Deck 8: Revenue Recognition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

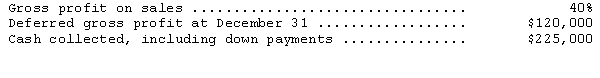

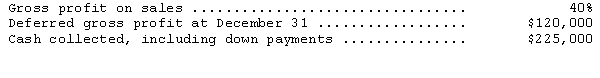

سؤال

سؤال

سؤال

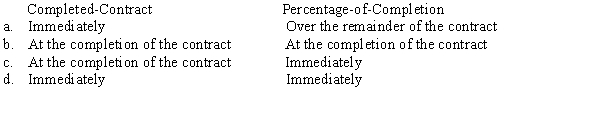

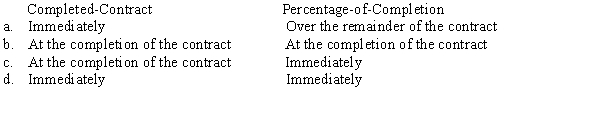

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 8: Revenue Recognition

1

The cost recovery method is

A)used only when circumstances surrounding a sale are so uncertain that earlier recognition is impossible.

B)the most common method of accounting for real estate sales.

C)similar to percentage-of-completion accounting.

D)never acceptable under generally accepted accounting principles.

A)used only when circumstances surrounding a sale are so uncertain that earlier recognition is impossible.

B)the most common method of accounting for real estate sales.

C)similar to percentage-of-completion accounting.

D)never acceptable under generally accepted accounting principles.

A

2

When the percentage-of-completion method of accounting for long-term construction projects is used,why is Construction in Progress increased by the annual recognized gross profit on long-term construction contracts?

A)The cost of the contract has increased.

B)The project's value has increased above cost.

C)The economy experiences inflation over the construction period.

D)Construction in Progress is not increased by the annual recognized profit.

A)The cost of the contract has increased.

B)The project's value has increased above cost.

C)The economy experiences inflation over the construction period.

D)Construction in Progress is not increased by the annual recognized profit.

B

3

How should the balances of Progress Billings and Construction in Progress be shown at reporting dates prior to the completion of a long-term contract?

A)Progress Billings as income, Construction in Progress as inventory

B)Net, as income from construction if credit balance, and loss from construction if debit balance

C)Progress Billings as deferred income, Construction in Progress as a current asset

D)Net, as a current asset if debit balance and current liability if credit balance

A)Progress Billings as income, Construction in Progress as inventory

B)Net, as income from construction if credit balance, and loss from construction if debit balance

C)Progress Billings as deferred income, Construction in Progress as a current asset

D)Net, as a current asset if debit balance and current liability if credit balance

D

4

Which of the following best describes the condition(s)that must be present for the recognition of revenue?

A)The revenue must be earned, measurable, and collected.

B)The revenue must be earned and collectible.

C)The revenue must be earned, measurable, and collectible.

D)The revenue must be measurable and collectible.

A)The revenue must be earned, measurable, and collected.

B)The revenue must be earned and collectible.

C)The revenue must be earned, measurable, and collectible.

D)The revenue must be measurable and collectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

The theoretical support for using the percentage-of-completion method of accounting for long-term construction projects is that it

A)is more conservative than the completed-contract method.

B)produces a realistic matching of expenses with revenues.

C)more closely conforms to the cost principle.

D)reports a lower Net Income figure than the completed-contract method.

A)is more conservative than the completed-contract method.

B)produces a realistic matching of expenses with revenues.

C)more closely conforms to the cost principle.

D)reports a lower Net Income figure than the completed-contract method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following types of service transactions is most likely to require the proportional performance method of revenue recognition based on the seller's direct costs to perform each act?

A)Processing of monthly mortgage payments by a mortgage banker

B)Providing lessons, examinations, and grading by a correspondence school

C)Providing maintenance services on equipment for a fixed periodic fee

D)Delivering freight (by a trucking firm)

A)Processing of monthly mortgage payments by a mortgage banker

B)Providing lessons, examinations, and grading by a correspondence school

C)Providing maintenance services on equipment for a fixed periodic fee

D)Delivering freight (by a trucking firm)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

An adjusting entry in which revenue is recognized and a receivable is established indicates that revenue has been

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the completed-contract method is used,what is the basis for determining the income to be recognized in the second year of a three-year contract?

A)Cumulative actual costs incurred only

B)Incremental cost for the second year only

C)Latest available estimated costs

D)No income would be recognized in year 2

A)Cumulative actual costs incurred only

B)Incremental cost for the second year only

C)Latest available estimated costs

D)No income would be recognized in year 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

Assume the percentage-of-completion method of revenue recognition is used on a long-term construction contract.Under this method,revenues that are earned but unbilled at the balance sheet date should be disclosed

A)as a long-term receivable in the noncurrent assets section of the balance sheet.

B)only as a footnote disclosure until the customer is billed for the percentage of work completed.

C)as construction in progress in the current assets section of the balance sheet.

D)as construction in progress in the noncurrent assets section of the balance sheet.

A)as a long-term receivable in the noncurrent assets section of the balance sheet.

B)only as a footnote disclosure until the customer is billed for the percentage of work completed.

C)as construction in progress in the current assets section of the balance sheet.

D)as construction in progress in the noncurrent assets section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

The completed-contract method of accounting for long-term construction-type contracts is preferable when

A)a contractor is involved in numerous projects.

B)the contracts are of a relatively long duration.

C)estimates of costs to complete and extent of progress toward completion are reasonably dependable.

D)there are inherent uncertainties in the contract beyond normal business risks.

A)a contractor is involved in numerous projects.

B)the contracts are of a relatively long duration.

C)estimates of costs to complete and extent of progress toward completion are reasonably dependable.

D)there are inherent uncertainties in the contract beyond normal business risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

When using the installment sales method,

A)total revenues and costs are recognized at the point of sale, but gross profit is deferred in proportion to the cash that is uncollected from the sale.

B)gross profit is recognized only after the amount of cash collected exceeds the cost of the item sold.

C)revenue, costs, and gross profit are recognized proportionally as the cash is received from the sale of product.

D)gross profit is deferred until all cash is received, but revenues and costs are recognized in proportion to the cash collected from the sale.

A)total revenues and costs are recognized at the point of sale, but gross profit is deferred in proportion to the cash that is uncollected from the sale.

B)gross profit is recognized only after the amount of cash collected exceeds the cost of the item sold.

C)revenue, costs, and gross profit are recognized proportionally as the cash is received from the sale of product.

D)gross profit is deferred until all cash is received, but revenues and costs are recognized in proportion to the cash collected from the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

When comparing the percentage-of-completion and completed-contract methods of accounting for long-term construction contracts,both methods will report the same

A)balances each period in the Progress Billings account.

B)expense for cost of construction each year.

C)amount of income in the year of completion.

D)inventory carrying value each year during the construction period.

A)balances each period in the Progress Billings account.

B)expense for cost of construction each year.

C)amount of income in the year of completion.

D)inventory carrying value each year during the construction period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

A company providing maintenance services on equipment for a fixed periodic fee would recognize

A)an equal amount of service revenue for each act.

B)service revenue over the fixed period by the straight-line method.

C)service revenue in proportion to the direct costs to the provider of the services to perform each act.

D)service revenue only when the fixed period has ended.

A)an equal amount of service revenue for each act.

B)service revenue over the fixed period by the straight-line method.

C)service revenue in proportion to the direct costs to the provider of the services to perform each act.

D)service revenue only when the fixed period has ended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

The installment method of recognizing revenue

A)should be used only in cases in which no reasonable basis exists for estimating the collectibility of receivables.

B)is not a generally accepted accounting principle under any circumstances.

C)should be used for book purposes only if it is used for tax purposes.

D)is an acceptable alternative accounting principle for a firm that makes installment sales.

A)should be used only in cases in which no reasonable basis exists for estimating the collectibility of receivables.

B)is not a generally accepted accounting principle under any circumstances.

C)should be used for book purposes only if it is used for tax purposes.

D)is an acceptable alternative accounting principle for a firm that makes installment sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the percentage-of-completion method is used,what is the basis for determining the gross profit to be recognized in the second year of a three-year contract?

A)Cumulative actual costs and estimated costs to complete

B)Incremental cost for the second year only

C)Cumulative actual costs incurred only

D)No gross profit would be recognized in year 2

A)Cumulative actual costs and estimated costs to complete

B)Incremental cost for the second year only

C)Cumulative actual costs incurred only

D)No gross profit would be recognized in year 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a company uses the completed-contract method of accounting for long-term construction contracts,then during the period of construction,financial information related to a long-term contract will

A)appear on both the income statement and balance sheet during the construction period.

B)appear only on the income statement during the period of construction.

C)appear only on the balance sheet during the period of construction.

D)not appear on the financial statements.

A)appear on both the income statement and balance sheet during the construction period.

B)appear only on the income statement during the period of construction.

C)appear only on the balance sheet during the period of construction.

D)not appear on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

Builder Construction Company's projects extend over several years and collection of receivables is reasonably certain.Each project has a contract that specifies a price and the rights and obligations of all parties.Both the contractor and the customer are expected to fulfill their contractual obligations on each project.Reliable estimates can be made of the extent of progress and cost to complete each project.The method that the company should use to account for construction revenue is

A)installment sales.

B)percentage-of-completion.

C)completed-contract.

D)cost recovery.

A)installment sales.

B)percentage-of-completion.

C)completed-contract.

D)cost recovery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

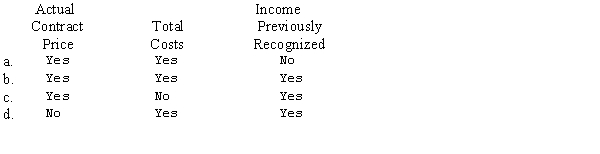

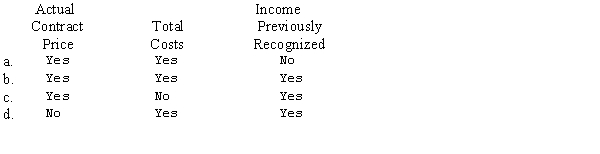

Which of the following would be used in the calculation of the gross profit recognized in the third and final year of a construction contract that is accounted for using the percentage-of-completion method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is NOT an element identified by the AICPA as being necessary in order to use percentage-of-completion accounting?

A)The construction period can be reasonably estimated.

B)The buyer can be expected to satisfy obligations under the contract.

C)Dependable estimates can be made of the extent of progress toward completion.

D)Dependable estimates can be made of contract costs.

A)The construction period can be reasonably estimated.

B)The buyer can be expected to satisfy obligations under the contract.

C)Dependable estimates can be made of the extent of progress toward completion.

D)Dependable estimates can be made of contract costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is NOT a difference between the percentage-of completion and completed-contract methods of accounting for long-term construction contracts?

A)They report different amounts for inventory during the construction period.

B)They report different amounts for progress billings during the construction period.

C)They cause a different cash inflow during the construction period.

D)They report different amounts for accounts receivable during the construction period.

A)They report different amounts for inventory during the construction period.

B)They report different amounts for progress billings during the construction period.

C)They cause a different cash inflow during the construction period.

D)They report different amounts for accounts receivable during the construction period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

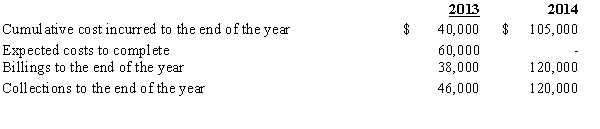

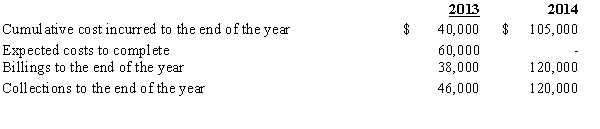

21

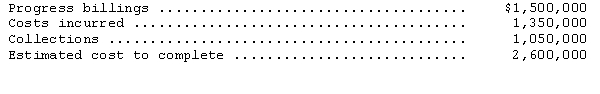

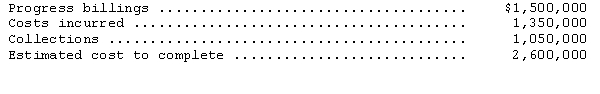

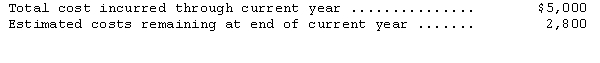

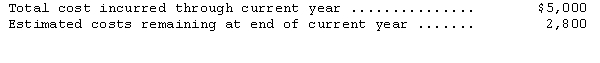

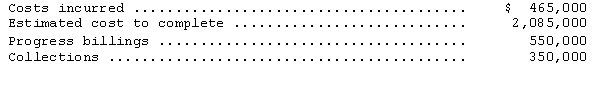

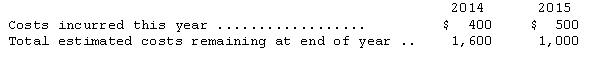

F & R Construction,Inc.has consistently used the percentage-of-completion method of recognizing revenue.Last year F & R started work on a $5,000,000 construction contract,which was completed this year.The accounting records disclosed the following data for last year:

How much revenue should F & R have recognized on this contract last year?

A)$1,500,000

B)$1,700,000

C)$1,100,000

D)$400,000

How much revenue should F & R have recognized on this contract last year?

A)$1,500,000

B)$1,700,000

C)$1,100,000

D)$400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

In accounting for sales on consignment,sales revenue and the related cost of goods sold should be recognized by the

A)consignor when the goods are shipped to the consignee.

B)consignee when the goods are shipped to the third party.

C)consignor when notification is received the consignee has sold the goods.

D)consignee when cash is received from the customer.

A)consignor when the goods are shipped to the consignee.

B)consignee when the goods are shipped to the third party.

C)consignor when notification is received the consignee has sold the goods.

D)consignee when cash is received from the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

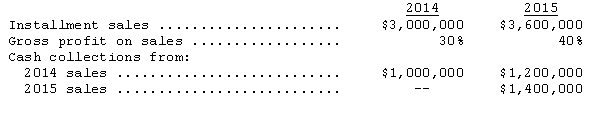

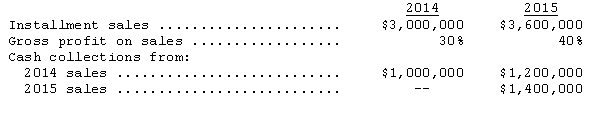

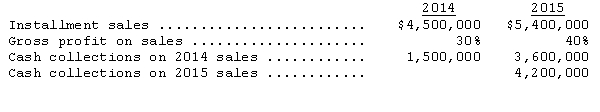

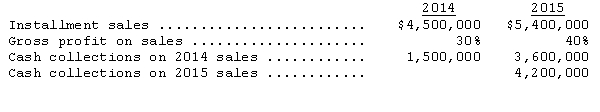

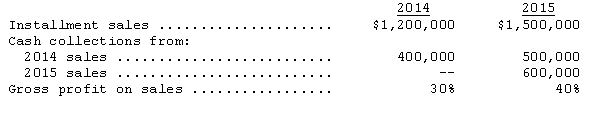

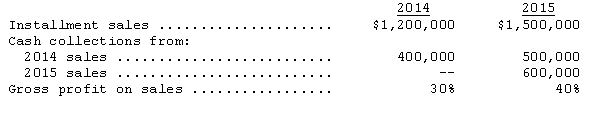

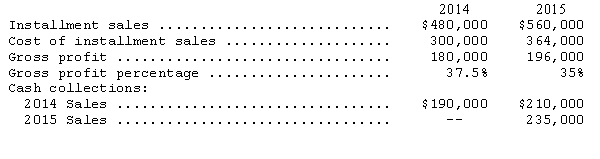

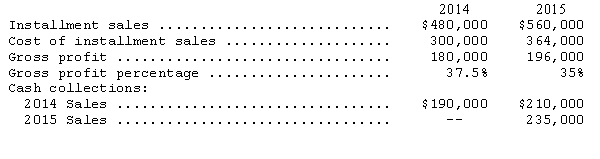

Chantal Company began operations on January 2,2014,and appropriately used the installment sales method of accounting.The following data are available for 2014 and 2015:

The realized gross profit for 2015 is

A)$1,440,000.

B)$1,040,000.

C)$920,000.

D)$780,000.

The realized gross profit for 2015 is

A)$1,440,000.

B)$1,040,000.

C)$920,000.

D)$780,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

Franchise fees are properly recognized as revenue

A)when received in cash.

B)when a contractual agreement has been signed.

C)after the franchise business has begun operations.

D)after the franchiser has substantially performed its service.

A)when received in cash.

B)when a contractual agreement has been signed.

C)after the franchise business has begun operations.

D)after the franchiser has substantially performed its service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

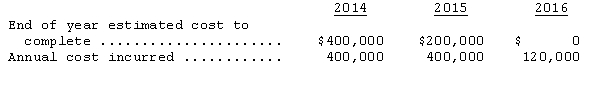

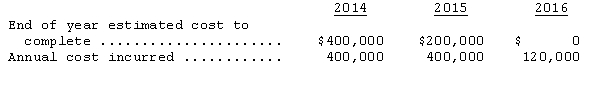

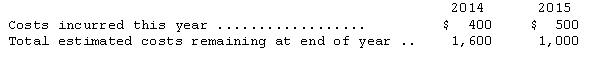

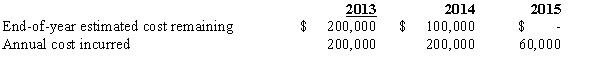

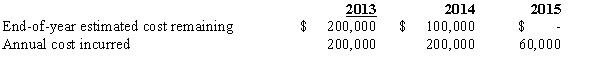

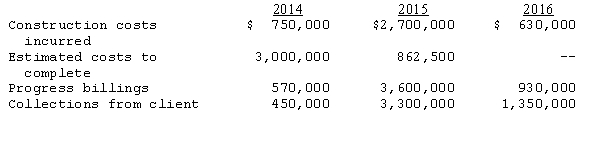

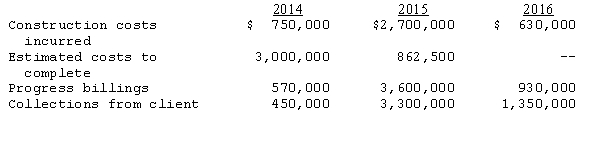

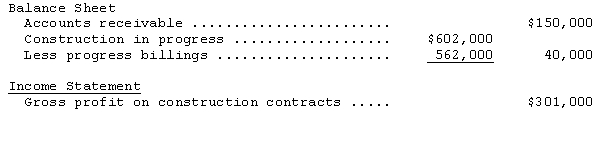

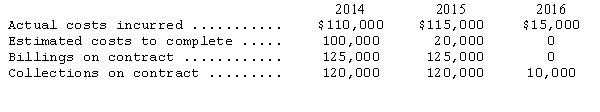

Astor Construction Company uses the percentage-of-completion method for long-term construction contracts.A specific job was begun in 2014 and completed in 2016.The contract price was $1,400,000 and cost information as of each year-end is given below:

Assuming Astor correctly recorded gross profit in 2014,how much gross profit should the company record in 2015?

A)$0

B)$20,000

C)$300,000

D)$320,000

Assuming Astor correctly recorded gross profit in 2014,how much gross profit should the company record in 2015?

A)$0

B)$20,000

C)$300,000

D)$320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

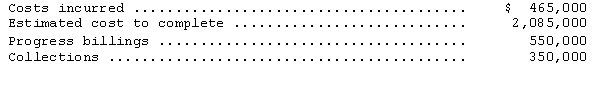

Steinman Construction Company uses the percentage-of-completion method for long-term construction contracts.The company has a project with a contract price of $7,000 on which $600 of gross profit has been recognized in prior years.Information for the current year is as follows:

What is the loss that Steinman should recognize in the current year?

A)$600

B)$800

C)$1,400

D)No loss should be recognized.

What is the loss that Steinman should recognize in the current year?

A)$600

B)$800

C)$1,400

D)No loss should be recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

For a construction firm using the completed-contract method,if costs exceed billings on some contracts by $1,000,000 and billings exceed costs by $800,000 on others,the contracts should ordinarily be reported as a

A)current asset of $200,000.

B)current liability of $200,000.

C)current asset of $1,000,000 less a contra-current asset of $800,000.

D)current asset of $1,000,000 and a current liability of $800,000.

A)current asset of $200,000.

B)current liability of $200,000.

C)current asset of $1,000,000 less a contra-current asset of $800,000.

D)current asset of $1,000,000 and a current liability of $800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

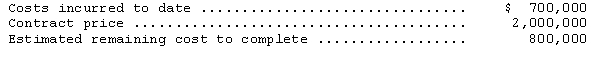

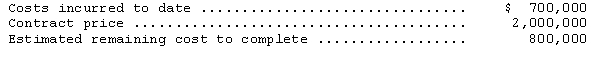

Sonnet Construction Company uses the completed-contract method for long-term construction contracts.The information for a specific contract as of January 1,2014,is shown below.

$600,000 of cost was incurred during 2014 and on December 31,2014,the estimated remaining cost to complete was still $800,000.The correct balance for the Construction in Progress at December 31,2014 is

A)$600,000.

B)$700,000.

C)$1,200,000.

D)$1,300,000.

$600,000 of cost was incurred during 2014 and on December 31,2014,the estimated remaining cost to complete was still $800,000.The correct balance for the Construction in Progress at December 31,2014 is

A)$600,000.

B)$700,000.

C)$1,200,000.

D)$1,300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

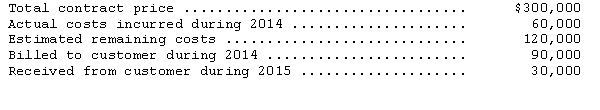

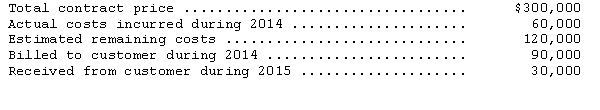

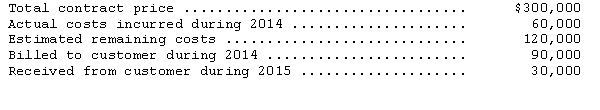

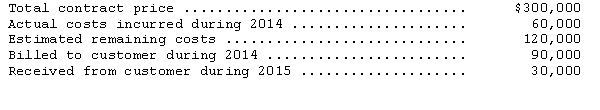

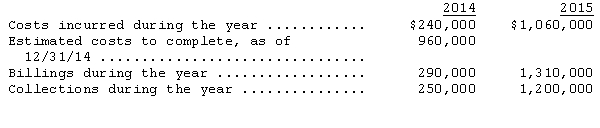

The following data relate to a construction job started by Harrington Co. during 2014:

See Harrington Co.information above.Under the completed-contract method,how much should Harrington recognize as gross profit for 2014?

A)$0

B)$30,000

C)$40,000

D)$90,000

See Harrington Co.information above.Under the completed-contract method,how much should Harrington recognize as gross profit for 2014?

A)$0

B)$30,000

C)$40,000

D)$90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

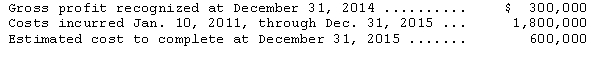

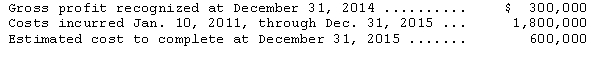

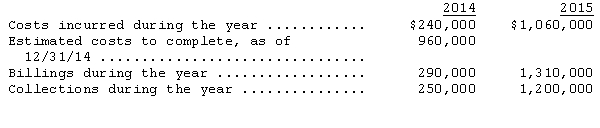

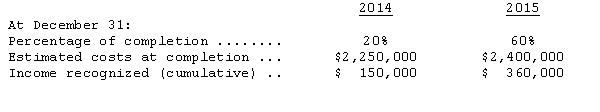

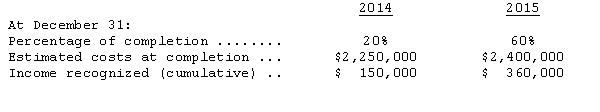

Sailor Construction Company has consistently used the percentage-of- completion method.On January 10,2014,Sailor began work on a $3,000,000 construction contract.At the inception date,the estimated cost of construction was $2,250,000.The following data relate to the progress of the contract:

How much gross profit should Sailor recognize for the year ended December 31,2015?

A)$150,000

B)$262,500

C)$300,000

D)$450,000

How much gross profit should Sailor recognize for the year ended December 31,2015?

A)$150,000

B)$262,500

C)$300,000

D)$450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

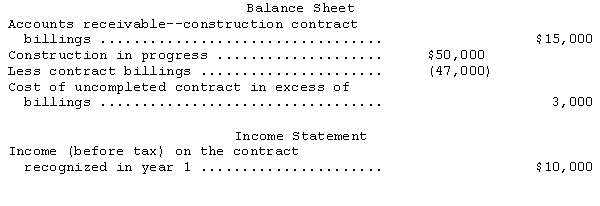

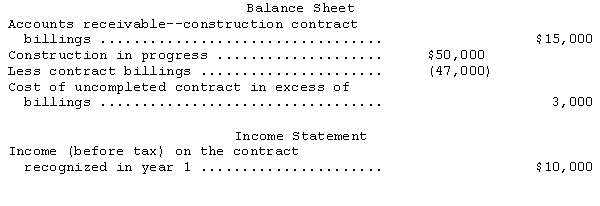

In 2011,Huxley Corp.began construction work under a three-year contract.The contract price is $800,000.Huxley used the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial presentations relating to this contract at December 31,2014,appear below.

How much cash was collected in 2014 on this contract?

A)$32,000

B)$35,000

C)$47,000

D)$50,000

How much cash was collected in 2014 on this contract?

A)$32,000

B)$35,000

C)$47,000

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following data relate to a construction job started by Harrington Co. during 2014:

See Harrington Co.information above.Under the percentage-of-completion method,how much should Harrington recognize as gross profit for 2014?

A)$0

B)$40,000

C)$80,000

D)$100,000

See Harrington Co.information above.Under the percentage-of-completion method,how much should Harrington recognize as gross profit for 2014?

A)$0

B)$40,000

C)$80,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

In accounting for a long-term construction contract for which there is a projected profit,the balance in the Construction in Progress account at the end of the first year of work using the percentage-of-completion method would be

A)zero.

B)the same as the completed-contract method.

C)higher than the completed-contract method.

D)lower than the completed-contract method.

A)zero.

B)the same as the completed-contract method.

C)higher than the completed-contract method.

D)lower than the completed-contract method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

Gunner Construction,Inc.has consistently used the percentage-of-completion method of recognizing revenue.During 2014,Gunner started work on a $2,500,000 fixed-price construction contract.The accounting records disclosed the following data for the year ended December 31,2014:

How much loss should Gunner have recognized in 2014?

A)$15,000

B)$35,000

C)$50,000

D)$315,000

How much loss should Gunner have recognized in 2014?

A)$15,000

B)$35,000

C)$50,000

D)$315,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

Sunfish Construction Company uses the percentage-of-completion method of accounting.In 2014,Sunfish began work on a project which had a contract price of $1,600,000 and estimated costs of $1,200,000.Additional information is as follows:

The amount of gross profit Sunfish should recognize on this contract during 2014 is

A)$40,000.

B)$80,000.

C)$100,000.

D)$200,000.

The amount of gross profit Sunfish should recognize on this contract during 2014 is

A)$40,000.

B)$80,000.

C)$100,000.

D)$200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

Golden Construction Company uses the percentage-of-completion method for long-term construction contracts.The company started a project with a contract price of $2,750 in 2014.Given the following data,what is the balance in Construction in Progress for this contract at the end of 2014?

A)$150

B)$400

C)$550

D)$1,750

A)$150

B)$400

C)$550

D)$1,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

On May 1,2014,Lavender Construction Company entered into a fixed-price contract to construct an apartment building for $3,000,000.Lavender appropriately accounts for this contract under the percentage-of-completion method.Information relating to the contract is as follows:

What is the amount of contract costs incurred during the year ended December 31,2015?

A)$600,000

B)$960,000

C)$990,000

D)$1,440,000

What is the amount of contract costs incurred during the year ended December 31,2015?

A)$600,000

B)$960,000

C)$990,000

D)$1,440,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company uses the percentage-of-completion method to account for a four-year construction contract.Progress billings sent in the second year that were collected in the third year would

A)be included in the calculation of the income recognized in the second year.

B)be included in the calculation of the income recognized in the third year.

C)be included in the calculation of the income recognized in the fourth year.

D)not be included in the calculation of the income recognized in any year.

A)be included in the calculation of the income recognized in the second year.

B)be included in the calculation of the income recognized in the third year.

C)be included in the calculation of the income recognized in the fourth year.

D)not be included in the calculation of the income recognized in any year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

Samuels Company began operations on January 1,2014,and uses the installment sales method of accounting.The company has the following information available for 2014 and 2015:

The realized gross profit for 2015 would be

A)$1,680,000.

B)$2,760,000.

C)$3,120,000.

D)$4,320,000.

The realized gross profit for 2015 would be

A)$1,680,000.

B)$2,760,000.

C)$3,120,000.

D)$4,320,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

Goods on consignment should be included in the inventory of

A)the consignor but not the consignee.

B)both the consignor and the consignee.

C)the consignee but not the consignor.

D)neither the consignor nor the consignee.

A)the consignor but not the consignee.

B)both the consignor and the consignee.

C)the consignee but not the consignor.

D)neither the consignor nor the consignee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

Johann Builders has a fixed -price contract providing $120,000 of revenue.Construction on the contract was begun in 2013 and was completed in 2014.Information relating to the contract is as follows:

What amount of income should Johann recognize in 2014 assuming that the company appropriately uses the percentage-of-completion method of income recognition?

A)$9,286

B)$15,000

C)$17,000

D)$7,000

What amount of income should Johann recognize in 2014 assuming that the company appropriately uses the percentage-of-completion method of income recognition?

A)$9,286

B)$15,000

C)$17,000

D)$7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

Hussong,Inc.,appropriately uses the installment sales method of revenue recognition.The company sold $1,500,000 on installment accounts during 2014.The cost of items sold was $900,000.At December 31,2014,Hussong reported a balance of $100,000 in the Deferred Gross Profit account.How much cash did Hussong collect on installment contracts during 2014?

A)$600,000

B)$500,000

C)$250,000

D)$1,250,000

A)$600,000

B)$500,000

C)$250,000

D)$1,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

Warthog Enterprises,which began operations on January 1,appropriately uses the installment method of accounting.The following information is available for its first year:

What is the total amount of Warthog's installment sales for the first year?

A)$300,000

B)$345,000

C)$425,000

D)$525,000

What is the total amount of Warthog's installment sales for the first year?

A)$300,000

B)$345,000

C)$425,000

D)$525,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

When Progress Billings are made by a contractor on a long-term contract,what account is credited?

A)Contract Billings, a contra-asset account

B)Contract Revenue, a revenue account

C)Contract Receivable, an asset account

D)Contract Billings, a contra-revenue account

A)Contract Billings, a contra-asset account

B)Contract Revenue, a revenue account

C)Contract Receivable, an asset account

D)Contract Billings, a contra-revenue account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

The completed-contract method (as opposed to the percentage-of-completion method)of accounting for revenue from long-term construction contracts should be used in which of the following circumstances?

A)The contractor has been in business for many years and has completed many contracts in the past.

B)Reasonably accurate estimates of the degree of completion cannot be made due to the lack of experience with similar types of contracts.

C)Reasonable accurate estimates of the degree of completion can be made based on past experience.

D)The contracts are of a relatively long duration.

A)The contractor has been in business for many years and has completed many contracts in the past.

B)Reasonably accurate estimates of the degree of completion cannot be made due to the lack of experience with similar types of contracts.

C)Reasonable accurate estimates of the degree of completion can be made based on past experience.

D)The contracts are of a relatively long duration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

When a contractor determines that a contract will result in an overall loss,when should that loss be recognized within the completed-contract and percentage-of-completion methods?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

On November 30,Monet Company consigned 90 freezers to Vangogh Company for sale at $1,600 each and paid $1,200 in transportation costs.A report of sales was received on December 30 from Vangogh reporting the sale of 20 freezers,together with a remittance of the $27,200 balance due.The remittance was net of the agreed 15% commission.How much,and in what month,should Monet recognize as consignment sales revenue?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

Simpson Construction entered into a contract to construct a floating bridge across a lake.The contract price for the bridge is $7,500,000.During 2012,costs of $1,800,000 were incurred representing 30% of total expected costs.

Prepare the necessary entries for 2014 to recognize gross profit for the year assuming the firm uses the

(1)completed-contract method.

(2)percentage-of-completion method.

Prepare the necessary entries for 2014 to recognize gross profit for the year assuming the firm uses the

(1)completed-contract method.

(2)percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

Cantor Company sold $400,000 to customers on account during 2014,and collected $200,000 during the year.The company properly uses the installment sales method of revenue recognition due to the uncertainty of collection of these installment receivables.The company has determined that cost of sales for the $400,000 of sales was $340,000.

What is the correct balance of the company's Deferred Gross Profit account at the end of 2014,after the recognition of revenue for that year?

A)$0

B)$30,000

C)$60,000

D)$140,000

What is the correct balance of the company's Deferred Gross Profit account at the end of 2014,after the recognition of revenue for that year?

A)$0

B)$30,000

C)$60,000

D)$140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

On January 3,2014,Continental Services,Inc.,signed an agreement authorizing Peen Company to operate as a franchisee over a 20-year period for an initial franchise fee of $200,000 received when the agreement was signed.Peen commenced operations on July 1,2014,at which date all of the initial services required of Continental had been performed.The agreement also provides that Peen must pay a continuing franchise fee equal to 6% of the revenue from the franchise annually to Continental.Peen's franchise revenue for 2014 was $900,000.For the year ended December 31,2014,how much should Continental record as revenue from franchise fees from the Peen franchise?

A)$100,000

B)$106,000

C)$254,000

D)$266,000

A)$100,000

B)$106,000

C)$254,000

D)$266,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

Tussle Company began operations on January 1,2014,and appropriately uses the installment method of accounting.The following data are available for 2014 and 2015:

The realized gross profit for 2015 is

A)$440,000.

B)$240,000.

C)$390,000.

D)$600,000.

The realized gross profit for 2015 is

A)$440,000.

B)$240,000.

C)$390,000.

D)$600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

Assume the Abokair Corporation sold $30,000 worth of merchandise on the installment basis.The cost of the merchandise was $24,000,and collectibility of the receivable is uncertain.Collection in the current year on the account is $8,000.How much gross profit should be reported as realized?

A)$1,600

B)$2,000

C)$6,000

D)$8,000

A)$1,600

B)$2,000

C)$6,000

D)$8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

Under which of the following circumstances is the installment sales method appropriate for the recognition of revenue in the income statement?

A)For any sales where collection is spread over a reasonable long period of time.

B)In any situation where management wishes to delay the recognition of revenue in order to smooth its income.

C)For sales where collection is spread over a reasonable long period of time and significant doubt exists about the ultimate collection of the receivables.

D)For sales where collection is spread over a reasonable long period of time and no significant doubt exists concerning ultimate collection of the receivables.

A)For any sales where collection is spread over a reasonable long period of time.

B)In any situation where management wishes to delay the recognition of revenue in order to smooth its income.

C)For sales where collection is spread over a reasonable long period of time and significant doubt exists about the ultimate collection of the receivables.

D)For sales where collection is spread over a reasonable long period of time and no significant doubt exists concerning ultimate collection of the receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

Marshland,Inc.had the following consignment transactions during December:

No sales of consigned goods were made through December 31.Marshland's December 31 balance sheet should include consigned inventory at

A)$18,900.

B)$18,000.

C)$12,500.

D)$12,000.

No sales of consigned goods were made through December 31.Marshland's December 31 balance sheet should include consigned inventory at

A)$18,900.

B)$18,000.

C)$12,500.

D)$12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

55

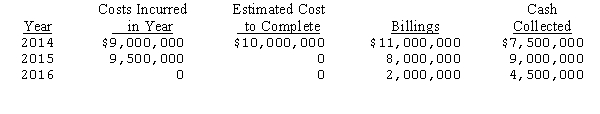

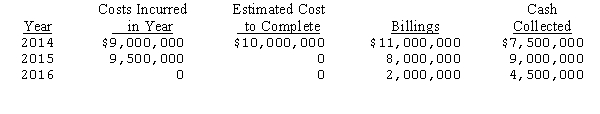

Baywatch Construction contracted to build a ship over a two year period.The contract price was $21,000,000 with an estimate total cost of $18,400,000.The following cost data relate to the construction period.

Prepare the necessary journal entries for 2014,2015,and 2016 assuming Baywatch uses the percentage-of-completion method.

Prepare the necessary journal entries for 2014,2015,and 2016 assuming Baywatch uses the percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

56

A construction company uses the percentage-of-completion method for long-term construction contracts.A particular job was begun in 2014 and completed in 2015.During 2014,it appeared that the project would cost 25 percent more than originally expected.Data at the end of each year are given below:

The contract price was $700,000.Assuming the company properly recorded income in 2013,how much income should be recorded in 2014?

A)$10,000

B)$42,000

C)$160,000

D)$192,000

The contract price was $700,000.Assuming the company properly recorded income in 2013,how much income should be recorded in 2014?

A)$10,000

B)$42,000

C)$160,000

D)$192,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

57

Carson Distributing,which began operating on January 1,appropriately uses the installment method of accounting.The following information pertains to Carson's operations for the first year:

The balance in the deferred gross profit account at December 31 should be

A)$400,000.

B)$320,000.

C)$240,000.

D)$200,000.

The balance in the deferred gross profit account at December 31 should be

A)$400,000.

B)$320,000.

C)$240,000.

D)$200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

58

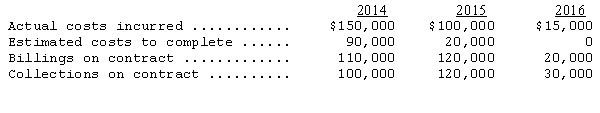

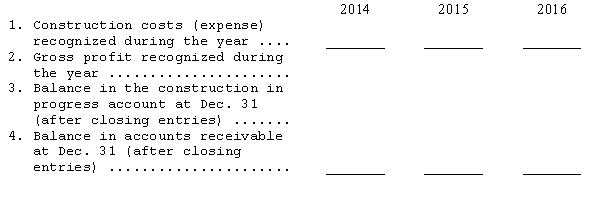

In 2014,Charlotte Engineering entered into an agreement to construct an office building at a contract price of $5,100,000.Construction data were as follows:

Prepare the necessary entries for each year,assuming the firm uses the:

(1)completed-contract method

(2)percentage-of-completion method.

Prepare the necessary entries for each year,assuming the firm uses the:

(1)completed-contract method

(2)percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

59

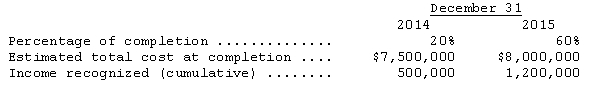

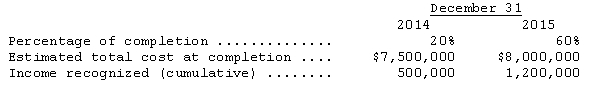

Antoine Construction Company has consistently used the percentage-of completion method of recognizing income.During 2014,Antoine entered into a fixed-price contract to construct an office building for $10,000,000.Information relating to the contract is as follows:

Contract costs incurred during 2015 were

A)$3,200,000.

B)$3,300,000.

C)$3,500,000.

D)$4,800,000.

Contract costs incurred during 2015 were

A)$3,200,000.

B)$3,300,000.

C)$3,500,000.

D)$4,800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

60

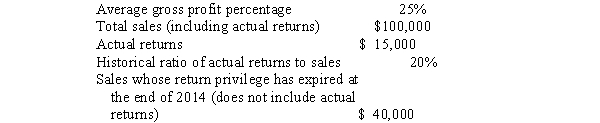

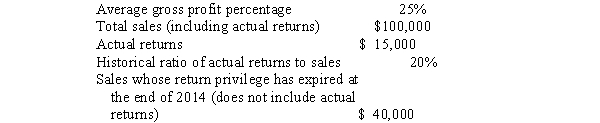

Santos Company allows a liberal return privilege on its normal sales.Products purchased by customers may be returned within 90 days of purchase if in resalable condition,for a full refund.The following information relates to 2014:

Assuming that all criteria of SFAS No.48,"Revenue Recognition When Right of Return Exists," are not met,what is the gross margin to be reported by the company in 2014?

A)$4,000

B)$10,000

C)$40,000

D)$2,000

Assuming that all criteria of SFAS No.48,"Revenue Recognition When Right of Return Exists," are not met,what is the gross margin to be reported by the company in 2014?

A)$4,000

B)$10,000

C)$40,000

D)$2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

61

The importance of revenue to a business enterprise has caused much discussion among accountants as to how the term "revenue" should be defined.The FASB in Statement of Financial Accounting Concepts No.6,"Elements of Financial Statements," defines revenue as "inflows or other enhancements of assets of an entity or settlements of its liabilities (or a combination of both)from delivering or producing goods,rendering services,or other activities that constitute the entity's ongoing major or central operations."

Evaluate the soundness of the definition of the term "revenue" provided by the FASB in Statement of Financial Accounting Concepts No.6.

Evaluate the soundness of the definition of the term "revenue" provided by the FASB in Statement of Financial Accounting Concepts No.6.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

62

Revenue is measured in terms of the value of the products or services exchanged in an "arms-length" transaction.This value represents either the net cash equivalent or the present discounted value of the money received or to be received in exchange for the products or services that an enterprise transfers to its customer.

Required:

Explain how this concept of the measurement of revenue might be used to determine the proper treatment of sales discounts and bad debt losses.

Required:

Explain how this concept of the measurement of revenue might be used to determine the proper treatment of sales discounts and bad debt losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

63

The percentage-of-completion method is used to recognize revenue and gross profit for construction and other types of projects that extend beyond one accounting period.A problem similar to long-term construction projects exists in accounting for service revenue that is earned for more than one performance act where such activity extends beyond one accounting period.

Provide examples of service activities that might extend beyond one accounting period and propose means of recognizing revenues for such activities.

Provide examples of service activities that might extend beyond one accounting period and propose means of recognizing revenues for such activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

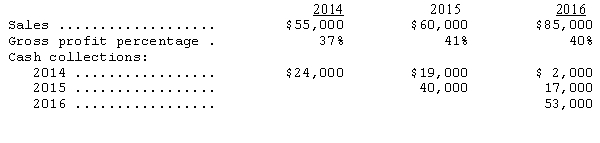

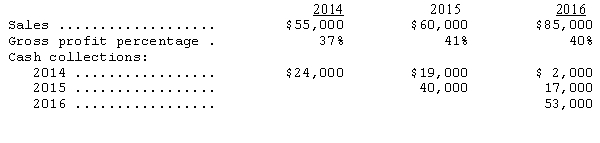

64

Kona Medical Center uses the cost recovery method of accounting for recognizing revenue.The following information is available:

Determine the amount of gross profit to be recognized for 2014,2015,and 2016.

Determine the amount of gross profit to be recognized for 2014,2015,and 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

65

Stone Company,a publicly traded company,delivers twenty truckloads of Stone to Mortar Company prior to December 31,2014,the end of Stone's fiscal year.Stone normally enters into a written sales agreement with customers similar to Mortar Company.The written sales agreement must be signed by both companies in order to be binding.Although the purchasing department of Mortar has orally agreed to the sale,Mortar management cannot sign the agreement until it is approved by the legal department of Mortar.Personnel of the legal department of Mortar will be on vacation until January 5,2015.

Can Stone recognize on its income statement for the year ending December 31,2014,the revenue related to the twenty truckloads delivered to Mortar? Explain.

Can Stone recognize on its income statement for the year ending December 31,2014,the revenue related to the twenty truckloads delivered to Mortar? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

66

Lennor Company sold inventory to Myers Incorporated and recorded the sale as revenue.Part of the agreement of the sale is that Lennor will repurchase the merchandise at a specified price over a specified period of time.Meanwhile,Myers uses the inventory purchased from Lennor as collateral for a loan.Myers uses the proceeds from the loan to pay Lennor for the inventory purchased.Lennor ultimately repurchases the inventory from Myers.Myers then uses the proceeds of the repayment to pay its loan obligation.

Required:

1.Explain the rationale for the two companies engaging in this series of transactions.

2.Explain how the sale of the inventory would be reported on the records of Lennor Company.

Required:

1.Explain the rationale for the two companies engaging in this series of transactions.

2.Explain how the sale of the inventory would be reported on the records of Lennor Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

67

Stanton Industrial sells machinery on the installment plan.On September 1,2014,Stanton entered into an installment sale contract with Saunders Productions for a six-year period.Equal annual payments under the installment sale are $187,500 and are due on August 31 of each year beginning in 2015.

Additional information:

(a)The cost of the machinery sold to Saunders was $637,500.

(b)The implicit interest rate on the installment sale is 10%.

Compute the income or loss before taxes that Stanton should record for the year ended December 31,2014,as a result of the above transaction,assuming that circumstances are such that the collection of the installments due under the contract

(1)is reasonably assured.

(2)cannot be reasonably assured.

Additional information:

(a)The cost of the machinery sold to Saunders was $637,500.

(b)The implicit interest rate on the installment sale is 10%.

Compute the income or loss before taxes that Stanton should record for the year ended December 31,2014,as a result of the above transaction,assuming that circumstances are such that the collection of the installments due under the contract

(1)is reasonably assured.

(2)cannot be reasonably assured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

68

Arnold's Club is a discount retailer subject to SEC regulation.Arnold's Club charges its customers an annual membership fee.Although the fee is collected in advance,a customer can cancel and receive a full refund at any time during the year of membership.

Should Arnold's Club recognize the entire initial membership fee at the beginning of the year or on a straight-line basis over the course of the membership year? Explain.

What journal entry should be made to record the initial receipt of the membership fees?

Should Arnold's Club recognize the entire initial membership fee at the beginning of the year or on a straight-line basis over the course of the membership year? Explain.

What journal entry should be made to record the initial receipt of the membership fees?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

69

Andrew Greene recently purchased on layaway a big screen television from Zack & Zany Home Furnishings.Zack & Zany is a public company.Gary paid $100 as a cash deposit on the television.The television cost Zack & Zany $1,500 and has a total retail price of $2,000.Zack & Zany has set the television aside pending the payment by Miller of the balance owed.

Zack & Zany does not require its customers to enter into an installment note or other fixed payment commitment or agreement when the initial deposit is received.Merchandise on layaway generally is not released to the customer until the customer pays the full purchase price.If the customer fails to pay the remaining purchase price,the customer forfeits his or her cash deposit.In the event the merchandise is lost,damaged,or destroyed,Zack & Zany either must refund the cash deposit to the customer or provide replacement merchandise.

When should Zack & Zany recognized the revenue from the sale to Greene?

Prepare the appropriate journal entries on Zack & Zany's books to record the receipt of the cash and the subsequent delivery of the television when the remaining balance is collected.

Zack & Zany does not require its customers to enter into an installment note or other fixed payment commitment or agreement when the initial deposit is received.Merchandise on layaway generally is not released to the customer until the customer pays the full purchase price.If the customer fails to pay the remaining purchase price,the customer forfeits his or her cash deposit.In the event the merchandise is lost,damaged,or destroyed,Zack & Zany either must refund the cash deposit to the customer or provide replacement merchandise.

When should Zack & Zany recognized the revenue from the sale to Greene?

Prepare the appropriate journal entries on Zack & Zany's books to record the receipt of the cash and the subsequent delivery of the television when the remaining balance is collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

70

The percentage-of-completion method is a generally accepted accounting procedure that allows revenue to be recognized prior to the completion of a project or product.Revenues and gross profit are recognized each period based upon the progress of the construction.Construction costs plus gross profit earned to date are accumulated in an inventory account (Construction in Progress)and progress billings are accumulated in a contra-inventory account (Billings on Construction in Progress).

Required:

Explain the effect on shareholders and managers if an enterprise did not use the percentage-of-completion method to account for long-term contracts and projects.

Required:

Explain the effect on shareholders and managers if an enterprise did not use the percentage-of-completion method to account for long-term contracts and projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

71

Tundra Electronics Company sends appliances to dealers on a consignment basis.The selling price per unit is $920 and the dealer earns a 30% commission.The manufacturing cost of the appliance to Tundra Electronics is $570.Assume that in 2014,800 units were sent on consignment to Farber Hardware.Four hundred of these units were sold for cash,and by December 31,2011,remittance had been made to Tundra Electronics for 380 units.

Prepare the required journal entries on the books of Tundra Electronics Company and Farber Hardware for the transactions in 2014.

Prepare the required journal entries on the books of Tundra Electronics Company and Farber Hardware for the transactions in 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

72

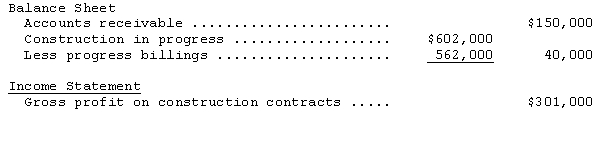

In 2014,Amsterdam Builders began construction work under a three-year contract at a price of $7,525,000.The firm uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of cost incurred to the total estimated costs for completing the contract.The financial statement presentations relating to this contract on December 31,2014,are:

Determine the

(1)cash collected in 2014.

(2)estimated income on the construction contract.

Determine the

(1)cash collected in 2014.

(2)estimated income on the construction contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

73

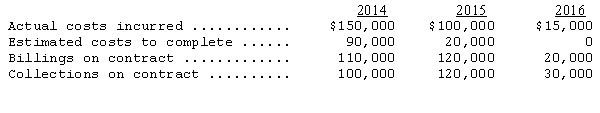

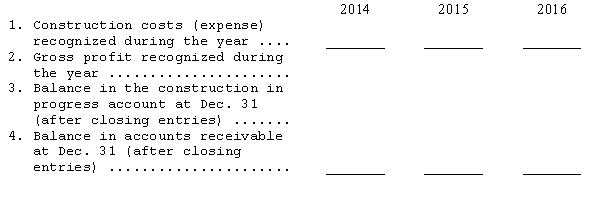

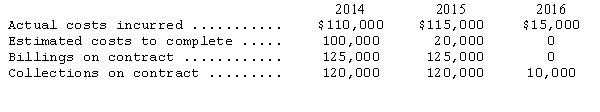

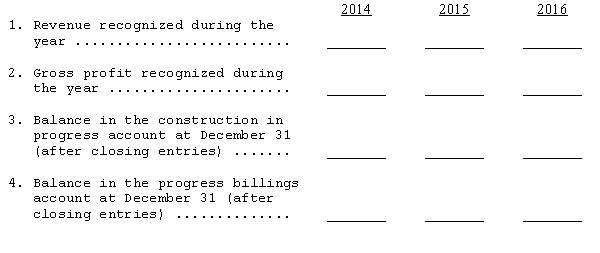

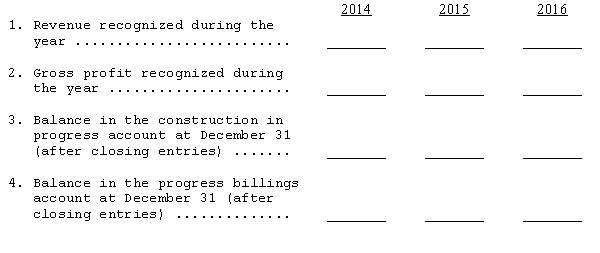

On January 1,2014,Artigas,Inc.obtained a contract to construct a building.It was estimated at the beginning of the contract that it would take 3 years to complete the project at an expected cost of $200,000.The contract price was $250,000.The following information describes the status of the job at the close of production each year:

Compute the items listed below for each year assuming the use of the percentage-of- completion cost-to-cost method.(Round all percentages to two decimals.)

Compute the items listed below for each year assuming the use of the percentage-of- completion cost-to-cost method.(Round all percentages to two decimals.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

74

On January 1,2014 Flora Enterprises obtained a contract to construct a building.It was estimated at the beginning of the contract that it would take three years to complete the project at an expected cost of $200,000.The contract price was $250,000.The following information describes the status of the job at the close of production each year:

Compute the items listed below for each year assuming the use of the percentage-of-completion cost-to-cost method.(Round all percentages to two decimals).

Compute the items listed below for each year assuming the use of the percentage-of-completion cost-to-cost method.(Round all percentages to two decimals).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

75

The collection of credit sales is usually predictable and reasonably assured as a result of credit approval,collections procedures,and historical evidence.In such cases,revenue is appropriately recognized at the point of sale.If a company makes credit sales to customers of relatively poor credit risk,however,recognition of revenue at the point of sale may be inappropriate.Although revenue may have been earned and is measurable,ultimate collection of the proceeds on the sale are highly uncertain.The creditor in such circumstances may defer the recognition of revenue until the amount due is collected.The installment sales method thus may be used.Under the installment sales method,both sales and cost of sales are recognized in the period of sale,but the related gross margin is deferred to those periods in which cash is collected.The gross margin rate for the installment sales is computed and multiplied times the cash collection to determine the portion of deferred gross margin to be recognized.

Required:

Evaluate the conceptual soundness of the installment sales method.

Required:

Evaluate the conceptual soundness of the installment sales method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

76

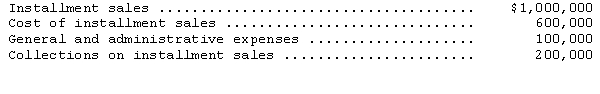

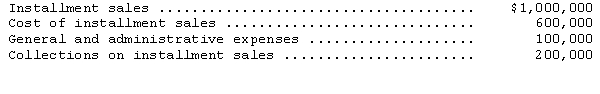

The Albert Corporation sells merchandise on the installment basis,and the uncertainties of cash collection make the use of the installment sales method of accounting acceptable.The following data relate to two years of operations.

Record the transactions related to installment sales for 2014 and 2015.

Record the transactions related to installment sales for 2014 and 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

77

Franklyn Publishing Company is marketing a new principles of accounting text.The new text is quite revolutionary in its approach.The use of the new approach raises some question as to the marketability of the text,however.

On July 31,2014,Franklyn sold 5,000 copies of the new text to college bookstores at a unit price of $60.The textbooks have a unit cost to Franklyn of $40.Franklyn uses a perpetual inventory system.The company's accounting period ends on December 31.

In view of the uncertainty regarding the marketability of the text,Franklyn sold the text with terms of net 30 days,but has allowed the bookstores until January 31,2015,to return any unsold texts for a cash refund.Franklyn has no means of estimating the number of texts that will be returned.

On September 12,2014,Franklyn collected $260,000 on the account receivable.On November 15,2014,350 texts were returned by the bookstore to Franklyn.

Required:

1.Prepare the appropriate journal entries for each of the dates given above.

2.Explain the appropriate treatment on the financial statements of any accounts unique to this sales transaction.

3.Provide authoritative support for the journal entries you made in part 1 above both for public and private companies.

On July 31,2014,Franklyn sold 5,000 copies of the new text to college bookstores at a unit price of $60.The textbooks have a unit cost to Franklyn of $40.Franklyn uses a perpetual inventory system.The company's accounting period ends on December 31.

In view of the uncertainty regarding the marketability of the text,Franklyn sold the text with terms of net 30 days,but has allowed the bookstores until January 31,2015,to return any unsold texts for a cash refund.Franklyn has no means of estimating the number of texts that will be returned.

On September 12,2014,Franklyn collected $260,000 on the account receivable.On November 15,2014,350 texts were returned by the bookstore to Franklyn.

Required:

1.Prepare the appropriate journal entries for each of the dates given above.

2.Explain the appropriate treatment on the financial statements of any accounts unique to this sales transaction.

3.Provide authoritative support for the journal entries you made in part 1 above both for public and private companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Yoder Supply Company sells maintenance contracts to the purchasers of the equipment they sell.The cost of the contract is $1,450,payable at the signing of the contract.The contract covers a three-year period with regularly scheduled inspection visits (every six months)plus any emergency visits.Experience shows that,on the average,one emergency visit per contract is required each year.Assume that 2,200 contracts were sold in 2014 and that contract sales were made evenly over the year.

Give the entries required for 2014 and 2015 to account for the 2,200 contracts.

Give the entries required for 2014 and 2015 to account for the 2,200 contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

79

Measuring progress toward completion of long-term construction projects can be accomplished in a number of ways.Nonetheless,all of these measurements can be classified into two basic groups: input measures and output measures.Input measures attempt to measure the effort devoted to a project to date compared to the total effort expected to be required in order to complete the project.A common input measure is the ratio of costs incurred to date to total estimated costs for the project.Output measures attempt to measure the results to date compared to total results when the project is completed.A common output measure would be the number of stories of a building completed compared to the total number of stories to be built.

Identify the general problems associated with input and output measures in determining the level of completion of a long-term construction project.

Identify the general problems associated with input and output measures in determining the level of completion of a long-term construction project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

80

Sonny's Dry Cleaners,Inc.charges an initial franchise fee of $195,000.When the agreement is signed,a payment of $75,000 is due,followed by four annual payments of $30,000 at the end of each period.Sonny's normal borrowing rate is 12%.Prepare the entries to record the initial franchise fee on the books of Sonny's under each of the following circumstances.

(1)The franchiser has substantial services to perform and the collection of the note is extremely uncertain.

(2)The down payment is nonrefundable,collection of the note is reasonably assured,and the franchiser has performed substantially all of the services required by the initial fee.

(3)The down payment is nonrefundable,collection of the note is reasonably assured,the franchiser has performed services equivalent to the down payment,but substantial services remain to be performed.

(1)The franchiser has substantial services to perform and the collection of the note is extremely uncertain.

(2)The down payment is nonrefundable,collection of the note is reasonably assured,and the franchiser has performed substantially all of the services required by the initial fee.

(3)The down payment is nonrefundable,collection of the note is reasonably assured,the franchiser has performed services equivalent to the down payment,but substantial services remain to be performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck