Deck 19: Equity and Hybrid Instruments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/72

العب

ملء الشاشة (f)

Deck 19: Equity and Hybrid Instruments

1

Which one of the following is the reason for paying a different price for different classes of shares in the case of a takeover?

A) Prices depend on the tax treatment of each class.

B) Prices depend on the dividend yield offered by the class.

C) Prices depend on the voting rights of the shares.

D) Prices depend on the floating of shares.

A) Prices depend on the tax treatment of each class.

B) Prices depend on the dividend yield offered by the class.

C) Prices depend on the voting rights of the shares.

D) Prices depend on the floating of shares.

C

2

Residual owners are:

A) bond holders

B) equity holders

C) equity and preferred shareholders

D) all of the above

A) bond holders

B) equity holders

C) equity and preferred shareholders

D) all of the above

B

3

Which of the following statements about family trusts is true?

A) Family trusts separate ownership and control.

B) Income flows to the trust beneficiaries.

C) The trustees retain the voting power.

D) All of the above statements are true.

A) Family trusts separate ownership and control.

B) Income flows to the trust beneficiaries.

C) The trustees retain the voting power.

D) All of the above statements are true.

D

4

Preferred shares are ______ financing.

A) a form of debt

B) a form of equity

C) a combined form of debt and equity

D) different from debt and equity

A) a form of debt

B) a form of equity

C) a combined form of debt and equity

D) different from debt and equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

5

The retraction feature:

A) protects the issuer from interest-rate risk.

B) allows the shareholder to sell it to the issuer at an early maturity date.

C) allows the issuer to buy it back from the shareholder at an early maturity date.

D) protects both the shareholder and the issuer regardless of interest rates.

A) protects the issuer from interest-rate risk.

B) allows the shareholder to sell it to the issuer at an early maturity date.

C) allows the issuer to buy it back from the shareholder at an early maturity date.

D) protects both the shareholder and the issuer regardless of interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

6

Use the following statements to answer this question:

I)Today,the pre-emptive right is always used by corporations to protect their investors from dilution.

II)A common share has the characteristics of a call option because it has unlimited upside potential.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct and II is incorrect.

D) I is incorrect and II is correct.

I)Today,the pre-emptive right is always used by corporations to protect their investors from dilution.

II)A common share has the characteristics of a call option because it has unlimited upside potential.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct and II is incorrect.

D) I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

7

The following may or may NOT be in a list of shareholders' rights.Choose the letter that corresponds to the correct list of rights:

1)Share in dividends

2)Elect directors

3)Appoint managers

4)Vote in general meetings

5)Vote in directors' meetings

6)Examine the company records

7)Priority over unsecured junior debt

9)Declare a stock split

A) 1, 2, 3, 5, 8

B) 1, 2, 3, 5, 8, 9

C) 1, 2, 4, 6

D) 1, 2, 6, 9

1)Share in dividends

2)Elect directors

3)Appoint managers

4)Vote in general meetings

5)Vote in directors' meetings

6)Examine the company records

7)Priority over unsecured junior debt

9)Declare a stock split

A) 1, 2, 3, 5, 8

B) 1, 2, 3, 5, 8, 9

C) 1, 2, 4, 6

D) 1, 2, 6, 9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is correct?

A) Family trusts ensure income flows to the people descended from the company founder.

B) Family trusts ensure all the votes are held by the trustees.

C) Family trusts nominate the managers of the corporation.

D) all of the above.

E) a and b

A) Family trusts ensure income flows to the people descended from the company founder.

B) Family trusts ensure all the votes are held by the trustees.

C) Family trusts nominate the managers of the corporation.

D) all of the above.

E) a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the following statements to answer this question:

I)A retractable preferred share can be sold back to the issuer.

II)Preferred shares provide a benefit for taxes given that dividend income receives preferential tax treatment as compared to interest income.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct and II is incorrect.

D) I is incorrect and II is correct.

I)A retractable preferred share can be sold back to the issuer.

II)Preferred shares provide a benefit for taxes given that dividend income receives preferential tax treatment as compared to interest income.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct and II is incorrect.

D) I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

10

The right of shareholders to receive new shares when new shares are issued is called:

A) a residual owner.

B) a general cash offer.

C) a private placement.

D) a pre-emptive right.

A) a residual owner.

B) a general cash offer.

C) a private placement.

D) a pre-emptive right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a corporation has only one class of shares,which of the following is NOT one of the rights of shareholders?

A) To vote at any shareholder meeting of the corporation.

B) To vote at any director meeting of the corporation.

C) To receive any dividend declared by the corporation.

D) To receive any residual property of the corporation on dissolution.

A) To vote at any shareholder meeting of the corporation.

B) To vote at any director meeting of the corporation.

C) To receive any dividend declared by the corporation.

D) To receive any residual property of the corporation on dissolution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

12

How would you price preferred shares?

A) As an annuity

B) As a growing annuity due

C) As a perpetuity

D) As a growing perpetuity

A) As an annuity

B) As a growing annuity due

C) As a perpetuity

D) As a growing perpetuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements about dividends is true?

A) Dividends are paid before interest is paid.

B) Dividends received by Canadian households are taxed at the marginal personal tax rate.

C) Dividends are tax deductible.

D) Dividends received by one Canadian corporation from another Canadian corporation are not taxed.

A) Dividends are paid before interest is paid.

B) Dividends received by Canadian households are taxed at the marginal personal tax rate.

C) Dividends are tax deductible.

D) Dividends received by one Canadian corporation from another Canadian corporation are not taxed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

14

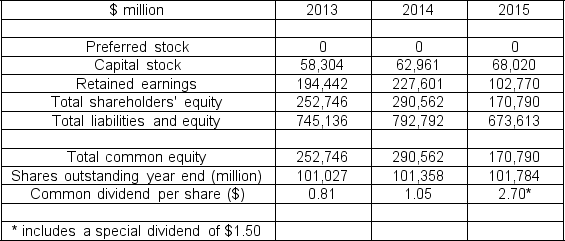

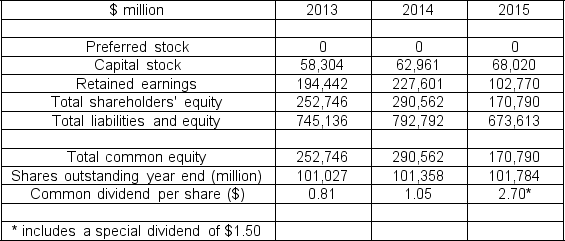

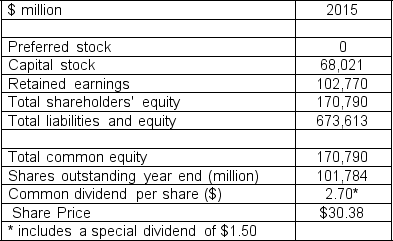

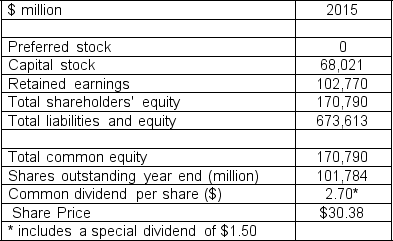

You are given the following shareholders' equity figures for Toronto Skaters Inc.(TS)for the fiscal year ends of 2013,2014,and 2015.What is TS's book value per share for each of the three years,beginning with 2013?

a) $1.92, $2.25, and $1.01

b) $2.50, $2.87, and $1.68

c) $7.38, $7.82, and $6.62

d) $1.30, $1.28, and $1.66

a) $1.92, $2.25, and $1.01

b) $2.50, $2.87, and $1.68

c) $7.38, $7.82, and $6.62

d) $1.30, $1.28, and $1.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

15

When dividends that have been in arrears are paid,the preferred shares have a ______ provision.

A) participating

B) cumulative

C) non-cumulative

D) retractable

A) participating

B) cumulative

C) non-cumulative

D) retractable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

16

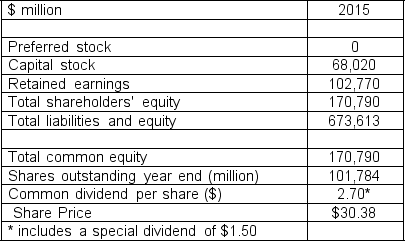

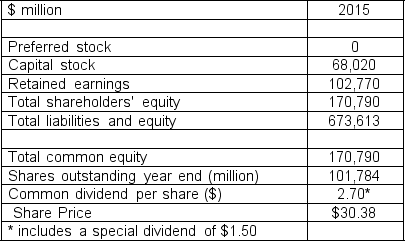

You are given the following shareholders' equity figures for Toronto Skaters Inc.(TS)for the fiscal year end of 2015.What is TS's market to book ratio?

a) 4.59

b) 18.28

c) 30.09

d) 18.11

a) 4.59

b) 18.28

c) 30.09

d) 18.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

17

Different classes of common shares are usually issued:

A) to give some shareholders control of the firm.

B) to pay more dividends to a specific class of common shares.

C) to vote at any director meeting of the corporation.

D) none of the above.

A) to give some shareholders control of the firm.

B) to pay more dividends to a specific class of common shares.

C) to vote at any director meeting of the corporation.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

18

The book value of the shareholders' equity is represented by:

A) the total assets minus the current liabilities.

B) the sum of the par value of common stock and the accumulated retained earnings.

C) the sum of preferred stock, retained earnings, and common equity.

D) the total assets minus equity.

A) the total assets minus the current liabilities.

B) the sum of the par value of common stock and the accumulated retained earnings.

C) the sum of preferred stock, retained earnings, and common equity.

D) the total assets minus equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the event of liquidation,preferred shareholders rank ahead of:

A) subordinated debt holders.

B) secured debt.

C) common shareholders.

D) debenture holders.

A) subordinated debt holders.

B) secured debt.

C) common shareholders.

D) debenture holders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

20

You are given the following shareholders' equity figures for Toronto Skaters Inc.(TS)for the fiscal year end of 2015.What is TS's dividend yield,including and excluding the special dividend?

a) 4.9%, 3.9%

b) 8.9%, 3.9%

c) 11.3%, 25.3%

d) 2.7%, 1.2%

a) 4.9%, 3.9%

b) 8.9%, 3.9%

c) 11.3%, 25.3%

d) 2.7%, 1.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the tax value of money?

A) The difference between your before-tax and after-tax earnings.

B) The tax rate multiplied by the total income reported to the government.

C) Accounting for the fact that dividends are taxed more favourably than is interest income.

D) Accounting for the fact that dividends are not taxed while interest income is taxable.

A) The difference between your before-tax and after-tax earnings.

B) The tax rate multiplied by the total income reported to the government.

C) Accounting for the fact that dividends are taxed more favourably than is interest income.

D) Accounting for the fact that dividends are not taxed while interest income is taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following characteristics apply to straight preferred shares?

I)No maturity date

II)Pay a fixed dividend

III)Dividends are paid at regular intervals

IV)Have a positive yield spread over long Canada bonds

V)The right to sell them back to the issuer

A) I and II

B) I, II, and III

C) I, II, III, and IV

D) I, II, IV, and V

I)No maturity date

II)Pay a fixed dividend

III)Dividends are paid at regular intervals

IV)Have a positive yield spread over long Canada bonds

V)The right to sell them back to the issuer

A) I and II

B) I, II, and III

C) I, II, III, and IV

D) I, II, IV, and V

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

23

Interest rates have gone up to 14 percent since you purchased your 10 percent preferred shares.You would be best off if the shares had a(n)______ feature.

A) call

B) extraction

C) redemption

D) retraction

A) call

B) extraction

C) redemption

D) retraction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is true regarding convertible bonds?

A) The convertible bond value is unrelated to the value of the stock.

B) The value of convertible debt is a function of the risk of default.

C) The conversion factor can be separated from the bond and sold separately to other investors.

D) When a bond is converted into shares, the company receives additional funds as part of the conversion.

A) The convertible bond value is unrelated to the value of the stock.

B) The value of convertible debt is a function of the risk of default.

C) The conversion factor can be separated from the bond and sold separately to other investors.

D) When a bond is converted into shares, the company receives additional funds as part of the conversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

25

Evaluate the following statement:

The cost of preferred stock is the rate of return shareholders require on the firm's preferred stock.

A) False.

B) True.

The cost of preferred stock is the rate of return shareholders require on the firm's preferred stock.

A) False.

B) True.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following characteristics apply to retractable preferred shares?

I)No maturity date

II)Pay a fixed dividend at regular intervals

III)Have a positive yield spread (before tax)over mid-term Canada bonds

IV)The right to sell them back to the issuer

A) I and II

B) I, II, and III

C) I, II, III, and IV

D) II, III, and IV

I)No maturity date

II)Pay a fixed dividend at regular intervals

III)Have a positive yield spread (before tax)over mid-term Canada bonds

IV)The right to sell them back to the issuer

A) I and II

B) I, II, and III

C) I, II, III, and IV

D) II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following characteristics apply to floating rate preferred shares?

I)Long maturity date

II)Pay a fixed dividend

III)Dividends are paid at regular intervals

IV)Have a positive yield spread (after tax)over bankers' acceptances

V)The right to sell them back to the issuer

A) I and II

B) I, II, and III

C) III, IV, and V

D) I, III, and IV

I)Long maturity date

II)Pay a fixed dividend

III)Dividends are paid at regular intervals

IV)Have a positive yield spread (after tax)over bankers' acceptances

V)The right to sell them back to the issuer

A) I and II

B) I, II, and III

C) III, IV, and V

D) I, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

28

Warrants attached to a bond:

A) are used as sweeteners to make bond issues less attractive.

B) always increase the risk of the bond.

C) always decrease the risk of the bond.

D) all of the above.

A) are used as sweeteners to make bond issues less attractive.

B) always increase the risk of the bond.

C) always decrease the risk of the bond.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

29

The ______ specifies the number of shares received for each convertible bond.

A) conversion price

B) subscription price

C) conversion ratio

D) subscription ratio

A) conversion price

B) subscription price

C) conversion ratio

D) subscription ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

30

Hudson Bay Fishing Corporation has issued bonds that can be converted into common shares when the share price is $50.The current market price of the stock is $35.The bond has a face value of $1,000 and currently sells for $975.What is the conversion ratio for this bond?

a) 20

b) 28.6

c) 24.4

d) 27.9

a) 20

b) 28.6

c) 24.4

d) 27.9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

31

In which of the following ways are some preferred shares similar to bonds?

I)Call provisions

II)Convertible features

III)Retraction provisions

IV)Rated by rating agencies

A) I, II, and III

B) I, II, and IV

C) II and III

D) I, II, III, and IV

I)Call provisions

II)Convertible features

III)Retraction provisions

IV)Rated by rating agencies

A) I, II, and III

B) I, II, and IV

C) II and III

D) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

32

Warrants are similar to call options on stocks.What's the equivalent of the strike price?

A) The initial price of the warrant

B) The market price of the warrant

C) The price of exercise of the warrant

D) None of the above

A) The initial price of the warrant

B) The market price of the warrant

C) The price of exercise of the warrant

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

33

Issuing bonds plus warrants is similar to issuing:

A) Retractable bonds.

B) Convertible bonds.

C) Floating rate bonds.

D) Preferred shares.

A) Retractable bonds.

B) Convertible bonds.

C) Floating rate bonds.

D) Preferred shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

34

The conversion premium is defined as which of the following?

A) The number of shares that a convertible security can be exchanged for.

B) The price at which a convertible security can be converted into common shares.

C) The value of a convertible security if it is immediately converted into common shares.

D) The percentage difference between the value at which the bonds are trading and their conversion value.

A) The number of shares that a convertible security can be exchanged for.

B) The price at which a convertible security can be converted into common shares.

C) The value of a convertible security if it is immediately converted into common shares.

D) The percentage difference between the value at which the bonds are trading and their conversion value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the following statements to answer this question:

I)A warrant's value is due,in part,to its long-term maturity.

II)The intrinsic value of a warrant does not depend on the volatility of the stock.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct and II is incorrect.

D) I is incorrect and II is correct.

I)A warrant's value is due,in part,to its long-term maturity.

II)The intrinsic value of a warrant does not depend on the volatility of the stock.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct and II is incorrect.

D) I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

36

Punta Oil Company has 600,000 shares outstanding and has just issued 640,000 warrants.Each warrant entitles its owner to buy one share anytime in the next quarter at a price of $40.The common stock price is current $50.What is the payoff to the warrant holders exercising them,rounded to the nearest dollar?

a) $774.193.54

b) $3,096,774.19

c) $3,577,684.67

d)$3,844,599.16

a) $774.193.54

b) $3,096,774.19

c) $3,577,684.67

d)$3,844,599.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

37

In which of the following ways do warrants differ from call options?

I)Warrants impact the firm while call options do not.

II)Call options generally have shorter maturities than warrants.

III)Any profit received from call options is taxable while that from warrants is not taxable.

IV)Volatility increases the value of call options but makes warrants less valuable.

V)The longer maturities of warrants make them less valuable.

A) I, II, and III

B) I, III, and V

C) II, IV, and V

D) I and II

I)Warrants impact the firm while call options do not.

II)Call options generally have shorter maturities than warrants.

III)Any profit received from call options is taxable while that from warrants is not taxable.

IV)Volatility increases the value of call options but makes warrants less valuable.

V)The longer maturities of warrants make them less valuable.

A) I, II, and III

B) I, III, and V

C) II, IV, and V

D) I and II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company has 20 million shares outstanding that are trading at $30 per share.The company has 2 million warrants outstanding that have an exercise price of $28 per share.What is the payoff to the warrant holders exercising them,rounded to the nearest dollar?

a) $3,636,364

b) $ 2,800,000

c) - $3,636,364

d) $6,000,000

a) $3,636,364

b) $ 2,800,000

c) - $3,636,364

d) $6,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following support the rationale for issuing convertible bonds?

A) To reduce underwriting costs

B) To permit cheaper initial financing

C) To minimize dilution

D) All of the above are good reasons for issuing convertible bonds.

A) To reduce underwriting costs

B) To permit cheaper initial financing

C) To minimize dilution

D) All of the above are good reasons for issuing convertible bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements is correct?

A) Companies issue preferred shares only to have better control of the firm.

B) Preferred shares pay a guaranteed dividend.

C) None of the above

C) Preferred dividends are not tax deductible to the issuing firm.

A) Companies issue preferred shares only to have better control of the firm.

B) Preferred shares pay a guaranteed dividend.

C) None of the above

C) Preferred dividends are not tax deductible to the issuing firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

41

A 10% semiannual coupon bond has 10 years to maturity when market rates on similar non-convertible bonds are 8.5%.It is convertible into 40 common shares and has a $1,000 par value.The shares are currently trading at $30.What is the floor value of the bond,assuming it pays semi-annual coupons?

a) $2,000

b) $1,100

c) $1,200

d) $1,000

a) $2,000

b) $1,100

c) $1,200

d) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

42

A 12% coupon bond has 20 years to maturity when market rates on similar non-convertible bonds are 9.25%.It is convertible into 20 common shares and has a $1,000 par value.The shares are currently trading at $40.What is the straight bond value,assuming it pays annual coupons?

a) $1,247

b) $1,000

c) $1,207

d) $1,287

a) $1,247

b) $1,000

c) $1,207

d) $1,287

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

43

The price at which a convertible bond would sell for if it could NOT be converted into common stock is called:

A) floor value.

B) straight bond value.

C) convertible bond value.

D) conversion value.

A) floor value.

B) straight bond value.

C) convertible bond value.

D) conversion value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

44

Discuss how preferred shares have features of both debt and equity instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following statements is correct?

A) Adjustable rate convertible subordinated securities make the interest payments conditional on prior dividend payments.

B) Income bonds pay out guaranteed and fixed coupons prior to common dividends.

C) Original issue discount bonds (OIDs) sell at a discount when issued by firms.

D) All of the above are correct.

A) Adjustable rate convertible subordinated securities make the interest payments conditional on prior dividend payments.

B) Income bonds pay out guaranteed and fixed coupons prior to common dividends.

C) Original issue discount bonds (OIDs) sell at a discount when issued by firms.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

46

What are the costs and benefits of preferred share financing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is the hard retraction requirement?

A) The preferred shares must be paid off with common shares or other preferred shares.

B) The preferred shares must be paid off with cash.

C) The preferred shares must be paid off within 30 days of retraction.

D) The preferred shares can only be retracted in cases of financial distress.

A) The preferred shares must be paid off with common shares or other preferred shares.

B) The preferred shares must be paid off with cash.

C) The preferred shares must be paid off within 30 days of retraction.

D) The preferred shares can only be retracted in cases of financial distress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

48

A LYON is a note that:

A) is convertible.

B) has a zero coupon.

C) both of the above.

A) is convertible.

B) has a zero coupon.

C) both of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements regarding income bonds is/are true?

A) They appear similar to debt but are closer to equity.

B) They are generally issued after a reorganization.

C) The interest is tied to some level of the cash flow of the firm.

D) All of the above statements are true.

A) They appear similar to debt but are closer to equity.

B) They are generally issued after a reorganization.

C) The interest is tied to some level of the cash flow of the firm.

D) All of the above statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements regarding convertible bonds is true?

A) The floor value is the lowest price a convertible bond will sell for.

B) The convertible bond's floor value is determined by the maximum of the straight bond value and the conversion value.

C) If the share price rises above the conversion price, investors will convert the bonds.

D) All of the above statements are true.

A) The floor value is the lowest price a convertible bond will sell for.

B) The convertible bond's floor value is determined by the maximum of the straight bond value and the conversion value.

C) If the share price rises above the conversion price, investors will convert the bonds.

D) All of the above statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

51

Montreal Financing has preferred shares with a par value of $20 outstanding.These shares pay $1.60 in dividends annually.

a) What will be the market price of these shares if the current market yield is 11 percent?

b) What will be the market price of these shares if the current market yield is 11 percent and the issue is retractable in five years at the par value?

c) What is the value of this retractable feature? Why does it have value?

d) What will be the market price of these shares if the issue is immediately redeemable and retractable at par?

a) What will be the market price of these shares if the current market yield is 11 percent?

b) What will be the market price of these shares if the current market yield is 11 percent and the issue is retractable in five years at the par value?

c) What is the value of this retractable feature? Why does it have value?

d) What will be the market price of these shares if the issue is immediately redeemable and retractable at par?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

52

A firm has $45,000,000 of preferred shares outstanding that have a yield of 10 percent on par and are callable at a 3 percent premium.New issues will cost $980,000 in issuing and underwriting expenses.

a) At what interest rates would the firm want to refinance?

b) If the dividend yield drops to 8 percent, how long will it take before the present value of the interest savings exceeds the cost of refinancing?

a) At what interest rates would the firm want to refinance?

b) If the dividend yield drops to 8 percent, how long will it take before the present value of the interest savings exceeds the cost of refinancing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following securities provides a firm with results similar to those of a real return bond?

A) Adjustable rate convertible subordinated securities

B) Liquid yield option notes

C) Income bond

D) Original issue discount bond

A) Adjustable rate convertible subordinated securities

B) Liquid yield option notes

C) Income bond

D) Original issue discount bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following factors are considered when determining whether a security is debt or equity?

I)Permanence factor

II)Subordination factor

III)Objective factor

IV)Legal factor

V)Subjective factor

A) I and II

B) I, II, and III

C) I, II, and IV

D) I, II, IV, and V

I)Permanence factor

II)Subordination factor

III)Objective factor

IV)Legal factor

V)Subjective factor

A) I and II

B) I, II, and III

C) I, II, and IV

D) I, II, IV, and V

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is NOT an example of an indexed bond?

A) Commodity bond

B) Real return bond

C) Income bond

D) Callable bond

A) Commodity bond

B) Real return bond

C) Income bond

D) Callable bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

56

You want to buy a portfolio of financial securities consisting of three,$1,000 face value Government of Canada bonds and 500 preferred shares of Laurentide Resort Inc.

Laurentide Resort has a preferred share series trading on the Toronto Stock Exchange.It pays a dividend of $0.56 semi-annually.The required rate of return on the stock is 12 percent compounded semi-annually.The bonds have 4 years to maturity and an 8 percent semi-annual coupon.Currently,the yield to maturity on these bonds is 10 percent compounded semi-annually.

a) What is the current intrinsic value of Laurentide Resort's preferred stock?

b) What is the current price of the 4-year coupon bonds?

c) What is the current value of your portfolio (i.e., bonds + preferred stock)?

d) It is now 2 years later. Market interest rates have dropped and the yield to maturity on these bonds is now 8 percent. What is the value of the bonds at this time?

e) It is still 2 years later and the yield to maturity has dropped to 8%. Assume that the price of Laurentide Resort Inc. is now $8.50. What is the expected annual rate of return on your portfolio over the two years from your investment?

Laurentide Resort has a preferred share series trading on the Toronto Stock Exchange.It pays a dividend of $0.56 semi-annually.The required rate of return on the stock is 12 percent compounded semi-annually.The bonds have 4 years to maturity and an 8 percent semi-annual coupon.Currently,the yield to maturity on these bonds is 10 percent compounded semi-annually.

a) What is the current intrinsic value of Laurentide Resort's preferred stock?

b) What is the current price of the 4-year coupon bonds?

c) What is the current value of your portfolio (i.e., bonds + preferred stock)?

d) It is now 2 years later. Market interest rates have dropped and the yield to maturity on these bonds is now 8 percent. What is the value of the bonds at this time?

e) It is still 2 years later and the yield to maturity has dropped to 8%. Assume that the price of Laurentide Resort Inc. is now $8.50. What is the expected annual rate of return on your portfolio over the two years from your investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

57

If you are to allocate the amount of soft retractable preferred shares in the financial statements,where would they go?

A) Assets

B) Liabilities

C) Ownership equity

D) None of the above

A) Assets

B) Liabilities

C) Ownership equity

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

58

A 12% coupon bond has 20 years to maturity when market rates on similar non-convertible bonds are 9.25%.It is convertible into 20 common shares and has a $1,000 par value.The shares are currently trading at $40.What is the floor value of the bond,assuming it pays annual coupons?

a) $1,247

b) $1,000

c) $800

d) $2,000

a) $1,247

b) $1,000

c) $800

d) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

59

If you are to allocate the amount of hard retractable preferred shares in the financial statements,where would they go?

A) Assets

B) Liabilities

C) Ownership equity

D) None of the above

A) Assets

B) Liabilities

C) Ownership equity

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

60

Rank the risk of the following securities from lowest to highest.

I)Long-term unsecured debt

II)Convertible preferred shares

III)Common equity

IV)Bank loans

A) I, II, III, IV

B) IV, III, II, I

C) I, II, IV, III

D) IV, I, II, III

I)Long-term unsecured debt

II)Convertible preferred shares

III)Common equity

IV)Bank loans

A) I, II, III, IV

B) IV, III, II, I

C) I, II, IV, III

D) IV, I, II, III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

61

Explain how a warrant is viewed as a call option on the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

62

Why is there a difference between the way the market classifies debt and the way the CRA classifies it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain an important implication of viewing a company's common shares as a call option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

64

Explain how the value of convertible debt varies as a function of the common share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

65

Toronto Skaters currently has $1,000,000 of 8 percent convertible debt outstanding.The coupon interest is paid on an annual basis.The $1,000 face value debentures mature in 12 years and have a conversion price of $50.Similar straight debt currently yields 7 percent.The firm's common stock is currently trading for $55 per share.What is the current straight debt value and the current conversion value of the convertibles? What is the floor price for the convertibles? If all the convertible holders decided to convert,how many additional shares would have to be issued?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

66

Explain the difference between the conversion price and the conversion ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

67

Explain the differences and similarities between warrants and convertibles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

68

Explain the importance of warrants in financing for firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

69

Give four reasons why companies use convertibles to raise capital instead of straight debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

70

Explain how equity can be viewed as a call option on the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

71

Describe convertible debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

72

Hudson Bay Fishing Corporation has just issued a 10-year,9 percent annual-pay bond with a $1,000 face value.In addition,the bond was issued with 50 detachable warrants.The bond was issued at par.Each warrant gives the owner the right to purchase 2 shares of the company's stock for $15 each.Bonds with equivalent risk but with no attached warrants currently yield 11 percent.What is the value of one warrant?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck