Deck 22: Accounting Corrections and Error Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

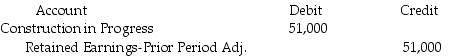

سؤال

سؤال

سؤال

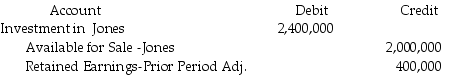

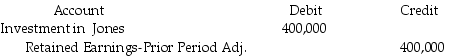

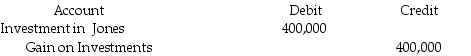

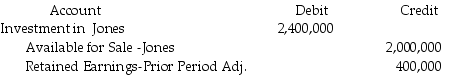

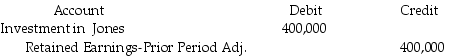

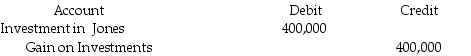

سؤال

سؤال

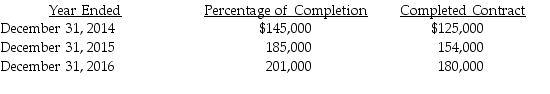

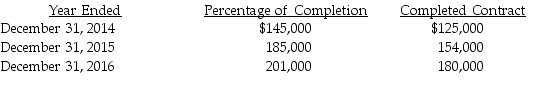

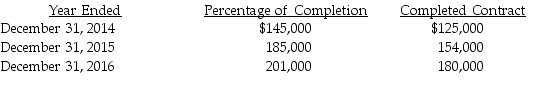

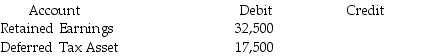

سؤال

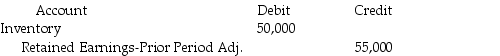

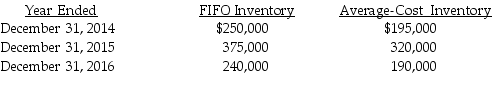

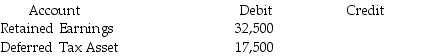

سؤال

سؤال

سؤال

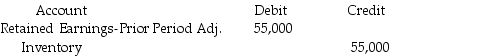

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

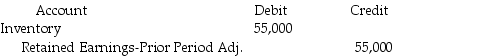

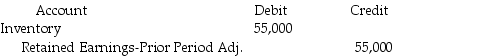

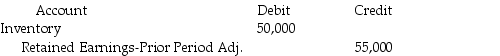

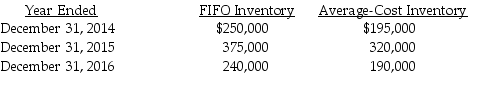

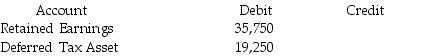

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

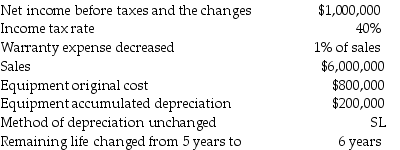

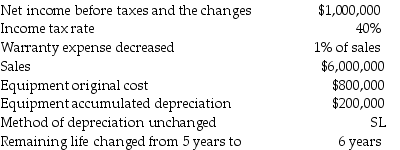

سؤال

سؤال

سؤال

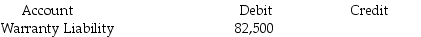

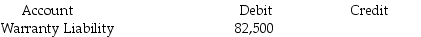

سؤال

سؤال

سؤال

سؤال

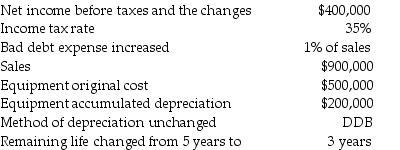

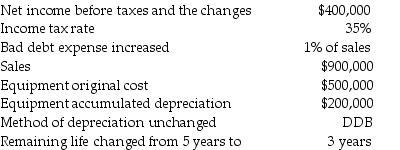

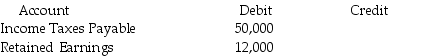

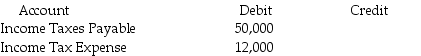

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/395

العب

ملء الشاشة (f)

Deck 22: Accounting Corrections and Error Analysis

1

Which one of the following would not be effected by a change in revenue recognition requiring a retrospective change?

A)cash

B)revenue

C)unearned revenue

D)deferred taxes

A)cash

B)revenue

C)unearned revenue

D)deferred taxes

A

2

Accounting entity changes are handled prospectively.

False

3

Which one of the following changes is not an accounting change?

A)principle

B)estimate

C)error

D)entity

A)principle

B)estimate

C)error

D)entity

C

4

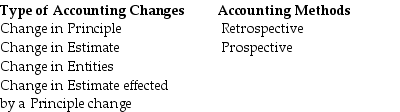

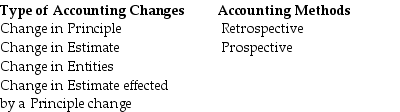

Describe the two methods for reporting accounting changes and how they differ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a mandatory accounting change requires too much work for a firm to use the retrospective approach,then the firm can choose to use the prospective approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

6

Prospective changes require changes be made to the current year and all future years affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

7

Accounting changes detract from which one of the following enhancing qualitative characteristics of accounting?

A)comparability

B)consistency

C)representational faithfulness

D)materiality

A)comparability

B)consistency

C)representational faithfulness

D)materiality

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

8

Mandatory accounting changes require retrospective application of the new accounting standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

9

Indirect effects of changes in an accounting principle are those that change current or future cash flows and are applied prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

10

Accounting principle changes are generally handled retrospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

11

Accounting changes are only permitted when ________.

A)the effect is material

B)adequate disclosures are made

C)the method used is prospective

D)the company has not made prior changes

A)the effect is material

B)adequate disclosures are made

C)the method used is prospective

D)the company has not made prior changes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

12

Changes in accounting principles can be mandatory or voluntary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

13

Accounting estimate changes are handled prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

14

A firm may choose to apply indirect effects of an accounting principle change either prospectively or retrospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

15

Retrospective changes require all but which of the following?

A)restatement of all prior years presented

B)adjustment to assets and liabilities for the first period presented

C)detailed numerical comparisons of all prior periods to restated statements

D)retained earnings restated for the adjustments of the current period

A)restatement of all prior years presented

B)adjustment to assets and liabilities for the first period presented

C)detailed numerical comparisons of all prior periods to restated statements

D)retained earnings restated for the adjustments of the current period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

16

Explain why comparability and consistency are considerations for accounting changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

17

When making a voluntary accounting change,a firm must explain the justification for the change on the basis that it more accurately portrays its financial position and performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

18

There are four types of accounting changes - principles,estimates,entities and errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

19

Retrospective changes require restatement of all periods reported in the annual report as if it had been used in those prior years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

20

Direct effects of changes in an accounting principle are those necessary to implement the change and are applied retrospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

21

Fields Construction decides to change from completed-contract method to percentage-of-completion method of recording construction projects.It also has a compensation plan for bonuses to supervisors for three percent of net income,which are retroactive for changes in prior years net income.Discuss the direct and indirect effects of this change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

22

Johnston Controls began operation in 2014 using FIFO inventory methods.In 2015,management decided they should have chosen LIFO to more accurately portray financial position and performance.The beginning 2015 inventory using FIFO was $100,000.Under the LIFO method the beginning inventory would have been $120,000.The adjustment to inventory for the accounting principal change for 2014 would be ________.

A)$0

B)$10,000 debit

C)$20,000 credit

D)$20,000 debit

A)$0

B)$10,000 debit

C)$20,000 credit

D)$20,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

23

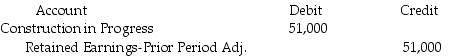

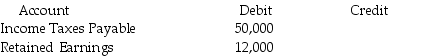

Journal entry for the year of the change: January 1,2016

Retained Earnings-Prior Period Adj. $51,000

Retained Earnings-Prior Period Adj. $51,000

Cumulative effect of the change: $20,000 (2014)+ $31,000 (2015)= $51,000

Retained Earnings-Prior Period Adj. $51,000

Retained Earnings-Prior Period Adj. $51,000Cumulative effect of the change: $20,000 (2014)+ $31,000 (2015)= $51,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which one of the following would not be a required disclosure for a change in accounting principle?

A)description of the nature of the change

B)management's justification for the change

C)the estimated effect on future earnings per share

D)cumulative effect of the change on retained earnings for the first year presented

A)description of the nature of the change

B)management's justification for the change

C)the estimated effect on future earnings per share

D)cumulative effect of the change on retained earnings for the first year presented

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

25

Anzelmo Corporation invested in Jones Manufacturing by purchasing a 10% interest in the company.Anzelmo had no significant influence in Jones.Over time,Anzelmo acquired more shares in Jones,and in 2016,Anzelmo's president became a member of the board of directors when its ownership interest reached 30% of Jones.This change is ________.

A)an accounting principal change requiring retrospective adjustment

B)an accounting principal change requiring prospective adjustment

C)a correction of an error

D)an estimate change

A)an accounting principal change requiring retrospective adjustment

B)an accounting principal change requiring prospective adjustment

C)a correction of an error

D)an estimate change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

26

Anzelmo Corporation invested in Jones Manufacturing by purchasing a 10% interest in the company.Anzelmo had no significant influence in Jones.Over time,Anzelmo acquired more shares in Jones,and in 2016,Anzelmo's president became a member of the board of directors when its ownership interest reached 30% of Jones.The cost basis of their investment is $2,000,000.Under the equity method,the valuation of the investment would be $2,400,000.The fair value of the investment is $2,600,000.What is the proper journal entry to properly record the change in accounting principal,ignoring income taxes?

A)No entry needed.

B)

C)

D)

A)No entry needed.

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

27

When a company makes a change in an accounting principle,IFRS additionally requires a company to report ________.

A)three years of all financial statements

B)two years of all financial statements

C)two years of balance sheets and two years of income statements

D)three years of balance sheets and two years of other financial statements

A)three years of all financial statements

B)two years of all financial statements

C)two years of balance sheets and two years of income statements

D)three years of balance sheets and two years of other financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

28

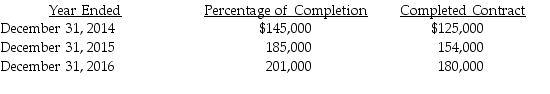

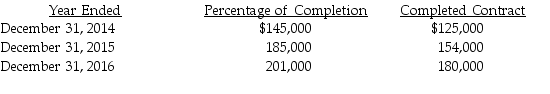

Hampton's Construction,Inc.decided to change from completed-contract method of accounting to percentage-of-completion method.Hampton will continue to us the completed-contract method for income tax purposes.The following information is available for net income.The income tax rate for all years is 35%.

What is the journal entry to record the change in accounting principle on January 1,2016?

What is the journal entry to record the change in accounting principle on January 1,2016?

A)No journal entry need for prospective application of the change in principle.

B)

C) Construction in Progress 72,000

Construction in Progress 72,000

D) Retained Earnings-Prior Period Adj. 33,150

Retained Earnings-Prior Period Adj. 33,150

What is the journal entry to record the change in accounting principle on January 1,2016?

What is the journal entry to record the change in accounting principle on January 1,2016?A)No journal entry need for prospective application of the change in principle.

B)

C)

Construction in Progress 72,000

Construction in Progress 72,000D)

Retained Earnings-Prior Period Adj. 33,150

Retained Earnings-Prior Period Adj. 33,150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

29

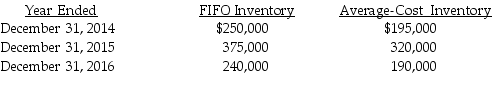

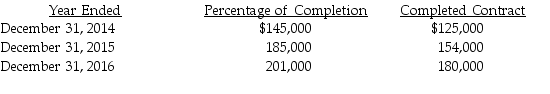

Butler Products decided in 2016 to change inventory methods to more effectively report its results of operations.In the past,management has measured its ending inventories by the average-cost method and they now believe that FIFO is a better representation of its profitability.  Ignoring income tax,which one of the following journal entries correctly records the change in the accounting principle at January 1,2016?

Ignoring income tax,which one of the following journal entries correctly records the change in the accounting principle at January 1,2016?

A)No journal entry need for prospective application of the change in principle.

B)

C)

D)

Ignoring income tax,which one of the following journal entries correctly records the change in the accounting principle at January 1,2016?

Ignoring income tax,which one of the following journal entries correctly records the change in the accounting principle at January 1,2016?A)No journal entry need for prospective application of the change in principle.

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

30

Bronco Construction,Inc.decided to change from completed-contract method of accounting to percentage-of-completion method.The following information is available for net income.Ignore income tax effects:

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

31

Energy,Inc began operations in 2015 using LIFO inventory methods.In 2016,management decided they should have chosen FIFO.The beginning inventory for 2016 using LIFO was $125,000.Under the FIFO method,the beginning inventory would have been $140,000.The adjustment to inventory for the change in accounting principle for 2016 would be ________.

A)$0

B)$15,000 debit

C)$15,000 credit

D)$30,000 debit

A)$0

B)$15,000 debit

C)$15,000 credit

D)$30,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

32

Hampton's Construction,Inc.decided to change from completed-contract method of accounting to percentage-of-completion method.The following information is available for net income.Ignore income tax effects:

What is the journal entry to record the change in accounting principle on January 1,2016?

What is the journal entry to record the change in accounting principle on January 1,2016?

A)No journal entry need for prospective application of the change in principle.

B)

C)

D) Retained Earnings Prior Period Adj. 51,000

Retained Earnings Prior Period Adj. 51,000

What is the journal entry to record the change in accounting principle on January 1,2016?

What is the journal entry to record the change in accounting principle on January 1,2016?A)No journal entry need for prospective application of the change in principle.

B)

C)

D)

Retained Earnings Prior Period Adj. 51,000

Retained Earnings Prior Period Adj. 51,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

33

Prepare the footnote disclosure for the change from the completed-contract method to the percentage-of-completion method.Designate the note as "Note A: Change in Method of Accounting for Bronco construction,Inc."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

34

Johnston Controls began operation in 2014 using FIFO inventory methods.In 2015,management decided they should have chose LIFO.The beginning 2015 inventory using FIFO was $100,000.Under the LIFO method the beginning inventory would have been $120,000.

Required: Prepare the journal entry to record the change in accounting principle and discuss the required disclosures.

Required: Prepare the journal entry to record the change in accounting principle and discuss the required disclosures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which one of the following might be effected by a change in revenue recognition requiring a prospective change?

A)retained earnings

B)management compensation

C)unearned revenue

D)deferred taxes

A)retained earnings

B)management compensation

C)unearned revenue

D)deferred taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

36

Anzelmo Corporation invested in Jones Manufacturing by purchasing a 10% interest in the company.Anzelmo had no significant influence in Jones.Over time,Anzelmo acquired more shares in Jones,and in 2016,Anzelmo's president became a member of the board of directors when its ownership interest reached 30% of Jones.The cost basis of its investment is $2,000,000.Under the equity method,the valuation of the investment would be $2,400,000.The fair value of the investment is $2,600,000.What is the amount of the adjustment to the investment account necessary to properly record the change in accounting principal?

A)$0

B)$400,000 debit

C)$400,000 credit

D)$600,000 debit

A)$0

B)$400,000 debit

C)$400,000 credit

D)$600,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

37

Prepare the journal entry required to record the accounting change on January 1,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

38

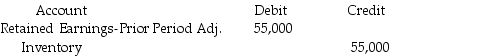

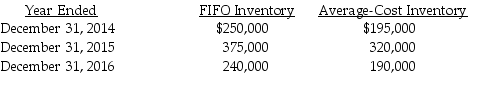

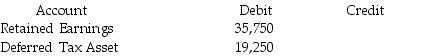

Butler Products decided to change inventory methods on January 1,2016 to more effectively report its results of operations.In the past,management has measured its ending inventories by the average-cost method and they now believe that FIFO is a better representation of its financial position and profitability.Butler's tax rate is 35% for all years.  Which one of the following journal entries correctly records the change in the accounting principle?

Which one of the following journal entries correctly records the change in the accounting principle?

A)No journal entry need for prospective application of the change in principle.

B) Inventory 55,000

Inventory 55,000

C) Retained Earnings-Prior Period Adj. 35,750

Retained Earnings-Prior Period Adj. 35,750

D) Inventory 50,000

Inventory 50,000

Which one of the following journal entries correctly records the change in the accounting principle?

Which one of the following journal entries correctly records the change in the accounting principle?A)No journal entry need for prospective application of the change in principle.

B)

Inventory 55,000

Inventory 55,000C)

Retained Earnings-Prior Period Adj. 35,750

Retained Earnings-Prior Period Adj. 35,750D)

Inventory 50,000

Inventory 50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

39

When a firm decides to change an accounting principal,but does not have sufficient information to use the retrospective approach,it may ________.

A)estimate the numbers to do so

B)declare the change to be impractical

C)be forced to abandon the change

D)use the prospective approach

A)estimate the numbers to do so

B)declare the change to be impractical

C)be forced to abandon the change

D)use the prospective approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

40

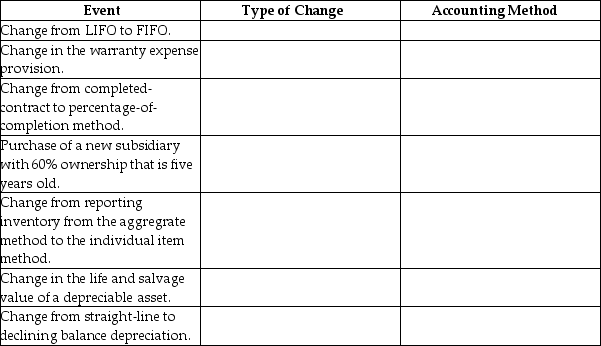

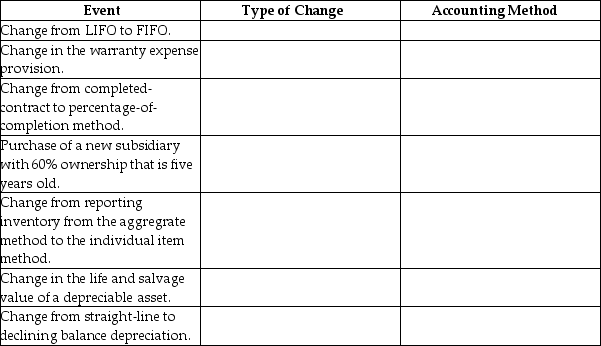

For each of the following situations,determine the type of change and the accounting method that should be employed.

Complete the following table by selecting the appropriate type of changes and the accounting method appropriate for each event.

Complete the following table by selecting the appropriate type of changes and the accounting method appropriate for each event.

Complete the following table by selecting the appropriate type of changes and the accounting method appropriate for each event.

Complete the following table by selecting the appropriate type of changes and the accounting method appropriate for each event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

41

Changes in amortization,depletion,and depreciation effected by a change in accounting principle are are handled prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

42

Journal entry on January 1,2016 to effect the change in principle is:

Retained Earnings-Prior Period Adj. 27,000

Retained Earnings-Prior Period Adj. 27,000

Retained Earnings-Prior Period Adj. 27,000

Retained Earnings-Prior Period Adj. 27,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

43

Changes in accounting principles may be handled prospectively if insufficient information is available to properly account for the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which one of the following is a change in estimate effected by a change in an accounting principle?

A)salvage value of an asset

B)estimated life of an asset

C)change from declining-balance to straight-line depreciation

D)changes in pension plan asset revenues

A)salvage value of an asset

B)estimated life of an asset

C)change from declining-balance to straight-line depreciation

D)changes in pension plan asset revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

45

Prior years financial statement are affected by changes in material accounting estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

46

Prepare the journal entry on January 1,2016 for the change in accounting principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

47

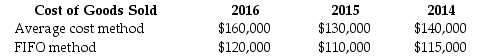

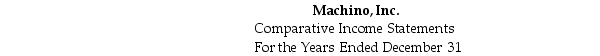

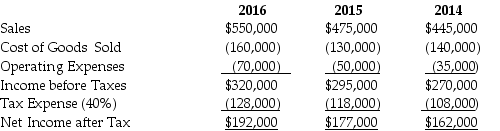

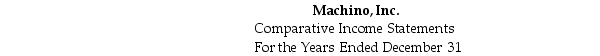

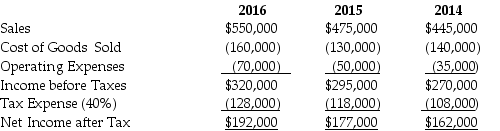

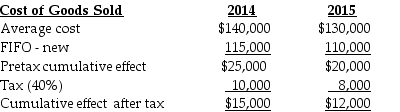

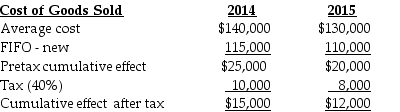

Machino,Inc.began operations on January 1,2014.During 2016,management decided to change from average-cost method to FIFO for its merchandise inventories.The change was effective at January 1,2016.Management determined that cost of goods sold for each method would be:

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

Required:

Required:

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

48

Judgments are important in determining which type of estimates used by accountants?

A)bad debt expense

B)earnings per share

C)net income

D)computation of gains and losses

A)bad debt expense

B)earnings per share

C)net income

D)computation of gains and losses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

49

For the Years Ended December 31

For the Years Ended December 31 *Restated

*Restated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

50

Note A: Change in Method of Accounting for Bronco Construction,Inc.

On January 1,2016 the company changed its method of accounting for long-term construction from the completed-contract method to the percentage of completion method.The new method of accounting is considered preferable because it better reflects changes in the nature of the company's operations.Comparative financial statements have been adjusted to apply the new method retrospectively.Net income is increased by $31,000 and $20,000 in the years ended December 31,2015 and 2014,respectively.As a result of the change to the percentage-of-completion method,the current year's net income is higher by $21,000 as compared to the results obtained if the completed-contract method was still used.Construction-in-progress has been increased by $51,000 as of the beginning of the current year.The cumulative effect of the change is to increase beginning retained earnings by $51,000.The accounting change in principle is reported retrospectively.

On January 1,2016 the company changed its method of accounting for long-term construction from the completed-contract method to the percentage of completion method.The new method of accounting is considered preferable because it better reflects changes in the nature of the company's operations.Comparative financial statements have been adjusted to apply the new method retrospectively.Net income is increased by $31,000 and $20,000 in the years ended December 31,2015 and 2014,respectively.As a result of the change to the percentage-of-completion method,the current year's net income is higher by $21,000 as compared to the results obtained if the completed-contract method was still used.Construction-in-progress has been increased by $51,000 as of the beginning of the current year.The cumulative effect of the change is to increase beginning retained earnings by $51,000.The accounting change in principle is reported retrospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

51

Changes in depreciation methods are changes in accounting principles handled retrospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

52

The first balance sheet presented under the new method is December 31,2014.The cumulative effect after tax in retained earnings is computed as follows:

The cumulative effect of the change is $15,000 plus $12,000 equals $27,000.

The cumulative effect of the change is $15,000 plus $12,000 equals $27,000.

The cumulative effect of the change is $15,000 plus $12,000 equals $27,000.

The cumulative effect of the change is $15,000 plus $12,000 equals $27,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

53

Determine the after-tax cumulative effect in retained earnings at January 1,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

54

The auditor for Universal Tools,Inc.discovered in 2017 that the warranty liability account showed a $25,000 debit balance.She reasoned that the correct treatment of this discovery is to ________.

A)conduct a fraud investigation to see if a fraud has occurred

B)make engineering investigate to see if there is a production failure

C)wait until next year to see if the trend continues

D)investigate and increase the warranty expense and liability to an appropriate level

A)conduct a fraud investigation to see if a fraud has occurred

B)make engineering investigate to see if there is a production failure

C)wait until next year to see if the trend continues

D)investigate and increase the warranty expense and liability to an appropriate level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

55

If a company has recorded a liability for a lawsuit,and the amount of the settlement is more than the provision in the liability,it must consider this an error and retrospectively correct it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

56

Prepare the comparative income statements for Machino,Inc.after the change to FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

57

Changes in methods of depreciation are changes in estimates effected by changes in accounting principles and are handled prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

58

Georgio,Inc.decided to move its business from its current location to another larger plant.Management should examine the salvage value of the building in the future and the change in the useful life to see if a change in the depreciation of the current building is warranted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

59

For which one of the following changes is it appropriate to use the prospective method?

A)change in principles

B)change in entity

C)errors

D)change in estimate

A)change in principles

B)change in entity

C)errors

D)change in estimate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

60

Disclosures are required for all accounting estimates made in normal operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

61

When a large corporation purchases a new business which is included in consolidated statements for the year,it is not a change in a reporting entity,and it is handled prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

62

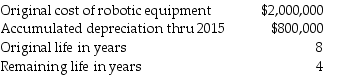

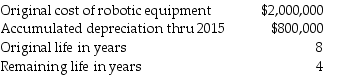

Jenkins,Inc.builds custom machines for manufacturers using robotic equipment.In 2016,the company decided to change from straight-line to double-declining-balance depreciation for its robotic equipment.It changed the life expectancy as follows:

Determine the correct amount of depreciation to expense for 2016.

Determine the correct amount of depreciation to expense for 2016.

A)$250,000

B)$300,000

C)$400,000

D)$600,000

Determine the correct amount of depreciation to expense for 2016.

Determine the correct amount of depreciation to expense for 2016. A)$250,000

B)$300,000

C)$400,000

D)$600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

63

In reconciling information to complete its financial statements,Biltmore,Inc.discovered the following situations:

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,warranty expense change,net income before taxes,income tax expense,and net income.

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,warranty expense change,net income before taxes,income tax expense,and net income.

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,warranty expense change,net income before taxes,income tax expense,and net income.

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,warranty expense change,net income before taxes,income tax expense,and net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

64

John Pickens writes mystery novels.His publisher pays him royalties for books sold each year.He is paid royalties for the first half of the year on September 30 and the second half of the year on March 31 of the following year.He received $42,000 in September,2016.The publisher estimated that his royalties for the second half of the year would be $53,000.On March 31,2017,he received $57,500.Assuming that he recorded $53,000 at December 31,2016,what kind of change does this represent?

A)not a change

B)change in estimate

C)prior period error correction

D)change from accrual to cash method

A)not a change

B)change in estimate

C)prior period error correction

D)change from accrual to cash method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

65

Emma's Clothes,Inc.has accounts receivable of $210,000.In the current economy,she has noticed an increase in uncollectible accounts.In 2016,her sales were $3,200,000 and in 2017,sales were $3,800,000.She has estimated in the past that 2% of sales would eventually be uncollectible.Emma believes that her losses were closer to 3% last year.She has recorded bad debt expense of 2% for 2017.Does she need to make a retroactive correction for 2016,and should she add an additional adjustment to 2017? If so,write the journal entry for the year-end adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

66

The auditor for Universal Tools,Inc.discovered in 2017 that the warranty liability account showed a $25,000 debit balance.She investigated and discovered that the 2% estimate for warranty expense was recorded and understated,and it was more likely 3.5%.Sales for 2017 were $5,500,000.She should make which one of the following entries?

A) Warranty Expense 25,000

Warranty Expense 25,000

B) Warranty Liability 82,500

Warranty Liability 82,500

C) Warranty Expense 82,500

Warranty Expense 82,500

D) Warranty Liability 192,500

Warranty Liability 192,500

A)

Warranty Expense 25,000

Warranty Expense 25,000B)

Warranty Liability 82,500

Warranty Liability 82,500C)

Warranty Expense 82,500

Warranty Expense 82,500D)

Warranty Liability 192,500

Warranty Liability 192,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

67

Brown Furniture Company decided to go after the younger market to create a newer customer base.In doing so,Ms.Brown offered a liberal credit policy and estimated she would have a 4% bad debt expense.In 2016,sales under this promotion were $600,000.Accordingly,she estimated a bad debt expense of $24,000.Her actual bad debt expenses were far less than expected,at about 2%.Her 2017 sales under the program are $800,000.How much bad debt expense should be reported on comparative income statements based on this information?

A)2016,$12,000; 2017,$16,000

B)2016,$24,000; 2017,$20,000

C)2016,$24,000; 2017,$16,000

D)2016,$24,000; 2017,$32,000

A)2016,$12,000; 2017,$16,000

B)2016,$24,000; 2017,$20,000

C)2016,$24,000; 2017,$16,000

D)2016,$24,000; 2017,$32,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

68

The State of Alabama filed suit against Edwards Chemical Company for violations of water pollution laws in 2015.During 2015,the company accrued a $250,000 loss for litigation.At the end of 2016,Edwards was able to settle with the State for $205,000.What entry should Edwards make when it pays the State in December,2016?

A) Cash 205,000

Cash 205,000

B) Cash 205,000

Cash 205,000

C) Cash 205,000

Cash 205,000

D) Cash 205,000

Cash 205,000

A)

Cash 205,000

Cash 205,000B)

Cash 205,000

Cash 205,000C)

Cash 205,000

Cash 205,000D)

Cash 205,000

Cash 205,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

69

A change in reporting entity must be treated retrospectively for all years presented in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

70

In reconciling information to complete its financial statements,Flying High Corporation discovered the following situations:

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,bad debt expense,net income before taxes,income tax expense,and net income.

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,bad debt expense,net income before taxes,income tax expense,and net income.

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,bad debt expense,net income before taxes,income tax expense,and net income.

Required: Assuming that no depreciation had been recorded,recompute depreciation expense,bad debt expense,net income before taxes,income tax expense,and net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

71

Emma's Clothes,Inc.has accounts receivable of $210,000.In the current economy,she has noticed an increase in uncollectible accounts.In 2016,her sales were $3,200,000 and in 2017,sales were $3,800,000.She has estimated in the past that 2% of sales would eventually be uncollectible.Emma believes that her losses were closer to 3% last year.What should be the bad debt expense for 2016 and 2017 in the comparative income statements for 2016 and 2017?

A)2016,$96,000; 2017,$114,000

B)2016,$64,000; 2017,$114,000

C)2016,$64,000; 2017,$146,000

D)2016,$96,000; 2017,$146,000

A)2016,$96,000; 2017,$114,000

B)2016,$64,000; 2017,$114,000

C)2016,$64,000; 2017,$146,000

D)2016,$96,000; 2017,$146,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

72

Changes in specific subsidiaries that make up the group of entities are changes in a reporting entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

73

Humphrey Contractors purchased customized equipment in January,2015 for $500,000.The manufacturer warranted the equipment for six years.Humphrey used double-declining balance depreciation with a useful life of eight years and no salvage value.After two full years,he now believes that the equipment will only last a total of five years.Compute his depreciation expense for 2017 if he switches to straight-line depreciation.

A)$62,500

B)$75,000

C)$93,750

D)$100,000

A)$62,500

B)$75,000

C)$93,750

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

74

Peoples Corporation purchased a building on December 29,2012 that cost $1,000,000 and occupied it on January 2,2013.The owner estimated that the building would last 40 years with a salvage value of $100,000 using straight-line depreciation.In early 2016,Mr.Peoples learned that due to a permanent highway closure,the company needs to relocate at the end of 2018.He believes that the salvage value at that time will be $700,000.Compute the amount of depreciation to record during 2016,and each of the two years thereafter.

A)$22,500

B)$52,500

C)$77,500

D)$100,000

A)$22,500

B)$52,500

C)$77,500

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

75

Miller Manufacturing purchased a packaging machine for $300,000 on January 2,2012.The seller assumed that the machine would be functional for at least five years with no salvage value.In 2015,Miller decided that the machine would last an additional five years with a salvage value of $20,000.The company uses straight-line depreciation for all assets.What amount of depreciation should Miller record in 2015 and following years?

A)$20,000

B)$24,000

C)$32,000

D)$60,000

A)$20,000

B)$24,000

C)$32,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

76

John Pickens writes mystery novels.His publisher pays him royalties for books sold each year.He is paid royalties for the first half of the year on September 30 and the second half of the year on March 31 of the following year.He received $42,000 in September,2016.The publisher estimated that his royalties for the second half of the year would be $53,000.On March 31,2017,he received $57,500.Assuming that he recorded $53,000 at December 31,2016,which one of the following is the correct journal entry on March 31,2017? His tax rate is 35%.

A) Royalty Revenue 4,500

Royalty Revenue 4,500

B) Royalty Revenue 57,500

Royalty Revenue 57,500

C) Retained Earnings 4,500

Retained Earnings 4,500

D) Retained Earnings 2,925

Retained Earnings 2,925

Income Taxes Payable 1,575

A)

Royalty Revenue 4,500

Royalty Revenue 4,500B)

Royalty Revenue 57,500

Royalty Revenue 57,500C)

Retained Earnings 4,500

Retained Earnings 4,500D)

Retained Earnings 2,925

Retained Earnings 2,925Income Taxes Payable 1,575

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

77

Presenting consolidated statements instead of individual financial statements is a change in a reporting entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

78

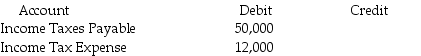

The IRS is investigating Miller Productions tax returns for 2015 and 2016.Based on the IRS audit procedures,the company accrued a $50,000 loss additional assessment in 2016 for the 2015 tax year.At the end of 2016,Miller was able to settle with IRS for $62,000.What entry should Edwards make when it pays the deficiency in December,2016?

A)

Cash 62,000

Cash 62,000

B)

Cash 62,000

Cash 62,000

C)

Cash 38,000

Cash 38,000

D)

Cash 62,000

Cash 62,000

A)

Cash 62,000

Cash 62,000 B)

Cash 62,000

Cash 62,000 C)

Cash 38,000

Cash 38,000 D)

Cash 62,000

Cash 62,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

79

Changes in reporting entities are handled prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck

80

Highland Corporation has always used declining-balance depreciation for its equipment.Beginning in 2016,the company has decided to use straight-line depreciation for all new equipment purchases.How should the company report this decision? Describe any journal entries and disclosures that need to be made for this change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 395 في هذه المجموعة.

فتح الحزمة

k this deck