Deck 14: Disposition and Renovation of Income Properties

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/38

العب

ملء الشاشة (f)

Deck 14: Disposition and Renovation of Income Properties

1

An investor purchased a property expecting to receive a 14% rate of return.However,the rate of return on the property over a 5 year holding period turned out to be only 11.5%.Therefore,the property should be sold.

False

2

If a real estate tax law becomes more favorable,this generally benefits existing investors over new investors.

False

3

In general,equity buildup tends to lower the marginal rate of return of holding a property.

True

4

For refinancing to be profitable,the effective cost of the debt must be less than the unlevered return on the projects being financed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

5

One factor an investor should consider when trying to decide whether to dispose of a property he or she has owned for several years is the expected IRR for holding versus sale of the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

6

The investment foundation of a real estate investment is another name for the initial investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is NOT a typical benefit of renovating a property?

A)Increasing rents

B)Lowering vacancy

C)Increasing operating expenses

D)Increasing the future property value

A)Increasing rents

B)Lowering vacancy

C)Increasing operating expenses

D)Increasing the future property value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

8

The marginal rate of return for a property is:

A)The APR on an incremental amount of borrowing

B)The expected holding period return earned when the investor purchases the property

C)The return earned on subprime property relative to prime property

D)The return gained by holding the property for one additional year

A)The APR on an incremental amount of borrowing

B)The expected holding period return earned when the investor purchases the property

C)The return earned on subprime property relative to prime property

D)The return gained by holding the property for one additional year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

9

A property should be sold when the marginal rate of return falls below the rate at which funds can be reinvested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

10

Given the same expectations for future rents and expenses,a new buyer may earn a different after-tax return than the current owner of the same property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

11

One disadvantage of refinancing a property instead of selling the property is that taxes have to be paid on funds received by additional borrowing,but no taxes would have to be paid if the property is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

12

An investor calculates an incremental return of renovating a building of 14%.Other properties provide a 12.5% overall rate of return to equity investors.Therefore,the property is a good investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

13

When evaluating the incremental costs of borrowing,if the interest rate is higher on the larger loan amount,the incremental cost of the additional funds borrowed tends to be lower than the rate on the larger loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

14

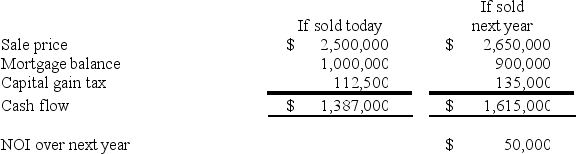

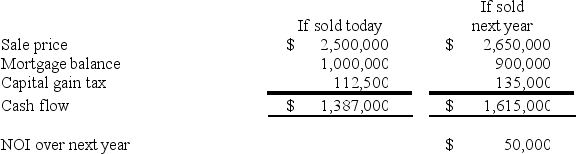

Consider the information in the table below.What is the marginal rate of return for keeping the property one additional year?

A)16.4%

B)20.0%

C)$50,000

D)$277,500

A)16.4%

B)20.0%

C)$50,000

D)$277,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

15

A property should be sold when the marginal rate of return rises above the rate at which funds can be reinvested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

16

Increasing rents tend to increase the marginal rate of return on a property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

17

The marginal rate of return on a property usually increases until the sale of the property.Equity buildup should always be avoided if possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

18

The benefits of equity buildup in a property are lessened over time because with an amortizing mortgage,an investor will lose some tax benefits each year as the interest portion of the payments decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

19

If an investor is deciding whether to sell a property,his equity buildup in the existing property should be considered as an opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

20

If capital gains tax must be paid,the opportunity cost of selling increases relative to the opportunity costs of keeping the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

21

In a real estate transaction,gross profit divided by the contact price is referred to as the:

A)Net profit

B)Operating profit

C)Profit ratio

D)Mortgage profit

A)Net profit

B)Operating profit

C)Profit ratio

D)Mortgage profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

22

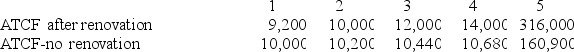

An investor is considering renovating a building.The total cost of renovation is expected to be $100,000,of which 75% can be borrowed.Given the after-tax cash flows to the equity investor as showed below,what is the incremental return from renovating?

A)9.75%

B)10.14%

C)15.32%

D)12.67%

A)9.75%

B)10.14%

C)15.32%

D)12.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is NOT a benefit of refinancing?

A)The investor can increase financial leverage

B)It is an alternative to sale of the property

C)Risk is decreased

D)No taxes have to be paid on funds received by additional borrowing

A)The investor can increase financial leverage

B)It is an alternative to sale of the property

C)Risk is decreased

D)No taxes have to be paid on funds received by additional borrowing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

24

The return calculated assuming the property is held for one additional year is referred to as the:

A)After-tax cash flow from sale

B)Marginal rate of return

C)Reinvestment rate

D)None of the above

A)After-tax cash flow from sale

B)Marginal rate of return

C)Reinvestment rate

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

25

A property could be sold today to provide an after-tax cash flow from sale of $800,000.The current after-tax cash flow from operations is $20,000,which is expected to grow by 4% per year.If sold next year,the property is expected to provide an after-tax cash flow of $824,000.What is the marginal rate of return for holding the property for an additional year?

A)5.6%

B)2.6%

C)3.1%

D)9.3%

A)5.6%

B)2.6%

C)3.1%

D)9.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following represents the formula for the annual marginal rate of return (MRR)when trying to decide whether to hold or sell a property (ATCFS equals the after-tax cash flow from sale and ATCFO equals the after-tax cash flow from operations)?

A)MRR = (ATCFS (year t + 1)+ ATCFO (year t + 1)− ATCFS (year t)− ATCFO (year t)/ ATCFS (year t)

B)MRR = (ATCFS (year t + 1)− ATCFO (year t + 1)+ ATCFS (year t))/ ATCFS (year t)

C)MRR = (ATCFS (year t + 1)+ ATCFO (year t + 1)− ATCFS (year t))/ ATCFS (year t)

D)MRR = (ATCFS (year t + 1)+ ATCFO (year t + 1)+ ATCFS (year t))/ ATCFS (year t)

A)MRR = (ATCFS (year t + 1)+ ATCFO (year t + 1)− ATCFS (year t)− ATCFO (year t)/ ATCFS (year t)

B)MRR = (ATCFS (year t + 1)− ATCFO (year t + 1)+ ATCFS (year t))/ ATCFS (year t)

C)MRR = (ATCFS (year t + 1)+ ATCFO (year t + 1)− ATCFS (year t))/ ATCFS (year t)

D)MRR = (ATCFS (year t + 1)+ ATCFO (year t + 1)+ ATCFS (year t))/ ATCFS (year t)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

27

A property worth $16 million can be refinanced with an 80% loan at 9.5% over 20 years.The balance on the current loan is $12,148,566.Loan payments are $113,302 per month.The loan balance in 10 years will be $8,396,769.If the property is expected to be sold in 10 years,what is the incremental cost of refinancing?

A)9.71%

B)10.36%

C)12.42%

D)14.58%

A)9.71%

B)10.36%

C)12.42%

D)14.58%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following would be considered when an investor is trying to decide whether or not to renovate a property?

A)After-tax operating income before renovation

B)The difference between future operating income if renovated and if not renovated

C)After-tax cash flow from sale the year of renovation

D)The mortgage balance on the property the year before renovation

A)After-tax operating income before renovation

B)The difference between future operating income if renovated and if not renovated

C)After-tax cash flow from sale the year of renovation

D)The mortgage balance on the property the year before renovation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

29

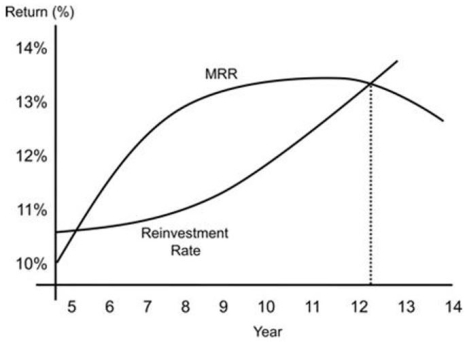

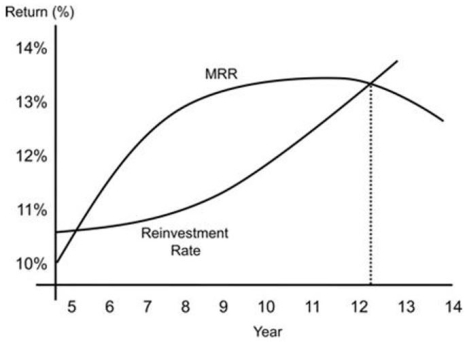

Consider the figure below.The dotted (vertical)line denotes the:

A)Incremental rate of return on additional borrowed funds

B)Marginal rate of return

C)Optimal holding period

D)Optimal yield

A)Incremental rate of return on additional borrowed funds

B)Marginal rate of return

C)Optimal holding period

D)Optimal yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

30

A property,if sold today,will provide the equity investor with $150,000 in cash flow after taxes.If the property is held,the annual after-tax cash flow received by the investor will be as follows: $18,000 for years 1 to 5,$24,000 for years 6 to 10.If held and sold in 10 years,the property is expected to provide $180,000 in after-tax cash flow to the investor.What should the investor do if she can receive a 14% rate of return by investing the sales proceeds today in a different project?

A)Sell the property and invest proceeds in the second property

B)Do not sell the property

C)Renovate the property

D)Can't tell without knowing the cash flow from the second property

A)Sell the property and invest proceeds in the second property

B)Do not sell the property

C)Renovate the property

D)Can't tell without knowing the cash flow from the second property

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

31

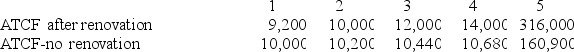

Consider the information in the table below.What is the rate of return the investor would earn on the additional funds invested in renovating the property,assuming that the investor would not borrow any additional funds?

A)6.0%

B)106%

C)$15,000

D)$265,000

A)6.0%

B)106%

C)$15,000

D)$265,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following factors would NOT be considered when an investor is trying to decide whether to hold or sell a property at the end of year five?

A)After-tax operating income in year five

B)After-tax cash flow from the sale in year five

C)After-tax cash flow from the sale in the future

D)After-tax operating income after year five

A)After-tax operating income in year five

B)After-tax cash flow from the sale in year five

C)After-tax cash flow from the sale in the future

D)After-tax operating income after year five

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

33

An investor purchased a building in 1982 when the building could be depreciated over 19 years.A new investor is interested in purchasing the building in 1992 when the depreciable life according to tax laws is 31.5 years.Assuming both investors are in the same tax bracket and that everything else is equal,what can be said about the after-tax cash flow received by the new investor as compared to the after-tax cash flow that would be received by the original owner of the building?

A)The new investor will have a higher after-tax cash flow because the depreciation expense will be lower

B)The new investor will have a higher after-tax cash flow because the depreciation expense will be higher

C)Both investors will have to use the 31.5 year depreciable life after 1986 so the after-tax cash flow will be equal

D)The new investor will have a lower after-tax cash flow because the depreciation expense will be lower

A)The new investor will have a higher after-tax cash flow because the depreciation expense will be lower

B)The new investor will have a higher after-tax cash flow because the depreciation expense will be higher

C)Both investors will have to use the 31.5 year depreciable life after 1986 so the after-tax cash flow will be equal

D)The new investor will have a lower after-tax cash flow because the depreciation expense will be lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

34

Disposition when dealing with real estate means which of the following?

A)The way a property fits in with its surroundings

B)Refinancing the property

C)Improving property value

D)Sale of the property

A)The way a property fits in with its surroundings

B)Refinancing the property

C)Improving property value

D)Sale of the property

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

35

The marginal rate of return can be defined as the:

A)Return that results from holding the property for one additional year

B)IRR the year the internal rate of return starts to decrease from holding the property

C)Incremental return over a holding period resulting from renovating a property

D)Rate of return at which the net present value equals zero

A)Return that results from holding the property for one additional year

B)IRR the year the internal rate of return starts to decrease from holding the property

C)Incremental return over a holding period resulting from renovating a property

D)Rate of return at which the net present value equals zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

36

An investor is considering refinancing a property.The current mortgage has an interest rate of 8.75% and a mortgage balance equal to 45% of the property value due to amortization of the loan and some appreciation in value.However,the investor would like to refinance at an amount equal to 75% of the property value.He has found out that the property can be refinanced at a 75% loan-to-value ratio for 9.5% interest over 15 years.What can be said about the incremental cost of refinancing?

A)It will be higher than 9.5%

B)It will be less than 9.5%

C)It will be equal to 9.5%

D)Can't tell without additional information

A)It will be higher than 9.5%

B)It will be less than 9.5%

C)It will be equal to 9.5%

D)Can't tell without additional information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

37

A property should be sold when which of the following occurs?

A)The marginal rate of return is rising but less than the reinvestment rate

B)The marginal rate of return is constant

C)The marginal rate of return is zero

D)The marginal rate of return is falling and becomes equal to the reinvestment rate

A)The marginal rate of return is rising but less than the reinvestment rate

B)The marginal rate of return is constant

C)The marginal rate of return is zero

D)The marginal rate of return is falling and becomes equal to the reinvestment rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

38

A property sale in which the buyer may make payments over time instead of paying the full price at the time of purchase,is referred to as a(an):

A)Like kind sale

B)Carry over sale

C)Equivalent investment sale

D)Installment sale

A)Like kind sale

B)Carry over sale

C)Equivalent investment sale

D)Installment sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck