

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

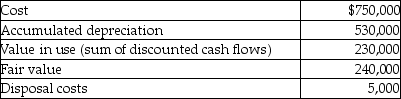

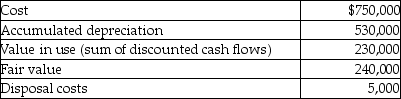

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 10: Applications of Fair Value to Non-Current Assets

1

Which statement is correct?

A)The revaluation model is required for non-current assets under IFRS.

B)The revaluation model is required for non-current assets under ASPE.

C)The revaluation model is optional for non-current assets under IFRS.

D)The revaluation model is optional for non-current assets under ASPE.

A)The revaluation model is required for non-current assets under IFRS.

B)The revaluation model is required for non-current assets under ASPE.

C)The revaluation model is optional for non-current assets under IFRS.

D)The revaluation model is optional for non-current assets under ASPE.

C

2

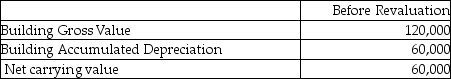

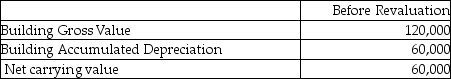

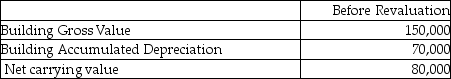

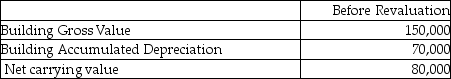

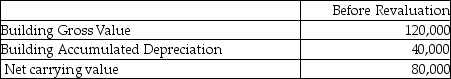

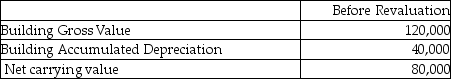

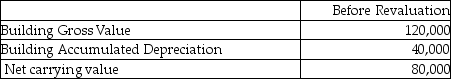

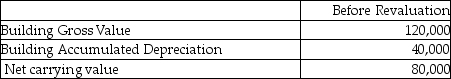

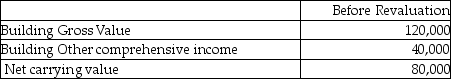

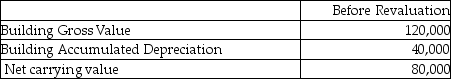

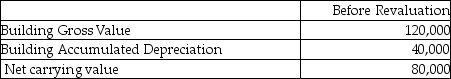

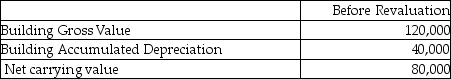

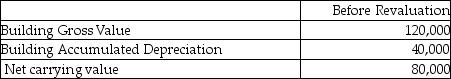

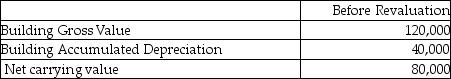

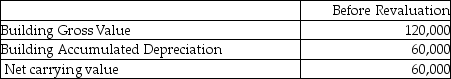

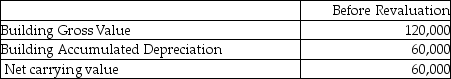

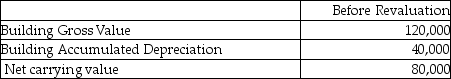

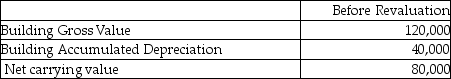

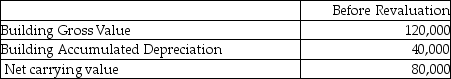

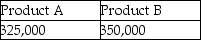

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the elimination method to record the revaluation?

The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the elimination method to record the revaluation?

A)$60,000 debit

B)$60,000 credit

C)$90,000 credit

D)$150,000 debit

The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the elimination method to record the revaluation?

The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the elimination method to record the revaluation?A)$60,000 debit

B)$60,000 credit

C)$90,000 credit

D)$150,000 debit

A

3

How should a revaluation entry generally not be booked?

A)Using the "proportional method."

B)Adjusting the difference between fair value and carrying value to profit and loss.

C)Adjusting the carrying value and accumulated depreciation by the same percentage so that the carrying amount equals fair value after revaluation.

D)Restating the gross carrying amount to fair value and removing the accumulated depreciation.

A)Using the "proportional method."

B)Adjusting the difference between fair value and carrying value to profit and loss.

C)Adjusting the carrying value and accumulated depreciation by the same percentage so that the carrying amount equals fair value after revaluation.

D)Restating the gross carrying amount to fair value and removing the accumulated depreciation.

B

4

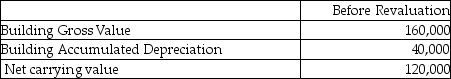

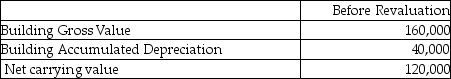

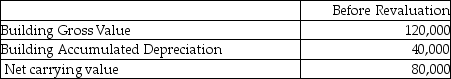

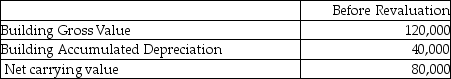

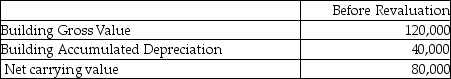

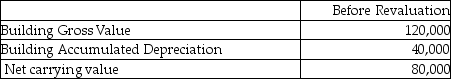

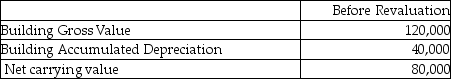

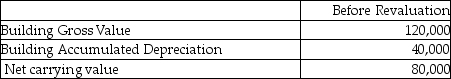

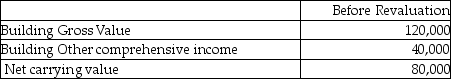

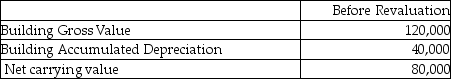

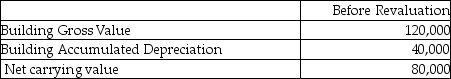

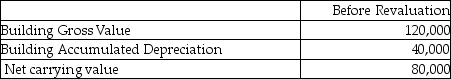

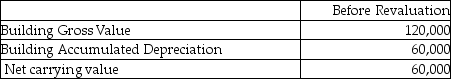

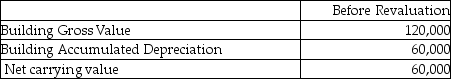

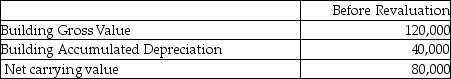

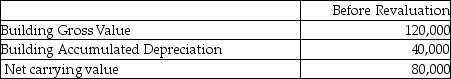

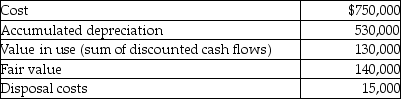

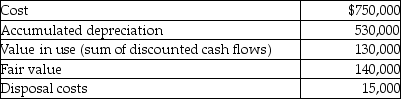

Grover Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Grover chooses to use the elimination method to record the revaluation?

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Grover chooses to use the elimination method to record the revaluation?

A)$0

B)$20,000 credit

C)$20,000 debit

D)$30,000 credit

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Grover chooses to use the elimination method to record the revaluation?

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Grover chooses to use the elimination method to record the revaluation?A)$0

B)$20,000 credit

C)$20,000 debit

D)$30,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

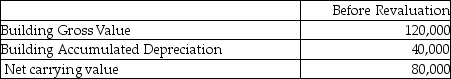

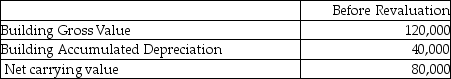

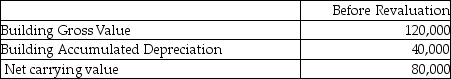

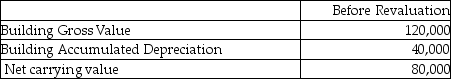

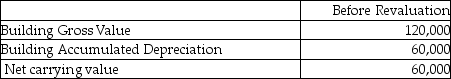

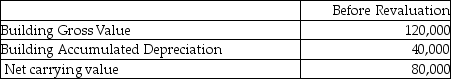

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?

A)$20,000 debit

B)$70,000 credit

C)$70,000 debit

D)$60,000 credit

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?A)$20,000 debit

B)$70,000 credit

C)$70,000 debit

D)$60,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

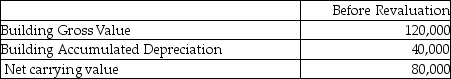

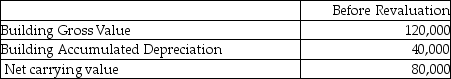

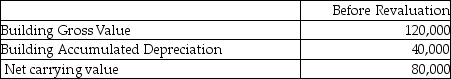

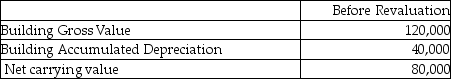

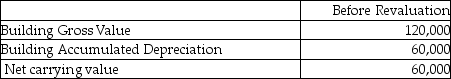

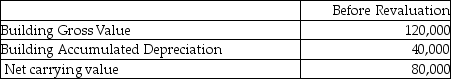

Grover Inc wishes to use the revaluation model for this property:  The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the proportional method to record the revaluation?

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the proportional method to record the revaluation?

A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 credit

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the proportional method to record the revaluation?

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the proportional method to record the revaluation?A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

How is revaluation of non-current assets accounted for?

A)Revaluation surplus is always booked to profit and loss.

B)Revaluation loss is booked to other comprehensive income.

C)Cumulative revaluation loss is booked to profit and loss.

D)Revaluation surplus is not recognized in other comprehensive income.

A)Revaluation surplus is always booked to profit and loss.

B)Revaluation loss is booked to other comprehensive income.

C)Cumulative revaluation loss is booked to profit and loss.

D)Revaluation surplus is not recognized in other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which is correct with respect to the accounting treatment under the cost or revaluation model?

A)Companies can choose to apply the revaluation model to each individual PPE or intangible asset under IFRS.

B)Companies can choose to apply the revaluation model to each class of PPE or intangible asset under IFRS.

C)Companies can choose to apply the revaluation model to each individual PPE or intangible asset under ASPE.

D)Companies can choose to apply the revaluation model to each class PPE or intangible asset under ASPE.

A)Companies can choose to apply the revaluation model to each individual PPE or intangible asset under IFRS.

B)Companies can choose to apply the revaluation model to each class of PPE or intangible asset under IFRS.

C)Companies can choose to apply the revaluation model to each individual PPE or intangible asset under ASPE.

D)Companies can choose to apply the revaluation model to each class PPE or intangible asset under ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?

A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 debit

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?

The fair value for the property is $60,000. What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $20,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?

The fair value for the property is $20,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?

A)$0

B)$30,000 debit

C)$30,000 credit

D)$60,000 debit

The fair value for the property is $20,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?

The fair value for the property is $20,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?A)$0

B)$30,000 debit

C)$30,000 credit

D)$60,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

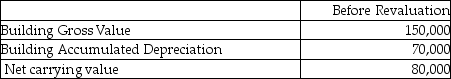

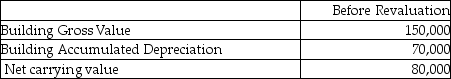

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the proportional method to record the revaluation?

The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the proportional method to record the revaluation?

A)$0

B)$35,000 debit

C)$35,000 credit

D)$70,000 credit

The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the proportional method to record the revaluation?

The fair value for the property is $150,000. What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the proportional method to record the revaluation?A)$0

B)$35,000 debit

C)$35,000 credit

D)$70,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Smith chooses to use the proportional method to record the revaluation?

The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Smith chooses to use the proportional method to record the revaluation?

A)$35,000 debit

B)$35,000 credit

C)$70,000 debit

D)$70,000 credit

The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Smith chooses to use the proportional method to record the revaluation?

The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Smith chooses to use the proportional method to record the revaluation?A)$35,000 debit

B)$35,000 credit

C)$70,000 debit

D)$70,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

How is a revaluation loss on non-current assets accounted for?

A)Revaluation loss is booked to profit and loss.

B)Revaluation loss is booked to other comprehensive income.

C)Revaluation loss is booked to profit and loss or to other comprehensive income, depending on any pre-existing revaluation surplus.

D)Revaluation loss is not recognized in other comprehensive income.

A)Revaluation loss is booked to profit and loss.

B)Revaluation loss is booked to other comprehensive income.

C)Revaluation loss is booked to profit and loss or to other comprehensive income, depending on any pre-existing revaluation surplus.

D)Revaluation loss is not recognized in other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the elimination method to record the revaluation?

The fair value for the property is $140,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the elimination method to record the revaluation?

A)$40,000 debit

B)$40,000 credit

C)$60,000 debit

D)$140,000 credit

The fair value for the property is $140,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the elimination method to record the revaluation?

The fair value for the property is $140,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the elimination method to record the revaluation?A)$40,000 debit

B)$40,000 credit

C)$60,000 debit

D)$140,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $20,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wilson chooses to use the proportional method to record the revaluation?

The fair value for the property is $20,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wilson chooses to use the proportional method to record the revaluation?

A)$0

B)$30,000 debit

C)$30,000 credit

D)$60,000 debit

The fair value for the property is $20,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wilson chooses to use the proportional method to record the revaluation?

The fair value for the property is $20,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wilson chooses to use the proportional method to record the revaluation?A)$0

B)$30,000 debit

C)$30,000 credit

D)$60,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

Grover Inc wishes to use the revaluation model for this property:  The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

A)$20,000 credit

B)$40,000 debit

C)$40,000 credit

D)$80,000 debit

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?A)$20,000 credit

B)$40,000 debit

C)$40,000 credit

D)$80,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which statement describes the "revaluation model"?

A)A model which keeps the carrying value of an asset and adjusts for depreciation and impairment.

B)A model which restates the value of an asset at each measurement date.

C)A model which restates the carrying value of an asset to the asset's fair value on the date of revaluation.

D)A model which values the asset based on its productive capacity.

A)A model which keeps the carrying value of an asset and adjusts for depreciation and impairment.

B)A model which restates the value of an asset at each measurement date.

C)A model which restates the carrying value of an asset to the asset's fair value on the date of revaluation.

D)A model which values the asset based on its productive capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

Grover Inc wishes to use the revaluation model for this property:  The fair value for the property is $100,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Grover chooses to use the proportional method to record the revaluation?

The fair value for the property is $100,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Grover chooses to use the proportional method to record the revaluation?

A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 credit

The fair value for the property is $100,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Grover chooses to use the proportional method to record the revaluation?

The fair value for the property is $100,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Grover chooses to use the proportional method to record the revaluation?A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wallace chooses to use the proportional method to record the revaluation?

The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wallace chooses to use the proportional method to record the revaluation?

A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 debit

The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wallace chooses to use the proportional method to record the revaluation?

The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the "other comprehensive income" account if Wallace chooses to use the proportional method to record the revaluation?A)$0

B)$10,000 debit

C)$10,000 credit

D)$20,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which statement describes the "historical cost model"?

A)A model which keeps the carrying value of an asset and adjusts for depreciation and impairment.

B)A model which restates the value of an asset at each measurement date.

C)A model which restates the carrying value of an asset to the asset's fair value on the date of revaluation.

D)A model which values the asset based on its productive capacity.

A)A model which keeps the carrying value of an asset and adjusts for depreciation and impairment.

B)A model which restates the value of an asset at each measurement date.

C)A model which restates the carrying value of an asset to the asset's fair value on the date of revaluation.

D)A model which values the asset based on its productive capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

Sigma Company has a piece of equipment with an original cost of $1,440,000. The equipment's carrying value at the beginning of this year (net of accumulated depreciation)was $1,080,000. Sigma recorded $120,000 for depreciation for this year. The equipment's fair value at the end of the year was $1,056,000. This is the first year that the company has revalued this equipment.

Required:

a. Record the journal entry for the revaluation adjustment assuming that Sigma uses the elimination method.

b. Record the journal entry for the revaluation adjustment assuming that Sigma uses the proportional method.

Required:

a. Record the journal entry for the revaluation adjustment assuming that Sigma uses the elimination method.

b. Record the journal entry for the revaluation adjustment assuming that Sigma uses the proportional method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

A)8,000 credit

B)8,000 debit

C)16,000 credit

D)16,000 debit

The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?A)8,000 credit

B)8,000 debit

C)16,000 credit

D)16,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $40,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

The fair value for the property is $40,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

A)$40,000 debit to profit and loss

B)$40,000 credit to profit and loss

C)$40,000 debit to OCI

D)$40,000 credit to OCI

The fair value for the property is $40,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

The fair value for the property is $40,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?A)$40,000 debit to profit and loss

B)$40,000 credit to profit and loss

C)$40,000 debit to OCI

D)$40,000 credit to OCI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Smith chooses to use the elimination method to record the revaluation?

The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Smith chooses to use the elimination method to record the revaluation?

A)$0

B)$60,000 debit

C)$60,000 credit

D)$90,000 credit

The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Smith chooses to use the elimination method to record the revaluation?

The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Smith chooses to use the elimination method to record the revaluation?A)$0

B)$60,000 debit

C)$60,000 credit

D)$90,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

Company Twelve purchased land for $900,000 some years ago. Fair value was $800,000 at the beginning of this year and $1,000,000 at the end of this year.

Prepare the journal entry to record this year's revaluation adjustment.

Prepare the journal entry to record this year's revaluation adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

A)$16,000 debit

B)$16,000 credit

C)$28,000 credit

D)$28,000 debit

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?A)$16,000 debit

B)$16,000 credit

C)$28,000 credit

D)$28,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

A)$60,000 debit to profit and loss

B)$60,000 credit to profit and loss

C)$60,000 debit to OCI

D)$60,000 credit to OCI

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

The fair value for the property is $140,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?A)$60,000 debit to profit and loss

B)$60,000 credit to profit and loss

C)$60,000 debit to OCI

D)$60,000 credit to OCI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A)$12,000 debit

B)$12,000 credit

C)$16,000 credit

D)$16,000 debit

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?A)$12,000 debit

B)$12,000 credit

C)$16,000 credit

D)$16,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

Company One purchased land for $900,000 some years ago. Fair value was $450,000 at the beginning of this year and $340,000 at the end of this year.

Prepare the journal entry to record this year's revaluation adjustment.

Prepare the journal entry to record this year's revaluation adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

Company Ten purchased land for $400,000 during the year. Fair value at the end of the year was $500,000.

Prepare the journal entry to record the revaluation adjustment.

Prepare the journal entry to record the revaluation adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

Explain the accounting under the revaluation model available under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

A)$12,000 debit

B)$12,000 credit

C)$30,000 credit

D)$30,000 debit

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?A)$12,000 debit

B)$12,000 credit

C)$30,000 credit

D)$30,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

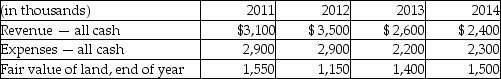

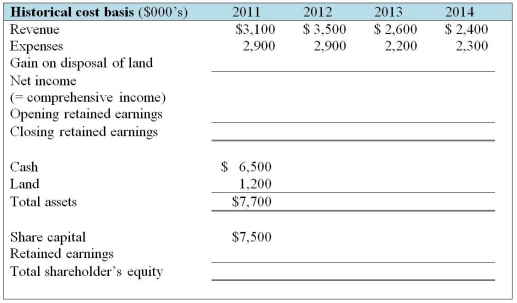

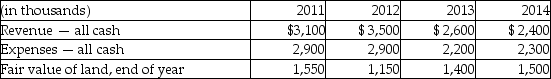

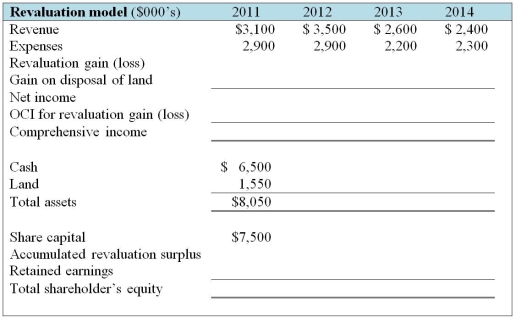

Wright Now Limited (WNL)was incorporated on January 1, 2011 when the sole shareholder invested $7,500,000. This is the only financing the firm needed. WNL used $1,200,000 of the funds to purchase land. The company has a single project that it developed over four years. Below are details of the four years of operations. At the end of 2014 the land was sold for its fair value.

Required:

Required:

Complete the following table, assuming that WNL uses the historical cost basis of measurement.

Required:

Required:Complete the following table, assuming that WNL uses the historical cost basis of measurement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A)$12,000 debit

B)$12,000 credit

C)$30,000 credit

D)$30,000 debit

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?A)$12,000 debit

B)$12,000 credit

C)$30,000 credit

D)$30,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

A)$12,000 debit

B)$12,000 credit

C)$16,000 credit

D)$16,000 debit

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?A)$12,000 debit

B)$12,000 credit

C)$16,000 credit

D)$16,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

36

Company Nine purchased land for $600,000 some years ago. Fair value was $800,000 at the beginning of this year and $350,000 at the end of this year.

Prepare the journal entry to record this year's revaluation adjustment.

Prepare the journal entry to record this year's revaluation adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

Compare the proportional method and the elimination method for recording the revaluation entry. Which method is preferred?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

38

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A)$16,000 debit

B)$16,000 credit

C)$28,000 credit

D)$28,000 debit

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?A)$16,000 debit

B)$16,000 credit

C)$28,000 credit

D)$28,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?

A)$20,000 debit

B)$20,000 credit

C)$70,000 debit

D)$80,000 credit

The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000. Assuming this is the first year of using the revaluation model, what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?A)$20,000 debit

B)$20,000 credit

C)$70,000 debit

D)$80,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A)$8,000 credit

B)$8,000 debit

C)$16,000 credit

D)$16,000 debit

The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?A)$8,000 credit

B)$8,000 debit

C)$16,000 credit

D)$16,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the "recoverable amount"?

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The lower of an asset's fair value less costs to sell and its value in use.

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The lower of an asset's fair value less costs to sell and its value in use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

Explain how non-current assets such as definite lived intangibles, indefinite lived intangibles and goodwill are tested for impairment under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

A company owns an office building that it rents out to other businesses. Due to a downturn in the economy, rental rates have dropped while vacancy rates have increased. Due to these circumstances, the company evaluated the building for impairment. The building has a cost of $70 million, accumulated depreciation of $47.05 million, and a value in use of $20 million. In addition, the company has recently received an offer to purchase the building for $22 million. Legal and other costs necessary to complete a sale of this type would amount to $200,000.

Required:

Determine the amount of impairment, if any.

Required:

Determine the amount of impairment, if any.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which statement is not correct?

A)Impairment testing is required under ASPE.

B)Impairment testing is required under IFRS.

C)Impairment testing is not required under ASPE.

D)Impairment testing is required under both IFRS and ASPE.

A)Impairment testing is required under ASPE.

B)Impairment testing is required under IFRS.

C)Impairment testing is not required under ASPE.

D)Impairment testing is required under both IFRS and ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which is not a source of information that would be used as an indicator of impairment?

A)Adverse changes in the technological competitive or legal environment of the entity.

B)Market value of asset has increased more than would be expected from normal aging.

C)Market value of asset has decreased more than would be expected from normal aging.

D)The market value of the entity as a whole is less than the carrying value of its net assets.

A)Adverse changes in the technological competitive or legal environment of the entity.

B)Market value of asset has increased more than would be expected from normal aging.

C)Market value of asset has decreased more than would be expected from normal aging.

D)The market value of the entity as a whole is less than the carrying value of its net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

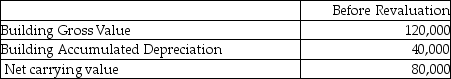

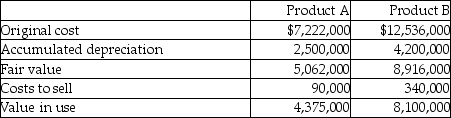

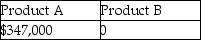

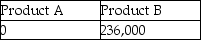

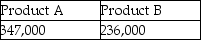

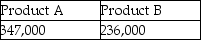

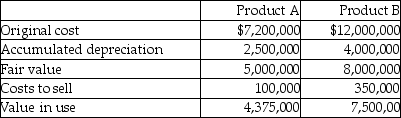

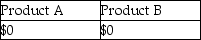

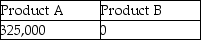

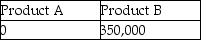

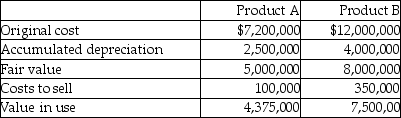

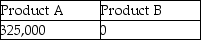

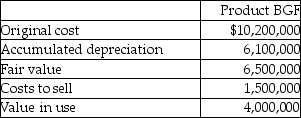

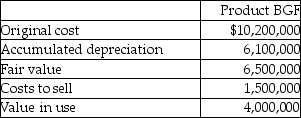

What impairment, if any, exists on these product lines?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which is an exception to the rule: "test for impairment only if there are indicators for impairment"?

A)Intangible assets with indefinite lives.

B)Intangible assets with definite lives.

C)Internally generated goodwill.

D)Tangible assets with definite lives.

A)Intangible assets with indefinite lives.

B)Intangible assets with definite lives.

C)Internally generated goodwill.

D)Tangible assets with definite lives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

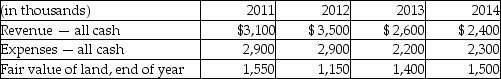

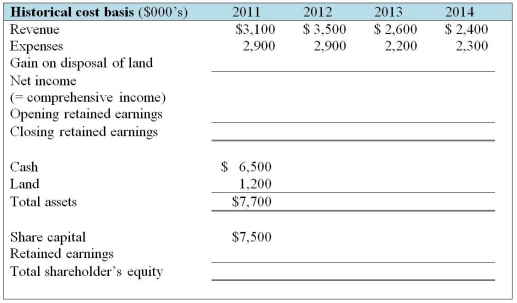

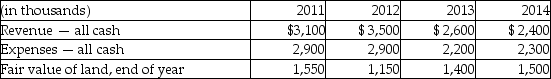

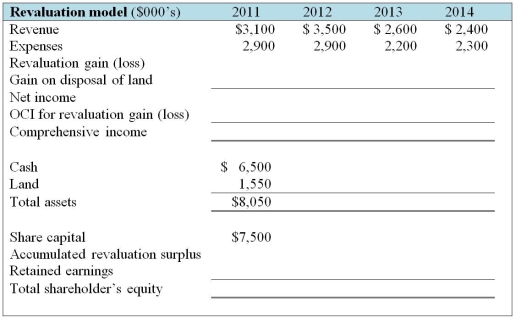

Wright Now Limited (WNL)was incorporated on January 1, 2011 when the sole shareholder invested $7,500,000. This is the only financing the firm needed. WNL used $1,200,000 of the funds to purchase land. The company has a single project that it developed over four years. Below are details of the four years of operations. At the end of 2014 the land was sold for its fair value.

Required:

Required:

Complete the following table, assuming that WNL uses the revaluation model of measurement. OCI refers to other comprehensive income.

Required:

Required:Complete the following table, assuming that WNL uses the revaluation model of measurement. OCI refers to other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

Explain when a non-current asset is impaired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is correct with respect to when the impairment test must be performed?

A)An annual test is required for definite lived assets under IFRS.

B)An annual test is required for definite lived assets under ASPE.

C)An annual test is required for indefinite lived assets under IFRS.

D)An annual test is required for indefinite lived assets under ASPE.

A)An annual test is required for definite lived assets under IFRS.

B)An annual test is required for definite lived assets under ASPE.

C)An annual test is required for indefinite lived assets under IFRS.

D)An annual test is required for indefinite lived assets under ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

What impairment, if any, exists on these product lines?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

What is "fair value"?

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The amount obtainable from the sale of an asset in an arm's-length transaction between knowledgeable, willing parties.

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The amount obtainable from the sale of an asset in an arm's-length transaction between knowledgeable, willing parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

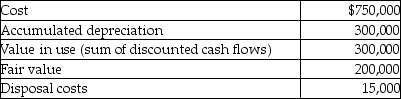

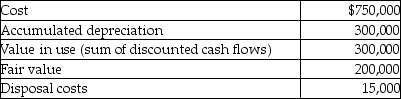

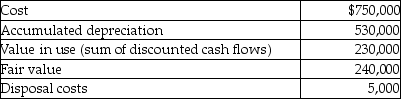

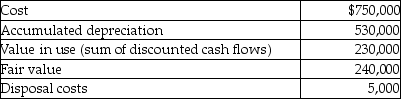

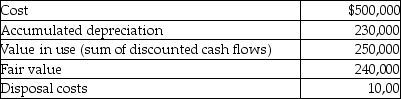

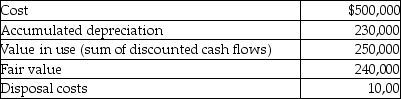

Due to increased competition from low-cost foreign manufacturers, Genevive's Toy Company is experiencing significant declines in sales. The company produces its toys from an assembly line. The equipment in this assembly line has not been previously revalued or impaired. For the year ending December 31, 2010, the controller gathered the following information relating to the assembly line equipment, which is considered to be a cash generating unit:

Required:

Required:

Determine whether the assembly line is impaired, and if so, the amount of the impairment.

Required:

Required:Determine whether the assembly line is impaired, and if so, the amount of the impairment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the recoverable amount for this product line?

A)$900,000

B)$3,100,000

C)$4,000,000

D)$4,100,000

A)$900,000

B)$3,100,000

C)$4,000,000

D)$4,100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

What impairment, if any, exists on this product line?

A)$0

B)$900,000

C)$1,200,000

D)$4,000,000

A)$0

B)$900,000

C)$1,200,000

D)$4,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is "fair value less costs to sell"?

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The amount obtainable from the sale of an asset in an arm's-length transaction between knowledgeable, willing parties.

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The amount obtainable from the sale of an asset in an arm's-length transaction between knowledgeable, willing parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is "value in use"?

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The lower of an asset's fair value less costs to sell and its value in use.

A)The present value of the future cash flows expected to be derived from an asset.

B)The amount obtainable from the sale of an asset in an arm's-length transaction less the costs of disposal.

C)The higher of an asset's fair value less costs to sell and its value in use.

D)The lower of an asset's fair value less costs to sell and its value in use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not a concept supporting impairment testing?

A)An asset should be presented at its fair value.

B)An asset's carrying value should be recoverable from sale.

C)An asset's carrying value should be recoverable from use.

D)An asset should not be overstated.

A)An asset should be presented at its fair value.

B)An asset's carrying value should be recoverable from sale.

C)An asset's carrying value should be recoverable from use.

D)An asset should not be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the recoverable amount for this product line?

A)$100,000

B)$4,000,000

C)$4,100,000

D)$5,000,000

A)$100,000

B)$4,000,000

C)$4,100,000

D)$5,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

What are "costs of disposal"?

A)The incremental costs directly attributable to the disposal of an asset.

B)The incremental costs directly attributable to the disposal of an asset, excluding finance costs and income tax expense.

C)The incremental costs directly attributable to the disposal of an asset, excluding finance costs.

D)The amount obtainable from the sale of an asset in an arm's-length transaction between knowledgeable, willing parties.

A)The incremental costs directly attributable to the disposal of an asset.

B)The incremental costs directly attributable to the disposal of an asset, excluding finance costs and income tax expense.

C)The incremental costs directly attributable to the disposal of an asset, excluding finance costs.

D)The amount obtainable from the sale of an asset in an arm's-length transaction between knowledgeable, willing parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is correct with respect to the "impairment loss under the revaluation model"?

A)All impairment losses flow through the income statement under ASPE.

B)All impairment losses flow through the income statement under IFRS.

C)All impairment losses flow through the revaluation surplus account under ASPE.

D)All impairment losses flow through the revaluation surplus account under IFRS.

A)All impairment losses flow through the income statement under ASPE.

B)All impairment losses flow through the income statement under IFRS.

C)All impairment losses flow through the revaluation surplus account under ASPE.

D)All impairment losses flow through the revaluation surplus account under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

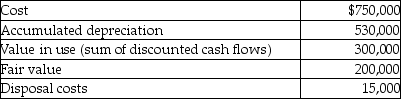

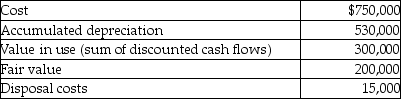

Based on the following information, what is the recoverable amount?

A)$185,000

B)$200,000

C)$220,000

D)$300,000

A)$185,000

B)$200,000

C)$220,000

D)$300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is correct with respect to when the impairment test must be performed?

A)An annual test is required for long-lived assets under IFRS.

B)An annual test is required for long-lived assets under ASPE.

C)Under IFRS, a test is required for long-lived assets only when there are indications an asset may be impaired.

D)Under ASPE, a test is required for long-lived assets only when there are indications an asset may be impaired.

A)An annual test is required for long-lived assets under IFRS.

B)An annual test is required for long-lived assets under ASPE.

C)Under IFRS, a test is required for long-lived assets only when there are indications an asset may be impaired.

D)Under ASPE, a test is required for long-lived assets only when there are indications an asset may be impaired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

Based on the following information, what is the impairment amount to be recorded?

A)$90,000

B)$125,000

C)$130,000

D)$220,000

A)$90,000

B)$125,000

C)$130,000

D)$220,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

Based on the following information, what is the impairment booked at December 31, 2012?

A)$150,000

B)$185,000

C)$300,000

D)$450,000

A)$150,000

B)$185,000

C)$300,000

D)$450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

On December 31, 2012, CA Inc. had a machine with an original cost of $20,000 and accumulated depreciation of $5,000. An impairment test on that date indicated that the machine had a value in use of $12,000 and a fair value of $10,000 (no disposal costs). What impairment loss is recorded for fiscal 2012?

A)$3,000

B)$5,000

C)$8,000

D)$10,000

A)$3,000

B)$5,000

C)$8,000

D)$10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

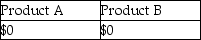

Based on the following information, what is the impairment amount to be recorded?

A)$0

B)$10,000

C)$15,000

D)$20,000

A)$0

B)$10,000

C)$15,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

How is an impairment loss allocated to the non-current asset(s)?

A)Allocate the impairment loss in proportion to the gross amounts of the assets in the cash generating unit.

B)Allocate the impairment loss to assets with the highest carrying amounts in the cash generating unit.

C)Allocate the impairment loss in proportion to the net carrying amounts of the assets in the cash generating unit.

D)Allocate the impairment loss to assets with the lowest carrying amounts in the cash generating unit.

A)Allocate the impairment loss in proportion to the gross amounts of the assets in the cash generating unit.

B)Allocate the impairment loss to assets with the highest carrying amounts in the cash generating unit.

C)Allocate the impairment loss in proportion to the net carrying amounts of the assets in the cash generating unit.

D)Allocate the impairment loss to assets with the lowest carrying amounts in the cash generating unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following is correct with respect to the "impairment loss"?

A)It is defined as the carrying amount less recoverable amount under IFRS.

B)It is defined as the carrying amount less recoverable amount under ASPE.

C)Under IFRS, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

D)Under ASPE, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

A)It is defined as the carrying amount less recoverable amount under IFRS.

B)It is defined as the carrying amount less recoverable amount under ASPE.

C)Under IFRS, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

D)Under ASPE, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is correct with respect to the "reversal of impairment loss"?

A)It is defined as the carrying amount less recoverable amount under IFRS.

B)It is defined as the carrying amount less fair value under ASPE.

C)It is possible under IFRS if the recoverable amount subsequently rises.

D)It is possible under ASPE if the recoverable amount subsequently rises.

A)It is defined as the carrying amount less recoverable amount under IFRS.

B)It is defined as the carrying amount less fair value under ASPE.

C)It is possible under IFRS if the recoverable amount subsequently rises.

D)It is possible under ASPE if the recoverable amount subsequently rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

Based on the following information, what is the net amount that this equipment should be reported at on FlexiHose's balance sheet at December 31, 2012?

A)$220,000

B)$230,000

C)$240,000

D)$250,000

A)$220,000

B)$230,000

C)$240,000

D)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is correct with respect to the "recoverable amount"?

A)It is defined as the lower of the value in use or fair value less cost to sell under IFRS.

B)It is defined as the lower of the value in use or fair value less cost to sell under ASPE.

C)Under IFRS, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

D)Under ASPE, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

A)It is defined as the lower of the value in use or fair value less cost to sell under IFRS.

B)It is defined as the lower of the value in use or fair value less cost to sell under ASPE.

C)Under IFRS, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

D)Under ASPE, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

Based on the following information, what is the net book value of the asset on the December 31, 2012 balance sheet?

A)$185,000

B)$200,000

C)$300,000

D)$350,000

A)$185,000

B)$200,000

C)$300,000

D)$350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

Based on the following information, what is the recoverable amount for the impairment test?

A)$220,000

B)$230,000

C)$235,000

D)$240,000

A)$220,000

B)$230,000

C)$235,000

D)$240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is correct with respect to the "impairment loss"?

A)It is defined as the carrying amount plus recoverable amount under IFRS.

B)It is defined as the carrying amount less fair value under ASPE.

C)Under IFRS, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

D)Under ASPE, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

A)It is defined as the carrying amount plus recoverable amount under IFRS.

B)It is defined as the carrying amount less fair value under ASPE.

C)Under IFRS, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

D)Under ASPE, it is defined as the sum of the undiscounted cash flows expected from use of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

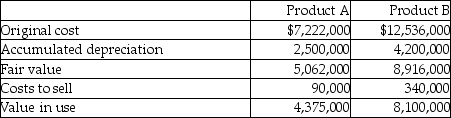

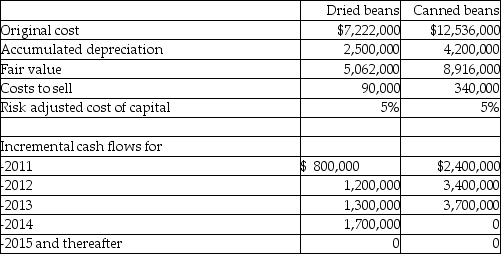

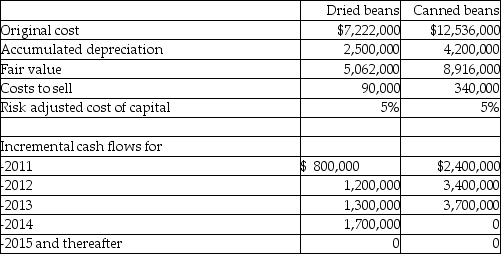

Bean World Company produces two distinct product lines: dried beans and canned beans. Due to changing consumer tastes, the company is evaluating these two cash generating units for impairment for the year ending December 31, 2010. Relevant information is as follows:

Required:

Required:

Determine whether either product line is impaired, and if so, the amount of the impairment.

Required:

Required:Determine whether either product line is impaired, and if so, the amount of the impairment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

Explain how an impairment loss is allocated to non-current assets that are part of a cash generating unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

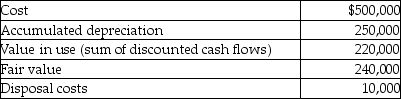

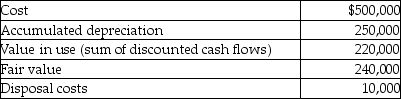

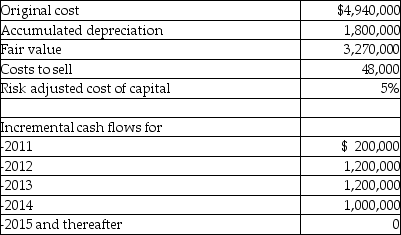

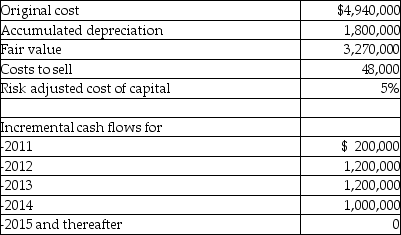

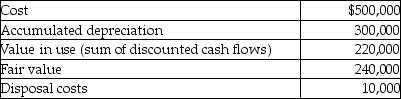

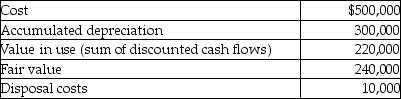

Reid Resch is a maker of instruments for measuring weight, temperature, pressure, and so on. Due to the increasing use of digital instruments, one of the company production lines based on analogue technology is potentially impaired. Management has produced the following information relating to this production line, which is considered to be a cash generating unit:

Required:

Required:

Determine whether the production line is impaired, and if so, the amount of the impairment.

Required:

Required:Determine whether the production line is impaired, and if so, the amount of the impairment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

Based on the following information, what is the net amount that this equipment should be reported at in the balance sheet at December 31, 2012?

A)$230,000

B)$240,000

C)$250,000

D)$270,000

A)$230,000

B)$240,000

C)$250,000

D)$270,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

Based on the following information, what is the net amount that this equipment should be reported at on BAC's balance sheet at December 31, 2012?

A)$200,000

B)$220,000

C)$230,000

D)$240,000

A)$200,000

B)$220,000

C)$230,000

D)$240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck