Deck 8: Accounting for Long-Term Operational Assets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/157

العب

ملء الشاشة (f)

Deck 8: Accounting for Long-Term Operational Assets

1

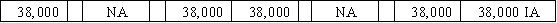

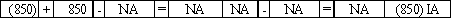

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

Shelton Robotics Company amortized $30,400 of patent cost.How does this entry affect Shelton's financial statements?

Shelton Robotics Company amortized $30,400 of patent cost.How does this entry affect Shelton's financial statements?

(D)(N)(D)(N)(I)(D)(N)

2

What is meant by a "basket purchase," and what method is normally used to determine the cost of individual assets?

A basket purchase is the acquisition of several assets in a single transaction at a single price.The cost of the individual assets is normally determined by the relative fair value method,using the appraised values of the various assets.

3

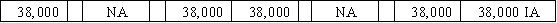

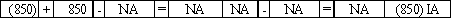

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

The Greer Company purchased equipment on account on January 1,2016.Show how the purchase affected the financial statements of 2016.

The Greer Company purchased equipment on account on January 1,2016.Show how the purchase affected the financial statements of 2016.

(I)(I)(N)(N)(N)(N)(N)

4

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

On May 16,2016,Zirkle Corporation found it necessary to recognize an impairment loss of $50,000 of goodwill.The goodwill was originally recorded two years earlier in connection with the acquisition of another company.Show how the impairment loss affected the financial statements in 2016.

On May 16,2016,Zirkle Corporation found it necessary to recognize an impairment loss of $50,000 of goodwill.The goodwill was originally recorded two years earlier in connection with the acquisition of another company.Show how the impairment loss affected the financial statements in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

5

Name three examples of property,plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

6

Give an example of an intangible asset with an identifiable useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

7

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

Gulfshore Oil Company recognized $2,000,000 of depletion expense related to an oil reserve.How does this entry affect Gulfshore's financial statements?

Gulfshore Oil Company recognized $2,000,000 of depletion expense related to an oil reserve.How does this entry affect Gulfshore's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

8

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

The Jenkins Company purchased equipment for $25,000 on January 1,2016.The equipment had an estimated useful life of four years and an estimated salvage value of $5,000.At the beginning of 2018,the equipment was sold for $8,000.Show how the sale affected the financial statements for 2018,assuming Jenkins uses straight-line depreciation.

The Jenkins Company purchased equipment for $25,000 on January 1,2016.The equipment had an estimated useful life of four years and an estimated salvage value of $5,000.At the beginning of 2018,the equipment was sold for $8,000.Show how the sale affected the financial statements for 2018,assuming Jenkins uses straight-line depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

9

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

The Benitez Company purchased an asset for $50,000 on January 1,2016.The asset had a zero salvage value and an 8-year estimated useful life.On January 1,2018,the company spent $2,400 cash on routine repairs and maintenance.What effect will the 2018 expenditure have on the company's financial statements?

The Benitez Company purchased an asset for $50,000 on January 1,2016.The asset had a zero salvage value and an 8-year estimated useful life.On January 1,2018,the company spent $2,400 cash on routine repairs and maintenance.What effect will the 2018 expenditure have on the company's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

10

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

The Baltimore Company acquired the Chesapeake Company for $650,000 cash.Chesapeake's assets had been appraised at $660,000.At the time of sale Chesapeake's accounting records showed total assets of $590,000,liabilities of $180,000 and equity of $410,000.How would the purchase affect Baltimore's financial statements?

The Baltimore Company acquired the Chesapeake Company for $650,000 cash.Chesapeake's assets had been appraised at $660,000.At the time of sale Chesapeake's accounting records showed total assets of $590,000,liabilities of $180,000 and equity of $410,000.How would the purchase affect Baltimore's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

11

What type of account is Accumulated Depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

12

Explain how the gain or loss is computed on the sale of a piece of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

13

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

The Boothe Company paid $9,000 to extend the useful life of one of its assets.How will this expenditure affect Boothe's financial statements?

The Boothe Company paid $9,000 to extend the useful life of one of its assets.How will this expenditure affect Boothe's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

14

Why is land classified separately from other tangible long-term assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

15

Give an example of a type of industry in which a company can be very successful with a relatively small amount of operational assets.Give an example of a type of industry that requires a very large amount of operational assets in order to be successful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

16

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

The Baker Company purchased an asset on January 1,2016 for $200,000.The asset had a $50,000 salvage value and a 10 year life.The asset was sold on January 1,2018 for $174,000.Show how the sale will affect Baker's financial statements,assuming that Baker uses straight-line depreciation.

The Baker Company purchased an asset on January 1,2016 for $200,000.The asset had a $50,000 salvage value and a 10 year life.The asset was sold on January 1,2018 for $174,000.Show how the sale will affect Baker's financial statements,assuming that Baker uses straight-line depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

17

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

The Fisher Company paid $28,000 to improve the quality of a manufacturing machine.How will this expenditure affect Fisher's financial statements?

The Fisher Company paid $28,000 to improve the quality of a manufacturing machine.How will this expenditure affect Fisher's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

18

What items are included in the cost of a newly purchased building?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

19

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

Belvedere Company recognized $2,500 of depreciation expense on a delivery van.

Belvedere Company recognized $2,500 of depreciation expense on a delivery van.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which method of depreciation generally allocates the largest amount of depreciation to the first year of the asset's life?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

21

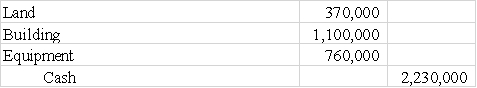

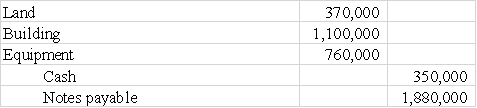

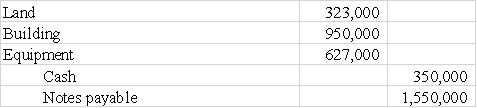

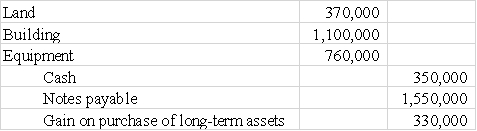

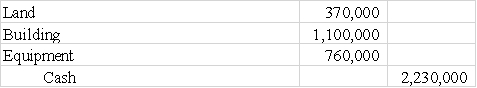

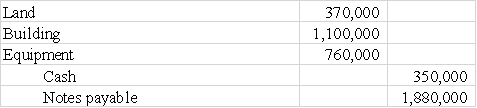

Use the following to answer questions

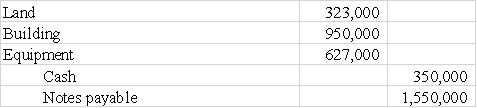

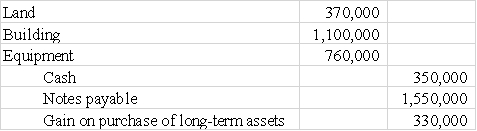

Harding Corporation acquired real estate that contained land,building and equipment.The property cost Harding $1,900,000.Harding paid $350,000 and issued a note payable for the remainder of the cost.An appraisal of the property reported the following values: Land,$374,000;Building,$1,100,000 and Equipment,$726,000.

-What journal entry would be used to record the purchase of the above assets?

Harding Corporation acquired real estate that contained land,building and equipment.The property cost Harding $1,900,000.Harding paid $350,000 and issued a note payable for the remainder of the cost.An appraisal of the property reported the following values: Land,$374,000;Building,$1,100,000 and Equipment,$726,000.

-What journal entry would be used to record the purchase of the above assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would be classified as a tangible asset?

A)Land.

B)Goodwill.

C)Copyright.

D)Trademark.

A)Land.

B)Goodwill.

C)Copyright.

D)Trademark.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

23

What term is used for the process of expense allocation of natural resources?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

24

For what types of assets is the recognition of expense called "amortization?"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

25

Explain how a choice of depreciation methods will have an impact on financial performance measures.Give one example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

26

Explain the meaning of "impairment" as used in accounting for goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

27

Describe what is meant by the term "goodwill."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following intangible assets does not convey a specific legal right or privilege?

A)Copyrights

B)Franchises

C)Goodwill

D)Trademarks

A)Copyrights

B)Franchises

C)Goodwill

D)Trademarks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would not be classified as a tangible long-term asset?

A)Delivery truck

B)Timber reserve

C)Land

D)Copyright

A)Delivery truck

B)Timber reserve

C)Land

D)Copyright

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

30

Explain how a business using the straight-line method would re-compute depreciation after revising the useful life estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not classified as property,plant and equipment?

A)Computers

B)Buildings

C)Land

D)Office furniture

A)Computers

B)Buildings

C)Land

D)Office furniture

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

32

What is the name of the tax rule that requires six months of depreciation expense to be taken in the year of purchase of the asset and the year of disposal regardless of the purchase date?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a business chooses to use the straight-line method for tax purposes,how will this affect income tax in the first year of an asset's life,compared to MACRS?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the following to answer questions

Harding Corporation acquired real estate that contained land,building and equipment.The property cost Harding $1,900,000.Harding paid $350,000 and issued a note payable for the remainder of the cost.An appraisal of the property reported the following values: Land,$374,000;Building,$1,100,000 and Equipment,$726,000.

-What value will be recorded for the building?

A)$175,000

B)$950,000

C)$800,000

D)$1,100,000

Harding Corporation acquired real estate that contained land,building and equipment.The property cost Harding $1,900,000.Harding paid $350,000 and issued a note payable for the remainder of the cost.An appraisal of the property reported the following values: Land,$374,000;Building,$1,100,000 and Equipment,$726,000.

-What value will be recorded for the building?

A)$175,000

B)$950,000

C)$800,000

D)$1,100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following would be classified as a long-term operational asset?

A)Notes receivable.

B)Trademark.

C)Inventory.

D)Accounts receivable.

A)Notes receivable.

B)Trademark.

C)Inventory.

D)Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

36

Why do some say that the GAAP treatment of research and development puts the US at a competitive disadvantage compared to businesses in other countries?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following terms is used to identify the process of expense recognition for property,plant and equipment?

A)Amortization

B)Depreciation

C)Depletion

D)Revision

A)Amortization

B)Depreciation

C)Depletion

D)Revision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

38

State the reason that goodwill is not amortized as some other intangible assets are.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

39

What account is debited to record an expenditure that extends the life of a plant asset such as equipment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

40

Explain the meaning of the terms "tangible" and "intangible" and discuss how these terms are used in describing assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

41

Emir Company purchased equipment that cost $110,000 cash on January 1,2015.The equipment had an expected useful life of six years and an estimated salvage value of $8,000.Assuming that Emir depreciates its assets under the straight-line method,the amount of depreciation expense appearing on the 2018 income statement and the amount of accumulated depreciation appearing on the December 31,2018 balance sheet would be:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the following to answer questions

Jing Company was started on January 1,2016 when it issued common stock for $50,000 cash.Also,on January 1,2016 the company purchased office equipment that cost $34,000 cash.The equipment was delivered under terms FOB shipping point,and transportation cost was $2,000.The equipment had a five-year useful life and a $12,000 expected salvage value.

-Assume that Jing Company earned $30,000 cash revenue and incurred $19,000 in cash expenses in 2018.Using straight-line depreciation and assuming that the office equipment was sold on December 31,2018 for $16,000,the amount of net income or (loss)appearing on the December 31,2018 income statement would be:

A)($6,600).

B)$6,600.

C)$600.

D)$5,400.

Jing Company was started on January 1,2016 when it issued common stock for $50,000 cash.Also,on January 1,2016 the company purchased office equipment that cost $34,000 cash.The equipment was delivered under terms FOB shipping point,and transportation cost was $2,000.The equipment had a five-year useful life and a $12,000 expected salvage value.

-Assume that Jing Company earned $30,000 cash revenue and incurred $19,000 in cash expenses in 2018.Using straight-line depreciation and assuming that the office equipment was sold on December 31,2018 for $16,000,the amount of net income or (loss)appearing on the December 31,2018 income statement would be:

A)($6,600).

B)$6,600.

C)$600.

D)$5,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

43

On January 1,2016 Missouri Co.purchased a truck that cost $57,000.The truck had an expected useful life of 10 years and a $6,000 salvage value.The amount of depreciation expense recognized in 2017 assuming that Missouri uses the double declining-balance method is:

A)$9,120.

B)$11,400.

C)$10,200.

D)$8,160.

A)$9,120.

B)$11,400.

C)$10,200.

D)$8,160.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

44

Anchor Company purchased a manufacturing machine with a list price of $160,000 and received a 2% cash discount on the purchase.The machine was delivered under terms FOB shipping point,and freight costs amounted to $2,400.Anchor paid $3,000 to have the machine installed and tested.Insurance costs to protect the asset from fire and theft amounted to $3,600 for the first year of operations.Based on this information,the amount of cost recorded in the asset account would be:

A)$156.800.

B)$159,200.

C)$165,800.

D)$162,200.

A)$156.800.

B)$159,200.

C)$165,800.

D)$162,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

45

Chubb Company paid cash to purchase equipment on January 1,2016.Select the answer that shows how the recognition of depreciation expense in 2017 would affect assets,liabilities,equity,net income,and cash flow (+ means increase,- decrease,and NA not affected).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following to answer questions

Harding Corporation acquired real estate that contained land,building and equipment.The property cost Harding $1,900,000.Harding paid $350,000 and issued a note payable for the remainder of the cost.An appraisal of the property reported the following values: Land,$374,000;Building,$1,100,000 and Equipment,$726,000.

-Assume that Harding uses the units of production method when depreciating its equipment.Harding estimates that the purchased equipment will produce 1,000,000 units over its 5-year useful life and has salvage value of $34,000.Harding produced 265,000 units with the equipment by the end of the first year of purchase.

Which amount below is closest to the amount Harding will record for depreciation expense for the equipment in the first year?

A)$193,450

B)$125,200

C)$157,145

D)$165,890

Harding Corporation acquired real estate that contained land,building and equipment.The property cost Harding $1,900,000.Harding paid $350,000 and issued a note payable for the remainder of the cost.An appraisal of the property reported the following values: Land,$374,000;Building,$1,100,000 and Equipment,$726,000.

-Assume that Harding uses the units of production method when depreciating its equipment.Harding estimates that the purchased equipment will produce 1,000,000 units over its 5-year useful life and has salvage value of $34,000.Harding produced 265,000 units with the equipment by the end of the first year of purchase.

Which amount below is closest to the amount Harding will record for depreciation expense for the equipment in the first year?

A)$193,450

B)$125,200

C)$157,145

D)$165,890

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

47

Laramie Co.paid $800,000 for a purchase that included land,building,and office furniture.An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Land,$100,000,Building,$740,000,and Office Furniture,$160,000.Based on this information the cost that would be allocated to the land is:

A)$80,000.

B)$70,000.

C)$100,000.

D)$107,000.

A)$80,000.

B)$70,000.

C)$100,000.

D)$107,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which method of depreciation is used by most U.S.companies for financial reporting purposes?

A)Straight line

B)Units of production

C)Double declining balance

D)MACRS

A)Straight line

B)Units of production

C)Double declining balance

D)MACRS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

49

On January 1,2016,Milton Manufacturing Company purchased equipment with a list price of $88,000.A total of $4,000 was paid for installation and testing.During the first year,Milton paid $6,000 for insurance on the equipment and another $2,200 for routine maintenance and repairs.Innovative uses the units-of-production method of depreciation.Useful life is estimated at 100,000 units,and estimated salvage value is $8,000.During 2016,the equipment produced 13,000 units.What is closest to the amount of depreciation for the year?

A)$10,920

B)$11,960

C)$11,700

D)$12,740

A)$10,920

B)$11,960

C)$11,700

D)$12,740

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the following to answer questions

Jing Company was started on January 1,2016 when it issued common stock for $50,000 cash.Also,on January 1,2016 the company purchased office equipment that cost $34,000 cash.The equipment was delivered under terms FOB shipping point,and transportation cost was $2,000.The equipment had a five-year useful life and a $12,000 expected salvage value.

-Using double-declining balance depreciation,determine the amount of depreciation expense and the amount of accumulated depreciation that would appear on the December 31,2018 financial statements.

A)$0/$24,000.

B)$960/$24,000.

C)$8,640/$23,040.

D)$5,184/$28,224.

Jing Company was started on January 1,2016 when it issued common stock for $50,000 cash.Also,on January 1,2016 the company purchased office equipment that cost $34,000 cash.The equipment was delivered under terms FOB shipping point,and transportation cost was $2,000.The equipment had a five-year useful life and a $12,000 expected salvage value.

-Using double-declining balance depreciation,determine the amount of depreciation expense and the amount of accumulated depreciation that would appear on the December 31,2018 financial statements.

A)$0/$24,000.

B)$960/$24,000.

C)$8,640/$23,040.

D)$5,184/$28,224.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

51

On January 1,2016,Friedman Company purchased a truck that cost $48,000.The truck had an expected useful life of 8 years and an $8,000 salvage value.The book value of the truck at the end of 2016,assuming that Friedman uses the double declining balance method,is:

A)$43,000.

B)$38,000.

C)$40,000.

D)$36,000.

A)$43,000.

B)$38,000.

C)$40,000.

D)$36,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

52

On March 1,Bartholomew Company purchased a new stamping machine with a list price of $34,000.The company paid cash for the machine;therefore,it was allowed a 5% discount.Other costs associated with the machine were: transportation costs,$550;sales tax paid,$1,360;installation costs,$450;routine maintenance during the first month of operation,$500.The cost recorded for the machine was:

A)$34,210.

B)$32,300.

C)$35,160.

D)$34,660.

A)$34,210.

B)$32,300.

C)$35,160.

D)$34,660.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

53

At the end of the current accounting period,Ringgold Co.recorded depreciation of $15,000 on its equipment.The effect of this entry on the company's balance sheet is to:

A)decrease assets and increase liabilities.

B)decrease owners' equity and decrease assets.

C)decrease assets and increase owners' equity.

D)decrease owners' equity and increase liabilities.

A)decrease assets and increase liabilities.

B)decrease owners' equity and decrease assets.

C)decrease assets and increase owners' equity.

D)decrease owners' equity and increase liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is considered an accelerated depreciation method?

A)Double declining balance

B)Units of production

C)MACRS

D)Both double-declining-balance and MACRS

A)Double declining balance

B)Units of production

C)MACRS

D)Both double-declining-balance and MACRS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

55

On January 1,2016,Phillips Company made a basket purchase including land,a building and equipment for $380,000.The appraised values of the assets are $20,000 for the land,$340,000 for the building and $40,000 for equipment.Phillips uses the double declining balance method of depreciation for the equipment which is estimated to have a useful life of four years and a salvage value of $5,000.The depreciation expense for 2016 for the equipment is:

A)$17,000.

B)$20,000.

C)$9,500.

D)$19,000.

A)$17,000.

B)$20,000.

C)$9,500.

D)$19,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 1,2016,Friedman Company purchased a truck that cost $48,000.The truck had an expected useful life of 100,000 miles over 8 years and an $8,000 salvage value.During 2017,Friedman drove the truck 18,500 miles.The amount of depreciation expense recognized in 2017 assuming that Friedman uses the units of production method is:

A)$8,880.

B)$7,400.

C)$6,000.

D)$5,000.

A)$8,880.

B)$7,400.

C)$6,000.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

57

Chico Company paid $950,000 for a basket purchase that included office furniture,a building and land.An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Office furniture - $190,000;Building - $740,000,Land - $132,000.Based on this information,and rounding allocations to two decimal places,the amount of cost that would be allocated to the office furniture is closest to:

A)$171,000.

B)$190,000.

C)$316,667.

D)$105,000.

A)$171,000.

B)$190,000.

C)$316,667.

D)$105,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

58

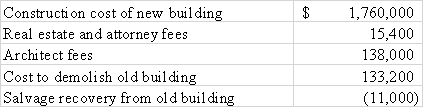

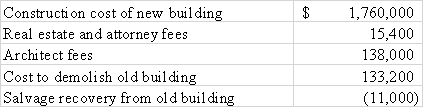

On January 6,2016,the Mount Jackson Corporation purchased a tract of land for a factory site for $1,500,000.An existing building on the site was demolished and the new factory was completed on October 11,2016.Additional cost data are shown below:

Which of the following correctly states the capitalized cost of the (a)land and (b)the new building?

A)$1,637,600/$1,898,000

B)$1,515,400/$2,020,200

C)$1,648,600/$1,887,000

D)$1,500,000/$2,035,600

Which of the following correctly states the capitalized cost of the (a)land and (b)the new building?

A)$1,637,600/$1,898,000

B)$1,515,400/$2,020,200

C)$1,648,600/$1,887,000

D)$1,500,000/$2,035,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

59

Flagler Company purchased equipment that cost $90,000.The equipment had a useful life of 5 years and a $10,000 salvage value.Flagler used the double-declining-balance method to depreciate its assets.Which of the following choices accurately reflects how the recognition of the first year's depreciation would affect the company's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

60

On January 1,2016 Dinwiddie Company purchased a car that cost $45,000.The car had an expected useful life of 6 years and a $10,000 salvage value.Based on this information alone:

A)The total amount of depreciation expense recognized over the six year useful life will be greater under the double declining balance method than the straight-line method.

B)The amount of depreciation expense recognized in 2019 would be greater if Dinwiddie depreciates the car under the straight-line method than if the double declining balance method is used.

C)At the end of 2018,the amount in accumulated depreciation account will be less if the double declining balance method is used than it would be if the straight-line method is used.

D)None of these statements is true.

A)The total amount of depreciation expense recognized over the six year useful life will be greater under the double declining balance method than the straight-line method.

B)The amount of depreciation expense recognized in 2019 would be greater if Dinwiddie depreciates the car under the straight-line method than if the double declining balance method is used.

C)At the end of 2018,the amount in accumulated depreciation account will be less if the double declining balance method is used than it would be if the straight-line method is used.

D)None of these statements is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

61

On September 10,2016,Farmer Company sold a piece of equipment for $6,000.The equipment had an original cost of $34,000 and accumulated depreciation of $31,000 at the time of the sale.Which of the following correctly shows the effect of the sale on the 2016 financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

62

A machine with a book value of $38,000 is sold for $32,000.Which of the following answers would accurately represent the effects of the sale on the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

63

On January 1,2016 Boothe Company paid $12,000 cash to extend the useful life of a machine.Which of the following general journal entries would be required to recognize this expenditure?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is true with regard to depreciation expense?

A)Different companies in the same industry always depreciate similar assets by the same methods.

B)A company using straight line will show a smaller book value for assets than if the same company uses double declining balance.

C)Choosing double declining balance over straight line will produce a greater total depreciation expense over the asset's life.

D)A company should use the depreciation method that best matches expense recognition with the use of the asset.

A)Different companies in the same industry always depreciate similar assets by the same methods.

B)A company using straight line will show a smaller book value for assets than if the same company uses double declining balance.

C)Choosing double declining balance over straight line will produce a greater total depreciation expense over the asset's life.

D)A company should use the depreciation method that best matches expense recognition with the use of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

65

Good Company paid cash to purchase mineral rights on a large parcel of land.Which of the following choices accurately reflects how this event would affect Good's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following statements is true concerning the modified accelerated cost recovery system (MACRS)for the recognition of depreciation expense,for tax purposes?

A)7-year property will be depreciated more rapidly than 10-year property under the MACRS depreciation method.

B)Under MACRS more depreciation will be recorded in the second accounting period than in the first accounting period because of the half-year convention.

C)MACRS is used for the determination of depreciation expense that is reported on an income tax return.

D)All of these answer choices are true.

A)7-year property will be depreciated more rapidly than 10-year property under the MACRS depreciation method.

B)Under MACRS more depreciation will be recorded in the second accounting period than in the first accounting period because of the half-year convention.

C)MACRS is used for the determination of depreciation expense that is reported on an income tax return.

D)All of these answer choices are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

67

On January 1,2016 Ballard Company spent $12,000 on an asset to improve its quality.The asset had been purchased on January 1,2015 for $52,000.The asset had a $4,000 salvage value and a 6-year life.Ballard uses straight-line depreciation.What would be the book value of the asset on January 1,2019?

A)$24,800.

B)$20,800.

C)$10,400.

D)$24,000.

A)$24,800.

B)$20,800.

C)$10,400.

D)$24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the following to answer questions

Farmer Company purchased equipment on January 1,2015 for $82,000.The machines are estimated to have a 5-year life and a salvage value of $4,000.The company uses the straight-line depreciation method.

-If the original expected life remained the same (i.e. ,5-years),but at the beginning of 2018,the salvage value was revised to $8,000,the annual depreciation expense for each of the remaining years would be:

A)$5,440.

B)$27,200.

C)$13,600.

D)$14,800.

Farmer Company purchased equipment on January 1,2015 for $82,000.The machines are estimated to have a 5-year life and a salvage value of $4,000.The company uses the straight-line depreciation method.

-If the original expected life remained the same (i.e. ,5-years),but at the beginning of 2018,the salvage value was revised to $8,000,the annual depreciation expense for each of the remaining years would be:

A)$5,440.

B)$27,200.

C)$13,600.

D)$14,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

69

Gillock,Inc.uses MACRS for its income tax returns and straight line depreciation for its financial statements.The company purchased 5 year property on January 1,2016 that cost $130,000 and has a $10,000 salvage value and an expected 8 year useful life.There is a depreciation percentage of 20% for the first year for 5-year property,for tax purposes.The company would show which of the following on its financial records?

A)less depreciation expense on the tax return than on the income statement.

B)the same amount of depreciation expense for financial reporting as for income tax preparation.

C)depreciation expense of $26,000 on the income statement and $15,000 on the tax return.

D)a deferred tax liability.

A)less depreciation expense on the tax return than on the income statement.

B)the same amount of depreciation expense for financial reporting as for income tax preparation.

C)depreciation expense of $26,000 on the income statement and $15,000 on the tax return.

D)a deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

70

On January 1,2016,Ruiz Company spent $850 on a plant asset to improve its quality.The asset had been purchased on January 1,2014 for $8,400 and had an estimated salvage value of $1,200 and a useful life of five years.Owens uses the straight-line depreciation method.Which of the following correctly shows the effects of the 2016 expenditure on the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

71

Madison Company owned an asset that had cost $44,000.The company sold the asset on January 1,2016 for $16,000.Accumulated depreciation on the day of sale amounted to $32,000.Based on this information,the sale would result in:

A)A $16,000 cash inflow in the investing activities section of the cash flow statement.

B)A $16,000 increase in total assets.

C)A $4,000 gain in the investing activities section of the statement of cash flows.

D)A $4,000 cash inflow in the financing activities section of the cash flow statement.

A)A $16,000 cash inflow in the investing activities section of the cash flow statement.

B)A $16,000 increase in total assets.

C)A $4,000 gain in the investing activities section of the statement of cash flows.

D)A $4,000 cash inflow in the financing activities section of the cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the following to answer questions

Farmer Company purchased equipment on January 1,2015 for $82,000.The machines are estimated to have a 5-year life and a salvage value of $4,000.The company uses the straight-line depreciation method.

-At the beginning of 2018,Furst revised the expected life to eight years.The annual amount of depreciation expense for each of the remaining years would be:

A)$6,240.

B)$4,400.

C)$7,040.

D)$3,900.

Farmer Company purchased equipment on January 1,2015 for $82,000.The machines are estimated to have a 5-year life and a salvage value of $4,000.The company uses the straight-line depreciation method.

-At the beginning of 2018,Furst revised the expected life to eight years.The annual amount of depreciation expense for each of the remaining years would be:

A)$6,240.

B)$4,400.

C)$7,040.

D)$3,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

73

Anton Company paid cash to prolong the life of one of its assets.Which of the following choices accurately reflects how this event would affect Anton's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

74

On January 1,2012 Eller Company purchased an asset that had cost $24,000.The asset had an 8-year useful life and an estimated salvage value of $1,000.Eller depreciates its assets on the straight-line basis.On January 1,2016 the company spent $6,000 to improve the quality of the asset.Based on this information,the recognition of depreciation expense in 2016 would

A)increase total assets by $4,375.

B)reduce total equity by $4,375.

C)reduce total assets by $4,625.

D)increase total equity by $4,625.

A)increase total assets by $4,375.

B)reduce total equity by $4,375.

C)reduce total assets by $4,625.

D)increase total equity by $4,625.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the following to answer questions

Jing Company was started on January 1,2016 when it issued common stock for $50,000 cash.Also,on January 1,2016 the company purchased office equipment that cost $34,000 cash.The equipment was delivered under terms FOB shipping point,and transportation cost was $2,000.The equipment had a five-year useful life and a $12,000 expected salvage value.

-At the end of 2020,assuming the equipment had not been sold,the book value of the office equipment using straight-line depreciation and double-declining balance depreciation,respectively,would be:

A)$12,000/$1,680.

B)$12,000/$12,000.

C)$0/$0.

D)None of these answer choices are correct.

Jing Company was started on January 1,2016 when it issued common stock for $50,000 cash.Also,on January 1,2016 the company purchased office equipment that cost $34,000 cash.The equipment was delivered under terms FOB shipping point,and transportation cost was $2,000.The equipment had a five-year useful life and a $12,000 expected salvage value.

-At the end of 2020,assuming the equipment had not been sold,the book value of the office equipment using straight-line depreciation and double-declining balance depreciation,respectively,would be:

A)$12,000/$1,680.

B)$12,000/$12,000.

C)$0/$0.

D)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

76

On January 1,2015,Li Company purchased an asset that cost $80,000.The asset had an expected useful life of five years and an estimated salvage value of $16,000.Li uses the straight-line method for the recognition of depreciation expense.At the beginning of the fourth year of usage,the company revised its estimated salvage value to $8,000.Based on this information,the amount of depreciation expense to be recognized at the end of 2018 is:

A)$12,800.

B)$16,800.

C)$33,600.

D)$20,800.

A)$12,800.

B)$16,800.

C)$33,600.

D)$20,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

77

For 2016,The Oscar Company records depreciation expense of $12,000 on its income statement and $9,000 of MACRS depreciation on its tax return.Which of the following answers is correct regarding the difference between the two figures?

A)Net income is understated by $3,000 on the 2016 income statement.

B)Deferred taxes of $3,000 are subtracted from taxable income of 2016.

C)The difference in depreciation expense is caused by differences between GAAP and the tax code.

D)The amount of depreciation recorded on the income tax return must be incorrect.

A)Net income is understated by $3,000 on the 2016 income statement.

B)Deferred taxes of $3,000 are subtracted from taxable income of 2016.

C)The difference in depreciation expense is caused by differences between GAAP and the tax code.

D)The amount of depreciation recorded on the income tax return must be incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

78

On April 1,2016,Fossil Energy Company purchased an oil producing well at a cash cost of $12,000,000.It is estimated that the oil well contains 600,000 barrels of oil,of which only 500,000 can be profitably extracted.By December 31,2016,25,000 barrels of oil were produced and sold.The amount of depletion expense for 2016 on this well would be:

A)$800,000.

B)$600,000.

C)$480,000.

D)$500,000.

A)$800,000.

B)$600,000.

C)$480,000.

D)$500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

79

On January 1,2016,the City Taxi Company purchased a new taxi cab for $36,000.The cab has an expected salvage value of $2,000.The company estimates that the cab will be driven 200,000 miles over its life.It uses the units of production method to determine depreciation expense.The cab was driven 45,000 miles the first year and 48,000 the second year.What would be the depreciation expense reported on the 2017 income statement and the book value of the taxi at the end of 2017?

A)$8,640/$19,260.

B)$8,640/$17,260.

C)$8,160/$20,190.

D)$8,160/$18,190.

A)$8,640/$19,260.

B)$8,640/$17,260.

C)$8,160/$20,190.

D)$8,160/$18,190.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck

80

Dinkins Company purchased a truck that cost $46,000.The company expected to drive the truck 100,000 miles over its 5-year useful life,and the truck had an estimated salvage value of $8,000.If the truck is driven 26,000 miles in the current accounting period,what would be the amount of depreciation expense for the year?

A)$11,960.

B)$9,880.

C)$9,200.

D)$7,600.

A)$11,960.

B)$9,880.

C)$9,200.

D)$7,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 157 في هذه المجموعة.

فتح الحزمة

k this deck