Deck 5: Consolidation: Non-Controlling Interest

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/61

العب

ملء الشاشة (f)

Deck 5: Consolidation: Non-Controlling Interest

1

Viner Ltd. acquired 70% of Bittner Ltd. on January 1, 2010. On January 1, 2014, Viner acquired another 10% of Bittner's common shares for $250,000. With respect to this additional purchase, which of the following is TRUE?

A)On the consolidated statement of financial position, the goodwill balance will increase.

B)Viner should ignore any changes in the fair values of Bittner's net assets between

January 1, 2010 and January 1, 2014.

C)On the consolidated statement of financial position, the common shares balance will increase.

D)Viner must use the equity method to report the additional investment.

A)On the consolidated statement of financial position, the goodwill balance will increase.

B)Viner should ignore any changes in the fair values of Bittner's net assets between

January 1, 2010 and January 1, 2014.

C)On the consolidated statement of financial position, the common shares balance will increase.

D)Viner must use the equity method to report the additional investment.

B

2

Under the partial goodwill method, the NCI is measured as a proportion of the net fair value of the identifiable net assets of the subsidiary at the acquisition date.

True

3

All intragroup transactions require an adjustment to the NCI.

False

4

A parent's consolidated net income which includes it's fully and partially owned subsidiaries is best described as:

A)Net income recorded by the parent

B)Net income reported by both the parent and subsidiaries.

C)Net income reported by the parent and it's share of net income of subsidiaries

D)Income for both the parent and subsidiaries resulting from transactions with third parties.

A)Net income recorded by the parent

B)Net income reported by both the parent and subsidiaries.

C)Net income reported by the parent and it's share of net income of subsidiaries

D)Income for both the parent and subsidiaries resulting from transactions with third parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

5

The NCI consists of the accumulation of all the interests in the subsidiary other than that belonging to the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

6

In the rare case where a gain on bargain purchase may arise, such a gain has no effect on the calculation of the NCI share of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

7

When preparing and presenting a consolidated statement of comprehensive income, the non-controlling interest is presented as a separate component of revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

8

There are three main concepts of consolidation - proprietary, entity and parent entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which consolidation method does NOT include incorporating 100% of a subsidiary's revenues and expenses?

A)Parent-company method.

B)Parent-company extension method.

C)Proportional consolidation.

D)Entity method.

A)Parent-company method.

B)Parent-company extension method.

C)Proportional consolidation.

D)Entity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under the partial goodwill method, the NCI does not get a share of any equity relating to goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the purpose of showing an allocation of the net income between the parent and the subsidiary companies on the consolidated statement of comprehensive income?

A)To report the net income of the subsidiary company to its shareholders.

B)To report the net income of the parent and subsidiary companies to their respective shareholders.

C)To report the net income of the parent and subsidiary companies to the tax department.

D)To report the net income of the parent company to its shareholders.

A)To report the net income of the subsidiary company to its shareholders.

B)To report the net income of the parent and subsidiary companies to their respective shareholders.

C)To report the net income of the parent and subsidiary companies to the tax department.

D)To report the net income of the parent company to its shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

12

The proprietary concept is sometimes referred to as proportional consolidation or pro rata consolidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under the entity concept of consolidation, the group consists of the combined assets and liabilities of the parent and the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

14

If a gain on bargain purchase arises on a business combination, the non-controlling interest is allocated 100% of the gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

15

Whereas the goodwill of the subsidiary may be determined by calculating the goodwill acquired by the parent entity and then adding the fair value of the NCI, this process is not applicable for a gain on bargain purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

16

Levi Ltd. owns 60% of the outstanding common shares of Modry Ltd. During 2013, sales from Modry to Levi were $200,000. Merchandise was priced to provide Modry with a gross margin of 20%. Levi's inventories contained $40,000 at December 31, 2012 and $15,000 at December 31, 2013 of merchandise purchased from Modry. Cost of goods sold for Levi and Modry for 2013 on their separate-entity income statements were as follows: What is the balance of the inventory account on Levi's consolidated statement of financial position at December 31, 2013?

A)$162,000

B)$140,000

C)$160,000

D)$165,000

A)$162,000

B)$140,000

C)$160,000

D)$165,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

17

Ownership interests in a subsidiary entity that do not belong to the parent entity are known as un-owned interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

18

What is the recommended method for disclosing a non-controlling interest in a company on a consolidated balance sheet where significant sales have occurred between the two companies?

A)Goodwill adjustment.

B)On the balance sheet as a specially designated long-term liability.

C)In shareholder's equity.

D)None of the above.

A)Goodwill adjustment.

B)On the balance sheet as a specially designated long-term liability.

C)In shareholder's equity.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

19

The calculation of the NCI is necessary both for the Statement of Changes in Equity and for the Statement of Financial Position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

20

When a parent increases its ownership interest, the difference between the amount that was paid by the parent and the amount that was transferred from the non-controlling interest is allocated to equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

21

When preparing consolidated financial statements, any profit or loss that arises in relation to the intragroup transfer of services is regarded as:

A)Immaterial and does not get adjusted on a consolidation worksheet.

B)Immediately realized.

C)Unrealized.

D)Having no impact on the non-controlling interest, and so ignored for consolidation reporting.

A)Immaterial and does not get adjusted on a consolidation worksheet.

B)Immediately realized.

C)Unrealized.

D)Having no impact on the non-controlling interest, and so ignored for consolidation reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements relating to a gain on bargain purchase is FALSE?

A)Such gains are common.

B)Such gains have no effect on the calculation of the NCI share of equity.

C)Whereas the goodwill of the subsidiary may be determined by calculating the goodwill acquired by the parent entity and then adding the fair value of the NCI to determine the goodwill for the subsidiary, this process is not applicable for a gain on bargain purchase.

D)The gain is made by the parent paying less than the net fair value of the acquirer's share of the identifiable assets, liabilities and contingent liabilities of the subsidiary.

A)Such gains are common.

B)Such gains have no effect on the calculation of the NCI share of equity.

C)Whereas the goodwill of the subsidiary may be determined by calculating the goodwill acquired by the parent entity and then adding the fair value of the NCI to determine the goodwill for the subsidiary, this process is not applicable for a gain on bargain purchase.

D)The gain is made by the parent paying less than the net fair value of the acquirer's share of the identifiable assets, liabilities and contingent liabilities of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

23

Ownership interests in a subsidiary entity that do not belong to the parent entity are known as:

A)Unowned interests.

B)Non-controlling interests.

C)Proprietary interests.

D)Pro rata ownership rights.

A)Unowned interests.

B)Non-controlling interests.

C)Proprietary interests.

D)Pro rata ownership rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

24

Tamer Limited is a subsidiary of Wallen Limited. When Wallen acquired its 60% interest, the retained earnings of Tamer Limited were $20 000. At the beginning of the current period, Tamer Limited's retained earnings had increased to $50,000. Tamer earned net income of $10 000 during the current period. The share of the non-controlling interest in the equity of Tamer Limited at the reporting date is:

A)$24,000

B)$32,000

C)$36,000

D)$48,000

A)$24,000

B)$32,000

C)$36,000

D)$48,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

25

Arnold Ltd holds a 60% interest in Burford Ltd. Burford Ltd sells inventory to Arnold Ltd during the year for $10,000. The inventory originally cost $7,000. At the end of the year, 50% of the inventory is still on hand. The tax rate is 30%. The NCI share of net income adjustment required, in relation to this transaction, is a decrease of:

A)NIL.

B)$420.

C)$630.

D)$1,050.

A)NIL.

B)$420.

C)$630.

D)$1,050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

26

Under the partial goodwill method, the NCI is measured as a proportion of the _______ of the identifiable net assets of the subsidiary at the acquisition date.

A)Net fair value

B)Net book value

C)Carrying value

D)Future value.

A)Net fair value

B)Net book value

C)Carrying value

D)Future value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

27

How is the consolidated ending retained earnings balance calculated?

A)Add together the ending retained earnings of all the affiliated companies.

B)Add the beginning consolidated retained earnings to consolidated net income and subtract the parent company's dividends declared.

C)Adjust the parent company's opening retained earnings for the subsidiary's profits and dividends.

D)Adjust the parent company's ending retained earnings for the subsidiary's profits and dividends.

A)Add together the ending retained earnings of all the affiliated companies.

B)Add the beginning consolidated retained earnings to consolidated net income and subtract the parent company's dividends declared.

C)Adjust the parent company's opening retained earnings for the subsidiary's profits and dividends.

D)Adjust the parent company's ending retained earnings for the subsidiary's profits and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

28

Wilson Ltd. owns 60% of the outstanding common shares of Miller Ltd. During 2013, sales from Miller to Wilson were $200,000. Merchandise was priced to provide Miller with a gross margin of 20%. Wilson' inventories contained $40,000 at December 31, 2012 and $15,000 at December 31, 2013 of merchandise purchased from Miller. Cost of goods sold for Wilson and Miller for 2013 on their separate-entity income statements were as follows: What is cost of goods sold on the consolidated income statement for 2013?

A)$687,000

B)$685,000

C)$660,000

D)$680,000

A)$687,000

B)$685,000

C)$660,000

D)$680,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a gain on bargain purchase arises on a business combination, the non-controlling interest:

A)Is allocated 100% of the gain.

B)Has no involvement with the gain.

C)Is entitled to a proportionate share of the gain based on its level of share ownership.

D)Receives a proportionate share of the gain after adjustments for tax effects have been made.

A)Is allocated 100% of the gain.

B)Has no involvement with the gain.

C)Is entitled to a proportionate share of the gain based on its level of share ownership.

D)Receives a proportionate share of the gain after adjustments for tax effects have been made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

30

Arbiter Ltd. holds a 60% interest in Brown Ltd. On July 1, 2012, Brown Ltd. transferred a depreciable non-current asset to Arbiter Ltd. at a profit of $5,000. The remaining useful life of the asset at the date of transfer was 4 years and the tax rate is 30%. The impact of the above on the NCI share of net income for the year ended June 30, 2013 is:

A)An increase of $2,625.

B)A decrease of $2,625.

C)An increase of $1,050.

D)A decrease of $1,050.

A)An increase of $2,625.

B)A decrease of $2,625.

C)An increase of $1,050.

D)A decrease of $1,050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

31

Kafka Ltd. purchased 80% of Littman Ltd. for $700,000. At the time of acquisition, the carrying value of Littman's net identifiable assets was $1,000,000 and the fair value was $1,350,000. The companies pay tax at the rate of 30%. What is the amount of the goodwill under the partial goodwill method?

A)$180,000

B)$(56,000)

C)$144,000

D)None of the above.

A)$180,000

B)$(56,000)

C)$144,000

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

32

Dobson Co. purchased 80% of Niki Ltd. for $1,200,000. At the date of acquisition, the carrying value of Niki's net identifiable assets was $1,000,000, and the fair value was $1,300,000 net of tax. What is the amount of the goodwill under the partial goodwill method?

A)$200,000.

B)$160,000.

C)$300,000.

D)$0.

A)$200,000.

B)$160,000.

C)$300,000.

D)$0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

33

Manuel Ltd. purchases 65% of Faiz Co. Under the entity method of consolidation, what is allocated to non-controlling interest?

A)35% of Faiz's net assets at fair value.

B)35% of Faiz's net assets at carrying value plus 35% of Faiz's fair value increments including goodwill.

C)35% of Faiz's net assets at carrying value.

D)35% of Faiz's net assets at carrying value plus 35% of Faiz's fair value increments excluding goodwill.

A)35% of Faiz's net assets at fair value.

B)35% of Faiz's net assets at carrying value plus 35% of Faiz's fair value increments including goodwill.

C)35% of Faiz's net assets at carrying value.

D)35% of Faiz's net assets at carrying value plus 35% of Faiz's fair value increments excluding goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

34

Robson Ltd. acquired 80% of Cool Co. in 2012. During 2012, Cool sold inventory to Robson. At the end of 2013, the goods were still in Robson's inventory. Robson correctly eliminated the $20,000 of unrealized profits on its 2013 consolidated financial statements and the goods were finally sold in 2014. In preparing its 2014 consolidated financial statements, what adjustments should be made with respect to the previously unrealized profit?

A)Decrease cost of sales by $20,000, decrease beginning retained earnings by $16,000, and decrease the beginning non-controlling interest by $4,000.

B)Increase both cost of sales and beginning retained earnings by $20,000.

C)Increase cost of sales by $20,000, increase beginning retained earnings by $16,000, and increase the beginning non-controlling interest by $4,000.

D)No entry is required.

A)Decrease cost of sales by $20,000, decrease beginning retained earnings by $16,000, and decrease the beginning non-controlling interest by $4,000.

B)Increase both cost of sales and beginning retained earnings by $20,000.

C)Increase cost of sales by $20,000, increase beginning retained earnings by $16,000, and increase the beginning non-controlling interest by $4,000.

D)No entry is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

35

Gerrard Ltd. acquired 75% of Sittler Ltd. at April 30, 2012. Both companies have April 30 year-ends. Which of the following adjustements should be made to the opening non-controlling interest (NCI)balance to arrive at the April 30, 2013 NCI balance on Gerrard's statement of financial position?

A)Subtract the NCI's share of Sittler's fiscal 2013 net income and add in the NCI's share of Sittler's dividends declared.

B)Add in both the NCI's share of Sittler's fiscal 2013 net income and dividends declared.

C)Add in the NCI's share of Sittler's fiscal 2013 net income and subtract the NCI's share of Sittler's dividends declared.

D)Subtract both the NCI's share of Sittler's fiscal 2013 net income and dividends declared.

A)Subtract the NCI's share of Sittler's fiscal 2013 net income and add in the NCI's share of Sittler's dividends declared.

B)Add in both the NCI's share of Sittler's fiscal 2013 net income and dividends declared.

C)Add in the NCI's share of Sittler's fiscal 2013 net income and subtract the NCI's share of Sittler's dividends declared.

D)Subtract both the NCI's share of Sittler's fiscal 2013 net income and dividends declared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements regarding the non-controlling interest is FALSE?

A)In a subsidiary that is not wholly owned by the parent, there are two ownership interests, namely the parent and the non-controlling interest (NCI).

B)The NCI consists of the accumulation of all the interests in the subsidiary other than the parent.

C)The NCI is classified as a contributor of equity to the group.

D)The NCI is entitled to a share of the equity, as recorded, of the subsidiary.

A)In a subsidiary that is not wholly owned by the parent, there are two ownership interests, namely the parent and the non-controlling interest (NCI).

B)The NCI consists of the accumulation of all the interests in the subsidiary other than the parent.

C)The NCI is classified as a contributor of equity to the group.

D)The NCI is entitled to a share of the equity, as recorded, of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

37

Any gain on bargain purchase adjusts for the ___________ share of ___________ equity only.

A)parent's; pre-acquisition

B)subsidiary's; pre-acquisition

C)parent's; post-acquisition

D)subsidiary's; post-acquisition.

A)parent's; pre-acquisition

B)subsidiary's; pre-acquisition

C)parent's; post-acquisition

D)subsidiary's; post-acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

38

Where does the non-controlling interest (NCI)appear on the statement of financial position?

A)Under the liabilities section.

B)Between the liabilities and shareholders' equity sections.

C)Under the shareholders' equity section.

D)NCI does not appear on the statement of financial position.

A)Under the liabilities section.

B)Between the liabilities and shareholders' equity sections.

C)Under the shareholders' equity section.

D)NCI does not appear on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements regarding the full goodwill method is FALSE?

A)The NCI is measured at fair value at acquisition date.

B)Goodwill is recognized at 100%.

C)The fair value of the NCI is determined on the basis of the market prices for shares not acquired by the parent, or, if these are not available, a valuation technique is used.

D)Only the parent's share of goodwill is recognized on consolidation.

A)The NCI is measured at fair value at acquisition date.

B)Goodwill is recognized at 100%.

C)The fair value of the NCI is determined on the basis of the market prices for shares not acquired by the parent, or, if these are not available, a valuation technique is used.

D)Only the parent's share of goodwill is recognized on consolidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

40

There are three main concepts of consolidation - proprietary, entity and parent entity. The choice of concept affects how consolidated financial statements are prepared:

A)Only where the subsidiary is less than wholly owned by the parent.

B)Only where the subsidiary is wholly owned by the parent.

C)Always.

D)Only where the subsidiary is profitable.

A)Only where the subsidiary is less than wholly owned by the parent.

B)Only where the subsidiary is wholly owned by the parent.

C)Always.

D)Only where the subsidiary is profitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

41

What does the "group" consist of under the entity concept of consolidation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

42

On January 1, 2012, Kiss Ltd. acquired a 60% interest in Rosebud Inc. For $115,000. At this date, the equity of Rosebud consisted of the following:

At this date, the identifiable assets and liabilities of Rosebud were recorded at fair value except for the following assets:

The equipment had a further 5-year useful life and half of the inventory on hand at the acquisition date was sold by December 31, 2012. The other half was sold in 2013. The land has not been sold.

Kiss uses the full goodwill method. The fair value of the non-controlling interest at January 1, 2012 was $75,000.

During the three years since acquisition, Rosebud has recorded the following annual results:

Year-ended December 31, 2012: Profit of $20,000

Year-ended December 31, 2013: Profit of $25,000

There has been no dividend paid or declared by Rosebud since the acquisition date. The tax rate is 30%.

Required:

a()Prepare the consolidated financial statements adjustment as at January 1, 2012

b()Prepare the consolidated financial statements adjustments for the year ended December 31, 2012

c()Prepare the consolidated financial statements adjustments for the year ended December 31, 2013

At this date, the identifiable assets and liabilities of Rosebud were recorded at fair value except for the following assets:

The equipment had a further 5-year useful life and half of the inventory on hand at the acquisition date was sold by December 31, 2012. The other half was sold in 2013. The land has not been sold.

Kiss uses the full goodwill method. The fair value of the non-controlling interest at January 1, 2012 was $75,000.

During the three years since acquisition, Rosebud has recorded the following annual results:

Year-ended December 31, 2012: Profit of $20,000

Year-ended December 31, 2013: Profit of $25,000

There has been no dividend paid or declared by Rosebud since the acquisition date. The tax rate is 30%.

Required:

a()Prepare the consolidated financial statements adjustment as at January 1, 2012

b()Prepare the consolidated financial statements adjustments for the year ended December 31, 2012

c()Prepare the consolidated financial statements adjustments for the year ended December 31, 2013

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements regarding the proprietary concept of consolidation is FALSE?

A)The proprietary concept is sometimes referred to as proportional consolidation or pro rata consolidation.

B)The group consists of the assets and liabilities of the parent and the parent's proportional share of the assets and liabilities of the subsidiary.

C)The consolidated financial statements include all the net assets of a subsidiary.

D)As the NCI is outside the group, the NCI share of subsidiary equity is not disclosed.

A)The proprietary concept is sometimes referred to as proportional consolidation or pro rata consolidation.

B)The group consists of the assets and liabilities of the parent and the parent's proportional share of the assets and liabilities of the subsidiary.

C)The consolidated financial statements include all the net assets of a subsidiary.

D)As the NCI is outside the group, the NCI share of subsidiary equity is not disclosed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

44

When preparing and presenting a consolidated statement of comprehensive income, the non-controlling interest is:

A)Presented as a separate component of revenue.

B)Shown as a separate component of profit before tax and a separate component of tax expense.

C)Shown as a separate component of each line item.

D)Presented as an allocation of profit or loss attributable to the non-controlling interest.

A)Presented as a separate component of revenue.

B)Shown as a separate component of profit before tax and a separate component of tax expense.

C)Shown as a separate component of each line item.

D)Presented as an allocation of profit or loss attributable to the non-controlling interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

45

What are the characteristics for a transaction to require an adjustment to the calculation of the NCI share of equity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

46

Discuss the implications of a gain on bargain purchase for the non-controlling interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

47

Norman Ltd. owns 60% of the outstanding common shares of Arnie Ltd. During 2013, sales from Arnie to Norman were $200,000. Merchandise was priced to provide Arnie with a gross margin of 20%. Norman's inventories contained $40,000 at December 31, 2012 and $15,000 at December 31, 2013 of merchandise purchased from Arnie. Cost of goods sold for Norman and Arnie for 2013 on their separate-entity income statements were as follows: How much is the non-controlling interest adjusted for its share of the consolidated net income for the year ended December 31, 2013?

A)$3,000.

B)$5,000.

C)$1,250.

D)$2,000.

A)$3,000.

B)$5,000.

C)$1,250.

D)$2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

48

The IASB and the AASB have chosen to adopt the ________ concept of consolidation, mainly because of the conceptual framework decision that financial statements are prepared for a wide range of users.

A)cost

B)entity

C)parent entity

D)proprietary

A)cost

B)entity

C)parent entity

D)proprietary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

49

Harry Co. acquired 75% of Samir Ltd. 3 years ago. In calculating the balance for the non-controlling interest share of net income, Harry started with the net income from Samir's current year-end single-entity financial statements. Which of the following adjustments must be added to Samir's net income in calculating NCI's share of net income?

A)Unrealized gain on an upstream sale of a capital asset.

B)Realized profits in the current year on upstream sales of inventory from the previous year.

C)Unrealized profit on upstream sales of inventory in the current year.

D)Amortization of fair value increments.

A)Unrealized gain on an upstream sale of a capital asset.

B)Realized profits in the current year on upstream sales of inventory from the previous year.

C)Unrealized profit on upstream sales of inventory in the current year.

D)Amortization of fair value increments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

50

Kiara Ltd. acquired 90% of Udder Ltd. for $200,000 less than the fair value. How should this $200,000 be treated on Kiara's consolidated financial statements?

A)As goodwill on the consolidated statement of financial position.

B)As a gain on the consolidated statement of comprehensive income.

C)Allocated as fair value increments over Udder's net identifiable assets.

D)As a separate item under shareholders' equity.

A)As goodwill on the consolidated statement of financial position.

B)As a gain on the consolidated statement of comprehensive income.

C)Allocated as fair value increments over Udder's net identifiable assets.

D)As a separate item under shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements regarding the partial goodwill method is FALSE?

A)The NCI is measured at the NCI's proportionate share of the fair value of the acquiree's identifiable net assets.

B)The NCI does not get a share of any equity relating to goodwill.

C)Goodwill consists of the consideration transferred plus previously acquired investment by parent plus parent's share of the net fair value of the identifiable net assets of the subsidiary.

D)The only goodwill recognized is that acquired by the parent in the business combination.

A)The NCI is measured at the NCI's proportionate share of the fair value of the acquiree's identifiable net assets.

B)The NCI does not get a share of any equity relating to goodwill.

C)Goodwill consists of the consideration transferred plus previously acquired investment by parent plus parent's share of the net fair value of the identifiable net assets of the subsidiary.

D)The only goodwill recognized is that acquired by the parent in the business combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

52

Why is the calculation of the NCI necessary for both for the Statement of Changes in Equity and for the Statement of Financial Position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

53

Describe the key characteristics of the entity concept of consolidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

54

Discuss the implications of a parent's increase and decrease in ownership interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

55

Fillington Inc. acquired a 75% shareholding in Donhenry Ltd. for $20 million. Book value of net identifiable assets of Donhenry is $14 million. The fair value of Donhenry's asset is the same as their book value except accounts receivables, which are impaired by $1 million. Book value of assets is $54 million while book value of liabilities is $40 million. The NCI has been valued at $5 million. The tax rate is 30%.

Required:

Calculate goodwill using the full goodwill method.

Required:

Calculate goodwill using the full goodwill method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

56

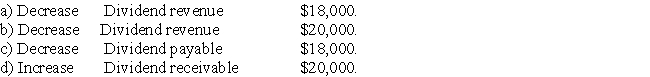

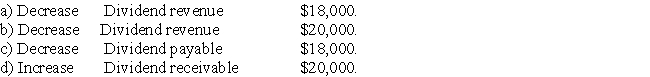

T Limited owns 90% of the share capital of S Limited. S Limited paid a dividend of $20,000 during the period. The adjustment in the consolidated financial statements for the dividend includes:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

57

Compare the full goodwill method and the partial goodwill methods of calculating the NCI at the acquisition date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

58

A non-controlling interest is entitled to a share of which of the following items? I Equity of the group entity at acquisition date.

II Current period profit or loss of the subsidiary entity.

III Changes in equity of the subsidiary since acquisition date and the beginning of the financial period.

IV Equity of the subsidiary at acquisition date.

A)I, II and III.

B)I and II only.

C)II, III and IV only.

D)III only.

II Current period profit or loss of the subsidiary entity.

III Changes in equity of the subsidiary since acquisition date and the beginning of the financial period.

IV Equity of the subsidiary at acquisition date.

A)I, II and III.

B)I and II only.

C)II, III and IV only.

D)III only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

59

Chase Ltd. purchased 60% of Latham Ltd. for $1,500,000. At the date of acquisition, the carrying value of Latham's net identifiable assets was $1,800,000 and the fair value was $2,200,000 after accounting for the tax effect. The fair value of the NCI at that date is $1,000,000. What is the amount of the goodwill under the full goodwill method?

A)$300,000.

B)$(300,000).

C)$120,000.

D)$400,000.

A)$300,000.

B)$(300,000).

C)$120,000.

D)$400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

60

Resnick Inc. acquired 75% shareholding in Canty Ltd. for $20 million. Book value of net identifiable assets of Canty is $14 million. The fair value of Canty's asset is the same as their book value except accounts receivables which are impaired by $1 million. Book value of assets is $54 million while book value of liabilities is $40 million. The tax rate is 30%.

Required:

Calculate goodwill using the partial goodwill method.

Required:

Calculate goodwill using the partial goodwill method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck

61

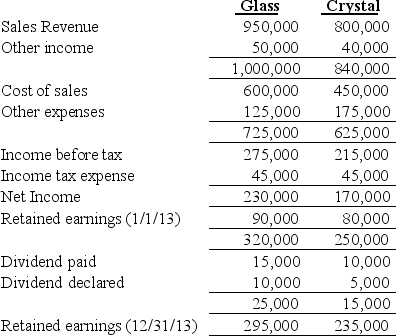

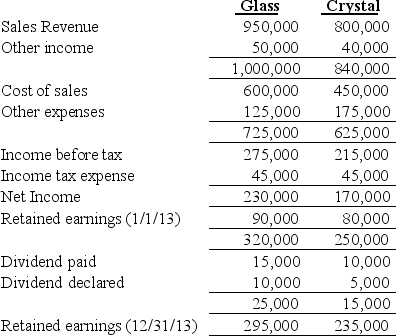

On January 1, 2011 Glass Inc. acquired 80% of the share capital of Crystal Ltd. For $400,000. At this date, the equity of Crystal consisted of:

Share capital: $200,000

Retained earnings: $75,000

At January 1, 2011 all of Crystal's identifiable assets and liabilities were recorded at fair value except for the following:

Equipment (cost ) Carrying amount: Fair value:

Land Carrying amount: Fair V alue: The equipment had a further useful life of 5 years. The land is still on hand. Glass uses the partial goodwill method.

Financial information for the two companies at December 31, 2013 is as follows:

Additional information:

Additional information:

1. During 2012, Crystal sold some inventory to Glass for $10,000. This inventory had originally cost Crystal $4,000. At December 31, 2012, 20% of these remained unsold by Glass.

2. The ending inventory of 2013, of Glass, included inventory sold to it by Crystal at a profit of $4,000 before tax. This had cost Crystal $15,000.

3. The tax rate is 30%.

4. Glass's share capital has always been $100,000.

5. On January 1, 2014, Glass sold 10% of its ownership in Crystal so that it now owns 70%. They received $30,000 for the shares.

Required:

(a)Prepare the consolidated statement of comprehensive income and statement of changes in equity at December 31, 2013.

(b)Calculate the effect on consolidated equity in 2014 from the sale of the shares.

Share capital: $200,000

Retained earnings: $75,000

At January 1, 2011 all of Crystal's identifiable assets and liabilities were recorded at fair value except for the following:

Equipment (cost ) Carrying amount: Fair value:

Land Carrying amount: Fair V alue: The equipment had a further useful life of 5 years. The land is still on hand. Glass uses the partial goodwill method.

Financial information for the two companies at December 31, 2013 is as follows:

Additional information:

Additional information:1. During 2012, Crystal sold some inventory to Glass for $10,000. This inventory had originally cost Crystal $4,000. At December 31, 2012, 20% of these remained unsold by Glass.

2. The ending inventory of 2013, of Glass, included inventory sold to it by Crystal at a profit of $4,000 before tax. This had cost Crystal $15,000.

3. The tax rate is 30%.

4. Glass's share capital has always been $100,000.

5. On January 1, 2014, Glass sold 10% of its ownership in Crystal so that it now owns 70%. They received $30,000 for the shares.

Required:

(a)Prepare the consolidated statement of comprehensive income and statement of changes in equity at December 31, 2013.

(b)Calculate the effect on consolidated equity in 2014 from the sale of the shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 61 في هذه المجموعة.

فتح الحزمة

k this deck