Deck 13: Risk and the Pricing of Options

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

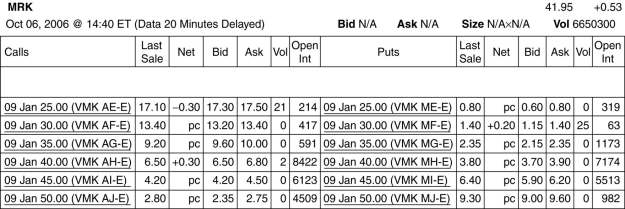

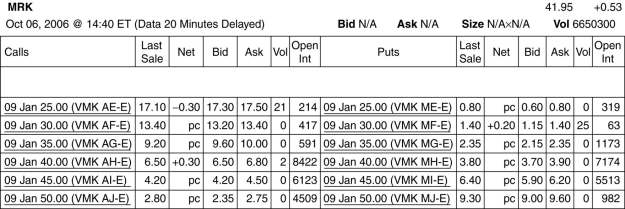

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

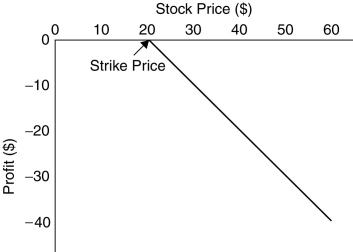

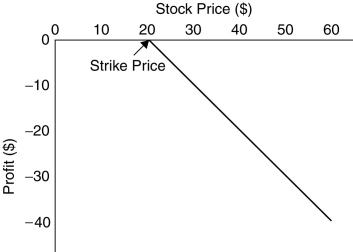

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 13: Risk and the Pricing of Options

1

The writer of a call option has:

A)the obligation to sell a security for a given price.

B)the obligation to buy a security for a given price.

C)the right to sell a security for a given price.

D)the right to buy a security for a given price.

E)the long position in the contract.

A)the obligation to sell a security for a given price.

B)the obligation to buy a security for a given price.

C)the right to sell a security for a given price.

D)the right to buy a security for a given price.

E)the long position in the contract.

the obligation to sell a security for a given price.

2

When the exercise price of a call option is lower than the current price of the stock,the option is said to be:

A)at-the-money.

B)in-the-money.

C)out-of-the-money.

D)trading at par.

E)trading below par.

A)at-the-money.

B)in-the-money.

C)out-of-the-money.

D)trading at par.

E)trading below par.

in-the-money.

3

Hedging is accomplished by holding contracts or securities whose payoffs are positively correlated with some risk exposure that already exists.

False

4

When a company writes a call option on new stock in the company,it is called a:

A)convertible bond.

B)put option.

C)stock option.

D)warrant.

E)stock.

A)convertible bond.

B)put option.

C)stock option.

D)warrant.

E)stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

________ options allow the holder to exercise the option only on the expiration date.

A) Canadian

B) American

C) European

D)Brazilian

E) Chinese

A) Canadian

B) American

C) European

D)Brazilian

E) Chinese

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

The price at which the holder of an option buys or sells a share of stock when the option is exercised is called the ________ price.

A)strike

B)American

C) dilutive

D)closing

E)spot

A)strike

B)American

C) dilutive

D)closing

E)spot

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

Options are also called derivative assets because they derive their value solely from the price of another asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

Using an option to reduce the risk of a portfolio is called ________,while using options to bet on the direction of the market or an asset is called ________.

A)hedging,speculation

B)hedging,verification

C)verification,hedging

D)speculation,hedging

E)verification,speculation

A)hedging,speculation

B)hedging,verification

C)verification,hedging

D)speculation,hedging

E)verification,speculation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

Standard stock options are traded and bought and sold through dealers only and cannot be bought via an exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

A call option gives the owner the right to ________ an asset at a fixed price at some future date.

A)sell

B)buy

C)hold

D)exchange

E)provide

A)sell

B)buy

C)hold

D)exchange

E)provide

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

A put option gives the owner the right to ________ an asset at a fixed price at some future date.

A)sell

B)buy

C)hold

D)obtain

E)purchase

A)sell

B)buy

C)hold

D)obtain

E)purchase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

The holder of a put option has:

A)the obligation to sell a security for a given price.

B)the right to buy a security for a given price.

C)the right to sell a security for a given price.

D)the obligation to buy a security for a given price.

E)the short position in the contract.

A)the obligation to sell a security for a given price.

B)the right to buy a security for a given price.

C)the right to sell a security for a given price.

D)the obligation to buy a security for a given price.

E)the short position in the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

An options contract gives the owner the ________ but not the ________ to buy or sell an asset at a fixed price at some future date.

A)obligation,right

B)right,option

C)right,obligation

D)option,right

E)obligation,option

A)obligation,right

B)right,option

C)right,obligation

D)option,right

E)obligation,option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

The ________ side of an options contract has the option to exercise,while the ________ side has an obligation to fulfill the contract.

A) long, long

B)short,long

C)long,short

D)short,short

E)short,other

A) long, long

B)short,long

C)long,short

D)short,short

E)short,other

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

________ options allow the holder to exercise the option on any date up to and including the expiration date.

A) Canadian

B) American

C) European

D) Brazilian

E) Chinese

A) Canadian

B) American

C) European

D) Brazilian

E) Chinese

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

American options allow their holders to exercise the option only on the expiration date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

Using options to reduce risk is called:

A)speculation.

B)a naked position.

C)hedging.

D)a covered position.

E)risk-taking.

A)speculation.

B)a naked position.

C)hedging.

D)a covered position.

E)risk-taking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

When the exercise price of an option is equal to the current price of the stock,the option is said to be:

A)at-the-money.

B)in-the-money.

C)out-of-the-money.

D)trading at par.

E)trading below par.

A)at-the-money.

B)in-the-money.

C)out-of-the-money.

D)trading at par.

E)trading below par.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

When the exercise price of a call option is higher than the current price of the stock,the option is said to be:

A)at-the-money.

B)in-the-money.

C)out-of-the-money.

D)trading at par.

E)trading below par.

A)at-the-money.

B)in-the-money.

C)out-of-the-money.

D)trading at par.

E)trading below par.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

The ________ is the total number of contracts of a particular option that have been written and not yet closed.

A)market interest

B)open interest

C)turnover

D)local turnover

E)volume

A)market interest

B)open interest

C)turnover

D)local turnover

E)volume

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

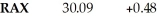

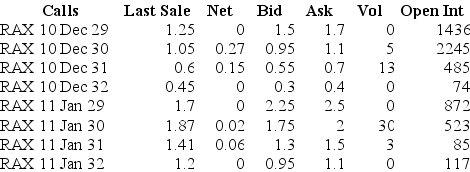

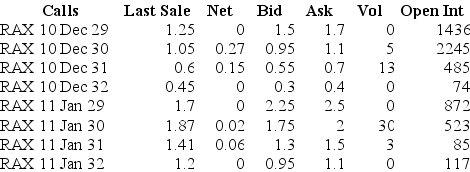

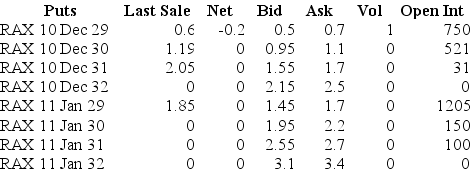

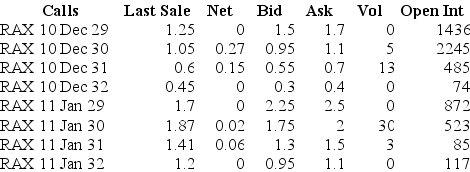

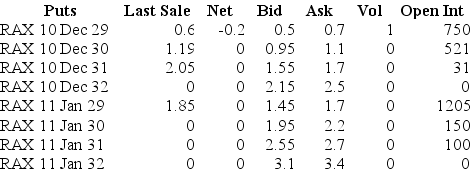

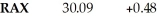

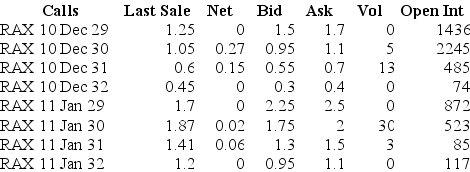

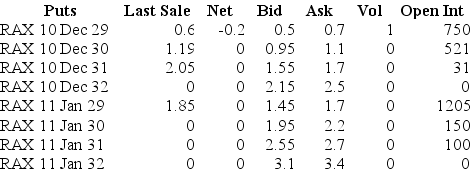

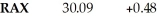

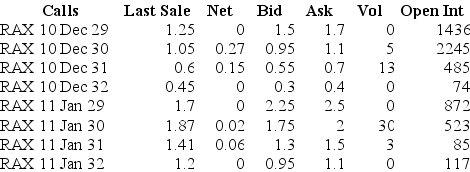

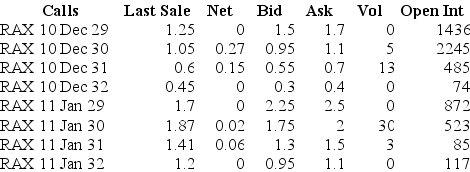

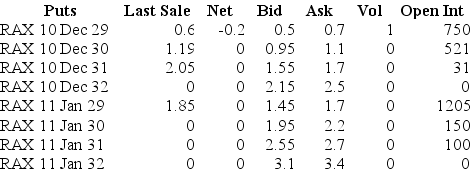

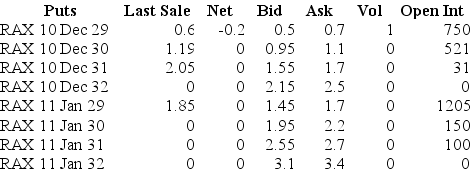

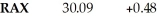

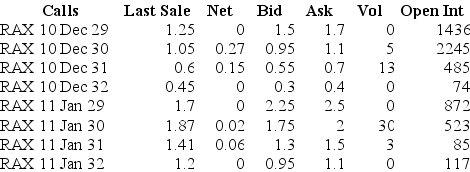

Use the table for the questions below

Consider the following information on options from the CBOE for Rackspace.

Assume you want to buy five call option contracts with an exercise price closest to being at-the-money and that expires December 2010.The current price that you would have to pay for such a contract is:

A)$550

B)$110

C)$475

D)$300

E)$525

Consider the following information on options from the CBOE for Rackspace.

Assume you want to buy five call option contracts with an exercise price closest to being at-the-money and that expires December 2010.The current price that you would have to pay for such a contract is:

A)$550

B)$110

C)$475

D)$300

E)$525

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is a put option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the table for the questions below

Consider the following information on options from the CBOE for Rackspace.

Assume you want to sell 20 call option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

A)$4500

B)$2600

C)$3900

D)$4000

E)$3500

Consider the following information on options from the CBOE for Rackspace.

Assume you want to sell 20 call option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

A)$4500

B)$2600

C)$3900

D)$4000

E)$3500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

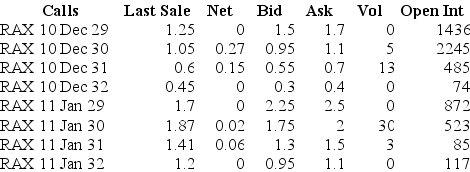

How many of the January 2009 put options are in-the-money?

A)1

B)3

C)2

D)4

E)0

A)1

B)3

C)2

D)4

E)0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is a call option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

How many of the January 2009 put options are out-of-the-money?

A)0

B)1

C)2

D)3

E)4

A)0

B)1

C)2

D)3

E)4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the table for the questions below

Consider the following information on options from the CBOE for Rackspace.

Assume you want to buy 10 put option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would have to pay for such a contract is:

A)$1750

B)$2000

C)$1950

D)$2200

E)$2550

Consider the following information on options from the CBOE for Rackspace.

Assume you want to buy 10 put option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would have to pay for such a contract is:

A)$1750

B)$2000

C)$1950

D)$2200

E)$2550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

How many of the January 2009 call options are out-of-the-money?

A)0

B)1

C)2

D)3

E)4

A)0

B)1

C)2

D)3

E)4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

What are European options?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

When is an option at-the-money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

When is an option out-the-money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

What are American options?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

The open interest for a January 2009 put option that is closest to being at-the-money is:

A)7174

B)982

C)319

D)8422

E)5513

A)7174

B)982

C)319

D)8422

E)5513

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

How many of the January 2009 call options are in-the-money?

A)2

B)4

C)1

D)3

E)0

A)2

B)4

C)1

D)3

E)0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

When is an option in-the-money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the table for the questions below

Consider the following information on options from the CBOE for Rackspace.

Assume you want to sell 20 put option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

A)$1750

B)$2000

C)$3500

D)$3900

E)$4400

Consider the following information on options from the CBOE for Rackspace.

Assume you want to sell 20 put option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

A)$1750

B)$2000

C)$3500

D)$3900

E)$4400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

Assume you want to buy one options contract with an exercise price closest to being at-the-money and that expires January 2009.The current price that you would have to pay for such a contract is:

A)$680

B)$380

C)$650

D)$420

E)$450

Consider the following information on options from the CBOE for Merck:

Assume you want to buy one options contract with an exercise price closest to being at-the-money and that expires January 2009.The current price that you would have to pay for such a contract is:

A)$680

B)$380

C)$650

D)$420

E)$450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

The open interest for a January 2011 call option that is closest to being at-the-money is:

A)1436

B)2245

C)872

D)523

E)117

A)1436

B)2245

C)872

D)523

E)117

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

Using options to place a bet on the direction in which you believe the market is likely to move is called:

A)speculation.

B)hedging.

C)a covered position.

D)a naked position.

E)diversification.

A)speculation.

B)hedging.

C)a covered position.

D)a naked position.

E)diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

How many of the December 2010 put options are in-the-money?

A)1

B)2

C)3

D)4

E)5

A)1

B)2

C)3

D)4

E)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

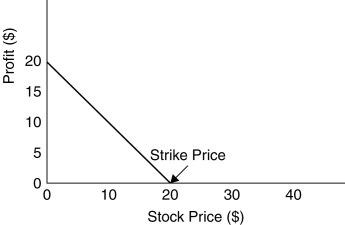

Use the figure for the question(s)below.

This graph depicts the payoffs of a:

A)short position in a put option at expiration.

B)short position in a call option at expiration.

C)long position in a put option at expiration.

D)long position in a call option at expiration.

E)long position in a call option before expiration.

This graph depicts the payoffs of a:

A)short position in a put option at expiration.

B)short position in a call option at expiration.

C)long position in a put option at expiration.

D)long position in a call option at expiration.

E)long position in a call option before expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

The payoff to the holder of a put option is given by:

A)P = max(K - S,0)

B)P= max(S - K,0)

C)P = min(S - K,0)

D)P = max(K,0)

E)P = max(S - K,0)

A)P = max(K - S,0)

B)P= max(S - K,0)

C)P = min(S - K,0)

D)P = max(K,0)

E)P = max(S - K,0)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

A put option on a stock has an exercise price of $31.If the stock price at expiration is $33.40,what is the option payoff for a short put position?

A)$33.40

B)-$2.40

C)$2.40

D)$0

E)-$33.40

A)$33.40

B)-$2.40

C)$2.40

D)$0

E)-$33.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

A put option on a stock has an exercise price of $31.If the stock price at expiration is $29.45,what is the option payoff for a long put position?

A)$29.45

B)$0

C)$1.55

D)-$1.55

E)-$29.45

A)$29.45

B)$0

C)$1.55

D)-$1.55

E)-$29.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

Although the payouts on a long position in an options contract are never negative,the profit from purchasing and holding it could be negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

A put option on a stock has an exercise price of $74.If the stock price at expiration is $79,what is the option payoff for a long put position?

A)$0

B)$5

C)-$5

D)$79

E)-$79

A)$0

B)$5

C)-$5

D)$79

E)-$79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

A call option on a stock has an exercise price of $22.25.If the stock price at expiration is $25,what is the option payoff for a long call position?

A)$2.75

B)$0

C)-$2.75

D)$25

E)$22.25

A)$2.75

B)$0

C)-$2.75

D)$25

E)$22.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

An investor purchases a call option and its underlying stock on the same day.If the stock appreciates by 25%,the call option will appreciate by:

A)more than 25%

B)less than 25%

C)exactly 25%

D)0%

E)less than 0%

A)more than 25%

B)less than 25%

C)exactly 25%

D)0%

E)less than 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

A put option on a stock has an exercise price of $42.If the stock price at expiration is $35,what is the option payoff for a short put position?

A)$0

B)$7

C)-$7

D)$35

E)-$35

A)$0

B)$7

C)-$7

D)$35

E)-$35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

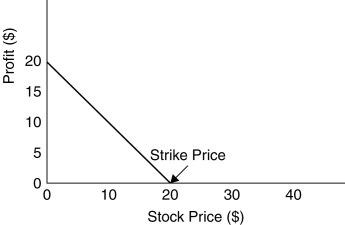

Use the figure for the question(s)below.

This graph depicts the payoffs of a:

A)long position in a put option at expiration.

B)short position in a call option at expiration.

C)short position in a put option at expiration.

D)long position in a call option at expiration.

E)long position in a call option before expiration.

This graph depicts the payoffs of a:

A)long position in a put option at expiration.

B)short position in a call option at expiration.

C)short position in a put option at expiration.

D)long position in a call option at expiration.

E)long position in a call option before expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

Suppose you purchase a call option for $5 and a strike price of $40.On the expiration day,the price of the stock is $55.What is the return on the call option if you hold your position until maturity?

A)125%

B)200%

C)275%

D)300%

E)-100%

A)125%

B)200%

C)275%

D)300%

E)-100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

A call option on a stock has an exercise price of $14.If the stock price at expiration is $13.50,what is the option payoff for a long call position?

A)$0.50

B)$0

C)-$0.50

D)$13.50

E)$14

A)$0.50

B)$0

C)-$0.50

D)$13.50

E)$14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

Suppose you purchase a call option for $5 and a strike price of $20.On the expiration day,the price of the stock is $30.What is the return on the call option if you hold your position until maturity?

A)25%

B)50%

C)75%

D)100%

E)0%

A)25%

B)50%

C)75%

D)100%

E)0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

You have shorted a call option on WSJ stock with a strike price of $50.The option will expire in exactly six months.If the stock is trading at $60 in three months,what will you owe for each share in the contract?

A)$0

B)$60

C)$50

D)$10

E)$40

A)$0

B)$60

C)$50

D)$10

E)$40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

The payoff to the holder of a call option is given by:

A)C = max(S - K,0)

B)C = min(K,0)

C)C = max(K - S,0)

D)C = min(K - S,0)

E)C = min(S - K,0)

A)C = max(S - K,0)

B)C = min(K,0)

C)C = max(K - S,0)

D)C = min(K - S,0)

E)C = min(S - K,0)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

When a stock price appreciates by a certain percentage,a call option on the same stock appreciates by a lower percentage amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

A call option on a stock has an exercise price of $34.50.If the stock price at expiration is $37.50,what is the option payoff for a short call position?

A)$34.50

B)$0

C)$3

D)-$3

E)-$34.50

A)$34.50

B)$0

C)$3

D)-$3

E)-$34.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

A call option on a stock has an exercise price of $12.15.If the stock price at expiration is $11,what is the option payoff for a short call position?

A)$-11

B)$11

C)$1.15

D)-$1.15

E)$0

A)$-11

B)$11

C)$1.15

D)-$1.15

E)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

You pay $3.25 for a call option on Luther Industries that expires in three months with a strike price of $40.00.Three months later,at expiration,Luther Industries is trading at $41.00 per share.Your profit per share on this transaction is closest to:

A)-$1.00

B)$1.00

C)-$2.25

D)$2.25

E)$0

A)-$1.00

B)$1.00

C)-$2.25

D)$2.25

E)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

Suppose you purchase a call option for $4 and a strike price of $30.On the expiration day,the price of the stock is $40.What is the return on the call option if you hold your position until maturity?

A)125%

B)130%

C)150%

D)170%

E)250%

A)125%

B)130%

C)150%

D)170%

E)250%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

You have shorted a call option on WSJ stock with a strike price of $50.The option will expire in exactly six months.If the stock is trading at $45 in three months,what will you owe for each share in the contract?

A)$0

B)$50

C)$60

D)$10

E)$40

A)$0

B)$50

C)$60

D)$10

E)$40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

A European option on a stock is more valuable than an otherwise similar American option on the same stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

Suppose a stock is currently trading for $35,and in one period it will either increase to $38 or decrease to $33.If the one-period risk-free rate is 6%,what is the price of a European put option that expires in one period and has an exercise price of $36?

A)$1.55

B)$1.50

C)$3.00

D)$0.51

E)$2.49

A)$1.55

B)$1.50

C)$3.00

D)$0.51

E)$2.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

Suppose a stock is currently trading for $23,and in one period it will either increase to $30 or decrease to $20.If the one-period risk-free rate is 5%,what is the price of a European put option that expires in one period and has an exercise price of $25?

A)$2.79

B)$2.50

C)$2.38

D)$2.21

E)$2.66

A)$2.79

B)$2.50

C)$2.38

D)$2.21

E)$2.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the short position of an options contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

Suppose a stock is currently trading for $35,and in one period it will either increase to $38 or decrease to $33.If the one-period risk-free rate is 6%,what is the price of a European call option that expires in one period and has an exercise price of $36?

A)$1.55

B)$0.80

C)$2.00

D)$1.63

E)$1.00

A)$1.55

B)$0.80

C)$2.00

D)$1.63

E)$1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

A European option with a later exercise date may trade potentially for less than an otherwise identical option with an earlier exercise date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

The value of an otherwise identical American call option is ________ if the exercise date is ________.

A)higher,longer

B)lower,longer

C)higher,closer

D)unchanged,closer

E)unchanged,longer

A)higher,longer

B)lower,longer

C)higher,closer

D)unchanged,closer

E)unchanged,longer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

What effect does volatility of the underlying asset have on the price of the option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

The value of an otherwise identical call option is ________ if the stock price is ________.

A)higher,higher

B)lower,higher

C)higher,lower

D)unchanged,higher

E)unchanged,lower

A)higher,higher

B)lower,higher

C)higher,lower

D)unchanged,higher

E)unchanged,lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

Suppose a stock is currently trading for $12,and in one period it will either increase to $15 or decrease to $8.If the one-period risk-free rate is 4%,what is the price of a European put option that expires in one period and has an exercise price of $10?

A)$0.96

B)$1.92

C)$1.00

D)$2.00

E)$0.69

A)$0.96

B)$1.92

C)$1.00

D)$2.00

E)$0.69

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

Suppose a stock is currently trading for $23,and in one period it will either increase to $30 or decrease to $20.If the one-period risk-free rate is 5%,what is the price of a European call option that expires in one period and has an exercise price of $25?

A)$1.25

B)$1.98

C)$1.50

D)$2.21

E)$2.50

A)$1.25

B)$1.98

C)$1.50

D)$2.21

E)$2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

The binomial option pricing model calculates the option price by creating a replicating portfolio out of a risk-free bond and the underlying stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

The value of an otherwise identical call option is ________ if the strike price the holder must pay to buy the stock is ________.

A)higher,higher

B)lower,lower

C)higher,lower

D)unchanged,lower

E)unchanged,higher

A)higher,higher

B)lower,lower

C)higher,lower

D)unchanged,lower

E)unchanged,higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

Suppose a stock is currently trading for $12,and in one period it will either increase to $15 or decrease to $8.If the one-period risk-free rate is 4%,what is the price of a European call option that expires in one period and has an exercise price of $7?

A)$4.68

B)$4.50

C)$5.27

D)$5.00

E)$7.00

A)$4.68

B)$4.50

C)$5.27

D)$5.00

E)$7.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

76

The value of a call option ________ with the risk-free rate,and the value of a put option ________ with the risk-free rate.

A)increases,increases

B)decreases,decreases

C)increases,decreases

D)decreases,increases

E)increases,does not change

A)increases,increases

B)decreases,decreases

C)increases,decreases

D)decreases,increases

E)increases,does not change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following will increase the value of a put option?

A)a decrease in the time to maturity

B)an increase in the stock price

C)a decrease in the stock's volatility

D)a decrease in the exercise price

E)a decrease in the risk-free rate

A)a decrease in the time to maturity

B)an increase in the stock price

C)a decrease in the stock's volatility

D)a decrease in the exercise price

E)a decrease in the risk-free rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

78

In practice,option prices are not very sensitive to changes in the risk-free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

What is the long position of an options contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following will increase the value of a call option?

A)a decrease in the time to maturity

B)a decrease in the stock price

C)a decrease in the stock's volatility

D)a decrease in the exercise price

E)a decrease in the risk-free rate

A)a decrease in the time to maturity

B)a decrease in the stock price

C)a decrease in the stock's volatility

D)a decrease in the exercise price

E)a decrease in the risk-free rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck