Deck 2: Financial Statements and Ratio Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 2: Financial Statements and Ratio Analysis

1

In cross-sectional analysis,a firm's financial ratios are

A) judged against the performance of firms in the same industry.

B) compared with the firm's ratios from the most recent period.

C) compared with ratios from all firms.

D) compared with a general standard.

E) plotted over time to isolate trends.

A) judged against the performance of firms in the same industry.

B) compared with the firm's ratios from the most recent period.

C) compared with ratios from all firms.

D) compared with a general standard.

E) plotted over time to isolate trends.

judged against the performance of firms in the same industry.

2

In common-size financial statements,

A) all balance sheet items are divided by total liabilities.

B) total sales are divided by total assets.

C) depreciation expense is divided by total sales.

D) accrued taxes are divided by total sales.

E) net income is divided by total assets.

A) all balance sheet items are divided by total liabilities.

B) total sales are divided by total assets.

C) depreciation expense is divided by total sales.

D) accrued taxes are divided by total sales.

E) net income is divided by total assets.

depreciation expense is divided by total sales.

3

Using financial information to aid in decision making is called

A) "what-if" analysis.

B) factor analysis.

C) financial analysis.

D) quantitative analysis.

E) managerial economics.

A) "what-if" analysis.

B) factor analysis.

C) financial analysis.

D) quantitative analysis.

E) managerial economics.

financial analysis.

4

Which of the following is one of the financial statements critical to financial statement analysis?

A) 8-K

B) SEC registration statement

C) Disclosure

D) 10-Q

E) Statement of Cash Flows

A) 8-K

B) SEC registration statement

C) Disclosure

D) 10-Q

E) Statement of Cash Flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is a variation of the accounting identity?

A) Assets − Fixed assets = Equity − Liabilities

B) Owner's equity = Assets − Liabilities

C) Equity − Liabilities = Assets

D) Assets + Equity = Liabilities

E) Assets + Lease obligations = Equity + Liabilities

A) Assets − Fixed assets = Equity − Liabilities

B) Owner's equity = Assets − Liabilities

C) Equity − Liabilities = Assets

D) Assets + Equity = Liabilities

E) Assets + Lease obligations = Equity + Liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

________ ratios measure the efficiency with which assets are converted to sales or cash.

A) Liquidity

B) Activity

C) Profitability

D) Market

E) Financing

A) Liquidity

B) Activity

C) Profitability

D) Market

E) Financing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

When financial ratios are compared to financial ratios from previous years,a ________ is conducted.

A) cross-time

B) SIC code

C) time series

D) cross-sectional

E) None of the above

A) cross-time

B) SIC code

C) time series

D) cross-sectional

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is the return on equity if net income was $55,000,total assets are $115,000,EBIT was $100,000,and equity is $75,000?

A) 47.8%

B) 63.1%

C) 73.3%

D) 87.0%

E) 55.0%

A) 47.8%

B) 63.1%

C) 73.3%

D) 87.0%

E) 55.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

An income statement contains all of the following EXCEPT

A) revenues.

B) assets.

C) losses.

D) gains.

E) expenses.

A) revenues.

B) assets.

C) losses.

D) gains.

E) expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

Each of the following is a ratio category EXCEPT

A) productivity ratios.

B) market ratios.

C) liquidity ratios.

D) financing ratios.

E) activity ratios.

A) productivity ratios.

B) market ratios.

C) liquidity ratios.

D) financing ratios.

E) activity ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Find the return on assets if net income was $55,000,total assets are $115,000,EBIT was $100,000,and equity is $75,000.

A) 73.3%

B) 63.1%

C) 87.0%

D) 47.8%

E) 55.0%

A) 73.3%

B) 63.1%

C) 87.0%

D) 47.8%

E) 55.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not a commonly used source of information for financial analysis?

A) A consultant's analysis of industry conditions

B) Key employees' guesses about future trends

C) The Securities and Exchange Commission's filings

D) The firm's annual report

E) The economic data from a forecasting firm

A) A consultant's analysis of industry conditions

B) Key employees' guesses about future trends

C) The Securities and Exchange Commission's filings

D) The firm's annual report

E) The economic data from a forecasting firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

If net income was $10,000,interest expense was $4,000,and taxes were $1,000,what is the operating profit margin if sales were $50,000?

A) 28%

B) 30%

C) 22%

D) 10%

E) 20%

A) 28%

B) 30%

C) 22%

D) 10%

E) 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

Balance sheets

A) show how the firm raised funds to purchase assets.

B) report a firm's activities over a period of time.

C) describe a firm's cash flows.

D) provide information about a firm's labor costs.

E) may not balance if the firm suffered a net loss.

A) show how the firm raised funds to purchase assets.

B) report a firm's activities over a period of time.

C) describe a firm's cash flows.

D) provide information about a firm's labor costs.

E) may not balance if the firm suffered a net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

The right-hand side of the balance sheet shows

A) the cash flow generated by a firm's assets.

B) how the firm financed its assets.

C) the level of accumulated depreciation.

D) profits earned by the firm in the current period.

E) the firm's good will.

A) the cash flow generated by a firm's assets.

B) how the firm financed its assets.

C) the level of accumulated depreciation.

D) profits earned by the firm in the current period.

E) the firm's good will.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

Sales for a firm are $500,000,cost of goods sold are $400,000,and interest expenses are $20,000.What is the gross profit margin?

A) 16.0%

B) 20.0%

C) 4.0%

D) 25.0%

E) 30.0%

A) 16.0%

B) 20.0%

C) 4.0%

D) 25.0%

E) 30.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not included in a cash flow statement?

A) Labor productivity

B) Interest earnings

C) Cash flow from operations

D) Depreciation expense

E) The increase in long-term debt

A) Labor productivity

B) Interest earnings

C) Cash flow from operations

D) Depreciation expense

E) The increase in long-term debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

The four-digit codes used by the government to classify firms into industries are known as

A) ratio standards.

B) EIC codes.

C) USIC codes.

D) financial benchmarks.

E) SIC codes.

A) ratio standards.

B) EIC codes.

C) USIC codes.

D) financial benchmarks.

E) SIC codes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

The ________ is a snapshot of the firm at a particular point in time.

A) income statement

B) statement of cash flows

C) statement of retained earnings

D) balance sheet

E) None of the above

A) income statement

B) statement of cash flows

C) statement of retained earnings

D) balance sheet

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

All of the following are problems with cross-sectional financial analysis EXCEPT that

A) an industry may be dominated by a few firms.

B) annual reports sometimes do not disclose divisional financial data.

C) many firms are conglomerates.

D) it provides no basis for comparison to other firms.

E) there may be no obvious firms to be used for comparison.

A) an industry may be dominated by a few firms.

B) annual reports sometimes do not disclose divisional financial data.

C) many firms are conglomerates.

D) it provides no basis for comparison to other firms.

E) there may be no obvious firms to be used for comparison.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

Ratio interaction refers to

A) using multiple ratios to make a decision.

B) the way ratios are affected by managerial decisions.

C) how ratios affect managerial decisions.

D) the effect one ratio has on another.

E) when a ratio raises a red flag for analysts.

A) using multiple ratios to make a decision.

B) the way ratios are affected by managerial decisions.

C) how ratios affect managerial decisions.

D) the effect one ratio has on another.

E) when a ratio raises a red flag for analysts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the current ratio if cash is $10,000,accounts receivable are $25,000,inventories are $30,000,accounts payable are $40,000,and accrued payroll is $15,000?

A) 2.00

B) 1.18

C) 1.13

D) 0.64

E) 0.73

A) 2.00

B) 1.18

C) 1.13

D) 0.64

E) 0.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

Find accounts receivable turnover if a firm has an accounts receivable of $80,000,a total asset turnover of .75,and total assets of $230,000.

A) 2.15

B) 3.8

C) 2.9

D) 1.5

E) 0.65

A) 2.15

B) 3.8

C) 2.9

D) 1.5

E) 0.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is a firm's total asset turnover if its fixed assets are $120,000,current assets are $30,000,current liabilities are $44,000,sales were $200,000,and net income was $75,000?

A) 0.5 times

B) 2.2 times

C) 1.3 times

D) 2.0 times

E) 1.7 times

A) 0.5 times

B) 2.2 times

C) 1.3 times

D) 2.0 times

E) 1.7 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

The quick ratio improves upon the current ratio by

A) using more up-to-date information.

B) simplifying the calculation.

C) subtracting intangible assets like goodwill.

D) recognizing that inventory is the current asset that is easiest to value.

E) recognizing that inventory is the least liquid current asset.

A) using more up-to-date information.

B) simplifying the calculation.

C) subtracting intangible assets like goodwill.

D) recognizing that inventory is the current asset that is easiest to value.

E) recognizing that inventory is the least liquid current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

A firm has accounts receivable of $150,000.During the year,total sales are $500,000,of which $300,000 are cash sales.What is the average collection period?

A) 109.5 days

B) 182.5 days

C) 273.8 days

D) 486.7 days

E) None of the above

A) 109.5 days

B) 182.5 days

C) 273.8 days

D) 486.7 days

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

A firm has current assets of $350,000,current liabilities of $200,000,cost of goods sold of $250,000,and inventory of $75,000.The firm's inventory turnover is

A) 5.0 times.

B) 3.3 times.

C) 2.7 times.

D) 2.0 times.

E) 4.7 times.

A) 5.0 times.

B) 3.3 times.

C) 2.7 times.

D) 2.0 times.

E) 4.7 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

Market ratios differ from other ratios because

A) they are based on information not contained in the firm's financial statements.

B) they are the only ratios that may have negative values.

C) they are the most important ratios to shareholders.

D) they are the only ratios that relate equity measures to other variables.

E) they are less precise.

A) they are based on information not contained in the firm's financial statements.

B) they are the only ratios that may have negative values.

C) they are the most important ratios to shareholders.

D) they are the only ratios that relate equity measures to other variables.

E) they are less precise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is a firms times interest earned if it posts revenues of $200,000,taxes of $35,000,expenses of $100,000,and interest of $30,000

A) 3.3 times

B) 2.0 times

C) 2.2 times

D) 0.5 times

E) 1.3 times

A) 3.3 times

B) 2.0 times

C) 2.2 times

D) 0.5 times

E) 1.3 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

A firm has sales of $1 million,net income of $250,000,total current assets of $300,000,and accounts receivable of $200,000.The firm's accounts receivable turnover is

A) 0.33 times.

B) 0.20 times.

C) 1.50 times.

D) 5.00 times.

E) 1.25 times.

A) 0.33 times.

B) 0.20 times.

C) 1.50 times.

D) 5.00 times.

E) 1.25 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

All of the following are part of a financial analysis EXCEPT

A) examining the strengths and weaknesses of the firm.

B) performing a means-end analysis.

C) calculating the DuPont ratio.

D) analyzing the competition.

E) performing an industry analysis.

A) examining the strengths and weaknesses of the firm.

B) performing a means-end analysis.

C) calculating the DuPont ratio.

D) analyzing the competition.

E) performing an industry analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

The quick ratio is 1.0.Current assets are $100,000 and current liabilities are $80,000.What is the amount in the inventory account?

A) $20,000

B) $80,000

C) $125,000

D) $180,000

E) Cannot be determined with the information provided.

A) $20,000

B) $80,000

C) $125,000

D) $180,000

E) Cannot be determined with the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

If net income after tax was $10,000,interest expense was $4,000,and taxes were $1,000,what is the net profit margin if sales were $50,000?

A) 10%

B) 30%

C) 22%

D) 28%

E) 20%

A) 10%

B) 30%

C) 22%

D) 28%

E) 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which type of ratio measures how effectively the firm uses its resources to generate income?

A) Activity

B) Liquidity

C) Profitability

D) Leverage

E) Market

A) Activity

B) Liquidity

C) Profitability

D) Leverage

E) Market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a firm has 100,000 shares of common stock outstanding and has just recorded a $45,000 profit,what is its price/earnings ratio if its current share price is $35?

A) 0.78

B) 0.45

C) 14.00

D) 45.00

E) 78.00

A) 0.78

B) 0.45

C) 14.00

D) 45.00

E) 78.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is true?

A) The quick ratio is classified as an activity ratio.

B) Current assets are expected to be converted into cash in less than 2 years.

C) A firm's debt holders prefer a low quick ratio.

D) Activity ratios go hand in hand with liquidity ratios

E) Lower current ratios are always preferable.

A) The quick ratio is classified as an activity ratio.

B) Current assets are expected to be converted into cash in less than 2 years.

C) A firm's debt holders prefer a low quick ratio.

D) Activity ratios go hand in hand with liquidity ratios

E) Lower current ratios are always preferable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

The DuPont analysis calculates ROE as the product of

A) leverage, market value, and turnover.

B) margin, turnover, and leverage.

C) profitability, liquidity, and leverage.

D) activity, leverage, and debt.

E) margin, profitability, and leverage.

A) leverage, market value, and turnover.

B) margin, turnover, and leverage.

C) profitability, liquidity, and leverage.

D) activity, leverage, and debt.

E) margin, profitability, and leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is a firm's debt ratio if its total assets are $135,000,equity is $75,000,current liabilities are $24,000,and total liabilities are $105,000?

A) 140%

B) 110%

C) 50%

D) 60%

E) 78%

A) 140%

B) 110%

C) 50%

D) 60%

E) 78%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

What is the quick ratio if cash is $10,000,accounts receivable are $25,000,inventories are $30,000,accounts payable are $40,000,and accrued payroll is $15,000?

A) 2.00

B) 1.18

C) 0.73

D) 1.13

E) 0.09

A) 2.00

B) 1.18

C) 0.73

D) 1.13

E) 0.09

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a firm's total asset turnover is low,but its fixed asset turnover is high,which of the following ratios should an analyst examine to locate the source of the problem?

A) Debt/equity

B) Price/earnings

C) Return on equity

D) Accounts receivable turnover

E) Times interest earned

A) Debt/equity

B) Price/earnings

C) Return on equity

D) Accounts receivable turnover

E) Times interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

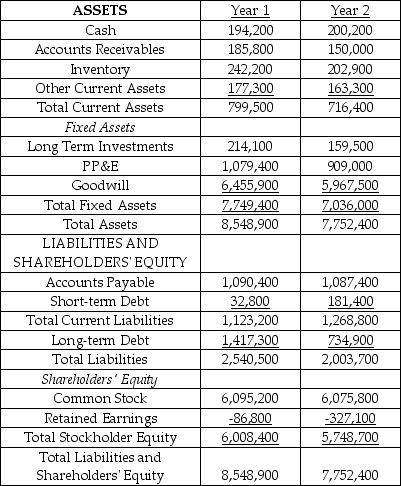

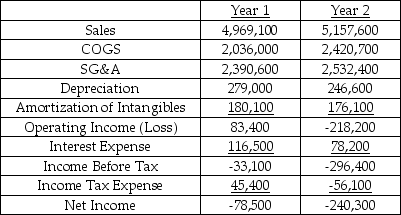

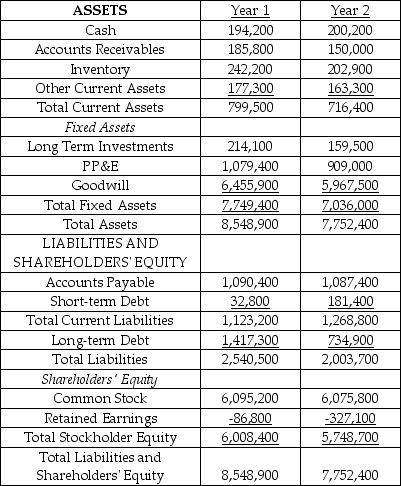

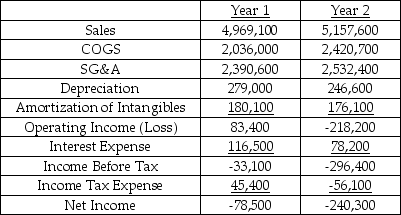

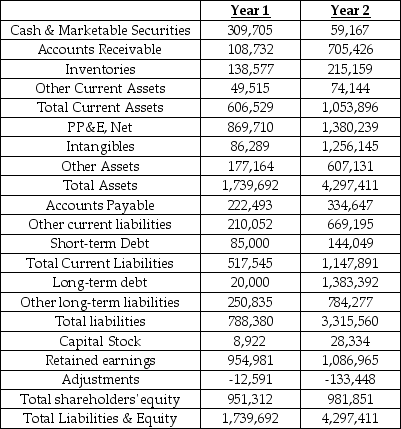

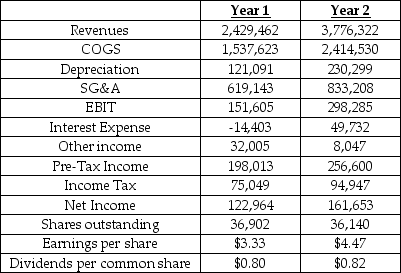

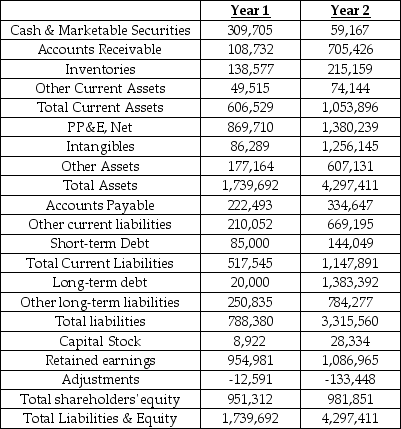

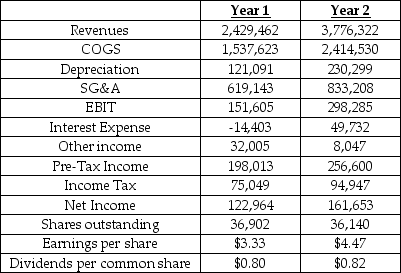

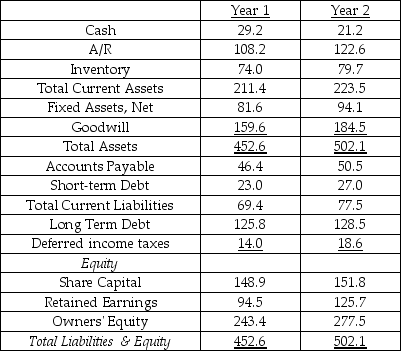

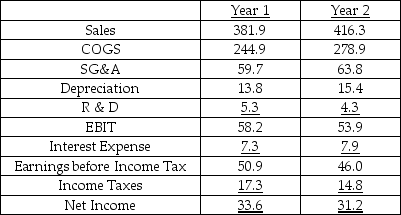

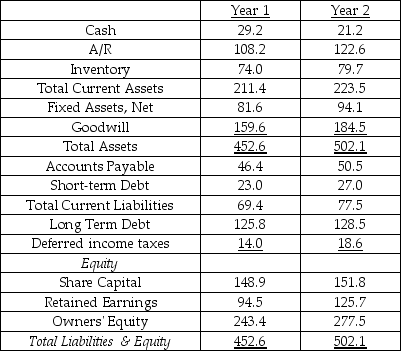

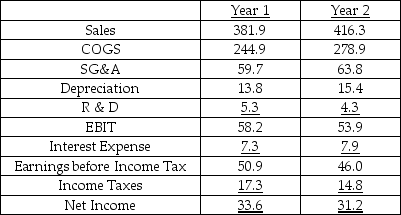

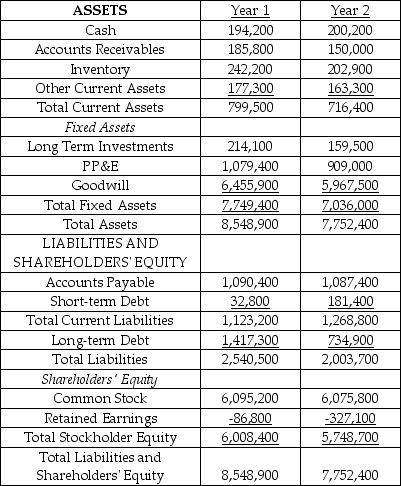

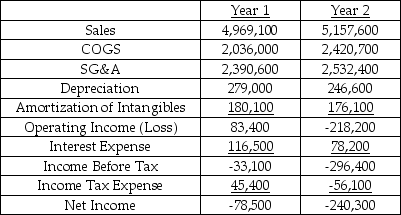

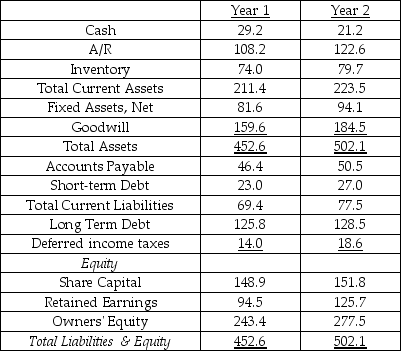

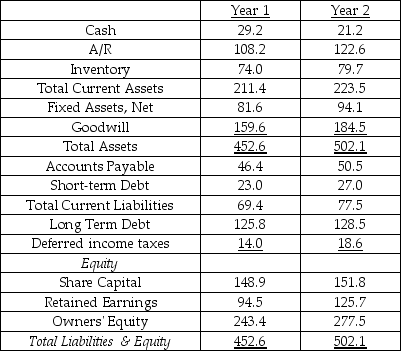

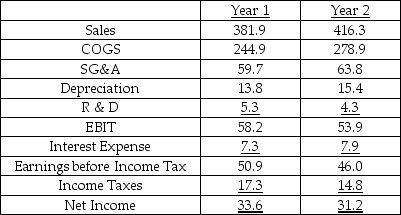

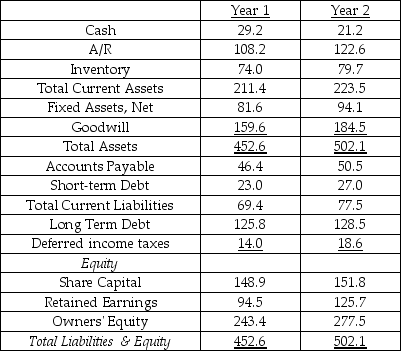

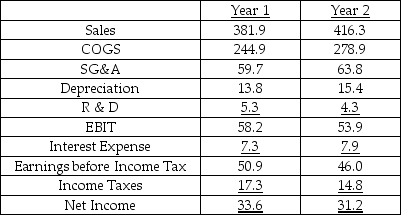

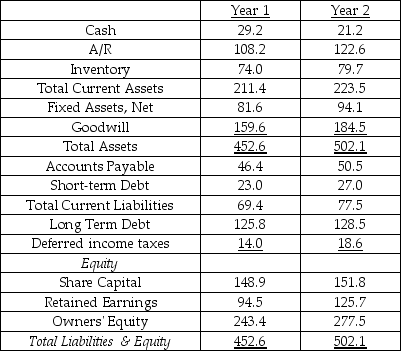

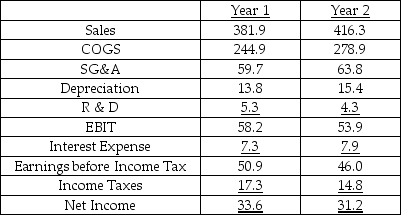

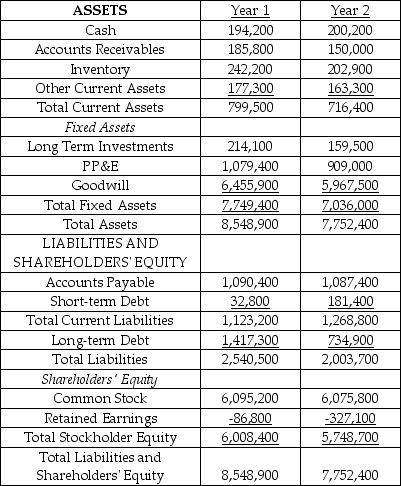

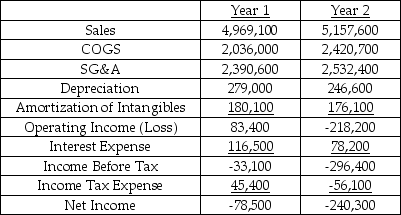

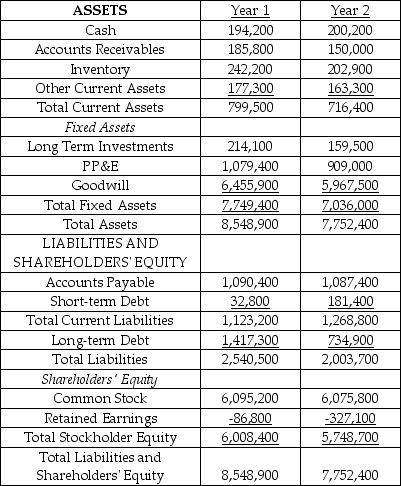

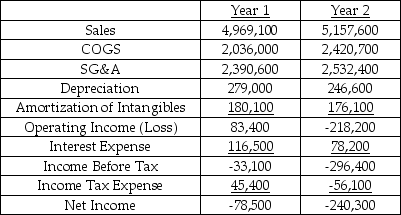

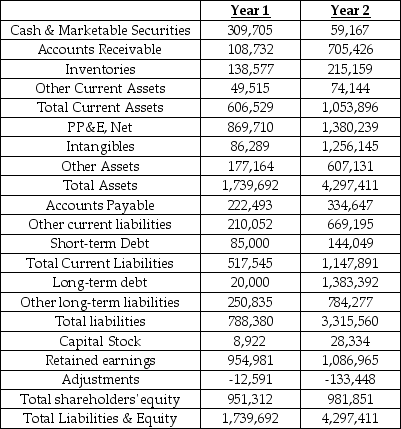

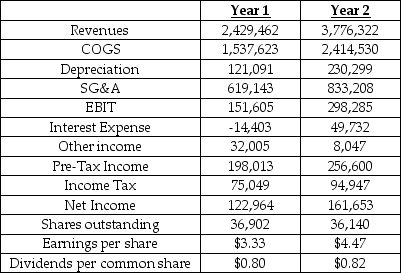

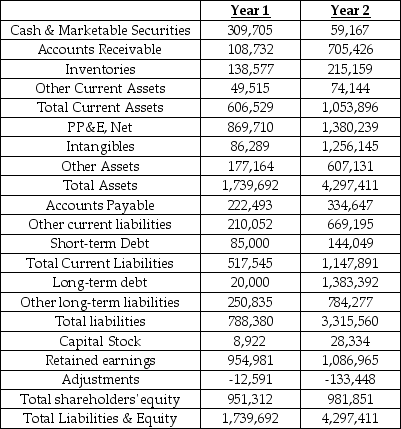

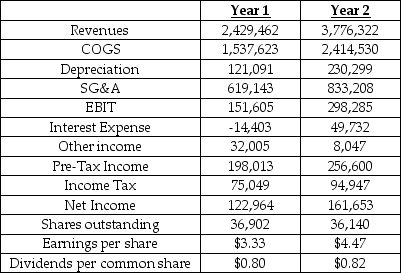

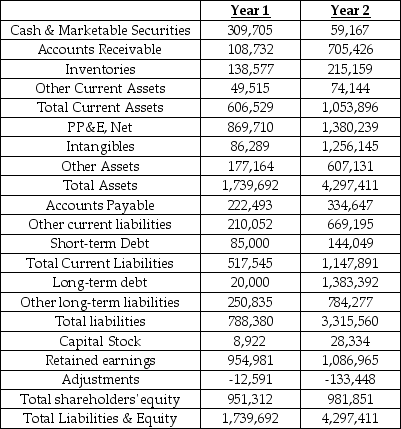

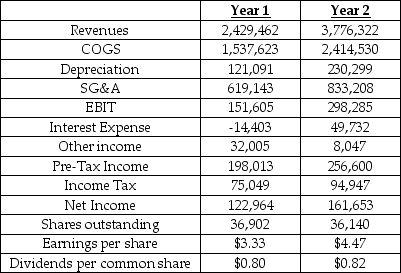

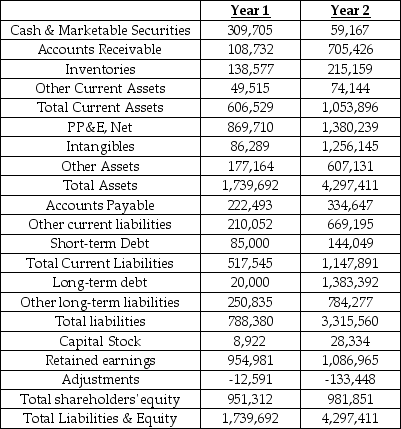

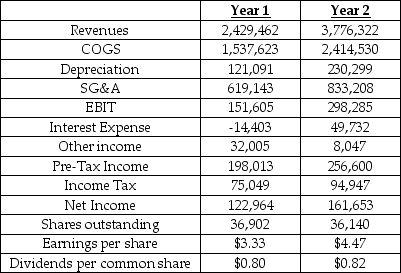

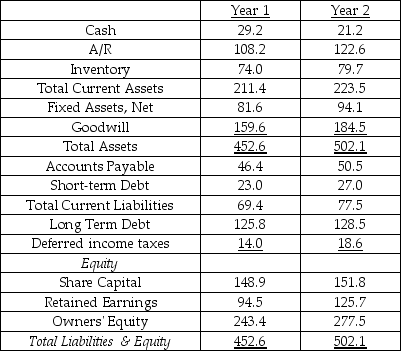

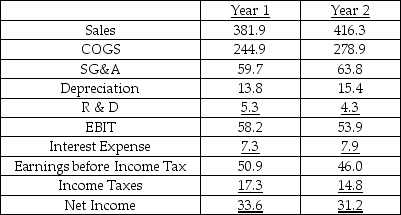

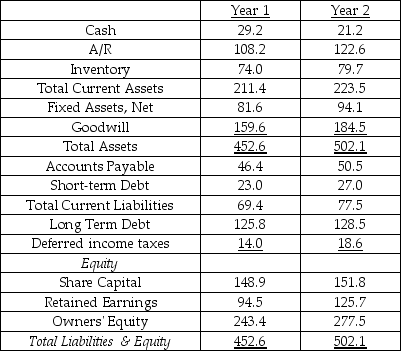

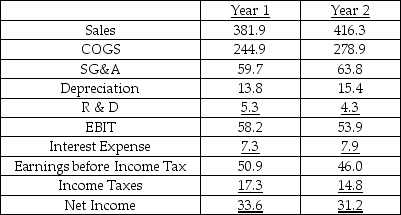

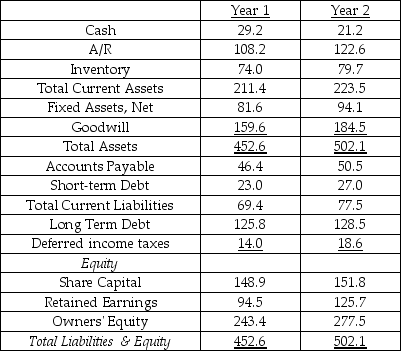

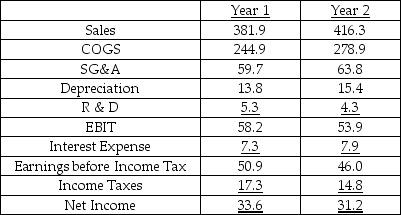

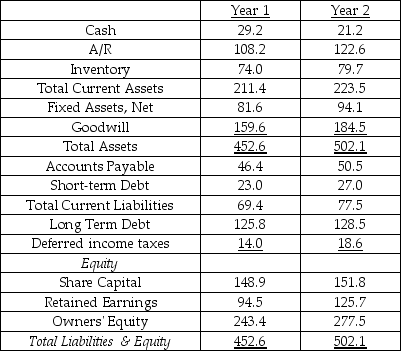

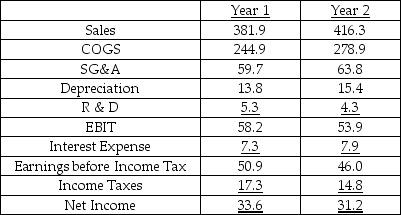

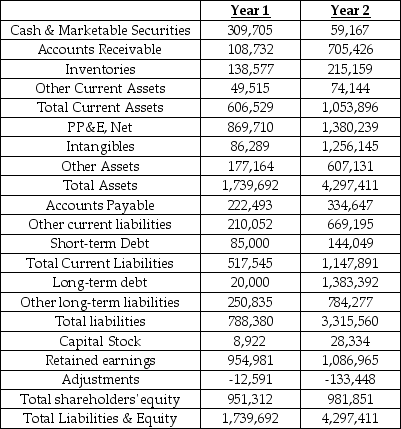

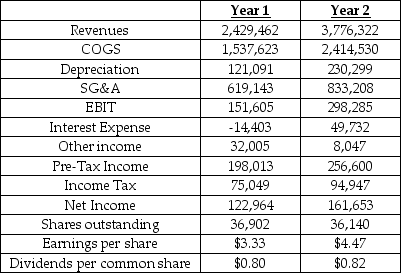

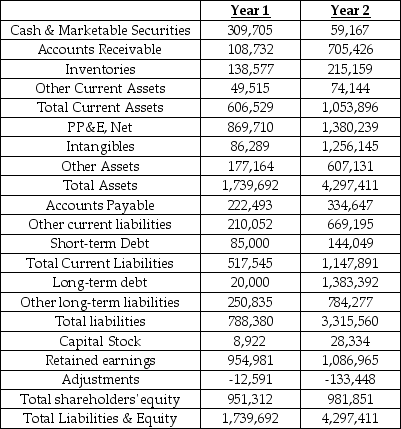

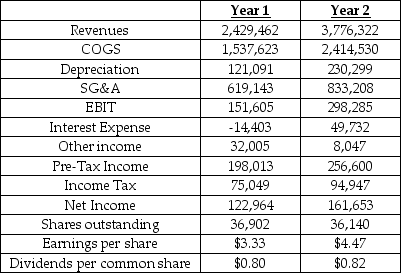

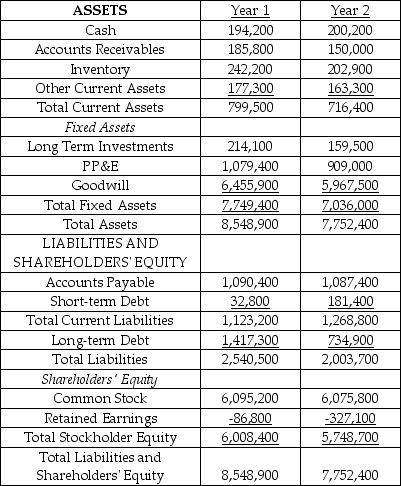

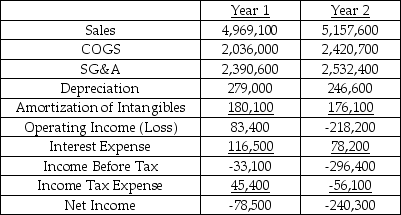

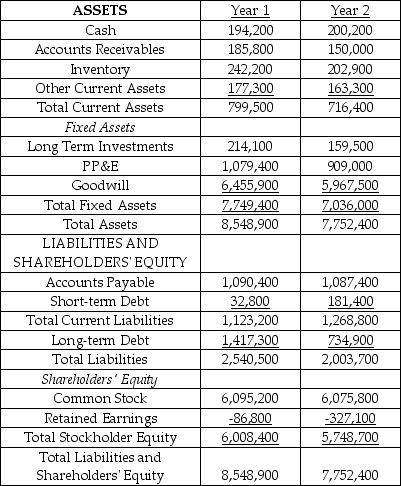

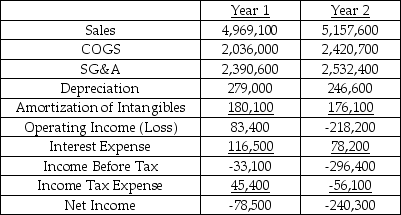

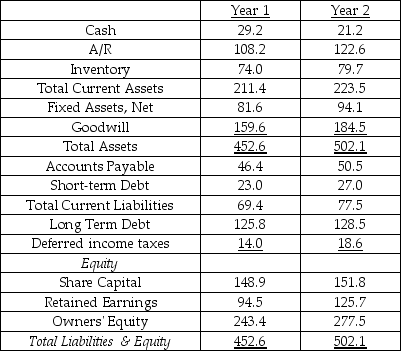

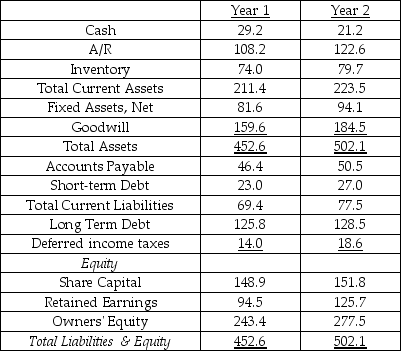

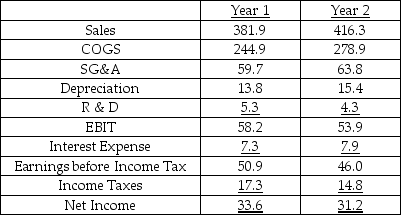

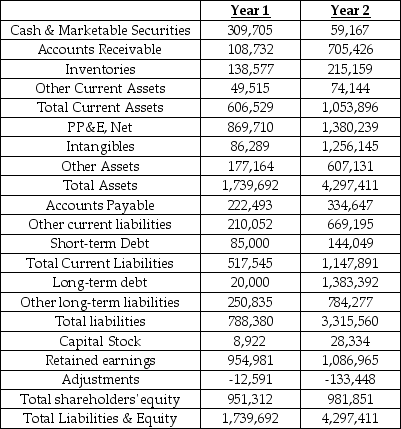

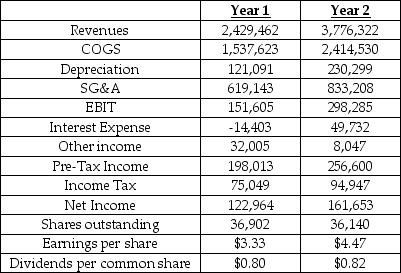

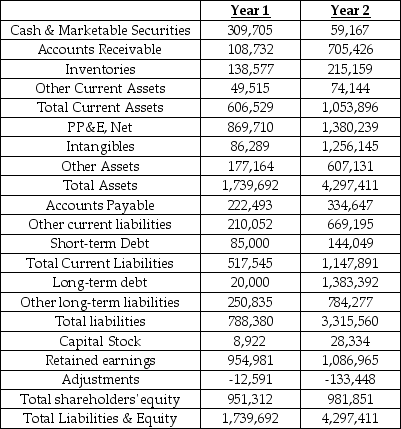

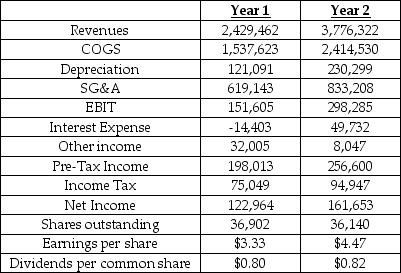

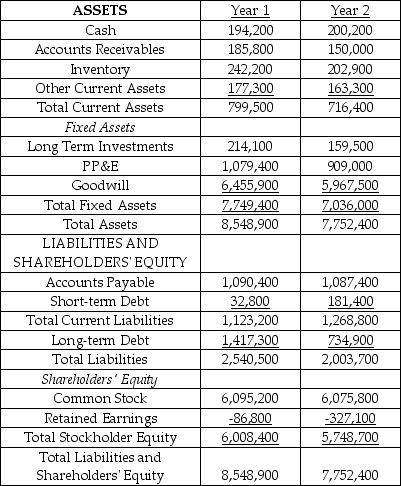

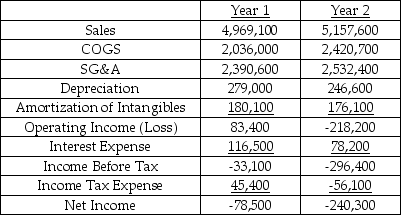

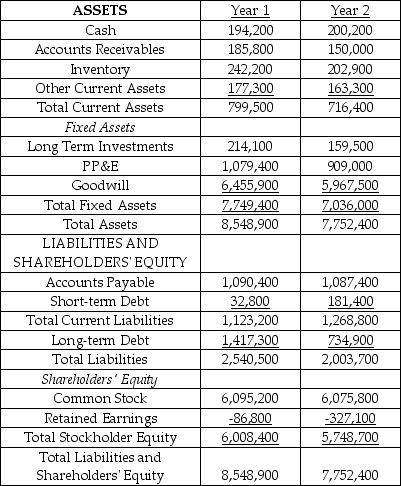

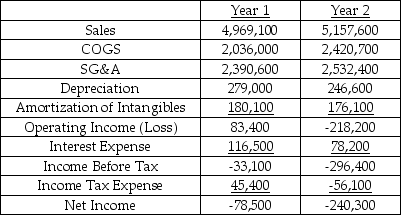

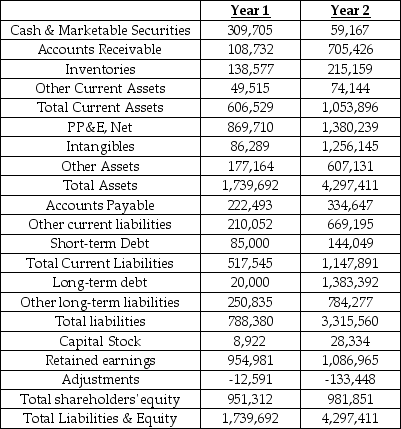

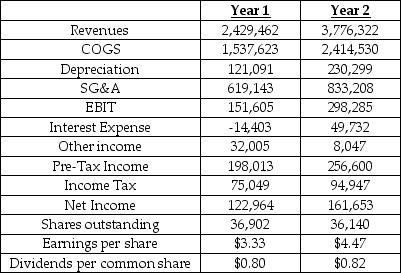

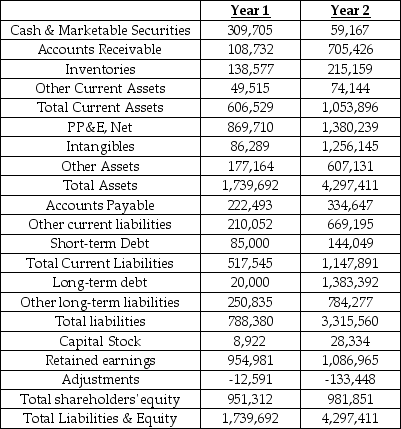

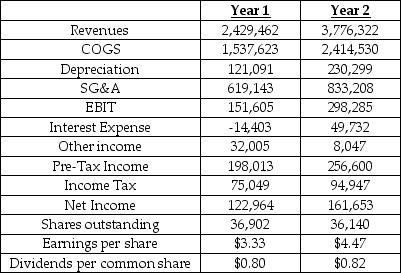

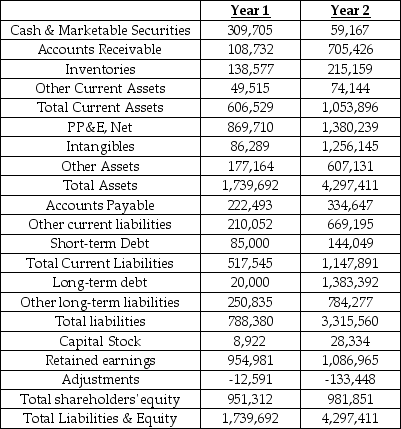

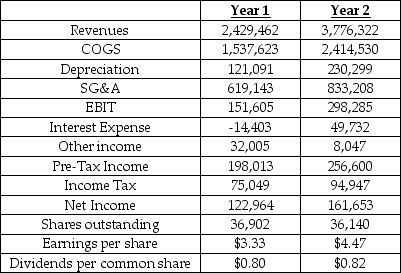

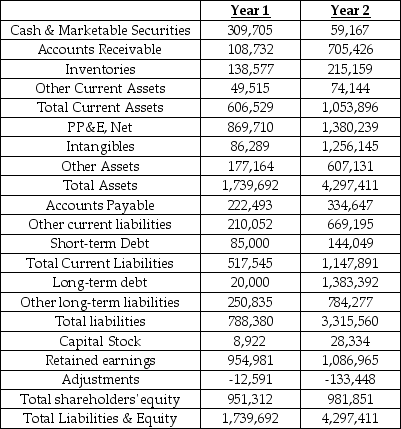

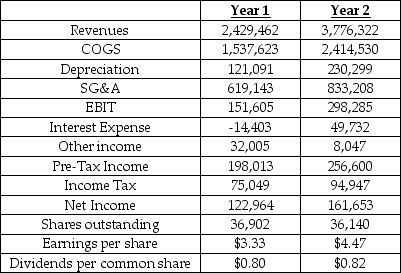

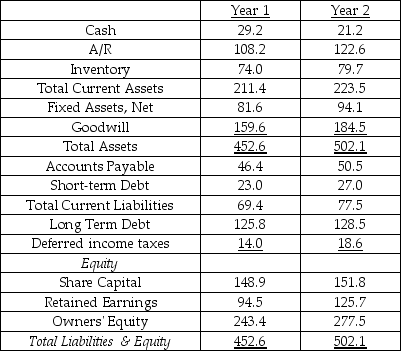

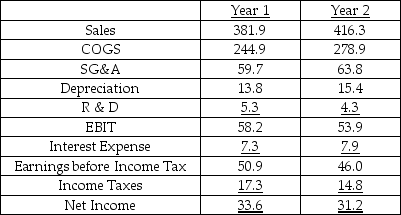

Balance Sheet for year-ended Dec 31 ($000's)

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the most important underlying reason for the change in ROE?

A) Decrease in cost of goods sold

B) Increase in debt caused the debt/equity ratio to rise

C) Increase in sales resulted in an increase in product returns which caused inventory turnover to decline

D) Increase in cost of goods sold caused a big drop in gross margin

E) Decrease in debt

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the most important underlying reason for the change in ROE?

A) Decrease in cost of goods sold

B) Increase in debt caused the debt/equity ratio to rise

C) Increase in sales resulted in an increase in product returns which caused inventory turnover to decline

D) Increase in cost of goods sold caused a big drop in gross margin

E) Decrease in debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

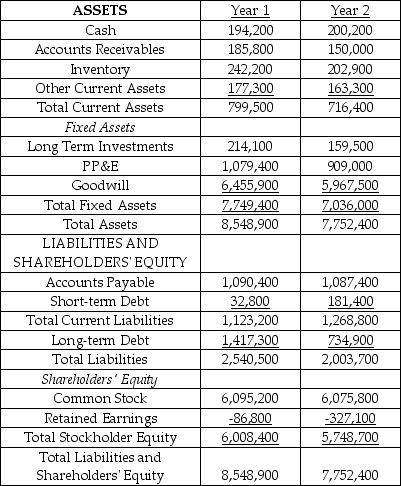

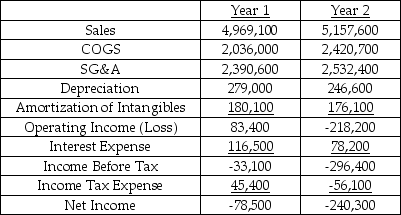

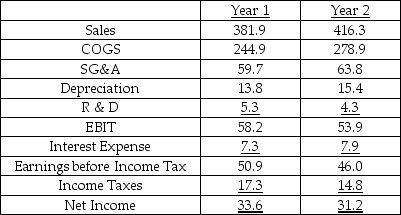

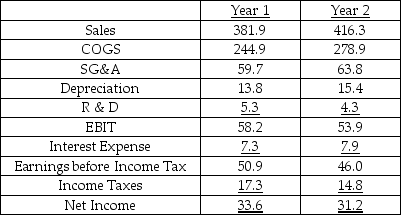

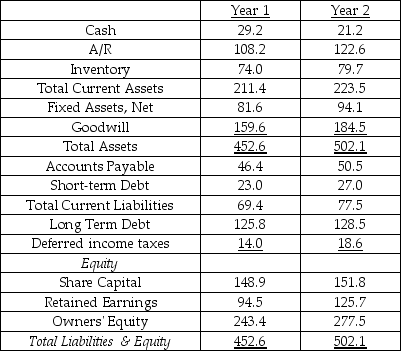

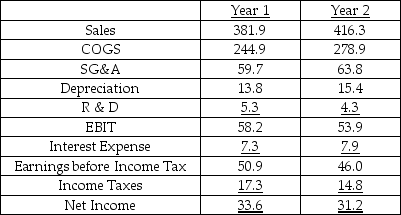

Molson Coors Inc.

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is the Equity Multiplier from the Du Pont equation (1 + D/E)in Year 2?

A) 2.41

B) 3.95

C) 4.05

D) 4.38

E) 4.58

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is the Equity Multiplier from the Du Pont equation (1 + D/E)in Year 2?

A) 2.41

B) 3.95

C) 4.05

D) 4.38

E) 4.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

Years 1 & 2 ($000,000s)

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,which is the bigger or more important determinant of the change in ROE?

A) ROA

B) The Equity Multiplier

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,which is the bigger or more important determinant of the change in ROE?

A) ROA

B) The Equity Multiplier

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Balance Sheet for year-ended Dec 31 ($000's)

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the change in ROA from Year 1 to Year 2?

A) -8.40%

B) -7.54%

C) -2.18%

D) 8.40%

E) 23.72%

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the change in ROA from Year 1 to Year 2?

A) -8.40%

B) -7.54%

C) -2.18%

D) 8.40%

E) 23.72%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

Years 1 & 2 ($000,000s)

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,did ROE rise or fall from Year 1 to Year 2?

A) Fall

B) Rise

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,did ROE rise or fall from Year 1 to Year 2?

A) Fall

B) Rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

Your banker is concerned about your company's liquidity.Which of the following actions would increase the firm's current ratio and ease the bank's concern?

A) Sell some inventory for cash.

B) File for bankruptcy.

C) Call your convertible bonds and thereby force the bond holders to become shareholders.

D) Sell some of the firm's long-term bonds and purchase marketable securities.

E) Sell long-term bonds to purchase new machinery.

A) Sell some inventory for cash.

B) File for bankruptcy.

C) Call your convertible bonds and thereby force the bond holders to become shareholders.

D) Sell some of the firm's long-term bonds and purchase marketable securities.

E) Sell long-term bonds to purchase new machinery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

Years 1 & 2 ($000,000s)

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,What is Net Profit Margin in Year 1?

A) 5.0%

B) 6.6%

C) 7.5%

D) 8.8%

E) 9.1%

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,What is Net Profit Margin in Year 1?

A) 5.0%

B) 6.6%

C) 7.5%

D) 8.8%

E) 9.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

Balance Sheet for year-ended Dec 31 ($000's)

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the change in ROE from Year 1 to Year 2? (ΔROE =

-

)

A) -4.80%

B) -4.18%

C) -2.87%

D) -1.20%

E) -1.17%

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the change in ROE from Year 1 to Year 2? (ΔROE =

-

)

A) -4.80%

B) -4.18%

C) -2.87%

D) -1.20%

E) -1.17%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

Molson Coors Inc.

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is the most important determinant of the change in ROE?

A) ROA

B) Profit Margin

C) Total Asset Turnover

D) The change in leverage

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is the most important determinant of the change in ROE?

A) ROA

B) Profit Margin

C) Total Asset Turnover

D) The change in leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

Molson Coors Inc.

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,did ROE rise or fall from Year 1 to Year 2?

A) Rise

B) Fall

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,did ROE rise or fall from Year 1 to Year 2?

A) Rise

B) Fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

Years 1 & 2 ($000,000s)

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,is the change between Year 1 and Year 2 in Total Asset Turnover important in explaining the change in ROA?

A) No

B) Yes

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,is the change between Year 1 and Year 2 in Total Asset Turnover important in explaining the change in ROA?

A) No

B) Yes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

Years 1 & 2 ($000,000s)

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,what is the change Equity Multiplier from Year 1 to Year 2?

A) -1.86

B) -0.05

C) 0.95

D) 1.81

E) 1.86

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,what is the change Equity Multiplier from Year 1 to Year 2?

A) -1.86

B) -0.05

C) 0.95

D) 1.81

E) 1.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

When would the "return on equity" equal the "return on assets"?

A) Whenever the debt to equity ratio is one

B) Whenever the debt ratio is zero

C) Whenever a firm has positive net worth

D) Whenever the firm has positive net worth and positive net income

A) Whenever the debt to equity ratio is one

B) Whenever the debt ratio is zero

C) Whenever a firm has positive net worth

D) Whenever the firm has positive net worth and positive net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

Molson Coors Inc.

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what reason best explains the change in leverage between Year 1 and Year 2?

A) Purchase of another company

B) A large dividend to common shareholders

C) An increase in goodwill

D) Relaxation of the collection policy

E) Large amount of capital expenditures in Year 2

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what reason best explains the change in leverage between Year 1 and Year 2?

A) Purchase of another company

B) A large dividend to common shareholders

C) An increase in goodwill

D) Relaxation of the collection policy

E) Large amount of capital expenditures in Year 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

Balance Sheet for year-ended Dec 31 ($000's)

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the change in Gross Margin from Year 1 to Year 2? (ΔGM =

-

)

A) -7.54%

B) -5.96%

C) -2.28%

D) 5.96%

E) 7.54%

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,what is the change in Gross Margin from Year 1 to Year 2? (ΔGM =

-

)

A) -7.54%

B) -5.96%

C) -2.28%

D) 5.96%

E) 7.54%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

Years 1 & 2 ($000,000s)

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,what happened to ROA from Year 1 to Year 2?

A) Increased

B) Decreased

C) Stayed the same

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,what happened to ROA from Year 1 to Year 2?

A) Increased

B) Decreased

C) Stayed the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

Molson Coors Inc.

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is the change in ROA from Year 1 to Year 2? (ΔROA =

-

)

A) -3.3%

B) -2.3%

C) 2.3%

D) 3.5%

E) 3.8%

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is the change in ROA from Year 1 to Year 2? (ΔROA =

-

)

A) -3.3%

B) -2.3%

C) 2.3%

D) 3.5%

E) 3.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

Balance Sheet for year-ended Dec 31 ($000's)

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,which of the following ratios decreased from Year 1 to Year 2:

I.Equity Multiplier

II.Net Profit Margin

III.Total Asset Turnover

A) I

B) II

C) III

D) I & II

E) II & III

Blockbuster Inc.

Income Statement for year-ended Dec 31 ($000's)

Referring to the Blockbuster financial statements,which of the following ratios decreased from Year 1 to Year 2:

I.Equity Multiplier

II.Net Profit Margin

III.Total Asset Turnover

A) I

B) II

C) III

D) I & II

E) II & III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

Molson Coors Inc.

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what asset was the main reason for the decline in Total Asset Turnover between Year 1 and Year 2?

A) Property Plant and Equipment

B) Cash and Marketable Securities

C) Inventory

D) Intangibles

E) Accounts Receivable

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what asset was the main reason for the decline in Total Asset Turnover between Year 1 and Year 2?

A) Property Plant and Equipment

B) Cash and Marketable Securities

C) Inventory

D) Intangibles

E) Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

Molson Coors Inc.

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is Net Profit Margin in Year 1?

A) 4.3%

B) 5.1%

C) 8.0%

D) 8.2%

E) 12.9%

Years 1 & 2 ($000's)

Income Statement

Molson Coors Inc.

Years 1 & 2 ($000s)

Referring to the Molson Coors financial statements,what is Net Profit Margin in Year 1?

A) 4.3%

B) 5.1%

C) 8.0%

D) 8.2%

E) 12.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

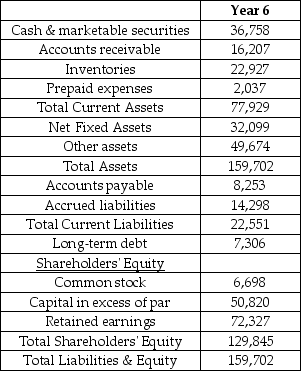

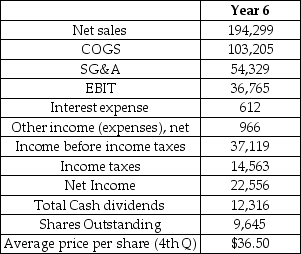

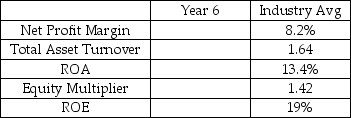

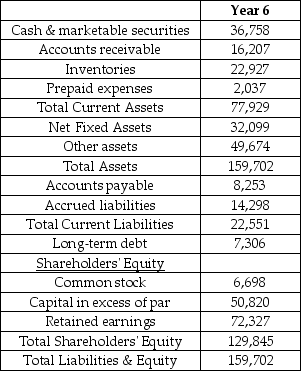

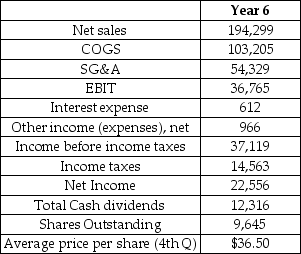

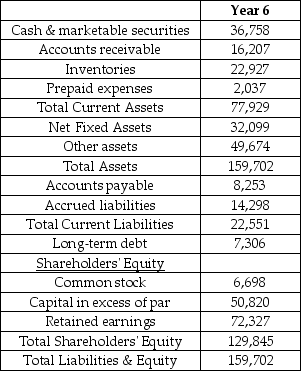

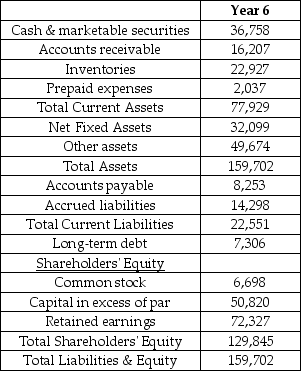

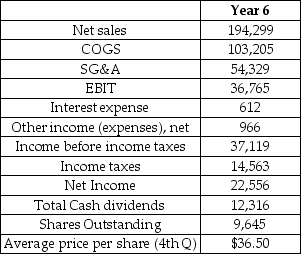

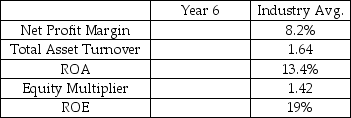

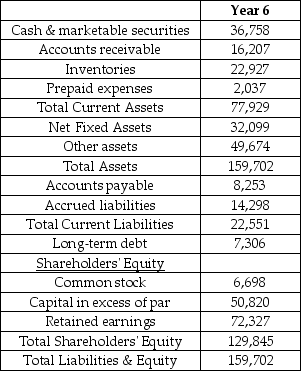

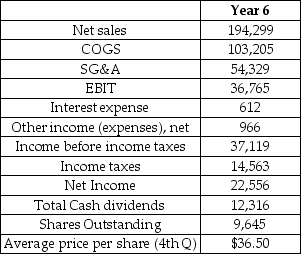

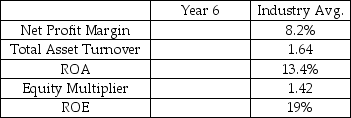

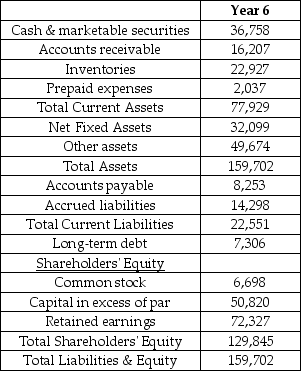

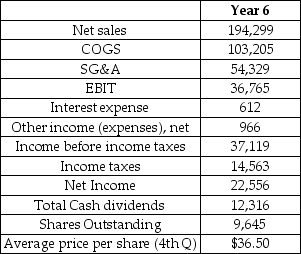

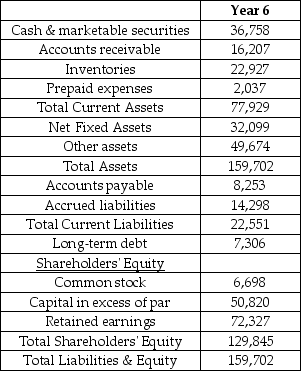

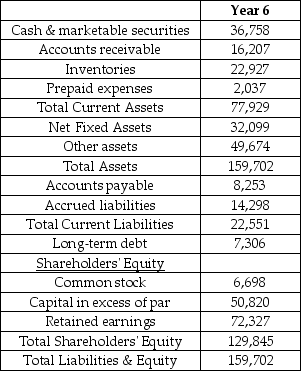

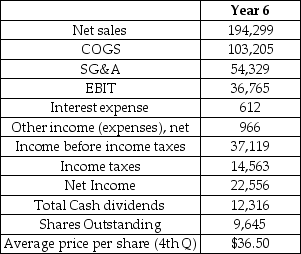

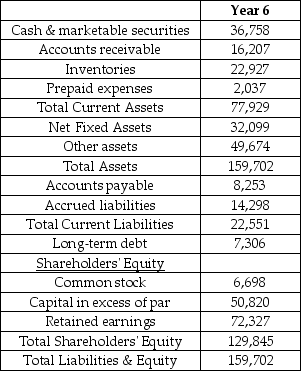

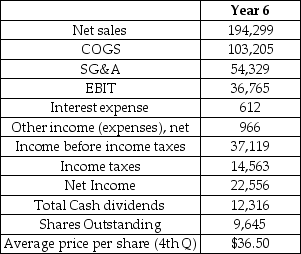

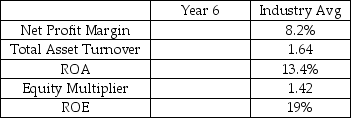

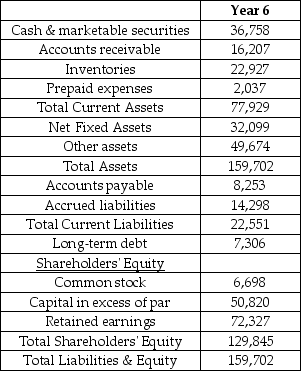

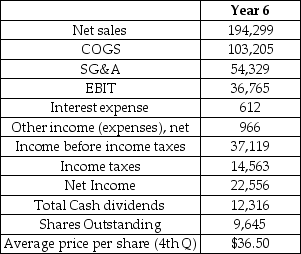

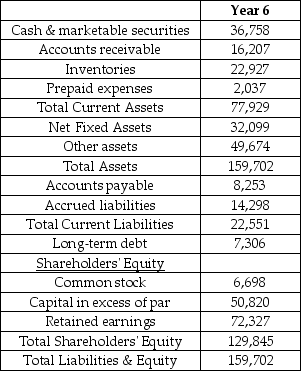

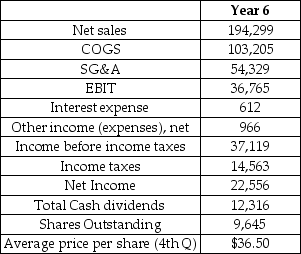

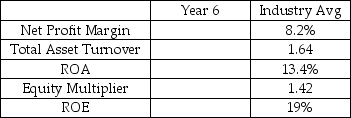

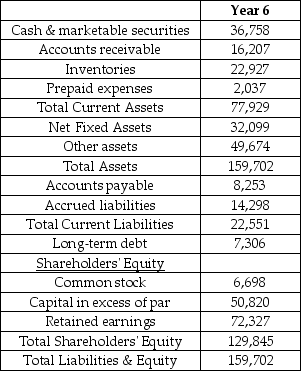

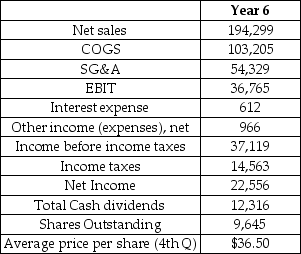

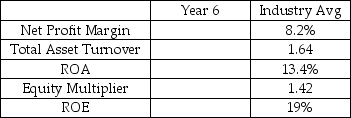

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy since 1896. Its products are sold under the familiar brand names Tootsie Roll, Tootsie Roll Pops, Charms, Blow Pops, Cella's, Mason Dots and Mason Crows. Tootsie Roll operates four plants in Illinois, New York, Tennessee and Mexico. Tootsie Roll is traded on the New York Stock Exchange and maintains its head office in Chicago, Illinois.

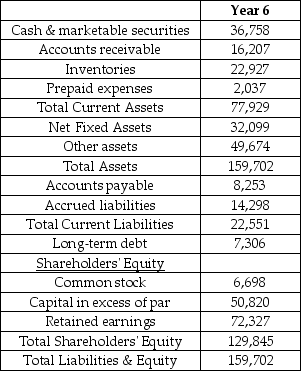

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

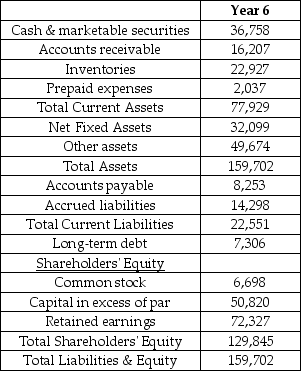

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

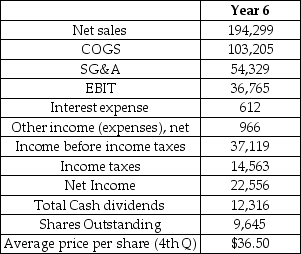

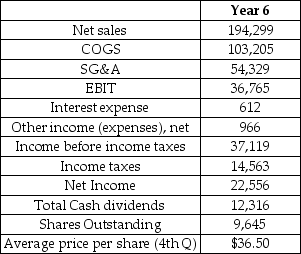

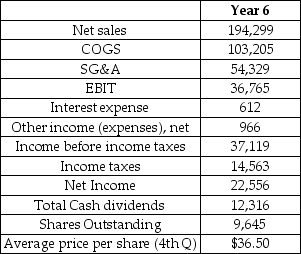

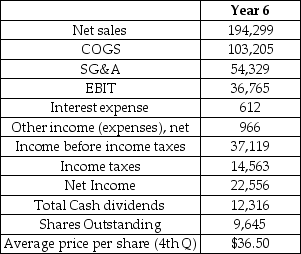

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

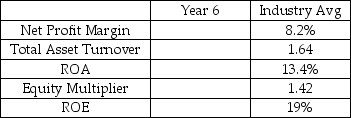

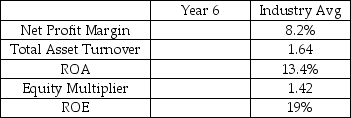

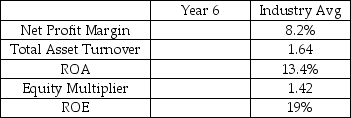

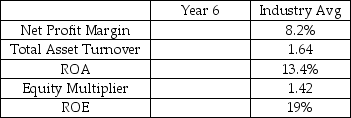

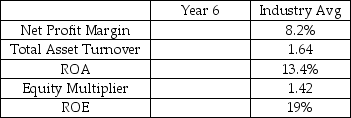

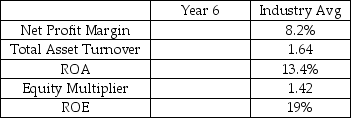

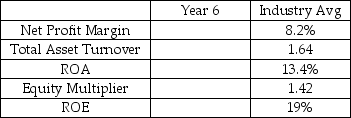

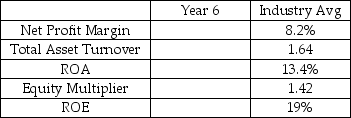

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for the return on equity? (Tootsie - Industry)

A) -2.14%

B) -2.02%

C) -1.81%

D) -1.63%

E) 2.14%

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for the return on equity? (Tootsie - Industry)

A) -2.14%

B) -2.02%

C) -1.81%

D) -1.63%

E) 2.14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy since 1896. Its products are sold under the familiar brand names Tootsie Roll, Tootsie Roll Pops, Charms, Blow Pops, Cella's, Mason Dots and Mason Crows. Tootsie Roll operates four plants in Illinois, New York, Tennessee and Mexico. Tootsie Roll is traded on the New York Stock Exchange and maintains its head office in Chicago, Illinois.

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for return on assets (ROA)? (Tootsie - Industry)

A) -0.70%

B) 0.72%

C) 1.72%

D) 7.00%

E) 14.00%

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for return on assets (ROA)? (Tootsie - Industry)

A) -0.70%

B) 0.72%

C) 1.72%

D) 7.00%

E) 14.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy since 1896. Its products are sold under the familiar brand names Tootsie Roll, Tootsie Roll Pops, Charms, Blow Pops, Cella's, Mason Dots and Mason Crows. Tootsie Roll operates four plants in Illinois, New York, Tennessee and Mexico. Tootsie Roll is traded on the New York Stock Exchange and maintains its head office in Chicago, Illinois.

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for the net profit margin? (Tootsie - Industry)

A) 3.1%

B) 3.4%

C) 5.4%

D) 8.2%

E) 11.6%

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for the net profit margin? (Tootsie - Industry)

A) 3.1%

B) 3.4%

C) 5.4%

D) 8.2%

E) 11.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy since 1896. Its products are sold under the familiar brand names Tootsie Roll, Tootsie Roll Pops, Charms, Blow Pops, Cella's, Mason Dots and Mason Crows. Tootsie Roll operates four plants in Illinois, New York, Tennessee and Mexico. Tootsie Roll is traded on the New York Stock Exchange and maintains its head office in Chicago, Illinois.

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what amount of leverage (i.e.debt-to-equity)would Tootsie need to make its Year 6 return on equity equal (ROE)to the industry average ROE? (Round to initial ratios to nearest percentage.)

A) 0.3456

B) 0.9200

C) 1.1333

D) 1.4200

E) 1.7632

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what amount of leverage (i.e.debt-to-equity)would Tootsie need to make its Year 6 return on equity equal (ROE)to the industry average ROE? (Round to initial ratios to nearest percentage.)

A) 0.3456

B) 0.9200

C) 1.1333

D) 1.4200

E) 1.7632

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy since 1896. Its products are sold under the familiar brand names Tootsie Roll, Tootsie Roll Pops, Charms, Blow Pops, Cella's, Mason Dots and Mason Crows. Tootsie Roll operates four plants in Illinois, New York, Tennessee and Mexico. Tootsie Roll is traded on the New York Stock Exchange and maintains its head office in Chicago, Illinois.

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for total asset turnover? (Tootsie - Industry)

A) -0.20

B) -0.25

C) -0.34

D) -0.38

E) -0.42

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for total asset turnover? (Tootsie - Industry)

A) -0.20

B) -0.25

C) -0.34

D) -0.38

E) -0.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy since 1896. Its products are sold under the familiar brand names Tootsie Roll, Tootsie Roll Pops, Charms, Blow Pops, Cella's, Mason Dots and Mason Crows. Tootsie Roll operates four plants in Illinois, New York, Tennessee and Mexico. Tootsie Roll is traded on the New York Stock Exchange and maintains its head office in Chicago, Illinois.

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll and based on the Du Pont analysis,what main reasons explain the difference(s)between Tootsie's ROE and the industry average ROE?

I.Tootsie does not have enough leverage.

II.Tootsie has more leverage than the industry.

III.Tootsie manages their assets poorly - low total asset turnover.

IV.Tootsie manages their assets poorly - high total asset turnover.

A) I

B) III

C) I and III

D) I or IV

E) II or III

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll and based on the Du Pont analysis,what main reasons explain the difference(s)between Tootsie's ROE and the industry average ROE?

I.Tootsie does not have enough leverage.

II.Tootsie has more leverage than the industry.

III.Tootsie manages their assets poorly - low total asset turnover.

IV.Tootsie manages their assets poorly - high total asset turnover.

A) I

B) III

C) I and III

D) I or IV

E) II or III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

Years 1 & 2 ($000,000s)

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,pick the most informative explanation for why ROA fell.

A) ROA fell because both gross margin fell and Selling, General & Admin expenses as a percentage of sales fell.

B) ROA fell because Total Asset Turnover fell.

C) ROA fell because the Equity Multiplier fell and because Cost of Goods Sold over Sales rose.

D) ROA fell because Net Income grew more slowly than Total Assets.

E) ROA fell mainly because gross margin fell.

Income Statement

CFM Majestic Inc.

Years 1 & 2 ($000,000s)

Referring to the CFM Majestic financial statements,pick the most informative explanation for why ROA fell.

A) ROA fell because both gross margin fell and Selling, General & Admin expenses as a percentage of sales fell.

B) ROA fell because Total Asset Turnover fell.

C) ROA fell because the Equity Multiplier fell and because Cost of Goods Sold over Sales rose.

D) ROA fell because Net Income grew more slowly than Total Assets.

E) ROA fell mainly because gross margin fell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

All else held constant,an increase in leverage should increase the ROE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy since 1896. Its products are sold under the familiar brand names Tootsie Roll, Tootsie Roll Pops, Charms, Blow Pops, Cella's, Mason Dots and Mason Crows. Tootsie Roll operates four plants in Illinois, New York, Tennessee and Mexico. Tootsie Roll is traded on the New York Stock Exchange and maintains its head office in Chicago, Illinois.

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for the equity multiplier? (Tootsie - Industry)

A) -0.19

B) -0.17

C) -0.15

D) -0.13

E) -0.11

Tootsie Roll's financial statements for Year 5 and Year 6 are provided below.

Tootsie Roll Industries Inc.

Balance Sheet

As of December 31, Year 6 ($000s)

Tootsie Roll Industries Inc.

Income Statement

As of December 31,Year 6 ($000s)

Selected Financial Ratios

Referring to the financial statements for Tootsie Roll,what is the difference between the Industry and Tootsie for the equity multiplier? (Tootsie - Industry)

A) -0.19

B) -0.17

C) -0.15

D) -0.13

E) -0.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck