Deck 7: Process-Costing Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

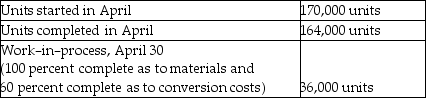

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

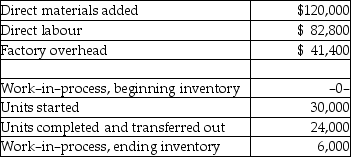

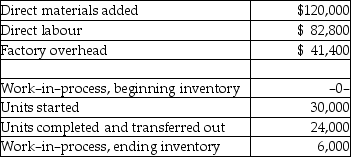

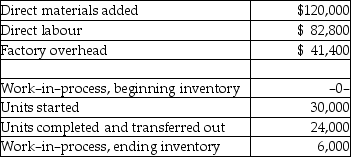

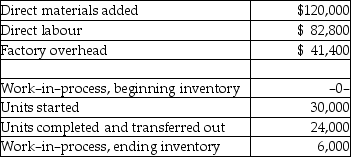

سؤال

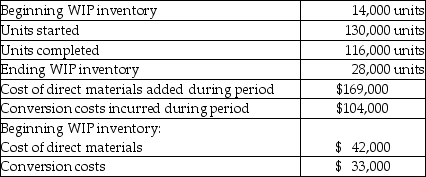

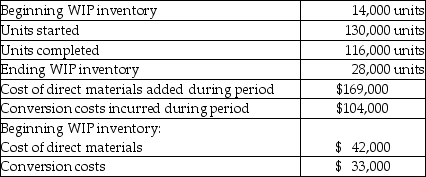

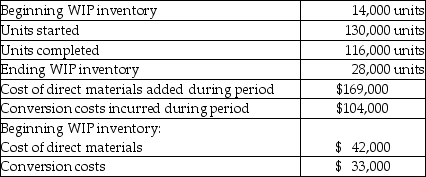

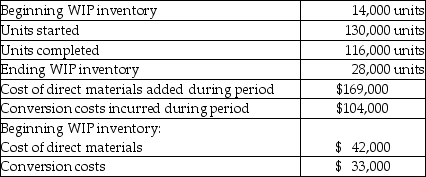

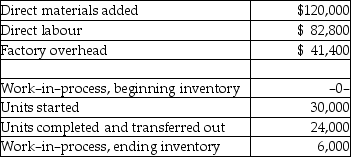

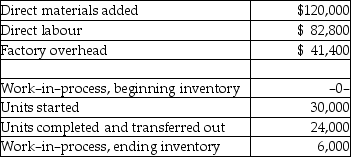

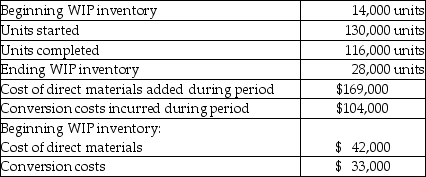

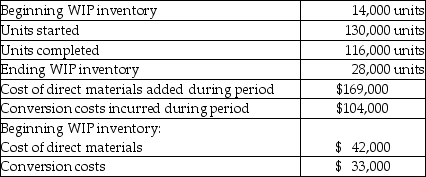

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

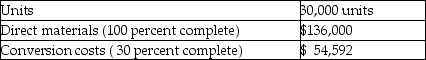

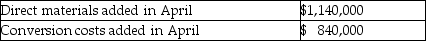

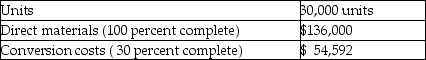

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/82

العب

ملء الشاشة (f)

Deck 7: Process-Costing Systems

1

When there is beginning work-in-process inventory, the weighted-average method of process costing must be used.

False

2

The unique feature of backflush costing is an absence of a cost of goods sold account.

False

3

Unlike job-order costing, process costing requires only one work-in-process account.

False

4

The system, which applies costs to like products that are usually mass-produced in continuous fashion through a series of production processes, is known as

A) process costing.

B) variable costing.

C) job-order costing.

D) JIT costing.

A) process costing.

B) variable costing.

C) job-order costing.

D) JIT costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

5

Conversion costs include all manufacturing costs other than direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

6

The first step in preparing a production-cost report is to calculate unit cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

7

Under weighted-average process costing, the unit costs used for applying costs to products are affected by the total costs incurred to date, regardless of whether those costs were incurred during or before the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

8

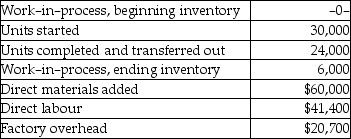

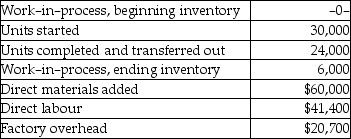

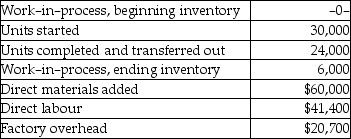

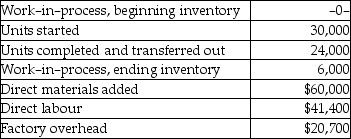

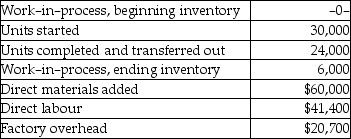

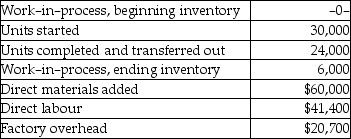

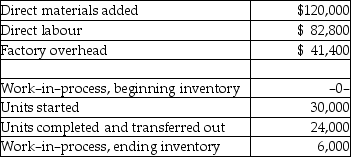

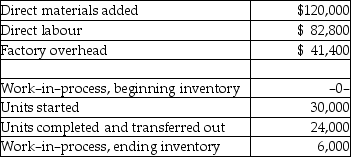

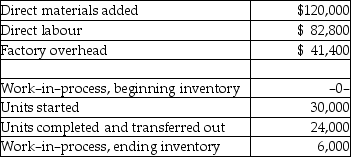

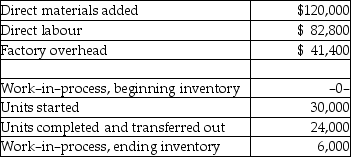

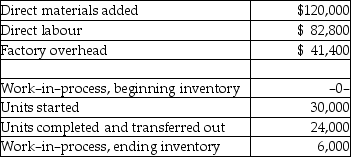

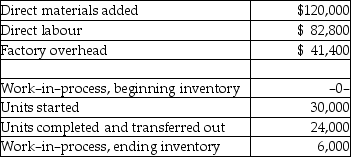

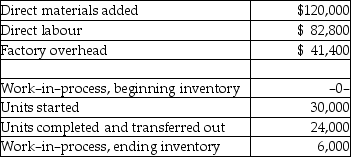

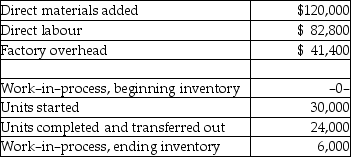

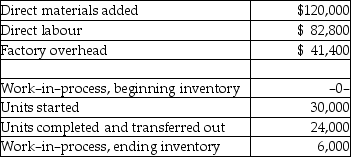

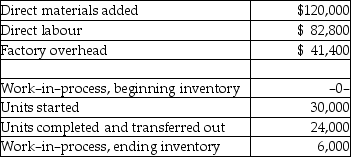

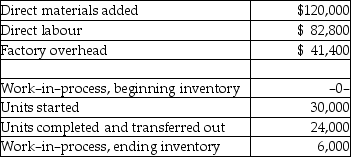

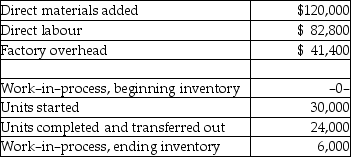

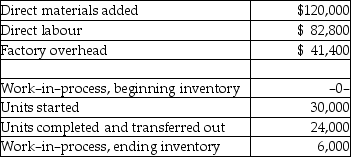

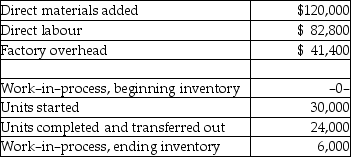

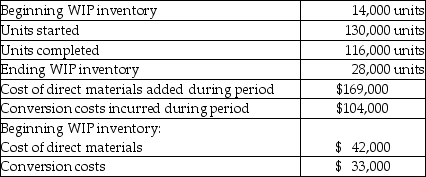

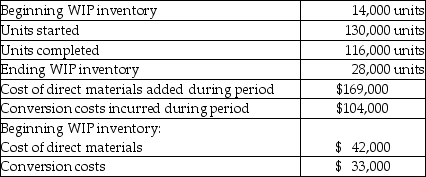

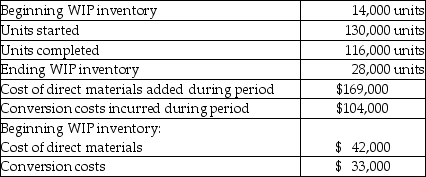

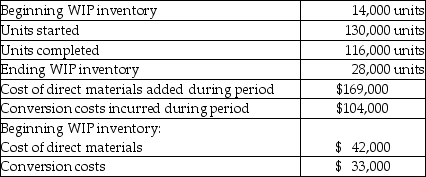

Bunn Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The equivalent units for materials are

A) 24,000.

B) 30,000.

C) 27,600.

D) 6,000.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The equivalent units for materials are

A) 24,000.

B) 30,000.

C) 27,600.

D) 6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

9

Hybrid-costing systems are blends of ideas from both job costing and process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

10

All product costing uses averaging to determine total costs of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

11

Bunn Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The equivalent units for conversion costs are

A) 6,000.

B) 30,000.

C) 24,000.

D) 27,600.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The equivalent units for conversion costs are

A) 6,000.

B) 30,000.

C) 24,000.

D) 27,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

12

The degree of completion for conversion costs depends on what proportion of the total effort needed to complete one unit or one batch has been devoted to units still in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

13

The last step in preparing a production-cost report is to determine equivalent units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

14

Backflush costing is a standardized method or technique that is repetitively performed, regardless of the distinguishing features of the finished product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is NOT an example of a product that would be manufactured in a process-costing system?

A) Flour

B) Glass

C) Toothpaste

D) A house

A) Flour

B) Glass

C) Toothpaste

D) A house

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

16

Cost-accounting systems fulfill two major purposes: (1) they allocate costs to departments for planning and control, and (2) they apply costs to units of product for product costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

17

Bunn Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs. The total of costs to account for is

A) $122,100.

B) $60,000.

C) $41,400.

D) $20,700.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs. The total of costs to account for is

A) $122,100.

B) $60,000.

C) $41,400.

D) $20,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

18

The key difference between the FIFO and weighted-average computations for WIP inventory is equivalent units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

19

Backflush costing has only two categories of costs: materials and conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

20

The FIFO process-costing method sharply distinguishes the current work done from the previous work done on the beginning inventory of work-in-process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

21

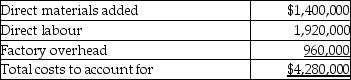

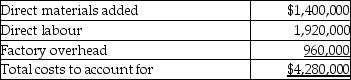

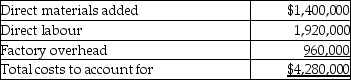

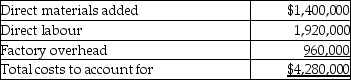

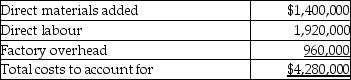

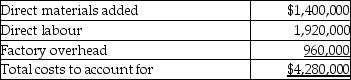

Ankenbauer Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The unit cost of conversion costs is

A) $5.00.

B) $2.50.

C) $7.20.

D) $7.50.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The unit cost of conversion costs is

A) $5.00.

B) $2.50.

C) $7.20.

D) $7.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

22

Ankenbauer Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The equivalent units for conversion costs are

A) 400,000.

B) 336,000.

C) 384,000.

D) 64,000.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The equivalent units for conversion costs are

A) 400,000.

B) 336,000.

C) 384,000.

D) 64,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

23

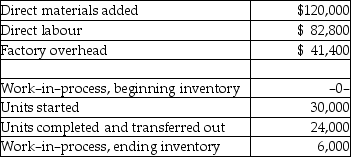

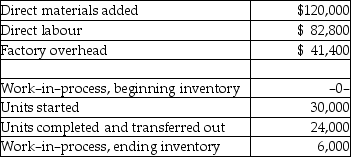

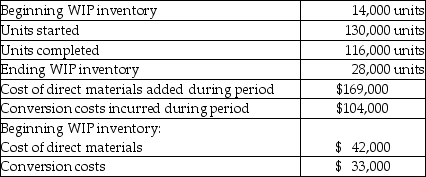

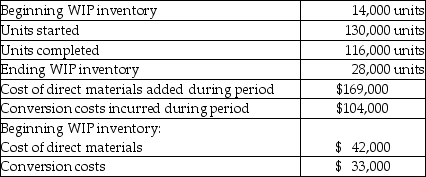

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The total of costs to account for is

A) $244,200.

B) $120,000.

C) $ 82,800.

D) $ 41,400.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The total of costs to account for is

A) $244,200.

B) $120,000.

C) $ 82,800.

D) $ 41,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

24

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The equivalent units for conversion costs are

A) 6,000.

B) 30,000.

C) 24,000.

D) 27,600.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The equivalent units for conversion costs are

A) 6,000.

B) 30,000.

C) 24,000.

D) 27,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

25

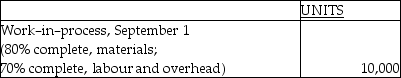

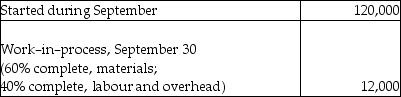

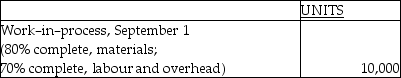

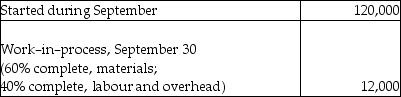

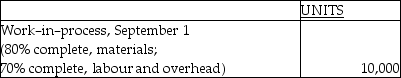

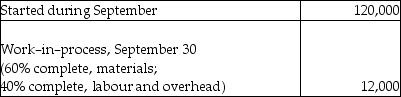

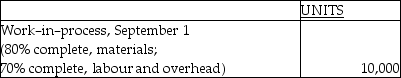

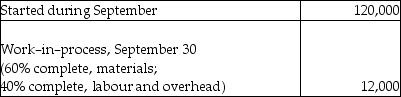

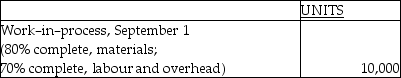

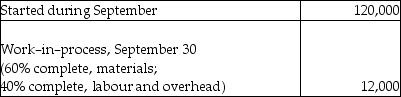

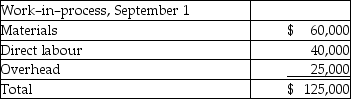

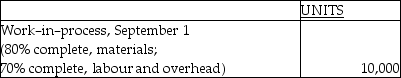

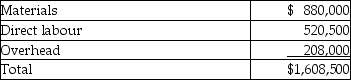

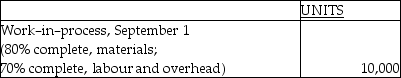

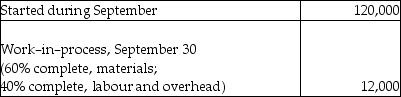

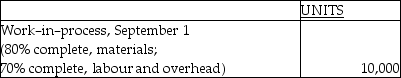

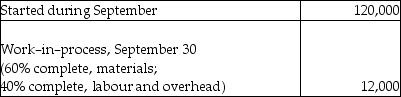

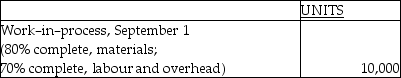

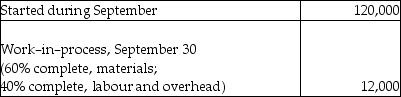

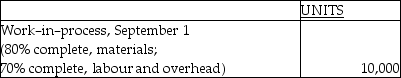

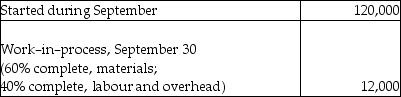

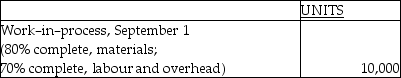

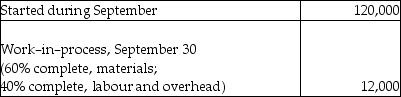

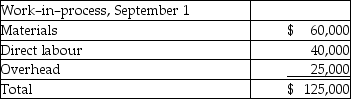

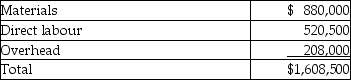

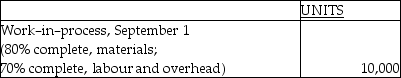

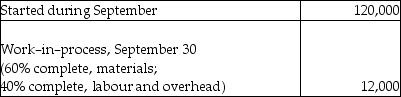

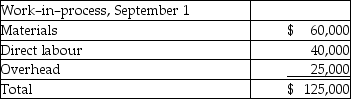

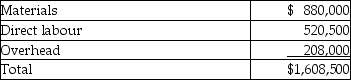

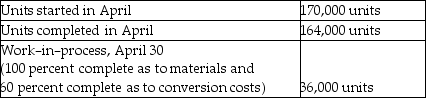

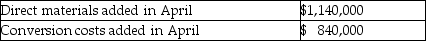

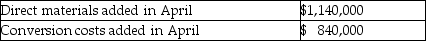

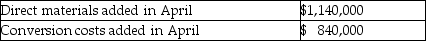

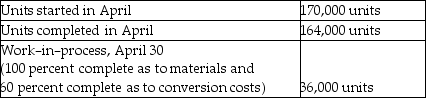

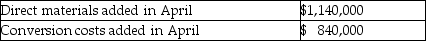

The following information pertains to the mixing department of Carson Company for September 2006:

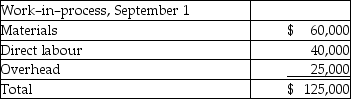

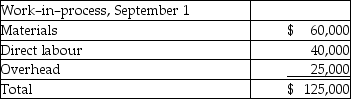

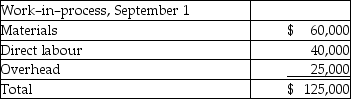

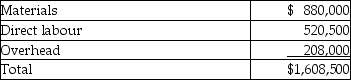

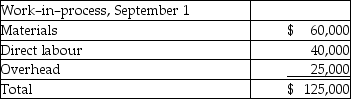

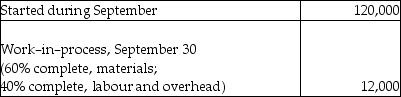

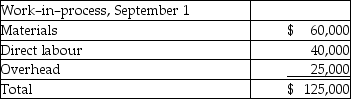

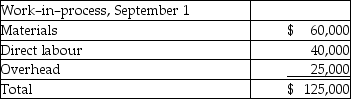

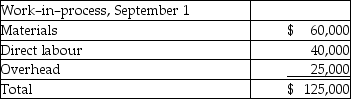

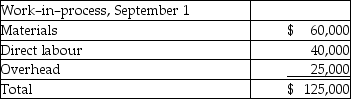

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows:

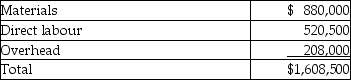

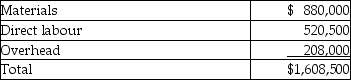

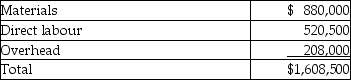

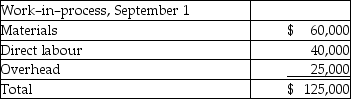

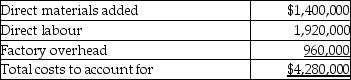

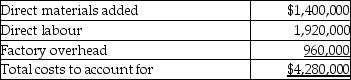

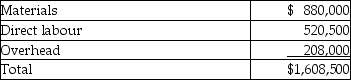

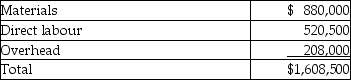

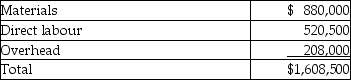

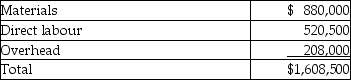

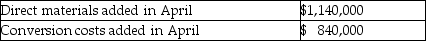

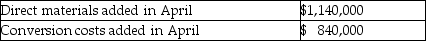

Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows:

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

The unit cost for materials is

A) $5.69.

B) $7.07.

C) $7.23.

D) $7.51.

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows: Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows: Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.The unit cost for materials is

A) $5.69.

B) $7.07.

C) $7.23.

D) $7.51.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

26

The following information pertains to the mixing department of Carson Company for September 2006:

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows:

Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows:

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Cost of goods transferred out is

A) $1,649,640.

B) $1,652,000.

C) $1,716,744.

D) $1,817,400.

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows: Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows: Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.Cost of goods transferred out is

A) $1,649,640.

B) $1,652,000.

C) $1,716,744.

D) $1,817,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

27

Chen Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The equivalent units for materials are

A) 168,000.

B) 200,000.

C) 192,000.

D) 32,000.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The equivalent units for materials are

A) 168,000.

B) 200,000.

C) 192,000.

D) 32,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

28

The following information pertains to the mixing department of Carson Company for September 2006:

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows:

Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows:

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

The equivalent units of production for materials is

A) $118,000.

B) $125,200.

C) $130,000.

D) $142,000.

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows: Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows: Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.The equivalent units of production for materials is

A) $118,000.

B) $125,200.

C) $130,000.

D) $142,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

29

Chen Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The total cost of ending work-in-process inventory is

A) $352,000.

B) $292,000.

C) $264,000.

D) $240,000.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The total cost of ending work-in-process inventory is

A) $352,000.

B) $292,000.

C) $264,000.

D) $240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

30

Chen Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The unit cost of conversion costs is

A) $5.00.

B) $2.50.

C) $7.20.

D) $7.50.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The unit cost of conversion costs is

A) $5.00.

B) $2.50.

C) $7.20.

D) $7.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

31

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The equivalent units for materials are

A) 24,000.

B) 30,000.

C) 27,600.

D) 6,000.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The equivalent units for materials are

A) 24,000.

B) 30,000.

C) 27,600.

D) 6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

32

Ankenbauer Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The total cost of units completed and transferred to Finishing is

A) $4,224,000.

B) $4,280,000.

C) $3,696,000.

D) $704,000.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The total cost of units completed and transferred to Finishing is

A) $4,224,000.

B) $4,280,000.

C) $3,696,000.

D) $704,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

33

Ankenbauer Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The unit cost of direct materials is

A) $3.50.

B) $4.17.

C) $3.65.

D) $0.29.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The unit cost of direct materials is

A) $3.50.

B) $4.17.

C) $3.65.

D) $0.29.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

34

The following information pertains to the mixing department of Carson Company for September 2006:

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows:

Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows:

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

The equivalent units of production for conversion is

A) 112,000.

B) 118,000.

C) 122,800.

D) 130,000.

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows: Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows: Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.The equivalent units of production for conversion is

A) 112,000.

B) 118,000.

C) 122,800.

D) 130,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following information pertains to the mixing department of Carson Company for September 2006:

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows:

Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows:

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

The unit cost for conversion costs is

A) $4.23.

B) $5.94.

C) $6.26.

D) $6.47.

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows: Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows: Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.The unit cost for conversion costs is

A) $4.23.

B) $5.94.

C) $6.26.

D) $6.47.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

36

Chen Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The unit cost of direct materials is

A) $3.50.

B) $4.17.

C) $3.65.

D) $0.29.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The unit cost of direct materials is

A) $3.50.

B) $4.17.

C) $3.65.

D) $0.29.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

37

The following information pertains to the mixing department of Carson Company for September 2006:

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows:

Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows:

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Cost of ending work-in-process is

A) $77,640.

B) $82,632.

C) $85,128.

D) $90,120.

The costs of work-in-process at September 1 for the mixing department were as follows:

The costs of work-in-process at September 1 for the mixing department were as follows: Costs added by the mixing department during September were as follows:

Costs added by the mixing department during September were as follows: Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.

Using the above information and the weighted average method, answer the following items regarding the mixing department for September 2006.Cost of ending work-in-process is

A) $77,640.

B) $82,632.

C) $85,128.

D) $90,120.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

38

Chen Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The total cost of units completed and transferred to Finishing is

A) $2,112,000.

B) $2,140,000.

C) $1,848,000.

D) $352,000.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The total cost of units completed and transferred to Finishing is

A) $2,112,000.

B) $2,140,000.

C) $1,848,000.

D) $352,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

39

Ankenbauer Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The equivalent units for materials are

A) 336,000.

B) 400,000.

C) 384,000.

D) 64,000.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The equivalent units for materials are

A) 336,000.

B) 400,000.

C) 384,000.

D) 64,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

40

Chen Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The equivalent units for conversion costs are

A) 200,000.

B) 168,000.

C) 192,000.

D) 32,000.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 200,000 units started in production 168,000 were completed and transferred to the Finishing department, while 32,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The equivalent units for conversion costs are

A) 200,000.

B) 168,000.

C) 192,000.

D) 32,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

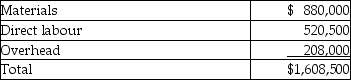

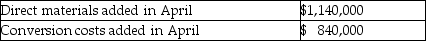

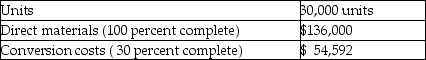

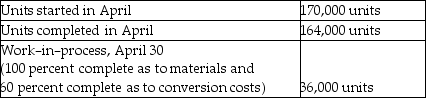

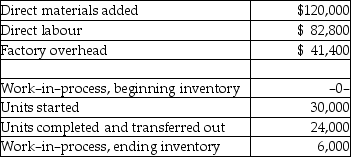

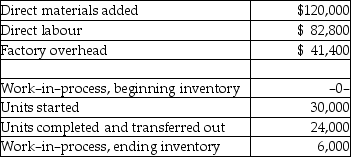

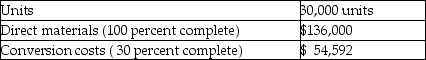

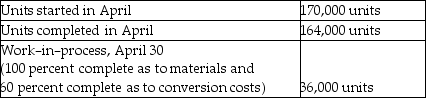

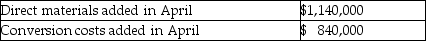

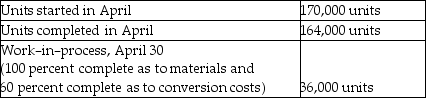

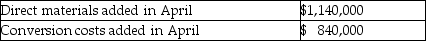

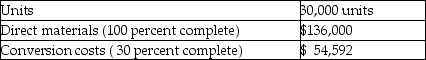

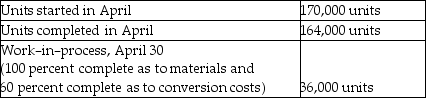

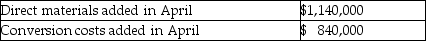

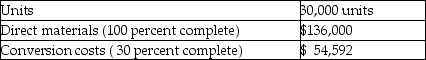

41

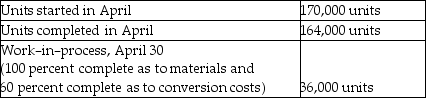

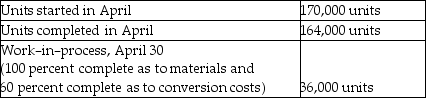

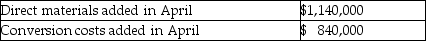

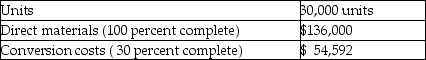

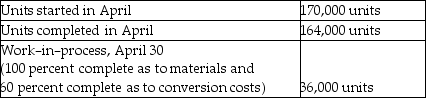

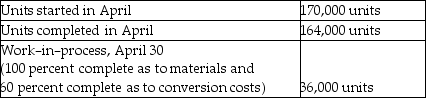

Fan Corporation manufactures snowboards. Material is introduced at the beginning of the process in the Assembly department. Conversion costs are applied uniformly throughout the process. The weighted-average method of product costing is used. Data for the Assembly department for the month of April, 20X1 follow:

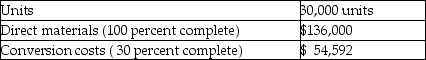

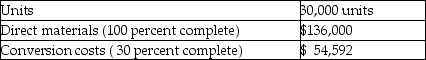

Work-in-process, April 1.

The total cost of goods transferred out of the Assembly department is

A) $2,170,592.

B) $1,836,800.

C) $1,904,000.

D) $1,980,000.

Work-in-process, April 1.

The total cost of goods transferred out of the Assembly department is

A) $2,170,592.

B) $1,836,800.

C) $1,904,000.

D) $1,980,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

42

Fan Corporation manufactures snowboards. Material is introduced at the beginning of the process in the Assembly department. Conversion costs are applied uniformly throughout the process. The weighted-average method of product costing is used. Data for the Assembly department for the month of April, 20X1 follow:

Work-in-process, April 1.

The equivalent units for materials are

A) 164,000.

B) 194,000.

C) 200,000.

D) 206,000.

Work-in-process, April 1.

The equivalent units for materials are

A) 164,000.

B) 194,000.

C) 200,000.

D) 206,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

43

Ankenbauer Company manufactures keyboards in a two-department process, Assembly and Finishing. Information on the first department, Assembly, follows:

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

The total cost of ending work-in-process inventory is

A) $704,000.

B) $584,000.

C) $528,000.

D) $480,000.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.

There was no beginning inventory, and of the 400,000 units started in production 336,000 were completed and transferred to the Finishing department, while 64,000 units were still in process. These units had all materials added but were only 75 percent complete as far as conversion costs.The total cost of ending work-in-process inventory is

A) $704,000.

B) $584,000.

C) $528,000.

D) $480,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

44

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

What is the unit cost of direct materials?

A) $5.00

B) $4.33

C) $4.00

D) $1.00

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.What is the unit cost of direct materials?

A) $5.00

B) $4.33

C) $4.00

D) $1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

45

Fan Corporation manufactures snowboards. Material is introduced at the beginning of the process in the Assembly department. Conversion costs are applied uniformly throughout the process. The weighted-average method of product costing is used. Data for the Assembly department for the month of April, 20X1 follow:

Work-in-process, April 1.

Under process costing, the method of handling beginning work-in-process inventory that is almost never used in practice is

A) weighted-average.

B) FIFO.

C) last-in, first-out.

D) specific identification.

Work-in-process, April 1.

Under process costing, the method of handling beginning work-in-process inventory that is almost never used in practice is

A) weighted-average.

B) FIFO.

C) last-in, first-out.

D) specific identification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

46

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

In a production-cost report, the total costs accounted for is equal to the cost of units completed and transferred plus the cost of

A) beginning work-in-process.

B) the units started and finished.

C) the units completed but still on hand.

D) ending work-in-process.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.In a production-cost report, the total costs accounted for is equal to the cost of units completed and transferred plus the cost of

A) beginning work-in-process.

B) the units started and finished.

C) the units completed but still on hand.

D) ending work-in-process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

47

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

In process costing, the journal entry to record direct materials used would include a

A) credit to Direct-Materials Inventory.

B) debit to Cost of Goods Sold.

C) credit to Work-in-processDepartment Name.

D) debit to Finished Goods.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.In process costing, the journal entry to record direct materials used would include a

A) credit to Direct-Materials Inventory.

B) debit to Cost of Goods Sold.

C) credit to Work-in-processDepartment Name.

D) debit to Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

48

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The weighted-average process-costing method adds the cost of all work done in the current period to the

A) work done in the preceding period on the current period's beginning inventory of work-in-process.

B) the ending inventory of work-in-process.

C) all costs estimated to be incurred in the next department.

D) the work done in the preceding department on the current period's ending inventory of work-in-process.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The weighted-average process-costing method adds the cost of all work done in the current period to the

A) work done in the preceding period on the current period's beginning inventory of work-in-process.

B) the ending inventory of work-in-process.

C) all costs estimated to be incurred in the next department.

D) the work done in the preceding department on the current period's ending inventory of work-in-process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

49

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The cost of the ending work-in-process inventory is

A) $40,200.

B) $51,000.

C) $30,600.

D) $61,050.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The cost of the ending work-in-process inventory is

A) $40,200.

B) $51,000.

C) $30,600.

D) $61,050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

50

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

In process costing, the journal entry to record direct labour would include a

A) debit to Accrued Payroll.

B) credit to Factory Overhead.

C) debit to Work-in-processDepartment Name.

D) credit to Finished Goods.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.In process costing, the journal entry to record direct labour would include a

A) debit to Accrued Payroll.

B) credit to Factory Overhead.

C) debit to Work-in-processDepartment Name.

D) credit to Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

51

Fan Corporation manufactures snowboards. Material is introduced at the beginning of the process in the Assembly department. Conversion costs are applied uniformly throughout the process. The weighted-average method of product costing is used. Data for the Assembly department for the month of April, 20X1 follow:

Work-in-process, April 1.

The unit cost for conversion costs is

A) $4.53.

B) $5.45.

C) $5.07.

D) $4.82.

Work-in-process, April 1.

The unit cost for conversion costs is

A) $4.53.

B) $5.45.

C) $5.07.

D) $4.82.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

52

Fan Corporation manufactures snowboards. Material is introduced at the beginning of the process in the Assembly department. Conversion costs are applied uniformly throughout the process. The weighted-average method of product costing is used. Data for the Assembly department for the month of April, 20X1 follow:

Work-in-process, April 1.

The total cost of the ending work-in-process is

A) $403,200.

B) $241,920.

C) $333,792.

D) $342,720.

Work-in-process, April 1.

The total cost of the ending work-in-process is

A) $403,200.

B) $241,920.

C) $333,792.

D) $342,720.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

53

Fan Corporation manufactures snowboards. Material is introduced at the beginning of the process in the Assembly department. Conversion costs are applied uniformly throughout the process. The weighted-average method of product costing is used. Data for the Assembly department for the month of April, 20X1 follow:

Work-in-process, April 1.

The unit cost for materials is

A) $5.70.

B) $6.95.

C) $7.78.

D) $6.38.

Work-in-process, April 1.

The unit cost for materials is

A) $5.70.

B) $6.95.

C) $7.78.

D) $6.38.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

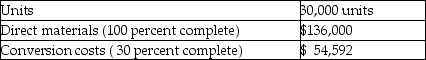

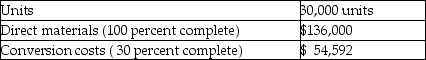

54

Kirkpatrick Company uses a process-cost system with the FIFO method of accounting for beginning inventories. Materials are added at the beginning of the process, and conversion costs are incurred uniformly. Work-in-process at the beginning is assumed to be 40 percent complete and at the end to be 70 percent complete. Additional data follow:

The unit cost for materials is

A) $1.62.

B) $1.47.

C) $1.17.

D) $1.30.

The unit cost for materials is

A) $1.62.

B) $1.47.

C) $1.17.

D) $1.30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

55

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

What is the unit cost of conversion costs?

A) $ .88

B) $5.18

C) $4.14

D) $4.50

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.What is the unit cost of conversion costs?

A) $ .88

B) $5.18

C) $4.14

D) $4.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

56

Kirkpatrick Company uses a process-cost system with the FIFO method of accounting for beginning inventories. Materials are added at the beginning of the process, and conversion costs are incurred uniformly. Work-in-process at the beginning is assumed to be 40 percent complete and at the end to be 70 percent complete. Additional data follow:

The equivalent units for conversion costs are

A) 130,000.

B) 144,000.

C) 116,000.

D) 135,600.

The equivalent units for conversion costs are

A) 130,000.

B) 144,000.

C) 116,000.

D) 135,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

57

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The total cost of units completed and transferred is

A) $45,120.

B) $244,200.

C) $204,000.

D) $228,000.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.The total cost of units completed and transferred is

A) $45,120.

B) $244,200.

C) $204,000.

D) $228,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

58

Kirkpatrick Company uses a process-cost system with the FIFO method of accounting for beginning inventories. Materials are added at the beginning of the process, and conversion costs are incurred uniformly. Work-in-process at the beginning is assumed to be 40 percent complete and at the end to be 70 percent complete. Additional data follow:

The equivalent units for materials are

A) 130,000.

B) 144,000.

C) 116,000.

D) 135,600.

The equivalent units for materials are

A) 130,000.

B) 144,000.

C) 116,000.

D) 135,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

59

Edwards Company produces calendars in a one-department process. The following information is available:

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

In process costing, the journal entry to record factory overhead applied would include a

A) debit to Factory Overhead.

B) debit to Work-in-processDepartment Name.

C) credit to Cost of Goods Sold.

D) credit to Finished Goods.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.

The units still in process are 100 percent complete with respect to direct materials and 60 percent complete with respect to conversion costs.In process costing, the journal entry to record factory overhead applied would include a

A) debit to Factory Overhead.

B) debit to Work-in-processDepartment Name.

C) credit to Cost of Goods Sold.

D) credit to Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fan Corporation manufactures snowboards. Material is introduced at the beginning of the process in the Assembly department. Conversion costs are applied uniformly throughout the process. The weighted-average method of product costing is used. Data for the Assembly department for the month of April, 20X1 follow:

Work-in-process, April 1.

The equivalent units for conversion costs are

A) 200,000.

B) 185,600.

C) 176,600.

D) 164,000.

Work-in-process, April 1.

The equivalent units for conversion costs are

A) 200,000.

B) 185,600.

C) 176,600.

D) 164,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

61

A hybrid-costing system often used for batch or group manufacturing of goods that have some common characteristic plus some individual characteristics is called

A) job-order costing.

B) process costing.

C) operation costing.

D) backflush costing.

A) job-order costing.

B) process costing.

C) operation costing.

D) backflush costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

62

A report that summarizes the manufacturing activity for a department during a period and discloses physical flow, equivalent units, total costs to account for, unit cost computation, and costs assigned to goods transferred out and to units in ending work-in-process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

63

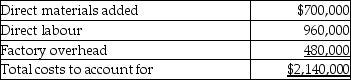

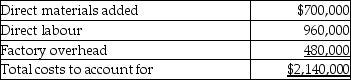

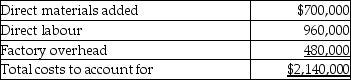

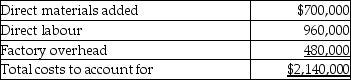

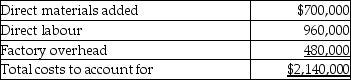

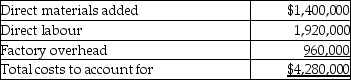

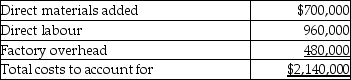

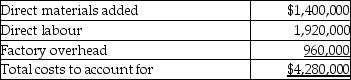

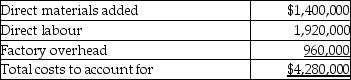

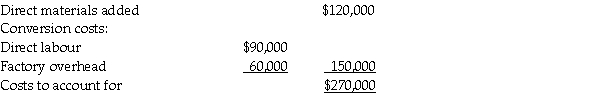

The manufacturing costs of the Assembly department for the month of June are as follows:  The cost of goods completed and transferred to finished goods was $231,500 in June.

The cost of goods completed and transferred to finished goods was $231,500 in June.

Required: Prepare summary journal entries for the use of direct materials, direct labour and factory overhead applied. Also prepare a journal entry for the transfer of goods completed.

The cost of goods completed and transferred to finished goods was $231,500 in June.

The cost of goods completed and transferred to finished goods was $231,500 in June.Required: Prepare summary journal entries for the use of direct materials, direct labour and factory overhead applied. Also prepare a journal entry for the transfer of goods completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

64

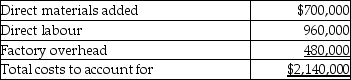

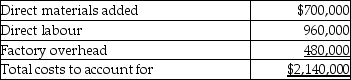

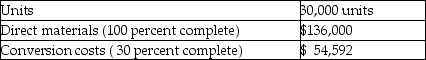

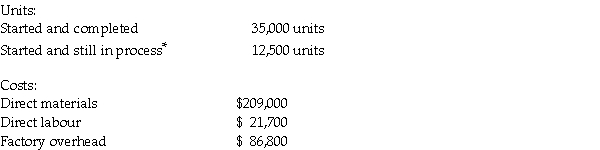

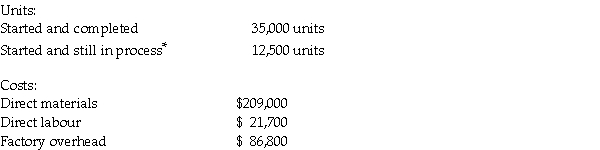

Lowden Company produces one product in a process-costing system involving several departments. The first department's costs and output for the month of June are as follows:

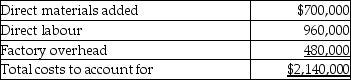

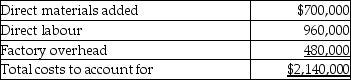

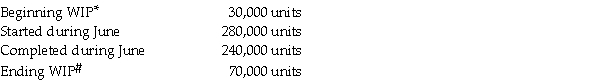

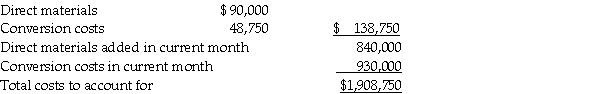

Units: Costs:

Costs:

Beginning WIP: *100 percent completed for materials, 40 percent completed for conversion costs

*100 percent completed for materials, 40 percent completed for conversion costs

#100 percent completed for materials, 30 percent completed for conversion costs

Required: Compute the cost of work completed and the cost of the ending inventory of work-in-process using the weighted-average method.

Units:

Costs:

Costs:Beginning WIP:

*100 percent completed for materials, 40 percent completed for conversion costs

*100 percent completed for materials, 40 percent completed for conversion costs#100 percent completed for materials, 30 percent completed for conversion costs

Required: Compute the cost of work completed and the cost of the ending inventory of work-in-process using the weighted-average method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

65

Kirkpatrick Company uses a process-cost system with the FIFO method of accounting for beginning inventories. Materials are added at the beginning of the process, and conversion costs are incurred uniformly. Work-in-process at the beginning is assumed to be 40 percent complete and at the end to be 70 percent complete. Additional data follow:

The unit cost for conversion costs is

A) $1.05.

B) $0.80.

C) $0.72.

D) $0.95.

The unit cost for conversion costs is

A) $1.05.

B) $0.80.

C) $0.72.

D) $0.95.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

66

Backflush costing provides reasonably accurate product costs if

A) materials inventories are high and production cycle times are short.

B) materials inventories are low and production cycle times are short.

C) materials inventories are low and production cycle times are long.

D) materials inventories are high and production cycle times are long.

A) materials inventories are high and production cycle times are short.

B) materials inventories are low and production cycle times are short.

C) materials inventories are low and production cycle times are long.

D) materials inventories are high and production cycle times are long.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

67

A method of process manufacturing in which subunits pass through different sequential processes before being brought together in a final process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

68

An accounting system that applies costs to products only when the production is complete is referred to as

A) operation costing.

B) process costing.

C) job-order costing.

D) backflush costing.

A) operation costing.

B) process costing.

C) job-order costing.

D) backflush costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

69

In backflush costing, the journal entry to record the cost of goods sold during the period would include a

A) debit to Finished Goods Inventory.

B) debit to Conversion Costs.

C) credit to Work-in-process.

D) debit to Cost of Goods Sold.

A) debit to Finished Goods Inventory.

B) debit to Conversion Costs.

C) credit to Work-in-process.

D) debit to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

70

A unit-costing method that excludes prior-period work and costs in computing current-period unit work and costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

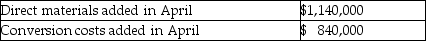

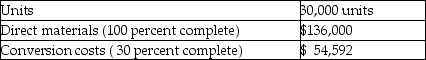

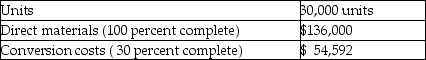

71

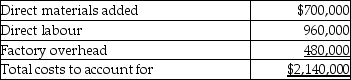

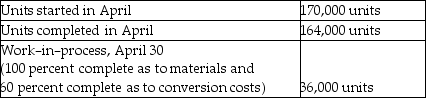

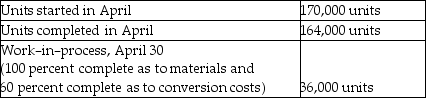

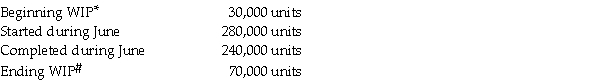

Josef Company makes a variety of chemicals. Its Mixing department had the following information regarding costs and output:  *Direct materials: 100 percent complete; Conversion costs: 30 percent complete

*Direct materials: 100 percent complete; Conversion costs: 30 percent complete

Required: Compute the cost of work completed and the cost of the ending WIP inventory.

*Direct materials: 100 percent complete; Conversion costs: 30 percent complete

*Direct materials: 100 percent complete; Conversion costs: 30 percent completeRequired: Compute the cost of work completed and the cost of the ending WIP inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

72

In backflush costing, the journal entry to record the costs of completed production would include a

A) debit to Conversion Costs.

B) credit to Accounts Payable.

C) debit to Finished Goods Inventory.

D) credit to Work-in-process.

A) debit to Conversion Costs.

B) credit to Accounts Payable.

C) debit to Finished Goods Inventory.

D) credit to Work-in-process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

73

Kirkpatrick Company uses a process-cost system with the FIFO method of accounting for beginning inventories. Materials are added at the beginning of the process, and conversion costs are incurred uniformly. Work-in-process at the beginning is assumed to be 40 percent complete and at the end to be 70 percent complete. Additional data follow:

The total cost of the units completed and transferred is

A) $295,920.

B) $306,840.

C) $289,200.

D) $298,840.

The total cost of the units completed and transferred is

A) $295,920.

B) $306,840.

C) $289,200.

D) $298,840.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

74

The expression of a department's processing activity in terms of fully completed units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

75

All of the following are examples of products that would be accounted for using operation costing EXCEPT

A) personal computers.

B) clothing.

C) semiconductors.

D) airplanes.

A) personal computers.

B) clothing.

C) semiconductors.

D) airplanes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following classifications vanish as a result of operation costing?

A) Direct labour only

B) Direct materials only

C) Direct materials and factory overhead

D) Direct labour and factory overhead

A) Direct labour only

B) Direct materials only

C) Direct materials and factory overhead

D) Direct labour and factory overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

77

A method of process manufacturing in which units flow from one process to another in a sequential pattern.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

78

Kirkpatrick Company uses a process-cost system with the FIFO method of accounting for beginning inventories. Materials are added at the beginning of the process, and conversion costs are incurred uniformly. Work-in-process at the beginning is assumed to be 40 percent complete and at the end to be 70 percent complete. Additional data follow:

The total cost of the units still in process is

A) $52,080.

B) $58,800.

C) $41,160.

D) $49,160.

The total cost of the units still in process is

A) $52,080.

B) $58,800.

C) $41,160.

D) $49,160.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

79

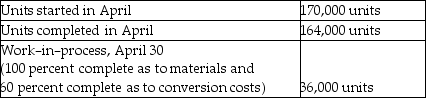

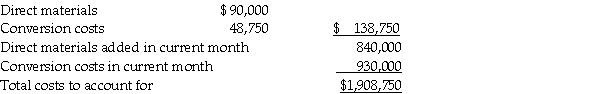

Lee Stevens makes frozen pizzas. All direct materials are introduced at the start of the process. Conversion costs are incurred evenly throughout the process. In January there was no beginning WIP inventory, but 690,000 units were started, completed and transferred to finished goods inventory. At January 31 there were 165,000 units still in process at the 70 percent stage of completion. Total costs incurred during January amounted to $1,068,750 for materials and $402,750 for conversion costs.

Required: Prepare a production-cost report for January.

Required: Prepare a production-cost report for January.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

80

In backflush costing, any remaining balance in the conversion costs account at the end of an accounting period is charged to

A) Cost of Goods Sold.

B) Work-in-process.

C) Finished Goods Inventory.

D) Cost of Goods Sold, WIP and Finished Goods Inventory proportionately.

A) Cost of Goods Sold.

B) Work-in-process.

C) Finished Goods Inventory.

D) Cost of Goods Sold, WIP and Finished Goods Inventory proportionately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck