Deck 14: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/177

العب

ملء الشاشة (f)

Deck 14: Financial Statement Analysis

1

An accurate description of horizontal analysis would be which of the following?

A)Study of percentage changes in various financial statement amounts from year to year

B)Study of changes in individual financial statement amounts as a percentage of a related base amount

C)Study of changes in key financial ratios from year to year

D)None of the above

A)Study of percentage changes in various financial statement amounts from year to year

B)Study of changes in individual financial statement amounts as a percentage of a related base amount

C)Study of changes in key financial ratios from year to year

D)None of the above

A

2

Most financial statement analysis covers trends of more than one year.

True

3

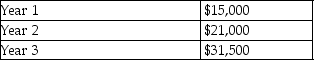

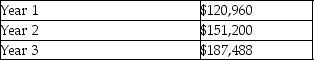

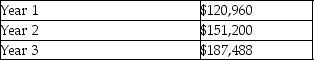

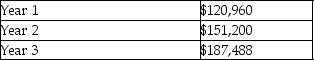

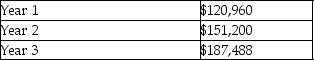

A company reported the following amounts of net income:

Which of the following is the percentage change from Year 1 to Year 2?

A)150.00%

B)110.00%

C)40.00%

D)50.00%

Which of the following is the percentage change from Year 1 to Year 2?

A)150.00%

B)110.00%

C)40.00%

D)50.00%

C

Explanation:C)

Year 1 $15,000

Year 2 21,000

Increase 6,000 /15,000 = 40%

Explanation:C)

Year 1 $15,000

Year 2 21,000

Increase 6,000 /15,000 = 40%

4

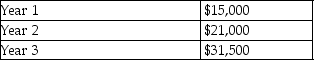

A company reported the following amounts of net income:

Which of the following is the percentage change from Year 2 to Year 3?

A)40.00%

B)50.00%

C)110.00%

D)150.00%

Which of the following is the percentage change from Year 2 to Year 3?

A)40.00%

B)50.00%

C)110.00%

D)150.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

5

Horizontal analysis is the study of percentage changes in comparative financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

6

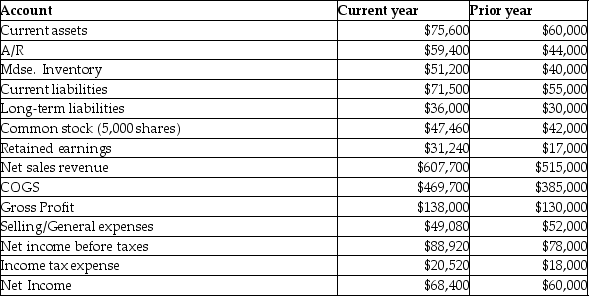

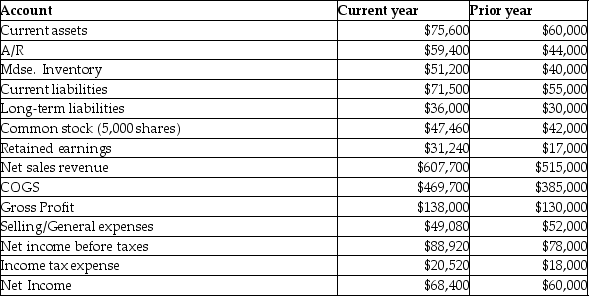

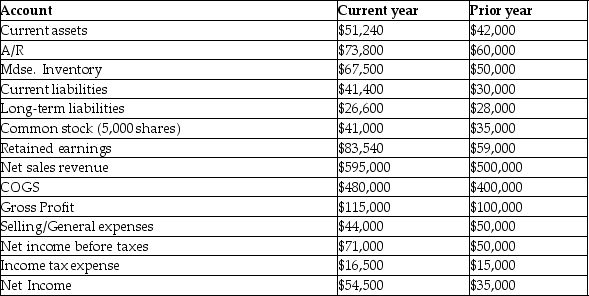

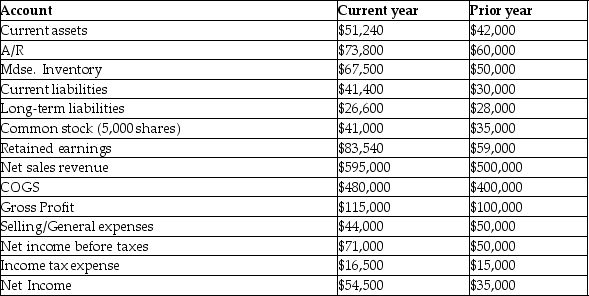

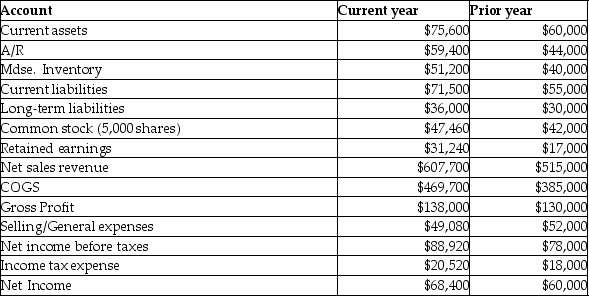

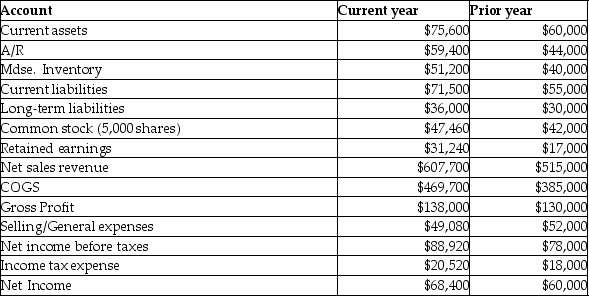

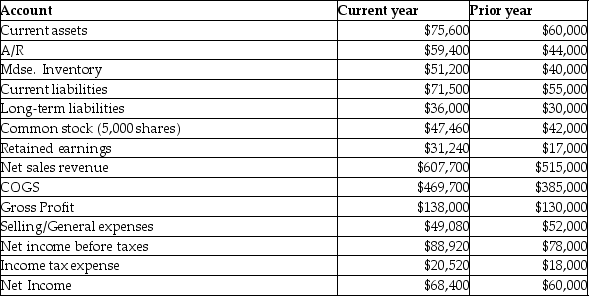

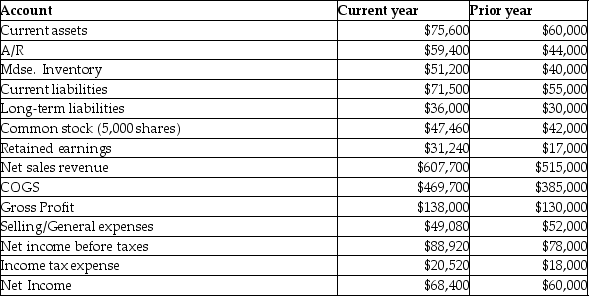

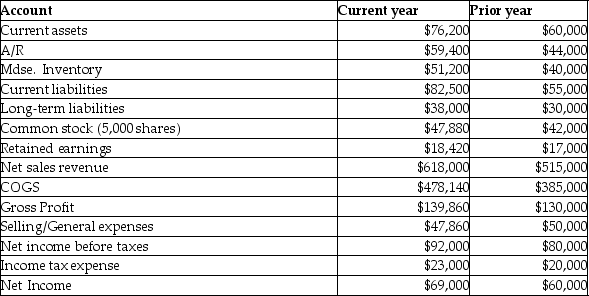

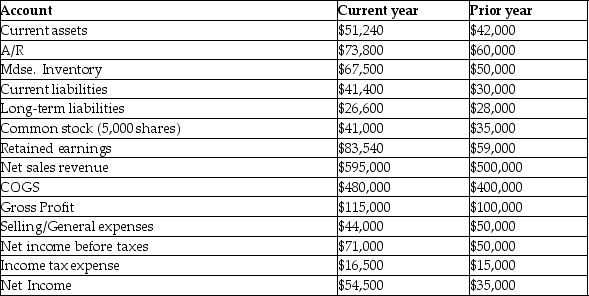

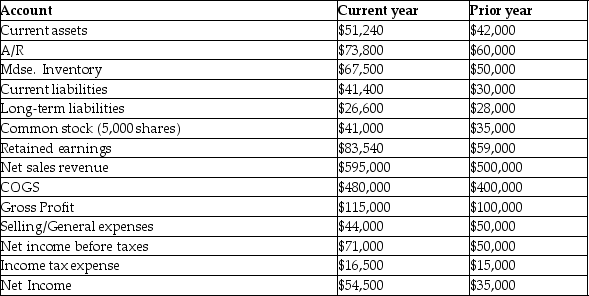

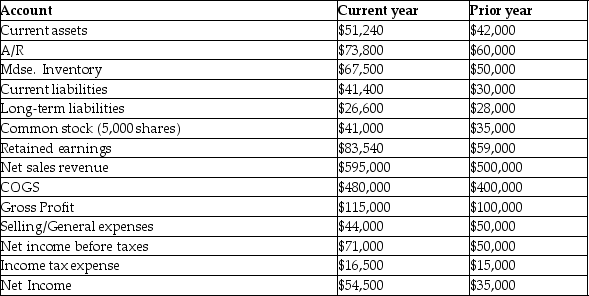

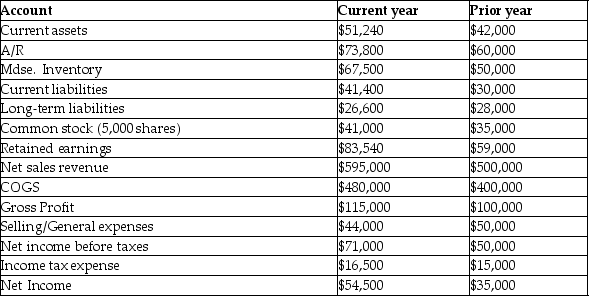

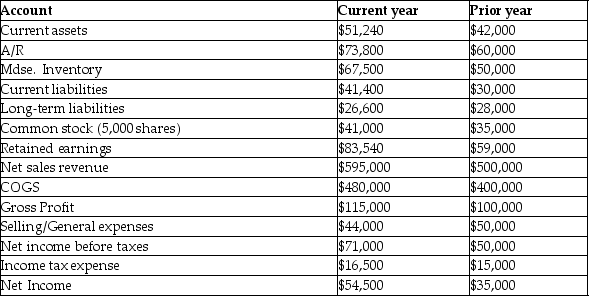

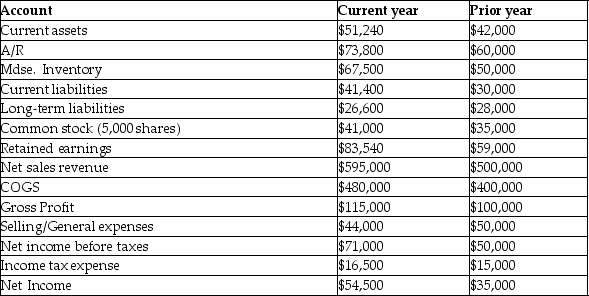

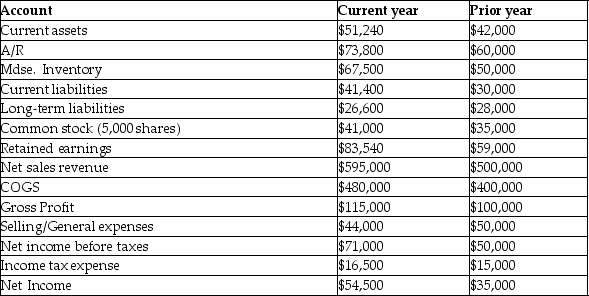

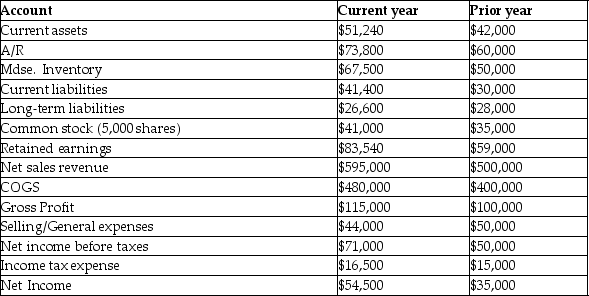

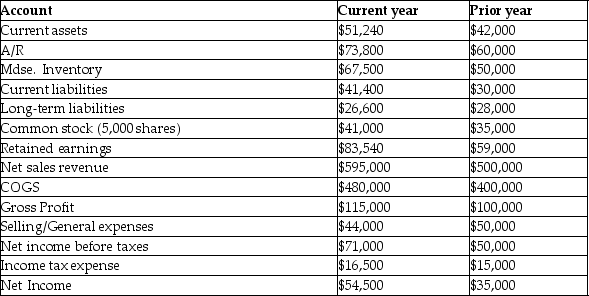

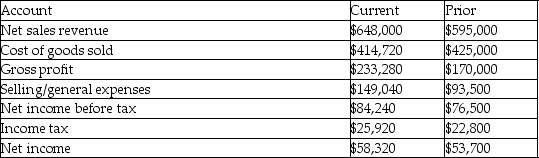

The Nichols Corporation data for the current year:

What would a horizontal analysis report with respect to net income before income tax expense and net income?

A)Both net income before tax expense and net income were 11.26% of net sales revenue.

B)Both net income before income tax expense and net income increased by $128,400.

C)The current ratio is 1:06.

D)There was an increase in both net income before income tax expense and net income of 14.00%.

What would a horizontal analysis report with respect to net income before income tax expense and net income?

A)Both net income before tax expense and net income were 11.26% of net sales revenue.

B)Both net income before income tax expense and net income increased by $128,400.

C)The current ratio is 1:06.

D)There was an increase in both net income before income tax expense and net income of 14.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which type of analysis includes the computation of the percentage change in total assets between two balance sheet dates?

A)Profitability

B)Vertical

C)Horizontal

D)Capital

A)Profitability

B)Vertical

C)Horizontal

D)Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

8

Investors and creditors generally evaluate a company by using a single year's data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

9

Horizontal analysis and vertical analysis are used to analyze the performance of a single company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which type of analysis compares the data of the current year to the data of the previous year in both percentage and dollar amount of increase or decrease?

A)Vertical analysis

B)Trend analysis

C)Horizontal analysis

D)Benchmarking

A)Vertical analysis

B)Trend analysis

C)Horizontal analysis

D)Benchmarking

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

11

In a horizontal analysis,the earlier period is the base period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

12

A trend percentage is computed by dividing the dollar amount of change by the base-year amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

13

Generally,using more than one year of data to analyze company performance is desirable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a horizontal analysis,the actual dollar change is a better analytical tool than knowing the percentage change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

15

The comparison of operating expenses in Year 1 and Year 2 would be included in which of the following types of analysis?

A)Profitability

B)Capital

C)Horizontal

D)Trend

A)Profitability

B)Capital

C)Horizontal

D)Trend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Nichols Corporation data for the current year:

What would a horizontal analysis report with respect to current liabilities?

A)Current liabilities saw a 30% increase from the prior year to the current year.

B)Current liabilities are 11.77% of total capital.

C)The current ratio is 1.06.

D)Current liabilities saw a 76.92% increase from the prior year to the current year.

What would a horizontal analysis report with respect to current liabilities?

A)Current liabilities saw a 30% increase from the prior year to the current year.

B)Current liabilities are 11.77% of total capital.

C)The current ratio is 1.06.

D)Current liabilities saw a 76.92% increase from the prior year to the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

17

Using a base year as 100% and expressing other years as a percentage of the base year is an example of

A)trend analysis.

B)vertical analysis.

C)horizontal analysis.

D)benchmarking.

A)trend analysis.

B)vertical analysis.

C)horizontal analysis.

D)benchmarking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following types of analysis include trend percentage analysis?

A)Vertical

B)Horizontal

C)Benchmarking

D)Profitability

A)Vertical

B)Horizontal

C)Benchmarking

D)Profitability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

19

The study of percentage changes in comparative financial statements is an example of

A)vertical analysis.

B)trend analysis.

C)benchmarking.

D)horizontal analysis.

A)vertical analysis.

B)trend analysis.

C)benchmarking.

D)horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which type of analysis would reveal a sales increase of $5000 from Year 1 to Year 2?

A)Horizontal

B)Capital

C)Profitability

D)Vertical

A)Horizontal

B)Capital

C)Profitability

D)Vertical

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

21

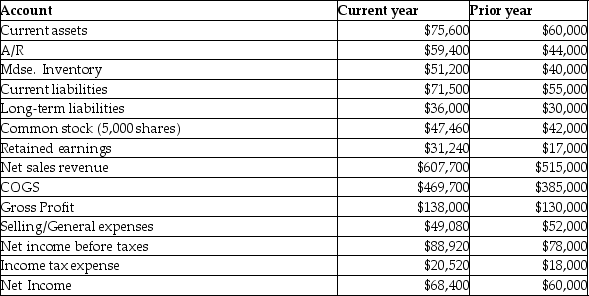

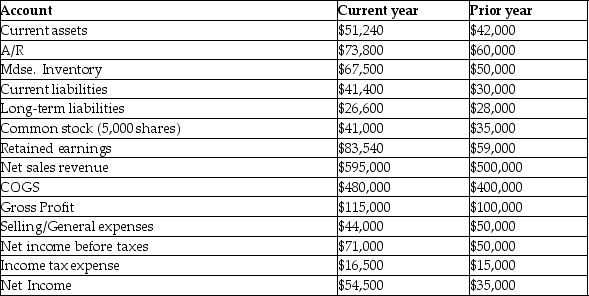

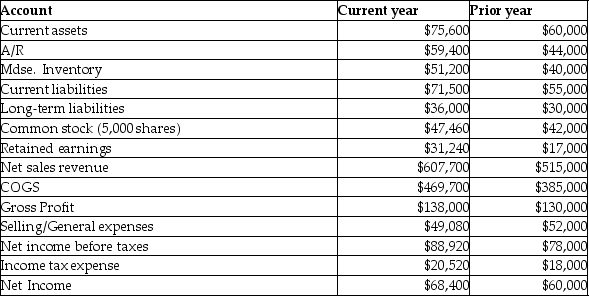

The McCumber Corporation data for the current year:

With respect to net sales revenue,what would a horizontal analysis report?

A)There was an increase of 20.00% in net sales revenue.

B)There is a sales return of $10.40.

C)The cost of goods sold is 77.37% of net sales revenue.

D)There is an accounts receivable turnover of 11.17 times.

With respect to net sales revenue,what would a horizontal analysis report?

A)There was an increase of 20.00% in net sales revenue.

B)There is a sales return of $10.40.

C)The cost of goods sold is 77.37% of net sales revenue.

D)There is an accounts receivable turnover of 11.17 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

22

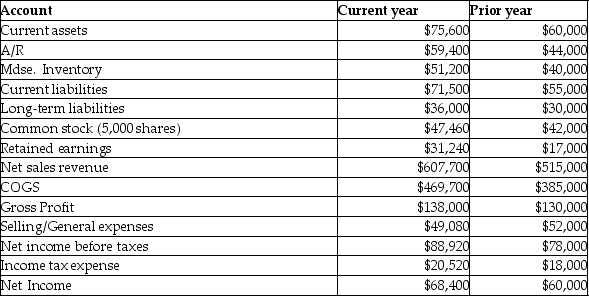

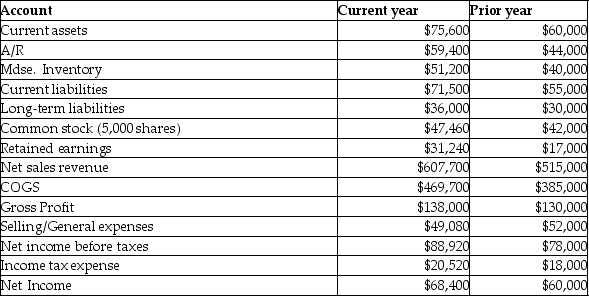

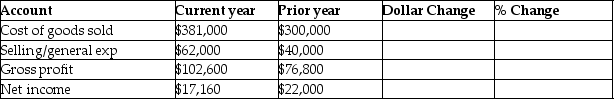

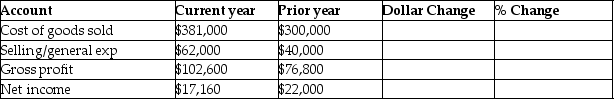

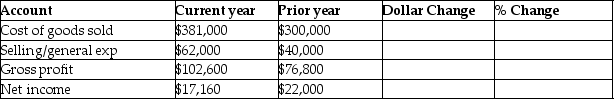

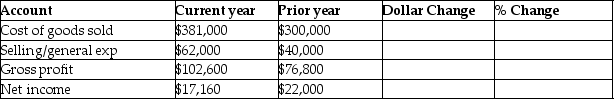

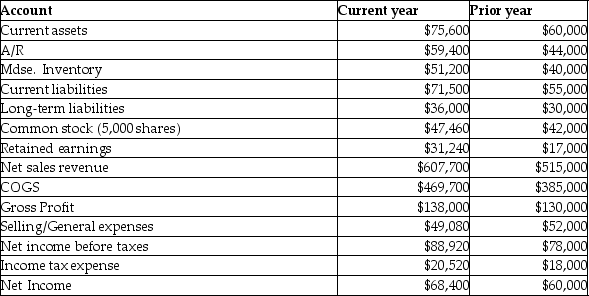

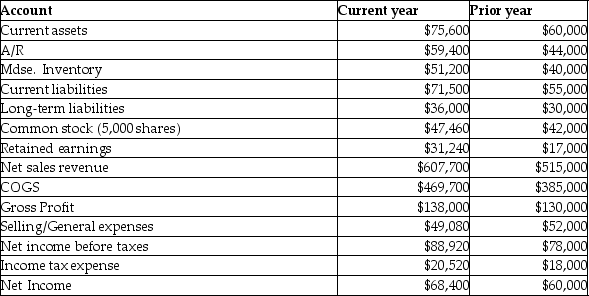

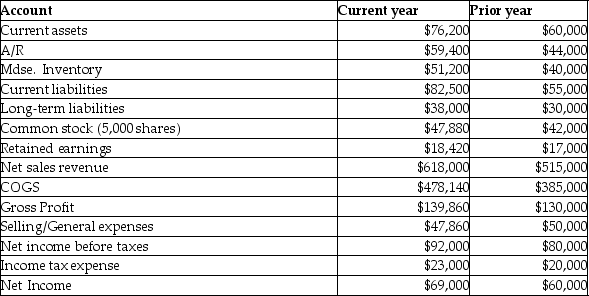

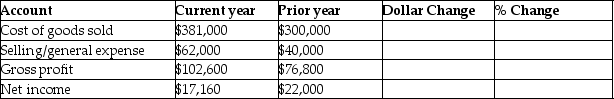

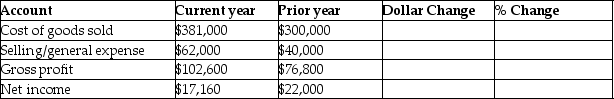

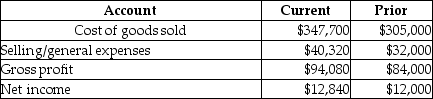

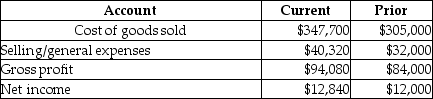

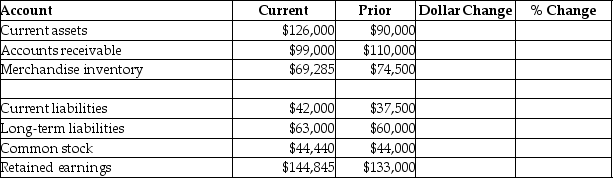

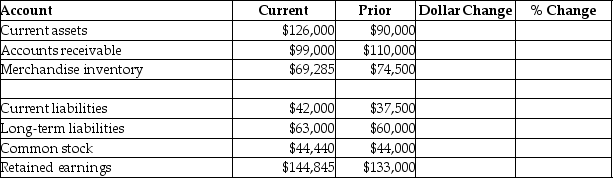

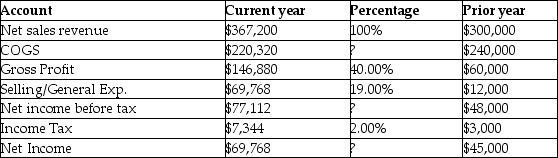

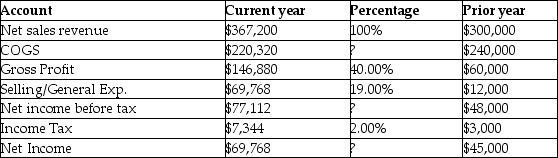

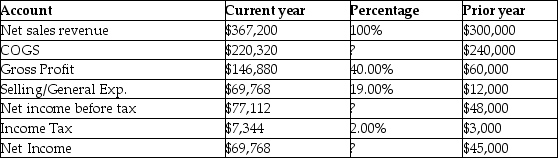

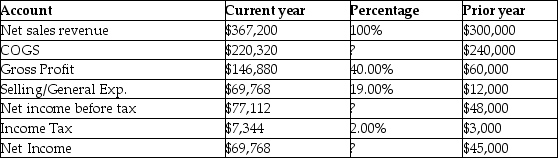

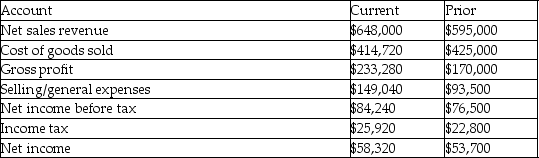

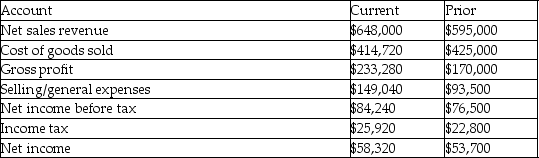

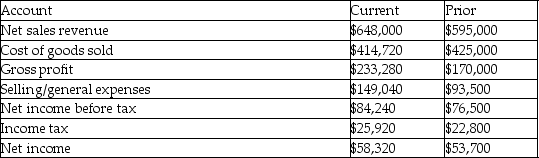

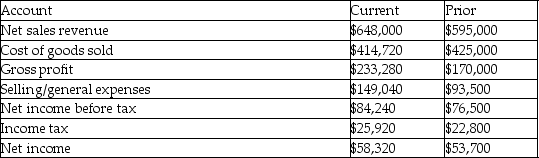

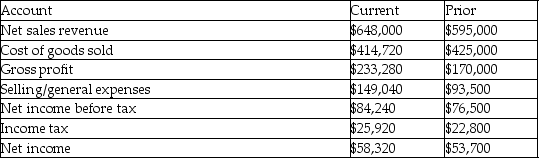

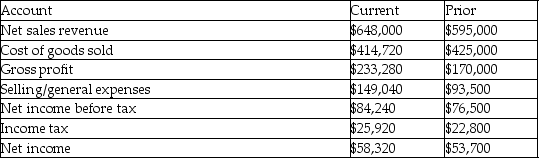

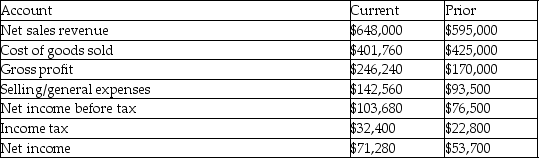

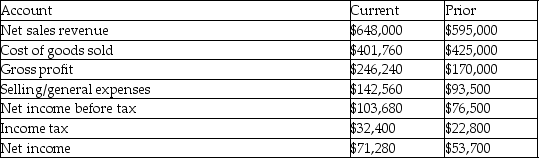

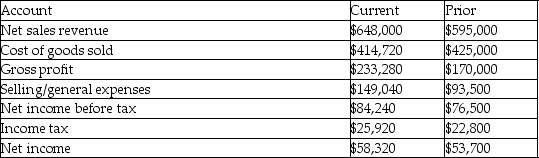

Use the following information to do a horizontal analysis of Marcus Corporation's income statement for the current year and prior year:

What is the dollar change in selling/general expenses?

A)$(4,840)

B)$81,000

C)$22,000

D)$102,000

What is the dollar change in selling/general expenses?

A)$(4,840)

B)$81,000

C)$22,000

D)$102,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

23

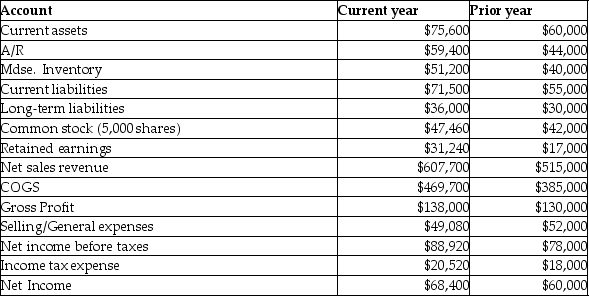

The Stemple Corporation data for the current year:

What would a horizontal analysis report with respect to current liabilities show?

A)Current liabilities are 6.96% of total capital.

B)Current liabilities saw a 72.46% increase from the prior year to the current year.

C)The current ratio is 1.24.

D)Current liabilities saw a 38.00% increase from the prior year to the current year.

What would a horizontal analysis report with respect to current liabilities show?

A)Current liabilities are 6.96% of total capital.

B)Current liabilities saw a 72.46% increase from the prior year to the current year.

C)The current ratio is 1.24.

D)Current liabilities saw a 38.00% increase from the prior year to the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

24

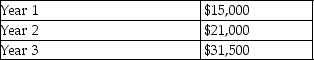

A company reported the following amounts of net income:

Which of the following is the percentage change from Year 1 to Year 2?

A)24.00%

B)25.00%

C)124.00%

D)55.00%

Which of the following is the percentage change from Year 1 to Year 2?

A)24.00%

B)25.00%

C)124.00%

D)55.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Nichols Corporation data for the current year:

What would a horizontal analysis report with respect to net sales revenue?

A)There is a sales return of $10.23.

B)There was an increase of 18.00% in net sales revenue.

C)The cost of goods sold is 77.29% of net sales revenue.

D)There is an accounts receivable turnover of 11.26 times.

What would a horizontal analysis report with respect to net sales revenue?

A)There is a sales return of $10.23.

B)There was an increase of 18.00% in net sales revenue.

C)The cost of goods sold is 77.29% of net sales revenue.

D)There is an accounts receivable turnover of 11.26 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

26

The McCumber Corporation data for the current year:

With respect to common stock,what would a horizontal analysis report?

A)Stockholder's equity as 7.75% of total capital

B)Sales return of $11.17

C)87.72% increase from prior to current year of cost of goods sold

D)Increase of $5,880 in common stock

With respect to common stock,what would a horizontal analysis report?

A)Stockholder's equity as 7.75% of total capital

B)Sales return of $11.17

C)87.72% increase from prior to current year of cost of goods sold

D)Increase of $5,880 in common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the following information to do a horizontal analysis of Marcus Corporation's income statement for the current year and prior year

What is the percentage change in cost of goods sold?

A)-22.00%

B)27.00%

C)127.00%

D)33.59%

What is the percentage change in cost of goods sold?

A)-22.00%

B)27.00%

C)127.00%

D)33.59%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Nichols Corporation data for the current year:

What would a horizontal analysis report with respect to common stock?

A)Stockholder's equity as 7.81% of total capital

B)Increase of $5,460 in common stock

C)88.50% increase from prior to current year of cost of goods sold

D)Sales return of $11.26

What would a horizontal analysis report with respect to common stock?

A)Stockholder's equity as 7.81% of total capital

B)Increase of $5,460 in common stock

C)88.50% increase from prior to current year of cost of goods sold

D)Sales return of $11.26

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

29

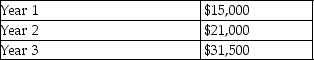

A company reported the following amounts of net income:

Which of the following is the percentage change from Year 2 to Year 3?

A)24.00%

B)55.00%

C)124.00%

D)25.00%

Which of the following is the percentage change from Year 2 to Year 3?

A)24.00%

B)55.00%

C)124.00%

D)25.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Nichols Corporation data for the current year:

What would a horizontal analysis report with respect to current assets?

A)Inventory turnover of 9.17 times

B)Current ratio of 1.06

C)A 26.00% increase in current assets

D)Current assets as 40.60% of total assets

What would a horizontal analysis report with respect to current assets?

A)Inventory turnover of 9.17 times

B)Current ratio of 1.06

C)A 26.00% increase in current assets

D)Current assets as 40.60% of total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

31

The McCumber Corporation data for the current year:

With respect to selling/general expenses,what would a horizontal analysis report?

A)The current ratio is 0.92.

B)There was a 4.47% increase from prior to current year.

C)There was a 4.28% decrease from prior to current year.

D)Selling/general expenses are 7.74% of net sales revenue.

With respect to selling/general expenses,what would a horizontal analysis report?

A)The current ratio is 0.92.

B)There was a 4.47% increase from prior to current year.

C)There was a 4.28% decrease from prior to current year.

D)Selling/general expenses are 7.74% of net sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

32

The McCumber Corporation data for the current year:

With respect to net income before income tax expense and net income,what would a horizontal analysis report?

A)There was an increase in both net income before income tax expense and net income of 15.00%.

B)Both net income before income tax expense and net income increased by $129,000.

C)The current ratio is 0.92.

D)Both net income before tax expense and net income were 11.17% of net sales revenue.

With respect to net income before income tax expense and net income,what would a horizontal analysis report?

A)There was an increase in both net income before income tax expense and net income of 15.00%.

B)Both net income before income tax expense and net income increased by $129,000.

C)The current ratio is 0.92.

D)Both net income before tax expense and net income were 11.17% of net sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Nichols Corporation data for the current year:

What would a horizontal analysis report with respect to selling/general expenses?

A)There was a 5.62% decrease from prior to current year.

B)There was a 5.95% increase from prior to current year.

C)The current ratio is 1.06.

D)Selling/general expenses are 8.08% of net sales revenue.

What would a horizontal analysis report with respect to selling/general expenses?

A)There was a 5.62% decrease from prior to current year.

B)There was a 5.95% increase from prior to current year.

C)The current ratio is 1.06.

D)Selling/general expenses are 8.08% of net sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

34

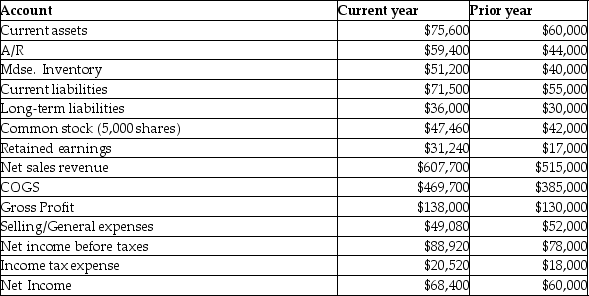

The Stemple Corporation data for the current year:

What would a horizontal analysis report with respect to net income show?

A)Both net income before tax expense and net income are 9.16% of net sales revenue.

B)There was an increase in net income of 55.71%.

C)Both net income before income tax expense and net income increased by $89,500.

D)The current ratio is 1.24.

What would a horizontal analysis report with respect to net income show?

A)Both net income before tax expense and net income are 9.16% of net sales revenue.

B)There was an increase in net income of 55.71%.

C)Both net income before income tax expense and net income increased by $89,500.

D)The current ratio is 1.24.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

35

The McCumber Corporation data for the current year:

With respect to current assets,what would a horizontal analysis report?

A)Inventory turnover of 9.34 times

B)Current ratio of 0.92

C)Current assets as 40.79% of total assets

D)A 27.00% increase in current assets

With respect to current assets,what would a horizontal analysis report?

A)Inventory turnover of 9.34 times

B)Current ratio of 0.92

C)Current assets as 40.79% of total assets

D)A 27.00% increase in current assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Nichols Corporation data for the current year:

What would a horizontal analysis report with respect to long-term liabilities?

A)Long-term liabilities increased by $6,000.

B)Long-term liabilities decreased by 5.92%.

C)Long-term liabilities increased by 6.21%.

D)Long-term liabilities decreased by $1,500.

What would a horizontal analysis report with respect to long-term liabilities?

A)Long-term liabilities increased by $6,000.

B)Long-term liabilities decreased by 5.92%.

C)Long-term liabilities increased by 6.21%.

D)Long-term liabilities decreased by $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

37

The McCumber Corporation data for the current year:

With respect to long-term liabilities,what would a horizontal analysis report?

A)Long-term liabilities decreased by 6.15%.

B)Long-term liabilities increased by $8,000.

C)Long-term liabilities increased by 6.15%.

D)Long-term liabilities decreased by $1,800.

With respect to long-term liabilities,what would a horizontal analysis report?

A)Long-term liabilities decreased by 6.15%.

B)Long-term liabilities increased by $8,000.

C)Long-term liabilities increased by 6.15%.

D)Long-term liabilities decreased by $1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

38

The McCumber Corporation data for the current year:

With respect to current liabilities,what would a horizontal analysis report?

A)The current ratio is 0.92.

B)Current liabilities are 13.35% of total capital.

C)Current liabilities saw a 50% increase from the prior year to the current year.

D)Current liabilities saw a 66.67% increase from the prior year to the current year.

With respect to current liabilities,what would a horizontal analysis report?

A)The current ratio is 0.92.

B)Current liabilities are 13.35% of total capital.

C)Current liabilities saw a 50% increase from the prior year to the current year.

D)Current liabilities saw a 66.67% increase from the prior year to the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

39

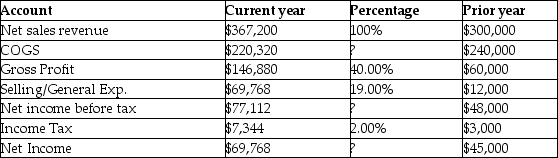

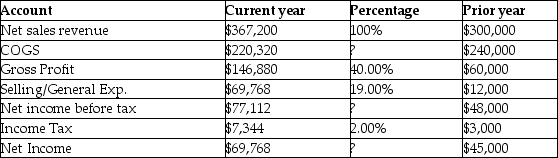

Use the following information to do a horizontal analysis of Marcus Corporation's income statement for the current year and prior year:

What is the dollar change in gross profit?

A)$22,000

B)$(4,840)

C)$179,400

D)$25,800

What is the dollar change in gross profit?

A)$22,000

B)$(4,840)

C)$179,400

D)$25,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information to do a horizontal analysis of Marcus Corporation's income statement for the current year and prior year:

What is the percentage change in net income?

A)78.00%

B)-22.00%

C)16.73%

D)35.59%

What is the percentage change in net income?

A)78.00%

B)-22.00%

C)16.73%

D)35.59%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Stemple Corporation data for the current year:

What would a horizontal analysis report with respect to selling/general expenses show?

A)A 13.64% increase

B)Selling/general expenses as 7.39% of net sales revenue

C)A current ratio of 1.24

D)A 12% decrease

What would a horizontal analysis report with respect to selling/general expenses show?

A)A 13.64% increase

B)Selling/general expenses as 7.39% of net sales revenue

C)A current ratio of 1.24

D)A 12% decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

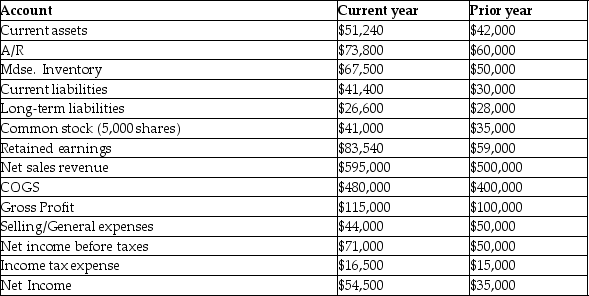

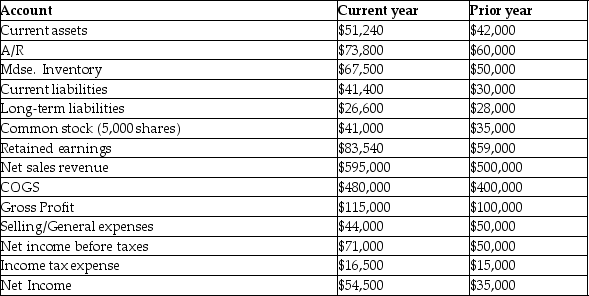

k this deck

42

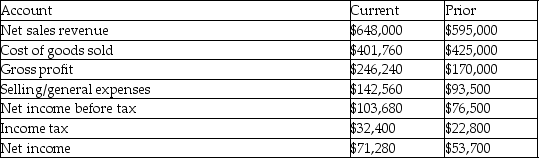

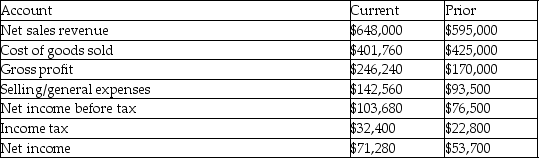

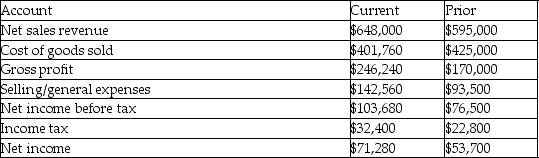

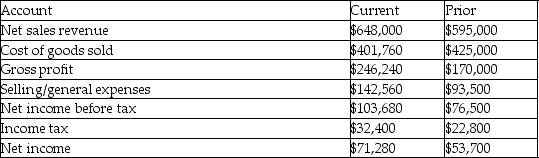

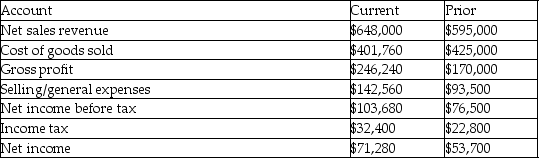

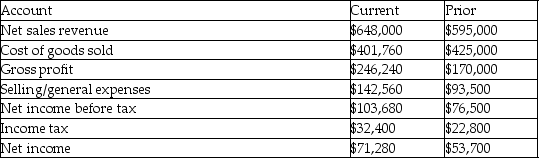

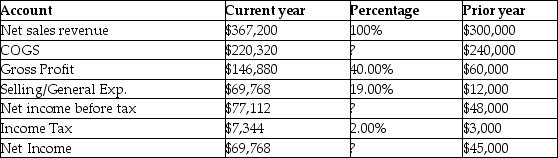

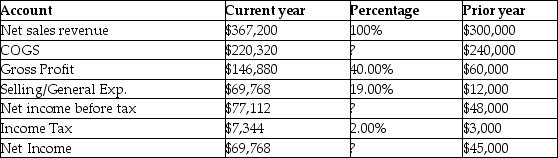

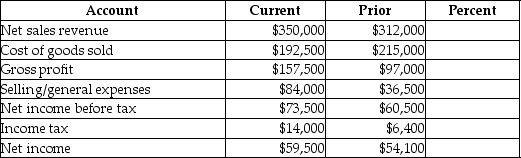

Use the following information to do a horizontal analysis of Boyce Corporation's income statement for the current year and prior year:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

43

Trend analysis is the same thing as a vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

44

In performing a vertical analysis of an income statement,which of the following is generally used as the base amount?

A)Net sales

B)Total expenses

C)Gross sales

D)Gross profit

A)Net sales

B)Total expenses

C)Gross sales

D)Gross profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following terms is defined as an analysis of a financial statement that reveals the relationship of each statement item to a specific base?

A)Benchmarking

B)Horizontal analysis

C)Vertical analysis

D)Capital analysis

A)Benchmarking

B)Horizontal analysis

C)Vertical analysis

D)Capital analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Stemple Corporation data for the current year:

What would a horizontal analysis report with respect to long-term liabilities show?

A)The debt ratio is 35.32%.

B)Long-term liabilities increased by 4.47%.

C)The current ratio is 1.24.

D)Long-term liabilities decreased by $(1,400).

What would a horizontal analysis report with respect to long-term liabilities show?

A)The debt ratio is 35.32%.

B)Long-term liabilities increased by 4.47%.

C)The current ratio is 1.24.

D)Long-term liabilities decreased by $(1,400).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

47

In vertical analysis,the base used for comparison on the balance sheet is

A)total stockholders' equity.

B)total liabilities.

C)total liabilities plus total stockholders' equity or total assets.

D)none of the above

A)total stockholders' equity.

B)total liabilities.

C)total liabilities plus total stockholders' equity or total assets.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Stemple Corporation data for the current year:

What would a horizontal analysis report with respect to current assets show?

A)Inventory turnover of 7.11 times

B)Current ratio of 1.24

C)A 22% increase in current assets

D)Current assets as 26.61% of total assets

What would a horizontal analysis report with respect to current assets show?

A)Inventory turnover of 7.11 times

B)Current ratio of 1.24

C)A 22% increase in current assets

D)Current assets as 26.61% of total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following information to do a horizontal analysis of Carlin Corporation's balance sheet for the end of the current and prior years.Fill in the table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

50

Vertical analysis would rarely be performed on which of the following?

A)Income statement

B)Schedule of depreciation

C)Balance sheet

D)All of the above are common targets of vertical analysis.

A)Income statement

B)Schedule of depreciation

C)Balance sheet

D)All of the above are common targets of vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

51

Net income is used as the base for vertical analysis percentages on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

52

Trend percentages are not a form of vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

53

Taylor Company reported the following information for the current year:

What would a vertical analysis report with respect to current year net income before income tax and income tax expense?

A)An increase of $125,112 from prior to current year

B)An increase of both net income before income tax and income tax of 22%

C)A decrease of $29,112 in net income before tax

D)Net income before tax of 21% and income tax of 2.00% of net sales revenue

What would a vertical analysis report with respect to current year net income before income tax and income tax expense?

A)An increase of $125,112 from prior to current year

B)An increase of both net income before income tax and income tax of 22%

C)A decrease of $29,112 in net income before tax

D)Net income before tax of 21% and income tax of 2.00% of net sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

54

The formula used in vertical analysis of the balance sheet is: (each balance sheet line item/total assets)= vertical %.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

55

In a vertical analysis of an income statement,sales revenue is assigned a percentage of 100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

56

In performing a vertical analysis of a balance sheet,which of the following is generally used as the base amount?

A)Total liabilities

B)Net assets

C)Total assets

D)Total stockholder's equity

A)Total liabilities

B)Net assets

C)Total assets

D)Total stockholder's equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Stemple Corporation data for the current year:

What would a horizontal analysis report with respect to common stock show?

A)An increase of 6.89 in sales revenue

B)Increase of $6,000 in common stock

C)An increase of 85.37% from prior to current year

D)Sales return of $9.16

What would a horizontal analysis report with respect to common stock show?

A)An increase of 6.89 in sales revenue

B)Increase of $6,000 in common stock

C)An increase of 85.37% from prior to current year

D)Sales return of $9.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

58

In a vertical analysis of a balance sheet,total liabilities is assigned a percentage of 100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Stemple Corporation data for the current year:

What would a horizontal analysis report with respect to net sales revenue show?

A)Cost of goods sold as 80.67% of net sales revenue

B)A sales return of 9.16%

C)An increase of 19.00% in net sales revenue

D)Accounts receivable turnover of 8.06 times

What would a horizontal analysis report with respect to net sales revenue show?

A)Cost of goods sold as 80.67% of net sales revenue

B)A sales return of 9.16%

C)An increase of 19.00% in net sales revenue

D)Accounts receivable turnover of 8.06 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

60

Vertical analysis is the analysis of a financial statement that reveals the relationship of each statement item to a specified base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

61

The common size statement percentages are different from those that appear in horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

62

Taylor Company reported the following information for the current year:

What would a vertical analysis report with respect to the relationship between current year net sales revenue and COGS?

A)COGS was 60.00% of net sales revenue

B)A 8.20% decrease from prior to current year

C)An increase of $19,680 from prior to current year

D)An increase of $460,320 from prior to current year

What would a vertical analysis report with respect to the relationship between current year net sales revenue and COGS?

A)COGS was 60.00% of net sales revenue

B)A 8.20% decrease from prior to current year

C)An increase of $19,680 from prior to current year

D)An increase of $460,320 from prior to current year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

63

Taylor Company reported the following information for the current year:

What would a vertical analysis report with respect to current year selling and general expenses?

A)An increase of $57,768

B)19% of net sales revenue

C)A decrease of 82.80%

D)25% of net sales revenue

What would a vertical analysis report with respect to current year selling and general expenses?

A)An increase of $57,768

B)19% of net sales revenue

C)A decrease of 82.80%

D)25% of net sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

64

Selected information about The Staccato Company for the current year and prior year is given below.

The current year's net income percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)11.00%.

B)11.98%.

C)32.74%.

D)132.74%.

The current year's net income percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)11.00%.

B)11.98%.

C)32.74%.

D)132.74%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

65

To follow is selected information about The Boston Company for the current year and prior year.

What is the current year's selling and general expenses percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)25.05%

B)14.43%

C)159.40%

D)23.00%

What is the current year's selling and general expenses percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)25.05%

B)14.43%

C)159.40%

D)23.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

66

Benchmarking is a valid analysis measure of performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

67

Horizontal analysis allows the comparison of companies with different amounts of net sales and net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

68

Ferrero Company reported the following information for the current year:

With respect to current year net sales revenue,what would a vertical analysis report?

A)COGS would be 15.00% of net sales revenue

B)A dividend yield of $8.20

C)A decrease of 10% in net sales revenue

D)Net sales revenue would be the base amount

With respect to current year net sales revenue,what would a vertical analysis report?

A)COGS would be 15.00% of net sales revenue

B)A dividend yield of $8.20

C)A decrease of 10% in net sales revenue

D)Net sales revenue would be the base amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

69

To follow is selected information about The Boston Company for the current year and prior year.

What is the current year's net income percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)8.60%

B)9.80%

C)9.00%

D)108.60%

What is the current year's net income percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)8.60%

B)9.80%

C)9.00%

D)108.60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

70

The data provided by the horizontal or vertical analysis of the financial statements can be used in benchmarking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

71

A common size statement reports only percentages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

72

Comparing the horizontal analysis of McDonald's financial statements to the horizontal analysis of Burger King's financial statements in percentages of increase or decrease from 2010 to 2011 would be

A)vertical analysis.

B)benchmarking.

C)ratio analysis.

D)horizontal analysis.

A)vertical analysis.

B)benchmarking.

C)ratio analysis.

D)horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

73

Selected information about The Staccato Company for the current year and prior year is given below.

The current year's cost of goods sold percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)94.53%.

B)67.52%.

C)-5.47%.

D)62.00%.

The current year's cost of goods sold percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)94.53%.

B)67.52%.

C)-5.47%.

D)62.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

74

To follow is selected information about The Boston Company for the current year and prior year.

What is the current year's cost of goods sold percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)69.70%

B)64.00%

C)-2.42%

D)97.58%

What is the current year's cost of goods sold percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)69.70%

B)64.00%

C)-2.42%

D)97.58%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

75

Common size statements allow the comparison of two or more companies with different amounts of net sales and net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

76

Selected information about The Staccato Company for the current year and prior year is given below.

The current year's income tax percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)142.11%.

B)42.11%.

C)5.00%.

D)5.45%.

The current year's income tax percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)142.11%.

B)42.11%.

C)5.00%.

D)5.45%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

77

Selected information about The Staccato Company for the current year and prior year is given below.

The current year's selling and general expenses percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)22.00%.

B)23.96%.

C)152.47%.

D)14.43%.

The current year's selling and general expenses percentage (as would be found on a vertical analysis of the income statement for the current year)is

A)22.00%.

B)23.96%.

C)152.47%.

D)14.43%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

78

Taylor Company reported the following information for the current year:

What would a vertical analysis report with respect to current year income tax expense?

A)A decrease of $24,768

B)A decrease of 144.80% from prior to current year

C)Income tax expense is 2.00% of net sales revenue

D)A decrease of $4,344

What would a vertical analysis report with respect to current year income tax expense?

A)A decrease of $24,768

B)A decrease of 144.80% from prior to current year

C)Income tax expense is 2.00% of net sales revenue

D)A decrease of $4,344

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

79

To follow is selected information about The Boston Company for the current year and prior year.

What is the current year's income tax percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)4.00%

B)13.68%

C)113.68%

D)4.36%

What is the current year's income tax percentage (as would be found on a vertical analysis of the income statement for the current year)?

A)4.00%

B)13.68%

C)113.68%

D)4.36%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

80

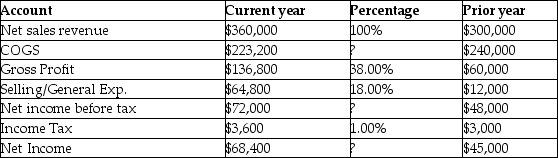

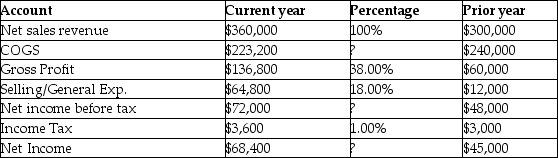

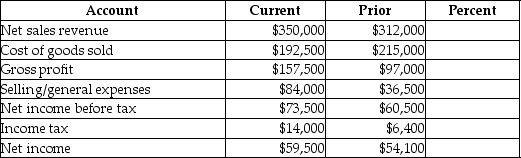

Use the following information about The Conley Company to do a vertical analysis of the income statement for the current year.Fill in the missing components in the table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck