Deck 1: The Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/162

العب

ملء الشاشة (f)

Deck 1: The Financial Statements

1

Financial statements are:

A)standard documents issued by outside consultants who are hired to analyze key operations of the business in financial terms.

B)the business documents that companies use to report the results of their financial activities to various user groups.

C)reports created by management that states it is responsible for the acts of the corporation.

D)the mechanical part of accounting.

A)standard documents issued by outside consultants who are hired to analyze key operations of the business in financial terms.

B)the business documents that companies use to report the results of their financial activities to various user groups.

C)reports created by management that states it is responsible for the acts of the corporation.

D)the mechanical part of accounting.

B

2

Bookkeeping is a type of accounting used primarily by proprietorships.

False

3

An example of a regulatory body that uses accounting information is the Internal Revenue Service.

True

4

What type of accounting provides information for decision makers outside the entity?

A)Bookkeeping

B)Managerial accounting.

C)Internal auditing.

D)Financial accounting.

A)Bookkeeping

B)Managerial accounting.

C)Internal auditing.

D)Financial accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

5

In an LLP, each partner is liable for partnership debts only to the extent of their investment in the partnership plus their share of the liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

6

Who ultimately controls a corporation?

A)Board of Directors

B)The Chief Executive Officer (CEO)

C)The stockholders

D)The President

A)Board of Directors

B)The Chief Executive Officer (CEO)

C)The stockholders

D)The President

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

7

For which form of business ownership are the owners of a business legally distinct from the business?

A)Corporation

B)Partnership

C)Proprietorship

D)All of the above

A)Corporation

B)Partnership

C)Proprietorship

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

8

Financial accounting provides budgeting information to a company's managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

9

Management accounting:

A)includes information such as budgets and forecasts.

B)is used to make strategic decisions for the entity.

C)must be relevant to decision makers within the entity.

D)is all of the above.

A)includes information such as budgets and forecasts.

B)is used to make strategic decisions for the entity.

C)must be relevant to decision makers within the entity.

D)is all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

10

Accounting:

A)measures business activities.

B)processes data into reports and communicates the data to decision makers.

C)is often called the language of business.

D)is all of the above.

A)measures business activities.

B)processes data into reports and communicates the data to decision makers.

C)is often called the language of business.

D)is all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

11

The business records of a proprietorship should include the proprietor's personal finances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

12

Limited Liability Companies (LLCs)have members instead of stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

13

Managerial accounting information is used mainly by external users.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

14

All business owners are personally liable for the debts of their businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

15

The major forms of business organizations are proprietorships, partnerships, and for-profit organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

16

Mutual agency of a partnership means that each partner may conduct business in the name of the partnership and can legally bind all the partners without limit for the partnership's debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

17

Users of accounting information include investors, creditors, and regulatory bodies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

18

Characteristics of a sole proprietor include:

A)multiple owners.

B)limited personal liability for all business debts.

C)a distinct entity, separate from its owner for accounting purposes.

D)formation under state law.

A)multiple owners.

B)limited personal liability for all business debts.

C)a distinct entity, separate from its owner for accounting purposes.

D)formation under state law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

19

Bookkeeping is the mechanical part of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

20

The two types of accounting are:

A)profit and nonprofit.

B)financial and managerial.

C)internal and external.

D)bookkeeping and decision-oriented.

A)profit and nonprofit.

B)financial and managerial.

C)internal and external.

D)bookkeeping and decision-oriented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

21

To be relevant, accounting information must be capable of making a difference to the decision maker.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

22

An entity that is organized according to state law and in which ownership units are called stock is a:

A)proprietorship.

B)corporation.

C)partnership.

D)limited liability company.

A)proprietorship.

B)corporation.

C)partnership.

D)limited liability company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

23

A partnership:

A)is a taxpaying entity.

B)is not a distinct entity, separate from its owners for accounting purposes.

C)has mutual agency.

D)has limited liability for the partners.

A)is a taxpaying entity.

B)is not a distinct entity, separate from its owners for accounting purposes.

C)has mutual agency.

D)has limited liability for the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

24

Generally accepted accounting principles, or GAAP, are the rules and procedures established by the Financial Accounting Standards Board, or the FASB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Financial Accounting Standards Board is responsible for establishing:

A)the code of professional conduct for accountants.

B)the Securities and Exchange Commission.

C)generally accepted accounting principles.

D)the American Institute of Certified Public Accountants.

A)the code of professional conduct for accountants.

B)the Securities and Exchange Commission.

C)generally accepted accounting principles.

D)the American Institute of Certified Public Accountants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

26

Accounting information is subject to the constraints of:

A)comparability and consistency.

B)comparability and verifiability.

C)materiality and cost.

D)relevance and faithful representation.

A)comparability and consistency.

B)comparability and verifiability.

C)materiality and cost.

D)relevance and faithful representation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

27

International financial reporting standards are set by the:

A)IASB.

B)GAAP.

C)FASB.

D)SEC.

A)IASB.

B)GAAP.

C)FASB.

D)SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

28

Advantages of a corporation include:

A)a single owner.

B)the double taxation of distributed profits.

C)limited liability of the stockholders.

D)mutual agency.

A)a single owner.

B)the double taxation of distributed profits.

C)limited liability of the stockholders.

D)mutual agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

29

All of the following are characteristics of useful accounting information EXCEPT:

A)comparability.

B)timeliness

C)informative.

D)verifiability.

A)comparability.

B)timeliness

C)informative.

D)verifiability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

30

The stable-monetary-unit assumption of accounting:

A)ensures that accounting records and statements are based on the most reliable data available.

B)holds that the entity will remain in operation for the foreseeable future.

C)maintains that each organization or section of an organization stands apart from other organizations and individuals.

D)enables accountants to ignore the effect of inflation in the accounting records.

A)ensures that accounting records and statements are based on the most reliable data available.

B)holds that the entity will remain in operation for the foreseeable future.

C)maintains that each organization or section of an organization stands apart from other organizations and individuals.

D)enables accountants to ignore the effect of inflation in the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

31

The continuity (going-concern)assumption of accounting:

A)enables accountants to ignore the effect of inflation in the accounting records.

B)holds that the entity will remain in operation long enough to use its existing assets.

C)maintains that each organization, or section of an organization, stands apart from other organizations and individuals.

D)ensures that accounting records and statements are based on the most reliable data available.

A)enables accountants to ignore the effect of inflation in the accounting records.

B)holds that the entity will remain in operation long enough to use its existing assets.

C)maintains that each organization, or section of an organization, stands apart from other organizations and individuals.

D)ensures that accounting records and statements are based on the most reliable data available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

32

All of the following are forms of business organizations EXCEPT for the:

A)proprietorship.

B)limited liability partnership.

C)limited proprietorship.

D)limited liability company.

A)proprietorship.

B)limited liability partnership.

C)limited proprietorship.

D)limited liability company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

33

To be useful, accounting information must have the fundamental qualitative characteristics of:

A)comparability and relevance.

B)relevance and faithful representation.

C)materiality and understandability.

D)faithful representation and timeliness.

A)comparability and relevance.

B)relevance and faithful representation.

C)materiality and understandability.

D)faithful representation and timeliness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

34

One overall objective of accounting is to provide financial information that is useful to potential capital providers who are making investment and lending decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

35

The accounting assumption that states that the business, rather than its owners, is the reporting unit is the:

A)entity assumption.

B)going concern assumption.

C)stable-monetary-unit assumption.

D)historical cost assumption.

A)entity assumption.

B)going concern assumption.

C)stable-monetary-unit assumption.

D)historical cost assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

36

Accountants follow guidelines for professional measurement and disclosure of financial information called:

A)IASB.

B)GAAP.

C)FASB.

D)SEC.

A)IASB.

B)GAAP.

C)FASB.

D)SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

37

When information is important enough to the informed user, so that, if it was omitted or erroneous, it would make a difference in the user's decision, it is:

A)comparable.

B)material

C)timely.

D)understandable.

A)comparable.

B)material

C)timely.

D)understandable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

38

For accounting purposes, the business entity should be considered separate from its owners if the business is organized as a:

A)proprietorship.

B)corporation.

C)partnership.

D)any of the above.

A)proprietorship.

B)corporation.

C)partnership.

D)any of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

39

The acronym GAAP stands for:

A)generally acceptable authorized pronouncements.

B)government authorized accountant principles.

C)generally accepted accounting principles.

D)government audited accounting pronouncements.

A)generally acceptable authorized pronouncements.

B)government authorized accountant principles.

C)generally accepted accounting principles.

D)government audited accounting pronouncements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

40

Owners of an LLC are called:

A)partners.

B)sole proprietors.

C)members.

D)stockholders.

A)partners.

B)sole proprietors.

C)members.

D)stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

41

Common stock and retained earnings are the main components of paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

42

An Oklahoma City business paid $15,000 cash for equipment used in the business. At the time of purchase, the equipment had a list price of $20,000. When the balance sheet was prepared, the value of the equipment was $22,000. What is the relevant measure of the value of the equipment?

A)Historical cost, $15,000

B)Fair market cost, $20,000

C)Current market cost, $22,000

D)$15,000 on the day of purchase, $22,000 on balance sheet date

A)Historical cost, $15,000

B)Fair market cost, $20,000

C)Current market cost, $22,000

D)$15,000 on the day of purchase, $22,000 on balance sheet date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

43

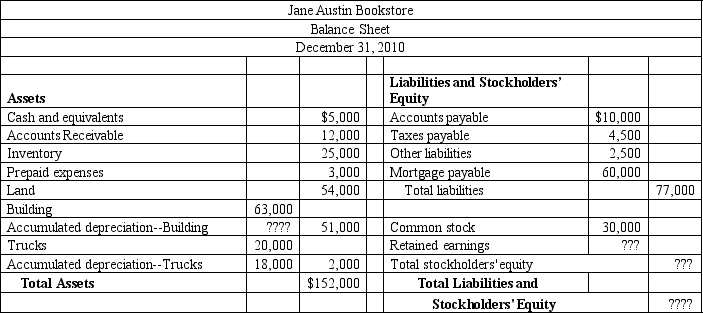

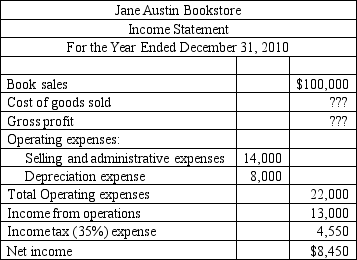

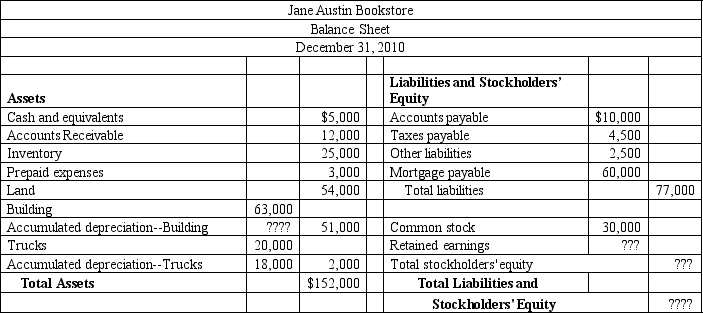

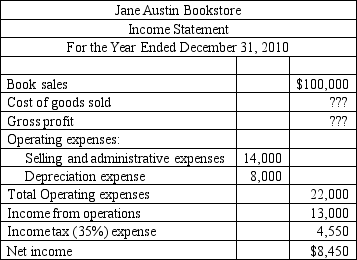

Use the following Balance Sheet and Income Statement to answer the question.

What is the Retained earnings shown on the Balance Sheet for 2010?

What is the Retained earnings shown on the Balance Sheet for 2010?

A)$15,000

B)$45,000

C)$75,000

D)$77,000

What is the Retained earnings shown on the Balance Sheet for 2010?

What is the Retained earnings shown on the Balance Sheet for 2010?A)$15,000

B)$45,000

C)$75,000

D)$77,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

44

The word "payable" always signifies a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

45

The relevant measure of the value of the assets of a company that is going out of business is the:

A)book value.

B)current market value.

C)historical cost.

D)recorded value.

A)book value.

B)current market value.

C)historical cost.

D)recorded value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

46

The CEO of a business owns a residence in Flagstaff. The company the CEO works for owns a factory in Chandler. Which of these properties is considered an asset(s)of the business?

A)The Flagstaff residence only

B)The Chandler factory only

C)Both the Flagstaff and Chandler properties

D)Neither the Flagstaff nor Chandler properties

A)The Flagstaff residence only

B)The Chandler factory only

C)Both the Flagstaff and Chandler properties

D)Neither the Flagstaff nor Chandler properties

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

47

"Net assets", as stockholders' equity is often referred to, represents the residual amount of business assets which can be claimed by the owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

48

Stockholders' equity is the stockholders' interest in the assets of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

49

Expenses are increases in retained earnings that result from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

50

The accounting equation expresses the idea that Resources - Insider claims = Outsider claims.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

51

Dividends never affect net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

52

An office building is appraised for $250,000 and offered for sale at $260,000. The buyer pays $245,000 for the building. The building should be recorded on the books of the buyer at:

A)$250,000.

B)$260,000.

C)$245,000.

D)some other amount.

A)$250,000.

B)$260,000.

C)$245,000.

D)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

53

The FASB:

A)is working towards a convergence of standards with the IASB.

B)will not accept IASB rules.

C)does not want US companies to adopt IFRS standards.

D)feels that the global use of IFRS will significantly increase costs of doing global business.

A)is working towards a convergence of standards with the IASB.

B)will not accept IASB rules.

C)does not want US companies to adopt IFRS standards.

D)feels that the global use of IFRS will significantly increase costs of doing global business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

54

The calculation of ending retained earnings considers beginning retained earnings, current net income or net loss and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

55

The owners' equity of proprietorships and corporations are the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

56

Dividend payments are NOT classified as expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

57

Liabilities are divided into "outsider claims" and "insider claims."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

58

The financial statements are based on the accounting equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

59

The accounting equation must always be in balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

60

The principle stating that assets acquired by the business should be recorded at their actual cost on the date of purchase is the:

A)cost principle.

B)objectivity principle.

C)reliability principle.

D)stable dollar principle.

A)cost principle.

B)objectivity principle.

C)reliability principle.

D)stable dollar principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

61

The owners' equity of any business is its:

A)revenues minus expenses.

B)assets minus liabilities.

C)assets plus liabilities.

D)paid-in capital plus assets.

A)revenues minus expenses.

B)assets minus liabilities.

C)assets plus liabilities.

D)paid-in capital plus assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

62

The owners' interest in the assets of a corporation is known as:

A)common stock.

B)stockholders' equity.

C)long-term assets.

D)operating expenses.

A)common stock.

B)stockholders' equity.

C)long-term assets.

D)operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

63

Examples of liabilities include:

A)accounts payable and accounts receivable.

B)accounts payable and land.

C)investments and owners' equity.

D)accounts payable and long-term debt.

A)accounts payable and accounts receivable.

B)accounts payable and land.

C)investments and owners' equity.

D)accounts payable and long-term debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

64

Revenues are:

A)decreases in assets resulting from delivering goods or services to customers.

B)increases in liabilities resulting from delivering goods or services to customers.

C)increases in retained earnings resulting from delivering goods or services to customers.

D)decreases in retained earnings resulting from delivering goods or services to customers.

A)decreases in assets resulting from delivering goods or services to customers.

B)increases in liabilities resulting from delivering goods or services to customers.

C)increases in retained earnings resulting from delivering goods or services to customers.

D)decreases in retained earnings resulting from delivering goods or services to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

65

Dividends:

A)are expenses.

B)always affect net income.

C)are distributions to stockholders of assets (usually cash)generated by net income.

D)are distributions to stockholders of assets (usually cash)generated by a favorable balance in retained earnings.

A)are expenses.

B)always affect net income.

C)are distributions to stockholders of assets (usually cash)generated by net income.

D)are distributions to stockholders of assets (usually cash)generated by a favorable balance in retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

66

Ramos, Inc. has monthly revenues of $30,000 and monthly expenses of $18,000, and the company paid $4,000 in dividends. Therefore, net income for the month is $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

67

Yummy Inc. has beginning retained earnings of $10,000, net income of $50,000, and dividends paid of $5,000. Therefore, the ending retained Earnings is $65,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

68

Receivables are classified as:

A)increases in earnings.

B)decreases in earnings.

C)liabilities.

D)assets.

A)increases in earnings.

B)decreases in earnings.

C)liabilities.

D)assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

69

The economic resources of a business that are expected to produce a benefit in the future are:

A)liabilities.

B)assets.

C)owners' equity.

D)expenses.

A)liabilities.

B)assets.

C)owners' equity.

D)expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

70

The sum of "outsider claims" plus "insider claims" equals:

A)net income.

B)total liabilities.

C)total assets.

D)total stockholders' equity.

A)net income.

B)total liabilities.

C)total assets.

D)total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

71

Able Co. has $500,000 in assets and $400,000 in liabilities. Therefore, the equity is $900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

72

The major types of transactions that affect retained earnings are:

A)paid-in capital and common stock.

B)assets and liabilities.

C)revenues, expenses, and dividends.

D)revenues and liabilities.

A)paid-in capital and common stock.

B)assets and liabilities.

C)revenues, expenses, and dividends.

D)revenues and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following best describes a liability? Liabilities are:

A)a form of paid-in capital.

B)future economic benefits to which a company is entitled.

C)debts payable to outsiders called creditors.

D)economic obligations to owners to be paid at some future date by the corporation.

A)a form of paid-in capital.

B)future economic benefits to which a company is entitled.

C)debts payable to outsiders called creditors.

D)economic obligations to owners to be paid at some future date by the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

74

The accounting equation can be stated as:

A)Assets + Stockholders' Equity = Liabilities.

B)Assets -Liabilities = Stockholders' Equity.

C)Assets = Liabilities - Stockholders' Equity.

D)Assets - Stockholders' Equity + Liabilities = Zero.

A)Assets + Stockholders' Equity = Liabilities.

B)Assets -Liabilities = Stockholders' Equity.

C)Assets = Liabilities - Stockholders' Equity.

D)Assets - Stockholders' Equity + Liabilities = Zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

75

Expenses are:

A)increases in liabilities resulting from purchasing assets.

B)increases in assets resulting from operations.

C)increases in retained earnings resulting from operations.

D)decreases in retained earnings resulting from operations.

A)increases in liabilities resulting from purchasing assets.

B)increases in assets resulting from operations.

C)increases in retained earnings resulting from operations.

D)decreases in retained earnings resulting from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

76

A corporation's paid-in capital includes:

A)revenues and expenses.

B)assets and liabilities.

C)common stock.

D)net income.

A)revenues and expenses.

B)assets and liabilities.

C)common stock.

D)net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

77

Payables are classified as:

A)increases in earnings.

B)decreases in earnings.

C)liabilities.

D)assets.

A)increases in earnings.

B)decreases in earnings.

C)liabilities.

D)assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

78

The two main components of stockholders' equity are:

A)retained earnings and paid-in capital.

B)assets and liabilities.

C)paid-in capital and assets.

D)net income and retained earnings.

A)retained earnings and paid-in capital.

B)assets and liabilities.

C)paid-in capital and assets.

D)net income and retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is NOT an asset?

A)Inventory

B)Accounts payable

C)Accounts receivable

D)Cash

A)Inventory

B)Accounts payable

C)Accounts receivable

D)Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

80

The amount that stockholders have invested in a corporation is called:

A)retained earnings.

B)investment.

C)revenue.

D)paid-in capital.

A)retained earnings.

B)investment.

C)revenue.

D)paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck