Deck 10: Bond Prices and Yields

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/93

العب

ملء الشاشة (f)

Deck 10: Bond Prices and Yields

1

__________ are examples of synthetically created zero coupon bonds.

A) COLTS

B) OPOSSMS

C) STRIPS

D) ARMs

A) COLTS

B) OPOSSMS

C) STRIPS

D) ARMs

C

2

TIPS offer investors inflation protection by ______________ by the inflation rate each year.

A) increasing only the coupon rate

B) increasing only the par value

C) increasing both the par value and the coupon payment

D) increasing the promised yield to maturity

A) increasing only the coupon rate

B) increasing only the par value

C) increasing both the par value and the coupon payment

D) increasing the promised yield to maturity

C

3

TIPS are an example of _______________.

A) Eurobonds

B) convertible bonds

C) indexed bonds

D) catastrophe bonds

A) Eurobonds

B) convertible bonds

C) indexed bonds

D) catastrophe bonds

C

4

Bonds issued in the currency of the issuer's country but sold in other national markets are called _____________.

A) Eurobonds

B) Yankee bonds

C) Samurai bonds

D) foreign bonds

A) Eurobonds

B) Yankee bonds

C) Samurai bonds

D) foreign bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

5

When discussing bonds,convexity relates to the _______.

A) shape of the bond price curve with respect to interest rates

B) shape of the yield curve with respect to maturity

C) slope of the yield curve with respect to liquidity premiums

D) size of the bid-ask spread

A) shape of the bond price curve with respect to interest rates

B) shape of the yield curve with respect to maturity

C) slope of the yield curve with respect to liquidity premiums

D) size of the bid-ask spread

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

6

A Japanese firm issued and sold a pound denominated bond in the United Kingdom.A U.S.firm issued bonds denominated in dollars but sold the bonds in Japan.Which one of the following statements is correct?

A) Both bonds are examples of Eurobonds.

B) The Japanese bond is a Eurobond and the U.S. bond is termed a foreign bond.

C) The U.S. bond is a Eurobond and the Japanese bond is termed a foreign bond.

D) Neither bond is a Eurobond.

A) Both bonds are examples of Eurobonds.

B) The Japanese bond is a Eurobond and the U.S. bond is termed a foreign bond.

C) The U.S. bond is a Eurobond and the Japanese bond is termed a foreign bond.

D) Neither bond is a Eurobond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

7

Bonds issued in the U.S.are __________ and most bonds issued overseas are ___________.

A) bearer bonds; registered bonds

B) registered bonds; bearer bonds

C) straight bonds; convertible bonds

D) puttable bonds; callable

A) bearer bonds; registered bonds

B) registered bonds; bearer bonds

C) straight bonds; convertible bonds

D) puttable bonds; callable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

8

To earn a high rating from the bond rating agencies,a company would want to have _________.

I)a low times interest earned ratio

II)a low debt to equity ratio

III)a high quick ratio

A) I only

B) II and III only

C) I and III only

D) I, II and III

I)a low times interest earned ratio

II)a low debt to equity ratio

III)a high quick ratio

A) I only

B) II and III only

C) I and III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

9

You buy a TIPS at issue at par for $1,000.The bond has a 3% coupon.Inflation turns out to be 2%,3% and 4% over the next three years.The total annual coupon income you will receive in year three is _________.

A) $30.00

B) $33.00

C) $32.78

D) $30.90

A) $30.00

B) $33.00

C) $32.78

D) $30.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

10

Sinking funds are commonly viewed as protecting the _______ of the bond.

A) issuer

B) underwriter

C) holder

D) dealer

A) issuer

B) underwriter

C) holder

D) dealer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

11

Inflation-indexed Treasury securities are commonly called ____.

A) PIKs

B) CARs

C) TIPS

D) STRIPS

A) PIKs

B) CARs

C) TIPS

D) STRIPS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

12

According to the liquidity preference theory of the term structure of interest rates an increase in the yield on long term corporate bonds versus short term bonds could be due to _______.

A) declining liquidity premiums

B) expectation of an upcoming recession

C) a decline in future inflation expectations

D) increase in expected interest rate volatility

A) declining liquidity premiums

B) expectation of an upcoming recession

C) a decline in future inflation expectations

D) increase in expected interest rate volatility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

13

A mortgage bond is _______.

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

14

You would typically find all but which one of the following in a bond contract?

A) A dividend restriction clause

B) A sinking fund clause

C) A requirement to subordinate any new debt issued

D) A price-earnings ratio

A) A dividend restriction clause

B) A sinking fund clause

C) A requirement to subordinate any new debt issued

D) A price-earnings ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

15

A debenture is _________.

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

16

The primary difference between Treasury notes and bonds is ________.

A) maturity at issue

B) default risk

C) coupon rate

D) tax status

A) maturity at issue

B) default risk

C) coupon rate

D) tax status

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

17

A collateral trust bond is _______.

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

18

A __________ bond is a bond where the bondholder has the right to cash in the bond before maturity at a specific price after a specific date.

A) callable

B) coupon

C) puttable

D) treasury

A) callable

B) coupon

C) puttable

D) treasury

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

19

The invoice price of a bond is the ______.

A) stated or flat price in a quote sheet plus accrued interest

B) stated or flat price in a quote sheet minus accrued interest

C) bid price

D) average of the bid and ask price

A) stated or flat price in a quote sheet plus accrued interest

B) stated or flat price in a quote sheet minus accrued interest

C) bid price

D) average of the bid and ask price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

20

Floating rate bonds have a __________ that is adjusted with current market interest rates.

A) maturity date

B) coupon payment date

C) coupon rate

D) dividend yield

A) maturity date

B) coupon payment date

C) coupon rate

D) dividend yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

21

A __________ bond is a bond where the issuer has an option to retire the bond before maturity at a specific price after a specific date.

A) callable

B) coupon

C) puttable

D) treasury

A) callable

B) coupon

C) puttable

D) treasury

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

22

A convertible bond has a par value of $1,000 but its current market price is $975.The current price of the issuing company's stock is $26 and the conversion ratio is 34 shares.The bond's market conversion value is _________.

A) $1,000

B) $884

C) $933

D) $980

A) $1,000

B) $884

C) $933

D) $980

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

23

The issuer of a/an ________ bond may choose to pay interest either in cash or in additional bonds.

A) asset backed bonds

B) TIPS

C) catastrophe

D) pay in kind

A) asset backed bonds

B) TIPS

C) catastrophe

D) pay in kind

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

24

Consider the liquidity preference theory of the term structure of interest rates.On average,one would expect investors to require _________.

A) a higher yield on short term bonds than long term bonds

B) a higher yield on long term bonds than short term bonds

C) the same yield on both short term bonds and long term bonds

D) the liquidity preference theory cannot be used to make any of the other statements.

A) a higher yield on short term bonds than long term bonds

B) a higher yield on long term bonds than short term bonds

C) the same yield on both short term bonds and long term bonds

D) the liquidity preference theory cannot be used to make any of the other statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which one of the following statements is correct?

A) Invoice price = Flat price - Accrued Interest

B) Invoice price = Flat price + Accrued Interest

C) Flat price = Invoice price + Accrued Interest

D) Invoice price = Settlement price - Accrued Interest

A) Invoice price = Flat price - Accrued Interest

B) Invoice price = Flat price + Accrued Interest

C) Flat price = Invoice price + Accrued Interest

D) Invoice price = Settlement price - Accrued Interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

26

Consider two bonds,A and B.Both bonds presently are selling at their par value of $1,000.Each pay interest of $120 annually.Bond A will mature in 5 years while bond B will mature in 6 years.If the yields to maturity on the two bonds change from 12% to 14%,_________.

A) both bonds will increase in value but bond A will increase more than bond B

B) both bonds will increase in value but bond B will increase more than bond A

C) both bonds will decrease in value but bond A will decrease more than bond B

D) both bonds will decrease in value but bond B will decrease more than bond A

A) both bonds will increase in value but bond A will increase more than bond B

B) both bonds will increase in value but bond B will increase more than bond A

C) both bonds will decrease in value but bond A will decrease more than bond B

D) both bonds will decrease in value but bond B will decrease more than bond A

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

27

A convertible bond has a par value of $1,000 but its current market price is $950.The current price of the issuing company's stock is $19 and the conversion ratio is 40 shares.The bond's conversion premium is _________.

A) $50.00

B) $190.00

C) $200.00

D) $240.00

A) $50.00

B) $190.00

C) $200.00

D) $240.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

28

Bonds rated _____ or better by Standard and Poor's are considered investment grade.

A) AA

B) BBB

C) BB

D) CCC

A) AA

B) BBB

C) BB

D) CCC

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

29

_______ bonds represent a novel way of obtaining insurance from capital markets against specified disasters.

A) Asset backed bonds

B) TIPS

C) Catastrophe

D) Pay in Kind

A) Asset backed bonds

B) TIPS

C) Catastrophe

D) Pay in Kind

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

30

Everything else equal _________ bonds will require a higher promised YTM than ________ bonds.

A) catastrophe; standard

B) non-callable; callable

C) mortgage; debenture

D) AAA rated; BAA rated

A) catastrophe; standard

B) non-callable; callable

C) mortgage; debenture

D) AAA rated; BAA rated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

31

In an era of particularly low interest rates,which of the following bonds is most likely to be called?

A) Zero coupon bonds

B) Coupon bonds selling at a discount

C) Coupon bonds selling at a premium

D) Floating rate bonds

A) Zero coupon bonds

B) Coupon bonds selling at a discount

C) Coupon bonds selling at a premium

D) Floating rate bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

32

The bonds of Elbow Grease Dishwashing Company have received a rating of "C" by Moody's.The "C" rating indicates the bonds are _________.

A) high grade

B) intermediate grade

C) investment grade

D) junk bonds

A) high grade

B) intermediate grade

C) investment grade

D) junk bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

33

Serial bonds are associated with _________.

A) staggered maturity dates

B) collateral

C) coupon payment dates

D) conversion features

A) staggered maturity dates

B) collateral

C) coupon payment dates

D) conversion features

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

34

A coupon bond which pays interest of $60 annually,has a par value of $1,000,matures in 5 years,and is selling today at a $84.52 discount from par value.The approximate yield to maturity on this bond is _________.

A) 6%

B) 7%

C) 8%

D) 9%

A) 6%

B) 7%

C) 8%

D) 9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

35

Consider the expectations theory of the term structure of interest rates.If the yield curve is downward sloping,this indicates that investors expect short-term interest rates to __________ in the future.

A) increase

B) decrease

C) not change

D) change in an unpredictable manner

A) increase

B) decrease

C) not change

D) change in an unpredictable manner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

36

A coupon bond which pays interest of 4% annually,has a par value of $1,000,matures in 5 years,and is selling today at $785.The actual yield to maturity on this bond is _________.

A) 7.2%

B) 8.8%

C) 9.1%

D) 9.6%

A) 7.2%

B) 8.8%

C) 9.1%

D) 9.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following possible provisions of a bond indenture is designed to ease the burden of principal repayment by spreading it out over several years?

A) Callable feature

B) Convertible feature

C) Subordination clause

D) Sinking fund

A) Callable feature

B) Convertible feature

C) Subordination clause

D) Sinking fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

38

Everything else equal the __________ the maturity of a bond and the __________ the coupon the greater the sensitivity of the bond's price to interest rate changes.

A) longer; higher

B) longer; lower

C) shorter; higher

D) shorter; lower

A) longer; higher

B) longer; lower

C) shorter; higher

D) shorter; lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

39

A coupon bond which pays interest of $60 annually,has a par value of $1,000,matures in 5 years,and is selling today at a $75.25 discount from par value.The current yield on this bond is _________.

A) 6.00%

B) 6.49%

C) 6.73%

D) 7.00%

A) 6.00%

B) 6.49%

C) 6.73%

D) 7.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

40

Bonds with coupon rates that fall when the general level of interest rates rise are called _____________.

A) asset-backed bonds

B) convertible bonds

C) inverse floaters

D) index bonds

A) asset-backed bonds

B) convertible bonds

C) inverse floaters

D) index bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

41

A treasury bond due in one year has a yield of 6.3% while a treasury bond due in 5 years has a yield of 8.8%.A bond due in 5 years issued by High Country Marketing Corporation has a yield of 9.6% while a bond due in one year issued by High Country Marketing Corporation has a yield of 6.8%.The default risk premiums on the one-year and 5-year bonds issued by High Country Marketing Corp.are respectively __________ and _________.

A) 0.4%, 0.3%

B) 0.4%, 0.5%

C) 0.5%, 0.5%

D) 0.5%, 0.8%

A) 0.4%, 0.3%

B) 0.4%, 0.5%

C) 0.5%, 0.5%

D) 0.5%, 0.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following bonds would most likely sell at the lowest yield?

A) A callable debenture

B) A putable mortgage bond

C) A callable mortgage bond

D) A putable debenture

A) A callable debenture

B) A putable mortgage bond

C) A callable mortgage bond

D) A putable debenture

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

43

You purchased a 5-year annual interest coupon bond one year ago.Its coupon interest rate was 6% and its par value was $1,000.At the time you purchased the bond,the yield to maturity was 4%.If you sold the bond after receiving the first interest payment and the bond's yield to maturity had changed to 3%,your annual total rate of return on holding the bond for that year would have been approximately _________.

A) 5.0%

B) 5.5%

C) 7.6%

D) 8.9%

A) 5.0%

B) 5.5%

C) 7.6%

D) 8.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

44

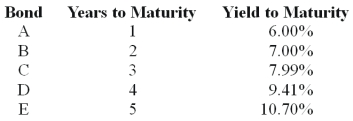

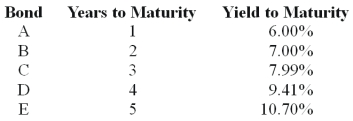

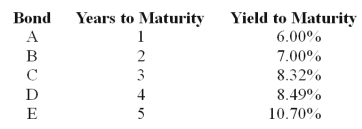

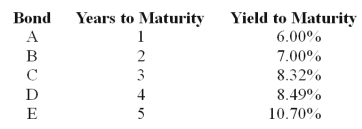

$1,000 par value zero coupon bonds, ignore liquidity premiums

The __________ of a bond is computed as the ratio of coupon payments to market price.

A) nominal yield

B) current yield

C) yield to maturity

D) yield to call

The __________ of a bond is computed as the ratio of coupon payments to market price.

A) nominal yield

B) current yield

C) yield to maturity

D) yield to call

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

45

Yields on municipal bonds are typically ___________ yields on corporate bonds of similar risk and time to maturity.

A) lower than

B) slightly higher than

C) identical to

D) twice as high as

A) lower than

B) slightly higher than

C) identical to

D) twice as high as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

46

A bond has a par value of $1,000,a time to maturity of 10 years,and a coupon rate of 8% with interest paid annually.If the current market price is $750,what is the approximate capital gain yield of this bond over the next year?

A) 0.7%

B) 1.8%

C) 2.5%

D) 3.4%

A) 0.7%

B) 1.8%

C) 2.5%

D) 3.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

47

Consider the following $1,000 par value zero-coupon bonds:  The expected one-year interest rate four years from now should be _________.

The expected one-year interest rate four years from now should be _________.

A) 16.00%

B) 18.00%

C) 20.00%

D) 22.00%

The expected one-year interest rate four years from now should be _________.

The expected one-year interest rate four years from now should be _________.A) 16.00%

B) 18.00%

C) 20.00%

D) 22.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

48

A coupon bond pays semi-annual interest is reported as having an ask price of 117% of its $1,000 par value in the Wall Street Journal.If the last interest payment was made 2 months ago and the coupon rate is 6%,the invoice price of the bond will be _________.

A) $1,140

B) $1,170

C) $1,180

D) $1,200

A) $1,140

B) $1,170

C) $1,180

D) $1,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

49

A callable bond pays annual interest of $60,has a par value of $1,000,matures in 20 years but is callable in 10 years at a price of $1,100,and has a value today of $1055.84.The yield to call on this bond is _________.

A) 6.00%

B) 6.58%

C) 7.20%

D) 8.00%

A) 6.00%

B) 6.58%

C) 7.20%

D) 8.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

50

A coupon bond which pays interest semi-annually has a par value of $1,000,matures in 8 years,and has a yield to maturity of 6%.If the coupon rate is 7%,the intrinsic value of the bond today will be __________ (to the nearest dollar).

A) $1,000

B) $1,063

C) $1,081

D) $1,100

A) $1,000

B) $1,063

C) $1,081

D) $1,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

51

A coupon bond which pays interest annually,has a par value of $1,000,matures in 5 years and has a yield to maturity of 12%.If the coupon rate is 9%,the intrinsic value of the bond today will be approximately _________.

A) $856

B) $892

C) $926

D) $1,000

A) $856

B) $892

C) $926

D) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

52

$1,000 par value zero coupon bonds, ignore liquidity premiums

The expected one-year interest rate one year from now should be about _________.

A) 6.00%

B) 7.50 %

C) 9.00%

D) 10.00%

The expected one-year interest rate one year from now should be about _________.

A) 6.00%

B) 7.50 %

C) 9.00%

D) 10.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

53

$1,000 par value zero coupon bonds, ignore liquidity premiums

One year from now Bond C should sell for ________ (to the nearest dollar).

A) $857

B) $842

C) $835

D) $821

One year from now Bond C should sell for ________ (to the nearest dollar).

A) $857

B) $842

C) $835

D) $821

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

54

Consider the following $1,000 par value zero-coupon bonds:  The expected one-year interest rate two years from now should be _________.

The expected one-year interest rate two years from now should be _________.

A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

The expected one-year interest rate two years from now should be _________.

The expected one-year interest rate two years from now should be _________.A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

55

You can be sure that a bond will sell at a premium to par when _________.

A) its coupon rate is greater than its yield to maturity

B) its coupon rate is less than its yield to maturity

C) its coupon rate equal to its yield to maturity

D) its coupon rate is less than its conversion value

A) its coupon rate is greater than its yield to maturity

B) its coupon rate is less than its yield to maturity

C) its coupon rate equal to its yield to maturity

D) its coupon rate is less than its conversion value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

56

Consider the following $1,000 par value zero-coupon bonds:  The expected one-year interest rate three years from now should be _________.

The expected one-year interest rate three years from now should be _________.

A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

The expected one-year interest rate three years from now should be _________.

The expected one-year interest rate three years from now should be _________.A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

57

$1,000 par value zero coupon bonds, ignore liquidity premiums

The expected two year interest rate three years from now should be _________.

A) 9.55%

B) 11.74%

C) 14.89%

D) 13.73%

The expected two year interest rate three years from now should be _________.

A) 9.55%

B) 11.74%

C) 14.89%

D) 13.73%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

58

A 1% decline in yield will have the least effect on the price of the bond with a _________.

A) 10-year maturity, selling at 80

B) 10-year maturity, selling at 100

C) 20-year maturity, selling at 80

D) 20-year maturity, selling at 100

A) 10-year maturity, selling at 80

B) 10-year maturity, selling at 100

C) 20-year maturity, selling at 80

D) 20-year maturity, selling at 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

59

Analysis of bond returns over a multiyear horizon based on forecasts of the bond's yield to maturity and reinvestment rate of coupons is called ______.

A) multiyear analysis

B) horizon analysis

C) maturity analysis

D) reinvestment analysis

A) multiyear analysis

B) horizon analysis

C) maturity analysis

D) reinvestment analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

60

A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000.If the bond matures in 16 years,it should sell for a price of __________ today.

A) $458.00

B) $641.00

C) $789.00

D) $1,100.00

A) $458.00

B) $641.00

C) $789.00

D) $1,100.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

61

Yields on municipal bonds are generally lower than yields on similar corporate bonds because of differences in _________.

A) marketability

B) risk

C) taxation

D) call protection

A) marketability

B) risk

C) taxation

D) call protection

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

62

Consider a 7-year bond with a 9% coupon and a yield to maturity of 12%.If interest rates remain constant,one year from now the price of this bond will be _________.

A) higher

B) lower

C) the same

D) indeterminate

A) higher

B) lower

C) the same

D) indeterminate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

63

If the quote for a Treasury bond is listed in the newspaper as 99:08 bid,99:11 ask,the actual price you can sell this bond given a $10,000 par value is _____________.

A) $9,828.12

B) $9,925.00

C) $9,934.37

D) $9,955.43

A) $9,828.12

B) $9,925.00

C) $9,934.37

D) $9,955.43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

64

A bond pays a semi-annual coupon and the last coupon was paid 61 days ago.If the annual coupon payment is $75,what is the accrued interest?

A) $13.21

B) $12.57

C) $15.44

D) $16.32

A) $13.21

B) $12.57

C) $15.44

D) $16.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

65

Under the pure expectations hypothesis and constant real interest rates for different maturities,an upward sloping yield curve would indicate __________________.

A) expected increases in inflation over time

B) expected decreases in inflation over time

C) the presence of a liquidity premium

D) that the equilibrium interest rate in the short term part of the market is lower than the equilibrium interest rate in the long-term part of the market

A) expected increases in inflation over time

B) expected decreases in inflation over time

C) the presence of a liquidity premium

D) that the equilibrium interest rate in the short term part of the market is lower than the equilibrium interest rate in the long-term part of the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the price of a $10,000 par Treasury bond is $10,237.50 the quote would be listed in the newspaper as ________.

A) 102:10

B) 102:11

C) 102:12

D) 102:13

A) 102:10

B) 102:11

C) 102:12

D) 102:13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

67

The yield to maturity of an 10-year zero coupon bond,with a par value of $1,000 and a market price of $625,is _____.

A) 4.8%

B) 6.1%

C) 7.7%

D) 10.4%

A) 4.8%

B) 6.1%

C) 7.7%

D) 10.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the quote for a Treasury bond is listed in the newspaper as 98:09 bid,98:13 ask,the actual price for you to purchase this bond given a $10,000 par value is _____________.

A) $9,828.12

B) $9,809.38

C) $9,840.62

D) $9,813.42

A) $9,828.12

B) $9,809.38

C) $9,840.62

D) $9,813.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

69

A discount bond that pays interest semiannually will ______.

I)have a lower price than an equivalent annual payment bond

II)have a higher EAR than an equivalent annual payment bond

III)sell for less than its conversion value

A) I and II only

B) I and III only

C) II and III only

D) I, II and III

I)have a lower price than an equivalent annual payment bond

II)have a higher EAR than an equivalent annual payment bond

III)sell for less than its conversion value

A) I and II only

B) I and III only

C) II and III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

70

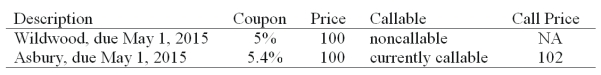

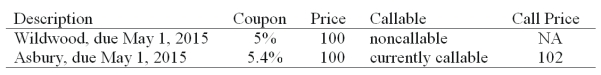

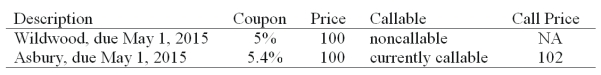

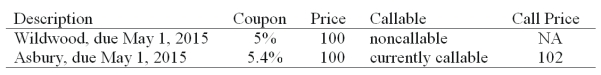

On May 1, 2007, Joe Hill is considering one of the following newly-issued 10 year AAA corporate bonds.

Suppose market interest rates decline by 100 basis points (i.e.,1%).The effect of this decline would be:

A) The price of Wildwood bond would decline by more than the Asbury bond.

B) The price of Wildwood bond would decline by less than the Asbury bond.

C) The price of Wildwood bond would increase by more than the Asbury bond.

D) The price of Wildwood bond would increase by less than the Asbury bond.

Suppose market interest rates decline by 100 basis points (i.e.,1%).The effect of this decline would be:

A) The price of Wildwood bond would decline by more than the Asbury bond.

B) The price of Wildwood bond would decline by less than the Asbury bond.

C) The price of Wildwood bond would increase by more than the Asbury bond.

D) The price of Wildwood bond would increase by less than the Asbury bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

71

One,two and three year maturity,default-free,zero-coupon bonds have yields-to-maturity of 7%,8% and 9% respectively.What is the implied one-year forward rate,one year from today?

A) 2.0%

B) 8.0%

C) 9.0%

D) 11.1%

A) 2.0%

B) 8.0%

C) 9.0%

D) 11.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

72

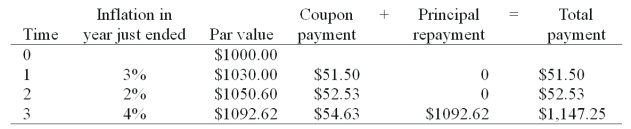

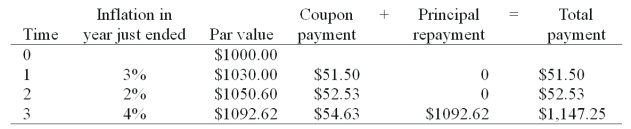

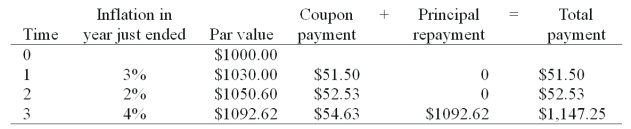

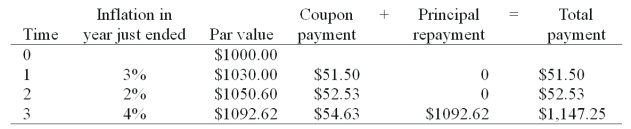

Consider a newly issued TIPS bond with a three year maturity, par value of $1000, and a coupon rate of 5%. Assume annual coupon payments.

What is the real rate of return on the TIPS bond in the first year?

A) 5.00%

B) 8.15%

C) 7.15%

D) 4.00%

What is the real rate of return on the TIPS bond in the first year?

A) 5.00%

B) 8.15%

C) 7.15%

D) 4.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

73

A bond has a flat price of $985 and it pays an annual coupon.The last coupon payment was made 90 days ago.What is the invoice price if the annual coupon is $69?

A) $999.55

B) $1,002.01

C) $1,007.45

D) $1,012.13

A) $999.55

B) $1,002.01

C) $1,007.45

D) $1,012.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

74

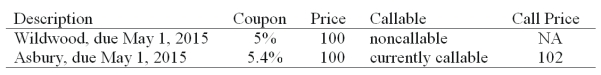

On May 1, 2007, Joe Hill is considering one of the following newly-issued 10 year AAA corporate bonds.

If interest rates are expected to rise,then Joe Hill should ____.

A) prefer the Wildwood bond to the Asbury bond

B) prefer the Asbury bond to the Wildwood bond

C) be indifferent between the Wildwood bond and the Asbury bond

D) there is not enough information given to tell

If interest rates are expected to rise,then Joe Hill should ____.

A) prefer the Wildwood bond to the Asbury bond

B) prefer the Asbury bond to the Wildwood bond

C) be indifferent between the Wildwood bond and the Asbury bond

D) there is not enough information given to tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

75

A corporate bond has a 10 year maturity and pays interest semiannually.The quoted coupon rate is 6% and the bond is priced at par.The bond is callable in 3 years at 110% of par.What is the bond's yield to call?

A) 6.72%

B) 9.17%

C) 4.49%

D) 8.98%

A) 6.72%

B) 9.17%

C) 4.49%

D) 8.98%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

76

Assuming semiannual compounding,a 20-year zero coupon bond with a par value of $1,000 and a required return of 12% would be priced at _________.

A) $97

B) $104

C) $364

D) $732

A) $97

B) $104

C) $364

D) $732

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

77

A 6% coupon U.S.treasury note pays interest on May 31 and November 30 and is traded for settlement on August 10.The accrued interest on $100,000 face amount of this note is _________.

A) $581.97

B) $1,163.93

C) $2,327.87

D) $3,000.00

A) $581.97

B) $1,163.93

C) $2,327.87

D) $3,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

78

The yield to maturity on a bond is ________.

I)above the coupon rate when the bond sells at a discount,and below the coupon rate when the bond sells at a premium

II)the discount rate that will set the present value of the payments equal to the bond price

III)equal to the true compound return on investment only if all interest payments received are reinvested at the yield to maturity

A) I only

B) II only

C) I and II only

D) I, II and III

I)above the coupon rate when the bond sells at a discount,and below the coupon rate when the bond sells at a premium

II)the discount rate that will set the present value of the payments equal to the bond price

III)equal to the true compound return on investment only if all interest payments received are reinvested at the yield to maturity

A) I only

B) II only

C) I and II only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

79

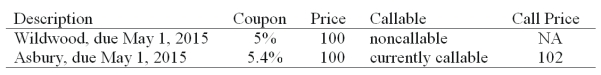

On May 1, 2007, Joe Hill is considering one of the following newly-issued 10 year AAA corporate bonds.

If the volatility of interest rates is expected to increase,the Joe Hill should __.

A) prefer the Wildwood bond to the Asbury bond

B) prefer the Asbury bond to the Wildwood bond

C) be indifferent between the Wildwood bond and the Asbury bond

D) there is not enough information given to tell

If the volatility of interest rates is expected to increase,the Joe Hill should __.

A) prefer the Wildwood bond to the Asbury bond

B) prefer the Asbury bond to the Wildwood bond

C) be indifferent between the Wildwood bond and the Asbury bond

D) there is not enough information given to tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

80

Consider a newly issued TIPS bond with a three year maturity, par value of $1000, and a coupon rate of 5%. Assume annual coupon payments.

What is the nominal rate of return on the TIPS bond in the first year?

A) 5.00%

B) 5.15%

C) 8.15%

D) 9.00%

What is the nominal rate of return on the TIPS bond in the first year?

A) 5.00%

B) 5.15%

C) 8.15%

D) 9.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck