Deck 2: Introduction to Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 2: Introduction to Financial Statement Analysis

1

Financial statements are accounting reports issued periodically by a firm which present information on the past performance of the firm, a summary of the firm's assets and the financing of those assets, and a prediction of the firm's future performance.

False

2

International Financial Reporting Standards are taking root throughout the world. However, it is unlikely that Australia will report according to IFRS before the second half of the 21st century.

False

3

What is the main problem in using a balance sheet to provide an accurate assessment of the value of a company's equity?

A)The balance sheet does not accurately represent the book value of assets held by the company.

B)The equity shown on the balance sheet does not reflect the market capitalisation of the company.

C)Knowing at a single point in time what assets a firm possesses and the liabilities a firm owes does not give any indication of what those assets can produce in the future.

D)Valuable assets such as the company's reputation, the quality of its work force, and the strength of its management are not captured on the balance sheet.

A)The balance sheet does not accurately represent the book value of assets held by the company.

B)The equity shown on the balance sheet does not reflect the market capitalisation of the company.

C)Knowing at a single point in time what assets a firm possesses and the liabilities a firm owes does not give any indication of what those assets can produce in the future.

D)Valuable assets such as the company's reputation, the quality of its work force, and the strength of its management are not captured on the balance sheet.

Valuable assets such as the company's reputation, the quality of its work force, and the strength of its management are not captured on the balance sheet.

4

Which of the following amounts would be included on the right side of a balance sheet?

A)the amount of money owed to the company by customers who have not yet paid for goods and services they have received

B)the amount of deferred tax liability held by the company

C)the value of government bonds held by the company

D)the cash held by the company

A)the amount of money owed to the company by customers who have not yet paid for goods and services they have received

B)the amount of deferred tax liability held by the company

C)the value of government bonds held by the company

D)the cash held by the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following best describes why firms produce financial statements?

A)to provide interested parties, both inside and outside the company, with an overview of the short- and long-term financial condition of a business

B)to show what activities the company has undertaken in the previous financial year, and what activities are planned for the near future

C)to provide a means of enticing new investors to a firm

D)to use as a tool when planning future investments within the firm

A)to provide interested parties, both inside and outside the company, with an overview of the short- and long-term financial condition of a business

B)to show what activities the company has undertaken in the previous financial year, and what activities are planned for the near future

C)to provide a means of enticing new investors to a firm

D)to use as a tool when planning future investments within the firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following best describes why the left and right sides of a balance sheet are equal?

A)By definition, the assets plus the liabilities will be the same as the shareholders' equity.

B)In a properly run business, the value of liabilities will not exceed the assets held by the company.

C)The assets must equal liabilities plus shareholders' equity, because shareholders' equity is the difference between the assets and the liabilities.

D)By accounting convention, the assets of a company must be equal to the liabilities of that company.

A)By definition, the assets plus the liabilities will be the same as the shareholders' equity.

B)In a properly run business, the value of liabilities will not exceed the assets held by the company.

C)The assets must equal liabilities plus shareholders' equity, because shareholders' equity is the difference between the assets and the liabilities.

D)By accounting convention, the assets of a company must be equal to the liabilities of that company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

Shareholders' equity is the difference between a firm's assets and liabilities, as shown on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

8

The third party who checks annual financial statements to ensure that they are prepared according to Generally Accepted Accounting Principles (GAAP)and verifies that the information reported is reliable is the

A)Australian Securities and Investments Commission (ASIC).

B)auditor.

C)Australian Securities Exchange.

D)Australian Accounting Standards Board.

A)Australian Securities and Investments Commission (ASIC).

B)auditor.

C)Australian Securities Exchange.

D)Australian Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

A small company has current assets of $1 112 000 and current liabilities of $717 000. Which of the following statements about that company is most likely to be true?

A)Since net working capital is nearly zero, the company is well run and will have little difficulty attracting investors.

B)Since net working capital is negative, the company will not have enough funds to meet its obligations.

C)Since net working capital is high, the company will likely have little difficulty meeting its obligations.

D)Since net working capital is very high, the company will have ample money to invest after it meets its obligations.

A)Since net working capital is nearly zero, the company is well run and will have little difficulty attracting investors.

B)Since net working capital is negative, the company will not have enough funds to meet its obligations.

C)Since net working capital is high, the company will likely have little difficulty meeting its obligations.

D)Since net working capital is very high, the company will have ample money to invest after it meets its obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is NOT one of the financial statements that must be produced by a public company?

A)the statement of cash flows

B)the statement of activities

C)the income statement

D)the balance sheet

A)the statement of cash flows

B)the statement of activities

C)the income statement

D)the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

A delivery company is creating a balance sheet. Which of the following would most likely be considered a short-term liability on this balance sheet?

A)revenue received for the delivery of items that have not yet been delivered

B)the depreciation over the last year in the value of the vehicles owned by the company

C)a loan which must be paid back in two years' time

D)prepaid rent on the offices occupied by the company

A)revenue received for the delivery of items that have not yet been delivered

B)the depreciation over the last year in the value of the vehicles owned by the company

C)a loan which must be paid back in two years' time

D)prepaid rent on the offices occupied by the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

The International Financial Reporting Standards set out by the International Accounting Standards Board are NOT accepted by the exchanges in which of the following countries or regions?

A)France

B)the United Kingdom

C)the United States

D)Germany

A)France

B)the United Kingdom

C)the United States

D)Germany

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

What are the four financial statements that all public companies must produce?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

The balance sheet shows the assets, liabilities, and shareholders' equity of a firm at a given point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is NOT a financial statement that every public company is required to produce?

A)statement of sources and uses of cash

B)income statement

C)balance sheet

D)statement of changes in equity

A)statement of sources and uses of cash

B)income statement

C)balance sheet

D)statement of changes in equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is the main reason that it is necessary for public companies to follow the rules and format set out in the Generally Accepted Accounting Principles (GAAP)when creating financial statements?

A)It makes it easier to compare the financial results of different firms.

B)It ensures that important information is not omitted and superfluous information is not included.

C)It is easier to find specific information in such a report if it is laid out in a clear and consistent manner.

D)It ensures that information on the performance of private companies is readily available to the public.

A)It makes it easier to compare the financial results of different firms.

B)It ensures that important information is not omitted and superfluous information is not included.

C)It is easier to find specific information in such a report if it is laid out in a clear and consistent manner.

D)It ensures that information on the performance of private companies is readily available to the public.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is the role of an auditor in financial statement analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

In Australia, publicly traded companies can choose whether or not they wish to release periodic financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

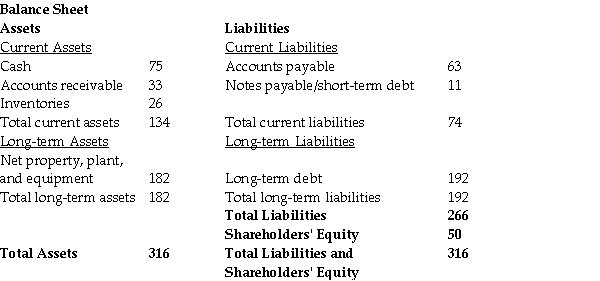

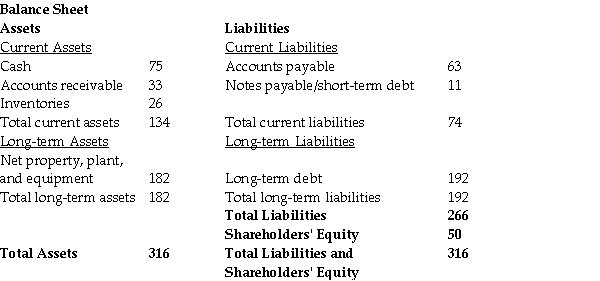

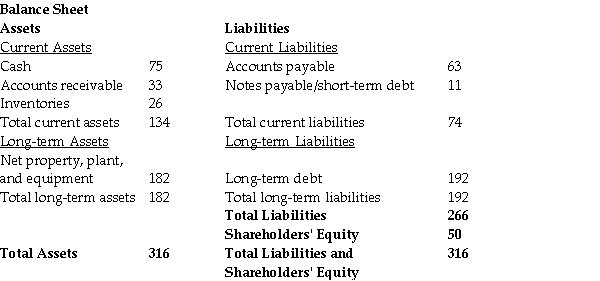

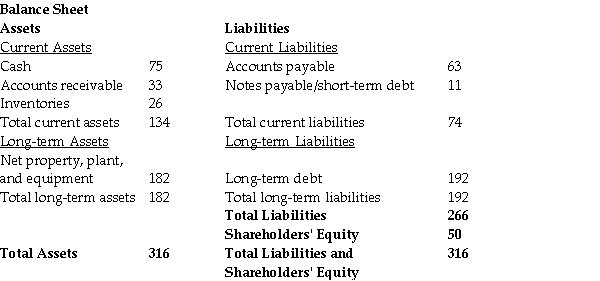

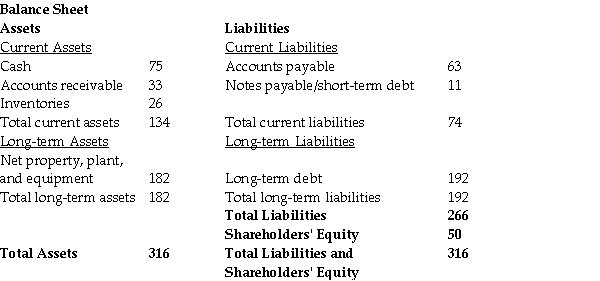

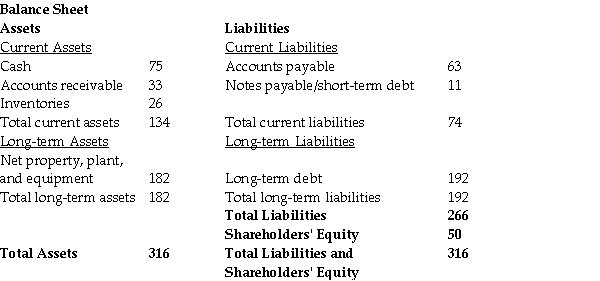

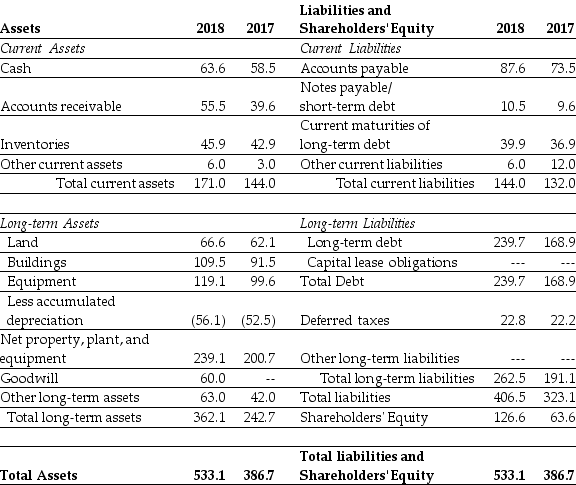

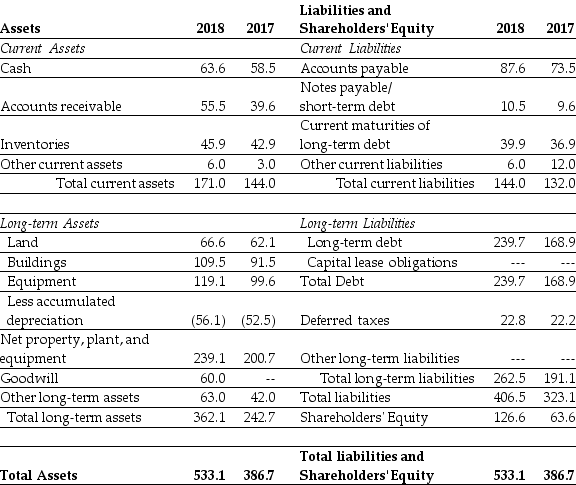

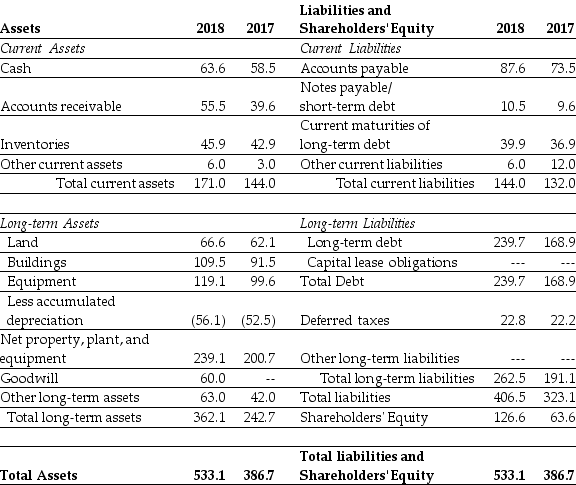

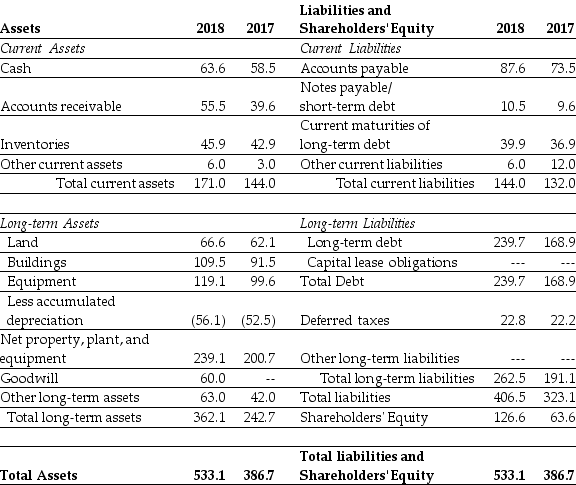

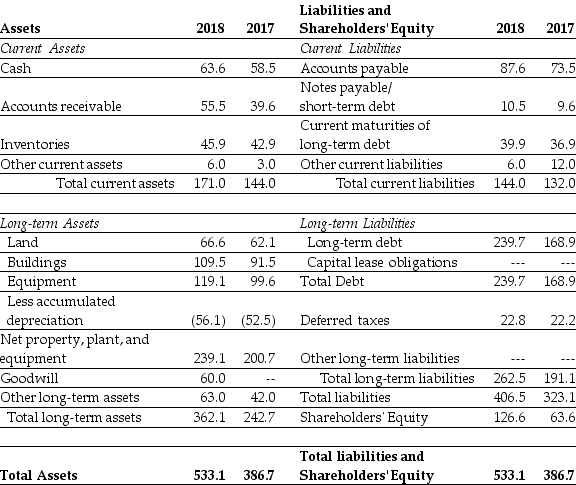

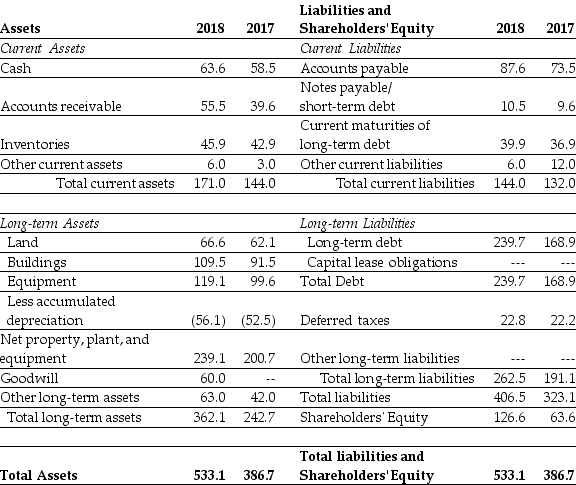

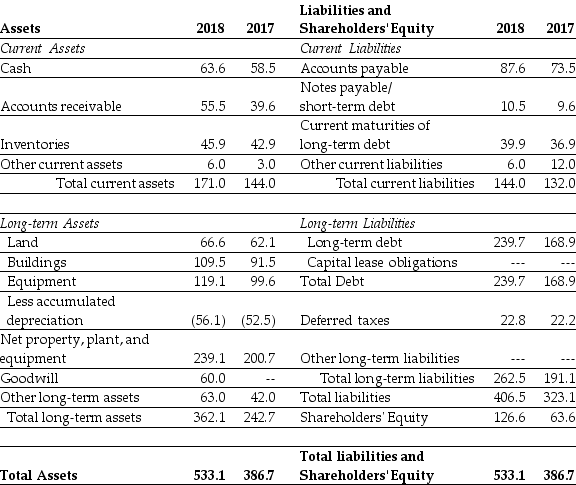

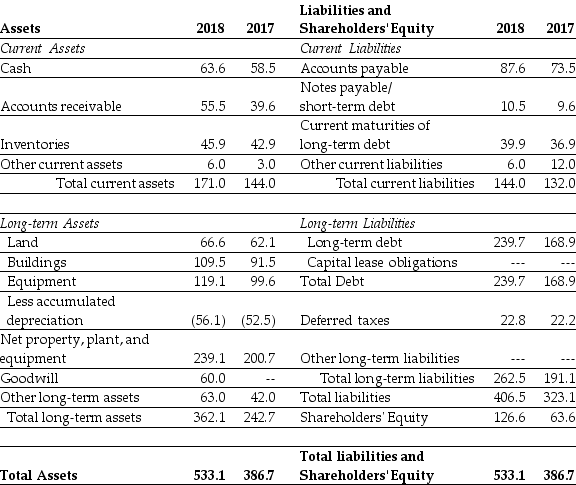

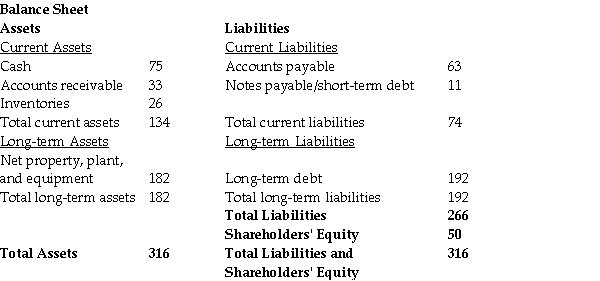

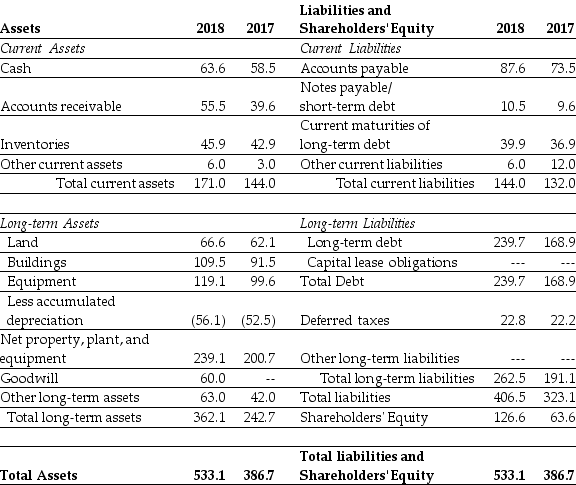

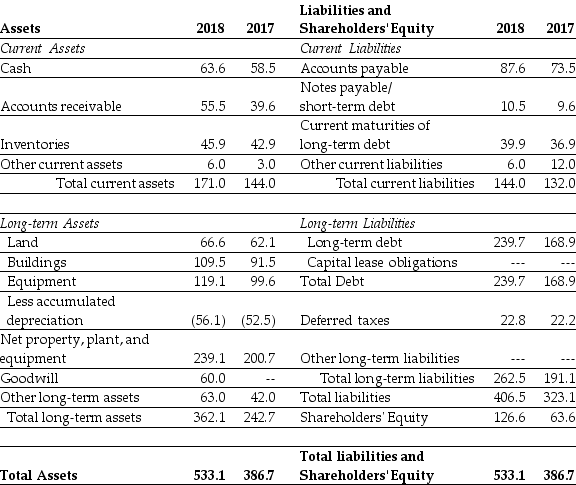

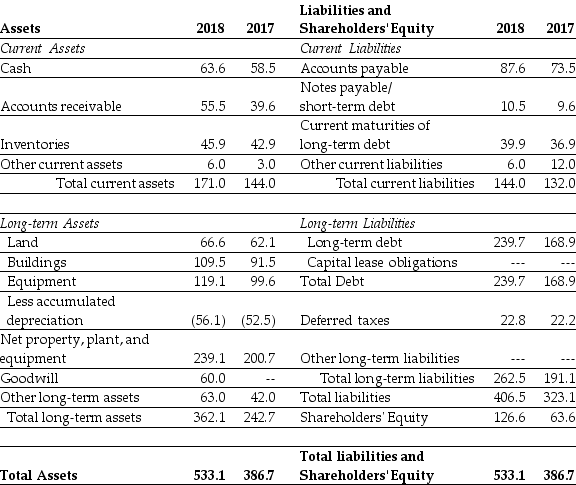

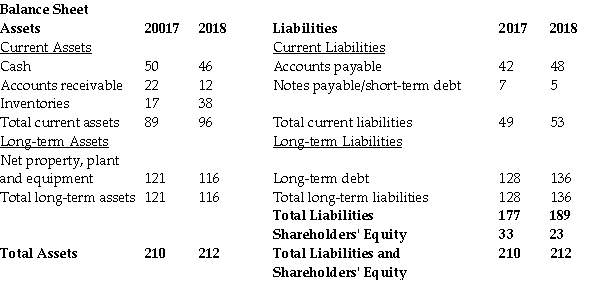

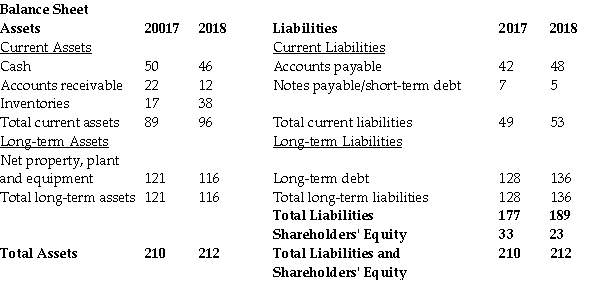

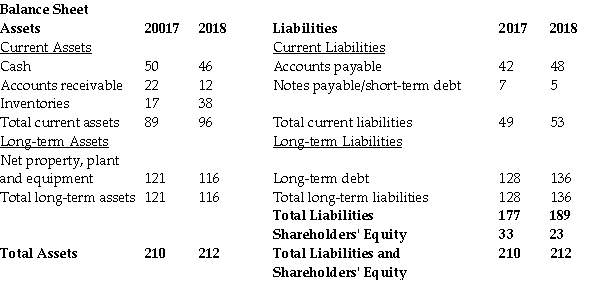

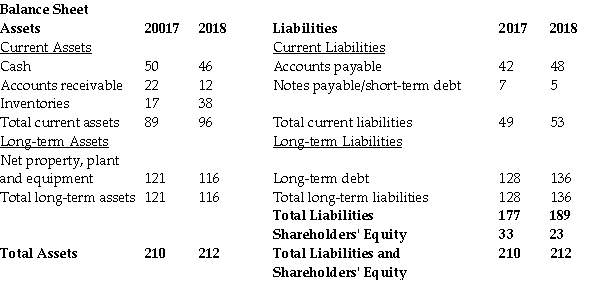

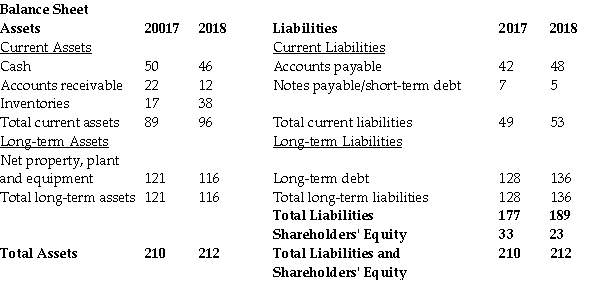

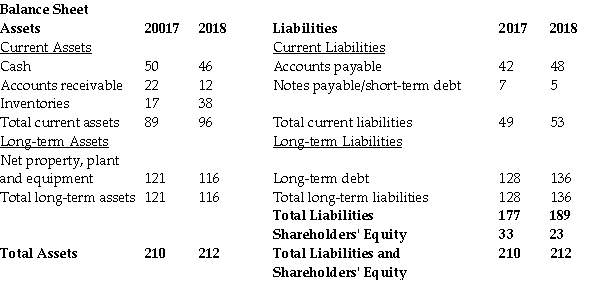

Use the table for the question(s)below.

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. What is the company's net working capital?

A)$60 million

B)$11 million

C)$50 million

D)$48 million

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. What is the company's net working capital?

A)$60 million

B)$11 million

C)$50 million

D)$48 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

A company that produces pharmaceutical drugs is preparing a balance sheet. Which of the following would be most likely to be considered a long-term asset on this balance sheet?

A)the inventory of chemicals used to produce the drugs made by the company

B)commercial paper held by the company

C)a patent for a drug held by the company

D)the cash reserves of the company

A)the inventory of chemicals used to produce the drugs made by the company

B)commercial paper held by the company

C)a patent for a drug held by the company

D)the cash reserves of the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

Net property, plant, and equipment is a

A)Long-term Asset.

B)Current Asset.

C)Long-term Liability.

D)Current Liability.

A)Long-term Asset.

B)Current Asset.

C)Long-term Liability.

D)Current Liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

A 30-year mortgage loan is a

A)Long-term Liability.

B)Current Asset.

C)Long-term Asset.

D)Current Liability.

A)Long-term Liability.

B)Current Asset.

C)Long-term Asset.

D)Current Liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

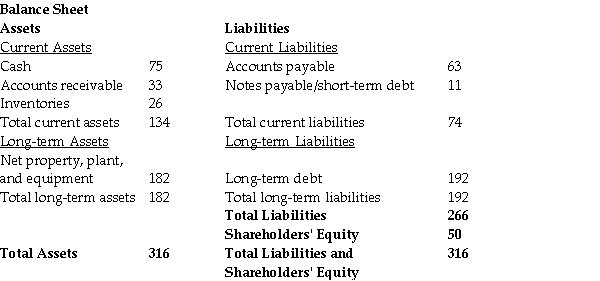

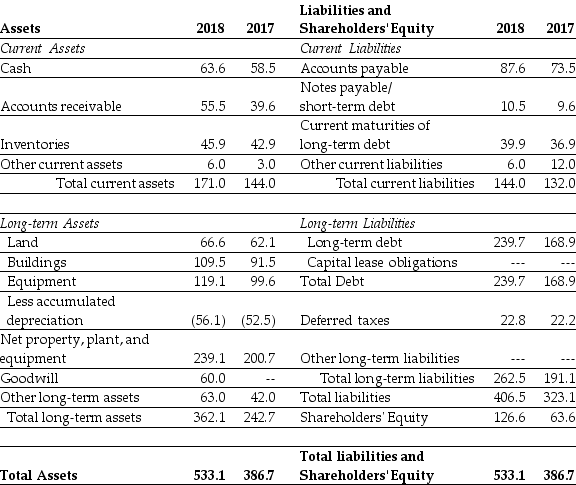

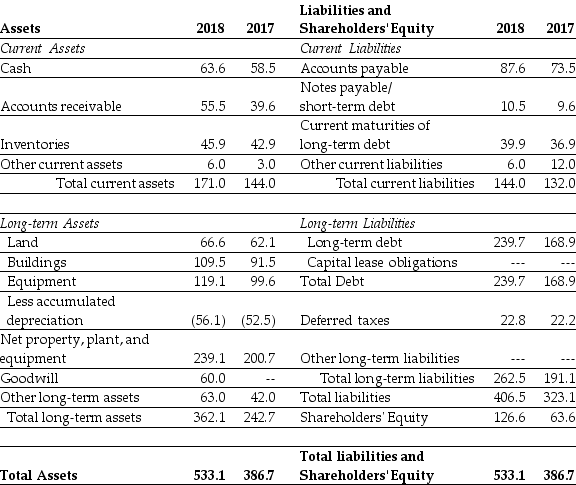

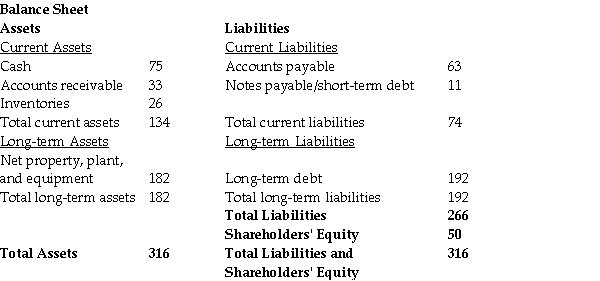

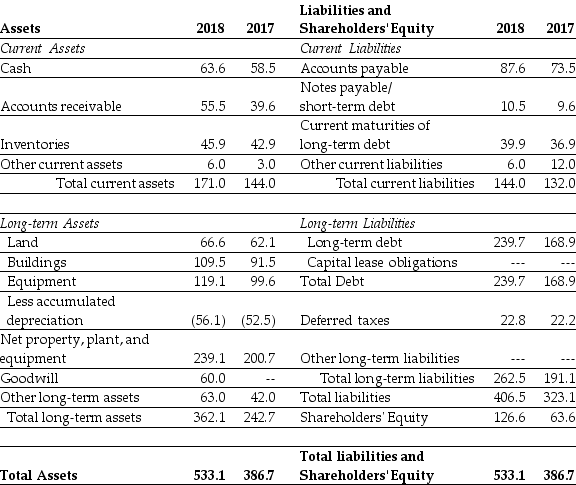

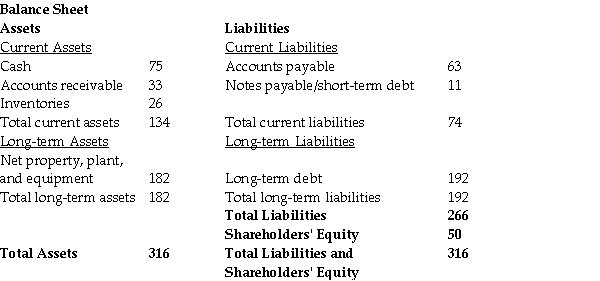

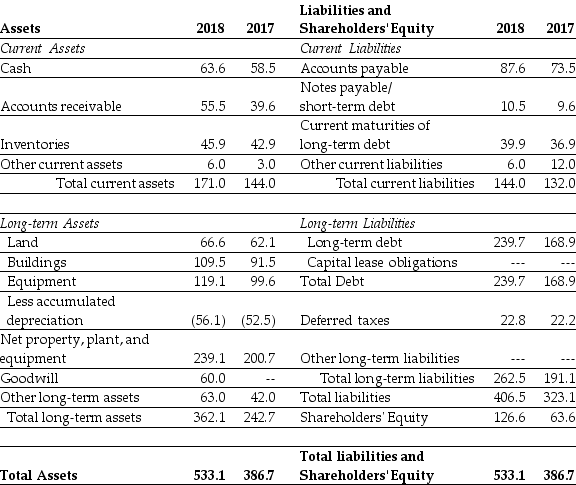

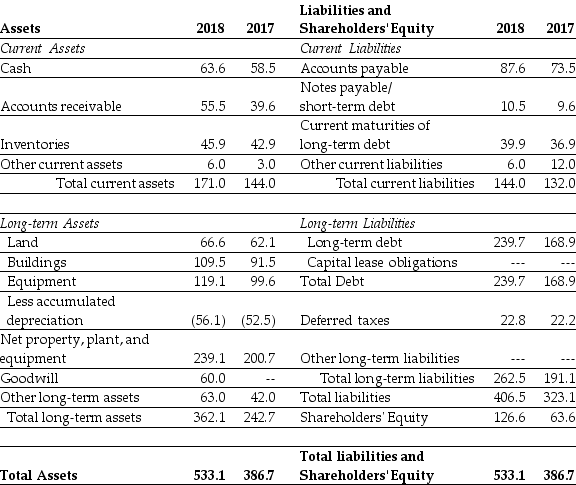

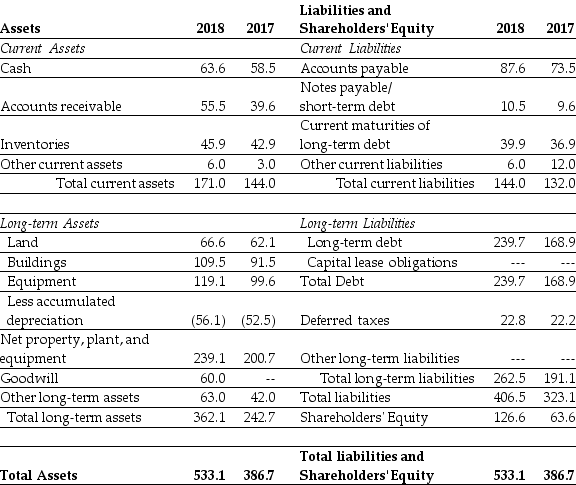

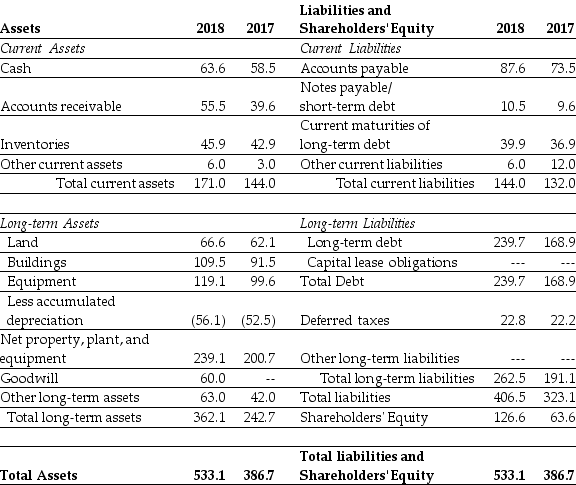

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. When using the book value of equity, the debt-equity ratio for Luther in 2017 is closest to:

A)3.98

B)3.43

C)3.21

D)3.39

Refer to the balance sheet above. When using the book value of equity, the debt-equity ratio for Luther in 2017 is closest to:

A)3.98

B)3.43

C)3.21

D)3.39

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

Use the table for the question(s)below.

The above diagram shows a balance sheet for a certain company. If the company buys new property, plant and equipment today using its entire cash balance, what will its net working capital be?

A)-$5 million

B)-$15 million

C)$15 million

D)$60 million

The above diagram shows a balance sheet for a certain company. If the company buys new property, plant and equipment today using its entire cash balance, what will its net working capital be?

A)-$5 million

B)-$15 million

C)$15 million

D)$60 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

Use the table for the question(s)below.

The above diagram shows a balance sheet for a certain company. If the company pays back all of its accounts payable today using cash, what will its net working capital be?

A)$48 million

B)$60 million

C)$11 million

D)$50 million

The above diagram shows a balance sheet for a certain company. If the company pays back all of its accounts payable today using cash, what will its net working capital be?

A)$48 million

B)$60 million

C)$11 million

D)$50 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

Accounts payable is a

A)Long-term Liability.

B)Current Liability.

C)Long-term Asset.

D)Current Asset.

A)Long-term Liability.

B)Current Liability.

C)Long-term Asset.

D)Current Asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

In general, a successful firm will have a market-to-book ratio that is substantially greater than 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the table for the question(s)below.

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 4 million shares outstanding, and these shares are trading at a price of $12.45 per share, what does this tell you about how investors view this firm's book value?

A)Investors consider that the firm's market value is worth less than its book value.

B)Investors consider that the firm's market value is worth more than its book value.

C)Investors consider that the firm's market value and its book value are roughly equivalent.

D)Investors consider that the firm's market value is worth very much less than its book value.

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 4 million shares outstanding, and these shares are trading at a price of $12.45 per share, what does this tell you about how investors view this firm's book value?

A)Investors consider that the firm's market value is worth less than its book value.

B)Investors consider that the firm's market value is worth more than its book value.

C)Investors consider that the firm's market value and its book value are roughly equivalent.

D)Investors consider that the firm's market value is worth very much less than its book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. Luther's current ratio for 2017 is closest to:

A)1.15

B)1.09

C)1.17

D)1.18

Refer to the balance sheet above. Luther's current ratio for 2017 is closest to:

A)1.15

B)1.09

C)1.17

D)1.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

30

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. If in 2017, Luther has 5.2 million shares outstanding and these shares are trading at $16 per share, then Luther's market-to-book ratio would be closest to:

A)1.29

B)1.31

C)1.76

D)1.39

Refer to the balance sheet above. If in 2017, Luther has 5.2 million shares outstanding and these shares are trading at $16 per share, then Luther's market-to-book ratio would be closest to:

A)1.29

B)1.31

C)1.76

D)1.39

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following balance sheet equations is INCORRECT?

A)Assets = Liabilities + Shareholders' Equity

B)Assets - Current Liabilities = Long-term Liabilities + Shareholders' Equity

C)Assets - Liabilities = Shareholders' Equity

D)Assets - Current Liabilities = Long-term Liabilities

A)Assets = Liabilities + Shareholders' Equity

B)Assets - Current Liabilities = Long-term Liabilities + Shareholders' Equity

C)Assets - Liabilities = Shareholders' Equity

D)Assets - Current Liabilities = Long-term Liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. The change in Luther's quick ratio from 2017 to 2018 is closest to:

A)an increase of 0.10

B)an increase of 0.15

C)a decrease of 0.15

D)a decrease of 0.10

Refer to the balance sheet above. The change in Luther's quick ratio from 2017 to 2018 is closest to:

A)an increase of 0.10

B)an increase of 0.15

C)a decrease of 0.15

D)a decrease of 0.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

What will be the effect on the balance sheet if a firm buys a new processing plant through a new loan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements regarding the balance sheet is INCORRECT?

A)The balance sheet reports shareholders' equity on the right-hand side.

B)The balance sheet provides a snapshot of the firm's financial position at a given point in time.

C)The balance sheet reports liabilities on the left-hand side.

D)The balance sheet lists the firm's assets and liabilities.

A)The balance sheet reports shareholders' equity on the right-hand side.

B)The balance sheet provides a snapshot of the firm's financial position at a given point in time.

C)The balance sheet reports liabilities on the left-hand side.

D)The balance sheet lists the firm's assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the table for the question(s)below.

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. What is Luther's net working capital in 2018?

A)$27 million

B)$63.6 million

C)$12 million

D)$39 million

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. What is Luther's net working capital in 2018?

A)$27 million

B)$63.6 million

C)$12 million

D)$39 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. If in 2017, Luther has 5.2 million shares outstanding and these shares are trading at $16 per share, then using the market value of equity, the debt-equity ratio for Luther in 2017 is closest to:

A)2.71

B)2.61

C)2.59

D)2.55

Refer to the balance sheet above. If in 2017, Luther has 5.2 million shares outstanding and these shares are trading at $16 per share, then using the market value of equity, the debt-equity ratio for Luther in 2017 is closest to:

A)2.71

B)2.61

C)2.59

D)2.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the table for the question(s)below.

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. How would the balance sheet change if the company's long-term assets were judged to depreciate at an extra $5 million per year?

A)Net property, plant, and equipment would rise to $187 million, and Total Assets and Shareholders' Equity would be adjusted accordingly.

B)Net property, plant, and equipment would fall to $177 million, and Total Assets and Shareholders' Equity would be adjusted accordingly.

C)Long-term Liabilities would fall to $172 million, and Total Liabilities and Shareholders' Equity would be adjusted accordingly.

D)Long-term Liabilities would rise to $182 million, and Total Liabilities and Shareholders' Equity would be adjusted accordingly.

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. How would the balance sheet change if the company's long-term assets were judged to depreciate at an extra $5 million per year?

A)Net property, plant, and equipment would rise to $187 million, and Total Assets and Shareholders' Equity would be adjusted accordingly.

B)Net property, plant, and equipment would fall to $177 million, and Total Assets and Shareholders' Equity would be adjusted accordingly.

C)Long-term Liabilities would fall to $172 million, and Total Liabilities and Shareholders' Equity would be adjusted accordingly.

D)Long-term Liabilities would rise to $182 million, and Total Liabilities and Shareholders' Equity would be adjusted accordingly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. Luther's quick ratio for 2017 is closest to:

A)0.77

B)1.09

C)0.92

D)1.31

Refer to the balance sheet above. Luther's quick ratio for 2017 is closest to:

A)0.77

B)1.09

C)0.92

D)1.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

How does a firm select the date for preparation of its balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. If in 2018, Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then what is Luther's enterprise value?

A)$353.1 million

B)$516.9 million

C)-$63.3 million

D)$389.7 million

Refer to the balance sheet above. If in 2018, Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then what is Luther's enterprise value?

A)$353.1 million

B)$516.9 million

C)-$63.3 million

D)$389.7 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

Company A has current assets of $42 billion and current liabilities of $31 billion. Company B has current assets of $2.7 billion and current liabilities of $1.8 billion. Which of the following statements is correct, based on this information?

A)Company A has less leverage than Company B.

B)Company A has greater leverage than Company B.

C)Company A and Company B have roughly equivalent enterprise values.

D)Company A is less likely than Company B to have sufficient working capital to meet its short-term needs.

A)Company A has less leverage than Company B.

B)Company A has greater leverage than Company B.

C)Company A and Company B have roughly equivalent enterprise values.

D)Company A is less likely than Company B to have sufficient working capital to meet its short-term needs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

A firm's gross profit is equal to the difference between sales revenues and the costs associated with those sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

43

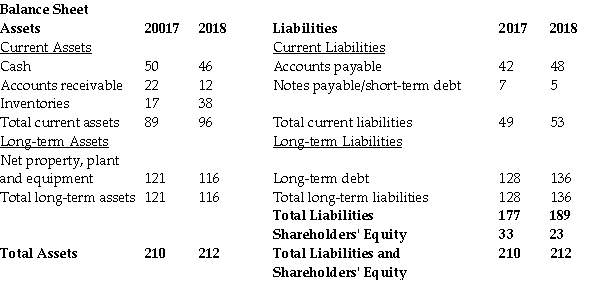

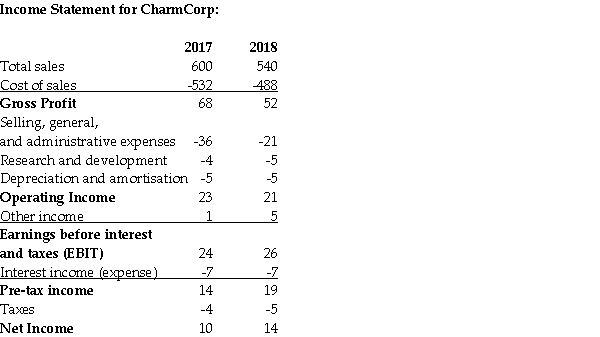

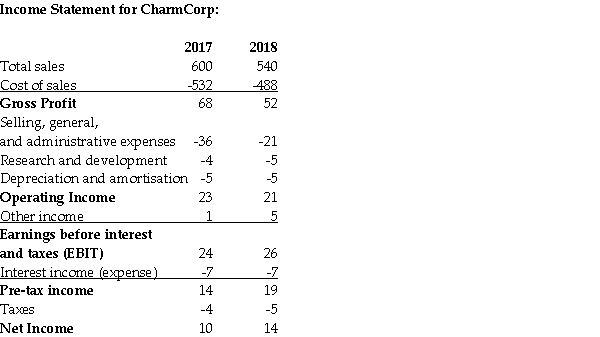

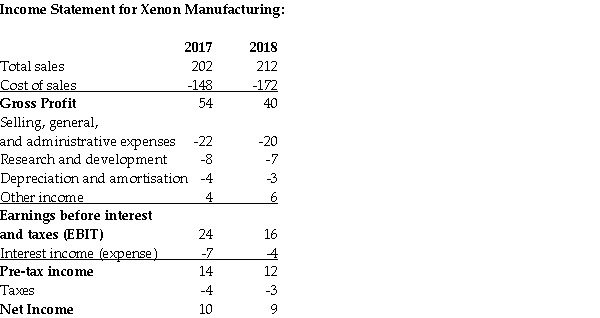

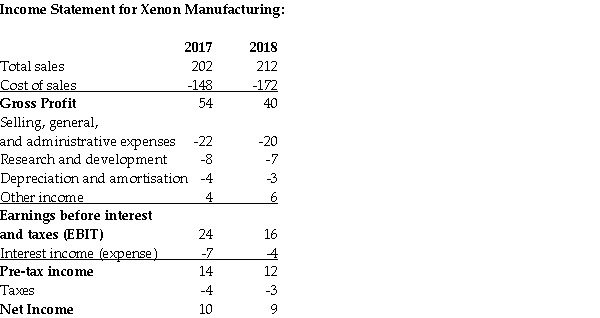

Use the table for the question(s)below.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in the balance sheet between 2017 and 2018?

A)The company has reduced its debt.

B)The company has added a major new asset in terms of plant and equipment.

C)The company is having difficulties selling its product.

D)The company has experienced a significant rise in its market value.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in the balance sheet between 2017 and 2018?

A)The company has reduced its debt.

B)The company has added a major new asset in terms of plant and equipment.

C)The company is having difficulties selling its product.

D)The company has experienced a significant rise in its market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

Corporate taxes are considered to be an operating expense on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. If on 30 June 2017 Luther has 8 million shares outstanding trading at $15 per share, then what is Luther's market-to-book ratio?

Refer to the balance sheet above. If on 30 June 2017 Luther has 8 million shares outstanding trading at $15 per share, then what is Luther's market-to-book ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

Convex Industries has inventories of $150 million, current assets of $1.05 billion, and current liabilities of $400 million. What is its quick ratio?

A)2.25

B)2.12

C)0.44

D)0.38

A)2.25

B)2.12

C)0.44

D)0.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

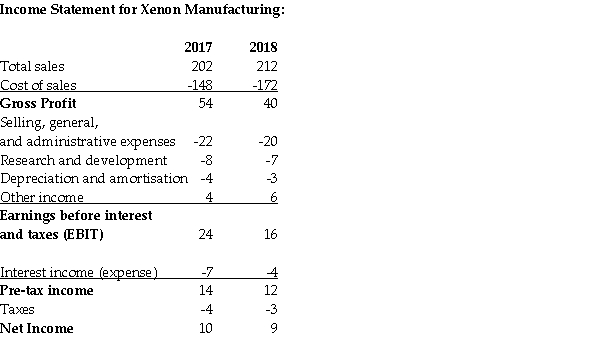

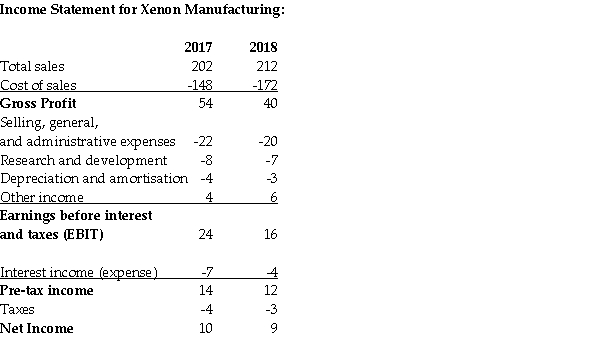

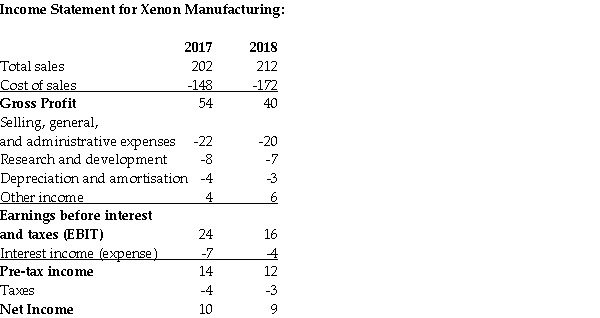

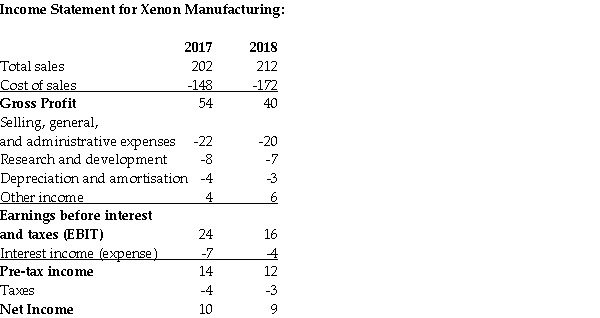

Use the table for the question(s)below.

Consider the above Income Statement for Xenon Manufacturing. All values are in millions of dollars. If Xenon Manufacturing has 25 million shares outstanding, what is its EPS in 2018?

A)$0.84

B)$0.40

C)$0.36

D)$0.63

Consider the above Income Statement for Xenon Manufacturing. All values are in millions of dollars. If Xenon Manufacturing has 25 million shares outstanding, what is its EPS in 2018?

A)$0.84

B)$0.40

C)$0.36

D)$0.63

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

GenCorp has a total debt of $140 million and shareholders' equity of $50 million. It also has 25 million shares outstanding, with a market price of $3.50 per share. What is GenCorp's market debt-equity ratio?

A)1.60

B)0.63

C)1.02

D)0.36

A)1.60

B)0.63

C)1.02

D)0.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

'Gross profit' is calculated as

A)Total sales - Cost of sales.

B)Total sales - Cost of sales - Selling, general, and administrative expenses - Depreciation and amortisation.

C)Total sales - Cost of sales - Selling, general, and administrative expenses.

D)none of the above

A)Total sales - Cost of sales.

B)Total sales - Cost of sales - Selling, general, and administrative expenses - Depreciation and amortisation.

C)Total sales - Cost of sales - Selling, general, and administrative expenses.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which ratio would you use to measure the financial health of a firm by assessing that firm's leverage?

A)market debt-equity ratio

B)current or quick ratio

C)debt-equity or equity multiplier ratio

D)market-to-book ratio

A)market debt-equity ratio

B)current or quick ratio

C)debt-equity or equity multiplier ratio

D)market-to-book ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the table for the question(s)below.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in quick ratio between 2017 and 2018?

A)The company has reduced the risk that it will experience a cash shortfall in the near future.

B)The risk that the company will experience a cash shortfall in the near future is unchanged.

C)The company has increased the risk that it will experience a cash shortfall in the near future.

D)The company has eliminated the risk that it will experience a cash shortfall in the near future.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in quick ratio between 2017 and 2018?

A)The company has reduced the risk that it will experience a cash shortfall in the near future.

B)The risk that the company will experience a cash shortfall in the near future is unchanged.

C)The company has increased the risk that it will experience a cash shortfall in the near future.

D)The company has eliminated the risk that it will experience a cash shortfall in the near future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

A company has a share price of $24.50 and $118 million shares outstanding. Its market-to-book ratio is 4.2, its book debt-equity ratio is 3.2, and it has cash of $800 million. How much would it cost to take over this business assuming you pay its enterprise value?

A)$4.2 billion

B)$1.5

C)$3.6 billion

D)$2.8 billion

A)$4.2 billion

B)$1.5

C)$3.6 billion

D)$2.8 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the table for the question(s)below.

Consider the above Income Statement for CharmCorp. All values are in millions of dollars. If CharmCorp has 6 million shares outstanding, and its managers and employees have stock options for 1 million shares, what is its diluted EPS in 2018?

A)$2.33

B)$2.00

C)$1.67

D)$1.42

Consider the above Income Statement for CharmCorp. All values are in millions of dollars. If CharmCorp has 6 million shares outstanding, and its managers and employees have stock options for 1 million shares, what is its diluted EPS in 2018?

A)$2.33

B)$2.00

C)$1.67

D)$1.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements regarding the income statement is INCORRECT?

A)The last or 'bottom' line of the income statement shows the firm's net income.

B)The income statement shows the flow of earnings and expenses generated by the firm between two dates.

C)The first line of an income statement lists the revenues from the sales of products or services.

D)The income statement shows the earnings and expenses at a given point in time.

A)The last or 'bottom' line of the income statement shows the firm's net income.

B)The income statement shows the flow of earnings and expenses generated by the firm between two dates.

C)The first line of an income statement lists the revenues from the sales of products or services.

D)The income statement shows the earnings and expenses at a given point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the table for the question(s)below.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in shareholders' equity between 2017 and 2018?

A)The company is very profitable because it is obviously collecting receivables faster.

B)The company's net income in 2018 was negative.

C)The company is selling its property, plant and equipment, which may result in a long-term deficiency in production capacity.

D)No conclusions can be drawn regarding shareholders' equity without additional information.

If the above balance sheet is for a retail company, what indications about this company would best be drawn from the changes in shareholders' equity between 2017 and 2018?

A)The company is very profitable because it is obviously collecting receivables faster.

B)The company's net income in 2018 was negative.

C)The company is selling its property, plant and equipment, which may result in a long-term deficiency in production capacity.

D)No conclusions can be drawn regarding shareholders' equity without additional information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

Luther Corporation Consolidated Balance Sheet 30 June 2017 and 2018 (in $ millions)

Refer to the balance sheet above. If on 30 June 2017, Luther has 8 million shares outstanding trading at $15 per share, then what is Luther's enterprise value?

Refer to the balance sheet above. If on 30 June 2017, Luther has 8 million shares outstanding trading at $15 per share, then what is Luther's enterprise value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is a firm's 'net income'?

A)a measure of the firm's profitability over a given period

B)the difference between the sales and other income generated by the firm, and all costs, taxes, and expenses incurred by the firm in a given period

C)the last or 'bottom' line of the income statement

D)all of the above

A)a measure of the firm's profitability over a given period

B)the difference between the sales and other income generated by the firm, and all costs, taxes, and expenses incurred by the firm in a given period

C)the last or 'bottom' line of the income statement

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the table for the question(s)below.

If the above balance sheet is for a retail company, how has the company's leverage changed between 2017 and 2018?

A)The company has experienced no significant change in its leverage.

B)The company has experienced a significant increase in its leverage.

C)The company has experienced a very significant decrease in its leverage.

D)The company has experienced a significant decrease in its leverage.

If the above balance sheet is for a retail company, how has the company's leverage changed between 2017 and 2018?

A)The company has experienced no significant change in its leverage.

B)The company has experienced a significant increase in its leverage.

C)The company has experienced a very significant decrease in its leverage.

D)The company has experienced a significant decrease in its leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

A public company has a book value of $128 million. They have 20 million shares outstanding, with a market price of $4 per share. Which of the following statements is true regarding this company?

A)Investors may consider this firm to be a growth company.

B)The value of the firm's assets is greater than their liquidation value.

C)The firm's market value is more than its book value.

D)Investors believe the company's assets are not likely to be profitable as its market value is worth less than its book value.

A)Investors may consider this firm to be a growth company.

B)The value of the firm's assets is greater than their liquidation value.

C)The firm's market value is more than its book value.

D)Investors believe the company's assets are not likely to be profitable as its market value is worth less than its book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

The income statement reports the firm's revenues and expenses, and it computes the firm's bottom line of net income, or earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

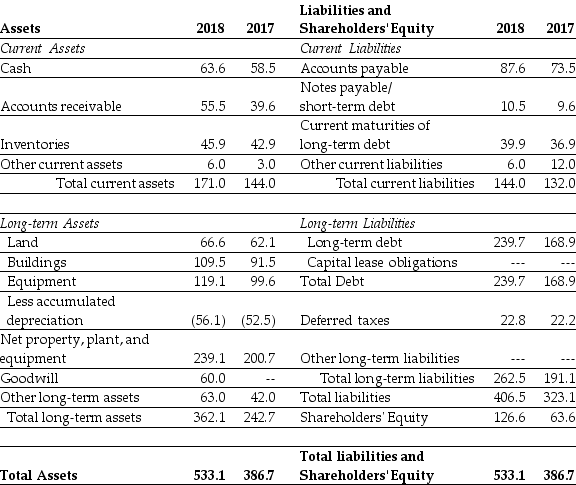

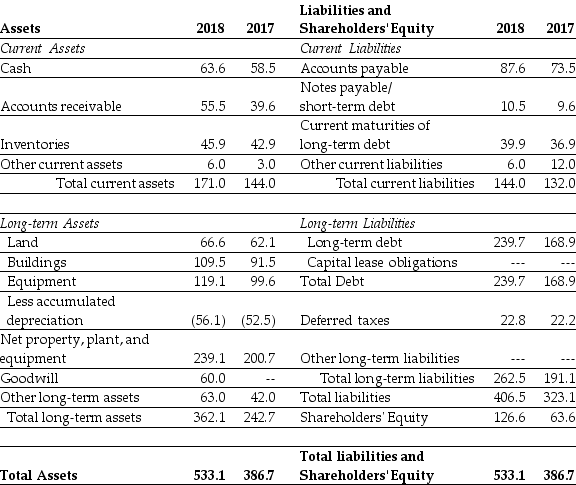

Use the table for the question(s)below.

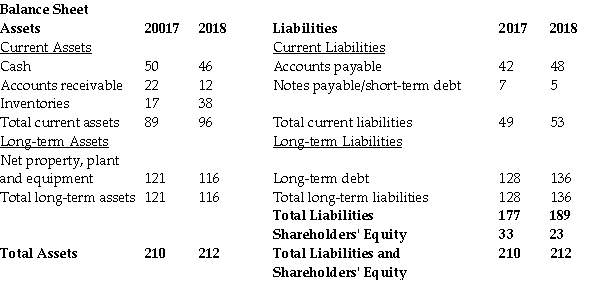

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. For the year ending 30 June 2018, Luther's earnings per share are closest to:

A)$1.01

B)$1.04

C)$4.04

D)$1.58

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. For the year ending 30 June 2018, Luther's earnings per share are closest to:

A)$1.01

B)$1.04

C)$4.04

D)$1.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

Manufacturer A has a profit margin of 2.0%, an asset turnover of 1.7 and an equity multiplier of 4.9. Manufacturer B has a profit margin of 2.3%, an asset turnover of 1.1 and an equity multiplier of 4.7.

How much asset turnover should manufacturer B have to match manufacturer A's ROE?

A)3.09%

B)4.77%

C)1.54%

D)3.00%

How much asset turnover should manufacturer B have to match manufacturer A's ROE?

A)3.09%

B)4.77%

C)1.54%

D)3.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

Why must care be taken when comparing a firm's share price to its operating income?

A)Share price is a quantity related to the entire firm, while operating income is an amount that is related solely to equity holders.

B)Both share price and operating income are related solely to equity holders.

C)Share price is a quantity related to equity holders, while operating income is an amount that is related to the whole firm.

D)Both share price and operating income are related to the whole firm.

A)Share price is a quantity related to the entire firm, while operating income is an amount that is related solely to equity holders.

B)Both share price and operating income are related solely to equity holders.

C)Share price is a quantity related to equity holders, while operating income is an amount that is related to the whole firm.

D)Both share price and operating income are related to the whole firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's earnings before interest, taxes, depreciation, and amortisation (EBITDA)for the year ending 30 June 2018 is closest to:

A)$41.2 million

B)$37.6 million

C)$44.8 million

D)$19.7 million

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's earnings before interest, taxes, depreciation, and amortisation (EBITDA)for the year ending 30 June 2018 is closest to:

A)$41.2 million

B)$37.6 million

C)$44.8 million

D)$19.7 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Price-earnings ratios tend to be high for fast-growing firms.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Price-earnings ratios tend to be high for fast-growing firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is the LEAST likely explanation for a firm's high ROE?

A)The firm has very efficient use of its assets.

B)The firm is growing.

C)The firm is able to find investment opportunities that are very profitable.

D)The firm enjoys high sales margins.

A)The firm has very efficient use of its assets.

B)The firm is growing.

C)The firm is able to find investment opportunities that are very profitable.

D)The firm enjoys high sales margins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

Use the table for the question(s)below.

Consider the above Income Statement for Xenon Manufacturing. All values are in millions of dollars. Calculate the gross margin for 2017 and 2018. What does the change in the gross margin between these two years imply about the company?

A)The leverage of Xenon Manufacturing fell slightly between 2017 and 2018.

B)The ability of Xenon Manufacturing to sell its goods and services for more than the costs of producing them rose between 2017 and 2018.

C)The ability of Xenon Manufacturing to sell its goods and services for more than the costs of producing them fell between 2017 and 2018.

D)The efficiency of Xenon Manufacturing has significantly risen between 2017 and 2018.

Consider the above Income Statement for Xenon Manufacturing. All values are in millions of dollars. Calculate the gross margin for 2017 and 2018. What does the change in the gross margin between these two years imply about the company?

A)The leverage of Xenon Manufacturing fell slightly between 2017 and 2018.

B)The ability of Xenon Manufacturing to sell its goods and services for more than the costs of producing them rose between 2017 and 2018.

C)The ability of Xenon Manufacturing to sell its goods and services for more than the costs of producing them fell between 2017 and 2018.

D)The efficiency of Xenon Manufacturing has significantly risen between 2017 and 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's return on equity (ROE)for the year ending 30 June 2018 is closest to:

A)2.0%

B)12.7%

C)8.4%

D)6.5%

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's return on equity (ROE)for the year ending 30 June 2018 is closest to:

A)2.0%

B)12.7%

C)8.4%

D)6.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Assuming that Luther has no convertible bonds outstanding, then for the year ending 30 June 2018, Luther's diluted earnings per share are closest to:

A)$1.04

B)$1.01

C)$1.53

D)$3.92

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Assuming that Luther has no convertible bonds outstanding, then for the year ending 30 June 2018, Luther's diluted earnings per share are closest to:

A)$1.04

B)$1.01

C)$1.53

D)$3.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following firms would be expected to have a high ROE based on that firm's high profitability?

A)a grocery store chain that has very high turnover, selling many multiples of their assets per year

B)a brokerage firm that has high levels of leverage

C)a low-end retailer that has a low mark-up on all items it sells

D)a medical supply company that provides very precise instruments at a high price to large medical establishments such as hospitals

A)a grocery store chain that has very high turnover, selling many multiples of their assets per year

B)a brokerage firm that has high levels of leverage

C)a low-end retailer that has a low mark-up on all items it sells

D)a medical supply company that provides very precise instruments at a high price to large medical establishments such as hospitals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

What will be the effect on the income statement if a firm buys a new processing plant through a new loan?

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

What will be the effect on the income statement if a firm buys a new processing plant through a new loan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

How does a firm select the dates for preparation of its income statement?

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

How does a firm select the dates for preparation of its income statement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the table for the question(s)below.

Consider the above Income Statement for Xenon Manufacturing. All values are in millions of dollars. Calculate the operating margin for 2017 and 2018. What does the change in the operating margin between these two years imply about the company?

A)The efficiency of Xenon Manufacturing has significantly fallen between 2017 and 2018.

B)The ability of Xenon Manufacturing to sell its goods and services for more than the costs of producing them rose between 2017 and 2018.

C)The efficiency of Xenon Manufacturing has significantly risen between 2017 and 2018.

D)The leverage of Xenon Manufacturing fell slightly between 2017 and 2018.

Consider the above Income Statement for Xenon Manufacturing. All values are in millions of dollars. Calculate the operating margin for 2017 and 2018. What does the change in the operating margin between these two years imply about the company?

A)The efficiency of Xenon Manufacturing has significantly fallen between 2017 and 2018.

B)The ability of Xenon Manufacturing to sell its goods and services for more than the costs of producing them rose between 2017 and 2018.

C)The efficiency of Xenon Manufacturing has significantly risen between 2017 and 2018.

D)The leverage of Xenon Manufacturing fell slightly between 2017 and 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's return on assets (ROA)for the year ending 30 June 2018 is closest to:

A)8.4%

B)12.7%

C)2.0%

D)6.5%

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's return on assets (ROA)for the year ending 30 June 2018 is closest to:

A)8.4%

B)12.7%

C)2.0%

D)6.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following firms would be expected to have a high ROE based on that firm's high operating efficiency?

A)a high-end fashion retailer that has a very high mark-up on all items it sells

B)a grocery store chain that has very high turnover, selling many multiples of their assets per year

C)a medical supply company that provides very precise instruments at a high price to large medical establishments such as hospitals

D)a brokerage firm that has high levels of leverage

A)a high-end fashion retailer that has a very high mark-up on all items it sells

B)a grocery store chain that has very high turnover, selling many multiples of their assets per year

C)a medical supply company that provides very precise instruments at a high price to large medical establishments such as hospitals

D)a brokerage firm that has high levels of leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following is NOT an operating expense?

A)depreciation and amortisation

B)research and development

C)selling, general, and administrative expenses

D)interest expense

A)depreciation and amortisation

B)research and development

C)selling, general, and administrative expenses

D)interest expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's operating margin for the year ending 30 June 2017 is closest to:

A)2.7%

B)16.7%

C)1.8%

D)5.4%

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's operating margin for the year ending 30 June 2017 is closest to:

A)2.7%

B)16.7%

C)1.8%

D)5.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

The firm's statement of cash flows only uses the balance sheet and net income to determine the amount of cash a firm has generated and how it has used that cash during a given period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

In 2009, an agricultural company introduced a new cropping process which reduced the cost of growing some of its crops. If sales in 2008 and 2009 were steady at $25 million, but the gross margin increased from 2.3% to 3.4% between those years, by what amount was the cost of sales reduced?

A)$575 000

B)$325 000

C)$275 000

D)$425 000

A)$575 000

B)$325 000

C)$275 000

D)$425 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the table for the question(s)below.

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's net profit margin for the year ending 30 June 2017 is closest to:

A)16.7%

B)1.8%

C)5.4%

D)2.7%

Luther Corporation Consolidated Income Statement Year ended 30 June (in $ millions)

Refer to the income statement above. Luther's net profit margin for the year ending 30 June 2017 is closest to:

A)16.7%

B)1.8%

C)5.4%

D)2.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck