Deck 12: Cost Allocation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

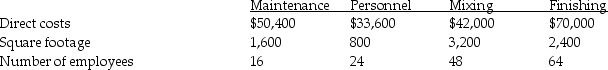

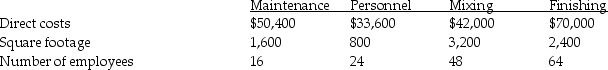

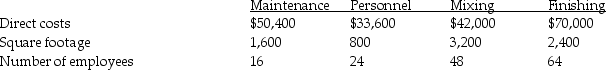

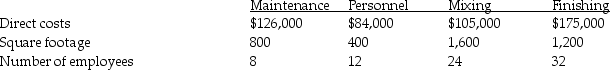

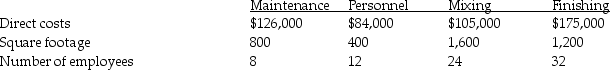

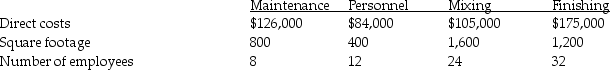

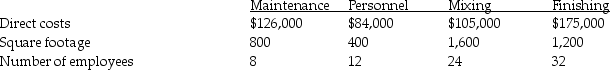

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

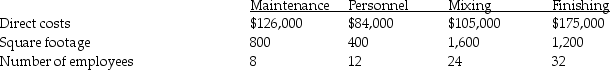

سؤال

سؤال

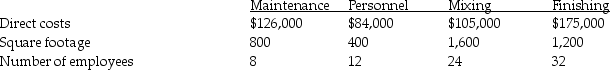

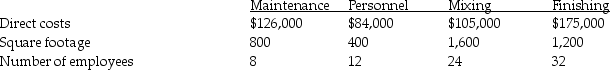

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 12: Cost Allocation

1

Budgeted cost rates are used for allocating variable costs of service departments to user departments because ________.

A)it protects user departments from intervening price fluctuations

B)it protects user departments from inefficiencies in service departments

C)it protects managers in producing departments from uncontrollable costs

D)all of the above

A)it protects user departments from intervening price fluctuations

B)it protects user departments from inefficiencies in service departments

C)it protects managers in producing departments from uncontrollable costs

D)all of the above

D

2

Companies must assign all production costs and only production costs to products for external financial reporting purposes.

True

3

What formula should be used to allocate variable costs from service departments to user departments?

A)budgeted unit rate x total budgeted units planned to be used

B)actual unit rate x total budgeted units planned to be used

C)budgeted unit rate x actual units used

D)actual unit rate x actual units used

A)budgeted unit rate x total budgeted units planned to be used

B)actual unit rate x total budgeted units planned to be used

C)budgeted unit rate x actual units used

D)actual unit rate x actual units used

C

4

A cost allocation base refers to a ________.

A)cost object

B)sum total of costs to be allocated

C)cost driver

D)cost pool

A)cost object

B)sum total of costs to be allocated

C)cost driver

D)cost pool

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

For external financial reporting,only ________ costs are assigned to products or services.For internal financial reporting,any ________ costs can be assigned to products or services.

A)controllable; avoidable

B)avoidable; controllable

C)common; unavoidable

D)production; nonproduction

A)controllable; avoidable

B)avoidable; controllable

C)common; unavoidable

D)production; nonproduction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

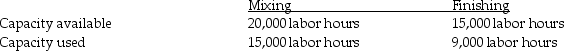

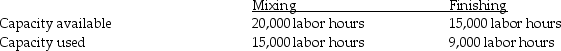

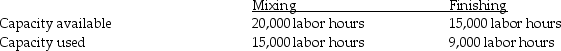

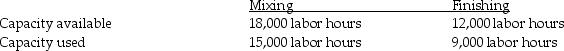

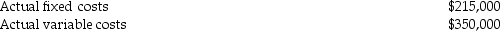

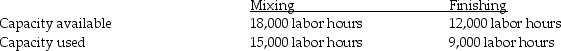

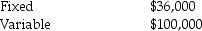

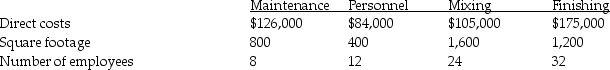

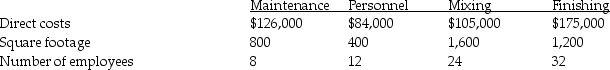

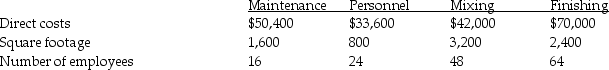

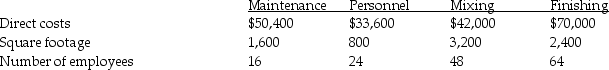

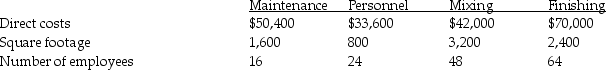

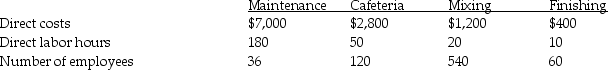

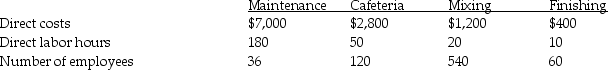

Rodney Company has two production departments called Mixing and Finishing.The maintenance department serves both production departments.Budgeted fixed costs for the maintenance department are $30,000.Budgeted variable costs for the maintenance department are $5.00 per labor hour.Other relevant data follow:  Actual maintenance department costs:

Actual maintenance department costs:

The amount of variable maintenance department costs allocated to the Finishing Department should be ________.

The amount of variable maintenance department costs allocated to the Finishing Department should be ________.

A)$37,500

B)$42,000

C)$45,000

D)$75,000

Actual maintenance department costs:

Actual maintenance department costs: The amount of variable maintenance department costs allocated to the Finishing Department should be ________.

The amount of variable maintenance department costs allocated to the Finishing Department should be ________.A)$37,500

B)$42,000

C)$45,000

D)$75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

Companies must assign all value chain costs to products for internal financial reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

Examples of service departments include human resources and technical support centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

Cubic feet are the logical cost driver for depreciation expense from heating and air conditioning equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

Allocation of costs to cost objects may be described as apportion or attribute.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

For costs that accountants cannot directly trace to products or services,accountants use ________ or ________.

A)cost-allocation methods; leave costs unallocated

B)cost-budgeting methods; ignore remaining costs

C)sensitivity analysis; financial planning models

D)financial planning models; post-audits

A)cost-allocation methods; leave costs unallocated

B)cost-budgeting methods; ignore remaining costs

C)sensitivity analysis; financial planning models

D)financial planning models; post-audits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

Many companies develop ________ to assign service department costs to production departments.

A)cost accumulation methods

B)cost allocation methods

C)cost budgeting methods

D)cost diagrams

A)cost accumulation methods

B)cost allocation methods

C)cost budgeting methods

D)cost diagrams

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

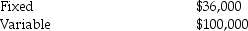

13

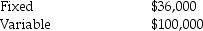

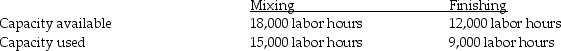

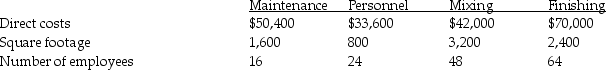

James Company has two production departments called Mixing and Finishing.The maintenance department serves both production departments.Budgeted fixed costs for the maintenance department are $30,000.Budgeted variable costs for the maintenance department are $5.00 per labor hour.Actual maintenance department costs are $36,000 fixed and $100,000 variable.Other relevant data follow:  The amount of variable maintenance department costs allocated to the Mixing Department should be ________.

The amount of variable maintenance department costs allocated to the Mixing Department should be ________.

A)$48,000

B)$62,500

C)$75,000

D)$100,000

The amount of variable maintenance department costs allocated to the Mixing Department should be ________.

The amount of variable maintenance department costs allocated to the Mixing Department should be ________.A)$48,000

B)$62,500

C)$75,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

Variable costs of service departments are allocated to user departments using ________ cost rates instead of ________ cost rates.

A)actual; budgeted

B)budgeted; actual

C)long-range; short-range

D)short-range; long-range

A)actual; budgeted

B)budgeted; actual

C)long-range; short-range

D)short-range; long-range

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the vast majority of costs were directly traceable to cost objects,then cost allocation would be a minor issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Service departments in organizations exist to support ________ departments or ________.

A)other service; governmental agencies

B)producing; suppliers

C)other service and producing; customers

D)producing; governmental agencies

A)other service; governmental agencies

B)producing; suppliers

C)other service and producing; customers

D)producing; governmental agencies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

The preferred guidelines for allocating service department costs to user departments include ________.

A)allocating variable-cost and fixed-cost pools separately

B)establishing details about cost allocation after providing services

C)using actual costs for allocation

D)none of the above

A)allocating variable-cost and fixed-cost pools separately

B)establishing details about cost allocation after providing services

C)using actual costs for allocation

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

The logical cost driver for costs from janitorial services is square feet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

Some service department activities support customers rather than the production process.These costs are traced directly to ________ instead of ________.

A)products; producing departments

B)services; producing departments

C)customers; producing departments

D)service departments; producing departments

A)products; producing departments

B)services; producing departments

C)customers; producing departments

D)service departments; producing departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

Examples of service departments in a large company do NOT include ________.

A)human resources department

B)technical support department

C)maintenance department

D)assembly department in factory

A)human resources department

B)technical support department

C)maintenance department

D)assembly department in factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

The ________ method recognizes that some service departments support the activities in other service departments as well as those in production departments.

A)direct

B)indirect

C)step-down

D)cost driver

A)direct

B)indirect

C)step-down

D)cost driver

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Technical Services Department of Michigan State University leased a photocopy machine for $2,000 per month plus $0.04 per copy.Additional budgeted variable operating costs were $0.02 per copy.The Technical Services Department estimated the machine would produce 30,000 copies per month.The Accounting Department estimated is would make 6,000 copies per month but actually made 4,000 copies.Assume fixed and variable cost pools are allocated separately.What is the amount of fixed cost allocated to the Accounting Department for the month?

A)$200

B)$240

C)$360

D)$400

A)$200

B)$240

C)$360

D)$400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

The step down method of allocating service department costs to producing departments recognizes that service departments provide support activities in ________ departments and ________ departments.

A)producing; traditional

B)producing; other service

C)activity-based costing; traditional costing

D)variable-costing; absorption-costing

A)producing; traditional

B)producing; other service

C)activity-based costing; traditional costing

D)variable-costing; absorption-costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

In the step-down method,the first service department used in the sequence to allocate service department costs is the department that renders the ________ departments.

A)least service to the greatest number of other service departments

B)least service to the greatest number of producing departments

C)greatest service to the greatest number of other service departments

D)greatest service to the greatest number of producing departments

A)least service to the greatest number of other service departments

B)least service to the greatest number of producing departments

C)greatest service to the greatest number of other service departments

D)greatest service to the greatest number of producing departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

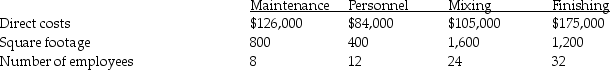

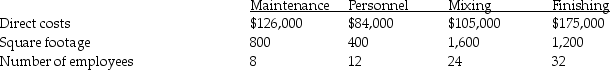

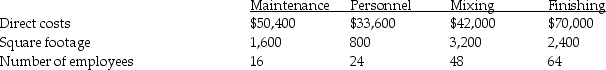

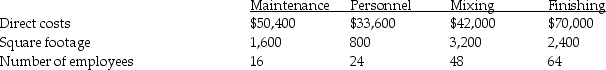

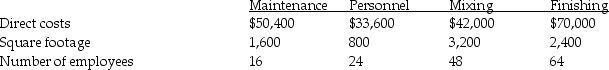

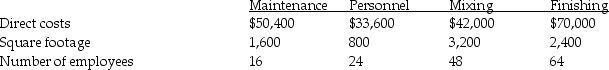

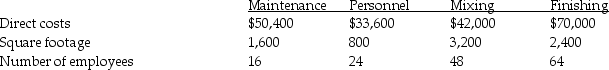

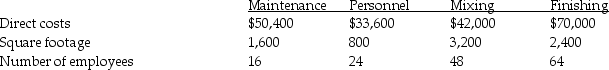

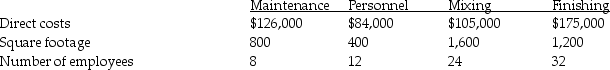

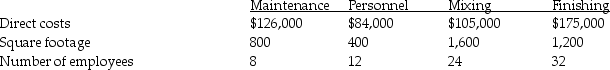

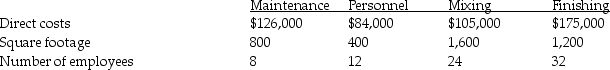

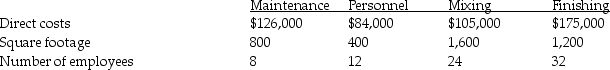

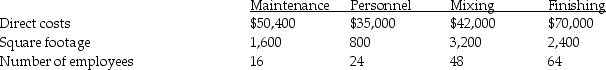

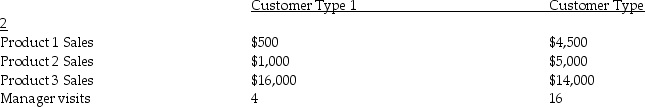

Theresa Company has two service departments,Maintenance and Personnel.Theresa Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the total cost of the Mixing Department after allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Mixing Department after allocation would be ________.

A)$36,000

B)$72,000

C)$105,000

D)$213,000

If the direct method is used to allocate service department costs,then the total cost of the Mixing Department after allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Mixing Department after allocation would be ________.A)$36,000

B)$72,000

C)$105,000

D)$213,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

In practice,companies often inappropriately allocate fixed cost pools for service departments to producing departments on the basis of ________ instead of ________.

A)budgeted costs; actual costs

B)actual costs; budgeted costs

C)capacity used; capacity available

D)capacity available; capacity used

A)budgeted costs; actual costs

B)actual costs; budgeted costs

C)capacity used; capacity available

D)capacity available; capacity used

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

A reason for using capacity available instead of capacity used when allocating fixed costs from service departments to producing departments is ________.

A)actual usage by user departments does not affect short run allocations to other user departments

B)actual usage by user departments does not affect long run allocations to other user departments

C)the allocation methods to assign service department costs to producing departments are inaccurate

D)the allocation methods to assign service department costs to producing departments are not available

A)actual usage by user departments does not affect short run allocations to other user departments

B)actual usage by user departments does not affect long run allocations to other user departments

C)the allocation methods to assign service department costs to producing departments are inaccurate

D)the allocation methods to assign service department costs to producing departments are not available

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

Allocating fixed costs based on long-range plans may inadvertently result in a tendency of mangers to ________.

A)underutilize available capacity

B)overestimate planned usage

C)underestimate planned usage

D)overestimate planned costs

A)underutilize available capacity

B)overestimate planned usage

C)underestimate planned usage

D)overestimate planned costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Technical Services Department of Michigan State University leased a photocopy machine for $1,500 per month plus $0.04 per copy.Additional budgeted variable operating costs were $0.02 per copy.The Technical Services Department estimated the machine would produce 30,000 copies per month.The Accounting Department estimated is would make 6,000 copies per month but actually made 5,000 copies.Assume fixed and variable cost pools are allocated separately.What is the amount of variable cost allocated to the Accounting Department for the month?

A)$200

B)$240

C)$300

D)$360

A)$200

B)$240

C)$300

D)$360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

When allocating service department costs to user departments,fixed costs should be allocated using budgeted cost rates times the actual cost driver level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

When allocating fixed costs from service departments to user departments,a predetermined lump-sum allocation based on the long-range capacity available to the user should be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

Variable and fixed costs from service departments should be allocated separately to user departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

The direct method of allocating service department costs to producing departments ignores ________.

A)services provided by producing departments to service departments

B)services provided by user departments to service departments

C)services provided by service departments to other service departments

D)services provided by producing departments to other producing departments

A)services provided by producing departments to service departments

B)services provided by user departments to service departments

C)services provided by service departments to other service departments

D)services provided by producing departments to other producing departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

If a company allocated fixed costs from service departments to user departments based on long-range plans,there is a tendency on the part of managers to underestimate their planned usage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

When allocating fixed costs from service departments to production departments,managers should use ________ instead of ________.

A)capacity used; capacity available

B)capacity available; budgeted capacity

C)capacity used; budgeted capacity

D)capacity available; capacity used

A)capacity used; capacity available

B)capacity available; budgeted capacity

C)capacity used; budgeted capacity

D)capacity available; capacity used

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

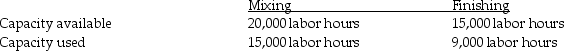

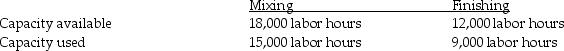

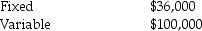

Johnson Company has two production departments called Mixing and Finishing.The maintenance department serves both production departments.Budgeted fixed costs for the maintenance department are $40,000.Budgeted variable costs for the maintenance department are $4.00 per labor hour.Other relevant data follow:  Actual maintenance department costs:

Actual maintenance department costs:

The amount of fixed maintenance department costs allocated to the Finishing Department should be ________.

The amount of fixed maintenance department costs allocated to the Finishing Department should be ________.

A)$11,250

B)$14,000

C)$16,000

D)$18,000

Actual maintenance department costs:

Actual maintenance department costs: The amount of fixed maintenance department costs allocated to the Finishing Department should be ________.

The amount of fixed maintenance department costs allocated to the Finishing Department should be ________.A)$11,250

B)$14,000

C)$16,000

D)$18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

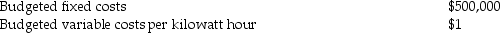

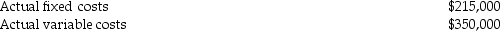

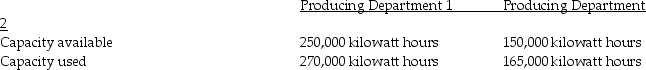

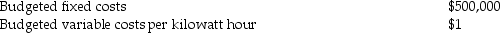

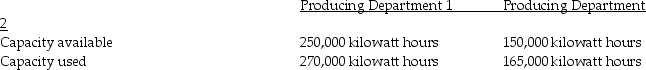

Robert Company's power plant provides electricity to two producing departments.The annual budget for the power plant shows the following:

Actual annual costs incurred by the power plant were:

Actual annual costs incurred by the power plant were:

Additional annual data follows:

Additional annual data follows:

Required:

Required:

A)Compute the amount of fixed costs allocated to each producing department.

B)Compute the amount of variable costs allocated to each producing department.

Actual annual costs incurred by the power plant were:

Actual annual costs incurred by the power plant were: Additional annual data follows:

Additional annual data follows: Required:

Required: A)Compute the amount of fixed costs allocated to each producing department.

B)Compute the amount of variable costs allocated to each producing department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

The use of actual cost rates for allocating variable costs of service departments protects the user departments from intervening price fluctuations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

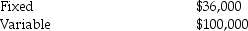

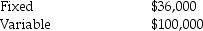

Samuel Company has two production departments called Mixing and Finishing.The maintenance department serves both production departments.Budgeted fixed costs for the maintenance department are $40,000.Budgeted variable costs for the maintenance department are $4.00 per labor hour.Other relevant data follow:  Actual maintenance department costs:

Actual maintenance department costs:

The amount of fixed maintenance department costs allocated to the Mixing Department should be ________.

The amount of fixed maintenance department costs allocated to the Mixing Department should be ________.

A)$12,000

B)$14,000

C)$20,000

D)$24,000

Actual maintenance department costs:

Actual maintenance department costs: The amount of fixed maintenance department costs allocated to the Mixing Department should be ________.

The amount of fixed maintenance department costs allocated to the Mixing Department should be ________.A)$12,000

B)$14,000

C)$20,000

D)$24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

The two methods for allocating service department costs to other departments are ________.

A)step-down and indirect

B)direct and step-up

C)step-down and direct

D)step-up and indirect

A)step-down and indirect

B)direct and step-up

C)step-down and direct

D)step-up and indirect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

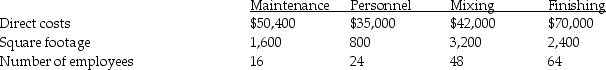

Garcia Company has two service departments,Maintenance and Personnel.Garcia Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the amount of cost allocated from the Maintenance Department to the Personnel Department is ________.

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the amount of cost allocated from the Maintenance Department to the Personnel Department is ________.

A)$0

B)$5,040

C)$6,300

D)$6,825

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the amount of cost allocated from the Maintenance Department to the Personnel Department is ________.

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the amount of cost allocated from the Maintenance Department to the Personnel Department is ________.A)$0

B)$5,040

C)$6,300

D)$6,825

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

The step-down method sequence of allocations begins with the service department that renders the greatest service to the greatest number of other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

Serena Company has two service departments,Maintenance and Personnel.Serena Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first.The amount of cost allocated from the Maintenance Department to the Finishing Department would be ________.

Assume the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first.The amount of cost allocated from the Maintenance Department to the Finishing Department would be ________.

A)$31,500

B)$42,750

C)$47,250

D)$57,000

Assume the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first.The amount of cost allocated from the Maintenance Department to the Finishing Department would be ________.

Assume the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first.The amount of cost allocated from the Maintenance Department to the Finishing Department would be ________.A)$31,500

B)$42,750

C)$47,250

D)$57,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

Two popular methods for allocating service department costs to user departments are the direct method and the step-up method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

The greatest virtue of the step-down method for allocating service department costs is ________.

A)its simplicity

B)its ability to allocate production department costs to service departments

C)its ability to allocate user department costs to production departments

D)the recognition of reciprocal relationships between service departments

A)its simplicity

B)its ability to allocate production department costs to service departments

C)its ability to allocate user department costs to production departments

D)the recognition of reciprocal relationships between service departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

Martinez Company has two service departments,Maintenance and Personnel.Martinez Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.Then the amount of cost allocated from the Personnel Department to the Maintenance Department would be ________.

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.Then the amount of cost allocated from the Personnel Department to the Maintenance Department would be ________.

A)$0

B)$3,539

C)$4,200

D)$4,998

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.Then the amount of cost allocated from the Personnel Department to the Maintenance Department would be ________.

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.Then the amount of cost allocated from the Personnel Department to the Maintenance Department would be ________.A)$0

B)$3,539

C)$4,200

D)$4,998

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

When using the step-down method,once a service department's costs are allocated to other departments,nothing is ever allocated back to it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

Roller Company has two service departments,Maintenance and Personnel.Roller Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the total cost of the Personnel Department after the Maintenance Department cost allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Personnel Department after the Maintenance Department cost allocation would be ________.

A)$33,600

B)$38,640

C)$39,900

D)$63,480

If the direct method is used to allocate service department costs,then the total cost of the Personnel Department after the Maintenance Department cost allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Personnel Department after the Maintenance Department cost allocation would be ________.A)$33,600

B)$38,640

C)$39,900

D)$63,480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

Kevin Company has two service departments,Maintenance and Personnel.Kevin Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of cost allocated from the Personnel Department to the Finishing Department?

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of cost allocated from the Personnel Department to the Finishing Department?

A)$31,500

B)$42,000

C)$72,000

D)$105,000

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of cost allocated from the Personnel Department to the Finishing Department?

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of cost allocated from the Personnel Department to the Finishing Department?A)$31,500

B)$42,000

C)$72,000

D)$105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

Marcos Company has two service departments,Maintenance and Personnel.Marcos Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the total cost of the Maintenance Department after the Personnel Department cost allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Maintenance Department after the Personnel Department cost allocation would be ________.

A)$42,000

B)$50,400

C)$54,600

D)$70,000

If the direct method is used to allocate service department costs,then the total cost of the Maintenance Department after the Personnel Department cost allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Maintenance Department after the Personnel Department cost allocation would be ________.A)$42,000

B)$50,400

C)$54,600

D)$70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

The direct method of allocating service department costs ignores other service departments when allocating service departments' costs to user departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

Valdez Company has two service departments,Maintenance and Personnel.Valdez Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What amount of costs would be allocated from the Maintenance Department to the Personnel Department?

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What amount of costs would be allocated from the Maintenance Department to the Personnel Department?

A)$0

B)$5,040

C)$6,300

D)$16,800

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What amount of costs would be allocated from the Maintenance Department to the Personnel Department?

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What amount of costs would be allocated from the Maintenance Department to the Personnel Department?A)$0

B)$5,040

C)$6,300

D)$16,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

Thomas Company has two service departments,Maintenance and Personnel.Thomas Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What are the total costs of the Mixing Department after allocation of service department costs?

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What are the total costs of the Mixing Department after allocation of service department costs?

A)$210,750

B)$275,500

C)$277,000

D)$279,250

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What are the total costs of the Mixing Department after allocation of service department costs?

Assume the step-down method is used to allocate service department costs and the Maintenance Department is allocated first.What are the total costs of the Mixing Department after allocation of service department costs?A)$210,750

B)$275,500

C)$277,000

D)$279,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

Gomez Company has two service departments,Maintenance and Personnel.Gomez Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first,the amount of costs allocated from the Maintenance Department to the Mixing Department is ________.

If the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first,the amount of costs allocated from the Maintenance Department to the Mixing Department is ________.

A)$36,000

B)$42,000

C)$42,750

D)$63,000

If the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first,the amount of costs allocated from the Maintenance Department to the Mixing Department is ________.

If the step-down method is used to allocate service department costs,and the Maintenance Department is allocated first,the amount of costs allocated from the Maintenance Department to the Mixing Department is ________.A)$36,000

B)$42,000

C)$42,750

D)$63,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

Alleluia Company has two service departments,Maintenance and Personnel.Alleluia Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the cost allocated from the Maintenance Department to the Mixing Department is ________.

If the direct method is used to allocate service department costs,then the cost allocated from the Maintenance Department to the Mixing Department is ________.

A)$20,160

B)$25,200

C)$28,800

D)$50,400

If the direct method is used to allocate service department costs,then the cost allocated from the Maintenance Department to the Mixing Department is ________.

If the direct method is used to allocate service department costs,then the cost allocated from the Maintenance Department to the Mixing Department is ________.A)$20,160

B)$25,200

C)$28,800

D)$50,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

Murphy Company has two service departments,Maintenance and Personnel.Murphy Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of costs allocated from the Personnel Department to the Mixing Department?

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of costs allocated from the Personnel Department to the Mixing Department?

A)$29,746

B)$31,500

C)$58,500

D)$63,000

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of costs allocated from the Personnel Department to the Mixing Department?

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the amount of costs allocated from the Personnel Department to the Mixing Department?A)$29,746

B)$31,500

C)$58,500

D)$63,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Derby Company has two service departments,Maintenance and Personnel.Derby Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the total cost of the Finishing Department after allocation of the service departments costs?

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the total cost of the Finishing Department after allocation of the service departments costs?

A)$175,000

B)$275,500

C)$277,000

D)$279,250

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the total cost of the Finishing Department after allocation of the service departments costs?

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the total cost of the Finishing Department after allocation of the service departments costs?A)$175,000

B)$275,500

C)$277,000

D)$279,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

Patti Company has two service departments,Maintenance and Personnel.Patti Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the total cost of the Finishing Department after allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Finishing Department after allocation would be ________.

A)$48,000

B)$54,000

C)$175,000

D)$277,000

If the direct method is used to allocate service department costs,then the total cost of the Finishing Department after allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Finishing Department after allocation would be ________.A)$48,000

B)$54,000

C)$175,000

D)$277,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

Aguia Company has two service departments,Maintenance and Personnel.Aguia Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the cost allocated from the Personnel Department to the Maintenance Department is ________.

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the cost allocated from the Personnel Department to the Maintenance Department is ________.

A)$0

B)$3,539

C)$4,200

D)$13,440

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the cost allocated from the Personnel Department to the Maintenance Department is ________.

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.Then the cost allocated from the Personnel Department to the Maintenance Department is ________.A)$0

B)$3,539

C)$4,200

D)$13,440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

Tardy Company has two service departments,Maintenance and Personnel.Tardy Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the cost allocated from the Personnel Department to the Finishing Department is ________.

If the direct method is used to allocate service department costs,then the cost allocated from the Personnel Department to the Finishing Department is ________.

A)$14,147

B)$16,800

C)$20,000

D)$33,600

If the direct method is used to allocate service department costs,then the cost allocated from the Personnel Department to the Finishing Department is ________.

If the direct method is used to allocate service department costs,then the cost allocated from the Personnel Department to the Finishing Department is ________.A)$14,147

B)$16,800

C)$20,000

D)$33,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

Typical cost drivers in a traditional approach to costing products are direct labor hours and machine hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

The direct method of cost allocation is generally preferred because it recognizes the effect of support provided by service departments to other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

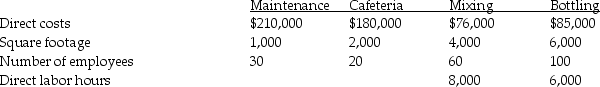

Cougar Company has two service departments,Maintenance and Cafeteria,as well as two production departments,Mixing and Finishing.Maintenance Department costs are allocated based on direct labor hours and Cafeteria Department costs are allocated based on number of employees.The following data are available:

Assume the step-down method of allocating service departments' costs is used.The Maintenance Department renders the greatest service and is allocated first.

Assume the step-down method of allocating service departments' costs is used.The Maintenance Department renders the greatest service and is allocated first.

Required:

A)Determine the total costs of the Mixing Department after allocating the service departments' costs.

B)Determine the total costs of the Finishing Department after allocating the service departments' costs.

Assume the step-down method of allocating service departments' costs is used.The Maintenance Department renders the greatest service and is allocated first.

Assume the step-down method of allocating service departments' costs is used.The Maintenance Department renders the greatest service and is allocated first.Required:

A)Determine the total costs of the Mixing Department after allocating the service departments' costs.

B)Determine the total costs of the Finishing Department after allocating the service departments' costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

The phrase "cost application" refers to the allocation of the total departmental costs to ________.

A)service departments

B)service departments and producing departments

C)revenue-producing departments

D)revenue-producing products

A)service departments

B)service departments and producing departments

C)revenue-producing departments

D)revenue-producing products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

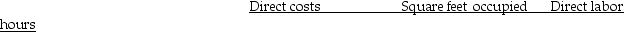

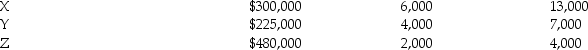

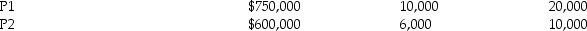

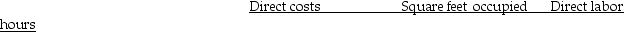

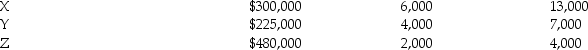

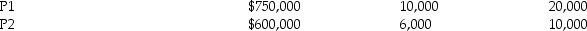

Puma Company has three service departments,X,Y and Z and two production departments,P1 and P2.Costs in Departments X and Y are allocated based on square feet and costs in Department Z are allocated based on direct labor hours.

The following data are available:

Service Department:

Service Department:

Producing Department:

Producing Department:

Assume the direct method of allocating service department costs is used.

Assume the direct method of allocating service department costs is used.

Required:

A)What is the total cost of Producing Department P1 after allocating the service departments' costs?

B)What is the total cost of Producing Department P2 after allocating the service departments' costs?

The following data are available:

Service Department:

Service Department: Producing Department:

Producing Department: Assume the direct method of allocating service department costs is used.

Assume the direct method of allocating service department costs is used.Required:

A)What is the total cost of Producing Department P1 after allocating the service departments' costs?

B)What is the total cost of Producing Department P2 after allocating the service departments' costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

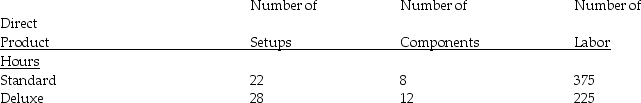

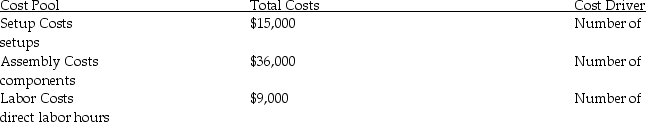

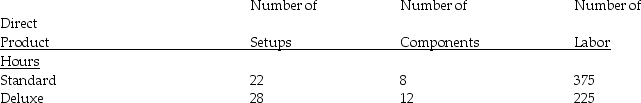

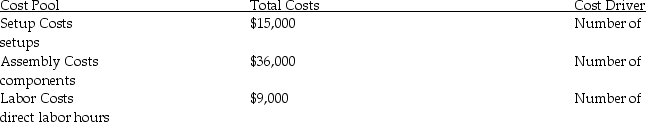

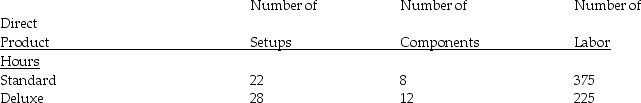

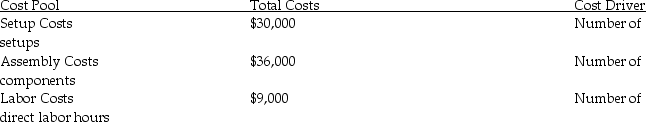

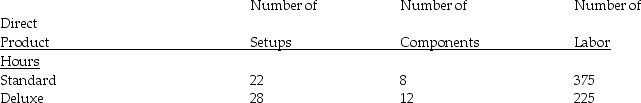

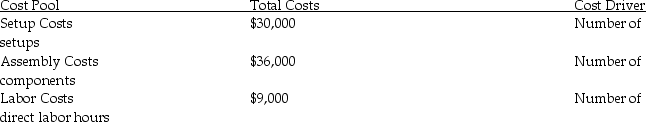

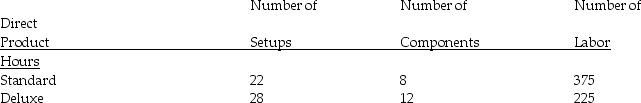

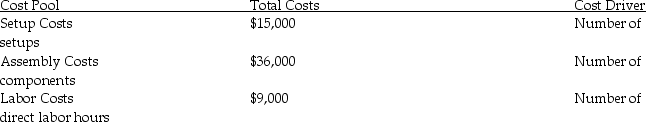

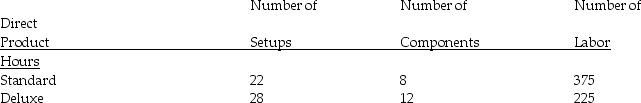

Herman Company manufactures two models of pens,a standard model and a deluxe model.Three activities have been identified in the production of the pens.The following information is available:

If activity-based costing is used,the total cost assigned to the deluxe model is ________.

If activity-based costing is used,the total cost assigned to the deluxe model is ________.

A)$22,500

B)$26,625

C)$33,375

D)$37,500

If activity-based costing is used,the total cost assigned to the deluxe model is ________.

If activity-based costing is used,the total cost assigned to the deluxe model is ________.A)$22,500

B)$26,625

C)$33,375

D)$37,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

Assume the cost object is customers.Why should indirect costs associated with customers be allocated to customers instead of producing departments?

A)The allocation to customers would be based on production-related output measures that are related to the cause of customer-service costs.

B)The allocation to customers would be based on production-related output measures that are probably not related to the cause of customer-service costs.

C)The cost-allocation base cannot be determined.

D)Actual costs would be used instead of budgeted costs.

A)The allocation to customers would be based on production-related output measures that are related to the cause of customer-service costs.

B)The allocation to customers would be based on production-related output measures that are probably not related to the cause of customer-service costs.

C)The cost-allocation base cannot be determined.

D)Actual costs would be used instead of budgeted costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

Seahawks Company has two service departments,Maintenance and Cafeteria,as well as two production departments,Mixing and Bottling.Maintenance Department costs are allocated based on square footage and Cafeteria Department costs are allocated based on number of employees.The following data was available:

Assume the direct method is used to allocate service department costs to producing departments.

Assume the direct method is used to allocate service department costs to producing departments.

Required:

A)Determine the total costs of the Mixing Department after allocating the service departments' costs.

B)Determine the total costs of the Bottling Department after allocating the service departments' costs.

Assume the direct method is used to allocate service department costs to producing departments.

Assume the direct method is used to allocate service department costs to producing departments.Required:

A)Determine the total costs of the Mixing Department after allocating the service departments' costs.

B)Determine the total costs of the Bottling Department after allocating the service departments' costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

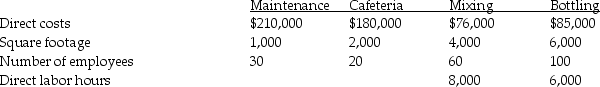

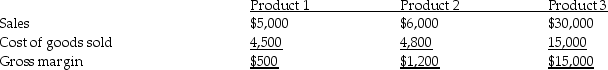

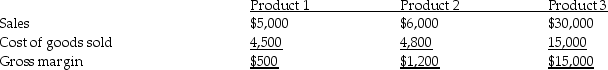

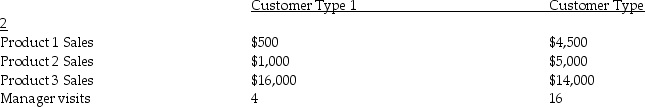

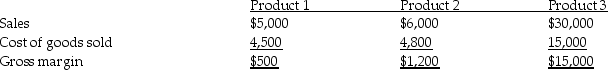

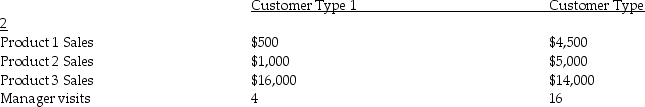

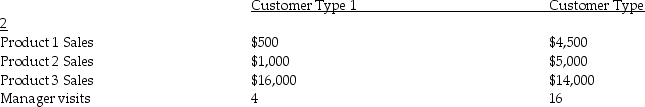

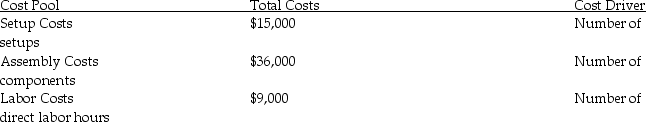

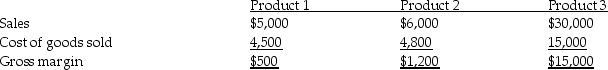

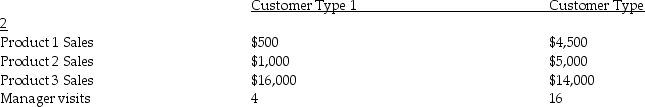

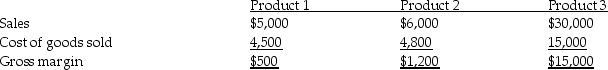

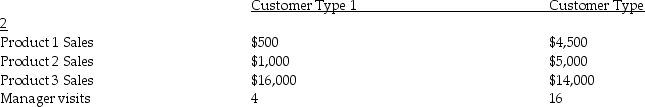

Patricia Company makes three types of products.The company has two types of customers.The cost to serve all customers is $12,000 and is allocated to customer types based on the number of manager visits to customer locations.The following data are available:

What is the gross profit margin for all three products for Customer Type 2?

What is the gross profit margin for all three products for Customer Type 2?

A)$450

B)$1,000

C)$7,000

D)$8,450

What is the gross profit margin for all three products for Customer Type 2?

What is the gross profit margin for all three products for Customer Type 2?A)$450

B)$1,000

C)$7,000

D)$8,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

Gonzalez Company makes three types of products.The company has two types of customers.The cost to serve all customers is $12,000 and is allocated to customer types based on the number of manager visits to customer locations.The following data are available:

What is the gross profit margin for all three products for Customer Type 1?

What is the gross profit margin for all three products for Customer Type 1?

A)$8,000

B)$8,200

C)$8,250

D)$9,000

What is the gross profit margin for all three products for Customer Type 1?

What is the gross profit margin for all three products for Customer Type 1?A)$8,000

B)$8,200

C)$8,250

D)$9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

The phrase "cost distribution" refers to the allocation of total departmental costs to revenue-producing products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

When determining product cost,the last step in the traditional approach to cost allocation is ________.

A)divide costs in each producing department into direct costs and indirect costs

B)trace direct costs to products

C)select cost pools and cost allocation bases in each production department and assign indirect department costs to the appropriate cost pool

D)allocate the costs in each cost pool to the product in proportion to the usage of the related cost-allocation base

A)divide costs in each producing department into direct costs and indirect costs

B)trace direct costs to products

C)select cost pools and cost allocation bases in each production department and assign indirect department costs to the appropriate cost pool

D)allocate the costs in each cost pool to the product in proportion to the usage of the related cost-allocation base

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Assume the cost object is customers.It is important to directly trace or allocate costs associated with customer actions to ________ instead of ________.

A)producing departments; service departments

B)service departments; producing departments

C)products; producing departments

D)customers; producing departments

A)producing departments; service departments

B)service departments; producing departments

C)products; producing departments

D)customers; producing departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

Hawn Company manufactures two models of pens,a standard model and a deluxe model.Three activities have been identified in the production of the pens.The following information is available:

If activity-based costing is used,the setup cost assigned to the standard model is ________.

If activity-based costing is used,the setup cost assigned to the standard model is ________.

A)$33

B)$8,400

C)$13,200

D)$44,000

If activity-based costing is used,the setup cost assigned to the standard model is ________.

If activity-based costing is used,the setup cost assigned to the standard model is ________.A)$33

B)$8,400

C)$13,200

D)$44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

Under the traditional approach to cost allocation,the costs in each cost pool are allocated to a product in proportion to the product's usage of the ________.

A)available capacity

B)budgeted capacity

C)cost-allocation base

D)step down method

A)available capacity

B)budgeted capacity

C)cost-allocation base

D)step down method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

Haha Company manufactures two models of pens,a standard model and a deluxe model.Three activities have been identified in the production of the pens.The following information is available:

If activity-based costing is used,the total costs assigned to the standard model are ________.

If activity-based costing is used,the total costs assigned to the standard model are ________.

A)$22,500

B)$26,625

C)$33,375

D)$37,500

If activity-based costing is used,the total costs assigned to the standard model are ________.

If activity-based costing is used,the total costs assigned to the standard model are ________.A)$22,500

B)$26,625

C)$33,375

D)$37,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

Activity-based costing systems focus on accumulating costs into key activities instead of departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

Ernie Company makes three types of products.The company has two types of customers.The cost to serve all customers is $12,000 and is allocated to customer types based on the number of manager visits to customer locations.The following data are available:

What is the cost to serve for Customer Type 1?

What is the cost to serve for Customer Type 1?

A)$2,400

B)$6,000

C)$9,600

D)$12,000

What is the cost to serve for Customer Type 1?

What is the cost to serve for Customer Type 1?A)$2,400

B)$6,000

C)$9,600

D)$12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

Power costs can be allocated using megawatt hours as the cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

The traditional approach to cost allocation focuses on accumulating and reporting costs by ________.The activity-based approach to cost allocation focuses on accumulating and reporting costs by ________.

A)cost behavior; resources used

B)departments; activities

C)fixed costs; variable costs

D)product; customer

A)cost behavior; resources used

B)departments; activities

C)fixed costs; variable costs

D)product; customer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck