Deck 19: Valuation and Financial Modeling: a Case Study

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/49

العب

ملء الشاشة (f)

Deck 19: Valuation and Financial Modeling: a Case Study

1

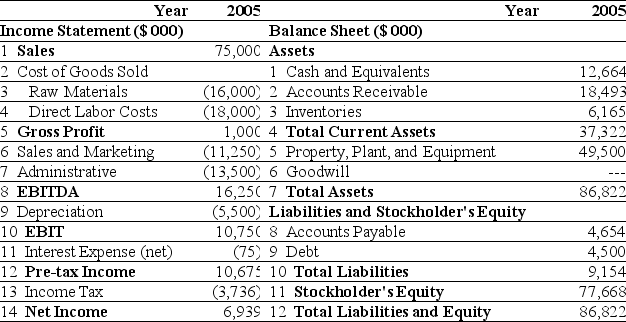

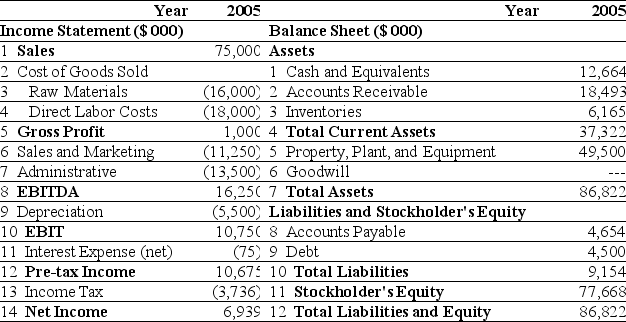

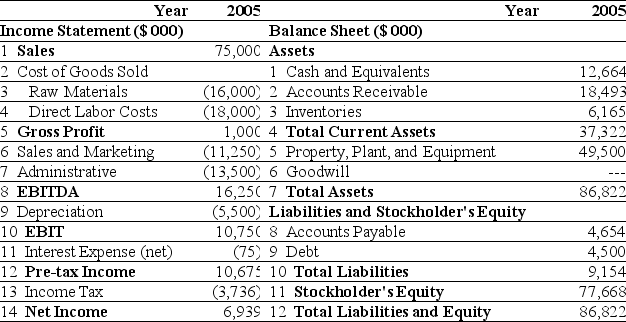

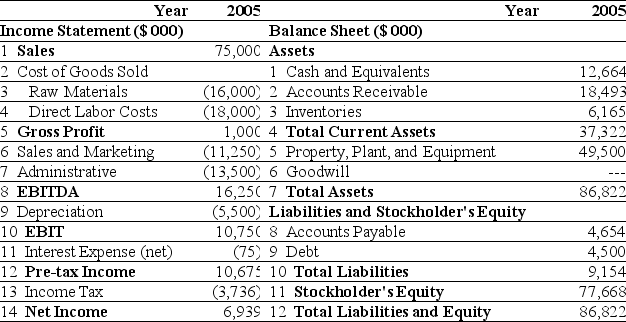

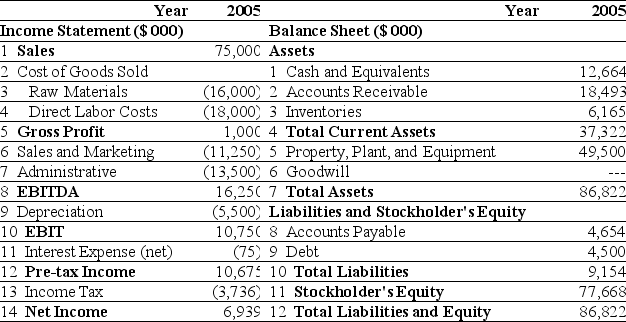

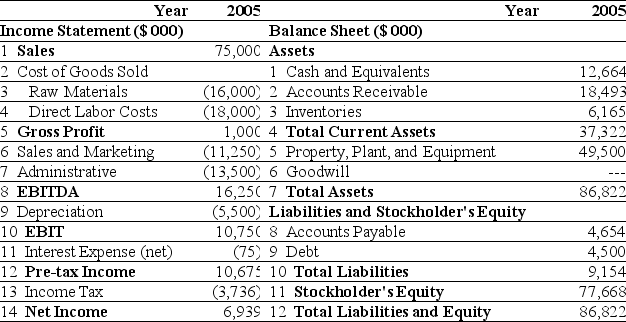

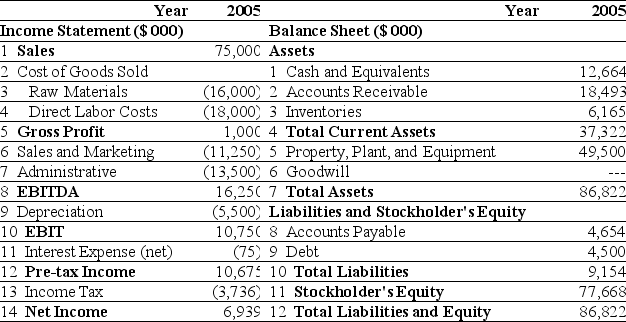

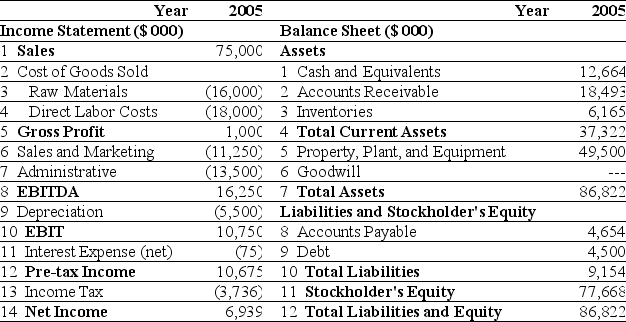

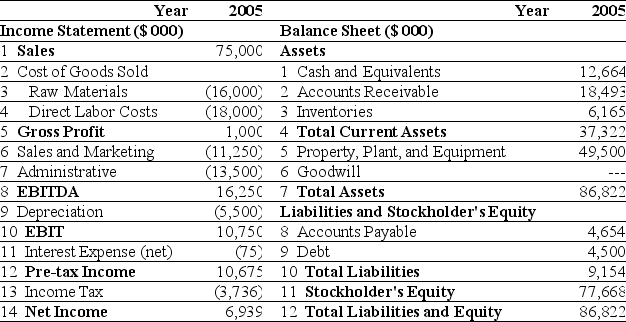

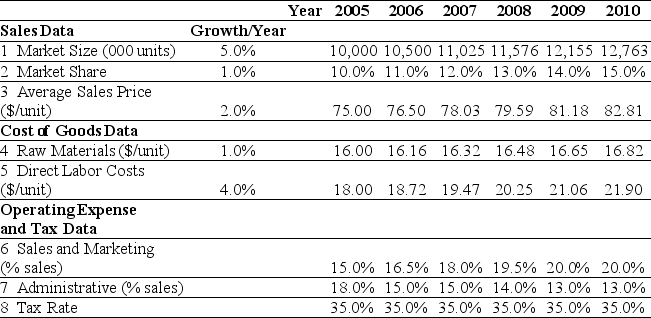

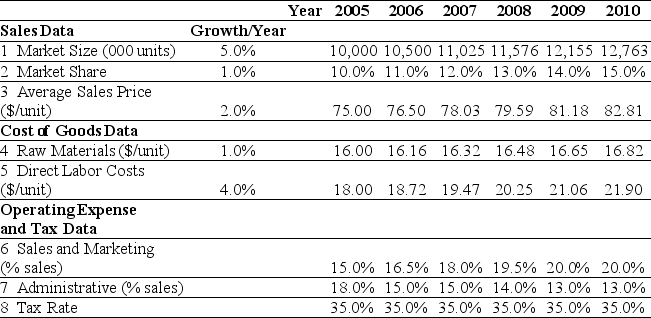

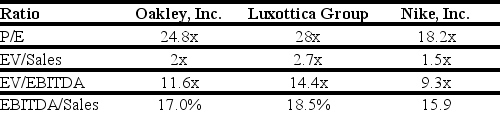

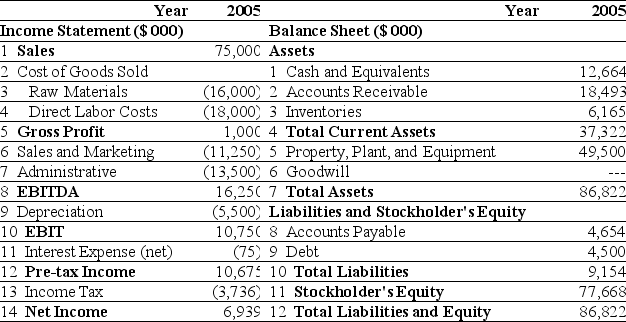

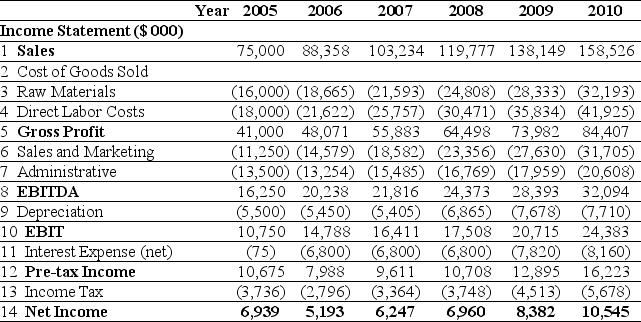

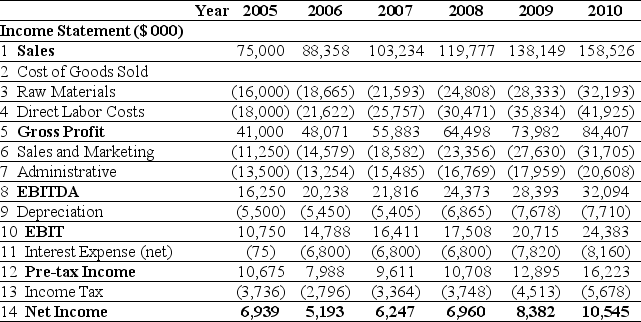

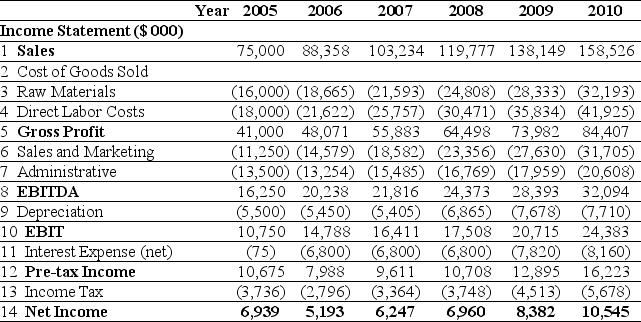

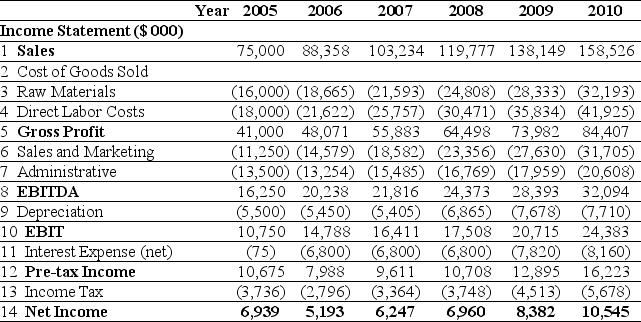

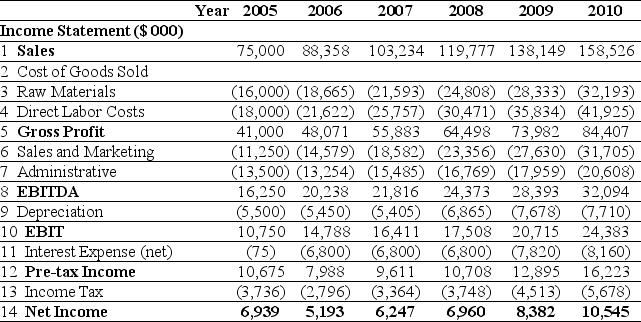

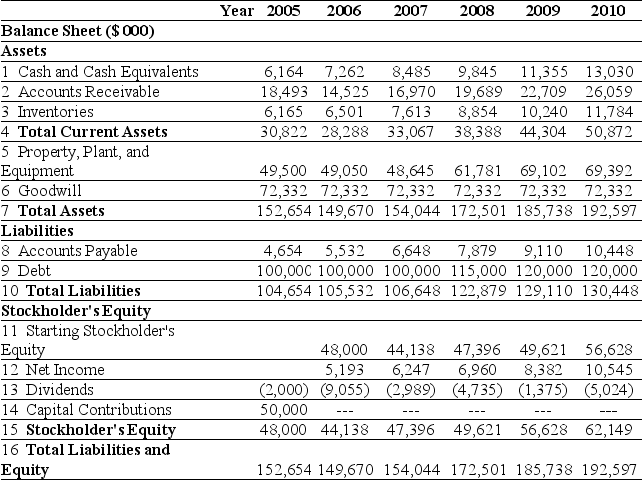

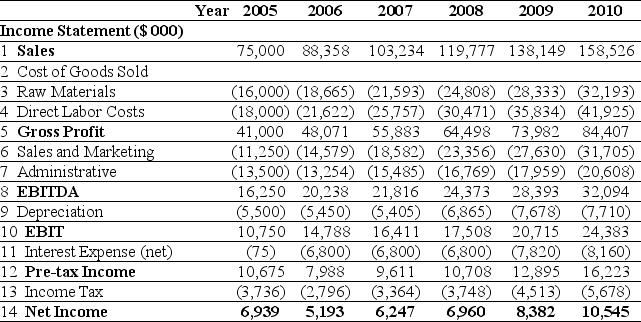

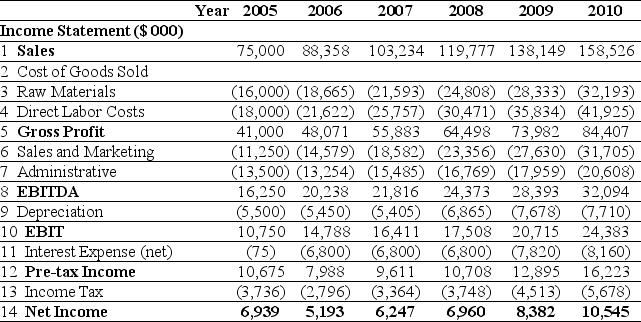

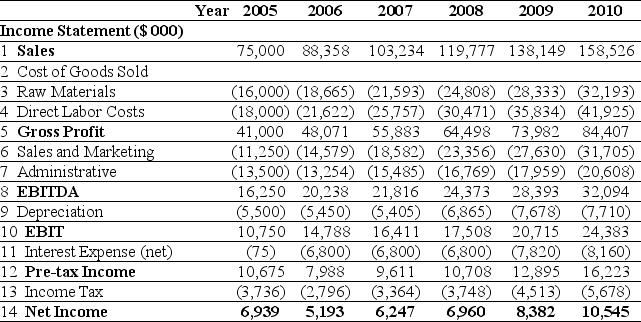

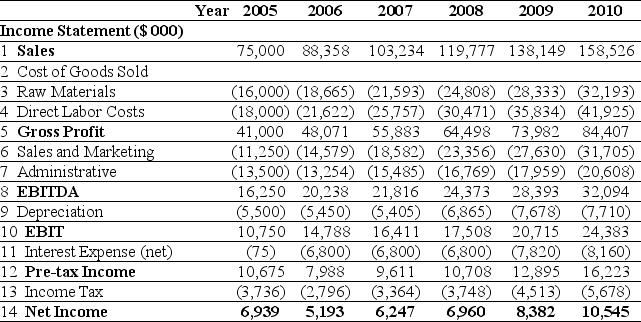

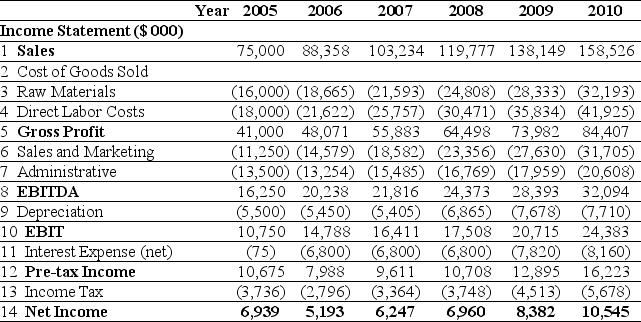

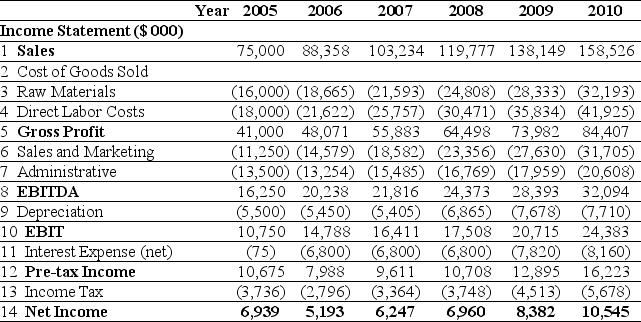

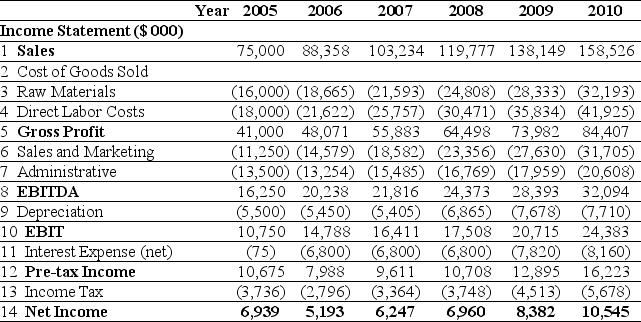

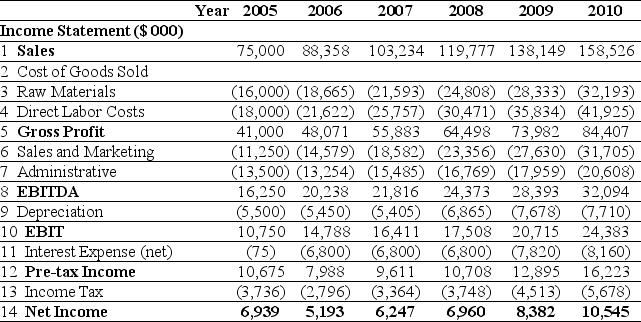

Use the tables for the question(s)below.

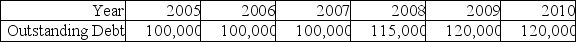

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

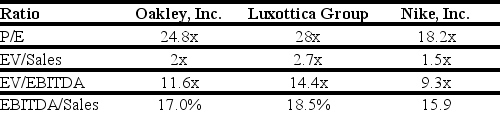

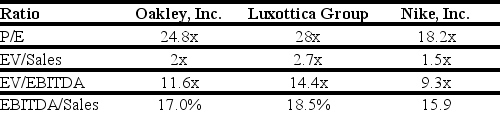

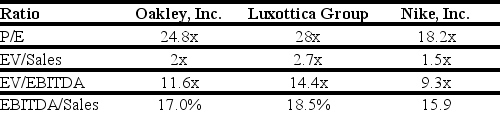

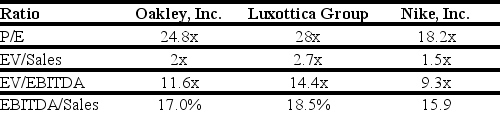

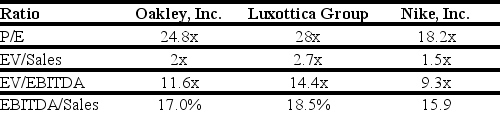

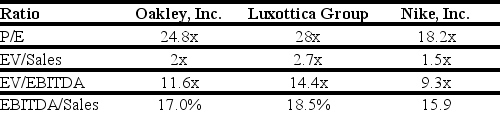

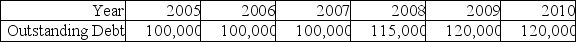

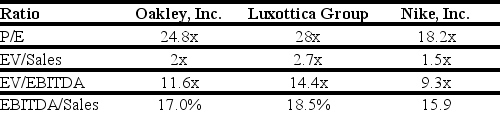

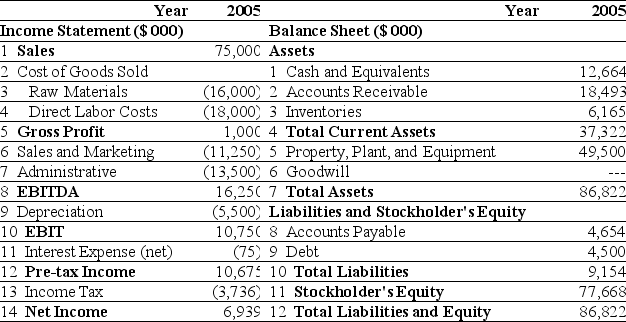

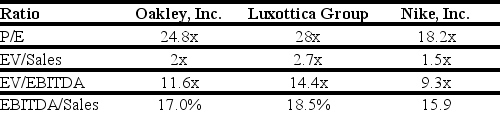

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms, if Ideko holds $6.5 million of cash in excess of its working capital needs, then Ideko's target market value of equity is closest to:

A)$165 million

B)$157 million

C)$193 million

D)$191 million

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms, if Ideko holds $6.5 million of cash in excess of its working capital needs, then Ideko's target market value of equity is closest to:

A)$165 million

B)$157 million

C)$193 million

D)$191 million

$157 million

2

Use the tables for the question(s)below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average P/E ratio of the comparable firms, Ideko's target market value of equity is closest to:

A)$157 million

B)$155 million

C)$193 million

D)$165 million

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average P/E ratio of the comparable firms, Ideko's target market value of equity is closest to:

A)$157 million

B)$155 million

C)$193 million

D)$165 million

$165 million

3

Use the tables for the question(s)below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms, if Ideko holds $6.5 million of cash in excess of its working capital needs, then Ideko's target market value of equity is closest to:

A)$155 million

B)$157 million

C)$165 million

D)$193 million

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms, if Ideko holds $6.5 million of cash in excess of its working capital needs, then Ideko's target market value of equity is closest to:

A)$155 million

B)$157 million

C)$165 million

D)$193 million

$193 million

4

Use the following information to answer the question(s)below:

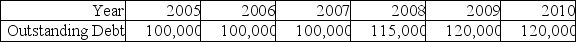

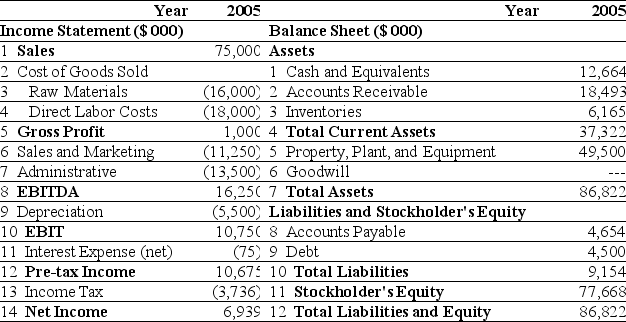

Ideko's Planned Debt

If Ideko's loans will have an interest rate of 6.8%, then the interest expense paid in 2009 is closest to:

A)$6,800

B)$7,310

C)$7,820

D)$7,990

Ideko's Planned Debt

If Ideko's loans will have an interest rate of 6.8%, then the interest expense paid in 2009 is closest to:

A)$6,800

B)$7,310

C)$7,820

D)$7,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

5

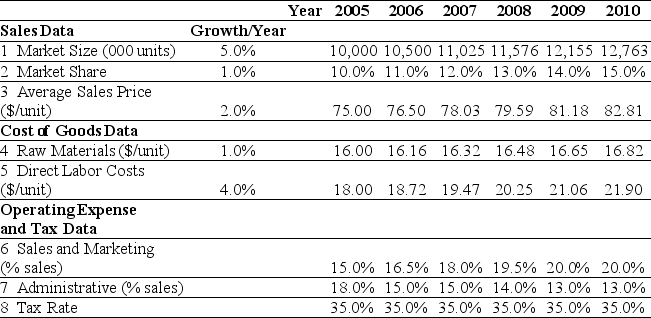

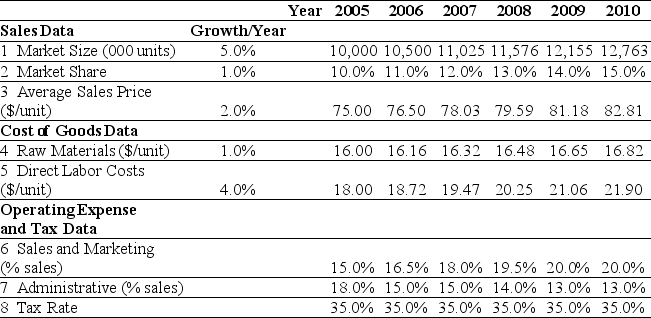

Use the table for the question(s)below.

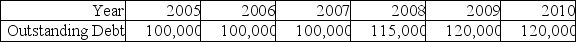

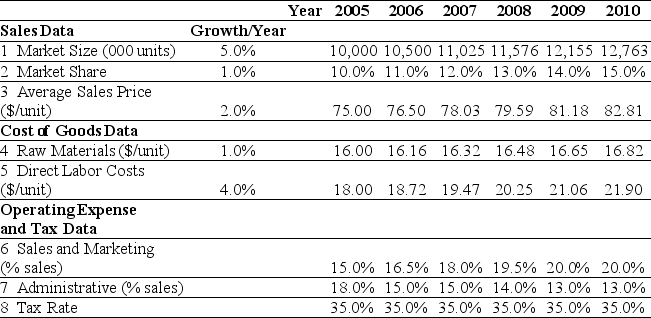

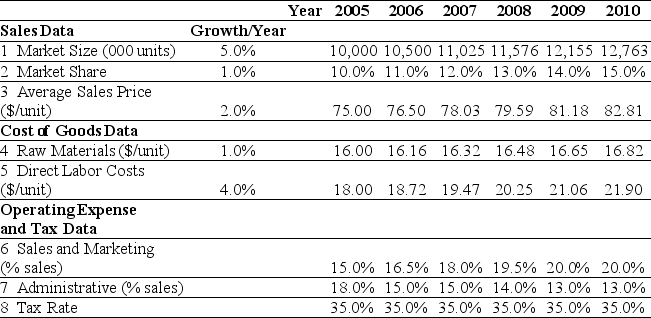

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2009?

A)1,505 units

B)1,115 units

C)1,323 units

D)1,702 units

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2009?

A)1,505 units

B)1,115 units

C)1,323 units

D)1,702 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

6

The after tax interest expense in 2010 is closest to:

A)0

B)2,856

C)5,304

D)8,160

A)0

B)2,856

C)5,304

D)8,160

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the following information to answer the question(s)below:

Ideko's Planned Debt

If Ideko's loans will have an interest rate of 6.8%, then the interest expense paid in 2008 is closest to:

A)$6,800

B)$7,310

C)$7,820

D)$7,990

Ideko's Planned Debt

If Ideko's loans will have an interest rate of 6.8%, then the interest expense paid in 2008 is closest to:

A)$6,800

B)$7,310

C)$7,820

D)$7,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

8

Use the tables for the question(s)below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms, Ideko's target economic value is closest to:

A)$191 million

B)$155 million

C)$157 million

D)$193 million

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/EBITDA ratio of the comparable firms, Ideko's target economic value is closest to:

A)$191 million

B)$155 million

C)$157 million

D)$193 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

9

What range for the market value of equity for Ideko is implied by the range of EV/EBITDA multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

10

The free cash flow to the firm in 2010 is closest to:

A)10,684

B)11,559

C)23,698

D)26,394

A)10,684

B)11,559

C)23,698

D)26,394

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the following information to answer the question(s)below:

The free cash flow to the firm in 2008 is closest to:

A)-5,005

B)-1,755

C)5,575

D)14,995

The free cash flow to the firm in 2008 is closest to:

A)-5,005

B)-1,755

C)5,575

D)14,995

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the tables for the question(s)below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

Ideko's Accounts Receivable Days is closest to:

A)84 days

B)95 days

C)90 days

D)75 days

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

Ideko's Accounts Receivable Days is closest to:

A)84 days

B)95 days

C)90 days

D)75 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

13

The free cash flow to equity in 2008 is closest to:

A)-5,005

B)-1,755

C)5,575

D)9,995

A)-5,005

B)-1,755

C)5,575

D)9,995

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

14

What range for the market value of equity for Ideko is implied by the range of EV/Sales multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

15

Use the following information to answer the question(s)below:

The after tax interest expense in 2008 is closest to:

A)2,380

B)4,420

C)6,800

D)7,820

The after tax interest expense in 2008 is closest to:

A)2,380

B)4,420

C)6,800

D)7,820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the table for the question(s)below.

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2008?

A)1,702 units

B)1,323 units

C)1,505 units

D)1,914 units

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2008?

A)1,702 units

B)1,323 units

C)1,505 units

D)1,914 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the tables for the question(s)below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms, Ideko's target economic value is closest to:

A)$191 million

B)$155 million

C)$165 million

D)$157 million

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

Based upon the average EV/Sales ratio of the comparable firms, Ideko's target economic value is closest to:

A)$191 million

B)$155 million

C)$165 million

D)$157 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

18

The free cash flow to equity in 2010 is closest to:

A)6,255

B)10,684

C)11,559

D)18,394

A)6,255

B)10,684

C)11,559

D)18,394

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

19

What range for the market value of equity for Ideko is implied by the range of P/E multiples for the comparable firms?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

20

Use the table for the question(s)below.

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2007?

A)1,505 units

B)1,323 units

C)1,914 units

D)1,115 units

Ideko Sales and Operating Cost Assumptions

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2007?

A)1,505 units

B)1,323 units

C)1,914 units

D)1,115 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

21

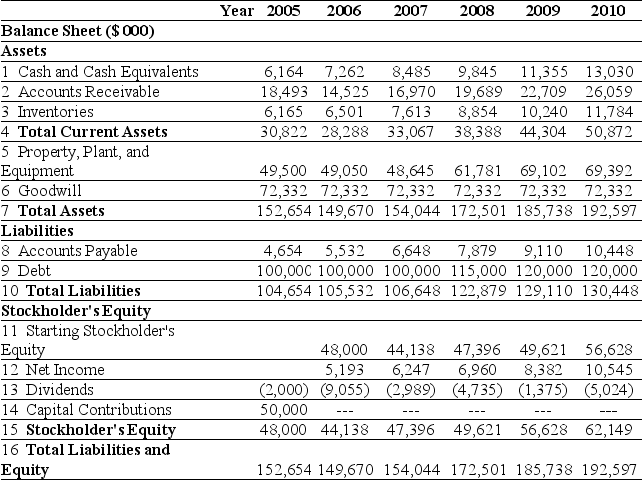

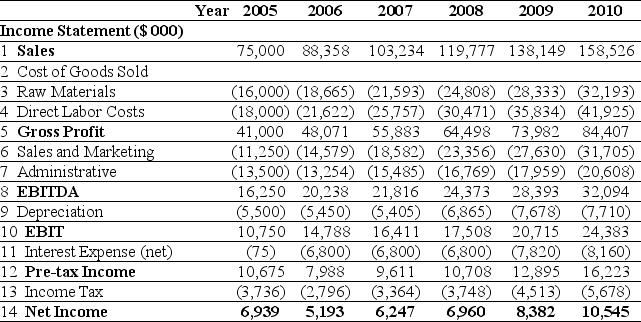

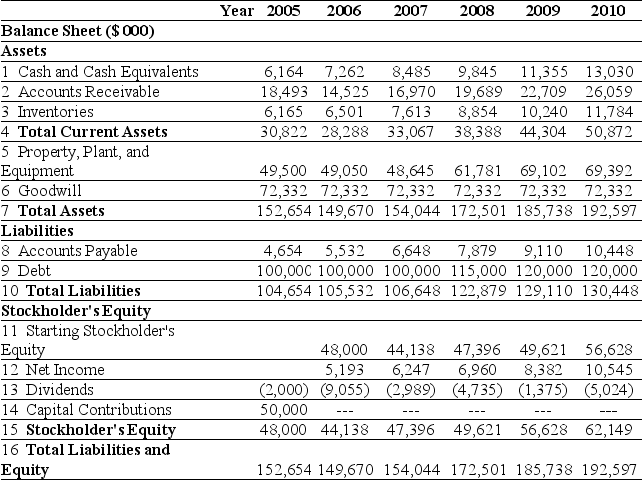

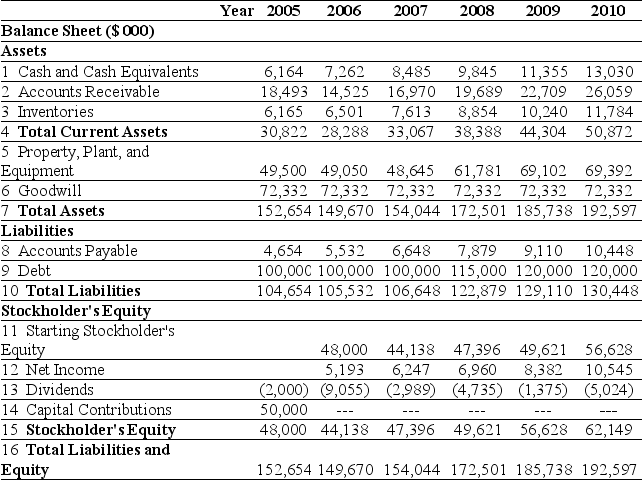

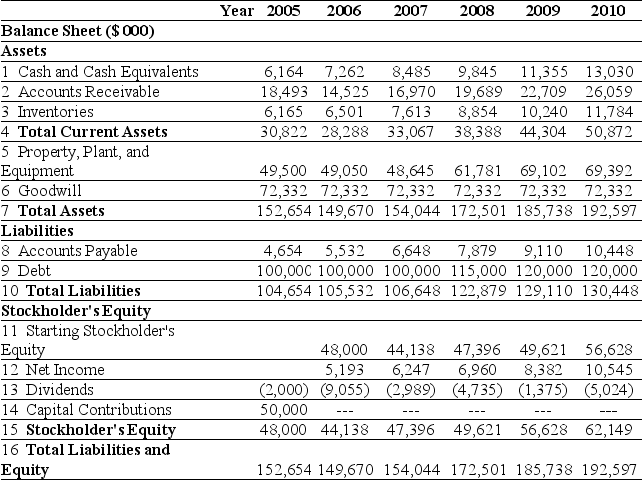

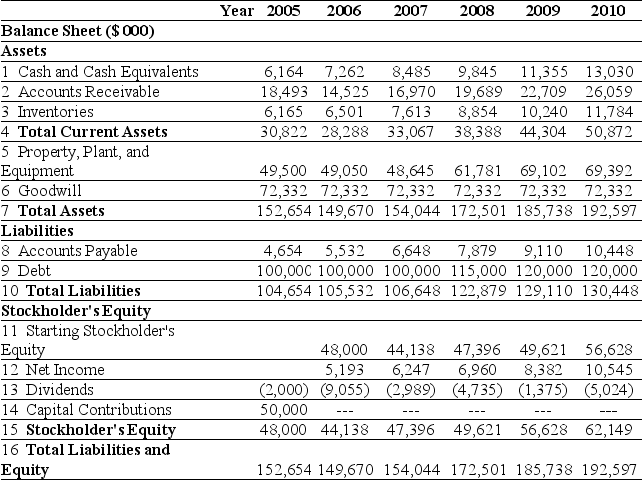

Use the tables for the question(s)below.

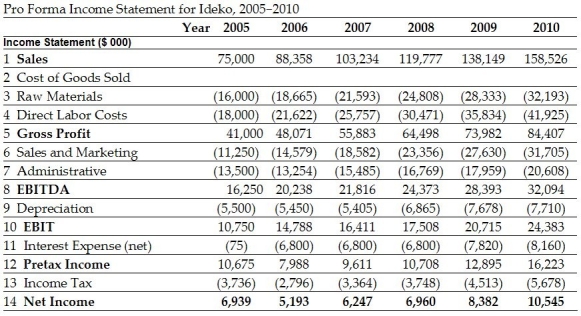

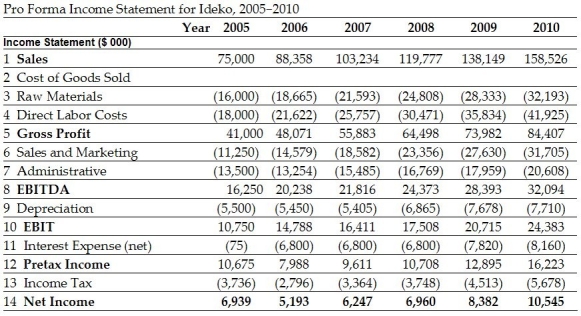

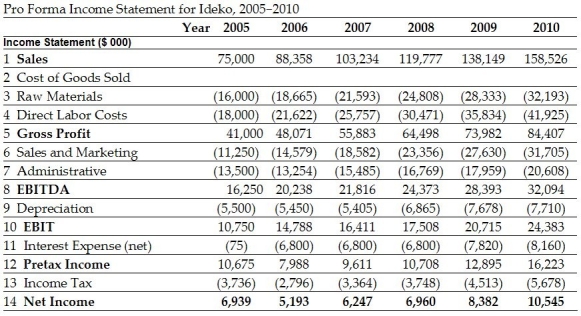

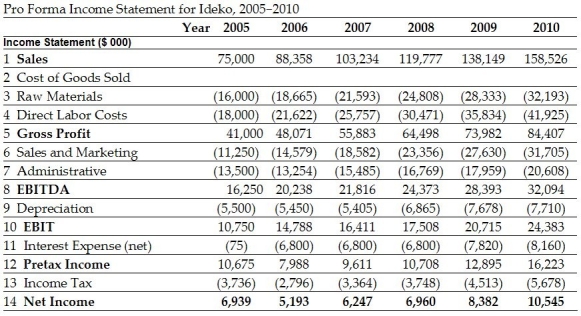

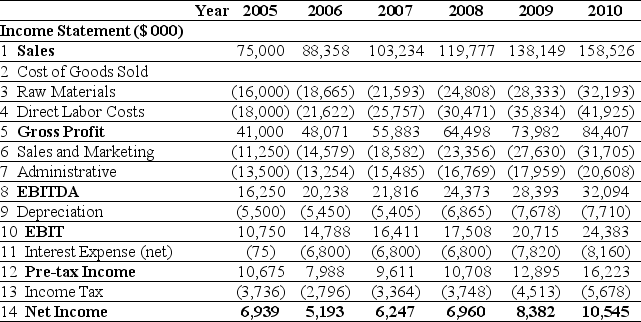

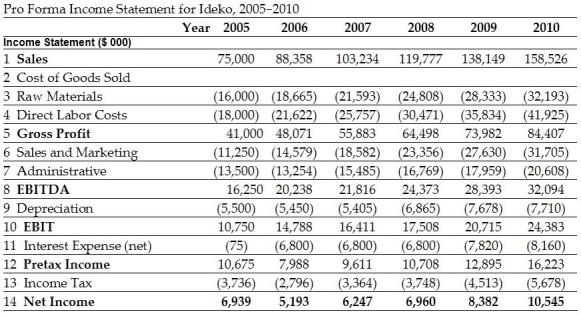

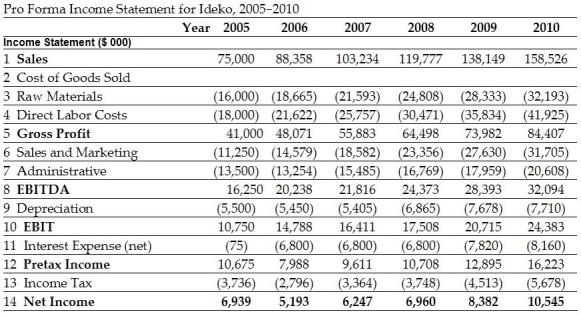

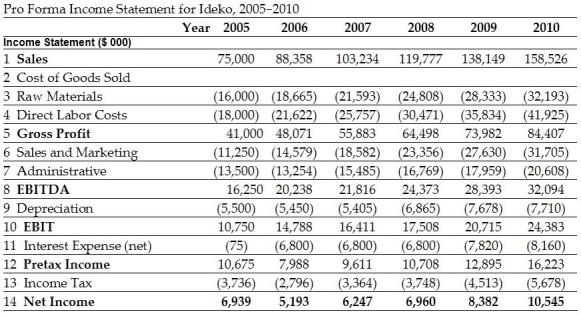

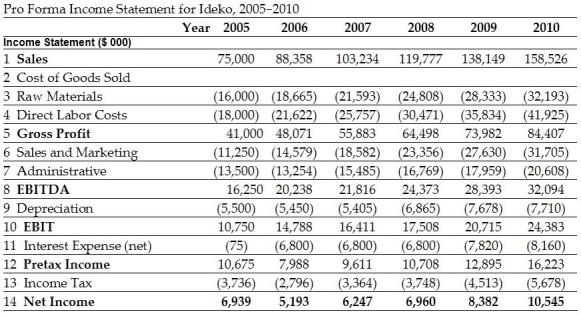

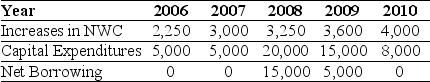

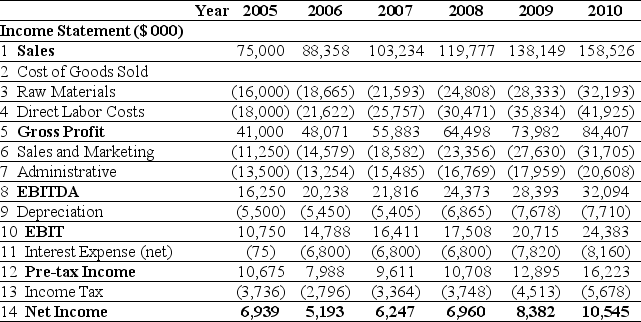

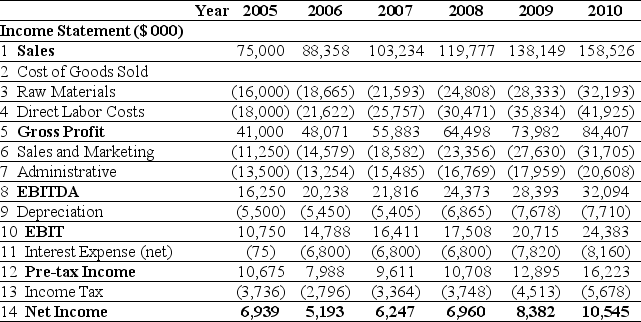

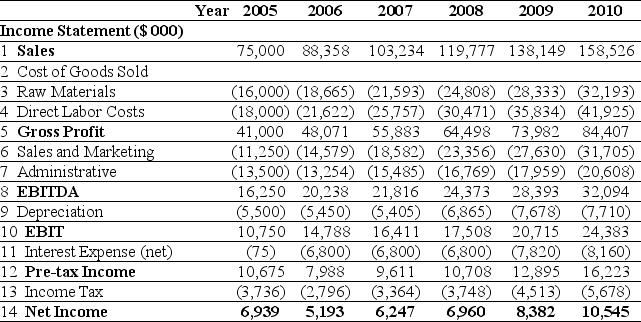

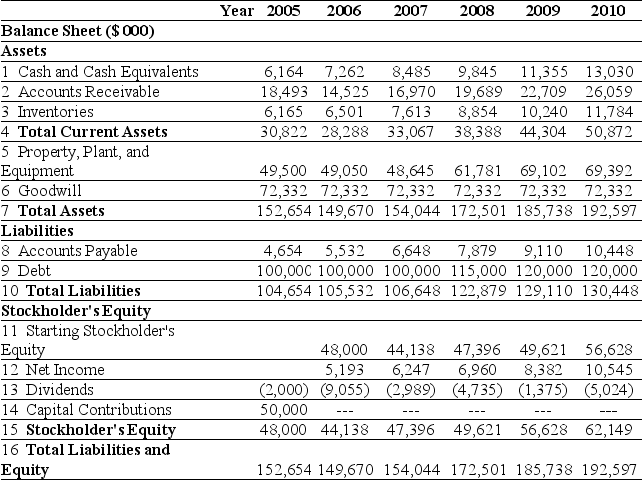

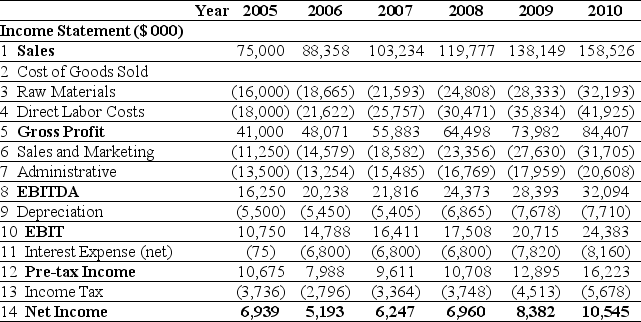

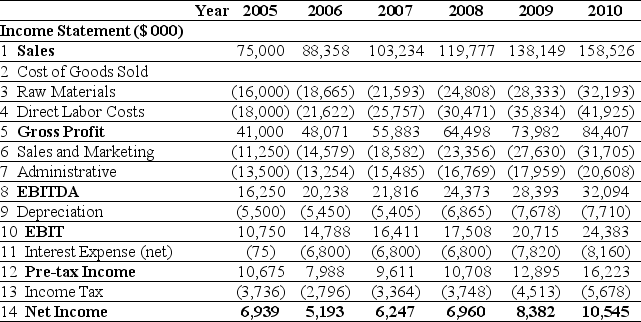

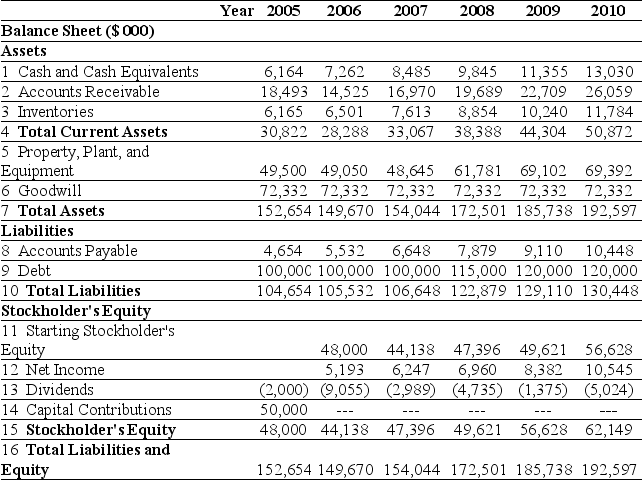

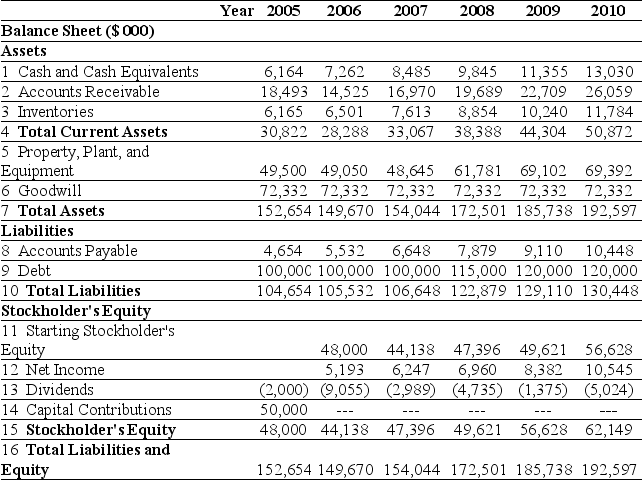

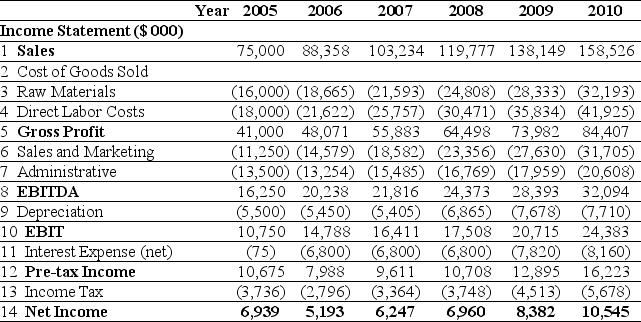

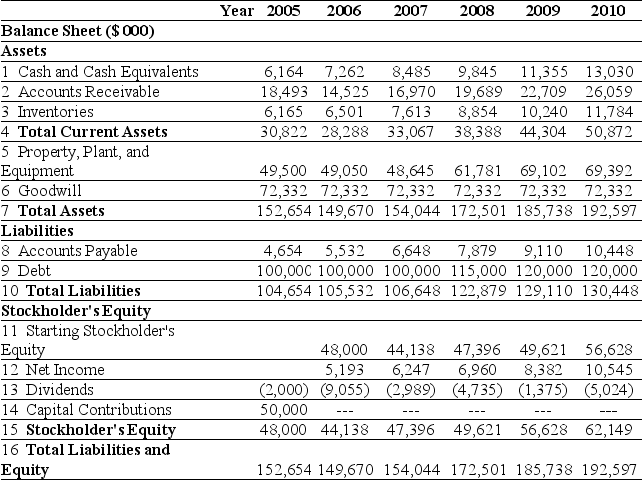

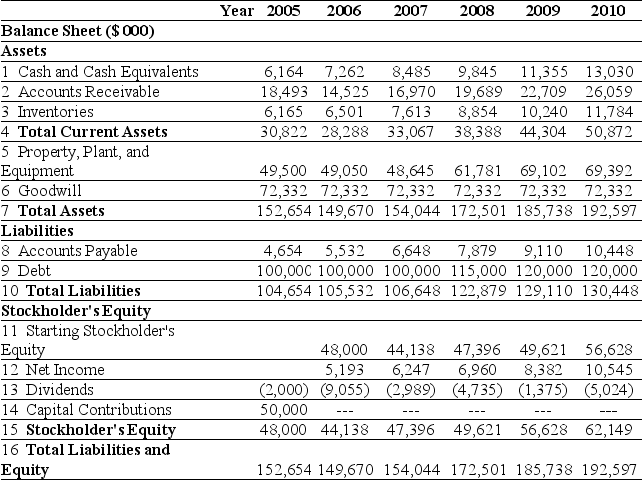

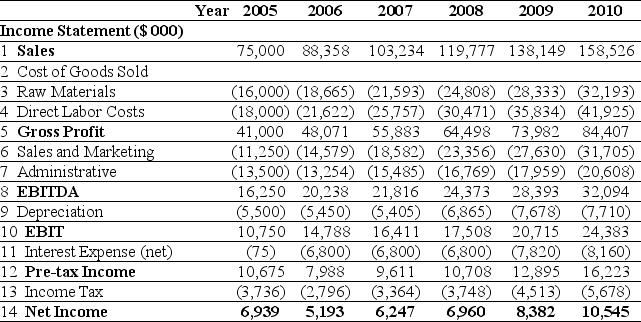

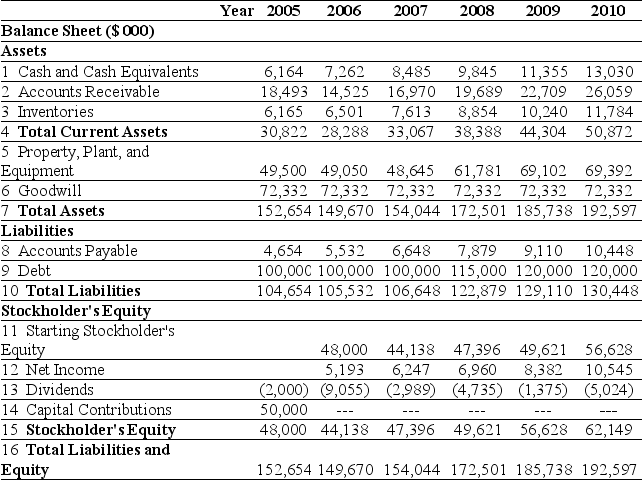

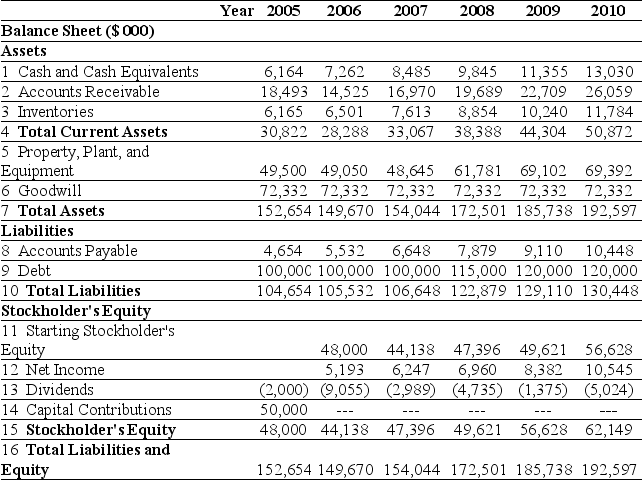

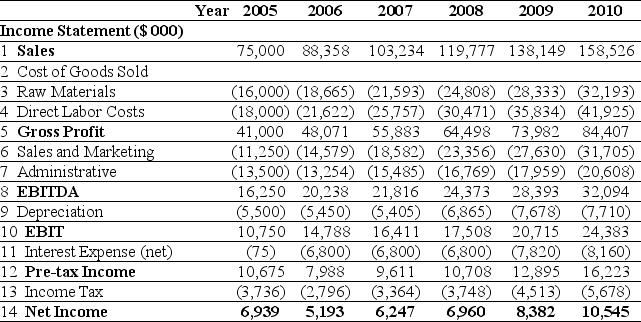

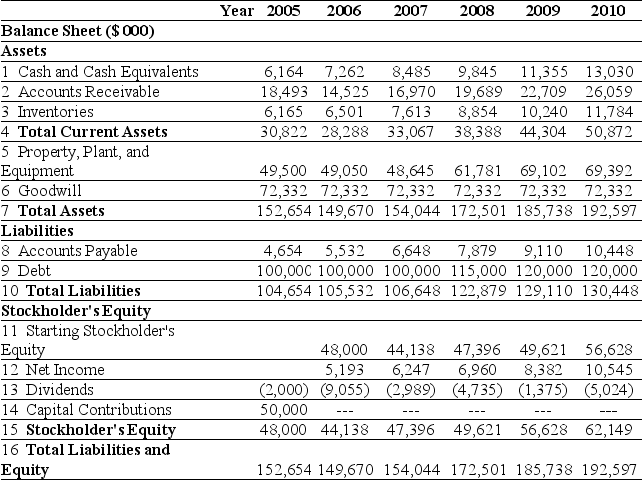

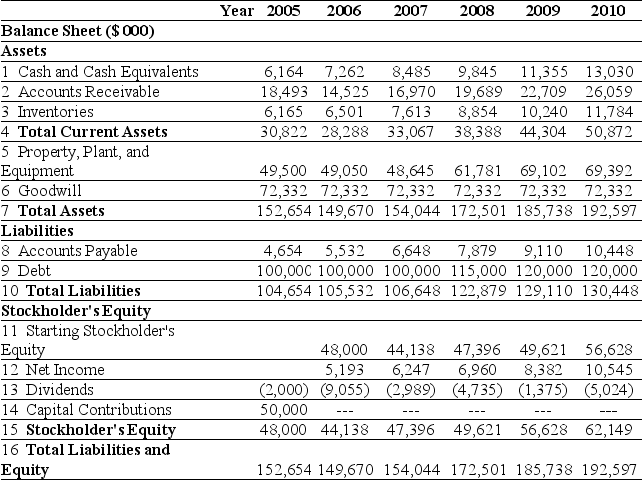

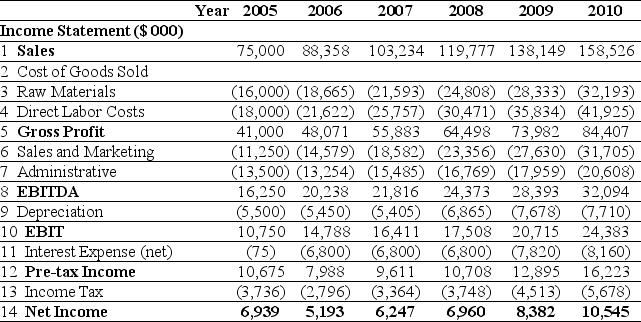

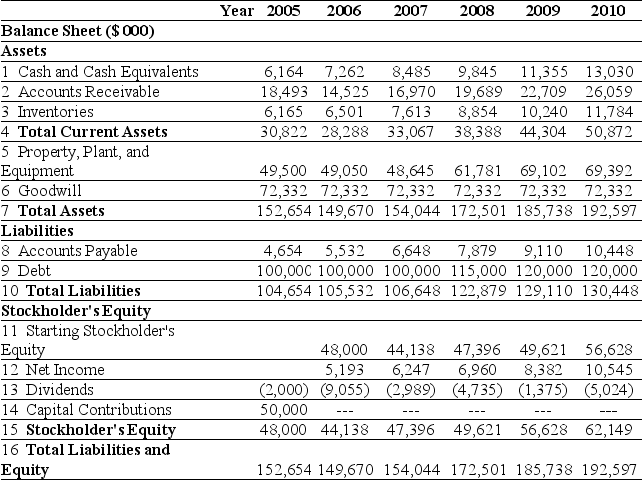

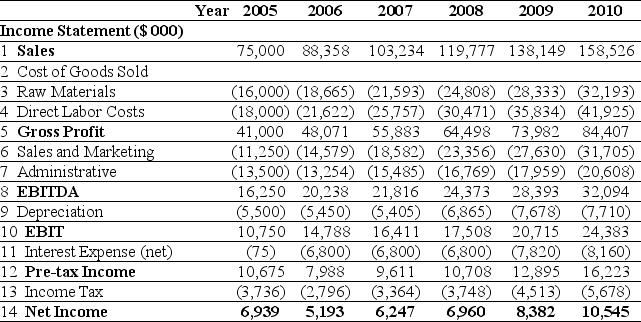

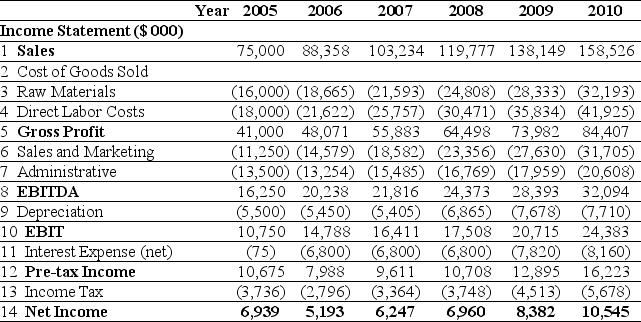

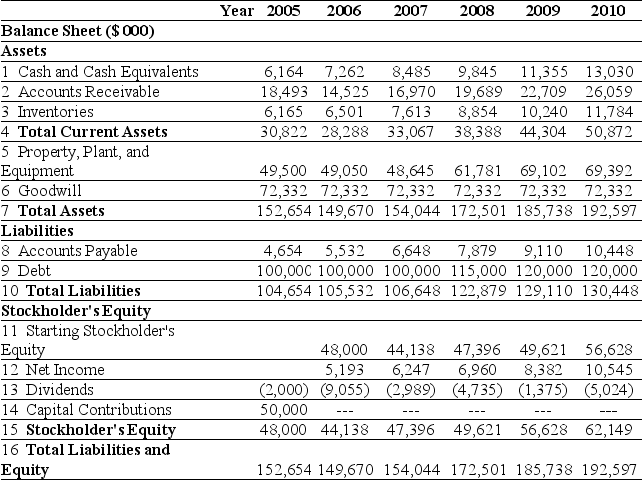

Pro Forma Income Statement for Ideko, 2005-2010

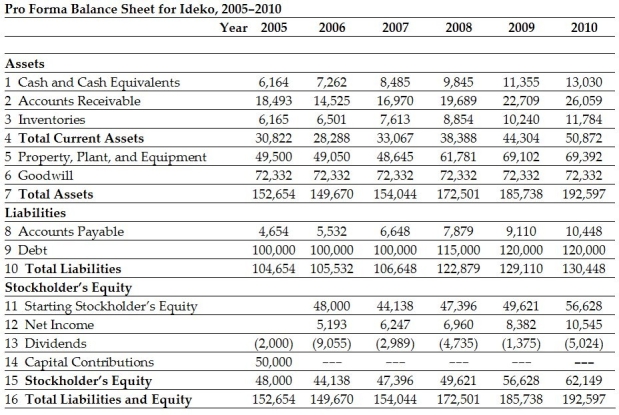

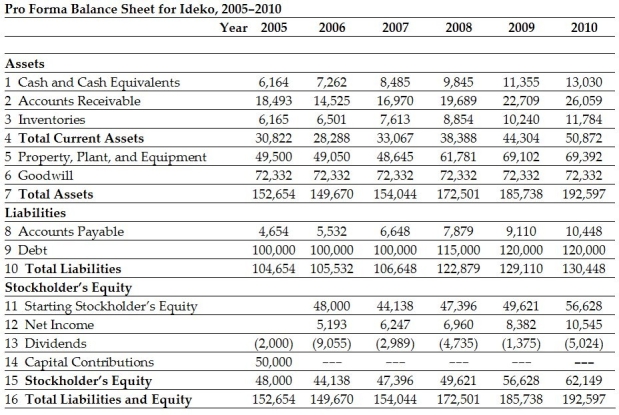

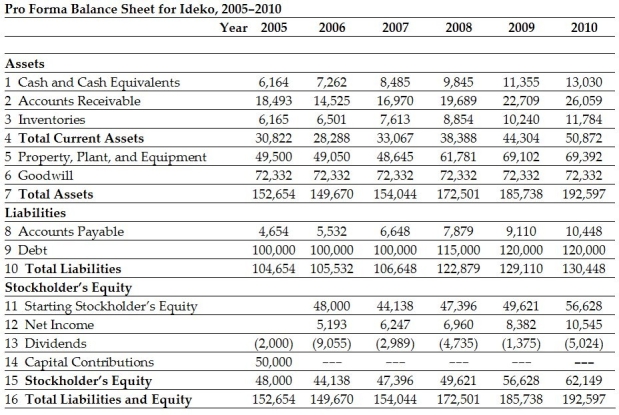

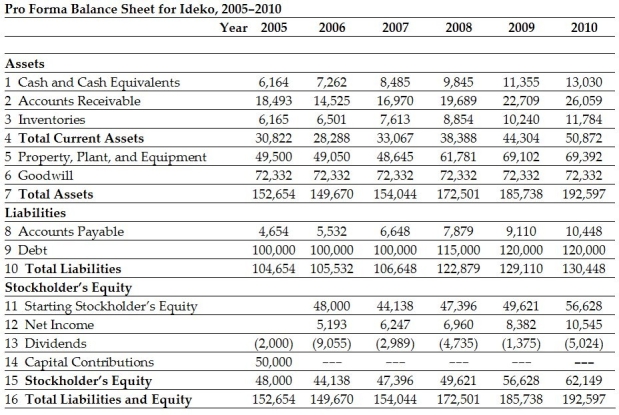

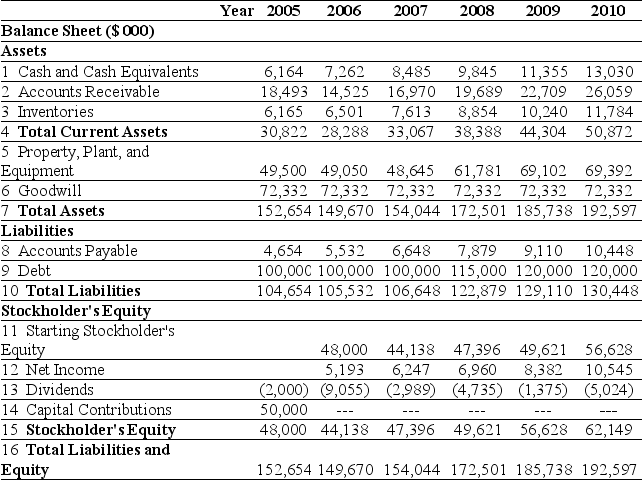

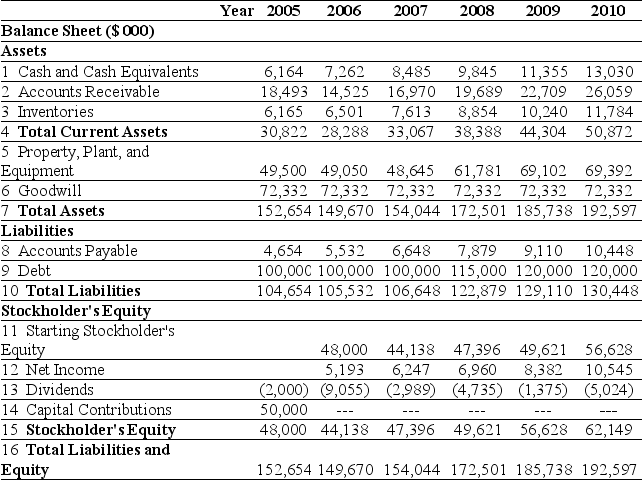

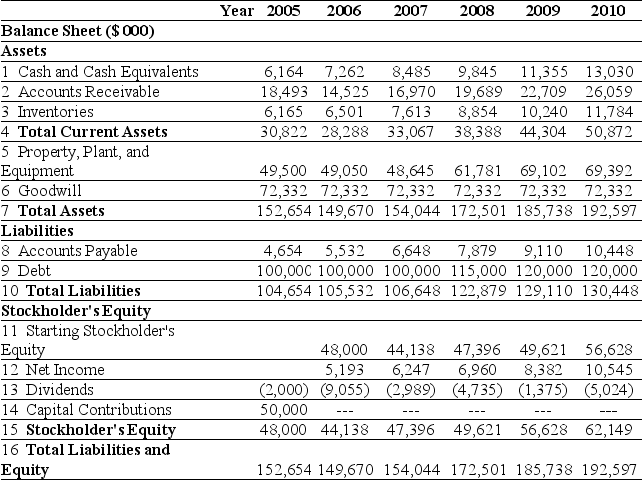

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation equity value of Ideko in 2010 is closest to:

A)$181.7 million

B)$272.8 million

C)$152.8 million

D)$301.7 million

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation equity value of Ideko in 2010 is closest to:

A)$181.7 million

B)$272.8 million

C)$152.8 million

D)$301.7 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

22

The amount of the increase in net working capital for Ideko in 2007 is closest to:

A)$4,090

B)$4,685

C)$3,665

D)$5,230

A)$4,090

B)$4,685

C)$3,665

D)$5,230

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60. The forecasted accounts receivable for Ideko in 2007 is closest to:

A)$14,525

B)$16,970

C)22,710

D)$19,690

Pro Forma Income Statement for Ideko, 2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60. The forecasted accounts receivable for Ideko in 2007 is closest to:

A)$14,525

B)$16,970

C)22,710

D)$19,690

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

24

The amount of net working capital for Ideko in 2007 is closest to:

A)$30,510

B)$26,420

C)$22,170

D)$35,195

A)$30,510

B)$26,420

C)$22,170

D)$35,195

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

25

Use the following information to answer the question(s)below:

If Ideko's future expected growth rate is 5% and its WACC is 9%, then the continuation value in 2010 is closest to:

A)164,200

B)278,775

C)280,450

D)303,425

If Ideko's future expected growth rate is 5% and its WACC is 9%, then the continuation value in 2010 is closest to:

A)164,200

B)278,775

C)280,450

D)303,425

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the following information to answer the question(s)below:

If Ideko's future expected growth rate is 5%, then the estimated free cash flow for 2011 is closest to:

A)6,568

B)11,151

C)11,218

D)12,137

If Ideko's future expected growth rate is 5%, then the estimated free cash flow for 2011 is closest to:

A)6,568

B)11,151

C)11,218

D)12,137

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the table for the question(s)below.

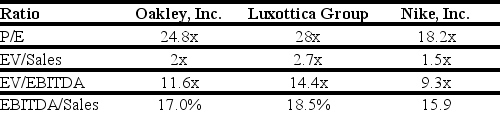

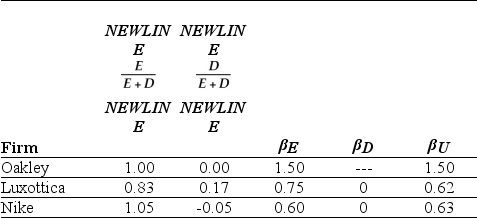

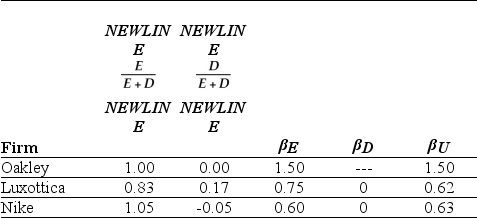

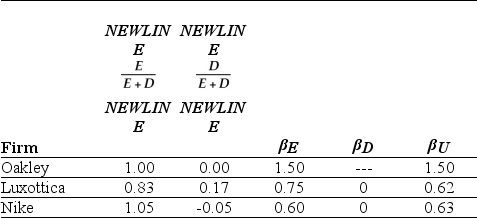

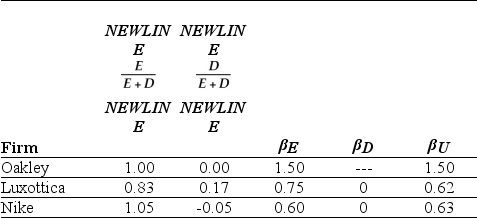

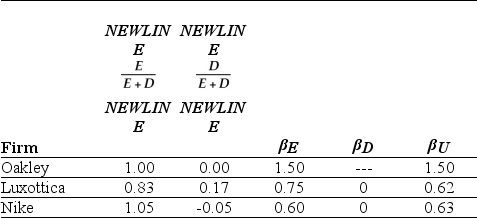

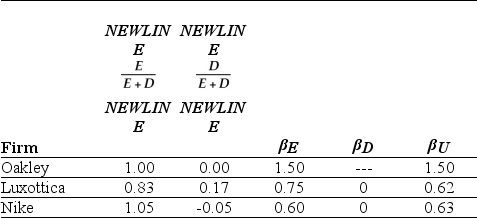

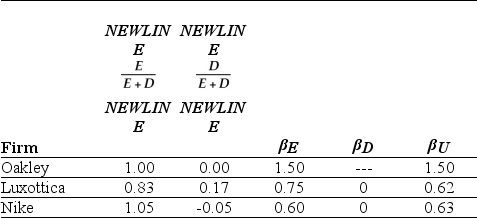

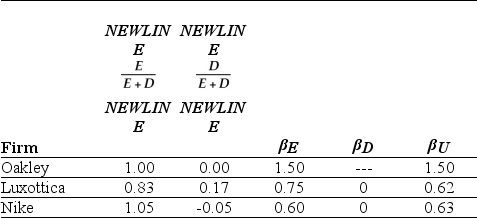

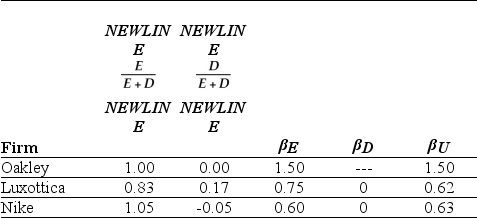

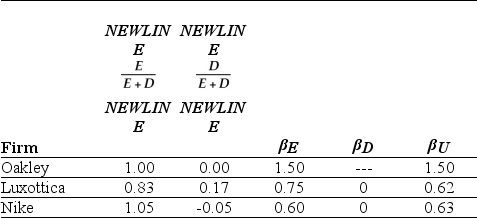

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Nike is closest to:

A)14.7%

B)10.2%

C)9.1%

D)13.5%

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Nike is closest to:

A)14.7%

B)10.2%

C)9.1%

D)13.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

28

The amount of net working capital for Ideko in 2008 is closest to:

A)$35,195

B)$26,420

C)$22,170

D)$30,510

A)$35,195

B)$26,420

C)$22,170

D)$30,510

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

29

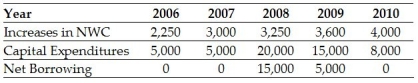

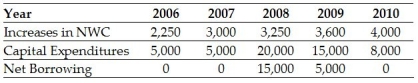

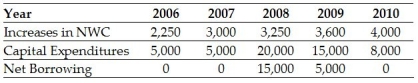

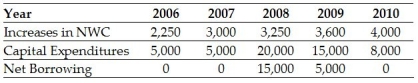

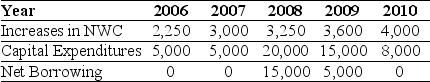

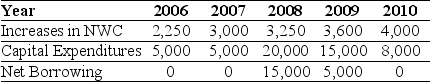

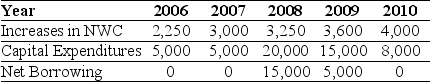

Using the income statement above and the following information:

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

30

The amount of net working capital for Ideko in 2006 is closest to:

A)$22,750

B)$35,195

C)$30,510

D)$26,420

A)$22,750

B)$35,195

C)$30,510

D)$26,420

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60. The forecasted accounts receivable for Ideko in 2006 is closest to:

A)$19,690

B)$16,970

C)22,710

D)$14,525

Pro Forma Income Statement for Ideko, 2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60. The forecasted accounts receivable for Ideko in 2006 is closest to:

A)$19,690

B)$16,970

C)22,710

D)$14,525

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Oakley is closest to:

A)0.70

B)1.50

C)1.00

D)0.60

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Oakley is closest to:

A)0.70

B)1.50

C)1.00

D)0.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation enterprise value of Ideko in 2010 is closest to:

A)$152.8 million

B)$272.8 million

C)$301.7 million

D)$181.7 million

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation enterprise value of Ideko in 2010 is closest to:

A)$152.8 million

B)$272.8 million

C)$301.7 million

D)$181.7 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Luxottica is closest to:

A)10.2%

B)13.5%

C)9.1%

D)14.7%

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Luxottica is closest to:

A)10.2%

B)13.5%

C)9.1%

D)14.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the table for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60. The forecasted accounts receivable for Ideko in 2008 is closest to:

A)$14,525

B)$19,690

C)22,710

D)$16,970

Pro Forma Income Statement for Ideko, 2005-2010

With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60. The forecasted accounts receivable for Ideko in 2008 is closest to:

A)$14,525

B)$19,690

C)22,710

D)$16,970

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

36

The amount of the increase in net working capital for Ideko in 2008 is closest to:

A)$4,685

B)$3,665

C)$4,090

D)$5,230

A)$4,685

B)$3,665

C)$4,090

D)$5,230

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Luxottica is closest to:

A)1.00

B)0.60

C)0.70

D)1.50

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Luxottica is closest to:

A)1.00

B)0.60

C)0.70

D)1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Oakley is closest to:

A)13.5%

B)10.2%

C)9.1%

D)14.7%

Capital Structure and Unlevered Beta Estimates for Comparable Firms

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Oakley is closest to:

A)13.5%

B)10.2%

C)9.1%

D)14.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

39

Using the income statement above and the following information:

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2007.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the table for the question(s)below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Nike is closest to:

A)0.70

B)1.00

C)1.50

D)0.60

Capital Structure and Unlevered Beta Estimates for Comparable Firms

The unlevered beta for Nike is closest to:

A)0.70

B)1.00

C)1.50

D)0.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.7

B)1.9

C)1.6

D)1.8

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.7

B)1.9

C)1.6

D)1.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)17.2

B)14.5

C)19.0

D)16.4

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)17.2

B)14.5

C)19.0

D)16.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation enterprise value of Ideko in 2010 is closest to:

A)$181.7 million

B)$152.8 million

C)$272.8 million

D)$301.7 million

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation enterprise value of Ideko in 2010 is closest to:

A)$181.7 million

B)$152.8 million

C)$272.8 million

D)$301.7 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.9

B)1.7

C)1.6

D)1.8

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

A)1.9

B)1.7

C)1.6

D)1.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is the purpose of the sensitivity analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.2

B)16.4

C)14.5

D)19.4

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.2

B)16.4

C)14.5

D)19.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.6

B)16.4

C)14.5

D)19.0

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

A)17.6

B)16.4

C)14.5

D)19.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)19.0

B)17.2

C)16.4

D)14.5

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 8.5, then the continuation levered P/E ratio of Ideko in 2010 is closest to:

A)19.0

B)17.2

C)16.4

D)14.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation equity value of Ideko in 2010 is closest to:

A)$152.8 million

B)$181.7 million

C)$301.7 million

D)$272.8 million

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Assuming that Ideko has a EBITDA multiple of 9.4, then the continuation equity value of Ideko in 2010 is closest to:

A)$152.8 million

B)$181.7 million

C)$301.7 million

D)$272.8 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck