Deck 7: Capital Asset Pricing and Arbitrage Pricing Theory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/85

العب

ملء الشاشة (f)

Deck 7: Capital Asset Pricing and Arbitrage Pricing Theory

1

Consider the CAPM.The expected return on the market is 18%.The expected return on a stock with a beta of 1.2 is 20%.What is the risk-free rate?

A) 2%

B) 6%

C) 8%

D) 12%

A) 2%

B) 6%

C) 8%

D) 12%

C

2

When all investors analyze securities in the same way and share the same economic view of the world we say they have ____________________.

A) heterogeneous expectations

B) equal risk aversion

C) asymmetric information

D) homogeneous expectations

A) heterogeneous expectations

B) equal risk aversion

C) asymmetric information

D) homogeneous expectations

D

3

If enough investors decide to purchase stocks they are likely to drive up stock prices thereby causing _____________ and ___________.

A) expected returns to fall; risk premiums to fall

B) expected returns to rise; risk premiums to fall

C) expected returns to rise; risk premiums to rise

D) expected returns to fall; risk premiums to rise

A) expected returns to fall; risk premiums to fall

B) expected returns to rise; risk premiums to fall

C) expected returns to rise; risk premiums to rise

D) expected returns to fall; risk premiums to rise

A

4

Which of the following are assumptions of the simple CAPM model?

I)Individual trades of investors do not affect a stock's price

II)All investors plan for one identical holding period

III)All investors analyze securities in the same way and share the same economic view of the world

IV)All investors have the same level of risk aversion

A) I, II and IV only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

I)Individual trades of investors do not affect a stock's price

II)All investors plan for one identical holding period

III)All investors analyze securities in the same way and share the same economic view of the world

IV)All investors have the same level of risk aversion

A) I, II and IV only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

5

In a well diversified portfolio,__________ risk is negligible.

A) nondiversifiable

B) market

C) systematic

D) unsystematic

A) nondiversifiable

B) market

C) systematic

D) unsystematic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

6

Consider the CAPM.The risk-free rate is 5% and the expected return on the market is 15%.What is the beta on a stock with an expected return of 17%?

A) .5

B) .7

C) 1

D) 1.2

A) .5

B) .7

C) 1

D) 1.2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

7

The market portfolio has a beta of _________.

A) -1.0

B) 0

C) 0.5

D) 1.0

A) -1.0

B) 0

C) 0.5

D) 1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

8

An adjusted beta will be ______ than the unadjusted beta.

A) lower

B) higher

C) closer to 1

D) closer to 0

A) lower

B) higher

C) closer to 1

D) closer to 0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

9

Fama and French claim that after controlling for firm size and the ratio of firm's book value to market value,beta is ______________.

I)highly significant in predicting future stock returns

II)relatively useless in predicting future stock returns

III)a good predictor of firm's specific risk

A) I only

B) II only

C) I and III only

D) I, II and III

I)highly significant in predicting future stock returns

II)relatively useless in predicting future stock returns

III)a good predictor of firm's specific risk

A) I only

B) II only

C) I and III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

10

Investors require a risk premium as compensation for bearing ______________.

A) unsystematic risk

B) alpha risk

C) residual risk

D) systematic risk

A) unsystematic risk

B) alpha risk

C) residual risk

D) systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

11

In a simple CAPM world which of the following statements is/are correct?

I)All investors will choose to hold the market portfolio,which includes all risky assets in the world

II)Investors' complete portfolio will vary depending on their risk aversion

III)The return per unit of risk will be identical for all individual assets

IV)The market portfolio will be on the efficient frontier and it will be the optimal risky portfolio

A) I, II and III only

B) II, III and IV only

C) I, III and IV only

D) I, II, III and IV

I)All investors will choose to hold the market portfolio,which includes all risky assets in the world

II)Investors' complete portfolio will vary depending on their risk aversion

III)The return per unit of risk will be identical for all individual assets

IV)The market portfolio will be on the efficient frontier and it will be the optimal risky portfolio

A) I, II and III only

B) II, III and IV only

C) I, III and IV only

D) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

12

According to the capital asset pricing model,a security with a _________.

A) negative alpha is considered a good buy

B) positive alpha is considered overpriced

C) positive alpha is considered underpriced

D) zero alpha is considered a good buy

A) negative alpha is considered a good buy

B) positive alpha is considered overpriced

C) positive alpha is considered underpriced

D) zero alpha is considered a good buy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to the capital asset pricing model,a fairly priced security will plot _________.

A) above the security market line

B) along the security market line

C) below the security market line

D) at no relation to the security market line

A) above the security market line

B) along the security market line

C) below the security market line

D) at no relation to the security market line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

14

The capital asset pricing model was developed by _________.

A) Kenneth French

B) Stephen Ross

C) William Sharpe

D) Eugene Fama

A) Kenneth French

B) Stephen Ross

C) William Sharpe

D) Eugene Fama

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

15

The arbitrage pricing theory was developed by _________.

A) Henry Markowitz

B) Stephen Ross

C) William Sharpe

D) Eugene Fama

A) Henry Markowitz

B) Stephen Ross

C) William Sharpe

D) Eugene Fama

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

16

Consider the CAPM.The risk-free rate is 6% and the expected return on the market is 18%.What is the expected return on a stock with a beta of 1.3?

A) 6%

B) 15.6%

C) 18%

D) 21.6%

A) 6%

B) 15.6%

C) 18%

D) 21.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the context of the capital asset pricing model,the systematic measure of risk is captured by _________.

A) unique risk

B) beta

C) standard deviation of returns

D) variance of returns

A) unique risk

B) beta

C) standard deviation of returns

D) variance of returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

18

Arbitrage is based on the idea that _________.

A) assets with identical risks must have the same expected rate of return

B) securities with similar risk should sell at different prices

C) the expected returns from equally risky assets are different

D) markets are perfectly efficient

A) assets with identical risks must have the same expected rate of return

B) securities with similar risk should sell at different prices

C) the expected returns from equally risky assets are different

D) markets are perfectly efficient

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

19

Empirical results estimated from historical data indicate that betas _________.

A) are always close to zero

B) are constant over time

C) of all securities are always between zero and one

D) seem to regress toward one over time

A) are always close to zero

B) are constant over time

C) of all securities are always between zero and one

D) seem to regress toward one over time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

20

If all investors become more risk averse the SML will _______________ and stock prices will _______________.

A) shift upward; rise

B) shift downward; fall

C) have the same intercept with a steeper slope; fall

D) have the same intercept with a flatter slope; rise

A) shift upward; rise

B) shift downward; fall

C) have the same intercept with a steeper slope; fall

D) have the same intercept with a flatter slope; rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

21

Consider the multi-factor APT with two factors.Portfolio A has a beta of 0.5 on factor 1 and a beta of 1.25 on factor 2.The risk premiums on the factors 1 and 2 portfolios are 1% and 7% respectively.The risk-free rate of return is 7%.The expected return on portfolio A is __________ if no arbitrage opportunities exist.

A) 13.5%

B) 15.0%

C) 16.25%

D) 23.0%

A) 13.5%

B) 15.0%

C) 16.25%

D) 23.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

22

Consider the capital asset pricing model.The market degree of risk aversion,A,is 3.The variance of return on the market portfolio is .0225.If the risk-free rate of return is 4%,the expected return on the market portfolio is _________.

A) 6.75%

B) 9.0%

C) 10.75%

D) 12.0%

A) 6.75%

B) 9.0%

C) 10.75%

D) 12.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

23

Consider the single factor APT.Portfolio A has a beta of 0.2 and an expected return of 13%.Portfolio B has a beta of 0.4 and an expected return of 15%.The risk-free rate of return is 10%.If you wanted to take advantage of an arbitrage opportunity,you should take a short position in portfolio __________ and a long position in portfolio _________.

A) A, A

B) A, B

C) B, A

D) B, B

A) A, A

B) A, B

C) B, A

D) B, B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

24

In a single factor market model the beta of a stock ________.

A) measures the stock's contribution to the standard deviation of the market portfolio

B) measures the stock's unsystematic risk

C) changes with the variance of the residuals

D) measures the stock's contribution to the standard deviation of the stock

A) measures the stock's contribution to the standard deviation of the market portfolio

B) measures the stock's unsystematic risk

C) changes with the variance of the residuals

D) measures the stock's contribution to the standard deviation of the stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

25

The possibility of arbitrage arises when ____________.

A) there is no consensus among investors regarding the future direction of the market, and thus trades are made arbitrarily

B) mis-pricing among securities creates opportunities for riskless profits

C) two identically risky securities carry the same expected returns

D) investors do not diversify

A) there is no consensus among investors regarding the future direction of the market, and thus trades are made arbitrarily

B) mis-pricing among securities creates opportunities for riskless profits

C) two identically risky securities carry the same expected returns

D) investors do not diversify

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

26

Consider the single factor APT.Portfolio A has a beta of 1.3 and an expected return of 21%.Portfolio B has a beta of 0.7 and an expected return of 17%.The risk-free rate of return is 8%.If you wanted to take advantage of an arbitrage opportunity,you should take a short position in portfolio __________ and a long position in portfolio _________.

A) A, A

B) A, B

C) B, A

D) B, B

A) A, A

B) A, B

C) B, A

D) B, B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

27

You invest $600 in security A with a beta of 1.5 and $400 in security B with a beta of .90.The beta of this portfolio is _________.

A) 1.14

B) 1.20

C) 1.26

D) 1.50

A) 1.14

B) 1.20

C) 1.26

D) 1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

28

According to the capital asset pricing model,fairly priced securities have _________.

A) negative betas

B) positive alphas

C) positive betas

D) zero alphas

A) negative betas

B) positive alphas

C) positive betas

D) zero alphas

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

29

You have a $50,000 portfolio consisting of Intel,GE and Con Edison.You put $20,000 in Intel,$12,000 in GE and the rest in Con Edison.Intel,GE and Con Edison have betas of 1.3,1.0 and 0.8 respectively.What is your portfolio beta?

A) 1.048

B) 1.033

C) 1.000

D) 1.037

A) 1.048

B) 1.033

C) 1.000

D) 1.037

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

30

Security A has an expected rate of return of 12% and a beta of 1.10.The market expected rate of return is 8% and the risk-free rate is 5%.The alpha of the stock is _________.

A) -1.7%

B) 3.7%

C) 5.5%

D) 8.7%

A) -1.7%

B) 3.7%

C) 5.5%

D) 8.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

31

An important characteristic of market equilibrium is _______________.

A) the presence of many opportunities for creating zero-investment portfolios

B) all investors exhibit the same degree of risk aversion

C) the absence of arbitrage opportunities

D) the a lack of liquidity in the market

A) the presence of many opportunities for creating zero-investment portfolios

B) all investors exhibit the same degree of risk aversion

C) the absence of arbitrage opportunities

D) the a lack of liquidity in the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

32

Building a zero-investment portfolio will always involve _____________.

A) an unknown mixture of short and long positions

B) only short positions

C) only long positions

D) equal investments in a short and a long position

A) an unknown mixture of short and long positions

B) only short positions

C) only long positions

D) equal investments in a short and a long position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

33

In a world where the CAPM holds which one of the following is not a true statement regarding the capital market line?

A) The capital market line always has a positive slope

B) The capital market line is also called the security market line

C) The capital market line is the best attainable capital allocation line

D) The capital market line is the line from the risk-free rate through the market portfolio

A) The capital market line always has a positive slope

B) The capital market line is also called the security market line

C) The capital market line is the best attainable capital allocation line

D) The capital market line is the line from the risk-free rate through the market portfolio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

34

According to the capital asset pricing model,_________.

A) all securities' returns must lie on the capital market line

B) all securities' returns must lie on the security market line

C) the slope of the security market line must be less than the market risk premium

D) any security with a beta of 1 must have an excess return of zero

A) all securities' returns must lie on the capital market line

B) all securities' returns must lie on the security market line

C) the slope of the security market line must be less than the market risk premium

D) any security with a beta of 1 must have an excess return of zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

35

Research has revealed that regardless of what the current estimate of a firm's beta is,it will tend to move closer to ______ over time.

A) 1

B) 0

C) -1

D) 0.5

A) 1

B) 0

C) -1

D) 0.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

36

The graph of the relationship between expected return and beta in the CAPM context is called the _________.

A) CML

B) CAL

C) SML

D) SCL

A) CML

B) CAL

C) SML

D) SCL

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

37

Consider the one-factor APT.The variance of the return on the factor portfolio is .08.The beta of a well-diversified portfolio on the factor is 1.2.The variance of the return on the well-diversified portfolio is approximately _________.

A) .1152

B) .1270

C) .1521

D) .1342

A) .1152

B) .1270

C) .1521

D) .1342

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

38

Security X has an expected rate of return of 13% and a beta of 1.15.The risk-free rate is 5% and the market expected rate of return is 15%.According to the capital asset pricing model,security X is _________.

A) fairly priced

B) overpriced

C) underpriced

D) None of the above

A) fairly priced

B) overpriced

C) underpriced

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

39

According to the CAPM which of the following is not a true statement regarding the market portfolio.

A) All securities in the market portfolio are held in proportion to their market values

B) It includes all risky assets in the world, including human capital

C) It is always the minimum variance portfolio on the efficient frontier

D) It lies on the efficient frontier

A) All securities in the market portfolio are held in proportion to their market values

B) It includes all risky assets in the world, including human capital

C) It is always the minimum variance portfolio on the efficient frontier

D) It lies on the efficient frontier

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

40

The beta of a security is equal to _________.

A) the covariance between the security and market returns divided by the variance of the market's returns

B) the covariance between the security and market returns divided by the standard deviation of the market's returns

C) the variance of the security's returns divided by the covariance between the security and market returns

D) the variance of the security's returns divided by the variance of the market's returns

A) the covariance between the security and market returns divided by the variance of the market's returns

B) the covariance between the security and market returns divided by the standard deviation of the market's returns

C) the variance of the security's returns divided by the covariance between the security and market returns

D) the variance of the security's returns divided by the variance of the market's returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

41

The risk-free rate is 4%.The expected market rate of return is 11%.If you expect stock X with a beta of .8 to offer a rate of return of 12 percent,then you should _________.

A) buy stock X because it is overpriced

B) buy stock X because it is underpriced

C) sell short stock X because it is overpriced

D) sell short stock X because it is underpriced

A) buy stock X because it is overpriced

B) buy stock X because it is underpriced

C) sell short stock X because it is overpriced

D) sell short stock X because it is underpriced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

42

Arbitrage is __________________________.

A) is an example of the law of one price

B) the creation of riskless profits made possible by relative mispricing among securities

C) is a common opportunity in modern markets

D) an example of a risky trading strategy based on market forecasting

A) is an example of the law of one price

B) the creation of riskless profits made possible by relative mispricing among securities

C) is a common opportunity in modern markets

D) an example of a risky trading strategy based on market forecasting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

43

According to the CAPM,investors are compensated for all but which of the following?

A) Expected inflation

B) Systematic risk

C) Time value of money

D) Residual risk

A) Expected inflation

B) Systematic risk

C) Time value of money

D) Residual risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

44

Beta is a measure of ______________.

A) total risk

B) relative systematic risk

C) relative non-systematic risk

D) relative business risk

A) total risk

B) relative systematic risk

C) relative non-systematic risk

D) relative business risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

45

The expected return of the risky asset portfolio with minimum variance is _________.

A) the market rate of return

B) zero

C) the risk-free rate

D) There is not enough information to answer this question

A) the market rate of return

B) zero

C) the risk-free rate

D) There is not enough information to answer this question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider the one-factor APT.The standard deviation of return on a well-diversified portfolio is 20%.The standard deviation on the factor portfolio is 12%.The beta of the well-diversified portfolio is approximately _________.

A) 0.60

B) 1.00

C) 1.67

D) 3.20

A) 0.60

B) 1.00

C) 1.67

D) 3.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

47

Liquidity is a risk factor that __________.

A) has yet to be accurately measured and incorporated into portfolio management

B) is unaffected by trading mechanisms on various stock exchanges

C) has no effect on the market value of an asset

D) affects bond prices but not stock prices

A) has yet to be accurately measured and incorporated into portfolio management

B) is unaffected by trading mechanisms on various stock exchanges

C) has no effect on the market value of an asset

D) affects bond prices but not stock prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

48

In a study conducted by Jagannathan and Wang,it was found that the performance of beta in explaining security returns could be considerably enhanced by _____________.

I)including the unsystematic risk of a stock

II)including human capital in the market portfolio

III)allowing for changes in beta over time

A) I and II only

B) II and III only

C) I and III only

D) I, II and III

I)including the unsystematic risk of a stock

II)including human capital in the market portfolio

III)allowing for changes in beta over time

A) I and II only

B) II and III only

C) I and III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

49

According to capital asset pricing theory,the key determinant of portfolio returns is _________.

A) the degree of diversification

B) the systematic risk of the portfolio

C) the firm specific risk of the portfolio

D) economic factors

A) the degree of diversification

B) the systematic risk of the portfolio

C) the firm specific risk of the portfolio

D) economic factors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

50

Consider the following two stocks,A and B.Stock A has an expected return of 10% and a beta of 1.20.Stock B has an expected return of 14% and a beta of 1.80.The expected market rate of return is 9% and the risk-free rate is 5%.Security __________ would be considered a good buy because _________.

A) A, it offers an expected excess return of 0.2%

B) A, it offers an expected excess return of 2.2%

C) B, it offers an expected excess return of 1.8%

D) B, it offers an expected return of 2.4%

A) A, it offers an expected excess return of 0.2%

B) A, it offers an expected excess return of 2.2%

C) B, it offers an expected excess return of 1.8%

D) B, it offers an expected return of 2.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

51

The most significant conceptual difference between the arbitrage pricing theory (APT)and the capital asset pricing model (CAPM)is that the CAPM _____________.

A) places less emphasis on market risk

B) recognizes multiple unsystematic risk factors

C) recognizes only one systematic risk factor

D) recognizes multiple systematic risk factors

A) places less emphasis on market risk

B) recognizes multiple unsystematic risk factors

C) recognizes only one systematic risk factor

D) recognizes multiple systematic risk factors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

52

The risk-free rate and the expected market rate of return are 6% and 16% respectively.According to the capital asset pricing model,the expected rate of return on security X with a beta of 1.2 is equal to _________.

A) 12%

B) 17%

C) 18%

D) 23%

A) 12%

B) 17%

C) 18%

D) 23%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

53

In his famous critique of the CAPM,Roll argued that the CAPM ______________.

A) is not testable because the true market portfolio can never be observed

B) is of limited use because systematic risk can never be entirely eliminated

C) should be replaced by the APT

D) should be replaced by the Fama French 3 factor model

A) is not testable because the true market portfolio can never be observed

B) is of limited use because systematic risk can never be entirely eliminated

C) should be replaced by the APT

D) should be replaced by the Fama French 3 factor model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

54

Standard deviation of portfolio returns is a measure of ___________.

A) total risk

B) relative systematic risk

C) relative non-systematic risk

D) relative business risk

A) total risk

B) relative systematic risk

C) relative non-systematic risk

D) relative business risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

55

A stock's alpha measures the stock's ____________________.

A) expected return

B) abnormal return

C) excess return

D) residual return

A) expected return

B) abnormal return

C) excess return

D) residual return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

56

The SML is valid for _______________ and the CML is valid for ______________.

A) only individual assets; well diversified portfolios only

B) only well diversified portfolios; only individual assets

C) both well diversified portfolios and individual assets; both well diversified portfolios and individual assets

D) both well diversified portfolios and individual assets; well diversified portfolios only

A) only individual assets; well diversified portfolios only

B) only well diversified portfolios; only individual assets

C) both well diversified portfolios and individual assets; both well diversified portfolios and individual assets

D) both well diversified portfolios and individual assets; well diversified portfolios only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

57

The variance of the return on the market portfolio is .0400 and the expected return on the market portfolio is 20%.If the risk-free rate of return is 10%,the market degree of risk aversion,A,is _________.

A) 0.5

B) 2.5

C) 3.5

D) 5.0

A) 0.5

B) 2.5

C) 3.5

D) 5.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following variables do Fama and French claim do a better job explaining stock returns than beta?

I)Book to market ratio

II)Unexpected change in industrial production

III)Firm size

A) I only

B) I and II only

C) I and III only

D) I, II and III

I)Book to market ratio

II)Unexpected change in industrial production

III)Firm size

A) I only

B) I and II only

C) I and III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

59

The measure of unsystematic risk can be found from an index model as _________.

A) residual standard deviation

B) R-square

C) degrees of freedom

D) sum of squares of the regression

A) residual standard deviation

B) R-square

C) degrees of freedom

D) sum of squares of the regression

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

60

According to the CAPM,the risk premium an investor expects to receive on any stock or portfolio is _______________.

A) directly related to the risk aversion of the particular investor

B) inversely related to the risk aversion of the particular investor

C) directly related to the beta of the stock

D) inversely related to the alpha of the stock

A) directly related to the risk aversion of the particular investor

B) inversely related to the risk aversion of the particular investor

C) directly related to the beta of the stock

D) inversely related to the alpha of the stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is the expected return on a stock with a beta of 0.8,given a risk free rate of 3.5% and an expected market return of 15.5%?

A) 3.8%

B) 13.1%

C) 15.6%

D) 19.1%

A) 3.8%

B) 13.1%

C) 15.6%

D) 19.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

62

One of the main problems with the arbitrage pricing theory is __________.

A) its use of several factors instead of a single market index to explain the risk-return relationship

B) the introduction of non-systematic risk as a key factor in the risk-return relationship

C) that the APT requires an even larger number of unrealistic assumptions than the CAPM

D) the model fails to identify the key macroeconomic variables in the risk-return relationship

A) its use of several factors instead of a single market index to explain the risk-return relationship

B) the introduction of non-systematic risk as a key factor in the risk-return relationship

C) that the APT requires an even larger number of unrealistic assumptions than the CAPM

D) the model fails to identify the key macroeconomic variables in the risk-return relationship

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

63

Two investment advisors are comparing performance.Advisor A averaged a 20% return with a portfolio beta of 1.5 and Advisor B averaged a 15% return with a portfolio beta of 1.2.If the T-bill rate was 5% and the market return during the period was 13%,which advisor was the better stock picker?

A) Advisor A was better because he generated a larger alpha

B) Advisor B was better because he generated a larger alpha

C) Advisor A was better because he generated a higher return

D) Advisor B was better because he achieved a good return with a lower beta

A) Advisor A was better because he generated a larger alpha

B) Advisor B was better because he generated a larger alpha

C) Advisor A was better because he generated a higher return

D) Advisor B was better because he achieved a good return with a lower beta

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

64

According to the CAPM,what is the market risk premium given an expected return on a security of 13.6%,a stock beta of 1.2,and a risk free interest rate of 4.0%?

A) 4.0%

B) 4.8%

C) 6.6%

D) 8.0%

A) 4.0%

B) 4.8%

C) 6.6%

D) 8.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the alpha of a portfolio with a beta of 2 and actual return of 15%?

A) 0%

B) 13%

C) 15%

D) 17%

A) 0%

B) 13%

C) 15%

D) 17%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the beta of the market index is 1.0 and the standard deviation of the market index increases from 12% to 18%,what is the new beta of the market index?

A) 0.8

B) 1.0

C) 1.2

D) 1.5

A) 0.8

B) 1.0

C) 1.2

D) 1.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

67

What is the beta for a portfolio with an expected return of 12.5%?

A) 0

B) 1

C) 1.5

D) 2

A) 0

B) 1

C) 1.5

D) 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

68

You consider buying a share of stock at a price of $25.The stock is expected to pay a dividend of $1.50 next year and your advisory service tells you that you can expect to sell the stock in one year for $28.The stock's beta is 1.1,rf is 6% and E[rm] = 16%.What is the stock's abnormal return?

A) 1%

B) 2%

C) -1%

D) -2%

A) 1%

B) 2%

C) -1%

D) -2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

69

What is the expected return on the market?

A) 0%

B) 5%

C) 10%

D) 15%

A) 0%

B) 5%

C) 10%

D) 15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is the expected return for a portfolio with a beta of 0.5?

A) 5%

B) 7.5%

C) 12.5%

D) 15%

A) 5%

B) 7.5%

C) 12.5%

D) 15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

71

Research has identified two systematic factors that affect U.S.stock returns.The factors are growth in industrial production and changes in long term interest rates.Industrial production growth is expected to be 3% and long term interest rates are expected to increase by 1%.You are analyzing a stock is that has a beta of 1.2 on the industrial production factor and 0.5 on the interest rate factor.It currently has an expected return of 12%.However,if industrial production actually grows 5% and interest rates drop 2% what is your best guess of the stock's return?

A) 15.9%

B) 12.9%

C) 13.2%

D) 12.0%

A) 15.9%

B) 12.9%

C) 13.2%

D) 12.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

72

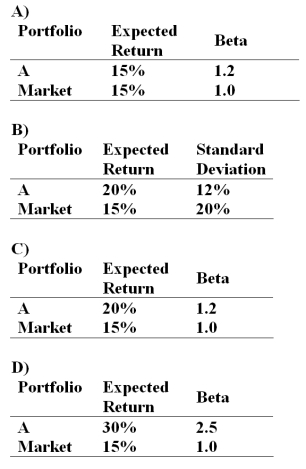

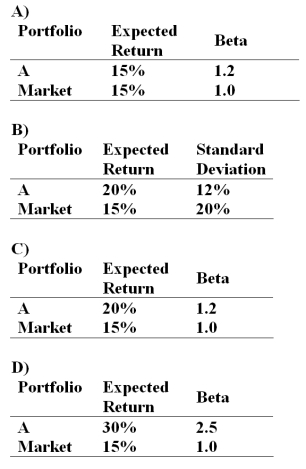

If the simple CAPM is valid and all portfolios are priced correctly,which of the situations below are possible? Consider each situation independently and assume the risk free rate is 5%.

A) Opiton A

B) Opiton B

C) Opiton C

D) Opiton D

A) Opiton A

B) Opiton B

C) Opiton C

D) Opiton D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

73

Assume that both X and Y are well-diversified portfolios and the risk-free rate is 8%.Portfolio X has an expected return of 14% and a beta of 1.00.Portfolio Y has an expected return of 9.5% and a beta of 0.25.In this situation,you would conclude that portfolios X and Y _________.

A) are in equilibrium

B) offer an arbitrage opportunity

C) are both underpriced

D) are both fairly priced

A) are in equilibrium

B) offer an arbitrage opportunity

C) are both underpriced

D) are both fairly priced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

74

The expected return on the market is the risk free rate plus the _____________.

A) diversified returns

B) equilibrium risk premium

C) historical market return

D) unsystematic return

A) diversified returns

B) equilibrium risk premium

C) historical market return

D) unsystematic return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

75

Using the index model,the alpha of a stock is 3.0%,the beta if 1.1 and the market return is 10%.What is the residual given an actual return of 15%?

A) 0.0%

B) 1.0%

C) 2.0%

D) 3.0%

A) 0.0%

B) 1.0%

C) 2.0%

D) 3.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

76

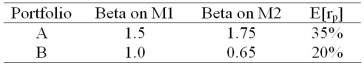

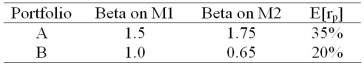

There are two independent economic factors M1 and M2.The risk-free rate is 5% and all stocks have independent firm-specific components with a standard deviation of 25%.Portfolios A and B are well diversified.Given the data below which equation provides the correct pricing model?

A) E(rP) = 5 + 1.12 P1 + 11.86 P2

B) E(rP) = 5 + 4.96 P1 + 13.26 P2

C) E(rP) = 5 + 3.23 P1 + 8.46 P2

D) E(rP) = 5 + 8.71 P1 + 9.68 P2

A) E(rP) = 5 + 1.12 P1 + 11.86 P2

B) E(rP) = 5 + 4.96 P1 + 13.26 P2

C) E(rP) = 5 + 3.23 P1 + 8.46 P2

D) E(rP) = 5 + 8.71 P1 + 9.68 P2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

77

According to the CAPM,what is the expected market return given an expected return on a security of 15.8%,a stock beta of 1.2,and a risk free interest rate of 5.0%?

A) 5.0%

B) 9.0%

C) 13.0%

D) 14.0%

A) 5.0%

B) 9.0%

C) 13.0%

D) 14.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

78

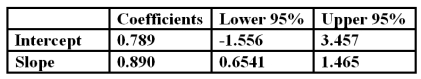

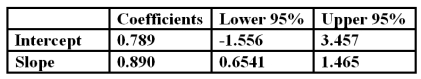

You run a regression of a stock's returns versus a market index and find the following:  Based on the data you know that the stock

Based on the data you know that the stock

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to 0.890

C) has a beta that could be anything between 0.6541 and 1.465 inclusive

D) has no systematic risk

Based on the data you know that the stock

Based on the data you know that the stockA) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to 0.890

C) has a beta that could be anything between 0.6541 and 1.465 inclusive

D) has no systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

79

A stock has a beta of 1.3.The unsystematic risk of this stock is ____________ the stock market as a whole.

A) higher than

B) lower than

C) equal to

D) indeterminable compared to

A) higher than

B) lower than

C) equal to

D) indeterminable compared to

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

80

The expected return on the market portfolio is 15%.The risk-free rate is 8%.The expected return on SDA Corp.common stock is 16%.The beta of SDA Corp.common stock is 1.25.Within the context of the capital asset pricing model,_________.

A) SDA Corp. stock is underpriced

B) SDA Corp. stock is fairly priced

C) SDA Corp. stock's alpha is -0.75%

D) SDA Corp. stock alpha is 0.75%

A) SDA Corp. stock is underpriced

B) SDA Corp. stock is fairly priced

C) SDA Corp. stock's alpha is -0.75%

D) SDA Corp. stock alpha is 0.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck