Deck 19: International Managerial Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/108

العب

ملء الشاشة (f)

Deck 19: International Managerial Finance

1

The official melding of the national currencies of the European Union into one currency, the euro, created the European monetary union in 2002.

True

2

NAFTA is an international financial market that provides for borrowing and lending currencies outside their country of origin.

False

3

Fluctuations in foreign exchange markets can affect foreign revenues and profits of a multinational company, but they have no impact on its overall value.

False

4

Mercosur is a major South American trading bloc that includes countries that account for more than half of the total of Latin America's GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

5

The existence of specific regulations and controls on dollar deposits in the United States, including interest rate ceiling imposed by the government, has contributed to the growth of the Euromarket.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

6

A joint venture is a partnership under which the participants have contractually agreed to contribute specified amounts of money and expertise in exchange for stated proportions of ownership and profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is considered as a major offshore center for Euromarket business?

A) Cuba

B) North Korea

C) Iran

D) Hong Kong

A) Cuba

B) North Korea

C) Iran

D) Hong Kong

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

8

Offshore Centers are cities or states that have achieved prominence as major centers for Euromarket business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

9

In 2003-2004, the United States signed a regional trade pact with the Dominican Republic, Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua called the Central American Free Trade Agreement or CAFTA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

10

The World Trade Organization is an international body established to police world trading practices and to mediate disputes among member countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Euromarket provides multinational companies with an external opportunity to borrow or lend funds with the additional feature of less government regulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

12

As a result of the Maastricht Treaty of 1991, 12 EU nations adopted a single currency, the euro, as a continent-wide medium of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

13

A partnership under which the participants have contractually agreed to contribute specified amounts of money and expertise in exchange for stated proportions of ownership and profit is called a(n) ________.

A) S corporation

B) GmbH

C) S.A.R.L.

D) joint venture

A) S corporation

B) GmbH

C) S.A.R.L.

D) joint venture

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

14

Multinational companies are firms that have international assets but operations in domestic markets only and draw part of their total revenue and profits from such markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Euromarket is the international financial market that provides for borrowing and lending currencies outside their country of origin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

16

The ________ is the taxation technique that increases the U.S. income of an MNC by the amount of foreign income (before foreign taxes). The U.S. tax calculation is then based on that higher level.

A) unitary tax law

B) grossing up procedure

C) GmbH

D) nationalization procedure

A) unitary tax law

B) grossing up procedure

C) GmbH

D) nationalization procedure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the grossing up procedure, MNCs add the before-tax subsidiary income to their total taxable income, calculate the U.S. tax liability on the grossed -up income, and the related taxes are paid in the foreign country are applied as a credit against the additional U.S. tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

18

NAFTA is a treaty establishing free trade and open markets among Europe and the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

19

A partnership between a multinational company and a foreign investor in which contractually specified amounts of money and expertise are contributed by the participants for stated proportions of ownership and profit is a ________.

A) multinational corporation

B) floating relationship

C) joint venture

D) consolidation

A) multinational corporation

B) floating relationship

C) joint venture

D) consolidation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

20

The Mercosur is a major European trading bloc that includes former Soviet bloc countries in Eastern Europe.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

21

Harry Mining, a U.S.-based MNC has a foreign subsidiary that earns $1,050,000 before local taxes, with all the after tax funds to be available to the parent in the form of dividends. The foreign income tax rate is 30 percent, the foreign dividend withholding tax rate is 15 percent, and the firm's U.S. tax rate is 35 percent. What are the funds available to the parent MNC if foreign taxes can be applied as a credit against the MNC's U.S. tax liability?

A) $624,750

B) $425,250

C) $257,250

D) $735,000

A) $624,750

B) $425,250

C) $257,250

D) $735,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

22

CAFTA is ________.

A) a treaty establishing free trade and open markets between Europe and five Central American Countries

B) a major South American trading bloc that includes countries that account for more than half of total Latin American GDP

C) a significant economic force currently made up of 28 nations with a population of more than 500 million that permits free trade within the countries that make up this group

D) a trade agreement signed in 2003-2004 by the United States, the Dominican Republic, and five Central American countries

A) a treaty establishing free trade and open markets between Europe and five Central American Countries

B) a major South American trading bloc that includes countries that account for more than half of total Latin American GDP

C) a significant economic force currently made up of 28 nations with a population of more than 500 million that permits free trade within the countries that make up this group

D) a trade agreement signed in 2003-2004 by the United States, the Dominican Republic, and five Central American countries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

23

A functional currency is the currency of the parent company's country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

24

The temporal method requires specific assets and liabilities to be translated at so-called historic exchange rates and that foreign-exchange translation gains or losses be reflected in the current year's income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

25

________ is a major South American trading bloc that includes countries that account for more than half of total Latin American GDP.

A) The group of five

B) Mercosur

C) Latin and South American Free Trade Area (LASTA)

D) The group of seven

A) The group of five

B) Mercosur

C) Latin and South American Free Trade Area (LASTA)

D) The group of seven

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

26

The all-current-rate method dictated by the FASB No. 52 statement requires the translation of all balance sheet accounts at the ________ rate and all income statement items at the ________ rates.

A) closing; average

B) average; closing

C) historical; current

D) average; historical

A) closing; average

B) average; closing

C) historical; current

D) average; historical

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

27

FASB No. 52 is a statement issued by the Financial Accounting Standards Board requiring American MNCs to first convert the financial statement accounts of foreign subsidiaries into the country's functional currency and then translate the accounts into the parent firm's currency using the ________ method.

A) historical rate

B) all-current-rate

C) average rate

D) weighted average

A) historical rate

B) all-current-rate

C) average rate

D) weighted average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

28

A functional currency is the currency of the host country in which a subsidiary primarily generates and expends cash and in which its accounts are maintained.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

29

A U.S.-based MNC has three subsidiaries: S1 (40 percent owned by the MNC); S2 (33 percent owned by S1), and S3 (20 percent owned by S2). The taxable income for each firm is $100 million. The local taxes for each firm are $15 million, $20 million, and $10 million, respectively. The MNC's tax rate is 40 percent.

(a) Can the MNC apply all of its local taxes as a credit against its U.S. taxes?

(b) Based on the "grossing up" concept, calculate all tax credits applicable to the MNC.

(a) Can the MNC apply all of its local taxes as a credit against its U.S. taxes?

(b) Based on the "grossing up" concept, calculate all tax credits applicable to the MNC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

30

The all-current-rate method is the method by which the functional currency-denominated financial statements of an MNC's subsidiary are translated into the parent company's currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

31

Harry Mining, a U.S.-based MNC has a foreign subsidiary that earns $1,050,000 before local taxes, with all the after tax funds to be available to the parent in the form of dividends. The foreign income tax rate is 30 percent, the foreign dividend withholding tax rate is 15 percent, and the firm's U.S. tax rate is 35 percent. What are the funds available to the parent MNC if no tax credits are allowed?

A) $624,752

B) $425,250

C) $406,088

D) $735,000

A) $624,752

B) $425,250

C) $406,088

D) $735,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

32

________ is a treaty that has governed world trade throughout most of the post World War II era.

A) NAFTA

B) GATT

C) WTO

D) CAFTA

A) NAFTA

B) GATT

C) WTO

D) CAFTA

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

33

Current U.S. tax laws require the separation of financial statements of subsidiaries and the operating results for some subsidiaries are excluded from the parent entirely for some countries such as China and India.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

34

FASB No. 52 requires U.S. multinationals to first convert the financial statement accounts of foreign subsidiaries into their functional currency and then to translate the accounts into the parent firm's currency using the all-current-rate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

35

________ is an international body that polices world commercial trading practices and mediates disputes among two or more member countries.

A) NAFTA

B) GATT

C) WTO

D) CAFTA

A) NAFTA

B) GATT

C) WTO

D) CAFTA

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

36

The negative implications for the operation of a foreign-based subsidiary due to joint venture laws and restrictions can result in ________.

A) high degree of leverage

B) deficit in balance-of-payment position for the home country

C) difficulties obtaining the remission of profits

D) manipulation of tax rules

A) high degree of leverage

B) deficit in balance-of-payment position for the home country

C) difficulties obtaining the remission of profits

D) manipulation of tax rules

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is a reason for growth of the Euromarket?

A) The sudden decline of U.S dollars after the introduction of Euro.

B) The functional-currency-denominated financial statements of the foreign subsidiary were translated into the parent's currency without authorization.

C) The existence of offshore centers caused massive financial losses and problems for MNCs.

D) The consistently large U.S. balance-of-payments deficits helped scatter dollars around the world.

A) The sudden decline of U.S dollars after the introduction of Euro.

B) The functional-currency-denominated financial statements of the foreign subsidiary were translated into the parent's currency without authorization.

C) The existence of offshore centers caused massive financial losses and problems for MNCs.

D) The consistently large U.S. balance-of-payments deficits helped scatter dollars around the world.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following factors can influence the operations of an MNC?

A) foreign ownership of portions of equity

B) debt and equity structures based on home country's capital market

C) dividend payout policy

D) consolidation of financial statements based on only one currency

A) foreign ownership of portions of equity

B) debt and equity structures based on home country's capital market

C) dividend payout policy

D) consolidation of financial statements based on only one currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

39

The ________ is a significant economic force currently made up of 28 nations with a population of more than 500 million that permits free trade within the countries that make up this group.

A) North American Free Trade Agreement (NAFTA)

B) Mercosur Group

C) Asian Economic Area Network (ASEAN)

D) European Union (EU)

A) North American Free Trade Agreement (NAFTA)

B) Mercosur Group

C) Asian Economic Area Network (ASEAN)

D) European Union (EU)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

40

Self-sustaining foreign entity operates independent of the parent multinational and the current-rate method is the primary approach for translation of individual accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

41

Although several economic and political factors can influence foreign exchange rate movements, by far the most important explanation for long-term changes in exchange rates is fiscal policy that a country adopts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

42

When more units of a foreign currency are required to buy one dollar, the currency is said to have appreciated with respect to the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

43

Both theory and empirical evidence indicate that the capital structures of MNCs are not different from those of purely domestic firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

44

Accounting exposure is the risk resulting from the effects of changes in foreign exchange rates on the translated value of a firm's financial statement accounts denominated in a given foreign currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

45

The spot exchange rate is the rate of exchange between two currencies at some specified future date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

46

Although several economic and political factors can influence foreign exchange rate movements, by far the most important explanation for long-term changes in exchange rates is a differing inflation rate between two countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

47

Countries that experience high inflation rates will see their currencies decline in value relative to the currencies of countries with lower inflation rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is considered to be a major or hard currency?

A) the Algerian dinar

B) the Barbadian dollar

C) the Mexican peso

D) the Japanese yen

A) the Algerian dinar

B) the Barbadian dollar

C) the Mexican peso

D) the Japanese yen

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

49

Macro political risk is the risk faced by all foreign firms in a host country related to political change, revolution, or the adoption of new policies by the government of host country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

50

The functional currency is the currency in which a business entity primarily generates and expends cash and in which its accounts are maintained.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

51

Both theory and empirical evidence indicate that the capital structures of MNCs differ from those of purely domestic firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

52

The forward exchange rate is the rate of exchange between two currencies on any given day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

53

National entry control systems are comprehensive rules, regulations, and immigration policies introduced by xenophobic host governments to regulate inflows of foreign workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

54

Economic exposure is the risk resulting from the effects of changes in foreign exchange rates on a firm's value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

55

Micro political risk is the risk faced by all foreign firms in a host country related to political change, revolution, and the adoption of new policies by the government of host country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

56

National entry control systems are comprehensive rules, regulations, and incentives introduced by host governments to regulate inflows of foreign direct investment from MNCs and at the same time extract more benefits from their presence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

57

When fewer units of a foreign currency are required to buy one dollar, the currency is said to have ________.

A) appreciated with respect to the dollar

B) depreciated with respect to the dollar

C) appreciated with respect to the home currency

D) appreciated with respect to the average rate of the home currency

A) appreciated with respect to the dollar

B) depreciated with respect to the dollar

C) appreciated with respect to the home currency

D) appreciated with respect to the average rate of the home currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

58

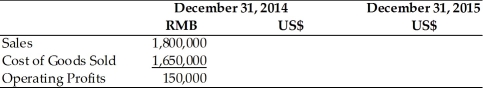

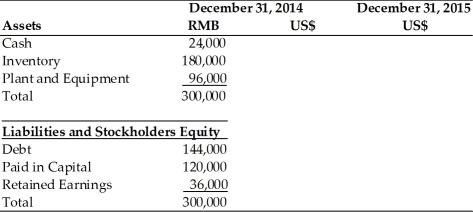

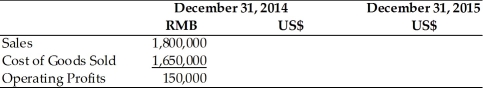

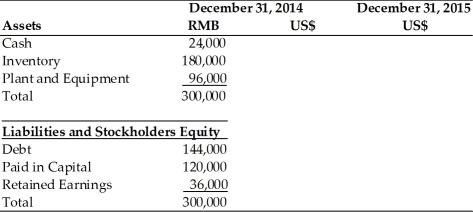

A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2014, the exchange rate was 8.27 RMB/US$. Assume the local currency figures in the statement below remain the same on December 31, 2015. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2014 and December 31, 2015, the Chinese government revalues (appreciates) the RMB by 20 percent.

Translation of Income Statement Translation of Balance Sheet

Translation of Balance Sheet

Translation of Income Statement

Translation of Balance Sheet

Translation of Balance Sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

59

The three basic types of risks associated with international cash flows are business and financial risks, inflation and exchange rate risks, and political risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

60

Recent years have seen the emergence of a third path to political risk that encompasses "global" events such as terrorism, antiglobalization movements and protests, Internet-based risks, and concerns over poverty, AIDS, and the environment all affect various MNCs' operations worldwide.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

61

For a Eurodollar bond, the interest rate will reflect several different rates, most notably the U.S. long-term rate, the Eurodollar rate, and long-term rates in other countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

62

Between two major currencies, the spot exchange rate is the rate ________ and the forward exchange rate is the rate ________.

A) on that date; today

B) at some specified future date; on that date

C) today; on that date

D) on that date; at some specified future date

A) on that date; today

B) at some specified future date; on that date

C) today; on that date

D) on that date; at some specified future date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

63

The foreign direct investment (FDI) is a multi-national corporation's transfer of capital, managerial, and technical assets from a foreign country to its home country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

64

The transfer of capital, managerial, and technical assets by a multinational firm from its home country to a foreign country is termed ________.

A) an MNC

B) an SDI

C) an FDI

D) a CAPM

A) an MNC

B) an SDI

C) an FDI

D) a CAPM

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

65

If the exchange rate between the U.S. dollar and the Euro is $1.20 per Euro and the annual rate of inflation is 5 percent in the United States and 10 percent in Europe, what will be U.S. dollar per Euro exchange rate in one year?

A) 1.050

B) 0.8730

C) 1.257

D) 0.7955

A) 1.050

B) 0.8730

C) 1.257

D) 0.7955

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

66

Foreign exchange risk refers to the risk created by ________.

A) the potential seizure of an MNC's operations in a host country

B) the varying exchange rate between two currencies

C) the fixed exchange rate between two currencies

D) the potential nationalization of the MNC's operations by a host government

A) the potential seizure of an MNC's operations in a host country

B) the varying exchange rate between two currencies

C) the fixed exchange rate between two currencies

D) the potential nationalization of the MNC's operations by a host government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

67

Because of their access to the international bond and equity markets, MNCs may have lower long-term financing costs, thus resulting in differences between the capital structures of these firms and those of purely domestic companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

68

For foreign bonds, interest rates are usually not directly correlated with the domestic rates prevailing in the respective countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

69

Macro political risk and micro political risk in international business refer to the risk ________.

A) that will affect all foreign firms and the risk that will affect an individual firm or specific industry, respectively

B) of the devaluation of the host country's currency and the risk of sudden taxes on exporting the manufactured goods of a particular industry, respectively

C) that will affect an individual firm or specific industry and the risk that will affect all foreign firms, respectively

D) of sudden taxes on exporting the manufactured goods of a particular industry and the risk of the devaluation of the host country's currency, respectively

A) that will affect all foreign firms and the risk that will affect an individual firm or specific industry, respectively

B) of the devaluation of the host country's currency and the risk of sudden taxes on exporting the manufactured goods of a particular industry, respectively

C) that will affect an individual firm or specific industry and the risk that will affect all foreign firms, respectively

D) of sudden taxes on exporting the manufactured goods of a particular industry and the risk of the devaluation of the host country's currency, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

70

Comprehensive rules, regulations, and incentives aimed at regulating the inflow of direct foreign investments involving MNCs and at extracting more benefits from their presence are termed as ________.

A) unitary tax laws

B) foreign direct investments

C) Eurocurrency markets

D) national entry control systems

A) unitary tax laws

B) foreign direct investments

C) Eurocurrency markets

D) national entry control systems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

71

The risk resulting from the effects of changes in foreign exchange rates on the translated value of a firm's accounts denominated in a given foreign currency is ________.

A) economic exposure

B) macro political risk

C) accounting exposure

D) micro political risk

A) economic exposure

B) macro political risk

C) accounting exposure

D) micro political risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

72

A political risk that might affect all foreign firms in a host country is termed a ________ risk; a political risk that might affect only an individual firm or specific industry in a host country is termed a ________ risk.

A) macro political; micro political

B) micro political; macro political

C) micro political; foreign exchange

D) foreign exchange; micro political

A) macro political; micro political

B) micro political; macro political

C) micro political; foreign exchange

D) foreign exchange; micro political

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

73

Fixed relationship among currencies refers to ________.

A) the relationship in which the value of any one currency with respect to all other currencies is allowed to fluctuate on a yearly basis

B) the relationship in which the value of any two currencies with respect to each other is allowed to fluctuate on a monthly basis

C) the constant relationship of a currency to one of the major currencies, a combination of major currencies, or some type of international foreign exchange standard

D) the constant relationship of a currency to one of the major foreign exchange market or a combination of markets

A) the relationship in which the value of any one currency with respect to all other currencies is allowed to fluctuate on a yearly basis

B) the relationship in which the value of any two currencies with respect to each other is allowed to fluctuate on a monthly basis

C) the constant relationship of a currency to one of the major currencies, a combination of major currencies, or some type of international foreign exchange standard

D) the constant relationship of a currency to one of the major foreign exchange market or a combination of markets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

74

The risk resulting from the effects of changes in foreign exchange rates on the firm's value is ________.

A) economic exposure

B) macro political risk

C) accounting exposure

D) micro political risk

A) economic exposure

B) macro political risk

C) accounting exposure

D) micro political risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

75

In general, an international bond is one that is initially sold in the country of the borrower and, then, often distributed in home country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

76

If the exchange rate between the U.S. dollar and the Euro is $1.20 per Euro and the exchange rate between the U.S. dollar and the Japanese yen is 120 Yen per dollar, then what is the Euro per Yen exchange rate?

A) 0.0100

B) 144.00

C) 0.0069

D) 100.00

A) 0.0100

B) 144.00

C) 0.0069

D) 100.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

77

Foreign bond is an international bond that is sold primarily in countries other than the country of the currency in which the issue is denominated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

78

A multi-national corporation (MNC) can give some protection to international cash flows by reducing its liabilities if the currency is appreciating, or by reducing its financial assets if the currency is depreciating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

79

The potential risk of a host government's implementation of specific rules and regulations that can result in the discontinuity or seizure of the operations of a foreign company is called ________.

A) exchange rate risk

B) financial risk

C) political risk

D) business risk

A) exchange rate risk

B) financial risk

C) political risk

D) business risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is a positive approach of coping with political risk?

A) control of transportation to external markets

B) control of downstream processing

C) license or patent restrictions under international agreement

D) joint venture with government or local private sector

A) control of transportation to external markets

B) control of downstream processing

C) license or patent restrictions under international agreement

D) joint venture with government or local private sector

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck