Deck 11: Accounting Periods and Methods

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/103

العب

ملء الشاشة (f)

Deck 11: Accounting Periods and Methods

1

C corporations and partnerships with a corporate partner may use the cash method of accounting if average annual gross receipts for the three preceding tax years do not exceed $10 million.

False

2

An improper election to use a fiscal year automatically places the taxpayer on the calendar year.

True

3

A subsidiary corporation filing a consolidated return with its parent corporation must change its accounting period to conform with its parent's tax year.

True

4

The final tax return of Marjorie,a single taxpayer on the calendar basis,who died on July 15,2013,is due on April 15,2014 (ignoring extensions).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

5

Generally,an income tax return covers an accounting period of 12 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

6

Except in a few specific circumstances,once adopted,an accounting period may be changed without IRS approval.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

7

All C corporations can elect a tax year other than a calendar year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under the cash method of accounting,income is reported for the tax year in which payments are actually or constructively received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

9

A taxpayer must use the same accounting method on the personal tax return that the taxpayer uses in the taxpayer's trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

10

If the majority of the partners do not have the same tax year,the partnership must use the tax year of its principal partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

11

Alvin,a practicing attorney who also owns an office supplies store,may use the cash basis for his practice and the accrual basis for his office supplies store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

12

If Jett Corporation receives a charter in 2011 but does not begin operations and file its first tax return until 2013,Jett may elect a fiscal year on the 2013 return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

13

A newly married person may change tax years to conform to that of his or her spouse so that a joint return may be filed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

14

Partnerships,S corporations,and personal service corporations may elect a taxable year which results in a tax deferral of four months or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

15

Taxpayers who change from one accounting period to another must annualize their income for the resulting short period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

16

Generally,if inventories are an income-producing factor to the business,the accrual method must be used for sales and cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

17

A partnership must generally use the same tax year of the partners who own the majority of partnership income and capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

18

A fiscal year is a 12-month period that ends on the last day of any month other than December.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

19

A taxpayer's tax year must coincide with the year used to keep the taxpayer's books and records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the cash method of accounting,all expenses are deductible when paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

21

Points paid on a mortgage to buy a personal residence are deductible in the year paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

22

Contracts for services including accounting,legal and architectural services do not qualify for long-term contract treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a cash basis taxpayer gives a note in payment of an expense,the deduction may not be taken until the note is paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

24

Interest is not imputed on a gift loan between two individuals totaling $12,000 except when the borrowed funds are used to purchase income-producing property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

25

A taxpayer may use a combination of accounting methods as long as income is clearly reflected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

26

The uniform capitalization rules (UNICAP)require the capitalization of some overhead costs that are expensed for financial accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under the accrual method of accounting,the two tests to determine when income must be reported and expenses deducted are the all-events test and the economic performance test.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

28

For tax purposes,"market" for purposes of applying the lower of cost or market method means the price at which the taxpayer can sell the inventory item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

29

A business which provides a warranty on goods sold will deduct a reserve for warranty expense consistent with the reporting on its financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

30

The all-events test requires that the accrual-basis taxpayer report income when all events have occurred that fix the taxpayer's right to the income and when the amount can be determined with reasonable accuracy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

31

A taxpayer who uses the LIFO method of inventory valuation may use the lower of cost or market method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

32

A taxpayer who uses the cash method in computing gross income from his or her business must use the cash method in computing expenses of such business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

33

A taxpayer must use the same accounting method,either percentage of completion or completed contract method,for all long-term contracts in the same trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

34

For tax purposes,the lower of cost or market method must ordinarily be applied to each separate inventory item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

35

One criterion which will permit a deduction for an expenditure by the accrual-basis taxpayer prior to economic performance is that either the amount is not material or the earlier accrual of the item results in a better matching of income and expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

36

A taxpayer may use the FIFO or average cost methods for financial statement purposes,while using the LIFO method for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

37

Under the cash method of accounting,payment by credit card entitles the taxpayer to deduct the expenditure at the time the charge is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

38

Many taxpayers use the LIFO method of inventory valuation because during inflationary periods,LIFO normally results in the lowest inventory value and hence the lowest taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

39

The installment sale method may be used on the sale of property at a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

40

The installment method is not applicable to sales of inventory and marketable securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

41

Under the percentage of completion method,gross income is reported

A)when the contract is completed.

B)using a percentage that is determined by dividing current year costs by the expected total revenue.

C)based on the portion of work that is incomplete.

D)based on the portion of work that has been completed.

A)when the contract is completed.

B)using a percentage that is determined by dividing current year costs by the expected total revenue.

C)based on the portion of work that is incomplete.

D)based on the portion of work that has been completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

42

In general,a change in accounting method must be approved by the IRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

43

In year 1 a contractor agrees to build a building for $2,500,000 by the end of year 2.The builder's cost is estimated to be $1,800,000.The actual costs year 1 are $900,000 and year 2's actual costs are $1,100,000.Under the percentage of completion method year 1's gross profit is

A)$0.

B)$300,000.

C)$350,000.

D)$700,000.

A)$0.

B)$300,000.

C)$350,000.

D)$700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under the cash method of accounting,all of the following are true with the exception of:

A)Fixed assets are always expensed as the taxpayer pays for the assets.

B)Gross income includes the value of property received.

C)To some extent,a taxpayer may control the year in which an expense is deductible by choosing when to make the payment.

D)Income is reported in the tax year in which payments are actually or constructively received.

A)Fixed assets are always expensed as the taxpayer pays for the assets.

B)Gross income includes the value of property received.

C)To some extent,a taxpayer may control the year in which an expense is deductible by choosing when to make the payment.

D)Income is reported in the tax year in which payments are actually or constructively received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following statements regarding UNICAP is incorrect?

A)The UNICAP rules result in more costs being included in inventory for tax purposes than for financial accounting.

B)Taxpayers with gross receipts averaging more than $10,000,000 or more for the prior three years must apply the UNICAP provisions.

C)Interest must be included in inventory if the property produced is real property or long-lived property.

D)UNICAP requires that advertising and selling costs be allocated between inventory and cost of sales.

A)The UNICAP rules result in more costs being included in inventory for tax purposes than for financial accounting.

B)Taxpayers with gross receipts averaging more than $10,000,000 or more for the prior three years must apply the UNICAP provisions.

C)Interest must be included in inventory if the property produced is real property or long-lived property.

D)UNICAP requires that advertising and selling costs be allocated between inventory and cost of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

46

Inventory may be valued on the tax return at the lower of cost or market unless

A)replacement cost is higher than historical cost.

B)the taxpayer determines inventory cost using the LIFO method.

C)the taxpayer determines inventory cost using the FIFO method.

D)the cash method of accounting is used by the taxpayer.

A)replacement cost is higher than historical cost.

B)the taxpayer determines inventory cost using the LIFO method.

C)the taxpayer determines inventory cost using the FIFO method.

D)the cash method of accounting is used by the taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

47

A new business is established.It is not a seasonal business.All of the following are acceptable accounting tax years with the exception of

A)an S corporation year ending October 31.

B)a C corporation (not a personal service corporation)tax year ending on February 15.

C)a C corporation (not a personal service corporation)tax year ending on April 30.

D)a partnership tax year ending on October 31 with three equal partners whose tax years end on September 30,October 31,and November 30.

A)an S corporation year ending October 31.

B)a C corporation (not a personal service corporation)tax year ending on February 15.

C)a C corporation (not a personal service corporation)tax year ending on April 30.

D)a partnership tax year ending on October 31 with three equal partners whose tax years end on September 30,October 31,and November 30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following partnerships can elect the cash basis method of accounting?

A)a CPA firm with average revenues of $20 million

B)a chocolate manufacturer with average revenues of $3 million

C)a cleaning service partnership generating average revenues of $5.5 million whose partners are Joe,Larry and Smith Inc.

D)None of the above.

A)a CPA firm with average revenues of $20 million

B)a chocolate manufacturer with average revenues of $3 million

C)a cleaning service partnership generating average revenues of $5.5 million whose partners are Joe,Larry and Smith Inc.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

49

Under UNICAP,all of the following overhead costs are included in inventory except

A)factory utilities,rent,insurance and depreciation.

B)officers' salaries and factory administration.

C)research and experimentation.

D)factory payroll,purchasing and warehouse costs.

A)factory utilities,rent,insurance and depreciation.

B)officers' salaries and factory administration.

C)research and experimentation.

D)factory payroll,purchasing and warehouse costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

50

Interest is not imputed on a gift loan between two individuals totaling $100,000 except when the borrowed funds are used to purchase income-producing property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

51

For purposes of the accrual method of accounting,the economic performance test is met when

A)the property or services are actually provided.

B)the amount of the item can be reasonably estimated.

C)all events have occurred that establish the fact of a liability.

D)all events have occurred that fix the taxpayer's right to receive income.

A)the property or services are actually provided.

B)the amount of the item can be reasonably estimated.

C)all events have occurred that establish the fact of a liability.

D)all events have occurred that fix the taxpayer's right to receive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

52

This year,Hamilton,a local manufacturer of off-shore drilling platforms,entered into a contract to construct a drilling platform that will be placed in the North Atlantic Ocean.The total contract price is $5,000,000,and Hamilton estimates the total construction cost at $3,000,000.Actual costs incurred this year are $600,000.If Hamilton uses the percentage of completion method,the gross profit for this year is

A)$0.

B)$400,000.

C)$600,000.

D)$2,000,000.

A)$0.

B)$400,000.

C)$600,000.

D)$2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

53

All of the following statements are true except:

A)once adopted,an accounting period normally cannot be changed without approval by the IRS.

B)taxpayers who change from one accounting period to another must annualize their income for the resulting short period.

C)taxpayers filing an initial tax return are required to annualize the year's income and prorate exemptions and credits.

D)an existing partnership can change its tax year without prior approval if the partners with a majority interest have the same tax year to which the partnership changes.

A)once adopted,an accounting period normally cannot be changed without approval by the IRS.

B)taxpayers who change from one accounting period to another must annualize their income for the resulting short period.

C)taxpayers filing an initial tax return are required to annualize the year's income and prorate exemptions and credits.

D)an existing partnership can change its tax year without prior approval if the partners with a majority interest have the same tax year to which the partnership changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

54

Emma,a single taxpayer,obtains permission to change from a calendar year to a fiscal year ending June 30,2013.During the six months ending June 30,2013,she earns $40,000 and has $8,000 of itemized deductions.What is the amount of her annualized income?

A)$32,150

B)$30,050

C)$60,100

D)$64,300

A)$32,150

B)$30,050

C)$60,100

D)$64,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

55

In 2013,Richard's Department Store changes its inventory method from FIFO to LIFO.Richard's uses the simplified LIFO method.Richard's year-end inventory under FIFO is as follows: 2012- $300,000; 2013 - $350,000.The 2012 price index is 110% and the 2013 index is 120%.The 2013 layer is

A)$19,097.

B)$20,833.

C)$22,727.

D)$50,000.

A)$19,097.

B)$20,833.

C)$22,727.

D)$50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

56

When preparing a tax return for a short period,the taxpayer should annualize the income if the short period return

A)is the last return for a decedent who died on June 15.

B)is the first return for a corporation created on June 1.

C)is the last return for a partnership,which was terminated on October 12.

D)is a return for June 1 to December 31,for a corporation changing from a fiscal year to a calendar year.

A)is the last return for a decedent who died on June 15.

B)is the first return for a corporation created on June 1.

C)is the last return for a partnership,which was terminated on October 12.

D)is a return for June 1 to December 31,for a corporation changing from a fiscal year to a calendar year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

57

When accounting for long-term contracts (other than those for services),all of the following accounting methods may be acceptable with the exception of

A)the cash method of accounting.

B)the completed contract method.

C)the percentage of completion method.

D)the modified percentage of completion method.

A)the cash method of accounting.

B)the completed contract method.

C)the percentage of completion method.

D)the modified percentage of completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

58

In year 1 a contractor agrees to build a building for $2,500,000 by the end of year 2.The builder's cost is estimated to be $1,800,000.The actual costs year 1 are $900,000 and year 2's actual costs are $1,300,000.Under the completed contract method the gross profit for year 1 is

A)$0.

B)$300,000.

C)$350,000.

D)$700,000.

A)$0.

B)$300,000.

C)$350,000.

D)$700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

59

In year 1 a contractor agrees to build a building for $2,500,000 by the end of year 2.The builder's cost is estimated to be $1,800,000.The actual costs year 1 are $900,000 and year 2's actual costs are $1,300,000.Under the completed contract method the gross profit for year 2 is

A)$0.

B)$300,000.

C)$350,000.

D)$700,000.

A)$0.

B)$300,000.

C)$350,000.

D)$700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

60

Bergeron is a local manufacturer of off-shore drilling platforms.This year,Bergeron entered into a contract to construct a drilling platform,which will be placed in the North Atlantic Ocean.The total contract price is $5,000,000,and Bergeron estimates the total construction cost at $2,000,000.Actual costs incurred this year are $600,000.If Bergeron uses the completed contract method,the gross profit for this year is

A)$0.

B)$400,000.

C)$600,000.

D)$2,000,000.

A)$0.

B)$400,000.

C)$600,000.

D)$2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

61

Andrew sold land to Becca,Andrew's daughter.The fair market value of the land was $300,000 (basis $250,000).Becca agreed to pay Andrew $300,000 over 8 years.Becca immediately sold the land to Olga for $300,000 cash.The gain of $50,000 must be recognized

A)by Becca in installments.

B)by Becca when Becca sells to Olga.

C)by Andrew when Andrew sells to Becca.

D)by Andrew when Becca sells to Olga.

A)by Becca in installments.

B)by Becca when Becca sells to Olga.

C)by Andrew when Andrew sells to Becca.

D)by Andrew when Becca sells to Olga.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

62

The installment sale method can be used for all of the following transactions except

A)the sale of an antique by a collector.

B)the sale of shares of publicly-traded corporate stock.

C)the sale of farmland used in a farming business.

D)the sale of a boat held for personal use.

A)the sale of an antique by a collector.

B)the sale of shares of publicly-traded corporate stock.

C)the sale of farmland used in a farming business.

D)the sale of a boat held for personal use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

63

In year 1 a contractor agrees to build a building for $2,500,000 by the end of year 2.The builder's cost is estimated to be $1,800,000.The actual costs year 1 are $900,000 and year 2's actual costs are $1,100,000.Under the percentage of completion method year 2's gross profit is

A)$150,000.

B)$500,000.

C)$700,000.

D)$350,000.

A)$150,000.

B)$500,000.

C)$700,000.

D)$350,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

64

An installment sale is best defined as

A)any disposition of property in which at least three payments are received.

B)any disposition of property in which the installment method is elected by the taxpayer.

C)any disposition of property where at least one payment is received after the close of the taxable year in which disposition occurs.

D)any disposition of publicly traded property or inventory where at least one payment is received after the close of the taxable year in which disposition occurs.

A)any disposition of property in which at least three payments are received.

B)any disposition of property in which the installment method is elected by the taxpayer.

C)any disposition of property where at least one payment is received after the close of the taxable year in which disposition occurs.

D)any disposition of publicly traded property or inventory where at least one payment is received after the close of the taxable year in which disposition occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

65

On July 25 of this year,Raj sold land with a cost of $15,000 for $40,000.Raj collected $20,000 this year and is scheduled to receive $5,000 each year for four years starting next year plus an acceptable rate of interest.Raj's gain recognized this year is

A)$7,500.

B)$12,500.

C)$20,000.

D)$25,000.

A)$7,500.

B)$12,500.

C)$20,000.

D)$25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

66

The look-back interest adjustment involves the

A)calculation of interest on an installment sale.

B)calculation of gross profit on an installment sale collection.

C)calculation of additional tax due if actual cost rather than estimated cost had been used on the percentage of completion method.

D)calculation of interest on additional tax that would have been due if actual cost rather than estimated cost had been used on the percentage of completion method.

A)calculation of interest on an installment sale.

B)calculation of gross profit on an installment sale collection.

C)calculation of additional tax due if actual cost rather than estimated cost had been used on the percentage of completion method.

D)calculation of interest on additional tax that would have been due if actual cost rather than estimated cost had been used on the percentage of completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

67

Freida is an accrual-basis taxpayer who owns a furniture store.The furniture store had the following sales of inventory:  For tax purposes,Freida should report gross profit for 2013 of

For tax purposes,Freida should report gross profit for 2013 of

A)$40,000.

B)$65,000.

C)$90,000.

D)$125,00.

For tax purposes,Freida should report gross profit for 2013 of

For tax purposes,Freida should report gross profit for 2013 ofA)$40,000.

B)$65,000.

C)$90,000.

D)$125,00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

68

On May 18,of last year,Yuji sold unlisted stock with a cost of $12,000 for $30,000.Yuji collected $10,000 initially and is scheduled to receive $5,000 each year for four years starting this year plus an acceptable rate of interest.After receiving the first scheduled $5,000 payment,Yuji was unable to collect any further payments.After incurring legal fees of $500,Yuji recovered a portion of the stock valued at $13,000.Yuji's basis in the recovered stock is

A)$6,500.

B)$7,000.

C)$12,500.

D)$13,000.

A)$6,500.

B)$7,000.

C)$12,500.

D)$13,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

69

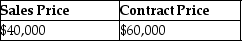

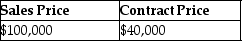

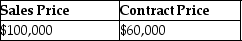

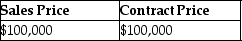

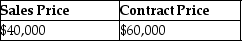

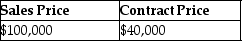

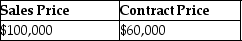

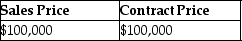

This year,John purchased property from William by assuming an existing mortgage of $40,000 and agreed to pay an additional $60,000,plus interest,in the 3 years following the year of sale (i.e.$20,000 annual payments for three years,plus interest).William had an adjusted basis of $44,000 in the building.What are the sales price and the contract price in this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

70

The installment sale method can be used for all of the following transactions except

A)the sale of an painting by an art collector.

B)the sale of a sole proprietor's office building.

C)the sale of an individual's personal car.

D)the sale of a yacht by a shipbuilder.

A)the sale of an painting by an art collector.

B)the sale of a sole proprietor's office building.

C)the sale of an individual's personal car.

D)the sale of a yacht by a shipbuilder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

71

The installment method may be used for sales of all kinds of property with the exception of

A)real property.

B)personal property.

C)capital assets.

D)marketable securities.

A)real property.

B)personal property.

C)capital assets.

D)marketable securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

72

On June 11,of last year,Derrick sold land with a cost of $15,000 for $45,000.Derrick collected $20,000 last year and is scheduled to receive $5,000 each year for five years starting this year plus an acceptable rate of interest.Derrick receives the $5,000 installment required this year.Derrick's recognized gain this year is

A)$0.

B)$1,667.

C)$3,333.

D)$5,000.

A)$0.

B)$1,667.

C)$3,333.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

73

On June 11,two years ago,Gia sold land with a cost of $15,000 for $45,000.Gia collected $20,000 initially and is scheduled to receive $5,000 each year for five years starting last year plus an acceptable rate of interest.This year,Gia decided to sell one installment note to a bank that agreed to pay $4,100.As a result of the sale of the note,Gia must report

A)$0.

B)$1,667 gain.

C)$2,433 gain.

D)($900)loss.

A)$0.

B)$1,667 gain.

C)$2,433 gain.

D)($900)loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

74

On May 18,of last year,Carter sells unlisted stock with a cost of $24,000 for $60,000.Carter collects $20,000 initially and is scheduled to receive $10,000 each year for four years starting this year plus an acceptable rate of interest.After receiving the first $10,000 scheduled installment payment,Carter is unable to collect any further payments.After incurring legal fees of $1,000,Carter recovers a portion of the stock valued at $26,000.As a result of the repossession,Carter must report

A)ordinary income of $9,000.

B)capital gain of $9,000.

C)ordinary income of $13,000.

D)capital gain of $13,000.

A)ordinary income of $9,000.

B)capital gain of $9,000.

C)ordinary income of $13,000.

D)capital gain of $13,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following conditions are required for the use of the installment method?

A)The taxpayer must realize a gain on the sale of the property.

B)The taxpayer cannot be on the cash method.

C)The value of the obligations received is determinable at the date of sale.

D)All of the above are required.

A)The taxpayer must realize a gain on the sale of the property.

B)The taxpayer cannot be on the cash method.

C)The value of the obligations received is determinable at the date of sale.

D)All of the above are required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

76

Kyle sold land on the installment basis for $100,000.His basis in the land was $70,000.Kyle received a $40,000 down payment and a real estate installment sale contract calling for $60,000 in additional payments in future years.In addition,Kyle paid $6,000 in commissions on the sale.What is the gross profit to be recognized in the current year?

A)$0

B)$9,600

C)$12,000

D)$24,000

A)$0

B)$9,600

C)$12,000

D)$24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

77

Sela sold a machine for $140,000.The machine originally cost $90,000 and $10,000 of MACRS depreciation had been allowable.The buyer assumed an existing loan of $40,000,paid $20,000 cash down and agreed to pay $10,000 per year for eight years plus interest.Selling expenses are $10,000.The total gross profit for installment sale recognition purposes is

A)$30,000.

B)$40,000.

C)$50,000.

D)$60,000.

A)$30,000.

B)$40,000.

C)$50,000.

D)$60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

78

This year,a contractor agrees to build a building for $2,000,000,which will be completed by the end of next year.The builder's cost is estimated to be $1,700,000.The actual costs this year are $800,000 and next year's actual costs are $800,000.If the tax rate is 20% and the interest rate is 10%,the look back interest for the percentage of completion method is

A)$ 0.

B)$1,176.

C)$2,000.

D)$6,000.

A)$ 0.

B)$1,176.

C)$2,000.

D)$6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

79

Kevin sold property with an adjusted basis of $58,000.The buyer assumed Kevin's existing mortgage of $40,000 and agreed to pay an additional $60,000 consisting of a cash down payment of $40,000,and payments of $4,000,plus interest,per year for the next 5 years.Kevin paid selling expenses totaling $2,000.What is Kevin's gross profit percentage?

A)33 1/3%

B)40%

C)60%

D)66 2/3%

A)33 1/3%

B)40%

C)60%

D)66 2/3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

80

Malea sold a machine for $140,000.The machine originally cost $90,000 and $10,000 of MACRS depreciation had been allowable.The buyer assumed an existing loan of $40,000,paid $20,000 cash down and agreed to pay $10,000 per year for eight years plus interest.Selling expenses are $10,000.The contract price is

A)$40,000.

B)$80,000.

C)$100,000.

D)$130,000.

A)$40,000.

B)$80,000.

C)$100,000.

D)$130,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck