Deck 2: Cost Behaviour and Cost-Volume Relationships

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/96

العب

ملء الشاشة (f)

Deck 2: Cost Behaviour and Cost-Volume Relationships

1

A fixed cost is fixed per unit.

False

2

The volume of sales at which revenue equals expenses, and net income is zero is known as the break-even point.

True

3

Cost drivers are machines that take the place of labour.

False

4

As the level of activity increases within the relevant range,

A) total fixed costs remain unchanged.

B) fixed costs per unit increases.

C) total variable costs remain unchanged.

D) variable costs per unit decreases.

A) total fixed costs remain unchanged.

B) fixed costs per unit increases.

C) total variable costs remain unchanged.

D) variable costs per unit decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

5

Activities that affect costs are often called

A) cost drivers.

B) stages of production.

C) fixed activities.

D) variable activities.

A) cost drivers.

B) stages of production.

C) fixed activities.

D) variable activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

6

A variable cost varies per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

7

A change in the tax rate will not affect the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

8

A cost that changes in direct proportion to changes in the cost driver is a

A) fixed cost.

B) joint cost.

C) mixed cost.

D) variable cost.

A) fixed cost.

B) joint cost.

C) mixed cost.

D) variable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

9

Sales mix is defined as the relative proportions of products that comprise total sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

10

Gross margin is the same as contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

11

The variable cost percentage plus the contribution margin percentage must equal 100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

12

If fixed expenses doubled, the break-even point in units would double and the break-even point in dollars would be cut in half.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

13

As the level of activity increases within the relevant range,

A) total fixed costs increases.

B) fixed costs per unit decreases.

C) total variable costs remain unchanged.

D) variable costs per unit decreases.

A) total fixed costs increases.

B) fixed costs per unit decreases.

C) total variable costs remain unchanged.

D) variable costs per unit decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

14

The break-even point is located at the intersection of the total revenue line and the total expenses line on a cost-volume-profit graph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

15

In certain situations, gross margin can equal contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

16

Break-even is the point at which the company achieves its targeted net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

17

An increase in sales price would cause a decrease in the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

18

As the level of activity decreases within the relevant range,

A) total fixed costs increases.

B) fixed costs per unit decreases.

C) total variable costs decreases.

D) variable costs per unit decreases.

A) total fixed costs increases.

B) fixed costs per unit decreases.

C) total variable costs decreases.

D) variable costs per unit decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

19

The way in which the activities of an organization affect its costs is called cost behaviour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

20

When changes occur in the sales mix, there is no effect on the cost-volume-profit relationships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

21

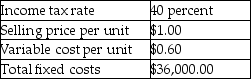

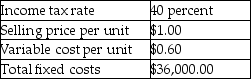

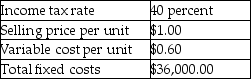

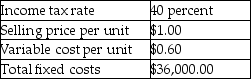

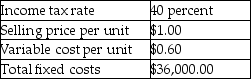

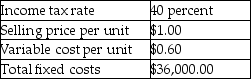

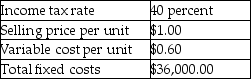

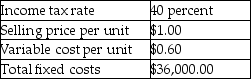

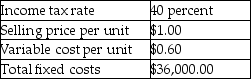

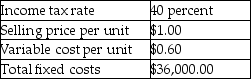

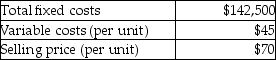

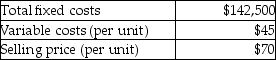

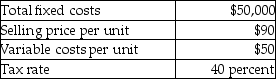

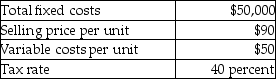

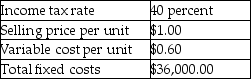

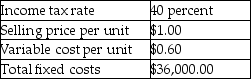

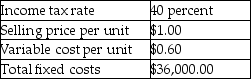

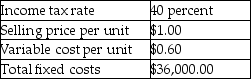

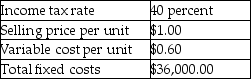

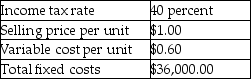

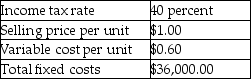

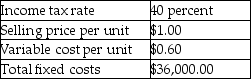

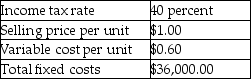

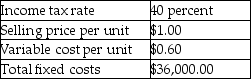

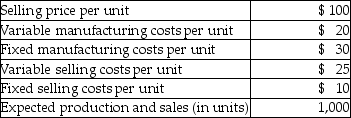

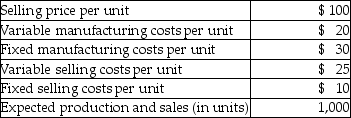

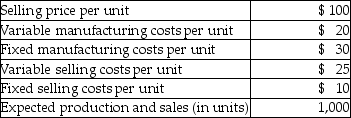

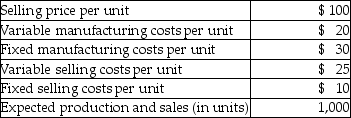

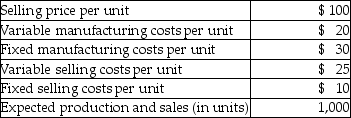

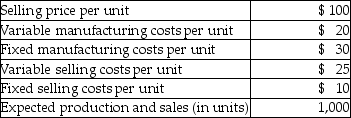

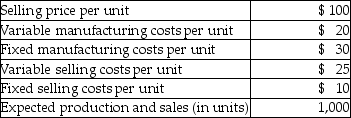

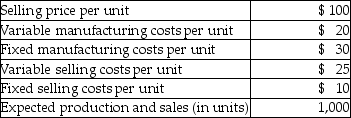

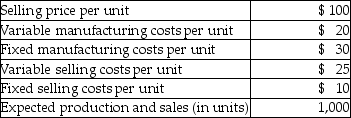

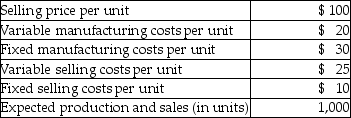

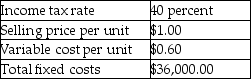

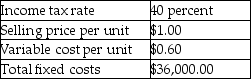

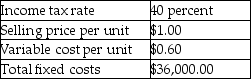

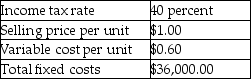

Hampton Company, a producer of computer disks, has the following information:

What is the contribution margin per unit?

A) 0.40

B) 0.60

C) 1.00

D) None of the above.

What is the contribution margin per unit?

A) 0.40

B) 0.60

C) 1.00

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

22

Hampton Company, a producer of computer disks, has the following information:

What is the contribution-margin ratio?

A) 40 percent

B) 60 percent

C) 100 percent

D) None of the above.

What is the contribution-margin ratio?

A) 40 percent

B) 60 percent

C) 100 percent

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

23

Reese, Inc. produces pliers. Each pair of pliers sells for $8.00. Variable costs per unit total $5.60 of which $2.50 is for direct materials and $2.10 is for direct labour.

If total fixed costs are $213,000, then the break-even volume in sales dollars is

A) $710,000.

B) $304,288.

C) $370,432.

D) $177,500.

If total fixed costs are $213,000, then the break-even volume in sales dollars is

A) $710,000.

B) $304,288.

C) $370,432.

D) $177,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the sales price per unit is $10.00, the unit contribution margin is $4.00, and total fixed costs are $20,000, the break-even point in units is

A) 5,000.

B) 1,429.

C) 2,000.

D) 3,333.

A) 5,000.

B) 1,429.

C) 2,000.

D) 3,333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

25

Reese, Inc. produces pliers. Each pair of pliers sells for $8.00. Variable costs per unit total $5.60 of which $2.50 is for direct materials and $2.10 is for direct labour.

If total fixed costs are $174,000, then the break-even point in units is

A) 31,071.

B) 37,826.

C) 72,500.

D) 21,750.

If total fixed costs are $174,000, then the break-even point in units is

A) 31,071.

B) 37,826.

C) 72,500.

D) 21,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

26

The margin of safety

A) equals break-even unit sales less actual unit sales.

B) shows how far sales can fall below the planned level before losses occur.

C) is the sales price minus all the variable expenses.

D) is the same as break-even point.

A) equals break-even unit sales less actual unit sales.

B) shows how far sales can fall below the planned level before losses occur.

C) is the sales price minus all the variable expenses.

D) is the same as break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

27

Hampton Company, a producer of computer disks, has the following information:

The horizontal axis on the cost-volume-profit graph is the

A) dollars of cost.

B) sales volume.

C) dollars of revenue.

D) net income.

The horizontal axis on the cost-volume-profit graph is the

A) dollars of cost.

B) sales volume.

C) dollars of revenue.

D) net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the sales price per unit is $48.00, the total fixed costs are $67,500, and the break-even volume in dollar sales is $270,000, then the unit variable cost is

A) $4.00.

B) $6.33.

C) $12.00.

D) $36.00.

A) $4.00.

B) $6.33.

C) $12.00.

D) $36.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

29

Reese, Inc. produces pliers. Each pair of pliers sells for $8.00. Variable costs per unit total $5.60 of which $2.50 is for direct materials and $2.10 is for direct labour.

If total fixed costs are $62,000, contribution margin per unit is $5.00, and targeted after-tax net income is $12,000 with a 40 percent tax rate, how many units must be sold to break even?

A) 16,400

B) 14,800

C) 12,400

D) 11,440

If total fixed costs are $62,000, contribution margin per unit is $5.00, and targeted after-tax net income is $12,000 with a 40 percent tax rate, how many units must be sold to break even?

A) 16,400

B) 14,800

C) 12,400

D) 11,440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the sales price per unit is $17.00, the unit variable cost is $13.50, and the break-even point is 78,000 units, then the total fixed costs are

A) $105,300.

B) $89,140.

C) $273,000.

D) $156,000.

A) $105,300.

B) $89,140.

C) $273,000.

D) $156,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

31

If variable costs are increasing in total,

A) activity is decreasing.

B) activity is increasing.

C) variable costs per unit are decreasing.

D) variable costs per unit are increasing.

A) activity is decreasing.

B) activity is increasing.

C) variable costs per unit are decreasing.

D) variable costs per unit are increasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

32

Reese, Inc. produces pliers. Each pair of pliers sells for $8.00. Variable costs per unit total $5.60 of which $2.50 is for direct materials and $2.10 is for direct labour.

If targeted after-tax net income is $27,000 with a 40 percent tax rate, contribution margin per unit is $0.80, and total fixed costs are $148,000, how many units must be sold to break even?

A) 218,750

B) 241,250

C) 185,000

D) 167,250

If targeted after-tax net income is $27,000 with a 40 percent tax rate, contribution margin per unit is $0.80, and total fixed costs are $148,000, how many units must be sold to break even?

A) 218,750

B) 241,250

C) 185,000

D) 167,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

33

Contribution margin

A) is not the same as marginal income.

B) can be calculated as a ratio or per unit.

C) equals the sales price minus all the fixed expenses.

D) equals total fixed costs minus total variable costs.

A) is not the same as marginal income.

B) can be calculated as a ratio or per unit.

C) equals the sales price minus all the fixed expenses.

D) equals total fixed costs minus total variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the sales price per unit is $200.00, the unit variable cost is $148.00, and total fixed costs are $164,000, then the break-even volume in dollar sales rounded to the nearest whole dollar is

A) $630,769.

B) $221,622.

C) $1,640,000.

D) $206,308.

A) $630,769.

B) $221,622.

C) $1,640,000.

D) $206,308.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

35

As sales volume in units increases and all other relationships remain constant

A) break-even increases.

B) break-even decreases.

C) total contribution margin decreases.

D) total contribution margin increases.

A) break-even increases.

B) break-even decreases.

C) total contribution margin decreases.

D) total contribution margin increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

36

Hampton Company, a producer of computer disks, has the following information:

What is the break-even point in units?

A) 36,000

B) 90,000

C) 60,000

D) 54,000

What is the break-even point in units?

A) 36,000

B) 90,000

C) 60,000

D) 54,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

37

Reese, Inc. produces pliers. Each pair of pliers sells for $8.00. Variable costs per unit total $5.60 of which $2.50 is for direct materials and $2.10 is for direct labour.

If the break-even volume in sales dollars is $578,400, then the total fixed costs for the period must be

A) $173,520.

B) $144,600.

C) $206,570.

D) $251,747.

If the break-even volume in sales dollars is $578,400, then the total fixed costs for the period must be

A) $173,520.

B) $144,600.

C) $206,570.

D) $251,747.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

38

As production increases within the relevant range, fixed costs per unit

A) decrease.

B) increase.

C) stay the same.

D) cannot be determined with the information given.

A) decrease.

B) increase.

C) stay the same.

D) cannot be determined with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

39

Hampton Company, a producer of computer disks, has the following information:

What is the break-even point in dollars?

A) $54,000

B) $36,000

C) $90,000

D) $60,000

What is the break-even point in dollars?

A) $54,000

B) $36,000

C) $90,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

40

In defining a cost as fixed, the accountant must consider

A) the variable costs.

B) the contribution margin.

C) the relevant range.

D) projected sales revenue.

A) the variable costs.

B) the contribution margin.

C) the relevant range.

D) projected sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

41

The variable-cost ratio is

A) all variable costs divided by fixed costs.

B) net income divided by all variable costs.

C) fixed costs divided by all variable costs.

D) all variable costs divided by sales.

A) all variable costs divided by fixed costs.

B) net income divided by all variable costs.

C) fixed costs divided by all variable costs.

D) all variable costs divided by sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

42

As sales exceed the break-even point, a high contribution-margin percentage

A) decreases profits faster than does a small contribution-margin percentage.

B) decreases profits at the same rate as a small contribution-margin percentage.

C) increases profits at the same rate as a small contribution-margin percentage.

D) increases profits faster than does a small contribution-margin percentage.

A) decreases profits faster than does a small contribution-margin percentage.

B) decreases profits at the same rate as a small contribution-margin percentage.

C) increases profits at the same rate as a small contribution-margin percentage.

D) increases profits faster than does a small contribution-margin percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

43

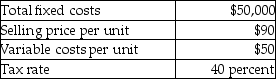

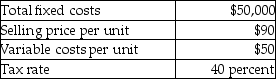

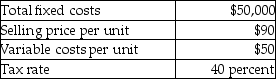

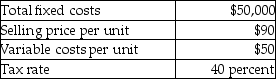

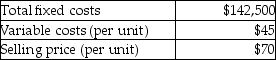

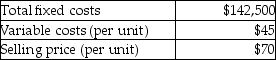

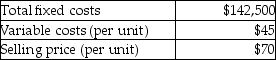

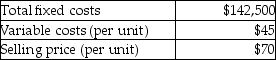

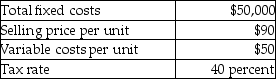

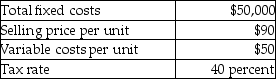

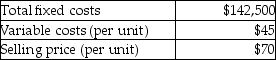

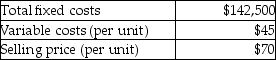

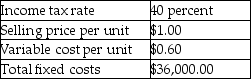

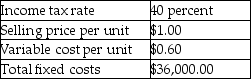

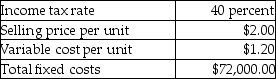

Assume the following cost information for Quayle Corporation:

If fixed costs increased by 10 percent, and management wanted to maintain the original break-even point, then the selling price per unit would have to be increased to

A) $99

B) $130

C) $94

D) $97

If fixed costs increased by 10 percent, and management wanted to maintain the original break-even point, then the selling price per unit would have to be increased to

A) $99

B) $130

C) $94

D) $97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

44

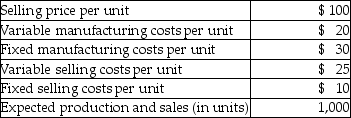

The following information is for Lyceum, Ltd.:

If management has a targeted net income of $21,000 (ignore income taxes), then the number of units which must be sold is

A) 2,036.

B) 2,336.

C) 6,540.

D) 5,700.

If management has a targeted net income of $21,000 (ignore income taxes), then the number of units which must be sold is

A) 2,036.

B) 2,336.

C) 6,540.

D) 5,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

45

The change in total results under a new condition, in comparison with some given or known condition, is the definition of

A) incremental.

B) detrimental.

C) conditional.

D) comparability.

A) incremental.

B) detrimental.

C) conditional.

D) comparability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

46

Assume the following cost information for Quayle Corporation:

What volume of sales dollars is required to earn an after-tax net income of $15,000?

A) $196,875

B) $157,500

C) $135,000

D) $168,750

What volume of sales dollars is required to earn an after-tax net income of $15,000?

A) $196,875

B) $157,500

C) $135,000

D) $168,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

47

Assume the following cost information for Quayle Corporation:

What is the number of units that must be sold to earn an after-tax net income of $25,500?

A) 3,700

B) 2,313

C) 1,594

D) 1,063

What is the number of units that must be sold to earn an after-tax net income of $25,500?

A) 3,700

B) 2,313

C) 1,594

D) 1,063

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

48

The following information is for Lyceum, Ltd.:

If total fixed costs increased to $156,750, then break-even volume in dollars would increase by

A) 12.3 percent.

B) 20.0 percent.

C) 34.3 percent.

D) 10.0 percent.

If total fixed costs increased to $156,750, then break-even volume in dollars would increase by

A) 12.3 percent.

B) 20.0 percent.

C) 34.3 percent.

D) 10.0 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

49

If the contribution-margin ratio is .30, targeted net income is $64,000, and targeted sales volume in dollars is $400,000, then total fixed costs are

A) $56,000.

B) $120,000.

C) $36,800.

D) $19,200.

A) $56,000.

B) $120,000.

C) $36,800.

D) $19,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

50

If targeted sales volume in units is 124,600, total fixed costs are $15,600, and contribution margin per unit is $0.30, then the targeted net income is

A) $37,380.

B) $32,700.

C) $15,600.

D) $21,780.

A) $37,380.

B) $32,700.

C) $15,600.

D) $21,780.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

51

Hampton Company, a producer of computer disks, has the following information:

The cost-volume-profit graph does NOT show

A) the break-even point.

B) the profit or loss at any rate of activity.

C) the fixed cost per unit.

D) sales volume.

The cost-volume-profit graph does NOT show

A) the break-even point.

B) the profit or loss at any rate of activity.

C) the fixed cost per unit.

D) sales volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following information is for Lyceum, Ltd.:

The contribution-margin ratio is

A) 64.3 percent.

B) 55.6 percent.

C) 35.7 percent.

D) 44.4 percent.

The contribution-margin ratio is

A) 64.3 percent.

B) 55.6 percent.

C) 35.7 percent.

D) 44.4 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

53

Operating leverage is

A) the ratio of net income to sales.

B) the ability of a firm to pay off its debts.

C) the ratio of fixed costs to variable costs.

D) also referred to as working capital.

A) the ratio of net income to sales.

B) the ability of a firm to pay off its debts.

C) the ratio of fixed costs to variable costs.

D) also referred to as working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

54

Hampton Company, a producer of computer disks, has the following information:

Which of the following is NOT an underlying assumption of the cost-volume-profit graph?

A) Expenses are categorized into variable and fixed.

B) Sales mix will not be constant.

C) Revenues and expenses are linear over the relevant range.

D) Efficiency and productivity will be unchanged.

Which of the following is NOT an underlying assumption of the cost-volume-profit graph?

A) Expenses are categorized into variable and fixed.

B) Sales mix will not be constant.

C) Revenues and expenses are linear over the relevant range.

D) Efficiency and productivity will be unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the sales price per unit is $150.00, variable cost per unit is $80.00, targeted net income is $44,000, and total fixed costs are $33,000, the number of units that must be sold is

A) 513.

B) 1,100.

C) 963.

D) 629.

A) 513.

B) 1,100.

C) 963.

D) 629.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

56

Assume the following cost information for Quayle Corporation:

What is the break-even point in units?

A) 1,000

B) 1,250

C) 556

D) 500

What is the break-even point in units?

A) 1,000

B) 1,250

C) 556

D) 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

57

In a highly leveraged company,

A) fixed costs are low and variable costs are high.

B) large changes in sales volume result in small changes in net income.

C) there is a higher possibility of net income or net loss and therefore more risk than a low leveraged firm.

D) a variation in sales leads to only a small variability in net income.

A) fixed costs are low and variable costs are high.

B) large changes in sales volume result in small changes in net income.

C) there is a higher possibility of net income or net loss and therefore more risk than a low leveraged firm.

D) a variation in sales leads to only a small variability in net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

58

Hampton Company, a producer of computer disks, has the following information:

If fixed expenses were doubled and contribution margin per unit was cut in half, then the break-even point would

A) be cut in half.

B) double.

C) triple.

D) quadruple.

If fixed expenses were doubled and contribution margin per unit was cut in half, then the break-even point would

A) be cut in half.

B) double.

C) triple.

D) quadruple.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

59

The following information is for Lyceum, Ltd.:

If management has a targeted net income of $27,000 (ignore income taxes), then sales revenue should be

A) $263,667.

B) $474,600.

C) $108,964.

D) $169,500.

If management has a targeted net income of $27,000 (ignore income taxes), then sales revenue should be

A) $263,667.

B) $474,600.

C) $108,964.

D) $169,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

60

Given a break-even point of 44,000 units and a contribution margin per unit of $4.80, the total number of units that must be sold to reach a net profit of $9,048 is

A) 45,885 units.

B) 44,000 units.

C) 1,885 units.

D) cannot be determined with the above information.

A) 45,885 units.

B) 44,000 units.

C) 1,885 units.

D) cannot be determined with the above information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

61

Hampton Company, a producer of computer disks, has the following information:

How many units must be sold to obtain a targeted after-tax income of $6,000?

A) 115,000

B) 42,000

C) 90,000

D) 105,000

How many units must be sold to obtain a targeted after-tax income of $6,000?

A) 115,000

B) 42,000

C) 90,000

D) 105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assuming a constant mix of 3 units of X for every 1 unit of Y, a selling price of $18 for X and $24 for Y, variable costs per unit of $12 for X and $14 for Y, and total fixed costs of $89,600, the break-even point in units would be

A) 9,600 units of X and 3,200 units of Y.

B) 2,400 units of X and 800 units of Y.

C) 3,200 units of X and 9,600 units of Y.

D) 1,867 units of X and 622 units of Y.

A) 9,600 units of X and 3,200 units of Y.

B) 2,400 units of X and 800 units of Y.

C) 3,200 units of X and 9,600 units of Y.

D) 1,867 units of X and 622 units of Y.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

63

Hampton Company, a producer of computer disks, has the following information:

The limiting assumptions of CVP analysis include all of the following EXCEPT

A) a nonlinear revenue function and a nonlinear cost function.

B) that the inventory levels at the beginning of the period are close to the inventory levels at the end of a period.

C) selling prices and costs are known with certainty.

D) costs can be separated into fixed and variable components.

The limiting assumptions of CVP analysis include all of the following EXCEPT

A) a nonlinear revenue function and a nonlinear cost function.

B) that the inventory levels at the beginning of the period are close to the inventory levels at the end of a period.

C) selling prices and costs are known with certainty.

D) costs can be separated into fixed and variable components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

64

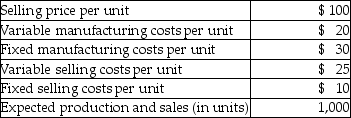

Use the following information to answer the next question(s).

If the firm wants to earn $70,000 in before-tax profit, sales revenue must equal

A) $60,500.

B) $110,000.

C) $200,000.

D) $244,444.

If the firm wants to earn $70,000 in before-tax profit, sales revenue must equal

A) $60,500.

B) $110,000.

C) $200,000.

D) $244,444.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

65

Activities that affect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use the following information to answer the next question(s).

If the firm wants to earn $70,000 in before-tax profit, contribution margin must equal

A) $98,000.

B) $110,000.

C) $125,000.

D) $155,000.

If the firm wants to earn $70,000 in before-tax profit, contribution margin must equal

A) $98,000.

B) $110,000.

C) $125,000.

D) $155,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

67

Gross margin is

A) the excess of gross profit over operating expenses.

B) the excess of sales over the cost of goods sold.

C) also referred to as net profit.

D) the same as contribution margin.

A) the excess of gross profit over operating expenses.

B) the excess of sales over the cost of goods sold.

C) also referred to as net profit.

D) the same as contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the following information to answer the next question(s).

Breakeven for the product (rounded to the nearest whole unit) is

A) 727 units.

B) 888 units.

C) 1,000 units.

D) 1,500.

Breakeven for the product (rounded to the nearest whole unit) is

A) 727 units.

B) 888 units.

C) 1,000 units.

D) 1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

69

Hampton Company, a producer of computer disks, has the following information:

How many units must be sold to obtain a targeted income before taxes of $6,000?

A) 36,000

B) 42,000

C) 90,000

D) 105,000

How many units must be sold to obtain a targeted income before taxes of $6,000?

A) 36,000

B) 42,000

C) 90,000

D) 105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

70

Use the following information to answer the next question(s).

If the tax rate is 40 percent, how many units must be sold to earn an after-tax profit of $60,000?

A) 4,000

B) 1,500

C) 2,640

D) 2,546

If the tax rate is 40 percent, how many units must be sold to earn an after-tax profit of $60,000?

A) 4,000

B) 1,500

C) 2,640

D) 2,546

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

71

If targeted after-tax net income is $27,000 with a 40 percent tax rate, contribution margin per unit is $0.80, and total fixed costs are $148,000, then the number of units that must be sold is

A) 218,750.

B) 241,250.

C) 160,833.

D) 167,250.

A) 218,750.

B) 241,250.

C) 160,833.

D) 167,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

72

If total fixed costs are $62,000, contribution margin per unit is $5.00, and targeted after-tax net income is $12,000 with a 40 percent tax rate, then the number of units that must be sold is

A) 16,400.

B) 14,800.

C) 24,667.

D) 11,440.

A) 16,400.

B) 14,800.

C) 24,667.

D) 11,440.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the proportions in a sales mix change, the

A) contribution margin per unit increases.

B) break-even point will remain the same.

C) cost-volume-profit relationship also changes.

D) net income will not be altered.

A) contribution margin per unit increases.

B) break-even point will remain the same.

C) cost-volume-profit relationship also changes.

D) net income will not be altered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

74

The manner in which the activities of an organization affect its costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the following information to answer the next question(s).

Contribution margin per unit is

A) $15.

B) $50.

C) $55.

D) $80.

Contribution margin per unit is

A) $15.

B) $50.

C) $55.

D) $80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

76

Hampton Company, a producer of computer disks, has the following information:

The contribution margin ratio equals

A) revenue minus variable costs.

B) variable costs divided by revenue.

C) contribution margin divided by revenue.

D) variable costs divided by contribution margin.

The contribution margin ratio equals

A) revenue minus variable costs.

B) variable costs divided by revenue.

C) contribution margin divided by revenue.

D) variable costs divided by contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

77

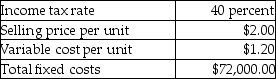

Hampton Company, a producer of computer disks, has the following information:

Barrell Company, a producer of computer disks, has the following information: What sales volume in dollars is needed to obtain a targeted after-tax income of $12,000?

What sales volume in dollars is needed to obtain a targeted after-tax income of $12,000?

A) $84,000

B) $180,000

C) $210,000

D) $230,000

Barrell Company, a producer of computer disks, has the following information:

What sales volume in dollars is needed to obtain a targeted after-tax income of $12,000?

What sales volume in dollars is needed to obtain a targeted after-tax income of $12,000?A) $84,000

B) $180,000

C) $210,000

D) $230,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

78

If total fixed costs are $420,000, contribution margin per unit is $6.75, the tax rate is 40 percent, and the number of units to be sold is 130,000, then the after-tax net income will be

A) $457,500.

B) $877,500.

C) $420,000.

D) $274,500.

A) $457,500.

B) $877,500.

C) $420,000.

D) $274,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use the following information to answer the next question(s).

The contribution margin ratio is

A) 15%.

B) 45%.

C) 50%.

D) 55%.

The contribution margin ratio is

A) 15%.

B) 45%.

C) 50%.

D) 55%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

80

The relative proportions or combinations of quantities of products that comprise total sales is called

A) sales mix.

B) gross margin.

C) proportional sales.

D) product ratio.

A) sales mix.

B) gross margin.

C) proportional sales.

D) product ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck