Deck 6: Inventory and Cost of Goods Sold

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

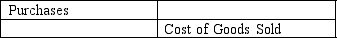

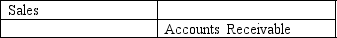

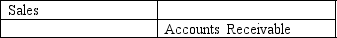

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

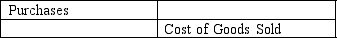

سؤال

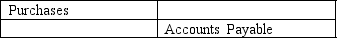

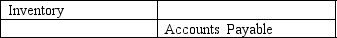

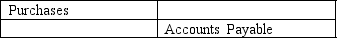

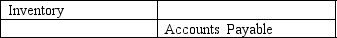

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/133

العب

ملء الشاشة (f)

Deck 6: Inventory and Cost of Goods Sold

1

In a merchandising business, gross profit is the sum of sales revenue and the cost of goods sold.

False

2

The number of inventory units on hand during the year may be determined from the accounting records under a perpetual inventory system; therefore, using this method, it is never necessary to count inventory at the end of the year.

False

3

In a perpetual inventory system, businesses maintain a continuous record for each inventory item.

True

4

Inventory is presented on the balance sheet at the selling price of the item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

5

Two accounts that would appear on the financial statements of a merchandising company that are not needed by a service company are:

A)cost of goods sold and depreciation.

B)cost of goods sold and net income.

C)cost of goods sold and inventory.

D)inventory and depreciation.

A)cost of goods sold and depreciation.

B)cost of goods sold and net income.

C)cost of goods sold and inventory.

D)inventory and depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

6

When a sale is made under the perpetual inventory system, there is no entry to cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

7

Purchase returns and allowances and purchase discounts reduce the cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a merchandising business, gross profit is equal to sales revenue minus:

A)cost of goods sold, operating expenses and prepaid expenses combined.

B)cost of goods sold and operating expenses combined.

C)cost of goods sold only.

D)cost of goods sold and sales commissions combined.

A)cost of goods sold, operating expenses and prepaid expenses combined.

B)cost of goods sold and operating expenses combined.

C)cost of goods sold only.

D)cost of goods sold and sales commissions combined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under the perpetual inventory system, inventory shifts from an asset to an expense when the seller delivers the goods to the buyer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

10

To record the cost of inventory sold under a perpetual inventory, a debit to Cost of Goods Sold and a credit to Inventory is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

11

As a perpetual inventory system continuously updates the inventory account, a physical inventory count is not necessary to prove the inventory records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

12

The cost of the inventory that the business has sold to customers is called:

A)Inventory.

B)Cost of Goods Sold.

C)Purchases.

D)Gross Profit.

A)Inventory.

B)Cost of Goods Sold.

C)Purchases.

D)Gross Profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

13

The cost of the inventory is the net amount of the purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a merchandising company's income statement, which of the following would NOT be included in the Cost of Goods Sold calculation?

A)Shipping costs from the manufacturer to the merchandiser

B)Sales commissions

C)Returns of inventory purchases

D)Sales taxes on inventory purchases, as shown on the invoices

A)Shipping costs from the manufacturer to the merchandiser

B)Sales commissions

C)Returns of inventory purchases

D)Sales taxes on inventory purchases, as shown on the invoices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

15

The merchandise inventory is reported as an asset until it is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

16

The cost of inventory that is still on hand and has NOT been sold to customers is called:

A)cost of goods sold, and it appears on the balance sheet.

B)inventory, a current asset that appears on the income statement.

C)inventory, a current asset that appears on the balance sheet.

D)cost of goods sold, and it appears on the income statement.

A)cost of goods sold, and it appears on the balance sheet.

B)inventory, a current asset that appears on the income statement.

C)inventory, a current asset that appears on the balance sheet.

D)cost of goods sold, and it appears on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

17

The largest expense on the income statement for most merchandising companies is:

A)administrative expenses.

B)selling expenses.

C)cost of goods sold.

D)other expenses.

A)administrative expenses.

B)selling expenses.

C)cost of goods sold.

D)other expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

18

Only freight-out costs associated with merchandise inventory are included in cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

19

A purchase return is a decrease in the cost of purchases because the purchaser returned goods to the supplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

20

Sales revenue is based on the _________ price of the inventory, while cost of goods sold is based on the __________ of the inventory.

A)cost, sales

B)cost, cost

C)sales, sales

D)sales, cost

A)cost, sales

B)cost, cost

C)sales, sales

D)sales, cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is added to the purchase price of the inventory to determine net purchases?

A)Freight-out

B)Freight-in

C)Purchase returns

D)Purchase discounts

A)Freight-out

B)Freight-in

C)Purchase returns

D)Purchase discounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

22

On the income statement, after a company computes gross profit, it subtracts:

A)cost of goods sold.

B)inventory.

C)operating expenses.

D)all of the above.

A)cost of goods sold.

B)inventory.

C)operating expenses.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

23

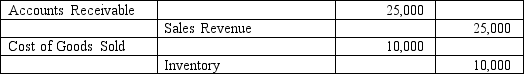

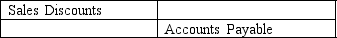

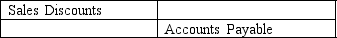

On July 16, 2011, Martson and Co. made the following journal entry:  What is the Gross Profit from this sale?

What is the Gross Profit from this sale?

A)$10,000

B)$15,000

C)$25,000

D)$ 0

What is the Gross Profit from this sale?

What is the Gross Profit from this sale?A)$10,000

B)$15,000

C)$25,000

D)$ 0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

24

The inventory system that uses computer software to keep a running record of inventory on hand is the:

A)cost of goods sold inventory system.

B)periodic inventory system.

C)perpetual inventory system.

D)hybrid inventory system.

A)cost of goods sold inventory system.

B)periodic inventory system.

C)perpetual inventory system.

D)hybrid inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

25

BMX Co. sells item XJ15 for $1,000 per unit, and has a cost of goods sold percentage of 80%. The gross profit to be found for selling 20 items:

A)is $20,000.

B)is $16,000.

C)is $ 4,000.

D)cannot be calculated with a cost of goods sold percentage greater than 50%.

A)is $20,000.

B)is $16,000.

C)is $ 4,000.

D)cannot be calculated with a cost of goods sold percentage greater than 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

26

The inventory system that does not keep a running record of all goods bought, sold, and on hand and- therefore-must take a physical count of the inventory on hand to determine the ending inventory is:

A)the cost of goods sold inventory system.

B)the periodic inventory system.

C)the perpetual inventory system.

D)all of the above.

A)the cost of goods sold inventory system.

B)the periodic inventory system.

C)the perpetual inventory system.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

27

A periodic inventory system:

A)is used for inexpensive goods.

B)is not expensive to maintain.

C)does not keep a running record of inventory on hand.

D)is all of the above.

A)is used for inexpensive goods.

B)is not expensive to maintain.

C)does not keep a running record of inventory on hand.

D)is all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

28

A company using a perpetual inventory system will use which of the following accounts?

A)Cost of Goods Purchases

B)Inventory Returns

C)Purchases

D)Inventory

A)Cost of Goods Purchases

B)Inventory Returns

C)Purchases

D)Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

29

Under a perpetual inventory system, when a sale is made:

A)the company makes a journal entry to record the sale only.

B)the company makes a journal entry to record only the cost of goods sold.

C)the company makes a journal entry to record the sale and the cost of goods sold.

D)no journal entry needs to be made.

A)the company makes a journal entry to record the sale only.

B)the company makes a journal entry to record only the cost of goods sold.

C)the company makes a journal entry to record the sale and the cost of goods sold.

D)no journal entry needs to be made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

30

The two main types of inventory accounting systems are:

A)cost of goods sold and gross profit.

B)perpetual and periodic.

C)perpetual and continuous.

D)none of the above.

A)cost of goods sold and gross profit.

B)perpetual and periodic.

C)perpetual and continuous.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

31

Unlike the periodic inventory system, the perpetual inventory system:

A)does not require a physical count of the ending inventory.

B)includes only the inventory purchased for cash.

C)provides a continuous record of inventory on hand.

D)is not required by GAAP.

A)does not require a physical count of the ending inventory.

B)includes only the inventory purchased for cash.

C)provides a continuous record of inventory on hand.

D)is not required by GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

32

What is the formula used to calculate net purchases?

A)Purchases less Purchase Returns and Allowances plus Purchase Discounts less freight-in

B)Purchases plus Purchase Returns and Allowances less Purchase Discounts plus freight-in

C)Purchases less Purchase Returns and Allowances less Purchase Discounts plus freight-in

D)Beginning Inventory less Purchases

A)Purchases less Purchase Returns and Allowances plus Purchase Discounts less freight-in

B)Purchases plus Purchase Returns and Allowances less Purchase Discounts plus freight-in

C)Purchases less Purchase Returns and Allowances less Purchase Discounts plus freight-in

D)Beginning Inventory less Purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

33

A perpetual inventory system offers which of the following advantages?

A)Inventory balances have to be counted to be accurate.

B)This system is used for inexpensive goods.

C)This system is more expensive than a periodic system.

D)This system helps to determine if there is a sufficient supply of inventory on hand to fill customer orders, just by reviewing the inventory records.

A)Inventory balances have to be counted to be accurate.

B)This system is used for inexpensive goods.

C)This system is more expensive than a periodic system.

D)This system helps to determine if there is a sufficient supply of inventory on hand to fill customer orders, just by reviewing the inventory records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

34

A company purchased inventory for $800 per unit. The inventory was marked up to sell for $1,000 per unit. The entries to record the sale for cash and the cost of a unit of inventory would include debits to which of the following accounts?

A)Sales, $1,000; Inventory, $800

B)Cash, $1,000; Cost of Goods Sold, $800

C)Cash, $800; Cost of Goods Sold, $1,000

D)Sales, $800; Inventory, $800

A)Sales, $1,000; Inventory, $800

B)Cash, $1,000; Cost of Goods Sold, $800

C)Cash, $800; Cost of Goods Sold, $1,000

D)Sales, $800; Inventory, $800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

35

A company purchased merchandise inventory on credit for $600 per unit, and later sold the inventory for $800 per unit. The journal entry to record the purchase of inventory included a debit to:

A)Accounts Receivable.

B)Inventory.

C)Accounts Payable.

D)Cost of Goods Sold.

A)Accounts Receivable.

B)Inventory.

C)Accounts Payable.

D)Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

36

How do purchase returns and allowances and purchase discounts affect net purchases?

A)Both are added to purchases.

B)Both are subtracted from purchases.

C)Purchase returns and allowances are added to purchases; purchase discounts are subtracted from purchases.

D)Purchase returns and allowances are subtracted from purchases; purchase discounts are added to purchases.

A)Both are added to purchases.

B)Both are subtracted from purchases.

C)Purchase returns and allowances are added to purchases; purchase discounts are subtracted from purchases.

D)Purchase returns and allowances are subtracted from purchases; purchase discounts are added to purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

37

Exter Co. receives terms of 2/10, n/30 on all invoices from Garn Industries. On January 15, 2011, Exter purchased items from Garn for $4,200, excluding taxes and shipping costs. What amount would Exter use as the purchase discount if the invoice was paid on January 28, 2011?

A)$ 0

B)$ 84

C)$4,116

D)$4,200

A)$ 0

B)$ 84

C)$4,116

D)$4,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

38

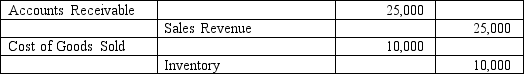

On July 16, 2011, Martson and Co. made the following journal entry:  Martson and Co. is using the _________ Inventory system.

Martson and Co. is using the _________ Inventory system.

A)Periodic

B)Perpetual

C)FIFO

D)LIFO

Martson and Co. is using the _________ Inventory system.

Martson and Co. is using the _________ Inventory system.A)Periodic

B)Perpetual

C)FIFO

D)LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

39

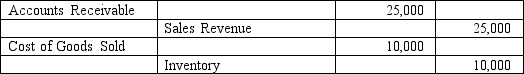

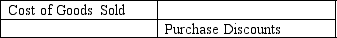

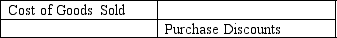

Using a perpetual inventory system, which of the following entries would record the cost of merchandise sold on credit?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

40

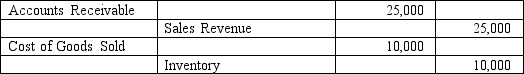

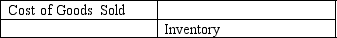

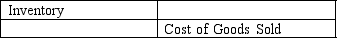

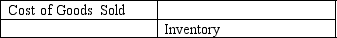

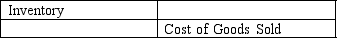

Under a perpetual inventory system, which of the following entries would record the purchase of merchandise on credit?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

41

When prices are rising, a company using the FIFO costing method will generally pay less taxes than if the company had been using the LIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following are subtracted from the purchase price of the inventory to determine net purchases?

A)Freight-out and freight-in

B)Purchase returns, purchase allowances and freight-in

C)Purchase returns, purchase allowances, and purchase discounts

D)None of the above

A)Freight-out and freight-in

B)Purchase returns, purchase allowances and freight-in

C)Purchase returns, purchase allowances, and purchase discounts

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

43

Using the lower-of-cost-or-market rules to value ending inventory complies with the ongoing principles of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

44

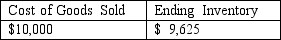

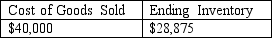

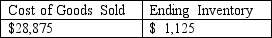

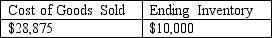

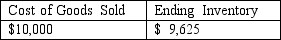

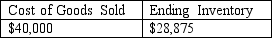

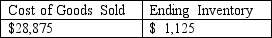

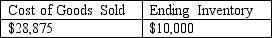

A company purchased 400 units at $75 per unit. The company sold 385 units. What is the cost of goods sold and ending inventory?

A)

B)

C)

D) .

.

A)

B)

C)

D)

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

45

Companies may choose to determine the cost of goods sold using the lower-of-cost-or-market rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

46

The choice of an inventory costing method has no significant impact on the company's income statement and balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

47

The cost of inventory is the:

A)purchase price.

B)sum of all the costs incurred to bring the inventory to its intended use.

C)sum of all the costs incurred to bring the inventory to its intended use, plus any discounts and allowances.

D)sum of all the costs incurred to bring the inventory to its intended use, less any discounts and allowances.

A)purchase price.

B)sum of all the costs incurred to bring the inventory to its intended use.

C)sum of all the costs incurred to bring the inventory to its intended use, plus any discounts and allowances.

D)sum of all the costs incurred to bring the inventory to its intended use, less any discounts and allowances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

48

Adjusting entries for inventory are required under the perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

49

Bonz, Inc. is using a perpetual inventory system with a December 31 year end date. The balance in this company's inventory account as of September 30 would be equal to:

A)beginning inventory as of January 01.

B)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30, less all items sold from the beginning of the year through September 30.

C)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30.

D)all purchases from the beginning of the year through September 30.

A)beginning inventory as of January 01.

B)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30, less all items sold from the beginning of the year through September 30.

C)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30.

D)all purchases from the beginning of the year through September 30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

50

In a period of increasing prices, LIFO generally results in a lower tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

51

The inventory cost method based on the particular cost of certain units of inventory is the:

A)first-in, first-out method.

B)last-in, first-out method.

C)specific-unit-cost method.

D)weighted-average method.

A)first-in, first-out method.

B)last-in, first-out method.

C)specific-unit-cost method.

D)weighted-average method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

52

The inventory cost under the average cost per unit method will generally fall in between the inventory costs using the LIFO and FIFO methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

53

The weighted-average cost per unit is calculated as the cost of goods sold divided by the number of units actually sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

54

When applying the lower-of-cost-or-market rules to beginning inventory valuation, market value generally refers to the cost at which the company can sell a unit of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

55

Under the disclosure principle, the inventory accounting method must be disclosed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

56

The specific unit cost method is preferred by accountants because it is easy to use and fairly accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

57

A company whose inventory consists of very unique items would probably use which inventory method?

A)First-in, first-out

B)Last-in, first-out

C)Specific-unit-cost

D)Weighted-average of only the unique items

A)First-in, first-out

B)Last-in, first-out

C)Specific-unit-cost

D)Weighted-average of only the unique items

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

58

The ending inventory using the LIFO costing method reports the oldest inventory costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

59

Net sales is computed as:

A)sales revenue less freight-out.

B)sales revenue less sales returns and allowances plus sales discounts.

C)sales less cost of goods sold.

D)sales revenue less sales returns and allowances less sales discounts.

A)sales revenue less freight-out.

B)sales revenue less sales returns and allowances plus sales discounts.

C)sales less cost of goods sold.

D)sales revenue less sales returns and allowances less sales discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

60

A LIFO liquidation occurs when the inventory prices fall below prices of the previous period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

61

The lower-of-cost-or-market rule is based on accounting:

A)disclosure.

B)materiality.

C)conservatism.

D)revenue.

A)disclosure.

B)materiality.

C)conservatism.

D)revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

62

The choice of an inventory costing method will affect:

A)the ending inventory.

B)the cost of goods sold.

C)the ending inventory and cost of goods sold.

D)none of the above.

A)the ending inventory.

B)the cost of goods sold.

C)the ending inventory and cost of goods sold.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

63

The conservatism principle in accounting means that a company should:

A)report enough information in its financial statements for outsiders to make knowledgeable decisions about the company.

B)report items in the financial statements at the least favorable amounts.

C)use the same accounting methods and procedures from period to period.

D)perform strictly proper accounting for items and transactions that are significant to the company's financial statements.

A)report enough information in its financial statements for outsiders to make knowledgeable decisions about the company.

B)report items in the financial statements at the least favorable amounts.

C)use the same accounting methods and procedures from period to period.

D)perform strictly proper accounting for items and transactions that are significant to the company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which inventory method gives the most realistic net income?

A)FIFO, because it uses cost in the order in which they were incurred

B)LIFO, because it includes the most recent costs in cost of goods sold

C)Average-cost, because it averages old and recent costs

D)The answer depends on whether prices are rising or falling.

A)FIFO, because it uses cost in the order in which they were incurred

B)LIFO, because it includes the most recent costs in cost of goods sold

C)Average-cost, because it averages old and recent costs

D)The answer depends on whether prices are rising or falling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

65

If prices are rising and a company is using LIFO, large purchases of inventory near the end of the year will:

A)increase income taxes paid.

B)decrease income taxes paid.

C)not change the value of ending inventory.

D)do none of the above.

A)increase income taxes paid.

B)decrease income taxes paid.

C)not change the value of ending inventory.

D)do none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

66

All of the following are reasons for choosing the FIFO versus the LIFO costing method EXCEPT that:

A)FIFO reports the most up-to-date inventory values on the balance sheet.

B)FIFO generally results in higher net income in period of rising prices.

C)FIFO uses more current costs in calculating the value of ending inventory.

D)FIFO results in lower income taxes.

A)FIFO reports the most up-to-date inventory values on the balance sheet.

B)FIFO generally results in higher net income in period of rising prices.

C)FIFO uses more current costs in calculating the value of ending inventory.

D)FIFO results in lower income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

67

When LIFO is used and inventory quantities fall below the level of the previous period, the situation is called a:

A)LIFO adjustment.

B)LIFO failure.

C)LIFO liquidation.

D)LIFO materiality.

A)LIFO adjustment.

B)LIFO failure.

C)LIFO liquidation.

D)LIFO materiality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

68

The principle that can be summarized as "anticipate no gains, but provide for all possible losses and if in doubt, record an asset at the lowest reasonable amount and report a liability at the highest reasonable amount" is the:

A)revenue concept.

B)accounting conservatism principle.

C)the materiality principle.

D)disclosure principle.

A)revenue concept.

B)accounting conservatism principle.

C)the materiality principle.

D)disclosure principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

69

When inventory costs are increasing with no LIFO liquidation:

A)FIFO cost of goods sold will be higher than LIFO cost of goods sold.

B)FIFO ending inventory will be lower than LIFO ending inventory.

C)FIFO cost of goods sold will be lower than LIFO cost of goods sold.

D)FIFO and LIFO will result in the same cost of goods sold and ending inventory.

A)FIFO cost of goods sold will be higher than LIFO cost of goods sold.

B)FIFO ending inventory will be lower than LIFO ending inventory.

C)FIFO cost of goods sold will be lower than LIFO cost of goods sold.

D)FIFO and LIFO will result in the same cost of goods sold and ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

70

When inventory prices are increasing, the FIFO costing method will generally yield a cost of goods sold that is:

A)higher than cost of goods sold under the LIFO method.

B)lower than cost of goods sold under the LIFO method.

C)equal to the gross profit under the LIFO method.

D)equal to cost of goods sold under the LIFO method.

A)higher than cost of goods sold under the LIFO method.

B)lower than cost of goods sold under the LIFO method.

C)equal to the gross profit under the LIFO method.

D)equal to cost of goods sold under the LIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

71

When inventory prices are falling, the LIFO costing method will generally result in a:

A)lower gross profit than under FIFO.

B)higher gross profit than under FIFO.

C)lower inventory value than under FIFO.

D)lower owners' equity balance than under FIFO.

A)lower gross profit than under FIFO.

B)higher gross profit than under FIFO.

C)lower inventory value than under FIFO.

D)lower owners' equity balance than under FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

72

The accounting principle that states that a business should use the same accounting methods and procedures from period to period is the:

A)consistency principle.

B)historical cost principle.

C)disclosure principle.

D)conservatism principle.

A)consistency principle.

B)historical cost principle.

C)disclosure principle.

D)conservatism principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

73

The disclosure principle requires that management prepare financial reports that disclose all of the following types of information EXCEPT:

A)information that is relevant to decision making.

B)forecasts of expected future earnings to help investors decide whether to invest in the company.

C)the method of inventory used.

D)information that facilitates comparison with other companies' financial reports.

A)information that is relevant to decision making.

B)forecasts of expected future earnings to help investors decide whether to invest in the company.

C)the method of inventory used.

D)information that facilitates comparison with other companies' financial reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

74

A company uses LIFO in one year, then switches to FIFO and then to average-cost. This is a violation of the:

A)disclosure principle

B)historical cost principle.

C)consistency principle.

D)conservatism principle.

A)disclosure principle

B)historical cost principle.

C)consistency principle.

D)conservatism principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

75

The use of the FIFO method generally increases taxable income:

A)when prices are constant.

B)when prices are declining.

C)when prices are increasing.

D)under all circumstances.

A)when prices are constant.

B)when prices are declining.

C)when prices are increasing.

D)under all circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

76

Ace Company began the current accounting period with 9,000 units of inventory purchased for $100 per unit. Ace sells its units at $300 per unit. Ace would experience a LIFO liquidation if:

A)the sales price falls below $300 per unit.

B)the purchase price falls below $100 per unit.

C)the level of ending inventory falls below 9,000 units.

D)any of the above scenarios happened.

A)the sales price falls below $300 per unit.

B)the purchase price falls below $100 per unit.

C)the level of ending inventory falls below 9,000 units.

D)any of the above scenarios happened.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

77

Harmon Fraiser Industries had beginning inventory of 20,000 candles and an ending inventory of 15,000 candles. Harmon originally paid $1.80 each when it purchased the candles. The current replacement cost of the candles is $2.20 each. Each candle retails for $3.00. Harmon uses the LIFO method to account for its inventory. How did the LIFO liquidation affect the company's taxable income?

A)Taxable income increased because of the liquidation.

B)Taxable income decreased because of the liquidation.

C)Taxable income remained the same despite the liquidation.

D)You cannot determine taxable income from the given data.

A)Taxable income increased because of the liquidation.

B)Taxable income decreased because of the liquidation.

C)Taxable income remained the same despite the liquidation.

D)You cannot determine taxable income from the given data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

78

When the FIFO method is used, ending inventory is assumed to consist of the:

A)units with the lowest per unit cost.

B)units with the highest per unit cost.

C)oldest units.

D)most recently purchased units.

A)units with the lowest per unit cost.

B)units with the highest per unit cost.

C)oldest units.

D)most recently purchased units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

79

When using the average-cost method to determine the cost of inventory, the average cost per unit is calculated as the cost of goods:

A)in ending inventory, divided by the number of units in ending inventory.

B)sold, divided by the number of units sold.

C)available for sale, divided by the number of units available for sale.

D)sold, divided by the average number of units in inventory.

A)in ending inventory, divided by the number of units in ending inventory.

B)sold, divided by the number of units sold.

C)available for sale, divided by the number of units available for sale.

D)sold, divided by the average number of units in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

80

Deciding on which inventory method a company should use affects:

A)the profits to be reported.

B)the income taxes to be paid.

C)the values of ratios reported from the balance sheet.

D)all of the above.

A)the profits to be reported.

B)the income taxes to be paid.

C)the values of ratios reported from the balance sheet.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck