Deck 17: Preferred and Restricted Shares of Investee Corporation

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/5

العب

ملء الشاشة (f)

Deck 17: Preferred and Restricted Shares of Investee Corporation

1

Under IFRS,which of the following statements is true?

A)Preferred shares must be classified as debt.

B)Preferred shares must be classified as equity.

C)Preferred shares can be classified as debt or equity depending on the rights attached to them.

D)Preferred shares can be classified as debt or equity at the option of the issuing company.

A)Preferred shares must be classified as debt.

B)Preferred shares must be classified as equity.

C)Preferred shares can be classified as debt or equity depending on the rights attached to them.

D)Preferred shares can be classified as debt or equity at the option of the issuing company.

C

2

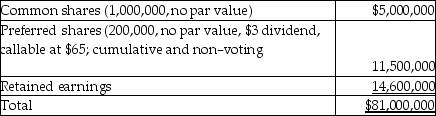

On January 1,20X9,Far Limited purchased 70% of the common shares of Near Limited for $50,400,000.On the date of acquisition,Nears shareholders' equity was as follows:

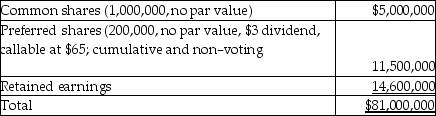

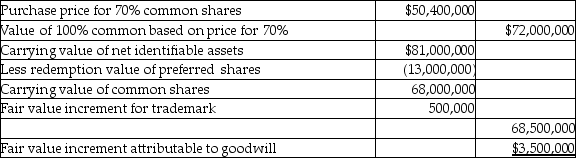

The fair value of Nears assets on the date of acquisition equalled their carrying value,except for a trademark worth $500,000 that was no on Near's books.The trademark is estimated to have a useful life of 10 years.During the fiscal year ended December 31,20X9,Near earned a net income of $1,700,000,and paid dividends of $800,000.

Required:

What is the non-controlling interest on the consolidated statements of financial position at December 31,20X9?

The company uses the entity approach to calculate goodwill.

The fair value of Nears assets on the date of acquisition equalled their carrying value,except for a trademark worth $500,000 that was no on Near's books.The trademark is estimated to have a useful life of 10 years.During the fiscal year ended December 31,20X9,Near earned a net income of $1,700,000,and paid dividends of $800,000.

Required:

What is the non-controlling interest on the consolidated statements of financial position at December 31,20X9?

The company uses the entity approach to calculate goodwill.

Non-controlling interest on common shares at acquisition date 30% × $72,000,000 = $21,600,000

Non-controlling interest on common shares at acquisition date 30% × $72,000,000 = $21,600,000Non-controlling interest,December 31,20X9

3

A parent company owns a subsidiary's preferred and common shares.How should the acquisition of the preferred shares be treated?

A)In the same manner as common shares

B)As a retirement of shares

C)As an expense

D)As a deduction from retained earnings

A)In the same manner as common shares

B)As a retirement of shares

C)As an expense

D)As a deduction from retained earnings

B

4

What is a coattail provision?

A)It allows preferred shares to be converted to common shares.

B)It allows restricted shares to become fully voting shares under limited circumstances.

C)It allows common shares to be converted to preferred shares.

D)It allows restricted shares to receive additional dividends.

A)It allows preferred shares to be converted to common shares.

B)It allows restricted shares to become fully voting shares under limited circumstances.

C)It allows common shares to be converted to preferred shares.

D)It allows restricted shares to receive additional dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 5 في هذه المجموعة.

فتح الحزمة

k this deck

5

Ngo Ltd.'s subsidiary has restricted shares.What must Ngo look at in determining non-controlling interest?

A)Number of shares only

B)Participation in earnings only

C)Participation in dividends only

D)Participation in earnings and dividends

A)Number of shares only

B)Participation in earnings only

C)Participation in dividends only

D)Participation in earnings and dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 5 في هذه المجموعة.

فتح الحزمة

k this deck