Deck 22: The Master Budget and Responsibility Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/155

العب

ملء الشاشة (f)

Deck 22: The Master Budget and Responsibility Accounting

1

The master budget includes 3 components-the operating budget, the capital expenditures budget and the financial budget.

True

2

Budgeting is a technique that is used to plan for future cash inflows and outflows.

True

3

The production budget must be prepared before any other component of the operating budget.

False

4

Which of the following statements about budgeting is INCORRECT?

A) Budgeting is an accounting function and does not need involvement of operations personnel.

B) Budgeting is an aid to planning and control.

C) Budgets help to coordinate the activities of the entire organization.

D) Budgets promote communication and coordination between departments.

A) Budgeting is an accounting function and does not need involvement of operations personnel.

B) Budgeting is an aid to planning and control.

C) Budgets help to coordinate the activities of the entire organization.

D) Budgets promote communication and coordination between departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

5

In preparing an operating budget, the sales budget is prepared first. Which of the following is the last component of the operating budget?

A) Capital expenditures

B) Budgeted income statement

C) Operating expenses

D) Inventory, purchases and cost of goods sold

A) Capital expenditures

B) Budgeted income statement

C) Operating expenses

D) Inventory, purchases and cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

6

A budgeted income statement is based on estimated amounts and not actual amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is an example of the benchmarking function of a budget?

A) A budget demands integrated input from different business units and functions.

B) Budgeting requires close cooperation between accountants and operational personnel.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

A) A budget demands integrated input from different business units and functions.

B) Budgeting requires close cooperation between accountants and operational personnel.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

8

Budgets provide benchmarks that help managers evaluate performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

9

The capital expenditure budget stands alone and is not part of either the operating budget or the financial budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

10

A goal of the budgeting process is to assist managers with coordinating and implementing the business plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

11

A goal of the budgeting process is to communicate a consistent set of plans throughout the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

12

The capital expenditure budget is part of the operating budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is NOT a characteristic of the budgeting process?

A) The budget process aids in performance evaluation.

B) The budget process helps coordinate the activities of the organization.

C) The budget process forces management to plan ahead.

D) The budget process ensures that the business will make a profit.

A) The budget process aids in performance evaluation.

B) The budget process helps coordinate the activities of the organization.

C) The budget process forces management to plan ahead.

D) The budget process ensures that the business will make a profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

14

In preparing an operating budget, the sales budget is prepared first. Which of the following is prepared next?

A) Capital expenditures

B) Budgeted income statement

C) Operating expenses

D) Inventory, purchases and cost of goods sold

A) Capital expenditures

B) Budgeted income statement

C) Operating expenses

D) Inventory, purchases and cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following budgets focuses on the income statement and its supporting schedules?

A) Operating budget

B) Cash budget

C) Capital expenditures budget

D) Sales budget

A) Operating budget

B) Cash budget

C) Capital expenditures budget

D) Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

16

The starting point in the budgeting process is the preparation of the:

A) cash budget.

B) budgeted statement of cash flows.

C) sales budget.

D) budgeted income statement.

A) cash budget.

B) budgeted statement of cash flows.

C) sales budget.

D) budgeted income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

17

Management must get employees to accept the budget's goals in order to effectively use the budget as a benchmark for evaluating performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

18

A budget focuses primarily on financial information, but does not reflect specific business strategies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is an example of the coordination and communication function of a budget?

A) A budget demands integrated input from different business units and functions.

B) Employees are motivated to achieve the goals set by the budget.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

A) A budget demands integrated input from different business units and functions.

B) Employees are motivated to achieve the goals set by the budget.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is an example of the planning function of a budget?

A) A budget demands integrated input from different business units and functions.

B) Employees are motivated to achieve the goals set by the budget.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

A) A budget demands integrated input from different business units and functions.

B) Employees are motivated to achieve the goals set by the budget.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

21

A department store has budgeted cost of sales of $36,000 for its men's suits in March. Management also wants to have $15,000 of men's suits in inventory at the end of March to prepare for the summer season. Beginning inventory of men's suits for March is expected to be $9,000. What dollar amount of men's suits should be purchased in March?

A) $42,000

B) $45,000

C) $51,000

D) $60,000

A) $42,000

B) $45,000

C) $51,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

22

In order to prepare a budgeted income statement, several other budgets need to be prepared first. Which of the following is NOT one of the budgets needed to prepare the budgeted income statement?

A) Capital expenditures

B) Sales

C) Operating expenses

D) Inventory, purchases and cost of goods sold

A) Capital expenditures

B) Sales

C) Operating expenses

D) Inventory, purchases and cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following describes the operating expenses budget?

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

24

Norton Company prepared the following sales budget:

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

- How much are the budgeted purchases for the month of March?

A) $214,400

B) $123,900

C) $134,400

D) $99,700

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

- How much are the budgeted purchases for the month of March?

A) $214,400

B) $123,900

C) $134,400

D) $99,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements is TRUE about the capital expenditures budget?

A) It is a part of the financial budget.

B) It must be completed before the budgeted income statement is prepared.

C) It includes the sales budget.

D) It must be completed before the cash budget can be prepared.

A) It is a part of the financial budget.

B) It must be completed before the budgeted income statement is prepared.

C) It includes the sales budget.

D) It must be completed before the cash budget can be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is TRUE about the operating budget?

A) It is a part of the financial budget.

B) It includes the capital expenditures budget.

C) It includes the operating expenses budget.

D) Its final component is the cash budget.

A) It is a part of the financial budget.

B) It includes the capital expenditures budget.

C) It includes the operating expenses budget.

D) Its final component is the cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

27

Norton Company prepared the following sales budget:

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

- What is the desired beginning inventory on June 1?

A) $36,000

B) $39,600

C) $43,200

D) $46,800

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

- What is the desired beginning inventory on June 1?

A) $36,000

B) $39,600

C) $43,200

D) $46,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following describes the sales budget?

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

29

The financial budget includes all of the following EXCEPT the:

A) budgeted balance sheet.

B) budgeted income statement.

C) cash budget.

D) budgeted statement of cash flows.

A) budgeted balance sheet.

B) budgeted income statement.

C) cash budget.

D) budgeted statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

30

Norton Company prepared the following sales budget:

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

- How much are the budgeted purchases for the month of May?

A) $139,200

B) $123,900

C) $108,200

D) $90,700

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

- How much are the budgeted purchases for the month of May?

A) $139,200

B) $123,900

C) $108,200

D) $90,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following describes the inventory, purchases, and cost of goods sold budget?

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

32

Argyle Company forecasts Sales of $50,000 in January, $60,000 in February, $70,000 in March, and $75,000 in April. The inventory balance at January 1 is $12,000. Cost of goods sold is budgeted at 40% of sales revenue. Argyle wishes to have inventory levels at the end of each month equal to 60% of the cost of goods sold for the following month, plus a "safety cushion" of $1,000. How much should be budgeted for inventory purchases in March?

A) $21,000

B) $22,100

C) $29,200

D) $23,400

A) $21,000

B) $22,100

C) $29,200

D) $23,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

33

Norton Company prepared the following sales budget:

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

-How much are the budgeted purchases for the month of April?

A) $157,200

B) $123,900

C) $134,400

D) $99,700

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold.

-How much are the budgeted purchases for the month of April?

A) $157,200

B) $123,900

C) $134,400

D) $99,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following describes the cash budget?

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

A) It aids in planning to ensure the company has adequate inventory on hand.

B) It captures the variable and fixed expenses of the business.

C) It depicts the breakdown of sales based on terms of collection.

D) It helps in planning to ensure the business has adequate cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

35

Argyle Company forecasts sales of $50,000 in January, $60,000 in February, $70,000 in March, and $75,000 in April. The inventory balance at January 1 is $12,000. Cost of goods sold is budgeted at 40% of sales revenue. Argyle wishes to have inventory levels at the end of each month equal to 60% of cost of goods sold for the following month, plus a "safety cushion" of $1,000. How much should be budgeted for inventory purchases in February?

A) $21,000

B) $22,100

C) $26,400

D) $23,400

A) $21,000

B) $22,100

C) $26,400

D) $23,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

36

Liu Electronics budgeted sales of $400,000 for the month of November; cost of goods sold is equal to 65% of sales. Beginning inventory for November was $80,000 and ending inventory for November should be $72,000. How much are the budgeted purchases for November?

A) $252,000

B) $254,800

C) $264,800

D) $265,200

A) $252,000

B) $254,800

C) $264,800

D) $265,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

37

Argyle Company forecasts sales of $50,000 in January, $60,000 in February, $70,000 in March, and $75,000 in April. The inventory balance at January 1 is $12,000. Cost of goods sold is budgeted at 40% of sales revenue. Argyle wishes to have inventory levels at the end of each month equal to 60% of the cost of goods sold for the following month, plus a "safety cushion" of $1,000. How much should be budgeted for inventory purchases in January?

A) $21,000

B) $22,100

C) $26,400

D) $23,400

A) $21,000

B) $22,100

C) $26,400

D) $23,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

38

Budgeted operating expenses for the current year include the expiration of insurance that was paid for in a previous period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

39

Lan Corporation had beginning inventory of $42,000 and expects cost of sales of $96,000 units during the month. Desired ending inventory is $31,000. How much inventory should Lan Corporation purchase?

A) $65,000

B) $73,000

C) $85,000

D) $107,000

A) $65,000

B) $73,000

C) $85,000

D) $107,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements is TRUE about the financial budget?

A) It includes the capital expenditures budget.

B) It must be completed before the budgeted income statement is prepared.

C) It includes the sales budget.

D) It includes the cash budget and the budgeted balance sheet.

A) It includes the capital expenditures budget.

B) It must be completed before the budgeted income statement is prepared.

C) It includes the sales budget.

D) It includes the cash budget and the budgeted balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

41

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

-

How much is the net operating income/(loss) in October?

A) $6,200

B) $11,700

C) $7,480

D) $8,950

-

How much is the net operating income/(loss) in October?

A) $6,200

B) $11,700

C) $7,480

D) $8,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

42

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

-

How much are the total operating expenses in October?

A) $29,800

B) $30,300

C) $30,050

D) $29,990

-

How much are the total operating expenses in October?

A) $29,800

B) $30,300

C) $30,050

D) $29,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

43

The cash budget may be used to determine whether a company will need additional financing for the coming period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

44

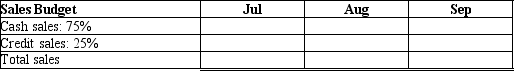

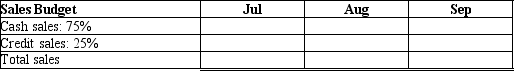

Hi-value Products Company is creating an operating budget for the 3rd quarter and will begin with a sales budget. Budgeted sales are $100,000 in July, $120,000 in August, and $160,000 in September. 75% of sales are cash and 25% of sales are on account. Please use the following format and prepare a sales budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

45

The budgeted "Cash payments for purchases" must be completed before the "Inventory, Purchases and Cost of goods sold budget" can be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

46

Caskill Company forecasts $40,000 of sales in January, $38,000 in February, $30,000 in March, and $32,000 in April. Cost of goods sold is budgeted at 75% of sales. Caskill should have inventory on hand at the end of each month equal to $5,000 plus 20% of the following month's cost of goods sold.

How much are budgeted purchases for March?

A) $22,800

B) $27,300

C) $29,700

D) $24,900

How much are budgeted purchases for March?

A) $22,800

B) $27,300

C) $29,700

D) $24,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

47

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

-

How much is the net operating income/(loss) in December?

A) $6,200

B) $11,700

C) $7,480

D) $8,950

-

How much is the net operating income/(loss) in December?

A) $6,200

B) $11,700

C) $7,480

D) $8,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

48

Hi-value Products Company is creating an operating budget for the 3rd quarter, and is now preparing the operating expense budget. Assumptions for operating expenses are as follows:

Miscellaneous expense - variable portion: 10% of sales revenue

Miscellaneous expense - fixed portion: $4,200 per month

Salary expense - fixed: $12,000 per month

Rent expense - fixed: $8,000 per month

Depreciation expense - fixed: $5,600 per month

Sales for July, August and September were budgeted at $100.000, $120,000, and $160,000.

Using the format below, please prepare an operating expense budget.

Miscellaneous expense - variable portion: 10% of sales revenue

Miscellaneous expense - fixed portion: $4,200 per month

Salary expense - fixed: $12,000 per month

Rent expense - fixed: $8,000 per month

Depreciation expense - fixed: $5,600 per month

Sales for July, August and September were budgeted at $100.000, $120,000, and $160,000.

Using the format below, please prepare an operating expense budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

49

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

- How much are the total operating expenses in December?

A) $29,800

B) $30,300

C) $30,050

D) $29,990

- How much are the total operating expenses in December?

A) $29,800

B) $30,300

C) $30,050

D) $29,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

50

Caskill Company forecasts $40,000 of sales in January, $38,000 in February, $30,000 in March, and $32,000 in April. Cost of goods sold is budgeted at 75% of sales. Caskill should have inventory on hand at the end of each month equal to $5,000 plus 20% of the following month's cost of goods sold.

How much are budgeted purchases for February?

A) $22,800

B) $27,300

C) $29,700

D) $24,900

How much are budgeted purchases for February?

A) $22,800

B) $27,300

C) $29,700

D) $24,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

51

Bartholomew Manufacturing Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Cost of goods sold is budgeted at 40% of Sales. Variable and fixed expenses are as follows:

Variable: Miscellaneous expenses : of Sales

Fixed: Salary expense: per month

Rent expense: per month

Depreciation expense: per month

Miscellaneous expenses/fixed portion: per month

-

How much is the operating net income/(loss) for February?

A) $3,500

B) $1,450

C) ($500)

D) $7,500

Variable: Miscellaneous expenses : of Sales

Fixed: Salary expense: per month

Rent expense: per month

Depreciation expense: per month

Miscellaneous expenses/fixed portion: per month

-

How much is the operating net income/(loss) for February?

A) $3,500

B) $1,450

C) ($500)

D) $7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

52

Bartholomew Manufacturing Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Cost of goods sold is budgeted at 40% of Sales. Variable and fixed expenses are as follows:

Variable: Miscellaneous expenses : of Sales

Fixed: Salary expense: per month

Rent expense: per month

Depreciation expense: per month

Miscellaneous expenses/fixed portion: per month

-

How much is the operating net income/(loss) for January?

A) $3,500

B) $1,450

C) ( $500)

D) $7,500

Variable: Miscellaneous expenses : of Sales

Fixed: Salary expense: per month

Rent expense: per month

Depreciation expense: per month

Miscellaneous expenses/fixed portion: per month

-

How much is the operating net income/(loss) for January?

A) $3,500

B) $1,450

C) ( $500)

D) $7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

53

The budgeted cash collections for the current month typically take into consideration collections pertaining to credit sales of prior months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

54

Hi-value Products Company is creating an operating budget for the 3rd quarter. Please review the following budgets:

Using the format below, please prepare a budgeted income statement.

Using the format below, please prepare a budgeted income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

55

Bartholomew Manufacturing Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Cost of goods sold is budgeted at 40% of Sales. Variable and fixed expenses are as follows:

Variable: Miscellaneous expenses : of Sales

Fixed: Salary expense: per month

Rent expense: per month

Depreciation expense: per month

Miscellaneous expenses/fixed portion: per month

-

How much is the operating net income/(loss) for March?

A) $3,500

B) $1,450

C) ($500)

D) $7,500

Variable: Miscellaneous expenses : of Sales

Fixed: Salary expense: per month

Rent expense: per month

Depreciation expense: per month

Miscellaneous expenses/fixed portion: per month

-

How much is the operating net income/(loss) for March?

A) $3,500

B) $1,450

C) ($500)

D) $7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

56

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

-

How much is the net operating income/(loss) in November?

A) $6,200

B) $11,700

C) $7,480

D) $8,950

-

How much is the net operating income/(loss) in November?

A) $6,200

B) $11,700

C) $7,480

D) $8,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

57

The cash budget can be prepared before the sales budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

58

Caskill Company forecasts $40,000 of sales in January, $38,000 in February, $30,000 in March, and $32,000 in April. Cost of goods sold is budgeted at 75% of sales. Caskill should have inventory on hand at the end of each month equal to $5,000 plus 20% of the following month's cost of goods sold. How much are budgeted purchases for January?

A) $22,800

B) $27,300

C) $29,700

D) $24,900

A) $22,800

B) $27,300

C) $29,700

D) $24,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

59

Hi-value Products Company is creating an operating budget for the 3rd quarter. Budgeted sales are $100,000 in July, $120,000 in August, $160,000 in September, and $200,000 in October. Cost of goods sold is 60% of sales. The desired ending inventory is 50% of the Cost of goods sold for the following month, plus a "safety cushion" of $2,000.

The inventory balance at the end of June was $50,000. Using the format below, please prepare a budget for Inventory, Purchases and Cost of goods sold.

(a) COGS = 60% of sales

(b) $2,000 + 50% of COGS for next month

The inventory balance at the end of June was $50,000. Using the format below, please prepare a budget for Inventory, Purchases and Cost of goods sold.

(a) COGS = 60% of sales

(b) $2,000 + 50% of COGS for next month

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

60

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

-

How much are the total operating expenses in November?

A) $29,800

B) $30,300

C) $30,050

D) $29,990

-

How much are the total operating expenses in November?

A) $29,800

B) $30,300

C) $30,050

D) $29,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

61

Craig Manufacturing Company's budgeted income statement includes the following data:

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

-

How much is the total of the budgeted cash payments for operating expenses for the month of June?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

-

How much is the total of the budgeted cash payments for operating expenses for the month of June?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

62

AAA Company is preparing its 3rd quarter budget and provides the following data:

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

What is the budgeted cash balance at the end of July, after required financing transactions?

A) $0

B) $5,000

C) $3.000

D) $8,000

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

What is the budgeted cash balance at the end of July, after required financing transactions?

A) $0

B) $5,000

C) $3.000

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

63

Berkeley Products has a cash balance of $20,000 at April 1, 2011. They are now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows:

There are no budgeted capital expenditures or financing transactions during the quarter.

- Based on the above data, what is the projected cash balance at the end of May?

A) $22,000

B) $21,900

C) $23,700

D) $22,400

There are no budgeted capital expenditures or financing transactions during the quarter.

- Based on the above data, what is the projected cash balance at the end of May?

A) $22,000

B) $21,900

C) $23,700

D) $22,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

64

California Products Company has the following data as part of its budget for the 2nd quarter:

The cash balance at April 1 is forecast to be $8,200.

-Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at April 30?

A) $26,500

B) $40,800

C) $33,900

D) $21,800

The cash balance at April 1 is forecast to be $8,200.

-Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at April 30?

A) $26,500

B) $40,800

C) $33,900

D) $21,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

65

Fast Foods has budgeted sales for June and July at $520,000 and $480,000, respectively. Sales are 80% credit, of which 50% is collected in the month of sale and 50% is collected in the following month. What is the accounts receivable balance on July 31?

A) $192,000

B) $240,000

C) $384,000

D) $400,000

A) $192,000

B) $240,000

C) $384,000

D) $400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

66

Berkeley Products has a cash balance of $20,000 at April 1, 2011. They are now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows:

There are no budgeted capital expenditures or financing transactions during the quarter.

- Based on the above data, what is the projected cash balance at the end of April?

A) $22,000

B) $21,900

C) $23,700

D) $22,400

There are no budgeted capital expenditures or financing transactions during the quarter.

- Based on the above data, what is the projected cash balance at the end of April?

A) $22,000

B) $21,900

C) $23,700

D) $22,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

67

AAA Company is preparing its 3rd quarter budget and provides the following data:

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

How much cash shortfall will the company have at the end of July, before financing?

A) $2,000

B) $6,500

C) $5,000

D) $1,250

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

How much cash shortfall will the company have at the end of July, before financing?

A) $2,000

B) $6,500

C) $5,000

D) $1,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

68

AAA Company is preparing its 3rd quarter budget and provides the following data:

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

What is the projected cash shortfall at the end of August, before financing transactions have been taken into consideration?

A) $0

B) $5,000

C) $3.000

D) $8,000

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

What is the projected cash shortfall at the end of August, before financing transactions have been taken into consideration?

A) $0

B) $5,000

C) $3.000

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

69

Della Company prepared the following purchases budget:

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

-

What are the total cash payments made in August for purchases?

A) $72,630

B) $70,680

C) $70,520

D) $63,500

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

-

What are the total cash payments made in August for purchases?

A) $72,630

B) $70,680

C) $70,520

D) $63,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

70

Craig Manufacturing Company's budgeted income statement includes the following data:

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

-

How much is the total of the budgeted cash payments for operating expenses for the month of April?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

-

How much is the total of the budgeted cash payments for operating expenses for the month of April?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

71

Zygot Biotech Company is budgeting for the 3rd quarter, and provides the following data:

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter.

- What is the projected cash balance at the end of July?

A) $21,000

B) $12,600

C) $18,000

D) $2,600

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter.

- What is the projected cash balance at the end of July?

A) $21,000

B) $12,600

C) $18,000

D) $2,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

72

Zygot Biotech Company is budgeting for the 3rd quarter, and provide the following data:

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter.

-What is the projected cash balance at the end of September?

A) $21,000

B) $12,600

C) $18,000

D) $2,600

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter.

-What is the projected cash balance at the end of September?

A) $21,000

B) $12,600

C) $18,000

D) $2,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

73

California Products Company has the following data as part of its budget for the 2nd quarter:

The cash balance at April 1 is forecast to be $8,200.

- Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at May 31?

A) $26,500

B) $40,800

C) $33,900

D) $21,800

The cash balance at April 1 is forecast to be $8,200.

- Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at May 31?

A) $26,500

B) $40,800

C) $33,900

D) $21,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

74

California Products Company has the following data as part of its budget for the 2nd quarter:

The cash balance at April 1 is forecast to be $8,200.

-Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at June 30?

A) $26,500

B) $40,800

C) $33,900

D) $21,800

The cash balance at April 1 is forecast to be $8,200.

-Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at June 30?

A) $26,500

B) $40,800

C) $33,900

D) $21,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

75

Della Company prepared the following purchases budget:

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

-

What are the total cash payments made in October for purchases?

A) $77,680

B) $79,480

C) $69,330

D) $74,290

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

-

What are the total cash payments made in October for purchases?

A) $77,680

B) $79,480

C) $69,330

D) $74,290

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

76

Zygot Biotech Company is budgeting for the 3rd quarter, and provide the following data:

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter.

- What is the projected cash balance at the end of August?

A) $21,000

B) $12,600

C) $18,000

D) $2,600

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter.

- What is the projected cash balance at the end of August?

A) $21,000

B) $12,600

C) $18,000

D) $2,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

77

Craig Manufacturing Company's budgeted income statement includes the following data:

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

-

How much is the total of the budgeted cash payments for operating expenses for the month of May?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

-

How much is the total of the budgeted cash payments for operating expenses for the month of May?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

78

AAA Company is preparing its 3rd quarter budget and provides the following data:

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

How much will the company have to borrow at the end of July?

A) $0

B) $5,000

C) $15,000

D) $10,000

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

-

How much will the company have to borrow at the end of July?

A) $0

B) $5,000

C) $15,000

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

79

Berkeley Products has a cash balance of $20,000 at April 1, 2011. They are now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows:

There are no budgeted capital expenditures or financing transactions during the quarter.

- Based on the above data, what is the projected cash balance at the end of June?

A) $22,000

B) $21,900

C) $23,700

D) $22,400

There are no budgeted capital expenditures or financing transactions during the quarter.

- Based on the above data, what is the projected cash balance at the end of June?

A) $22,000

B) $21,900

C) $23,700

D) $22,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

80

Felton Manufacturing provides the following data excerpted from its 3rd quarter budget:

The cash balance at June 30 is projected to be $4,000.Based on the above data, how much cash shortfall is the company projected to have at the end of August?

A) $6,500

B) $2,700

C) $5,000

D) $4,770

The cash balance at June 30 is projected to be $4,000.Based on the above data, how much cash shortfall is the company projected to have at the end of August?

A) $6,500

B) $2,700

C) $5,000

D) $4,770

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck