Deck 17: Futures Markets and Risk Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/87

العب

ملء الشاشة (f)

Deck 17: Futures Markets and Risk Management

1

An investor who goes long in a futures contract will _____ any increase in value of the underlying asset and will _____ any decrease in value in the underlying asset.

A) pay; pay

B) pay; receive

C) receive; pay

D) receive; receive

A) pay; pay

B) pay; receive

C) receive; pay

D) receive; receive

C

2

Synthetic stock positions are commonly used by ______ because of their ______.

A) market timers; lower transaction cost

B) banks; lower risk

C) wealthy investors; tax treatment

D) money market funds; limited exposure

A) market timers; lower transaction cost

B) banks; lower risk

C) wealthy investors; tax treatment

D) money market funds; limited exposure

A

3

A wheat farmer should __________ in order to reduce his exposure to risk associated with fluctuations in wheat prices.

A) sell wheat futures

B) buy wheat futures

C) buy a contract for delivery of wheat now, and sell a contract for delivery of wheat at harvest time

D) sell wheat futures if the basis is currently positive and buy wheat futures if the basis is currently negative

A) sell wheat futures

B) buy wheat futures

C) buy a contract for delivery of wheat now, and sell a contract for delivery of wheat at harvest time

D) sell wheat futures if the basis is currently positive and buy wheat futures if the basis is currently negative

A

4

The time on Friday with simultaneous expirations of S&P index futures,S&P index options and options on some individual stocks is commonly called the _______.

A) mad minute

B) double-witching hour

C) happy hour

D) triple-witching hour

A) mad minute

B) double-witching hour

C) happy hour

D) triple-witching hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

5

Interest rate futures contracts exist for all of the following except __________.

A) Federal funds

B) Eurodollars

C) banker's acceptances

D) repurchase agreements

A) Federal funds

B) Eurodollars

C) banker's acceptances

D) repurchase agreements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

6

A person with a long position in a commodity futures contract wants the price of the commodity to ______.

A) decrease substantially

B) increase substantially

C) remain unchanged

D) increase or decrease substantially

A) decrease substantially

B) increase substantially

C) remain unchanged

D) increase or decrease substantially

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

7

You take a long position in a futures contract of one maturity and a short position in a contract of a different maturity,both on the same commodity.This is called __________.

A) a cross hedge

B) a reversing trade

C) a spread position

D) a straddle

A) a cross hedge

B) a reversing trade

C) a spread position

D) a straddle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

8

If an asset price declines,the investor with a _______ is exposed to the largest potential loss.

A) long call option

B) long put option

C) long futures contract

D) short futures contract

A) long call option

B) long put option

C) long futures contract

D) short futures contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which one of the following contracts requires no cash to change hands when initiated?

A) Listed put option

B) Short futures contract

C) Forward contract

D) Listed call option

A) Listed put option

B) Short futures contract

C) Forward contract

D) Listed call option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

10

The S&P500 index futures contract is an example of a(n)______ delivery contract.The pork bellies contract is an example of a(n)______ delivery contract.

A) cash; cash

B) cash; actual

C) actual; cash

D) actual; actual

A) cash; cash

B) cash; actual

C) actual; cash

D) actual; actual

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

11

The clearing corporation has a net position equal to ______.

A) the open interest

B) the open interest times two

C) the open interest divided by two

D) zero

A) the open interest

B) the open interest times two

C) the open interest divided by two

D) zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

12

Futures contracts have many advantages over forward contracts except that _________.

A) futures positions are easier to trade

B) futures contracts are tailored to the specific needs of the investor

C) futures trading preserves the anonymity of the participants

D) counterparty credit risk is not a concern on futures

A) futures positions are easier to trade

B) futures contracts are tailored to the specific needs of the investor

C) futures trading preserves the anonymity of the participants

D) counterparty credit risk is not a concern on futures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

13

An investor who goes short in a futures contract will _____ any increase in value of the underlying asset and will _____ any decrease in value in the underlying asset.

A) pay; pay

B) pay; receive

C) receive; pay

D) receive; receive

A) pay; pay

B) pay; receive

C) receive; pay

D) receive; receive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

14

In the futures market the short position's loss is ___________ the long position's gain.

A) greater than

B) less than

C) equal to

D) sometimes less than and sometimes greater than

A) greater than

B) less than

C) equal to

D) sometimes less than and sometimes greater than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

15

The open interest on silver futures at a particular time is the number of __________.

A) all outstanding silver futures contracts

B) long and short silver futures positions counted separately on a particular trading day

C) silver futures contracts traded during the day

D) silver futures contracts traded the previous day

A) all outstanding silver futures contracts

B) long and short silver futures positions counted separately on a particular trading day

C) silver futures contracts traded during the day

D) silver futures contracts traded the previous day

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

16

Recently most of the growth in the number of contracts traded on the Chicago Board of Trade has come in the _______ contracts.

A) metals

B) agriculture

C) financial

D) commodity

A) metals

B) agriculture

C) financial

D) commodity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

17

The fact that the exchange is the counter-party to every futures contract issued is important because it eliminates _________ risk.

A) market

B) credit

C) interest rate

D) basis

A) market

B) credit

C) interest rate

D) basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following provides the profit to a long position at contract maturity?

A) Original futures price - Spot price at maturity

B) Spot price at maturity - Original futures price

C) Zero

D) Basis

A) Original futures price - Spot price at maturity

B) Spot price at maturity - Original futures price

C) Zero

D) Basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

19

An investor who is hedging a corporate bond portfolio using a T-bond futures contract is said to have a(n)_______.

A) arbitrage

B) cross-hedge

C) over-hedge

D) spread-hedge

A) arbitrage

B) cross-hedge

C) over-hedge

D) spread-hedge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

20

The advantage that standardization of futures contracts brings is that _____ is improved because ____________________.

A) liquidity; all traders must trade a small set of identical contracts

B) credit risk; all traders understand the risk of the contracts

C) pricing; convergence is more likely to take place with fewer contracts

D) trading cost; trading volume is reduced

A) liquidity; all traders must trade a small set of identical contracts

B) credit risk; all traders understand the risk of the contracts

C) pricing; convergence is more likely to take place with fewer contracts

D) trading cost; trading volume is reduced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

21

On February 25,2008 you could have purchased a futures contract from Intrade that would pay you $1 if Barack Obama wins the 2008 Democratic Party nomination.At a price of $0.81,the contract for Obama carried the highest price of any Democratic candidate.This tells you _______________.

A) that the market believed that Obama had 81% chance of winning

B) that the market believed that Obama had the least chance of winning

C) nothing about the markets' belief concerning the odds of Obama winning

D) that the market believed Obama's chances of winning were about 19%

A) that the market believed that Obama had 81% chance of winning

B) that the market believed that Obama had the least chance of winning

C) nothing about the markets' belief concerning the odds of Obama winning

D) that the market believed Obama's chances of winning were about 19%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

22

An investor would want to __________ to exploit an expected fall in interest rates.

A) sell S&P 500 index futures

B) sell treasury bond futures

C) buy treasury bond futures

D) buy wheat futures

A) sell S&P 500 index futures

B) sell treasury bond futures

C) buy treasury bond futures

D) buy wheat futures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which one of the following refers to the daily settlement of obligations on future positions?

A) Marking to market

B) The convergence property

C) The open interest

D) The triple witching hour

A) Marking to market

B) The convergence property

C) The open interest

D) The triple witching hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

24

Probably the most active forward market is for _____________.

A) agricultural commodities

B) metals and minerals

C) financial futures

D) foreign currencies

A) agricultural commodities

B) metals and minerals

C) financial futures

D) foreign currencies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

25

Futures markets are regulated by the __________.

A) AIMR

B) CFTC

C) CIA

D) SEC

A) AIMR

B) CFTC

C) CIA

D) SEC

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following provides the profit to a short position at contract maturity?

A) Original futures price - Spot price at maturity

B) Spot price at maturity - Original futures price

C) Zero

D) Basis

A) Original futures price - Spot price at maturity

B) Spot price at maturity - Original futures price

C) Zero

D) Basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

27

The CME weather futures contract is an example of ______________.

A) a cash settled contract

B) an agricultural contract

C) a financial future

D) a commodity future

A) a cash settled contract

B) an agricultural contract

C) a financial future

D) a commodity future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which one of the following exploits differences between actual future prices and their theoretically correct parity values?

A) Index arbitrage

B) Marking to market

C) Reversing trades

D) Settlement transactions

A) Index arbitrage

B) Marking to market

C) Reversing trades

D) Settlement transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

29

An established value below which a trader's margin may not fall is called the ________.

A) daily limit

B) daily margin

C) maintenance margin

D) convergence limit

A) daily limit

B) daily margin

C) maintenance margin

D) convergence limit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

30

Margin requirements for futures contracts can be met by ______________.

A) cash only

B) cash or highly marketable securities such as Treasury bills

C) cash or any marketable securities

D) cash or warehouse receipts for an equivalent quantity of the underlying commodity

A) cash only

B) cash or highly marketable securities such as Treasury bills

C) cash or any marketable securities

D) cash or warehouse receipts for an equivalent quantity of the underlying commodity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company which mines bauxite decides to short aluminum futures.This is an example of __________ to limit its risk.

A) cross hedging

B) long hedging

C) spreading

D) speculating

A) cross hedging

B) long hedging

C) spreading

D) speculating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which one of the following is a true statement?

A) A margin deposit can only be met by cash

B) All futures contracts require the same margin deposit

C) The maintenance margin is the amount of money you post with your broker when you buy or sell a futures contract

D) The maintenance margin is the value of the margin account below which the holder of a futures contract receives a margin call

A) A margin deposit can only be met by cash

B) All futures contracts require the same margin deposit

C) The maintenance margin is the amount of money you post with your broker when you buy or sell a futures contract

D) The maintenance margin is the value of the margin account below which the holder of a futures contract receives a margin call

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

33

A futures contract __________.

A) is a contract to be signed in the future by the buyer and the seller of a commodity

B) is an agreement to buy or sell a specified amount of an asset at a predetermined price on the expiration date of the contract

C) is an agreement to buy or sell a specified amount of an asset at whatever the spot price happens to be on the expiration date of the contract

D) gives the buyer the right, but not the obligation, to buy an asset some time in the future

A) is a contract to be signed in the future by the buyer and the seller of a commodity

B) is an agreement to buy or sell a specified amount of an asset at a predetermined price on the expiration date of the contract

C) is an agreement to buy or sell a specified amount of an asset at whatever the spot price happens to be on the expiration date of the contract

D) gives the buyer the right, but not the obligation, to buy an asset some time in the future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

34

Single stock futures,as opposed to stock index futures,are _______________.

A) not yet being offered by any exchanges

B) offered overseas but not in the U.S.

C) currently trading on OneChicago, a joint venture of several exchanges

D) scheduled to begin trading in 2010 at various exchanges

A) not yet being offered by any exchanges

B) offered overseas but not in the U.S.

C) currently trading on OneChicago, a joint venture of several exchanges

D) scheduled to begin trading in 2010 at various exchanges

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

35

The daily settlement of obligations on futures positions is called _____________.

A) a margin call

B) marking to market

C) a variation margin check

D) initial margin requirement

A) a margin call

B) marking to market

C) a variation margin check

D) initial margin requirement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

36

At maturity of a future contract,the spot price and futures price must be approximately the same because of __________.

A) marking to market

B) the convergence property

C) the open interest

D) the triple witching hour

A) marking to market

B) the convergence property

C) the open interest

D) the triple witching hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

37

A hog farmer decides to sell hog futures.This is an example of __________ to limit its risk.

A) cross hedging

B) short hedging

C) spreading

D) speculating

A) cross hedging

B) short hedging

C) spreading

D) speculating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

38

Margin must be posted by ________.

A) buyers of futures contracts only

B) sellers of futures contracts only

C) both buyers and sellers of futures contracts

D) speculators only

A) buyers of futures contracts only

B) sellers of futures contracts only

C) both buyers and sellers of futures contracts

D) speculators only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

39

You are currently long in a futures contract.You then instruct a broker to enter the short side of a futures contract to close your position.This is called __________.

A) a cross hedge

B) a reversing trade

C) a speculation

D) marking to market

A) a cross hedge

B) a reversing trade

C) a speculation

D) marking to market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

40

Initial margin is usually set in the region of ________ of the total value of a futures contract.

A) 5%-15%

B) 10%-20%

C) 15%-25%

D) 20%-30%

A) 5%-15%

B) 10%-20%

C) 15%-25%

D) 20%-30%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

41

A short hedge is a simultaneous __________ position in the spot market and a __________ position in the futures market.

A) long; long

B) long; short

C) short; long

D) short; short

A) long; long

B) long; short

C) short; long

D) short; short

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

42

On January 1,you sold one April S&P 500 index futures contract at a futures price of 1300.If the April futures price is 1250 on February 1,your profit would be __________ if you close your position.(The contract multiplier is 250.)

A) -$12,500

B) -$15,000

C) $15,000

D) $12,500

A) -$12,500

B) -$15,000

C) $15,000

D) $12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

43

In the context of a futures contract,the basis is defined as ______________.

A) the futures price minus the spot price

B) the spot price minus the futures price

C) the futures price minus the initial margin

D) the profit on the futures contract

A) the futures price minus the spot price

B) the spot price minus the futures price

C) the futures price minus the initial margin

D) the profit on the futures contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

44

When dividend paying assets are involved,the spot-futures parity relationship can be stated as _________________.

A) F1 = S0(1 + rf)

B) F0 = S0(1 + rf - d)T

C) F0 = S0(1 + rf + d)T

D) F0 = S0(1 + rf)T

A) F1 = S0(1 + rf)

B) F0 = S0(1 + rf - d)T

C) F0 = S0(1 + rf + d)T

D) F0 = S0(1 + rf)T

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the S&P 500 index futures contract is overpriced relative to the spot S&P 500 index,you should __________.

A) buy all the stocks in the S&P 500 and write put options on the S&P 500 index

B) sell all the stocks in the S&P 500 and buy call options on S&P 500 index

C) sell S&P 500 index futures and buy all the stocks in the S&P 500

D) sell short all the stocks in the S&P 500 and buy S&P 500 index futures

A) buy all the stocks in the S&P 500 and write put options on the S&P 500 index

B) sell all the stocks in the S&P 500 and buy call options on S&P 500 index

C) sell S&P 500 index futures and buy all the stocks in the S&P 500

D) sell short all the stocks in the S&P 500 and buy S&P 500 index futures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

46

Forward contracts _________ traded on an organized exchange and futures contracts __________ traded on an organized exchange.

A) are; are

B) are; are not

C) are not; are

D) are not; are not

A) are; are

B) are; are not

C) are not; are

D) are not; are not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

47

The current level of the S&P 500 is 1250.The dividend yield on the S&P 500 is 3%.The risk-free interest rate is 6%.The futures price quote for a contract on the S&P 500 due to expire 6 months from now should be __________.

A) 1274.33

B) 1286.95

C) 1268.61

D) 1291.29

A) 1274.33

B) 1286.95

C) 1268.61

D) 1291.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

48

Violation of the spot-futures parity relationship results in _______________.

A) fines and other penalties imposed by the SEC

B) arbitrage opportunities for investors who spot them

C) suspension of delivery privileges

D) suspension of trading

A) fines and other penalties imposed by the SEC

B) arbitrage opportunities for investors who spot them

C) suspension of delivery privileges

D) suspension of trading

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

49

At year end,taxes on a futures position _______________.

A) must be paid if the position has been closed out

B) must be paid if the position has not been closed out

C) must be paid regardless of whether the position has been closed out or not

D) need not be paid if the position supports a hedge

A) must be paid if the position has been closed out

B) must be paid if the position has not been closed out

C) must be paid regardless of whether the position has been closed out or not

D) need not be paid if the position supports a hedge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

50

A speculator will often prefer to buy a futures contract rather than the underlying asset because ____________.

I)gains in futures contracts can be larger due to leverage

II)transaction costs in futures are typically lower than in spot markets

III)futures markets are often more liquid than the markets of the underlying commodities

A) I and II only

B) II and III only

C) I and III only

D) I, II and III

I)gains in futures contracts can be larger due to leverage

II)transaction costs in futures are typically lower than in spot markets

III)futures markets are often more liquid than the markets of the underlying commodities

A) I and II only

B) II and III only

C) I and III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

51

Futures contracts are said to exhibit the property of convergence because _______________.

A) the profits from long positions and short positions must ultimately be equal

B) the profits from long positions and short positions must ultimately net to zero

C) price discrepancies would open arbitrage opportunities for investors who spot them

D) the futures price and spot price of any asset must ultimately net to zero

A) the profits from long positions and short positions must ultimately be equal

B) the profits from long positions and short positions must ultimately net to zero

C) price discrepancies would open arbitrage opportunities for investors who spot them

D) the futures price and spot price of any asset must ultimately net to zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

52

An investor would want to __________ to hedge a long position in treasury bonds.

A) buy interest rate futures

B) buy treasury bonds in the spot market

C) sell interest rate futures

D) sell S&P 500 futures

A) buy interest rate futures

B) buy treasury bonds in the spot market

C) sell interest rate futures

D) sell S&P 500 futures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

53

If you expect a stock market downturn,one potential defensive strategy would be to __________.

A) buy stock index futures

B) sell stock index futures

C) buy stock index options

D) sell foreign exchange futures

A) buy stock index futures

B) sell stock index futures

C) buy stock index options

D) sell foreign exchange futures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

54

The world's largest futures and options exchange is the _______.

A) CBOE

B) CBOT

C) CME

D) Eurex

A) CBOE

B) CBOT

C) CME

D) Eurex

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

55

An investor establishes a long position in a futures contract now (time 0)and holds the position until maturity (Time T).The sum of all daily settlements will be __________.

A) F0 - FT

B) F0 - S0

C) FT - F0

D) FT - S0

A) F0 - FT

B) F0 - S0

C) FT - F0

D) FT - S0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

56

The spot price for is $650.The dividend yield on the S&P 500 is 2.5%.The risk-free interest rate is 5%.The futures price for gold for a one year contract should be __________.

A) $658.58

B) $675.43

C) $682.50

D) $666.25

A) $658.58

B) $675.43

C) $682.50

D) $666.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

57

A long hedge is a simultaneous __________ position in the spot market and a __________ position in the futures market.

A) long; long

B) long; short

C) short; long

D) short; short

A) long; long

B) long; short

C) short; long

D) short; short

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

58

Investors who take short positions in futures contract agree to ___________ delivery of the commodity on the delivery date,and those who take long positions agree to __________ delivery of the commodity.

A) make; make

B) make; take

C) take; make

D) take; take

A) make; make

B) make; take

C) take; make

D) take; take

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

59

Approximately __________ of futures contracts result in actual delivery.

A) 0%

B) 1% to 3%

C) 5% to 15%

D) 60% to 80%

A) 0%

B) 1% to 3%

C) 5% to 15%

D) 60% to 80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

60

A long hedger will __________ from an increase in the basis a short hedger will __________.

A) be hurt; be hurt

B) be hurt; profit

C) profit; be hurt

D) profit; profit

A) be hurt; be hurt

B) be hurt; profit

C) profit; be hurt

D) profit; profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

61

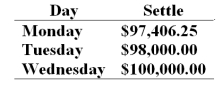

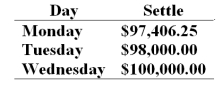

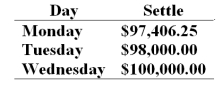

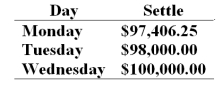

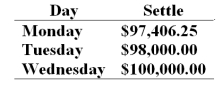

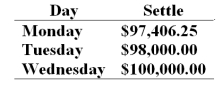

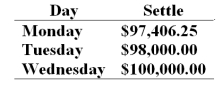

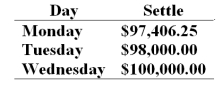

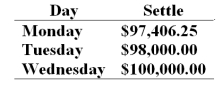

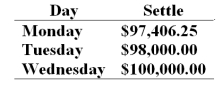

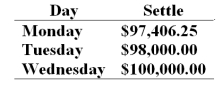

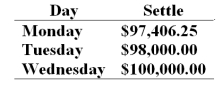

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

At the close of day Tuesday your cumulative rate of return on your investment is

A) 16.2%

B) -5.8%

C) -0.16%

D) -2.2%

At the close of day Tuesday your cumulative rate of return on your investment is

A) 16.2%

B) -5.8%

C) -0.16%

D) -2.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

62

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

The volume of interest rate swaps increased from almost zero in 1980 to over __________ today.

A) $20 million

B) $200 million

C) $200 billion

D) $200 trillion

The volume of interest rate swaps increased from almost zero in 1980 to over __________ today.

A) $20 million

B) $200 million

C) $200 billion

D) $200 trillion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

63

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

Your cumulative rate of return on your investment after Wednesday is a/an ____.

A) 79.9% loss

B) 2.6% loss

C) 33.0% gain

D) 53.9% loss

Your cumulative rate of return on your investment after Wednesday is a/an ____.

A) 79.9% loss

B) 2.6% loss

C) 33.0% gain

D) 53.9% loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

64

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

If rf is greater than d then we know that _______________.

A) the futures price will be higher as contract maturity increases

B) F0 < S0

C) FT > ST

D) arbitrage profits are possible

If rf is greater than d then we know that _______________.

A) the futures price will be higher as contract maturity increases

B) F0 < S0

C) FT > ST

D) arbitrage profits are possible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

65

The ________ and the _______ have the lowest correlations with the large-cap indexes.

A) Nasdaq Composite; Russell 2000

B) NYSE; DJIA

C) S&P500; DJIA

D) Russell 2000; S&P500

A) Nasdaq Composite; Russell 2000

B) NYSE; DJIA

C) S&P500; DJIA

D) Russell 2000; S&P500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

66

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

On which of the given days do you get a margin call?

A) Monday

B) Tuesday

C) Wednesday

D) None

On which of the given days do you get a margin call?

A) Monday

B) Tuesday

C) Wednesday

D) None

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

67

The use of leverage is practiced in the futures markets due to the existence of _________.

A) banks

B) brokers

C) clearinghouse

D) margin

A) banks

B) brokers

C) clearinghouse

D) margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

68

The _________ contract dominates trading in stock index futures.

A) S&P500

B) DJIA

C) Nasdaq 100

D) Russell 2000

A) S&P500

B) DJIA

C) Nasdaq 100

D) Russell 2000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

69

Interest rate swaps involve the exchange of ________________.

A) fixed rate bonds for floating rate bonds

B) floating rate bonds for fixed rate bonds

C) net interest payments and an actual principal swap

D) net interest payments based on notional principal, but no exchange of principal

A) fixed rate bonds for floating rate bonds

B) floating rate bonds for fixed rate bonds

C) net interest payments and an actual principal swap

D) net interest payments based on notional principal, but no exchange of principal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

70

A one year gold futures contract is selling for $641. Spot gold prices are $600 and the one year risk free rate is 6%.

Based on the above data,which of the following set of transactions will yield positive riskless arbitrage profits?

A) Buy gold in the spot with borrowed money and sell the futures contract

B) Buy the futures contract and sell the gold spot and invest the money earned

C) Buy gold spot with borrowed money and buy the futures contract

D) Buy the futures contract and buy the gold spot using borrowed money

Based on the above data,which of the following set of transactions will yield positive riskless arbitrage profits?

A) Buy gold in the spot with borrowed money and sell the futures contract

B) Buy the futures contract and sell the gold spot and invest the money earned

C) Buy gold spot with borrowed money and buy the futures contract

D) Buy the futures contract and buy the gold spot using borrowed money

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

71

You believe that the spread between the September T-bond contract and the June T-bond futures contract is too large and will soon correct.This market exhibits positive cost of carry for all contracts.To take advantage of this you should ______________.

A) buy the September contract and sell the June contract

B) sell the September contract and buy the June contract

C) sell the September contract and sell the June contract

D) buy the September contract and buy the June contract

A) buy the September contract and sell the June contract

B) sell the September contract and buy the June contract

C) sell the September contract and sell the June contract

D) buy the September contract and buy the June contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

72

At contract maturity the basis should equal ___________.

A) 1

B) 0

C) risk-free interest rate

D) -1

A) 1

B) 0

C) risk-free interest rate

D) -1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

73

You purchase an interest rate futures contract that has an initial margin requirement of 15% and a futures price of $115,098.The contract has a $100,000 underlying par value bond.If the futures price falls to $108,000 you will experience a ______ percent loss on your money invested.

A) 31

B) 41

C) 52

D) 64

A) 31

B) 41

C) 52

D) 64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

74

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

After Monday's close the balance on your margin account will be ________.

A) $2,700.00

B) $2,000.00

C) $3,137.50

D) $2,262.50

After Monday's close the balance on your margin account will be ________.

A) $2,700.00

B) $2,000.00

C) $3,137.50

D) $2,262.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

75

You own a $15 million bond portfolio with a modified duration of 11 years and you want to limit your risk but institutional constraints prohibit trading the bond portfolio.T-bond futures are available with a modified duration of the deliverable instrument of 8 years.The futures are priced at $105,000.The proper hedge ratio to use is ______.

A) 104

B) 143

C) 196

D) 213

A) 104

B) 143

C) 196

D) 213

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

76

Sahali Trading Company has issued $100 million worth of long-term bonds at a fixed rate of 9%.Sahali Trading Company then enters into an interest rate swap where they will pay LIBOR and receive a fixed 8.00% on a notional principal of $100 million.After all these transactions are considered,Sahali's cost of funds is __________.

A) 17%

B) LIBOR

C) LIBOR + 1%

D) LIBOR - 1%

A) 17%

B) LIBOR

C) LIBOR + 1%

D) LIBOR - 1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

77

A one year gold futures contract is selling for $641. Spot gold prices are $600 and the one year risk free rate is 6%.

A hypothetical futures contract on a non-dividend-paying stock with current spot price of $100 has a maturity of one year.If the T-bill rate is 5% what should the futures price be?

A) $95.24

B) $100

C) $105

D) $107

A hypothetical futures contract on a non-dividend-paying stock with current spot price of $100 has a maturity of one year.If the T-bill rate is 5% what should the futures price be?

A) $95.24

B) $100

C) $105

D) $107

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

78

A one year gold futures contract is selling for $641. Spot gold prices are $600 and the one year risk free rate is 6%.

A hypothetical futures contract on a non-dividend-paying stock with current spot price of $100 has a maturity of four years.If the T-bill rate is 7% what should the futures price be?

A) $76.29

B) $93.46

C) $107.00

D) $131.08

A hypothetical futures contract on a non-dividend-paying stock with current spot price of $100 has a maturity of four years.If the T-bill rate is 7% what should the futures price be?

A) $76.29

B) $93.46

C) $107.00

D) $131.08

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

79

A one year gold futures contract is selling for $641. Spot gold prices are $600 and the one year risk free rate is 6%.

The arbitrage profit implied by these prices is _____________.

A) $3

B) $4

C) $5

D) $6

The arbitrage profit implied by these prices is _____________.

A) $3

B) $4

C) $5

D) $6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

80

From the perspective of determining profit and loss,the long futures position most closely resembles a levered investment in a ____________.

A) long call

B) short call

C) short stock position

D) long stock position

A) long call

B) short call

C) short stock position

D) long stock position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck