Deck 14: Raising Equity Capital

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

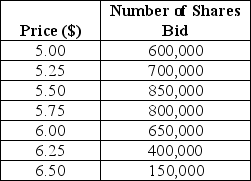

سؤال

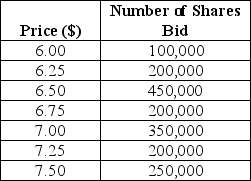

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

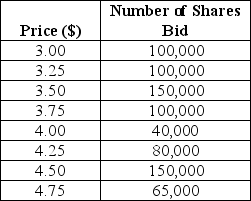

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

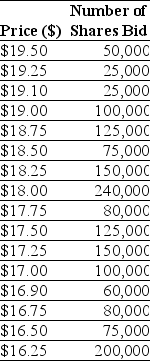

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/106

العب

ملء الشاشة (f)

Deck 14: Raising Equity Capital

1

A large publishing firm specializing in college textbooks wishes to expand into online delivery of its materials.In order to facilitate this,it invests in a number of small start-up companies that deliver college courses online and uses these companies to start diversifying the delivery of its content.Which of the following best describes the role of the publishing firm as described above?

A)a venture capitalist

B)an institutional investor

C)a corporate investor

D)a family investor

E)a sovereign wealth fund

A)a venture capitalist

B)an institutional investor

C)a corporate investor

D)a family investor

E)a sovereign wealth fund

a corporate investor

2

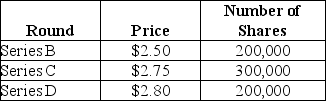

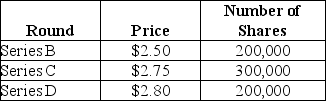

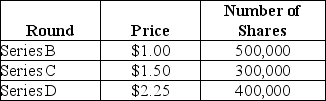

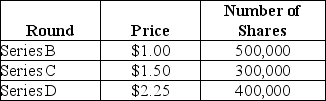

Use the table for the question(s)below.

The founder of a company issues 100,000 shares of series A stock for his own $250,000 investment.He then goes through three further rounds of investment,as shown below:

Which of the following is closest to the percentage of the company owned by the founder of the company?

A)11.2%

B)12.5%

C)25.0%

D)37.5%

E)42%

The founder of a company issues 100,000 shares of series A stock for his own $250,000 investment.He then goes through three further rounds of investment,as shown below:

Which of the following is closest to the percentage of the company owned by the founder of the company?

A)11.2%

B)12.5%

C)25.0%

D)37.5%

E)42%

12.5%

3

Which of the following statements regarding angel investors is most accurate?

A)They are typically arranged as limited partnerships.

B)For many start-ups,the first round of outside private equity financing is often obtained from them.

C)Because their capital investment is often small relative to the amount of capital already in place at the firm,they typically receive a small equity share in the business in return for their funds.

D)These investors are typically not acquaintances or friends of the entrepreneur.

E)They have little influence on the business decisions of the firm.

A)They are typically arranged as limited partnerships.

B)For many start-ups,the first round of outside private equity financing is often obtained from them.

C)Because their capital investment is often small relative to the amount of capital already in place at the firm,they typically receive a small equity share in the business in return for their funds.

D)These investors are typically not acquaintances or friends of the entrepreneur.

E)They have little influence on the business decisions of the firm.

For many start-ups,the first round of outside private equity financing is often obtained from them.

4

Which of the following is a reason why an investor would choose to invest in new and growing firms as a limited partner in a venture capital firm rather than making those investments directly by themselves?

A)Venture capital firms use their control of the companies they invest in to protect those investments.

B)The investments of venture capital firm are less diversified than the investments of a single individual.

C)A venture capital firm generally has a narrow range of expertise among its general partners.

D)The investor will have a direct say in how the companies that the venture capital firm funds will be run.

E)The venture capital firm guarantees a higher return.

A)Venture capital firms use their control of the companies they invest in to protect those investments.

B)The investments of venture capital firm are less diversified than the investments of a single individual.

C)A venture capital firm generally has a narrow range of expertise among its general partners.

D)The investor will have a direct say in how the companies that the venture capital firm funds will be run.

E)The venture capital firm guarantees a higher return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

5

When a company founder sells stock to outside investors in order to raise capital,the share of the company owned by the founder and the founder's control over the company will be reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

6

Why do most people launching a start-up company acquire their funds through the venture capital industry rather than through angel investors?

A)Most entrepreneurs are not willing to relinquish the control of their business demanded by angel investors.

B)Most entrepreneurs do not want the fees associated with investment by an angel investor.

C)Most entrepreneurs do not need the expertise brought to a young firm by an angel investor.

D)Most entrepreneurs do not have any relationships with individuals with substantial capital to invest.

E)Most entrepreneurs do not want to work with angel investors.

A)Most entrepreneurs are not willing to relinquish the control of their business demanded by angel investors.

B)Most entrepreneurs do not want the fees associated with investment by an angel investor.

C)Most entrepreneurs do not need the expertise brought to a young firm by an angel investor.

D)Most entrepreneurs do not have any relationships with individuals with substantial capital to invest.

E)Most entrepreneurs do not want to work with angel investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

7

A firm's founder sells equity to outside investors for the first time in the form of preferred stock.In what way is this preferred stock most likely to differ from the preferred stock issued by an established public firm?

A)It will have a larger dividend.

B)It will most likely not pay cash dividends.

C)It will give the holder seniority in any liquidation of the company.

D)It cannot be converted into common stock.

E)It will not have special voting rights.

A)It will have a larger dividend.

B)It will most likely not pay cash dividends.

C)It will give the holder seniority in any liquidation of the company.

D)It cannot be converted into common stock.

E)It will not have special voting rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following best describes a limited partnership that specializes in raising money to invest in the private equity of young firms?

A)venture capital firms

B)institutional investors

C)corporate investors

D)a sovereign wealth fund

E)family investors

A)venture capital firms

B)institutional investors

C)corporate investors

D)a sovereign wealth fund

E)family investors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the table for the question(s)below.

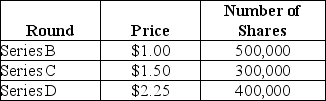

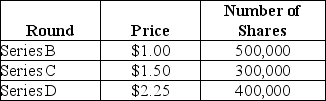

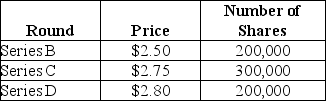

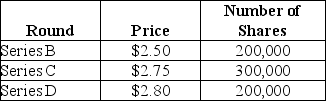

Jeremy founded a company.He issues 200,000 shares of series A stock for his own $100,000 investment.He then goes through three further rounds of investment,as shown below:

Which of the following is closest to the percentage of the company owned by the series D investors?

A)25%

B)29%

C)33%

D)40%

E)46%

Jeremy founded a company.He issues 200,000 shares of series A stock for his own $100,000 investment.He then goes through three further rounds of investment,as shown below:

Which of the following is closest to the percentage of the company owned by the series D investors?

A)25%

B)29%

C)33%

D)40%

E)46%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

10

Nature's Bounty,an organic seed company,is seeking to grow from a small company selling seeds in local markets into a company that sells seeds across several states.The funding for this expansion comes from a wealthy individual who uses his considerable inherited wealth to fund a variety of eco-friendly businesses.Which of the following best describes this individual's relationship with Nature's Bounty?

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a corporate investor

E)a sovereign wealth fund

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a corporate investor

E)a sovereign wealth fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

11

Melanie founded her company using $250,000 of her own money,issuing herself 100,000 shares of stock.An angel investor bought an additional 50,000 shares for $350,000.She now sells another 75,000 shares to a venture capitalist for $600,000.What is the post-money valuation for the company?

A)$600,000

B)$1.2 million

C)$950,000

D)$1.8 million

E)$1 million

A)$600,000

B)$1.2 million

C)$950,000

D)$1.8 million

E)$1 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the table for the question(s)below.

Jeremy founded a company.He issues 200,000 shares of series A stock for his own $100,000 investment.He then goes through three further rounds of investment,as shown below:

What is the post-money valuation for the series D funding round?

A)$1.4 million

B)$1.95 million

C)$2.025 million

D)$2.85 million

E)$3.15 million

Jeremy founded a company.He issues 200,000 shares of series A stock for his own $100,000 investment.He then goes through three further rounds of investment,as shown below:

What is the post-money valuation for the series D funding round?

A)$1.4 million

B)$1.95 million

C)$2.025 million

D)$2.85 million

E)$3.15 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

13

Melissa founded her company using $100,000 of her own money,issuing herself 50,000 shares of stock.An angel investor bought an additional 30,000 shares for $75,000.She now sells another 30,000 shares to a venture capitalist for $450,000.What is the post-money valuation for the company?

A)$1.65 million

B)$625,000

C)$1 million

D)$450,000

E)$850,000

A)$1.65 million

B)$625,000

C)$1 million

D)$450,000

E)$850,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements regarding private equity investors is most accurate?

A)A venture capital firm specializes in raising money to invest in the equity of public firms.

B)Venture capitalists typically control about three-quarters of the seats on a start-up's board of directors,and often represent the single largest voting block on the board.

C)The initial capital that is required to start a business is usually provided by the entrepreneur herself and venture capital investors.

D)A limited partnership that buys equity in small private firms is called an angel investor.

E)Institutional investors are typically the limited partners in a venture capital firm.

A)A venture capital firm specializes in raising money to invest in the equity of public firms.

B)Venture capitalists typically control about three-quarters of the seats on a start-up's board of directors,and often represent the single largest voting block on the board.

C)The initial capital that is required to start a business is usually provided by the entrepreneur herself and venture capital investors.

D)A limited partnership that buys equity in small private firms is called an angel investor.

E)Institutional investors are typically the limited partners in a venture capital firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Ontario Teachers' Pension Plan is a pension fund for public school teachers in the province of Ontario.It has a large and diverse portfolio of investments,both in Canada and internationally,and had net assets in December 2012 of $108.5 billion.Which of the following best describes the Ontario Teachers' Pension Plan?

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a family investor

E)a sovereign wealth fund

A)an angel investor

B)a venture capitalist

C)an institutional investor

D)a family investor

E)a sovereign wealth fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

16

Melanie founded her company using $250,000 of her own money,issuing herself 100,000 shares of stock.An angel investor bought an additional 50,000 shares for $350,000.She now sells another 190,000 shares to a venture capitalist for $750,000.What percentage of the firm does Melanie now own?

A)33%

B)19%

C)29%

D)50%

E)38%

A)33%

B)19%

C)29%

D)50%

E)38%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements regarding venture capitalists is most accurate?

A)They do not provide capital for young companies.

B)The firms do not offer limited partners a number of advantages over investing directly in start-ups themselves as angel investors.

C)They use their control to protect their investments,so they may therefore perform a key nurturing and monitoring role for the firm.

D)They might invest for strategic objectives in addition to the desire for investment returns.

E)They are typically friends or acquaintances of the entrepreneur.

A)They do not provide capital for young companies.

B)The firms do not offer limited partners a number of advantages over investing directly in start-ups themselves as angel investors.

C)They use their control to protect their investments,so they may therefore perform a key nurturing and monitoring role for the firm.

D)They might invest for strategic objectives in addition to the desire for investment returns.

E)They are typically friends or acquaintances of the entrepreneur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

18

Use the table for the question(s)below.

The founder of a company issues 100,000 shares of series A stock for his own $250,000 investment.He then goes through three further rounds of investment,as shown below:

What is the post-money valuation for the series D funding round?

A)$1.89 million

B)$1.96 million

C)$2.14 million

D)$2.24 million

E)$2.43 million

The founder of a company issues 100,000 shares of series A stock for his own $250,000 investment.He then goes through three further rounds of investment,as shown below:

What is the post-money valuation for the series D funding round?

A)$1.89 million

B)$1.96 million

C)$2.14 million

D)$2.24 million

E)$2.43 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

19

Melissa founded her company using $100,000 of her own money,issuing herself 50,000 shares of stock.An angel investor bought an additional 30,000 shares for $75,000.She now sells another 30,000 shares to a venture capitalist for $450,000.What percentage of the firm does Melissa now own?

A)100%

B)45%

C)16%

D)50%

E)33%

A)100%

B)45%

C)16%

D)50%

E)33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

20

Equity investors in a private company usually plan to realize a return on their investment by selling their stock when that company is acquired by another firm or sold to the public in a public offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the difference between preferred stocks issued by a private company and a mature company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements regarding stock issues is most accurate?

A)The preferred stock issued by young companies typically pays regular cash dividends.

B)The preferred stock issued by young companies usually gives the owner an option to convert it to common stock on some future date,so it is often called callable preferred stock.

C)If the company runs into financial difficulties,the preferred stockholders have a senior claim on the assets of the firm relative to any common stockholders.

D)Preferred stock issued by mature companies such as banks usually has no dividend.

E)When a company founder decides to sell equity to outside investors for the first time,it is common practice for private companies to issue common stock to raise capital.

A)The preferred stock issued by young companies typically pays regular cash dividends.

B)The preferred stock issued by young companies usually gives the owner an option to convert it to common stock on some future date,so it is often called callable preferred stock.

C)If the company runs into financial difficulties,the preferred stockholders have a senior claim on the assets of the firm relative to any common stockholders.

D)Preferred stock issued by mature companies such as banks usually has no dividend.

E)When a company founder decides to sell equity to outside investors for the first time,it is common practice for private companies to issue common stock to raise capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

23

The predominant characteristics of an Angel Investor today are:

A)They are distance from Venture Capital investors who tend to provide first-round financing rather than seed money.

B)Entrepreneurs typically require a larger contribution of seed money than was needed in the past.

C)The angel capital market has consolidated such that it is almost entirely composed of wealthy investors with domain experience.

D)Small investors are effectively precluded from this activity due to the significant minimum level of investment required.

E)Because of the increased demand for start-up capital,angel investors and venture capitalists are increasingly working together to fund several of the financial stages of new entrepreneurial ventures.

A)They are distance from Venture Capital investors who tend to provide first-round financing rather than seed money.

B)Entrepreneurs typically require a larger contribution of seed money than was needed in the past.

C)The angel capital market has consolidated such that it is almost entirely composed of wealthy investors with domain experience.

D)Small investors are effectively precluded from this activity due to the significant minimum level of investment required.

E)Because of the increased demand for start-up capital,angel investors and venture capitalists are increasingly working together to fund several of the financial stages of new entrepreneurial ventures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following best describes an auction IPO?

A)The underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The underwriter sells new issues directly to the public through an online bidding process.

C)The underwriter tries to sell the stock for the best possible price but does not guarantee that the stock will be sold.

D)The underwriter solicits bids from investors and chooses the highest price at which there is sufficient demand to sell the entire issue.

E)The underwriter sets a deliberately low price to ensure the entire issue is sold.

A)The underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The underwriter sells new issues directly to the public through an online bidding process.

C)The underwriter tries to sell the stock for the best possible price but does not guarantee that the stock will be sold.

D)The underwriter solicits bids from investors and chooses the highest price at which there is sufficient demand to sell the entire issue.

E)The underwriter sets a deliberately low price to ensure the entire issue is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

25

The post-money valuation of your firm is closest to:

A)$12.5 million

B)$5.2 million

C)$10.0 million

D)$5.0 million

E)$5.3 million

A)$12.5 million

B)$5.2 million

C)$10.0 million

D)$5.0 million

E)$5.3 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following best describes those shares sold when a company goes public which raise new capital?

A)primary offering

B)secondary offering

C)tertiary offering

D)preliminary offering

E)exit strategy

A)primary offering

B)secondary offering

C)tertiary offering

D)preliminary offering

E)exit strategy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following best describes a firm commitment IPO?

A)The underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The underwriter sells new issues directly to the public in an online auction.

C)The underwriter tries to sell the stock for the best possible price but does not guarantee that the stock will be sold.

D)The underwriter solicits bids from investors and chooses the highest price at which there is sufficient demand to sell the entire issue.

E)The underwriter sets a deliberately low price to ensure the entire issue is sold.

A)The underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The underwriter sells new issues directly to the public in an online auction.

C)The underwriter tries to sell the stock for the best possible price but does not guarantee that the stock will be sold.

D)The underwriter solicits bids from investors and chooses the highest price at which there is sufficient demand to sell the entire issue.

E)The underwriter sets a deliberately low price to ensure the entire issue is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a best-efforts IPO,the underwriter guarantees that all stock will be sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

29

Assuming that this is the venture capitalist's first investment in your firm,what percentage of the firm will the venture capitalist own?

A)50%

B)40%

C)25%

D)33%

E)60%

A)50%

B)40%

C)25%

D)33%

E)60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

30

After the venture capitalist's investment,the post-money valuation of the angel investor's shares are closest to:

A)$12.5 million

B)$4.0 million

C)$5.0 million

D)$2.5 million

E)$1.0 million

A)$12.5 million

B)$4.0 million

C)$5.0 million

D)$2.5 million

E)$1.0 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

31

At what stage of the IPO process do senior management and the lead underwriters travel to promote the company and explain their rationale for the offer price to the underwriters' largest customers?

A)when filing the preliminary prospectus

B)when filing the final prospectus

C)when managing risk

D)when matching buyers to sellers of the stock

E)when valuating the firm

A)when filing the preliminary prospectus

B)when filing the final prospectus

C)when managing risk

D)when matching buyers to sellers of the stock

E)when valuating the firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

32

Suppose you had sold the 1 million shares to the angel investor for $500,000.What would have been the post-money valuation of your shares immediately following the angel investor's investment?

A)$500,000

B)$700,000

C)$1.0 million

D)$2.0 million

E)$2.5 million

A)$500,000

B)$700,000

C)$1.0 million

D)$2.0 million

E)$2.5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

33

What advantages do venture capital firms offer limited partners compared to investing directly in start-ups themselves as angel investors?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

34

Characteristics of crowdfunding include:

A)Raising funds from a large number of people other than accredited investors with relatively modest regulatory restrictions.

B)Raising funds from a large number of people but it is still subject to tight regulations.

C)Crowdfunding must be coordinated through registered companies such as Kickstarter or Indiegogo.

D)Regulations on crowdfunding are imposed only by the federal governments in Canada and the U.S.

E)Regulations are in place to set the minimum and maximum contributions an individual can make.

A)Raising funds from a large number of people other than accredited investors with relatively modest regulatory restrictions.

B)Raising funds from a large number of people but it is still subject to tight regulations.

C)Crowdfunding must be coordinated through registered companies such as Kickstarter or Indiegogo.

D)Regulations on crowdfunding are imposed only by the federal governments in Canada and the U.S.

E)Regulations are in place to set the minimum and maximum contributions an individual can make.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

35

Suppose you had sold the 1 million shares to the angel investor for $500,000.What would have been your percentage ownership in the company immediately following the angel investor's investment?

A)28.6%

B)33.3%

C)50%

D)66.7%

E)100%

A)28.6%

B)33.3%

C)50%

D)66.7%

E)100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

36

After the venture capitalist's investment,the post-money valuation of your shares are closest to:

A)$5.0 million

B)$12.5 million

C)$4.0 million

D)$2.5 million

E)$200,000

A)$5.0 million

B)$12.5 million

C)$4.0 million

D)$2.5 million

E)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is a reason why an IPO is attractive to the managers of a private company?

A)It gives their private equity investors the opportunity to diversify.

B)They will be able to reduce their financial disclosure costs.

C)It reduces the complexity of requirements regulating the company's management.

D)It limits the amount of capital that can be raised through the public markets in subsequent offerings.

E)The managers benefit significantly from underpricing.

A)It gives their private equity investors the opportunity to diversify.

B)They will be able to reduce their financial disclosure costs.

C)It reduces the complexity of requirements regulating the company's management.

D)It limits the amount of capital that can be raised through the public markets in subsequent offerings.

E)The managers benefit significantly from underpricing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

38

The firm commitment process is the most common practice for IPOs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

39

The main advantages for a firm in going public are greater liquidity,better access to capital,and greater ability of investors to monitor the management of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

40

After the venture capitalist's investment,what percentage of the firm will you own?

A)50%

B)40%

C)33%

D)25%

E)16%

A)50%

B)40%

C)33%

D)25%

E)16%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

What will be the IPO price per share?

A)$3.40

B)$20.25

C)$33.33

D)$33.75

E)$60.00

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What will be the IPO price per share?

A)$3.40

B)$20.25

C)$33.33

D)$33.75

E)$60.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

42

An IPO in which the underwriter purchases the entire issue at a discount and then resells it at the offer price is:

A)a primary offering.

B)a secondary offering.

C)an auction IPO.

D)a best-efforts IPO.

E)a firm commitment IPO.

A)a primary offering.

B)a secondary offering.

C)an auction IPO.

D)a best-efforts IPO.

E)a firm commitment IPO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

An IPO is offered at $9.50 per share for 7 million shares.The IPO underwriters had a spread of 7.25%.What price did the underwriters pay per share of the IPO firm?

A)$9.17

B)$8.86

C)$10.19

D)$9.50

E)$8.81

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.An IPO is offered at $9.50 per share for 7 million shares.The IPO underwriters had a spread of 7.25%.What price did the underwriters pay per share of the IPO firm?

A)$9.17

B)$8.86

C)$10.19

D)$9.50

E)$8.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

What share of the company will David own after the IPO?

A)11%

B)14%

C)16%

D)22%

E)50%

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What share of the company will David own after the IPO?

A)11%

B)14%

C)16%

D)22%

E)50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

45

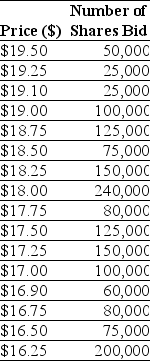

Felicity Industries is selling 2 million shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?

Felicity Industries is selling 2 million shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?A)$5.00

B)$5.25

C)$5.75

D)$6.00

E)$6.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

46

Harrison Products is selling 1 million shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?

Harrison Products is selling 1 million shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?A)$6.25

B)$6.60

C)$6.75

D)$7.00

E)$7.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the table for the question(s)below.

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

What is the major reason that underwriters tend to offer stocks in an IPO at a price that is below that which the market will pay?

A)to gain from the rise in value of any stocks they hold after the IPO

B)to reduce their exposure to losses from unsold stock

C)to benefit from greenshoe provisions

D)to increase their spread

E)The market price is unknown until after the IPO.

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What is the major reason that underwriters tend to offer stocks in an IPO at a price that is below that which the market will pay?

A)to gain from the rise in value of any stocks they hold after the IPO

B)to reduce their exposure to losses from unsold stock

C)to benefit from greenshoe provisions

D)to increase their spread

E)The market price is unknown until after the IPO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the table for the question(s)below.

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

What will be closest to the IPO price per share?

A)$12

B)$21.25

C)$22

D)$36

E)$45

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What will be closest to the IPO price per share?

A)$12

B)$21.25

C)$22

D)$36

E)$45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the table for the question(s)below.

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

What portion of the company will be owned by the angel investor after the IPO?

A)12%

B)16%

C)22%

D)30%

E)33%

The founders and owners of a private company have funded it through the following rounds of investment:

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.

The owners decide to take the company public through an IPO,issuing 1 million new shares.Assuming that they successfully complete the IPO,the net income for the next year is estimated to be $5 million.The price of shares is set using average price-earnings ratios for similar businesses of 17.0.What portion of the company will be owned by the angel investor after the IPO?

A)12%

B)16%

C)22%

D)30%

E)33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

An IPO is offered at $14 per share for 6 million shares.The IPO underwriters had a spread of 7.5%.What proceeds did the firm receive from the IPO?

A)$6.3 million

B)$90.3 million

C)$84 million

D)$77.7 million

E)$75 million

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.An IPO is offered at $14 per share for 6 million shares.The IPO underwriters had a spread of 7.5%.What proceeds did the firm receive from the IPO?

A)$6.3 million

B)$90.3 million

C)$84 million

D)$77.7 million

E)$75 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

An IPO is offered at $12.50 per share for 4 million shares.The IPO underwriters had a spread of 6.5%.What was the total fee paid to the underwriters?

A)$3.25 million

B)$4 million

C)$260,000

D)$2.25 million

E)$12.5 million

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.An IPO is offered at $12.50 per share for 4 million shares.The IPO underwriters had a spread of 6.5%.What was the total fee paid to the underwriters?

A)$3.25 million

B)$4 million

C)$260,000

D)$2.25 million

E)$12.5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

An IPO is offered at $23 per share for 12 million shares.The IPO underwriters had a spread of 6%.What proceeds did the firm receive from the IPO?

A)$259 million

B)$276 million

C)$260 million

D)$293 million

E)$270 million

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.An IPO is offered at $23 per share for 12 million shares.The IPO underwriters had a spread of 6%.What proceeds did the firm receive from the IPO?

A)$259 million

B)$276 million

C)$260 million

D)$293 million

E)$270 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

53

A restriction that prevents existing shareholders from selling their shares for some period after an IPO is called:

A)a greenshoe provision.

B)book building.

C)a secondary offering.

D)a lockup.

E)a red herring.

A)a greenshoe provision.

B)book building.

C)a secondary offering.

D)a lockup.

E)a red herring.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements regarding IPOs is most accurate?

A)In an auction IPO,the underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The shares that are sold in the IPO may either be new shares that raise new capital,known as a secondary offering,or existing shares that are sold by current shareholders (as part of their exit strategy),known as a primary offering.

C)Many IPOs,especially the larger offerings,are managed by a group of underwriters,called a syndicate.

D)At an IPO,a firm returns to the public market to offer more shares.

E)Auction IPOs are the most common type of IPO.

A)In an auction IPO,the underwriter purchases the entire issue at a small discount and then resells it at the offer price.

B)The shares that are sold in the IPO may either be new shares that raise new capital,known as a secondary offering,or existing shares that are sold by current shareholders (as part of their exit strategy),known as a primary offering.

C)Many IPOs,especially the larger offerings,are managed by a group of underwriters,called a syndicate.

D)At an IPO,a firm returns to the public market to offer more shares.

E)Auction IPOs are the most common type of IPO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

An IPO is offered at $6.75 per share for 2 million shares.The IPO underwriters had a spread of 9%.What was the total fee paid to the underwriters?

A)$13,500,000

B)$1,215,000

C)$12,285,000

D)$12,385,000

E)$1,800,000

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.An IPO is offered at $6.75 per share for 2 million shares.The IPO underwriters had a spread of 9%.What was the total fee paid to the underwriters?

A)$13,500,000

B)$1,215,000

C)$12,285,000

D)$12,385,000

E)$1,800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

56

Bejeweled,a chain of crafting shops,is selling 500,000 shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?

Bejeweled,a chain of crafting shops,is selling 500,000 shares of stock in an auction IPO.At the end of the bidding period they have received the bids shown above.Which of the following is closest to the price at which the shares will be offered?A)$3.50

B)$3.75

C)$4.25

D)$4.50

E)$4.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

57

A situation in which the underwriter does not guarantee the stock will be sold,but instead tries to sell the stock for the best possible price is:

A)a primary offering.

B)a secondary offering.

C)an auction IPO.

D)a best-efforts IPO.

E)a firm commitment IPO.

A)a primary offering.

B)a secondary offering.

C)an auction IPO.

D)a best-efforts IPO.

E)a firm commitment IPO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

58

The founder of a company currently holds 12 million of the 15 million shares in that company.She considers an IPO where she sells a mix of primary shares and 2 million of her own secondary shares for $18 per share.If she wants to retain a 60% ownership of the company,how much money can she raise in this IPO?

A)$30 million

B)$36 million

C)$42 million

D)$54 million

E)$66 million

A)$30 million

B)$36 million

C)$42 million

D)$54 million

E)$66 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the table for the question(s)below.

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

An IPO is offered at $17 per share for 3 million shares.The IPO underwriters had a spread of 7%.What price did the underwriters pay per share of the IPO firm?

A)$14

B)$17

C)$15.81

D)$18.19

E)$16

David founds a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.An IPO is offered at $17 per share for 3 million shares.The IPO underwriters had a spread of 7%.What price did the underwriters pay per share of the IPO firm?

A)$14

B)$17

C)$15.81

D)$18.19

E)$16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements regarding selling shares to the public is most accurate?

A)The process of selling stock to the public for the first time is called a seasoned equity offering (SEO).

B)Public companies typically have access to much larger amounts of capital through the public markets.

C)By going public,companies prevent their private equity investors from diversifying.

D)An IPO is typically the last time a company needs to raise capital from the public markets.

E)Going public gives current shareholders less liquidity for their shares.

A)The process of selling stock to the public for the first time is called a seasoned equity offering (SEO).

B)Public companies typically have access to much larger amounts of capital through the public markets.

C)By going public,companies prevent their private equity investors from diversifying.

D)An IPO is typically the last time a company needs to raise capital from the public markets.

E)Going public gives current shareholders less liquidity for their shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

61

In an IPO,an option that allows the underwriter to issue more stock,usually amounting to 15% of the original offer size,at the IPO offer price,is called a(n):

A)final prospectus.

B)lockup.

C)IPO overdraft.

D)red herring.

E)greenshoe provision.

A)final prospectus.

B)lockup.

C)IPO overdraft.

D)red herring.

E)greenshoe provision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

62

How does the size of an issue affect the fees charged by underwriters?

A)Although large issues generally have a smaller spread,the large number of shares released means that the total fees are somewhat larger than for smaller issues.

B)Large issues generally have a similar spread to small issues and thus attract much greater fees.

C)Large issues have a reduced spread,which means that the total fees are generally the same as for smaller issues.

D)Large issues have substantially larger direct costs and,thus,must charge a larger spread in order to be profitable for the underwriter.

E)Large issues involve a flat fee rather than a spread.

A)Although large issues generally have a smaller spread,the large number of shares released means that the total fees are somewhat larger than for smaller issues.

B)Large issues generally have a similar spread to small issues and thus attract much greater fees.

C)Large issues have a reduced spread,which means that the total fees are generally the same as for smaller issues.

D)Large issues have substantially larger direct costs and,thus,must charge a larger spread in order to be profitable for the underwriter.

E)Large issues involve a flat fee rather than a spread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

63

What are some of the disadvantages of going public?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements concerning the volume and number of IPOs issued over time is most accurate?

A)They are cyclical.

B)They tend to rise over time.

C)They tend to fall over time.

D)They remain approximately the same over time.

E)They do not follow any pattern.

A)They are cyclical.

B)They tend to rise over time.

C)They tend to fall over time.

D)They remain approximately the same over time.

E)They do not follow any pattern.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

65

As part of the registration statement,the preliminary prospectus circulates to investors before the stock is offered.This preliminary prospectus is also called a(n):

A)IPO filing.

B)10-K filing.

C)blue whale.

D)red herring.

E)greenshoe provision.

A)IPO filing.

B)10-K filing.

C)blue whale.

D)red herring.

E)greenshoe provision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

66

What are some of the advantages of going public?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

67

What are the four IPO puzzles?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is a notable puzzle in IPOs?

A)The number of IPOs is highly underestimated.

B)The number of IPOs is highly seasonal.

C)The number of IPOs is almost the same every year.

D)The number of IPOs does not follow any pattern.

E)The number of IPOs is highly cyclical.

A)The number of IPOs is highly underestimated.

B)The number of IPOs is highly seasonal.

C)The number of IPOs is almost the same every year.

D)The number of IPOs does not follow any pattern.

E)The number of IPOs is highly cyclical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use the information for the question(s)below.

Luther Industries is in the process of selling shares of stock in an auction IPO.At the end of the bidding period,Luther's investment bank has received the following bids:

What will the offer price of these shares be if Luther is selling 1 million shares?

A)$17.00

B)$17.50

C)$17.25

D)$16.75

E)$18.00

Luther Industries is in the process of selling shares of stock in an auction IPO.At the end of the bidding period,Luther's investment bank has received the following bids:

What will the offer price of these shares be if Luther is selling 1 million shares?

A)$17.00

B)$17.50

C)$17.25

D)$16.75

E)$18.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

70

Who benefits from IPO underpricing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

71

What are some of the highlights of Google's IPO process?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

72

The offer price of shares in an IPO is generally less than the price those shares sell for at the end of the first trading day.Which of the following parties suffer most from this situation?

A)the buyers of shares after the initial offering

B)the underwriters of the IPO

C)the pre-IPO shareholders of the issuing firm

D)the lead underwriter of the IPO

E)the buyers of the shares at the end of the first trading day

A)the buyers of shares after the initial offering

B)the underwriters of the IPO

C)the pre-IPO shareholders of the issuing firm

D)the lead underwriter of the IPO

E)the buyers of the shares at the end of the first trading day

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

73

Underpricing of an IPO would most likely be greatest in which of the following markets?

A)Australia

B)China

C)Japan

D)United States

E)Canada

A)Australia

B)China

C)Japan

D)United States

E)Canada

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

74

How does the total cost of issuing stock for the first time compare to the costs of other securities?

A)substantially larger than the costs for most other securities

B)about the same as the cost for most other securities

C)substantially less than the cost for a few other securities

D)substantially less than the costs for most other securities

E)it is different for every IPO

A)substantially larger than the costs for most other securities

B)about the same as the cost for most other securities

C)substantially less than the cost for a few other securities

D)substantially less than the costs for most other securities

E)it is different for every IPO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

75

Newly listed firms tend to perform relatively poorly in the three to five years after their IPOs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

76

The proceeds from the IPO be if Luther is selling 1.25 million shares is closest to:

A)$20.6 million

B)$21.6 million

C)$21.1 million

D)$20.9 million

E)$21.5 million

A)$20.6 million

B)$21.6 million

C)$21.1 million

D)$20.9 million

E)$21.5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

77

Stock issued in an IPO usually trades significantly higher at the end of the first day of trading than the original IPO price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is the general long-run performance of an IPO?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements regarding firm commitment IPOs is most accurate?

A)If the entire issue does not sell out,the remaining shares must be sold at a lower price and the underwriter must take the loss.

B)The underwriter does not guarantee that the stock will be sold,but instead tries to sell the stock for the best possible price.

C)It is the least common underwriting arrangement.

D)Rather than setting the offer price,the underwriter lets the market determine the price through bids from potential investors.

E)Often these arrangements have an all-or-none clause: either all of the shares are sold in the IPO,or the deal is called off.

A)If the entire issue does not sell out,the remaining shares must be sold at a lower price and the underwriter must take the loss.

B)The underwriter does not guarantee that the stock will be sold,but instead tries to sell the stock for the best possible price.

C)It is the least common underwriting arrangement.

D)Rather than setting the offer price,the underwriter lets the market determine the price through bids from potential investors.

E)Often these arrangements have an all-or-none clause: either all of the shares are sold in the IPO,or the deal is called off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements regarding best efforts IPOs is most accurate?

A)For smaller IPOs,the underwriter rarely uses a best-efforts IPO.

B)The underwriter guarantees that the stock will be sold at the offer price.

C)Often these arrangements have an all-or-none clause: either all of the shares are sold in the IPO,or the deal is called off.

D)If the entire issue does not sell out,the underwriter is on the hook.

E)The underwriter sells new issues directly to the public through an online bidding process.

A)For smaller IPOs,the underwriter rarely uses a best-efforts IPO.

B)The underwriter guarantees that the stock will be sold at the offer price.

C)Often these arrangements have an all-or-none clause: either all of the shares are sold in the IPO,or the deal is called off.

D)If the entire issue does not sell out,the underwriter is on the hook.

E)The underwriter sells new issues directly to the public through an online bidding process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck