Deck 3: Financial Statements and Ratio Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/209

العب

ملء الشاشة (f)

Deck 3: Financial Statements and Ratio Analysis

1

The original price per share received by the firm on a single issue of common stock is equal to the sum of the common stock and paid-in capital in excess of par accounts divided by the number of shares outstanding.

True

2

The balance sheet is a statement which balances the firm's assets (what it owns) against its debt (what it has borrowed).

False

3

The Financial Accounting Standards Board (FASB) is the federal regulatory body that governs the sale and listing of securities.

False

4

The president's letter, as the first component of the stockholders' report, is the primary communication from management to the firm's employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

5

GAAP is the accounting profession's rule-setting body.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

6

Publicly-owned corporations are required by the Securities and Exchange Commission (SEC) and individual state securities commissions to provide their stockholders with an annual stockholders' report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

7

A U.S. parent company's foreign equity accounts are translated into dollars using the exchange rate that prevailed when the parent's equity investment was made (the historical rate).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

8

The income statement is a financial summary of the firm's operating results during a specified period while the balance sheet is a summary statement of the firm's financial position at a given point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

9

Earnings per share results from dividing earnings available for common stockholders by the number of shares of common stock authorized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

10

Net fixed assets represent the difference between gross fixed assets and the total expense recorded for the depreciation over then entire lives of the firm's fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

11

The amount paid in by the original purchasers of common stock is shown by two entries in the firm's balance sheetcommon stock and paid-in capital in excess of par on common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

12

Earnings per share represents amount earned during the period on each outstanding share of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

13

Common stock dividends paid to stockholders are equal to the earnings available for common stockholders divided by the number of shares of common stock outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

14

Retained earnings represent the cumulative total of all earnings retained and reinvested in the firm since its inception.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

15

Publicly-owned corporations are those which are financed by the proceeds from the treasury securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

16

Generally-accepted accounting principles are authorized by the Financial Accounting Standards Board (FASB).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

17

Paid-in capital in excess of par represents the firm's book value received from the original sale of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

18

The statement of cash flows provides insight into the firm's assets and liabilities and reconciles them with changes in its cash and marketable securities during the period of concern.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

19

The statement of cash flows reconciles the net income earned during a given year, and any cash dividends paid, with the change in retained earnings between the start and end of that year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

20

The par value of common stock is an arbitrarily assigned per share value used primarily for accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

21

One of the most influential documents issued by a publicly-held corporation is the

A) letter to stockholders.

B) annual report.

C) cash flow statement.

D) income statement.

A) letter to stockholders.

B) annual report.

C) cash flow statement.

D) income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

22

The stockholder's report may include all of the following EXCEPT

A) a cash budget.

B) an income statement.

C) a statement of cash flows.

D) a statement of retained earnings.

A) a cash budget.

B) an income statement.

C) a statement of cash flows.

D) a statement of retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

23

Gross profits are defined as

A) operating profits minus depreciation.

B) operating profits minus cost of goods sold.

C) sales revenue minus operating expenses.

D) sales revenue minus cost of goods sold.

A) operating profits minus depreciation.

B) operating profits minus cost of goods sold.

C) sales revenue minus operating expenses.

D) sales revenue minus cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

24

The ________ provides a financial summary of the firm's operating results during a specified period.

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

25

Accounting practices and procedures used to prepare financial statements are called

A) SEC.

B) FASB.

C) GAAP.

D) IRB.

A) SEC.

B) FASB.

C) GAAP.

D) IRB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

26

The federal regulatory body governing the sale and listing of securities is called the

A) IRS.

B) FASB.

C) GAAP.

D) SEC.

A) IRS.

B) FASB.

C) GAAP.

D) SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

27

The rule-setting body, which authorizes generally accepted accounting principles is

A) GAAP.

B) FASB.

C) SEC.

D) Federal Reserve System.

A) GAAP.

B) FASB.

C) SEC.

D) Federal Reserve System.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

28

A U.S. parent company's foreign retained earnings are adjusted to reflect gains and losses resulting from currency movements as well as each year's operating profits or losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Sarbanes-Oxley Act of 2002 was passed to eliminate many of the disclosure and conflict of interest problems of corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Sarbanes-Oxley Act of 2002 established the Public Company Accounting Oversight Board (PCAOB) which is a not-for-profit corporation that oversees auditors of public corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

31

Total assets less net fixed assets equals

A) gross assets.

B) current assets.

C) depreciation.

D) liabilities and equity.

A) gross assets.

B) current assets.

C) depreciation.

D) liabilities and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Financial Accounting Standards Board (FASB) Standard No. 52 mandates that U.S.-based companies translate their foreign-currency-denominated assets and liabilities into dollars using the current rate (translation) method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

33

Net profits after taxes are defined as

A) gross profits minus operating expenses.

B) sales revenue minus cost of goods sold.

C) EBIT minus interest.

D) EBIT minus interest and taxes.

A) gross profits minus operating expenses.

B) sales revenue minus cost of goods sold.

C) EBIT minus interest.

D) EBIT minus interest and taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

34

Earnings available to common shareholders are defined as net profits

A) after taxes.

B) after taxes minus preferred dividends.

C) after taxes minus common dividends.

D) before taxes.

A) after taxes.

B) after taxes minus preferred dividends.

C) after taxes minus common dividends.

D) before taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Sarbanes-Oxley Act of 2002 established the Private Company Accounting Oversight Board (PCAOB) which is a for-profit corporation that oversees CEOs of public corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

36

Operating profits are defined as

A) gross profits minus operating expenses.

B) sales revenue minus cost of goods sold.

C) earnings before depreciation and taxes.

D) sales revenue minus depreciation expense.

A) gross profits minus operating expenses.

B) sales revenue minus cost of goods sold.

C) earnings before depreciation and taxes.

D) sales revenue minus depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

37

Operating profits are defined as

A) sales revenue minus cost of goods sold.

B) earnings before interest and taxes.

C) earnings before depreciation and taxes.

D) earnings after tax.

A) sales revenue minus cost of goods sold.

B) earnings before interest and taxes.

C) earnings before depreciation and taxes.

D) earnings after tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

38

All of the following are examples of current assets EXCEPT

A) accounts receivable.

B) cash.

C) accruals.

D) inventory.

A) accounts receivable.

B) cash.

C) accruals.

D) inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

39

The McCain-Feingold Act of 2002 was passed to eliminate many of the disclosure and conflict of interest problems of corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

40

The stockholder's annual report must include

A) a statement of cash flows.

B) an income statement.

C) a balance sheet.

D) a statement of retained earnings.

E) all of the above.

A) a statement of cash flows.

B) an income statement.

C) a balance sheet.

D) a statement of retained earnings.

E) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

41

All of the following are examples of current liabilities EXCEPT

A) accounts receivable.

B) accounts payable.

C) accruals.

D) notes payable.

A) accounts receivable.

B) accounts payable.

C) accruals.

D) notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

42

Retained earnings on the balance sheet represents

A) net profits after taxes.

B) cash.

C) net profits after taxes minus preferred dividends.

D) the cumulative total of earnings reinvested in the firm.

A) net profits after taxes.

B) cash.

C) net profits after taxes minus preferred dividends.

D) the cumulative total of earnings reinvested in the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

43

A corporation had a year end 2004 retained earnings balance of $220,000. The firm reported net profits after taxes of $50,000 in 2005 and paid dividends in 2005 of $30,000. The firm's retained earnings balance at year end 2005 was

A) $240,000.

B) $250,000.

C) $270,000.

D) $300,000.

A) $240,000.

B) $250,000.

C) $270,000.

D) $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

44

Firm ABC had operating profits of $100,000, taxes of $17,000, interest expense of $34,000 and preferred dividends of $5,000. What was the firm's net profit after taxes?

A) $66,000

B) $49,000

C) $44,000

D) $83,000

A) $66,000

B) $49,000

C) $44,000

D) $83,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

45

Candy Corporation had pretax profits of $1.2 million, an average tax rate of 34 percent, and it paid preferred stock dividends of $50,000. There were 100,000 shares outstanding and no interest expense. What were Candy Corporation's earnings per share?

A) $3.91

B) $4.52

C) $7.42

D) $7.59

A) $3.91

B) $4.52

C) $7.42

D) $7.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

46

The ________ summarizes the firm's funds flow over a given period of time.

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

47

When preparing a statement of cash flows, retained earnings adjustments are required so that which of the following are separated on the statement?

A) Revenue and cost.

B) Assets and liabilities.

C) Depreciation and purchases.

D) Net profits and dividends.

A) Revenue and cost.

B) Assets and liabilities.

C) Depreciation and purchases.

D) Net profits and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

48

The statement of retained earnings reports all of the following EXCEPT

A) net profits after taxes.

B) interest.

C) common stock dividends.

D) preferred stock dividends.

A) net profits after taxes.

B) interest.

C) common stock dividends.

D) preferred stock dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

49

A firm had year end 2004 and 2005 retained earnings balances of $670,000 and $560,000, respectively. The firm paid $10,000 in dividends in 2005. The firm's net profit after taxes in 2002 was

A) -$100,000.

B) -$110,000.

C) $100,000.

D) $110,000.

A) -$100,000.

B) -$110,000.

C) $100,000.

D) $110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

50

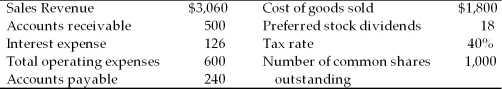

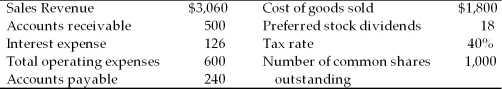

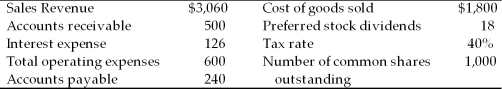

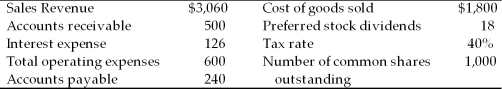

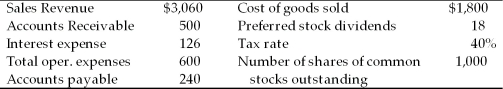

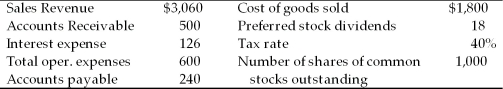

A firm had the following accounts and financial data for 2005:  The firm's earnings per share, rounded to the nearest cent, for 2005 was ________.

The firm's earnings per share, rounded to the nearest cent, for 2005 was ________.

A) $0.5335

B) $0.5125

C) $0.3204

D) $0.3024

The firm's earnings per share, rounded to the nearest cent, for 2005 was ________.

The firm's earnings per share, rounded to the nearest cent, for 2005 was ________.A) $0.5335

B) $0.5125

C) $0.3204

D) $0.3024

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

51

The statement of cash flows may also be called the

A) income statement.

B) statement of retained earnings.

C) bank statement.

D) funds statement.

A) income statement.

B) statement of retained earnings.

C) bank statement.

D) funds statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

52

On the balance sheet net fixed assets represent

A) gross fixed assets at cost minus depreciation expense.

B) gross fixed assets at market value minus depreciation expense.

C) gross fixed assets at cost minus accumulated depreciation.

D) gross fixed assets at market value minus accumulated deprecation.

A) gross fixed assets at cost minus depreciation expense.

B) gross fixed assets at market value minus depreciation expense.

C) gross fixed assets at cost minus accumulated depreciation.

D) gross fixed assets at market value minus accumulated deprecation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

53

The ________ represents a summary statement of the firm's financial position at a given point in time.

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

54

The net value of fixed assets is also called its

A) market value.

B) par value.

C) book value.

D) price.

A) market value.

B) par value.

C) book value.

D) price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

55

All of the following are examples of fixed assets EXCEPT

A) automobiles.

B) buildings.

C) marketable securities.

D) equipment.

A) automobiles.

B) buildings.

C) marketable securities.

D) equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

56

A corporation had year end 2004 and 2005 retained earnings balances of $320,000 and $400,000, respectively. The firm reported net profits after taxes of $100,000 in 2005. The firm paid dividends in 2005 of

A) $0.

B) $20,000.

C) $80,000.

D) $100,000.

A) $0.

B) $20,000.

C) $80,000.

D) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

57

Paid-in-capital in excess of par represents the amount of proceeds

A) from the original sale of stock.

B) in excess of the par value from the original sale of common stock.

C) at the current market value of common stock.

D) at the current book value of common stock.

A) from the original sale of stock.

B) in excess of the par value from the original sale of common stock.

C) at the current market value of common stock.

D) at the current book value of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

58

A firm had the following accounts and financial data for 2005.  The firm's net profit after taxes for 2005 was ________.

The firm's net profit after taxes for 2005 was ________.

A) -$206.40

B) $213.80

C) $320.40

D) $206.25

The firm's net profit after taxes for 2005 was ________.

The firm's net profit after taxes for 2005 was ________.A) -$206.40

B) $213.80

C) $320.40

D) $206.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

59

A firm had the following accounts and financial data for 2005.  The firm's earnings available to common shareholders for 2005 were

The firm's earnings available to common shareholders for 2005 were

A) -$224.25

B) $195.40

C) $302.40

D) $516.60

The firm's earnings available to common shareholders for 2005 were

The firm's earnings available to common shareholders for 2005 wereA) -$224.25

B) $195.40

C) $302.40

D) $516.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

60

FASB Standard No. 52 mandates that U.S. based companies must translate their foreign-currency-denominated assets and liabilities into dollars using the

A) historical rate.

B) current rate.

C) average rate.

D) none of the above.

A) historical rate.

B) current rate.

C) average rate.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

61

At the end of 2005, the Long Life Light Bulb Company announced it had produced a gross profit of $1 million. The company has also established that over the course of this year it has incurred $345,000 in operating expenses and $125,000 in interest expenses. The company is subject to a 30% tax rate and has declared $57,000 total preferred stock dividends.

(a) How much is the earnings available for common stockholders?

(b) Compute the increased retained earnings for 2005 if the company were to declare a $4.25 common stock dividend. The company has 15,000 shares of common stock outstanding.

(a) How much is the earnings available for common stockholders?

(b) Compute the increased retained earnings for 2005 if the company were to declare a $4.25 common stock dividend. The company has 15,000 shares of common stock outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

62

In a cross-sectional comparison of firms operating in several lines of business, the industry average ratios of any of the firm's product lines may be used to analyze the multiproduct firm's financial performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

63

The 2002 Sarbanes-Oxley Act was designed to

A) limit the compensation that could be paid to corporate CEOs.

B) eliminate the many disclosure and conflict of interest problems of corporations.

C) provide uniform international accounting standards.

D) two of the above.

A) limit the compensation that could be paid to corporate CEOs.

B) eliminate the many disclosure and conflict of interest problems of corporations.

C) provide uniform international accounting standards.

D) two of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

64

Colonial Furniture's net profits before taxes for 2002 totaled $354,000. The company's total retained earnings were $338,000 for 2004 year end and $389,000 for 2005 year end. Colonial is subject to a 26 percent tax rate. How large was the cash dividend declared by Colonial Furniture in 2005?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

65

Benchmarking is a type of cross-sectional analysis in which the firm's ratio values are compared to those of firms in other industries, primarily to identify areas for improvement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

66

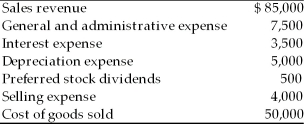

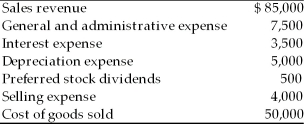

Reliable Auto Parts has 5,000 shares of common stock outstanding. The company also has the following amounts in revenue and expense accounts.  Calculate

Calculate

(a) gross profits.

(b) operating profits.

(c) net profits before taxes.

(d) net profits after taxes (assume a 40 percent tax rate).

(e) cash flow from operations.

(f) earnings available to common stockholders.

(g) earnings per share.

Calculate

Calculate(a) gross profits.

(b) operating profits.

(c) net profits before taxes.

(d) net profits after taxes (assume a 40 percent tax rate).

(e) cash flow from operations.

(f) earnings available to common stockholders.

(g) earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

67

Benchmarking is a type of time-series analysis in which the firm's ratio values are compared to those of a key competitor or group of competitors, primarily to isolate areas of opportunity for improvement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Sunshine Company had a retained earnings balance of $850,000 at the beginning of 2005. By the end of 2005, the company's retained earnings balance was $950,000. During 2005, the company earned $245,000 as net profits after paying its taxes. The company was then able to pay its preferred stockholders $45,000. Compute the common stock dividend per share in 2005 assuming 10,000 shares of common stock outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

69

On December 31, 2004, the Bradshaw Corporation had $485,000 as an ending balance for its retained earnings account. During 2005, the corporation declared a $3.50/share dividend to its stockholders. The Bradshaw Corporation has 35,000 shares of common stock outstanding. When the books were closed for 2005 year end, the corporation had a final retained earnings balance of $565,000. What was the net profit earned by Bradshaw Corporation during 2005?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

70

Cross-sectional ratio analysis involves comparing the firm's ratios to those of firms in other industries at the same point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

71

The firm's creditors are primarily interested in the short-term liquidity of the company and its ability to make interest and principal payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

72

The 2002 law that established the Public Company Accounting Oversight Board (PCAOB) was called

A) the McCain-Feingold Act.

B) the Harkins-Oxley Act.

C) the Sarbanes-Harkins Act.

D) the Sarbanes-Oxley Act.

A) the McCain-Feingold Act.

B) the Harkins-Oxley Act.

C) the Sarbanes-Harkins Act.

D) the Sarbanes-Oxley Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

73

Time-series analysis is the evaluation of the firm's financial performance in comparison to other firm(s) at the same point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

74

Ratio analysis merely directs the analyst to potential areas of concern; it does not provide conclusive evidence as to the existence of a problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

75

As a rule, the necessary inputs to an effective financial analysis include, at minimum, the income statement and the statement of cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

76

A firm had year end 2004 and 2005 retained earnings balance of $670,000 and $560,000, respectively. The firm reported net profits after taxes of $100,000 in 2005. The firm paid dividends in 2005 of

A) $10,000.

B) $100,000.

C) $110,000.

D) $210,000.

A) $10,000.

B) $100,000.

C) $110,000.

D) $210,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

77

Ag Silver Mining, Inc. has $500,000 of earnings before interest and taxes at the year end. Interest expenses for the year were $10,000. The firm expects to distribute $100,000 in dividends. Calculate the earnings after taxes for the firm assuming a 40 percent tax on ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

78

Time-series analysis evaluates performance of firms at the same point in time using financial ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

79

The Public Company Accounting Oversight Board (PCAOB)

A) is a not-for-profit corporation that oversees auditors of public corporations.

B) is a not-for-profit corporation that oversees managers of public corporations.

C) is a for-profit corporation that oversees auditors of public corporations.

D) is a for-profit corporation that oversees managers of public corporations.

A) is a not-for-profit corporation that oversees auditors of public corporations.

B) is a not-for-profit corporation that oversees managers of public corporations.

C) is a for-profit corporation that oversees auditors of public corporations.

D) is a for-profit corporation that oversees managers of public corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck

80

Due to inflationary effects, inventory costs and depreciation write-offs can differ from their true values, thereby distorting profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 209 في هذه المجموعة.

فتح الحزمة

k this deck