Deck 21: Statement of Cash Flows Revisited

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/68

العب

ملء الشاشة (f)

Deck 21: Statement of Cash Flows Revisited

1

On a statement of cash flows prepared using the direct method,cash paid for income taxes would be income tax expense minus

A)an increase in income taxes payable.

B)a decrease in income taxes payable.

C)beginning income taxes payable.

D)ending income taxes payable.

A)an increase in income taxes payable.

B)a decrease in income taxes payable.

C)beginning income taxes payable.

D)ending income taxes payable.

A

2

In the preparation of a statement of cash flows,adjustments to net income to reconcile net income to cash from operating activities include

A)amortization of organization cost.

B)the difference between the purchase price and the resale price of treasury stock (assuming the cost method of accounting for treasury stock).

C)dividends received.

D)redemption premium on preferred stock redeemed during the period.

A)amortization of organization cost.

B)the difference between the purchase price and the resale price of treasury stock (assuming the cost method of accounting for treasury stock).

C)dividends received.

D)redemption premium on preferred stock redeemed during the period.

A

3

Which of the following is a non-cash transaction that should be disclosed in a schedule accompanying the statement of cash flows?

A)Sale of an investment for cash

B)Purchase of a machine for cash

C)Issuance of common stock in exchange for land

D)Declaration and payment of a cash dividend on common stock

A)Sale of an investment for cash

B)Purchase of a machine for cash

C)Issuance of common stock in exchange for land

D)Declaration and payment of a cash dividend on common stock

C

4

Which of the following investments should be classified as cash equivalents for Lastima Company in preparing the statement of cash flows?

1

Shares of stock in Lastima Company.

2

A one-month Treasury note purchased by Lastima Company when only

3 months remained in the note's term.

3

Share in a money market fund purchased by Lastima Company; the fund

Purchases only investment grade corporate debt instruments with

Maturities of 2 months or less.

4

A one-year treasury note purchased by Lastima Company when the

Treasury note was issued,which now has only 2 months

Remaining in its term.

A)2, 3

B)2, 4

C)2, 3, 4

D)1, 2, 3, 4

1

Shares of stock in Lastima Company.

2

A one-month Treasury note purchased by Lastima Company when only

3 months remained in the note's term.

3

Share in a money market fund purchased by Lastima Company; the fund

Purchases only investment grade corporate debt instruments with

Maturities of 2 months or less.

4

A one-year treasury note purchased by Lastima Company when the

Treasury note was issued,which now has only 2 months

Remaining in its term.

A)2, 3

B)2, 4

C)2, 3, 4

D)1, 2, 3, 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

5

Proceeds from the sale of investments in common stock accounted for by the equity method would be classified into which of the following sections of the statement of cash flows?

A)Operating

B)Investing

C)Financing

D)Non-cash item

A)Operating

B)Investing

C)Financing

D)Non-cash item

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

6

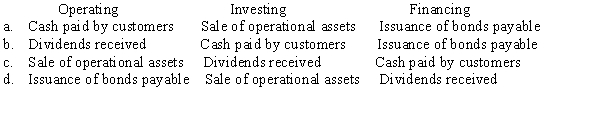

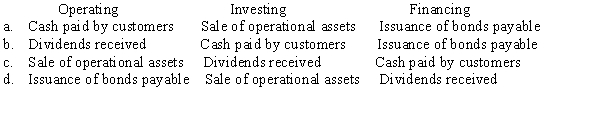

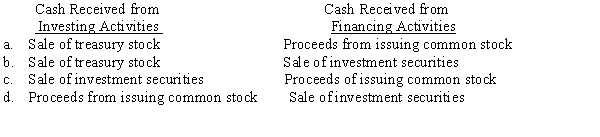

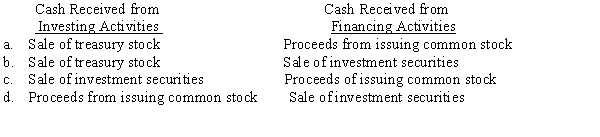

Choose the combination that best reflects the appropriate classification of cash received from operating,investing and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following items involving current trade accounts receivable is most likely to appear in a statement of cash flows?

A)The balance in the allowance for doubtful accounts

B)The change in net sales

C)Sales returns and allowances

D)Collection of an account previously written off

A)The balance in the allowance for doubtful accounts

B)The change in net sales

C)Sales returns and allowances

D)Collection of an account previously written off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following transactions would not be reported on the statement of cash flows?

A)Purchase of treasury stock

B)Declaration of a cash dividend which has not yet been paid

C)Patent amortization

D)Purchase of an operational asset by issuing common stock

A)Purchase of treasury stock

B)Declaration of a cash dividend which has not yet been paid

C)Patent amortization

D)Purchase of an operational asset by issuing common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

9

A change in unearned revenue would be classified into which of the following categories for purposes of disclosure in the statement of cash flows?

A)Operating cash flow

B)Investing cash flow

C)Financing cash flow

D)As an item reconciling earnings and operating cash flow

A)Operating cash flow

B)Investing cash flow

C)Financing cash flow

D)As an item reconciling earnings and operating cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following causes a change in the amount of cash held by a company?

A)Write-off of a bad debt

B)Declaration of a cash dividend

C)Payment of a cash dividend declared in a previous period

D)Declaration and issuance of a stock dividend

A)Write-off of a bad debt

B)Declaration of a cash dividend

C)Payment of a cash dividend declared in a previous period

D)Declaration and issuance of a stock dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

11

A gain on the sale of a plant assets should be included in which of the following sections of a statement of cash flows prepared using the indirect method?

A)Investing activities

B)Operating activities

C)Financing activities

D)Non-cash investing and financing activities

A)Investing activities

B)Operating activities

C)Financing activities

D)Non-cash investing and financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would be reported in the operating,investing,or financing sections of the statement of cash flows prepared under the indirect method?

A)Declaration of an unpaid cash dividend

B)Acquisition of a factory warehouse by issuing long-term debt

C)Gain on the sale of cash equivalents

D)Write-off of an uncollectible account receivable

A)Declaration of an unpaid cash dividend

B)Acquisition of a factory warehouse by issuing long-term debt

C)Gain on the sale of cash equivalents

D)Write-off of an uncollectible account receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

13

When preparing a reconciliation of net income to cash from operations,an increase in the ending inventory over the beginning inventory will result in an adjustment to reported net income because

A)cash is increased because inventory is a current asset.

B)inventory is an expense deducted in computing net earnings, but is not a use of cash.

C)the net increase in inventory is part of the difference between cost of goods sold and cash paid to suppliers.

D)all changes in noncash accounts must be disclosed.

A)cash is increased because inventory is a current asset.

B)inventory is an expense deducted in computing net earnings, but is not a use of cash.

C)the net increase in inventory is part of the difference between cost of goods sold and cash paid to suppliers.

D)all changes in noncash accounts must be disclosed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is NOT classified as an operating activity?

A)Interest received

B)Interest paid

C)Dividends received

D)Dividends paid

A)Interest received

B)Interest paid

C)Dividends received

D)Dividends paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

15

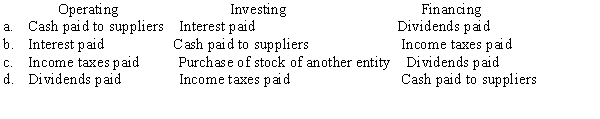

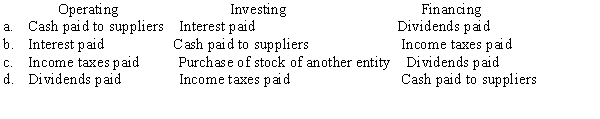

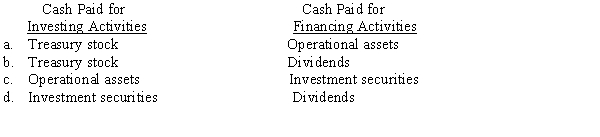

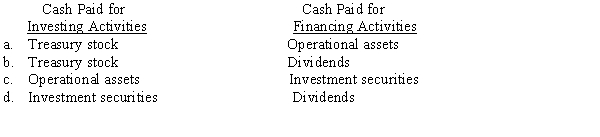

Choose the combination that best reflects the appropriate classification of cash paid for operating,investing and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following independent transactions would cause net income to be more than cash from operating activities?

A)A decrease in the accounts receivable account

B)An increase in the merchandise inventory account

C)An increase in the accounts payable account

D)An increase in the accrued wages payable account

A)A decrease in the accounts receivable account

B)An increase in the merchandise inventory account

C)An increase in the accounts payable account

D)An increase in the accrued wages payable account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

17

Jacquin Corporation reports its income from investments under the equity method and recognized income of $15,000 from its investment in Trapper Company during the current year.Trapper declared no dividends during the current year.On Jacquin's statement of cash flows the $15,000 would

A)be shown as cash from investing activities.

B)be shown as an addition to net income in the reconciliation of net income to cash from operations.

C)be shown as a deduction from net income in the reconciliation of net income to cash from operations.

D)not be shown.

A)be shown as cash from investing activities.

B)be shown as an addition to net income in the reconciliation of net income to cash from operations.

C)be shown as a deduction from net income in the reconciliation of net income to cash from operations.

D)not be shown.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

18

Under the direct method,cash paid to suppliers can be computed as cost of goods sold for the period

A)minus a decrease in inventory and plus an increase in accounts payable.

B)plus a decrease in inventory and minus an increase in accounts payable.

C)minus an increase in inventory and plus an increase in accounts payable.

D)plus an increase in inventory and minus an increase in accounts

A)minus a decrease in inventory and plus an increase in accounts payable.

B)plus a decrease in inventory and minus an increase in accounts payable.

C)minus an increase in inventory and plus an increase in accounts payable.

D)plus an increase in inventory and minus an increase in accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is NOT required by generally accepted accounting principles?

A)Statement of cash flows

B)Earnings per share

C)Cash per share

D)Disclosure in notes to financial statements of the projected benefit obligation of a defined-benefit pension plan

A)Statement of cash flows

B)Earnings per share

C)Cash per share

D)Disclosure in notes to financial statements of the projected benefit obligation of a defined-benefit pension plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following would appear in both the operating activities section of the direct method format and the reconciliation of earnings to net operating cash flow format?

A)Sale of cash equivalents at a gain

B)Sale of cash equivalents at cost

C)Dividends received on equity method investments

D)Collection of an account receivable previously written off

A)Sale of cash equivalents at a gain

B)Sale of cash equivalents at cost

C)Dividends received on equity method investments

D)Collection of an account receivable previously written off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

21

In preparing a statement of cash flows,the reconciliation of net income to cash from operating activities does NOT include

A)loss on sale of operational assets.

B)bond discount or premium amortization for the period.

C)gain on sale of debt and equity securities classified as Trading Securities.

D)adjustment to record debt or equity securities classified as Securities Available for Sale at fair value.

A)loss on sale of operational assets.

B)bond discount or premium amortization for the period.

C)gain on sale of debt and equity securities classified as Trading Securities.

D)adjustment to record debt or equity securities classified as Securities Available for Sale at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under the direct method,which one of the following would represent cash paid?

A)Losses on sales of plant assets

B)Gains on sales of plant assets

C)Interest expense, adjusted for changes in interest payable and amortization of bond premium or discount

D)Depreciation expense, adjusted for changes in depreciation methods

A)Losses on sales of plant assets

B)Gains on sales of plant assets

C)Interest expense, adjusted for changes in interest payable and amortization of bond premium or discount

D)Depreciation expense, adjusted for changes in depreciation methods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following would NOT be a cash flow from financing activities for Carlton Company?

A)Cash from issuance of Carlton Co. common stock

B)Cash from issuance of Carlton Co. preferred stock

C)Cash from issuance of Carlton Co. bonds payable

D)Cash from sale of Fern Company common stock

A)Cash from issuance of Carlton Co. common stock

B)Cash from issuance of Carlton Co. preferred stock

C)Cash from issuance of Carlton Co. bonds payable

D)Cash from sale of Fern Company common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is not an inflow of cash?

A)Collection of a short-term receivable

B)Sale of an operational asset

C)Cash borrowed on a short-term note

D)Depletion expense

A)Collection of a short-term receivable

B)Sale of an operational asset

C)Cash borrowed on a short-term note

D)Depletion expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

25

Choose the combination that best reflects the appropriate classification of cash paid for investing and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is a deduction from net income in reconciling net income to cash flow from operating activities?

A)Amortization of bond premium

B)Cash dividend declared and paid

C)Collection of an account receivable

D)Write-off of an uncollectible account receivable

A)Amortization of bond premium

B)Cash dividend declared and paid

C)Collection of an account receivable

D)Write-off of an uncollectible account receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

27

The statement of cash flows and related disclosures would be of the least assistance in helping a potential investor assess

A)a firm's ability to generate cash.

B)a firm's ability to make good use of cash reserves to earn interest or other return.

C)a firm's ability to meet its obligations.

D)the reasons for differences between income and associated cash flows.

A)a firm's ability to generate cash.

B)a firm's ability to make good use of cash reserves to earn interest or other return.

C)a firm's ability to meet its obligations.

D)the reasons for differences between income and associated cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

28

The amortization of bond discount related to long-term debt should be presented in a statement of cash flows prepared using the indirect method as a(n)

A)addition to net income in the adjustments to reconcile net income to cash from operating activities.

B)deduction from net income in the adjustments to reconcile net income to cash from operating activities.

C)outflow of cash.

D)inflow and outflow of cash.

A)addition to net income in the adjustments to reconcile net income to cash from operating activities.

B)deduction from net income in the adjustments to reconcile net income to cash from operating activities.

C)outflow of cash.

D)inflow and outflow of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

29

On a reconciliation of net income to cash from operations,depreciation is added back to net income as depreciation

A)is a direct outflow of cash.

B)reduces net income but does not involve an outflow of cash.

C)reduces net income and involves an outflow of cash.

D)is an outflow of cash to a fund established for the replacement of assets.

A)is a direct outflow of cash.

B)reduces net income but does not involve an outflow of cash.

C)reduces net income and involves an outflow of cash.

D)is an outflow of cash to a fund established for the replacement of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cash inflows from investing activities would include all of the following except

A)interest collect on notes receivable.

B)proceeds from sale of investments accounted for by the equity method.

C)proceeds from sale of operating assets.

D)proceeds from sale of securities available for sale.

A)interest collect on notes receivable.

B)proceeds from sale of investments accounted for by the equity method.

C)proceeds from sale of operating assets.

D)proceeds from sale of securities available for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

31

Amortization of the premium on bonds payable is subtracted from net income in the reconciliation of net income to cash flows from operations because

A)interest expense understates the cash paid for interest by the amount of the premium amortization.

B)it reduces income without causing a cash outflow.

C)it increases income without causing a cash flow.

D)it is a financing cash outflow.

A)interest expense understates the cash paid for interest by the amount of the premium amortization.

B)it reduces income without causing a cash outflow.

C)it increases income without causing a cash flow.

D)it is a financing cash outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

32

Cash outflows from investing activities would include payments for all of the following except

A)operational assets.

B)investments in securities-available-for-sale.

C)purchase of treasury stock.

D)loans to customers.

A)operational assets.

B)investments in securities-available-for-sale.

C)purchase of treasury stock.

D)loans to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

33

On a statement of cash flows prepared using the direct method,cash from customers would be sales plus a(n)

A)decrease in accounts payable.

B)increase in accounts payable.

C)decrease in accounts receivable.

D)increase in accounts receivable.

A)decrease in accounts payable.

B)increase in accounts payable.

C)decrease in accounts receivable.

D)increase in accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

34

A loss on the sale of machinery in the ordinary course of business should be presented in a statement of cash flows prepared under the indirect method as a(n)

A)inflow from operating activities.

B)inflow from investing activities.

C)adjustment to reconcile net income to cash from operating activities.

D)outflow from investing activities.

A)inflow from operating activities.

B)inflow from investing activities.

C)adjustment to reconcile net income to cash from operating activities.

D)outflow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is NOT an adjustment to reconcile net income to cash from operating activities?

A)Increase or decrease in an accrued liability

B)Amortization of premium or discount on bonds payable

C)Cash dividend declared but not yet paid

D)Increase or decrease in a prepaid expense

A)Increase or decrease in an accrued liability

B)Amortization of premium or discount on bonds payable

C)Cash dividend declared but not yet paid

D)Increase or decrease in a prepaid expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company with substantial operating profits prepares its statement of cash flows using the indirect method.The gain on the sale of a long-term investment should be disclosed separately as a(n)

A)inflow from operating activities.

B)adjustment to net income in the reconciliation of net income to cash from operating activities.

C)inflow from investing activities.

D)outflow from investing activities.

A)inflow from operating activities.

B)adjustment to net income in the reconciliation of net income to cash from operating activities.

C)inflow from investing activities.

D)outflow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

37

Choose the combination below that best reflects the appropriate classification of cash received from investing and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is NOT added to net income as an adjustment to reconcile net income to cash from operating activities on the statement of cash flows?

A)Increase in an accrued liability

B)Amortization of discount on bond payable

C)Loss on sale of operational asset

D)Increase in deferred tax asset

A)Increase in an accrued liability

B)Amortization of discount on bond payable

C)Loss on sale of operational asset

D)Increase in deferred tax asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

39

The amortization of patents should be presented in a statement of cash flows prepared using the indirect method as a(n)

A)inflow and outflow of cash.

B)outflow of cash.

C)addition to net income in the adjustments to reconcile net income to cash from operating activities.

D)deduction from net income in the adjustments to reconcile net income to cash from operating activities.

A)inflow and outflow of cash.

B)outflow of cash.

C)addition to net income in the adjustments to reconcile net income to cash from operating activities.

D)deduction from net income in the adjustments to reconcile net income to cash from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following would be a cash outflow from operating activities for Poe Company?

A)Cash paid for dividends on Poe Co. common stock

B)Cash paid for treasury stock

C)Cash paid for the purchase of an investment in securities of Raven Company classified as trading securities

D)Cash paid for dividends on Poe Co. preferred stock

A)Cash paid for dividends on Poe Co. common stock

B)Cash paid for treasury stock

C)Cash paid for the purchase of an investment in securities of Raven Company classified as trading securities

D)Cash paid for dividends on Poe Co. preferred stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following items is included on a statement of cash flows as a noncash exchange?

A)Depreciation

B)Issuance (sale) of common stock

C)Purchase of treasury stock

D)Retirement of long-term debt by issuance of preferred stock

A)Depreciation

B)Issuance (sale) of common stock

C)Purchase of treasury stock

D)Retirement of long-term debt by issuance of preferred stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

42

How should the sale of $3,000 worth of cash equivalents costing $2,500 be reflected on the statement of cash flows prepared under the indirect method?

A)$500 operating cash inflow

B)No disclosure

C)$500 operating cash outflow

D)$500 subtraction in the reconciliation of earnings to net operating cash flow

A)$500 operating cash inflow

B)No disclosure

C)$500 operating cash outflow

D)$500 subtraction in the reconciliation of earnings to net operating cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

43

Aboard Company began the current year with the following:

During the current year,the following events occurred:

At the end of the current year,Aboard showed a balance in gross accounts receivable (before the allowance for doubtful accounts)of $16,800.

What amount would be shown as an operating cash inflow in the statement of cash flows under the indirect method?

A)$21,000

B)$22,000

C)$30,000

D)$28,200

During the current year,the following events occurred:

At the end of the current year,Aboard showed a balance in gross accounts receivable (before the allowance for doubtful accounts)of $16,800.

What amount would be shown as an operating cash inflow in the statement of cash flows under the indirect method?

A)$21,000

B)$22,000

C)$30,000

D)$28,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

44

At the beginning of the year,a firm leased equipment on a capital lease,capitalizing $60,000 in both its lease liability and leased assets accounts.The contract calls for December 31 payments of $15,000.The lessee's annual reporting period ends December 31 and the contract reflects 10% interest.The lessee made the first payment as required.The direct method statement of cash flows for the lessee should reflect which of the following in the first year of the lease contract (ignore noncash disclosures)?

A)$15,000 financing cash outflow

B)$15,000 operating cash outflow

C)$6,000 operating cash outflow; $9,000 financing cash outflow

D)$9,000 financing cash outflow

A)$15,000 financing cash outflow

B)$15,000 operating cash outflow

C)$6,000 operating cash outflow; $9,000 financing cash outflow

D)$9,000 financing cash outflow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

45

At the beginning of the year,a firm leased equipment on a capital lease,capitalizing $60,000 in its lease receivable account.The contract calls for December 31 payments of $15,000.The lessor's annual reporting period ends December 31 and the contract reflects 10% interest.The lessee made the first payment as required.The direct method statement of cash flows for the lessor should reflect which of the following in the first year of the lease contract (ignore noncash disclosures)?

A)$15,000 operating cash flow

B)$6,000 operating cash flow; $9,000 investing cash flow

C)$6,000 operating cash flow; $9,000 addition reconciling adjustment

D)$9,000 investing cash flow

A)$15,000 operating cash flow

B)$6,000 operating cash flow; $9,000 investing cash flow

C)$6,000 operating cash flow; $9,000 addition reconciling adjustment

D)$9,000 investing cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

46

Melville Company reported sales of $700,000,bad debt expense of $60,000,and an increase in net accounts receivable of $150,000 during the current year.What is the amount of cash collected from customers for the current year if the company did not record any write-offs during the current year?

A)$550,000

B)$590,000

C)$610,000

D)$640,000

A)$550,000

B)$590,000

C)$610,000

D)$640,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

47

The conversion of nonparticipating preferred stock into common stock should be presented in a statement of cash flows as a(n)

A)operating activity.

B)investing activity.

C)financing activity.

D)noncash exchange.

A)operating activity.

B)investing activity.

C)financing activity.

D)noncash exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

48

A company's income statement disclosed $45,000 of investment revenue on equity method investments.The company did not purchase or dispose of any such investments during the year,yet the equity method investments account increased $30,000 during the year.What is the complete disclosure of these events in the statement of cash flows prepared under the indirect method?

A)Operating cash inflow, $45,000; $30,000 subtraction in reconciliation of earnings and net operating cash flow

B)$30,000 subtraction in reconciliation of earnings and net operating cash flow

C)Operating cash inflow, $15,000; $30,000 subtraction in reconciliation of earnings and net operating cash flow

D)Operating cash inflow, $15,000

A)Operating cash inflow, $45,000; $30,000 subtraction in reconciliation of earnings and net operating cash flow

B)$30,000 subtraction in reconciliation of earnings and net operating cash flow

C)Operating cash inflow, $15,000; $30,000 subtraction in reconciliation of earnings and net operating cash flow

D)Operating cash inflow, $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is the effect of the sale of $5,000 worth of cash equivalents at cost in the statement of cash flows prepared under the direct method?

A)Add $5,000 in the reconciliation

B)$5,000 investing cash inflow

C)$5,000 operating cash inflow

D)No disclosure

A)Add $5,000 in the reconciliation

B)$5,000 investing cash inflow

C)$5,000 operating cash inflow

D)No disclosure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

50

A firm purchased $35,000 worth of investments classified as securities available for sale.At the end of the year,the investments were worth $23,000.What is the correct presentation of these events in the statement of cash flows prepared under the direct method?

A)Investing cash outflow, $35,000

B)Add $23,000 in reconciliation of earnings and net operating cash flow

C)Investing cash outflow, $35,000; subtract $12,000 in reconciliation of earnings and net operating cash flow

D)No disclosure is needed.

A)Investing cash outflow, $35,000

B)Add $23,000 in reconciliation of earnings and net operating cash flow

C)Investing cash outflow, $35,000; subtract $12,000 in reconciliation of earnings and net operating cash flow

D)No disclosure is needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

51

A company sold an investment in trading securities originally costing $30,000,for $28,000.At the beginning of the year,the investment had a valuation allowance of $3,000,debit.What is the correct disclosure for these events on the statement of cash flows prepared under the direct method,assuming that this is the only investment in trading securities?

A)$28,000 operating cash inflow; add $5,000 in the reconciliation of earnings and net operating cash flow

B)$28,000 operating cash inflow

C)$28,000 operating cash inflow; add $33,000 in the reconciliation of earnings and net operating cash flow

D)Add $5,000 in the reconciliation of earnings and net operating cash flow.

A)$28,000 operating cash inflow; add $5,000 in the reconciliation of earnings and net operating cash flow

B)$28,000 operating cash inflow

C)$28,000 operating cash inflow; add $33,000 in the reconciliation of earnings and net operating cash flow

D)Add $5,000 in the reconciliation of earnings and net operating cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

52

A firm purchased $20,000 worth of investments classified as trading securities.At the end of the year,the investments are worth $23,000.What is the correct disclosure of these events in the statement of cash flows prepared under the direct method?

A)Operating cash inflow, $3,000

B)Addition of $17,000 in reconciliation of earnings and net operating cash flow

C)Operating cash outflow, $20,000; subtract $3,000 in reconciliation of earnings and net operating cash flow

D)No disclosure is needed.

A)Operating cash inflow, $3,000

B)Addition of $17,000 in reconciliation of earnings and net operating cash flow

C)Operating cash outflow, $20,000; subtract $3,000 in reconciliation of earnings and net operating cash flow

D)No disclosure is needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following need not be disclosed in a statement of cash flows as a noncash exchange?

A)Dividend paid in capital stock of the company (stock dividend).

B)Acquisition of fixed assets in exchange for capital stock

C)Retirement of a bond issue through the issuance of another bond issue

D)Conversion of convertible debt to capital stock

A)Dividend paid in capital stock of the company (stock dividend).

B)Acquisition of fixed assets in exchange for capital stock

C)Retirement of a bond issue through the issuance of another bond issue

D)Conversion of convertible debt to capital stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

54

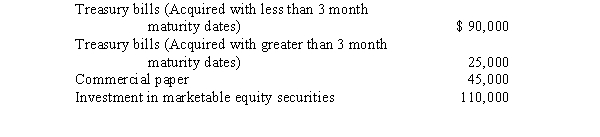

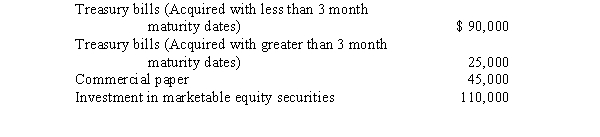

Assume Bellini Company holds the following assets at year-end and classifies as cash equivalents everything allowed by professional standards.

What would be the total cash equivalents at year-end for Bellini Company?

A)$90,000

B)$115,000

C)$135,000

D)$160,000

What would be the total cash equivalents at year-end for Bellini Company?

A)$90,000

B)$115,000

C)$135,000

D)$160,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

55

Assume cash paid to suppliers for the current year is $350,000,merchandise inventory increased by $5,000 during the year,and accounts payable decreased by $10,000 during the year.What was the cost of goods sold for the current year?

A)$335,000

B)$345,000

C)$355,000

D)$365,000

A)$335,000

B)$345,000

C)$355,000

D)$365,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

56

A firm sold an investment in securities available for sale originally costing $30,000,for $28,000.At the beginning of the year,the investment had a valuation allowance of $3,000,debit.What is the correct disclosure for these events in the statement of cash flows prepared under the direct method,assuming this is the only investment in securities available for sale?

A)$28,000 investing cash inflow; add $33,000 in the reconciliation of earnings and net operating cash flow

B)$28,000 investing cash inflow; add $2,000 in the reconciliation of earnings and net operating cash inflow

C)$28,000 investing cash inflow; add $5,000 in the reconciliation of earnings and net operating cash inflow

D)Add $5,000 in the reconciliation of earnings and net operating cash flow.

A)$28,000 investing cash inflow; add $33,000 in the reconciliation of earnings and net operating cash flow

B)$28,000 investing cash inflow; add $2,000 in the reconciliation of earnings and net operating cash inflow

C)$28,000 investing cash inflow; add $5,000 in the reconciliation of earnings and net operating cash inflow

D)Add $5,000 in the reconciliation of earnings and net operating cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

57

Assume cash paid to suppliers for 2014 is $420,000,that merchandise inventory increased by $20,000 during the year,and that cost of goods sold was $415,000 for the year.During 2014,accounts payable must have

A)increased by $5,000.

B)decreased by $5,000.

C)increased by $15,000.

D)decreased by $15,000.

A)increased by $5,000.

B)decreased by $5,000.

C)increased by $15,000.

D)decreased by $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

58

A firm's accumulated depreciation account increased $30,000 for the year and total plant assets at cost increased $200,000.During the year,the firm purchased $350,000 of new equipment for cash,and sold equipment for $50,000 cash.This equipment had been depreciated $30,000 at the time of the sale.What is the complete disclosure of these events in the statement of cash flows prepared under the direct method?

A)$300,000 investing cash outflow; $130,000 addition reconciling adjustment

B)$350,000 investing cash outflow; $50,000 investing cash inflow; $60,000 addition reconciling adjustment

C)$350,000 investing cash outflow; $50,000 investing cash inflow; $60,000 addition reconciling adjustment; $70,000 addition reconciling adjustment

D)$350,000 investing cash outflow; $50,000 investing cash inflow; $70,000 addition reconciling adjustment

A)$300,000 investing cash outflow; $130,000 addition reconciling adjustment

B)$350,000 investing cash outflow; $50,000 investing cash inflow; $60,000 addition reconciling adjustment

C)$350,000 investing cash outflow; $50,000 investing cash inflow; $60,000 addition reconciling adjustment; $70,000 addition reconciling adjustment

D)$350,000 investing cash outflow; $50,000 investing cash inflow; $70,000 addition reconciling adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

59

At the beginning of the year,a firm leased equipment on a capital lease,capitalizing $50,000 in both its lease liability and leased assets accounts.The contract calls for payments each December 31 of $10,000.The lessee's annual reporting period ends December 31 and the contract reflects 10% interest.The lessee made the first payment as required.Which of the following should be reflected on the statement of cash flows under the indirect method for the first year of the contract (ignoring noncash disclosures)?

A)$10,000 financing cash outflow

B)$10,000 operating cash outflow

C)$5,000 operating cash outflow; $5,000 financing cash outflow

D)$5,000 addition in the reconciliation of earnings and net operating cash flow

A)$10,000 financing cash outflow

B)$10,000 operating cash outflow

C)$5,000 operating cash outflow; $5,000 financing cash outflow

D)$5,000 addition in the reconciliation of earnings and net operating cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

60

If a company issues both a balance sheet and an income statement with comparative figures from last year,a statement of cash flows:

A)is no longer necessary; but may be used at the company's option.

B)should not be issued.

C)should be issued for the current year only.

D)should be issued for each period for which an income statement is presented.

A)is no longer necessary; but may be used at the company's option.

B)should not be issued.

C)should be issued for the current year only.

D)should be issued for each period for which an income statement is presented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

61

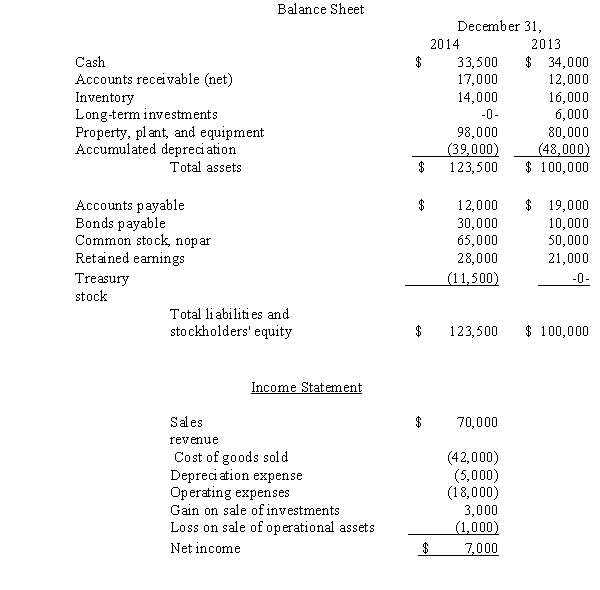

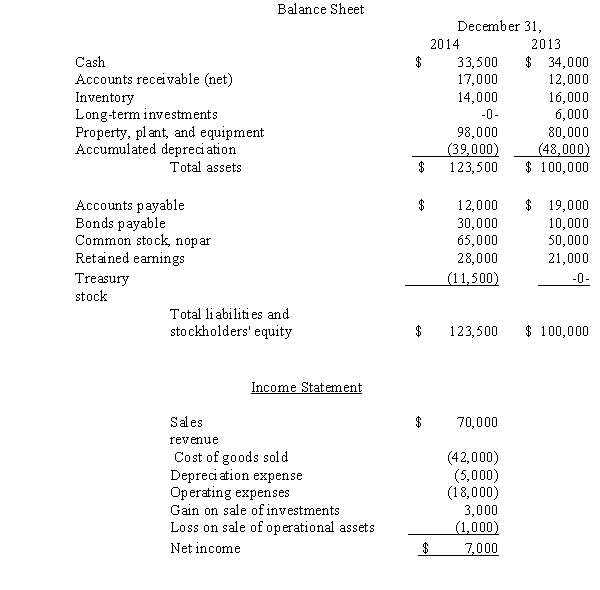

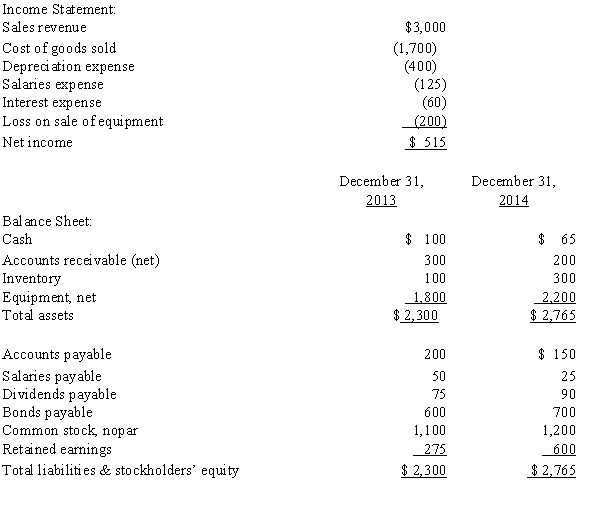

Financial information for Inverness Company at December 31,2014,and for the year then ended,are presented below:

Additional information:

1.Purchased operational assets for cash,$9,000.

2.Sold an operational asset for $6,000 cash (cost,$21,000,two-thirds depreciated).

3.Sold unissued common stock for $5,000 cash.

4.Purchased operational assets; exchanged unissued bonds of $30,000 (face value equaled market value)in payment.

5.Sold the long-term investments classified as available-for-sale for $9,000 cash; the market value of these investments had not changed since 2013.

6.Purchased treasury stock for cash,$11,500.

7.Retired bonds payable at maturity date by issuing common stock,$10,000.

Required:

Prepare the statement of cash flows using the direct method.

Additional information:

1.Purchased operational assets for cash,$9,000.

2.Sold an operational asset for $6,000 cash (cost,$21,000,two-thirds depreciated).

3.Sold unissued common stock for $5,000 cash.

4.Purchased operational assets; exchanged unissued bonds of $30,000 (face value equaled market value)in payment.

5.Sold the long-term investments classified as available-for-sale for $9,000 cash; the market value of these investments had not changed since 2013.

6.Purchased treasury stock for cash,$11,500.

7.Retired bonds payable at maturity date by issuing common stock,$10,000.

Required:

Prepare the statement of cash flows using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

62

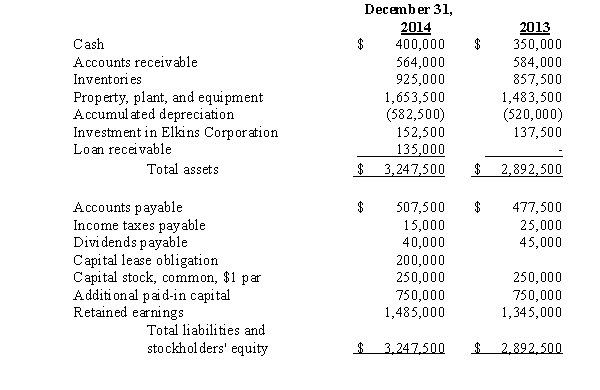

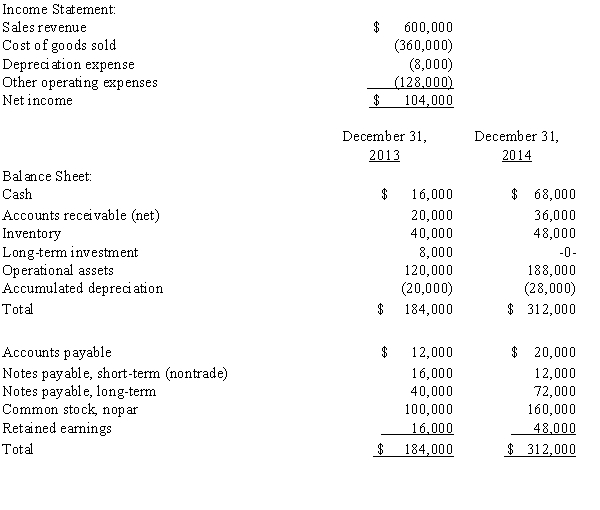

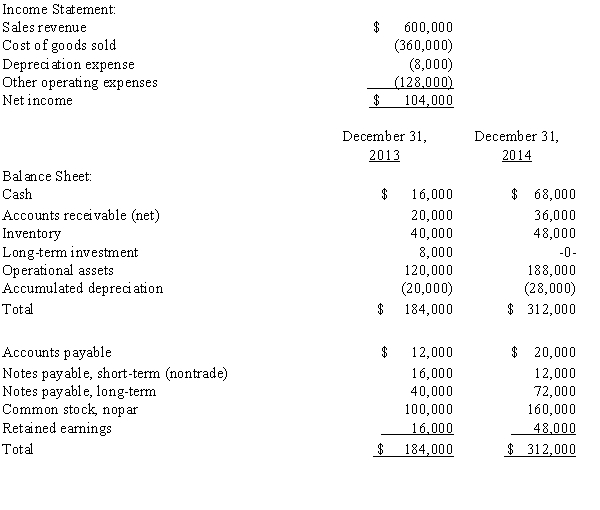

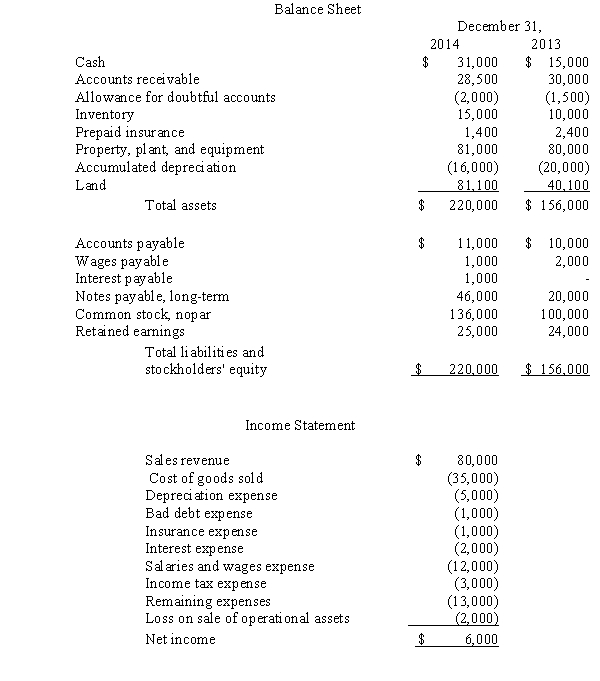

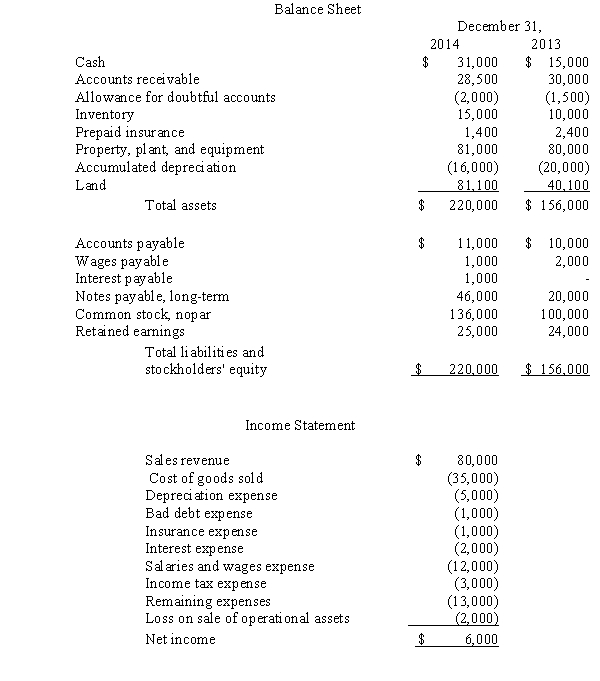

The following information for Connor Company is available at December 31,2014,and for the year then ending:

The book value of equipment sold was $300.All dividends declared were cash dividends.

Required:

Prepare a statement of cash flows for Connor Company for the year ending December 31,2014,using the direct method.

The book value of equipment sold was $300.All dividends declared were cash dividends.

Required:

Prepare a statement of cash flows for Connor Company for the year ending December 31,2014,using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

63

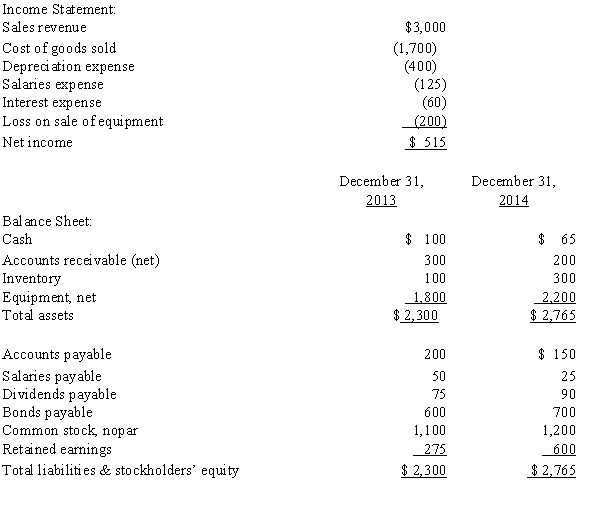

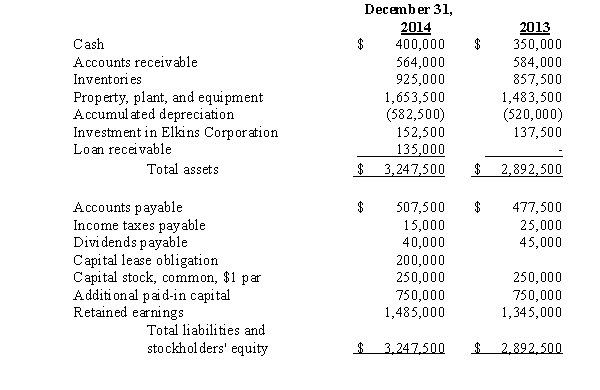

The following is Grafton Corporation's comparative balance sheets for 2014 and 2013:

Additional information:

1.On December 31,2013,Grafton acquired 25 percent of Elkins Corporation's common stock for $137,500.On that date,the carrying value of Elkins' net assets and liabilities (which approximated fair value)was $550,000.Elkins reported income of $60,000 for the year ended December 31,2014.No dividend was paid on Elkins' common stock during the year.

2.During 2014,Grafton loaned $150,000 to Beckley Company,an unrelated entity.Beckley made the first semi-annual principal payment of $15,000,plus interest at 10 percent,on October 1,2014.

3.On January 2,2014,Grafton sold equipment costing $30,000,with a carrying value of $17,500,for $20,000 cash.

4.On January 2,2014,Grafton entered into a capital lease for an office building.The present value of the annual rental payments is $200,000,which equals the fair value of the building.Grafton made the first lease payment of $30,000 when due on January 2,2015.

5.Grafton's net income for 2014 was $180,000.

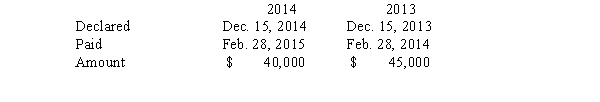

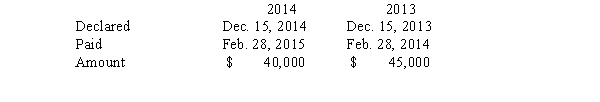

6.Grafton declared and paid cash dividends for 2014 and 2013 as follows:

Required:

Prepare a statement of cash flows for Grafton Company for 2014 using the indirect method.Include relevant supplemental schedules.

Additional information:

1.On December 31,2013,Grafton acquired 25 percent of Elkins Corporation's common stock for $137,500.On that date,the carrying value of Elkins' net assets and liabilities (which approximated fair value)was $550,000.Elkins reported income of $60,000 for the year ended December 31,2014.No dividend was paid on Elkins' common stock during the year.

2.During 2014,Grafton loaned $150,000 to Beckley Company,an unrelated entity.Beckley made the first semi-annual principal payment of $15,000,plus interest at 10 percent,on October 1,2014.

3.On January 2,2014,Grafton sold equipment costing $30,000,with a carrying value of $17,500,for $20,000 cash.

4.On January 2,2014,Grafton entered into a capital lease for an office building.The present value of the annual rental payments is $200,000,which equals the fair value of the building.Grafton made the first lease payment of $30,000 when due on January 2,2015.

5.Grafton's net income for 2014 was $180,000.

6.Grafton declared and paid cash dividends for 2014 and 2013 as follows:

Required:

Prepare a statement of cash flows for Grafton Company for 2014 using the indirect method.Include relevant supplemental schedules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

64

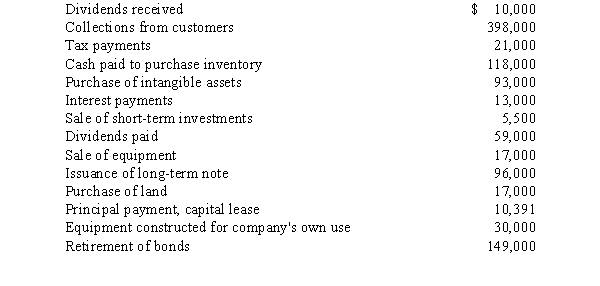

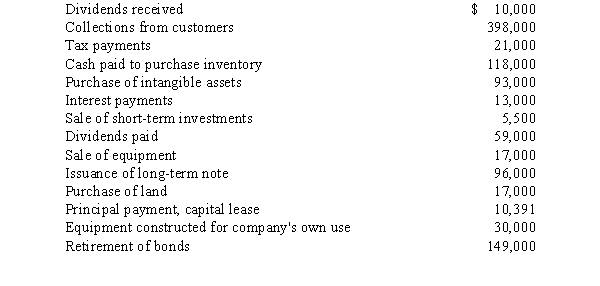

The records of Bramhall Company provided the following information for the year ended December 31,2014:

Additional Information:

1.Sold the long-term investment at cost,for cash.The securities were classified as available-for-sale.The market value had not changed since acquisition.

2.Declared and paid a cash dividend of $28,000.

3.Purchased operational assets that cost $68,000 by giving a $48,000 long-term note payable and by paying $20,000 cash.

4.Paid a $16,000 long-term note payable by issuing common stock having a market value of $16,000.

5.Issued a stock dividend of $44,000.

Required:

Prepare a statement of cash flows using the direct method for Bramhall Company for the year ending December 31,2014.

Additional Information:

1.Sold the long-term investment at cost,for cash.The securities were classified as available-for-sale.The market value had not changed since acquisition.

2.Declared and paid a cash dividend of $28,000.

3.Purchased operational assets that cost $68,000 by giving a $48,000 long-term note payable and by paying $20,000 cash.

4.Paid a $16,000 long-term note payable by issuing common stock having a market value of $16,000.

5.Issued a stock dividend of $44,000.

Required:

Prepare a statement of cash flows using the direct method for Bramhall Company for the year ending December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

65

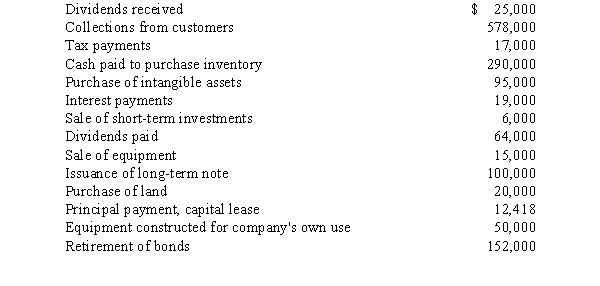

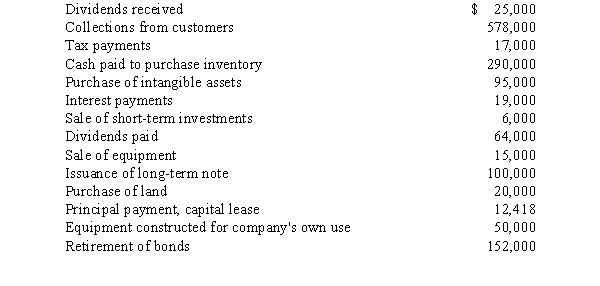

Show the U.S.Approach and the U.K.Approach to compute the cash flow from operating activities using the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

66

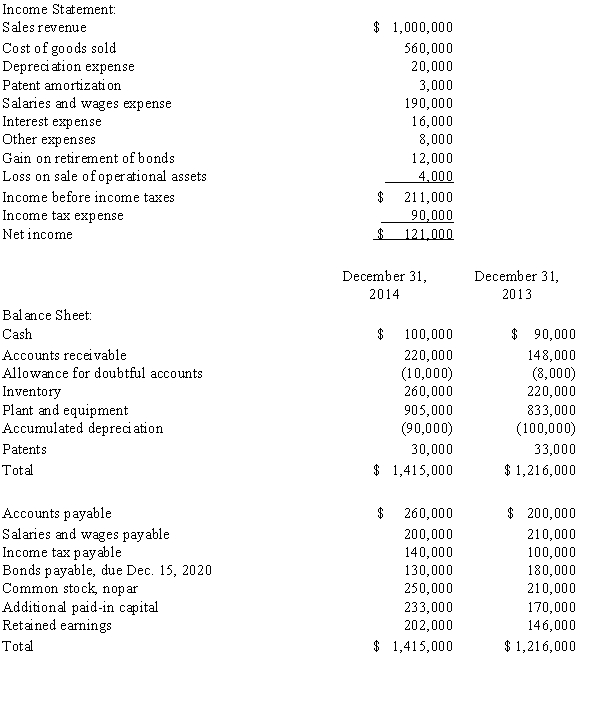

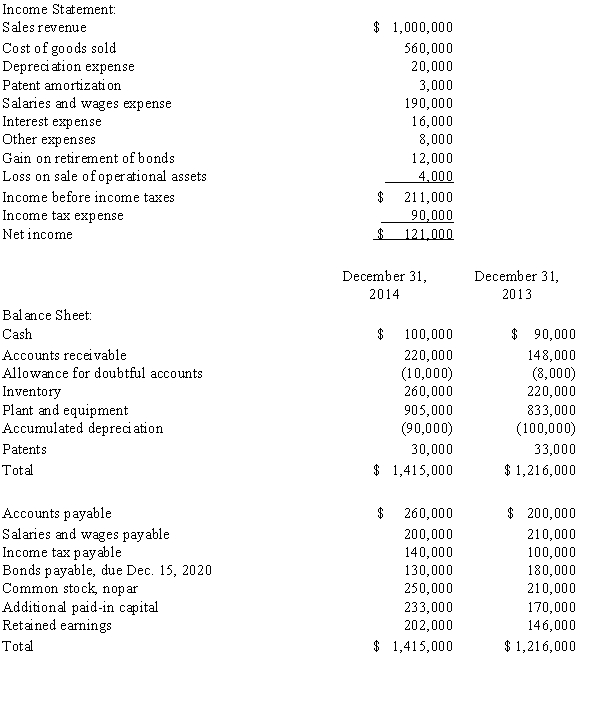

The following information for Amphora Company is available at December 31,2014,and for the year then ending:

The following information is available for specific accounts and transactions:

1.On February 2,2014,Amphora issued a 10 percent stock dividend to shareholders of record on January 15,2014.Market price per share of the common stock on February 2,2014,was $15.

2.On March 1,2014,Amphora issued 3,800 shares of common stock for land.The common stock had a current market value of approximately $40,000 on March 1,2014.

3.On April 15,2014,Amphora repurchased its long-term bonds payable with a face value of $50,000 for cash.

4.On June 30,2014,Amphora sold for $19,000 cash equipment having a book value of $23,000 and an original cost of $53,000.

5.On September 30,2014,Amphora declared and paid a 4 cent per share cash dividend to shareholders of record on August 1,2014.

6.On October 1,2014,Amphora purchased land for $85,000 cash.

Required:

Prepare a statement of cash flows for Amphora Company for the year ending December 31,2014,using the indirect method.

The following information is available for specific accounts and transactions:

1.On February 2,2014,Amphora issued a 10 percent stock dividend to shareholders of record on January 15,2014.Market price per share of the common stock on February 2,2014,was $15.

2.On March 1,2014,Amphora issued 3,800 shares of common stock for land.The common stock had a current market value of approximately $40,000 on March 1,2014.

3.On April 15,2014,Amphora repurchased its long-term bonds payable with a face value of $50,000 for cash.

4.On June 30,2014,Amphora sold for $19,000 cash equipment having a book value of $23,000 and an original cost of $53,000.

5.On September 30,2014,Amphora declared and paid a 4 cent per share cash dividend to shareholders of record on August 1,2014.

6.On October 1,2014,Amphora purchased land for $85,000 cash.

Required:

Prepare a statement of cash flows for Amphora Company for the year ending December 31,2014,using the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

67

Use the following information to compute the cash flow from operating activities under (1)the U.S.approach,and (2)the U.K.approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

68

Financial information for Princeton Company at December 31,2014,and for the year then ended,are presented below:

Additional information:

1.Wrote off $500 accounts receivable as uncollectible.

2.Sold an operational asset for $4,000 cash (cost,$15,000,accumulated depreciation,$9,000).

3.Issued common stock for $5,000 cash.

4.Declared and paid a cash dividend of $5,000.

5.Purchased land for $20,000 cash.

6.Acquired land for $21,000,and issued common stock as payment in full.

7.Acquired operational assets,cost $16,000; issued a $16,000,three-year,interest-bearing note payable.

8.Paid a $10,000 long-term note installment by issuing common stock to the creditor.

9.Borrowed cash on a long-term note,$20,000.

Required:

Prepare the statement of cash flows using the indirect method.

Additional information:

1.Wrote off $500 accounts receivable as uncollectible.

2.Sold an operational asset for $4,000 cash (cost,$15,000,accumulated depreciation,$9,000).

3.Issued common stock for $5,000 cash.

4.Declared and paid a cash dividend of $5,000.

5.Purchased land for $20,000 cash.

6.Acquired land for $21,000,and issued common stock as payment in full.

7.Acquired operational assets,cost $16,000; issued a $16,000,three-year,interest-bearing note payable.

8.Paid a $10,000 long-term note installment by issuing common stock to the creditor.

9.Borrowed cash on a long-term note,$20,000.

Required:

Prepare the statement of cash flows using the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck