Deck 9: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/108

العب

ملء الشاشة (f)

Deck 9: Financial Statement Analysis

1

An analysis procedure that uses percentages to compare each of the parts of an individual statement to a key dollar amount from the financial statements is:

A) Ratio analysis.

B) Contribution analysis.

C) Horizontal analysis.

D) Vertical analysis.

A) Ratio analysis.

B) Contribution analysis.

C) Horizontal analysis.

D) Vertical analysis.

D

Explanation: Horizontal analysis compares items over many time periods; vertical analysis compares many items within the same time period.

Explanation: Horizontal analysis compares items over many time periods; vertical analysis compares many items within the same time period.

2

Which of the following statements regarding ratio analysis is incorrect?

A) Ratio analysis is a specific form of horizontal analysis.

B) There are many different ratios available for evaluating a firm's performance.

C) Some ratios involve an account from the balance sheet and one from the income statement.

D) Ratio analysis involves making comparisons between different accounts in the same set of financial statements.

A) Ratio analysis is a specific form of horizontal analysis.

B) There are many different ratios available for evaluating a firm's performance.

C) Some ratios involve an account from the balance sheet and one from the income statement.

D) Ratio analysis involves making comparisons between different accounts in the same set of financial statements.

A

Explanation: Horizontal analysis, also called trend analysis, refers to studying the behavior of individual financial statement items over several accounting periods. These periods may be several quarters within the same fiscal year or they may be several different years. Ratio analysis involves studying various relationships between different items reported in a set of financial statements.

Explanation: Horizontal analysis, also called trend analysis, refers to studying the behavior of individual financial statement items over several accounting periods. These periods may be several quarters within the same fiscal year or they may be several different years. Ratio analysis involves studying various relationships between different items reported in a set of financial statements.

3

Common methods of financial statement analysis include all of the following except:

A) Incremental analysis.

B) Horizontal analysis.

C) Vertical analysis.

D) Ratio analysis.

A) Incremental analysis.

B) Horizontal analysis.

C) Vertical analysis.

D) Ratio analysis.

A

4

Which of the following statements regarding the information disclosed in financial statements is incorrect?

A) The costs of providing all possible information about a firm would be prohibitively high for the business.

B) Some information disclosed in financial statements may be irrelevant to some users.

C) Financial statements should be detailed enough to answer any financial-related question an investor might have.

D) When too much information is presented users may suffer from information overload.

A) The costs of providing all possible information about a firm would be prohibitively high for the business.

B) Some information disclosed in financial statements may be irrelevant to some users.

C) Financial statements should be detailed enough to answer any financial-related question an investor might have.

D) When too much information is presented users may suffer from information overload.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements regarding the analysis of absolute amounts of various accounts reported on the financial statements is incorrect?

A) Financial statement users with expertise in particular industries can look at absolute amounts and assess a company's performance in a certain area.

B) To correctly evaluate an absolute amount, the analyst must consider its relative importance.

C) Economic statistics such as the gross national product are built upon totals of absolute amounts reported by businesses.

D) Using absolute amounts eliminates the problem of varying materiality levels.

A) Financial statement users with expertise in particular industries can look at absolute amounts and assess a company's performance in a certain area.

B) To correctly evaluate an absolute amount, the analyst must consider its relative importance.

C) Economic statistics such as the gross national product are built upon totals of absolute amounts reported by businesses.

D) Using absolute amounts eliminates the problem of varying materiality levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

6

All of the following are considered to be measures of a company's short-term debt-paying ability except:

A) Current ratio.

B) Earnings per share.

C) Inventory turnover.

D) Average collection period.

A) Current ratio.

B) Earnings per share.

C) Inventory turnover.

D) Average collection period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

7

Milton Company has total current assets of $46,000, including inventory of $10,000, and current liabilities of $20,000. The company's current ratio is:

A) 0.4.

B) 1.8.

C) 2.8.

D) 2.3.

A) 0.4.

B) 1.8.

C) 2.8.

D) 2.3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

8

Factor(s) involved in communicating useful information is (are):

A) Attributes of the users.

B) Purpose for which the information will be used.

C) Process by which the information is analyzed.

D) All of these answers are correct.

A) Attributes of the users.

B) Purpose for which the information will be used.

C) Process by which the information is analyzed.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

9

Financial ratios can be used to assess which of the following aspects of a firm's performance?

A) Liquidity

B) Solvency

C) Profitability

D) All of these answers are correct.

A) Liquidity

B) Solvency

C) Profitability

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is an (are) objective(s) of ratio analysis?

A) Assessing past performance.

B) Assessing the prospects for future performance.

C) Analyzing how a company finances its operations.

D) All of these answers are correct.

A) Assessing past performance.

B) Assessing the prospects for future performance.

C) Analyzing how a company finances its operations.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

11

The study of an individual financial statement item over several accounting periods is called:

A) Horizontal analysis.

B) Vertical analysis.

C) Ratio analysis.

D) Time and motion analysis.

A) Horizontal analysis.

B) Vertical analysis.

C) Ratio analysis.

D) Time and motion analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

12

Financial statement analysis involves forms of comparison including:

A) Comparing changes in the same item over a number of periods.

B) Comparing key relationships within the same year.

C) Comparing key items to industry averages.

D) All of these answers are correct.

A) Comparing changes in the same item over a number of periods.

B) Comparing key relationships within the same year.

C) Comparing key items to industry averages.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

13

Darden Company has cash of $40,000, accounts receivable of $60,000, inventory of $32,000, and equipment of $100,000. Assuming current liabilities of $48,000, this company's working capital is:

A) $12,000.

B) $52,000.

C) $144,000.

D) $84,000.

A) $12,000.

B) $52,000.

C) $144,000.

D) $84,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

14

Rialto Company collected $5,000 on account. What impact will this transaction have on the firm's current ratio?

A) No impact

B) Increase it

C) Decrease it

D) Not enough information is provided to answer the question.

A) No impact

B) Increase it

C) Decrease it

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

15

Knoell Company paid its sales employees $15,000 in sales commissions. What impact will this transaction have on the firm's working capital?

A) No impact

B) Increase it

C) Decrease it

D) Not enough information is provided to answer the question.

A) No impact

B) Increase it

C) Decrease it

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

16

Select the correct statement regarding vertical analysis.

A) Vertical analysis of the income statement involves showing each item as a percentage of sales.

B) Vertical analysis of the balance sheet involves showing each asset as a percentage of total assets.

C) Vertical analysis examines two or more items from the financial statements of one accounting period.

D) All of these answers are correct.

A) Vertical analysis of the income statement involves showing each item as a percentage of sales.

B) Vertical analysis of the balance sheet involves showing each asset as a percentage of total assets.

C) Vertical analysis examines two or more items from the financial statements of one accounting period.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

17

Current financial reporting standards assume that users of accounting information:

A) Have an expert's understanding of economic and financial events and conditions.

B) Have a reasonably informed knowledge of business.

C) Have widely differing levels of knowledge about business, and that financial reporting must meet these differing needs.

D) Have only minimal knowledge of business.

A) Have an expert's understanding of economic and financial events and conditions.

B) Have a reasonably informed knowledge of business.

C) Have widely differing levels of knowledge about business, and that financial reporting must meet these differing needs.

D) Have only minimal knowledge of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements regarding the quick ratio is incorrect?

A) The quick ratio is also known as the acid-test ratio.

B) The quick ratio ignores some current assets that are less liquid than others.

C) The quick ratio is a conservative variation of the current ratio.

D) The quick ratio equals quick assets divided by total liabilities.

A) The quick ratio is also known as the acid-test ratio.

B) The quick ratio ignores some current assets that are less liquid than others.

C) The quick ratio is a conservative variation of the current ratio.

D) The quick ratio equals quick assets divided by total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

19

Working capital is defined as:

A) Current assets divided by current liabilities.

B) Total assets minus total liabilities.

C) Current assets less current liabilities.

D) Current liabilities divided by total liabilities.

A) Current assets divided by current liabilities.

B) Total assets minus total liabilities.

C) Current assets less current liabilities.

D) Current liabilities divided by total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements regarding horizontal analysis is incorrect?

A) Percentage analysis involves establishing the relationship of one amount to another.

B) A horizontal analysis of cost of goods sold on the income statement includes dividing net income by total revenue.

C) Percentage analysis attempts to eliminate the materiality problem of comparing firms of different sizes.

D) In doing horizontal analysis, an account is expressed as a percentage of the previous balance of the same account.

A) Percentage analysis involves establishing the relationship of one amount to another.

B) A horizontal analysis of cost of goods sold on the income statement includes dividing net income by total revenue.

C) Percentage analysis attempts to eliminate the materiality problem of comparing firms of different sizes.

D) In doing horizontal analysis, an account is expressed as a percentage of the previous balance of the same account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements regarding the return on equity (ROE) measure is incorrect?

A) ROE is used to measure the profitability of the firm in relation to the amount invested by stockholders.

B) ROE equals net income divided by average total stockholders' equity.

C) ROE is affected by a company's use of leverage.

D) A company's ROE is lower than its return on investment because ROE does not consider that part of the business that is financed by debt.

A) ROE is used to measure the profitability of the firm in relation to the amount invested by stockholders.

B) ROE equals net income divided by average total stockholders' equity.

C) ROE is affected by a company's use of leverage.

D) A company's ROE is lower than its return on investment because ROE does not consider that part of the business that is financed by debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

22

You are considering an investment in Apple stock and wish to assess the firm's short-term debt-paying ability. All of the following ratios are used to assess liquidity except:

A) Debt to equity ratio.

B) Inventory turnover.

C) Quick ratio.

D) Accounts receivable turnover.

A) Debt to equity ratio.

B) Inventory turnover.

C) Quick ratio.

D) Accounts receivable turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

23

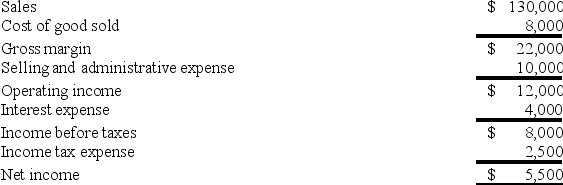

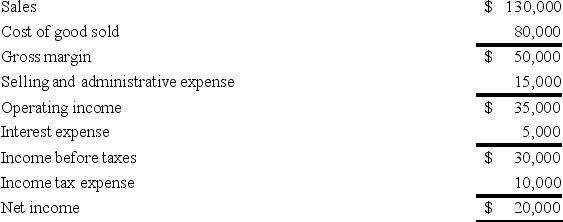

The Poole Company reported the following income for Year 2:  What is the company's net margin? (Round your answers to the nearest whole percent.)

What is the company's net margin? (Round your answers to the nearest whole percent.)

A) 73%

B) 40%

C) 18%

D) 27%

What is the company's net margin? (Round your answers to the nearest whole percent.)

What is the company's net margin? (Round your answers to the nearest whole percent.)A) 73%

B) 40%

C) 18%

D) 27%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

24

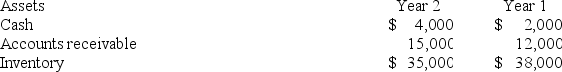

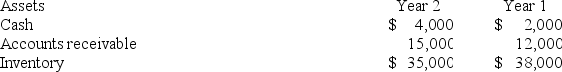

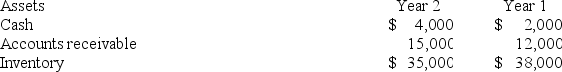

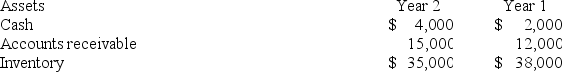

The following balance sheet information was provided by Western Company:  Assuming Year 2 net credit sales totaled $270,000, what were the company's average days to collect receivables? (Use 365 days in a year. Do not round intermediate calculations.)

Assuming Year 2 net credit sales totaled $270,000, what were the company's average days to collect receivables? (Use 365 days in a year. Do not round intermediate calculations.)

A) 18.25 days

B) 47.31 days

C) 16.22 days

D) 20.28 days

Assuming Year 2 net credit sales totaled $270,000, what were the company's average days to collect receivables? (Use 365 days in a year. Do not round intermediate calculations.)

Assuming Year 2 net credit sales totaled $270,000, what were the company's average days to collect receivables? (Use 365 days in a year. Do not round intermediate calculations.)A) 18.25 days

B) 47.31 days

C) 16.22 days

D) 20.28 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements regarding net margin is incorrect?

A) Net margin refers to the average amount of each sales dollar remaining after all expenses are subtracted.

B) Net margin may be calculated in several ways.

C) The amount of net margin is affected by a company's choices of accounting principles.

D) The smaller the net margin the better.

A) Net margin refers to the average amount of each sales dollar remaining after all expenses are subtracted.

B) Net margin may be calculated in several ways.

C) The amount of net margin is affected by a company's choices of accounting principles.

D) The smaller the net margin the better.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

26

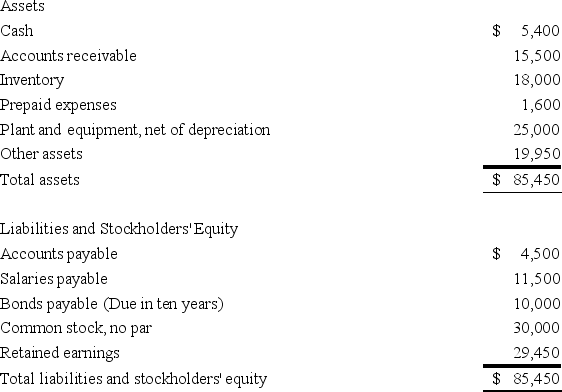

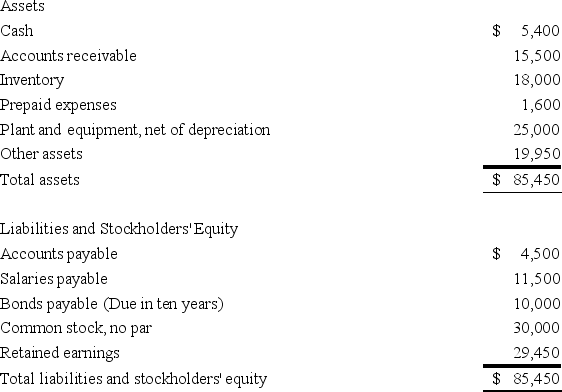

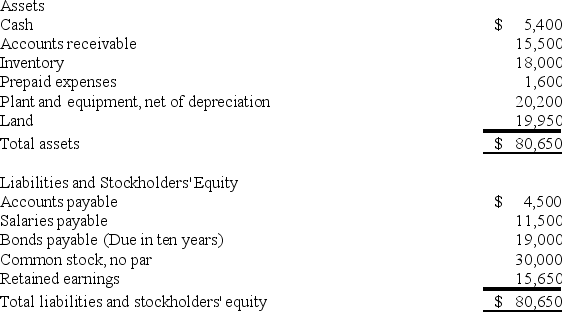

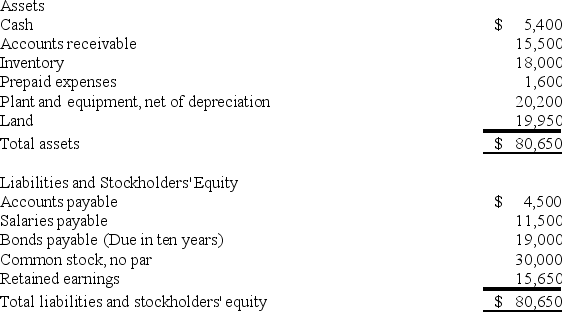

The following balance sheet information is provided for Apex Company for Year 2:  What is the company's working capital?

What is the company's working capital?

A) $20,300

B) $4,900

C) $22,900

D) $24,500

What is the company's working capital?

What is the company's working capital?A) $20,300

B) $4,900

C) $22,900

D) $24,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

27

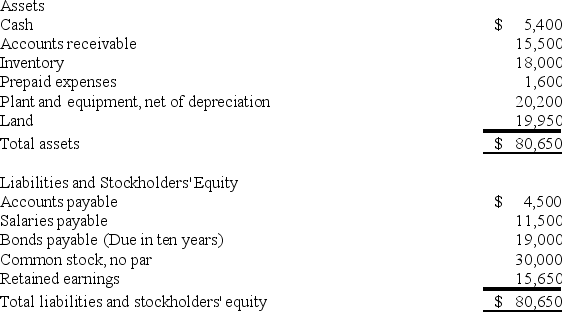

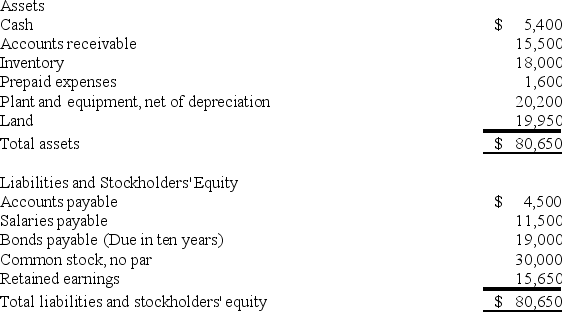

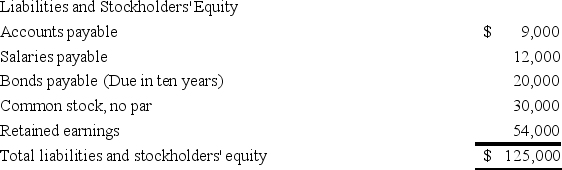

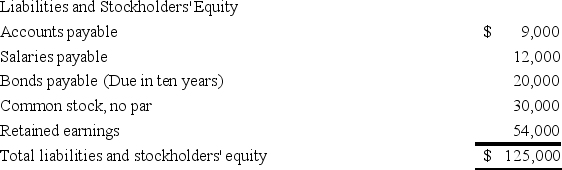

The following balance sheet information is provided for Santana Company for Year 2:  What is the company's debt to equity ratio? (Round your answers to the nearest whole percent.)

What is the company's debt to equity ratio? (Round your answers to the nearest whole percent.)

A) 42%

B) 130%

C) 43%

D) 77%

What is the company's debt to equity ratio? (Round your answers to the nearest whole percent.)

What is the company's debt to equity ratio? (Round your answers to the nearest whole percent.)A) 42%

B) 130%

C) 43%

D) 77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

28

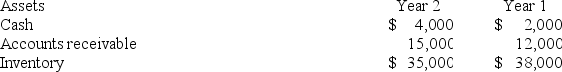

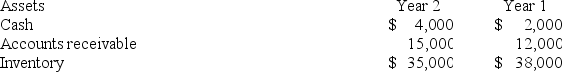

The following balance sheet information was provided by O'Connor Company:  Assuming that net credit sales for Year 2 totaled $270,000, what is the company's most recent accounts receivable turnover?

Assuming that net credit sales for Year 2 totaled $270,000, what is the company's most recent accounts receivable turnover?

A) 18 times

B) 20 times

C) 22.5 times

D) 7.7 times

Assuming that net credit sales for Year 2 totaled $270,000, what is the company's most recent accounts receivable turnover?

Assuming that net credit sales for Year 2 totaled $270,000, what is the company's most recent accounts receivable turnover?A) 18 times

B) 20 times

C) 22.5 times

D) 7.7 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

29

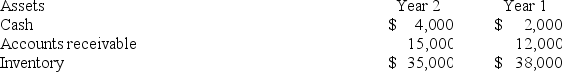

The following balance sheet information is provided for Patton Company:  Assuming Year 2 cost of goods sold is $730,000, what are the company's average days to sell inventory? (Use 365 days in a year. Do not round intermediate calculations.)

Assuming Year 2 cost of goods sold is $730,000, what are the company's average days to sell inventory? (Use 365 days in a year. Do not round intermediate calculations.)

A) 17.5 days

B) 18.25 days

C) 19 days

D) 20.86 days

Assuming Year 2 cost of goods sold is $730,000, what are the company's average days to sell inventory? (Use 365 days in a year. Do not round intermediate calculations.)

Assuming Year 2 cost of goods sold is $730,000, what are the company's average days to sell inventory? (Use 365 days in a year. Do not round intermediate calculations.)A) 17.5 days

B) 18.25 days

C) 19 days

D) 20.86 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

30

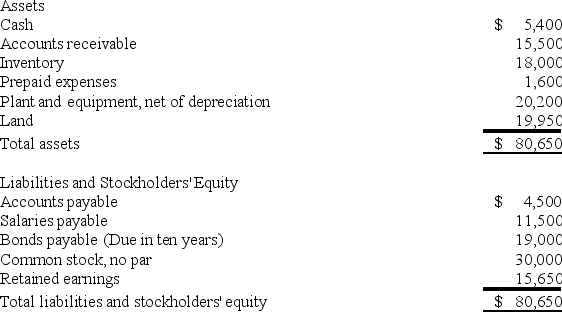

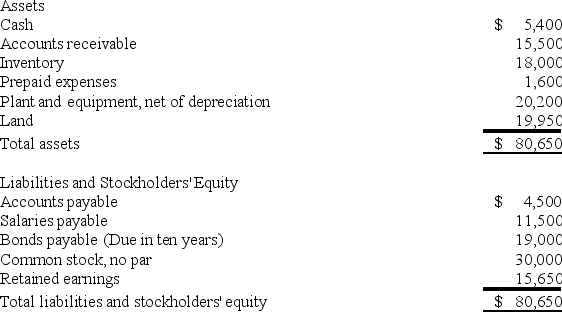

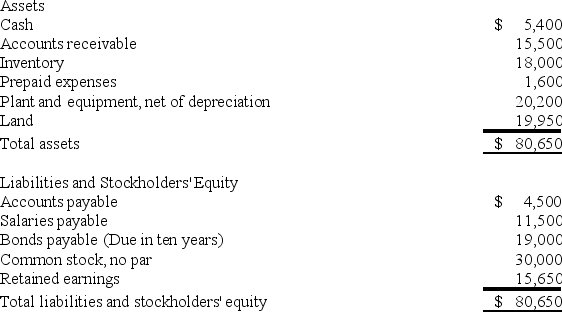

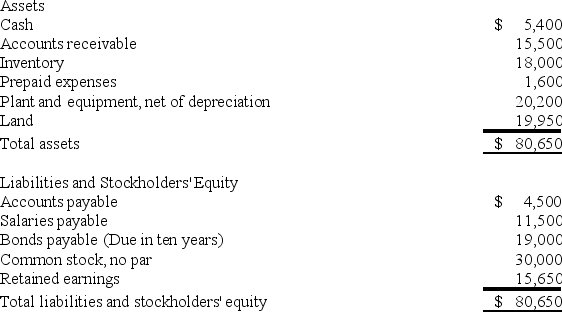

Alpha Company provided the following balance sheet for Year 2:  What is the company's plant assets to long-term liabilities ratio?

What is the company's plant assets to long-term liabilities ratio?

A) 2.5

B) 4.5

C) 1.7

D) None of these answers is correct.

What is the company's plant assets to long-term liabilities ratio?

What is the company's plant assets to long-term liabilities ratio?A) 2.5

B) 4.5

C) 1.7

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

31

Solvency ratios are used to assess a company's:

A) Long-term debt paying ability.

B) Profitability.

C) Short-term debt paying ability.

D) Efficiency in use of its assets.

A) Long-term debt paying ability.

B) Profitability.

C) Short-term debt paying ability.

D) Efficiency in use of its assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

32

You are considering an investment in IBM stock and wish to assess the firm's long-term debt-paying ability and its use of debt financing. All of the following ratios can be used to assess solvency except:

A) Number of times interest is earned.

B) Debt to assets ratio.

C) Debt to equity ratio.

D) Net margin.

A) Number of times interest is earned.

B) Debt to assets ratio.

C) Debt to equity ratio.

D) Net margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

33

The following balance sheet information is provided for Duke Company for Year 2:  What is the company's current ratio?

What is the company's current ratio?

A) 1.16

B) 1.31

C) 2.53

D) 3.79

What is the company's current ratio?

What is the company's current ratio?A) 1.16

B) 1.31

C) 2.53

D) 3.79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

34

The following partial balance sheet is provided for Groome Company:  What is the company's quick (acid-test) ratio?

What is the company's quick (acid-test) ratio?

A) 49%

B) 16%

C) 33%

D) Cannot be determined with the information given.

What is the company's quick (acid-test) ratio?

What is the company's quick (acid-test) ratio?A) 49%

B) 16%

C) 33%

D) Cannot be determined with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following balance sheet information is provided for Greene Company for Year 2:  What is the company's quick (acid-test) ratio?

What is the company's quick (acid-test) ratio?

A) 0.7

B) 1.4

C) 1.3

D) 3.8

What is the company's quick (acid-test) ratio?

What is the company's quick (acid-test) ratio?A) 0.7

B) 1.4

C) 1.3

D) 3.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Martin Company reported net income of $15,000 on gross sales of $80,000. The company has average total assets of $135,000, of which $102,000 is property, plant and equipment. What is the company's return on investment? (Round your final answer to 1 decimal place.)

A) 18.8%

B) 11.1%

C) 14.7%

D) 12.5%

A) 18.8%

B) 11.1%

C) 14.7%

D) 12.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

37

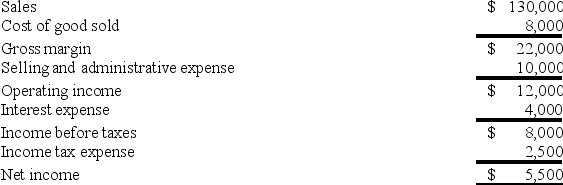

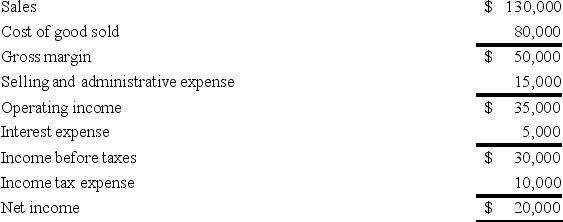

The Fortune Company reported the following income for Year 2:  What is the company's number of times interest is earned ratio?

What is the company's number of times interest is earned ratio?

A) 7 times

B) 6 times

C) 4 times

D) None of these answers is correct.

What is the company's number of times interest is earned ratio?

What is the company's number of times interest is earned ratio?A) 7 times

B) 6 times

C) 4 times

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

38

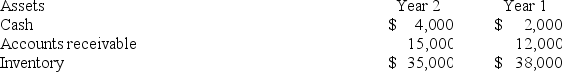

The following balance sheet information is provided for Gaynor Company:  Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?

Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?

A) 4.0 times

B) 4.4 times

C) 4.2 times

D) None of these answers is correct.

Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?

Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?A) 4.0 times

B) 4.4 times

C) 4.2 times

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

39

You are considering an investment in Frontier Airlines stock and wish to assess the firm's earnings performance. All of the following ratios can be used to assess profitability except:

A) Average days to collect receivables.

B) Asset turnover.

C) Return on investment.

D) Net margin.

A) Average days to collect receivables.

B) Asset turnover.

C) Return on investment.

D) Net margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Miller Company reported gross sales of $850,000, sales returns and allowances of $15,000 and sales discounts of $5,000. The company has average total assets of $500,000, of which $250,000 is property, plant, and equipment. What is the company's asset turnover ratio?

A) 3.32 times

B) 1.67 times

C) 1.66 times

D) 1.70 times

A) 3.32 times

B) 1.67 times

C) 1.66 times

D) 1.70 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

41

You are considering an investment in Facebook stock and wish to assess the company's position in the stock market. All of the following ratios can be used except:

A) Dividend yield.

B) Earnings per share.

C) Working capital.

D) Price-earnings ratio.

A) Dividend yield.

B) Earnings per share.

C) Working capital.

D) Price-earnings ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

42

Benson Company received cash of $1,000,000 from issuing common stock at par value. As a result of this transaction, the company's debt to equity ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is a potential limitation of financial statement analysis?

A) Lack of comparability of firms in different industries

B) The impact of changing economic conditions

C) The impact of having more than one acceptable alternative accounting principle for accounting for a given transaction or economic event

D) All of these answers are correct.

A) Lack of comparability of firms in different industries

B) The impact of changing economic conditions

C) The impact of having more than one acceptable alternative accounting principle for accounting for a given transaction or economic event

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Phibbs Company paid total cash dividends of $200,000 on 25,000 outstanding common shares. On the most recent trading day, the common shares sold at $80. What is this company's dividend yield?

A) 25%

B) 6.4%

C) 16.9%

D) 10%

A) 25%

B) 6.4%

C) 16.9%

D) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

45

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant collected $5,200 of accounts receivable. As a result of this transaction, Gant's working capital will:

A) Increase.

B) Decrease.

C) Remain the same.

D) Cannot be determined.

A) Increase.

B) Decrease.

C) Remain the same.

D) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

46

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant purchased merchandise on account for $4,000. Which of the following statements is correct?

A) Gant's current ratio will decrease.

B) Gant's quick ratio will increase.

C) Gant's working capital will increase.

D) Gant's quick ratio will increase and its current ratio will decrease.

A) Gant's current ratio will decrease.

B) Gant's quick ratio will increase.

C) Gant's working capital will increase.

D) Gant's quick ratio will increase and its current ratio will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

47

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2 Gant paid $3,600 on accounts payable. Which of the following statements is incorrect?

A) Gant's quick ratio will increase and its current ratio will decrease.

B) Gant's quick ratio will increase.

C) Gant's working capital will remain the same.

D) Gant's current ratio will increase.

A) Gant's quick ratio will increase and its current ratio will decrease.

B) Gant's quick ratio will increase.

C) Gant's working capital will remain the same.

D) Gant's current ratio will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements is generally incorrect from an investor's perspective?

A) A 1:1 current ratio is generally preferred over a 1.5:1 current ratio.

B) A 20-day average collection period for accounts receivable is generally preferred over a 30-day average collection period.

C) A 5% dividend yield is generally preferred over a 3% dividend yield.

D) A 10% net margin is generally preferred over an 8% net margin.

A) A 1:1 current ratio is generally preferred over a 1.5:1 current ratio.

B) A 20-day average collection period for accounts receivable is generally preferred over a 30-day average collection period.

C) A 5% dividend yield is generally preferred over a 3% dividend yield.

D) A 10% net margin is generally preferred over an 8% net margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

49

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant sold inventory on account. Which of the following statements is incorrect?

A) Gant's current ratio will increase.

B) Gant's quick ratio will increase.

C) Gant's working capital will increase.

D) None of these answers is correct.

A) Gant's current ratio will increase.

B) Gant's quick ratio will increase.

C) Gant's working capital will increase.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

50

Accrual accounting requires the use of many estimates, including:

A) Uncollectible accounts expense.

B) Warranty costs.

C) Assets' useful lives.

D) All of these answers are correct.

A) Uncollectible accounts expense.

B) Warranty costs.

C) Assets' useful lives.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

51

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant recorded cost of goods sold of $4,100. As a result of this transaction, Gant's quick ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Dennis Company reported net income of $50,000 on sales of $300,000. The company has average total assets of $500,000 and average total liabilities of $100,000. What is the company's return on equity ratio?

A) 10.0%

B) 16.7%

C) 12.5%

D) 50.0%

A) 10.0%

B) 16.7%

C) 12.5%

D) 50.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

53

The accounting concept or principle that is perhaps the greatest single culprit in distorting the results of financial statement analysis is the:

A) Matching principle.

B) Conservatism concept.

C) Historical cost principle.

D) Time value of money concept.

A) Matching principle.

B) Conservatism concept.

C) Historical cost principle.

D) Time value of money concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

54

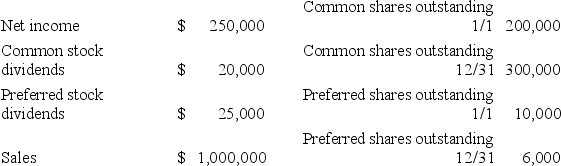

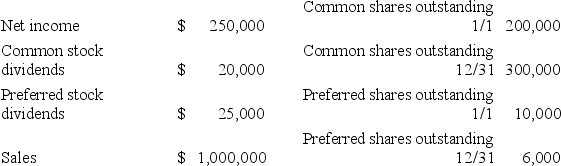

The Abel Company provided the following information from its financial records:  What is the amount of the company's earnings per share?

What is the amount of the company's earnings per share?

A) $0.82

B) $1.00

C) $0.90

D) $0.75

What is the amount of the company's earnings per share?

What is the amount of the company's earnings per share?A) $0.82

B) $1.00

C) $0.90

D) $0.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

55

Benson Company declared and paid a cash dividend totaling $500,000 on its common stock. As a result of this transaction, the company's debt to assets ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

56

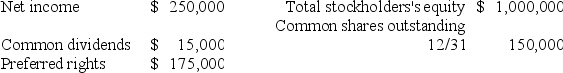

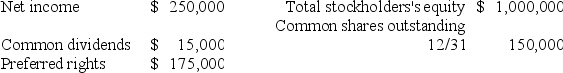

The Bernard Company provided the following information from its financial records:  What is the company's book value per share?

What is the company's book value per share?

A) $0.50

B) $5.50

C) $6.67

D) $1.67

What is the company's book value per share?

What is the company's book value per share?A) $0.50

B) $5.50

C) $6.67

D) $1.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Crestar Company reported net income of $112,000 on 20,000 average outstanding common shares. Preferred dividends total $12,000. On the most recent trading day, the preferred shares sold at $50 and the common shares sold at $95. What is this company's current price-earnings ratio?

A) 19

B) 17

C) 20

D) None of these answers is correct.

A) 19

B) 17

C) 20

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

58

The return on investment measure is also referred to as:

A) Net margin.

B) Return on equity.

C) Return on debt.

D) Return on assets.

A) Net margin.

B) Return on equity.

C) Return on debt.

D) Return on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

59

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant issued common stock at par value for $10,000 cash. Which of the following statement is correct?

A) Gant's current ratio will decrease.

B) Gant's current ratio will increase.

C) Gant's quick ratio will decrease.

D) Gant's working capital will decrease.

A) Gant's current ratio will decrease.

B) Gant's current ratio will increase.

C) Gant's quick ratio will decrease.

D) Gant's working capital will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

60

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant paid $250 for transportation cost on merchandise it had received. Which of the following statements is incorrect?

A) Grove's current ratio will remain the same

B) Grove's quick ratio will increase

C) Grove's working capital will remain the same

D) Grove's quick ratio will increase and its current ratio will remain the same.

A) Grove's current ratio will remain the same

B) Grove's quick ratio will increase

C) Grove's working capital will remain the same

D) Grove's quick ratio will increase and its current ratio will remain the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which ratios measure a company's long-term debt paying ability and its financing structure?

A) Solvency

B) Liquidity

C) Profitability

D) None of these answers is correct.

A) Solvency

B) Liquidity

C) Profitability

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

62

Lilly's Corporation has working capital of $620,000, and Harmon Corporation has working capital of $840,000. Which of the following statements is incorrect?

A) Since working capital is an absolute amount, other factors such as size of the company and materiality will help to determine liquidity of these two companies.

B) Since Harmon's working capital exceeds Lilly's working capital, it is safe to conclude that Harmon is more liquid than Lilly.

C) If Lilly Corporation is smaller than Harmon or has lower current liabilities; Lilly could be more liquid than Harmon.

D) None of these answers is correct.

A) Since working capital is an absolute amount, other factors such as size of the company and materiality will help to determine liquidity of these two companies.

B) Since Harmon's working capital exceeds Lilly's working capital, it is safe to conclude that Harmon is more liquid than Lilly.

C) If Lilly Corporation is smaller than Harmon or has lower current liabilities; Lilly could be more liquid than Harmon.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which type of approach should be used when evaluating corporate results using horizontal analysis?

A) Study of absolute amounts.

B) Percentages.

C) Trends.

D) All of these answers are correct.

A) Study of absolute amounts.

B) Percentages.

C) Trends.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

64

In vertical analysis, each item is expressed as a percentage of:

A) Total assets on the balance sheet.

B) Total cash on the balance sheet.

C) Total current assets on the balance sheet.

D) None of these answers is correct.

A) Total assets on the balance sheet.

B) Total cash on the balance sheet.

C) Total current assets on the balance sheet.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

65

Assume that you are considering purchasing some of a company's long-term bonds as an investment. Which of the company's financial statement ratios would you probably be most interested in?

A) Debt to assets ratio

B) Debt to equity

C) Plant assets to long-term liabilities

D) All of these answers are correct.

A) Debt to assets ratio

B) Debt to equity

C) Plant assets to long-term liabilities

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

66

Long-term creditors are usually most interested in evaluating:

A) Liquidity.

B) Managerial effectiveness.

C) Solvency.

D) Profitability.

A) Liquidity.

B) Managerial effectiveness.

C) Solvency.

D) Profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following statement is correct regarding the quick ratio?

A) The numerator for the quick ratio is current assets minus inventory minus accounts receivable.

B) The numerator for the quick ratio is current assets.

C) The quick ratio is also called the working capital ratio.

D) The quick ratio is a more conservative variation of the current ratio.

A) The numerator for the quick ratio is current assets minus inventory minus accounts receivable.

B) The numerator for the quick ratio is current assets.

C) The quick ratio is also called the working capital ratio.

D) The quick ratio is a more conservative variation of the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the company purchased a $60,000 piece of equipment by paying $30,000 and having the rest financed with a short-term note from the bank, then immediately after this transaction what is the expected impact on the components of the current ratio?

A) Current assets decrease and current liabilities increase by the same amount.

B) Current liabilities decrease.

C) Current assets and current liabilities decrease by the same amount.

D) Current assets increase.

A) Current assets decrease and current liabilities increase by the same amount.

B) Current liabilities decrease.

C) Current assets and current liabilities decrease by the same amount.

D) Current assets increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

69

Horizontal analysis is also known as:

A) Liquidity analysis.

B) Trend analysis.

C) Revenue analysis.

D) Variance analysis.

A) Liquidity analysis.

B) Trend analysis.

C) Revenue analysis.

D) Variance analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

70

Benson Company received cash of $5,000,000 by issuing 20-year bonds payable. As a result of this transaction, the company's current ratio will:

A) Remain the same.

B) Increase.

C) Decrease.

D) Cannot be determined.

A) Remain the same.

B) Increase.

C) Decrease.

D) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

71

Net income divided by sales is the formula for which of these analytical measures?

A) Return on assets

B) Return on equity

C) Earnings per share

D) Net margin

A) Return on assets

B) Return on equity

C) Earnings per share

D) Net margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

72

Two ratios that provide insight on the relationship between credit sales and receivables are:

A) Current ratio and inventory turnover ratio.

B) Accounts receivable turnover and average days to collect receivables.

C) Average days to collect receivables and asset turnover.

D) Accounts receivable turnover and current ratio.

A) Current ratio and inventory turnover ratio.

B) Accounts receivable turnover and average days to collect receivables.

C) Average days to collect receivables and asset turnover.

D) Accounts receivable turnover and current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

73

The study of an individual item or account over several periods in the same financial year or over many years is known as:

A) Liquidity analysis

B) Ratio analysis

C) Vertical analysis

D) Horizontal analysis

A) Liquidity analysis

B) Ratio analysis

C) Vertical analysis

D) Horizontal analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

74

Short-term creditors are usually most interested in assessing:

A) Liquidity.

B) Solvency.

C) Managerial effectiveness.

D) Profitability.

A) Liquidity.

B) Solvency.

C) Managerial effectiveness.

D) Profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

75

Earnings before interest and taxes divided by interest expense is the formula for which of these analytical measures?

A) Debt to assets ratio

B) Earnings per share

C) Return on investment

D) Number of times interest is earned

A) Debt to assets ratio

B) Earnings per share

C) Return on investment

D) Number of times interest is earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which ratio measures how effectively a company is using assets to generate revenue?

A) Net margin

B) Plant assets to long-term liabilities

C) Asset turnover

D) Inventory turnover

A) Net margin

B) Plant assets to long-term liabilities

C) Asset turnover

D) Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

77

Cost of goods sold divided by average inventory is the formula for which of these analytical measures?

A) Number of day's sales in inventory

B) Return on investment

C) Inventory turnover

D) Debt to assets ratio

A) Number of day's sales in inventory

B) Return on investment

C) Inventory turnover

D) Debt to assets ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which ratio would you use to examine a company's ability to pay its debts in the short term?

A) Earnings per share

B) Acid-test ratio

C) Debt to assets ratio

D) Return on equity

A) Earnings per share

B) Acid-test ratio

C) Debt to assets ratio

D) Return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

79

In vertical analysis, each item is expressed as a percentage of:

A) Total expenses on the income statement.

B) Net income on the income statement.

C) Sales on the income statement.

D) None of these answers is correct.

A) Total expenses on the income statement.

B) Net income on the income statement.

C) Sales on the income statement.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

80

Starwood Corporation has current assets of $200,000, total current liabilities of $750,000 net credit sales of $1,300,000, beginning accounts receivable of $65,000 and ending accounts receivable of $69,000. What is Starwood's accounts receivable turnover?

A) 21.8 times

B) 19.4 times

C) 22.4 times

D) 5.8 times

A) 21.8 times

B) 19.4 times

C) 22.4 times

D) 5.8 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck