Deck 17: Understanding and Analyzing Consolidated Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

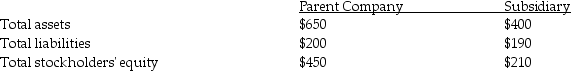

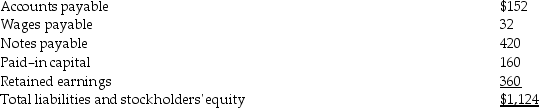

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

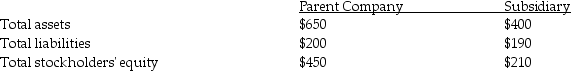

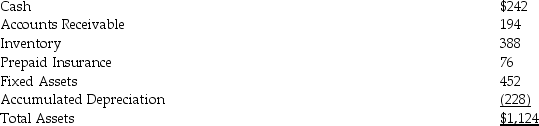

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/122

العب

ملء الشاشة (f)

Deck 17: Understanding and Analyzing Consolidated Financial Statements

1

Company B has 40,000 shares of its common stock outstanding.Company A owns 15,000 shares of Company B's stock.What method should Company A use to account for its investment in Company B?

A)market-value

B)equity

C)consolidated

D)available-for-sale

A)market-value

B)equity

C)consolidated

D)available-for-sale

B

2

Consolidated financial statements combine the books of two or more ________ into one set of financial statements.

A)subsidiaries

B)divisions

C)separate legal entities

D)segments

A)subsidiaries

B)divisions

C)separate legal entities

D)segments

C

3

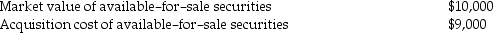

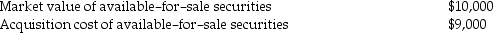

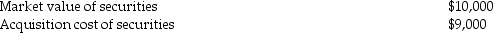

An investor in available-for-sale securities has the following information available at December 31,2012:  How does the investor report the change in market value on the available-for-sale securities at December 31,2012?

How does the investor report the change in market value on the available-for-sale securities at December 31,2012?

A)unrealized loss of $1,000 on income statement

B)unrealized gain of $1,000 on income statement

C)$1,000 is added to accumulated other comprehensive income account on the balance sheet

D)$1,000 is subtracted from the accumulated other comprehensive income account on the balance sheet

How does the investor report the change in market value on the available-for-sale securities at December 31,2012?

How does the investor report the change in market value on the available-for-sale securities at December 31,2012?A)unrealized loss of $1,000 on income statement

B)unrealized gain of $1,000 on income statement

C)$1,000 is added to accumulated other comprehensive income account on the balance sheet

D)$1,000 is subtracted from the accumulated other comprehensive income account on the balance sheet

C

4

Vince Company purchased common stock in Sanchez Company.During the current year,Sanchez Company earned $4,000,000 and paid dividends of $1,000,000.Assume that Vince Company owns 30% of the outstanding shares of Sanchez Company.Sanchez Company's dividend will affect Vince Company by ________.

A)increasing cash and stockholders' equity by $300,000

B)increasing investments and stockholders' equity by $300,000

C)increasing cash and decreasing investments by $300,000

D)increasing cash and increasing investments by $300,000

A)increasing cash and stockholders' equity by $300,000

B)increasing investments and stockholders' equity by $300,000

C)increasing cash and decreasing investments by $300,000

D)increasing cash and increasing investments by $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

5

Rocky Company acquired 40% of the voting stock of Boulder Company for $40 million.At the end of Year 1,Boulder Company reports net income of $15 million and pays cash dividends of $5 million.At the end of Year 1,the market value of Rocky Company's investment in Boulder Company is $44 million.The ________ method should be used by Rocky Company to account for the investment.

A)market-value

B)consolidated

C)cost

D)equity

A)market-value

B)consolidated

C)cost

D)equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

6

Jeff Company purchased common stock in Garcia Company.Jeff Company treats the investment as available-for-sale securities.During the current year,Garcia Company earned $4,000,000 and paid dividends of $1,000,000.Assume that Jeff Company owns 10% of the outstanding shares of Garcia Company.Garcia Company's net income will affect Jeff Company by ________.

A)increasing cash and investments by $400,000

B)increasing stockholders' equity and investments by $400,000

C)increasing cash and stockholders' equity by $400,000

D)no effect

A)increasing cash and investments by $400,000

B)increasing stockholders' equity and investments by $400,000

C)increasing cash and stockholders' equity by $400,000

D)no effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

7

Herman Company acquired 10 percent of the voting stock of Hudson Company for $10 million.Herman Company plans to keep the investment for several years.At the end of Year 1,Hudson Company reports net income of $15 million and pays cash dividends of $5 million.At the end of Year 1,the market value of Herman Company's investment in Hudson Company is $11 million.What entry is necessary at the end of Year 1 to account for the change in market value of Herman Company's investment in Hudson Company?

A)No entry is needed.

B)Cash increases $11 million and Stockholders' equity increases $11 million.

C)Investments increase $11 million and Stockholders' equity increases $11 million.

D)Investments increase $1 million and Stockholders' equity increases $1 million.

A)No entry is needed.

B)Cash increases $11 million and Stockholders' equity increases $11 million.

C)Investments increase $11 million and Stockholders' equity increases $11 million.

D)Investments increase $1 million and Stockholders' equity increases $1 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

8

Company B has 40,000 shares of its common stock outstanding.Company A owns 5,000 shares of Company B's stock.What method should Company A use to account for its investment in Company B?

A)market-value

B)equity

C)consolidated

D)available-for-sale

A)market-value

B)equity

C)consolidated

D)available-for-sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

9

Company B has 40,000 shares of its common stock outstanding.Company A owns 35,000 shares of Company B's stock.What method should Company A use to account for its investment in Company B?

A)market-value

B)equity

C)consolidated

D)cost

A)market-value

B)equity

C)consolidated

D)cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

10

Vince Company purchased common stock in Gill Company.During the current year,Gill Company earned $4,000,000 and paid dividends of $1,000,000.Assume that Vince Company owns 40 percent of the outstanding shares of Gill Company.Gill Company's net income will affect Vince Company by ________.

A)increasing investments by $1,600,000

B)increasing investments and cash by $2,000,000

C)increasing cash and stockholders' equity by $400,000

D)increasing cash and decreasing investments by $1,600,000

A)increasing investments by $1,600,000

B)increasing investments and cash by $2,000,000

C)increasing cash and stockholders' equity by $400,000

D)increasing cash and decreasing investments by $1,600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

11

Dividends received from trading securities are reported by the investor as ________.

A)an increase in the investment account

B)a decrease in the investment account

C)dividend revenue on the income statement

D)equity in earnings of the investee on the income statement

A)an increase in the investment account

B)a decrease in the investment account

C)dividend revenue on the income statement

D)equity in earnings of the investee on the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

12

Rocky Company acquired 40% of the voting stock of Boulder Company for $40 million.At the end of Year 1,Boulder Company reports net income of $15 million and pays cash dividends of $5 million.At the end of Year 1,the market value of Rocky Company's investment in Boulder Company is $44 million.At the time of the acquisition,what accounts would be affected on the books of Rocky Company?

A)Cash decrease $40 million and Investments increase $40 million

B)Cash decrease $40 million and Stockholders' Equity increase $40 million

C)Investments increase $40 million and Accounts Payable increase $40 million

D)No entry

A)Cash decrease $40 million and Investments increase $40 million

B)Cash decrease $40 million and Stockholders' Equity increase $40 million

C)Investments increase $40 million and Accounts Payable increase $40 million

D)No entry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

13

Jeff Company purchased common stock in Gonzalez Company.Jeff Company treats the investment as available-for-sale securities.During the current year,Gonzalez Company earned $4,000,000 and paid dividends of $1,000,000.Assume that Jeff Company owns 10% of the outstanding shares of Gonzalez Company.Gonzalez Company's dividend will affect Jeff Company by ________.

A)increasing cash and investments by $100,000

B)increasing investments and stockholders' equity by $100,000

C)increasing cash and stockholders' equity by $100,000

D)increasing cash and decreasing investments by $100,000

A)increasing cash and investments by $100,000

B)increasing investments and stockholders' equity by $100,000

C)increasing cash and stockholders' equity by $100,000

D)increasing cash and decreasing investments by $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

14

Dividends received from available-for-sale securities are reported by the investor as ________.

A)an increase in the investment account

B)a decrease in the investment account

C)dividend revenue on the income statement

D)equity in earnings of the investee on the income statement

A)an increase in the investment account

B)a decrease in the investment account

C)dividend revenue on the income statement

D)equity in earnings of the investee on the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

15

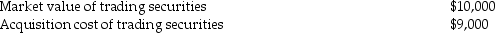

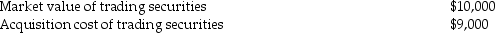

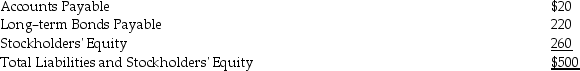

An investor in trading securities has the following information available at December 31,2012:  How does the investor report the change in market value on the trading securities at December 31,2012?

How does the investor report the change in market value on the trading securities at December 31,2012?

A)unrealized loss of $1,000 on income statement

B)unrealized gain of $1,000 on income statement

C)$1,000 is added to other comprehensive income account on the balance sheet

D)$1,000 is subtracted from the other comprehensive income account on the balance sheet

How does the investor report the change in market value on the trading securities at December 31,2012?

How does the investor report the change in market value on the trading securities at December 31,2012?A)unrealized loss of $1,000 on income statement

B)unrealized gain of $1,000 on income statement

C)$1,000 is added to other comprehensive income account on the balance sheet

D)$1,000 is subtracted from the other comprehensive income account on the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

16

Marketable securities that the investor company buys only with the intent to resell them shortly are called ________.

A)available-for-sale securities

B)underpriced securities

C)trading securities

D)options

A)available-for-sale securities

B)underpriced securities

C)trading securities

D)options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

17

Changes in the market value of trading securities are reflected in the ________ account.Changes in the market value of available-for-sale securities are reflected in the ________ account.

A)equity in earnings of investment; retained earnings

B)retained earnings; equity in earnings of investment

C)retained earnings; other comprehensive income or loss

D)other comprehensive income or loss; retained earnings

A)equity in earnings of investment; retained earnings

B)retained earnings; equity in earnings of investment

C)retained earnings; other comprehensive income or loss

D)other comprehensive income or loss; retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

18

Bobby Company purchased 40% of the outstanding shares of Wilson Company as a long-term investment.At the end of the year,the market value of the shares increased.The increase in market value of Wilson Company's shares will affect Bobby Company by ________.

A)increasing assets and increasing stockholders' equity

B)decreasing investments and increasing cash

C)increasing investments and increasing stockholders' equity

D)no effect

A)increasing assets and increasing stockholders' equity

B)decreasing investments and increasing cash

C)increasing investments and increasing stockholders' equity

D)no effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

19

Brian Company purchased 10% of the outstanding shares of Wilson Company.Brian Company classifies the investments as trading securities.At the end of the year,the market value of the shares increased.The increase in market value of Wilson Company's shares will affect Brian Company by ________.

A)increasing cash and increasing investments

B)decreasing investments and increasing stockholders' equity

C)increasing investments and increasing stockholders' equity

D)increasing cash and increasing stockholders' equity

A)increasing cash and increasing investments

B)decreasing investments and increasing stockholders' equity

C)increasing investments and increasing stockholders' equity

D)increasing cash and increasing stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

20

Marketable securities that the investor company does not intend to sell in the near future are called ________.

A)trading securities

B)options

C)available-for-sale securities

D)marketable securities

A)trading securities

B)options

C)available-for-sale securities

D)marketable securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

21

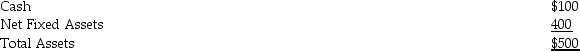

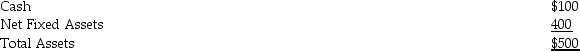

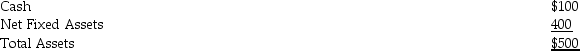

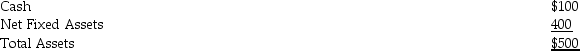

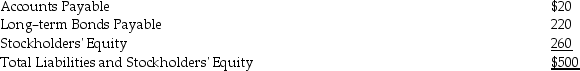

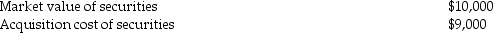

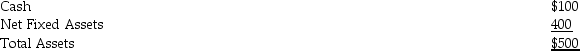

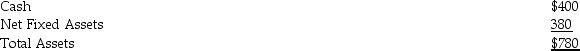

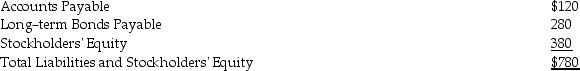

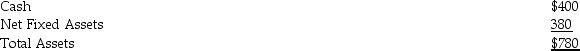

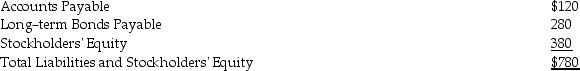

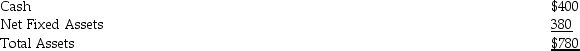

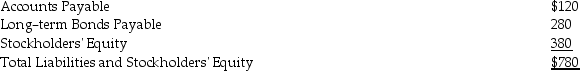

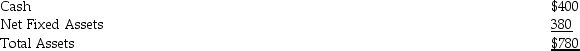

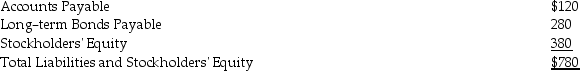

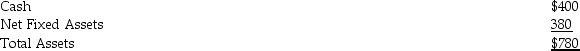

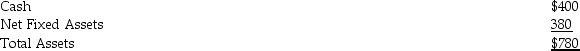

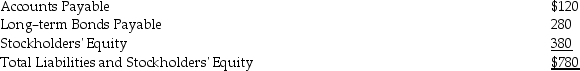

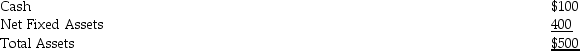

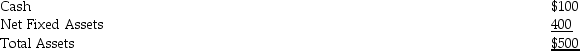

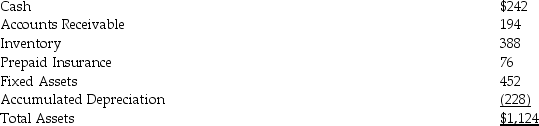

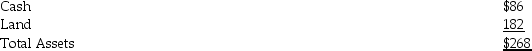

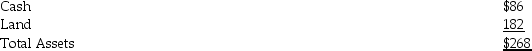

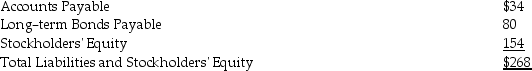

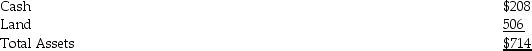

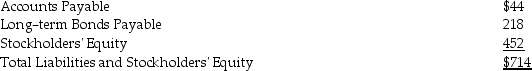

Presented below is the balance sheet of Hal Company at January 1,2015:

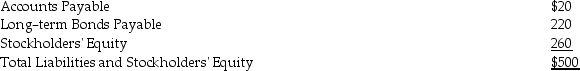

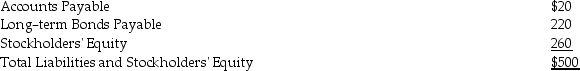

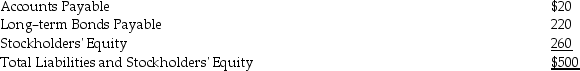

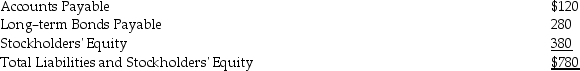

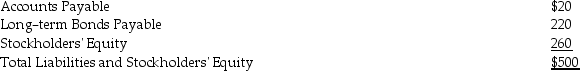

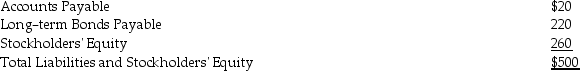

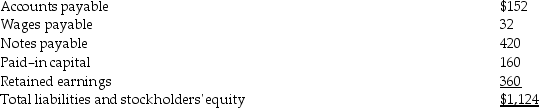

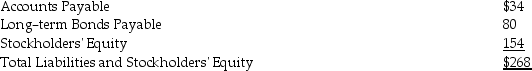

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the balance in the Investment in Hal Company account on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the balance in the Investment in Hal Company account on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

A)$0

B)$260

C)$380

D)$500

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the balance in the Investment in Hal Company account on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the balance in the Investment in Hal Company account on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)A)$0

B)$260

C)$380

D)$500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

22

Rocky Company acquired 40% of the voting stock of Boulder Company for $40 million.At the end of Year 1,Boulder Company reports net income of $15 million and pays cash dividends of $5 million.At the end of Year 1,the market value of Rocky Company's investment in Boulder Company is $44 million.What accounts on Rocky Company's books would be affected by the dividends of Boulder Company?

A)none

B)Cash increase $2 million and Stockholders' Equity increases $2 million

C)Cash increase $5 million and Stockholders' Equity increases $5 million

D)Cash increase $2 million and Investments decrease $2 million

A)none

B)Cash increase $2 million and Stockholders' Equity increases $2 million

C)Cash increase $5 million and Stockholders' Equity increases $5 million

D)Cash increase $2 million and Investments decrease $2 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

23

Under the equity method of accounting for investments,the acquisition cost of an investment is adjusted for ________.

A)dividends received only

B)investor's share of earnings or losses of investee after investment date only

C)changes in market value of investment

D)dividends received and investor's share of earnings or losses of investee after investment date

A)dividends received only

B)investor's share of earnings or losses of investee after investment date only

C)changes in market value of investment

D)dividends received and investor's share of earnings or losses of investee after investment date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

24

If an investor uses the equity method to account for a long-term equity investment,then the investor records income when the investee pays a dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

25

Presented below is the balance sheet of Hal Company at January 1,2015:

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Liabilities on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Liabilities on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

A)$0

B)$380

C)$400

D)$640

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Liabilities on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Liabilities on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)A)$0

B)$380

C)$400

D)$640

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

26

Burt Company purchased common stock in RR Company for $500,000.In the current year,RR Company reported net income of $48,000 and paid a dividend of $32,000.At the end of the year,the market value of the investment in RR Company was $525,000.

Required:

A)Assume Burt Company owns 10% of the shares of RR Company.Burt Company considers the investment to be available-for-sale securities.Show the effects of the transactions above on the accounts of Burt Company using the balance sheet equation.

B)Assume Burt Company owns 25% of the shares of RR Company.Show the effects of the transactions above on the accounts of Burt Company using the balance sheet equation.

Required:

A)Assume Burt Company owns 10% of the shares of RR Company.Burt Company considers the investment to be available-for-sale securities.Show the effects of the transactions above on the accounts of Burt Company using the balance sheet equation.

B)Assume Burt Company owns 25% of the shares of RR Company.Show the effects of the transactions above on the accounts of Burt Company using the balance sheet equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

27

Rocky Company acquired 40% of the voting stock of Boulder Company for $40 million.At the end of Year 1,Boulder Company reports net income of $15 million and pays cash dividends of $5 million.At the end of Year 1,the market value of Rocky Company's investment in Boulder Company is $44 million.What accounts on Rocky Company's books would be affected by the net income of Boulder Company?

A)none

B)Investments increase $15 million and Stockholders' equity increases $15 million

C)Cash increases $15 million and Stockholders' equity increases $15 million

D)Investments increase $6 million and Stockholders' equity increases $6 million

A)none

B)Investments increase $15 million and Stockholders' equity increases $15 million

C)Cash increases $15 million and Stockholders' equity increases $15 million

D)Investments increase $6 million and Stockholders' equity increases $6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

28

If an investor uses the equity method to account for a long-term equity investment,then the investor records income when the investee reports net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

29

An investor in securities accounted for by the equity method has the following information available at December 31,2012:  How does the investor report the change in market value on the securities at December 31,2012?

How does the investor report the change in market value on the securities at December 31,2012?

A)adjustment to Investment account

B)unrealized gain of $1,000 on income statement

C)adjustment to "other comprehensive income" account

D)not reported

How does the investor report the change in market value on the securities at December 31,2012?

How does the investor report the change in market value on the securities at December 31,2012?A)adjustment to Investment account

B)unrealized gain of $1,000 on income statement

C)adjustment to "other comprehensive income" account

D)not reported

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

30

Company A acquired 100 percent of the outstanding common stock of Company B.At the date of acquisition,no goodwill was involved and the book value of the assets and liabilities of Company B equal their fair values.Immediately after the acquisition,an elimination entry is prepared in order to prepare consolidated financial statements.What accounts are affected by the elimination entry?

A)Investment in Company B only

B)Stockholders' Equity of Company B only

C)Fixed Assets of Company B only

D)Investment in Company B and Stockholders' Equity of Company B

A)Investment in Company B only

B)Stockholders' Equity of Company B only

C)Fixed Assets of Company B only

D)Investment in Company B and Stockholders' Equity of Company B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

31

An investor that has effective control over an investee usually owns ________ of the investee's stock.

A)less than 20 percent

B)more than 20 percent

C)more than 40 percent

D)more than 50 percent

A)less than 20 percent

B)more than 20 percent

C)more than 40 percent

D)more than 50 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

32

Investments acquired with the intent to resell them in the near future are called trading securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

33

Presented below is the balance sheet of Hal Company at January 1,2015:

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Stockholders' Equity on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Stockholders' Equity on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

A)$0

B)$260

C)$380

D)$640

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Stockholders' Equity on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Stockholders' Equity on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)A)$0

B)$260

C)$380

D)$640

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

34

When a company owns less than 20 percent of the common stock of another company,the market value method of accounting for investments in equity securities is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

35

When preparing consolidated financial statements,eliminating entries are made to avoid double-counting ________.

A)assets only

B)liabilities only

C)assets,liabilities and stockholders' equity

D)none of the above

A)assets only

B)liabilities only

C)assets,liabilities and stockholders' equity

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

36

Under the equity method of accounting for investments,the investor recognizes income for ________.

A)the investor's share of income earned by the investee company

B)dividends received from the investee company

C)the change in market value of the investee company's stock

D)the amortization of goodwill associated with the investee company

A)the investor's share of income earned by the investee company

B)dividends received from the investee company

C)the change in market value of the investee company's stock

D)the amortization of goodwill associated with the investee company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

37

The company that owns 100 percent of another company's stock is called the ________.The company that is controlled by another company is called the ________.

A)majority interest; minority interest

B)controlling interest; noncontrolling interest

C)parent; subsidiary

D)subsidiary; segment

A)majority interest; minority interest

B)controlling interest; noncontrolling interest

C)parent; subsidiary

D)subsidiary; segment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

38

Rocky Company acquired 40% of the voting stock of Boulder Company for $40 million.At the end of Year 1,Boulder Company reports net income of $15 million and pays cash dividends of $5 million.At the end of Year 1,the market value of Rocky Company's investment in Boulder Company is $44 million.What accounts will be affected on Rocky Company's books to account for the increase in market value of the investment at the end of Year 1?

A)none

B)Cash increase $44 million and Stockholders' Equity increase $44 million

C)Investments increase $44 million and Stockholders' Equity increase $44 million

D)Investments increase $4 million and Stockholders' Equity increase $4 million

A)none

B)Cash increase $44 million and Stockholders' Equity increase $44 million

C)Investments increase $44 million and Stockholders' Equity increase $44 million

D)Investments increase $4 million and Stockholders' Equity increase $4 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

39

Presented below is the balance sheet of Hal Company at January 1,2015:

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Assets on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Assets on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

A)$0

B)$780

C)$1,020

D)$1,280

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Assets on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Assets on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)A)$0

B)$780

C)$1,020

D)$1,280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

40

A parent company purchases 100 percent of the outstanding common stock in a subsidiary.What happens to the subsidiary the day after the purchase? Which of the following statements is FALSE?

A)The purchase by the parent company does not affect the subsidiary's books.

B)The subsidiary ceases to exist.

C)The subsidiary continues as a separate legal entity.

D)The subsidiary has its own set of books.

A)The purchase by the parent company does not affect the subsidiary's books.

B)The subsidiary ceases to exist.

C)The subsidiary continues as a separate legal entity.

D)The subsidiary has its own set of books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

41

The existence of a parent company and a subsidiary requires special accounting procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

42

A subsidiary is a company that owns more than 50 percent of another company's outstanding common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

43

On January 1,2015,Jane Company acquired 80 percent of the outstanding shares of Tarzan Company for $152 in cash.At the time of the acquisition,Tarzan Company's total assets were $450.At the time of the acquisition,Tarzan Company's total liabilities were $260.What is the amount of noncontrolling interests on the consolidated balance sheet immediately after the acquisition of Tarzan Company's stock? (Assume elimination entries are completed.)

A)$0

B)$38

C)$114

D)$152

A)$0

B)$38

C)$114

D)$152

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

44

Presented below is the balance sheet of Hal Company at January 1,2015:

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.Hal Company generated net income of $30 during the year ended December 31,2015.There were no intercompany sales.What is the balance in the Investment in Hal Company account on December 31,2015 before elimination entries are prepared?

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.Hal Company generated net income of $30 during the year ended December 31,2015.There were no intercompany sales.What is the balance in the Investment in Hal Company account on December 31,2015 before elimination entries are prepared?

A)$0

B)$30

C)$230

D)$290

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.Hal Company generated net income of $30 during the year ended December 31,2015.There were no intercompany sales.What is the balance in the Investment in Hal Company account on December 31,2015 before elimination entries are prepared?

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.Hal Company generated net income of $30 during the year ended December 31,2015.There were no intercompany sales.What is the balance in the Investment in Hal Company account on December 31,2015 before elimination entries are prepared?A)$0

B)$30

C)$230

D)$290

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

45

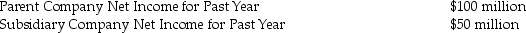

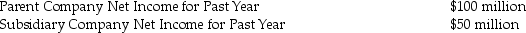

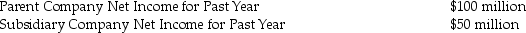

On January 1,2010,a parent company purchased 100 percent of the stock in a subsidiary.On January 1,2010,no goodwill was recorded and the book value of the subsidiary's assets equals the market value of the subsidiary's assets.On December 31,2010,the two companies report the following data:  What is the consolidated net income for the year ended December 31,2010?

What is the consolidated net income for the year ended December 31,2010?

A)$0

B)$50 million

C)$100 million

D)$150 million

What is the consolidated net income for the year ended December 31,2010?

What is the consolidated net income for the year ended December 31,2010?A)$0

B)$50 million

C)$100 million

D)$150 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

46

On January 1,2015,Julia Company acquired 80 percent of the outstanding shares of Harkins Company for $120.At the time of the acquisition,Harkins Company's total assets were $550 and total liabilities were $400.What is the balance in the Investment in Harkins Company account on the consolidated balance sheet immediately after the acquisition of Harkins Company's stock? (Assume elimination entries are completed.)

A)$0

B)$120

C)$190

D)$440

A)$0

B)$120

C)$190

D)$440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

47

On January 1,2015,Parent Company acquired 80 percent of the outstanding shares of Subsidiary Company.At the time of the acquisition,Parent Company's total liabilities were $210.At the time of the acquisition,Subsidiary Company's total liabilities were $280.What is the amount of total liabilities on the consolidated balance sheet immediately after the acquisition of Subsidiary Company's stock? (Assume elimination entries are completed.)

A)$0

B)$280

C)$338

D)$490

A)$0

B)$280

C)$338

D)$490

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

48

Elimination entries avoid double-counting assets,liabilities and stockholders' equity on the consolidated financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

49

Elway Company acquired 80 percent of the outstanding stock of Warner Company for $152 cash.(No goodwill is associated with the acquisition.)Elway Company's assets prior to the acquisition were $700.Warner Company's assets prior to the acquisition were $400.What are the total assets on the consolidated balance sheet prepared immediately after the acquisition of Warner Company's stock? (Assume elimination entries are completed.)

A)$400

B)$700

C)$948

D)$1,100

A)$400

B)$700

C)$948

D)$1,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

50

Presented below is the balance sheet of Hal Company at January 1,2015:

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.The net income for the year ending December 31,2015 was $30 for Hal Company.The net income for the year ending December 31,2015 was $40 for Monty Company.There were no intercompany sales.What is the net income on the consolidated income statement for the year ended December 31,2015?

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.The net income for the year ending December 31,2015 was $30 for Hal Company.The net income for the year ending December 31,2015 was $40 for Monty Company.There were no intercompany sales.What is the net income on the consolidated income statement for the year ended December 31,2015?

A)$0

B)$30

C)$40

D)$70

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.The net income for the year ending December 31,2015 was $30 for Hal Company.The net income for the year ending December 31,2015 was $40 for Monty Company.There were no intercompany sales.What is the net income on the consolidated income statement for the year ended December 31,2015?

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.The net income for the year ending December 31,2015 was $30 for Hal Company.The net income for the year ending December 31,2015 was $40 for Monty Company.There were no intercompany sales.What is the net income on the consolidated income statement for the year ended December 31,2015?A)$0

B)$30

C)$40

D)$70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

51

Noncontrolling interests affect only the balance sheet of consolidated financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

52

Beck Company owns a 60 percent interest in Subsidiary Company.For the year ended December 31,2016,the net income of Beck Company was $80 and the net income of Subsidiary Company was $10.What is the balance in the Noncontrolling Interests account on the consolidated income statement for the year ending December 31,2016?

A)$0

B)$4

C)$6

D)$48

A)$0

B)$4

C)$6

D)$48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Investment in Subsidiary account appears on a consolidated balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

54

Fisher Company acquired 80 percent of the outstanding shares of Gibbs Company for $152 in cash.(No goodwill was present at the time of acquisition.)The net income for the current year for Fisher Company is $100.The net income for the current year for Gibbs Company is $20.There were no intercompany sales.What is the net income on the consolidated income statement for the current year?

A)$80

B)$96

C)$100

D)$116

A)$80

B)$96

C)$100

D)$116

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

55

When an investing company owns less than 50 percent of another company,the companies must prepare consolidated financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

56

Noncontrolling interests appear on a consolidated balance sheet when a parent company owns more than 50 percent but less than 100 percent of a subsidiary's common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

57

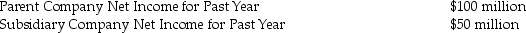

On January 1,2010,a parent company purchased 90 percent of the stock in a subsidiary.On January 1,2010,no goodwill was recorded and the book value of the subsidiary's assets equals the market value of the subsidiary's assets.On December 31,2010,the two companies report the following data:  What is the consolidated net income for the year ended December 31,2010?

What is the consolidated net income for the year ended December 31,2010?

A)$100 million

B)$135 million

C)$145 million

D)$150 million

What is the consolidated net income for the year ended December 31,2010?

What is the consolidated net income for the year ended December 31,2010?A)$100 million

B)$135 million

C)$145 million

D)$150 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a company acquires all of the common stock of a subsidiary,the books of the subsidiary are no longer used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

59

The account "Noncontrolling Interests" as reported on a balance sheet shows ________.

A)the parent company's interest in a subsidiary

B)the subsidiary's interest in a parent company

C)the outside stockholders' interest in a subsidiary

D)the outside stockholders' interest in a parent company

A)the parent company's interest in a subsidiary

B)the subsidiary's interest in a parent company

C)the outside stockholders' interest in a subsidiary

D)the outside stockholders' interest in a parent company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

60

On January 1,2015,Jane Company acquired 80 percent of the outstanding shares of Joan Company.At the time of the acquisition,Jane Company's total stockholders' equity was $420.At the time of the acquisition,Joan Company's total stockholders' equity was $190.What is the amount of total stockholders' equity on the consolidated balance sheet immediately after the acquisition of Joan Company's stock? (Assume elimination entries are completed.)

A)$0

B)$420

C)$458

D)$610

A)$0

B)$420

C)$458

D)$610

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

61

To prepare common size income statements,percentages for line items are usually based on ________.To prepare common size balance sheets,percentages for line items are usually based on ________.

A)net income; total stockholders' equity

B)net operating profit; total stockholders' equity

C)sales; total assets

D)expenses; total liabilities

A)net income; total stockholders' equity

B)net operating profit; total stockholders' equity

C)sales; total assets

D)expenses; total liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

62

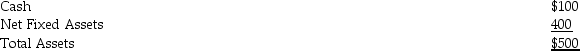

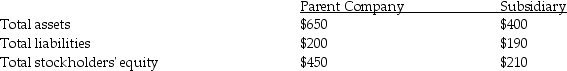

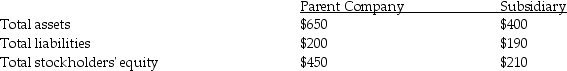

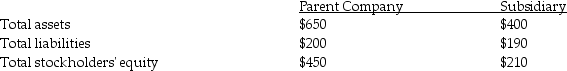

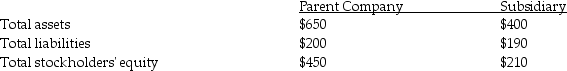

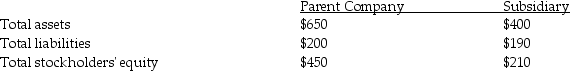

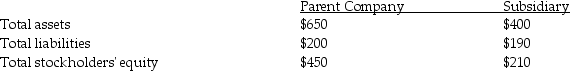

On January 1,2012,a parent company acquired all of the stock of a subsidiary.The following data is available:  The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what are the total assets on the consolidated balance sheet? (Assume elimination entries are completed.)

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what are the total assets on the consolidated balance sheet? (Assume elimination entries are completed.)

A)$650

B)$800

C)$840

D)$1,050

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what are the total assets on the consolidated balance sheet? (Assume elimination entries are completed.)

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what are the total assets on the consolidated balance sheet? (Assume elimination entries are completed.)A)$650

B)$800

C)$840

D)$1,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

63

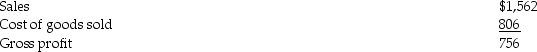

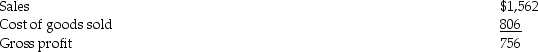

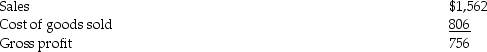

Hull Company has the following income statement for the year ending December 31,2016:  Operating expenses:

Operating expenses:

If Hull Company prepares a common size income statement,what will they report for Rent expense?

If Hull Company prepares a common size income statement,what will they report for Rent expense?

A)2.3%

B)4.3%

C)4.4%

D)6.1%

Operating expenses:

Operating expenses: If Hull Company prepares a common size income statement,what will they report for Rent expense?

If Hull Company prepares a common size income statement,what will they report for Rent expense?A)2.3%

B)4.3%

C)4.4%

D)6.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

64

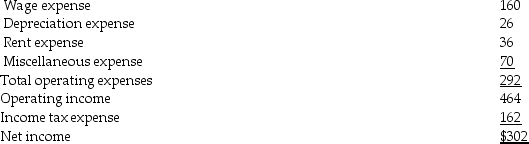

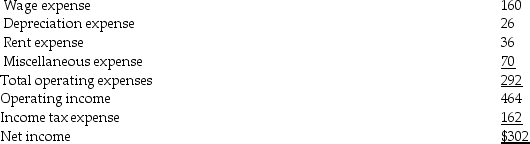

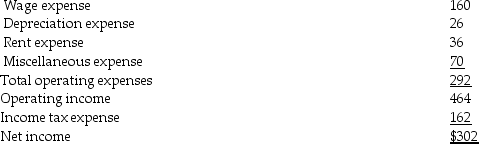

Goelzer Company has the following income statement for the year ending December 31,2016:  Operating expenses:

Operating expenses:

If Goelzer Company prepares a common size income statement,what will they report for Income tax expense?

If Goelzer Company prepares a common size income statement,what will they report for Income tax expense?

A)10.4%

B)11.0%

C)12.4%

D)39.9%

Operating expenses:

Operating expenses: If Goelzer Company prepares a common size income statement,what will they report for Income tax expense?

If Goelzer Company prepares a common size income statement,what will they report for Income tax expense?A)10.4%

B)11.0%

C)12.4%

D)39.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

65

Goodwill is recognized when one company purchases another company and ________.

A)the purchase price of the acquired company exceeds the book value of the acquired company's assets

B)the purchase price of the acquired company exceeds the book value of the acquired company's assets less liabilities

C)the purchase price of the acquired company exceeds the fair value of the acquired company's assets

D)the purchase price of the acquired company exceeds the fair value of the acquired company's assets less liabilities

A)the purchase price of the acquired company exceeds the book value of the acquired company's assets

B)the purchase price of the acquired company exceeds the book value of the acquired company's assets less liabilities

C)the purchase price of the acquired company exceeds the fair value of the acquired company's assets

D)the purchase price of the acquired company exceeds the fair value of the acquired company's assets less liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

66

To compare companies that differ in size,analysts use ________.

A)MD&A

B)10-K filings with the Securities and Exchange Commission

C)common size financial statements

D)the market-value method for investments

A)MD&A

B)10-K filings with the Securities and Exchange Commission

C)common size financial statements

D)the market-value method for investments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

67

Each year,goodwill on the consolidated balance sheet is ________.

A)amortized

B)depreciated

C)evaluated by management to determine if it is impaired

D)ignored

A)amortized

B)depreciated

C)evaluated by management to determine if it is impaired

D)ignored

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

68

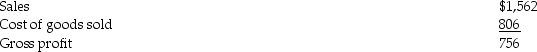

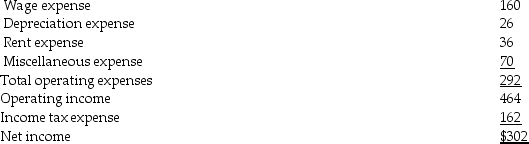

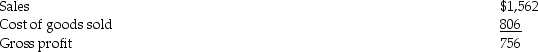

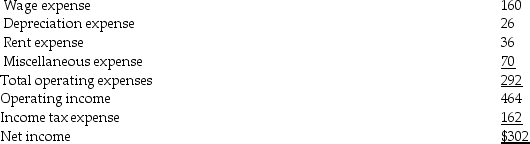

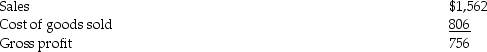

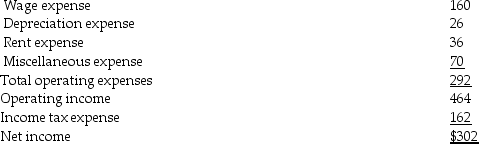

Mussa Company has the following income statement for the year ending December 31,2016:  Operating expenses:

Operating expenses:

If Mussa Company prepares a common size income statement,what will they report for Wage expense?

If Mussa Company prepares a common size income statement,what will they report for Wage expense?

A)9.8%

B)10.2%

C)34.4%

D)66.1%

Operating expenses:

Operating expenses: If Mussa Company prepares a common size income statement,what will they report for Wage expense?

If Mussa Company prepares a common size income statement,what will they report for Wage expense?A)9.8%

B)10.2%

C)34.4%

D)66.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

69

Goodwill can only be recognized when one company acquires another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

70

Goodwill from the purchase of another company appears on the consolidated balance sheet as a ________.

A)stockholders' equity item

B)part of the Investment in subsidiary

C)separate intangible asset account

D)component of other comprehensive income

A)stockholders' equity item

B)part of the Investment in subsidiary

C)separate intangible asset account

D)component of other comprehensive income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

71

At the date of acquisition by a parent company,the fair value of a subsidiary's fixed assets were larger than their book value.When preparing consolidated financial statements,the fixed assets of the subsidiary are ________ and depreciation expense is ________.

A)decreased to fair value; decreased

B)increased to fair value; increased

C)not adjusted; not adjusted

D)increased to fair value; not adjusted

A)decreased to fair value; decreased

B)increased to fair value; increased

C)not adjusted; not adjusted

D)increased to fair value; not adjusted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

72

On January 1,2012,a parent company acquired all of the stock of a subsidiary.The following data is available:  The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $450 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $450 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

A)$0

B)$10

C)$200

D)$240

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $450 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $450 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?A)$0

B)$10

C)$200

D)$240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

73

The balance sheet for Jimmy Company is given below:

If a common-size balance sheet was prepared,what would Jimmy Company report for accounts receivable?

If a common-size balance sheet was prepared,what would Jimmy Company report for accounts receivable?

A)13.5%

B)17.3%

C)62.3%

D)86.3%

If a common-size balance sheet was prepared,what would Jimmy Company report for accounts receivable?

If a common-size balance sheet was prepared,what would Jimmy Company report for accounts receivable?A)13.5%

B)17.3%

C)62.3%

D)86.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

74

Goodwill is amortized on the consolidated financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

75

On January 1,2012,a parent company acquired all of the stock of a subsidiary.The following data is available:  The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what is the total stockholders' equity on the consolidated balance sheet? (Assume elimination entries are completed.)

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what is the total stockholders' equity on the consolidated balance sheet? (Assume elimination entries are completed.)

A)$390

B)$450

C)$800

D)$840

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what is the total stockholders' equity on the consolidated balance sheet? (Assume elimination entries are completed.)

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to the book value.The parent company paid $250 for the 100 percent interest in the subsidiary.On January 1,2012,what is the total stockholders' equity on the consolidated balance sheet? (Assume elimination entries are completed.)A)$390

B)$450

C)$800

D)$840

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

76

The section of the annual report that explains major changes in the income statement,changes in liquidity and capital resources and the impact of inflation is called the ________.

A)notes to the financial statements

B)appendix to the financial statements

C)internal control report

D)management's discussion and analysis

A)notes to the financial statements

B)appendix to the financial statements

C)internal control report

D)management's discussion and analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the fair value of a subsidiary's assets exceeds their book value when the subsidiary is acquired,the assets of the subsidiary are written up at the time consolidated financial statements are prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

78

Orlando Company acquired all of the shares of Tampa Company for $100 cash.At the time of the acquisition,the fair values of Tampa Company's assets were $200.At the time of acquisition,the fair values of Tampa Company's liabilities were $120.On the date of acquisition,what is the amount of goodwill on the consolidated balance sheet?

A)$0

B)$20

C)$80

D)$100

A)$0

B)$20

C)$80

D)$100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

79

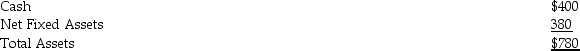

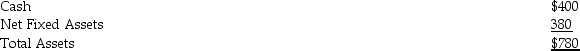

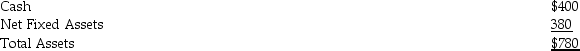

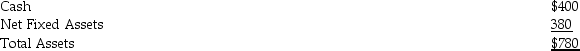

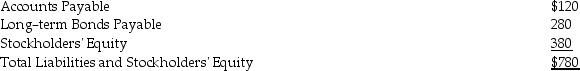

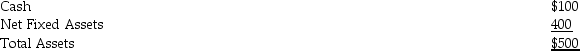

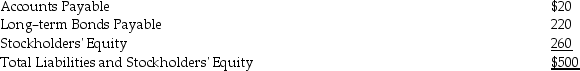

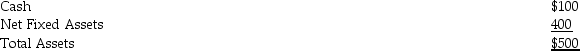

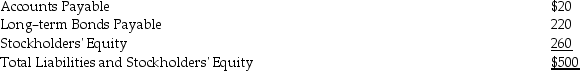

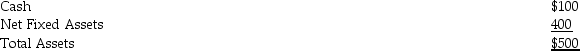

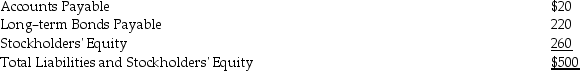

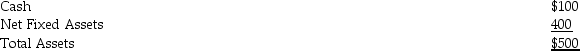

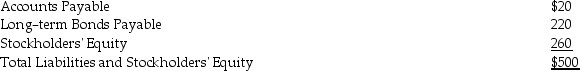

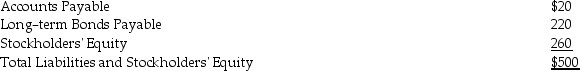

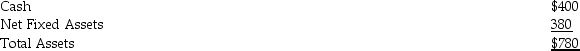

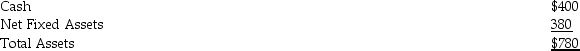

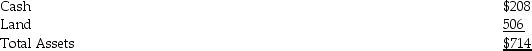

The balance sheet for Lewis Company at January 1,2016 follows:

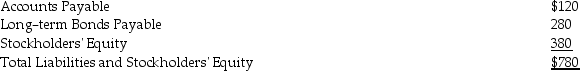

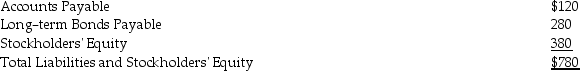

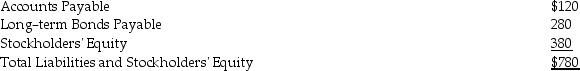

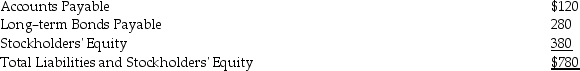

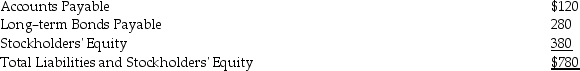

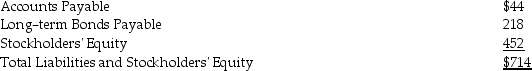

The balance sheet for Martin Company at January 1,2016 follows:

The balance sheet for Martin Company at January 1,2016 follows:

On January 1,2016,Martin Company paid $154 in cash for 100 percent of the outstanding stock of Lewis Company.The fair value of the assets and liabilities of the Lewis Company were equal to their book value.During the year ended December 31,2016,the Lewis Company had net income of $14 and the Martin Company had net income of $50.There were no intercompany sales.All net income for both companies is in the form of cash.

On January 1,2016,Martin Company paid $154 in cash for 100 percent of the outstanding stock of Lewis Company.The fair value of the assets and liabilities of the Lewis Company were equal to their book value.During the year ended December 31,2016,the Lewis Company had net income of $14 and the Martin Company had net income of $50.There were no intercompany sales.All net income for both companies is in the form of cash.

Required:

A)Prepare the consolidated balance sheet immediately after acquisition of stock in Lewis Company.

B)Prepare the consolidated balance sheet at December 31,2016.

The balance sheet for Martin Company at January 1,2016 follows:

The balance sheet for Martin Company at January 1,2016 follows:

On January 1,2016,Martin Company paid $154 in cash for 100 percent of the outstanding stock of Lewis Company.The fair value of the assets and liabilities of the Lewis Company were equal to their book value.During the year ended December 31,2016,the Lewis Company had net income of $14 and the Martin Company had net income of $50.There were no intercompany sales.All net income for both companies is in the form of cash.

On January 1,2016,Martin Company paid $154 in cash for 100 percent of the outstanding stock of Lewis Company.The fair value of the assets and liabilities of the Lewis Company were equal to their book value.During the year ended December 31,2016,the Lewis Company had net income of $14 and the Martin Company had net income of $50.There were no intercompany sales.All net income for both companies is in the form of cash.Required:

A)Prepare the consolidated balance sheet immediately after acquisition of stock in Lewis Company.

B)Prepare the consolidated balance sheet at December 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

80

On January 1,2012,a parent company acquired all of the stock of a subsidiary.The following data is available:  The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $250 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $250 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

A)$0

B)$10

C)$40

D)$200

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $250 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $250 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?A)$0

B)$10

C)$40

D)$200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck