Deck 3: The Adjusting Process

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/160

العب

ملء الشاشة (f)

Deck 3: The Adjusting Process

1

If a company is using the accrual method of accounting,when is revenue recorded?

A) When cash is received, even though services may be rendered at a later date

B) When services are rendered, even though cash may be received at a later date

C) When cash is received, before the completion of the services

D) When cash is received, 30 days after the completion of the services

A) When cash is received, even though services may be rendered at a later date

B) When services are rendered, even though cash may be received at a later date

C) When cash is received, before the completion of the services

D) When cash is received, 30 days after the completion of the services

B

2

The owner of Recipes.org purchases $2,000 of supplies on account.Under the accrual basis of accounting,no entry is made until the $2,000 is paid.

False

3

Which of the following would be considered an interim accounting period?

A) One to two months

B) One to two quarters

C) One to two years

D) Either one month or one quarter

A) One to two months

B) One to two quarters

C) One to two years

D) Either one month or one quarter

D

4

The revenue principle is the basis for recording revenues―both when to record revenue and the amount of revenue to record.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

5

Accrual accounting records transactions ONLY when cash is received or paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following entries would be recorded if a company is using the cash-basis method of accounting?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following situations would result in an increase in income under the accrual method of accounting,but would NOT result in an increase in income under the cash-basis method of accounting?

A) Purchase of supplies for cash

B) Performance of services on account

C) Use of supplies purchased earlier

D) Receipt of cash for services that were performed earlier on account

A) Purchase of supplies for cash

B) Performance of services on account

C) Use of supplies purchased earlier

D) Receipt of cash for services that were performed earlier on account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

8

Generally accepted accounting principles require the use of accrual accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

9

In cash-basis accounting,revenue is recognized when cash is received and expenses are recognized when they are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is TRUE?

A) Accrual accounting is required by generally accepted accounting principles.

B) Accrual accounting records expenses when incurred. Cash-basis accounting records expenses when cash is paid.

C) Accrual accounting records revenue when services are rendered. Cash-basis accounting records revenue when cash is received.

D) All of the above are true.

A) Accrual accounting is required by generally accepted accounting principles.

B) Accrual accounting records expenses when incurred. Cash-basis accounting records expenses when cash is paid.

C) Accrual accounting records revenue when services are rendered. Cash-basis accounting records revenue when cash is received.

D) All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under cash-basis accounting,revenue is recorded when it is earned,regardless of when cash is received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is NOT considered an interim accounting period?

A) Monthly

B) Quarterly

C) Annually

D) Semi-annually

A) Monthly

B) Quarterly

C) Annually

D) Semi-annually

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under cash-basis accounting,an expense is recorded ONLY when cash is paid out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under accrual basis accounting,revenue is recorded ONLY when cash is received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following accounts would be used under the accrual method of accounting,but NOT under the cash-basis method of accounting.

A) Cash

B) Unearned revenue

C) Equipment

D) Salary expense

A) Cash

B) Unearned revenue

C) Equipment

D) Salary expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under accrual basis accounting,an expense is recorded ONLY when the cash is paid out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following accounts does cash-basis accounting ignore?

A) Payables

B) Revenue

C) Cash

D) Expenses

A) Payables

B) Revenue

C) Cash

D) Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a company is using the cash-basis method of accounting,when is revenue recorded?

A) When services are rendered, even though cash may be received at a later date

B) When cash is received, prior to the services being rendered

C) When cash is received, at a time after the services were rendered

D) When cash is received, either prior to the services being rendered or at a time after the services were rendered

A) When services are rendered, even though cash may be received at a later date

B) When cash is received, prior to the services being rendered

C) When cash is received, at a time after the services were rendered

D) When cash is received, either prior to the services being rendered or at a time after the services were rendered

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following entries would be recorded ONLY if a company is using the accrual method of accounting?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

20

An example of an interim accounting period is one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

21

A contra account has two characteristics: (1)a contra account is paired with a companion account,and (2)a contra account's normal balance is the same as that of the companion account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

22

The matching principle means which of the following?

A) Revenues are subtracted from expenses.

B) Expenses are subtracted from revenues.

C) Assets are subtracted from liabilities.

D) Liabilities are subtracted from expenses.

A) Revenues are subtracted from expenses.

B) Expenses are subtracted from revenues.

C) Assets are subtracted from liabilities.

D) Liabilities are subtracted from expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

23

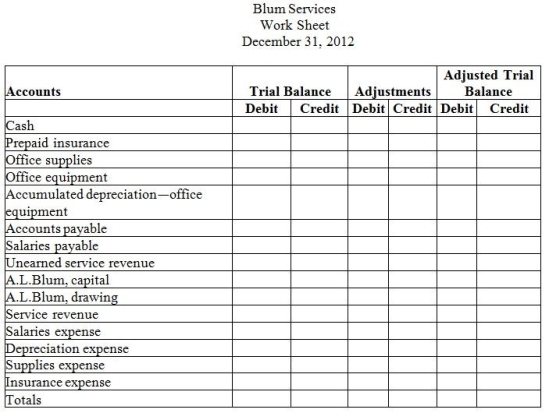

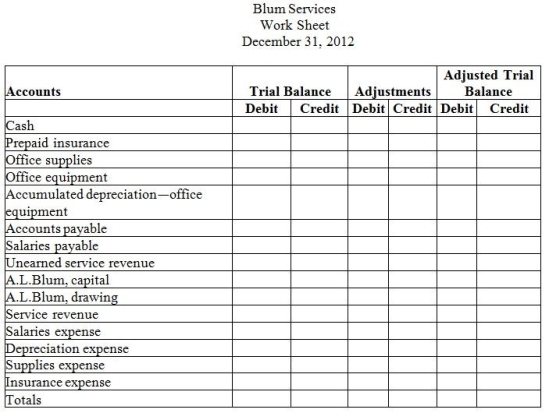

Blum Services has the following unadjusted balances at year-end.

The following information is available to use in making adjusting entries.

a.Office supplies on hand at year-end: $250

b.Prepaid insurance expired during the year: $325

c.Unearned revenue remaining at year-end: $2,500

d.Depreciation expense for the year: $1,800

e.Accrued salaries at year-end: $900

Using the work sheet below,prepare the trial balance,the adjustments and the adjusted trial balance for Blum Services.

The following information is available to use in making adjusting entries.

a.Office supplies on hand at year-end: $250

b.Prepaid insurance expired during the year: $325

c.Unearned revenue remaining at year-end: $2,500

d.Depreciation expense for the year: $1,800

e.Accrued salaries at year-end: $900

Using the work sheet below,prepare the trial balance,the adjustments and the adjusted trial balance for Blum Services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements BEST mirrors the matching principle?

A) The principle that ensures that information is reported at regular intervals

B) The principle that only determines when to record revenues

C) The principle that determines when to record expenses

D) None of the above

A) The principle that ensures that information is reported at regular intervals

B) The principle that only determines when to record revenues

C) The principle that determines when to record expenses

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

25

Prepaid rent is an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

26

Employees of Robert Rogers,CPA worked during the last two weeks of December.They received their paychecks on January 2.The matching principle would require that which of the following accounts appear on the balance sheet for December 31?

A) Accounts payable

B) Salaries payable

C) Salary expense

D) Prepaid expense

A) Accounts payable

B) Salaries payable

C) Salary expense

D) Prepaid expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

27

How do the adjusting entries differ from other journal entries?

A) Adjusting entries always include debits or credits to at least one income statement account and at least one balance sheet account.

B) Adjusting entries are made only at the end of the period.

C) Adjusting entries never affect cash.

D) All of the above are true.

A) Adjusting entries always include debits or credits to at least one income statement account and at least one balance sheet account.

B) Adjusting entries are made only at the end of the period.

C) Adjusting entries never affect cash.

D) All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

28

Robert Rogers,CPA owns a computer used for the company's business.The matching principle would require that which of the following accounts appear on the income statement for the year ended December 31?

A) Depreciation expense

B) Service revenue

C) Accumulated depreciation

D) Equipment expense

A) Depreciation expense

B) Service revenue

C) Accumulated depreciation

D) Equipment expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

29

The revenue principle guides accountants in which of the following ways?

A) Ensures that information is reported at regular intervals

B) Determines when to record expenses

C) Determines when to record revenue

D) Dictates that expenses be deducted from revenues

A) Ensures that information is reported at regular intervals

B) Determines when to record expenses

C) Determines when to record revenue

D) Dictates that expenses be deducted from revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

30

Employees of Robert Rogers,CPA worked during the last two weeks of December.They received their paychecks on January 2.The matching principle would require that which of the following accounts appear on the income statement for the year ended December 31?

A) Salary expense

B) Prepaid expense

C) Salaries payable

D) Unearned revenue

A) Salary expense

B) Prepaid expense

C) Salaries payable

D) Unearned revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

31

Ensuring that accounting information is updated each period is the purpose of the:

A) matching principle.

B) revenue principle.

C) time-period concept.

D) expense principle

A) matching principle.

B) revenue principle.

C) time-period concept.

D) expense principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following entries would be made as the result of the revenue principle?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

33

Prepaid insurance is an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is the time-period concept?

A) The concept that ensures that information is reported at regular intervals

B) The concept that determines when to record revenues

C) The concept that determines when to record expenses

D) None of the above

A) The concept that ensures that information is reported at regular intervals

B) The concept that determines when to record revenues

C) The concept that determines when to record expenses

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

35

The purposes of the adjusting process are:

A) to adjust expenses and revenues to the proper accrual basis.

B) to adjust asset and liability balances to the proper accrual basis.

C) to adjust expenses and revenues as well as asset and liability balances to the proper accrual basis.

D) none of the above.

A) to adjust expenses and revenues to the proper accrual basis.

B) to adjust asset and liability balances to the proper accrual basis.

C) to adjust expenses and revenues as well as asset and liability balances to the proper accrual basis.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

36

In accounting,the matching principle means to match which of the following?

A) Revenues to liabilities

B) Expenses to assets

C) Expenses to revenues

D) Expenses to liabilities

A) Revenues to liabilities

B) Expenses to assets

C) Expenses to revenues

D) Expenses to liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

37

Robert Rogers,CPA owns a computer used by the business.The matching principle would require that which of the following accounts appear on the balance sheet for the year ended December 31?

A) Depreciation expense

B) Service revenue

C) Accumulated depreciation

D) Equipment expense

A) Depreciation expense

B) Service revenue

C) Accumulated depreciation

D) Equipment expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following entries would be made because of the matching principle?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

39

To accrue revenue means that the cash receipt is recorded before the revenue is earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

40

Robert Rogers,CPA performed accounting services for a client in December.A bill was mailed to the client on December 30.Roberts received a check in the mail on January 5.The revenue principle would require that which of the following accounts appear on the balance sheet for December 31?

A) Prepaid expense

B) Accounts receivable

C) Unearned revenue

D) Accounts payable

A) Prepaid expense

B) Accounts receivable

C) Unearned revenue

D) Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

41

In the case of Unearned revenue,the adjusting entry at the end of the period includes a debit to Service revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

42

Argyle Designs has a contract to design 20 new dresses for a customer,and will collect a total of $40,000 when the design services are complete.They start on June 1.As of June 30,Argyle has finished 4 of the 20 designs.They will make an adjusting entry at the end of June to accrue $10,000 of service revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

43

At January 1,Smith has $1,200 of supplies on hand.During January,Smith purchases $3,000 worth of new supplies.At the end of the month,a count reveals $500 worth of supplies remaining on the shelves.The adjustment entry needed will include a debit to Supply expense of $3,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

44

In the case of Unearned revenue,the cash is received first,and the revenue is earned later.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

45

In the case of a prepaid expense,the adjusting entry required at the end of a period consists of a debit to Prepaid expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

46

In the case of a prepaid expense,the adjusting entry required at the end of a period consists of a credit to Prepaid expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

47

Real Losers,a diet magazine,collected $360,000 in subscription revenue in May.Each subscriber will receive an issue of the magazine for each of the next 12 months,beginning with the June issue.

-Real Losers,a diet magazine,collected $360,000 in subscription revenue in May.Each subscriber will receive an issue of the magazine for each of the next 12 months,beginning with the June issue.The company uses the accrual method of accounting.What is the balance in the Unearned revenue account at the end of December?

A) $150,000

B) $330,000

C) $360,000

D) $0

-Real Losers,a diet magazine,collected $360,000 in subscription revenue in May.Each subscriber will receive an issue of the magazine for each of the next 12 months,beginning with the June issue.The company uses the accrual method of accounting.What is the balance in the Unearned revenue account at the end of December?

A) $150,000

B) $330,000

C) $360,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

48

At January 1,Smith has a beginning balance in Unearned revenue of $1,000.During January,he earns $800 of that amount.He also collects $4,000 from a new customer for services to be rendered the following month.As of the end of January,the Unearned revenue account had a balance of $4,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

49

Smith signed a contract with a service provider for security services at a rate of $250 per month for the period of January through June.He will pay the service provider the entire amount at the end of June.Smith makes adjusting entries each month.During the month of February,Smith will record total security expense of $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

50

Unearned revenue would be classified as a(n)________ account.

A) liability

B) asset

C) revenue

D) equity

A) liability

B) asset

C) revenue

D) equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

51

Real Losers,a diet magazine,collected $360,000 in subscription revenue in May.Each subscriber will receive an issue of the magazine for each of the next 12 months,beginning with the June issue.

-The company uses the accrual method of accounting.By the end of December,how much Subscription revenue has been earned?

A) $120,000

B) $12,000

C) $360,000

D) $210,000

-The company uses the accrual method of accounting.By the end of December,how much Subscription revenue has been earned?

A) $120,000

B) $12,000

C) $360,000

D) $210,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

52

Smith borrows $10,000 on a one year Note payable that bears interest at 12% per year.He will repay the principal and interest at the end of the one-year period.Smith makes accrual adjustments and each month,he records interest expense of $1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

53

Smith owns manufacturing equipment that originally cost $12,600 and has an estimated useful life of 7 years.Smith records depreciation monthly in the amount of $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

54

The table below represents Able Company's supplies account.Please supply the missing amount.

A) $9,000

B) $5,000

C) $11,000

D) $13,000

A) $9,000

B) $5,000

C) $11,000

D) $13,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

55

In the case of Unearned revenue,the adjusting entry at the end of the period includes a credit to Service revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

56

The table below represents Able Company's supplies account.Please supply the missing amount.

A) $2,000

B) $15,000

C) $11,000

D) $6,000

A) $2,000

B) $15,000

C) $11,000

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

57

At January 1,Smith has a beginning balance in Prepaid insurance expense of $1,200.Smith pays insurance premiums once a year,and his total premium is $4,800.As of the end of February,the balance in prepaid insurance is $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

58

Robert Rogers,CPA performed accounting services for a client in December.A bill was mailed to the client on December 30.Roberts received a check in the mail on January 5.The revenue principle would require that which of the following accounts appear on the income statement for the year ended December 31?

A) Service revenue

B) Unearned revenue

C) Accounts payable

D) Prepaid expense

A) Service revenue

B) Unearned revenue

C) Accounts payable

D) Prepaid expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

59

The table below represents Able Company's supplies account.Please supply the missing amount.

A) $9,000

B) $1,000

C) $3,000

D) $11,000

A) $9,000

B) $1,000

C) $3,000

D) $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

60

Contra asset accounts like Accumulated depreciation have normal debit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

61

The entry to record depreciation includes a debit to which account?

A) Equipment

B) Cash

C) Accumulated depreciation

D) Depreciation expense

A) Equipment

B) Cash

C) Accumulated depreciation

D) Depreciation expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

62

The accountant for Noble Jewelry Repair Services forgot to make an adjusting entry for Depreciation expense for the current year.What is the effect of this error on total assets?

A) Total assets are understated.

B) Total assets are not affected.

C) Total assets are overstated.

D) There is not enough information presented to answer the question.

A) Total assets are understated.

B) Total assets are not affected.

C) Total assets are overstated.

D) There is not enough information presented to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is a contra account?

A) Depreciation expense

B) Accumulated depreciation

C) Unearned revenue

D) Earned revenue

A) Depreciation expense

B) Accumulated depreciation

C) Unearned revenue

D) Earned revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

64

An adjusting entry that debits Accounts receivable is an example of a(n):

A) prepaid expense.

B) accrued revenue.

C) accrued expense.

D) unearned revenue.

A) prepaid expense.

B) accrued revenue.

C) accrued expense.

D) unearned revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

65

Accrued revenue is revenue that:

A) has been collected and earned.

B) the business has collected, but not yet earned.

C) the business has earned, but not collected.

D) will be collected and earned in the future.

A) has been collected and earned.

B) the business has collected, but not yet earned.

C) the business has earned, but not collected.

D) will be collected and earned in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

66

At the end of the current year,the accountant for Navistar Graphics forgot to make an adjusting entry to accrue Wages payable to the company's employees for the last week in December.The wages will be paid to the employees in January.Which of the following is one of the effects of this error?

A) Net income is overstated.

B) Liabilities are overstated.

C) Net income is understated.

D) Expenses are overstated.

A) Net income is overstated.

B) Liabilities are overstated.

C) Net income is understated.

D) Expenses are overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following accounts would NOT be included in the adjusting entries made at the end of an accounting period?

A) Accounts receivable

B) Accounts payable

C) Cash

D) Prepaid insurance

A) Accounts receivable

B) Accounts payable

C) Cash

D) Prepaid insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

68

Adjusting entries NEVER involve:

A) expenses.

B) cash.

C) liabilities.

D) revenues.

A) expenses.

B) cash.

C) liabilities.

D) revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

69

The entry to record depreciation includes a credit to which account?

A) Equipment

B) Cash

C) Accumulated depreciation

D) Depreciation expense

A) Equipment

B) Cash

C) Accumulated depreciation

D) Depreciation expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is the effect of the adjusting entry for Depreciation expense?

A) The entry increases total liabilities and increases total expenses.

B) The entry increases total assets and increases total expenses.

C) The entry decreases total assets and increases total expenses.

D) The entry decreases total liabilities and increases total expenses.

A) The entry increases total liabilities and increases total expenses.

B) The entry increases total assets and increases total expenses.

C) The entry decreases total assets and increases total expenses.

D) The entry decreases total liabilities and increases total expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

71

An adjusting entry that credits Salaries payable is an example of a(n):

A) accrued expense.

B) unearned revenue.

C) accrued revenue.

D) prepaid expense.

A) accrued expense.

B) unearned revenue.

C) accrued revenue.

D) prepaid expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

72

Entries that record cash collected before the revenues are earned are:

A) accrued revenues.

B) prepaid expenses.

C) unearned revenues.

D) accrued expenses.

A) accrued revenues.

B) prepaid expenses.

C) unearned revenues.

D) accrued expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

73

The accountant for Noble Jewelry Repair Services forgot to make an adjusting entry for Depreciation expense for the current year.Which of the following is one of the effects of this error?

A) Net income is understated.

B) Total assets are understated.

C) Net income is overstated.

D) Total liabilities are understated.

A) Net income is understated.

B) Total assets are understated.

C) Net income is overstated.

D) Total liabilities are understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

74

An entry that reflects the using up of a portion of a fixed asset's value would be a(n)________ entry.

A) prepaid expense

B) accrued expense

C) accrued revenue

D) depreciation

A) prepaid expense

B) accrued expense

C) accrued revenue

D) depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

75

Unearned revenue is revenue that:

A) will be collected and earned in the future.

B) the business has collected, but not yet earned.

C) has been collected and earned.

D) the business has earned, but not collected.

A) will be collected and earned in the future.

B) the business has collected, but not yet earned.

C) has been collected and earned.

D) the business has earned, but not collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following accounts would NOT be adjusted at the end of an accounting period?

A) Accounts receivable

B) Unearned revenue

C) Equipment

D) Prepaid insurance

A) Accounts receivable

B) Unearned revenue

C) Equipment

D) Prepaid insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

77

Entries that record revenues earned before the cash is collected are:

A) accrued revenues.

B) prepaid expenses.

C) unearned revenues.

D) accrued expenses.

A) accrued revenues.

B) prepaid expenses.

C) unearned revenues.

D) accrued expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

78

If an adjusting entry includes a debit to Rent expense,that would indicate that the payment of rent had been previously recorded as a(n)________ entry.

A) prepaid expense

B) depreciation

C) accrued expense

D) accrued revenue

A) prepaid expense

B) depreciation

C) accrued expense

D) accrued revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

79

Entries that record an expense before the cash is paid are:

A) accrued revenues.

B) prepaid expenses.

C) unearned revenues.

D) accrued expenses.

A) accrued revenues.

B) prepaid expenses.

C) unearned revenues.

D) accrued expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

80

The table below represents Able Company's supplies account.Please supply the missing amount.

A) $9,000

B) $10,000

C) $6,000

D) $16,000

A) $9,000

B) $10,000

C) $6,000

D) $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck