Deck 15: Debt Financing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/101

العب

ملء الشاشة (f)

Deck 15: Debt Financing

1

What is a bond's seniority?

A)the bondholder's priority in claiming assets in the event of default

B)clauses restricting a company from issuing new debt

C)the yield to maturity of a bond as compared to bonds of comparable rating

D)the issue price of the bond as compared to its face value

A)the bondholder's priority in claiming assets in the event of default

B)clauses restricting a company from issuing new debt

C)the yield to maturity of a bond as compared to bonds of comparable rating

D)the issue price of the bond as compared to its face value

A

2

Smithfield Enterprises issues debt with a maturity of 7 years.In the case of bankruptcy,holders of this debt may only claim those assets of the firm that are not already pledged as collateral on other debt.Which of the following best describes this type of corporate debt?

A)a note

B)a mortgage bond

C)an asset-backed bond

D)unsecured debt

A)a note

B)a mortgage bond

C)an asset-backed bond

D)unsecured debt

A

3

Which of the following best describes a bond that is issued by a local entity and traded in a local market,but may be purchased by foreigners?

A)a domestic bond

B)a foreign bond

C)a Eurobond

D)a global bond

A)a domestic bond

B)a foreign bond

C)a Eurobond

D)a global bond

A

4

A firm issues $200 million in straight bonds at an original issue discount of 0.75% and a coupon rate of 7%.The firm pays fees of 2.5% on the face value of the bonds.The net amount of funds that the debt issue will provide for the firm is closest to which of the following?

A)$178,257,200

B)$180,375,000

C)$185,000,000

D)$193,500,000

A)$178,257,200

B)$180,375,000

C)$185,000,000

D)$193,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

5

A firm issues $160 million in straight bonds at par and a coupon rate of 8.5%.The firm pays fees of 2% on the face value of the bonds.The net amount of funds that the debt issue will provide for the firm is closest to which of the following?

A)$146 million

B)$154 million

C)$157 million

D)$160 million

A)$146 million

B)$154 million

C)$157 million

D)$160 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

6

Athelstone Realty issues debt with a maturity of 20 years.In the case of bankruptcy,holders of this debt may claim the property held by Athelstone Realty.Which of the following best describes this type of corporate debt?

A)a note

B)a debenture

C)a mortgage bond

D)an asset-backed bond

A)a note

B)a debenture

C)a mortgage bond

D)an asset-backed bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

7

Gepps Cross Industries issues debt with a maturity of 25 years.In the case of bankruptcy,holders of this debt may only claim those assets of the firm that are not already pledged as collateral on other debt.Which of the following best describes this type of corporate debt?

A)a note

B)a debenture

C)an asset-backed bond

D)unsecured debt

A)a note

B)a debenture

C)an asset-backed bond

D)unsecured debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

8

Private debt cannot be in the form of bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

9

By definition,a corporate bond is any form of debt security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following best describes an international bond that is not denominated in the local currency of the country in which it is issued?

A)a domestic bond

B)a foreign bond

C)a Eurobond

D)a global bond

A)a domestic bond

B)a foreign bond

C)a Eurobond

D)a global bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is NOT an advantage of private debt over public debt?

A)It is liquid.

B)It need not be registered with the U.S.Securities and Exchange Commission.

C)It has to have interest and principal payments made upon it.

D)It does not dilute the ownership of the firm.

A)It is liquid.

B)It need not be registered with the U.S.Securities and Exchange Commission.

C)It has to have interest and principal payments made upon it.

D)It does not dilute the ownership of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following terms best describes a loan where a larger line of credit or lower interest rate has been obtained by providing collateral to back that loan?

A)a term loan

B)a revolving line of credit

C)an asset-backed line of credit

D)a private placement

A)a term loan

B)a revolving line of credit

C)an asset-backed line of credit

D)a private placement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

13

A bond that makes payments in a certain currency contains the risk of holding that currency and so is priced according to the yields of similar bonds in that currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

14

A firm issues $250 million in straight bonds at an original issue discount of 1.5% and a coupon rate of 6%.The firm pays fees of 3% on the face value of the bonds.The net amount of funds that the debt issue will provide for the firm is closest to which of the following?

A)$225 million

B)$239 million

C)$250 million

D)$261 million

A)$225 million

B)$239 million

C)$250 million

D)$261 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is usually a form of public debt?

A)a private placement

B)a bank loan

C)a bond issue

D)a revolving line of credit

A)a private placement

B)a bank loan

C)a bond issue

D)a revolving line of credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is an advantage of a public bond issue over private placement?

A)It can be tailored to the particular situation.

B)It is less costly to issue.

C)It does not need to be registered with the SEC.

D)It is freely tradable on the bond market.

A)It can be tailored to the particular situation.

B)It is less costly to issue.

C)It does not need to be registered with the SEC.

D)It is freely tradable on the bond market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

17

Clearview Corporation,a company that deals mainly with the financing and distribution of music,issues debt with a maturity of 15 years.In the case of bankruptcy,holders of this debt will have claim to the intellectual property of Clearview.Which of the following best describes this type of corporate debt?

A)a note

B)a debenture

C)a mortgage bond

D)an asset-backed bond

A)a note

B)a debenture

C)a mortgage bond

D)an asset-backed bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

18

In terms of public offerings of bonds,what is a prospectus?

A)a list of the duties of the trust company representing the bondholders' interests

B)a memorandum that must be produced to describe the details of a bond offering

C)a formal contract that specifies the firm's obligations to the bondholders

D)a schedule of the fees charged by the underwriting company

A)a list of the duties of the trust company representing the bondholders' interests

B)a memorandum that must be produced to describe the details of a bond offering

C)a formal contract that specifies the firm's obligations to the bondholders

D)a schedule of the fees charged by the underwriting company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

19

In terms of public offerings of bonds,what is an indenture?

A)a list of the duties of the trust company representing the bondholders' interests

B)a memorandum that must be produced to describe the details of a bond offering

C)a formal contract that specifies the firm's obligations to the bondholders

D)a schedule of the fees charged by the underwriting company

A)a list of the duties of the trust company representing the bondholders' interests

B)a memorandum that must be produced to describe the details of a bond offering

C)a formal contract that specifies the firm's obligations to the bondholders

D)a schedule of the fees charged by the underwriting company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

20

The chief advantage of debt financing over financing through raising equity capital is that the former does not dilute the current owner's share of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

21

Eurobonds issued in France could NOT be issued in which of the following denominations?

A)U.S.dollars

B)euros

C)pounds sterling

D)yen

A)U.S.dollars

B)euros

C)pounds sterling

D)yen

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

22

What kind of corporate debt has a maturity of less than ten years?

A)asset-backed bonds

B)debentures

C)notes

D)mortgage bonds

A)asset-backed bonds

B)debentures

C)notes

D)mortgage bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

23

A firm issues $200 million in straight bonds at par and a coupon rate of 7%.The firm pays fees of 2.5% on the face value of the bonds.What is the net amount of funds that the debt issue will provide for the firm?

A)$186 million

B)$205 million

C)$195 million

D)$200 million

A)$186 million

B)$205 million

C)$195 million

D)$200 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is an original issue discount bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements is FALSE?

A)Almost all bonds that are issued today are registered bonds.

B)The trust company represents the bondholders and makes sure that the terms of the indenture are enforced.

C)For private placements,the prospectus must include an indenture,a formal contract between the bond issuer and a trust company.

D)In the case of default,the trust company represents the bondholders' interests.

A)Almost all bonds that are issued today are registered bonds.

B)The trust company represents the bondholders and makes sure that the terms of the indenture are enforced.

C)For private placements,the prospectus must include an indenture,a formal contract between the bond issuer and a trust company.

D)In the case of default,the trust company represents the bondholders' interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

26

A firm issues $500 million in straight bonds at an original issue discount of 1% and a coupon rate of 5%.The firm pays fees of 3% on the face value of the bonds.What is the net amount of funds that the debt issue will provide for the firm?

A)$500 million

B)$495 million

C)$485 million

D)$480 million

A)$500 million

B)$495 million

C)$485 million

D)$480 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

27

What kind of corporate debt must be secured by real property?

A)mortgage bonds

B)notes

C)asset-backed bonds

D)debentures

A)mortgage bonds

B)notes

C)asset-backed bonds

D)debentures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

28

What kind of unsecured corporate debt has a maturity of less than ten years?

A)mortgage bonds

B)asset-backed bonds

C)debentures

D)notes

A)mortgage bonds

B)asset-backed bonds

C)debentures

D)notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements is FALSE?

A)The registered bond system also facilitates tax collection because the government can easily keep track of all interest payments made.

B)Asset-backed bonds and mortgage bonds are secured debt: Specific assets are pledged as collateral that bondholders have a direct claim to in the event of bankruptcy.

C)Notes typically have longer maturities (more than ten years)than debentures.

D)Although the word "bond" is commonly used to mean any kind of debt security,technically a corporate bond must be secured.

A)The registered bond system also facilitates tax collection because the government can easily keep track of all interest payments made.

B)Asset-backed bonds and mortgage bonds are secured debt: Specific assets are pledged as collateral that bondholders have a direct claim to in the event of bankruptcy.

C)Notes typically have longer maturities (more than ten years)than debentures.

D)Although the word "bond" is commonly used to mean any kind of debt security,technically a corporate bond must be secured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is FALSE?

A)With registered bonds,on each coupon payment date,the bond issuer consults its list of registered owners and mails each owner a check (or directly deposits the coupon payment into the owner's brokerage account).

B)If a coupon bond is issued at a discount,it is called an original issue discount bond.

C)The face value or principal amount of the bond is denominated in standard increments,most often $10,000.

D)In a public offering,the indenture lays out the terms of the bond issue.

A)With registered bonds,on each coupon payment date,the bond issuer consults its list of registered owners and mails each owner a check (or directly deposits the coupon payment into the owner's brokerage account).

B)If a coupon bond is issued at a discount,it is called an original issue discount bond.

C)The face value or principal amount of the bond is denominated in standard increments,most often $10,000.

D)In a public offering,the indenture lays out the terms of the bond issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

31

Bonds issued by a foreign company in a local market,intended for local investors,and denominated in the local currency are known as

A)domestic bonds.

B)Yankee bonds.

C)Eurobonds.

D)foreign bonds.

A)domestic bonds.

B)Yankee bonds.

C)Eurobonds.

D)foreign bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

32

Bonds issued by a local entity,denominated in the local currency,traded in a local market,but purchased by foreigners are called

A)domestic bonds.

B)Yankee bonds.

C)Eurobonds.

D)foreign bonds.

A)domestic bonds.

B)Yankee bonds.

C)Eurobonds.

D)foreign bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is FALSE?

A)Global bonds combine the features of domestic,foreign,and Eurobonds,and are offered for sale in several different markets simultaneously.

B)In a leveraged buyout (LBO),a group of private investors purchases all the equity of a public corporation.

C)A term loan is a bank loan that lasts for a specific term.

D)Eurobonds are international bonds that are denominated in the local European currency of the country in which they are issued.

A)Global bonds combine the features of domestic,foreign,and Eurobonds,and are offered for sale in several different markets simultaneously.

B)In a leveraged buyout (LBO),a group of private investors purchases all the equity of a public corporation.

C)A term loan is a bank loan that lasts for a specific term.

D)Eurobonds are international bonds that are denominated in the local European currency of the country in which they are issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements regarding the private debt market is FALSE?

A)Private debt has the advantage that it avoids the cost of registration.

B)Bank loans are an example of private debt - debt that is not publicly traded.

C)Private debt has the disadvantage of being illiquid.

D)The public debt market is larger than the private debt market.

A)Private debt has the advantage that it avoids the cost of registration.

B)Bank loans are an example of private debt - debt that is not publicly traded.

C)Private debt has the disadvantage of being illiquid.

D)The public debt market is larger than the private debt market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is FALSE?

A)In the event of default,the assets not pledged as collateral for outstanding bonds cannot be used to pay off the holders of subordinated debentures until all more senior debt has been paid off.

B)Because more than one debenture might be outstanding,the bondholder's priority in claiming assets in the event of default,known as the bond's seniority,is important.

C)When a firm conducts a subsequent debenture issue that has lower priority than its outstanding debt,the new debt is known as a subordinated debenture.

D)Most debenture issues contain clauses restricting the company from issuing new debt with equal or lower priority than existing debt.

A)In the event of default,the assets not pledged as collateral for outstanding bonds cannot be used to pay off the holders of subordinated debentures until all more senior debt has been paid off.

B)Because more than one debenture might be outstanding,the bondholder's priority in claiming assets in the event of default,known as the bond's seniority,is important.

C)When a firm conducts a subsequent debenture issue that has lower priority than its outstanding debt,the new debt is known as a subordinated debenture.

D)Most debenture issues contain clauses restricting the company from issuing new debt with equal or lower priority than existing debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

36

Tompkinson's PLC. ,a British company,issues a bond in U.S.dollars in the United States which is intended for U.S.investors.Which of the following best describes this bond?

A)a foreign bond

B)a Eurobond

C)a global bond

D)a Yankee bond

A)a foreign bond

B)a Eurobond

C)a global bond

D)a Yankee bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

37

What kind of corporate debt can be secured by any specified assets?

A)mortgage bonds

B)notes

C)asset-backed bonds

D)debentures

A)mortgage bonds

B)notes

C)asset-backed bonds

D)debentures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

38

The face value of bonds are denominated most commonly in which of the following standard increments?

A)$10

B)$100

C)$1000

D)$10,000

A)$10

B)$100

C)$1000

D)$10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

39

Kruller A.G.issues a bond that is offered for sale simultaneously in Europe,the United States,and Japan.Which of the following best describes this bond?

A)a domestic bond

B)a foreign bond

C)a Eurobond

D)a global bond

A)a domestic bond

B)a foreign bond

C)a Eurobond

D)a global bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

40

A firm issues $500 million in straight bonds at par and a coupon rate of 5%.The firm pays fees of 3% on the face value of the bonds.What is the the net amount of funds that the debt issue will provide for the firm?

A)$475 million

B)$485 million

C)$505 million

D)$500 million

A)$475 million

B)$485 million

C)$505 million

D)$500 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements is FALSE?

A)By including more covenants,issuers increase their costs of borrowing.

B)Once bonds are issued,equity holders have an incentive to increase dividends at the expense of debt holders.

C)Covenants may restrict the level of further indebtedness and specify that the issuer must maintain a minimum amount of working capital.

D)If the covenants are designed to reduce agency costs by restricting management's ability to take negative-NPV actions that exploit debt holders,then the reduction in the firm's borrowing cost can more than outweigh the cost of the loss of flexibility associated with covenants.

A)By including more covenants,issuers increase their costs of borrowing.

B)Once bonds are issued,equity holders have an incentive to increase dividends at the expense of debt holders.

C)Covenants may restrict the level of further indebtedness and specify that the issuer must maintain a minimum amount of working capital.

D)If the covenants are designed to reduce agency costs by restricting management's ability to take negative-NPV actions that exploit debt holders,then the reduction in the firm's borrowing cost can more than outweigh the cost of the loss of flexibility associated with covenants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

42

When would it make sense for a firm to call a bond issue and refinance?

A)when the market price of the bond exceeds the call price,and market interest rates are greater than the bond's coupon rate

B)when the market price of the bond exceeds the call price,and market interest rates are less than the bond's coupon rate

C)when the market price of the bond is less than the call price,and market interest rates are greater than the bond's coupon rate

D)when the market price of the bond is less than the call price,and market interest rates are less than the bond's coupon rate

A)when the market price of the bond exceeds the call price,and market interest rates are greater than the bond's coupon rate

B)when the market price of the bond exceeds the call price,and market interest rates are less than the bond's coupon rate

C)when the market price of the bond is less than the call price,and market interest rates are greater than the bond's coupon rate

D)when the market price of the bond is less than the call price,and market interest rates are less than the bond's coupon rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

43

What are secured debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements is FALSE?

A)If the issuer fails to live up to any covenant,the issuer goes into bankruptcy.

B)The stronger the covenants in the bond contract,the less likely the issuer will default on the bond,and so the lower the interest rate investors will require to buy the bond.

C)Covenants are restrictive clauses in a bond contract that limit the issuer from taking actions that may undercut its ability to repay the bonds.

D)Bond agreements often contain covenants that restrict the ability of management to pay dividends.

A)If the issuer fails to live up to any covenant,the issuer goes into bankruptcy.

B)The stronger the covenants in the bond contract,the less likely the issuer will default on the bond,and so the lower the interest rate investors will require to buy the bond.

C)Covenants are restrictive clauses in a bond contract that limit the issuer from taking actions that may undercut its ability to repay the bonds.

D)Bond agreements often contain covenants that restrict the ability of management to pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is a call provision?

A)the periodic repurchasing of issued bonds through a sinking fund by the issuer

B)an option to the issuer to repurchase the bonds at a predetermined price

C)the option for the bondholder to convert each bond owned into a fixed number of shares of common stock

D)a clause in a bond contract that restricts the actions of the issuer that might harm the interests of the bondholders

A)the periodic repurchasing of issued bonds through a sinking fund by the issuer

B)an option to the issuer to repurchase the bonds at a predetermined price

C)the option for the bondholder to convert each bond owned into a fixed number of shares of common stock

D)a clause in a bond contract that restricts the actions of the issuer that might harm the interests of the bondholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

46

What are bond covenants?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

47

Bond covenants tend to increase a bond issuer's borrowing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

48

If a company issues both a straight bond and a convertible bond simultaneously,at par,then the straight bond will have a higher interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

49

Convertible bonds have a provision that gives the bondholder an option to convert each bond owned into a fixed number of shares of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

50

Why do the issuers of bonds not seek to minimize the strength and number of covenants in a bond agreement?

A)Covenants favor the equity holders that managers work for.

B)Covenants can increase the flexibility of the company issuing the bond.

C)Covenants lower the interest rate investors will require to buy the bond.

D)Covenants force the company to renegotiate the terms of the bond if they are broken.

A)Covenants favor the equity holders that managers work for.

B)Covenants can increase the flexibility of the company issuing the bond.

C)Covenants lower the interest rate investors will require to buy the bond.

D)Covenants force the company to renegotiate the terms of the bond if they are broken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

51

The sole way that a firm can repay its bonds is by making the coupon and principal payments as specified in the bond contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

52

A covenant that restricts a company from making loans or otherwise providing credit is best viewed as a restriction on which of the following?

A)issuing new debt

B)dividends and share repurchases

C)mergers and acquisitions

D)asset disposition

A)issuing new debt

B)dividends and share repurchases

C)mergers and acquisitions

D)asset disposition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

53

In which of the following situations would the yield to worst for a certain bond be that bond's yield to call?

I.The bond's coupon payments are high relative to market yields.

II.The bond price is at a discount.

III.The likelihood of the bond being called is high.

A)I only

B)II only

C)I and II

D)I and III

I.The bond's coupon payments are high relative to market yields.

II.The bond price is at a discount.

III.The likelihood of the bond being called is high.

A)I only

B)II only

C)I and II

D)I and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following will have the greatest need of strong bond covenants if it is to receive a high bond rating?

A)a debenture

B)a mortgage bond

C)an asset-backed bond

D)a foreign bond

A)a debenture

B)a mortgage bond

C)an asset-backed bond

D)a foreign bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

55

What are notes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

56

Covenants in a bond contract restrict the actions that management of a firm can take that would benefit the debt holders of the firm at the expense of the equity holders of that firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

57

What are the implications of stronger bond covenants?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

58

What are debentures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

59

A company issues a callable (at par)ten-year,6% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $104 per $100 of face value.What is the yield to call of this bond when it is released?

A)0.60%

B)1.50%

C)1.92%

D)5.47%

A)0.60%

B)1.50%

C)1.92%

D)5.47%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

60

If a bond covenant is not met,then the bond goes into technical default and the bondholder can demand immediate repayment or force the company to renegotiate the terms of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

61

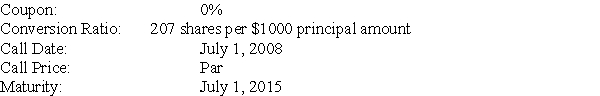

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $4.95.If the bonds are called on this date,which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A)Convert the bond and accept shares with a value of $10,000.

B)Convert the bond and accept shares with a value of $10,128.00.

C)Convert the bond and accept shares with a value of $10,246.50.

D)Accept the call price and receive $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements concerning the use of sinking funds to repurchase a bond issue is NOT true?

A)The firm makes regular payments into a sinking fund administered by a trustee over the life of the bond.

B)The firm can reduce the amount of outstanding debt without affecting the cash flows of the remaining bonds.

C)Payments from the sinking fund are used to repurchase bonds.

D)Bonds can be issued with a sinking fund provision or a call provision,but not both.

A)The firm makes regular payments into a sinking fund administered by a trustee over the life of the bond.

B)The firm can reduce the amount of outstanding debt without affecting the cash flows of the remaining bonds.

C)Payments from the sinking fund are used to repurchase bonds.

D)Bonds can be issued with a sinking fund provision or a call provision,but not both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

63

A bond with a face value of $1000 is convertible to common stock at a conversion ratio of 60.If the stock is currently trading at $8.20 per share,the value of the bond is probably closest in value to which of the following?

A)less than $492

B)about $492

C)about $1000

D)above $1666

A)less than $492

B)about $492

C)about $1000

D)above $1666

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

64

A company issues a callable (at par)five-year,7% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $110 per $100 of face value.What is the yield to call of this bond when it is released?

A)1.40%%

B)2.73%

C)4.71%

D)5.66%

A)1.40%%

B)2.73%

C)4.71%

D)5.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

65

A company issues a callable (at par)20-year,5% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $102 per $100 of face value.What is the yield to maturity of this bond when it is released?

A)2.40%

B)4.84%

C)5.60%

D)6.66%

A)2.40%

B)4.84%

C)5.60%

D)6.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

66

Supreme Industries issues the following announcement to holders of an issue of callable,convertible notes:

"Prior to the close of business on May 17,2008,holders may convert their Notes into shares of Supreme Industries common stock at 28.45 shares of Supreme Industries common stock per $1000 principal amount of the Notes.Cash will be paid in lieu of fractional shares.On April 16,2008,the last reported sale price of Supreme Industries common stock on the NYSE was $22.51 per share."

If on May 17,Supreme Industries is trading as $24.80,what is the value of common stock a holder of a $1,000 note would receive?

A)$787.51

B)$791.21

C)$868.00

D)$871.70

"Prior to the close of business on May 17,2008,holders may convert their Notes into shares of Supreme Industries common stock at 28.45 shares of Supreme Industries common stock per $1000 principal amount of the Notes.Cash will be paid in lieu of fractional shares.On April 16,2008,the last reported sale price of Supreme Industries common stock on the NYSE was $22.51 per share."

If on May 17,Supreme Industries is trading as $24.80,what is the value of common stock a holder of a $1,000 note would receive?

A)$787.51

B)$791.21

C)$868.00

D)$871.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following would be most likely to have the lowest price?

A)a straight senior bond

B)a convertible senior bond

C)a callable subordinated bond

D)a straight subordinated bond

A)a straight senior bond

B)a convertible senior bond

C)a callable subordinated bond

D)a straight subordinated bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

68

A company issues a callable (at par)five-year,7% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $110 per $100 of face value.What is the yield to worst of this bond when it is released?

A)1.40%%

B)2.73%

C)3.00%

D)4.71%

A)1.40%%

B)2.73%

C)3.00%

D)4.71%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

69

A company issues a callable (at par)ten-year,6% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $104 per $100 of face value.What is the yield to maturity of this bond when it is released?

A)0.60%

B)1.92%

C)4.00%

D)5.47%

A)0.60%

B)1.92%

C)4.00%

D)5.47%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

70

A bond has a face value of $100 and a conversion ratio of 28.What is the conversion price?

A)$0.28

B)$2.80

C)$3.57

D)$28.00

A)$0.28

B)$2.80

C)$3.57

D)$28.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

71

A bond has a face value of $10,000 and a conversion ratio of 265.The stock is currently trading at $38.80.What is the conversion price?

A)$1.56

B)$5.84

C)$25.73

D)$37.74

A)$1.56

B)$5.84

C)$25.73

D)$37.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company issues a callable (at par)20-year,5% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $102 per $100 of face value.What is the yield to call of this bond when it is released?

A)2.94%

B)4.11%

C)5.60%

D)6.66%

A)2.94%

B)4.11%

C)5.60%

D)6.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company issues a callable (at par)five-year,7% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $110 per $100 of face value.What is the yield to maturity of this bond when it is released?

A)1.40%%

B)2.80%

C)4.71%

D)5.66%

A)1.40%%

B)2.80%

C)4.71%

D)5.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

74

A company issues a callable (at par)20-year,5% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $102 per $100 of face value.What is the yield to worst of this bond when it is released?

A)2.94%

B)4.84%

C)5.60%

D)6.66%

A)2.94%

B)4.84%

C)5.60%

D)6.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

75

A firm issues $200 million in ten-year bonds with an annual coupon rate of 6%.The firm uses a sinking fund to repurchase 8% of the bond issue on each coupon payment date.What payment must they make on the tenth and final coupon payment?

A)$40 million

B)$52 million

C)$56 million

D)$68 million

A)$40 million

B)$52 million

C)$56 million

D)$68 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

76

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $6.58.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A)par

B)par plus 0.6%

C)par plus 4%

D)par plus 6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

77

A bond has a face value of $10,000 and a conversion ratio of 560.The stock is currently trading at $16.30.What is the conversion price?

A)$6.13

B)$16.30

C)$17.86

D)$56.00

A)$6.13

B)$16.30

C)$17.86

D)$56.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company issues a callable (at par)ten-year,6% coupon bond with annual coupon payments.The bond can be called at par in one year after release or any time after that on a coupon payment date.On release,it has a price of $104 per $100 of face value.What is the yield to worst of this bond when it is released?

A)0.60%

B)1.92%

C)4.00%

D)5.47%

A)0.60%

B)1.92%

C)4.00%

D)5.47%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

79

In which of the following situations does the value of a convertible bond exceed the value of straight debt or equity by the greatest amount?

A)when the price of the stock is high

B)when the price of the stock is close to the conversion price

C)when the price of the stock is low

D)when the price of the stock much lower than the conversion price

A)when the price of the stock is high

B)when the price of the stock is close to the conversion price

C)when the price of the stock is low

D)when the price of the stock much lower than the conversion price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements about bonds that are both convertible and callable is NOT true?

A)If these bonds are called by the issuer,the holder can choose to convert them rather than let them be called.

B)Prior to maturity,the value of such a bond will be greater than the shares of stock that bond can be converted into.

C)The decision to be made by the bondholder when the bonds are called is the same as she would have to make at maturity.

D)The issuer can force bondholders to decide whether or not to convert at a time of the issuer's choosing.

A)If these bonds are called by the issuer,the holder can choose to convert them rather than let them be called.

B)Prior to maturity,the value of such a bond will be greater than the shares of stock that bond can be converted into.

C)The decision to be made by the bondholder when the bonds are called is the same as she would have to make at maturity.

D)The issuer can force bondholders to decide whether or not to convert at a time of the issuer's choosing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck