Deck 3: Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/53

العب

ملء الشاشة (f)

Deck 3: Financial Statements

1

You bought a sanding machine from the local hardware store using the credit card of the store chain on December 30,2015 to be delivered on January 10,2016.When is the sale recognized?

A) When the payment is made to the card

B) When you receive the machine on Jan. 10

C) When you made the purchase on Dec. 30

D) When the credit card company makes the payment to the store

A) When the payment is made to the card

B) When you receive the machine on Jan. 10

C) When you made the purchase on Dec. 30

D) When the credit card company makes the payment to the store

C

2

Which of the following is not a source of cash?

A) Increase in owners' equity

B) Increase in accounts payable

C) Decrease in accounts receivable

D) Increase in inventory

A) Increase in owners' equity

B) Increase in accounts payable

C) Decrease in accounts receivable

D) Increase in inventory

D

3

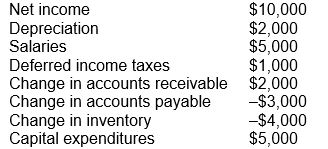

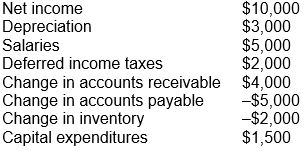

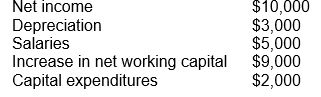

Assume the following information from the financial statements of ReStateM Company:

The change in net working capital for ReStateM Company is:

a) Increase $7,000

b) Decrease $7,000

c) Increase $1,000

d) Decrease $1,000

The change in net working capital for ReStateM Company is:

a) Increase $7,000

b) Decrease $7,000

c) Increase $1,000

d) Decrease $1,000

c,Change in AR + change in I - change in AP = 2 - 4- (-3)= increase 1

4

The IASB located in London is responsible for harmonizing accounting principles in:

A) US only

B) European Union

C) Developed countries

D) World countries

A) US only

B) European Union

C) Developed countries

D) World countries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

5

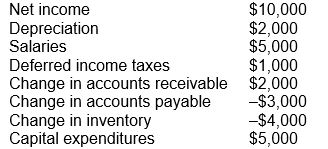

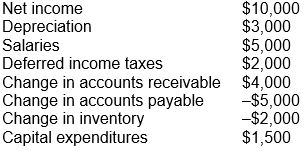

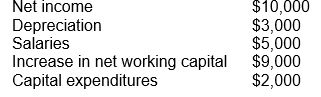

Assume the following information from the financial statements of ReStateM Company:

The change in net working capital for ReStateM Company is:

a) Increase $7,000

b) Decrease $7,000

c) Increase $2,000

d) Decrease $2,000

The change in net working capital for ReStateM Company is:

a) Increase $7,000

b) Decrease $7,000

c) Increase $2,000

d) Decrease $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

6

The basic principles of GAAP do not include:

A) The entity concept

B) Liquidation valuation

C) The matching principle

D) Revenue recognition

A) The entity concept

B) Liquidation valuation

C) The matching principle

D) Revenue recognition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following is a misrepresentation of financial statements?

A) The statements deceive investors.

B) The statements overstate earnings and inflate the value of assets.

C) The statements mislead analysts in estimating the market value of the firm.

D) All of the above.

A) The statements deceive investors.

B) The statements overstate earnings and inflate the value of assets.

C) The statements mislead analysts in estimating the market value of the firm.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

8

On January 15,2014,the Dam-M-Up Company entered into an agreement with Quebec Hydro to build a dam in northern Quebec.Construction will begin on January 1,2015 and will be completed by December 15,2016.According to the matching principle,when should the revenue from this project be recognized?

A) January 15, 2014 (when the contract is signed)

B) As the work is carried out (2015 and 2016)

C) When the work is completed

D) When payment is received

A) January 15, 2014 (when the contract is signed)

B) As the work is carried out (2015 and 2016)

C) When the work is completed

D) When payment is received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

9

The shares of Tremblay Maple Syrup Company are listed on both the Toronto and New York stock exchanges.Tremblay could prepare its financial statements in accordance with:

I)ASPE

II)US GAAP

III)IFRS

A) I only

B) II only

C) I and III only

D) II and III

I)ASPE

II)US GAAP

III)IFRS

A) I only

B) II only

C) I and III only

D) II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which accounting standards would be used by a publicly traded Canadian company that is not inter-listed?

A) IFRS

B) US GAAP

C) ASPE

D) Pension Accounting

A) IFRS

B) US GAAP

C) ASPE

D) Pension Accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is not correct?

A) The cash flow statement is a summary of the firm's cash receipts and disbursements over a specified period.

B) Traditional cash flow equals net income plus cash expenses.

C) Cash flow from operations equals traditional cash flow less the increase in net working capital.

D) Free cash flow equals cash flow from operations less capital expenditures.

A) The cash flow statement is a summary of the firm's cash receipts and disbursements over a specified period.

B) Traditional cash flow equals net income plus cash expenses.

C) Cash flow from operations equals traditional cash flow less the increase in net working capital.

D) Free cash flow equals cash flow from operations less capital expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one of the following is not true?

A) Accounting standards evolve to improve the representation of financial statements.

B) Accounting scandals introduced lower accounting standards.

C) There is more and more collaboration between different countries to harmonize accounting standards.

D) IASB is working with different accounting boards to harmonize worldwide standards.

A) Accounting standards evolve to improve the representation of financial statements.

B) Accounting scandals introduced lower accounting standards.

C) There is more and more collaboration between different countries to harmonize accounting standards.

D) IASB is working with different accounting boards to harmonize worldwide standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following properly orders the list of balance sheet items,from top to bottom?

A) Cash, Inventory, Factory

B) Cash, Factory, Inventory

C) Payable, Long-term Debt, Short-term Debt

D) Inventory, Receivables, Owner's Equity

A) Cash, Inventory, Factory

B) Cash, Factory, Inventory

C) Payable, Long-term Debt, Short-term Debt

D) Inventory, Receivables, Owner's Equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

14

"Debiting" an account

I)increases an asset account.

II)increases a liability account.

III)increases an equity account.

A) I only

B) II only

C) I or II only

D) II or III only

I)increases an asset account.

II)increases a liability account.

III)increases an equity account.

A) I only

B) II only

C) I or II only

D) II or III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

15

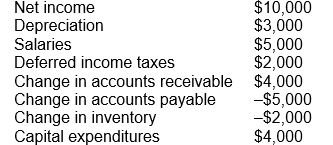

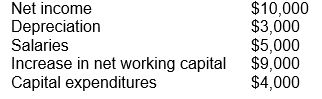

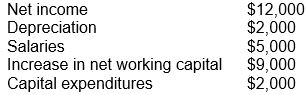

Assume the following information from the financial statements of ReStateM Company:

The traditional cash flow for ReStateM Company is:

a) $13,000

b) $8,000

c) $15,000

d) $10,000

The traditional cash flow for ReStateM Company is:

a) $13,000

b) $8,000

c) $15,000

d) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

16

The balance sheet can be best described as:

A) a snapshot taken at a single point of time

B) the accumulated result of multiple transactions

C) a representation of a firm's financial position

D) all of the above

A) a snapshot taken at a single point of time

B) the accumulated result of multiple transactions

C) a representation of a firm's financial position

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

17

You own a small business and you decide to purchase insurance for your business on March 31 that covers a 12-month period beginning the next day.The insurance company requires the annual premium amount upfront.On December 31,what portion of the premium should you expense in your financial statements?

A) 100%

B) 75%

C) 67%

D) 33%

A) 100%

B) 75%

C) 67%

D) 33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

18

"Crediting" an account

I)increases an asset account.

II)increases a liability account.

III)could increase both an equity account and a liability account.

A) I only

B) II only

C) I and II only

D) II and III only

I)increases an asset account.

II)increases a liability account.

III)could increase both an equity account and a liability account.

A) I only

B) II only

C) I and II only

D) II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

19

The CPA Canada Handbook contains the accounting principles of:

A) The United States

B) Canada

C) The European Community

D) Ontario

A) The United States

B) Canada

C) The European Community

D) Ontario

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

20

The Sarbanes-Oxley Act (SOX)requirements include:

I)An audit committee made up of independent directors

II)A separation of audit and consulting functions

III)A certification of financial statements by the CEO and CFO

A) I and II only

B) I and III only

C) III only

D) I, II, and III

I)An audit committee made up of independent directors

II)A separation of audit and consulting functions

III)A certification of financial statements by the CEO and CFO

A) I and II only

B) I and III only

C) III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

21

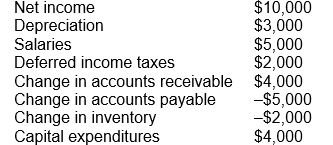

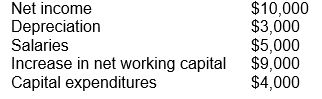

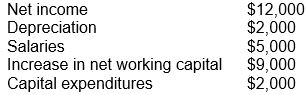

Assume the following information from the financial statements of ReStateM Company:

The cash flow from operations for ReStateM is:

a) $22,000

b) -$22,000

c) $4,000

d) -$4,000

The cash flow from operations for ReStateM is:

a) $22,000

b) -$22,000

c) $4,000

d) -$4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assume the following information from the financial statements of ReStateM Company:

The free cash flow for ReStateM is:

a) $24,000

b) $20,000

c) $6,000

d) $2,000

The free cash flow for ReStateM is:

a) $24,000

b) $20,000

c) $6,000

d) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

23

On June 1 of year 1,XYZ bought office equipment for $50,000.The equipment falls into class 8 with a CCA rate of 20%.Assuming that the equipment is the only asset in that class,what is the CCA that XYZ can claim for the fiscal year at the end of year 1?

A) $4,167

B) $5,833

C) $5,000

D) $10,000

A) $4,167

B) $5,833

C) $5,000

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is the difference between current and non-current liabilities?

A) current liabilities are due to be paid within a year, while non-current liabilities are dure more than a year into the future

B) current liabilities arose within the past year, while non-current liabilities arose more than a year ago

C) current liabilities are known to exist right now, while non-current liabilities will not be known until some time in the future

D) current liabilities are payable on specific due dates, while non-current liabilities can be repaid at any

A) current liabilities are due to be paid within a year, while non-current liabilities are dure more than a year into the future

B) current liabilities arose within the past year, while non-current liabilities arose more than a year ago

C) current liabilities are known to exist right now, while non-current liabilities will not be known until some time in the future

D) current liabilities are payable on specific due dates, while non-current liabilities can be repaid at any

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

25

The sale of depreciable assets cannot result in ____________.

a) capital gains

b) capital losses

c) CCA recapture

d) terminal losses

a) capital gains

b) capital losses

c) CCA recapture

d) terminal losses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

26

The consolidated financial statements of XYZ indicate minority interest of $10,000.The total owners' equity is $50,000.The minority interest value reflects:

A) The fraction of the other company's equity that is owned by visible minorities

B) The fraction of the other company's equity that is held by small shareholders

C) The fraction of the other company's equity that is not owned by XYZ's shareholders

D) The fraction of the other company's equity that has been authorized but not yet issued

A) The fraction of the other company's equity that is owned by visible minorities

B) The fraction of the other company's equity that is held by small shareholders

C) The fraction of the other company's equity that is not owned by XYZ's shareholders

D) The fraction of the other company's equity that has been authorized but not yet issued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements is true about personal taxes in Canada?

A) Individual and corporate marginal tax rates are the same.

B) Capital gains and interest income are taxed at the same rate for individuals.

C) Dividends received from Canadian corporations are taxed differently than dividends received from US corporations.

D) Capital losses occur when a depreciable asset is sold below its original purchase price.

A) Individual and corporate marginal tax rates are the same.

B) Capital gains and interest income are taxed at the same rate for individuals.

C) Dividends received from Canadian corporations are taxed differently than dividends received from US corporations.

D) Capital losses occur when a depreciable asset is sold below its original purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

28

At the beginning of year 1,LMOT Company had the following UCC balances:

Class 43,CCA rate = 30%,UCC = $25,000

Class 8,CCA rate = 20%,UCC = $10,000

During Year 1,LMOT neither bought nor sold any assets.The total CCA that LMOT can claim in Year 1 is:

a) $4,750

b) $7,000

c) $9,500

d) $10,500

Class 43,CCA rate = 30%,UCC = $25,000

Class 8,CCA rate = 20%,UCC = $10,000

During Year 1,LMOT neither bought nor sold any assets.The total CCA that LMOT can claim in Year 1 is:

a) $4,750

b) $7,000

c) $9,500

d) $10,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

29

Frank lives and works in Alberta and earned $50,000 in income.Percival lives and works in Nova Scotia and also earned $50,000 income.If the only difference between the two people is where they live,then

A) Frank and Percival will have the same total income tax bill.

B) Frank and Percival will have the same Federal income tax bill.

C) Frank and Percival will have the same Provincial income tax bill.

D) Where they live has no impact on their income tax bill.

A) Frank and Percival will have the same total income tax bill.

B) Frank and Percival will have the same Federal income tax bill.

C) Frank and Percival will have the same Provincial income tax bill.

D) Where they live has no impact on their income tax bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

30

On March 15 of year 1 XYZ bought a machine for $50,000.The machine is in class 43 with a CCA rate of 30%.Assuming that the machine is the only asset in that class,what is the CCA that XYZ can claim for the fiscal year ended at the end of year 1?

a) $7,500

b) $11,250

c) $12,750

d) $15,000

a) $7,500

b) $11,250

c) $12,750

d) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

31

Assume the following information from the financial statements of ReStateM Company:

The free cash flow for ReStateM is:

The free cash flow for ReStateM is:

a) $14,000

b) $5,000

c) $12,000

d) $3,000

The free cash flow for ReStateM is:

The free cash flow for ReStateM is: a) $14,000

b) $5,000

c) $12,000

d) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

32

A CCA recapture or terminal loss can arise when

I)the CCA asset class is terminated

II)assets are sold for less than UCC of asset class

III)assets are sold for more than UCC of asset class

A) I only

B) I, II, and III

C) II or III only

D) I or III only

I)the CCA asset class is terminated

II)assets are sold for less than UCC of asset class

III)assets are sold for more than UCC of asset class

A) I only

B) I, II, and III

C) II or III only

D) I or III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following best describes double taxation?

A) Both the provincial and federal levels of government collect tax on an income amount.

B) The taxable amount is collected at two different points in any given year.

C) Different levels of government use two different tax brackets.

D) Income that is taxed at the corporate level and then again at the personal level when the corporation pays a dividend.

A) Both the provincial and federal levels of government collect tax on an income amount.

B) The taxable amount is collected at two different points in any given year.

C) Different levels of government use two different tax brackets.

D) Income that is taxed at the corporate level and then again at the personal level when the corporation pays a dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

34

What does the UCC represent?

A) The amount of depreciation that should be expensed in the income statement.

B) The residual amount that should be depreciated over future years.

C) The salvage value of the asset.

D) The capital expenditure value that is reported on the cash flow statement.

A) The amount of depreciation that should be expensed in the income statement.

B) The residual amount that should be depreciated over future years.

C) The salvage value of the asset.

D) The capital expenditure value that is reported on the cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

35

At the beginning of year 1,XYZ bought a machine for $50,000.The machine is in class 43 with a CCA rate of 30%.Assuming that the machine is the only asset in the class,what is the CCA that XYZ can claim for the fiscal year ended at the end of year 2?

a) $7,500

b) $11,250

c) $12,750

d) $15,000

a) $7,500

b) $11,250

c) $12,750

d) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

36

Confu Corp's income statement for the year ended 2015 shows depreciation expense of $25,000.The total amount of CCA claimed in 2015 _____________ $25,000

A) must equal

B) cannot equal

C) need not equal

D) must be less than

A) must equal

B) cannot equal

C) need not equal

D) must be less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

37

At the beginning of year 1,XYZ bought a machine for $50,000.The machine is in class 43 with a CCA rate of 30%.Assuming that the machine is the only asset in the class,what is the UCC (undepreciated capital cost)for the machine class after CCA is claimed at the end of year 2?

a) $27,000

b) $27,500

c) $29,750

d) $50,000

a) $27,000

b) $27,500

c) $29,750

d) $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

38

Why is there a difference between earnings and cash flows?

A) Because of accruals and non-cash items.

B) Because of the difference in accounting methods.

C) Because cash flow statements and income statements follow different GAAP.

D) Because expenses are not accounted for the same way as revenues.

A) Because of accruals and non-cash items.

B) Because of the difference in accounting methods.

C) Because cash flow statements and income statements follow different GAAP.

D) Because expenses are not accounted for the same way as revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

39

Why can there be a substantial difference between net income and free cash flow?

A) Capital expenditures are not fully included in the net income calculation.

B) Free cash flow includes accrual items not found in net income.

C) Free cash flow does not deduct the same expense items as net income.

D) Net income only flows to retained earnings, while free cash flow can be used to pay dividends.

A) Capital expenditures are not fully included in the net income calculation.

B) Free cash flow includes accrual items not found in net income.

C) Free cash flow does not deduct the same expense items as net income.

D) Net income only flows to retained earnings, while free cash flow can be used to pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements is true?

A) The CCA rate is the same for most asset classes, with the exception of land.

B) When an asset is sold, the salvage value is added to the aggregate value of the asset class.

C) If no assets are bought or sold, the CCA amount will be constant over time.

D) In the year of the acquisition, the CCA claim is based on half the cost of the asset.

A) The CCA rate is the same for most asset classes, with the exception of land.

B) When an asset is sold, the salvage value is added to the aggregate value of the asset class.

C) If no assets are bought or sold, the CCA amount will be constant over time.

D) In the year of the acquisition, the CCA claim is based on half the cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

41

Fred is confused.He has just deposited $100 in his savings account and the cashier said: "Your account will be credited with $100." Fred knows that depositing the cash in his account has increased his assets and therefore his savings account should be debited,so why is the bank crediting his account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

42

It is April and Michael is doing his taxes and is very confused.In his finance text book,it says that in Canada the tax system was designed to reduce the double taxation of dividends from Canadian corporations.However,he finds that on his tax return he has to "gross-up" the amount of the dividends he received and add that to his income.Explain to Michael how the Canadian personal tax system reduces the double taxation of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

43

Charles is considering investing in PDQ Technical Instruments.He feels this is a good investment because the auditor said: "…in our opinion,these consolidated financial statements present fairly,in all material respects,the financial position of PDQ Technical Instruments." Comment on Charles' reasoning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

44

Five years ago,J.Hi Corp.bought a paper cup making machine for $50,000.Assume the machine is the only asset in its class.The company has just sold the machine for $35,000.The UCC of the asset class just before the sale is $15,000.What are the tax consequences of this sale?

A) There is zero tax consequence since the machine was sold for less than its acquisition cost.

B) A capital loss of $15,000.

C) A CCA recapture of $20,000.

D) A terminal loss of $20,000.

A) There is zero tax consequence since the machine was sold for less than its acquisition cost.

B) A capital loss of $15,000.

C) A CCA recapture of $20,000.

D) A terminal loss of $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

45

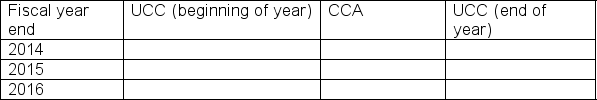

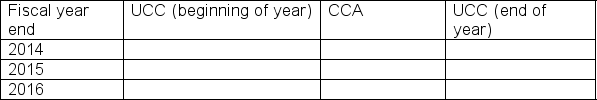

Montreal Smoked Meat Company (MSM)purchased a machine on February 1,2014 for $25,000.On October 10,2014 it purchased another machine for $50,000.Both machines have a CCA rate of 30% and are in the same asset class.These are the only machines in the class and the company made no asset purchases or sales for the following two years.MSM's fiscal year end is December 31.Complete the following table (and show your work):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

46

In the text the author says: "…corporate finance strategies that are based on the U.S.tax code are not directly applicable in Canada or Europe".Why is this true? Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

47

Mira is considering two job offers: one in Montreal and the other in Halifax.She found that it would pay her the same amount in terms of gross salary.What else should she consider in terms of decision making?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

48

Why is an increase in net working capital a decrease in free cash flow?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

49

Why is the tax deductibility of interest important for firm decision making?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

50

A company has net income this year of $45,500.Last year,the company's net working capital was $14,300 and this year's net working capital is $15,200.Depreciation this year is $7,300.What is cash from operations this year?

A) Net income

B) Add depreciation

C) Subtract change in NWC

D) CFO

A) Net income

B) Add depreciation

C) Subtract change in NWC

D) CFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

51

Five years ago,Ottawa Styling Institute bought a hair straightening machine for $200,000.Assume the machine is the only asset in its class.The company has just sold the machine for $235,000.The UCC of the asset class just before the sale is $85,000.The tax consequences of this sale are:

I)Capital gain

II)CCA recapture

III)CCA terminal loss

A) I only

B) I and II only

C) I and III only

D) II only

I)Capital gain

II)CCA recapture

III)CCA terminal loss

A) I only

B) I and II only

C) I and III only

D) II only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

52

Five years ago,Ottawa Styling Institute bought a hair straightening machine for $200,000.Assume the machine is the only asset in its class.The company has just sold the machine for $235,000.The UCC of the asset class just before the sale is $85,000.In terms of total amounts,the total taxable items of this sale are:

a) $17,500

b) $35,000

c) $115,000

d) $132,500

a) $17,500

b) $35,000

c) $115,000

d) $132,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

53

Explain the rationale behind the half-year rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck