Deck 24: Cost Allocation and Responsibility Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 24: Cost Allocation and Responsibility Accounting

1

Companies with diverse products can obtain better costing information by using a single plant wide rate.

False

2

Activity-based costing refines the cost allocation process even more than the traditional allocation costing.

True

3

Traditional costing provides more detailed information on costs of activities and the drivers of these costs than activity-based costing.

False

4

Which of the following is the most appropriate cost driver for allocating the cost of warranty services?

A)number of employees

B)number of materials purchased

C)number of machine hours

D)number of service calls

A)number of employees

B)number of materials purchased

C)number of machine hours

D)number of service calls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

Manufacturing overhead costs, which are also known as indirect costs, cannot be cost-effectively traced to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

Activity-based management focuses on making decisions that improve customers' satisfaction while also increasing profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

The main difference between activity-based costing and traditional costing systems is that activity-based costing uses a separate allocation base for each activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is correct regarding the activity-based costing system?

A)It uses separate indirect cost allocation rates for each activity.

B)It is not as accurate or precise as traditional costing systems.

C)It accumulates overhead costs by processing departments.

D)It is less complex and, therefore, less costly than traditional systems.

A)It uses separate indirect cost allocation rates for each activity.

B)It is not as accurate or precise as traditional costing systems.

C)It accumulates overhead costs by processing departments.

D)It is less complex and, therefore, less costly than traditional systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

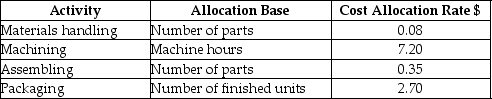

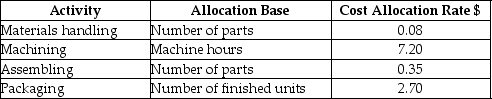

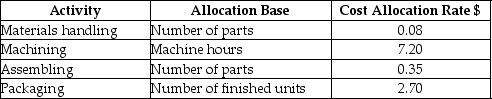

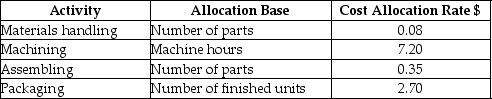

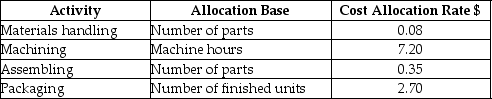

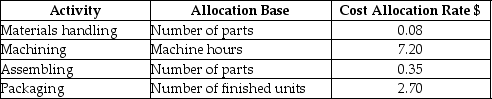

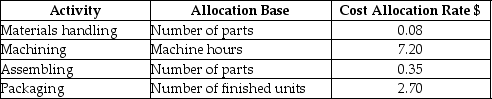

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts. The direct material cost is $95 and each ceiling fan requires 2.5 hours of machine time to manufacture. Additional information is as follows:  What is the cost of materials handling per ceiling fan?

What is the cost of materials handling per ceiling fan?

A)$1.60

B)$7.20

C)$6.00

D)$5.00

What is the cost of materials handling per ceiling fan?

What is the cost of materials handling per ceiling fan?A)$1.60

B)$7.20

C)$6.00

D)$5.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

The first step in developing an activity-based costing system is to identify the activities that will be used to assign the manufacturing overhead and estimate their total costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is the last step in developing an activity-based costing system?

A)estimate the total quantity of the cost driver

B)estimate the total indirect costs of each activity

C)identify the activities

D)allocate indirect costs to the cost object

A)estimate the total quantity of the cost driver

B)estimate the total indirect costs of each activity

C)identify the activities

D)allocate indirect costs to the cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

An activity-based costing system is developed in four steps. a. Compute the allocation rate for each activity

B. Identify activities and estimate their total costs

C. Identify the cost driver for each activity and then estimate the quantity of each driver's allocation base

D. Allocate the indirect costs to the cost object

Which of the following is the correct order of performing these steps?

A)a, b, c, d

B)c, a, b, d

C)b, c, a, d

D)b, a, c, d

B. Identify activities and estimate their total costs

C. Identify the cost driver for each activity and then estimate the quantity of each driver's allocation base

D. Allocate the indirect costs to the cost object

Which of the following is the correct order of performing these steps?

A)a, b, c, d

B)c, a, b, d

C)b, c, a, d

D)b, a, c, d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

Activity-based costing uses a common allocation base for all activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

Direct material costs and direct labor costs cannot be easily traced to products. Therefore, they are allocated to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

Traditional costing systems employ multiple allocation rates, but an activity-based costing system uses only one rate for allocating manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

Indirect costs allocated to products using activity-based costing are more accurate than traditional allocation systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

For a pharmaceutical company, the most suitable base for allocating research and development costs to the finished products would be:

A)direct labor hours.

B)cost of raw materials purchased.

C)number of new patents filed.

D)number of set ups.

A)direct labor hours.

B)cost of raw materials purchased.

C)number of new patents filed.

D)number of set ups.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

Activity-based costing focuses on a single predetermined overhead rate for cost analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

The predetermined overhead allocation rate is an estimated overhead cost per unit of the allocation base and is calculated at the beginning of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

Companies calculate predetermined overhead rate at the beginning of an accounting period using the actual values of overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

Archid, a manufacturer of spare parts, has two production departments: Assembling and Packaging. The Assembling department is machine oriented, while the Packaging department is labor oriented. Estimated manufacturing overhead costs for the year 2015 were $15,000,000 for Assembling and $10,000,000 for Packaging. Calculate departmental wide allocation rates if total estimated machine hours were 30,000 and labor hours were 20,000 for the year.

A)$250, $300

B)$500, $500

C)$300, $300

D)$450, $540

A)$250, $300

B)$500, $500

C)$300, $300

D)$450, $540

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would most likely be treated as an activity in an activity-based costing system?

A)Direct labor cost

B)Machine processing

C)Direct materials cost

D)Sales revenues

A)Direct labor cost

B)Machine processing

C)Direct materials cost

D)Sales revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts. The direct material cost is $95 and each ceiling fan requires 2.5 hours of machine time to manufacture. Additional information is as follows:  What is the cost of assembling per ceiling fan?

What is the cost of assembling per ceiling fan?

A)$87.50

B)$7.00

C)$7.50

D)$35.00

What is the cost of assembling per ceiling fan?

What is the cost of assembling per ceiling fan?A)$87.50

B)$7.00

C)$7.50

D)$35.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

Oscar prizes, a manufacturer of gift articles, uses a single plant wide rate to allocate indirect costs. The company allocates manufacturing overhead using a single plantwide rate with machine hours as the allocation base. Estimated overhead cost for the year is $5,000,000 and estimated machine hours are 25,000. During the year, the actual machine hours used were 30,000. Calculate the predetermined overhead allocation rate.

A)$166

B)$250

C)$200

D)$150

A)$166

B)$250

C)$200

D)$150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

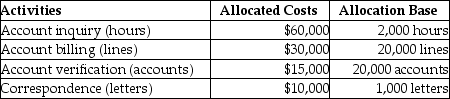

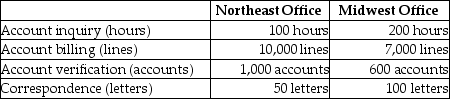

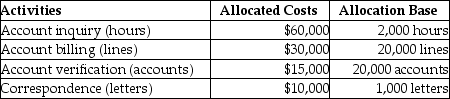

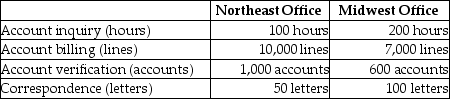

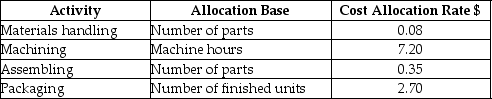

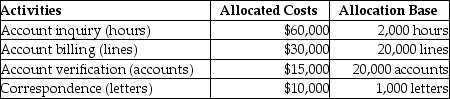

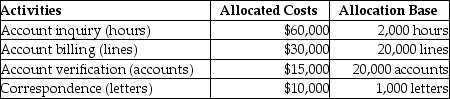

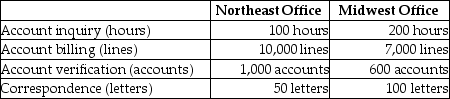

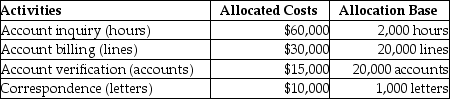

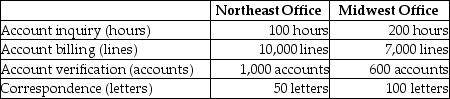

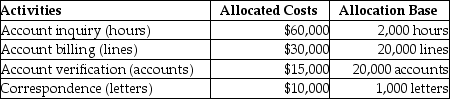

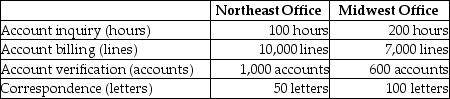

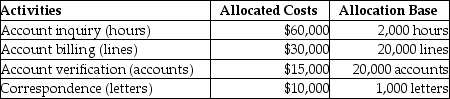

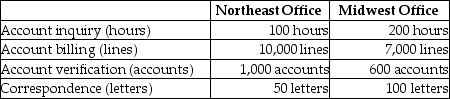

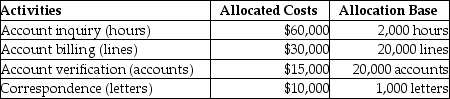

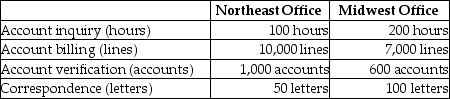

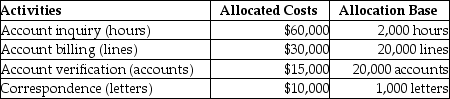

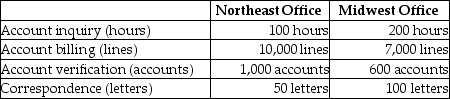

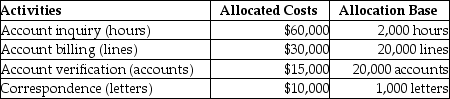

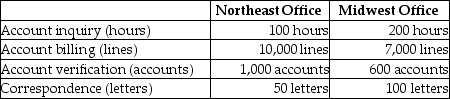

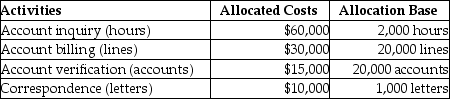

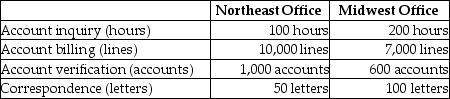

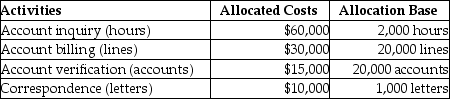

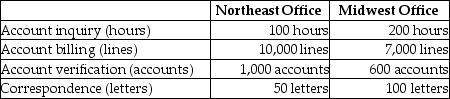

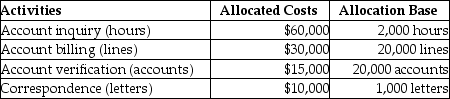

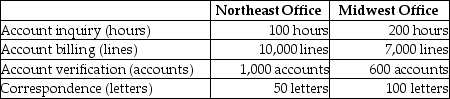

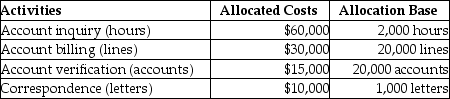

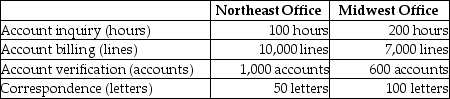

Pitt Jones Company had the following activities, allocated costs, and allocation bases:  The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per account for the account verification activity?

What is the cost per account for the account verification activity?

A)$30.00

B)$0.50

C)$2.25

D)$0.75

The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per account for the account verification activity?

What is the cost per account for the account verification activity?A)$30.00

B)$0.50

C)$2.25

D)$0.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts. The direct material cost is $95 and each ceiling fan requires 2.5 hours of machine time to manufacture. There is no direct labor cost. Additional information is as follows:  What is the total manufacturing cost per ceiling fan?

What is the total manufacturing cost per ceiling fan?

A)$125.75

B)$121.13

C)$115.32

D)$124.30

What is the total manufacturing cost per ceiling fan?

What is the total manufacturing cost per ceiling fan?A)$125.75

B)$121.13

C)$115.32

D)$124.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

Pitt Jones Company had the following activities, allocated costs, and allocation bases:  The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  How much of the account verification costs will be assigned to the Northeast Office?

How much of the account verification costs will be assigned to the Northeast Office?

A)$800

B)$2,500

C)$750

D)$1,500

The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  How much of the account verification costs will be assigned to the Northeast Office?

How much of the account verification costs will be assigned to the Northeast Office?A)$800

B)$2,500

C)$750

D)$1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

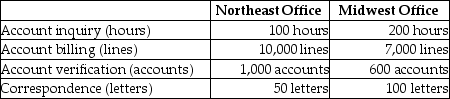

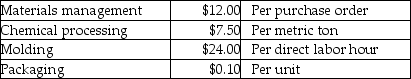

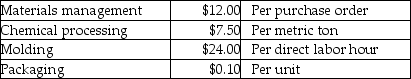

Ace Plastics produces different kinds of products, all in one manufacturing facility. They have identified four activities for their costing system:

Materials management-allocated by number of purchase orders

Chemical processing-allocated on metric tons

Molding-allocated on direct labor hours

Packaging-allocated by number of units produced

The activity rates are as follows: Engineering design shows that the order will require direct material worth $540, direct labor cost being $90, require 4 purchase orders to be placed, use 2 metric tons of chemical base, need 8 direct labor hours. The size of the order is to produce 3,000 units of product. Calculate total cost of production of the order.

Engineering design shows that the order will require direct material worth $540, direct labor cost being $90, require 4 purchase orders to be placed, use 2 metric tons of chemical base, need 8 direct labor hours. The size of the order is to produce 3,000 units of product. Calculate total cost of production of the order.

Materials management-allocated by number of purchase orders

Chemical processing-allocated on metric tons

Molding-allocated on direct labor hours

Packaging-allocated by number of units produced

The activity rates are as follows:

Engineering design shows that the order will require direct material worth $540, direct labor cost being $90, require 4 purchase orders to be placed, use 2 metric tons of chemical base, need 8 direct labor hours. The size of the order is to produce 3,000 units of product. Calculate total cost of production of the order.

Engineering design shows that the order will require direct material worth $540, direct labor cost being $90, require 4 purchase orders to be placed, use 2 metric tons of chemical base, need 8 direct labor hours. The size of the order is to produce 3,000 units of product. Calculate total cost of production of the order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

Pitt Jones Company had the following activities, allocated costs, and allocation bases:  The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  How much of the account inquiry cost will be assigned to the Midwest Office?

How much of the account inquiry cost will be assigned to the Midwest Office?

A)$2,000

B)$6,500

C)$3,000

D)$6,000

The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  How much of the account inquiry cost will be assigned to the Midwest Office?

How much of the account inquiry cost will be assigned to the Midwest Office?A)$2,000

B)$6,500

C)$3,000

D)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is true?

A)Many traditional costing systems can distort product costs and profitability.

B)Traditional costing systems tend to be more costly than activity-based costing systems.

C)Activity-based costing systems tend to combine various costs into a single cost pool.

D)Activity-based costing systems tend to use fewer cost pools than does a traditional costing system.

A)Many traditional costing systems can distort product costs and profitability.

B)Traditional costing systems tend to be more costly than activity-based costing systems.

C)Activity-based costing systems tend to combine various costs into a single cost pool.

D)Activity-based costing systems tend to use fewer cost pools than does a traditional costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

The activity-based costing system improves the allocation of:

A)indirect manufacturing costs.

B)direct labor.

C)direct materials.

D)sales commissions.

A)indirect manufacturing costs.

B)direct labor.

C)direct materials.

D)sales commissions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

Quality Stereo Company has provided the following information regarding its activity-based costing system: • Purchasing department costs are allocated based on the number of purchase orders and the cost allocation rate is $75 per purchase order.

• Assembly department costs are allocated based on the number of parts used and the cost allocation rate is $1.00 per part.

• Packaging department costs are allocated based on the number of units produced and the allocation rate is $2.00 per unit produced.

Each stereo produced has 50 parts, and the direct materials cost per unit is $70. There are no direct labor costs. Quality Stereo has an order for 1,000 stereos which will require 50 purchase orders in all. What is the total cost of the 1,000 stereos?

A)$125,750

B)$55,750

C)$123,750

D)$122,000

• Assembly department costs are allocated based on the number of parts used and the cost allocation rate is $1.00 per part.

• Packaging department costs are allocated based on the number of units produced and the allocation rate is $2.00 per unit produced.

Each stereo produced has 50 parts, and the direct materials cost per unit is $70. There are no direct labor costs. Quality Stereo has an order for 1,000 stereos which will require 50 purchase orders in all. What is the total cost of the 1,000 stereos?

A)$125,750

B)$55,750

C)$123,750

D)$122,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

Pitt Jones Company had the following activities, allocated costs, and allocation bases:  The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  How much of the correspondence cost will be assigned to the Northeast Office?

How much of the correspondence cost will be assigned to the Northeast Office?

A)$500

B)$1,200

C)$2,500

D)$800

The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  How much of the correspondence cost will be assigned to the Northeast Office?

How much of the correspondence cost will be assigned to the Northeast Office?A)$500

B)$1,200

C)$2,500

D)$800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

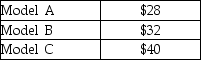

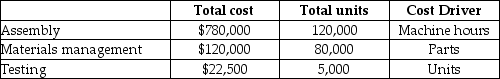

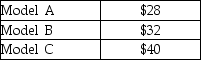

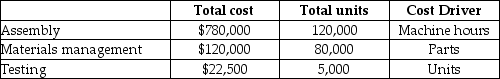

Orlando Avionics makes three types of radios for small aircraft: Model A, Model B, and Model C. The manufacturing operations are mechanized and there is no direct labor. Manufacturing overhead costs are significant, and Orlando has adopted an activity-based costing system. Direct materials costs per unit for each model are as follows:  Orlando has three activities: assembly, materials management, and testing. The cost driver for assembly is machine hours. The cost driver for materials management is number of parts, and the cost driver for testing is the number of units of product. Total costs and production volumes for the year 2015 were estimated as follows:

Orlando has three activities: assembly, materials management, and testing. The cost driver for assembly is machine hours. The cost driver for materials management is number of parts, and the cost driver for testing is the number of units of product. Total costs and production volumes for the year 2015 were estimated as follows:  The Model A radio requires 12 parts to construct, and requires 16 machine hours of processing. What is the manufacturing cost to make one unit of Model A?

The Model A radio requires 12 parts to construct, and requires 16 machine hours of processing. What is the manufacturing cost to make one unit of Model A?

A)$150.00

B)$132.00

C)$126.50

D)$154.50

Orlando has three activities: assembly, materials management, and testing. The cost driver for assembly is machine hours. The cost driver for materials management is number of parts, and the cost driver for testing is the number of units of product. Total costs and production volumes for the year 2015 were estimated as follows:

Orlando has three activities: assembly, materials management, and testing. The cost driver for assembly is machine hours. The cost driver for materials management is number of parts, and the cost driver for testing is the number of units of product. Total costs and production volumes for the year 2015 were estimated as follows:  The Model A radio requires 12 parts to construct, and requires 16 machine hours of processing. What is the manufacturing cost to make one unit of Model A?

The Model A radio requires 12 parts to construct, and requires 16 machine hours of processing. What is the manufacturing cost to make one unit of Model A?A)$150.00

B)$132.00

C)$126.50

D)$154.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts. The direct material cost is $95 and each ceiling fan requires 2.5 hours of machine time to manufacture. Additional information is as follows:  What is the cost of machining per ceiling fan?

What is the cost of machining per ceiling fan?

A)$18

B)$180

C)$30

D)$144

What is the cost of machining per ceiling fan?

What is the cost of machining per ceiling fan?A)$18

B)$180

C)$30

D)$144

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

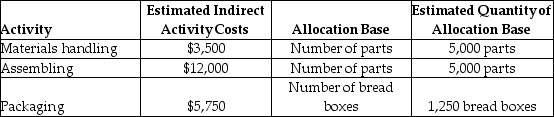

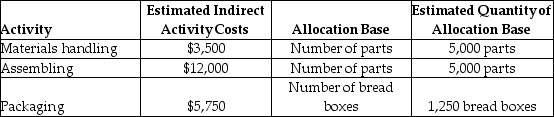

Alpha Company manufactures breadboxes and uses an activity-based costing system. The following information is provided for the month of May:  Each breadbox consists of 4 parts, and the direct materials cost per breadbox is $7.00. There is no direct labor. What is the total manufacturing cost per breadbox?

Each breadbox consists of 4 parts, and the direct materials cost per breadbox is $7.00. There is no direct labor. What is the total manufacturing cost per breadbox?

A)$17.40

B)$24.00

C)$12.40

D)$26.00

Each breadbox consists of 4 parts, and the direct materials cost per breadbox is $7.00. There is no direct labor. What is the total manufacturing cost per breadbox?

Each breadbox consists of 4 parts, and the direct materials cost per breadbox is $7.00. There is no direct labor. What is the total manufacturing cost per breadbox?A)$17.40

B)$24.00

C)$12.40

D)$26.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

Pitt Jones Company had the following activities, allocated costs, and allocation bases:  The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per letter for the correspondence activity?

What is the cost per letter for the correspondence activity?

A)$10.00

B)$30.50

C)$25.00

D)$0.75

The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per letter for the correspondence activity?

What is the cost per letter for the correspondence activity?A)$10.00

B)$30.50

C)$25.00

D)$0.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

Pitt Jones Company had the following activities, allocated costs, and allocation bases:  The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per hour for the account inquiry activity?

What is the cost per hour for the account inquiry activity?

A)$0.75

B)$30.00

C)$10.00

D)$1.50

The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per hour for the account inquiry activity?

What is the cost per hour for the account inquiry activity?A)$0.75

B)$30.00

C)$10.00

D)$1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

Pitt Jones Company had the following activities, allocated costs, and allocation bases:  The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per line for the account billing activity?

What is the cost per line for the account billing activity?

A)$1.50

B)$30.00

C)$1.60

D)$1.43

The above activities are carried out at two of their regional offices.

The above activities are carried out at two of their regional offices.  What is the cost per line for the account billing activity?

What is the cost per line for the account billing activity?A)$1.50

B)$30.00

C)$1.60

D)$1.43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

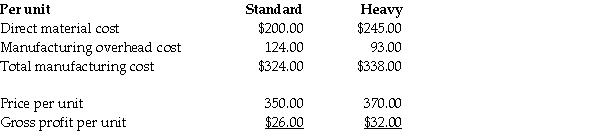

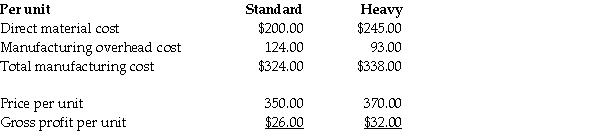

AAA Metal Bearings produces two sizes of metal bearings (sold by the crate)-standard and heavy. The standard bearings require $200 of direct materials per unit (per crate)and the heavy bearings require $245 of direct materials per unit. The operation is mechanized and there is no direct labor. Previously AAA used a single plant-wide allocation rate for manufacturing overhead, which was $1.55 per machine hour. Based on the single rate, gross profit was as follows:  Although the data showed that the heavy bearings were more profitable than the standard bearings, the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings, and that this factor was not adequately reflected in the single allocation rate. He suspected that it was distorting the profit data. He suggested adopting an activity-based costing approach.

Although the data showed that the heavy bearings were more profitable than the standard bearings, the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings, and that this factor was not adequately reflected in the single allocation rate. He suspected that it was distorting the profit data. He suggested adopting an activity-based costing approach.

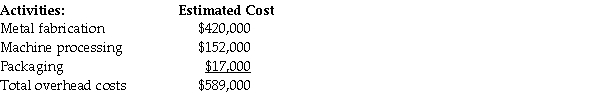

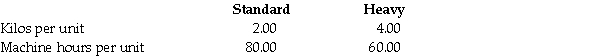

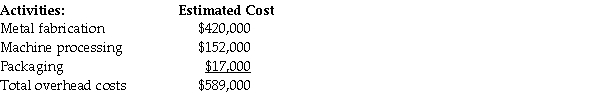

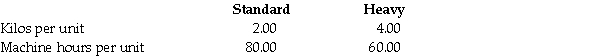

Working together, the engineers and accountants identified the following three manufacturing activities, and broke down the annual overhead costs as shown below: Engineers believed that metal fabrication costs should be allocated by weight, and estimated that the plant processed 12,000 kilos of metal per year. Machine processing costs were correlated to machine hours, and the engineers estimated a total of 380,000 machine hours for the year. Packaging costs were the same for both types of products, and so they could be allocated simply by the number of units produced. The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year. Additional data on a per unit basis was as given below:

Engineers believed that metal fabrication costs should be allocated by weight, and estimated that the plant processed 12,000 kilos of metal per year. Machine processing costs were correlated to machine hours, and the engineers estimated a total of 380,000 machine hours for the year. Packaging costs were the same for both types of products, and so they could be allocated simply by the number of units produced. The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year. Additional data on a per unit basis was as given below:  Using the data above, calculate activity rates. Then, following the ABC methodology, calculate the production cost and gross profit for one unit of standard bearings. (Round your intermediate calculations to two decimal places).

Using the data above, calculate activity rates. Then, following the ABC methodology, calculate the production cost and gross profit for one unit of standard bearings. (Round your intermediate calculations to two decimal places).

Although the data showed that the heavy bearings were more profitable than the standard bearings, the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings, and that this factor was not adequately reflected in the single allocation rate. He suspected that it was distorting the profit data. He suggested adopting an activity-based costing approach.

Although the data showed that the heavy bearings were more profitable than the standard bearings, the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings, and that this factor was not adequately reflected in the single allocation rate. He suspected that it was distorting the profit data. He suggested adopting an activity-based costing approach.Working together, the engineers and accountants identified the following three manufacturing activities, and broke down the annual overhead costs as shown below:

Engineers believed that metal fabrication costs should be allocated by weight, and estimated that the plant processed 12,000 kilos of metal per year. Machine processing costs were correlated to machine hours, and the engineers estimated a total of 380,000 machine hours for the year. Packaging costs were the same for both types of products, and so they could be allocated simply by the number of units produced. The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year. Additional data on a per unit basis was as given below:

Engineers believed that metal fabrication costs should be allocated by weight, and estimated that the plant processed 12,000 kilos of metal per year. Machine processing costs were correlated to machine hours, and the engineers estimated a total of 380,000 machine hours for the year. Packaging costs were the same for both types of products, and so they could be allocated simply by the number of units produced. The production plan provided for 4,000 units of standard and 1,000 units of heavy bearings to be produced during the year. Additional data on a per unit basis was as given below:  Using the data above, calculate activity rates. Then, following the ABC methodology, calculate the production cost and gross profit for one unit of standard bearings. (Round your intermediate calculations to two decimal places).

Using the data above, calculate activity rates. Then, following the ABC methodology, calculate the production cost and gross profit for one unit of standard bearings. (Round your intermediate calculations to two decimal places).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

Long-term investments are made by the manager of an investment division for the purpose of:

A)increasing profits.

B)decreasing profits.

C)increasing interest liability.

D)decreasing debt liability.

A)increasing profits.

B)decreasing profits.

C)increasing interest liability.

D)decreasing debt liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

A company in which major planning and controlling decisions are made by top management is considered as a centralized company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

Responsibility reports for a profit center includes:

A)revenues only.

B)invested capital.

C)both revenues and costs.

D)returns on investments.

A)revenues only.

B)invested capital.

C)both revenues and costs.

D)returns on investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

The payroll department of a manufacturing company is most likely to be a(n):

A)cost center.

B)revenue center.

C)investment center.

D)profit center.

A)cost center.

B)revenue center.

C)investment center.

D)profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

The responsibility report of Keith Paul, a manager of one of the divisions of a manufacturing company, includes profits as well as return on investment and residual income. Keith is most likely to the manager of a(n):

A)investment center.

B)profit center.

C)cost center.

D)revenue center.

A)investment center.

B)profit center.

C)cost center.

D)revenue center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

A system of evaluating the performance of each responsibility center and its manager is known as responsibility accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

Brad, one of the managers of a multi-national company, is responsible to generate revenues and control costs in order to increase the operating income of his division. However, he is not concerned with investment-related decisions. Brad is most likely to be the manager of a(n):

A)cost center.

B)investment center.

C)profit center.

D)revenue center.

A)cost center.

B)investment center.

C)profit center.

D)revenue center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

The term goal congruence refers to the:

A)matching of financial goal of the company with its nonfinancial goals.

B)aligning the goals of business segment managers with the goals of top management.

C)achievement of the goals set by the management by utilizing the resources available.

D)duplication of costs as a result of decentralization.

A)matching of financial goal of the company with its nonfinancial goals.

B)aligning the goals of business segment managers with the goals of top management.

C)achievement of the goals set by the management by utilizing the resources available.

D)duplication of costs as a result of decentralization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

Performance evaluation systems provide top management with a framework for maintaining control over the entire organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

The manager of a profit center is responsible for generating revenues and managing the center's invested capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

Centralized operations are better for small companies due to the smaller scope of their operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

The product line of a manufacturing company is most likely to be considered as:

A)cost centers.

B)profit centers.

C)revenue centers.

D)investment centers.

A)cost centers.

B)profit centers.

C)revenue centers.

D)investment centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following would most likely be evaluated using residual income?

A)cost center

B)profit center

C)revenue center

D)investment center

A)cost center

B)profit center

C)revenue center

D)investment center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

Centralized companies split their operations into different divisions, or operating units, and top management delegates decision making to the division/unit managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

In a decentralized company, all the planning and controlling decisions are made by the top management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is a disadvantage of decentralization?

A)increases the customer response time

B)only the top management is allowed to make decisions

C)demotivates employees as the decision making powers are not delegated

D)problems in achieving goal congruence

A)increases the customer response time

B)only the top management is allowed to make decisions

C)demotivates employees as the decision making powers are not delegated

D)problems in achieving goal congruence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

The manager of a cost center is responsible for controlling costs and generating revenues of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

The responsibilities of a manager of an investment center are to generate profits and to efficiently manage the center's invested capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

Communicating the expectations of top management to segment managers improves goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

One of the advantages of decentralization is that it allows top management to concentrate on long-term strategic planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

A good balanced scorecard focuses only on lead indicators, because lag indicators are not important for the scorecard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

A company that uses a balanced scorecard has established a KPI for product quality. If the actual warranty claims are higher than expected it indicates that the quality standards have been met.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

Sales revenue growth, gross margin growth, and return on investment are the key performance indicators (KPIs)for the:

A)financial perspective.

B)customer perspective.

C)internal business perspective.

D)learning and growth perspective.

A)financial perspective.

B)customer perspective.

C)internal business perspective.

D)learning and growth perspective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

A lag indicator is a performance measure that forecasts future performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a balanced scorecard, which of the following is a key performance indicator of the financial perspective?

A)hours of employee training

B)number of warranty claims

C)percentage of market share

D)return on investment

A)hours of employee training

B)number of warranty claims

C)percentage of market share

D)return on investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

Key performance indicators (KPIs)are summary performance measures that help managers assess whether the company is achieving its goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

The balanced scorecard is a performance evaluation system that requires management to consider financial performance measures of performance, but not nonfinancial measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following affects the company's ability to make on-time deliveries?

A)return on investment

B)product's price

C)warranty claims

D)production cycle time

A)return on investment

B)product's price

C)warranty claims

D)production cycle time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

In a balanced scorecard, which of the following is a key performance indicator of the customer perspective?

A)Defect rate

B)Employee satisfaction

C)Gross margin growth

D)Number of repeat customers

A)Defect rate

B)Employee satisfaction

C)Gross margin growth

D)Number of repeat customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following four perspectives of the balanced score card enables the management to answer the question: "How can we continue to improve and create value?"

A)financial perspective

B)customer perspective

C)internal business perspective

D)learning and growth perspective

A)financial perspective

B)customer perspective

C)internal business perspective

D)learning and growth perspective

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following perspectives of the balanced scorecard focuses on revenue growth and productivity?

A)financial perspective

B)customer perspective

C)internal business perspective

D)learning and growth perspective

A)financial perspective

B)customer perspective

C)internal business perspective

D)learning and growth perspective

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

Increased number of repeat customers and increased rate of on-time deliveries are the indicators of:

A)product quality.

B)market share.

C)customer satisfaction.

D)skills and knowledge of the employees.

A)product quality.

B)market share.

C)customer satisfaction.

D)skills and knowledge of the employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

The performance measurement system should provide incentives to segment managers for coordinating activities of the subunits and focusing them toward the overall company objectives. Which of the following performance measurement goals has been described by this statement?

A)Motivating segment managers

B)Promoting goal congruence

C)Providing feedback

D)Benchmarking

A)Motivating segment managers

B)Promoting goal congruence

C)Providing feedback

D)Benchmarking

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

One part of the balanced scorecard helps management answer the question "How do we look to shareholders?" Which of the four perspectives is being described here?

A)financial perspective

B)customer perspective

C)internal business perspective

D)learning and growth perspective

A)financial perspective

B)customer perspective

C)internal business perspective

D)learning and growth perspective

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

In a balanced scorecard, which of the following is a key performance indicator of the internal business perspective?

A)hours of employee training

B)number of warranty claims

C)percentage of market share

D)return on investment

A)hours of employee training

B)number of warranty claims

C)percentage of market share

D)return on investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

A high rate of employee turnover indicates that:

A)employees of the organization leave jobs frequently.

B)pay packages of employees are at par with that of industry.

C)the employees' retention ratio is also high.

D)employees also participate in the decision making process.

A)employees of the organization leave jobs frequently.

B)pay packages of employees are at par with that of industry.

C)the employees' retention ratio is also high.

D)employees also participate in the decision making process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

The goal of the balanced scorecard is to:

A)maximize profits.

B)maximize operational efficiency.

C)develop a set of organizational performance measures.

D)increase the market share and maximize shareholders' wealth.

A)maximize profits.

B)maximize operational efficiency.

C)develop a set of organizational performance measures.

D)increase the market share and maximize shareholders' wealth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

The practice of comparing a company's achievements against the best practices in the industry is known as goal congruence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements most accurately describes the company's "climate for action?"

A)a corporate culture that encourages communication, change, and growth

B)a corporate culture that is focused on strong, top-down command and control

C)a corporate culture which is aimed exclusively at period earnings

D)a corporate culture that encourages physical activity, sports and recreation to improve employee health and morale

A)a corporate culture that encourages communication, change, and growth

B)a corporate culture that is focused on strong, top-down command and control

C)a corporate culture which is aimed exclusively at period earnings

D)a corporate culture that encourages physical activity, sports and recreation to improve employee health and morale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following internal business perspective key performance indicators (KPIs)is commonly used to assess the innovation process?

A)number of new products developed

B)number of warranty claims

C)employee turnover rate

D)rate of on-time deliveries

A)number of new products developed

B)number of warranty claims

C)employee turnover rate

D)rate of on-time deliveries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck