Deck 12: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

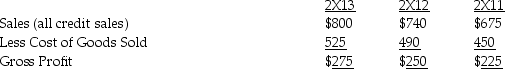

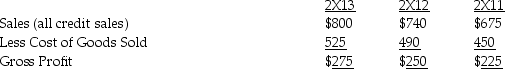

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

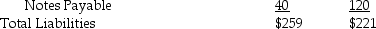

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

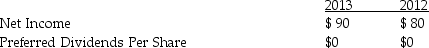

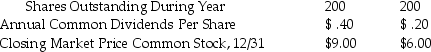

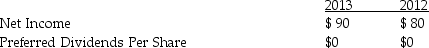

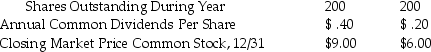

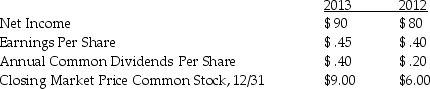

سؤال

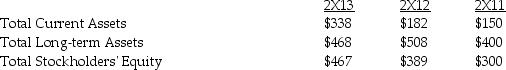

سؤال

سؤال

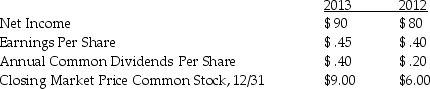

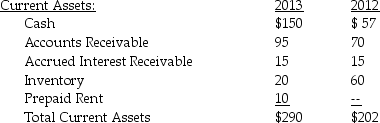

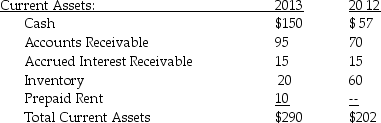

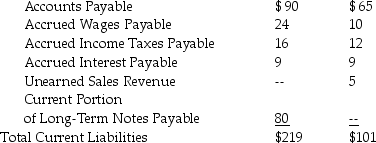

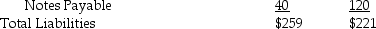

سؤال

سؤال

سؤال

سؤال

سؤال

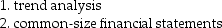

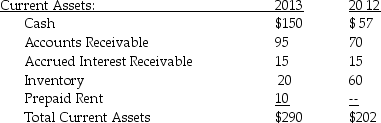

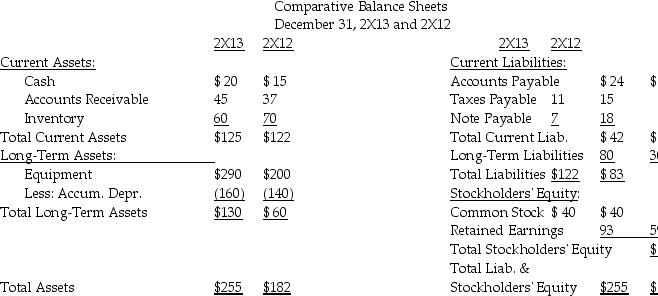

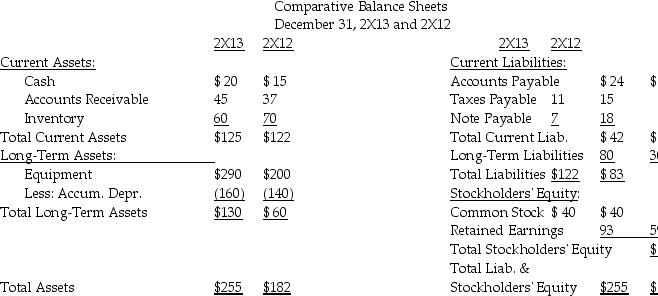

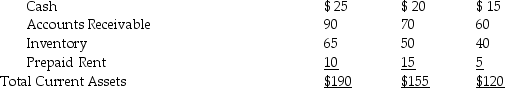

سؤال

سؤال

سؤال

سؤال

سؤال

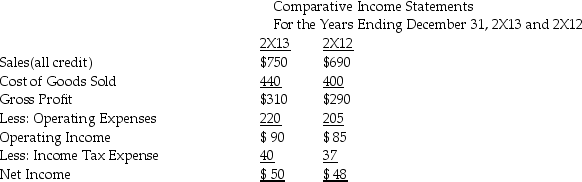

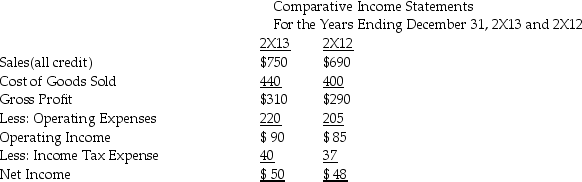

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

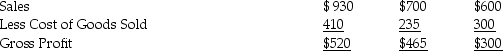

سؤال

سؤال

سؤال

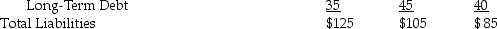

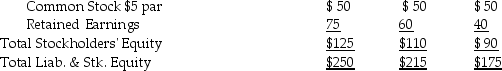

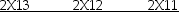

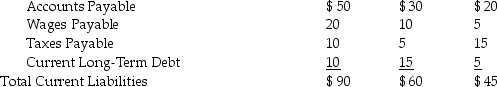

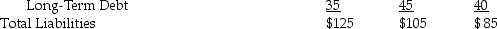

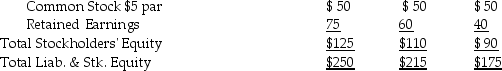

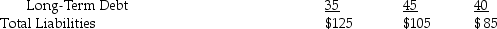

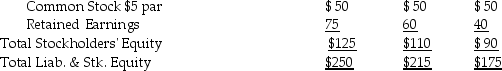

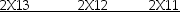

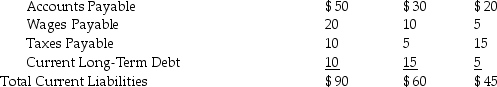

سؤال

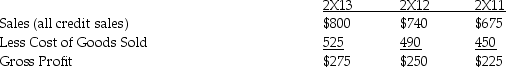

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/122

العب

ملء الشاشة (f)

Deck 12: Financial Statement Analysis

1

A management discussion and analysis (MD&A)of financial results,as well as footnotes to the financial statements,are part of a company's annual report.

True

2

Short-term liquidity is

A)a company's ability to turn plant assets into cash.

B)a company's ability to meet current payments as they become due.

C)current assets divided by current liabilities.

D)a company's ability to sell intangible assets.

E)a company's ability to shift current liabilities into long-term liabilities.

A)a company's ability to turn plant assets into cash.

B)a company's ability to meet current payments as they become due.

C)current assets divided by current liabilities.

D)a company's ability to sell intangible assets.

E)a company's ability to shift current liabilities into long-term liabilities.

B

3

The disclosure practices that have evolved in the United States have the specific and only purpose of providing information to tax authorities.

False

4

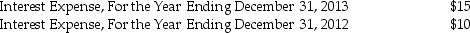

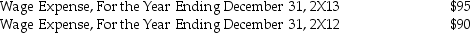

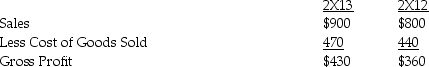

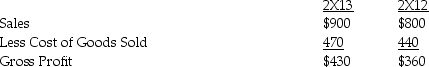

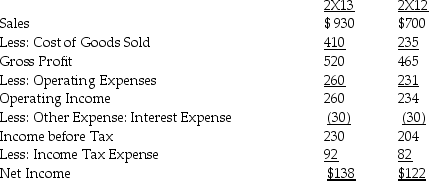

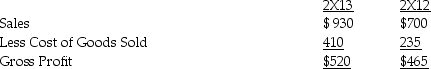

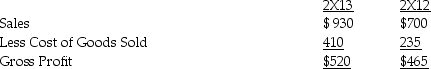

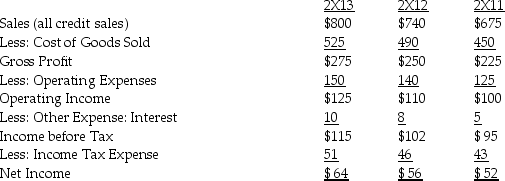

Fulton Company has the following data available:  What is the percentage increase or (decrease)in interest expense from 2012 to 2013 for Fulton Company?

What is the percentage increase or (decrease)in interest expense from 2012 to 2013 for Fulton Company?

A)33.3%

B)(50.0)%

C)(33.3)%

D)(100.0)%

E)50.0%

What is the percentage increase or (decrease)in interest expense from 2012 to 2013 for Fulton Company?

What is the percentage increase or (decrease)in interest expense from 2012 to 2013 for Fulton Company?A)33.3%

B)(50.0)%

C)(33.3)%

D)(100.0)%

E)50.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

5

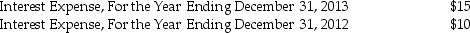

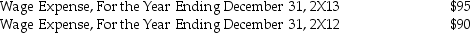

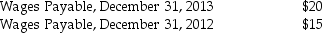

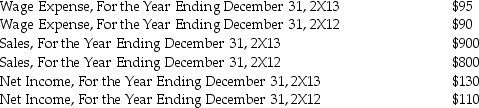

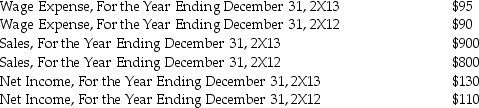

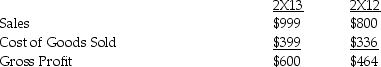

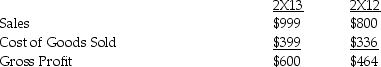

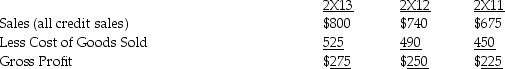

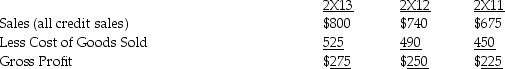

Fulton Company has the following data available:  What is the percentage increase or (decrease)in wage expense from 2X12 to 2X13 for Fulton Company?

What is the percentage increase or (decrease)in wage expense from 2X12 to 2X13 for Fulton Company?

A)5)3%

B)(5.3)%

C)2)6%

D)(5.6)%

E)5)6%

What is the percentage increase or (decrease)in wage expense from 2X12 to 2X13 for Fulton Company?

What is the percentage increase or (decrease)in wage expense from 2X12 to 2X13 for Fulton Company?A)5)3%

B)(5.3)%

C)2)6%

D)(5.6)%

E)5)6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statement(s)describe the principal reason(s)why investors and creditors use financial statement analysis? 1.To assess the risks associated with expected returns

2)To evaluate top and middle level management

3)To predict the amount of expected returns

4)To establish recommended dividend and interest payments

A)1 and 2

B)1,2,and 3

C)1 and 3

D)1 and 4

E)2,3,and 4

2)To evaluate top and middle level management

3)To predict the amount of expected returns

4)To establish recommended dividend and interest payments

A)1 and 2

B)1,2,and 3

C)1 and 3

D)1 and 4

E)2,3,and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

7

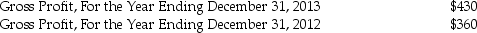

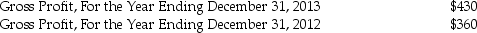

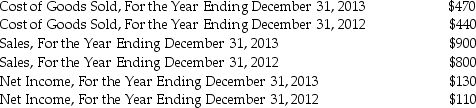

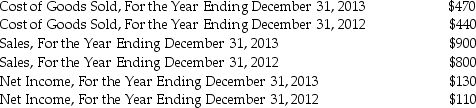

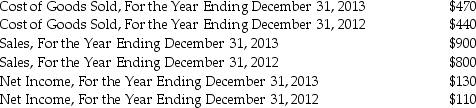

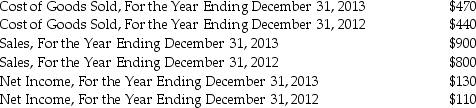

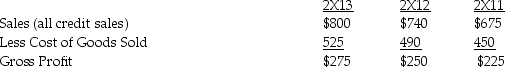

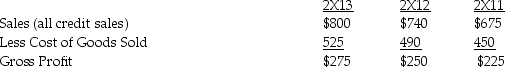

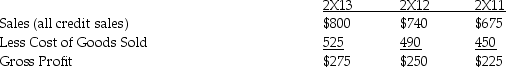

Fulton Company has the following information available:  What is the percentage increase or (decrease)in gross profit from 2012 to 2013 for Fulton Company?

What is the percentage increase or (decrease)in gross profit from 2012 to 2013 for Fulton Company?

A)(19.4)%

B)(12.5)%

C)6)8%

D)12.5%

E)19.4%

What is the percentage increase or (decrease)in gross profit from 2012 to 2013 for Fulton Company?

What is the percentage increase or (decrease)in gross profit from 2012 to 2013 for Fulton Company?A)(19.4)%

B)(12.5)%

C)6)8%

D)12.5%

E)19.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

8

A pro forma statement is a carefully formulated expression of predicted results conveyed in a statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

9

In addition to annual reports,financial information regarding a company can come from all of the following sources EXCEPT

A)a company's own press releases.

B)the popular press.

C)stockbrokers.

D)a company's Web site.

E)the Internal Revenue Service.

A)a company's own press releases.

B)the popular press.

C)stockbrokers.

D)a company's Web site.

E)the Internal Revenue Service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

10

Describe several advantages and several disadvantages to investor access to the Internet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

11

Annual reports and 10K filings for the Securities and Exchange Commission are timely,since they usually precede the events being reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

12

With respect to creditors and equity investors,which of the following statements is incorrect?

A)Creditors are concerned with assessing the short-term liquidity of a company.

B)Creditors are concerned with assessing the long-term solvency of a company.

C)Equity investors are concerned about dividend payments.

D)Both creditors and equity investors are concerned about profitability.

E)Creditors are more concerned about future security prices than equity investors.

A)Creditors are concerned with assessing the short-term liquidity of a company.

B)Creditors are concerned with assessing the long-term solvency of a company.

C)Equity investors are concerned about dividend payments.

D)Both creditors and equity investors are concerned about profitability.

E)Creditors are more concerned about future security prices than equity investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

13

Investors purchase capital stock expecting to receive dividends and an increase in the value of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

14

Long-term solvency refers to an organization's ability to meet current payments as they become due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

15

When analyzing the financial statements of a potential debtor,the primary concerns of creditors include

A)interest revenue.

B)dividend revenue.

C)short-term liquidity only.

D)long-term solvency only.

E)short-term liquidity and long-term solvency.

A)interest revenue.

B)dividend revenue.

C)short-term liquidity only.

D)long-term solvency only.

E)short-term liquidity and long-term solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

16

List the assets in the order from most liquid to least liquid.

A)Inventory,accounts receivable,cash

B)Inventory,cash,accounts receivable

C)Accounts receivable,inventory,cash

D)Cash,inventory,accounts receivable

E)Cash,accounts receivable,inventory

A)Inventory,accounts receivable,cash

B)Inventory,cash,accounts receivable

C)Accounts receivable,inventory,cash

D)Cash,inventory,accounts receivable

E)Cash,accounts receivable,inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Internet is a powerful,useful tool used by investors.Which statement is false regarding the Internet as it relates to investors?

A)The Internet provides almost immediate access to company press releases including company profitability.

B)Investors can purchase and sell securities online without the use of a broker.

C)The Internet is always an accurate source of company information.

D)An investor can use the Internet to get useful information about potential companies to invest in.

E)Often purchasing and selling stock online is free,but there are instances when an investor must have a brokerage account and pay for services.

A)The Internet provides almost immediate access to company press releases including company profitability.

B)Investors can purchase and sell securities online without the use of a broker.

C)The Internet is always an accurate source of company information.

D)An investor can use the Internet to get useful information about potential companies to invest in.

E)Often purchasing and selling stock online is free,but there are instances when an investor must have a brokerage account and pay for services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

18

A pro forma statement is

A)a comparative financial statement of the current year's results versus the prior year's results.

B)a statement by management,commenting on the results of the current operating period.

C)a projected financial statement based on predicted results.

D)an agreement between a company and its lenders,describing details concerning the loan payback.

E)a statement by the Internal Revenue Service,accepting a company's tax returns.

A)a comparative financial statement of the current year's results versus the prior year's results.

B)a statement by management,commenting on the results of the current operating period.

C)a projected financial statement based on predicted results.

D)an agreement between a company and its lenders,describing details concerning the loan payback.

E)a statement by the Internal Revenue Service,accepting a company's tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

19

Since financial statements report on past results,they are not particularly useful to investors and creditors,who want to predict future returns and their risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

20

Short-term liquidity refers to an organization's ability to generate enough cash to repay long-term debts as they mature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

21

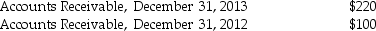

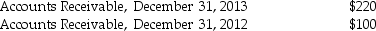

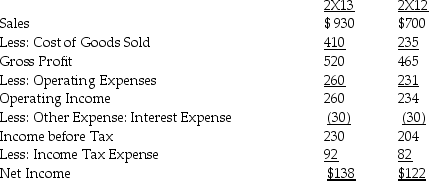

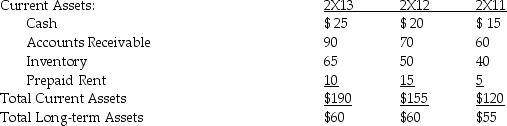

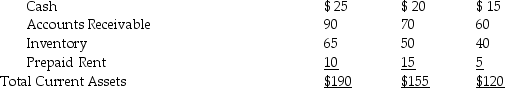

Manchester Technology has the following data available:  What is the percentage increase or (decrease)in accounts receivable from 2012 to 2013 for Manchester Technology?

What is the percentage increase or (decrease)in accounts receivable from 2012 to 2013 for Manchester Technology?

A)(120.0)%

B)(54.5)%

C)27.3%

D)54.5%

E)120.0%

What is the percentage increase or (decrease)in accounts receivable from 2012 to 2013 for Manchester Technology?

What is the percentage increase or (decrease)in accounts receivable from 2012 to 2013 for Manchester Technology?A)(120.0)%

B)(54.5)%

C)27.3%

D)54.5%

E)120.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

22

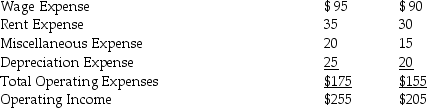

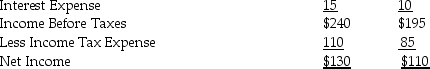

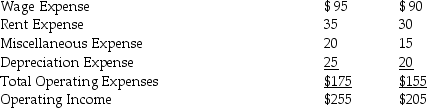

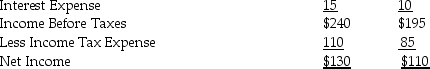

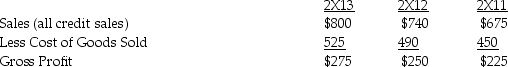

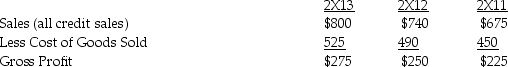

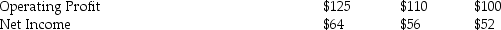

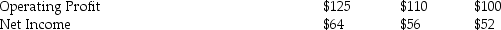

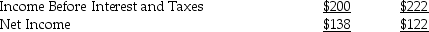

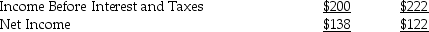

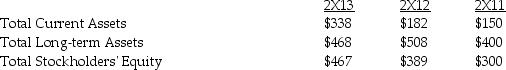

Frank Company has the following income statements available:  Operating Expenses:

Operating Expenses:

Less Other Expenses:

Less Other Expenses:

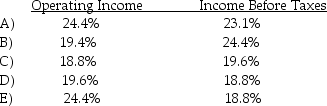

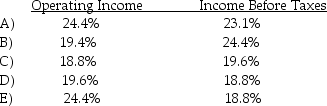

What is the percentage increase or (decrease)in operating income and income before taxes from 2X12 to 2X13 for Frank Company?

What is the percentage increase or (decrease)in operating income and income before taxes from 2X12 to 2X13 for Frank Company?

Operating Expenses:

Operating Expenses: Less Other Expenses:

Less Other Expenses: What is the percentage increase or (decrease)in operating income and income before taxes from 2X12 to 2X13 for Frank Company?

What is the percentage increase or (decrease)in operating income and income before taxes from 2X12 to 2X13 for Frank Company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

23

Segment reporting can disclose information on all except which of the following?

A)Each top executive's area of responsibility

B)Segments by product line

C)Sales revenue and net profits of each segment

D)Geographic segments

E)Total assets of each segment

A)Each top executive's area of responsibility

B)Segments by product line

C)Sales revenue and net profits of each segment

D)Geographic segments

E)Total assets of each segment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

24

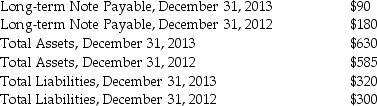

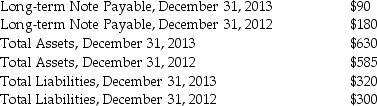

Manchester Technology has the following data available:  If a common size balance sheet were prepared,what percentage would be attributable to the 2012 long-term note payable of Manchester Technology?

If a common size balance sheet were prepared,what percentage would be attributable to the 2012 long-term note payable of Manchester Technology?

A)30.8%

B)60.0%

C)63.2%

D)69.2%

E)100.0%

If a common size balance sheet were prepared,what percentage would be attributable to the 2012 long-term note payable of Manchester Technology?

If a common size balance sheet were prepared,what percentage would be attributable to the 2012 long-term note payable of Manchester Technology?A)30.8%

B)60.0%

C)63.2%

D)69.2%

E)100.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

25

Trend analysis involves comparing data on one financial statement with other data on the same financial statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

26

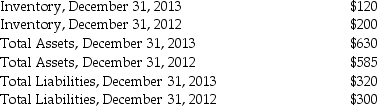

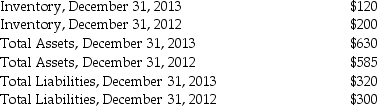

Manchester Technology has the following data available:  If a common size balance sheet were prepared,what percentage would be attributable to the 2013 inventory of Manchester Technology?

If a common size balance sheet were prepared,what percentage would be attributable to the 2013 inventory of Manchester Technology?

A)19.0%

B)21.6%

C)38.7%

D)52.2%

E)60.0%

If a common size balance sheet were prepared,what percentage would be attributable to the 2013 inventory of Manchester Technology?

If a common size balance sheet were prepared,what percentage would be attributable to the 2013 inventory of Manchester Technology?A)19.0%

B)21.6%

C)38.7%

D)52.2%

E)60.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

27

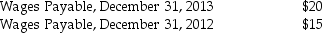

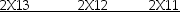

Manchester Technology has the following data available:  What is the percentage increase or (decrease)in wages payable from 2012 to 2013 for Manchester Technology?

What is the percentage increase or (decrease)in wages payable from 2012 to 2013 for Manchester Technology?

A)(33.3)%

B)(25.0)%

C)(12.5)%

D)25.0%

E)33.3%

What is the percentage increase or (decrease)in wages payable from 2012 to 2013 for Manchester Technology?

What is the percentage increase or (decrease)in wages payable from 2012 to 2013 for Manchester Technology?A)(33.3)%

B)(25.0)%

C)(12.5)%

D)25.0%

E)33.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Management Discussion and Analysis (MDA)section of the annual report concentrates on

A)analyzing the possible acquisition of other companies,and how those new acquisitions would mesh within the current corporate structure.

B)describing the background of management personnel,how long they have held their current position,and how long and in what capacities each manager has worked for the company.

C)examining how the company is performing relative to other companies in the industry.

D)explaining the major changes in the operating results,liquidity and capital resources.

E)explaining the auditor report.

A)analyzing the possible acquisition of other companies,and how those new acquisitions would mesh within the current corporate structure.

B)describing the background of management personnel,how long they have held their current position,and how long and in what capacities each manager has worked for the company.

C)examining how the company is performing relative to other companies in the industry.

D)explaining the major changes in the operating results,liquidity and capital resources.

E)explaining the auditor report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

29

For a given account,both the amount of the change from one year to the next and the percentage change are needed to recognize trends and understand their true meaning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

30

What issue would be of most concern on behalf of banks or other creditors of Manchester Technology?

A)Prepaid insurance decreased 62.5%.

B)The current portion of long-term notes payable increased by 300%.

C)Accounts receivable increased 20%.

D)Fixed assets decreased 9%.

E)Total liabilities increased 7%.

A)Prepaid insurance decreased 62.5%.

B)The current portion of long-term notes payable increased by 300%.

C)Accounts receivable increased 20%.

D)Fixed assets decreased 9%.

E)Total liabilities increased 7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

31

Fulton Company has the following data available:  If a common size income statement were prepared,what percentage would be attributable to the 2X13 wage expense of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2X13 wage expense of Fulton Company?

A)10.6%

B)11.2%

C)46.2%

D)58.1%

E)81.8%

If a common size income statement were prepared,what percentage would be attributable to the 2X13 wage expense of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2X13 wage expense of Fulton Company?A)10.6%

B)11.2%

C)46.2%

D)58.1%

E)81.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

32

Trend analysis can be used

A)only with income statement accounts.

B)only with balance sheet accounts.

C)only with statement of stockholders' equity accounts.

D)only with common-size financial statements.

E)on any financial statement.

A)only with income statement accounts.

B)only with balance sheet accounts.

C)only with statement of stockholders' equity accounts.

D)only with common-size financial statements.

E)on any financial statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

33

Trend analysis prompts investors to ask themselves what could cause the trends to end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

34

Fulton Company has the following data available:  If a common size income statement were prepared,what percentage would be attributable to the 2X12 wage expense of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2X12 wage expense of Fulton Company?

A)10.5%

B)81.8%

C)46.2%

D)58.1%

E)11.3%

If a common size income statement were prepared,what percentage would be attributable to the 2X12 wage expense of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2X12 wage expense of Fulton Company?A)10.5%

B)81.8%

C)46.2%

D)58.1%

E)11.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

35

Manchester Technology has the following data available:  What is the percentage increase or (decrease)in inventory from 2012 to 2013 for Manchester Technology?

What is the percentage increase or (decrease)in inventory from 2012 to 2013 for Manchester Technology?

A)(120.0)%

B)120.0%

C)40.0%

D)62.5%

E)(40.0)%

What is the percentage increase or (decrease)in inventory from 2012 to 2013 for Manchester Technology?

What is the percentage increase or (decrease)in inventory from 2012 to 2013 for Manchester Technology?A)(120.0)%

B)120.0%

C)40.0%

D)62.5%

E)(40.0)%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

36

Fulton Company has the following data available:  If a common size income statement were prepared,what percentage would be attributable to the 2013 cost of goods sold of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2013 cost of goods sold of Fulton Company?

A)52.2%

B)19.4%

C)28.3%

D)2)2%

E)100%

If a common size income statement were prepared,what percentage would be attributable to the 2013 cost of goods sold of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2013 cost of goods sold of Fulton Company?A)52.2%

B)19.4%

C)28.3%

D)2)2%

E)100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

37

Fulton Company has the following data available:  If a common size income statement were prepared,what percentage would be attributable to the 2013 sales of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2013 sales of Fulton Company?

A)2)2%

B)19.4%

C)28.3%

D)52.2%

E)100%

If a common size income statement were prepared,what percentage would be attributable to the 2013 sales of Fulton Company?

If a common size income statement were prepared,what percentage would be attributable to the 2013 sales of Fulton Company?A)2)2%

B)19.4%

C)28.3%

D)52.2%

E)100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

38

Each element on a common-size balance sheet is compared to total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

39

Common-size statements aid in comparing companies of different sizes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

40

The common-size income statement percentages use Cost of Goods Sold as the base amount at 100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

41

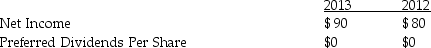

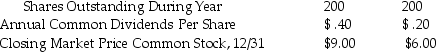

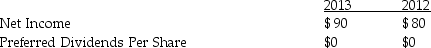

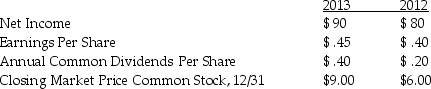

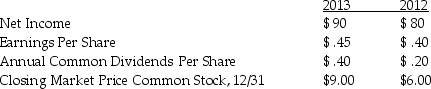

Montreal Electronics has the following data available:  Weighted Average Number of Common

Weighted Average Number of Common

What is the price-earnings ratio for Montreal Electronics in 2013? Has the price-earnings ratio improved or not improved since 2012?

What is the price-earnings ratio for Montreal Electronics in 2013? Has the price-earnings ratio improved or not improved since 2012?

A)15,not improved

B)15,improved

C)15,unknown

D)20,improved

E)20,not improved

Weighted Average Number of Common

Weighted Average Number of Common What is the price-earnings ratio for Montreal Electronics in 2013? Has the price-earnings ratio improved or not improved since 2012?

What is the price-earnings ratio for Montreal Electronics in 2013? Has the price-earnings ratio improved or not improved since 2012?A)15,not improved

B)15,improved

C)15,unknown

D)20,improved

E)20,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

42

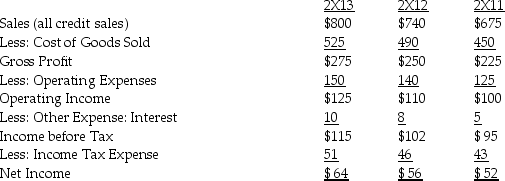

Tulip Company has the following data available:

What is the total asset turnover for Tulip Company in 2X13? Has the total asset turnover improved or not improved since 2X12?

What is the total asset turnover for Tulip Company in 2X13? Has the total asset turnover improved or not improved since 2X12?

A)1)2,improved

B)1)2,not improved

C)3)2,improved

D)3)4,improved

E)3)4,not improved

What is the total asset turnover for Tulip Company in 2X13? Has the total asset turnover improved or not improved since 2X12?

What is the total asset turnover for Tulip Company in 2X13? Has the total asset turnover improved or not improved since 2X12?A)1)2,improved

B)1)2,not improved

C)3)2,improved

D)3)4,improved

E)3)4,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

43

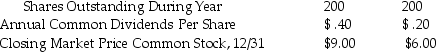

Montreal Electronics has the following data available:  What is the dividend-yield for Montreal Electronics in 2013? Has the dividend-yield increased or decreased since 2012?

What is the dividend-yield for Montreal Electronics in 2013? Has the dividend-yield increased or decreased since 2012?

A)10.0%,decreased

B)3)3%,decreased

C)4)4%,increased

D)4)4%,decreased

E)3)3%,increased

What is the dividend-yield for Montreal Electronics in 2013? Has the dividend-yield increased or decreased since 2012?

What is the dividend-yield for Montreal Electronics in 2013? Has the dividend-yield increased or decreased since 2012?A)10.0%,decreased

B)3)3%,decreased

C)4)4%,increased

D)4)4%,decreased

E)3)3%,increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

44

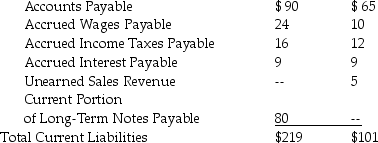

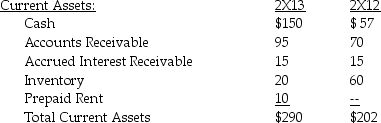

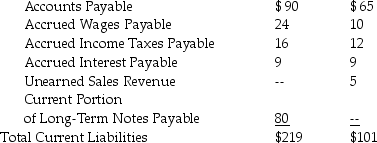

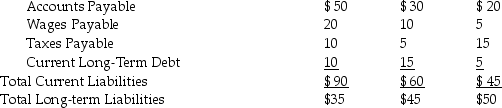

Montreal Electronics has the following data available:  Current Liabilities:

Current Liabilities:

Long-Term Liabilities:

Long-Term Liabilities:

What is the current ratio for Montreal Electronics in 2013? Has the current ratio improved or not improved since 2012?

What is the current ratio for Montreal Electronics in 2013? Has the current ratio improved or not improved since 2012?

A)2)0,improved

B)1)3,improved

C)1)3,not improved

D)0)5,improved

E)2)0,not improved

Current Liabilities:

Current Liabilities: Long-Term Liabilities:

Long-Term Liabilities: What is the current ratio for Montreal Electronics in 2013? Has the current ratio improved or not improved since 2012?

What is the current ratio for Montreal Electronics in 2013? Has the current ratio improved or not improved since 2012?A)2)0,improved

B)1)3,improved

C)1)3,not improved

D)0)5,improved

E)2)0,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

45

Trend analysis and common-size financial statements are important analytical techniques used to evaluate the strength of published financial statements.

a.Define:

b.How is each of these techniques helpful in the analysis of financial statements?

b.How is each of these techniques helpful in the analysis of financial statements?

a.Define:

b.How is each of these techniques helpful in the analysis of financial statements?

b.How is each of these techniques helpful in the analysis of financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

46

Montreal Electronics has the following data available:  Current Liabilities:

Current Liabilities:

Long-Term Liabilities:

Long-Term Liabilities:

What is the quick ratio for Montreal Electronics in 2013? Has the quick ratio improved or not improved since 2012?

What is the quick ratio for Montreal Electronics in 2013? Has the quick ratio improved or not improved since 2012?

A)2)0,not improved

B)1)2,not improved

C)1)3,improved

D)1)1,improved

Current Liabilities:

Current Liabilities: Long-Term Liabilities:

Long-Term Liabilities: What is the quick ratio for Montreal Electronics in 2013? Has the quick ratio improved or not improved since 2012?

What is the quick ratio for Montreal Electronics in 2013? Has the quick ratio improved or not improved since 2012?A)2)0,not improved

B)1)2,not improved

C)1)3,improved

D)1)1,improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

47

How is working capital calculated?

A)(total current assets)minus (total current liabilities)

B)(total current assets)minus (inventories and prepaid assets)

C)(total current assets)divided by (total current liabilities)

D)(total current assets)

E)(total current liabilities)

A)(total current assets)minus (total current liabilities)

B)(total current assets)minus (inventories and prepaid assets)

C)(total current assets)divided by (total current liabilities)

D)(total current assets)

E)(total current liabilities)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

48

Component percentages are line items of income statements that express each line item as a percentage of the total sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

49

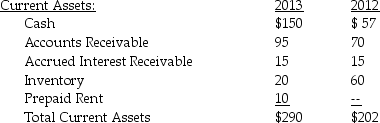

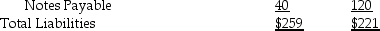

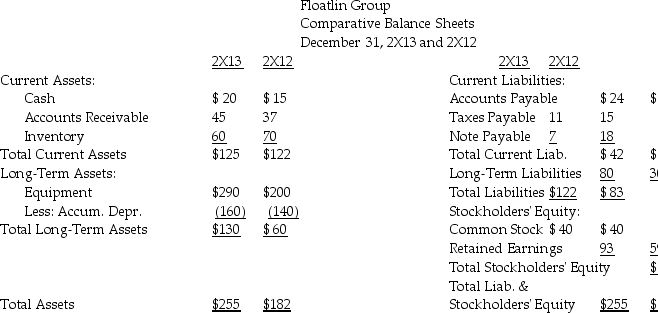

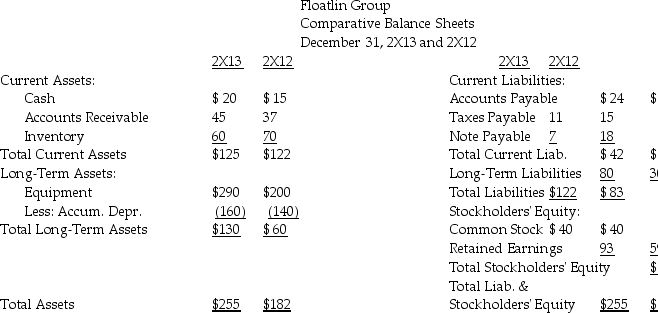

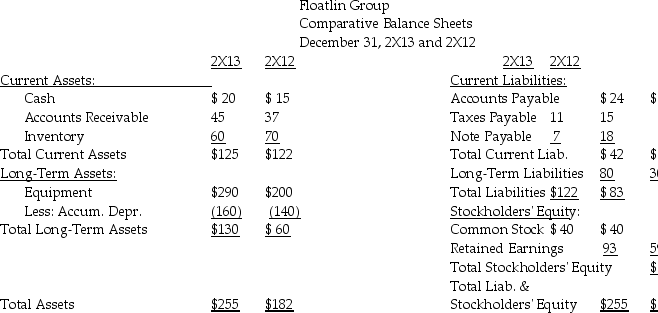

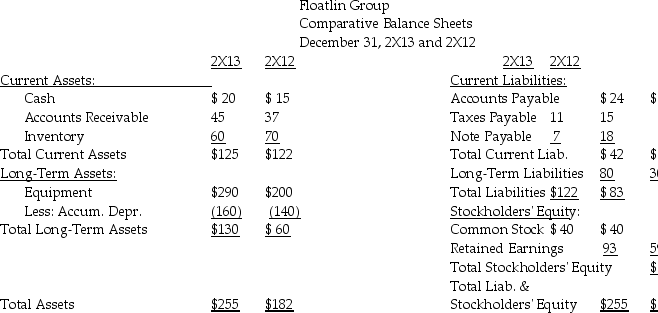

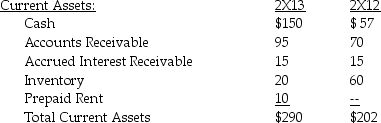

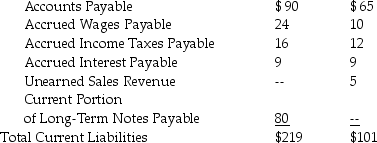

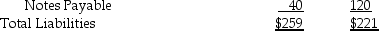

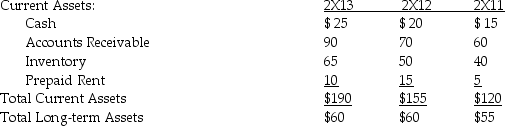

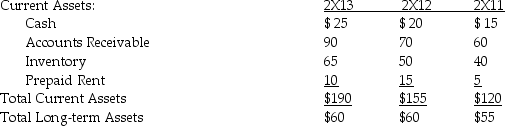

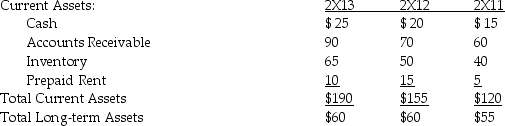

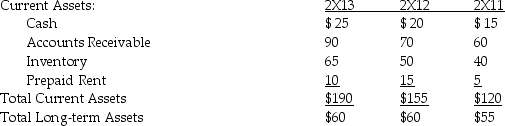

Comparative balance sheets are available for Floatlin Group:

Prepare a common-size balance sheet for Floatlin Group at December 31,2X13.

Prepare a common-size balance sheet for Floatlin Group at December 31,2X13.

Prepare a common-size balance sheet for Floatlin Group at December 31,2X13.

Prepare a common-size balance sheet for Floatlin Group at December 31,2X13.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

50

The MD&A section of a corporation's annual report contains information about changes in the income statement,liquidity,and capital resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

51

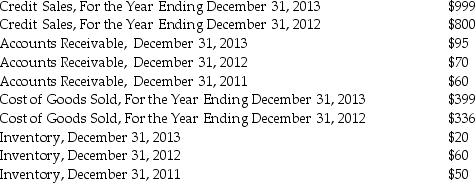

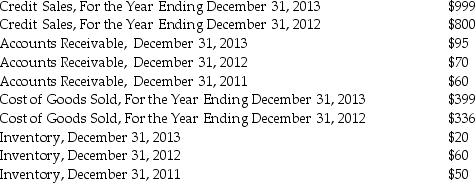

Montvale Company has the following information available:  What is the average collection period in days for Montvale in 2013? Has the average collection period in days improved or not improved since 2012?

What is the average collection period in days for Montvale in 2013? Has the average collection period in days improved or not improved since 2012?

A)30.0,not improved

B)10.0,unknown

C)10.0,improved

D)30.0,improved

E)30.2,not improved

What is the average collection period in days for Montvale in 2013? Has the average collection period in days improved or not improved since 2012?

What is the average collection period in days for Montvale in 2013? Has the average collection period in days improved or not improved since 2012?A)30.0,not improved

B)10.0,unknown

C)10.0,improved

D)30.0,improved

E)30.2,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

52

Floatlin Group has the following balance sheets available:

Determine the increase or decrease in dollars and percentage for each line on the balance sheet.

Determine the increase or decrease in dollars and percentage for each line on the balance sheet.

Determine the increase or decrease in dollars and percentage for each line on the balance sheet.

Determine the increase or decrease in dollars and percentage for each line on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

53

Montreal Electronics has the following data available:  Current Liabilities:

Current Liabilities:

Long-Term Liabilities:

Long-Term Liabilities:

What is the working capital for Montreal Electronics in 2X13? Has the working capital improved or not improved since 2X12?

What is the working capital for Montreal Electronics in 2X13? Has the working capital improved or not improved since 2X12?

A)$101,not improved

B)$101,improved

C)$ 71,improved

D)$ 71,not improved

E)$150,not improved

Current Liabilities:

Current Liabilities: Long-Term Liabilities:

Long-Term Liabilities: What is the working capital for Montreal Electronics in 2X13? Has the working capital improved or not improved since 2X12?

What is the working capital for Montreal Electronics in 2X13? Has the working capital improved or not improved since 2X12?A)$101,not improved

B)$101,improved

C)$ 71,improved

D)$ 71,not improved

E)$150,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

54

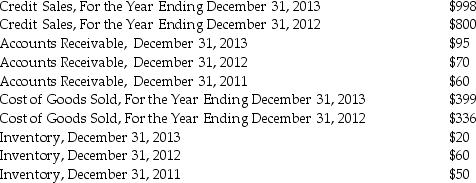

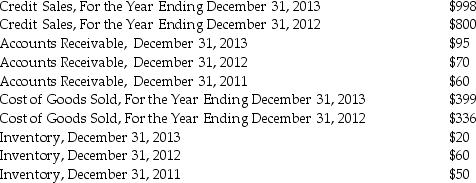

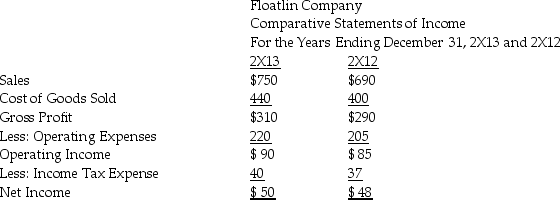

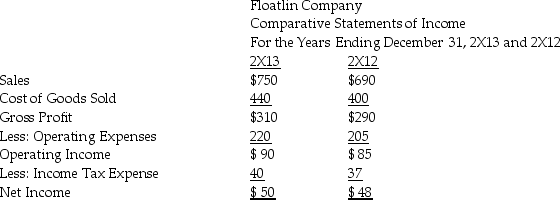

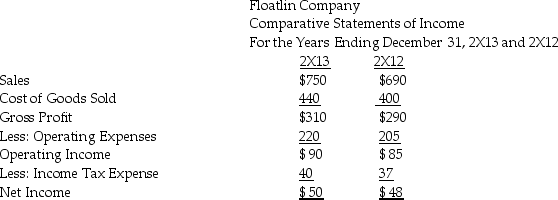

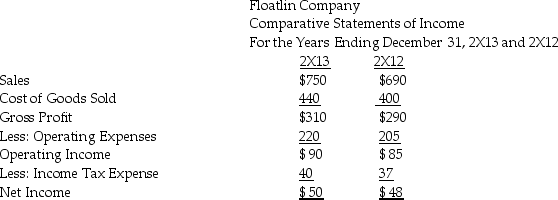

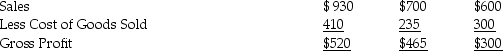

Comparative income statements are available for Floatlin Company:

Prepare common-size income statements for Floatlin Company for 2X13 and 2X12.

Prepare common-size income statements for Floatlin Company for 2X13 and 2X12.

Prepare common-size income statements for Floatlin Company for 2X13 and 2X12.

Prepare common-size income statements for Floatlin Company for 2X13 and 2X12.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

55

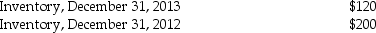

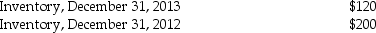

Monday Corporation has the following data available:  What is the inventory turnover for Monday Corporation in 2013? Has the inventory turnover improved or not improved since 2012?

What is the inventory turnover for Monday Corporation in 2013? Has the inventory turnover improved or not improved since 2012?

A)10.0,improved

B)10.0,unknown

C)10.0,not improved

D)30.0,improved

E)30.0,not improved

What is the inventory turnover for Monday Corporation in 2013? Has the inventory turnover improved or not improved since 2012?

What is the inventory turnover for Monday Corporation in 2013? Has the inventory turnover improved or not improved since 2012?A)10.0,improved

B)10.0,unknown

C)10.0,not improved

D)30.0,improved

E)30.0,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

56

Montreal Electronics has the following data available:  Weighted Average Number of Common

Weighted Average Number of Common

What are the earnings per share for Montreal Electronics in 2013? Has the earnings per share improved or not improved since 2012?

What are the earnings per share for Montreal Electronics in 2013? Has the earnings per share improved or not improved since 2012?

A)$)40,improved

B)$)40,not improved

C)$)40,unknown

D)$)45,not improved

E)$)45,improved

Weighted Average Number of Common

Weighted Average Number of Common What are the earnings per share for Montreal Electronics in 2013? Has the earnings per share improved or not improved since 2012?

What are the earnings per share for Montreal Electronics in 2013? Has the earnings per share improved or not improved since 2012?A)$)40,improved

B)$)40,not improved

C)$)40,unknown

D)$)45,not improved

E)$)45,improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

57

Montreal Electronics has the following data available:  What is the gross profit rate for Montreal Electronics in 2X13? Has the gross profit rate improved or not improved since 2X12?

What is the gross profit rate for Montreal Electronics in 2X13? Has the gross profit rate improved or not improved since 2X12?

A)58.0%,improved

B)39.9%,not improved

C)58.0%,not improved

D)39.9%,improved

E)60.1%,improved

What is the gross profit rate for Montreal Electronics in 2X13? Has the gross profit rate improved or not improved since 2X12?

What is the gross profit rate for Montreal Electronics in 2X13? Has the gross profit rate improved or not improved since 2X12?A)58.0%,improved

B)39.9%,not improved

C)58.0%,not improved

D)39.9%,improved

E)60.1%,improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

58

Montreal Electronics has the following data available:  What is the dividend-payout for Montreal Electronics in 2013? Has the dividend-payout increased or decreased since 2012?

What is the dividend-payout for Montreal Electronics in 2013? Has the dividend-payout increased or decreased since 2012?

A)100%,increased

B)89%,decreased

C)89%,increased

D)50%,increased

E)50%,decreased

What is the dividend-payout for Montreal Electronics in 2013? Has the dividend-payout increased or decreased since 2012?

What is the dividend-payout for Montreal Electronics in 2013? Has the dividend-payout increased or decreased since 2012?A)100%,increased

B)89%,decreased

C)89%,increased

D)50%,increased

E)50%,decreased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

59

Floatlin Company has the following income statements available:

Determine the increase or decrease in dollars and percentage for each line in the income statement.

Determine the increase or decrease in dollars and percentage for each line in the income statement.

Determine the increase or decrease in dollars and percentage for each line in the income statement.

Determine the increase or decrease in dollars and percentage for each line in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

60

Tulsa Company has the following data available:  What is the gross profit rate for Tulsa Company in 2X13? Has the gross profit rate improved or not improved since 2X12?

What is the gross profit rate for Tulsa Company in 2X13? Has the gross profit rate improved or not improved since 2X12?

A)23.3%,improved

B)34.4%,improved

C)34.4%,not improved

D)52.4%,improved

E)52.4%,not improved

What is the gross profit rate for Tulsa Company in 2X13? Has the gross profit rate improved or not improved since 2X12?

What is the gross profit rate for Tulsa Company in 2X13? Has the gross profit rate improved or not improved since 2X12?A)23.3%,improved

B)34.4%,improved

C)34.4%,not improved

D)52.4%,improved

E)52.4%,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

61

Ontario Appliances has the following data:  What is the interest coverage for Ontario Appliances in 2X13? Has the interest coverage improved or not improved since 2X12?

What is the interest coverage for Ontario Appliances in 2X13? Has the interest coverage improved or not improved since 2X12?

A)12.7,unknown

B)7)7,not improved

C)7)7,improved

D)8)7,improved

E)8)7,not improved

What is the interest coverage for Ontario Appliances in 2X13? Has the interest coverage improved or not improved since 2X12?

What is the interest coverage for Ontario Appliances in 2X13? Has the interest coverage improved or not improved since 2X12?A)12.7,unknown

B)7)7,not improved

C)7)7,improved

D)8)7,improved

E)8)7,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

62

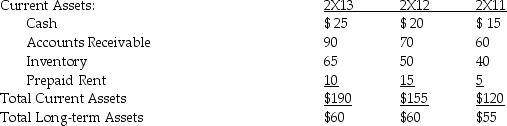

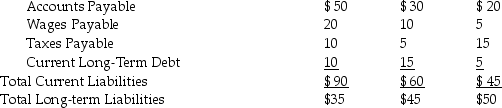

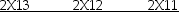

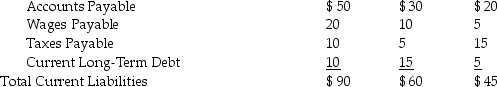

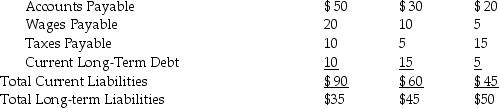

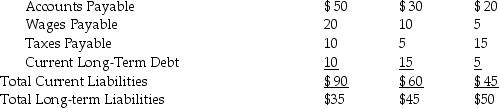

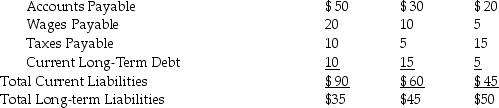

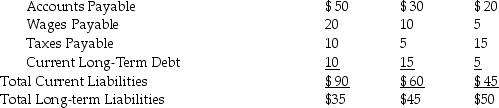

Lorna Company has the following data available:  Current Liabilities:

Current Liabilities:

What is the working capital for Lorna Company in 2X13? Has the working capital improved or not improved since 2X12?

What is the working capital for Lorna Company in 2X13? Has the working capital improved or not improved since 2X12?

A)$125,improved

B)$100,improved

C)$100,not improved

D)$60,improved

E)$125,not improved

Current Liabilities:

Current Liabilities: What is the working capital for Lorna Company in 2X13? Has the working capital improved or not improved since 2X12?

What is the working capital for Lorna Company in 2X13? Has the working capital improved or not improved since 2X12?A)$125,improved

B)$100,improved

C)$100,not improved

D)$60,improved

E)$125,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

63

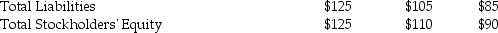

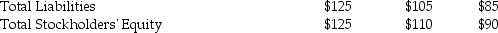

Wetzel Company has the following data:  Current Liabilities:

Current Liabilities:

Long-Term Liabilities:

Long-Term Liabilities:

Stockholders' Equity:

Stockholders' Equity:

What is the total-debt-to-total-assets ratio for Wetzel Company in 2X13? Has the total-debt-to-total-assets ratio improved or not improved since 2X12?

What is the total-debt-to-total-assets ratio for Wetzel Company in 2X13? Has the total-debt-to-total-assets ratio improved or not improved since 2X12?

A)0)14,improved

B)0)18,improved

C)0)18,not improved

D)0)50,improved

E)0)50,not improved

Current Liabilities:

Current Liabilities: Long-Term Liabilities:

Long-Term Liabilities: Stockholders' Equity:

Stockholders' Equity: What is the total-debt-to-total-assets ratio for Wetzel Company in 2X13? Has the total-debt-to-total-assets ratio improved or not improved since 2X12?

What is the total-debt-to-total-assets ratio for Wetzel Company in 2X13? Has the total-debt-to-total-assets ratio improved or not improved since 2X12?A)0)14,improved

B)0)18,improved

C)0)18,not improved

D)0)50,improved

E)0)50,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

64

Kornowski Company has the following data:

What is the inventory turnover for Kornowski Company in 2X13? Has the inventory turnover improved or not improved since 2X12?

What is the inventory turnover for Kornowski Company in 2X13? Has the inventory turnover improved or not improved since 2X12?

A)8)10,improved

B)8)10,not improved

C)9)13,improved

D)9)13,not improved

E)91,not improved

What is the inventory turnover for Kornowski Company in 2X13? Has the inventory turnover improved or not improved since 2X12?

What is the inventory turnover for Kornowski Company in 2X13? Has the inventory turnover improved or not improved since 2X12?A)8)10,improved

B)8)10,not improved

C)9)13,improved

D)9)13,not improved

E)91,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

65

Beck Company has the following data available:

What are the earnings per share for Beck Company in 2X13? Have the earnings per share improved or not improved since 2X12?

A)$1.28,improved

B)$1.28,not improved

C)$6.40,improved

D)$6.40,not improved

E)$12.80,not improved

What are the earnings per share for Beck Company in 2X13? Have the earnings per share improved or not improved since 2X12?

A)$1.28,improved

B)$1.28,not improved

C)$6.40,improved

D)$6.40,not improved

E)$12.80,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

66

Yellow Company has the following data available:  Current Liabilities:

Current Liabilities:

What is the quick ratio for Yellow Company in 2X13? Has the quick ratio improved or not improved since 2X12?

What is the quick ratio for Yellow Company in 2X13? Has the quick ratio improved or not improved since 2X12?

A)2)11,not improved

B)55,not improved

C)1)39,improved

D)1)39,not improved

E)55,improved

Current Liabilities:

Current Liabilities: What is the quick ratio for Yellow Company in 2X13? Has the quick ratio improved or not improved since 2X12?

What is the quick ratio for Yellow Company in 2X13? Has the quick ratio improved or not improved since 2X12?A)2)11,not improved

B)55,not improved

C)1)39,improved

D)1)39,not improved

E)55,improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

67

The following financial statements are available for Jerry Company:

Use the above information to determine the following ratios for 2X13:

Use the above information to determine the following ratios for 2X13:

a.Quick ratio

b.Average collection period in days

c.Total-debt-to-total-equity

d.Pretax return on assets (ROA)

e.Return on common stockholder's equity (ROE)

Use the above information to determine the following ratios for 2X13:

Use the above information to determine the following ratios for 2X13:a.Quick ratio

b.Average collection period in days

c.Total-debt-to-total-equity

d.Pretax return on assets (ROA)

e.Return on common stockholder's equity (ROE)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

68

Zeman Company has the following data:

What is the return on sales for Zeman Company in 2X13? Has the return on sales improved or not improved since 2X12?

What is the return on sales for Zeman Company in 2X13? Has the return on sales improved or not improved since 2X12?

A)8)0%,improved

B)8)0%,not improved

C)14.4%,improved

D)34.4%,improved

E)34.4%,not improved

What is the return on sales for Zeman Company in 2X13? Has the return on sales improved or not improved since 2X12?

What is the return on sales for Zeman Company in 2X13? Has the return on sales improved or not improved since 2X12?A)8)0%,improved

B)8)0%,not improved

C)14.4%,improved

D)34.4%,improved

E)34.4%,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

69

Liquidity focuses on whether there are sufficient current assets to satisfy current liabilities as they become due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

70

Valdo Vinyls has the following data available:

What is the return on sales for Valdo Vinyls in 2X13? Has the return on sales improved or not improved since 2X12?

What is the return on sales for Valdo Vinyls in 2X13? Has the return on sales improved or not improved since 2X12?

A)17.6%,not improved

B)14.8%,not improved

C)14.8%,improved

D)10.0%,improved

E)9)0%,improved

What is the return on sales for Valdo Vinyls in 2X13? Has the return on sales improved or not improved since 2X12?

What is the return on sales for Valdo Vinyls in 2X13? Has the return on sales improved or not improved since 2X12?A)17.6%,not improved

B)14.8%,not improved

C)14.8%,improved

D)10.0%,improved

E)9)0%,improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

71

A cross-sectional evaluation of financial ratios involves comparing a company's financial ratios with the ratios of other companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

72

Grady Company's inventory turnover was 8.2 in 2X13.After analyzing several similar,competing companies,Grady Company found that the average inventory turnover for those companies was 11.8.What should Grady Company consider doing?

A)Increase inventory by purchasing inventory on credit

B)Increase inventory by purchasing inventory with cash

C)Change the number of days Grady Company uses to calculate inventory turnover

D)Increase inventory by decreasing sales.

E)Decrease inventory by increasing sales

A)Increase inventory by purchasing inventory on credit

B)Increase inventory by purchasing inventory with cash

C)Change the number of days Grady Company uses to calculate inventory turnover

D)Increase inventory by decreasing sales.

E)Decrease inventory by increasing sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

73

The quick ratio is calculated as current assets divided by current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

74

Purple Company has the following data available:  Current Liabilities:

Current Liabilities:

What is the current ratio for Purple Company in 2X13? Has the current ratio improved or not improved since 2X12?

What is the current ratio for Purple Company in 2X13? Has the current ratio improved or not improved since 2X12?

A)2)11,improved

B)0)76,improved

C)0)76,not improved

D)0)36,improved

E)2)11,not improved

Current Liabilities:

Current Liabilities: What is the current ratio for Purple Company in 2X13? Has the current ratio improved or not improved since 2X12?

What is the current ratio for Purple Company in 2X13? Has the current ratio improved or not improved since 2X12?A)2)11,improved

B)0)76,improved

C)0)76,not improved

D)0)36,improved

E)2)11,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

75

Product Line Inc.has the following data:  What is the interest coverage for Product Line Inc.in 2X13? Has the interest coverage improved or not improved since 2X12?

What is the interest coverage for Product Line Inc.in 2X13? Has the interest coverage improved or not improved since 2X12?

A)12.5,not improved

B)6)4,not improved

C)11.5,improved

D)12.5,improved

E)6)4,improved

What is the interest coverage for Product Line Inc.in 2X13? Has the interest coverage improved or not improved since 2X12?

What is the interest coverage for Product Line Inc.in 2X13? Has the interest coverage improved or not improved since 2X12?A)12.5,not improved

B)6)4,not improved

C)11.5,improved

D)12.5,improved

E)6)4,improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

76

The cornerstone of financial statement analysis is the use of ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

77

Vivian Company has the following data available:

What is the total asset turnover for Vivian Company in 2X13? Has the total asset turnover improved or not improved since 2X12?

What is the total asset turnover for Vivian Company in 2X13? Has the total asset turnover improved or not improved since 2X12?

A)1)2,improved

B)1)2,not improved

C)1)5,improved

D)1)6,improved

E)1)6,not improved

What is the total asset turnover for Vivian Company in 2X13? Has the total asset turnover improved or not improved since 2X12?

What is the total asset turnover for Vivian Company in 2X13? Has the total asset turnover improved or not improved since 2X12?A)1)2,improved

B)1)2,not improved

C)1)5,improved

D)1)6,improved

E)1)6,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

78

Redwing Company has the following data:  Current Assets:

Current Assets:

What is the average collection period in days for Redwing Company in 2X13? Has the average collection period in days improved or not improved since 2X12?

What is the average collection period in days for Redwing Company in 2X13? Has the average collection period in days improved or not improved since 2X12?

A)41.1,improved

B)36.5,improved

C)36.5,not improved

D)8)9,improved

E)41.1,not improved

Current Assets:

Current Assets: What is the average collection period in days for Redwing Company in 2X13? Has the average collection period in days improved or not improved since 2X12?

What is the average collection period in days for Redwing Company in 2X13? Has the average collection period in days improved or not improved since 2X12?A)41.1,improved

B)36.5,improved

C)36.5,not improved

D)8)9,improved

E)41.1,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

79

A comparison of a company's financial ratios with its own historical ratios is referred to as a cross-sectional comparison.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

80

Cider Company has the following data:  Current Liabilities:

Current Liabilities:

Long-Term Liabilities:

Long-Term Liabilities:

Stockholders' Equity:

Stockholders' Equity:

What is the total-debt-to-total-equity ratio for Cider Company in 2X13? Has the total-debt-to-total equity ratio improved or not improved since 2X12?

What is the total-debt-to-total-equity ratio for Cider Company in 2X13? Has the total-debt-to-total equity ratio improved or not improved since 2X12?

A)0)28,improved

B)0)36,improved

C)0)36,not improved

D)1)00,improved

E)1)00,not improved

Current Liabilities:

Current Liabilities: Long-Term Liabilities:

Long-Term Liabilities: Stockholders' Equity:

Stockholders' Equity: What is the total-debt-to-total-equity ratio for Cider Company in 2X13? Has the total-debt-to-total equity ratio improved or not improved since 2X12?

What is the total-debt-to-total-equity ratio for Cider Company in 2X13? Has the total-debt-to-total equity ratio improved or not improved since 2X12?A)0)28,improved

B)0)36,improved

C)0)36,not improved

D)1)00,improved

E)1)00,not improved

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck