Deck 4: Long- and Short-Term Financial Planning

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/189

العب

ملء الشاشة (f)

Deck 4: Long- and Short-Term Financial Planning

1

Suppose that under the Tax Cuts and Jobs Act a firm that invests in equipment can immediately deduct the full cost of that equipment or it can depreciate the equipment under the MACRS system.For tax purposes the firm should ________.

A)use the MACRS system because doing so better matches the firms costs to its revenues

B)use the MACRS system because the firm will report higher profits in the year the equipment is purchased than it would report if it fully expensed the cost of the asset

C)deduct the full cost of the asset immediately because doing so reduces taxes and increases cash flow

D)deduct the full cost of the asset immediately because profits in years after the equipment is purchased will be higher

A)use the MACRS system because doing so better matches the firms costs to its revenues

B)use the MACRS system because the firm will report higher profits in the year the equipment is purchased than it would report if it fully expensed the cost of the asset

C)deduct the full cost of the asset immediately because doing so reduces taxes and increases cash flow

D)deduct the full cost of the asset immediately because profits in years after the equipment is purchased will be higher

deduct the full cost of the asset immediately because doing so reduces taxes and increases cash flow

2

Depreciation deductions,like any other business expenses,reduce the income that a firm reports on its income statement.

True

3

________ consider proposed fixed-asset outlays,research and development activities,marketing and product development actions,capital structure,and major sources of financing.

A)Short-term financial plans

B)Long-term financial plans

C)Pro forma statements

D)Cash budgeting

A)Short-term financial plans

B)Long-term financial plans

C)Pro forma statements

D)Cash budgeting

Long-term financial plans

4

Operating financial plans are planned short-term financial actions and the anticipated financial impact of those actions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

5

Short-term financial plans and long-term financial plans generally cover periods ranging from ________ years and ________ years,respectively.

A)one to two; two to ten

B)five to ten; ten to twenty

C)zero to one; five to ten

D)one to ten; ten to fifteen

A)one to two; two to ten

B)five to ten; ten to twenty

C)zero to one; five to ten

D)one to ten; ten to fifteen

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

6

Pro forma financial statements are used for ________.

A)cash budgeting

B)preparing financial statements

C)profit planning

D)auditing

A)cash budgeting

B)preparing financial statements

C)profit planning

D)auditing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

7

The financial planning process begins with ________ financial plans that in turn guide the formation of ________ plans and budgets.

A)short-term; long-term

B)short-term; short-term

C)long-term; long-term

D)long-term; short-term

A)short-term; long-term

B)short-term; short-term

C)long-term; long-term

D)long-term; short-term

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

8

Key inputs to short-term financial planning are ________.

A)cash flow statements and income statement

B)pro forma financial statements

C)sales forecasts,and operating and financial data

D)leverage analysis and pro forma income statement

A)cash flow statements and income statement

B)pro forma financial statements

C)sales forecasts,and operating and financial data

D)leverage analysis and pro forma income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

9

The key aspects of a financial planning process are ________.

A)cash planning and investment planning

B)operations planning and investment planning

C)investment planning and profit planning

D)cash planning and profit planning

A)cash planning and investment planning

B)operations planning and investment planning

C)investment planning and profit planning

D)cash planning and profit planning

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

10

The key outputs of the short-term financial planning process are the ________.

A)cash budget,pro forma income statement,and pro forma balance sheet

B)sales forecast and capital assets journal

C)sales forecast and schedule of changes in working capital

D)income statement,balance sheet,and source and use statement

A)cash budget,pro forma income statement,and pro forma balance sheet

B)sales forecast and capital assets journal

C)sales forecast and schedule of changes in working capital

D)income statement,balance sheet,and source and use statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

11

The key input to the short-term financial planning process is ________.

A)the audit report

B)the pro forma balance sheet

C)the sales forecast

D)the pro forma income statement

A)the audit report

B)the pro forma balance sheet

C)the sales forecast

D)the pro forma income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the Tax Cuts and Jobs Act requires a firm to fully deduct the cost of new equipment when it is purchased rather than depreciating that cost over several years,the investment becomes less attractive financially.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

13

A financial planning process begins with short-term,or operating,plans and budgets that in turn guide the formulation of long-term,or strategic,financial plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

14

Strategic financial plans are planned long-term financial actions and the anticipated financial impact of those actions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

15

Prior to passage of the Tax Cuts and Jobs Act,most large corporations faced a 35% marginal tax rate.Under the new tax law,the marginal tax rate is 21%.In terms of the effect of this tax change on a firm's decision to purchase assets that it will use for several years ________.

A)the tax change is beneficial because it lowers the after-tax cost of these assets

B)the tax change increases the tax benefits that the firm obtains when it acquires long-lived assets,whether it immediately deducts the full cost of those assets or depreciates the cost over time

C)the tax law reduces the tax benefits that a firm obtains when it acquires long-lived assets,whether it immediately deducts the full cost of those assets or depreciates the cost over time

D)the tax change has no effect because depreciation does not affect a firm's cash flow

A)the tax change is beneficial because it lowers the after-tax cost of these assets

B)the tax change increases the tax benefits that the firm obtains when it acquires long-lived assets,whether it immediately deducts the full cost of those assets or depreciates the cost over time

C)the tax law reduces the tax benefits that a firm obtains when it acquires long-lived assets,whether it immediately deducts the full cost of those assets or depreciates the cost over time

D)the tax change has no effect because depreciation does not affect a firm's cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

16

In the statement of cash flows,the cash flows from financing activities result from debt and equity financing transactions; including incurrence and repayment of debt,cash inflow from the sale of stock,and cash outflows to repurchase stock or pay cash dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

17

The sales forecast and various forms of operating and financial data are the key outputs of the short-run (operating)financial planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

18

Once sales are forecasted,________ must be generated to estimate required raw materials.

A)a production plan

B)a cash budget

C)an operating budget

D)a pro forma statement

A)a production plan

B)a cash budget

C)an operating budget

D)a pro forma statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

19

________ generally reflect(s)the anticipated financial impact of planned long-term actions.

A)A cash budget

B)Strategic financial plans

C)Operating financial plans

D)A pro forma income statement

A)A cash budget

B)Strategic financial plans

C)Operating financial plans

D)A pro forma income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

20

The primary purpose in preparing pro forma financial statements is ________.

A)for cash planning

B)to ensure the ability to pay dividends

C)to reduce risk

D)for profit planning

A)for cash planning

B)to ensure the ability to pay dividends

C)to reduce risk

D)for profit planning

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

21

Business firms are permitted to systematically charge a portion of the market value of fixed assets as depreciation against annual revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

22

A corporation ________.

A)must use the straight-line depreciation method for tax purposes and double declining depreciation method financial reporting purposes

B)can use straight-line depreciation method for tax purposes and MACRS depreciation method financial reporting purposes

C)can use different depreciation methods for tax and financial reporting purposes

D)must use different depreciation method for tax purposes,but strictly mandated depreciation methods for financial reporting purposes

A)must use the straight-line depreciation method for tax purposes and double declining depreciation method financial reporting purposes

B)can use straight-line depreciation method for tax purposes and MACRS depreciation method financial reporting purposes

C)can use different depreciation methods for tax and financial reporting purposes

D)must use different depreciation method for tax purposes,but strictly mandated depreciation methods for financial reporting purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

23

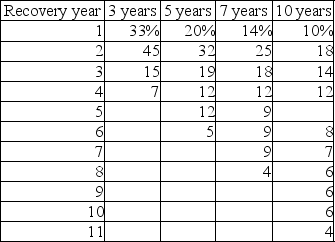

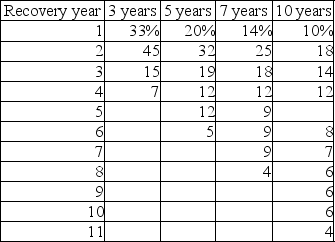

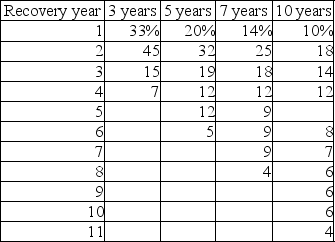

Darling Paper Container,Inc.purchased several machines at a total cost of $300,000.The installation cost for this equipment was $25,000.The firm plans to depreciate the equipment using the MACRS 5-year normal recovery period.Prepare a depreciation schedule showing the depreciation expense for each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

24

Given a financial manager's preference for faster receipt of cash flows,a longer depreciable life is preferred to a shorter one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under the basic MACRS procedures,the depreciable value of an asset is its full cost,including outlays for installation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

26

Allocation of the historic costs of fixed assets against the annual revenue they generate is called ________.

A)arbitraging

B)securitization

C)depreciation

D)amortization

A)arbitraging

B)securitization

C)depreciation

D)amortization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Modified Accelerated Cost Recovery System (MACRS)is a depreciation method used for ________ purposes.

A)tax

B)financial reporting

C)budget

D)cost accounting

A)tax

B)financial reporting

C)budget

D)cost accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

28

For tax purposes,using MACRS recovery periods,assets in the first four property classes are depreciated by the double-declining balance method using the half-year convention and switching to straight line when advantageous.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

29

Under MACRS,an asset which originally cost $100,000,incurred installation costs of $10,000,and has an estimated salvage value of $25,000,is being depreciated using a 5-year normal recovery period.What is the depreciation expense in year 1?

A)$15,000

B)$12,750

C)$11,250

D)$22,000

A)$15,000

B)$12,750

C)$11,250

D)$22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

30

Under MACRS,an asset which originally cost $10,000 is being depreciated using a 5-year normal recovery period.What is the depreciation expense in year 3?

A)$1,900

B)$1,200

C)$1,500

D)$2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

31

The MACRS depreciation method requires use of the half-year convention.Assets are assumed to be acquired in the middle of the year and only one-half of the first year's depreciation is recovered in the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under MACRS,an asset which originally cost $100,000 is being depreciated using a 10-year normal recovery period.The depreciation expense in year 5 is ________.

A)$10,000

B)$12,000

C)$21,000

D)$9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

33

The depreciable value of an asset,under MACRS,is the ________.

A)current cost

B)current cost minus salvage value

C)the original cost plus installation

D)the original cost plus installation costs,minus salvage value

A)current cost

B)current cost minus salvage value

C)the original cost plus installation

D)the original cost plus installation costs,minus salvage value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

34

Given a financial manager's preference for faster receipt of cash flows,________.

A)a longer depreciable life is preferred to a shorter one

B)a shorter depreciable life is preferred to a longer one

C)the manager is not concerned with depreciable life,because depreciation is a noncash expense

D)the manager is not concerned with depreciable life,because once purchased,depreciation is considered a sunk cost

A)a longer depreciable life is preferred to a shorter one

B)a shorter depreciable life is preferred to a longer one

C)the manager is not concerned with depreciable life,because depreciation is a noncash expense

D)the manager is not concerned with depreciable life,because once purchased,depreciation is considered a sunk cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Tax Cuts and Jobs Act allows firms to immediately deduct the full cost of many assets rather than depreciating that cost over several years using the MACRS rules.Suppose a firm buys a new assets and immediately deducts its full cost.The firm will have ________.

A)lower profits and higher cash flows than it would have had under the MACRS system

B)lower profits and lower cash flows than it would have had under the MACRS system

C)higher profits and higher cash flows than it would have had under the MACRS system

D)higher profits and lower cash flows than it would have had under the MACRS system

A)lower profits and higher cash flows than it would have had under the MACRS system

B)lower profits and lower cash flows than it would have had under the MACRS system

C)higher profits and higher cash flows than it would have had under the MACRS system

D)higher profits and lower cash flows than it would have had under the MACRS system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

36

The depreciable value of an asset,under MACRS,is ________.

A)the full cost excluding installation costs

B)the full cost minus salvage value

C)the full cost including installation costs

D)the full cost including installation costs adjusted for the salvage value

A)the full cost excluding installation costs

B)the full cost minus salvage value

C)the full cost including installation costs

D)the full cost including installation costs adjusted for the salvage value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

37

In general,________.

A)a longer depreciable life is preferred,because it will result in a faster receipt of cash flows

B)a shorter depreciable life is preferred,because it will result in a faster receipt of cash flows

C)a shorter depreciable life is preferred,because management can then purchase new assets,as the old assets are written off

D)a longer depreciable life is preferred,because management can postpone purchasing new assets,since the old assets still have a useful life

A)a longer depreciable life is preferred,because it will result in a faster receipt of cash flows

B)a shorter depreciable life is preferred,because it will result in a faster receipt of cash flows

C)a shorter depreciable life is preferred,because management can then purchase new assets,as the old assets are written off

D)a longer depreciable life is preferred,because management can postpone purchasing new assets,since the old assets still have a useful life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a firm acquires a long-lived asset such as equipment,if the tax law allows it managers would generally prefer to ________.

A)depreciate the equipment over a long life

B)depreciate the equipment over a short life

C)immediately take a deduction for the full cost of the asset when it is purchased

D)take no deduction at all for the cost of the equipment

A)depreciate the equipment over a long life

B)depreciate the equipment over a short life

C)immediately take a deduction for the full cost of the asset when it is purchased

D)take no deduction at all for the cost of the equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

39

Non-cash charges are expenses that involve an actual outlay of cash during the period but are not deducted on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under MACRS,an asset which originally cost $100,000 is being depreciated using a 10-year normal recovery period.The depreciation expense in year 11 is ________.

A)$3,000

B)$4,000

C)$0

D)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

41

A firm's operating cash flow (OCF)is defined as ________.

A)gross profit minus operating expenses

B)gross profit minus depreciation

C)EBIT times one minus the tax rate plus depreciation

D)EBIT plus depreciation

A)gross profit minus operating expenses

B)gross profit minus depreciation

C)EBIT times one minus the tax rate plus depreciation

D)EBIT plus depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

42

A firm's operating cash flow (OCF)is the cash flow it generates from its normal operations: producing and selling its output of goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

43

Depreciation is considered to be an outflow of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

44

Net operating profit after taxes (NOPAT)represents a firm's earnings before interest and after taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

45

Operating cash flow (OCF)is calculated by deducting depreciation from net operating profit after taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

46

The net fixed asset investment (NFAI)is defined as the change in net fixed assets plus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

47

It would be correct to define operating cash flow (OCF)as net operating profit after taxes plus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

48

A firm's free cash flow (FCF)equals the sum of operating cash flows,financing cash flows,and investing cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

49

Free cash flow (FCF)is the cash flow a firm generates from its normal operations; calculated as EBIT minus taxes plus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

50

Net operating profit after taxes (NOPAT)represents a firm's earnings after deducting both interest and taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

51

A firm's free cash flow (FCF)represents the amount of cash flow available to investors (stockholders and bondholders)after the firm has met all operating needs and after having paid for net fixed asset investments and net current asset investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the statement of cash flows,cash flows from operating activities are cash flows directly related to purchase and sale of fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

53

To assess whether any developments have occurred that are contrary to a company's financial policies,the financial manager should pay special attention to both the major categories of cash flow and the individual items of cash inflow and outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

54

The net current asset investment (NCAI)is defined as the change in current assets minus the change in sum of the accounts payable and accruals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

55

In the statement of cash flows,retained earnings are handled through the adjustment of ________.

A)"Revenue" and "Cost" accounts

B)"Current Assets" and "Current Liabilities" accounts

C)"Depreciation" and "Purchases" accounts

D)"Net Profits After Taxes" and "Dividends Paid" accounts

A)"Revenue" and "Cost" accounts

B)"Current Assets" and "Current Liabilities" accounts

C)"Depreciation" and "Purchases" accounts

D)"Net Profits After Taxes" and "Dividends Paid" accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

56

Operating cash flow (OCF)is equal to a firm's net operating profits after taxes minus all non-cash charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

57

The statement of cash flows allows the financial manager and other interested parties to analyze a firm's past and possibly future profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

58

________ is a noncash charge.

A)Labor expense

B)Depreciation

C)Salaries

D)Rent

A)Labor expense

B)Depreciation

C)Salaries

D)Rent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is an example of noncash charges?

A)depreciation

B)accruals

C)interest expense

D)dividends paid

A)depreciation

B)accruals

C)interest expense

D)dividends paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is a source of cash flows?

A)increase in marketable securities

B)increase in accounts payable

C)decrease in notes payable

D)repurchase of stock

A)increase in marketable securities

B)increase in accounts payable

C)decrease in notes payable

D)repurchase of stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

61

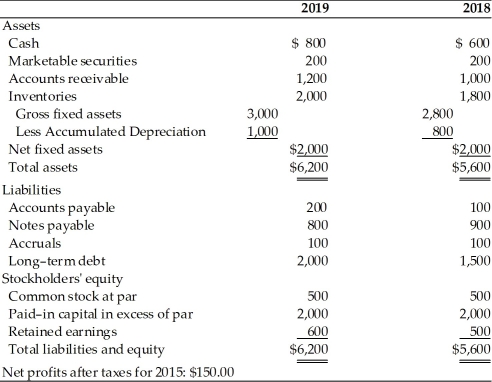

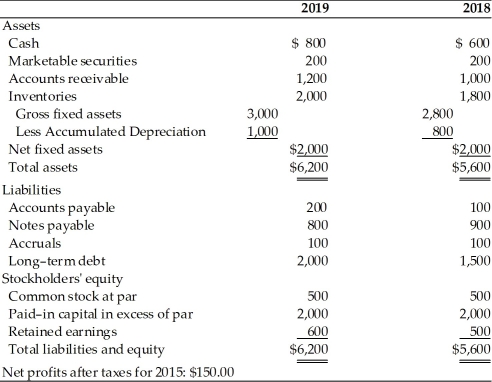

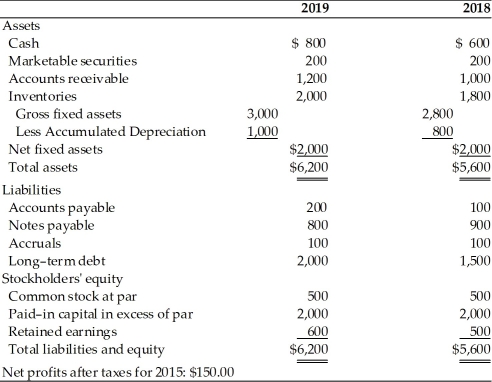

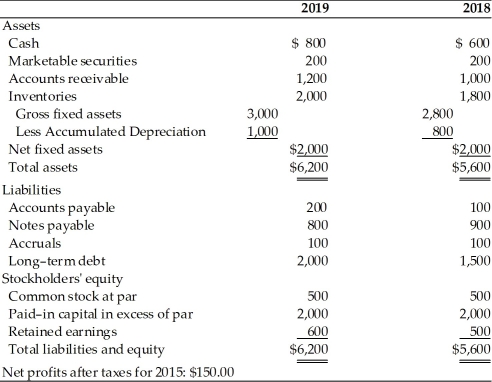

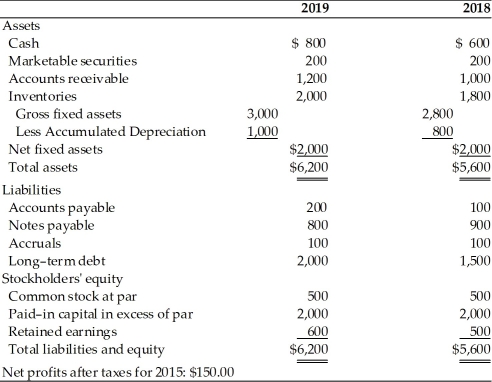

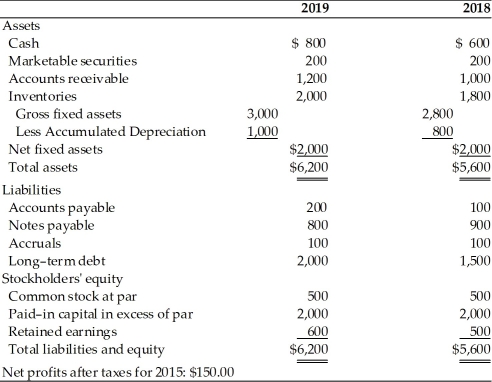

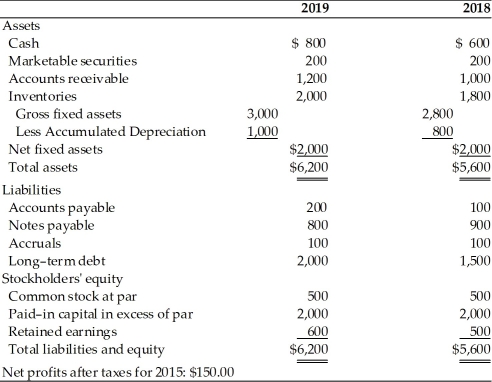

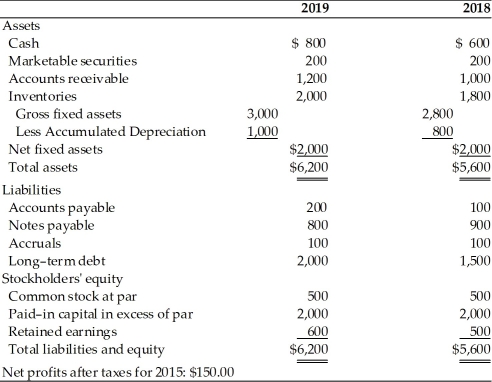

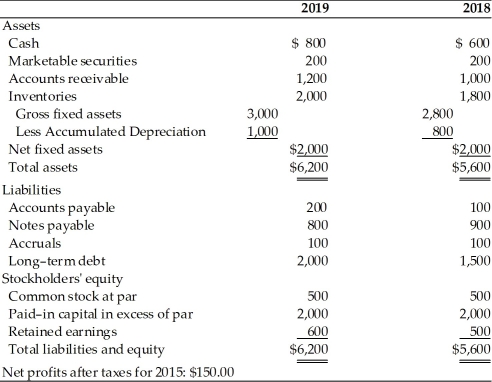

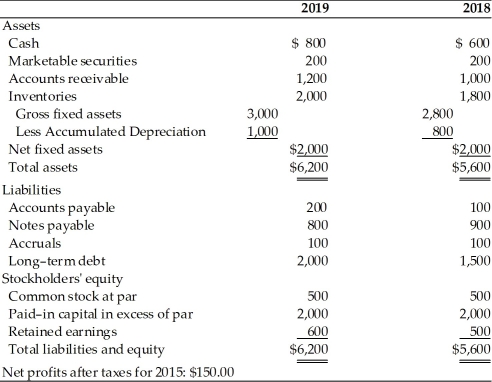

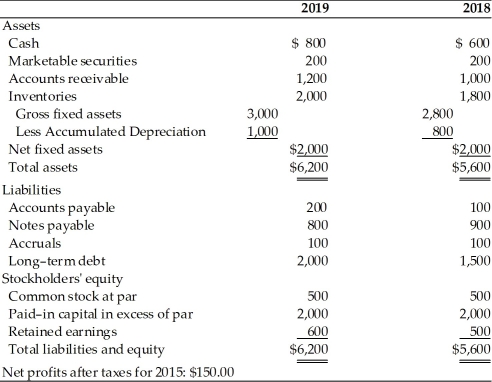

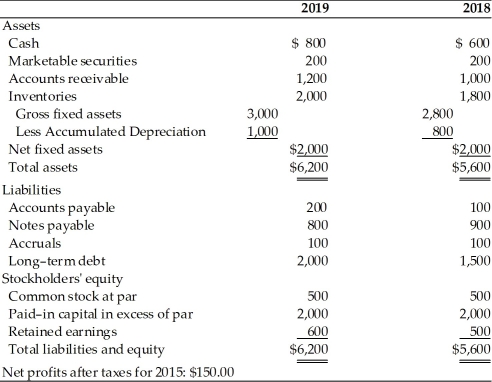

Table 4.1

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The firm may have increased long-term debts to finance ________.(See Table 4.1)

A)an increase in net fixed assets

B)an increase in current assets

C)accounts receivable payments

D)an increase in dividends

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The firm may have increased long-term debts to finance ________.(See Table 4.1)

A)an increase in net fixed assets

B)an increase in current assets

C)accounts receivable payments

D)an increase in dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

62

Cash flows directly related to production and sale of a firm's products and services are called ________.

A)cash flow from operating activities

B)cash flow from investment activities

C)cash flow from financing activities

D)cash flow from equity activities

A)cash flow from operating activities

B)cash flow from investment activities

C)cash flow from financing activities

D)cash flow from equity activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

63

Cash flows that result from debt and equity financing transactions,including incurrence and repayment of debt,cash inflows from the sale of stock,and cash outflows to pay cash dividends or repurchase stock are called cash flow from ________.

A)operating activities

B)investment activities

C)financing activities

D)miscellaneous activities

A)operating activities

B)investment activities

C)financing activities

D)miscellaneous activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

64

Cash flows associated with the purchase and sale of fixed assets and business interests are called cash flow from ________.

A)operating activities

B)investment activities

C)financing activities

D)equity activities

A)operating activities

B)investment activities

C)financing activities

D)equity activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

65

Table 4.1

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

Common stock dividends paid in 2019 amounted to ________.(See Table 4.1)

A)$100

B)$50

C)$600

D)$150

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

Common stock dividends paid in 2019 amounted to ________.(See Table 4.1)

A)$100

B)$50

C)$600

D)$150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

66

Table 4.1

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The firm's cash flow from operating activities is ________.(See Table 4.1)

A)$50

B)$350

C)$150

D)$200

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The firm's cash flow from operating activities is ________.(See Table 4.1)

A)$50

B)$350

C)$150

D)$200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is a cash flow from financing activities?

A)purchase of a long-term asset

B)decrease in accounts payable

C)increase in accounts payable

D)repurchasing stock

A)purchase of a long-term asset

B)decrease in accounts payable

C)increase in accounts payable

D)repurchasing stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

68

The three categories of a firm's statement of cash flows are ________.

A)cash flow from operating activities,cash flow from investment activities,and cash flow from noncash activities

B)cash flow from operating activities,cash flow from noncash activities,and cash flow from financing activities

C)cash flow from equity activities,cash flow from investment activities,and cash flow from financing activities

D)cash flow from operating activities,cash flow from investment activities,and cash flow from financing activities

A)cash flow from operating activities,cash flow from investment activities,and cash flow from noncash activities

B)cash flow from operating activities,cash flow from noncash activities,and cash flow from financing activities

C)cash flow from equity activities,cash flow from investment activities,and cash flow from financing activities

D)cash flow from operating activities,cash flow from investment activities,and cash flow from financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following represents a cash flow from operating activities?

A)dividends paid

B)increase or decrease in current liabilities

C)increase or decrease in fixed assets

D)repurchasing stock

A)dividends paid

B)increase or decrease in current liabilities

C)increase or decrease in fixed assets

D)repurchasing stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

70

Table 4.1

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The depreciation expense for 2019 is ________.(See Table 4.1)

A)$0

B)$200

C)$50

D)$1,000

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The depreciation expense for 2019 is ________.(See Table 4.1)

A)$0

B)$200

C)$50

D)$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

71

The cash flows from operating activities section of the statement of cash flows includes ________.

A)principal received

B)cost of raw materials

C)dividends paid

D)stock repurchases

A)principal received

B)cost of raw materials

C)dividends paid

D)stock repurchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following line items of the statement of cash flows must be obtained from the income statement?

A)accruals in current liabilities

B)interest expenses

C)accounts receivable

D)cash dividends paid on both preferred and common stocks

A)accruals in current liabilities

B)interest expenses

C)accounts receivable

D)cash dividends paid on both preferred and common stocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

73

The cash flows from financing activities section of the statement of cash flows includes ________.

A)labour expense

B)cost of raw materials

C)purchase of long-term assets

D)dividends paid

A)labour expense

B)cost of raw materials

C)purchase of long-term assets

D)dividends paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is a cash inflow?

A)a decrease in accounts payable

B)a decrease in accounts receivable

C)an increase in dividend payment

D)a decrease in accrued liabilities

A)a decrease in accounts payable

B)a decrease in accounts receivable

C)an increase in dividend payment

D)a decrease in accrued liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is a cash outflow?

A)an increase in accounts payable

B)a decrease in notes receivable

C)an increase in accounts receivable

D)an increase in accrued liabilities

A)an increase in accounts payable

B)a decrease in notes receivable

C)an increase in accounts receivable

D)an increase in accrued liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

76

A corporation sold a fixed asset for $100,000.This is ________.

A)an investment cash flow and a source of funds

B)an operating cash flow and a source of funds

C)an operating cash flow and a use of funds

D)an investment cash flow and a use of funds

A)an investment cash flow and a source of funds

B)an operating cash flow and a source of funds

C)an operating cash flow and a use of funds

D)an investment cash flow and a use of funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

77

Table 4.1

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The largest single source of funds for the firm in 2019 is ________.(See Table 4.1)

A)an increase in net profits after taxes

B)an increase in notes payable

C)an increase in long-term debt

D)an increase in inventory

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The largest single source of funds for the firm in 2019 is ________.(See Table 4.1)

A)an increase in net profits after taxes

B)an increase in notes payable

C)an increase in long-term debt

D)an increase in inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

78

A corporation raises $500,000 in long-term debt to acquire additional plant capacity.This is considered as ________.

A)an investment cash flow

B)a financing cash flow

C)a financing cash flow and investment cash flow,respectively

D)a financing cash flow and operating cash flow,respectively

A)an investment cash flow

B)a financing cash flow

C)a financing cash flow and investment cash flow,respectively

D)a financing cash flow and operating cash flow,respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

79

The cash flows from operating activities section of the statement of cash flows includes ________.

A)labor expense

B)proceeds from the sale of fixed assets

C)principal paid

D)dividends paid

A)labor expense

B)proceeds from the sale of fixed assets

C)principal paid

D)dividends paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck

80

Table 4.1

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The firm ________ fixed assets worth ________.(See Table 4.1)

A)purchased; $0

B)purchased; $200

C)sold; $0

D)sold; $200

True Sandpaper Co.

Balance Sheets

For the Years Ended 2018 and 2019

The firm ________ fixed assets worth ________.(See Table 4.1)

A)purchased; $0

B)purchased; $200

C)sold; $0

D)sold; $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 189 في هذه المجموعة.

فتح الحزمة

k this deck