Deck 6: Job-Costing Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

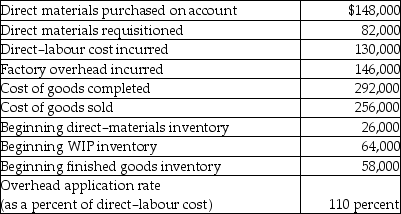

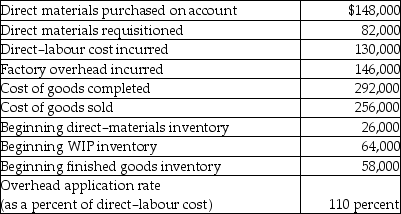

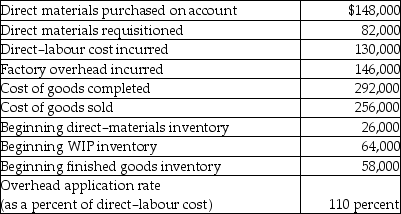

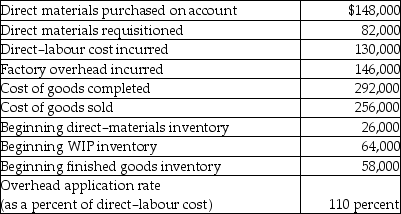

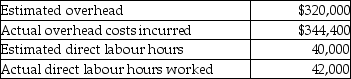

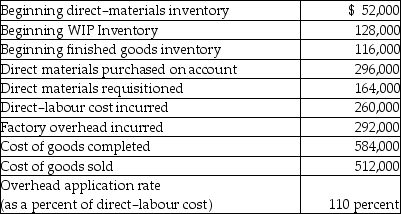

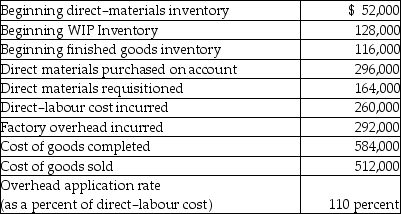

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

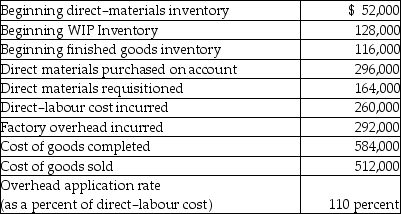

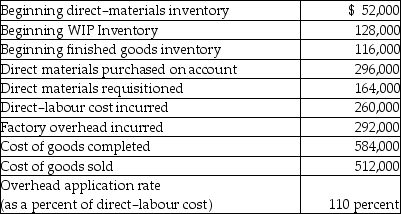

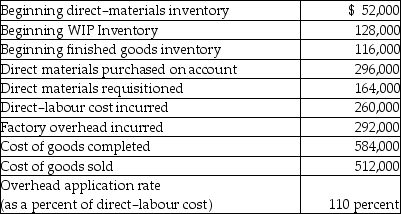

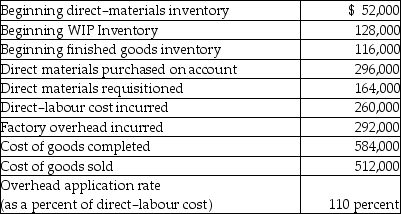

سؤال

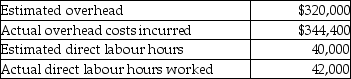

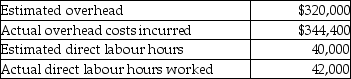

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

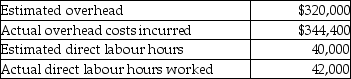

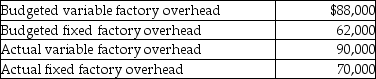

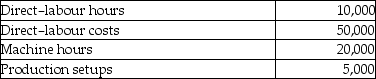

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/88

العب

ملء الشاشة (f)

Deck 6: Job-Costing Systems

1

Which of the following is a product cost?

A) Direct material costs

B) Selling costs

C) Distribution costs

D) Administrative costs

A) Direct material costs

B) Selling costs

C) Distribution costs

D) Administrative costs

A

2

Labour time tickets indicate the direct labour time worked by an individual on each job.

True

3

Material requisitions are used for recording

A) materials purchased.

B) materials issued and used in production.

C) materials on hand in the storeroom.

D) none of the above

A) materials purchased.

B) materials issued and used in production.

C) materials on hand in the storeroom.

D) none of the above

B

4

The centrepiece of a job-costing system is the

A) materials requisition form.

B) job-cost record.

C) labour time ticket.

D) budgeted overhead rate.

A) materials requisition form.

B) job-cost record.

C) labour time ticket.

D) budgeted overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

5

Two extremes of product costing are job-order costing and normal costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

6

The most widely used approach in disposing of an overhead variance is proration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

7

A unique individual product would be better accounted for using a

A) process costing system.

B) period costing system.

C) product costing system.

D) job-order costing system.

A) process costing system.

B) period costing system.

C) product costing system.

D) job-order costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following industries is most likely to NOT use a process costing system?

A) Chemicals

B) Plastics

C) Furniture

D) Meat packing

A) Chemicals

B) Plastics

C) Furniture

D) Meat packing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following industries is most likely to NOT use a job-order costing system?

A) Construction

B) Chemicals

C) Aircraft

D) Printing

A) Construction

B) Chemicals

C) Aircraft

D) Printing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

10

A job-order cost system associates costs with particular jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

11

The entry to record the requisition of direct materials would include a debit to WIP Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

12

The work-in-process account will have a balance only if there is unfinished work in the factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

13

The proration method of disposing of overhead variances prorates the variance among three accounts including Direct-Materials Inventory, WIP Inventory and Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements regarding process costing is FALSE?

A) Process costing deals with great masses of like units.

B) Process costing is an averaging process.

C) In process costing the measure of production is small, whereas in job-order costing the measure of production is large.

D) Process costing is one of the extremes of product costing.

A) Process costing deals with great masses of like units.

B) Process costing is an averaging process.

C) In process costing the measure of production is small, whereas in job-order costing the measure of production is large.

D) Process costing is one of the extremes of product costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

15

Most firms use actual costing because it provides product cost information on a timely basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

16

A job-order cost system is especially appropriate for situations where basically similar units flow through production on a fairly continuous basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

17

Materials inventory, work in process, and cost of goods sold would appear in the asset section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

18

In nonprofit organizations, the product is usually called a program or a class of service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

19

Job-order costing can be used only in manufacturing environments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

20

Product costs appear as cost of goods sold in income statements and as finished-goods inventory values in balance sheets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

21

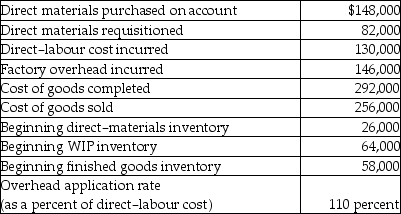

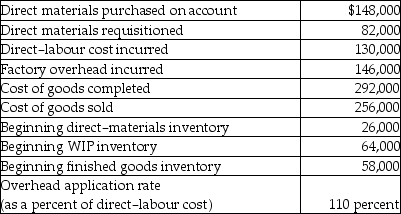

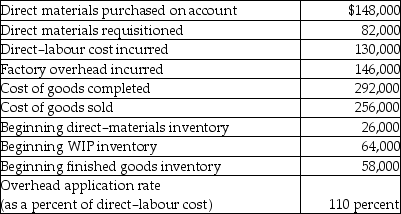

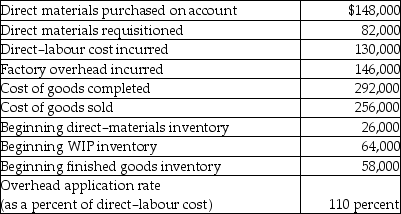

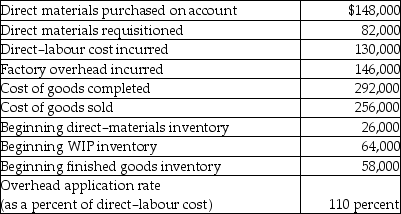

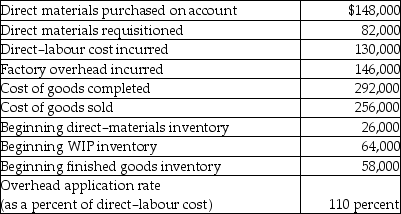

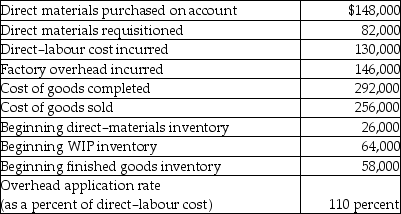

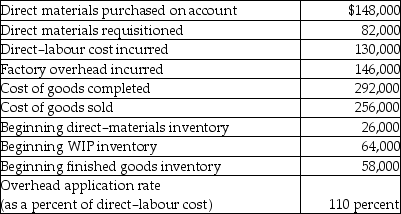

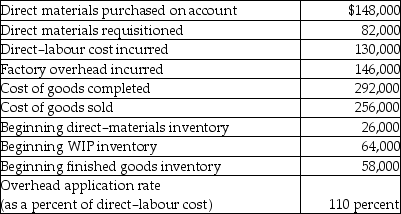

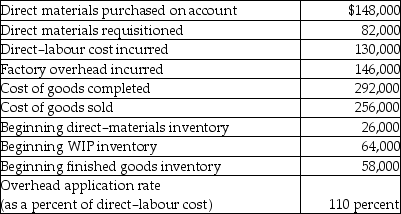

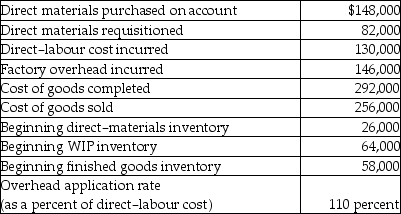

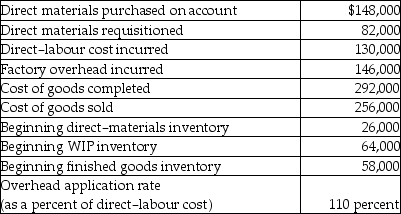

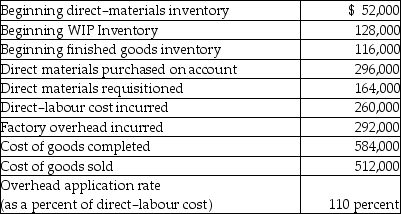

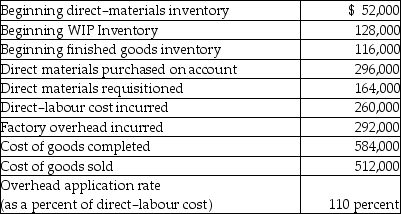

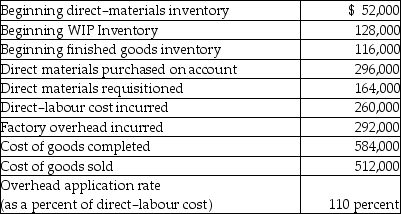

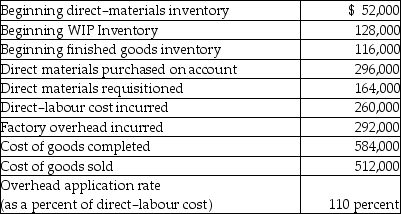

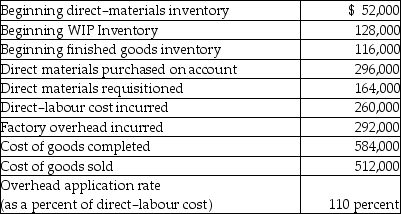

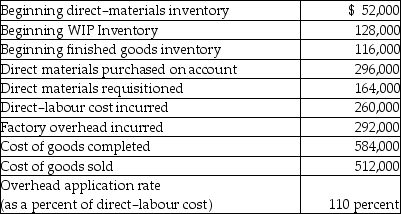

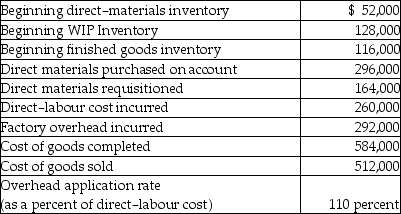

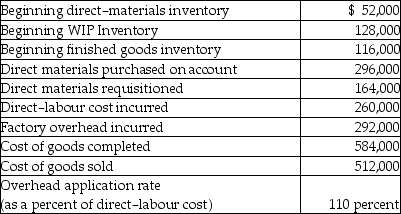

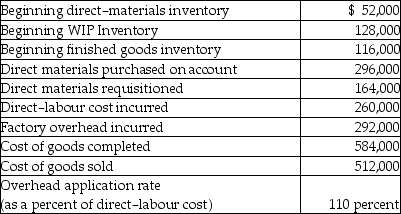

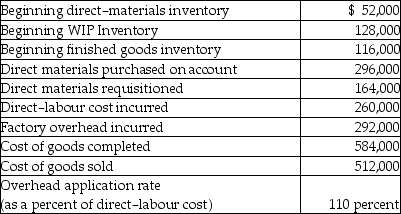

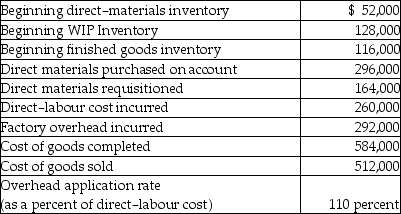

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The ending inventory of finished goods is

A) $58,000.

B) $36,000.

C) $94,000.

D) $292,000.

The ending inventory of finished goods is

A) $58,000.

B) $36,000.

C) $94,000.

D) $292,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

22

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The ending inventory of direct materials is

A) $92,000.

B) $174,000.

C) $82,000.

D) $108,000.

The ending inventory of direct materials is

A) $92,000.

B) $174,000.

C) $82,000.

D) $108,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

23

The overhead costs of a given period might appear in all of the following EXCEPT

A) materials inventory.

B) work in process.

C) finished goods.

D) cost of goods sold.

A) materials inventory.

B) work in process.

C) finished goods.

D) cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

24

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The journal entry to record the application of the factory overhead would include a

A) debit to Factory Department Overhead Control for $143,000.

B) debit to WIP Inventory for $143,000.

C) credit to Factory Department Overhead Control for $146,000.

D) credit to WIP Inventory for $146,000.

The journal entry to record the application of the factory overhead would include a

A) debit to Factory Department Overhead Control for $143,000.

B) debit to WIP Inventory for $143,000.

C) credit to Factory Department Overhead Control for $146,000.

D) credit to WIP Inventory for $146,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

25

A department that is equipment intensive would most likely use a budgeted factory overhead rate based on which of the following cost drivers:

A) machine hours

B) direct labour hours

C) direct labour cost

D) units of direct labour used

A) machine hours

B) direct labour hours

C) direct labour cost

D) units of direct labour used

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

26

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The journal entry to record the cost of goods completed would include a

A) debit to WIP Inventory for $256,000.

B) credit to Finished Goods Inventory for $292,000.

C) credit to Cost of Goods Sold for $256,000.

D) credit to WIP Inventory for $292,000.

The journal entry to record the cost of goods completed would include a

A) debit to WIP Inventory for $256,000.

B) credit to Finished Goods Inventory for $292,000.

C) credit to Cost of Goods Sold for $256,000.

D) credit to WIP Inventory for $292,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

27

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The journal entry to record the sale of all jobs would include a

A) debit to Finished Goods Inventory for $292,000.

B) credit to WIP Inventory for $256,000.

C) credit to Finished Goods Inventory for $256,000.

D) credit to Cost of Goods Sold for $292,000.

The journal entry to record the sale of all jobs would include a

A) debit to Finished Goods Inventory for $292,000.

B) credit to WIP Inventory for $256,000.

C) credit to Finished Goods Inventory for $256,000.

D) credit to Cost of Goods Sold for $292,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

28

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The ending inventory of work in process is

A) $130,000.

B) $127,000.

C) $64,000.

D) $36,000.

The ending inventory of work in process is

A) $130,000.

B) $127,000.

C) $64,000.

D) $36,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

29

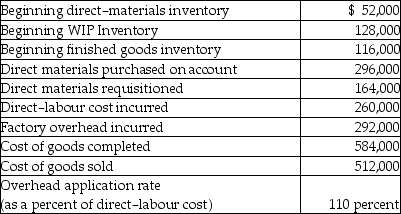

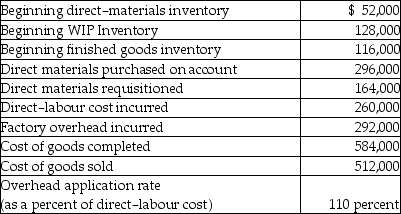

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The journal entry to record the sale of all jobs would include a

A) debit to Finished Goods Inventory for $584,000.

B) credit to WIP Inventory for $512,000.

C) credit to Finished Goods Inventory for $512,000.

D) credit to Cost of Goods Sold for $584,000.

The journal entry to record the sale of all jobs would include a

A) debit to Finished Goods Inventory for $584,000.

B) credit to WIP Inventory for $512,000.

C) credit to Finished Goods Inventory for $512,000.

D) credit to Cost of Goods Sold for $584,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

30

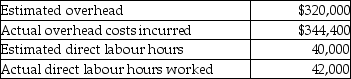

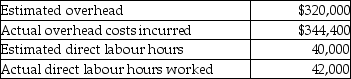

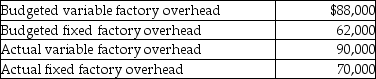

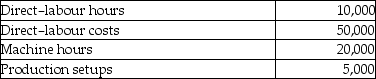

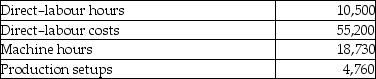

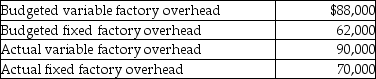

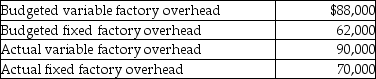

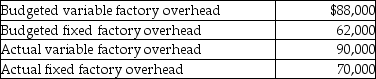

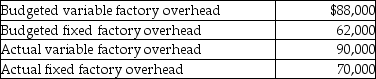

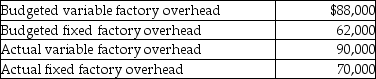

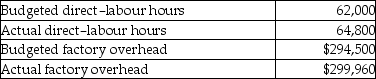

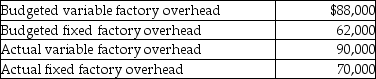

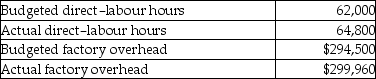

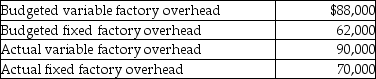

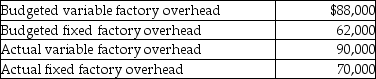

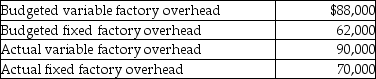

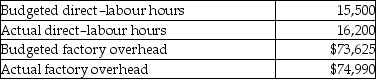

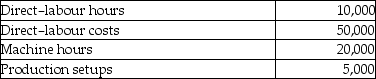

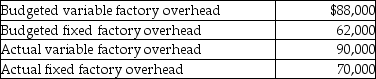

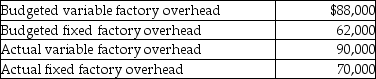

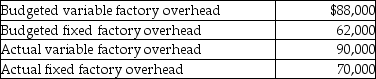

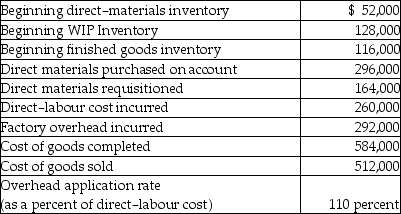

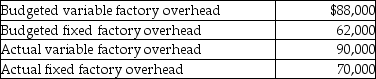

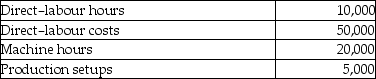

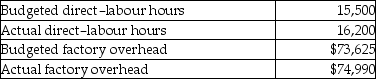

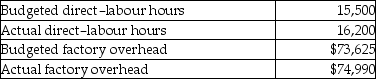

Use the following information to answer the following item(s).

The budgeted factory overhead rate for applying manufacturing overhead would be

A) $7.62.

B) $8.00.

C) $8.20.

D) $8.61.

The budgeted factory overhead rate for applying manufacturing overhead would be

A) $7.62.

B) $8.00.

C) $8.20.

D) $8.61.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

31

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The ending inventory of direct materials is

A) $184,000.

B) $348,000.

C) $164,000.

D) $216,000.

The ending inventory of direct materials is

A) $184,000.

B) $348,000.

C) $164,000.

D) $216,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

32

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The journal entry to record the application of the factory overhead would include a

A) debit to Factory Department Overhead Control for $286,000.

B) debit to WIP Inventory for $286,000.

C) credit to Factory Department Overhead Control for $292,000.

D) credit to WIP Inventory for $292,000.

The journal entry to record the application of the factory overhead would include a

A) debit to Factory Department Overhead Control for $286,000.

B) debit to WIP Inventory for $286,000.

C) credit to Factory Department Overhead Control for $292,000.

D) credit to WIP Inventory for $292,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

33

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The journal entry to record the factory overhead costs incurred would include a

A) debit to Factory Department Overhead Control for $292,000.

B) credit to Factory Department Overhead Control for $286,000.

C) debit to WIP Inventory for $292,000.

D) credit to WIP Inventory for $286,000.

The journal entry to record the factory overhead costs incurred would include a

A) debit to Factory Department Overhead Control for $292,000.

B) credit to Factory Department Overhead Control for $286,000.

C) debit to WIP Inventory for $292,000.

D) credit to WIP Inventory for $286,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

34

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The journal entry to record the materials placed into production would include a

A) credit to Direct-Materials Inventory for $82,000.

B) debit to Direct-Materials Inventory for $148,000.

C) credit to WIP Inventory for $82,000.

D) debit to WIP Inventory for $148,000.

The journal entry to record the materials placed into production would include a

A) credit to Direct-Materials Inventory for $82,000.

B) debit to Direct-Materials Inventory for $148,000.

C) credit to WIP Inventory for $82,000.

D) debit to WIP Inventory for $148,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

35

Witty, Inc. uses a job-order cost system and had the following data available for 20X1.

The journal entry to record the factory overhead costs incurred would include a

A) debit to Factory Department Overhead Control for $146,000.

B) credit to Factory Department Overhead Control for $143,000.

C) debit to WIP Inventory for $146,000.

D) credit to WIP Inventory for $143,000.

The journal entry to record the factory overhead costs incurred would include a

A) debit to Factory Department Overhead Control for $146,000.

B) credit to Factory Department Overhead Control for $143,000.

C) debit to WIP Inventory for $146,000.

D) credit to WIP Inventory for $143,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

36

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The journal entry to record the materials placed into production would include a

A) credit to Direct-Materials Inventory for $164,000.

B) debit to Direct-Materials Inventory for $296,000.

C) credit to WIP Inventory for $164,000.

D) debit to WIP Inventory for $296,000.

The journal entry to record the materials placed into production would include a

A) credit to Direct-Materials Inventory for $164,000.

B) debit to Direct-Materials Inventory for $296,000.

C) credit to WIP Inventory for $164,000.

D) debit to WIP Inventory for $296,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information to answer the following item(s).

The amount of the overhead variance would be

A) $24,400 overapplied.

B) $24,400 underapplied.

C) $8,400 overapplied.

D) $8,400 underapplied.

The amount of the overhead variance would be

A) $24,400 overapplied.

B) $24,400 underapplied.

C) $8,400 overapplied.

D) $8,400 underapplied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

38

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The journal entry to record the cost of goods completed would include a

A) debit to WIP Inventory for $512,000.

B) credit to Finished Goods Inventory for $584,000.

C) credit to Cost of Goods Sold for $512,000.

D) credit to WIP Inventory for $584,000.

The journal entry to record the cost of goods completed would include a

A) debit to WIP Inventory for $512,000.

B) credit to Finished Goods Inventory for $584,000.

C) credit to Cost of Goods Sold for $512,000.

D) credit to WIP Inventory for $584,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the following information to answer the following item(s).

If the budgeted factory overhead rate is used to apply overhead, applied manufacturing overhead would be

A) $321,000.

B) $328,000.

C) $336,000.

D) $344,400.

If the budgeted factory overhead rate is used to apply overhead, applied manufacturing overhead would be

A) $321,000.

B) $328,000.

C) $336,000.

D) $344,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

40

Budgeted factory overhead rates are calculated as

A) budgeted total overhead/budgeted total activity.

B) estimated total overhead/actual total activity.

C) actual total overhead/actual total activity.

D) actual total overhead/estimated total activity.

A) budgeted total overhead/budgeted total activity.

B) estimated total overhead/actual total activity.

C) actual total overhead/actual total activity.

D) actual total overhead/estimated total activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

41

As managers seek more accurate product costing, overhead application solely on the basis of direct-labour hours or direct-labour cost is certain to

A) increase in popularity.

B) remain about as popular as it currently is.

C) decrease in popularity.

D) increase or decrease depending upon amounts involved.

A) increase in popularity.

B) remain about as popular as it currently is.

C) decrease in popularity.

D) increase or decrease depending upon amounts involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

42

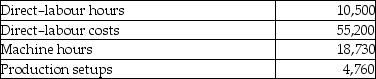

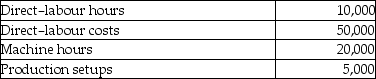

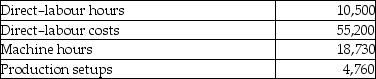

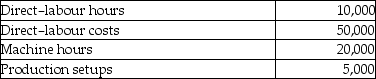

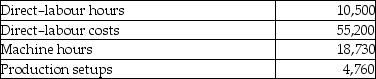

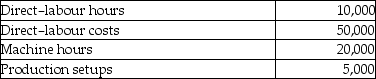

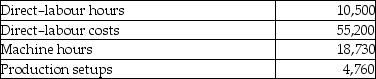

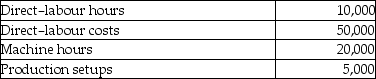

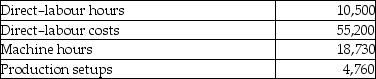

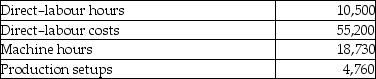

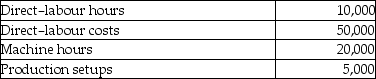

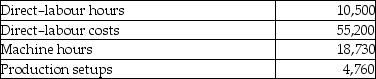

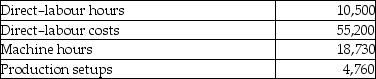

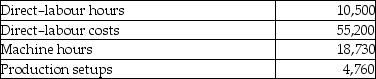

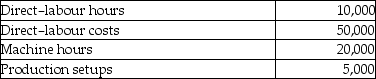

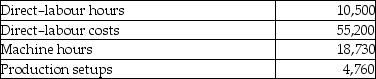

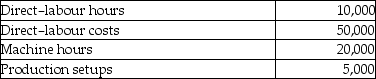

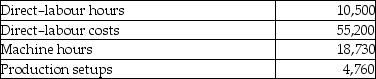

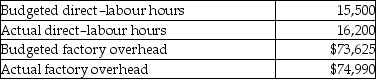

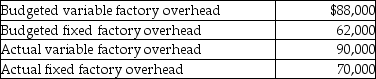

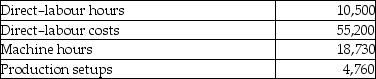

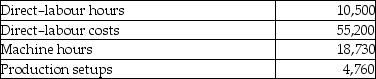

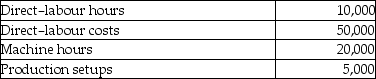

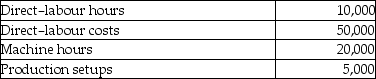

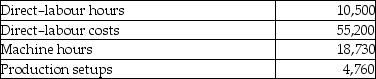

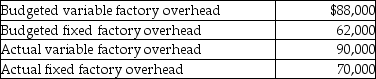

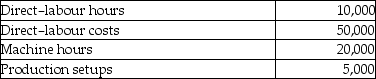

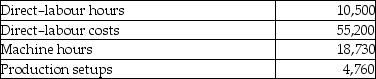

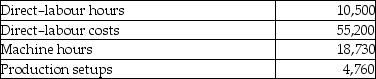

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

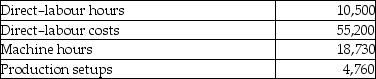

Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using direct-labour costs as the cost driver is

A) 272 percent.

B) 300 percent.

C) 320 percent.

D) 290 percent.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using direct-labour costs as the cost driver is

A) 272 percent.

B) 300 percent.

C) 320 percent.

D) 290 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is NOT a contributory cause of overhead variances?

A) Poor forecasting

B) Inefficient use of overhead items

C) Calendar variations, number of workdays in a month

D) Operating at the level of volume used as a denominator in calculating the budgeted overhead rate

A) Poor forecasting

B) Inefficient use of overhead items

C) Calendar variations, number of workdays in a month

D) Operating at the level of volume used as a denominator in calculating the budgeted overhead rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

44

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using production setups as the cost driver is

A) $31.51.

B) $32.00.

C) $30.00.

D) $33.61.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using production setups as the cost driver is

A) $31.51.

B) $32.00.

C) $30.00.

D) $33.61.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

45

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

To compute the budgeted factory-overhead rate, the budgeted cost driver is divided into the

A) actual factory overhead.

B) budgeted work-in-process.

C) estimated cost of goods sold.

D) budgeted total overhead.

To compute the budgeted factory-overhead rate, the budgeted cost driver is divided into the

A) actual factory overhead.

B) budgeted work-in-process.

C) estimated cost of goods sold.

D) budgeted total overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

46

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 100 used 838 direct-labour hours, the overhead applied using direct-labour hours as the cost driver should be

A) $11,972.

B) $12,570.

C) $13,408.

D) $12,770.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 100 used 838 direct-labour hours, the overhead applied using direct-labour hours as the cost driver should be

A) $11,972.

B) $12,570.

C) $13,408.

D) $12,770.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

47

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

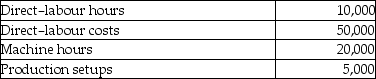

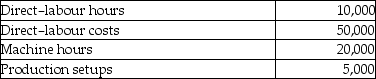

The following information was gathered for Barton Company for the year ended December 31, 20X1. Assume that direct-labour hours is the cost driver. What is the budgeted factory-overhead rate?

Assume that direct-labour hours is the cost driver. What is the budgeted factory-overhead rate?

A) $4.63

B) $4.54

C) $4.75

D) $4.84

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

The following information was gathered for Barton Company for the year ended December 31, 20X1.

Assume that direct-labour hours is the cost driver. What is the budgeted factory-overhead rate?

Assume that direct-labour hours is the cost driver. What is the budgeted factory-overhead rate?A) $4.63

B) $4.54

C) $4.75

D) $4.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

48

A normal costing system uses the following:

A) actual direct material, actual direct labour, and actual overhead.

B) actual direct material, actual direct labour, and applied overhead.

C) actual direct material, applied direct labour, and actual overhead.

D) applied direct material, applied direct labour, and actual overhead.

A) actual direct material, actual direct labour, and actual overhead.

B) actual direct material, actual direct labour, and applied overhead.

C) actual direct material, applied direct labour, and actual overhead.

D) applied direct material, applied direct labour, and actual overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

49

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 400 used 230 production setups, the overhead applied using production setups as the cost driver should be

A) $6,900.

B) $7,248.

C) $7,360.

D) $7,730.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 400 used 230 production setups, the overhead applied using production setups as the cost driver should be

A) $6,900.

B) $7,248.

C) $7,360.

D) $7,730.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

50

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using direct-labour hours as the cost driver is

A) $16.00.

B) $14.29.

C) $15.00.

D) $15.24.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using direct-labour hours as the cost driver is

A) $16.00.

B) $14.29.

C) $15.00.

D) $15.24.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

51

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The ending inventory of work in process is

A) $260,000.

B) $254,000.

C) $128,000.

D) $72,000.

The ending inventory of work in process is

A) $260,000.

B) $254,000.

C) $128,000.

D) $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

52

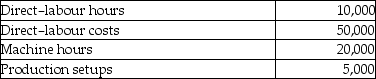

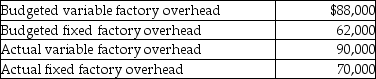

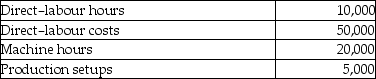

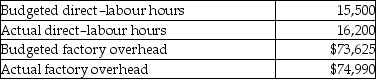

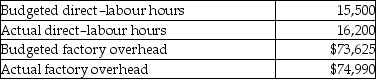

The following information was gathered for Larsen Company for the year ended December 31, 20X1.

Assume that direct-labour hours is the cost driver. What is the amount of factory overhead applied?

A) $73,625

B) $76,950

C) $71,765

D) $74,990

Assume that direct-labour hours is the cost driver. What is the amount of factory overhead applied?

A) $73,625

B) $76,950

C) $71,765

D) $74,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

53

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using machine hours as the cost driver is

A) $8.00.

B) $8.01.

C) $8.54.

D) $7.50.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

The budgeted factory-overhead rate using machine hours as the cost driver is

A) $8.00.

B) $8.01.

C) $8.54.

D) $7.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

54

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 300 used 2,558 machine hours, the overhead applied using machine hours as the cost driver should be

A) $20,490.

B) $20,464.

C) $21,846.

D) $19,185.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 300 used 2,558 machine hours, the overhead applied using machine hours as the cost driver should be

A) $20,490.

B) $20,464.

C) $21,846.

D) $19,185.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

55

The following information was gathered for Larsen Company for the year ended December 31, 20X1.

Assume that direct-labour hours is the cost driver. What is the budgeted factory-overhead rate?

A) $4.75

B) $4.63

C) $4.54

D) $4.84

Assume that direct-labour hours is the cost driver. What is the budgeted factory-overhead rate?

A) $4.75

B) $4.63

C) $4.54

D) $4.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

56

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

The ending inventory of finished goods is

A) $160,000.

B) $72,000.

C) $188,000.

D) $584,000.

The ending inventory of finished goods is

A) $160,000.

B) $72,000.

C) $188,000.

D) $584,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

57

A company that produces less than its planned volume for a year will

A) underapply overhead.

B) not have an overhead variance.

C) overapply overhead.

D) not necessarily over- or underapply overhead.

A) underapply overhead.

B) not have an overhead variance.

C) overapply overhead.

D) not necessarily over- or underapply overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

58

The excess of actual overhead over the overhead applied to products is called

A) overapplied overhead.

B) underapplied overhead.

C) overestimated overhead.

D) prorated overhead.

A) overapplied overhead.

B) underapplied overhead.

C) overestimated overhead.

D) prorated overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

59

Harnack Company had the following information:

Budgeted cost driver activity levels:

Budgeted cost driver activity levels:

Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 200 used $8,736 of direct labour cost, the overhead applied using direct-labour cost as the cost driver should be

A) $26,208.

B) $23,762.

C) $27,956.

D) $25,333.

Budgeted cost driver activity levels:

Budgeted cost driver activity levels: Actual cost driver activity levels:

Actual cost driver activity levels:

If Job 200 used $8,736 of direct labour cost, the overhead applied using direct-labour cost as the cost driver should be

A) $26,208.

B) $23,762.

C) $27,956.

D) $25,333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

60

Dentlinger Company uses a job-order cost system and had the following data available for 20X2.

To apply the budgeted overhead to a job, the budgeted overhead rate is multiplied by the

A) actual cost-driver data.

B) budgeted cost-driver data.

C) actual factory-overhead costs.

D) estimated factory-overhead costs.

To apply the budgeted overhead to a job, the budgeted overhead rate is multiplied by the

A) actual cost-driver data.

B) budgeted cost-driver data.

C) actual factory-overhead costs.

D) estimated factory-overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

61

If the overhead control account has a credit balance at the end of the period,

A) overhead is overapplied and the difference should be credited to the proper accounts.

B) overhead is overapplied and the difference should be debited to the proper accounts.

C) overhead is underapplied and the difference should be debited to the proper accounts.

D) overhead is underapplied and the difference should be credited to the proper accounts.

A) overhead is overapplied and the difference should be credited to the proper accounts.

B) overhead is overapplied and the difference should be debited to the proper accounts.

C) overhead is underapplied and the difference should be debited to the proper accounts.

D) overhead is underapplied and the difference should be credited to the proper accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

62

A rate that is calculated by dividing budgeted overhead by budgeted cost-driver activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

63

In the immediate write-off approach, underapplied overhead is regarded as

A) a reduction in current income.

B) an addition to the cost of inventory.

C) a decrease in cost of goods sold.

D) a decrease in the cost of inventory.

A) a reduction in current income.

B) an addition to the cost of inventory.

C) a decrease in cost of goods sold.

D) a decrease in the cost of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

64

Reed Company incurred actual overhead costs of $640,000 for the year. A budgeted factory-overhead rate of 210 percent of direct-labour cost was determined at the beginning of the year. Budgeted factory overhead was $630,000, and budgeted direct-labour cost was $300,000. Actual direct-labour cost was $320,000 for the year. The factory overhead variance for the year was

A) $10,000 underapplied.

B) $10,000 overapplied.

C) $32,000 underapplied.

D) $32,000 overapplied.

A) $10,000 underapplied.

B) $10,000 overapplied.

C) $32,000 underapplied.

D) $32,000 overapplied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

65

Reed Company incurred actual overhead costs of $640,000 for the year. A budgeted factory-overhead rate of 210 percent of direct-labour cost was determined at the beginning of the year. Budgeted factory overhead was $630,000, and budgeted direct-labour cost was $300,000. Actual direct-labour cost was $320,000 for the year. The disposition of the variance, assuming an immaterial amount, would include a

A) debit to Cost of Goods Sold for $32,000.

B) credit to Cost of Goods Sold for $32,000.

C) debit to Cost of Goods Sold for $10,000.

D) credit to Cost of Goods Sold for $10,000.

A) debit to Cost of Goods Sold for $32,000.

B) credit to Cost of Goods Sold for $32,000.

C) debit to Cost of Goods Sold for $10,000.

D) credit to Cost of Goods Sold for $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

66

A system that accumulates manufacturing costs by jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

67

Fulton Company incurred actual overhead costs of $160,000 for the year. A budgeted factory-overhead rate of 210 percent of direct-labour cost was determined at the beginning of the year. Budgeted factory overhead was $157,500, and budgeted direct-labour cost was $75,000. Actual direct-labour cost was $80,000 for the year. The factory overhead variance for the year was

A) $2,500 underapplied.

B) $2,500 overapplied.

C) $8,000 underapplied.

D) $8,000 overapplied.

A) $2,500 underapplied.

B) $2,500 overapplied.

C) $8,000 underapplied.

D) $8,000 overapplied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

68

The proration method of disposing of overhead variances assigns the variance in proportion to the sizes of the ending account balances to

A) WIP and finished goods inventory.

B) cost of goods sold and WIP inventory.

C) direct materials and WIP inventory.

D) cost of goods sold, WIP and finished goods inventory.

A) WIP and finished goods inventory.

B) cost of goods sold and WIP inventory.

C) direct materials and WIP inventory.

D) cost of goods sold, WIP and finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

69

A difference between actual overhead and applied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

70

In the immediate write-off approach, overapplied overhead is regarded as

A) a decrease in current income.

B) a decrease in cost of goods sold.

C) an addition to the cost of inventory.

D) a reduction to the cost of inventory.

A) a decrease in current income.

B) a decrease in cost of goods sold.

C) an addition to the cost of inventory.

D) a reduction to the cost of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

71

Reed Company incurred actual overhead costs of $640,000 for the year. A budgeted factory-overhead rate of 210 percent of direct-labour cost was determined at the beginning of the year. Budgeted factory overhead was $630,000, and budgeted direct-labour cost was $300,000. Actual direct-labour cost was $320,000 for the year. The disposition of the variance, assuming a material amount, would include a

A) debit to Factory Department Overhead Control for $32,000.

B) credit to Factory Department Overhead Control for $10,000.

C) debit to Cost of Goods Sold for $32,000.

D) credit to Cost of Goods Sold for $10,000.

A) debit to Factory Department Overhead Control for $32,000.

B) credit to Factory Department Overhead Control for $10,000.

C) debit to Cost of Goods Sold for $32,000.

D) credit to Cost of Goods Sold for $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

72

Fulton Company incurred actual overhead costs of $160,000 for the year. A budgeted factory-overhead rate of 210 percent of direct-labour cost was determined at the beginning of the year. Budgeted factory overhead was $157,500, and budgeted direct-labour cost was $75,000. Actual direct-labour cost was $80,000 for the year. The disposition of the variance, assuming an immaterial amount, would include a

A) debit to Cost of Goods Sold for $8,000.

B) credit to Cost of Goods Sold for $8,000.

C) debit to Cost of Goods Sold for $2,500.

D) credit to Cost of Goods Sold for $2,500.

A) debit to Cost of Goods Sold for $8,000.

B) credit to Cost of Goods Sold for $8,000.

C) debit to Cost of Goods Sold for $2,500.

D) credit to Cost of Goods Sold for $2,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the overhead control account has a debit balance at the end of the period,

A) overhead is overapplied and the difference should be credited to the proper accounts.

B) overhead is overapplied and the difference should be debited to the proper accounts.

C) overhead is underapplied and the difference should be debited to the proper accounts.

D) overhead is underapplied and the difference should be credited to the proper accounts.

A) overhead is overapplied and the difference should be credited to the proper accounts.

B) overhead is overapplied and the difference should be debited to the proper accounts.

C) overhead is underapplied and the difference should be debited to the proper accounts.

D) overhead is underapplied and the difference should be credited to the proper accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

74

A variance that results when applied overhead is greater than the actual overhead cost incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

75

A cost accumulation method that accumulates costs by processes or departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

76

The most widely used approach to disposing of overhead variances is

A) proration.

B) to allocate between cost of goods sold and finished goods inventory.

C) immediate write-off.

D) to capitalize as a cost of finished goods inventory.

A) proration.

B) to allocate between cost of goods sold and finished goods inventory.

C) immediate write-off.

D) to capitalize as a cost of finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

77

Fulton Company incurred actual overhead costs of $160,000 for the year. A budgeted factory-overhead rate of 210 percent of direct-labour cost was determined at the beginning of the year. Budgeted factory overhead was $157,500, and budgeted direct-labour cost was $75,000. Actual direct-labour cost was $80,000 for the year. The disposition of the variance, assuming a material amount, would include a

A) debit to Factory Department Overhead Control for $8,000.

B) credit to Factory Department Overhead Control for $2,500.

C) debit to Cost of Goods Sold for $8,000.

D) credit to Cost of Goods Sold for $2,500.

A) debit to Factory Department Overhead Control for $8,000.

B) credit to Factory Department Overhead Control for $2,500.

C) debit to Cost of Goods Sold for $8,000.

D) credit to Cost of Goods Sold for $2,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

78

The overhead assigned to production using a predetermined overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

79

A variance that results when the actual overhead cost incurred is greater than applied overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

80

The following information was gathered for Larsen Company for the year ended December 31, 20X1.

Assume that direct-labour hours is the cost driver.What is the amount of over/underapplied overhead?

A) $1,365 underapplied.

B) $1,365 overapplied.

C) $3,225 underapplied.

D) $1,960 overapplied.

Assume that direct-labour hours is the cost driver.What is the amount of over/underapplied overhead?

A) $1,365 underapplied.

B) $1,365 overapplied.

C) $3,225 underapplied.

D) $1,960 overapplied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck