Deck 2: A Review of the Accounting Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

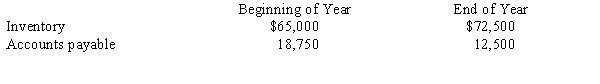

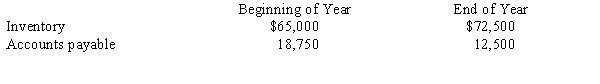

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

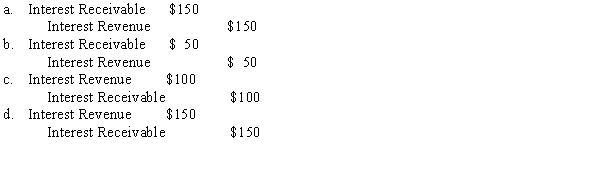

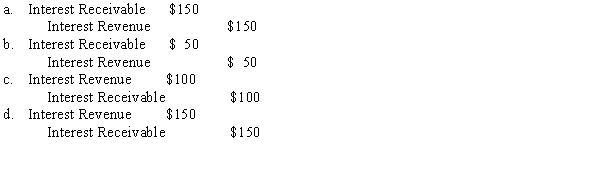

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 2: A Review of the Accounting Cycle

1

Which of the following would typically be considered a source document?

A)Chart of accounts

B)General ledger

C)General journal

D)Invoice received from seller

A)Chart of accounts

B)General ledger

C)General journal

D)Invoice received from seller

D

2

An adjusting entry will not take the format of which one of the following entries?

A)A debit to an expense account and a credit to an asset account

B)A debit to an expense account and a credit to a revenue account

C)A debit to an asset account and a credit to a revenue account

D)A debit to a liability account and a credit to a revenue account

A)A debit to an expense account and a credit to an asset account

B)A debit to an expense account and a credit to a revenue account

C)A debit to an asset account and a credit to a revenue account

D)A debit to a liability account and a credit to a revenue account

B

3

In an accrual accounting system,

A)all accounts have normal debit balances.

B)a debit entry is recorded on the left-hand side of an account.

C)liabilities, owner's capital, and dividends all have normal credit balances.

D)revenues are recorded only when cash is received.

A)all accounts have normal debit balances.

B)a debit entry is recorded on the left-hand side of an account.

C)liabilities, owner's capital, and dividends all have normal credit balances.

D)revenues are recorded only when cash is received.

B

4

The balance in a deferred revenue account represents an amount that is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

The debit and credit analysis of a transaction normally takes place when the

A)entry is posted to a subsidiary ledger.

B)entry is recorded in a journal.

C)trial balance is prepared.

D)financial statements are prepared.

A)entry is posted to a subsidiary ledger.

B)entry is recorded in a journal.

C)trial balance is prepared.

D)financial statements are prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

On June 30,a company paid $3,600 for insurance premiums for the current year and debited the amount to Prepaid Insurance.At December 31,the bookkeeper forgot to record the amount expired.The omission has the following effect on the financial statements prepared December 31:

A)overstates owners' equity.

B)overstates assets.

C)understates net income.

D)overstates both owners' equity and assets.

A)overstates owners' equity.

B)overstates assets.

C)understates net income.

D)overstates both owners' equity and assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

The premium on a two-year insurance policy expiring on June 30,2015,was paid in total on July 1,2013.The original payment was debited to the insurance expense account.The appropriate journal entry has been recorded on December 31,2013.The balance in the prepaid asset account on December 31,2013,should be

A)the same as the original payment.

B)higher than if the original payment had been initially debited to an asset account.

C)lower than if the original payment had been initially debited to an asset account.

D)the same as it would have been if the original payment had been initially debited to an asset account.

A)the same as the original payment.

B)higher than if the original payment had been initially debited to an asset account.

C)lower than if the original payment had been initially debited to an asset account.

D)the same as it would have been if the original payment had been initially debited to an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following criteria must be met before an event should be recorded for accounting purposes?

A)The event must be an arm's-length transaction.

B)The event must be repeatable in a future period.

C)The event must be measurable in financial terms.

D)The event must be disclosed in the reported footnotes.

A)The event must be an arm's-length transaction.

B)The event must be repeatable in a future period.

C)The event must be measurable in financial terms.

D)The event must be disclosed in the reported footnotes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

A trial balance is useful because it indicates that

A)owners' equity is correct.

B)net income is correct.

C)all entries were made correctly.

D)total debits equal total credits.

A)owners' equity is correct.

B)net income is correct.

C)all entries were made correctly.

D)total debits equal total credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

A routine collection on a customer's account was recorded and posted as a debit to Cash and a credit to Sales Revenue.The journal entry to correct this error would be

A)a debit to Sales Revenue and a credit to Accounts Receivable.

B)a debit to Sales Revenue and a credit to Unearned Revenue.

C)a debit to Cash and a credit to Accounts Receivable.

D)a debit to Accounts Receivable and a credit to Sales Revenue.

A)a debit to Sales Revenue and a credit to Accounts Receivable.

B)a debit to Sales Revenue and a credit to Unearned Revenue.

C)a debit to Cash and a credit to Accounts Receivable.

D)a debit to Accounts Receivable and a credit to Sales Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

The last step in the accounting cycle is to

A)prepare a post-closing trial balance.

B)journalize and post closing entries.

C)prepare financial statements.

D)journalize and post adjusting entries.

A)prepare a post-closing trial balance.

B)journalize and post closing entries.

C)prepare financial statements.

D)journalize and post adjusting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

A chart of accounts is a

A)subsidiary ledger.

B)listing of all account titles.

C)general ledger.

D)general journal.

A)subsidiary ledger.

B)listing of all account titles.

C)general ledger.

D)general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is an item that is reportable in the financial records of an enterprise?

A)The value of goodwill earned through business operations

B)The value of human resources

C)Changes in personnel

D)Changes in inventory costing methods

A)The value of goodwill earned through business operations

B)The value of human resources

C)Changes in personnel

D)Changes in inventory costing methods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

Failure to record the expired amount of prepaid rent expense would not

A)understate expense.

B)overstate net income.

C)overstate owners' equity.

D)understate liabilities.

A)understate expense.

B)overstate net income.

C)overstate owners' equity.

D)understate liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following errors will be detected when a trial balance is properly prepared?

A)An amount that was entered in the wrong account

B)A transaction that was entered twice

C)A transaction that had been omitted

D)None of these

A)An amount that was entered in the wrong account

B)A transaction that was entered twice

C)A transaction that had been omitted

D)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

If an inventory account is understated at year end,the effect will be to overstate the

A)net purchases.

B)gross margin.

C)cost of goods available for sale.

D)cost of goods sold.

A)net purchases.

B)gross margin.

C)cost of goods available for sale.

D)cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

An accrued expense can be described as an amount

A)paid and matched with earnings for the current period.

B)paid and not matched with earnings for the current period.

C)not paid and not matched with earnings for the current period.

D)not paid and matched with earnings for the current period.

A)paid and matched with earnings for the current period.

B)paid and not matched with earnings for the current period.

C)not paid and not matched with earnings for the current period.

D)not paid and matched with earnings for the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not among the first five steps in the accounting cycle?

A)Record transactions in journals.

B)Record closing entries.

C)Adjust the general ledger accounts.

D)Post entries to general ledger accounts.

A)Record transactions in journals.

B)Record closing entries.

C)Adjust the general ledger accounts.

D)Post entries to general ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

A common business transaction that would not affect the amount of owners' equity is

A)signing a note payable to purchase equipment.

B)payment of property taxes.

C)billing of customers for services rendered.

D)payment of dividends.

A)signing a note payable to purchase equipment.

B)payment of property taxes.

C)billing of customers for services rendered.

D)payment of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

Adjusting entries normally involve

A)real accounts only.

B)nominal accounts only.

C)real and nominal accounts.

D)liability accounts only.

A)real accounts only.

B)nominal accounts only.

C)real and nominal accounts.

D)liability accounts only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

Sky Corporation's salaries expense for 2012 was $136,000.Accrued salaries payable on December 31,2013,was $17,800 and $8,400 on December 31,2012.The cash paid for salaries during 2013 was

A)$126,600.

B)$127,600.

C)$145,400.

D)$153,800.

A)$126,600.

B)$127,600.

C)$145,400.

D)$153,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

For a given year,beginning and ending total liabilities were $8,400 and $10,000,respectively.At year-end,owners' equity was $26,000 and total assets were $2,000 larger than at the beginning of the year.If new capital stock issued exceeded dividends by $2,400,net income (loss)for the year was apparently

A)($2,800).

B)($2,000).

C)$400.

D)$2,800.

A)($2,800).

B)($2,000).

C)$400.

D)$2,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

On March 1,2012,Forest Co.borrowed cash and signed a 36-month,interest-bearing note on which both the principal and interest are payable on February 28,2015.At December 31,2014,the liability for accrued interest should be

A)10 months' interest.

B)22 months' interest.

C)34 months' interest.

D)36 months' interest.

A)10 months' interest.

B)22 months' interest.

C)34 months' interest.

D)36 months' interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

Failure to record depreciation expense at the end of an accounting period results in

A)understated income.

B)understated assets.

C)overstated expenses.

D)overstated assets.

A)understated income.

B)understated assets.

C)overstated expenses.

D)overstated assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

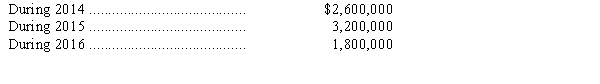

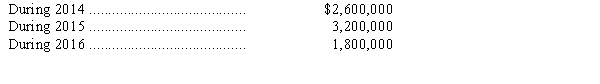

Winston Company sells magazine subscriptions for one- to three-year subscription periods.Cash receipts from subscribers are credited to Magazine Subscriptions Collected in Advance,and this account had a balance of $9,600,000 at December 31,2013,before year-end adjustment.Outstanding subscriptions at December 31,2013,expire as follows:

In its December 31,2013,balance sheet,what amount should Winston report as the balance for magazine subscriptions collected in advance?

A)$2,000,000

B)$3,800,000

C)$7,600,000

D)$9,600,000

In its December 31,2013,balance sheet,what amount should Winston report as the balance for magazine subscriptions collected in advance?

A)$2,000,000

B)$3,800,000

C)$7,600,000

D)$9,600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

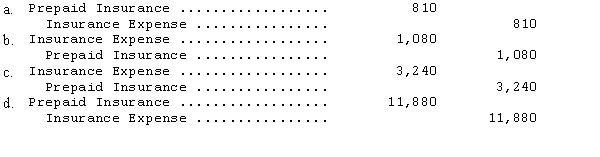

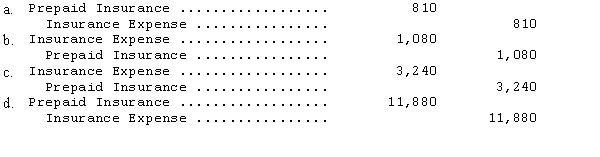

Arid Company paid $1,704 on June 1,2013,for a two-year insurance policy and recorded the entire amount as Insurance Expense.The December 31,2013,adjusting entry is

A)debit Prepaid Insurance and credit Insurance Expense, $497.

B)debit Insurance Expense and credit Prepaid Insurance, $497.

C)debit Insurance Expense and credit Prepaid Insurance, $1,207.

D)debit Prepaid Insurance and credit Insurance Expense, $1,207.

A)debit Prepaid Insurance and credit Insurance Expense, $497.

B)debit Insurance Expense and credit Prepaid Insurance, $497.

C)debit Insurance Expense and credit Prepaid Insurance, $1,207.

D)debit Prepaid Insurance and credit Insurance Expense, $1,207.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

In November and December 2013,Bee Company,a newly organized newspaper publisher,received $72,000 for 1,000 three-year subscriptions at $24 per year,starting with the January 2,2014,issue of the newspaper.How much should Bee report in its 2013 income statement for subscription revenue?

A)$0

B)$12,000

C)$24,000

D)$72,000

A)$0

B)$12,000

C)$24,000

D)$72,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Supplies on Hand account balance at the beginning of the period was $6,600.Supplies totaling $12,825 were purchased during the period and debited to Supplies on Hand.A physical count shows $3,825 of Supplies on Hand at the end of the period.The proper journal entry at the end of the period

A)debits Supplies on Hand and credits Supplies Expense for $9,000.

B)debits Supplies Expense and credits Supplies on Hand for $12,825.

C)debits Supplies on Hand and credits Supplies Expense for $15,600.

D)debits Supplies Expense and credits Supplies on Hand for $15,600.

A)debits Supplies on Hand and credits Supplies Expense for $9,000.

B)debits Supplies Expense and credits Supplies on Hand for $12,825.

C)debits Supplies on Hand and credits Supplies Expense for $15,600.

D)debits Supplies Expense and credits Supplies on Hand for $15,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

The following errors were made in preparing a trial balance: the $1,350 balance of Inventory was omitted; the $450 balance of Prepaid Insurance was listed as a credit; and the $300 balance of Salaries Expense was listed as Utilities Expense.The debit and credit totals of the trial balance would differ by

A)$1,350.

B)$1,800.

C)$2,100.

D)$2,250.

A)$1,350.

B)$1,800.

C)$2,100.

D)$2,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

On December 31 of the current year,Holmgren Company's bookkeeper made an entry debiting Supplies Expense and crediting Supplies on Hand for $12,600.The Supplies on Hand account had a $15,300 debit balance on January 1.The December 31 balance sheet showed Supplies on Hand of $11,400.Only one purchase of supplies was made during the month,on account.The entry for that purchase was

A)debit Supplies on Hand, $8,700 and credit Cash, $8,700.

B)debit Supplies Expense, $8,700 and credit Accounts Payable, $8,700.

C)debit Supplies on Hand, $8,700 and credit Accounts Payable, $8,700.

D)debit Supplies on Hand, $16,500 and credit Accounts Payable, $16,500.

A)debit Supplies on Hand, $8,700 and credit Cash, $8,700.

B)debit Supplies Expense, $8,700 and credit Accounts Payable, $8,700.

C)debit Supplies on Hand, $8,700 and credit Accounts Payable, $8,700.

D)debit Supplies on Hand, $16,500 and credit Accounts Payable, $16,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

If an expense has been incurred but not yet recorded,then the end-of-period adjusting entry would involve

A)a liability account and an asset account.

B)a liability account and a revenue account.

C)a liability and an expense account.

D)a receivable account and a revenue account.

A)a liability account and an asset account.

B)a liability account and a revenue account.

C)a liability and an expense account.

D)a receivable account and a revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

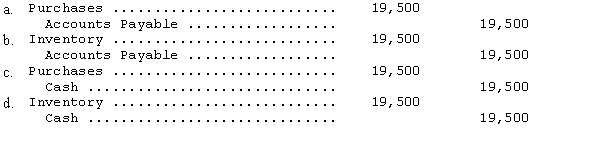

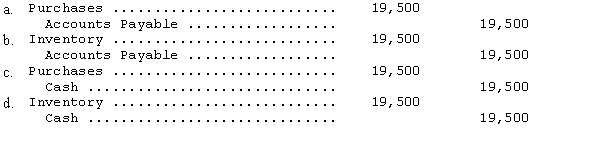

32

Iowa Cattle Company uses a perpetual inventory system.Iowa purchased cattle from Big D Ranch at a cost of $19,500,payable at time of delivery.The entry to record the delivery would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is presented in a balance sheet?

A)Prepaid expenses

B)Revenues

C)Net income

D)Gains

A)Prepaid expenses

B)Revenues

C)Net income

D)Gains

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

Crescent Corporation's interest revenue for 2013 was $13,100.Accrued interest receivable on December 31,2013,was $2,275 and $1,875 on December 31,2012.The cash received for interest during 2013 was

A)$1,350.

B)$10,825.

C)$12,700.

D)$13,100.

A)$1,350.

B)$10,825.

C)$12,700.

D)$13,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

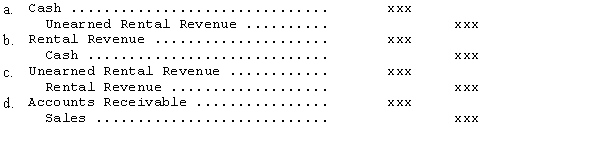

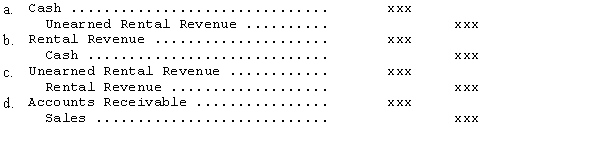

An example of an adjusting entry involving a deferred revenue is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

Beginning and ending Accounts Receivable balances were $28,000 and $24,000,respectively.If collections from clients during the period were $80,000,then total services rendered on account were apparently

A)$76,000.

B)$84,000.

C)$104,000.

D)$108,000.

A)$76,000.

B)$84,000.

C)$104,000.

D)$108,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

Moon Company purchased equipment on November 1,2013,by giving its supplier a 12-month,9 percent note with a face value of $48,000.The December 31,2013,adjusting entry is

A)debit Interest Expense and credit Cash, $720.

B)debit Interest Expense and credit Interest Payable, $720.

C)debit Interest Expense and credit Interest Payable, $1,080.

D)debit Interest Expense and credit Interest Payable, $4,320.

A)debit Interest Expense and credit Cash, $720.

B)debit Interest Expense and credit Interest Payable, $720.

C)debit Interest Expense and credit Interest Payable, $1,080.

D)debit Interest Expense and credit Interest Payable, $4,320.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

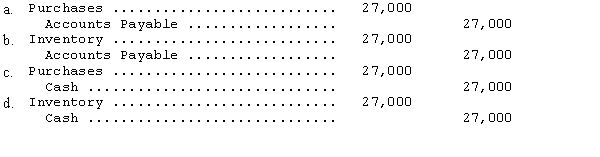

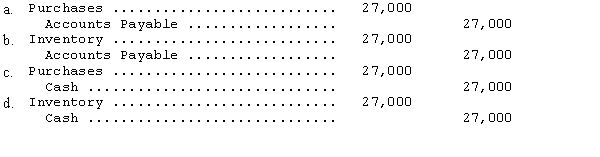

Iowa Cattle Company uses a periodic inventory system.Iowa purchased cattle from Big D Ranch at a cost of $27,000 on credit.The entry to record the receipt of the cattle would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

The allowance for doubtful accounts is an example of a(n)

A)expense account.

B)contra account.

C)adjunct account.

D)control account.

A)expense account.

B)contra account.

C)adjunct account.

D)control account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is not presented in an income statement?

A)Revenues

B)Expenses

C)Net income

D)Dividends

A)Revenues

B)Expenses

C)Net income

D)Dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

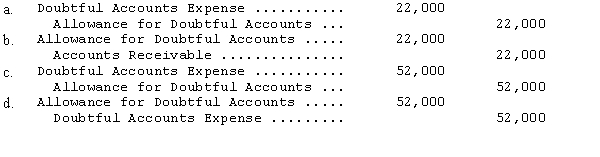

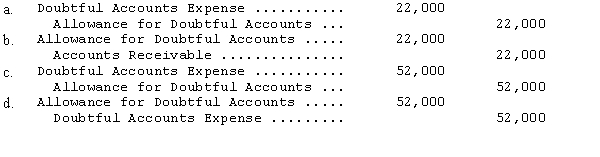

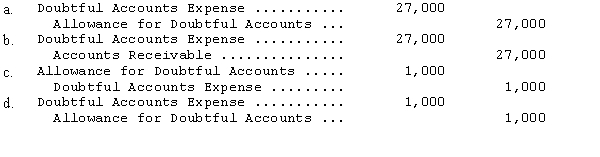

Teller Inc.reported an allowance for doubtful accounts of $30,000 (credit)at December 31,2013,before performing an aging of accounts receivable.As a result of the aging,Teller Inc.determined that an estimated $52,000 of the December 31,2013,accounts receivable would prove uncollectible.The adjusting entry required at December 31,2013,would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

The work sheet of PSI Company shows Income Tax Expense of $9,000 and Income Tax Payable of $9,000 in the Adjustments columns.What will be the ultimate disposition of these items on the work sheet?

A)Income Tax Expense will appear as a debit of $9,000 and Income Tax Payable as credit in the Balance Sheet columns.

B)Income Tax Expense will appear as a debit of $9,000 and Income Tax Payable as credit in the Income Statement columns.

C)Income Tax Expense will appear as a debit of $9,000 in the Balance Sheet columns and Income Tax Payable as credit in the Income Statement columns.

D)Income Tax Expense will appear as a debit of $9,000 in the Income Statement columns and Income Tax Payable as credit in the Balance Sheet columns.

A)Income Tax Expense will appear as a debit of $9,000 and Income Tax Payable as credit in the Balance Sheet columns.

B)Income Tax Expense will appear as a debit of $9,000 and Income Tax Payable as credit in the Income Statement columns.

C)Income Tax Expense will appear as a debit of $9,000 in the Balance Sheet columns and Income Tax Payable as credit in the Income Statement columns.

D)Income Tax Expense will appear as a debit of $9,000 in the Income Statement columns and Income Tax Payable as credit in the Balance Sheet columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

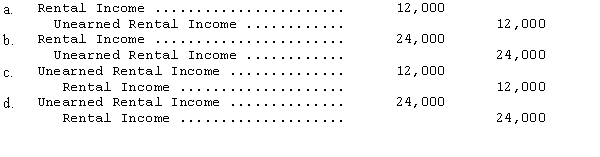

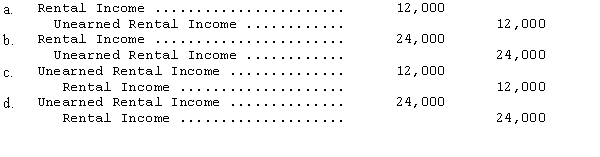

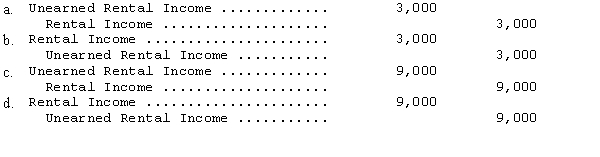

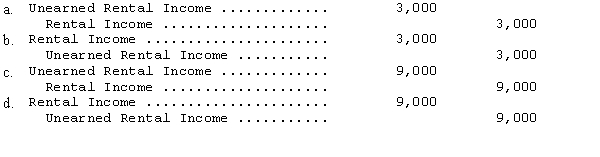

Thompson Company sublet a portion of its office space for ten years at an annual rental of $36,000,beginning on May 1.The tenant is required to pay one year's rent in advance,which Thompson recorded as a credit to Rental Income.Thompson reports on a calendar-year basis.The adjustment on December 31 of the first year should be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

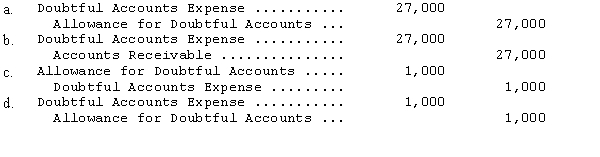

Scott Co.reported an allowance for doubtful accounts of $28,000 (credit)at December 31,2013,before performing an aging of accounts receivable.As a result of the aging,Scott determined that an estimated $27,000 of the December 31,2013,accounts receivable would prove uncollectible.The adjusting entry required at December 31,2013,would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

The basic financial statements are listed below:

(1)Balance sheet

(2)Statement of retained earnings

(3)Income statement

(4)Statement of cash flows

In which of the following sequences does the accountant ordinarily prepare the statements?

A)1, 4, 3, 2

B)2, 1, 3, 4

C)3, 2, 1, 4

D)3, 2, 4, 1

(1)Balance sheet

(2)Statement of retained earnings

(3)Income statement

(4)Statement of cash flows

In which of the following sequences does the accountant ordinarily prepare the statements?

A)1, 4, 3, 2

B)2, 1, 3, 4

C)3, 2, 1, 4

D)3, 2, 4, 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

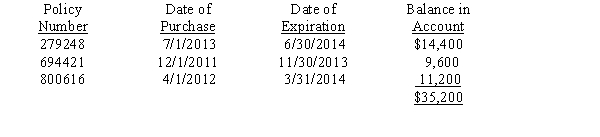

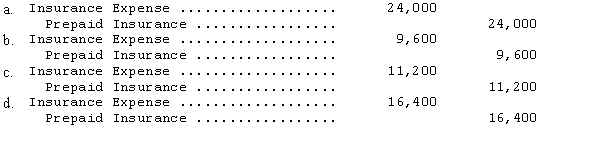

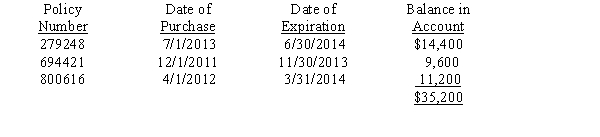

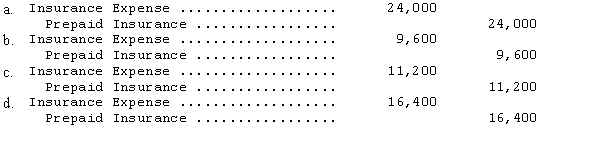

Bannister Inc.'s fiscal year ended on November 30,2013.The accounts had not been adjusted for the fiscal year ending November 30,2013.The balance in the prepaid insurance account as of November 30,2013,was $35,200 (before adjustment at Nov.30,2013)and consisted of the following policies:

The adjusting entry required on November 30,2013,would be

The adjusting entry required on November 30,2013,would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following regarding accrual versus cash-basis accounting is true?

A)The FASB believes that the cash basis is appropriate for some smaller companies, especially those in the service industry.

B)The cash basis is less useful in predicting the timing and amounts of future cash flows of an enterprise.

C)Application of the cash basis results in an income statement reporting only revenues.

D)The cash basis requires a complete set of double-entry records.

A)The FASB believes that the cash basis is appropriate for some smaller companies, especially those in the service industry.

B)The cash basis is less useful in predicting the timing and amounts of future cash flows of an enterprise.

C)Application of the cash basis results in an income statement reporting only revenues.

D)The cash basis requires a complete set of double-entry records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

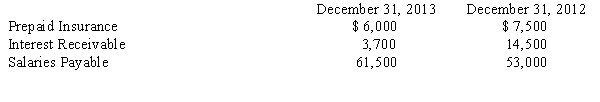

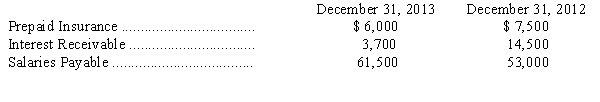

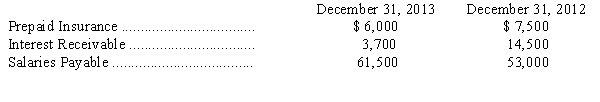

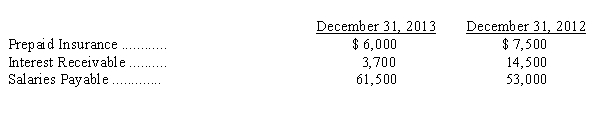

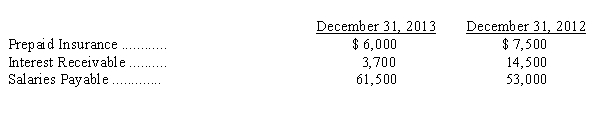

The following balances have been excerpted from Edwards' balance sheets:

Edwards Company paid or collected during 2013 the following items:

The insurance expense on the income statement for 2013 was

A)$28,000.

B)$40,000.

C)$43,000.

D)$55,000.

Edwards Company paid or collected during 2013 the following items:

The insurance expense on the income statement for 2013 was

A)$28,000.

B)$40,000.

C)$43,000.

D)$55,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

On September 1,2012,Star Corp.issued a note payable to Federal Bank in the amount of $450,000.The note had an interest rate of 12 percent and called for three equal annual principal payments of $150,000.The first payment for interest and principal was made on September 1,2013.At December 31,2013,Star should record accrued interest payable of

A)$11,000.

B)$12,000.

C)$16,500.

D)$18,000.

A)$11,000.

B)$12,000.

C)$16,500.

D)$18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

The use of computers in processing accounting data

A)eliminates the need for accountants.

B)eliminates the double entry system as a basis for analyzing transactions.

C)eliminates the need for financial reporting standards such as those promulgated by the FASB.

D)may result in the elimination of document trails used to verify accounting records.

A)eliminates the need for accountants.

B)eliminates the double entry system as a basis for analyzing transactions.

C)eliminates the need for financial reporting standards such as those promulgated by the FASB.

D)may result in the elimination of document trails used to verify accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

Chips-n-Bits Company sells service contracts for personal computers.The service contracts are for a one-year,two-year,or three-year period.All sales are for cash and all receipts are credited to Unearned Service Contract Revenues.This account had a balance of $144,000 at December 31,2012,before year-end adjustment.Service contract costs are charged as incurred to the Service Contract Expense account,which had a balance of $36,000 at December 31,2012.Service contracts still outstanding at December 31,2012,expire as follows:

What amount should be reported as unearned service contract revenues in Chips-n-Bits December 31,2012,balance sheet?

A)$49,000

B)$59,000

C)$95,000

D)$108,000

What amount should be reported as unearned service contract revenues in Chips-n-Bits December 31,2012,balance sheet?

A)$49,000

B)$59,000

C)$95,000

D)$108,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

Under the cash basis of accounting,

A)revenues are recorded when they are earned.

B)accounts receivable would appear on the balance sheet.

C)depreciation of assets having an economic life of more than one year is recognized.

D)the matching principle is ignored.

A)revenues are recorded when they are earned.

B)accounts receivable would appear on the balance sheet.

C)depreciation of assets having an economic life of more than one year is recognized.

D)the matching principle is ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

Ingle Company paid $12,960 for a four-year insurance policy on September 1 and recorded the $12,960 as a debit to Prepaid Insurance and a credit to Cash.What adjusting entry should Ingle make on December 31,the end of the accounting period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

Total net income over the life of an enterprise is

A)higher under the cash basis than under the accrual basis.

B)lower under the cash basis than under the accrual basis.

C)the same under the cash basis as under the accrual basis.

D)not susceptible to measurement.

A)higher under the cash basis than under the accrual basis.

B)lower under the cash basis than under the accrual basis.

C)the same under the cash basis as under the accrual basis.

D)not susceptible to measurement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

L.Lane received $12,000 from a tenant on December 1 for four months' rent of an office.This rent was for December,January,February,and March.If Lane debited Cash and credited Unearned Rental Income for $12,000 on December 1,what necessary adjustment would be made on December 31?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

Comet Corporation's liability account balances at June 30,2013,included a 10 percent note payable.The note is dated October 1,2011,and carried an original principal amount of $600,000.The note is payable in three equal annual payments of $200,000 plus interest.The first interest and principal payment was made on October 1,2012.In Comet's June 30,2013,balance sheet,what amount should be reported as Interest Payable for this note?

A)$10,000

B)$15,000

C)$30,000

D)$45,000

A)$10,000

B)$15,000

C)$30,000

D)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

Sky Company collected $12,350 in interest during 2013.Sky showed $1,850 in interest receivable on its December 31,2013,balance sheet and $5,300 on December 31,2012.The interest revenue on the income statement for 2013 was

A)$3,450.

B)$8,900.

C)$12,350.

D)$14,200.

A)$3,450.

B)$8,900.

C)$12,350.

D)$14,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

Kite Company paid $24,900 in insurance premiums during 2013.Kite showed $3,600 in prepaid insurance on its December 31,2013,balance sheet and $4,500 on December 31,2012.The insurance expense on the income statement for 2013 was

A)$16,800.

B)$24,000.

C)$25,800.

D)$33,000.

A)$16,800.

B)$24,000.

C)$25,800.

D)$33,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

The following balances have been excerpted from Edwards' balance sheets:

Edwards Company paid or collected during 2013 the following items:

The salary expense on the income statement for 2013 was

A)$366,500.

B)$472,500.

C)$489,500.

D)$595,500.

Edwards Company paid or collected during 2013 the following items:

The salary expense on the income statement for 2013 was

A)$366,500.

B)$472,500.

C)$489,500.

D)$595,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

The following balances have been excerpted from Edwards' balance sheets:

Edwards Company paid or collected during 2013 the following items:

The interest revenue on the income statement for 2013 was

A)$90,500.

B)$112,700.

C)$117,500.

D)$156,500.

Edwards Company paid or collected during 2013 the following items:

The interest revenue on the income statement for 2013 was

A)$90,500.

B)$112,700.

C)$117,500.

D)$156,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

Total sales for a year are $40,000,which includes cash sales of $5,000.The beginning and ending balances of accounts receivable are $10,000 and $15,000,respectively.How much cash was received from customers?

A)$30,000

B)$20,000

C)$25,000

D)$35,000

A)$30,000

B)$20,000

C)$25,000

D)$35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following accounts most likely would not appear in a post-closing trial balance?

A)Retained Earnings

B)Inventory

C)Sales Revenue

D)Common Stock

A)Retained Earnings

B)Inventory

C)Sales Revenue

D)Common Stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

A bond issued June 1,2013,by a calendar-year company pays interest on April 1 and

October 1.A bond is a financial security issued by a corporation in return for cash borrowed from investors.Bonds typically pay interest twice per year.The investor makes the investment on the date the bond is issued.Interest expense for 2013 is recognized on these bonds by the issuer for a period of

A)Seven months.

B)Six months.

C)Four months.

D)Three months.

October 1.A bond is a financial security issued by a corporation in return for cash borrowed from investors.Bonds typically pay interest twice per year.The investor makes the investment on the date the bond is issued.Interest expense for 2013 is recognized on these bonds by the issuer for a period of

A)Seven months.

B)Six months.

C)Four months.

D)Three months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the correct order of the following events in the accounting process?

I)Financial statements are prepared.

II)Adjusting entries are recorded.

III)Nominal accounts are closed.

A)I, II, III

B)II, I, III

C)III, II, I

D)II, III, I

I)Financial statements are prepared.

II)Adjusting entries are recorded.

III)Nominal accounts are closed.

A)I, II, III

B)II, I, III

C)III, II, I

D)II, III, I

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

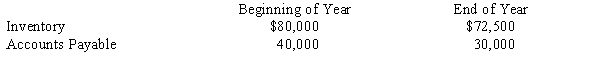

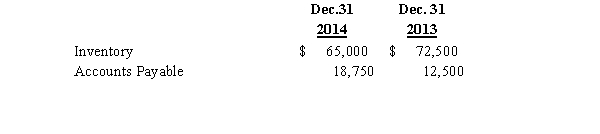

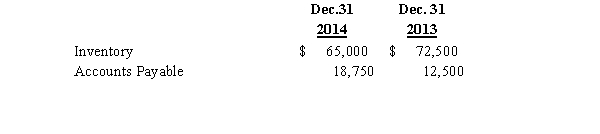

Caribou Corporation shows the following balances:

Caribou paid suppliers $100,000 during the year.What is Caribou's cost of goods sold for the year?

A)$97,500

B)$107,500

C)$102,500

D)$92,500

Caribou paid suppliers $100,000 during the year.What is Caribou's cost of goods sold for the year?

A)$97,500

B)$107,500

C)$102,500

D)$92,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is true?

A)Prepaid expenses are increased by a credit.

B)Gains are increased by a debit.

C)Losses are increased by a credit.

D)Accumulated depreciation is increased by a credit.

A)Prepaid expenses are increased by a credit.

B)Gains are increased by a debit.

C)Losses are increased by a credit.

D)Accumulated depreciation is increased by a credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

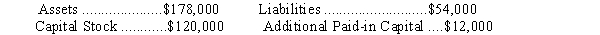

The following summary balance sheet account categories of Sun Company increased during 2013 by the amounts shown:

The only change to retained earnings during 2013 was for $26,000 of dividends.What was Sun Company's net income for 2011?

A)$34,000

B)$26,000

C)$18,000

D)$8,000

The only change to retained earnings during 2013 was for $26,000 of dividends.What was Sun Company's net income for 2011?

A)$34,000

B)$26,000

C)$18,000

D)$8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

An example of a nominal account would be

A)Allowance for Doubtful Accounts.

B)Notes Payable.

C)Prepaid Expense.

D)Cost of Goods Sold.

A)Allowance for Doubtful Accounts.

B)Notes Payable.

C)Prepaid Expense.

D)Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following is a summary of the increases in the account categories of the balance sheet of Riley Company for the most recent fiscal year:

The only change to retained earnings during the fiscal year was for $20,000 of dividends.What was the company's net income for the fiscal year?

A)$25,000

B)$15,000

C)$5,000

D)$20,000

The only change to retained earnings during the fiscal year was for $20,000 of dividends.What was the company's net income for the fiscal year?

A)$25,000

B)$15,000

C)$5,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

How would proceeds received in advance from the sale of nonrefundable tickets for the Super Bowl be reported in the seller's financial statements published before the Super Bowl?

A)Revenue for the entire proceeds.

B)Revenue less related costs.

C)Unearned revenue less related costs.

D)Unearned revenue for the entire proceeds.

A)Revenue for the entire proceeds.

B)Revenue less related costs.

C)Unearned revenue less related costs.

D)Unearned revenue for the entire proceeds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

A company sold 10,000 shares of its own $1 par value common stock for $60,000.The entry to record the sale would include a

A)debit to treasury stock for $60,000.

B)debit to contributed capital for $10,000.

C)credit to common stock, $1 par value for $10,000..

D)credit to common stock, $1 par value for $60,000.

A)debit to treasury stock for $60,000.

B)debit to contributed capital for $10,000.

C)credit to common stock, $1 par value for $10,000..

D)credit to common stock, $1 par value for $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company loaned $6,000 to another corporation on December 1,Year 1,and received a 90-day,10 percent,interest-bearing note with a face value of $6,000.The lender's December 31,Year 1,adjusting entry is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

Five percent bonds with a total face value of $12,000 were purchased at par during the year.The last interest payment for the year was received on July 31.The bonds pay interest semiannually.The adjusting entry at December 31 would include a

A)debit to interest revenue of $600.

B)debit to interest revenue of $250.

C)credit to interest revenue of $300.

D)credit to interest revenue of $250.

A)debit to interest revenue of $600.

B)debit to interest revenue of $250.

C)credit to interest revenue of $300.

D)credit to interest revenue of $250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

For a given year,beginning and ending total liabilities were $18,000 and $20,400,respectively.At year-end,owners' equity was $40,200 and total assets were $4,000 larger than at the beginning of the year.If new capital stock issued exceeded dividends by $4,800,net income (loss)for the year was apparently

A)$(3,200).

B)$(4,000).

C)$800.

D)$3,200.

A)$(3,200).

B)$(4,000).

C)$800.

D)$3,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

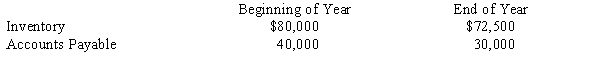

Montague Company reported the following balances:

Montague paid suppliers $122,500 during the year.What is Montague's cost of goods sold for the year?

A)$136,250

B)$123,750

C)$121,250

D)$108,750

Montague paid suppliers $122,500 during the year.What is Montague's cost of goods sold for the year?

A)$136,250

B)$123,750

C)$121,250

D)$108,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

At the beginning of the fiscal year,office supplies inventory amounted to $600.During the year,office supplies amounting to $8,800 were purchased.This amount was debited to office supplies expense.An inventory of office supplies at the end of the fiscal year showed $400 of supplies remaining.The beginning of the year balance is still reflected in the office supplies inventory account.What is the required amount of the adjustment to the office supplies expense account?

A)$9,000 debit

B)$200 debit

C)$8,400 credit

D)$8,800 credit

A)$9,000 debit

B)$200 debit

C)$8,400 credit

D)$8,800 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

Richards Company,a calendar-year company,sells magazine subscriptions to subscribers.The magazine is published semiannually and is shipped to subscribers on April 15 and October 15.Only one-year subscriptions for two issues are accepted.Subscriptions received after the March 31 and September 30 cutoff dates are held for the following publication.Cash is received evenly during the year and is credited to deferred subscription revenue.During 2013,$3,600,000 of cash was received from customers.The beginning balance for 2013 of the deferred subscription revenue account was $750,000.What is Richards' December 31,2013,deferred subscription revenue balance?

A)$2,700,000.

B)$1,800,000.

C)$1,650,000.

D)$900,000.

A)$2,700,000.

B)$1,800,000.

C)$1,650,000.

D)$900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

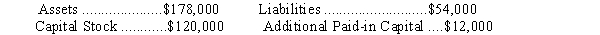

Melville Company manufactures electronic components.The company is a calendar-year company.The records of the company show the following information:

Melville paid suppliers $122,500 during 2013.What is Melville's cost of goods sold?

A)$136,250

B)$123,750

C)$121,250

D)$108,750

Melville paid suppliers $122,500 during 2013.What is Melville's cost of goods sold?

A)$136,250

B)$123,750

C)$121,250

D)$108,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is true regarding the accounting process?

A)Preparation of the trial balance ensures that all amounts have been posted to the correct accounts.

B)Preparation of the trial balance is a step in the recording process.

C)Preparation of the trial balance determines that total debits equal total credits.

D)Preparation of the trial balance determines both that total debits equal total credits and that all amounts have been posted to the correct accounts.

A)Preparation of the trial balance ensures that all amounts have been posted to the correct accounts.

B)Preparation of the trial balance is a step in the recording process.

C)Preparation of the trial balance determines that total debits equal total credits.

D)Preparation of the trial balance determines both that total debits equal total credits and that all amounts have been posted to the correct accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

On August 1,a company received cash of $9,324 for one year's rent in advance and recorded the transaction on that day as a credit to rent revenue.The December 31 adjusting entry would include

A)a debit to Rent Revenue for $3,885.

B)a credit to Unearned Rent Revenue for $5,439.

C)a debit to Unearned Rent Revenue for $3,885.

D)a credit to Rent Revenue for $9,324.

A)a debit to Rent Revenue for $3,885.

B)a credit to Unearned Rent Revenue for $5,439.

C)a debit to Unearned Rent Revenue for $3,885.

D)a credit to Rent Revenue for $9,324.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck