Deck 4: Review of the Accounting Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/154

العب

ملء الشاشة (f)

Deck 4: Review of the Accounting Cycle

1

Arnold Company provided services to its customers on credit for $25,000.This transaction ________.

A)increased assets

B)increased liabilities

C)increased expenses

D)decreased shareholders' equity

A)increased assets

B)increased liabilities

C)increased expenses

D)decreased shareholders' equity

A

2

Abacus Corporation purchased equipment costing $40,000.It paid $10,000 in cash and signed a note payable for $30,000.This transaction ________.

A)increased assets by $40,000,liabilities by $30,000 and shareholders' equity by $10,000.

B)increased assets by $40,000 and liabilities by $30,000.

C)increased assets and liabilities each by $30,000.

D)increased assets and shareholders' equity each by $40,000.

A)increased assets by $40,000,liabilities by $30,000 and shareholders' equity by $10,000.

B)increased assets by $40,000 and liabilities by $30,000.

C)increased assets and liabilities each by $30,000.

D)increased assets and shareholders' equity each by $40,000.

C

3

Douglas Corporation paid $6,000 for monthly rental on its warehouse.This transaction ________.

A)decreased liability

B)increased shareholders' equity

C)increased assets

D)increased expenses

A)decreased liability

B)increased shareholders' equity

C)increased assets

D)increased expenses

D

4

Bradley Company paid $25,000 in dividends to its shareholders.This transaction ________.

A)increased expenses

B)decreased revenues

C)increased liabilities

D)decreased shareholders' equity

A)increased expenses

B)decreased revenues

C)increased liabilities

D)decreased shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

5

To be recorded in the general journal,a transaction must be an economic event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

6

Accumulated other comprehensive income is included in retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

7

The final step in the accounting cycle is to ________.

A)prepare an adjusted trial balance

B)close temporary accounts

C)prepare a post-closing trial balance

D)prepare financial statements

A)prepare an adjusted trial balance

B)close temporary accounts

C)prepare a post-closing trial balance

D)prepare financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

8

The first step in the accounting cycle is recording transactions in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

9

Rent expense is normally considered a peripheral transaction of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

10

Financial statements are prepared after the temporary accounts are closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

11

The final step in the accounting cycle is the preparation of a post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

12

The accounting equation my be stated as Assets = Liabilities + Shareholders' Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

13

Decreases in equity that result from peripheral transactions of an entity are referred to as ________.

A)liabilities

B)expenses

C)losses

D)dividends

A)liabilities

B)expenses

C)losses

D)dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

14

The first step in the accounting cycle is to ________.

A)journalize transactions

B)analyze transactions

C)post transactions to the general ledger

D)prepare a worksheet

A)journalize transactions

B)analyze transactions

C)post transactions to the general ledger

D)prepare a worksheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

15

List the steps in the accounting cycle in the correct order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

16

Gains and losses result from peripheral transactions of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

17

The accounting equation is correctly stated as ________.

A)A = L + E

B)A + L = E

C)A = L - E

D)A = L = E

A)A = L + E

B)A + L = E

C)A = L - E

D)A = L = E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

18

Liabilities represent claims of third parties against the assets of a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

19

After transactions are recorded in the general journal,the next step in the accounting cycle is to ________.

A)prepare adjusting journal entries

B)prepare an adjusted trial balance

C)prepare financial statements

D)post transactions to the general ledger

A)prepare adjusting journal entries

B)prepare an adjusted trial balance

C)prepare financial statements

D)post transactions to the general ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

20

Jenner Corporation paid its annual dividend.This transaction represents a(n)________.

A)liability

B)distribution to shareholders

C)loss

D)expense

A)liability

B)distribution to shareholders

C)loss

D)expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

21

Issuance of common stock for cash would be recorded by a ________.

A)credit to Retained Earnings

B)credit to Common Stock

C)debit to Investments

D)credit to Revenues

A)credit to Retained Earnings

B)credit to Common Stock

C)debit to Investments

D)credit to Revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

22

A revenue account has a normal debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

23

Atlas Corporation sold a used machine for less than its carrying value.This transaction is a(n)________.

A)revenue

B)expense

C)gain

D)loss

A)revenue

B)expense

C)gain

D)loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

24

The normal balance of a liability account is a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

25

Cameron Diaz Corporation purchased a computer system for $20,000.The company paid $5,000 cash and issued a $15,000 note payable for the entire balance.The journal entry to record this transaction includes a(n)________.

A)debit to Equipment for $20,000

B)credit to Accounts Payable for $15,000

C)debit to Expense for $20,000

D)credit to Cash for $20,000

A)debit to Equipment for $20,000

B)credit to Accounts Payable for $15,000

C)debit to Expense for $20,000

D)credit to Cash for $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

26

Jackson Company sold land that had been held for future plant expansion for more than its carrying value.This transaction is a(n)________.

A)revenue

B)expense

C)gain

D)loss

A)revenue

B)expense

C)gain

D)loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

27

Bay City Corporation received $21,000 for 12 months rent in advance.What entry is used to record this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

28

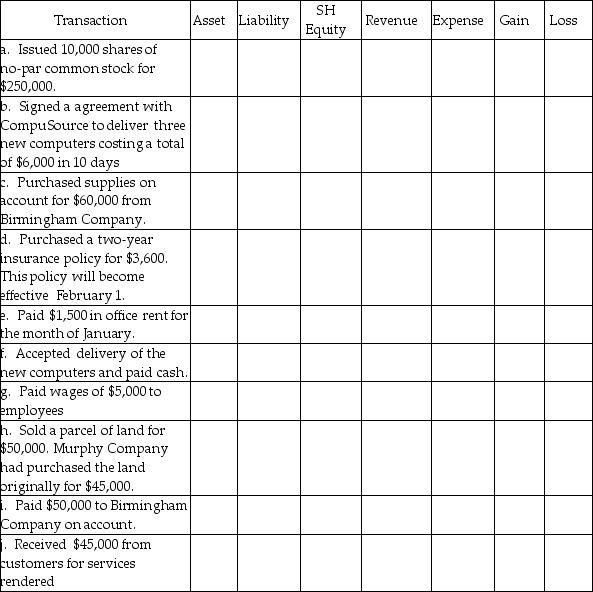

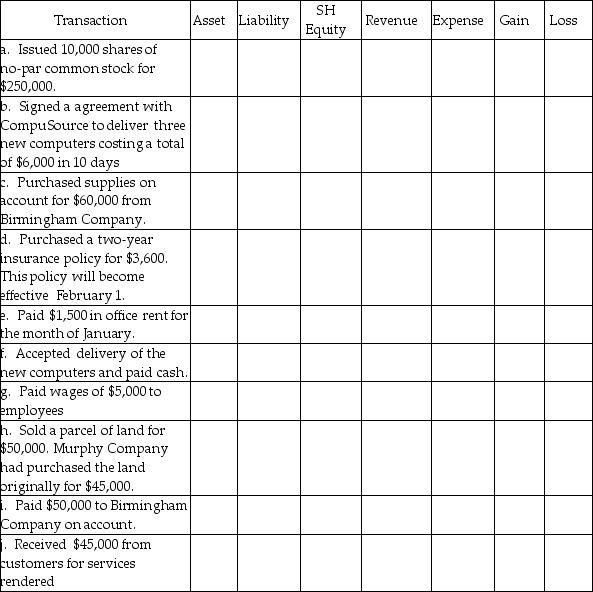

Murphy Corporation engaged in the following transactions during the month of February.Please analyze these transactions indicate whether they cause an increase (+)or decrease (-)in the balance sheet and income statement accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following accounts has a normal credit balance?

A)Accounts Receivable

B)Taxes Payable

C)Patents

D)Equipment

A)Accounts Receivable

B)Taxes Payable

C)Patents

D)Equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

30

The normal balance of an account is the side on which an increase in the account balance is recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

31

Each of the following accounts has a normal credit balance except ________.

A)Sales Revenue

B)Accumulated Depreciation

C)Investments

D)Accounts Payable

A)Sales Revenue

B)Accumulated Depreciation

C)Investments

D)Accounts Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

32

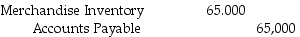

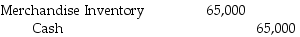

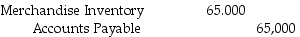

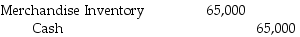

Smith Corporation purchased $65,000 of merchandise on credit.The company uses the perpetual method of recording inventory purchases.What would be the correct journal entry to record the purchase?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

33

The balance in the common stock account is increased by a credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

34

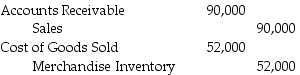

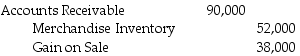

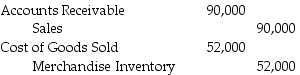

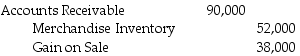

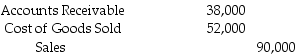

Jones Company sold merchandise on account for $90,000.This merchandise cost $52,000.The company uses the perpetual method of accounting for inventory.What would be the correct journal entry to record the transaction?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following accounts has a normal credit balance?

A)Interest Expense

B)Deferred Revenue

C)Investments

D)Loss on Sale of Equipment

A)Interest Expense

B)Deferred Revenue

C)Investments

D)Loss on Sale of Equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following accounts has a normal debit balance?

A)Accounts Payable

B)Advertising Expense

C)Gain on Sale of Assets

D)Retained Earnings

A)Accounts Payable

B)Advertising Expense

C)Gain on Sale of Assets

D)Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

37

Helmsley Corporation received one year's rent in advance on a warehouse.This transaction is a(n)________.

A)expense

B)liability

C)asset

D)revenue

A)expense

B)liability

C)asset

D)revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

38

List and define the elements of the accounting equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

39

ABC Corporation issued common stock to its investors for $125,000.The journal entry to record this transaction includes a(n)________.

A)debit to Investments

B)credit to Revenue

C)credit to Common Stock

D)debit to Expense

A)debit to Investments

B)credit to Revenue

C)credit to Common Stock

D)debit to Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

40

All of the following accounts has a normal debit balance except ________.

A)Dividends

B)Loss on Sale of Land

C)Additional Paid in Capital

D)Land

A)Dividends

B)Loss on Sale of Land

C)Additional Paid in Capital

D)Land

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following errors will not be revealed by the unadjusted trial balance?

A)incorrectly posting a debit for Salaries Expense to Supplies Expense

B)failing to post one side of a journal entry

C)posting a $50,000 debit to Accounts Receivable as $5,000 while recording the credit to revenue as $50,000

D)posting a credit to cash for $5,400 as $4,500 while posting the debit to expense as $5,400

A)incorrectly posting a debit for Salaries Expense to Supplies Expense

B)failing to post one side of a journal entry

C)posting a $50,000 debit to Accounts Receivable as $5,000 while recording the credit to revenue as $50,000

D)posting a credit to cash for $5,400 as $4,500 while posting the debit to expense as $5,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

42

Realistic Rentals collected $10,000 in payment of advance rent for 6 months.This an example of ________.

A)an accrued receivable

B)a prepaid expense

C)an unearned revenue

D)an accrued liability

A)an accrued receivable

B)a prepaid expense

C)an unearned revenue

D)an accrued liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

43

When a company receives a utility bill payable next month,the entry includes a(n)________.

A)debit to a liability

B)credit to an asset

C)debit to an expense

D)debit to an asset

A)debit to a liability

B)credit to an asset

C)debit to an expense

D)debit to an asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following recording errors will be revealed by the unadjusted trial balance?

A)incorrectly posting a debit for Supplies Expense to Salaries Expense

B)inadvertently omitting an entry recording the purchase of small tools from posting

C)posting a journal entry to record rent expense twice

D)posting a $50,000 entry to Accounts Receivable as $5,000 while correctly recording the corresponding revenue correctly

A)incorrectly posting a debit for Supplies Expense to Salaries Expense

B)inadvertently omitting an entry recording the purchase of small tools from posting

C)posting a journal entry to record rent expense twice

D)posting a $50,000 entry to Accounts Receivable as $5,000 while correctly recording the corresponding revenue correctly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a debit to Repairs Expense is inadvertently posted to Rent Expense,the unadjusted trial balance will still balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

46

Every adjusting journal entry will affect one balance sheet account and one income statement account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

47

Accruals occur when a company receives or pays cash before recognizing the revenue or expense in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

48

Adjusting journal entries are normally not necessary when cash based accounting is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

49

Financial statements are prepared using data from the unadjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

50

Orlando Company began operations on December 1.The company had the following transactions during December.Record these transactions in proper form,including explanations.If an entry is not required,please write "No Entry."

a.Issued 50,000 shares of no par and received $350,000 cash.

b.Extended an offer of employment to a sales manager who will begin work on January 1.

c.Purchased machinery on account for $450,000 from Tampa Company.

d.Purchased a two-year insurance policy for $4,800.This policy will become effective on January 1.

e.Paid $2,500 in office rent for the month of January.

f.Purchased office furniture for $50,000 with a 10% down payment and a six month note payable for the balance.

g.Paid wages of $15,000 to employees.

h.Provided services to customers for $85,000.

i.Paid $200,000 to Tampa Company on account.

j.Received payment in full for services rendered.

k.Paid a telephone bill for $525.

a.Issued 50,000 shares of no par and received $350,000 cash.

b.Extended an offer of employment to a sales manager who will begin work on January 1.

c.Purchased machinery on account for $450,000 from Tampa Company.

d.Purchased a two-year insurance policy for $4,800.This policy will become effective on January 1.

e.Paid $2,500 in office rent for the month of January.

f.Purchased office furniture for $50,000 with a 10% down payment and a six month note payable for the balance.

g.Paid wages of $15,000 to employees.

h.Provided services to customers for $85,000.

i.Paid $200,000 to Tampa Company on account.

j.Received payment in full for services rendered.

k.Paid a telephone bill for $525.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

51

Balance sheet accounts are the first accounts to be listed on the unadjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

52

The posting reference in the general journal is the general journal page number.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

53

Mobile Corporation had the following transactions for the month of January.Record these transactions along with explanations.If no entry is required,state "No Entry."

a.Issued 10,000 shares of no-par common stock for $250,000.

b.Signed a agreement with CompuSource to deliver three new computers costing a total of $6,000 in 10 days.

c.Purchased office furniture for $70,000 from Birmingham Company.

d.Purchased a two-year insurance policy for $3,600.This policy will become effective February 1.

e.Paid $1,500 in office rent for the month of January.

f.Accepted delivery of the new computers and paid cash.

g.Paid wages of $5,000 to employees.

h.Provided services on account for $80,000.

i.Paid $50,000 to Birmingham Company on account.

j.Received payment in full from customers.

k.Paid an electricity bill for $325.

a.Issued 10,000 shares of no-par common stock for $250,000.

b.Signed a agreement with CompuSource to deliver three new computers costing a total of $6,000 in 10 days.

c.Purchased office furniture for $70,000 from Birmingham Company.

d.Purchased a two-year insurance policy for $3,600.This policy will become effective February 1.

e.Paid $1,500 in office rent for the month of January.

f.Accepted delivery of the new computers and paid cash.

g.Paid wages of $5,000 to employees.

h.Provided services on account for $80,000.

i.Paid $50,000 to Birmingham Company on account.

j.Received payment in full from customers.

k.Paid an electricity bill for $325.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

54

The posting reference in the general ledger is the general journal page number.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

55

Accounts are presented in the general ledger in the same order as they are presented in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

56

What are the common errors that a trial balance will not reveal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

57

If a journal entry has not been posted to the general ledger,the unadjusted trial balance will still balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

58

Adjusting journal entries are made to ensure that all revenues and/or expenses are recognized in the period in which they are incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

59

The amounts on a company's unadjusted trial balance are taken from the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the total of all debit entries equals the total of all credit entries on the unadjusted trial balance,all transactions have been correctly recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

61

If a company does not adjust a prepaid expense initially recorded as an asset,assets will be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

62

The White Boar Pub purchased a two year insurance policy for $9,600 on February 1 and recorded it as an asset.On June 30,the adjusting entry that should be made is ________.

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

63

When a prepaid expense initially recorded as an asset is incurred,the adjusting entry includes ________.

A)a debit to an asset

B)a credit to a liability

C)a credit to an expense

D)a debit to an expense

A)a debit to an asset

B)a credit to a liability

C)a credit to an expense

D)a debit to an expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

64

Deferrals occur when a company receives or pays cash before recognizing the revenue or expense in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

65

When an unearned revenue is initially recorded as a liability,the adjusting entry includes ________.

A)a credit to a liability

B)a credit to a revenue

C)a debit to a revenue

D)a debit to an expense

A)a credit to a liability

B)a credit to a revenue

C)a debit to a revenue

D)a debit to an expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

66

Recording depreciation expense is necessary to allocate the cost of an asset over its expected useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

67

If a company fails to to adjust a deferred revenue recorded as a liability,revenues will be overstated on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

68

Accrued revenues are earned before they are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

69

Accrued expenses are paid before they are incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is not an adjusting entry?

A)Interest Receivable

B)Utilities Expense

C)Cash

D)Insurance Expense

A)Interest Receivable

B)Utilities Expense

C)Cash

D)Insurance Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a company fails to adjust a deferred revenue recorded as a liability,liabilities will be overstated on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

72

If a company earns interest in June but does not receive it until December,this is referred to as an accrued revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

73

Deferred expenses may be initially recorded as assets or expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

74

If a company initially records a deferred revenue as a liability,an adjusting entry must be made at the end of the period to increase the revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a company initially records a prepaid expense as an asset,an adjusting entry must be made at the end of the period to increase the expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a company initially records a deferred revenue as a liability,an adjusting entry must be made at the end of the period to increase the liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

77

If a company does not adjust a prepaid expense initially recorded as an asset,expenses will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following is an adjusting entry?

A)Allowance for Uncollectible Accounts

B)Depletion Expense

C)Cash

D)Interest Expense

A)Allowance for Uncollectible Accounts

B)Depletion Expense

C)Cash

D)Interest Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

79

Deferred expenses may be initially recorded as assets or revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

80

Deferrals occur when a company receives or pays cash before recognizing revenue or expense in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck