Deck 12: Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 12: Statement of Cash Flows

1

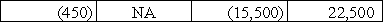

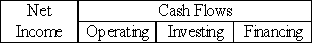

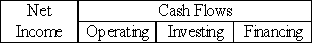

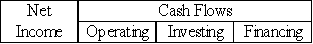

Howard Co.made a $25,000 cash payment on a term loan.The payment included a $23,000 reduction of principal as well as $2,000 of interest.Show the combined effects of the events.

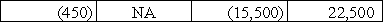

(D)(D)(N)(D)

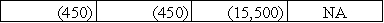

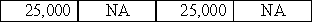

2

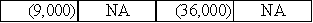

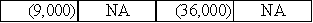

On January 1,2017,Howard Co.paid $10,000 to the Citizens Bank for accrued interest expense that had been accrued in an adjusting entry at the end of 2016.

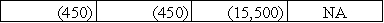

(N)(D)(N)(N)

3

Which method of preparing the operating activities section of a cash flow statement is recommended by the Financial Accounting Standards Board?

The FASB recommends the use of the direct method.

4

What is the major advantage of using the direct method of preparing the operating activities section of the statement of cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

Howard Co.purchased $4,000 of supplies,paying $1,500 in cash and charging the remainder on account.$1,600 of the supplies were used during the accounting period.Show the combined effects of the events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

Howard Co.sold equipment with a book value of $20,000 for $17,000 cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

Howard Co.purchased land by issuing a note payable in the amount of $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

On July 6,2016,Howard Corporation received an interest check on a note receivable.No principal was received at this time.Show the effects of this transaction on Howard's income statement and statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which section of a statement of cash flows resembles an income statement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

On September 10,2016,Howard Corporation received a check for $250 for dividends on Truxell Corporation stock that Howard holds as an investment.Show the effects of this transaction on Howard's income statement and statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which method do most companies use in preparing the operating activities section of the cash flow statement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is the purpose of the statement of cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

Howard Co.purchased land costing $25,000 by paying $8,000 cash and issuing a note payable for the remaining balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the major advantage of using the indirect method of preparing the operating activities section of the statement of cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

Howard Co.issued 20,000 shares of common stock for $300,000 cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

List the three categories of cash inflows and outflows shown on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

At the beginning of 2016,Howard Co.paid cash to purchase equipment costing $80,000.There was $10,000 of depreciation expense recognized during the accounting period.Show the combined effects of the events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

Give an example of a noncash financing and investing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

Howard Co.declared and paid a $1.50 per share cash dividend on the 20,000 shares of its common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

On December 31,2016,Howard Corporation recorded the expiration of $4,000 of insurance that was previously recorded as an asset.Show the effects of this transaction on Howard's income statement and statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the following to answer questions

The Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9%.The note was issued to the Galaxy Bank on August 1,2016.

-The amount of cash flow from financing activities on the December 31,2016 statement of cash flows would be:

A)$0.

B)$80,000 inflow.

C)$83,000 inflow.

D)($87,200)outflow.

The Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9%.The note was issued to the Galaxy Bank on August 1,2016.

-The amount of cash flow from financing activities on the December 31,2016 statement of cash flows would be:

A)$0.

B)$80,000 inflow.

C)$83,000 inflow.

D)($87,200)outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

Describe where on the Statement of Cash Flows one would find a noncash purchase of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the following to answer questions

The Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9%.The note was issued to the Galaxy Bank on August 1,2016.

-The amount of interest expense and total cash outflows related to the note shown on the December 31,2017 financial statements would be:

The Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9%.The note was issued to the Galaxy Bank on August 1,2016.

-The amount of interest expense and total cash outflows related to the note shown on the December 31,2017 financial statements would be:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

Can a company have a negative cash flow from operating activities for the year but still have a net income on the income statement? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

Use the following to answer questions

The Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9%.The note was issued to the Galaxy Bank on August 1,2016.

-The amount of interest expense and cash outflow shown on the December 31,2016 financial statements would be:

The Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9%.The note was issued to the Galaxy Bank on August 1,2016.

-The amount of interest expense and cash outflow shown on the December 31,2016 financial statements would be:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

Interest expense and interest paid are shown as:

A)an operating item on the income statement and an investing activity on the statement of cash flows.

B)an operating activity on the statement of cash flows and a non-operating item on the income statement.

C)an operating item on the income statement and a financing activity on the statement of cash flows.

D)a financing activity on the cash statement and an operating item on the income statement.

A)an operating item on the income statement and an investing activity on the statement of cash flows.

B)an operating activity on the statement of cash flows and a non-operating item on the income statement.

C)an operating item on the income statement and a financing activity on the statement of cash flows.

D)a financing activity on the cash statement and an operating item on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

What are the two methods used to prepare the operating activities section of the statement of cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

A cash purchase of land would appear in which of the following sections of the statement of cash flows?

A)Cash outflow from financing activities.

B)Cash inflow and cash outflow in a separate schedule of noncash investing and financing activities.

C)Cash outflow from investing activities.

D)Cash inflow from operating activities.

A)Cash outflow from financing activities.

B)Cash inflow and cash outflow in a separate schedule of noncash investing and financing activities.

C)Cash outflow from investing activities.

D)Cash inflow from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

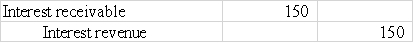

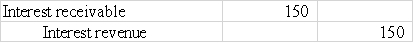

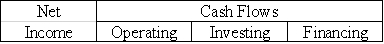

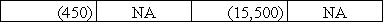

What effect does the following journal entry have on the amount of cash generated by operating activities?

A)Decreases it

B)Increases it

C)Has no effect

D)Cannot be determined from the information given

A)Decreases it

B)Increases it

C)Has no effect

D)Cannot be determined from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the following to answer questions

During 2016 the El Paso Company had the following changes in account balances:

1)The Accumulated Depreciation account had a beginning balance of $25,000 and an ending balance of $35,000.The increase was due to depreciation expense.

2)The Long-Term Notes Payable account had a beginning balance of $40,000 and an ending balance of $15,000.The decrease was due to repayment of debt.

3)The Equipment Account had a beginning balance of $25,000 and an ending balance of $92,500.The increase was due to the purchase of other operational assets.

4)The Long Term Investments Account (Marketable Securities)had a beginning balance of $18,000 and an ending balance of $12,500.The decrease was due to the sale of investments at cost.

5)The Dividends Payable account had a beginning balance of $12,000 and an ending balance of $10,000.There were $20,000 of dividends declared during the period.

6)The Interest Payable account had a beginning balance of $2,250 and an ending balance of $1,250.The difference was due to the payment of interest.

-What is the net cash flow from financing activities?

A)$22,000 inflow

B)$25,000 inflow

C)$25,000 outflow

D)$47,000 outflow

During 2016 the El Paso Company had the following changes in account balances:

1)The Accumulated Depreciation account had a beginning balance of $25,000 and an ending balance of $35,000.The increase was due to depreciation expense.

2)The Long-Term Notes Payable account had a beginning balance of $40,000 and an ending balance of $15,000.The decrease was due to repayment of debt.

3)The Equipment Account had a beginning balance of $25,000 and an ending balance of $92,500.The increase was due to the purchase of other operational assets.

4)The Long Term Investments Account (Marketable Securities)had a beginning balance of $18,000 and an ending balance of $12,500.The decrease was due to the sale of investments at cost.

5)The Dividends Payable account had a beginning balance of $12,000 and an ending balance of $10,000.There were $20,000 of dividends declared during the period.

6)The Interest Payable account had a beginning balance of $2,250 and an ending balance of $1,250.The difference was due to the payment of interest.

-What is the net cash flow from financing activities?

A)$22,000 inflow

B)$25,000 inflow

C)$25,000 outflow

D)$47,000 outflow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following to answer questions

During 2016 the El Paso Company had the following changes in account balances:

1)The Accumulated Depreciation account had a beginning balance of $25,000 and an ending balance of $35,000.The increase was due to depreciation expense.

2)The Long-Term Notes Payable account had a beginning balance of $40,000 and an ending balance of $15,000.The decrease was due to repayment of debt.

3)The Equipment Account had a beginning balance of $25,000 and an ending balance of $92,500.The increase was due to the purchase of other operational assets.

4)The Long Term Investments Account (Marketable Securities)had a beginning balance of $18,000 and an ending balance of $12,500.The decrease was due to the sale of investments at cost.

5)The Dividends Payable account had a beginning balance of $12,000 and an ending balance of $10,000.There were $20,000 of dividends declared during the period.

6)The Interest Payable account had a beginning balance of $2,250 and an ending balance of $1,250.The difference was due to the payment of interest.

-What is the net cash flow from investing activities?

A)$62,000 outflow

B)$62,000 inflow

C)$67,500 outflow

D)$73,000 outflow

During 2016 the El Paso Company had the following changes in account balances:

1)The Accumulated Depreciation account had a beginning balance of $25,000 and an ending balance of $35,000.The increase was due to depreciation expense.

2)The Long-Term Notes Payable account had a beginning balance of $40,000 and an ending balance of $15,000.The decrease was due to repayment of debt.

3)The Equipment Account had a beginning balance of $25,000 and an ending balance of $92,500.The increase was due to the purchase of other operational assets.

4)The Long Term Investments Account (Marketable Securities)had a beginning balance of $18,000 and an ending balance of $12,500.The decrease was due to the sale of investments at cost.

5)The Dividends Payable account had a beginning balance of $12,000 and an ending balance of $10,000.There were $20,000 of dividends declared during the period.

6)The Interest Payable account had a beginning balance of $2,250 and an ending balance of $1,250.The difference was due to the payment of interest.

-What is the net cash flow from investing activities?

A)$62,000 outflow

B)$62,000 inflow

C)$67,500 outflow

D)$73,000 outflow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

Why are financial analysts interested in the statement of cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

When the indirect method is used to prepare the operating activities section of the statement of cash flows,are increases in current liabilities added or subtracted from net income to arrive at the net cash flow?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

How is depreciation expense classified on the statement of cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

When the indirect method is used to prepare the operating activities section of the statement of cash flows,what is the starting point of that section?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

Cash receipts from interest on a note receivable would be classified on the statement of cash flows in the:

A)operating activity section.

B)investing activity section.

C)financing activity section.

D)noncash financing and investing section.

A)operating activity section.

B)investing activity section.

C)financing activity section.

D)noncash financing and investing section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

How can cash flow from operating activities be greater than net income from operations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

A mortgage issued in exchange for a building would be reported on the statement of cash flows in the

A)financing activity section.

B)investing activity section.

C)operating activity section.

D)noncash financing and investing section.

A)financing activity section.

B)investing activity section.

C)operating activity section.

D)noncash financing and investing section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following would not be a cash flow from financing activities?

A)Borrowing on a long-term note payable

B)Repayment of principal on bonds payable

C)Payment of interest on bonds payable

D)Payment of a cash dividend

A)Borrowing on a long-term note payable

B)Repayment of principal on bonds payable

C)Payment of interest on bonds payable

D)Payment of a cash dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

Valdez Co.sold land that had cost $48,000 for $60,000 cash.

A)The $12,000 gain would be subtracted from net income in the operating activities section using the indirect method.

B)$48,000 would appear as a cash inflow from investing activities and $12,000 would be added in the operating activities section using the indirect method.

C)$60,000 would appear as a cash inflow from investing activities.

D)The $12,000 gain would be subtracted from net income in the operating activities section using the indirect method and $60,000 would appear as a cash inflow from investing activities.

A)The $12,000 gain would be subtracted from net income in the operating activities section using the indirect method.

B)$48,000 would appear as a cash inflow from investing activities and $12,000 would be added in the operating activities section using the indirect method.

C)$60,000 would appear as a cash inflow from investing activities.

D)The $12,000 gain would be subtracted from net income in the operating activities section using the indirect method and $60,000 would appear as a cash inflow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which method of reporting cash flows from operating activities is used by most businesses in preparing the statement of cash flows?

A)Accrual method

B)Direct method

C)Indirect method

D)Computational method

A)Accrual method

B)Direct method

C)Indirect method

D)Computational method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

When using the indirect method to complete the cash flows from operating activities section of the statement of cash flows,what is the proper disposition of depreciation expense?

A)Subtract depreciation from net income.

B)Add depreciation to net income.

C)Disregard depreciation because it relates to an investing activity.

D)Disregard depreciation because it is a noncash expense.

A)Subtract depreciation from net income.

B)Add depreciation to net income.

C)Disregard depreciation because it relates to an investing activity.

D)Disregard depreciation because it is a noncash expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is the correct sequence for the major components of the Statement of Cash Flows?

A)Operating,Investing,Financing.

B)Investing,Operating,Financing.

C)Operating,Financing,Investing.

D)Financing,Investing,Operating.

A)Operating,Investing,Financing.

B)Investing,Operating,Financing.

C)Operating,Financing,Investing.

D)Financing,Investing,Operating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

During the 2016 accounting period the Mallard Company earned $165,000 of sales revenue on account and accrued $122,500 of operating expenses.The company also earned $26,400 of service revenue that had previously been recorded as unearned revenue.In addition,a $2,200 stock dividend was issued to the stockholders.What can be said about cash flows considering these transactions?

A)Cash outflows from financing activities are $2,200.

B)Cash inflows from operating activities are $68,900.

C)Cash inflows from operating activities are $42,500.

D)There are no cash effects.

A)Cash outflows from financing activities are $2,200.

B)Cash inflows from operating activities are $68,900.

C)Cash inflows from operating activities are $42,500.

D)There are no cash effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

On September 1,2016,the Laredo Company purchased equipment making a down payment of $15,500 cash and signing a one-year note payable on the $22,500 balance.The note carried an interest rate of 6%,and all interest was to be paid on the maturity date.Which of the following correctly shows the combined effect of the purchase as well as the accrual of interest on December 31,2016?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

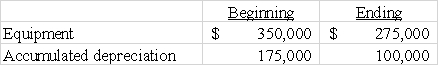

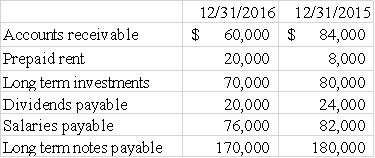

The following beginning and ending balances were drawn from the records of Allen Co.

If Allen Co.sold equipment that had an original cost of $175,000 and accumulated depreciation of $75,000 for $62,500,how much did Allen pay for new equipment?

A)$12,500.

B)$25,000.

C)$100,000.

D)$250,000.

If Allen Co.sold equipment that had an original cost of $175,000 and accumulated depreciation of $75,000 for $62,500,how much did Allen pay for new equipment?

A)$12,500.

B)$25,000.

C)$100,000.

D)$250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

On the statement of cash flows,the sum of the three major components (operating activities,investing activities,financing activities)adds up to

A)net income for the period.

B)the change in the cash account balance between the beginning and ending of the period.

C)the ending cash balance.

D)the amount of cash inflow for the period.

A)net income for the period.

B)the change in the cash account balance between the beginning and ending of the period.

C)the ending cash balance.

D)the amount of cash inflow for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

On January 1,2016,the Colgate Corporation decided to switch from the direct method to the indirect method of preparing the statement of cash flows.Assuming a positive net income figure but a decrease in the cash balance,what can be said about the change in method of preparing the statement?

A)The direct method will yield a larger amount for cash flows from operating activities.

B)The only difference will be in the cash flows from financing activities section.

C)The indirect method will yield a larger amount for cash flows from operating activities.

D)There will be no difference in the totals on the statement of cash flows.

A)The direct method will yield a larger amount for cash flows from operating activities.

B)The only difference will be in the cash flows from financing activities section.

C)The indirect method will yield a larger amount for cash flows from operating activities.

D)There will be no difference in the totals on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following transactions affects cash flows?

A)Accrual of interest receivable

B)Issuance of a stock dividend

C)Recognition of depreciation expense

D)Payment of dividends declared in a previous year

A)Accrual of interest receivable

B)Issuance of a stock dividend

C)Recognition of depreciation expense

D)Payment of dividends declared in a previous year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

On January 1,2016,the Chisolm Company purchased equipment for $36,000 cash.On December 31,2016,depreciation of $9,000 was recorded.Which of the following correctly shows the combined effect of these two events on the income statement and statement of cash flows? Chisolm uses the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

The 2016 income statement of Phillips Co.reported total sales revenue of $460,000;the 2015 balance sheet showed a balance in accounts receivable of $70,000 while the 2016 balance sheet showed a balance in accounts receivable of $100,000.The amount of cash collected from customers was:

A)$530,000.

B)$460,000.

C)$490,000.

D)$430,000.

A)$530,000.

B)$460,000.

C)$490,000.

D)$430,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

When using the indirect method to complete the cash flows from operating activities section of the statement of cash flows,what is the proper disposition of a loss on disposal of equipment?

A)Disregard the loss because it relates to an investing activity.

B)Disregard the loss because it relates to a financing activity.

C)Add the loss to net income.

D)Subtract the loss from net income.

A)Disregard the loss because it relates to an investing activity.

B)Disregard the loss because it relates to a financing activity.

C)Add the loss to net income.

D)Subtract the loss from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

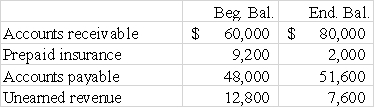

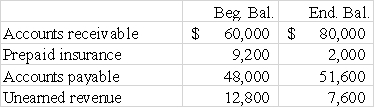

Use the following to answer questions

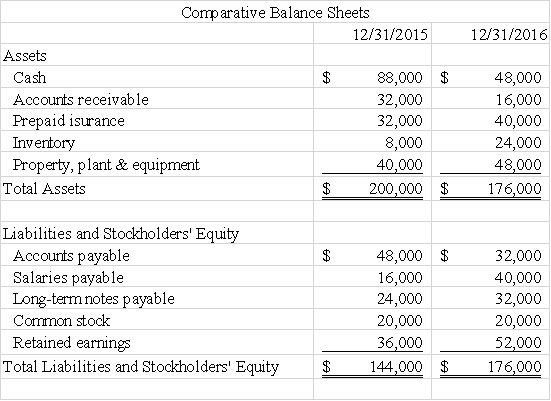

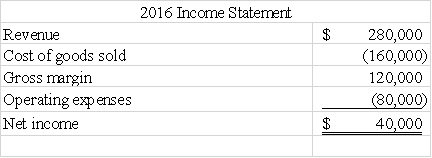

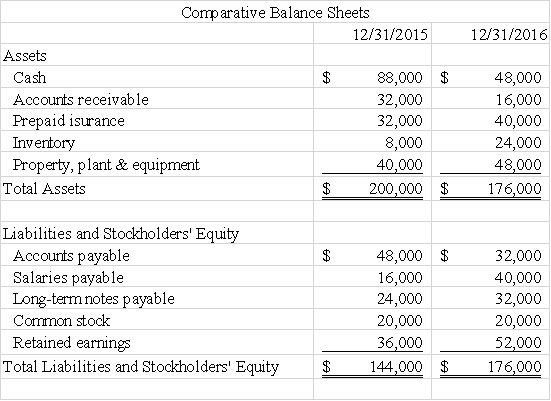

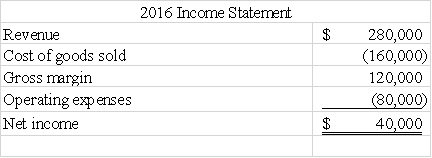

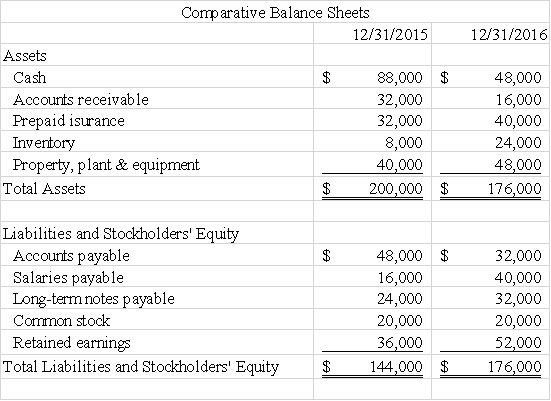

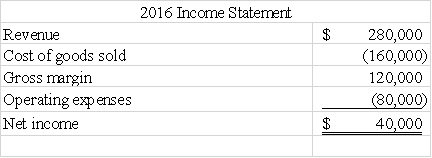

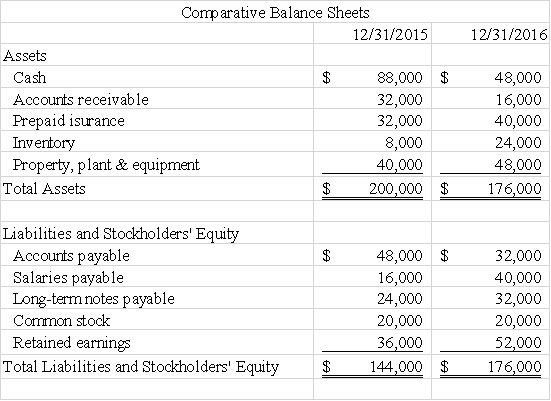

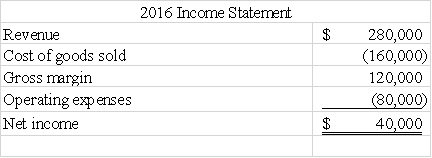

Erie Company reports the following comparative balance sheets and income statement information.

-The amount of cash revenue received from customers during 2016 was:

A)$296,000.

B)$264,000.

C)$280,000.

D)$248,000.

Erie Company reports the following comparative balance sheets and income statement information.

-The amount of cash revenue received from customers during 2016 was:

A)$296,000.

B)$264,000.

C)$280,000.

D)$248,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

When using the indirect method to prepare the statement of cash flows,a decrease in current liabilities is:

A)subtracted from current liabilities in the cash flows from financing activities section.

B)subtracted from current assets in the cash flows from financing activities section.

C)added to net income in the cash flows from operating activities section.

D)added to inventory purchases in the cash flows from investing activities section.

A)subtracted from current liabilities in the cash flows from financing activities section.

B)subtracted from current assets in the cash flows from financing activities section.

C)added to net income in the cash flows from operating activities section.

D)added to inventory purchases in the cash flows from investing activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following items would be used to compute "Net Cash Flow from Investing Activities" on a Statement of Cash Flows?

1)issue common stock

2)payment on principal of note payable

3)depreciation expense

4)sale of equipment for cash

A)1 and 4

B)4 only

C)3 only

D)1,2,3,and 4

1)issue common stock

2)payment on principal of note payable

3)depreciation expense

4)sale of equipment for cash

A)1 and 4

B)4 only

C)3 only

D)1,2,3,and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the following to answer questions

Erie Company reports the following comparative balance sheets and income statement information.

-Assuming accounts payable is used for inventory purchases only,the amount of cash paid for inventory purchases during 2016 was:

A)$32,000.

B)$176,000.

C)$192,000.

D)$160,000.

Erie Company reports the following comparative balance sheets and income statement information.

-Assuming accounts payable is used for inventory purchases only,the amount of cash paid for inventory purchases during 2016 was:

A)$32,000.

B)$176,000.

C)$192,000.

D)$160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following transactions is a use of cash?

A)Short-term borrowing of cash.

B)Acquisition of land by issuing a short-term note payable.

C)Issuance of a stock dividend.

D)Purchase of treasury stock.

A)Short-term borrowing of cash.

B)Acquisition of land by issuing a short-term note payable.

C)Issuance of a stock dividend.

D)Purchase of treasury stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

Ervin Company began the accounting period with $64,000 in accounts receivable.The ending balance in accounts receivable was $40,000.If the credit sales during the period were $588,000,what is the amount of cash received from customers?

A)$564,000

B)$612,000

C)$24,000

D)$548,000

A)$564,000

B)$612,000

C)$24,000

D)$548,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

When using the indirect method to prepare the statement of cash flows,an increase in noncash current assets is

A)subtracted from net income in the cash flows from operating activities section.

B)subtracted from current liabilities in the cash flows from financing activities section.

C)added to net income in the cash flows from operating activities section.

D)added to equipment purchases in the cash flows from investing activities section.

A)subtracted from net income in the cash flows from operating activities section.

B)subtracted from current liabilities in the cash flows from financing activities section.

C)added to net income in the cash flows from operating activities section.

D)added to equipment purchases in the cash flows from investing activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

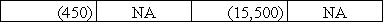

On January 1,2016,Mayer Corporation signed a contract to perform $25,000 worth of services for the Phibbs Company over the next three years.Which of the following indicates the effects of this event on the income statement and statement of cash flows of Mayer Corporation?

D)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following cash transactions would not be shown under operating activities?

A)Cash paid for interest

B)Cash paid for dividends

C)Cash received from dividends

D)All of these answer choices would not be shown under operating activities

A)Cash paid for interest

B)Cash paid for dividends

C)Cash received from dividends

D)All of these answer choices would not be shown under operating activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Baird Company reported depreciation expense of $10,000 and net income of $16,000 on its 2016 income statement.During 2016 the company's accounts receivable balance decreased by $4,000.Based on this information alone,what was the amount of cash flow from operating activities?

A)$12,000.

B)$16,000.

C)$32,000.

D)$30,000.

A)$12,000.

B)$16,000.

C)$32,000.

D)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

Hilliard Company,a small consulting firm,charges all of its operating expenses on Accounts Payable.On January 1,2016,Hilliard's Accounts Payable balance was $24,000 and,during the year,an additional $216,000 of operating expenses was charged on account.The ending Accounts Payable balance was $72,000.What is the amount of cash paid for expenses during 2016?

A)$264,000

B)$240,000

C)$168,000

D)$64,000

A)$264,000

B)$240,000

C)$168,000

D)$64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

Warren Corporation's balance sheet reports equipment that originally cost $65,000.The accumulated depreciation for the equipment is $25,000.Warren sells the equipment for $37,000.What would the effect be on its income statement and statement of cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

Under the indirect method,which of the following items would be added to net income to determine the cash flow from operating activities?

A)Gain on the sale of equipment.

B)Depreciation expense.

C)Accrued interest receivable.

D)Decrease in the balance of accounts payable.

A)Gain on the sale of equipment.

B)Depreciation expense.

C)Accrued interest receivable.

D)Decrease in the balance of accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

When preparing a statement of cash flows,in which section is it permitted to use either the direct method or the indirect method?

A)Operating activities

B)Investing activities

C)Financing activities

D)All of these answer choices are correct

A)Operating activities

B)Investing activities

C)Financing activities

D)All of these answer choices are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

Grace Company sold equipment for $40,000 cash.The equipment has cost $70,000 and had accumulated depreciation of $44,000 at the time of the sale.Based on this information alone,select the true statement.

A)Cash flow from investing activities would be less if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

B)Cash flow from investing activities would be greater if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

C)Cash flow from investing activities would be the same regardless of whether the sale of equipment is reported on the statement of cash flows under the direct method or the indirect method.

D)The answer cannot be determined because the amount of the salvage value is unknown.

A)Cash flow from investing activities would be less if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

B)Cash flow from investing activities would be greater if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

C)Cash flow from investing activities would be the same regardless of whether the sale of equipment is reported on the statement of cash flows under the direct method or the indirect method.

D)The answer cannot be determined because the amount of the salvage value is unknown.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is a correct statement of one of the rules for converting net income to the cash flow from operating activities using the indirect method?

A)All noncash expenses and losses are subtracted from net income.

B)Increases in current liabilities are added to net income.

C)Increases in current assets are added to net income.

D)Decreases in current assets are subtracted from net income.

A)All noncash expenses and losses are subtracted from net income.

B)Increases in current liabilities are added to net income.

C)Increases in current assets are added to net income.

D)Decreases in current assets are subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

On January 1,2016,the balance of Jacobs Corporation's Accounts Receivable was $40,000.Sales on account for 2016 amounted to $320,000 and the ending balance of Accounts Receivable was $64,000.What is the amount of cash collected from customers?

A)$296,000

B)$256,000

C)$344,000

D)$360,000

A)$296,000

B)$256,000

C)$344,000

D)$360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following would not be presented in the financing section of the statement of cash flows?

A)Purchased a new office building by issuing a note payable.

B)Purchased treasury stock.

C)Repayment of long-term bonds payable.

D)Issuing of preferred stock.

A)Purchased a new office building by issuing a note payable.

B)Purchased treasury stock.

C)Repayment of long-term bonds payable.

D)Issuing of preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements best explains the correct handling of depreciation on the statement of cash flows when using the indirect method?

A)Depreciation expense is a noncash expense that is added to net income to derive cash flows from operating activities.

B)Depreciation is subtracted in the cash flows from investing activities section because it reduces the book value of the corresponding plant asset.

C)Depreciation is subtracted from net income because it causes a loss when the related plant asset is sold.

D)Depreciation adds to the company's Cash account to help pay for new equipment.

A)Depreciation expense is a noncash expense that is added to net income to derive cash flows from operating activities.

B)Depreciation is subtracted in the cash flows from investing activities section because it reduces the book value of the corresponding plant asset.

C)Depreciation is subtracted from net income because it causes a loss when the related plant asset is sold.

D)Depreciation adds to the company's Cash account to help pay for new equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

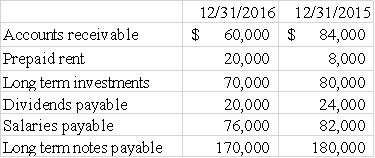

The following information is for Cleveland Company:

Additional data for 2016:

(1)Sales on account for the period were $80,000.

(2)Operating expenses for the period were $52,000.

Based on this limited information,what was the net cash inflow from operations?

A)$18,000.

B)$22,000.

C)$28,000.

D)$34,000.

Additional data for 2016:

(1)Sales on account for the period were $80,000.

(2)Operating expenses for the period were $52,000.

Based on this limited information,what was the net cash inflow from operations?

A)$18,000.

B)$22,000.

C)$28,000.

D)$34,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

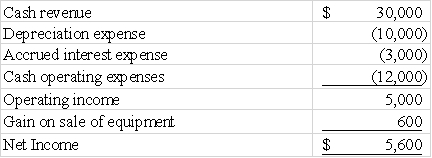

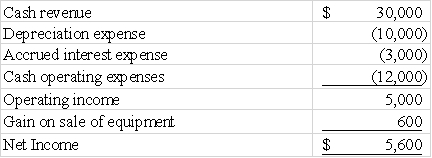

The following income statement was drawn from the annual report of Newtown Company:

The amount of cash flow from operating activities is

A)$18,000

B)$18,600

C)$13,000

D)$14,400

The amount of cash flow from operating activities is

A)$18,000

B)$18,600

C)$13,000

D)$14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is an incorrect statement of one of the rules for converting net income to the cash flow from operating activities using the indirect method?

A)Increases in current assets are subtracted from net income.

B)Decreases in current assets are added to net income.

C)Noncash revenue and gains are added to net income.

D)Increases in current liabilities are added to net income.

A)Increases in current assets are subtracted from net income.

B)Decreases in current assets are added to net income.

C)Noncash revenue and gains are added to net income.

D)Increases in current liabilities are added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

For the year ended December 31,2016,Fields Company made cash payments of $50,000 for dividends,paid interest of $20,500,paid $30,000 cash to suppliers,and purchased equipment for $64,000 cash.The amount of cash used by investing activities for 2016 is:

A)$114,000.

B)$64,000.

C)$20,500.

D)$134,500.

A)$114,000.

B)$64,000.

C)$20,500.

D)$134,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

Chisholm Associates uses the indirect method for preparing the statement of cash flows.The following accounts and balances were drawn from the company's accounting records:

Net income for the period was $80,000.The net cash flows from operating activities would be:

A)$70,400.

B)$65,600.

C)$76,000.

D)$94,400.

Net income for the period was $80,000.The net cash flows from operating activities would be:

A)$70,400.

B)$65,600.

C)$76,000.

D)$94,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following transactions would be disclosed on a schedule of noncash investing and financing activities?

A)A mortgage liability accepted in exchange for title to a building.

B)Writing off an uncollectible account receivable.

C)The issuance of bonds for cash.

D)A mortgage liability accepted in exchange for title to a building and also writing off an uncollectible account receivable.

A)A mortgage liability accepted in exchange for title to a building.

B)Writing off an uncollectible account receivable.

C)The issuance of bonds for cash.

D)A mortgage liability accepted in exchange for title to a building and also writing off an uncollectible account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

If cash from operations was $48,000,cash used for investing activities was ($88,000)and the net change in cash was $96,000,what was cash from/used for financing activities?

A)($144,000)

B)$48,000

C)$136,000

D)$96,000

A)($144,000)

B)$48,000

C)$136,000

D)$96,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

The only difference between the direct and indirect methods of preparing the statement of cash flows is the manner in which the

A)cash flows from operating activities is presented.

B)cash flows from investing activities is presented.

C)cash flows from financing activities is presented.

D)the schedule of noncash items is presented.

A)cash flows from operating activities is presented.

B)cash flows from investing activities is presented.

C)cash flows from financing activities is presented.

D)the schedule of noncash items is presented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

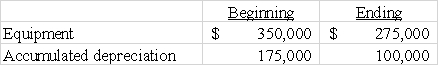

80

The Belvedere Corporation had a balance in its Equipment account on January 1,2016 of $320,000.During the year,equipment originally costing $85,000 and having Accumulated Depreciation of $20,000 was sold for $67,000.The ending balance of the Equipment Account was $275,000.How much did the company spend to purchase additional equipment during 2016?

A)$40,000

B)$25,000

C)$90,000

D)$92,000

A)$40,000

B)$25,000

C)$90,000

D)$92,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck