Deck 8: Risk and Return

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

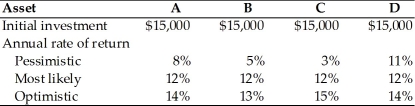

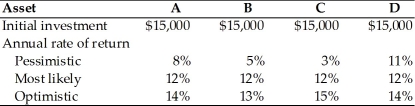

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

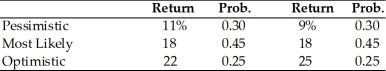

سؤال

سؤال

سؤال

سؤال

سؤال

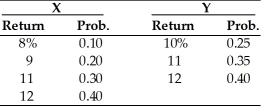

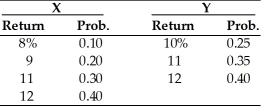

سؤال

سؤال

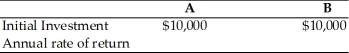

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/188

العب

ملء الشاشة (f)

Deck 8: Risk and Return

1

Nico bought 500 shares of a stock for $24.00 per share on January 1, 2013. He received a dividend of $2.50 per share at the end of 2013 and $4.00 per share at the end of 2014. At the end of 2015, Nico collected a dividend of $3.00 per share and sold his stock for $20.00 per share. What is Nico's realized total rate of return?

A) -12.5%

B) 12.5%

C) -20.7%

D) 20.7%

A) -12.5%

B) 12.5%

C) -20.7%

D) 20.7%

12.5%

2

For a risk-averse manager, required return would decrease for an increase in risk.

False

3

The interest rate risk associated with Treasury bonds is much higher than with bills.

True

4

Which of the following is true of risk-return trade off?

A) Risk can be measured on the basis of variability of return.

B) Risk and return are inversely proportional to each other.

C) T-bills are more riskier than equity due to imbalances in government policies.

D) Riskier investments tend to have lower returns.

A) Risk can be measured on the basis of variability of return.

B) Risk and return are inversely proportional to each other.

C) T-bills are more riskier than equity due to imbalances in government policies.

D) Riskier investments tend to have lower returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

5

Most managers are risk-averse, since for a given increase in risk they require an increase in return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

6

An investment's total return is the sum of any cash distributions minus the change in the investment's value, divided by the beginning-of-period value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the most basic sense, risk is a measure of the uncertainty surrounding the return that an investment will earn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

8

For a risk-indifferent manager, no change in return would be required for an increase in risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

9

Interest rate risk is the chance that changes in interest rates will adversely affect the value of an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

10

The return on an asset is the change in its value plus any cash distribution over a given period of time, expressed as a percentage of its ending value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

11

Investment A guarantees its holder $100 return. Investment B earns $0 or $200 with equal chances over the same period. Both investments have equal risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

12

Last year, Mike bought 100 shares of Dallas Corporation common stock for $53 per share. During the year he received dividends of $1.45 per share. The stock is currently selling for $60 per share. What rate of return did Mike earn over the year?

A) 11.7 percent

B) 13.2 percent

C) 14.1 percent

D) 15.9 percent

A) 11.7 percent

B) 13.2 percent

C) 14.1 percent

D) 15.9 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is true of risk?

A) Risk and return are inversely proportionate to each other.

B) Higher the risk associated with a security the lower is its return.

C) Risk is a measure of the uncertainty surrounding the return that an investment will earn.

D) Riskier investments tend to have lower returns as compared to T-bills which are risk free.

A) Risk and return are inversely proportionate to each other.

B) Higher the risk associated with a security the lower is its return.

C) Risk is a measure of the uncertainty surrounding the return that an investment will earn.

D) Riskier investments tend to have lower returns as compared to T-bills which are risk free.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

14

Most investments decline in value when the interest rates rise and increase in value when interest rates fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

15

Nico bought 100 shares of Cisco Systems stock for $30.00 per share on January 1, 2013. He received a dividend of $2.00 per share at the end of 2013 and $3.00 per share at the end of 2014. At the end of 2015, Nico collected a dividend of $4.00 per share and sold his stock for $33.00 per share. What was Nico's realized holding period return?

A) -40%

B) +40%

C) -36.36%

D) +36.36%

A) -40%

B) +40%

C) -36.36%

D) +36.36%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

16

For a risk-seeking manager, no change in return would be required for an increase in risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

17

Stocks are less riskier than either bonds or bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

18

For a risk-averse manager, the required return increases for an increase in risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

19

The term "risk" is used interchangeably with "uncertainty" to refer to the variability of returns associated with a given asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

20

The total rate of return on an investment over a given period of time is calculated by ________.

A) dividing the asset's cash distributions during the period, plus change in value, by its beginning-of period investment value.

B) dividing the asset's cash distributions during the period, plus change in value, by its ending-of period investment value.

C) dividing the asset's cash distributions during the period, minus change in value, by its ending-of period investment value.

D) dividing the asset's cash distributions during the period, minus change in value, by its beginning-of period investment value.

A) dividing the asset's cash distributions during the period, plus change in value, by its beginning-of period investment value.

B) dividing the asset's cash distributions during the period, plus change in value, by its ending-of period investment value.

C) dividing the asset's cash distributions during the period, minus change in value, by its ending-of period investment value.

D) dividing the asset's cash distributions during the period, minus change in value, by its beginning-of period investment value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

21

The more certain the return from an asset, the less variability and therefore the less risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

22

Larger the difference between an asset's worst outcome from its best outcome, the higher the risk of an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

23

Risk can be assessed by means of scenario analysis and probability distributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

24

The range of an asset's risk is found by subtracting the worst outcome from the best outcome.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

25

A normal probability distribution is a symmetrical distribution whose shape resembles a bell-shaped curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a manager requires greater return when risk increases, then he is said to be ________.

A) risk-seeking

B) risk-indifferent

C) risk-averse

D) risk-aware

A) risk-seeking

B) risk-indifferent

C) risk-averse

D) risk-aware

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

27

An approach for assessing risk that uses a number of possible return estimates to obtain a sense of the variability among outcomes is called scenario analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

28

The real utility of the coefficient of variation is in comparing assets that have equal expected returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

29

In U.S., during the past 75 years, on an average the return on small-company stocks has levelled the return on large-company stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

30

Tim purchased a bounce house one year ago for $6,500. During the year it generated $4,000 in cash flow. If Time sells the bounce house today, he could receive $6,100 for it. What would be his rate of return under these conditions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

31

Coefficient of variation is a measure of relative dispersion used in comparing the risks of assets with differing expected return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

32

In U.S., during the past 75 years, on an average the return on large-company stocks has exceeded the return on small-company stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

33

Perry purchased 100 shares of Ferro, Inc. common stock for $25 per share one year ago. During the year, Ferro, Inc. paid cash dividends of $2 per share. The stock is currently selling for $30 per share. If Perry sells all of his shares of Ferro, Inc. today, what rate of return would he realize?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

34

The risk of an asset can be measured by its variance, which is found by subtracting the worst outcome from the best outcome.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

35

Risk aversion is the behavior exhibited by managers who require ________.

A) an increase in return, for a given decrease in risk

B) an increase in return, for a given increase in risk

C) no changes in return, for a given increase in risk

D) decrease in return, for a given increase in risk

A) an increase in return, for a given decrease in risk

B) an increase in return, for a given increase in risk

C) no changes in return, for a given increase in risk

D) decrease in return, for a given increase in risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

36

Greater the range of an asset, more the variability, or risk, the asset is said to possess.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a manager prefers a higher return investment regardless of its risk, then he is following a ________ strategy.

A) risk-seeking

B) risk-neutral

C) risk-averse

D) risk-aware

A) risk-seeking

B) risk-neutral

C) risk-averse

D) risk-aware

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

38

If a manager prefers investments with greater risk even if they have lower expected returns, then he is following a ________ strategy.

A) risk-seeking

B) risk-indifferent

C) risk-averse

D) risk-neutral

A) risk-seeking

B) risk-indifferent

C) risk-averse

D) risk-neutral

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

39

Nico bought 100 shares of a company's stock for $22.00 per share on January 1, 2013. He received a dividend of $2.00 per share at the end of 2013 and $3.00 per share at the end of 2014. At the end of 2015, Nico collected a dividend of $4.00 per share and sold his stock for $18.00 per share. What was Nico's realized holding period return? What was Nico's compound annual rate of return? Explain the difference?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

40

Asset A was purchased six months ago for $25,000 and has generated $1,500 cash flow during that period. What is the asset's rate of return if it can be sold for $26,750 today?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

41

The ________ of a given outcome is its chance of occurring.

A) dispersion

B) standard deviation

C) probability

D) reliability

A) dispersion

B) standard deviation

C) probability

D) reliability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

42

________ is the extent of an asset's risk. It is found by subtracting the pessimistic outcome from the optimistic outcome.

A) Variance

B) Standard deviation

C) Probability distribution

D) Range

A) Variance

B) Standard deviation

C) Probability distribution

D) Range

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

43

Lower the coefficient of variation, the greater the risk and therefore the higher the expected return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

44

A common approach of estimating the variability of returns involving the forecast of pessimistic, most likely, and optimistic returns associated with an asset is called ________.

A) marginal analysis

B) scenario analysis

C) break-even analysis

D) DuPont analysis

A) marginal analysis

B) scenario analysis

C) break-even analysis

D) DuPont analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

45

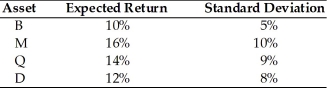

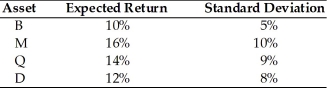

Given the following expected returns and standard deviations of assets B, M, Q, and D, which asset should the prudent financial manager select?

A) Asset B

B) Asset M

C) Asset Q

D) Asset D

A) Asset B

B) Asset M

C) Asset Q

D) Asset D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

46

Standard deviation is a measure of relative dispersion that is useful in comparing the risks of assets with different expected returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

47

A(n) ________ distribution shows all possible outcomes and associated probabilities for a given event.

A) discrete

B) lognormal

C) exponential

D) probability

A) discrete

B) lognormal

C) exponential

D) probability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

48

The simplest type of probability distribution is a ________.

A) bar chart

B) normal distribution

C) lognormal distribution

D) Poisson distribution

A) bar chart

B) normal distribution

C) lognormal distribution

D) Poisson distribution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

49

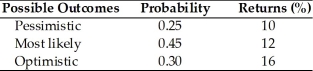

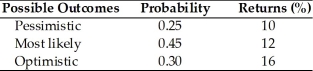

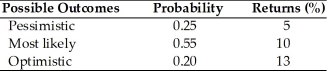

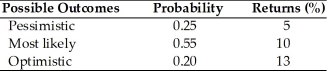

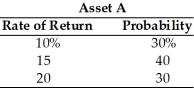

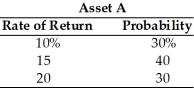

The expected value and the standard deviation of returns for asset A is ________. (See below.) Asset A

A) 12 percent and 4 percent

B) 12.7 percent and 2.3 percent

C) 12.7 percent and 4 percent

D) 12 percent and 2.3 percent

A) 12 percent and 4 percent

B) 12.7 percent and 2.3 percent

C) 12.7 percent and 4 percent

D) 12 percent and 2.3 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

50

Standard deviation measures the dispersion of an investment's return around the expected return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

51

In U.S., during the past 75 years, on an average the return on U.S. Treasury bills has exceeded the inflation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which asset would the risk-averse financial manager prefer? (See below.)

A) Asset A

B) Asset B

C) Asset C

D) Asset D

A) Asset A

B) Asset B

C) Asset C

D) Asset D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

53

Higher the coefficient of variation, the greater the risk and therefore the higher the expected return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

54

On average in U.S., during the past 75 years, the return on large-company stocks has exceeded the return on long-term corporate bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

55

A ________ is a measure of relative dispersion used in comparing the risk of assets with differing expected returns.

A) coefficient of variation

B) chi square

C) mean

D) standard deviation

A) coefficient of variation

B) chi square

C) mean

D) standard deviation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

56

The ________ the coefficient of variation, the ________ the risk.

A) lower; lower

B) higher; lower

C) lower; higher

D) more stable; higher

A) lower; lower

B) higher; lower

C) lower; higher

D) more stable; higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

57

A normal probability distribution is an asymmetrical distribution whose shape resembles a pyramid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

58

For normal probability distributions, 95 percent of the possible outcomes will lie between ±1 standard deviation from the expected return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

59

On average in U.S., during the past 75 years, the return on U.S. Treasury bills has exceeded the return on long-term government bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

60

A ________ measures the dispersion around the expected value.

A) coefficient of variation

B) chi square

C) mean

D) standard deviation

A) coefficient of variation

B) chi square

C) mean

D) standard deviation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

61

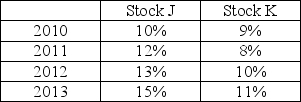

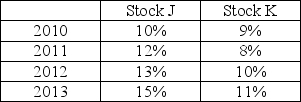

Given the returns of two stocks J and K in the table below over the next 4 years. Find the expected return and standard deviation of holding a portfolio of 40% of stock J and 60% in stock K over the next 4 years:

A) 10.7% and 1.34%

B) 10.6% and 1.79%

C) 10.6% and 1.16%

D) 14.3% and 2.02%

A) 10.7% and 1.34%

B) 10.6% and 1.79%

C) 10.6% and 1.16%

D) 14.3% and 2.02%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

62

Two assets whose returns move in the opposite directions and have a correlation coefficient of -1 ar either risk-free assets or low-risk assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

63

An investment advisor has recommended a $50,000 portfolio containing assets R, J, and K; $25,000 will be invested in asset R, with an expected annual return of 12 percent; $10,000 will be invested in asset J, with an expected annual return of 18 percent; and $15,000 will be invested in asset K, with an expected annual return of 8 percent. The expected annual return of this portfolio is ________.

A) 12.67%

B) 12.00%

C) 10.00%

D) 11.78%

A) 12.67%

B) 12.00%

C) 10.00%

D) 11.78%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

64

The standard deviation of a portfolio is a function of the standard deviations of the individual securities in the portfolio, the proportion of the portfolio invested in those securities, and the correlation between the returns of those securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

65

New investments must be considered in light of their impact on the risk and return of the portfolio of assets because the risk of any single proposed asset investment is not independent of other assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

66

An efficient portfolio is a portfolio that maximizes return for a given level of risk or minimizes risk for a given level of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

67

The expected value, standard deviation of returns, and coefficient of variation for asset A are ________. (See below.) Asset A

A) 10 percent, 8 percent, and 1.25, respectively

B) 9.33 percent, 8 percent, and 2.15, respectively

C) 9.35 percent, 4.68 percent, and 2.00, respectively

D) 9.35 percent, 2.76 percent, and 0.295, respectively

A) 10 percent, 8 percent, and 1.25, respectively

B) 9.33 percent, 8 percent, and 2.15, respectively

C) 9.35 percent, 4.68 percent, and 2.00, respectively

D) 9.35 percent, 2.76 percent, and 0.295, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

68

Perfectly ________ correlated series move exactly together and have a correlation coefficient of ________, while perfectly ________ correlated series move exactly in opposite directions and have a correlation coefficient of ________.

A) negatively; -1; positively; +1

B) negatively; +1; positively; -1

C) positively; -1; negatively; +1

D) positively; +1; negatively; -1

A) negatively; -1; positively; +1

B) negatively; +1; positively; -1

C) positively; -1; negatively; +1

D) positively; +1; negatively; -1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

69

________ is a statistical measure of the relationship between any two series of numbers.

A) Coefficient of variation

B) Standard deviation

C) Correlation

D) Probability

A) Coefficient of variation

B) Standard deviation

C) Correlation

D) Probability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

70

An efficient portfolio is one that ________.

A) guarantees a predetermined rate of return

B) maximizes return for a given level of risk

C) consists of a single asset, which gives maximum return

D) maximizes return at all risk levels

A) guarantees a predetermined rate of return

B) maximizes return for a given level of risk

C) consists of a single asset, which gives maximum return

D) maximizes return at all risk levels

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

71

Given the following information about the two assets A and B, determine which asset is preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

72

An efficient portfolio is defined as ________.

A) grouping of assets with same level of risk

B) collection of assets with the aim of maximizing the return

C) an investment in a single asset

D) grouping of assets with the highest possible correlation

A) grouping of assets with same level of risk

B) collection of assets with the aim of maximizing the return

C) an investment in a single asset

D) grouping of assets with the highest possible correlation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

73

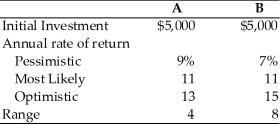

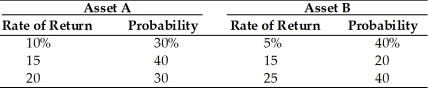

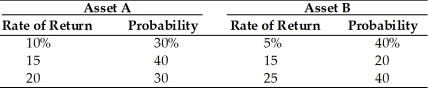

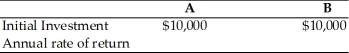

Champion Breweries must choose between two asset purchases. The annual rate of return and related probabilities given below summarize the firm's analysis.  For each asset, compute

For each asset, compute

(a) the expected rate of return.

(b) the standard deviation of the expected return.

(c) the coefficient of variation of the return.

(d) Which asset should Champion select?

For each asset, compute

For each asset, compute(a) the expected rate of return.

(b) the standard deviation of the expected return.

(c) the coefficient of variation of the return.

(d) Which asset should Champion select?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

74

The goal of an efficient portfolio is to ________.

A) achieve a predetermined rate of return for a given level of risk

B) maximize risk in order to maximize profit

C) minimize profit in order to minimize risk

D) minimize risk for a given level of return

A) achieve a predetermined rate of return for a given level of risk

B) maximize risk in order to maximize profit

C) minimize profit in order to minimize risk

D) minimize risk for a given level of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

75

Assuming the following returns and corresponding probabilities for asset A, compute its standard deviation and coefficient of variation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

76

Two assets whose returns move in the same direction and have a correlation coefficient of +1 are very risky assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

77

A(n) ________ portfolio maximizes return for a given level of risk, or minimizes risk for a given level of return.

A) efficient

B) risk-free

C) risk-neutral

D) risk-indifferent

A) efficient

B) risk-free

C) risk-neutral

D) risk-indifferent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

78

Given the following probability distribution for assets X and Y, compute the expected rate of return, variance, standard deviation, and coefficient of variation for the two assets. Which asset is a better investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

79

A financial manager's goal for the firm is to create a portfolio that maximizes return for a given level of risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck

80

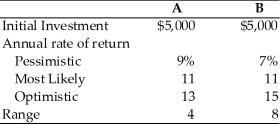

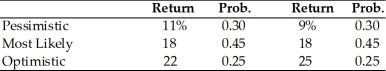

The College Copy Shop is in process of purchasing a high-tech copier. In its search, it has gathered the following information about two possible copiers A and B.

(a) Compute expected rate of return for each copier.

(a) Compute expected rate of return for each copier.

(b) Compute variance and standard deviation of rate of return for each copier.

(c) Which copier should they purchase?

(a) Compute expected rate of return for each copier.

(a) Compute expected rate of return for each copier.(b) Compute variance and standard deviation of rate of return for each copier.

(c) Which copier should they purchase?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 188 في هذه المجموعة.

فتح الحزمة

k this deck