Deck 4: Cost Management Systems and Activity-Based Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 4: Cost Management Systems and Activity-Based Costing

1

What type of users need aggregate cost information about products or services?

A)managers

B)external users

C)factory supervisors

D)internal users

A)managers

B)external users

C)factory supervisors

D)internal users

B

2

A cost is a sacrifice of resources for a particular purpose.

True

3

What types of firms need cost accounting?

A)manufacturing firms and service organizations

B)service organizations and nonprofit organizations

C)manufacturing firms and nonprofit organizations

D)manufacturing firms,service organizations,and nonprofit organizations

A)manufacturing firms and service organizations

B)service organizations and nonprofit organizations

C)manufacturing firms and nonprofit organizations

D)manufacturing firms,service organizations,and nonprofit organizations

D

4

Which of the following statements about cost accounting systems is FALSE?

A)The cost accounting system provides the cost data that managers use for decision making.

B)The cost accounting system is the most fundamental component of a cost management system.

C)A cost accounting system that provides accurate information is a key success factor for all types of organizations.

D)The cost accounting system does not provide data for financial reports.

A)The cost accounting system provides the cost data that managers use for decision making.

B)The cost accounting system is the most fundamental component of a cost management system.

C)A cost accounting system that provides accurate information is a key success factor for all types of organizations.

D)The cost accounting system does not provide data for financial reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

A cost management system provides information for strategic management decisions and financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

An example of a strategic management decision is the selection of the product mix that maximizes profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is an example of using cost information for operational control?

A)determination of cost of goods sold for the income statement

B)identification of capital assets to acquire for expansion purposes

C)selection of value-chain function to emphasize in corporate mission

D)evaluation of process improvement efforts in a manufacturing process

A)determination of cost of goods sold for the income statement

B)identification of capital assets to acquire for expansion purposes

C)selection of value-chain function to emphasize in corporate mission

D)evaluation of process improvement efforts in a manufacturing process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

Cost accounting is that part of the cost management system that measures costs for the sole purpose of financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

An example of a strategic management decision is the establishment of a pricing policy for a new product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is an example of a strategic management decision that uses cost information?

A)calculating the cost of production areas

B)determining the product mix

C)assessing a cost control program in a factory

D)determining the amount of cost of goods sold for financial reporting

A)calculating the cost of production areas

B)determining the product mix

C)assessing a cost control program in a factory

D)determining the amount of cost of goods sold for financial reporting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

Investors need more detailed information about products or services than managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

________ is the part of the accounting system that measures costs for the purposes of management decision making and financial reporting.

A)Activity-based costing

B)Activity-based management

C)Cost accounting

D)Cost allocation

A)Activity-based costing

B)Activity-based management

C)Cost accounting

D)Cost allocation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

An example of a strategic management decision is the decision to outsource a particular value-chain function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is an example of a strategic management decision that uses cost information?

A)determination of cost of goods sold for the income statement

B)identification of value-chain function to outsource

C)evaluation of operational cost control program

D)assessment of process improvement efforts in quality control

A)determination of cost of goods sold for the income statement

B)identification of value-chain function to outsource

C)evaluation of operational cost control program

D)assessment of process improvement efforts in quality control

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cost can be measured by yen,euros,and other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

What type of users need detailed cost information about products or services?

A)creditors

B)investors

C)managers

D)government regulators

A)creditors

B)investors

C)managers

D)government regulators

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

A cost pool is anything for which a separate measurement of costs is desired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

A cost management system provides ________.

A)measures of inventory value and cost of goods sold for financial reporting

B)cost information for strategic management decisions

C)cost information for operational control

D)all of the above

A)measures of inventory value and cost of goods sold for financial reporting

B)cost information for strategic management decisions

C)cost information for operational control

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which statement is FALSE?

A)A cost may be defined as a sacrifice or giving up of resources for a particular purpose.

B)Costs are frequently measured by the monetary units that must be paid for goods and services.

C)Only manufacturing firms need some form of cost accounting.

D)The first step in a cost accounting system is the collection of costs by some category.

A)A cost may be defined as a sacrifice or giving up of resources for a particular purpose.

B)Costs are frequently measured by the monetary units that must be paid for goods and services.

C)Only manufacturing firms need some form of cost accounting.

D)The first step in a cost accounting system is the collection of costs by some category.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

The process of collecting costs by some natural classification is called ________.

A)cost accounting

B)cost allocation

C)cost accumulation

D)cost application

A)cost accounting

B)cost allocation

C)cost accumulation

D)cost application

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

Depreciation expense on assembly equipment is an example of a direct cost for a manufactured product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

Customers and company activities are examples of cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following costs is a direct cost to a manufactured product?

A)depreciation expense on factory equipment used for the product

B)the wages of an assembly worker who works specifically on the product

C)accountants who accumulate the costs of the product

D)a factory supervisor who oversees the production of several different types of products

A)depreciation expense on factory equipment used for the product

B)the wages of an assembly worker who works specifically on the product

C)accountants who accumulate the costs of the product

D)a factory supervisor who oversees the production of several different types of products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of these costs is NOT an indirect production cost for a manufactured chair?

A)rental cost of factory building

B)depreciation expense on factory equipment

C)cost of legal staff to identify legal issues associated with the chair

D)salary of factory supervisor

A)rental cost of factory building

B)depreciation expense on factory equipment

C)cost of legal staff to identify legal issues associated with the chair

D)salary of factory supervisor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

Company activities such as processing orders,billing customers,and moving materials can be cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

Where a specific manufactured product is the cost object,the salary of the security guard in the factory would probably be classified as a(n)________.

A)direct production cost

B)indirect production cost

C)direct nonproduction cost

D)indirect nonproduction cost

A)direct production cost

B)indirect production cost

C)direct nonproduction cost

D)indirect nonproduction cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

Where a specific manufactured product is the cost object,minor materials,such as tacks and nails,used to manufacture the product would probably be classified as a(n)________.

A)direct; variable cost

B)direct; fixed cost

C)indirect; variable cost

D)indirect; fixed cost

A)direct; variable cost

B)direct; fixed cost

C)indirect; variable cost

D)indirect; fixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

Departments and territories are examples of cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

Cost allocation is used to assign direct costs to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

Where a specific manufactured product is the cost object,the hourly wages of assembly workers who work on only that product would be classified as a(n)________.

A)direct; variable cost

B)direct; fixed cost

C)indirect; variable cost

D)indirect; fixed cost

A)direct; variable cost

B)direct; fixed cost

C)indirect; variable cost

D)indirect; fixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

A cost accounting system first assigns costs to organizational units and then accumulates these costs within the unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

A cost accounting system typically includes two processes: cost allocation and cost determination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

Costs that can be allocated to a cost object are called direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

Costs can be classified as direct or indirect with respect to a particular cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

Accountants can specifically and exclusively identify indirect costs with a given cost object in an economically feasible way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which statement about indirect costs is FALSE?

A)Today,indirect costs exceed 50% of total costs in many companies.

B)Some indirect costs are variable.

C)Managers can ignore indirect costs and make good operational decisions.

D)Indirect costs include labor costs that cannot be traced to a particular product.

A)Today,indirect costs exceed 50% of total costs in many companies.

B)Some indirect costs are variable.

C)Managers can ignore indirect costs and make good operational decisions.

D)Indirect costs include labor costs that cannot be traced to a particular product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

Accountants initially collect costs by some natural classification such as activities performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

Cost assignment is attaching costs to one or more cost objects,such as activities and departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

The wages of the janitor in the factory are direct costs for a manufactured product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

Cost allocation refers to an ________.

A)actual tracing of indirect costs to a cost object

B)identification of the indirect costs associated with a cost object

C)assignment of indirect costs to a cost object

D)assignment of direct costs to a cost object

A)actual tracing of indirect costs to a cost object

B)identification of the indirect costs associated with a cost object

C)assignment of indirect costs to a cost object

D)assignment of direct costs to a cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

A cost pool is a group of individual costs that is allocated to cost objects using multiple cost drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which step is NOT used in the allocation of indirect costs to cost objects?

A)Accumulate indirect costs for a period of time in a cost pool.

B)Select an allocation base for each cost pool.

C)Determine the percentage of the cost pool used for each cost object.

D)Measure the units of the cost-allocation base used for each cost object.

A)Accumulate indirect costs for a period of time in a cost pool.

B)Select an allocation base for each cost pool.

C)Determine the percentage of the cost pool used for each cost object.

D)Measure the units of the cost-allocation base used for each cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which is NOT a purpose of cost allocation?

A)Predict the economic effects of strategic and operational control decisions.

B)Obtain reimbursement.

C)Provide motivation to managers.

D)Identify cost drivers.

A)Predict the economic effects of strategic and operational control decisions.

B)Obtain reimbursement.

C)Provide motivation to managers.

D)Identify cost drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

Direct manufacturing costs are the same as manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

Due to the decline in indirect costs in most companies,allocating indirect costs is no longer necessary to determine accurate product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

Allocation of costs to cost objects may be described as apportion or attribute.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

A century ago,a large proportion of labor costs were indirect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements is FALSE?

A)An unallocated cost for one company may be a direct cost for another company.

B)The cost of a system for tracing costs to cost objects should be less than its expected benefit.

C)A cost driver is a measure that causes the costs in a cost pool.

D)Because of the rise in direct costs for most companies,allocating direct costs is important in most companies today.

A)An unallocated cost for one company may be a direct cost for another company.

B)The cost of a system for tracing costs to cost objects should be less than its expected benefit.

C)A cost driver is a measure that causes the costs in a cost pool.

D)Because of the rise in direct costs for most companies,allocating direct costs is important in most companies today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

There is no universally best cost allocation system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

Allocated costs are irrelevant for most decisions when indirect costs represent a larger proportion of product costs than direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

Unallocated costs ________.

A)have an identifiable relationship to a cost pool

B)lack an identifiable relationship to a cost pool

C)have an identifiable relationship to a cost object

D)lack an identifiable relationship to a cost object

A)have an identifiable relationship to a cost pool

B)lack an identifiable relationship to a cost pool

C)have an identifiable relationship to a cost object

D)lack an identifiable relationship to a cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

An unallocated cost of one company may be an allocated cost in another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

Physically tracing ________ costs is usually straightforward,but allocating ________ costs is usually more complex.

A)indirect; direct

B)direct; product

C)direct; indirect

D)unallocated; indirect

A)indirect; direct

B)direct; product

C)direct; indirect

D)unallocated; indirect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

Companies must assign all production-related costs to cost objects for external financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

Square feet is a logical cost driver for allocating depreciation expense of heating equipment to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

Companies must assign all nonproduction costs to cost objects for internal management purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

In general,more costs are direct when a department is the cost object than when a product or service is the cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

Most cost allocation bases are not cost drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

Unallocated costs ________.

A)are not recorded in the cost accounting system

B)are not allocated to cost objects

C)are direct costs for service firms

D)are indirect costs for merchandising firms

A)are not recorded in the cost accounting system

B)are not allocated to cost objects

C)are direct costs for service firms

D)are indirect costs for merchandising firms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which purpose of cost allocation usually dominates most business situations?

A)to justify costs or obtain reimbursement

B)to compute income and asset valuations for financial reporting

C)to give feedback for performance evaluation

D)to predict the economic effects of strategic and operational control decisions

A)to justify costs or obtain reimbursement

B)to compute income and asset valuations for financial reporting

C)to give feedback for performance evaluation

D)to predict the economic effects of strategic and operational control decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

Period costs include selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

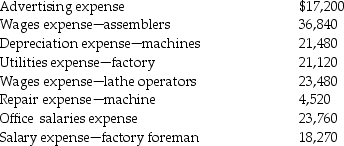

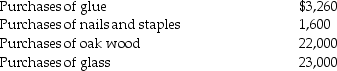

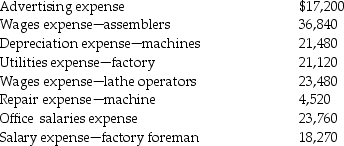

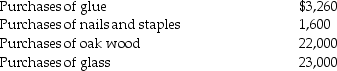

McBain Company,a manufacturer of windows,has prepared the following list of accounts and their balances:

The company also made the following purchases of raw materials:

The company also made the following purchases of raw materials:

There was no beginning or ending inventories.

There was no beginning or ending inventories.

Required:

Calculate the following:

A)Direct materials used

B)Direct labor

C)Indirect production costs

The company also made the following purchases of raw materials:

The company also made the following purchases of raw materials: There was no beginning or ending inventories.

There was no beginning or ending inventories.Required:

Calculate the following:

A)Direct materials used

B)Direct labor

C)Indirect production costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

For a merchandising firm,insurance expense on the factory building is a product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

A manufacturing company has identified several costs.Indicate whether each of the following costs is an Inventoriable cost(I)or a Period cost(P):

________ 1.depreciation on factory equipment

________ 2.depreciation on treasurer's desk

________ 3.direct materials

________ 4.factory supplies

________ 5.indirect labor

________ 6.repairs expensefactory

________ 7.office supplies

________ 8.advertising expense

________ 9.depreciation on office equipment

________10.direct labor

________11.factory supervisor's salary

________12.factory utilities

________13.indirect materials

________14.officer salaries

________15.sales commissions

________ 1.depreciation on factory equipment

________ 2.depreciation on treasurer's desk

________ 3.direct materials

________ 4.factory supplies

________ 5.indirect labor

________ 6.repairs expensefactory

________ 7.office supplies

________ 8.advertising expense

________ 9.depreciation on office equipment

________10.direct labor

________11.factory supervisor's salary

________12.factory utilities

________13.indirect materials

________14.officer salaries

________15.sales commissions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

A period cost is ________.

A)associated with production value-chain functions

B)associated with nonproduction value-chain functions

C)reported as an inventoriable cost

D)reported as a product cost

A)associated with production value-chain functions

B)associated with nonproduction value-chain functions

C)reported as an inventoriable cost

D)reported as a product cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

For a manufacturing firm,product costs first appear on the income statement and then on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

Manufactured goods fully completed but not sold are called ________.

A)merchandise inventory

B)direct materials inventory

C)finished goods inventory

D)work in process inventory

A)merchandise inventory

B)direct materials inventory

C)finished goods inventory

D)work in process inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

For both merchandising and manufacturing firms,selling and administrative costs are period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

In a manufacturing company,________.

A)inventoriable costs only become an expense when the company sells the inventory

B)inventoriable costs become an expense as soon as the company finishes manufacturing the product

C)there is only one inventory account

D)merchandise inventory is reported on the balance sheet and income statement

A)inventoriable costs only become an expense when the company sells the inventory

B)inventoriable costs become an expense as soon as the company finishes manufacturing the product

C)there is only one inventory account

D)merchandise inventory is reported on the balance sheet and income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

In a manufacturing company,product costs appear on either the balance sheet or income statement,but not both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

When work in process inventory ________,finished goods inventory ________.

A)increases; decreases

B)decreases; increases

C)increases; increases

D)increases; decreases

A)increases; decreases

B)decreases; increases

C)increases; increases

D)increases; decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

Period costs become expenses during a future period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is NOT a period expense in a manufacturing firm?

A)selling expense

B)administrative expenses

C)R&D expenses

D)cost of goods sold

A)selling expense

B)administrative expenses

C)R&D expenses

D)cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

In a merchandising company,________.

A)selling and administrative costs are period costs

B)insurance expense on the corporate building is a product cost

C)work in process inventory may be present

D)finished goods inventory may be present

A)selling and administrative costs are period costs

B)insurance expense on the corporate building is a product cost

C)work in process inventory may be present

D)finished goods inventory may be present

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

When looking at a manufactured product,an example of an inventoriable cost is ________.

A)depreciation expense on office equipment

B)insurance expense on vehicles used by sales staff

C)wages of plant security guard

D)clerical salaries in corporate office

A)depreciation expense on office equipment

B)insurance expense on vehicles used by sales staff

C)wages of plant security guard

D)clerical salaries in corporate office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

In a manufacturing company,unsold,partially complete products are called work-in-process inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

The computation for Cost of Goods Manufactured on the income statement is ________.(Assume there are no work-in-process inventories.)

A)direct materials used plus direct production costs

B)direct materials used plus direct labor plus indirect production costs

C)direct materials used plus direct labor

D)direct materials used plus direct labor plus direct production costs

A)direct materials used plus direct production costs

B)direct materials used plus direct labor plus indirect production costs

C)direct materials used plus direct labor

D)direct materials used plus direct labor plus direct production costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which is NOT an example of indirect production costs?

A)factory supplies

B)depreciation expense on factory building

C)depreciation expense on office equipment

D)wages of material handlers in factory

A)factory supplies

B)depreciation expense on factory building

C)depreciation expense on office equipment

D)wages of material handlers in factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

A merchandising company has raw materials inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

80

When determining the product cost of a manufactured product,________.

A)direct material costs include minor items such as tacks or glue

B)direct labor costs may not include employee benefits

C)indirect production costs may include selling costs

D)there may be no direct labor costs

A)direct material costs include minor items such as tacks or glue

B)direct labor costs may not include employee benefits

C)indirect production costs may include selling costs

D)there may be no direct labor costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck