Deck 21: Real Estate Investment Trusts Reits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/37

العب

ملء الشاشة (f)

Deck 21: Real Estate Investment Trusts Reits

1

The most common type of REITs in today's market are:

A)Equity trusts

B)Mortgage trusts

C)Hybrid trusts

D)Partnership trusts

A)Equity trusts

B)Mortgage trusts

C)Hybrid trusts

D)Partnership trusts

Equity trusts

2

A REIT has an NOI of $15 per share and currently pays a dividend of $10 per share.The dividend is projected to increase by 4 percent by next year and continue to increase by 4 percent per year thereafter.Assuming that the blended cap rate is 9.75 percent and the required rate of return is 10.5 percent,what would the net asset value (NAV)of the REIT be?

A)$60.15

B)$71.89

C)$153.85

D)$160.00

A)$60.15

B)$71.89

C)$153.85

D)$160.00

$153.85

3

The U.S.is the only country that allows REITs (or similar investments).

False

4

At least 95 percent of the value of a REIT's assets must consist of real estate assets,cash,and government securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

5

REITs can sometimes capitalize rather than lease certain expenditures to increase FFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

6

A blended capitalization rate is an average of the capitalization rates that would be used for the individual properties in a portfolio if each was being valued separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

7

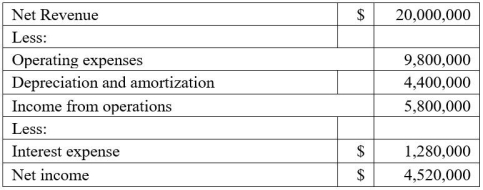

Consider the financial statements for a REIT,given above.Price multiples for comparable REITs are about 10 times current funds from operation (FFO).What price does this suggest for the REIT's shares if 1,000,000 shares are issued?

Consider the financial statements for a REIT,given above.Price multiples for comparable REITs are about 10 times current funds from operation (FFO).What price does this suggest for the REIT's shares if 1,000,000 shares are issued?A)$4.52 per share

B)$45.20 per share

C)$8.92 per share

D)$89.20 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

8

Real estate assets,cash,and government securities must represent at least 75% of REIT assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

9

Funds from operation (FFO),is calculated by adding back depreciation and amortization and other non-cash deductions to earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following regarding private (unlisted)REITs is TRUE?

A)Unlisted REITs are less expensive than listed REITs

B)Unlisted REITs are less liquid than listed REITS

C)Unlisted REITs are more subject to short-term market price volatility than listed REITS

D)"List or liquidate" provisions in unlisted REITs make such REITs less risky than listed REITS

A)Unlisted REITs are less expensive than listed REITs

B)Unlisted REITs are less liquid than listed REITS

C)Unlisted REITs are more subject to short-term market price volatility than listed REITS

D)"List or liquidate" provisions in unlisted REITs make such REITs less risky than listed REITS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

11

Because REITs are corporations,they are subject to double taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

12

REITs must be passive investments with external advisors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

13

The difference between EPS (earnings per share)and FFO (funds from operations)is the interest deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

14

Mortgage REITs use debt financing to increase their capital bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

15

REITs are required to pay out 90 percent of their earnings as dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

16

A mortgage REIT is a REIT that primarily invests in mortgages rather than equity ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

17

A REIT must have at least 200 shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

18

Usually ground leases are for relatively short periods of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

19

A REIT has an NOI of $15 per share and currently pays a dividend of $10 per share.The dividend is projected to increase by 4 percent by next year and continue to increase by 4 percent per year thereafter.Assuming that the blended cap rate is 9.75 percent and the required rate of return is 10.5 percent,what value would the Gordon Dividend Discount Model provide?

A)$60.15

B)$71.89

C)$153.85

D)$160.00

A)$60.15

B)$71.89

C)$153.85

D)$160.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

20

A portion of a REIT's dividend may be a non-taxable return of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

21

A REIT with 100 shares outstanding earns $1,000 in rent and incurs operating expenses of $400.In addition,the REIT owns property with an historic cost of $6,000 and depreciates it over a 15 year period using straight-line depreciation.What are the funds from operations per share and the earnings per share for this REIT?

A)$4 and $3,respectively

B)$4 and $2,respectively

C)$6 and $2,respectively

D)$6 and $3,respectively

A)$4 and $3,respectively

B)$4 and $2,respectively

C)$6 and $2,respectively

D)$6 and $3,respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following REIT types is NOT likely to own real property?

A)Hybrid REIT

B)Mortgage REIT

C)Equity REIT

D)All of the above

A)Hybrid REIT

B)Mortgage REIT

C)Equity REIT

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following REIT types is organized to acquire the specific property or properties described in its prospectus?

A)A property trust

B)A mixed trust

C)A purchasing trust

D)An exchange trust

A)A property trust

B)A mixed trust

C)A purchasing trust

D)An exchange trust

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

24

A REIT with 100 shares outstanding earns $1,000 in rent and incurs operating expenses of $400.In addition,the REIT owns property with an historic cost of $6,000 and depreciates it over a 15 year period using straight-line depreciation.At the very least,what dividend payment must it make to maintain its tax exempt status?

A)$1.80/share

B)$2.00/share

C)$3.60/share

D)$5.40/share

A)$1.80/share

B)$2.00/share

C)$3.60/share

D)$5.40/share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following represents the space that is currently being rented to paying tenants?

A)Leased space

B)Occupied space

C)Ground space

D)REIT space

A)Leased space

B)Occupied space

C)Ground space

D)REIT space

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

26

The difference between EPS (earnings per share)and FFO (funds from operations)is:

A)Irrelevant

B)Determined by growth of the company

C)Due to depreciation and amortization

D)Due to the number of shares outstanding

A)Irrelevant

B)Determined by growth of the company

C)Due to depreciation and amortization

D)Due to the number of shares outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

27

The funds from operations (FFO)for a REIT is roughly equal to:

A)NOI less interest deductions

B)Earnings before tax plus noncash expenses

C)NOI plus interest deductions

D)Earnings per share plus capital gains

A)NOI less interest deductions

B)Earnings before tax plus noncash expenses

C)NOI plus interest deductions

D)Earnings per share plus capital gains

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

28

An investor pays $63.00 per share for stock in a given REIT.The REIT declares a dividend of $4.00 per share and has an EPS of $2.37.Considering the recovery of capital (ROC),what is the new cost basis of the stock acquired by the investor?

A)$60.63

B)$61.37

C)$63.00

D)$64.63

A)$60.63

B)$61.37

C)$63.00

D)$64.63

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

29

The growth of the REIT industry in the early 1970s was mainly attributed to which of the following?

A)Mortgage trust loans were less regulated than bank loans

B)Increased interest rates

C)Declined performance of other investments

D)Increased value of real property throughout the country

A)Mortgage trust loans were less regulated than bank loans

B)Increased interest rates

C)Declined performance of other investments

D)Increased value of real property throughout the country

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

30

An arrangement in which a REIT collects a stream of rents from a building owner,then makes a lower,and sometimes fixed,payment to the landowner:

A)Fixed investment

B)REIT spreading

C)Spread investing

D)Renewal option

A)Fixed investment

B)REIT spreading

C)Spread investing

D)Renewal option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is likely to occur upon the sale of a REIT-owned property?

A)If a capital gain is realized,the REIT can retain the gain for future investment and be taxed at the appropriate corporate capital gains tax rate

B)If a capital gain is realized,the REIT can retain the gain for future investment and be taxed at the shareholder's capital gains tax rate

C)If a capital gain is realized,the REIT can distribute the gain as a dividend to shareholders who will realize it as dividend income for individual tax reporting purposes

D)If a capital loss is realized,the loss can be passed through to individual investors

A)If a capital gain is realized,the REIT can retain the gain for future investment and be taxed at the appropriate corporate capital gains tax rate

B)If a capital gain is realized,the REIT can retain the gain for future investment and be taxed at the shareholder's capital gains tax rate

C)If a capital gain is realized,the REIT can distribute the gain as a dividend to shareholders who will realize it as dividend income for individual tax reporting purposes

D)If a capital loss is realized,the loss can be passed through to individual investors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

32

REIT dividends are considered ________ income and thus do not qualify as passive income to offset passive losses.

A)Portfolio

B)Operating

C)Trading

D)Outside professional

A)Portfolio

B)Operating

C)Trading

D)Outside professional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is NOT a requirement of REITs?

A)A REIT must have at least 100 stockholders

B)Not more than 50% of a REIT's shares can be owned by five or fewer shareholders

C)At least 90% of a REIT's income must be distributed to shareholders

D)All of the above are REIT requirements

A)A REIT must have at least 100 stockholders

B)Not more than 50% of a REIT's shares can be owned by five or fewer shareholders

C)At least 90% of a REIT's income must be distributed to shareholders

D)All of the above are REIT requirements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

34

Hybrid REITs,which are no longer tracked by NAREIT,are comprised of what primary classifications of REITs?

A)UPREITs,mortgage

B)Mortgage,equity,retail

C)Mortgage,equity

D)Healthcare,retail,office

A)UPREITs,mortgage

B)Mortgage,equity,retail

C)Mortgage,equity

D)Healthcare,retail,office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

35

Once an entity has been terminated as a REIT,the entity cannot make a new election to be taxed as a REIT until ________ years after the termination.

A)2

B)3

C)4

D)5

A)2

B)3

C)4

D)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

36

Recovery of capital (ROC)results in:

A)An increase in the dividend available to the investor

B)An increase in the value of the stock

C)A reduction in the cost basis of acquired stock

D)A reduction in losses on the stock

A)An increase in the dividend available to the investor

B)An increase in the value of the stock

C)A reduction in the cost basis of acquired stock

D)A reduction in losses on the stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is NOT a current type of REIT?

A)Mortgage trust

B)Equity trust

C)Hybrid trust

D)Neither Mortgage trust nor Hybrid trust

A)Mortgage trust

B)Equity trust

C)Hybrid trust

D)Neither Mortgage trust nor Hybrid trust

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 37 في هذه المجموعة.

فتح الحزمة

k this deck