Deck 9: Relevant Information and Decision Making: Production Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/111

العب

ملء الشاشة (f)

Deck 9: Relevant Information and Decision Making: Production Decisions

1

An outlay cost is a cost that requires a cash disbursement.

True

2

All fixed costs are irrelevant and only variable costs are relevant to the decision-making process.

False

3

Make-or-buy decisions can apply to services as well as to products.

True

4

In a sell or process further decision, joint costs must be analyzed to determine maximum profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

5

Managers are often motivated to reject desirable economic decisions because of a conflict between the measures used in decision making and those used in performance evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

6

Unit costs not computed on the same volume basis should not be compared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

7

Amortization on old or new equipment is irrelevant information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

8

A homeowner has paid off the mortgage on his house and continues to live in the house. The interest income foregone by NOT selling the house and investing the proceeds is an example of a(n)

A) sunk cost.

B) detrimental cost.

C) opportunity cost.

D) outlay cost.

A) sunk cost.

B) detrimental cost.

C) opportunity cost.

D) outlay cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

9

A current or future action can always influence the long-run impact of a past outlay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

10

Conflicts in the decision-making process can arise when superiors evaluate a manager's performance using a model consistent with the decision model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

11

The split-off point is the juncture in manufacturing where the joint products become individually identifiable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

12

Separable costs are part of a joint process and can be exclusively identified with individual products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

13

The salary foregone by a person who quits a job to start a business is an example of a(n)

A) sunk cost.

B) opportunity cost.

C) amortizable cost.

D) outlay cost.

A) sunk cost.

B) opportunity cost.

C) amortizable cost.

D) outlay cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

14

Opportunity cost is

A) the contribution of the best alternative that is excluded from consideration.

B) the same as outlay cost.

C) never relevant to a decision.

D) always an experimental cost.

A) the contribution of the best alternative that is excluded from consideration.

B) the same as outlay cost.

C) never relevant to a decision.

D) always an experimental cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

15

A cost that requires a cash disbursement is called a(n)

A) sunk cost.

B) opportunity cost.

C) outlay cost.

D) common cost.

A) sunk cost.

B) opportunity cost.

C) outlay cost.

D) common cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

16

Opportunity cost is the maximum available contribution to profit foregone by using limited resources for a particular purpose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

17

In practice, sunk costs often influence important decisions, especially when a decision maker doesn't want to admit that a previous decision was a bad decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

18

Book value is defined as the cost of a depreciable asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

19

Differential cost is a synonym for

A) detrimental cost.

B) opportunity cost.

C) accidental cost.

D) incremental cost.

A) detrimental cost.

B) opportunity cost.

C) accidental cost.

D) incremental cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

20

Obsolete inventory costs are not relevant, because they are not an expected future cost but a past cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

21

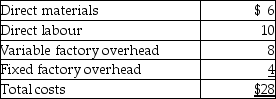

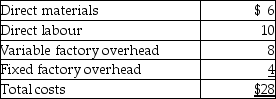

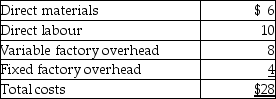

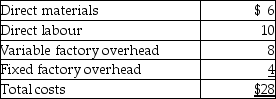

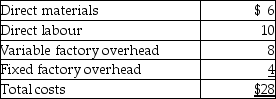

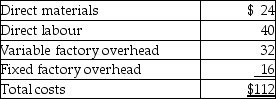

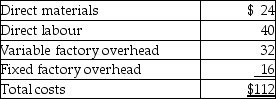

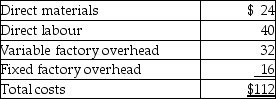

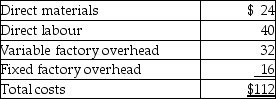

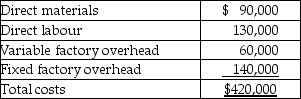

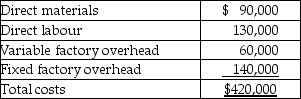

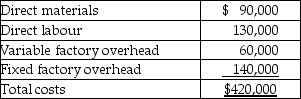

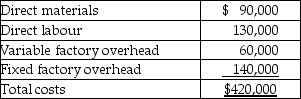

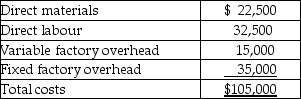

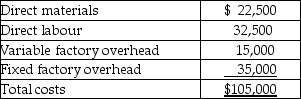

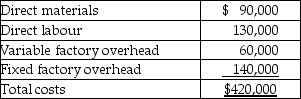

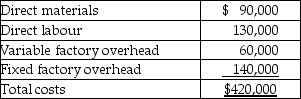

Speck Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Assume that Speck can buy 10,000 units of the part from another producer for $30 each. The facilities currently used to make the part could be rented out to another manufacturer for $40,000 a year. Speck should

A) make the part as that would save $2 per unit.

B) buy the part as that would save $6 per unit.

C) buy the part as that would save $2 per unit.

D) make the part as that would save $6 per unit.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Assume that Speck can buy 10,000 units of the part from another producer for $30 each. The facilities currently used to make the part could be rented out to another manufacturer for $40,000 a year. Speck should

A) make the part as that would save $2 per unit.

B) buy the part as that would save $6 per unit.

C) buy the part as that would save $2 per unit.

D) make the part as that would save $6 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would NOT be a consideration in a make or buy decision?

A) Excess capacity

B) Unavoidable fixed costs

C) Variable factory overhead

D) Rental income from unused facilities

A) Excess capacity

B) Unavoidable fixed costs

C) Variable factory overhead

D) Rental income from unused facilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

23

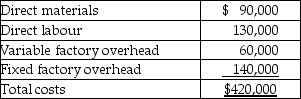

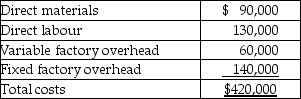

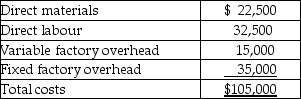

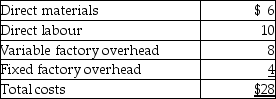

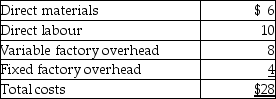

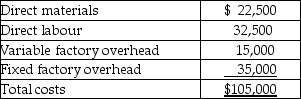

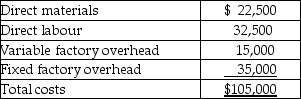

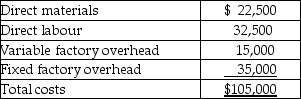

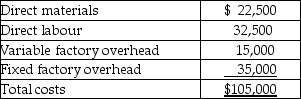

Barker Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.

Assume that Barker can buy 5,000 units of the part from another producer for $88 each. The facilities currently used to make the part could be rented out to another manufacturer for $80,000 a year. Barker should

A) make the part as that would save $16 per unit.

B) make the part as that would save the company $20,000.

C) buy the part as that would save $12 per unit.

D) buy the part as that would save the company $80,000.

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.Assume that Barker can buy 5,000 units of the part from another producer for $88 each. The facilities currently used to make the part could be rented out to another manufacturer for $80,000 a year. Barker should

A) make the part as that would save $16 per unit.

B) make the part as that would save the company $20,000.

C) buy the part as that would save $12 per unit.

D) buy the part as that would save the company $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

24

Speck Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Assume that Speck can buy 10,000 units of the part from another producer for $28 each. The current facilities could be used to make 10,000 units of a product that has a contribution margin of $10 per unit. No additional fixed costs would be incurred. Speck should

A) make the new product and buy the part to earn an extra $6 per unit contribution to profit.

B) make the new product and buy the part to earn an extra $2 per unit contribution to profit.

C) continue to make the part to earn an extra $2 per unit contribution to profit.

D) continue to make the part to earn an extra $6 per unit contribution to profit.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Assume that Speck can buy 10,000 units of the part from another producer for $28 each. The current facilities could be used to make 10,000 units of a product that has a contribution margin of $10 per unit. No additional fixed costs would be incurred. Speck should

A) make the new product and buy the part to earn an extra $6 per unit contribution to profit.

B) make the new product and buy the part to earn an extra $2 per unit contribution to profit.

C) continue to make the part to earn an extra $2 per unit contribution to profit.

D) continue to make the part to earn an extra $6 per unit contribution to profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

25

Pett Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.

Assuming no other use of their facilities, the highest price that Pett should be willing to pay for 5,000 units of the part is

A) $105,000.

B) $70,000.

C) $85,000.

D) $60,000.

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.Assuming no other use of their facilities, the highest price that Pett should be willing to pay for 5,000 units of the part is

A) $105,000.

B) $70,000.

C) $85,000.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a company has excess capacity, the most it would pay for buying a product that it currently makes would be the

A) total cost of producing the product.

B) market value of the product.

C) market value less usual markup on the product.

D) total variable cost of producing the product.

A) total cost of producing the product.

B) market value of the product.

C) market value less usual markup on the product.

D) total variable cost of producing the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

27

Speck Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Assuming no other use of their facilities, the highest price that Speck should be willing to pay for the part is

A) $24.

B) $28.

C) $16.

D) $22.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Assuming no other use of their facilities, the highest price that Speck should be willing to pay for the part is

A) $24.

B) $28.

C) $16.

D) $22.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

28

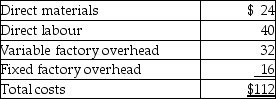

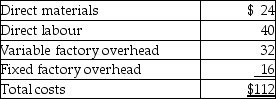

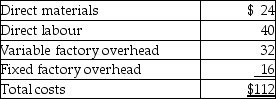

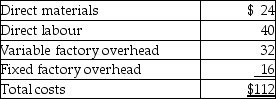

Bovee Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Assuming no other use of their facilities, the highest price that Bovee should be willing to pay for the part is

A) $112.

B) $64.

C) $88.

D) $96.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Assuming no other use of their facilities, the highest price that Bovee should be willing to pay for the part is

A) $112.

B) $64.

C) $88.

D) $96.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

29

Bovee Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Assume that Bovee can buy 10,000 units of the part from another producer for $112 each. The current facilities could be used to make 10,000 units of a product that has a contribution margin of $40 per unit. No additional fixed costs would be incurred. Bovee should

A) make the new product and buy the part to earn an extra $8 per unit contribution to profit.

B) continue to make the part to earn an extra $8 per unit contribution to profit.

C) continue to make the part to earn an extra $24 per unit contribution to profit.

D) make the new product and buy the part to earn an extra $24 per unit contribution to profit.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Assume that Bovee can buy 10,000 units of the part from another producer for $112 each. The current facilities could be used to make 10,000 units of a product that has a contribution margin of $40 per unit. No additional fixed costs would be incurred. Bovee should

A) make the new product and buy the part to earn an extra $8 per unit contribution to profit.

B) continue to make the part to earn an extra $8 per unit contribution to profit.

C) continue to make the part to earn an extra $24 per unit contribution to profit.

D) make the new product and buy the part to earn an extra $24 per unit contribution to profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

30

Speck Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Troxel Company has offered to sell 10,000 units of the same part to Speck for $26 a unit. Assuming no other use for the facilities, Speck should

A) buy from Troxel as this would save $2 per unit.

B) make the part as this would save $2 per unit.

C) buy from Troxel as this would save $10 per unit.

D) make the part as this would save $10 per unit.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Troxel Company has offered to sell 10,000 units of the same part to Speck for $26 a unit. Assuming no other use for the facilities, Speck should

A) buy from Troxel as this would save $2 per unit.

B) make the part as this would save $2 per unit.

C) buy from Troxel as this would save $10 per unit.

D) make the part as this would save $10 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

31

Bovee Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Assume that Bovee can buy 10,000 units of the part from another producer for $120 each. The facilities currently used to make the part could be rented out to another manufacturer for $160,000 a year. Bovee should

A) buy the part as that would save $24 per unit.

B) buy the part as that would save $4 per unit.

C) make the part as that would save $24 per unit.

D) make the part as that would save $8 per unit.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Assume that Bovee can buy 10,000 units of the part from another producer for $120 each. The facilities currently used to make the part could be rented out to another manufacturer for $160,000 a year. Bovee should

A) buy the part as that would save $24 per unit.

B) buy the part as that would save $4 per unit.

C) make the part as that would save $24 per unit.

D) make the part as that would save $8 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

32

A key factor in a make or buy decision is

A) whether or not there are idle facilities.

B) the amount of the sunk costs.

C) gain or loss on the disposal of equipment.

D) the total joint costs.

A) whether or not there are idle facilities.

B) the amount of the sunk costs.

C) gain or loss on the disposal of equipment.

D) the total joint costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

33

Pett Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.

Assume that Pett can buy 5,000 units of the part from another producer for $21 each. The current facilities could be used to make 5,000 units of a product that has a contribution margin of $5 per unit. Fixed factory overhead costs to produce this new product would be exactly the same as for the currently produced part. Pett should

A) continue to make the part and earn an extra $10,000 in profit.

B) buy the part and produce the new product and earn an extra $1 per unit contribution to profit.

C) continue to make the part and earn an extra $2 per unit contribution to profit.

D) buy the part and produce the new product and earn an extra $5 per unit contribution to profit.

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.Assume that Pett can buy 5,000 units of the part from another producer for $21 each. The current facilities could be used to make 5,000 units of a product that has a contribution margin of $5 per unit. Fixed factory overhead costs to produce this new product would be exactly the same as for the currently produced part. Pett should

A) continue to make the part and earn an extra $10,000 in profit.

B) buy the part and produce the new product and earn an extra $1 per unit contribution to profit.

C) continue to make the part and earn an extra $2 per unit contribution to profit.

D) buy the part and produce the new product and earn an extra $5 per unit contribution to profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

34

Future costs are relevant in decision making when

A) they differ between alternatives.

B) they equal future revenues.

C) they are not based on an estimate.

D) they are the same between alternatives.

A) they differ between alternatives.

B) they equal future revenues.

C) they are not based on an estimate.

D) they are the same between alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

35

Barker Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.

Blass Company has offered to sell 5,000 units of the same part to Barker for $72 per unit. Assuming there is no other use for the facilities, Barker should

A) make the part as this would save $12 per unit.

B) buy the part as this would save $12 per unit.

C) buy the part as this would save the company $60,000.

D) make the part as this would save $4 per unit.

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.Blass Company has offered to sell 5,000 units of the same part to Barker for $72 per unit. Assuming there is no other use for the facilities, Barker should

A) make the part as this would save $12 per unit.

B) buy the part as this would save $12 per unit.

C) buy the part as this would save the company $60,000.

D) make the part as this would save $4 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

36

Pett Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.

Assume that Pett can buy 5,000 units of the part from another producer for $22 each. The facilities currently used to make the part could be rented out to another manufacturer for $20,000 a year. Pett should

A) make the part as that would save $4 per unit.

B) make the part as that would save the company $5,000.

C) buy the part as that would save $3 per unit.

D) buy the part as that would save the company $20,000.

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.Assume that Pett can buy 5,000 units of the part from another producer for $22 each. The facilities currently used to make the part could be rented out to another manufacturer for $20,000 a year. Pett should

A) make the part as that would save $4 per unit.

B) make the part as that would save the company $5,000.

C) buy the part as that would save $3 per unit.

D) buy the part as that would save the company $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

37

Barker Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.

Assuming no other use of their facilities, the highest price that Barker should be willing to pay for 5,000 units of the part is

A) $420,000.

B) $280,000.

C) $340,000.

D) $240,000.

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.Assuming no other use of their facilities, the highest price that Barker should be willing to pay for 5,000 units of the part is

A) $420,000.

B) $280,000.

C) $340,000.

D) $240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

38

Bovee Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

Clarke Company has offered to sell 10,000 units of the same part to Bovee for $104 a unit. Assuming no other use for the facilities, Bovee should

A) make the part as this would save $8 per unit.

B) buy from Clarke as this would save $20 per unit.

C) make the part as this would save $20 per unit

D) buy from Clarke as this would save $8 per unit.

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.Clarke Company has offered to sell 10,000 units of the same part to Bovee for $104 a unit. Assuming no other use for the facilities, Bovee should

A) make the part as this would save $8 per unit.

B) buy from Clarke as this would save $20 per unit.

C) make the part as this would save $20 per unit

D) buy from Clarke as this would save $8 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

39

Pett Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.

Titus Company has offered to sell 5,000 units of the same part to Pett for $18 per unit. Assuming there is no other use for the facilities, Pett should

A) make the part as this would save $3 per unit.

B) buy the part as this would save $3 per unit.

C) buy the part as this would save the company $15,000.

D) make the part as this would save $1 per unit.

Of the fixed factory overhead costs, $15,000 is avoidable.

Of the fixed factory overhead costs, $15,000 is avoidable.Titus Company has offered to sell 5,000 units of the same part to Pett for $18 per unit. Assuming there is no other use for the facilities, Pett should

A) make the part as this would save $3 per unit.

B) buy the part as this would save $3 per unit.

C) buy the part as this would save the company $15,000.

D) make the part as this would save $1 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

40

Fixed costs that may be avoided in the future are

A) unavoidable costs.

B) sunk costs.

C) relevant costs.

D) replacement costs.

A) unavoidable costs.

B) sunk costs.

C) relevant costs.

D) replacement costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

41

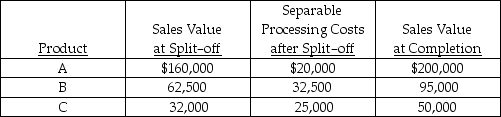

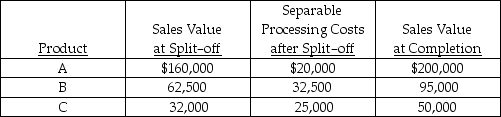

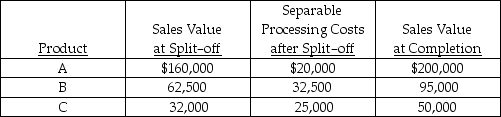

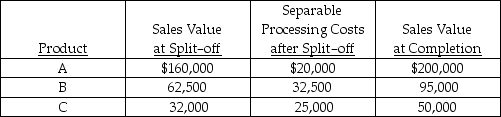

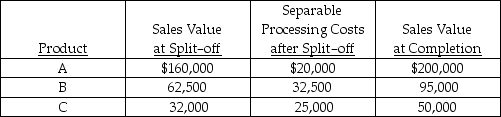

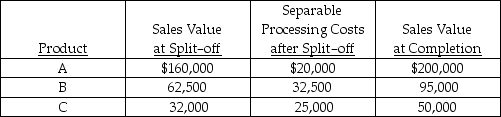

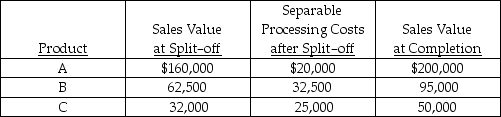

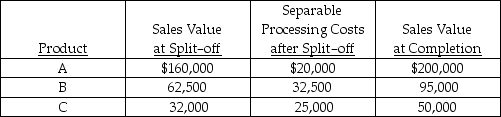

Mann Corporation has a joint process, which produces three products, A, B and C. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $125,000. Other relevant data are as follows:

To maximize profits, which products should Mann process further?

A) Product C only

B) Product B only

C) Product A only

D) Products A, B and C

To maximize profits, which products should Mann process further?

A) Product C only

B) Product B only

C) Product A only

D) Products A, B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is NOT likely to be relevant in a decision concerning the disposal of obsolete inventory?

A) Inventory cost

B) Expected future revenues

C) Scrap value of inventory

D) Expected future costs

A) Inventory cost

B) Expected future revenues

C) Scrap value of inventory

D) Expected future costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

43

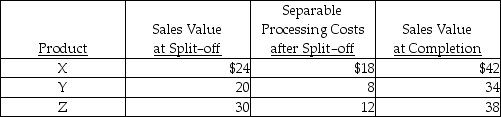

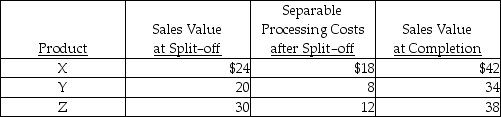

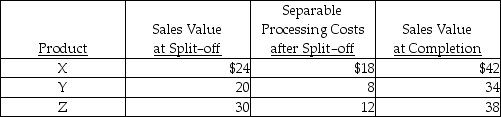

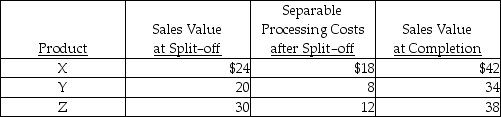

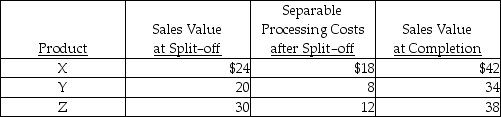

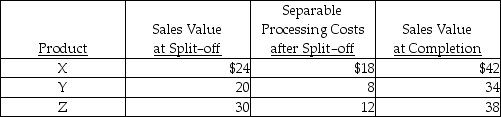

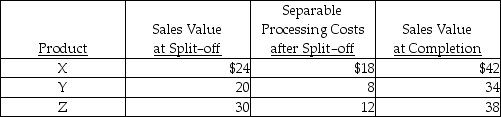

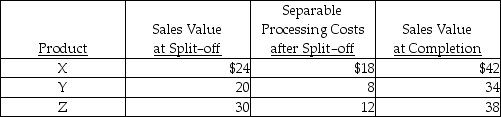

Hamilton, Inc. produces three products using a joint process which provides for $350,000 in joint costs. The products X, Y and Z can be sold at split-off or processed further and then sold. The production level for each product is 5,000 units. The following unit information is also available:

Once X is produced, processing it further will cause profits to

A) increase by $120,000.

B) stay the same.

C) decrease by $120,000.

D) increase by $24 per unit.

Once X is produced, processing it further will cause profits to

A) increase by $120,000.

B) stay the same.

C) decrease by $120,000.

D) increase by $24 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

44

Hamilton, Inc. produces three products using a joint process which provides for $350,000 in joint costs. The products X, Y and Z can be sold at split-off or processed further and then sold. The production level for each product is 5,000 units. The following unit information is also available:

To maximize profits, which products should Hamilton process further?

A) Product X only

B) Product Y only

C) Product Z only

D) Products X, Y and Z

To maximize profits, which products should Hamilton process further?

A) Product X only

B) Product Y only

C) Product Z only

D) Products X, Y and Z

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

45

Mann Corporation has a joint process, which produces three products, A, B and C. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $125,000. Other relevant data are as follows:

Product B

A) should be processed further to increase profits by $32,500.

B) should be sold at split-off since processing further would only reduce profits by $32,500.

C) should be processed further to increase profits by $95,000.

D) can be processed further or sold at split-off. There is no difference in profit.

Product B

A) should be processed further to increase profits by $32,500.

B) should be sold at split-off since processing further would only reduce profits by $32,500.

C) should be processed further to increase profits by $95,000.

D) can be processed further or sold at split-off. There is no difference in profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

46

The costs of manufacturing joint products after the split-off point are referred to as

A) joint costs.

B) outlay costs.

C) opportunity costs.

D) separable costs.

A) joint costs.

B) outlay costs.

C) opportunity costs.

D) separable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

47

Hamilton, Inc. produces three products using a joint process which provides for $350,000 in joint costs. The products X, Y and Z can be sold at split-off or processed further and then sold. The production level for each product is 5,000 units. The following unit information is also available:

Product Y

A) should be processed further as this will increase profits by $30,000.

B) should be sold at split-off to maximize profits.

C) should be processed further to increase profits by $14 per unit.

D) can be processed further or sold at split-off, it makes no difference.

Product Y

A) should be processed further as this will increase profits by $30,000.

B) should be sold at split-off to maximize profits.

C) should be processed further to increase profits by $14 per unit.

D) can be processed further or sold at split-off, it makes no difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

48

Hamilton, Inc. produces three products using a joint process which provides for $350,000 in joint costs. The products X, Y and Z can be sold at split-off or processed further and then sold. The production level for each product is 5,000 units. The following unit information is also available:

In processing product Z further,

A) incremental revenues will exceed incremental costs.

B) profits will increase by $8 per unit.

C) profits will decrease by $20,000.

D) additional costs will be less than additional revenues.

In processing product Z further,

A) incremental revenues will exceed incremental costs.

B) profits will increase by $8 per unit.

C) profits will decrease by $20,000.

D) additional costs will be less than additional revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

49

Costs of manufacturing two or more products that are NOT separately identifiable as individual products until their split-off point are known as

A) separable costs.

B) joint costs.

C) incremental costs.

D) sunk costs.

A) separable costs.

B) joint costs.

C) incremental costs.

D) sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is NOT an example of a joint product?

A) Sponges

B) Chemicals

C) Lumber

D) Meat packing

A) Sponges

B) Chemicals

C) Lumber

D) Meat packing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

51

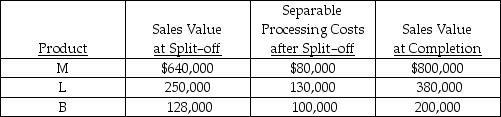

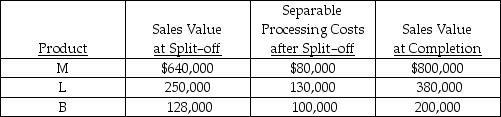

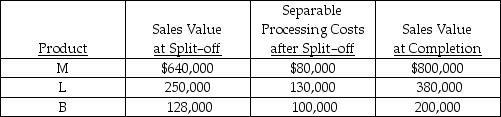

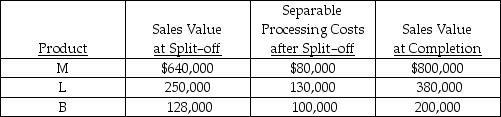

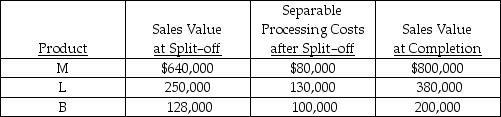

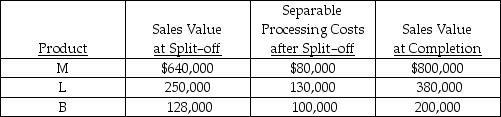

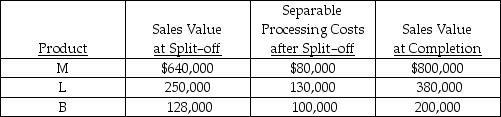

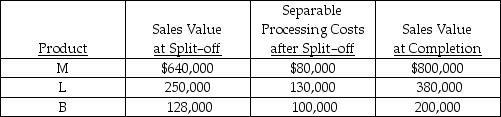

Avey Corporation has a joint process which produces three products, M, L and B. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $500,000. Other relevant data are as follows:

In processing Product B further,

A) profits will decrease by $28,000.

B) incremental profits will exceed incremental costs.

C) profits will increase by $100,000.

D) the additional revenue produced will exceed the additional costs.

In processing Product B further,

A) profits will decrease by $28,000.

B) incremental profits will exceed incremental costs.

C) profits will increase by $100,000.

D) the additional revenue produced will exceed the additional costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

52

It is profitable to extend processing or to incur additional distribution costs on a joint product if the

A) incremental expenses exceed incremental revenues.

B) sale of the product is guaranteed.

C) additional revenue exceeds the additional expenses.

D) joint products are inseparable.

A) incremental expenses exceed incremental revenues.

B) sale of the product is guaranteed.

C) additional revenue exceeds the additional expenses.

D) joint products are inseparable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

53

Avey Corporation has a joint process which produces three products, M, L and B. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $500,000. Other relevant data are as follows:

To maximize profits, which products should Avey process further?

A) Product B only

B) Product L only

C) Product M only

D) Products M, L and B

To maximize profits, which products should Avey process further?

A) Product B only

B) Product L only

C) Product M only

D) Products M, L and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

54

Avey Corporation has a joint process which produces three products, M, L and B. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $500,000. Other relevant data are as follows:

Once product M is produced, processing it further will cause profits to

A) increase by $160,000.

B) decrease by $ 80,000.

C) decrease by $160,000.

D) increase by $ 80,000.

Once product M is produced, processing it further will cause profits to

A) increase by $160,000.

B) decrease by $ 80,000.

C) decrease by $160,000.

D) increase by $ 80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

55

Avey Corporation has a joint process which produces three products, M, L and B. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $500,000. Other relevant data are as follows:

Product L

A) should be processed further to increase profits by $130,000.

B) should be sold at split-off since processing further would only reduce profits by $130,000.

C) should be processed further to increase profits by $380,000.

D) can be processed further or sold at split-off. There is no difference in profit.

Product L

A) should be processed further to increase profits by $130,000.

B) should be sold at split-off since processing further would only reduce profits by $130,000.

C) should be processed further to increase profits by $380,000.

D) can be processed further or sold at split-off. There is no difference in profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

56

Two or more manufactured products that have relatively significant sales values and are NOT separately identifiable as individual products until their split-off point are called

A) separable products.

B) by-products.

C) distinct products.

D) joint products.

A) separable products.

B) by-products.

C) distinct products.

D) joint products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

57

Mann Corporation has a joint process, which produces three products, A, B and C. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $125,000. Other relevant data are as follows:

In processing Product C further,

A) profits will decrease by $7,000.

B) incremental profits will exceed incremental costs.

C) profits will increase by $25,000.

D) the additional revenue produced will exceed the additional costs.

In processing Product C further,

A) profits will decrease by $7,000.

B) incremental profits will exceed incremental costs.

C) profits will increase by $25,000.

D) the additional revenue produced will exceed the additional costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

58

Mann Corporation has a joint process, which produces three products, A, B and C. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $125,000. Other relevant data are as follows:

Once product A is produced, processing it further will cause profits to

A) increase by $40,000.

B) decrease by $20,000.

C) decrease by $40,000.

D) increase by $20,000.

Once product A is produced, processing it further will cause profits to

A) increase by $40,000.

B) decrease by $20,000.

C) decrease by $40,000.

D) increase by $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

59

The juncture in manufacturing where the joint products become individually identifiable is known as the

A) joint processing juncture.

B) split-off point.

C) common point.

D) significant juncture.

A) joint processing juncture.

B) split-off point.

C) common point.

D) significant juncture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

60

Barker Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.

Assume that Barker can buy 5,000 units of the part from another producer for $84 each. The current facilities could be used to make 5,000 units of a product that has a contribution margin of $20 per unit. Fixed factory overhead costs to produce this new product would be exactly the same as for the currently produced part. Barker should

A) continue to make the part and earn an extra $40,000 in profit.

B) buy the part and produce the new product and earn an extra $4 per unit contribution to profit.

C) continue to make the part and earn an extra $8 per unit contribution to profit.

D) buy the part and produce the new product and earn an extra $20 per unit contribution to profit.

Of the fixed factory overhead costs, $60,000 is avoidable.

Of the fixed factory overhead costs, $60,000 is avoidable.Assume that Barker can buy 5,000 units of the part from another producer for $84 each. The current facilities could be used to make 5,000 units of a product that has a contribution margin of $20 per unit. Fixed factory overhead costs to produce this new product would be exactly the same as for the currently produced part. Barker should

A) continue to make the part and earn an extra $40,000 in profit.

B) buy the part and produce the new product and earn an extra $4 per unit contribution to profit.

C) continue to make the part and earn an extra $8 per unit contribution to profit.

D) buy the part and produce the new product and earn an extra $20 per unit contribution to profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

61

Variable costs are

A) irrelevant whenever they do not differ among alternatives.

B) always irrelevant.

C) always relevant.

D) relevant whenever they do not differ among alternatives.

A) irrelevant whenever they do not differ among alternatives.

B) always irrelevant.

C) always relevant.

D) relevant whenever they do not differ among alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

62

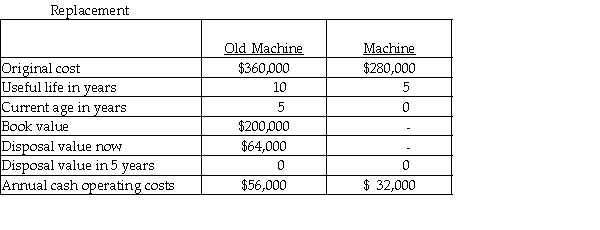

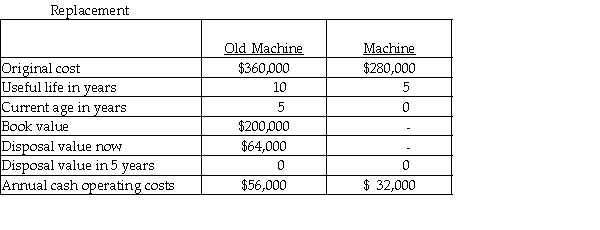

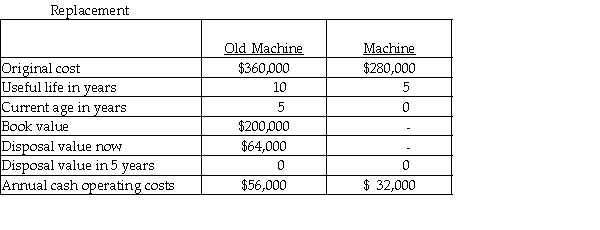

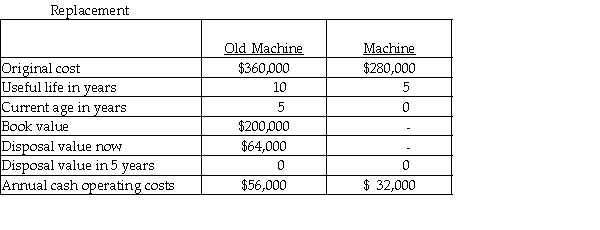

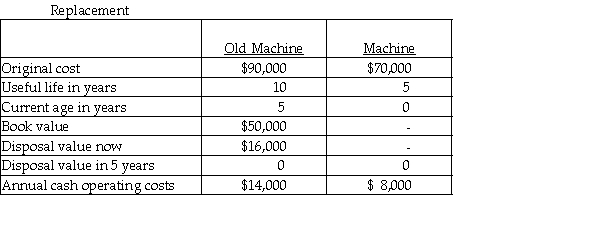

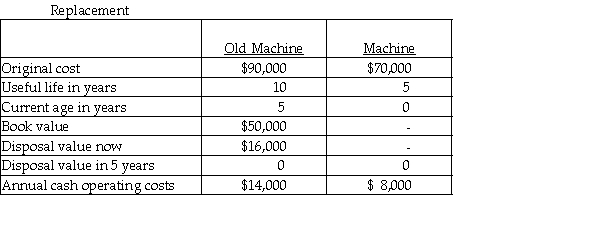

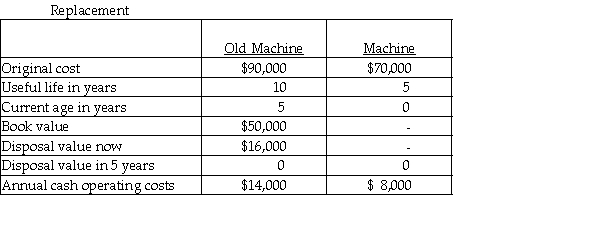

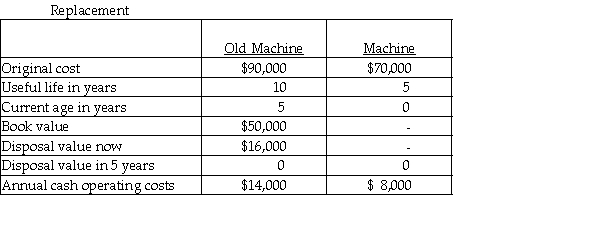

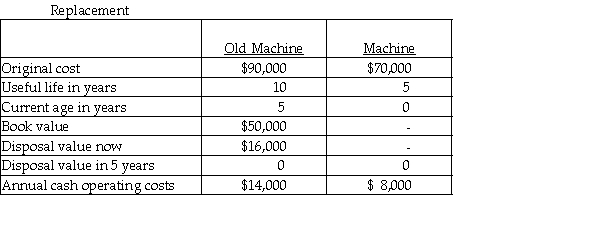

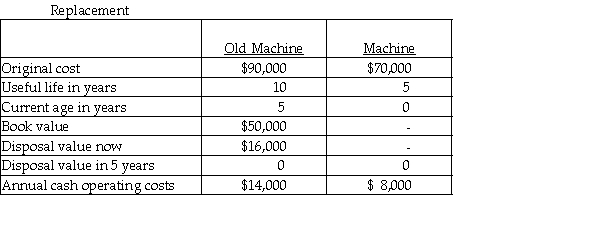

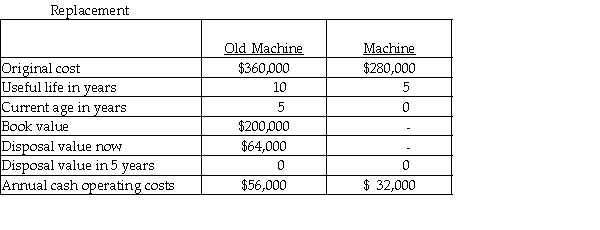

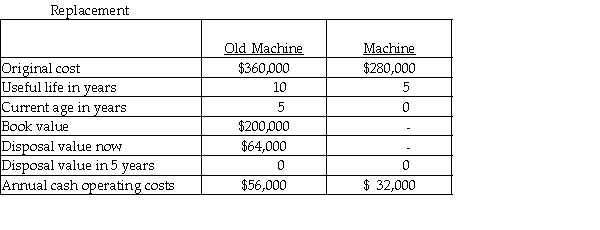

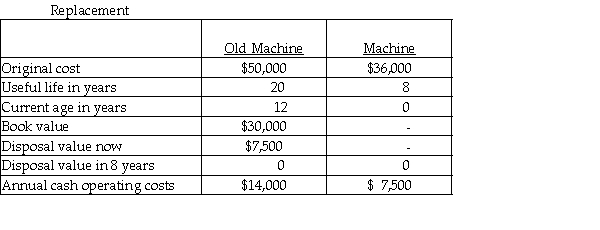

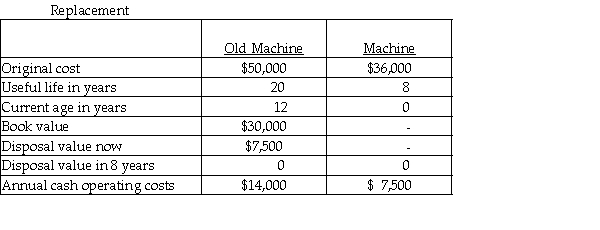

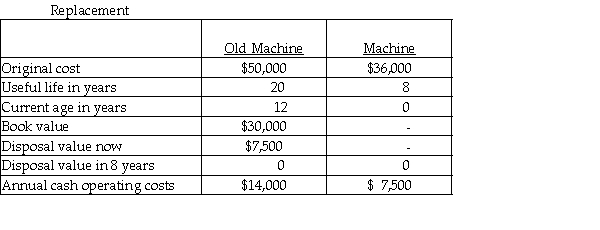

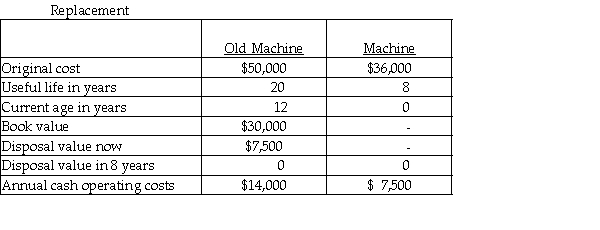

Buckner Company is considering replacing a machine that is presently used in the production of its product. The following data are available:

Which of the data provided in the table is a sunk cost?

A) The disposal value of the old machine

B) The original cost of the old machine

C) The annual cash operating costs of the old machine

D) The annual cash operating costs of the replacement machine

Which of the data provided in the table is a sunk cost?

A) The disposal value of the old machine

B) The original cost of the old machine

C) The annual cash operating costs of the old machine

D) The annual cash operating costs of the replacement machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

63

Buckner Company is considering replacing a machine that is presently used in the production of its product. The following data are available:

The total relevant costs to consider if the old machine is kept are

A) $480,000.

B) $280,000.

C) $376,000.

D) $576,000.

The total relevant costs to consider if the old machine is kept are

A) $480,000.

B) $280,000.

C) $376,000.

D) $576,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

64

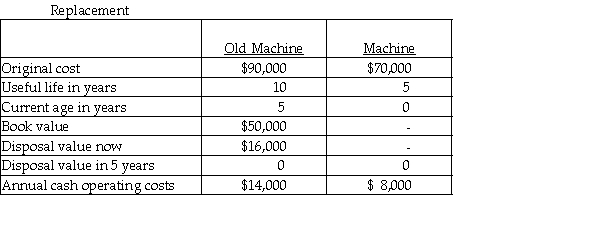

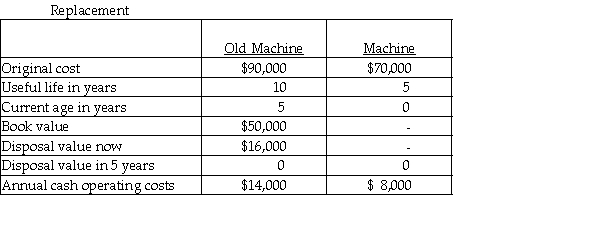

Overland Company is considering replacing a machine that is presently used in the production of its product. The following data are available:

The total relevant costs to consider if the old machine is kept are

A) $120,000.

B) $70,000.

C) $94,000.

D) $144,000.

The total relevant costs to consider if the old machine is kept are

A) $120,000.

B) $70,000.

C) $94,000.

D) $144,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

65

A cost that has already been incurred and is irrelevant to the decision-making process is a(n)

A) opportunity cost.

B) replacement cost.

C) outlay cost.

D) sunk cost.

A) opportunity cost.

B) replacement cost.

C) outlay cost.

D) sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

66

Overland Company is considering replacing a machine that is presently used in the production of its product. The following data are available:

The difference in cost between keeping the old machine and replacing the old machine, ignoring income taxes, is

A) $74,000 in favour of keeping the old machine.

B) $24,000 in favour of keeping the old machine.

C) $74,000 in favour of replacing the old machine.

D) $24,000 in favour of replacing the old machine.

The difference in cost between keeping the old machine and replacing the old machine, ignoring income taxes, is

A) $74,000 in favour of keeping the old machine.

B) $24,000 in favour of keeping the old machine.

C) $74,000 in favour of replacing the old machine.

D) $24,000 in favour of replacing the old machine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following statements regarding a decision to keep existing equipment or replace it is false?

A) The disposal value of the old equipment is irrelevant.

B) The book value of the old equipment is irrelevant.

C) The cost of the new equipment is relevant.

D) Depreciation on the new equipment is relevant.

A) The disposal value of the old equipment is irrelevant.

B) The book value of the old equipment is irrelevant.

C) The cost of the new equipment is relevant.

D) Depreciation on the new equipment is relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is NOT likely to be relevant in a decision to replace equipment?

A) Cost of new equipment

B) Book value of old equipment

C) Selling price of old equipment

D) Maintenance costs of old equipment

A) Cost of new equipment

B) Book value of old equipment

C) Selling price of old equipment

D) Maintenance costs of old equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

69

Overland Company is considering replacing a machine that is presently used in the production of its product. The following data are available:

Which of the data provided in the table is irrelevant?

A) The annual operating cost of the old machine

B) The original cost of the replacement machine

C) The disposal value of the old machine

D) The book value of the old machine

Which of the data provided in the table is irrelevant?

A) The annual operating cost of the old machine

B) The original cost of the replacement machine

C) The disposal value of the old machine

D) The book value of the old machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

70

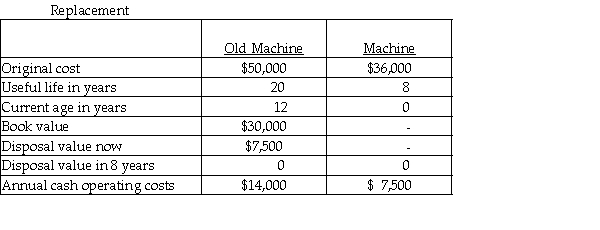

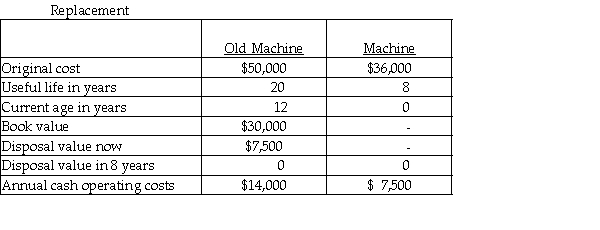

The Enger Company is contemplating replacing some old equipment. The pertinent information is as follows:

The difference in cost between keeping the old equipment and replacing the old equipment, ignoring income taxes, is

A) $23,500 in favour of replacing the old equipment.

B) $23,500 in favour of keeping the old equipment.

C) $6,500 in favour of keeping the old equipment.

D) $6,500 in favour of replacing the old equipment.

The difference in cost between keeping the old equipment and replacing the old equipment, ignoring income taxes, is

A) $23,500 in favour of replacing the old equipment.

B) $23,500 in favour of keeping the old equipment.

C) $6,500 in favour of keeping the old equipment.

D) $6,500 in favour of replacing the old equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

71

Buckner Company is considering replacing a machine that is presently used in the production of its product. The following data are available:

Which of the data provided in the table is irrelevant?

A) The original cost of the replacement machine

B) The disposal value of the old machine

C) The book value of the old machine

D) The annual operating cost of the old machine

Which of the data provided in the table is irrelevant?

A) The original cost of the replacement machine

B) The disposal value of the old machine

C) The book value of the old machine

D) The annual operating cost of the old machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

72

The gain or loss on the disposal of equipment is determined by

A) adding the book value of the old equipment to the cost of the new equipment.

B) adding the disposal value and the book value of the old equipment.

C) subtracting the book value from the disposal value of the old equipment.

D) subtracting the book value of the old equipment from the cost of the new equipment.

A) adding the book value of the old equipment to the cost of the new equipment.

B) adding the disposal value and the book value of the old equipment.

C) subtracting the book value from the disposal value of the old equipment.

D) subtracting the book value of the old equipment from the cost of the new equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

73

Overland Company is considering replacing a machine that is presently used in the production of its product. The following data are available:

Which of the data provided in the table is a sunk cost?

A) The annual cash operating costs of the old machine

B) The annual cash operating costs of the replacement machine

C) The disposal value of the old machine

D) The original cost of the old machine

Which of the data provided in the table is a sunk cost?

A) The annual cash operating costs of the old machine

B) The annual cash operating costs of the replacement machine

C) The disposal value of the old machine

D) The original cost of the old machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Enger Company is contemplating replacing some old equipment. The pertinent information is as follows:

Which of the data provided in the table is a sunk cost?

A) The annual cash operating costs of the old equipment

B) The annual cash operating costs of the replacement equipment

C) The disposal value of the old equipment

D) The original cost of the old equipment

Which of the data provided in the table is a sunk cost?

A) The annual cash operating costs of the old equipment

B) The annual cash operating costs of the replacement equipment

C) The disposal value of the old equipment

D) The original cost of the old equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

75

Expected future fixed costs are

A) always relevant.

B) always irrelevant.

C) relevant whenever they differ among alternatives.

D) irrelevant whenever they differ among alternatives.

A) always relevant.

B) always irrelevant.

C) relevant whenever they differ among alternatives.

D) irrelevant whenever they differ among alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

76

Book value is defined as

A) disposal value.

B) disposal value less accumulated depreciation.

C) cost less accumulation depreciation.

D) disposal value less original cost.

A) disposal value.

B) disposal value less accumulated depreciation.

C) cost less accumulation depreciation.

D) disposal value less original cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following would NOT be relevant to a decision to replace equipment?

A) Operating costs of old equipment

B) Cost of old equipment

C) Disposal value of old equipment

D) Acquisition cost of new equipment

A) Operating costs of old equipment

B) Cost of old equipment

C) Disposal value of old equipment

D) Acquisition cost of new equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

78

The periodic cost of equipment which is spread over the future periods in which the equipment is expected to be used is called

A) net book value.

B) current cost.

C) operating cost.

D) depreciation.

A) net book value.

B) current cost.

C) operating cost.

D) depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements is true?

A) Fixed costs should always be unitized as this would result in a better decision.

B) Unit costs need not be computed on the same volume basis.

C) Unit cost data are always more relevant than total cost data.

D) Unit cost changes with volume of activity, and therefore this fact must be considered in decision making.

A) Fixed costs should always be unitized as this would result in a better decision.

B) Unit costs need not be computed on the same volume basis.

C) Unit cost data are always more relevant than total cost data.

D) Unit cost changes with volume of activity, and therefore this fact must be considered in decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Enger Company is contemplating replacing some old equipment. The pertinent information is as follows:

The total relevant costs to consider if the old equipment is replaced are

A) $58,500.

B) $118,500.

C) $ 88,500.

D) $112,000.

The total relevant costs to consider if the old equipment is replaced are

A) $58,500.

B) $118,500.

C) $ 88,500.

D) $112,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck