Deck 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/156

العب

ملء الشاشة (f)

Deck 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition

1

The amount of capitalizable interest for a constructed asset is the lesser of actual interest incurred and avoidable interest.

True

2

Which of the following is not a major characteristic of a fixed asset?

A)acquired for resale

B)tangible in nature

C)expected to be used for more than one year

D)used in the production and sale of other assets

A)acquired for resale

B)tangible in nature

C)expected to be used for more than one year

D)used in the production and sale of other assets

A

3

Construction costs for fences and driveways are reported on the statement of financial position as ________.

A)current assets

B)intangible assets

C)land

D)land improvements

A)current assets

B)intangible assets

C)land

D)land improvements

D

4

When land is purchased and an old building thereon is demolished,the total purchase price plus the demolition cost is the total capitalized value of the land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under IFRS,there is no need to use the weighted-average accumulated expenditures to determine capitalizable interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

6

Firms capitalize interest costs from the time of the initial expenditure until the asset is actually put into service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

7

IFRS permits the use of full-cost accounting to allocate a proportionate share of indirect costs to a constructed asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

8

IFRS permits capitalization of interest on specific borrowings related to both constructed and purchased assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

9

With basket purchases,the firm allocates one purchase price to specific assets based on fair values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

10

Firms compute the amount of avoidable interest as the weighted-average accumulated expenditures times the appropriate interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

11

To determine the amount of interest to capitalize,the interest rate on specific borrowings to finance construction of the asset is multiplied times the total weighted-average accumulated expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

12

The debit for a sales tax paid on the purchase of machinery would be a charge to ________.

A)accumulated depreciation for machinery

B)a deferred liability account

C)the machinery account

D)miscellaneous tax expense

A)accumulated depreciation for machinery

B)a deferred liability account

C)the machinery account

D)miscellaneous tax expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

13

The cost of land includes the purchase price and land improvement costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

14

The cost of land does not include ________.

A)costs of removing old buildings

B)costs of improvements with limited lives

C)costs of grading and clearing the land

D)legal fees and closing costs

A)costs of removing old buildings

B)costs of improvements with limited lives

C)costs of grading and clearing the land

D)legal fees and closing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

15

When land is purchased and landscaping improvements are made,the total purchase price plus the improvement cost is the total capitalized value of the land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

16

Capitalization is the process of recording an expenditure as an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

17

For constructed assets,the amount of capitalized interest is calculated as total construction costs times the applicable interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

18

A cost that is recorded as an asset is ________.

A)an operating expenditure

B)a tangible expenditure

C)an intangible expenditure

D)a capital expenditure

A)an operating expenditure

B)a tangible expenditure

C)an intangible expenditure

D)a capital expenditure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

19

When more than one different type of asset is acquired in one purchase transaction,the total purchase price is allocated among the assets in proportion to their fair values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

20

Property,plant,and equipment include both tangible and intangible fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

21

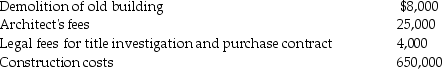

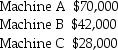

On February 1,2017,Ursa Corporation purchased a parcel of land as a factory site for $100,000.It demolished an old building on the property and began construction on a new building that was completed on October 2,2017.Costs incurred during this period are:

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.

Required:

a.At what amount should Ursa record the cost of the land and the new building,respectively?

b.If management misclassified a portion of the building's cost as part of the cost of the land,what

would be the effect on the financial statements?

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.Required:

a.At what amount should Ursa record the cost of the land and the new building,respectively?

b.If management misclassified a portion of the building's cost as part of the cost of the land,what

would be the effect on the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

22

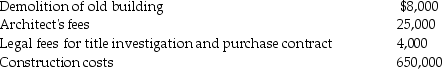

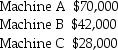

Seeder Inc.made a lump-sum purchase of three pieces of machinery for $130,000 from an unaffiliated company.At the time of acquisition,Seeder paid $5,000 to determine the appraised value of the machinery.The appraisal disclosed the following values:  What cost should be assigned to Machines A,B,and C,respectively?

What cost should be assigned to Machines A,B,and C,respectively?

A)A: $70,000; B: $42,000; C: $28,000

B)A: $67,500; B: $40,500; C: $27,000

C)A: $65,000; B: $39,000; C: $26,000

D)A: $45,000; B: $45,000; C: $45,000

What cost should be assigned to Machines A,B,and C,respectively?

What cost should be assigned to Machines A,B,and C,respectively?A)A: $70,000; B: $42,000; C: $28,000

B)A: $67,500; B: $40,500; C: $27,000

C)A: $65,000; B: $39,000; C: $26,000

D)A: $45,000; B: $45,000; C: $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

23

All fixed assets with a useful life of more than one year must be capitalized and depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

24

During 2016,Dosekis Co.incurred average accumulated expenditures of $400,000 during construction of assets that qualified for capitalization of interest.The only debt outstanding during 2016 was a $500,000,10%,5-year note payable dated January 1,2013.What is the amount of interest that should be capitalized by Dosekis during 2016?

A)$10,000

B)$40,000

C)$50,000

D)$80,000

A)$10,000

B)$40,000

C)$50,000

D)$80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

25

Alzparker Company constructed a building at a total actual cost of $24,000,000.Average accumulated expenditures during the construction period amounted to $17,000,000.As a result of financing arrangements,actual interest was $2,120,000,and avoidable interest was $1,600,000.What is the capitalizable cost of the equipment?

A)$19,120,000

B)$25,600,000

C)$26,120,000

D)$27,720,000

A)$19,120,000

B)$25,600,000

C)$26,120,000

D)$27,720,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

26

Scrap value is also referred to as depreciable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

27

Generally,which of the following costs are capitalized for self-constructed assets?

A)materials and labor only

B)labor and overhead only

C)materials and overhead only

D)materials,labor,and overhead

A)materials and labor only

B)labor and overhead only

C)materials and overhead only

D)materials,labor,and overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

28

In the context of constructing a plant asset,the interest that the company would not have paid if it had not borrowed funds to construct the asset is referred to as ________.

A)avoidable interest

B)marginal interest

C)capital interest

D)financing interest

A)avoidable interest

B)marginal interest

C)capital interest

D)financing interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

29

Assets that qualify for interest cost capitalization include ________.

A)assets under construction for a company's own use

B)assets not currently being used because of excess capacity

C)assets that are ready for their intended use and acquired through issuance of long-term debt

D)All of the above.

A)assets under construction for a company's own use

B)assets not currently being used because of excess capacity

C)assets that are ready for their intended use and acquired through issuance of long-term debt

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

30

What criteria does a company use to decide whether to include an expenditure in the cost of property,plant,and equipment rather than expensing it? Provide an example of a type of expenditure included in the cost of property,plant,and equipment as a result of applying these criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

31

When computing the amount of interest cost to be capitalized,the concept of "avoidable interest" refers to ________.

A)that portion of average accumulated expenditures on which no interest cost was incurred

B)that portion of total interest cost which would not have been incurred if expenditures for asset construction had not been made

C)the amount of interest cost actually incurred on financing undertaken specifically for the acquisition of the asset

D)a cost of capital charge for equity restricted to the acquisition of the specific asset

A)that portion of average accumulated expenditures on which no interest cost was incurred

B)that portion of total interest cost which would not have been incurred if expenditures for asset construction had not been made

C)the amount of interest cost actually incurred on financing undertaken specifically for the acquisition of the asset

D)a cost of capital charge for equity restricted to the acquisition of the specific asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

32

Depreciation is the systematic allocation of the cost of both tangible and intangible assets to expense over the asset's expected useful lives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

33

Ballyhigh Company purchased equipment for $20,000.Sales tax on the purchase was $1,500.Other costs incurred were freight charges of $400,repairs of $350 for damage during installation,and installation costs of $450.What is the capitalizable cost of the equipment?

A)$21,500

B)$21,850

C)$22,350

D)$22,700

A)$21,500

B)$21,850

C)$22,350

D)$22,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

34

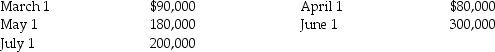

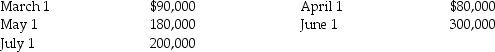

On March 1,Orono Co.began construction of a small building.The following expenditures were incurred for construction:

The building was completed and occupied on July 1.To help pay for construction $50,000 was borrowed on March 1 on a 12%,three-year note payable.The only other debt outstanding during the year was a $500,000,10% note issued two years ago.

The building was completed and occupied on July 1.To help pay for construction $50,000 was borrowed on March 1 on a 12%,three-year note payable.The only other debt outstanding during the year was a $500,000,10% note issued two years ago.

Required:

(a)Calculate the weighted-average accumulated expenditures.

(b)Calculate avoidable interest.

The building was completed and occupied on July 1.To help pay for construction $50,000 was borrowed on March 1 on a 12%,three-year note payable.The only other debt outstanding during the year was a $500,000,10% note issued two years ago.

The building was completed and occupied on July 1.To help pay for construction $50,000 was borrowed on March 1 on a 12%,three-year note payable.The only other debt outstanding during the year was a $500,000,10% note issued two years ago.Required:

(a)Calculate the weighted-average accumulated expenditures.

(b)Calculate avoidable interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

35

Ordinary repairs are expenditures to maintain the operating efficiency of an asset that do not extend its original useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

36

Woowee Company manufactures electric motorcycles.On April 1,it purchased a machine for its assembly line at a contract price of $300,000 with terms of 2/10,n/30.Woowee paid the contract price on April 8 and also incurred installation and transportation costs of $5,000,sales tax of $18,000,and testing costs of $4,000.During testing,the machine was accidentally damaged,so the company had to pay $2,000 to repair it.

Required:

(a)What characteristics are necessary for a company to include an asset in the category of property,plant,and equipment?

(b)What is the capitalizable cost of the machine?

Required:

(a)What characteristics are necessary for a company to include an asset in the category of property,plant,and equipment?

(b)What is the capitalizable cost of the machine?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

37

Scrap value reduces the depreciable base of an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

38

Adding new offices to an existing office building would qualify as a capital expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

39

Emerson Enterprises is constructing a building.Construction began in 2016 and the building was completed December 31,2016.Emerson made payments to the construction company of $600,000 on July 1,$1.800,000 on September 1,and $2,400,000 on December 31.What is the amount of weighted-average accumulated expenditures that provides the basis for determining capitalizable interest?

A)$900,000

B)$1,100,000

C)$1,200,000

D)$1,600,000

A)$900,000

B)$1,100,000

C)$1,200,000

D)$1,600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

40

The period of time for which interest is to be capitalized ends when ________.

A)no additional interest cost is actually being incurred on direct financing for the acquisition of the asset

B)a constructed is substantially complete and put into use

C)a constructed asset is substantially complete and ready for its intended use

D)an acquired asset is received and ready for its intended use

A)no additional interest cost is actually being incurred on direct financing for the acquisition of the asset

B)a constructed is substantially complete and put into use

C)a constructed asset is substantially complete and ready for its intended use

D)an acquired asset is received and ready for its intended use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

41

For income statement purposes,when is depreciation expense considered to be a variable expense?

A)When units-of-output method is used.

B)When double-declining-balance method is used.

C)When straight-line method is used.

D)Never.

A)When units-of-output method is used.

B)When double-declining-balance method is used.

C)When straight-line method is used.

D)Never.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

42

Double-declining balance method charges twice the amount of straight-line depreciation expense each period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

43

The half-year convention is not applicable for the double-declining balance method of determining depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

44

The depreciable base of an asset for all depreciation methods is the original cost of the asset minus planned scrap value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

45

An improvement made to a machine increased its fair value and its production capacity.The cost of the improvement should be debited to ________.

A)expense

B)accumulated depreciation

C)equipment

D)intangible assets

A)expense

B)accumulated depreciation

C)equipment

D)intangible assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

46

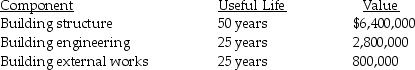

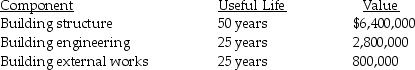

Presented below are the components related to an office building that Lorny Manufacturing Company purchased for $10,000,000 in January,2017.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

b.Assume that the building engineering was replaced after 20 years at a cost of $2,500,000.Prepare the journal entry to record the replacement of the old component with the new component.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.b.Assume that the building engineering was replaced after 20 years at a cost of $2,500,000.Prepare the journal entry to record the replacement of the old component with the new component.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

47

Accumulated depreciation is a contra-expense account that represents total depreciation taken over the life of an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

48

A production machine which cost $2,200,000 is acquired on October 1,2016.Its estimated residual value is $200,000 and its expected life is 10 years or about 80,000 operating hours.During 2016,the machine was used to produce products for 3,000 operating hours during 2016 and 8,100 operating hours during 2017.Lorny does not use the half-year convention for depreciating any assets.

Calculate depreciation expense for 2015 and 2016 by each of the following methods:

(a)Straight-line method

(b)Double-declining balance method

(c)Units-of-output method

Calculate depreciation expense for 2015 and 2016 by each of the following methods:

(a)Straight-line method

(b)Double-declining balance method

(c)Units-of-output method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

49

The purchase of a building would involve a number of different components,such as the foundation and frame,heating and air conditioning systems,and other non-weight-bearing parts.Which of the following statements concerning the components-based approach for determining depreciation is true?

A)Both U.S.GAAP and IFRS require the components-based approach.

B)Both U.S.GAAP and IFRS allow the components-based approach but do not require it.

C)IFRS allows the components-based approach but does not require it; U.S.GAAP requires the components-based approach.

D)U)S.GAAP allows the components-based approach but does not require it; IFRS requires the components-based approach.

A)Both U.S.GAAP and IFRS require the components-based approach.

B)Both U.S.GAAP and IFRS allow the components-based approach but do not require it.

C)IFRS allows the components-based approach but does not require it; U.S.GAAP requires the components-based approach.

D)U)S.GAAP allows the components-based approach but does not require it; IFRS requires the components-based approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

50

What type of account is Accumulated Depreciation?

A)contra-equity

B)contra-asset

C)expense

D)asset

A)contra-equity

B)contra-asset

C)expense

D)asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

51

Lunar Products purchased a computer for $13,000 on July 1,2016.The company intends to depreciate it over 4 years using the double-declining balance method.Residual value is $1,000.What is depreciation for 2017?

A)$3,000

B)$3,250

C)$4,500

D)$4,875

A)$3,000

B)$3,250

C)$4,500

D)$4,875

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use of the double-declining balance method ________.

A)ignores the scrap value of the asset for all purposes

B)results in twice the depreciation expense that would be recognized by the straight-line method each period

C)means that amount of depreciation expense decreases year after year

D)All of the above are true.

A)ignores the scrap value of the asset for all purposes

B)results in twice the depreciation expense that would be recognized by the straight-line method each period

C)means that amount of depreciation expense decreases year after year

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following expenditures made subsequent to acquisition should be fully expensed in the period the expenditure is made?

A)an expenditure made to add new asset services

B)an expenditure made to maintain an existing asset so that it can function in the manner intended

C)an expenditure made to extend the useful life of an existing asset beyond the time frame originally anticipated

D)an expenditure made to increase the efficiency or effectiveness of an existing asset

A)an expenditure made to add new asset services

B)an expenditure made to maintain an existing asset so that it can function in the manner intended

C)an expenditure made to extend the useful life of an existing asset beyond the time frame originally anticipated

D)an expenditure made to increase the efficiency or effectiveness of an existing asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is a realistic assumption of the straight-line method of depreciation?

A)Depreciation is a function usage.

B)The rate of return analysis is enhanced using the straight-line method.

C)The repair and maintenance expense is essentially the same each period.

D)The asset's economic usefulness is the same each year.

A)Depreciation is a function usage.

B)The rate of return analysis is enhanced using the straight-line method.

C)The repair and maintenance expense is essentially the same each period.

D)The asset's economic usefulness is the same each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

55

Net book value is equal to the original cost of an asset minus accumulated depreciation for that asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements about the double-declining-balance (DDB)method is true?

A)Companies that use the DDB method do not use partial-year depreciation.

B)Companies that use the DDB method generally do not use scrap value to calculate current-year depreciation expense.

C)Using the DDB method,the amount of depreciation expense varies from year to year depending on usage of the asset.

D)All of the above statements are true.

A)Companies that use the DDB method do not use partial-year depreciation.

B)Companies that use the DDB method generally do not use scrap value to calculate current-year depreciation expense.

C)Using the DDB method,the amount of depreciation expense varies from year to year depending on usage of the asset.

D)All of the above statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

57

U.S.GAAP allows a firm to record a half year of depreciation expense for any asset acquired at any time during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not a method for determining depreciation expense for a specific asset?

A)net method

B)units-of-output method

C)declining-balance method

D)straight-line method

A)net method

B)units-of-output method

C)declining-balance method

D)straight-line method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

59

Kaven Corporation purchased a truck at the beginning of 2016 for $75,000 which will be depreciated using the units-of-output method.The truck is estimated to have a residual value of $3,000 and a useful life of 4 years and 120,000 miles.It was driven 18,000 miles in 2016 and 32,000 miles in 2017.What is the depreciation expense for 2017?

A)$18,750

B)$19,200

C)$20,000

D)$32,000

A)$18,750

B)$19,200

C)$20,000

D)$32,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following information is not used to determine current period depreciation expense associated with a specific asset?

A)acquisition cost of the asset

B)useful life of the asset

C)residual value of the asset

D)current carrying value of the asset

A)acquisition cost of the asset

B)useful life of the asset

C)residual value of the asset

D)current carrying value of the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

61

When a firm sells or abandons an asset,how is the gain or loss to be recognized on the income statement measured?

A)The difference between cash proceeds received and the carrying value of the asset.

B)The difference between cash proceeds received and the acquisition value of the asset.

C)The difference between cash proceeds received and the accumulated depreciation of the asset.

D)The difference between the book value of the asset and the carrying value of the asset.

A)The difference between cash proceeds received and the carrying value of the asset.

B)The difference between cash proceeds received and the acquisition value of the asset.

C)The difference between cash proceeds received and the accumulated depreciation of the asset.

D)The difference between the book value of the asset and the carrying value of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

62

Companies are required to disclose the amount of depreciation expense for each major class of fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company will never recognize a gain on abandonment of a fixed asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following situations always results in a loss on derecognition of an asset?

A)The asset is abandoned.

B)The cash proceeds from the sale are less than the book value of the asset.

C)The carrying value of the asset is less than its book value at the time of derecognition.

D)The cash proceeds from the sale (if any)are less than the acquisition cost of the asset.

A)The asset is abandoned.

B)The cash proceeds from the sale are less than the book value of the asset.

C)The carrying value of the asset is less than its book value at the time of derecognition.

D)The cash proceeds from the sale (if any)are less than the acquisition cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

65

A company recognizes a loss on the income statement whenever it sells a fixed asset for less than its original cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

66

Companies are required to disclose the amount of depreciation expense for each major class of fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

67

A fixed asset with a five-year estimated useful life and no scrap value is sold at the end of the second year of its useful life.How would using the straight-line method of depreciation instead of the double-declining balance method of depreciation affect a gain or loss on the sale of the plant asset?

A)A gain would be greater or a loss would be less using straight-line depreciation.

B)A gain would be less or a loss would be greater using straight-line depreciation.

C)A gain would be less or a loss would be less using straight-line depreciation.

D)Neither the gain or loss would be different using straight-line depreciation instead of double-declining-balance method.

A)A gain would be greater or a loss would be less using straight-line depreciation.

B)A gain would be less or a loss would be greater using straight-line depreciation.

C)A gain would be less or a loss would be less using straight-line depreciation.

D)Neither the gain or loss would be different using straight-line depreciation instead of double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following statements about derecognition of an asset is true?

A)Derecognition requires that the firm remove the asset acquisition value from the balance sheet but not the related accumulated depreciation.

B)Derecognition increases or decreases the balance of the Allowance for Derecognition account.

C)Before a gain or loss on derecognition is recognized,the firm must always first recognize current period depreciation expense.

D)A loss on derecognition occurs when the amount of cash proceeds (if any)is less than the acquisition cost of the asset.

A)Derecognition requires that the firm remove the asset acquisition value from the balance sheet but not the related accumulated depreciation.

B)Derecognition increases or decreases the balance of the Allowance for Derecognition account.

C)Before a gain or loss on derecognition is recognized,the firm must always first recognize current period depreciation expense.

D)A loss on derecognition occurs when the amount of cash proceeds (if any)is less than the acquisition cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

69

a.What is the distinction between a capital and an operating expenditure? Give two examples of each.

b.Distinguish between ordinary repairs and maintenance and major repairs.How should a company account for each?

b.Distinguish between ordinary repairs and maintenance and major repairs.How should a company account for each?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

70

Companies are required to disclose the amount of accumulated depreciation either for each major class of fixed assets or in total for all fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

71

Identify and briefly describe the four factors involved in determining the dollar amount of a firm's periodic charge to depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

72

Companies commonly report the carrying value of property,plant,and equipment in total or by major class of long-term assets on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company recognizes a gain on the income statement whenever it sells a fixed asset for more than the net book value of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

74

Briefly describe the accounting for the acquisition and use of equipment and indicate which accounts are involved in accounting for equipment and what types of accounts are these?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

75

How is derecognition of an asset recognized in the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

76

Under what circumstances does derecognition of an asset occur?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

77

The loss on abandonment of an asset is equal to its carrying value on the date of abandonment plus disposal costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

78

Briefly explain the half-year convention for recognizing depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

79

U.S.GAAP requires companies to reconcile the historical cost and accumulated depreciation at the beginning of the period with amounts at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

80

Companies derecognize tangible fixed assets from their accounts when they abandon the assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck