Deck 12: Flexible Budgets and Variance Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

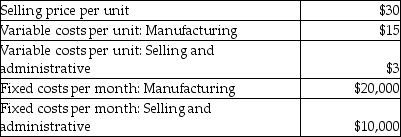

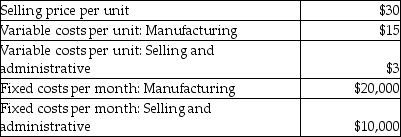

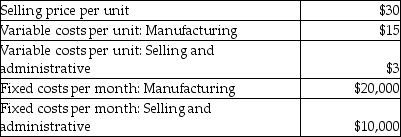

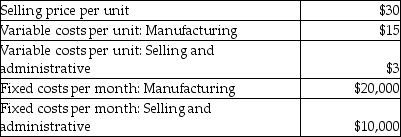

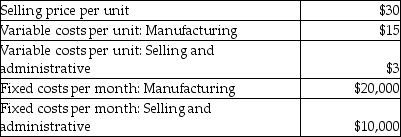

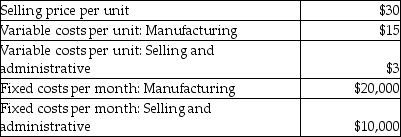

سؤال

سؤال

سؤال

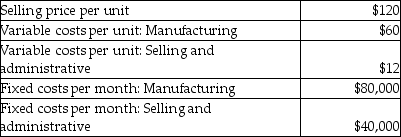

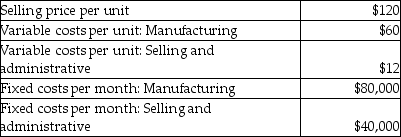

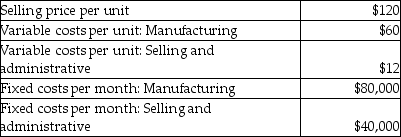

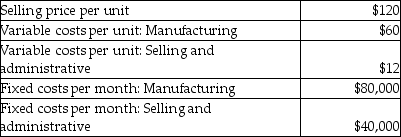

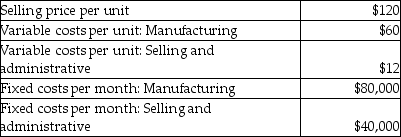

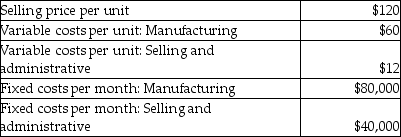

سؤال

سؤال

سؤال

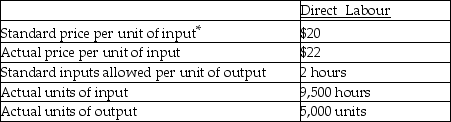

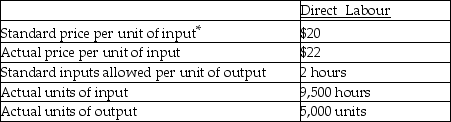

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

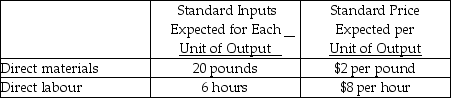

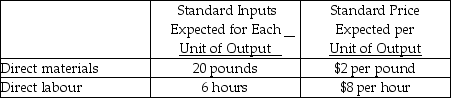

سؤال

سؤال

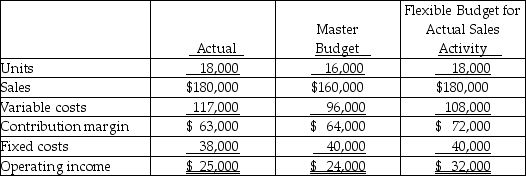

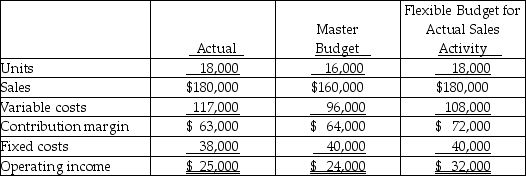

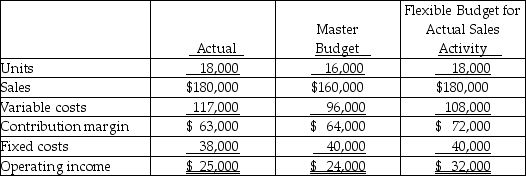

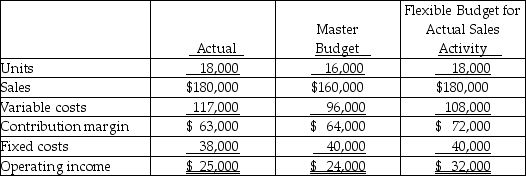

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/106

العب

ملء الشاشة (f)

Deck 12: Flexible Budgets and Variance Analysis

1

Favourable flexible-budget variances are always viewed as positive.

False

2

Flexible budgets are designed to show different possible costs for one anticipated level of output.

False

3

Flexible budgets evaluate whether operations are effective or not.

False

4

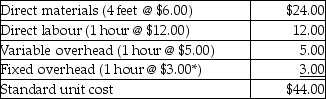

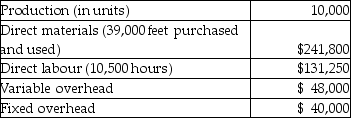

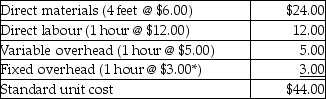

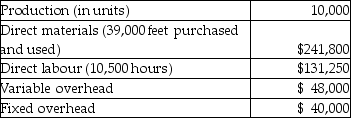

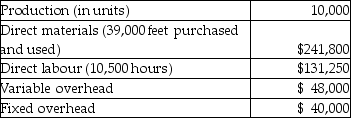

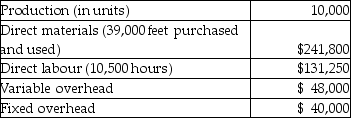

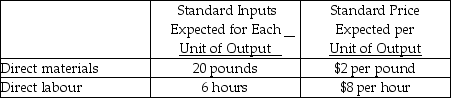

Use the following information to answer the next question(s):

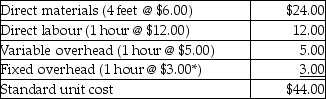

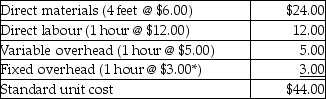

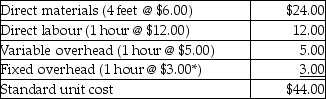

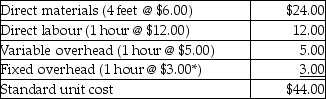

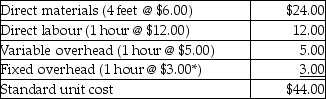

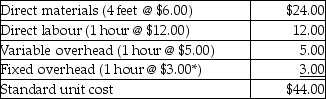

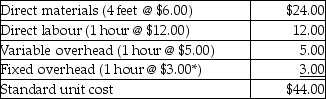

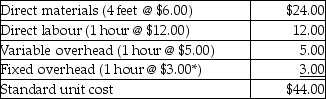

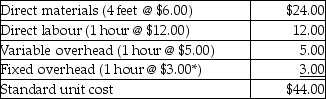

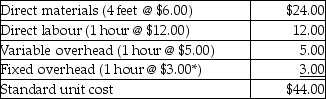

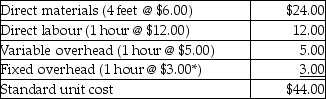

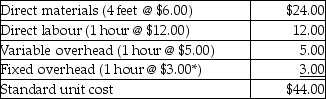

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hours

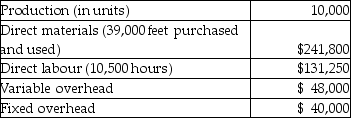

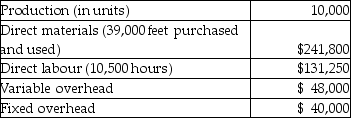

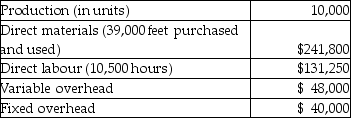

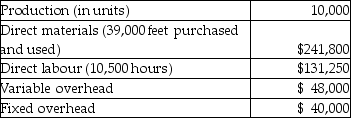

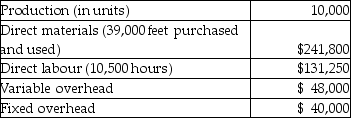

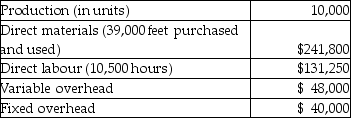

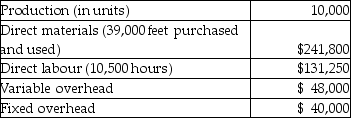

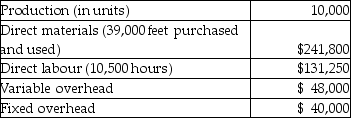

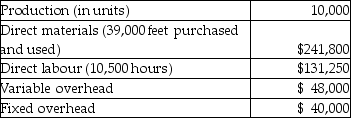

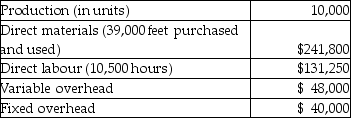

The following results for last year were recorded.

The materials price variance is

A) $7,800 unfavourable.

B) $7,800 favourable.

C) $8,400 unfavourable.

D) $8,400 favourable.

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hoursThe following results for last year were recorded.

The materials price variance is

A) $7,800 unfavourable.

B) $7,800 favourable.

C) $8,400 unfavourable.

D) $8,400 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

5

The difference between applied and budgeted fixed overhead is the production-volume variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a flexible budget, the fixed costs will remain constant regardless of different levels of activity shown in the budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

7

A usage variance measures actual deviations from the quantity of inputs that should have been used to achieve the actual output quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

8

The only way to account for standard cost variances is to adjust income in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

9

A performance report should include variances that indicate the difference between expected future results and desired results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

10

A cost system that applies actual direct materials and actual direct-labour costs to products or services but uses standards for applying overhead is known as a standard costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

11

One cause of a flexible-budget variance might be a difference between expected and actual hourly wages for factory workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

12

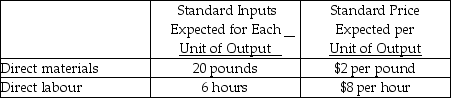

Use the following information to answer the next question(s):

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

The materials usage variance is

A) $4,000 favourable.

B) $4,000 unfavourable.

C) $6,000 favourable.

D) $6,000 unfavourable.

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hoursThe following results for last year were recorded.

The materials usage variance is

A) $4,000 favourable.

B) $4,000 unfavourable.

C) $6,000 favourable.

D) $6,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

13

As the terms are used in the budgeting process, it is possible for a company to be effective at the same time it is inefficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

14

Underapplied overhead is always the difference between the budgeted overhead and the overhead applied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

15

It is universally believed that the standards used in flexible budgets should be "perfection standards" so that individuals will constantly be challenged to perform better.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

16

All master budgets are prepared for only one level of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

17

When actual volume is less than expected volume, fixed overhead is overapplied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

18

The total flexible-budget variance can be broken down into a price variance and a usage variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

19

In most companies, variances are investigated only if they exceed a minimum dollar or percentage deviation from budgeted amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

20

If actual revenues and expenses exceed expected revenues and expenses, all variances in the performance report will be favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

21

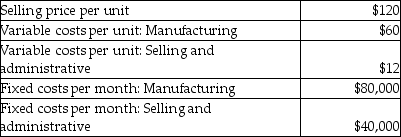

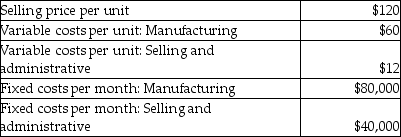

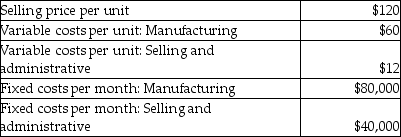

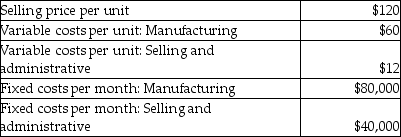

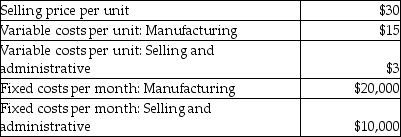

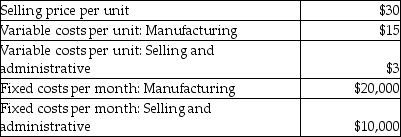

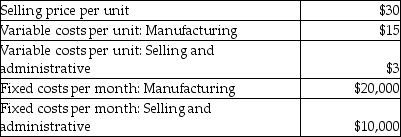

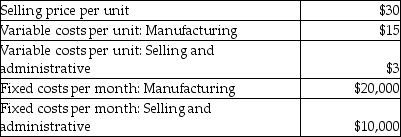

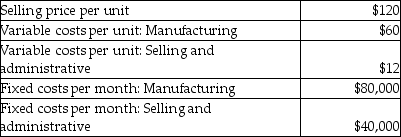

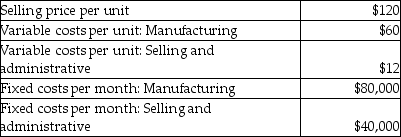

Woodlund Company had the following information:

What are the total selling and administrative expenses for 15,000 units?

A) $1,200,000

B) $180,000

C) $220,000

D) $1,080,000

What are the total selling and administrative expenses for 15,000 units?

A) $1,200,000

B) $180,000

C) $220,000

D) $1,080,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

22

Woodlund Company had the following information:

What are the total selling and administrative expenses for 10,000 units?

A) $120,000

B) $160,000

C) $720,000

D) $840,000

What are the total selling and administrative expenses for 10,000 units?

A) $120,000

B) $160,000

C) $720,000

D) $840,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

23

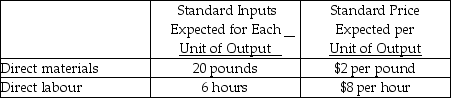

Use the following information to answer the next question(s):

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

The variable overhead efficiency variance is

A) $2,500 favourable.

B) $2,500 unfavourable.

C) $2,250 favourable.

D) $2,250 unfavourable.

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hoursThe following results for last year were recorded.

The variable overhead efficiency variance is

A) $2,500 favourable.

B) $2,500 unfavourable.

C) $2,250 favourable.

D) $2,250 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

24

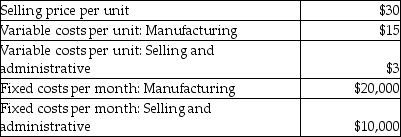

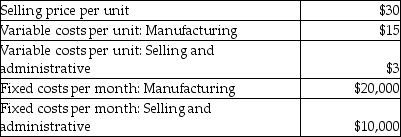

Harrison Company had the following information:

What is the net income for 10,000 units?

A) $90,000

B) $120,000

C) $300,000

D) $270,000

What is the net income for 10,000 units?

A) $90,000

B) $120,000

C) $300,000

D) $270,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

25

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

What is the cost function?

A) Costs = $ 75,000 + $0.098(Lines)

B) Costs = $ 75,000 + $0.068(Lines)

C) Costs = $245,000 + $0.068(Lines)

D) Cannot be determined

What is the cost function?

A) Costs = $ 75,000 + $0.098(Lines)

B) Costs = $ 75,000 + $0.068(Lines)

C) Costs = $245,000 + $0.068(Lines)

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

26

Harrison Company had the following information:

What is the net income for 15,000 units?

A) $450,000

B) $180,000

C) $405,000

D) $150,000

What is the net income for 15,000 units?

A) $450,000

B) $180,000

C) $405,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

27

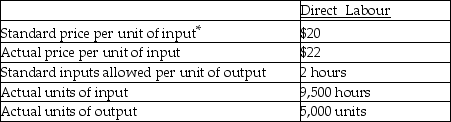

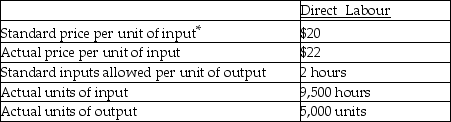

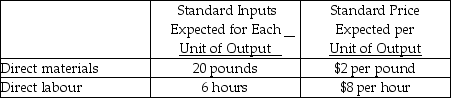

Use the following information to answer the next question(s):

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

The labour rate variance is

A) $5,250 favourable.

B) $5,250 unfavourable.

C) $5,000 favourable.

D) $5,000 unfavourable.

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hoursThe following results for last year were recorded.

The labour rate variance is

A) $5,250 favourable.

B) $5,250 unfavourable.

C) $5,000 favourable.

D) $5,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

28

Harrison Company had the following information:

What are the total selling and administrative expenses for 15,000 units?

A) $300,000

B) $ 45,000

C) $ 55,000

D) $270,000

What are the total selling and administrative expenses for 15,000 units?

A) $300,000

B) $ 45,000

C) $ 55,000

D) $270,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

29

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

What would be the total flexible budget if the number of lines increased to 2,600,000?

A) $176,800

B) $245,000

C) $251,800

D) Cannot be determined

What would be the total flexible budget if the number of lines increased to 2,600,000?

A) $176,800

B) $245,000

C) $251,800

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

30

Woodlund Company had the following information:

What are the total manufacturing costs for 10,000 units?

A) $600,000

B) $80,000

C) $680,000

D) $720,000

What are the total manufacturing costs for 10,000 units?

A) $600,000

B) $80,000

C) $680,000

D) $720,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

31

Harrison Company had the following information:

What are the total selling and administrative expenses for 10,000 units?

A) $30,000

B) $40,000

C) $180,000

D) $210,000

What are the total selling and administrative expenses for 10,000 units?

A) $30,000

B) $40,000

C) $180,000

D) $210,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

32

Woodlund Company had the following information:

What are the total manufacturing costs for 15,000 units?

A) $120,000

B) $980,000

C) $900,000

D) $1,080,000

What are the total manufacturing costs for 15,000 units?

A) $120,000

B) $980,000

C) $900,000

D) $1,080,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the following information to answer the next question(s):

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

The variable overhead spending variance is

A) $4,500 favourable.

B) $4,500 unfavourable.

C) $4,800 favourable.

D) $4,800 unfavourable.

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hoursThe following results for last year were recorded.

The variable overhead spending variance is

A) $4,500 favourable.

B) $4,500 unfavourable.

C) $4,800 favourable.

D) $4,800 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

34

Woodlund Company had the following information:

What is the net income for 10,000 units?

A) $360,000

B) $480,000

C) $1,200,000

D) $1,080,000

What is the net income for 10,000 units?

A) $360,000

B) $480,000

C) $1,200,000

D) $1,080,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

35

Harrison Company had the following information:

What are the total manufacturing costs for 10,000 units?

A) $150,000

B) $20,000

C) $170,000

D) $180,000

What are the total manufacturing costs for 10,000 units?

A) $150,000

B) $20,000

C) $170,000

D) $180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

36

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

What is the variable cost per line?

A) $0.068

B) $0.098

C) $0.030

D) Cannot be determined

What is the variable cost per line?

A) $0.068

B) $0.098

C) $0.030

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information to answer the next question(s):

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

The fixed overhead volume variance is

A) $4,000 unfavourable.

B) $4,000 favourable.

C) $6,000 favourable.

D) $6,000 favourable.

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hoursThe following results for last year were recorded.

The fixed overhead volume variance is

A) $4,000 unfavourable.

B) $4,000 favourable.

C) $6,000 favourable.

D) $6,000 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

38

Harrison Company had the following information:

What are the total manufacturing costs for 15,000 units?

A) $30,000

B) $245,000

C) $225,000

D) $270,000

What are the total manufacturing costs for 15,000 units?

A) $30,000

B) $245,000

C) $225,000

D) $270,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

39

Woodlund Company had the following information:

What is the net income for 15,000 units?

A) $1,800,000

B) $720,000

C) $1,620,000

D) $600,000

What is the net income for 15,000 units?

A) $1,800,000

B) $720,000

C) $1,620,000

D) $600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information to answer the next question(s):

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

The labour efficiency variance is

A) $5,250 favourable.

B) $5,250 unfavourable.

C) $6,000 favourable.

D) $6,000 unfavourable.

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

*Rate based on expected activity of 12,000 hoursThe following results for last year were recorded.

The labour efficiency variance is

A) $5,250 favourable.

B) $5,250 unfavourable.

C) $6,000 favourable.

D) $6,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

41

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

With regard to flexible-budget variances, Caulkins Corporation showed a $2,000 unfavourable variable cost variance and a $450 favourable fixed cost variance. The variance for operating income was

A) $1,550 unfavourable.

B) $2,450 favourable.

C) $2,450 unfavourable.

D) undeterminable.

With regard to flexible-budget variances, Caulkins Corporation showed a $2,000 unfavourable variable cost variance and a $450 favourable fixed cost variance. The variance for operating income was

A) $1,550 unfavourable.

B) $2,450 favourable.

C) $2,450 unfavourable.

D) undeterminable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

42

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

Identify which of the statements below is NOT a reason why actual results would differ from those projected in the master budget.

A) Current period projected sales volume differed from the prior period projection.

B) Actual sales volume differed from projected sales volume.

C) Variable costs per unit differed from expected amounts.

D) Actual fixed costs were different than expected.

Identify which of the statements below is NOT a reason why actual results would differ from those projected in the master budget.

A) Current period projected sales volume differed from the prior period projection.

B) Actual sales volume differed from projected sales volume.

C) Variable costs per unit differed from expected amounts.

D) Actual fixed costs were different than expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

43

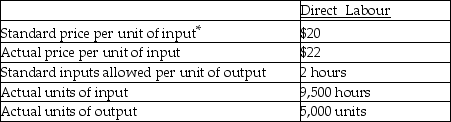

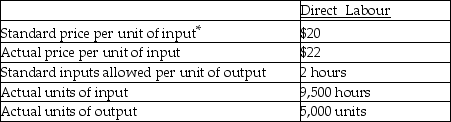

The following information pertains to Finger Company:

*Direct labour is measured in hours

*Direct labour is measured in hours

The price variance for direct labour is

A) $20,000 favourable.

B) $20,000 unfavourable.

C) $19,000 favourable.

D) $19,000 unfavourable.

*Direct labour is measured in hours

*Direct labour is measured in hoursThe price variance for direct labour is

A) $20,000 favourable.

B) $20,000 unfavourable.

C) $19,000 favourable.

D) $19,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

44

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

If the total sales activity variance was $15,000 favourable, and the total master-budget variance was $17,500 favourable, then the total flexible-budget variance must have been

A) $32,500 favourable.

B) $ 2,500 favourable.

C) $ 2,500 unfavourable.

D) undeterminable.

If the total sales activity variance was $15,000 favourable, and the total master-budget variance was $17,500 favourable, then the total flexible-budget variance must have been

A) $32,500 favourable.

B) $ 2,500 favourable.

C) $ 2,500 unfavourable.

D) undeterminable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

45

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

Which of the following is NOT an example of "efficient" performance?

A) More goods were produced and sold than anticipated.

B) Direct labour hours per unit were less than expected.

C) Direct material used per unit was less than expected.

D) More outputs were achieved with less inputs than predicted.

Which of the following is NOT an example of "efficient" performance?

A) More goods were produced and sold than anticipated.

B) Direct labour hours per unit were less than expected.

C) Direct material used per unit was less than expected.

D) More outputs were achieved with less inputs than predicted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

46

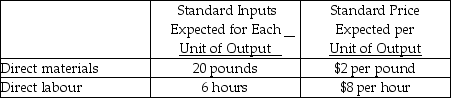

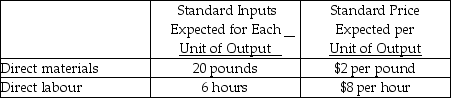

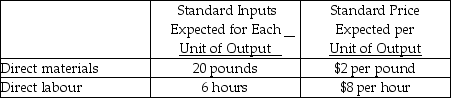

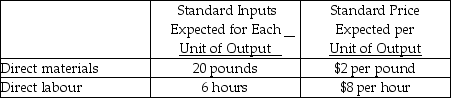

The Clamen Company makes table lamps, for which the following standards have been developed:

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-material price variance for October is

A) $420 unfavourable.

B) $420 favourable.

C) $400 favourable.

D) $400 unfavourable.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-material price variance for October is

A) $420 unfavourable.

B) $420 favourable.

C) $400 favourable.

D) $400 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

47

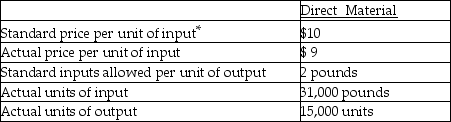

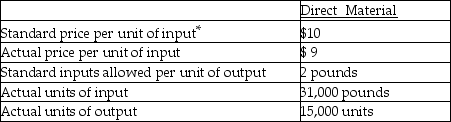

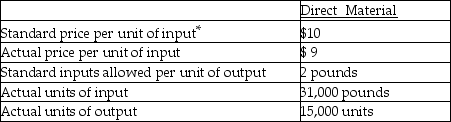

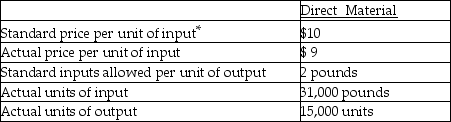

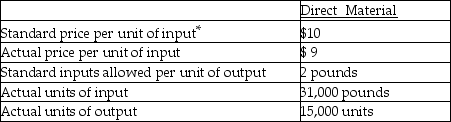

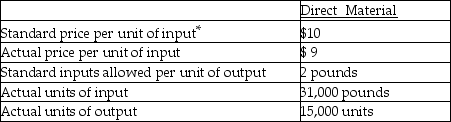

The following information is for Doran Corporation:

*Direct material is measured in pounds

*Direct material is measured in pounds

The total flexible-budget variance for direct material is

A) $21,000 unfavourable.

B) $21,000 favourable.

C) $40,000 favourable.

D) $40,000 unfavourable.

*Direct material is measured in pounds

*Direct material is measured in poundsThe total flexible-budget variance for direct material is

A) $21,000 unfavourable.

B) $21,000 favourable.

C) $40,000 favourable.

D) $40,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

48

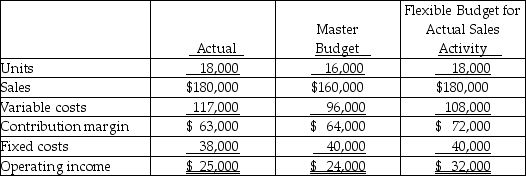

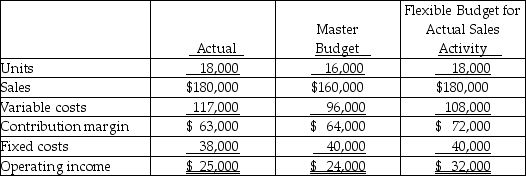

The following data are for Parker Corporation for 20X4.

The total of the sales-activity variances is

A) $8,000 favourable.

B) $8,000 unfavourable.

C) $7,000 favourable.

D) $7,000 unfavourable.

The total of the sales-activity variances is

A) $8,000 favourable.

B) $8,000 unfavourable.

C) $7,000 favourable.

D) $7,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

49

The following data are for Parker Corporation for 20X4.

The total of the master-budget variances is

A) $8,000 favourable.

B) $8,000 unfavourable.

C) $1,000 unfavourable.

D) $1,000 favourable.

The total of the master-budget variances is

A) $8,000 favourable.

B) $8,000 unfavourable.

C) $1,000 unfavourable.

D) $1,000 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

50

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

Flexible budgets help to measure

A) differences between projected and actual activity levels.

B) the efficiency of operations at the actual activity level.

C) the amount by which standard and expected prices differ.

D) the reasons why projected activity levels were not attained.

Flexible budgets help to measure

A) differences between projected and actual activity levels.

B) the efficiency of operations at the actual activity level.

C) the amount by which standard and expected prices differ.

D) the reasons why projected activity levels were not attained.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

51

The following information is for Doran Corporation:

*Direct material is measured in pounds

*Direct material is measured in pounds

The usage variance for direct material is

A) $10,000 unfavourable.

B) $9,000 unfavourable.

C) $9,000 favourable.

D) $10,000 favourable.

*Direct material is measured in pounds

*Direct material is measured in poundsThe usage variance for direct material is

A) $10,000 unfavourable.

B) $9,000 unfavourable.

C) $9,000 favourable.

D) $10,000 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

52

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

Flexible-budget variances are designed to measure

A) effectiveness of operations at projected level of activity.

B) effectiveness of operations at actual level of activity.

C) efficiency of operations at projected level of activity.

D) efficiency of operations at actual level of activity.

Flexible-budget variances are designed to measure

A) effectiveness of operations at projected level of activity.

B) effectiveness of operations at actual level of activity.

C) efficiency of operations at projected level of activity.

D) efficiency of operations at actual level of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

53

The following information pertains to Finger Company:

*Direct labour is measured in hours

*Direct labour is measured in hours

The total flexible-budget variance for direct labour is

A) $ 9,000 unfavourable.

B) $ 9,000 favourable.

C) $30,000 unfavourable.

D) $30,000 favourable.

*Direct labour is measured in hours

*Direct labour is measured in hoursThe total flexible-budget variance for direct labour is

A) $ 9,000 unfavourable.

B) $ 9,000 favourable.

C) $30,000 unfavourable.

D) $30,000 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Clamen Company makes table lamps, for which the following standards have been developed:

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The standard cost of direct material for each lamps produced is

A) $48.00.

B) $40.00.

C) $44.00.

D) $21.00.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The standard cost of direct material for each lamps produced is

A) $48.00.

B) $40.00.

C) $44.00.

D) $21.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

55

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

Which statement would NOT be a possible reason for a variance between a flexible budget and actual results?

A) Material prices were different than expected.

B) Labour prices were different than expected.

C) The actual volume of activity was different than expected.

D) The amount of labour used per unit of output was different than expected.

Which statement would NOT be a possible reason for a variance between a flexible budget and actual results?

A) Material prices were different than expected.

B) Labour prices were different than expected.

C) The actual volume of activity was different than expected.

D) The amount of labour used per unit of output was different than expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

56

The following information pertains to Finger Company:

*Direct labour is measured in hours

*Direct labour is measured in hours

The direct-labour usage variance is

A) $11,000 favourable.

B) $11,000 unfavourable.

C) $10,000 favourable.

D) $10,000 unfavourable.

*Direct labour is measured in hours

*Direct labour is measured in hoursThe direct-labour usage variance is

A) $11,000 favourable.

B) $11,000 unfavourable.

C) $10,000 favourable.

D) $10,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following information is for Doran Corporation:

*Direct material is measured in pounds

*Direct material is measured in pounds

The price variance for direct material is

A) $30,000 favourable.

B) $30,000 unfavourable.

C) $31,000 unfavourable.

D) $31,000 favourable.

*Direct material is measured in pounds

*Direct material is measured in poundsThe price variance for direct material is

A) $30,000 favourable.

B) $30,000 unfavourable.

C) $31,000 unfavourable.

D) $31,000 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

58

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

Who is best able to explain the reasons for flexible-budget variances?

A) The company president

B) A salesperson

C) A manufacturing department foreperson

D) A machine operator

Who is best able to explain the reasons for flexible-budget variances?

A) The company president

B) A salesperson

C) A manufacturing department foreperson

D) A machine operator

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

59

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

A favourable sales-activity variance means that

A) managers have been efficient in the implementation of a sales budget.

B) managers have been effective in accomplishing a planned sales level.

C) demand for the company product is strong.

D) the sales force has done an excellent job.

A favourable sales-activity variance means that

A) managers have been efficient in the implementation of a sales budget.

B) managers have been effective in accomplishing a planned sales level.

C) demand for the company product is strong.

D) the sales force has done an excellent job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

60

The following data are for Parker Corporation for 20X4.

The total of the flexible-budget variances is

A) $7,000 favourable.

B) $7,000 unfavourable.

C) $1,000 favourable.

D) $1,000 unfavourable.

The total of the flexible-budget variances is

A) $7,000 favourable.

B) $7,000 unfavourable.

C) $1,000 favourable.

D) $1,000 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

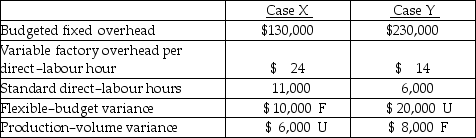

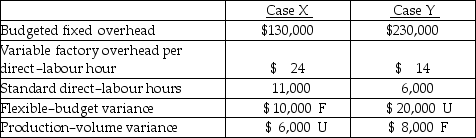

61

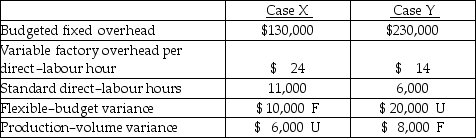

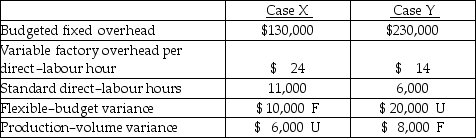

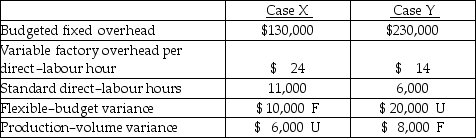

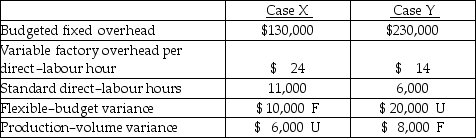

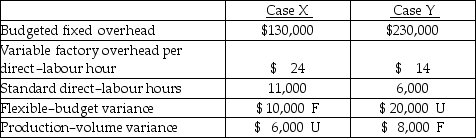

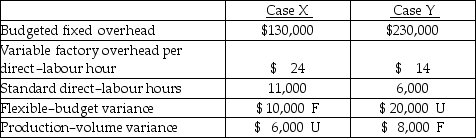

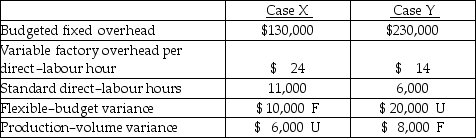

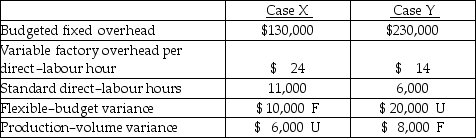

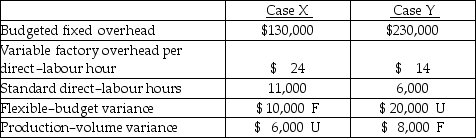

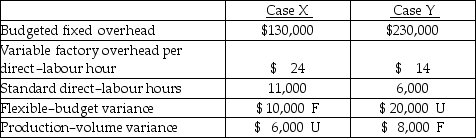

A company had the following information pertaining to two different cases:

The total overhead variance in Case X was

A) $126,000 unfavourable.

B) $16,000 favourable.

C) $4,000 favourable.

D) $134,000 favourable.

The total overhead variance in Case X was

A) $126,000 unfavourable.

B) $16,000 favourable.

C) $4,000 favourable.

D) $134,000 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

62

The following data apply to Walker Corporation for the year 20X4.

For Product X, the total actual quantity used was

A) 600 pounds.

B) 500 pounds.

C) 400 pounds.

D) 300 pounds.

For Product X, the total actual quantity used was

A) 600 pounds.

B) 500 pounds.

C) 400 pounds.

D) 300 pounds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company had the following information pertaining to two different cases:

Prorating the variances refers to assigning the variances to

A) cost of goods sold only.

B) inventories and cost of goods sold.

C) inventories only.

D) inventories, cost of goods sold, and sales.

Prorating the variances refers to assigning the variances to

A) cost of goods sold only.

B) inventories and cost of goods sold.

C) inventories only.

D) inventories, cost of goods sold, and sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

64

A company had the following information pertaining to two different cases:

The applied factory overhead cost in Case Y was

A) $322,000.

B) $238,000.

C) $346,000.

D) $222,000.

The applied factory overhead cost in Case Y was

A) $322,000.

B) $238,000.

C) $346,000.

D) $222,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

65

The following data apply to Walker Corporation for the year 20X4.

For Product Y, the usage variance was

A) $3,300 unfavourable.

B) $3,300 favourable.

C) $2,400 unfavourable.

D) $2,400 favourable.

For Product Y, the usage variance was

A) $3,300 unfavourable.

B) $3,300 favourable.

C) $2,400 unfavourable.

D) $2,400 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

66

A company had the following information pertaining to two different cases:

The fixed overhead volume variance arises because fixed-overhead accounting must serve two masters: the control-budget purpose and the

A) product-costing purpose.

B) period-costing purpose.

C) stockholders.

D) creditors.

The fixed overhead volume variance arises because fixed-overhead accounting must serve two masters: the control-budget purpose and the

A) product-costing purpose.

B) period-costing purpose.

C) stockholders.

D) creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

67

The following data apply to Walker Corporation for the year 20X4.

When actual volume is less than expected volume, fixed overhead is

A) favourable.

B) underapplied.

C) overapplied.

D) indeterminable.

When actual volume is less than expected volume, fixed overhead is

A) favourable.

B) underapplied.

C) overapplied.

D) indeterminable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Clamen Company makes table lamps, for which the following standards have been developed:

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-labour usage variance for the month of October is

A) $560 favourable.

B) $560 unfavourable.

C) $630 favourable.

D) $630 unfavourable.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-labour usage variance for the month of October is

A) $560 favourable.

B) $560 unfavourable.

C) $630 favourable.

D) $630 unfavourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following data apply to Walker Corporation for the year 20X4.

Which costing methods generate fixed overhead volume variances?

A) Normal and standard.

B) Standard and actual.

C) Actual and normal.

D) Actual, normal, and standard.

Which costing methods generate fixed overhead volume variances?

A) Normal and standard.

B) Standard and actual.

C) Actual and normal.

D) Actual, normal, and standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

70

The following data apply to Walker Corporation for the year 20X4.

For Product X, the flexible-budget variance was

A) $800 unfavourable.

B) $800 favourable.

C) $1,200 favourable.

D) $400 favourable.

For Product X, the flexible-budget variance was

A) $800 unfavourable.

B) $800 favourable.

C) $1,200 favourable.

D) $400 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

71

The following data apply to Walker Corporation for the year 20X4.

For Product Y, the total standard material cost for producing the 300 units was

A) $9,000.

B) $9,900.

C) $13,200.

D) $12,000.

For Product Y, the total standard material cost for producing the 300 units was

A) $9,000.

B) $9,900.

C) $13,200.

D) $12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

72

The following data apply to Walker Corporation for the year 20X4.

The costing system that uses actual direct labour and materials cost but uses standards for applying overhead is called

A) actual costing.

B) standard costing.

C) variance costing.

D) normal costing.

The costing system that uses actual direct labour and materials cost but uses standards for applying overhead is called

A) actual costing.

B) standard costing.

C) variance costing.

D) normal costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

73

The following data apply to Walker Corporation for the year 20X4.

For product X, the actual quantity used per unit was

A) 1.0 pound.

B) 2.0 pounds.

C) 3.0 pounds.

D) 3.5 pounds.

For product X, the actual quantity used per unit was

A) 1.0 pound.

B) 2.0 pounds.

C) 3.0 pounds.

D) 3.5 pounds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

74

The following data apply to Walker Corporation for the year 20X4.

For Product Y, the total actual cost for producing the 300 units was

A) $9,000.

B) $9,900.

C) $12,000.

D) $13,200.

For Product Y, the total actual cost for producing the 300 units was

A) $9,000.

B) $9,900.

C) $12,000.

D) $13,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

75

The following data apply to Walker Corporation for the year 20X4.

When actual volume is less than expected volume, the fixed overhead volume variance is

A) favourable.

B) overapplied.

C) unfavourable.

D) indeterminable.

When actual volume is less than expected volume, the fixed overhead volume variance is

A) favourable.

B) overapplied.

C) unfavourable.

D) indeterminable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

76

A company had the following information pertaining to two different cases:

The applied factory overhead cost in Case X was

A) $400,000.

B) $136,000.

C) $124,000.

D) $388,000.

The applied factory overhead cost in Case X was

A) $400,000.

B) $136,000.

C) $124,000.

D) $388,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

77

A company had the following information pertaining to two different cases:

Actual factory overhead cost in Case X was

A) $264,000.

B) $384,000.

C) $120,000.

D) $130,000.

Actual factory overhead cost in Case X was

A) $264,000.

B) $384,000.

C) $120,000.

D) $130,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Clamen Company makes table lamps, for which the following standards have been developed:

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-material usage variance for October is

A) $220 unfavourable.

B) $220 favourable.

C) $200 unfavourable.

D) $200 favourable.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-material usage variance for October is

A) $220 unfavourable.

B) $220 favourable.

C) $200 unfavourable.

D) $200 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

79

The following data apply to Walker Corporation for the year 20X4.

For Product Y, the standard price per unit was

A) $11.00 per pound.

B) $5.33 per pound.

C) $10.75 per pound.

D) $10.00 per pound.

For Product Y, the standard price per unit was

A) $11.00 per pound.

B) $5.33 per pound.

C) $10.75 per pound.

D) $10.00 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Clamen Company makes table lamps, for which the following standards have been developed:

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-labour price variance for the month of October is

A) $600 unfavourable.

B) $600 favourable.

C) $590 unfavourable.

D) $590 favourable.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.

During October, production of 100 lamps was expected, but 110 lamps were actually completed.Direct materials purchased and used were 2,100 pounds at an actual price of $2.20 per pound.

Direct labour cost for the month was $5,310, and the actual pay per hour was $9.00.

The direct-labour price variance for the month of October is

A) $600 unfavourable.

B) $600 favourable.

C) $590 unfavourable.

D) $590 favourable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck