Deck 11: Capital Budgeting Cash Flows and Risk Refinements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/208

العب

ملء الشاشة (f)

Deck 11: Capital Budgeting Cash Flows and Risk Refinements

1

Cash outlays that had been previously made and have no effect on the cash flows relevant to a current decision are called ________.

A) incremental historical costs

B) incremental past expenses

C) opportunity costs foregone

D) sunk costs

A) incremental historical costs

B) incremental past expenses

C) opportunity costs foregone

D) sunk costs

sunk costs

2

In developing the cash flows for an expansion project,the analysis is the same as the analysis for replacement projects where ________.

A) all cash flows from the old assets are equal

B) prior cash flows are irrelevant

C) all cash flows from the old asset are zero

D) cash inflows equal cash outflows

A) all cash flows from the old assets are equal

B) prior cash flows are irrelevant

C) all cash flows from the old asset are zero

D) cash inflows equal cash outflows

all cash flows from the old asset are zero

3

An opportunity cost is a cash flow that could be realized from the best alternative use of an owned asset.

True

4

The relevant cash flows for a proposed capital expenditure are the incremental after-tax cash outflows and resulting subsequent inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

5

A sunk cost is a cash flow that could be realized from the best alternative use of an owned asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a new asset is being considered as a replacement for an old asset,the relevant cash flows would be found by adding the operating cash flows from the old asset to the operating cash flows from the new asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

7

Should financing costs such as the returns paid to bondholders and stockholders be considered in computing after-tax operating cash flows? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

8

Opportunity costs should be included as cash outflows when determining a project's incremental cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

9

Relevant cash flows are the incremental cash outflows and inflows associated with a proposed capital expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

10

When making replacement decisions,the development of relevant cash flows is complicated when compared to expansion decisions,due to the need to calculate ________ cash inflows.

A) conventional

B) opportunity

C) incremental

D) sunk

A) conventional

B) opportunity

C) incremental

D) sunk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

11

Initial cash outflows and subsequent operating cash inflows for a project are referred to as ________.

A) necessary cash flows

B) relevant cash flows

C) perpetual cash flows

D) ordinary cash flows

A) necessary cash flows

B) relevant cash flows

C) perpetual cash flows

D) ordinary cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

12

Sunk costs are cash outlays that have already been made and therefore have no effect on the cash flows relevant to the current decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

13

A sunk cost is a cash outlay that has already been made and cannot be recovered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

14

Please explain the difference between a sunk cost and an opportunity cost and give an example of each type of cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

15

Accounting figures and cash flows are not necessarily the same due to the presence of certain non-cash expenditures on a firm's income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

16

The three major cash flow components include the initial investment,nonoperating cash flows,and terminal cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

17

The three major cash flow components include the initial investment,operating cash flows,and terminal cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

18

Cash flows that could be realized from the best alternative use of an owned asset are called ________.

A) incremental costs

B) lost resale opportunities

C) opportunity costs

D) sunk costs

A) incremental costs

B) lost resale opportunities

C) opportunity costs

D) sunk costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

19

Relevant cash flows for a project are best described as ________.

A) incidental cash flows

B) incremental cash flows

C) sunk cash flows

D) contingent cash flows

A) incidental cash flows

B) incremental cash flows

C) sunk cash flows

D) contingent cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

20

Incremental cash flows represent the additional cash flows expected as a direct result of the proposed project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

21

To calculate the initial investment,we subtract all cash inflows occurring at time zero from all cash outflows occurring at time zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

22

In evaluating a proposed project,incremental operating cash inflows are relevant cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

23

The book value of an asset is equal to its installed cost of asset minus the accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

24

Recaptured depreciation is the portion of the sale price that is in excess of the initial purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

25

If an investment in a new asset results in a change in current assets that exceeds the change in current liabilities,this change in net working capital represents an initial cash outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

26

In computing after-tax operating cash flows,only operating costs but not financing costs must be deducted from any cash inflows received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under MACRS depreciation,the depreciable value of an asset is equal to the asset's purchase price minus any installation costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

28

Capital gain is the portion of the sale price that is in excess of the initial purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

29

Net working capital is the difference between a firm's total assets and its total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

30

In case of an existing asset which is depreciable and is used in business and is sold for a price equal to its initial purchase price,the difference between the sales price and its book value is considered as recaptured depreciation and will be taxed as ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

31

All benefits expected from a proposed project must be measured on a cash flow basis which may be found by adding any non-cash charges deducted as an expense on a firm's income statement back to net profits after taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

32

If an asset is sold for more than its initial purchase price,the gain on the sale is composed of two parts: a capital gain and recaptured depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

33

The basic cash flows that must be considered when determining the initial investment associated with a capital expenditure are the installed cost of the new asset,the after-tax proceeds (if any)from the sale of an old asset,and the change (if any)in net working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

34

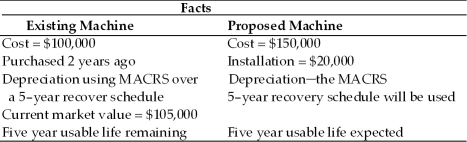

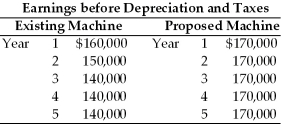

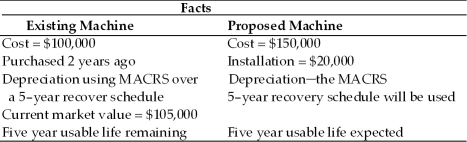

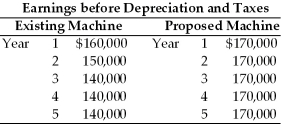

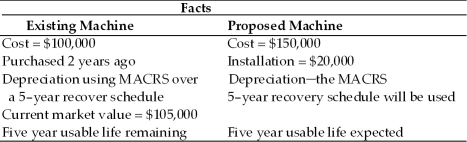

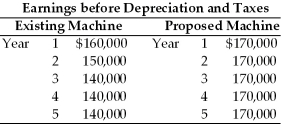

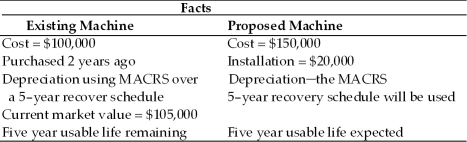

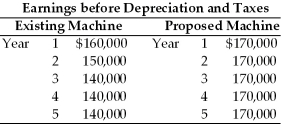

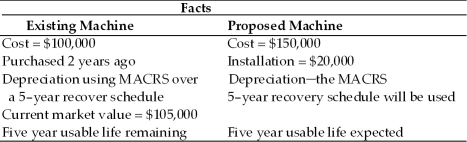

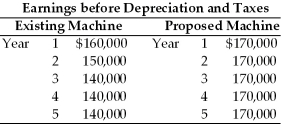

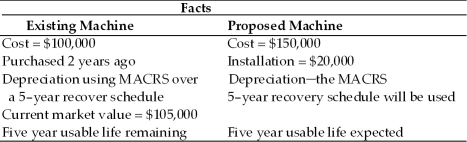

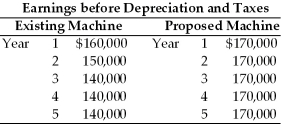

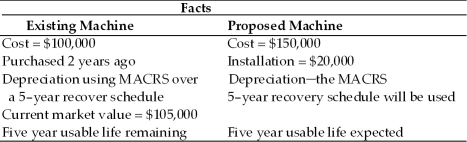

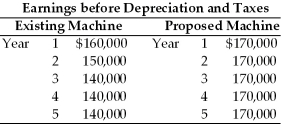

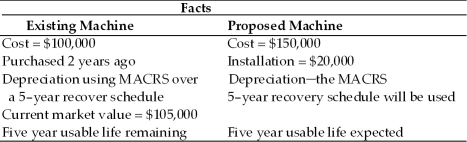

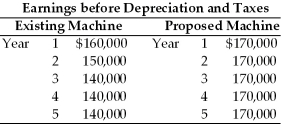

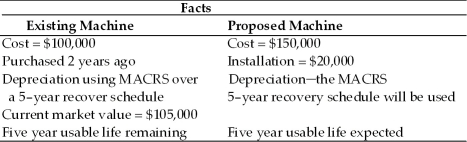

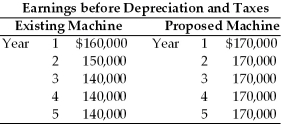

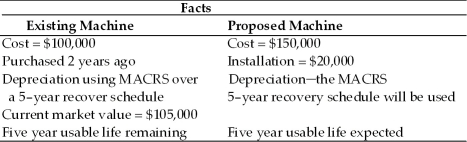

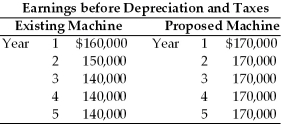

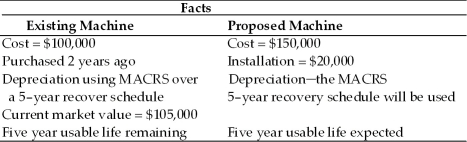

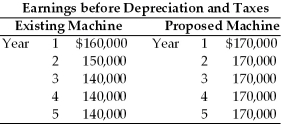

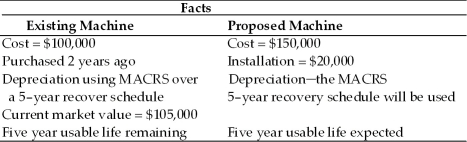

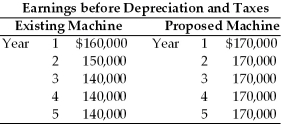

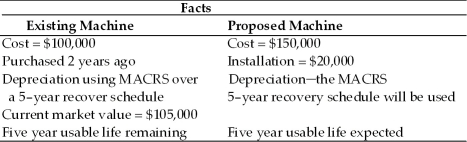

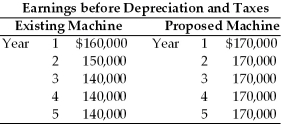

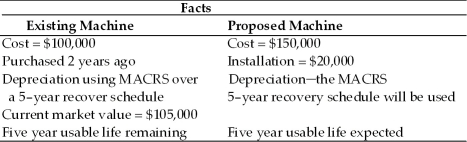

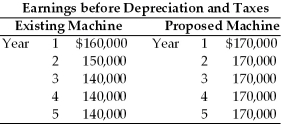

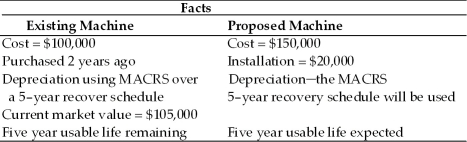

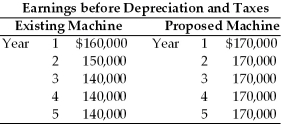

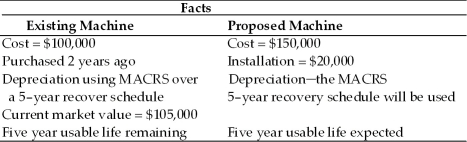

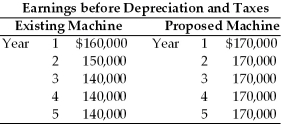

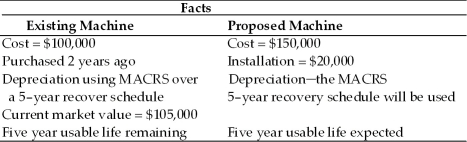

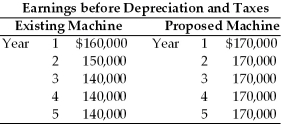

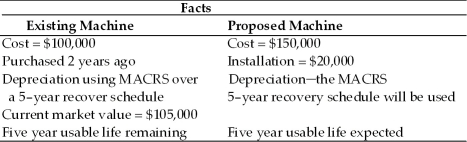

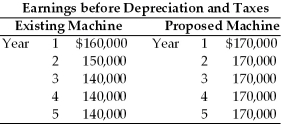

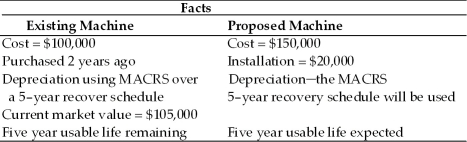

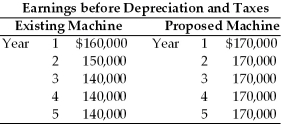

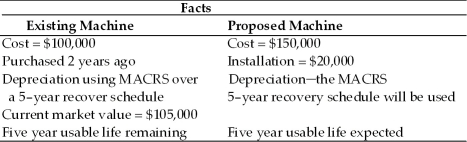

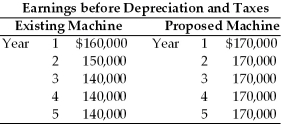

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Given the information in Table 11.4,compute the initial investment.

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Given the information in Table 11.4,compute the initial investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

35

Recaptured depreciation is the portion of the sale price that is below the book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

36

The change in net working capital-regardless of whether an increase or decrease-is not taxable because it merely involves a net buildup or net reduction of current accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

37

In computing after-tax operating cash flows,both operating costs and financing costs must be deducted from any cash inflows received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

38

If an asset is sold for less than its book value,the loss on the sale may be used to offset ordinary operating income provided the asset is used in the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

39

If an asset is sold for book value,the gain on the sale is composed of two parts: a capital gain and accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

40

If an asset is depreciable and used in business,any loss on the sale of the asset is tax-deductible only against other capital gains income,not against ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

41

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 2,the initial outlay equals ________.(See Table 11.2)

A) $120,720 cash outflow

B) $164,560 cash outflow

C) $150,000 cash outflow

D) $167,520 cash outflow

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 2,the initial outlay equals ________.(See Table 11.2)

A) $120,720 cash outflow

B) $164,560 cash outflow

C) $150,000 cash outflow

D) $167,520 cash outflow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

42

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 2,the tax effect on the sale of the existing asset at the end of the fifth year results in ________.(See Table 11.2)

A) $12,000 tax liability

B) $14,560 tax liability

C) $25,280 tax liability

D) $16,600 tax liability

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 2,the tax effect on the sale of the existing asset at the end of the fifth year results in ________.(See Table 11.2)

A) $12,000 tax liability

B) $14,560 tax liability

C) $25,280 tax liability

D) $16,600 tax liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

43

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Given the information in Table 11.4,compute the payback period.

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Given the information in Table 11.4,compute the payback period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

44

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 3,the initial outlay equals ________.(See Table 11.2)

A) $170,400

B) $211,000

C) $196,000

D) $300,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 3,the initial outlay equals ________.(See Table 11.2)

A) $170,400

B) $211,000

C) $196,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

45

One basic technique used to evaluate after-tax operating cash flows is to ________.

A) add noncash charges to net income

B) subtract depreciation from operating revenues

C) add cash expenses to net income

D) subtract cash expenses from noncash charges

A) add noncash charges to net income

B) subtract depreciation from operating revenues

C) add cash expenses to net income

D) subtract cash expenses from noncash charges

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

46

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 3,the incremental depreciation expense for year 3 is ________.(See Table 11.2)

A) $21,000

B) $42,000

C) $47,850

D) $50,850

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 3,the incremental depreciation expense for year 3 is ________.(See Table 11.2)

A) $21,000

B) $42,000

C) $47,850

D) $50,850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

47

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 2,the annual incremental after-tax cash flow from operations for year 2 is ________.(See Table 11.2)

A) $18,000

B) $24,000

C) $56,000

D) $84,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 2,the annual incremental after-tax cash flow from operations for year 2 is ________.(See Table 11.2)

A) $18,000

B) $24,000

C) $56,000

D) $84,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

48

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 3,the book value of the existing asset is ________.(See Table 11.2)

A) $21,000

B) $43,000

C) $52,000

D) $80,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 3,the book value of the existing asset is ________.(See Table 11.2)

A) $21,000

B) $43,000

C) $52,000

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

49

Benefits expected from proposed capital expenditures ________.

A) must be on a pre-tax basis because it provides the true position of profits by the firm

B) must be on an after-tax basis because no benefits may be used until tax claims are satisfied

C) may be valued either on pre-tax or after-tax basis based on the size of the firm

D) are independent of interest and taxes

A) must be on a pre-tax basis because it provides the true position of profits by the firm

B) must be on an after-tax basis because no benefits may be used until tax claims are satisfied

C) may be valued either on pre-tax or after-tax basis based on the size of the firm

D) are independent of interest and taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

50

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 1,the initial outlay equals ________.(See Table 11.2)

A) $1,380,000

B) $1,440,000

C) $1,500,000

D) $1,620,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 1,the initial outlay equals ________.(See Table 11.2)

A) $1,380,000

B) $1,440,000

C) $1,500,000

D) $1,620,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

51

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 1,the annual incremental after-tax cash flow from operations for year 1 is ________.(See Table 11.2)

A) $60,000

B) $255,000

C) $300,000

D) $210,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 1,the annual incremental after-tax cash flow from operations for year 1 is ________.(See Table 11.2)

A) $60,000

B) $255,000

C) $300,000

D) $210,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

52

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 3,the cash flow pattern for the replacement project is ________.(See Table 11.2)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 3,the cash flow pattern for the replacement project is ________.(See Table 11.2)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

53

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Given the information in Table 11.4,compute the incremental annual cash flows.

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Given the information in Table 11.4,compute the incremental annual cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

54

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 2,the incremental depreciation expense for year 2 is ________.(See Table 11.2)

A) $16,800

B) $26,400

C) $38,400

D) $60,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 2,the incremental depreciation expense for year 2 is ________.(See Table 11.2)

A) $16,800

B) $26,400

C) $38,400

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

55

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 2,the cash flow pattern for the replacement project is ________.(See Table 11.2)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 2,the cash flow pattern for the replacement project is ________.(See Table 11.2)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

56

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Given the information in Table 11.4 and 15 percent cost of capital,

(a)Compute the net present value.

(b)Should the project be accepted?

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Given the information in Table 11.4 and 15 percent cost of capital,

(a)Compute the net present value.

(b)Should the project be accepted?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

57

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 1,the cash flow pattern for the expansion project is ________.(See Table 11.2)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 1,the cash flow pattern for the expansion project is ________.(See Table 11.2)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

58

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 3,the tax effect on the sale of the existing asset results in ________.(See Table 11.2)

A) $8,000 tax liability

B) $16,000 tax liability

C) $20,000 tax liability

D) $23,200 tax liability

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 3,the tax effect on the sale of the existing asset results in ________.(See Table 11.2)

A) $8,000 tax liability

B) $16,000 tax liability

C) $20,000 tax liability

D) $23,200 tax liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

59

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 2,the book value of the existing asset at the end of the fifth year is ________.(See Table 11.2)

A) $13,600

B) $34,400

C) $66,400

D) $80,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 2,the book value of the existing asset at the end of the fifth year is ________.(See Table 11.2)

A) $13,600

B) $34,400

C) $66,400

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

60

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 1,the depreciation expense for year 1 is ________.(See Table 11.2)

A) $110,400

B) $115,200

C) $150,000

D) $300,000

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 1,the depreciation expense for year 1 is ________.(See Table 11.2)

A) $110,400

B) $115,200

C) $150,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

61

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 3,the incremental depreciation expense for year 6 is ________.(See Table 11.2)

A) $15,750

B) $10,750

C) $23,000

D) $36,150

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 3,the incremental depreciation expense for year 6 is ________.(See Table 11.2)

A) $15,750

B) $10,750

C) $23,000

D) $36,150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

62

Table 11.3

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The incremental depreciation expense for year 1 is ________.(See Table 11.3)

A) $2,250

B) $7,600

C) $7,000

D) $7,950

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The incremental depreciation expense for year 1 is ________.(See Table 11.3)

A) $2,250

B) $7,600

C) $7,000

D) $7,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

63

Table 11.5

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The payback period for the project is ________.(See Table 11.5)

A) 2 years

B) 3 years

C) between 3 and 4 years

D) between 4 and 5 years

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The payback period for the project is ________.(See Table 11.5)

A) 2 years

B) 3 years

C) between 3 and 4 years

D) between 4 and 5 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

64

Table 11.3

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The initial outlay equals ________.(See Table 11.3)

A) $41,100

B) $44,100

C) $38,800

D) $38,960

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The initial outlay equals ________.(See Table 11.3)

A) $41,100

B) $44,100

C) $38,800

D) $38,960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

65

Table 11.3

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The annual incremental after-tax cash flow from operations for year 1 is ________.(See Table 11.3)

A) $13,950

B) $16,600

C) $25,600

D) $30,000

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The annual incremental after-tax cash flow from operations for year 1 is ________.(See Table 11.3)

A) $13,950

B) $16,600

C) $25,600

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

66

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________ *Not applicable

*Not applicable

For Proposal 3,the annual incremental after-tax cash flow from operations for year 3 is ________.(See Table 11.2)

A) $45,000

B) $75,150

C) $90,150

D) $93,800

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

______________________________________________________________________

*Not applicable

*Not applicableFor Proposal 3,the annual incremental after-tax cash flow from operations for year 3 is ________.(See Table 11.2)

A) $45,000

B) $75,150

C) $90,150

D) $93,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

67

Table 11.3

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The cash flow pattern for the capital investment proposal is ________.(See Table 11.3)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The cash flow pattern for the capital investment proposal is ________.(See Table 11.3)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

68

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Calculate the incremental depreciation.(See Table 11.4)

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Calculate the incremental depreciation.(See Table 11.4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

69

Table 11.5

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The initial outlay for this project is ________.(See Table 11.5)

A) $42,820

B) $40,320

C) $47,820

D) $35,140

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The initial outlay for this project is ________.(See Table 11.5)

A) $42,820

B) $40,320

C) $47,820

D) $35,140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

70

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Calculate the tax effect from the sale of the existing asset.(See Table 11.4)

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Calculate the tax effect from the sale of the existing asset.(See Table 11.4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

71

Table 11.3

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The incremental depreciation expense for year 5 is ________.(See Table 11.3)

A) $2,250

B) $5,110

C) $7,950

D) $6,360

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The incremental depreciation expense for year 5 is ________.(See Table 11.3)

A) $2,250

B) $5,110

C) $7,950

D) $6,360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

72

Table 11.3

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The tax effect on the sale of the existing asset results in ________.(See Table 11.3)

A) $800 tax benefit

B) $1,000 tax liability

C) $1,100 tax liability

D) $6,000 tax liability

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The tax effect on the sale of the existing asset results in ________.(See Table 11.3)

A) $800 tax benefit

B) $1,000 tax liability

C) $1,100 tax liability

D) $6,000 tax liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

73

Table 11.5

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The net present value of the project is ________.(See Table 11.5)

A) $3,815

B) $2,445

C) $5,614

D) $7,500

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The net present value of the project is ________.(See Table 11.5)

A) $3,815

B) $2,445

C) $5,614

D) $7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

74

Table 11.3

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The book value of the existing asset is ________.(See Table 11.3)

A) $7,250

B) $15,000

C) $21,250

D) $25,000

Cuda Marine Engines, Inc. must develop the relevant cash flows for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five-year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate.

The book value of the existing asset is ________.(See Table 11.3)

A) $7,250

B) $15,000

C) $21,250

D) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

75

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Calculate the incremental earnings before depreciation and taxes.(See Table 11.4)

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Calculate the incremental earnings before depreciation and taxes.(See Table 11.4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

76

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Calculate the initial investment required for the new asset.(See Table 11.4)

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Calculate the initial investment required for the new asset.(See Table 11.4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

77

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Calculate the book value of the existing asset being replaced.(See Table 11.4)

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Calculate the book value of the existing asset being replaced.(See Table 11.4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

78

Table 11.5

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The tax effect of the sale of the existing asset is ________.(See Table 11.5)

A) a tax liability of $2,340

B) a tax benefit of $1,500

C) a tax liability of $3,320

D) a tax liability of $5,320

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The tax effect of the sale of the existing asset is ________.(See Table 11.5)

A) a tax liability of $2,340

B) a tax benefit of $1,500

C) a tax liability of $3,320

D) a tax liability of $5,320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

79

Table 11.4

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

Summarize the incremental after-tax cash flow (relevant cash flows)for years t = 0 through t = 5.(See Table 11.4)

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.Summarize the incremental after-tax cash flow (relevant cash flows)for years t = 0 through t = 5.(See Table 11.4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck

80

Table 11.5

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The present value of the project's annual cash flows is ________.(See Table 11.5)

A) $ 47,820

B) $ 42,820

C) $ 51,635

D) $100,563

Nuff Folding Box Company, Inc. is considering purchasing a new gluing machine. The gluing machine costs $50,000 and requires installation costs of $2,500. This outlay would be partially offset by the sale of an existing gluer. The existing gluer originally cost $10,000 and is four years old. It is being depreciated under MACRS using a five-year recovery schedule and can currently be sold for $15,000. The existing gluer has a remaining useful life of five years. If held until year 5, the existing machine's market value would be zero. Over its five-year life, the new machine should reduce operating costs (excluding depreciation) by $17,000 per year. Training costs of employees who will operate the new machine will be a one-time cost of $5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year recovery period. The firm has a 12 percent cost of capital and a 40 percent tax on ordinary income and capital gains.

The present value of the project's annual cash flows is ________.(See Table 11.5)

A) $ 47,820

B) $ 42,820

C) $ 51,635

D) $100,563

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 208 في هذه المجموعة.

فتح الحزمة

k this deck