Deck 11: Risk and Return in Capital Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/97

العب

ملء الشاشة (f)

Deck 11: Risk and Return in Capital Markets

1

Investors demand a higher return for investments that have larger fluctuations in values because

A)they do not like risk.

B)they invest for the long term.

C)they are risk seeking.

D)none of the above

A)they do not like risk.

B)they invest for the long term.

C)they are risk seeking.

D)none of the above

they do not like risk.

2

Versa Co share prices gave a realised return of 2%, -2%, 10%, and -10% over four successive quarters. What is the annual realised return for Versa Co for the year?

A)-1.04%

B)0.00%

C)2.50%

D)1.25%

A)-1.04%

B)0.00%

C)2.50%

D)1.25%

-1.04%

3

Suppose you bought a $55 share a month ago. It paid a dividend of $1.25 today and then you sold it for $54. What was your return on the investment?

A)0.45%

B)-1.00%

C)-2.00%

D)-0.99%

A)0.45%

B)-1.00%

C)-2.00%

D)-0.99%

0.45%

4

The total realised return earned from a stock investment comprises two components: dividend yield and capital gains yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

5

Your investment over one year yielded a capital gains yield of 5% and no dividend yield. If the sale price was $119 per share, what was the cost of the investment?

A)$113.33

B)$117.25

C)$111.67

D)$126.25

A)$113.33

B)$117.25

C)$111.67

D)$126.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

6

Greg purchased stock in Cockatoo Limited at a price of $89 per share one year ago. The company was acquired by Wombat Investments at a price of $10 per share. What is Greg's return on his investment?

A)-96.25%

B)-79.00%

C)-88.76%

D)-85.45%

A)-96.25%

B)-79.00%

C)-88.76%

D)-85.45%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

7

Suppose you bought a $100 share a month ago. It paid a dividend of $2 today and then you sold it for $99. What was your dividend yield and capital gains yield on the investment?

A)-2%, 1%

B)2%, 1%

C)2%, -1%

D)1%, 2%

A)-2%, 1%

B)2%, 1%

C)2%, -1%

D)1%, 2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

8

Suppose you bought a $98 share a month ago. It paid a dividend of $0.47 today and then you sold it for $99. What was your dividend yield and capital gains yield on the investment?

A)0.45%, 1.09%

B)0.47%, 1.02%

C)1.02%, 1.12%

D)0.47%, 1.08%

A)0.45%, 1.09%

B)0.47%, 1.02%

C)1.02%, 1.12%

D)0.47%, 1.08%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following investments offered the highest average annual return over the 20 years to June 2016?

A)Australian shares

B)Australian property

C)Australian bonds

D)Australian cash

A)Australian shares

B)Australian property

C)Australian bonds

D)Australian cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose you bought a $62 share a month ago. It paid a dividend of $0.75 today and then you sold it for $65. What was your return on the investment?

A)7.75%

B)6.00%

C)6.25%

D)6.05%

A)7.75%

B)6.00%

C)6.25%

D)6.05%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following investments offered the lowest average annual return over the 20 years to June 2016?

A)Australian bonds

B)Australian cash

C)Australian shares

D)Australian property

A)Australian bonds

B)Australian cash

C)Australian shares

D)Australian property

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

12

Investments with high returns are expected to have high variability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

13

Rational investors are not averse to moderate fluctuations in the value of their investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

14

On average, shares have delivered lower returns than bonds in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

15

The geometric average return will always be above the arithmetic average return, and the difference grows with the volatility of the annual returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

16

Suppose you bought a $100 share a month ago. It paid a dividend of $1 today and then you sold it for $100. What was your dividend yield and capital gains yield on the investment?

A)3%, 1%

B)2%, 1%

C)0%, 1%

D)1%, 0%

A)3%, 1%

B)2%, 1%

C)0%, 1%

D)1%, 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

17

Versa Co share prices gave a realised return of 5%, 5%, -10%, and -10% over four successive quarters. What is the annual realised return for Versa Co for the year?

A)-11.31%

B)-7.91%

C)-10.70%

D)-10.00%

A)-11.31%

B)-7.91%

C)-10.70%

D)-10.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

18

Historically, shares have delivered a ________ return on average compared to bonds but have experienced ________ fluctuations in values.

A)higher, higher

B)higher, lower

C)lower, lower

D)lower, higher

A)higher, higher

B)higher, lower

C)lower, lower

D)lower, higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

19

You own shares in Darling that were purchased at a price of $21 per share. Gorilla has offered to purchase Darling and buy your shares at a price of $31 per share. What will be your return if you tender your shares to Gorilla and the deal is completed?

A)43.34%

B)33.45%

C)49.65%

D)47.62%

A)43.34%

B)33.45%

C)49.65%

D)47.62%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

20

Suppose you bought a $58 share a month ago. It paid a dividend of $0.50 today and then you sold it for $62. What was your return on the investment?

A)7.80%

B)7.76%

C)7.98%

D)7.01%

A)7.80%

B)7.76%

C)7.98%

D)7.01%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the returns on a share index can be characterised by a normal distribution with mean 12%, the probability that returns will be lower than 12% over the next period equals

A)25%.

B)46%.

C)33%.

D)50%.

A)25%.

B)46%.

C)33%.

D)50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

22

If asset A's return is exactly two times asset B's return, then following risk return trade-off, the standard deviation of asset A should be ________ times the standard deviation of asset B.

A)1

B)3

C)2

D)4

A)1

B)3

C)2

D)4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

23

The S&P/ASX 200 index delivered a return of 5%, 5%, -10%, -10% over four successive years. What is the arithmetic average annual return per year?

A)-6.5%

B)5.5%

C)2.5%

D)-2.5%

A)-6.5%

B)5.5%

C)2.5%

D)-2.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

24

The S&P/ASX 200 index delivered a return of 2%, -2%, 10%, and -10% over four successive years. What is the arithmetic average annual return per year?

A)10%

B)2%

C)0%

D)6%

A)10%

B)2%

C)0%

D)6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

25

You purchase a 30-year, zero-coupon bond for a price of $20. The bond will pay back $100 after 30 years and make no interim payments. The annual compounded return (geometric average return)on this investment is

A)5.51%.

B)5.31%.

C)4.78%.

D)6.54%.

A)5.51%.

B)5.31%.

C)4.78%.

D)6.54%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

26

The standard deviation of returns of: I. small capitalisation shares is higher than that of large capitalisation shares.

II. large capitalisation shares is lower than that of corporate bonds.

III. corporate bonds is higher than that of Australian treasuries.

Which statement is true?

A)I and III

B)I only

C)I, II, and III

D)I and II

II. large capitalisation shares is lower than that of corporate bonds.

III. corporate bonds is higher than that of Australian treasuries.

Which statement is true?

A)I and III

B)I only

C)I, II, and III

D)I and II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

27

Fortescue Mining had realised returns of 10%, 20%, 20% and 10% over four quarters. What is the quarterly standard deviation of returns for Fortescue calculated from this sample?

A)5.11%

B)5.00%

C)5.99%

D)5.77%

A)5.11%

B)5.00%

C)5.99%

D)5.77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

28

The S&P/ASX 200 index delivered a return of 30%, -20%, -10%, and 5% over four successive years. What is the arithmetic average annual return per year?

A)-5.50%

B)3.75%

C)5.5%

D)1.25%

A)-5.50%

B)3.75%

C)5.5%

D)1.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

29

A security returns 5%, 4%, 3% and 6% over four years. The standard deviation of returns of the security is:

A)1.51%.

B)1.00%.

C)1.29%.

D)1.11%.

A)1.51%.

B)1.00%.

C)1.29%.

D)1.11%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

30

Versa Co share prices gave a realised return of 30%, -20%, -10%, and 5% over four successive quarters. What is the annual realised return for Versa Co for the year?

A)-5.00%

B)5.00%

C)-1.27%

D)-1.72%

A)-5.00%

B)5.00%

C)-1.27%

D)-1.72%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

31

Bear Inc.'s share price closed at $100, $105, $56, $30, $2 over five successive weeks. The weekly standard deviation of the stock price calculated from this sample is

A)$44.43.

B)$50.25.

C)$29.76.

D)$35.23.

A)$44.43.

B)$50.25.

C)$29.76.

D)$35.23.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

32

If returns on security A are more volatile than the returns on security B, the geometric average return of security A is ________ the geometric average return of security B when their arithmetic average return is the same.

A)lower than

B)the same as

C)higher than

D)cannot say for sure

A)lower than

B)the same as

C)higher than

D)cannot say for sure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

33

Fortescue had realised returns of 10%, 25%, -20% and -15% over four quarters. What is the quarterly standard deviation of returns for Fortescue?

A)19.67%

B)25.32%

C)23.13%

D)21.21%

A)19.67%

B)25.32%

C)23.13%

D)21.21%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

34

The geometric average annual return for a large capitalisation share portfolio is 12% for ten years and 5% per year for the next five years. The geometric average annual return for the entire 15-year period is

A)9.11%.

B)9.95%.

C)9.62%.

D)10.23%.

A)9.11%.

B)9.95%.

C)9.62%.

D)10.23%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

35

Fortescue Mining had realised returns of 5%, 15%, -10%, and -5% over four quarters. What is the quarterly standard deviation of returns for Fortescue?

A)10.31%

B)9.91%

C)11.09%

D)10.71%

A)10.31%

B)9.91%

C)11.09%

D)10.71%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

36

IGM Realty had a price of $30, $30, $35, $33 and $25 at the end of the last five quarters. If IGM pays a dividend of $2 at the end of each quarter, what is the annual realised return on IGM?

A)7.6%

B)8.09%

C)7.10%

D)8.61%

A)7.6%

B)8.09%

C)7.10%

D)8.61%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

37

Suppose that an investment gave a realised return of 20% over a two-year time period and a 10% return over the third year. The geometric average annual return is

A)9.70%.

B)14.96%.

C)16.55%.

D)11.20%.

A)9.70%.

B)14.96%.

C)16.55%.

D)11.20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

38

You purchased HIH shares at a price of $30 per share. Its price was $20 after six months and the company declared bankruptcy at the end of the next six months. The realised return over the last year is

A)-150%.

B)-100%.

C)-75%.

D)-99%.

A)-150%.

B)-100%.

C)-75%.

D)-99%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

39

If a share pays dividends at the end of each quarter, with realised returns of R1, R2, R3 and R4 each quarter, then the annual realised return is calculated as:

A)Rannual = R1 + R2 + R3 + R4.

B)Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4)- 1.

C)Rannual =.

D)Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4).

A)Rannual = R1 + R2 + R3 + R4.

B)Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4)- 1.

C)Rannual =.

D)Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose the quarterly arithmetic average return for a security is 5% per quarter and the security gives a return of 10% each over the next two quarters. The arithmetic average return over the six quarters is

A)7.5%.

B)9%.

C)6.67%.

D)10%.

A)7.5%.

B)9%.

C)6.67%.

D)10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

41

There is a clear link between the volatility of returns for individual shares and the returns for individual shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

42

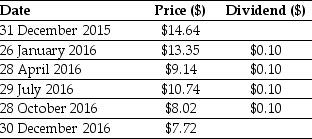

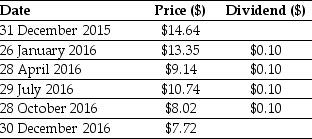

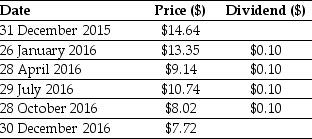

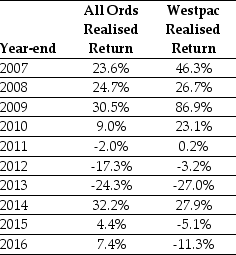

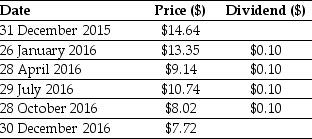

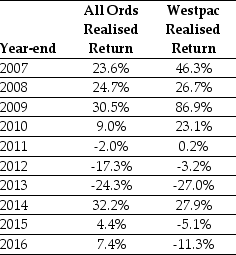

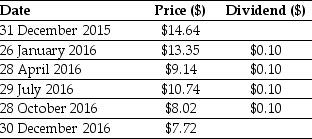

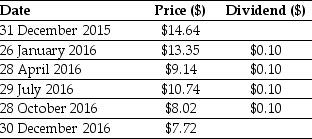

Use the table for the question(s)below.

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it after the dividend had been paid at the closing price on 26 January 2016. Your capital gains rate (yield)for this period is closest to:

A)0.75%

B)-8.15%

C)0.70%

D)-8.80%

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it after the dividend had been paid at the closing price on 26 January 2016. Your capital gains rate (yield)for this period is closest to:

A)0.75%

B)-8.15%

C)0.70%

D)-8.80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

43

Investments in Treasury bills have historically witnessed the lowest volatility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

44

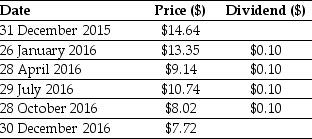

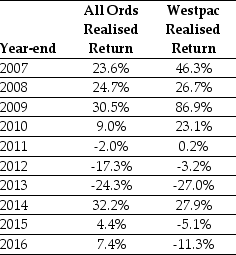

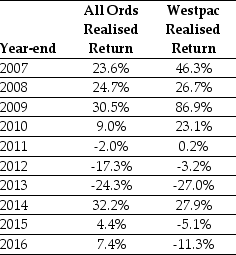

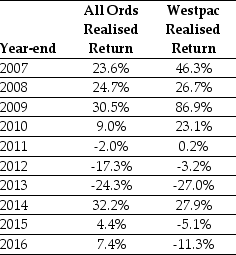

Use the table for the question(s)below.

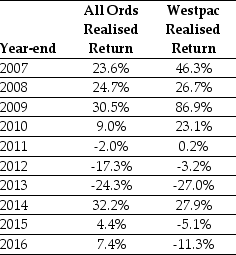

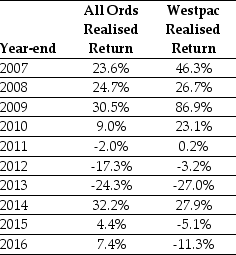

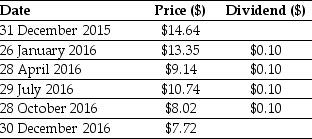

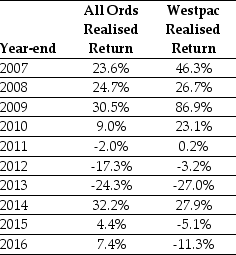

Consider the following realised annual returns:

McCoy paid a one-time special dividend of $3.20 on 18 October 2016. Suppose you bought McCoy stock for $47.00 on 18 July 2016, and sold it immediately after the dividend was paid for $63.32. What was your realised return from holding McCoy stock?

A)41.5%

B)6.8%

C)34.7%

D)4.15%

Consider the following realised annual returns:

McCoy paid a one-time special dividend of $3.20 on 18 October 2016. Suppose you bought McCoy stock for $47.00 on 18 July 2016, and sold it immediately after the dividend was paid for $63.32. What was your realised return from holding McCoy stock?

A)41.5%

B)6.8%

C)34.7%

D)4.15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the table for the question(s)below.

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it at the closing price on 30 December 2016. Your realised annual return for the year 2016 is closest to:

A)-44.5%

B)-47.3%

C)-48.5%

D)-45.1%

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it at the closing price on 30 December 2016. Your realised annual return for the year 2016 is closest to:

A)-44.5%

B)-47.3%

C)-48.5%

D)-45.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

46

Rational investors are unwilling to choose an investment that has additional risk but does not offer additional reward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

47

Historical evidence on the returns of large portfolios of shares and bonds shows that investments with higher volatility have rewarded investors with higher returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

48

Assume that the average annual historical return for shares that comprise the Australian All Ordinaries index is 10%, and the standard deviation of returns is 20%. Based on these numbers, what is a 95% prediction interval for 2016 returns?

A)-15%, 25%

B)-30%, 50%

C)-20%, 40%

D)-30%, 40%

A)-15%, 25%

B)-30%, 50%

C)-20%, 40%

D)-30%, 40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the information for the question(s)below.

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on a portfolio of 20 type U firms is closest to:

A)5.10%

B)23.0%

C)15.0%

D)5.25%

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on a portfolio of 20 type U firms is closest to:

A)5.10%

B)23.0%

C)15.0%

D)5.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the table for the question(s)below.

Consider the following realised annual returns:

The average annual return on the All Ords from 2007 to 2016 is closest to:

A)4.00%

B)9.75%

C)7.10%

D)8.75%

Consider the following realised annual returns:

The average annual return on the All Ords from 2007 to 2016 is closest to:

A)4.00%

B)9.75%

C)7.10%

D)8.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the information for the question(s)below.

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

What is the expected return for an individual firm?

A)14%

B)5%

C)3%

D)-5%

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

What is the expected return for an individual firm?

A)14%

B)5%

C)3%

D)-5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

52

Volatility is a reasonable measure of risk for large portfolios, once it is fully diversified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the table for the question(s)below.

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it after the dividend had been paid at the closing price on 26 January 2016. Your dividend yield for this period is closest to:

A)-8.15%

B)0.70%

C)-8.80%

D)0.75%

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it after the dividend had been paid at the closing price on 26 January 2016. Your dividend yield for this period is closest to:

A)-8.15%

B)0.70%

C)-8.80%

D)0.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume that the average annual historical return for shares that comprise the Australian All Ordinaries index is 12%, and the standard deviation of returns is 20%. Based on these numbers what is a 95% prediction interval for 2016 returns?

A)-20%, 35%

B)-10%, 40%

C)-28%, 52%

D)-15%, 35%

A)-20%, 35%

B)-10%, 40%

C)-28%, 52%

D)-15%, 35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the table for the question(s)below.

Consider the following realised annual returns:

The average annual return on Westpac from 2007 to 2016 is closest to:

A)29.9%

B)18.2%

C)18.7%

D)16.40%

Consider the following realised annual returns:

The average annual return on Westpac from 2007 to 2016 is closest to:

A)29.9%

B)18.2%

C)18.7%

D)16.40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the table for the question(s)below.

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it after the dividend had been paid at the closing price on 26 January 2016. Your total return rate (yield)for this period is closest to:

A)0.70%

B)-8.80%

C)0.75%

D)-8.13%

Consider the following price and dividend data for Cockatoo Limited:

Assume that you purchased Cockatoo shares at the closing price on 31 December 2015 and sold it after the dividend had been paid at the closing price on 26 January 2016. Your total return rate (yield)for this period is closest to:

A)0.70%

B)-8.80%

C)0.75%

D)-8.13%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the information for the question(s)below.

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on a portfolio of 20 type S firms is closest to:

A)5.25%

B)15.0%

C)23.0%

D)5.10%

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on a portfolio of 20 type S firms is closest to:

A)5.25%

B)15.0%

C)23.0%

D)5.10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the information for the question(s)below.

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on an individual firm is closest to:

A)15.0%

B)10.0%

C)23.0%

D)5.25%

Consider an economy with two types of firms: S and U. The S firms always move together, but U firms move independently of each other. For both types of firms there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on an individual firm is closest to:

A)15.0%

B)10.0%

C)23.0%

D)5.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the table for the question(s)below.

Consider the following realised annual returns:

McCoy paid a one-time special dividend of $3.20 on 18 October 2016. Suppose you bought McCoy stock for $47.00 on 18 July 2016, and sold it immediately after the dividend was paid for $63.32. What was your capital gain yield from holding McCoy stock?

A)6.8%

B)41.5%

C)34.7%

D)4.15%

Consider the following realised annual returns:

McCoy paid a one-time special dividend of $3.20 on 18 October 2016. Suppose you bought McCoy stock for $47.00 on 18 July 2016, and sold it immediately after the dividend was paid for $63.32. What was your capital gain yield from holding McCoy stock?

A)6.8%

B)41.5%

C)34.7%

D)4.15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

60

Assume that the average annual historical return for shares that comprise the Australian All Ordinaries index is 10.5%, and the standard deviation of returns is 18.5%. Based on these numbers what is a 95% prediction interval for 2016 returns?

A)-10%, 10%

B)-18.5%, 18.5%

C)-26.5%, 47.5%

D)-37%, 37%

A)-10%, 10%

B)-18.5%, 18.5%

C)-26.5%, 47.5%

D)-37%, 37%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

61

Two poker machines offer to double your money 3 times out of 5. Machine A takes $10 bets and Machine B takes $100 bets on each occasion. A risk-averse investor prefers to bet on

A)machine A.

B)machine B.

C)does not matter

D)none of the above

A)machine A.

B)machine B.

C)does not matter

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

62

While ________ seems to be a reasonable measure of risk when evaluating a large portfolio, the ________ of an individual security does not explain the size of its average return.

A)the mean return, standard deviation

B)volatility, volatility

C)mode, volatility

D)interest rate, cash flow

A)the mean return, standard deviation

B)volatility, volatility

C)mode, volatility

D)interest rate, cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements is TRUE?

A)On average, Treasury notes have higher returns than world shares.

B)On average, smaller cap shares have lower returns than larger cap shares.

C)Portfolios of smaller cap shares are typically less volatile than individual small cap shares.

D)On average, smaller cap shares have lower volatility than Treasury notes.

A)On average, Treasury notes have higher returns than world shares.

B)On average, smaller cap shares have lower returns than larger cap shares.

C)Portfolios of smaller cap shares are typically less volatile than individual small cap shares.

D)On average, smaller cap shares have lower volatility than Treasury notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the information for the question(s)below.

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the diversification achieved by an investor if he invests in Commonwealth Bank, ANZ Bank and Westpac?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the diversification achieved by an investor if he invests in Commonwealth Bank, ANZ Bank and Westpac?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

65

Volatility a reasonable measure of risk when evaluating the investment in a single share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

66

Independent risks can be diversified by holding a large number of uncorrelated assets with independent risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

67

A portfolio of shares where each share has a large component of independent risk benefits when such shares are held in a portfolio, because the independent risks are averaged out. This is also referred to as 'diversification of risks'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

68

Common risk is also called 'correlated risk'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

69

When looking at investment portfolios historically, is there a pattern between returns and volatility?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

70

Use the information for the question(s)below.

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the expected payoff for Big Cure's blockbuster drug?

A)$500 million

B)$100 million

C)$0

D)$1 billion

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the expected payoff for Big Cure's blockbuster drug?

A)$500 million

B)$100 million

C)$0

D)$1 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements is FALSE?

A)Expected return should rise proportionately with volatility.

B)The shares of the largest companies are typically more volatile than a portfolio of large cap shares.

C)Investors would not choose to hold a portfolio that is more volatile unless they expected to earn a higher return.

D)Smaller company shares have lower volatility than larger stocks.

A)Expected return should rise proportionately with volatility.

B)The shares of the largest companies are typically more volatile than a portfolio of large cap shares.

C)Investors would not choose to hold a portfolio that is more volatile unless they expected to earn a higher return.

D)Smaller company shares have lower volatility than larger stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

72

Investors should earn a risk premium for bearing unsystematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

73

A portfolio of shares can achieve diversification benefits if the shares that comprise the portfolio are

A)susceptible to common risks only.

B)not perfectly correlated.

C)perfectly correlated.

D)both B and C

A)susceptible to common risks only.

B)not perfectly correlated.

C)perfectly correlated.

D)both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

74

A share whose return does not depend on overall economic conditions has a low systematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following statements is FALSE?

A)Investments with higher volatility have rewarded investors with higher average returns.

B)Riskier investments must offer investors higher average returns to compensate them for the extra risk they are taking on.

C)Volatility seems to be a reasonable measure of risk when evaluating returns on large portfolios and the returns of individual securities.

D)Investments with higher volatility should have a higher risk premium and, therefore, higher returns.

A)Investments with higher volatility have rewarded investors with higher average returns.

B)Riskier investments must offer investors higher average returns to compensate them for the extra risk they are taking on.

C)Volatility seems to be a reasonable measure of risk when evaluating returns on large portfolios and the returns of individual securities.

D)Investments with higher volatility should have a higher risk premium and, therefore, higher returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the information for the question(s)below.

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the diversification achieved by an investor if he invests in Wesfarmers, National Australia Bank and BHP Billiton?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the diversification achieved by an investor if he invests in Wesfarmers, National Australia Bank and BHP Billiton?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

77

There is an overall relationship between ________ and ________-larger stocks have a lower volatility overall.

A)size, risk

B)volatility, mean

C)mean, standard deviation

D)risk aversion, size

A)size, risk

B)volatility, mean

C)mean, standard deviation

D)risk aversion, size

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

78

The risk that inflation rates are likely to increase in the next year is an example of 'common risk'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements is FALSE?

A)Portfolios of large cap shares are typically less volatile than individual large cap shares.

B)On average, Treasury notes have lower returns than corporate bonds.

C)On average, larger cap shares have higher volatility than smaller cap shares.

D)On average, smaller cap shares have higher returns than larger cap shares.

A)Portfolios of large cap shares are typically less volatile than individual large cap shares.

B)On average, Treasury notes have lower returns than corporate bonds.

C)On average, larger cap shares have higher volatility than smaller cap shares.

D)On average, smaller cap shares have higher returns than larger cap shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the information for the question(s)below.

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the expected payoff for Little Cure's 10 drugs?

A)$1 billion

B)$500 million

C)$100 million

D)$0

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential 'blockbuster' drug before the Therapeutic Goods Administration (TGA)waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate, less important drugs before the TGA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the TGA approving a drug is 50%.

What is the expected payoff for Little Cure's 10 drugs?

A)$1 billion

B)$500 million

C)$100 million

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck