Deck 4: Cost Management Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

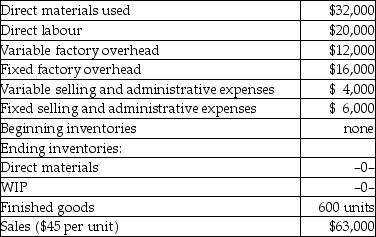

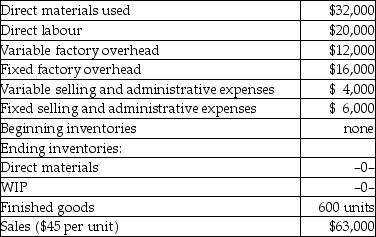

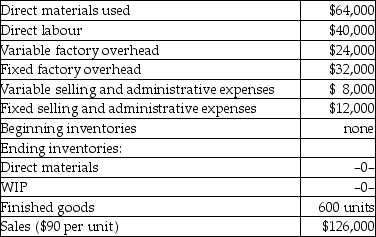

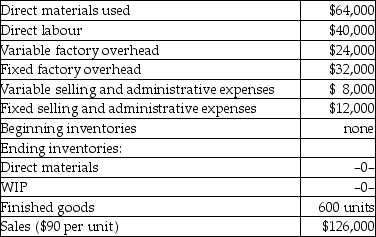

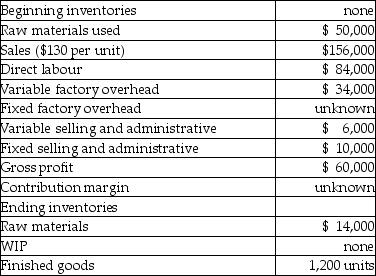

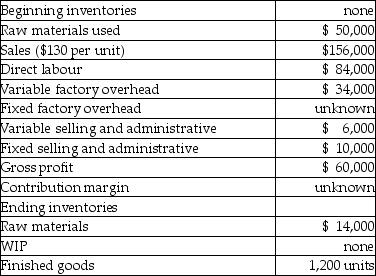

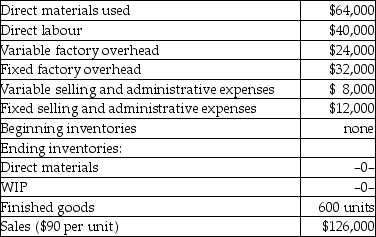

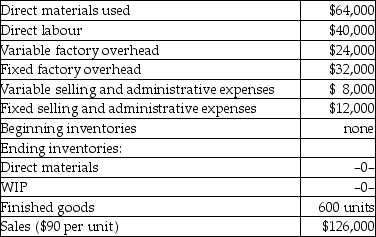

سؤال

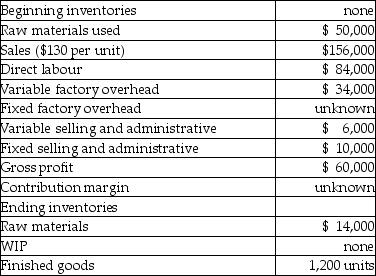

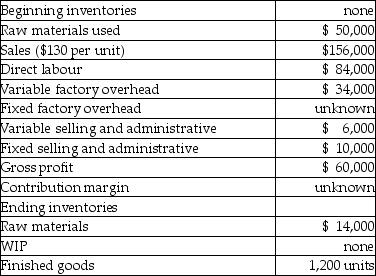

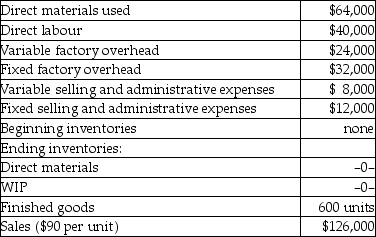

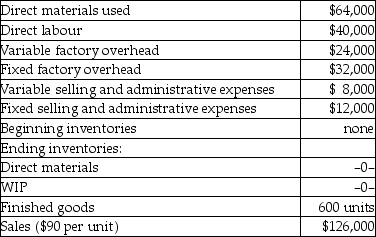

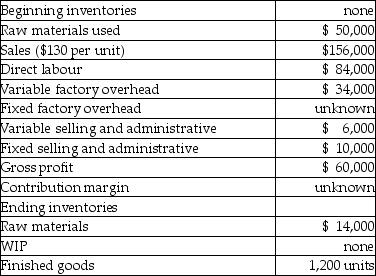

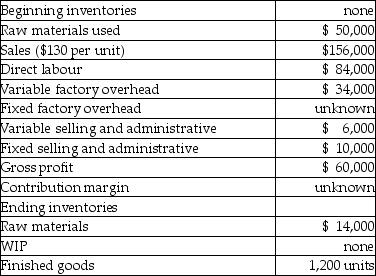

سؤال

سؤال

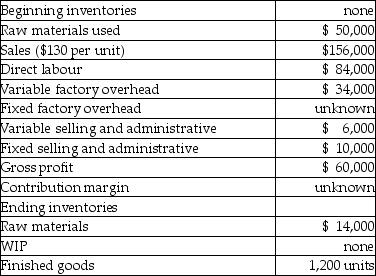

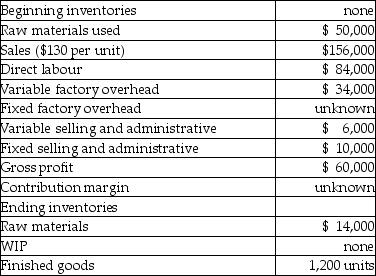

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/134

العب

ملء الشاشة (f)

Deck 4: Cost Management Systems

1

Cost accounting is that part of the accounting system that measures costs for the purposes of management decision making and financial reporting.

True

2

Absorption costing is more widely used than variable costing.

True

3

The three major categories of manufacturing costs are direct materials, direct labour and factory overhead.

True

4

Direct costs can be identified specifically and exclusively with a given cost objective in an economically feasible way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

5

A production-volume variance is calculated as the applied volume minus the actual volume multiplied by the actual-overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

6

Fixed manufacturing overhead is excluded from the cost of products under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

7

Period costs are inventoriable and are expensed when the inventory is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

8

The term expense is used to describe both an inventory expenditure and a cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

9

Indirect costs can be identified specifically with a given cost objective in an uneconomical way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

10

Product costs are identified with goods produced or purchased for resale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

11

Absorption-costing income is not affected by production volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

12

A manufacturer has three inventories as compared to a merchandiser, which has only one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

13

Prime costs include direct labour and factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

14

Variable costing is also referred to as the contribution approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

15

There is no difference between variable-costing and absorption-costing income if the inventory level does not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

16

Absorption costing separates costs into manufacturing and non-manufacturing categories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

17

Cost accounting system typically includes two processes, cost accumulation and cost determination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

18

In variable costing, inventories are valued at standard variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

19

The contribution approach is a method of internal reporting that emphasizes the distinction between variable and fixed costs for the purpose of better decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

20

In the contribution approach, all factory overhead is considered to be product costs that are expensed as incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

21

Prime costs include

A) direct labour and factory overhead.

B) direct materials and indirect labour.

C) factory overhead and indirect materials.

D) direct labour and direct materials.

A) direct labour and factory overhead.

B) direct materials and indirect labour.

C) factory overhead and indirect materials.

D) direct labour and direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

22

Factory overhead includes

A) direct materials and direct labour.

B) prime costs.

C) indirect and direct labour.

D) indirect labour and indirect materials.

A) direct materials and direct labour.

B) prime costs.

C) indirect and direct labour.

D) indirect labour and indirect materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

23

Costs identified with goods produced or purchased for resale are called

A) product costs.

B) period costs.

C) prime costs.

D) conversion costs.

A) product costs.

B) period costs.

C) prime costs.

D) conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

24

A period cost

A) is identified with goods produced or purchased for resale.

B) is accumulated in work-in-process.

C) is shown on the balance sheet.

D) is expensed as incurred.

A) is identified with goods produced or purchased for resale.

B) is accumulated in work-in-process.

C) is shown on the balance sheet.

D) is expensed as incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

25

Selling and general administrative costs are

A) period costs.

B) product costs.

C) prime costs.

D) conversion costs.

A) period costs.

B) product costs.

C) prime costs.

D) conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

26

The sum of direct labour and factory overhead costs is equal to

A) conversion costs.

B) prime costs.

C) period costs.

D) indirect costs.

A) conversion costs.

B) prime costs.

C) period costs.

D) indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

27

The part of the accounting system that measures costs for the purposes of management decision making and financial reporting is referred to as

A) period costing.

B) cost accounting.

C) system accounting.

D) product costing.

A) period costing.

B) cost accounting.

C) system accounting.

D) product costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

28

An example of direct labour would be

A) janitor's wages.

B) factory foreman's wages.

C) machine operator's wages.

D) plant guard's wages.

A) janitor's wages.

B) factory foreman's wages.

C) machine operator's wages.

D) plant guard's wages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

29

An activity for which a separate measurement of costs is desired is called a

A) cost objective.

B) period cost.

C) product cost.

D) cost accumulation system.

A) cost objective.

B) period cost.

C) product cost.

D) cost accumulation system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following would probably NOT be considered a direct material?

A) Lumber

B) Steel

C) Glue

D) Subassemblies

A) Lumber

B) Steel

C) Glue

D) Subassemblies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements is TRUE?

A) Indirect costs can be identified specifically with a given cost objective in an economically feasible way.

B) Managers prefer to classify costs as indirect rather than direct.

C) A cost may simultaneously be direct and indirect.

D) Direct costs cannot be identified specifically with a given cost objective in an economically feasible way.

A) Indirect costs can be identified specifically with a given cost objective in an economically feasible way.

B) Managers prefer to classify costs as indirect rather than direct.

C) A cost may simultaneously be direct and indirect.

D) Direct costs cannot be identified specifically with a given cost objective in an economically feasible way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

32

The three major categories of manufacturing costs are

A) prime costs, direct materials and factory overhead.

B) direct labour, factory overhead and direct materials.

C) indirect labour, indirect materials and conversion costs.

D) prime costs, period costs, and product costs.

A) prime costs, direct materials and factory overhead.

B) direct labour, factory overhead and direct materials.

C) indirect labour, indirect materials and conversion costs.

D) prime costs, period costs, and product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is NOT a factor in determining whether a cost is direct or indirect?

A) The cost can be identified specifically with a given cost objective.

B) The identification of the cost is economically feasible.

C) The cost objective used.

D) The manager's preference.

A) The cost can be identified specifically with a given cost objective.

B) The identification of the cost is economically feasible.

C) The cost objective used.

D) The manager's preference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is NOT true?

A) A cost may be defined as a sacrifice or giving up of resources for a particular purpose.

B) Costs are frequently measured by the monetary units that must be paid for goods and services.

C) Costs are shown on the income statement.

D) Costs are initially recorded in elementary form.

A) A cost may be defined as a sacrifice or giving up of resources for a particular purpose.

B) Costs are frequently measured by the monetary units that must be paid for goods and services.

C) Costs are shown on the income statement.

D) Costs are initially recorded in elementary form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is NOT a factory overhead cost?

A) Wages of machine operators

B) Wages of supervisors

C) Amortization of the machinery

D) Factory utilities

A) Wages of machine operators

B) Wages of supervisors

C) Amortization of the machinery

D) Factory utilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

36

A cost accumulation system typically includes two processes:

A) cost accumulation and cost allocation.

B) cost objectives and cost accounting.

C) cost accumulation and cost accounting.

D) cost allocation and cost application.

A) cost accumulation and cost allocation.

B) cost objectives and cost accounting.

C) cost accumulation and cost accounting.

D) cost allocation and cost application.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following would NOT be an example of a cost objective?

A) A department

B) A product

C) A territory

D) A parcel of land

A) A department

B) A product

C) A territory

D) A parcel of land

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

38

Manufacturing costs are eventually reported on

A) the income statement only.

B) the balance sheet only.

C) the income statement as cost of goods sold.

D) the balance sheet as cost of goods sold.

A) the income statement only.

B) the balance sheet only.

C) the income statement as cost of goods sold.

D) the balance sheet as cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

39

All costs other than direct material and direct labour that are associated with the manufacturing process are called

A) prime costs.

B) factory-overhead costs.

C) conversion costs.

D) product costs.

A) prime costs.

B) factory-overhead costs.

C) conversion costs.

D) product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements is FALSE?

A) Product costs are inventoriable costs.

B) Product costs are automatically deducted as expenses during the current period.

C) Product costs become expenses when the inventory is sold.

D) Product costs show up on the income statement in cost of goods sold.

A) Product costs are inventoriable costs.

B) Product costs are automatically deducted as expenses during the current period.

C) Product costs become expenses when the inventory is sold.

D) Product costs show up on the income statement in cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

41

When using the absorption approach to costing,

A) all variable costs are inventoriable.

B) all indirect manufacturing costs are inventoriable.

C) all fixed costs are treated as period costs.

D) all direct manufacturing costs are treated as period costs.

A) all variable costs are inventoriable.

B) all indirect manufacturing costs are inventoriable.

C) all fixed costs are treated as period costs.

D) all direct manufacturing costs are treated as period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following terms appears on an income statement prepared using the contribution approach but NOT on an income statement using absorption costing?

A) Operating income

B) Gross profit

C) Contribution margin

D) Sales

A) Operating income

B) Gross profit

C) Contribution margin

D) Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

43

The only difference between variable and absorption costing is the accounting for

A) direct labour.

B) fixed manufacturing overhead.

C) direct materials.

D) variable manufacturing overhead.

A) direct labour.

B) fixed manufacturing overhead.

C) direct materials.

D) variable manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is NOT a product cost?

A) Indirect labour

B) Raw materials used

C) Insurance on the plant

D) Advertising expense

A) Indirect labour

B) Raw materials used

C) Insurance on the plant

D) Advertising expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

45

Variable costing is commonly called

A) full costing.

B) direct costing.

C) traditional costing.

D) absorption costing.

A) full costing.

B) direct costing.

C) traditional costing.

D) absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

46

All of the following are inventoriable costs under variable costing EXCEPT

A) direct materials.

B) direct labour.

C) variable manufacturing overhead.

D) fixed manufacturing overhead.

A) direct materials.

B) direct labour.

C) variable manufacturing overhead.

D) fixed manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

47

Absorption costing classifies costs as either product costs or

A) period costs.

B) fixed costs.

C) prime costs.

D) conversion costs.

A) period costs.

B) fixed costs.

C) prime costs.

D) conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

48

An example of a product cost is

A) advertising expense.

B) amortization on office equipment.

C) indirect materials.

D) store supplies expense.

A) advertising expense.

B) amortization on office equipment.

C) indirect materials.

D) store supplies expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

49

How many inventory accounts does a merchandiser usually have?

A) One

B) Two

C) Three

D) Four

A) One

B) Two

C) Three

D) Four

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

50

How many inventory accounts does a manufacturer usually have?

A) Three

B) Two

C) One

D) None

A) Three

B) Two

C) One

D) None

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

51

Absorption costing is also known as all of the following EXCEPT

A) direct costing.

B) full costing.

C) traditional approach.

D) functional approach.

A) direct costing.

B) full costing.

C) traditional approach.

D) functional approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

52

The cost of goods purchased line on the income statement of a retailer is the equivalent to which line on a manufacturer's income statement?

A) Cost of raw materials purchased

B) Cost of goods sold

C) Cost of goods available for sale

D) Cost of goods manufactured

A) Cost of raw materials purchased

B) Cost of goods sold

C) Cost of goods available for sale

D) Cost of goods manufactured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following accounts would appear in the current asset section of a merchandiser's balance sheet?

A) Direct materials inventory

B) Finished goods inventory

C) Merchandise inventory

D) Work in process inventory

A) Direct materials inventory

B) Finished goods inventory

C) Merchandise inventory

D) Work in process inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is NOT an inventory account?

A) Direct labour

B) Direct materials

C) Work in process

D) Finished goods

A) Direct labour

B) Direct materials

C) Work in process

D) Finished goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

55

When using the contribution approach to costing,

A) all factory overhead is inventoriable.

B) all indirect manufacturing costs are inventoriable.

C) all selling expenses are deducted from the contribution margin.

D) all fixed costs are treated as period costs.

A) all factory overhead is inventoriable.

B) all indirect manufacturing costs are inventoriable.

C) all selling expenses are deducted from the contribution margin.

D) all fixed costs are treated as period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is NOT a period cost?

A) Wages of clerical staff

B) Advertising expense

C) Factory supplies used

D) Amortization on salesperson's car

A) Wages of clerical staff

B) Advertising expense

C) Factory supplies used

D) Amortization on salesperson's car

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following accounts would NOT be included in the current asset section of a manufacturer's balance sheet?

A) Work in process inventory

B) Merchandise inventory

C) Finished goods inventory

D) Direct materials inventory

A) Work in process inventory

B) Merchandise inventory

C) Finished goods inventory

D) Direct materials inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

58

Variable costing regards fixed manufacturing overhead as

A) an unexpired cost.

B) an inventoriable cost.

C) a charge against sales.

D) a product cost.

A) an unexpired cost.

B) an inventoriable cost.

C) a charge against sales.

D) a product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following would appear on an income statement of both a retailer and a manufacturer?

A) Direct labour

B) Selling expenses

C) Beginning finished goods inventory

D) Factory overhead

A) Direct labour

B) Selling expenses

C) Beginning finished goods inventory

D) Factory overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following methods is required for external financial reporting?

A) Contribution approach

B) Variable costing

C) Direct costing

D) Absorption approach

A) Contribution approach

B) Variable costing

C) Direct costing

D) Absorption approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

61

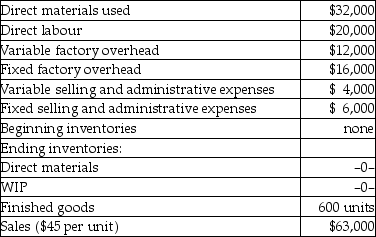

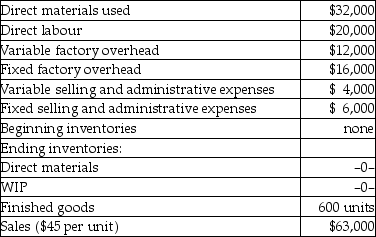

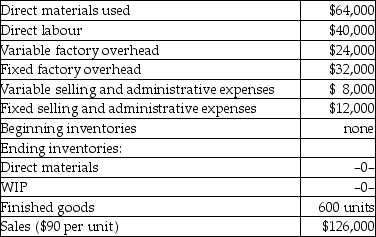

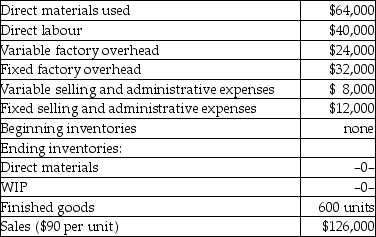

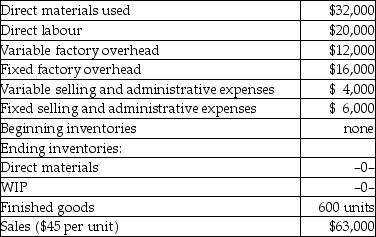

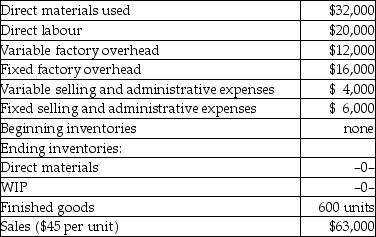

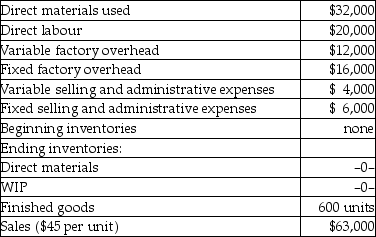

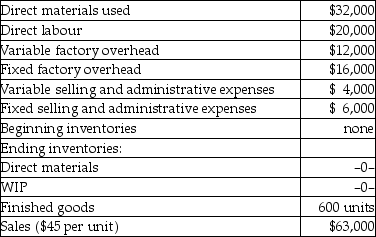

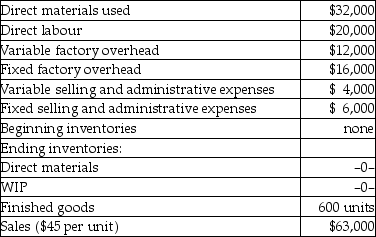

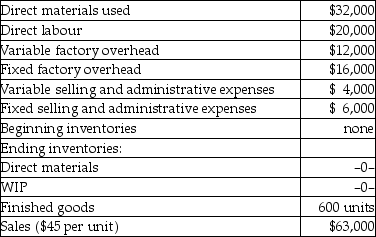

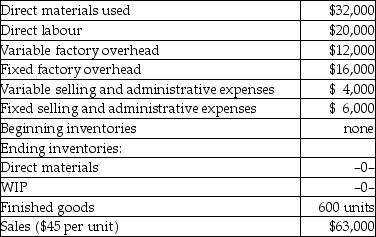

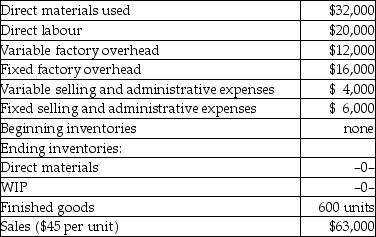

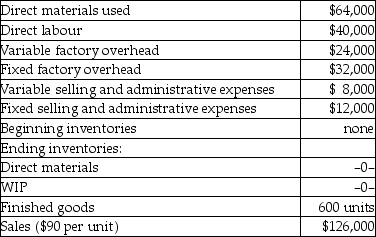

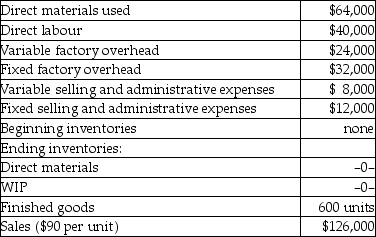

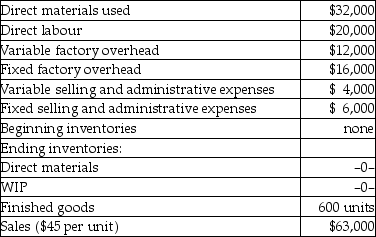

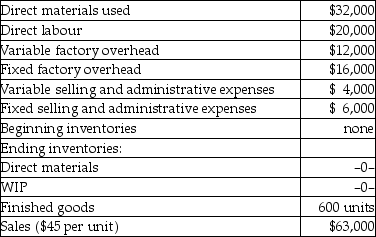

DeJager Company reported the following information about the production and sales of its only product:

The cost of producing one unit of product using variable costing would be

A) $32.

B) $40.

C) $45.

D) $26.

The cost of producing one unit of product using variable costing would be

A) $32.

B) $40.

C) $45.

D) $26.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

62

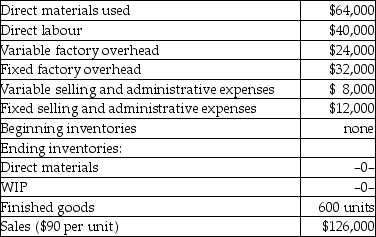

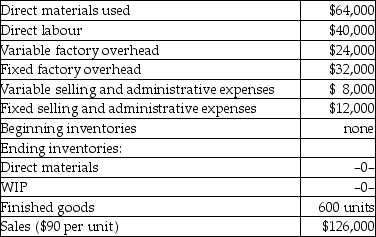

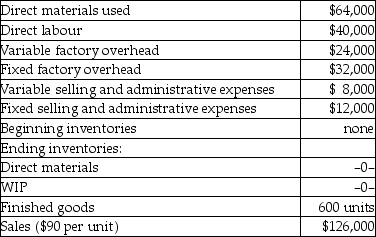

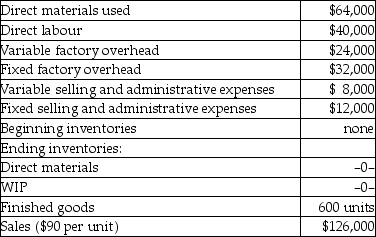

Schultz Company reported the following information about the production and sales of its only product:

The cost of producing one unit of product using absorption costing would be

A) $64.

B) $52.

C) $90.

D) $80.

The cost of producing one unit of product using absorption costing would be

A) $64.

B) $52.

C) $90.

D) $80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

63

DeJager Company reported the following information about the production and sales of its only product:

The operating income (loss) under variable costing would be

A) $14,200.

B) $ 8,200.

C) $(3,000).

D) $(7,800).

The operating income (loss) under variable costing would be

A) $14,200.

B) $ 8,200.

C) $(3,000).

D) $(7,800).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

64

A company has the following information:

Raw materials purchased during the current period were

A) $50,000.

B) $64,000.

C) $36,000.

D) not determinable.

Raw materials purchased during the current period were

A) $50,000.

B) $64,000.

C) $36,000.

D) not determinable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

65

Schultz Company reported the following information about the production and sales of its only product:

The ending inventory under variable costing would be

A) $48,000.

B) $54,000.

C) $38,400.

D) $31,200.

The ending inventory under variable costing would be

A) $48,000.

B) $54,000.

C) $38,400.

D) $31,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

66

A company has the following information:

The total contribution margin under variable costing would be

A) $42,000.

B) $14,000.

C) $66,000.

D) $72,000.

The total contribution margin under variable costing would be

A) $42,000.

B) $14,000.

C) $66,000.

D) $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

67

All manufacturing costs are assigned to the product under which method of product costing?

A) Direct costing

B) Variable costing

C) Absorption costing

D) Fixed costing

A) Direct costing

B) Variable costing

C) Absorption costing

D) Fixed costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

68

Schultz Company reported the following information about the production and sales of its only product:

The ending inventory under absorption costing would be

A) $54,000.

B) $48,000.

C) $31,200.

D) $38,400.

The ending inventory under absorption costing would be

A) $54,000.

B) $48,000.

C) $31,200.

D) $38,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

69

DeJager Company reported the following information about the production and sales of its only product:

The cost of goods sold under variable costing would be

A) $56,000.

B) $63,000.

C) $44,800.

D) $36,400.

The cost of goods sold under variable costing would be

A) $56,000.

B) $63,000.

C) $44,800.

D) $36,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

70

DeJager Company reported the following information about the production and sales of its only product:

The cost of producing one unit of product using absorption costing would be

A) $32.

B) $26.

C) $45.

D) $40.

The cost of producing one unit of product using absorption costing would be

A) $32.

B) $26.

C) $45.

D) $40.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

71

Schultz Company reported the following information about the production and sales of its only product:

The cost of goods sold under variable costing would be

A) $112,000.

B) $126,000.

C) $ 89,600.

D) $ 72,800.

The cost of goods sold under variable costing would be

A) $112,000.

B) $126,000.

C) $ 89,600.

D) $ 72,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which format does the CICA Handbook advocate for reporting income?

A) Direct costing

B) Variable costing

C) Indirect costing

D) Full costing

A) Direct costing

B) Variable costing

C) Indirect costing

D) Full costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company has the following information:

The ending inventory under variable costing would be

A) $96,000.

B) $168,000.

C) $84,000.

D) $192,000.

The ending inventory under variable costing would be

A) $96,000.

B) $168,000.

C) $84,000.

D) $192,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

74

Schultz Company reported the following information about the production and sales of its only product:

The contribution margin under variable costing would be

A) $36,400.

B) $28,400.

C) $ 6,000.

D) $45,200.

The contribution margin under variable costing would be

A) $36,400.

B) $28,400.

C) $ 6,000.

D) $45,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

75

Schultz Company reported the following information about the production and sales of its only product:

The cost of producing one unit of product using variable costing would be

A) $64.

B) $80.

C) $90.

D) $52.

The cost of producing one unit of product using variable costing would be

A) $64.

B) $80.

C) $90.

D) $52.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

76

A company has the following information:

The cost of goods sold under variable costing would be

A) $84,000.

B) $192,000.

C) $96,000.

D) $168,000.

The cost of goods sold under variable costing would be

A) $84,000.

B) $192,000.

C) $96,000.

D) $168,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

77

DeJager Company reported the following information about the production and sales of its only product:

The ending inventory under variable costing would be

A) $24,000.

B) $27,000.

C) $19,200.

D) $15,600.

The ending inventory under variable costing would be

A) $24,000.

B) $27,000.

C) $19,200.

D) $15,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

78

DeJager Company reported the following information about the production and sales of its only product:

The contribution margin under variable costing would be

A) $18,200.

B) $14,200.

C) $ 3,000.

D) $22,600.

The contribution margin under variable costing would be

A) $18,200.

B) $14,200.

C) $ 3,000.

D) $22,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

79

Schultz Company reported the following information about the production and sales of its only product:

The operating income (loss) under variable costing would be

A) $ 28,400.

B) $ 16,400.

C) $( 6,000).

D) $(15,600).

The operating income (loss) under variable costing would be

A) $ 28,400.

B) $ 16,400.

C) $( 6,000).

D) $(15,600).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

80

DeJager Company reported the following information about the production and sales of its only product:

The ending inventory under absorption costing would be

A) $27,000.

B) $24,000.

C) $15,600.

D) $19,200.

The ending inventory under absorption costing would be

A) $27,000.

B) $24,000.

C) $15,600.

D) $19,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck