Deck 11: Short-Term Operating Assets: Inventory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/134

العب

ملء الشاشة (f)

Deck 11: Short-Term Operating Assets: Inventory

1

The flow of a manufacturer's product costs through the inventory accounts is ________.

A)Work-in-Process Inventory,Cost of Goods Sold,and Finished Goods Inventory

B)Raw Materials Inventory,Cost of Goods Sold,and Finished Goods Inventory

C)Raw Materials Inventory,Finished Goods Inventory,and Work-in-Process Inventory

D)Raw Materials Inventory,Work-in-Process Inventory,and Finished Goods Inventory

A)Work-in-Process Inventory,Cost of Goods Sold,and Finished Goods Inventory

B)Raw Materials Inventory,Cost of Goods Sold,and Finished Goods Inventory

C)Raw Materials Inventory,Finished Goods Inventory,and Work-in-Process Inventory

D)Raw Materials Inventory,Work-in-Process Inventory,and Finished Goods Inventory

D

2

Charles Company's balance sheet reports Raw Materials Inventory,$512,000; Finished Goods Inventory,$667,000; and total inventories at $1,904,000.What is the value of Work-in-Process Inventory?

A)$1,479,000

B)$1,392,000

C)$725,000

D)$1,237,000

A)$1,479,000

B)$1,392,000

C)$725,000

D)$1,237,000

C

3

Freight-in costs are treated as a selling expense.

False

4

Richard Company's financial records report beginning inventory of $534,000; ending inventory of $697,000; and cost of goods sold of $1,354,000.What is the amount of purchases?

A)$1,517,000

B)$2,051,000

C)$1,234,000

D)$820,000

A)$1,517,000

B)$2,051,000

C)$1,234,000

D)$820,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

5

The work-in-process inventory is found on the books of a merchandising concern.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

6

A perpetual inventory system always provides current information about inventory levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

7

A periodic inventory system is used by most companies today due to the proliferation of computers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which statement is not correct about perpetual inventory systems?

A)The balance in the Inventory account is always up-to-date.

B)A physical inventory count is not required.

C)Current information is available for cost of goods sold.

D)The Inventory account is updated for each purchase and sale.

A)The balance in the Inventory account is always up-to-date.

B)A physical inventory count is not required.

C)Current information is available for cost of goods sold.

D)The Inventory account is updated for each purchase and sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

9

The Peggy Ahlers Company uses the perpetual inventory system and the FIFO method.At the end of the fiscal year,December 31,2015,the company conducted a physical count of the inventory on hand at all warehouses and stores.The FIFO cost of the physical count is $1,005,400.According to the records,ending inventory using FIFO is $1,122,000.Which journal entry is required at December 31,2015?

A)No journal entry is required.

B)Debit Inventory $116,600 and credit Allowance to Reduce Inventory $116,600.

C)Debit Cost of Goods Sold $116,600 and credit Allowance to Reduce Inventory $116,600.

D)Debit Loss on Inventory Shortage $116,600 and credit Inventory $116,600.

A)No journal entry is required.

B)Debit Inventory $116,600 and credit Allowance to Reduce Inventory $116,600.

C)Debit Cost of Goods Sold $116,600 and credit Allowance to Reduce Inventory $116,600.

D)Debit Loss on Inventory Shortage $116,600 and credit Inventory $116,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

10

The total cost in dollars of ending inventory is equal to the number of units on hand multiplied by the cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

11

Firms using the periodic inventory system record purchases of inventory with a ________.

A)credit to Purchases

B)debit to Purchases

C)debit to Inventory

D)credit to Inventory

A)credit to Purchases

B)debit to Purchases

C)debit to Inventory

D)credit to Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

12

A large company uses a perpetual inventory system and a sophisticated computerized system to account for its inventory over time.At the end of the accounting period,the company performs a physical count of the inventory on hand and hires hundreds of workers to carry out this task.

Required:

1.Why does the company perform a physical count of inventory?

2.After the physical count of inventory is completed,describe the required journal entry and provide an example.

Required:

1.Why does the company perform a physical count of inventory?

2.After the physical count of inventory is completed,describe the required journal entry and provide an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

13

When goods are shipped f.o.b.shipping point,title passes when the goods reach the buyer's dock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

14

Destiny Industries reports beginning inventory of $253,000,purchases of $556,000,and ending inventory of $195,000.What is the cost of goods sold?

A)$809,000

B)$1,345,000

C)$614,000

D)$1,062,000

A)$809,000

B)$1,345,000

C)$614,000

D)$1,062,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

15

Donaldson Corporation uses a periodic inventory system.On January 1,inventory is $253,000.On April 5,Donaldson sells inventory with a selling price of $75,000 on account.The cost of the inventory sold is $50,000.The journal entry (entries)to record the sale is (are)________.

A)debit Cash and credit Sales Revenue

B)debit Accounts Receivable and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

C)debit Cash and Cost of Goods Sold and credit Sales Revenue and Inventory

D)debit Accounts Receivable and credit Sales Revenue

A)debit Cash and credit Sales Revenue

B)debit Accounts Receivable and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

C)debit Cash and Cost of Goods Sold and credit Sales Revenue and Inventory

D)debit Accounts Receivable and credit Sales Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

16

Dombrose Company uses a perpetual inventory system.On January 1,inventory is $253,000.On April 5,Dombrose sells inventory with a selling price of $75,000 on account.The cost of the inventory sold is $50,000.The journal entry (entries)to record the sale is (are)________.

A)debit Cash and Cost of Goods Sold and credit Sales Revenue and Inventory

B)debit Accounts Receivable and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

C)debit Accounts Receivable and credit Sales Revenue

D)debit Cash and credit Sales Revenue

A)debit Cash and Cost of Goods Sold and credit Sales Revenue and Inventory

B)debit Accounts Receivable and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

C)debit Accounts Receivable and credit Sales Revenue

D)debit Cash and credit Sales Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

17

Purchase returns and purchase discounts are subtracted from purchases to calculate net purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

18

Beginning inventory + Net Purchases = Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

19

Purchase returns and purchase discounts are added to purchases to calculate net purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

20

Freight-out costs are included as part of inventory costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

21

On June 1,Atkinson Company purchased $5,000 of inventory on account from Donnie Company.Donnie Company offers a 3% discount if payment is received within 15 days.Atkinson Company records the purchase using the gross method and the perpetual inventory system.Atkinson Company makes the payment for the inventory on June 10.The journal entry on June 10 by Atkinson Company includes ________.

A)a debit to Cash for $5,000

B)a credit to Cash for $4,850

C)a debit to Inventory for $150

D)a credit to Interest Expense for $150

A)a debit to Cash for $5,000

B)a credit to Cash for $4,850

C)a debit to Inventory for $150

D)a credit to Interest Expense for $150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

22

On June 1,Johnson Company purchased $5,000 of inventory on account from Schmid Company on June 1.Schmid Company offers a 3% discount if payment is received within 15 days.Johnson Company records the purchase using the net method and the perpetual inventory system.Johnson Company paid for the inventory on June 30.The journal entry on June 30 by Johnson Company includes ________.

A)a debit to Accounts Payable for $4,850

B)a debit to Accounts Payable for $5,000

C)a credit to Interest Expense for $150

D)a credit to Cash for $4,850

A)a debit to Accounts Payable for $4,850

B)a debit to Accounts Payable for $5,000

C)a credit to Interest Expense for $150

D)a credit to Cash for $4,850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

23

Beck Company has inventory of $725,000 in its stores as of December 31.It also has two shipments in-transit that left the suppliers' warehouses by December 28.Both shipments are expected to arrive on January 5.The first shipment of $210,000 was sold f.o.b.destination and the second shipment of $102,000 was sold f.o.b.shipping point.Beck Company also has consigned goods of $72,000 awaiting sale with Meyer Company.What amount of inventory should Beck Company report on its balance sheet as of December 31?

A)$725,000

B)$899,000

C)$1,007,000

D)$1,109,000

A)$725,000

B)$899,000

C)$1,007,000

D)$1,109,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

24

Yankee Company uses the net method of recording purchase discounts on inventory and the perpetual inventory system.Yankee Company records a payment within the discount period.Which journal entry is prepared?

A)Debit Accounts Payable and credit Cash for the gross amount of the purchase.

B)Debit Accounts Payable and credit Cash for the net amount of the purchase.

C)Debit Accounts Payable,credit Cash and credit Inventory.

D)Debit Accounts Payable,credit Cash and credit Interest Revenue.

A)Debit Accounts Payable and credit Cash for the gross amount of the purchase.

B)Debit Accounts Payable and credit Cash for the net amount of the purchase.

C)Debit Accounts Payable,credit Cash and credit Inventory.

D)Debit Accounts Payable,credit Cash and credit Interest Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

25

The following transactions occurred for MM's Jewelry Store during the month:

a.On May 1,the owner purchased 100 rings on account at $6,000 each.Credit terms were 2/10,net 30.

b.On May 2,the owner returned one ring.

c.On May 3,the owner sold three of the rings on account at $8,000 each to one customer.The credit terms were 2/10,net 30.

d.On May 9,the owner paid the debt due.

e.On May 15,the customer from May 3 paid for the rings.

Required:

Prepare the journal entries for the above transactions.

1.The store uses the perpetual inventory system and the gross method to record purchase discounts.Explanations are not required.

2.The store uses the periodic inventory system and the net method to record purchase discounts.Explanations are not required.

a.On May 1,the owner purchased 100 rings on account at $6,000 each.Credit terms were 2/10,net 30.

b.On May 2,the owner returned one ring.

c.On May 3,the owner sold three of the rings on account at $8,000 each to one customer.The credit terms were 2/10,net 30.

d.On May 9,the owner paid the debt due.

e.On May 15,the customer from May 3 paid for the rings.

Required:

Prepare the journal entries for the above transactions.

1.The store uses the perpetual inventory system and the gross method to record purchase discounts.Explanations are not required.

2.The store uses the periodic inventory system and the net method to record purchase discounts.Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

26

The inventory allocation method that assigns the most recent costs to ending inventory and the oldest costs to cost of goods sold is the ________.

A)specific identification method

B)LIFO method

C)moving-average method

D)FIFO method

A)specific identification method

B)LIFO method

C)moving-average method

D)FIFO method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

27

On August 10,Charles Company purchased 75 refrigerators for $650 each from Appliances Wholesalers.The purchase was on account with terms of 3/10,n/30.Charles Company paid for 50 of the refrigerators on August 18 and the remaining refrigerators on August 30.Charles Company uses the gross method for purchase discounts and the perpetual inventory system to record the transactions.On August 30,Charles Company recorded ________.

A)a debit to Accounts Payable and a credit to Cash

B)a debit to Cash and a credit to Accounts Payable

C)a debit to Accounts Payable and a credit to Inventory

D)a debit to Cash and a credit to Inventory

A)a debit to Accounts Payable and a credit to Cash

B)a debit to Cash and a credit to Accounts Payable

C)a debit to Accounts Payable and a credit to Inventory

D)a debit to Cash and a credit to Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

28

Christian Company uses the gross method of recording purchase discounts on inventory and the perpetual inventory system.When Christian Company makes payment for the inventory within the discount period,the bookkeeper will ________.

A)debit Accounts Payable,credit Inventory and credit Cash

B)debit Accounts Payable and credit Inventory

C)debit Inventory and credit Cash

D)debit Accounts Payable and credit Purchases

A)debit Accounts Payable,credit Inventory and credit Cash

B)debit Accounts Payable and credit Inventory

C)debit Inventory and credit Cash

D)debit Accounts Payable and credit Purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

29

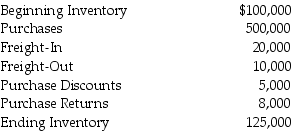

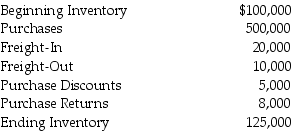

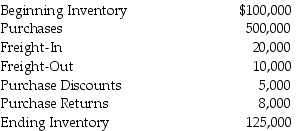

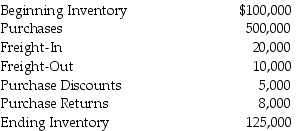

Chet Company provides the following information:  What is the cost of goods sold?

What is the cost of goods sold?

A)$607,000

B)$482,000

C)$620,000

D)$490,000

What is the cost of goods sold?

What is the cost of goods sold?A)$607,000

B)$482,000

C)$620,000

D)$490,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

30

Jamison Company sells goods to Matthews Company.When Jamison ships goods to Matthews with terms f.o.b.shipping point,________.

A)Jamison Company reports the goods in its inventory when the goods are in transit to Matthews Company

B)the title passes from Jamison Company to Matthews Company when the goods are received by Matthews Company

C)the title passes from Jamison Company to Matthews Company when the goods leave Jamison Company

D)Matthews Company does not include the goods in its inventory while the goods are in transit

A)Jamison Company reports the goods in its inventory when the goods are in transit to Matthews Company

B)the title passes from Jamison Company to Matthews Company when the goods are received by Matthews Company

C)the title passes from Jamison Company to Matthews Company when the goods leave Jamison Company

D)Matthews Company does not include the goods in its inventory while the goods are in transit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

31

Meyer Co.has the following information available:  What amount of inventory should the company report on the balance sheet?

What amount of inventory should the company report on the balance sheet?

A)$64,100

B)$62,100

C)$59,100

D)$57,100

What amount of inventory should the company report on the balance sheet?

What amount of inventory should the company report on the balance sheet?A)$64,100

B)$62,100

C)$59,100

D)$57,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

32

Walker Company provides the following information:  What is the cost of goods available for sale?

What is the cost of goods available for sale?

A)$607,000

B)$617,000

C)$732,000

D)$740,000

What is the cost of goods available for sale?

What is the cost of goods available for sale?A)$607,000

B)$617,000

C)$732,000

D)$740,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

33

Smith-Miller Enterprises has inventory of $657,000 in its stores as of December 31.It also has two shipments in-transit that left the suppliers' warehouses by December 28.Both shipments are expected to arrive on January 5.The first shipment of $128,000 was sold f.o.b.destination and the second shipment of $76,000 was sold f.o.b.shipping point.What amount of inventory should Smith-Miller report on its balance sheet as of December 31?

A)$657,000

B)$861,000

C)$785,000

D)$733,000

A)$657,000

B)$861,000

C)$785,000

D)$733,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

34

The moving-average method of determining Inventory is used with the perpetual system of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

35

On June 1,Kennedy Company purchased $5,000 of inventory on account from Sterner Company.Sterner Company offers a 3% discount if payment is received within 15 days.Kennedy Company records the purchase using the net method and the perpetual inventory system.The journal entry on June 1 by Kennedy Company includes ________.

A)a debit to Inventory for $5,000

B)a credit to Accounts Payable for $5,000

C)a credit to Cash for $4,850

D)a debit to Inventory for $4,850

A)a debit to Inventory for $5,000

B)a credit to Accounts Payable for $5,000

C)a credit to Cash for $4,850

D)a debit to Inventory for $4,850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

36

The specific identification inventory method is used by companies that sell high-dollar products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

37

The Wysocki Company has undertaken a physical count of inventory on hand on December 31,2015.The cost of the inventory on hand is $445,993.

Additional information follows:

1.Wysocki Company received goods costing $32,000 on January 2,2016.The goods were shipped f.o.b.shipping point,and left the seller's business on December 30,2015.

2.Wysocki Company received goods costing $40,000 on January 3,2016.The goods were shipped f.o.b.destination,and left the seller's business on December 30,2015.

3.Wysocki Company sold goods costing $20,000 on December 29,2015.The goods were picked up by the common carrier on December 29 and shipped f.o.b.destination.The goods arrived on January 2,2016.The retail price of the goods was $30,000.

4.Wysocki Company sold goods costing $30,000 on December 31,2015.The goods were picked up by the common carrier on December 31 and shipped f.o.b.shipping point.The goods were not included in Wysocki's physical count at December 31,2015.The goods arrived on January 4,2016.The retail price of the goods was $60,000.Wysocki paid the shipping costs of $433 on December 31.

5.Wysocki Company was the consignee for some goods from Walmart.The goods cost Walmart $100,000 and had a retail price of $300,000.These goods were included in Wysocki's physical count on December 31,2015 at the retail price.

6.Wysocki Company had some goods on consignment at Walmart.The goods cost $50,000 and had a retail price of $100,000.These goods were not included in Wysocki's physical count at December 31,2015 because the goods were not on the company's premises.

7.Wysocki Company sold goods costing $22,000 on December 31,2015.The goods were not picked up by the common carrier until January 2,2016.The retail price of the goods was $42,000; the wholesale price was $33,000.The goods were included in the physical count at December 31,2015.The terms of the sale were f.o.b.shipping point.

Required:

1.For each item listed above,indicate the amount and sign of the adjustment to the inventory balance at December 31,2015.If no adjustment is required,for an item,enter 0.

2.Determine the correct amount of inventory for Wysocki Company at December 31,2015.

Additional information follows:

1.Wysocki Company received goods costing $32,000 on January 2,2016.The goods were shipped f.o.b.shipping point,and left the seller's business on December 30,2015.

2.Wysocki Company received goods costing $40,000 on January 3,2016.The goods were shipped f.o.b.destination,and left the seller's business on December 30,2015.

3.Wysocki Company sold goods costing $20,000 on December 29,2015.The goods were picked up by the common carrier on December 29 and shipped f.o.b.destination.The goods arrived on January 2,2016.The retail price of the goods was $30,000.

4.Wysocki Company sold goods costing $30,000 on December 31,2015.The goods were picked up by the common carrier on December 31 and shipped f.o.b.shipping point.The goods were not included in Wysocki's physical count at December 31,2015.The goods arrived on January 4,2016.The retail price of the goods was $60,000.Wysocki paid the shipping costs of $433 on December 31.

5.Wysocki Company was the consignee for some goods from Walmart.The goods cost Walmart $100,000 and had a retail price of $300,000.These goods were included in Wysocki's physical count on December 31,2015 at the retail price.

6.Wysocki Company had some goods on consignment at Walmart.The goods cost $50,000 and had a retail price of $100,000.These goods were not included in Wysocki's physical count at December 31,2015 because the goods were not on the company's premises.

7.Wysocki Company sold goods costing $22,000 on December 31,2015.The goods were not picked up by the common carrier until January 2,2016.The retail price of the goods was $42,000; the wholesale price was $33,000.The goods were included in the physical count at December 31,2015.The terms of the sale were f.o.b.shipping point.

Required:

1.For each item listed above,indicate the amount and sign of the adjustment to the inventory balance at December 31,2015.If no adjustment is required,for an item,enter 0.

2.Determine the correct amount of inventory for Wysocki Company at December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

38

On June 1,Addison Company purchased $5,000 of inventory on account from Garrison Company.Garrison offers a 3% discount if payment is received within 15 days.Addison records the purchase using the gross method and the perpetual inventory system.The journal entry on June 1 by Addison Company includes ________.

A)a debit to Inventory for $4,850

B)a credit to Accounts Payable for $4,850

C)a debit to Inventory for $5,000

D)a credit to Cash for $5,000

A)a debit to Inventory for $4,850

B)a credit to Accounts Payable for $4,850

C)a debit to Inventory for $5,000

D)a credit to Cash for $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

39

The first-in,first-out inventory method assigns the most recent costs to the cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

40

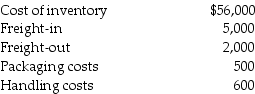

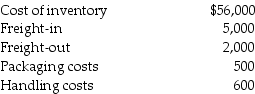

Inventory costs do not include ________.

A)freight-out costs

B)freight-in costs

C)packaging costs

D)handling costs

A)freight-out costs

B)freight-in costs

C)packaging costs

D)handling costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

41

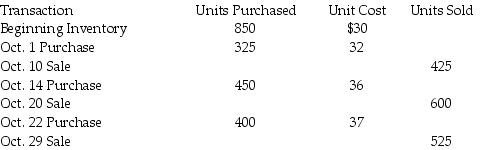

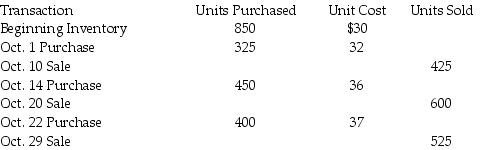

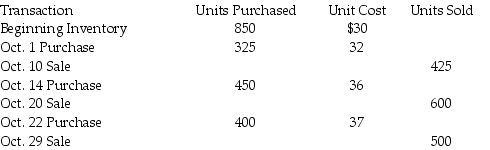

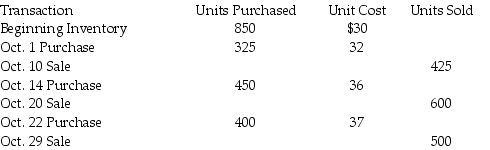

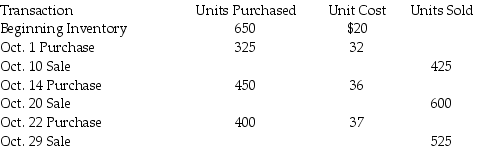

Vaclav Company has the following data available:  If Vaclav Company uses a perpetual moving-average inventory system,the cost of ending inventory on October 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

If Vaclav Company uses a perpetual moving-average inventory system,the cost of ending inventory on October 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

A)$34,357.48

B)$16,319.81

C)$50,580.19

D)$66,900.00

If Vaclav Company uses a perpetual moving-average inventory system,the cost of ending inventory on October 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

If Vaclav Company uses a perpetual moving-average inventory system,the cost of ending inventory on October 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)A)$34,357.48

B)$16,319.81

C)$50,580.19

D)$66,900.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

42

A company using LIFO for tax purposes ________.

A)can use either LIFO or FIFO for financial reporting

B)must use LIFO for financial reporting

C)will have more taxes to pay with LIFO than FIFO in a period of rising inventory costs and stable inventory levels

D)will report higher net income with LIFO than FIFO in a period of rising inventory costs and stable inventory levels

A)can use either LIFO or FIFO for financial reporting

B)must use LIFO for financial reporting

C)will have more taxes to pay with LIFO than FIFO in a period of rising inventory costs and stable inventory levels

D)will report higher net income with LIFO than FIFO in a period of rising inventory costs and stable inventory levels

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

43

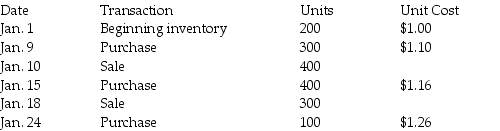

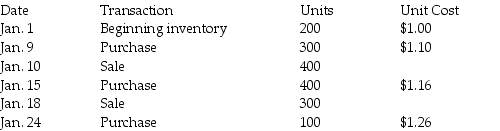

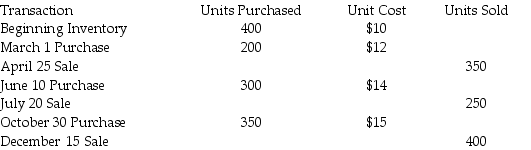

Gordon Company has the following data available:  If Gordon Company uses a perpetual FIFO inventory system,the cost of ending inventory on December 31 is ________.

If Gordon Company uses a perpetual FIFO inventory system,the cost of ending inventory on December 31 is ________.

A)$1,500

B)$700

C)$750

D)$500

If Gordon Company uses a perpetual FIFO inventory system,the cost of ending inventory on December 31 is ________.

If Gordon Company uses a perpetual FIFO inventory system,the cost of ending inventory on December 31 is ________.A)$1,500

B)$700

C)$750

D)$500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

44

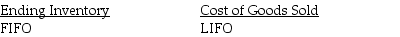

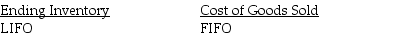

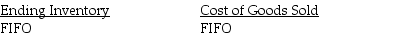

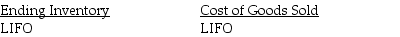

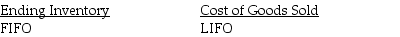

Which inventory costing method most closely approximates current cost for each of the following line items on the financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

45

Assume inventory costs are increasing over time and inventory levels are stable.Which inventory method results in a higher net income and a higher ending inventory?

A)FIFO

B)average cost

C)LIFO

D)conventional retail

A)FIFO

B)average cost

C)LIFO

D)conventional retail

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

46

Flynn Company uses LIFO for tax purposes and external reporting purposes.For internal reporting purposes,Flynn Company uses FIFO.

Required:

List a few reasons why a company uses different inventory costing methods for different purposes.

Required:

List a few reasons why a company uses different inventory costing methods for different purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

47

When inventory costs are falling,and inventory levels are stable,the LIFO method will generally result in ________.

A)a higher gross profit than under FIFO

B)a lower gross profit than under FIFO

C)a lower inventory value than under FIFO

D)a higher cost of goods sold than under FIFO

A)a higher gross profit than under FIFO

B)a lower gross profit than under FIFO

C)a lower inventory value than under FIFO

D)a higher cost of goods sold than under FIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

48

Wetzel Company has the following data available:  If Wetzel Company uses a perpetual moving-average inventory system,the cost of the ending inventory on December 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

If Wetzel Company uses a perpetual moving-average inventory system,the cost of the ending inventory on December 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

A)$12,131.30

B)$4,718.70

C)$16,850.00

D)$5,250.00

If Wetzel Company uses a perpetual moving-average inventory system,the cost of the ending inventory on December 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

If Wetzel Company uses a perpetual moving-average inventory system,the cost of the ending inventory on December 31 is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)A)$12,131.30

B)$4,718.70

C)$16,850.00

D)$5,250.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

49

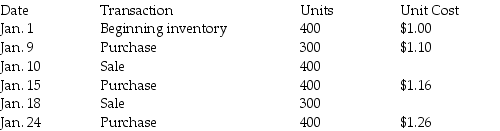

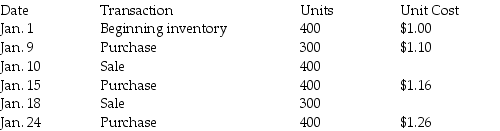

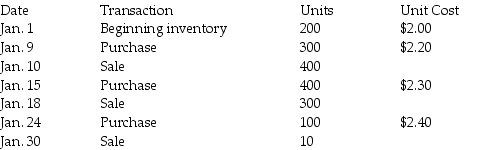

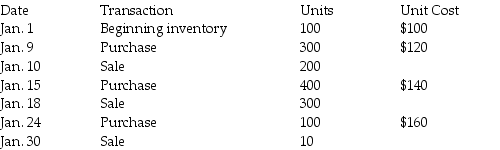

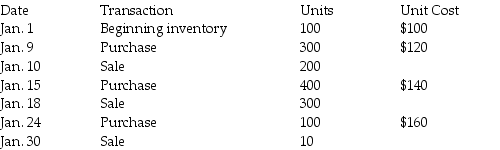

The Exclusive Company uses the perpetual inventory system.The Exclusive Company has the following data available for the month of January:  What is the cost of ending inventory on January 31 using LIFO?

What is the cost of ending inventory on January 31 using LIFO?

A)$846

B)$968

C)$920

D)$730

What is the cost of ending inventory on January 31 using LIFO?

What is the cost of ending inventory on January 31 using LIFO?A)$846

B)$968

C)$920

D)$730

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

50

Potter Company has the following data available:  If Potter Company uses a perpetual moving-average inventory system,the cost of goods sold for the year is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

If Potter Company uses a perpetual moving-average inventory system,the cost of goods sold for the year is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

A)$4,718.70

B)$12,087.88

C)$16,100.00

D)$11,381.30

If Potter Company uses a perpetual moving-average inventory system,the cost of goods sold for the year is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)

If Potter Company uses a perpetual moving-average inventory system,the cost of goods sold for the year is ________.(Round average cost per unit to four decimal places and all other numbers to two decimal places.)A)$4,718.70

B)$12,087.88

C)$16,100.00

D)$11,381.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

51

Excalibur Company uses the perpetual inventory method.Excalibur Company has the following data available for the month of January:  What is the Cost of Goods Sold for the month of January using LIFO?

What is the Cost of Goods Sold for the month of January using LIFO?

A)$778

B)$810

C)$762

D)$766

What is the Cost of Goods Sold for the month of January using LIFO?

What is the Cost of Goods Sold for the month of January using LIFO?A)$778

B)$810

C)$762

D)$766

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

52

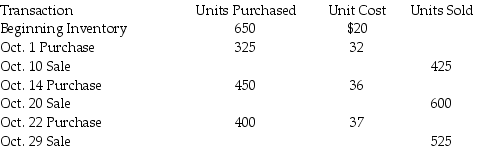

Jones Company has the following data available:  If Jones Company uses a perpetual LIFO inventory system,the cost of ending inventory on October 31 is ________.

If Jones Company uses a perpetual LIFO inventory system,the cost of ending inventory on October 31 is ________.

A)$14,800

B)$18,500

C)$15,000

D)$66,900

If Jones Company uses a perpetual LIFO inventory system,the cost of ending inventory on October 31 is ________.

If Jones Company uses a perpetual LIFO inventory system,the cost of ending inventory on October 31 is ________.A)$14,800

B)$18,500

C)$15,000

D)$66,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

53

The inventory allocation method used for companies that maintain base stocks of inventory items is the ________.

A)LIFO method

B)specific identification method

C)FIFO method

D)moving-average method

A)LIFO method

B)specific identification method

C)FIFO method

D)moving-average method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sikich Company has the following data available:  If Sikich Company uses a perpetual FIFO inventory system,the cost of goods sold for the month is ________.

If Sikich Company uses a perpetual FIFO inventory system,the cost of goods sold for the month is ________.

A)$54,400

B)$17,500

C)$44,225

D)$10,175

If Sikich Company uses a perpetual FIFO inventory system,the cost of goods sold for the month is ________.

If Sikich Company uses a perpetual FIFO inventory system,the cost of goods sold for the month is ________.A)$54,400

B)$17,500

C)$44,225

D)$10,175

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

55

Maki Company has the following data available:  If Maki Company uses a perpetual FIFO inventory system,the cost of ending inventory on October 31 is ________.

If Maki Company uses a perpetual FIFO inventory system,the cost of ending inventory on October 31 is ________.

A)$14,800

B)$13,875

C)$49,400

D)$63,900

If Maki Company uses a perpetual FIFO inventory system,the cost of ending inventory on October 31 is ________.

If Maki Company uses a perpetual FIFO inventory system,the cost of ending inventory on October 31 is ________.A)$14,800

B)$13,875

C)$49,400

D)$63,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

56

When comparing the FIFO and LIFO inventory methods,________.

A)LIFO reports the most up-to-date inventory cost on the balance sheet

B)FIFO results in the most realistic net income figure

C)FIFO matches old inventory costs against revenue

D)LIFO matches old inventory costs against revenue

A)LIFO reports the most up-to-date inventory cost on the balance sheet

B)FIFO results in the most realistic net income figure

C)FIFO matches old inventory costs against revenue

D)LIFO matches old inventory costs against revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

57

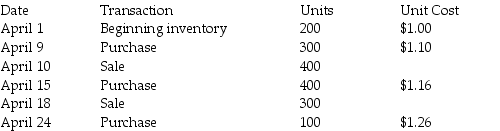

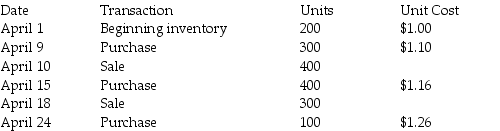

The ABC Enterprise Company uses the perpetual inventory system.The company has the following data available for the month of April:  What is the cost of ending inventory on April 30 using moving average?

What is the cost of ending inventory on April 30 using moving average?

A)$354

B)$336

C)$342

D)$310

What is the cost of ending inventory on April 30 using moving average?

What is the cost of ending inventory on April 30 using moving average?A)$354

B)$336

C)$342

D)$310

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

58

IFRS does not allow the LIFO inventory method because ________.

A)of the increased taxes owed under the LIFO method

B)the majority of companies do not actually sell the oldest items first

C)it is viewed as unrealistic and lacks representational faithfulness of inventory flows

D)the FIFO method more accurately reflects the cost of inventory

A)of the increased taxes owed under the LIFO method

B)the majority of companies do not actually sell the oldest items first

C)it is viewed as unrealistic and lacks representational faithfulness of inventory flows

D)the FIFO method more accurately reflects the cost of inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

59

Bombard Company has the following data available:  If Bombard Company uses a perpetual LIFO inventory system,the cost of goods sold for the year is ________.

If Bombard Company uses a perpetual LIFO inventory system,the cost of goods sold for the year is ________.

A)$3,500

B)$5,520

C)$16,850

D)$13,350

If Bombard Company uses a perpetual LIFO inventory system,the cost of goods sold for the year is ________.

If Bombard Company uses a perpetual LIFO inventory system,the cost of goods sold for the year is ________.A)$3,500

B)$5,520

C)$16,850

D)$13,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

60

Sampe Company has the following data available:  If Sampe Company uses a perpetual FIFO inventory system,the cost of goods sold for the year is ________.

If Sampe Company uses a perpetual FIFO inventory system,the cost of goods sold for the year is ________.

A)$5,400

B)$16,850

C)$12,100

D)$4,200

If Sampe Company uses a perpetual FIFO inventory system,the cost of goods sold for the year is ________.

If Sampe Company uses a perpetual FIFO inventory system,the cost of goods sold for the year is ________.A)$5,400

B)$16,850

C)$12,100

D)$4,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

61

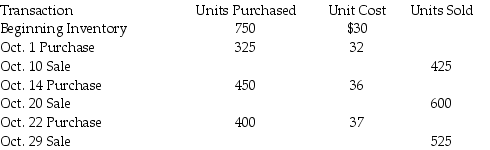

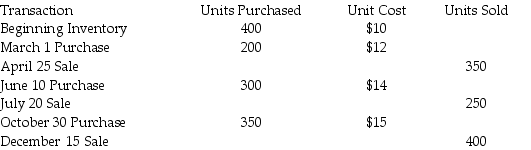

The Geewhiz Company uses the perpetual inventory system.The Geewhiz Company has the following data available for the month of January:

Determine the cost of the ending inventory using the following methods:

Determine the cost of the ending inventory using the following methods:

a.FIFO

b.LIFO

c.Moving-average (Round per unit costs to four decimal places and all other dollar amounts to two decimal places.)

Determine the cost of the ending inventory using the following methods:

Determine the cost of the ending inventory using the following methods:a.FIFO

b.LIFO

c.Moving-average (Round per unit costs to four decimal places and all other dollar amounts to two decimal places.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

62

A company begins the year with a zero balance in the LIFO Reserve account.Based on an analysis of LIFO and FIFO,the company determines the LIFO Reserve should be $20,000 at the end of the year? Which journal entry is needed?

A)Debit Cost of Goods Sold for $20,000 and Credit LIFO Reserve for $20,000.

B)Debit LIFO Reserve for $20,000 and Credit Cost of Goods Sold for $20,000.

C)Debit Cost of Goods Sold for $20,000 and Credit Inventory for $20,000.

D)Debit Inventory for $20,000 and Credit Gain on Inventory for $20,000.

A)Debit Cost of Goods Sold for $20,000 and Credit LIFO Reserve for $20,000.

B)Debit LIFO Reserve for $20,000 and Credit Cost of Goods Sold for $20,000.

C)Debit Cost of Goods Sold for $20,000 and Credit Inventory for $20,000.

D)Debit Inventory for $20,000 and Credit Gain on Inventory for $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

63

If costs are declining,using LIFO will result in lower cost of goods sold and a higher net income as compared to FIFO and moving-average methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

64

Sweet Treats is considering a change in its inventory valuation method.Sweet Treats currently uses the FIFO method and is considering a change to the LIFO method.Sweet Treats started the year on January 1 with inventory at a FIFO cost of $31,000 and a LIFO cost of $26,500.The ending inventory on December 31 is $29,650 at FIFO cost and $25,800 at LIFO cost.Cost of goods sold under the LIFO basis is $74,600 for the current year.The LIFO effect is ________.

A)$4,500

B)$3,800

C)$8,350

D)$650

A)$4,500

B)$3,800

C)$8,350

D)$650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

65

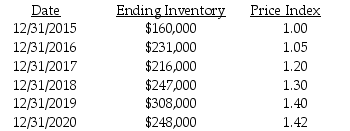

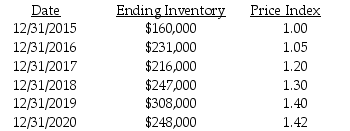

Information about the New Pace Company is presented below:

Required:

Required:

Compute the ending inventory for 2015 through 2020 using the dollar-value LIFO method.Round to the nearest dollar.

Required:

Required:Compute the ending inventory for 2015 through 2020 using the dollar-value LIFO method.Round to the nearest dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

66

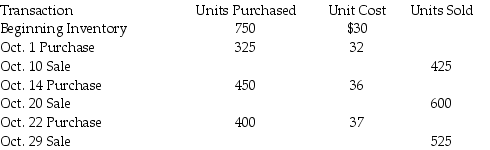

The Petrowski Company uses the perpetual inventory system.The Petrowski Company has the following data available for the month of January:

1.Determine the Cost of Goods Sold for January using the following methods:

1.Determine the Cost of Goods Sold for January using the following methods:

a.FIFO

b.LIFO

c.Moving-average (Round per unit costs and all other dollar amounts to two decimal places.)

1.Determine the Cost of Goods Sold for January using the following methods:

1.Determine the Cost of Goods Sold for January using the following methods:a.FIFO

b.LIFO

c.Moving-average (Round per unit costs and all other dollar amounts to two decimal places.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

67

Basking Company adopted the dollar-value LIFO method in 2014.At December 31,2014,ending inventory was $100,000,with a price index of 1.00,using dollar-value LIFO.At December 31,2015,the ending inventory using FIFO is $120,000 and the price index is 1.15.Round all dollar amounts to the nearest dollar.Basking Company's ending inventory at December 31,2015 on a dollar-value LIFO basis is ________.

A)$100,000

B)$104,348

C)$105,000

D)$120,000

A)$100,000

B)$104,348

C)$105,000

D)$120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

68

The balance in the LIFO reserve account is the difference between the beginning inventory and ending inventory measured using FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

69

Savage Company adopted the dollar-value LIFO method in 2014.At December 31,2014,ending inventory was $100,000,with a price index of 1.00,using dollar-value LIFO.At December 31,2015,the ending inventory using FIFO is $120,000 and the price index is 1.15.What is the LIFO Reserve on December 31,2015?

A)$4,348

B)$15,000

C)$15,652

D)$20,000

A)$4,348

B)$15,000

C)$15,652

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

70

What are the advantages of using of dollar-value LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

71

The LIFO effect is ________.

A)the change from the LIFO inventory value to the FIFO inventory value

B)the difference between the ending inventory measured using LIFO and FIFO

C)the change in the LIFO reserve account during the year and the impact on cost of goods sold

D)the difference between the beginning inventory measured using LIFO and FIFO

A)the change from the LIFO inventory value to the FIFO inventory value

B)the difference between the ending inventory measured using LIFO and FIFO

C)the change in the LIFO reserve account during the year and the impact on cost of goods sold

D)the difference between the beginning inventory measured using LIFO and FIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

72

What is a LIFO liquidation? In a period of rising costs,why is a LIFO liquidation feared?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

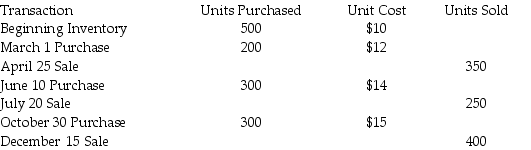

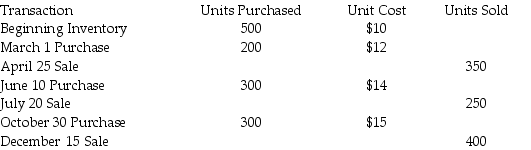

73

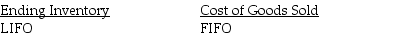

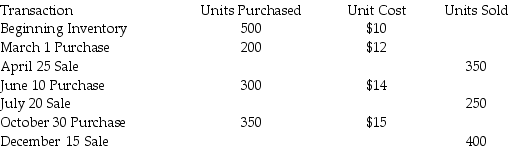

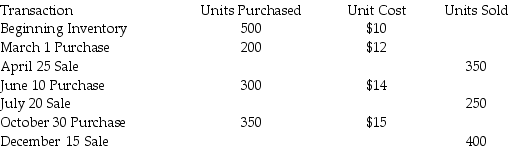

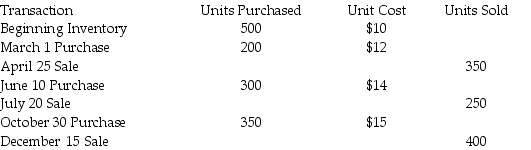

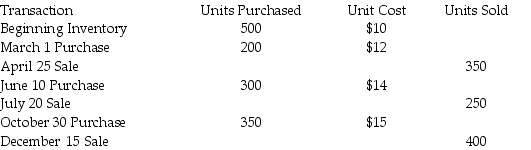

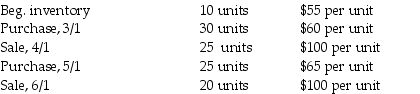

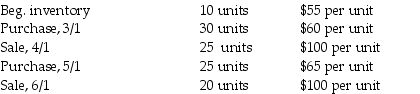

Carbondale Company had the following data available for the last six months:

Operating expenses are $2,000 per month.The income tax rate is 30%.

Operating expenses are $2,000 per month.The income tax rate is 30%.

Required:

1.Compute Cost of Goods Sold for the six months ending June 30 using:

a.FIFO perpetual

b.LIFO perpetual

2.How much will the company save in income taxes if they use LIFO instead of FIFO?

Operating expenses are $2,000 per month.The income tax rate is 30%.

Operating expenses are $2,000 per month.The income tax rate is 30%.Required:

1.Compute Cost of Goods Sold for the six months ending June 30 using:

a.FIFO perpetual

b.LIFO perpetual

2.How much will the company save in income taxes if they use LIFO instead of FIFO?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

74

1.What is the LIFO conformity rule?

2.Why is LIFO used by so many companies?

3.What is the disadvantage of LIFO?

2.Why is LIFO used by so many companies?

3.What is the disadvantage of LIFO?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

75

Goodee Bakery is considering a change in its inventory valuation method.Goodee Bakery currently uses the FIFO method and is considering a change to the LIFO method.Goodee Bakery started the year on January 1 with inventory at a FIFO cost of $22,000 and a LIFO cost of $20,500.The ending inventory on December 31 is $24,750 at FIFO cost and $21,800 at LIFO cost.The LIFO effect is ________.

A)$2,950

B)$1,500

C)$4,450

D)$1,450

A)$2,950

B)$1,500

C)$4,450

D)$1,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

76

Dollar-value LIFO computes inventory on a pool of inventory on the basis of units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

77

The LIFO reserve is disclosed in the footnotes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

78

Michael Jones Company has adopted the dollar-value LIFO method in 2014.At December 31,2014,the ending inventory at dollar-value LIFO is $100,000,with a price index of 1.00.At December 31,2015,the ending inventory using FIFO is $125,000.The price index is 1.30 in 2015.Round all dollar amounts to the nearest dollar.What is the ending inventory using dollar-value LIFO at December 31,2015?

A)$100,000

B)$119,231

C)$96,154

D)$125,000

A)$100,000

B)$119,231

C)$96,154

D)$125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

79

When following U.S.GAAP,the market value of inventory is always equal to the net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck

80

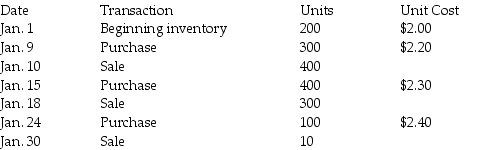

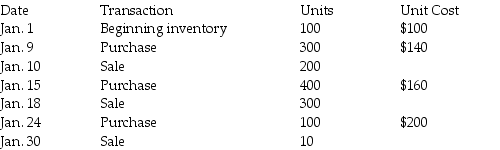

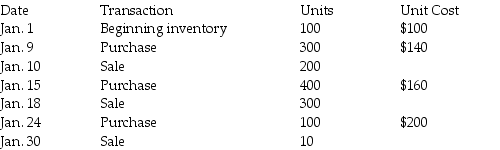

The Butters Company uses the FIFO perpetual inventory system.The company has the following data available for the month of January:

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

Required:

Prepare the income statement for the month ending January 31,2015 using a multiple-step format.

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.Required:

Prepare the income statement for the month ending January 31,2015 using a multiple-step format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 134 في هذه المجموعة.

فتح الحزمة

k this deck