Deck 3: Time Value of Money: an Introduction

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/107

العب

ملء الشاشة (f)

Deck 3: Time Value of Money: an Introduction

1

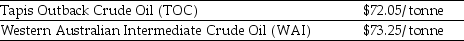

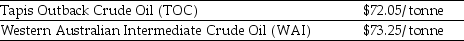

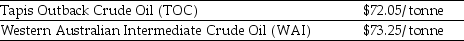

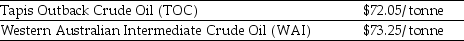

Use the information for the question(s)below.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

Another oil refiner is offering to trade you 10 150 tonnes of TOC crude oil for 10 000 tonnes of WAI crude oil. Assuming you just purchased 10 000 tonnes of WAI crude at the current market price, the total benefit (cost)to you if you take the trade is closest to:

A)$774 319

B)$772 500

C)$773 024

D)$773 908

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.Another oil refiner is offering to trade you 10 150 tonnes of TOC crude oil for 10 000 tonnes of WAI crude oil. Assuming you just purchased 10 000 tonnes of WAI crude at the current market price, the total benefit (cost)to you if you take the trade is closest to:

A)$774 319

B)$772 500

C)$773 024

D)$773 908

$773 024

2

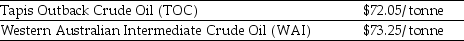

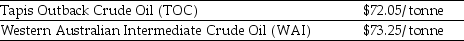

Use the information for the question(s)below.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

Another oil refiner is offering to trade you 10 150 tonnes of Tapis Outback Crude (TOC)oil for 10 000 tonnes of Western Australian Intermediate (WAI)crude oil. Assuming you currently have 10 000 tonnes of WAI crude, the added benefit (cost)to you if you take the trade is closest to:

A)($524)

B)$524

C)($1 819)

D)$1 819

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.Another oil refiner is offering to trade you 10 150 tonnes of Tapis Outback Crude (TOC)oil for 10 000 tonnes of Western Australian Intermediate (WAI)crude oil. Assuming you currently have 10 000 tonnes of WAI crude, the added benefit (cost)to you if you take the trade is closest to:

A)($524)

B)$524

C)($1 819)

D)$1 819

$524

3

In a trade with the government of an oil-producing nation, a manufacturer will deliver 14 Caterpillar D9 tractors, with a value of $350 000 per tractor, and receive 45 000 barrels of oil, valued at $115 per barrel. What is the net benefit of this trade to the manufacturer?

A)$275 000

B)$4 900 000

C)$1 750 000

D)$158 000

A)$275 000

B)$4 900 000

C)$1 750 000

D)$158 000

$275 000

4

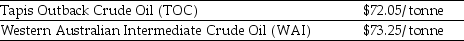

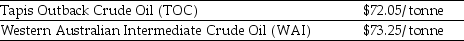

Use the information for the question(s)below.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

Assuming you currently have 10 000 tonnes of WAI crude, the total benefits to you if you were to sell the 10 000 tonnes of WAI crude and use the proceeds to purchase and refine TOC crude is closest to:

A)$773 908

B)$772 500

C)$773 024

D)$774 319

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.Assuming you currently have 10 000 tonnes of WAI crude, the total benefits to you if you were to sell the 10 000 tonnes of WAI crude and use the proceeds to purchase and refine TOC crude is closest to:

A)$773 908

B)$772 500

C)$773 024

D)$774 319

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

5

In general, if an action increases a firm's value by providing benefits with a value greater than any costs involved, then that action is good for the firm's investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

6

To enable costs and benefits to be compared, they are typically converted into a common currency and common point of time, such as dollars today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

7

Refer to the table above. An international seafood supplier is offered 9.45 million yen today for 1 000 kilograms of abalone frozen in the shell. The abalone can be sourced from various countries at the prices shown above. The current market exchange rates between Australia and the other relevant currencies are also shown. In addition, $1 AUD = 105 yen. What is the value of the best deal the international seafood supplier can make, in Australian dollars?

A)$8 000

B)$10 000

C)$7 000

D)$5 000

A)$8 000

B)$10 000

C)$7 000

D)$5 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

8

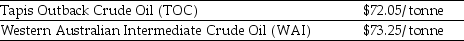

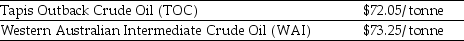

Use the information for the question(s)below.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

Assuming you just purchased 10 000 tonnes of WAI crude at the current market price, the total benefit (cost)to you if you were to refine this crude oil and sell the unleaded petrol is closest to:

A)$774 319

B)$772 500

C)$773 024

D)$773 908

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.Assuming you just purchased 10 000 tonnes of WAI crude at the current market price, the total benefit (cost)to you if you were to refine this crude oil and sell the unleaded petrol is closest to:

A)$774 319

B)$772 500

C)$773 024

D)$773 908

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

9

A metal fabrication company is pricing raw supplies of aluminium. The following are the costs to the company to receive one tonne of aluminium from various sources. Which source offers the best price for aluminium per tonne?

A)3 206 US dollars per tonne, with $1 AUD = $1.05 USD

B)3 012 Australian dollars per tonne

C)4 998 Brazilian reals per tonne, with $1 AUD = 1.282 BRL

D)121 756 Indian rupees per tonne, with $1 AUD = 47.619 INR

A)3 206 US dollars per tonne, with $1 AUD = $1.05 USD

B)3 012 Australian dollars per tonne

C)4 998 Brazilian reals per tonne, with $1 AUD = 1.282 BRL

D)121 756 Indian rupees per tonne, with $1 AUD = 47.619 INR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

10

Steve is offered an investment where for every $1.00 invested today, he will receive $1.10 in five years' time. Steve concludes that in five years' time he will have $1.10 for every $1.00 invested and that this investment will increase his personal value. What is Steve's major error in reasoning when making this decision?

A)There may be other investments that he can make that will offer even bigger benefits.

B)The investment may have hidden costs that will reduce the amount of benefit he receives.

C)The value of the cash he has today is greater than the value of the cash he may have in the future.

D)Costs and benefits must be in the same terms to be compared.

A)There may be other investments that he can make that will offer even bigger benefits.

B)The investment may have hidden costs that will reduce the amount of benefit he receives.

C)The value of the cash he has today is greater than the value of the cash he may have in the future.

D)Costs and benefits must be in the same terms to be compared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the information for the question(s)below.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

Assuming you currently have 10 000 tonnes of WAI crude, the added benefit (cost)to you if you were to sell the 10 000 tonnes of WAI crude and use the proceeds to purchase and refine TOC crude are closest to:

A)($524)

B)$524

C)($1 819)

D)$1 819

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.

As an oil refiner, you are able to produce $76.16 worth of unleaded petrol from one barrel of Tapis Outback Crude (TOC)oil. Because of its lower sulphur content, you can produce $77.25 worth of unleaded petrol from one barrel of Western Australian Intermediate (WAI)crude.Assuming you currently have 10 000 tonnes of WAI crude, the added benefit (cost)to you if you were to sell the 10 000 tonnes of WAI crude and use the proceeds to purchase and refine TOC crude are closest to:

A)($524)

B)$524

C)($1 819)

D)$1 819

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements regarding the valuing of costs and benefits is NOT correct?

A)The first step in evaluating a project is to identify its costs and benefits.

B)Competitive market prices allow us to calculate the value of a decision without worrying about the tastes or opinions of the decision maker.

C)Because competitive markets exist for most commodities and financial assets, we can use them to determine cash values and evaluate decisions in most situations.

D)In the absence of competitive markets, we can use one-sided prices to determine exact cash values.

A)The first step in evaluating a project is to identify its costs and benefits.

B)Competitive market prices allow us to calculate the value of a decision without worrying about the tastes or opinions of the decision maker.

C)Because competitive markets exist for most commodities and financial assets, we can use them to determine cash values and evaluate decisions in most situations.

D)In the absence of competitive markets, we can use one-sided prices to determine exact cash values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

13

A wholesale food retailer is offered $14 per carton for 5 000 cartons of peaches. The wholesaler can buy peaches from their growers at $12.50 per carton. Shipping costs $1.50 per carton, for the first 1 000 cartons, and $1.00 per carton for every carton over that. Will taking this opportunity increase the value of the wholesale food retailer?

A)No. The costs are $1 200 more than the benefits.

B)Yes. The costs are $1 000 less than the benefits.

C)Yes. The costs are $2 000 less than the benefits.

D)No. The costs and the benefits are the same.

A)No. The costs are $1 200 more than the benefits.

B)Yes. The costs are $1 000 less than the benefits.

C)Yes. The costs are $2 000 less than the benefits.

D)No. The costs and the benefits are the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

14

The overarching principal that a financial manager should follow when making decisions is that decisions should increase the value of the firm to its investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

15

A firm that provides tax services to the public intends to offer a premium tax-return service at a higher price than their current services. The managers of the company ask experts in marketing to determine how much an effective ad campaign for such a service would cost, and by how much sales would be increased. They consult experts in economics to calculate the increases in revenue from the success of the campaign, experts in operations to determine the cost of offering the service, and experts in strategy to anticipate possible countermoves by competitors. This example illustrates which of the following points about the role of financial managers?

A)Ultimately the decision whether to take a certain course of action rests with the financial managers of a company.

B)All of the costs and benefits associated with a decision can never be fully identified.

C)Real-world decisions are complex and require information from many sources if the decisions are to be valid.

D)Determining the costs associated with making a decision is easier than determining the potential benefits of the decision.

A)Ultimately the decision whether to take a certain course of action rests with the financial managers of a company.

B)All of the costs and benefits associated with a decision can never be fully identified.

C)Real-world decisions are complex and require information from many sources if the decisions are to be valid.

D)Determining the costs associated with making a decision is easier than determining the potential benefits of the decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

16

Costs and benefits must be put in common terms if they are to be compared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

17

An Australian manufacturer of sunscreen is contemplating using funds to purchase courtside advertising at major tennis matches such as the French Open and the US Open. Advertising at such well-viewed international events will then raise the domestic sales of the manufacturer's products. Which of the following factors will probably raise the LEAST difficulties when comparing the costs and benefits associated with this particular decision?

A)The costs and benefits will not be expressed in common terms.

B)The costs will be incurred well before any benefits are likely to be seen.

C)The costs and benefits will be difficult to measure.

D)The costs and benefits will be in different currencies.

A)The costs and benefits will not be expressed in common terms.

B)The costs will be incurred well before any benefits are likely to be seen.

C)The costs and benefits will be difficult to measure.

D)The costs and benefits will be in different currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

18

Another oil refiner is offering to trade you 10 150 tonnes of TOC crude oil for 10 000 tonnes of WAI crude oil. Assuming you currently have 10 000 tonnes of WAI crude, what should you do?

A)Do nothing, refine the 10 000 tonnes of WAI crude.

B)Sell 10 000 tonnes WAI crude on the market and use the proceeds to purchase and refine TOC crude.

C)Trade the 10 000 tonnes WAI crude with the other refiner and refine the 10 150 tonnes of TOC crude.

D)Trade the 10 000 tonnes WAI crude with the other refiner and then sell the 10 150 tonnes of TOC crude.

A)Do nothing, refine the 10 000 tonnes of WAI crude.

B)Sell 10 000 tonnes WAI crude on the market and use the proceeds to purchase and refine TOC crude.

C)Trade the 10 000 tonnes WAI crude with the other refiner and refine the 10 150 tonnes of TOC crude.

D)Trade the 10 000 tonnes WAI crude with the other refiner and then sell the 10 150 tonnes of TOC crude.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

19

Why is the personal decision a financial manager makes as to whether to buy or to rent an apartment as a personal residence most like the professional decision that a manager makes as to whether his/her firm should try to acquire a stake in a fast-growing new internet-based company?

A)Both decisions involve the purchase of assets.

B)Both decisions should be made based upon the trade-off between benefits and costs across time.

C)Both decisions are vital to the financial health of the decision maker.

D)Both decisions will be made based on what provides the greatest long-term benefit.

A)Both decisions involve the purchase of assets.

B)Both decisions should be made based upon the trade-off between benefits and costs across time.

C)Both decisions are vital to the financial health of the decision maker.

D)Both decisions will be made based on what provides the greatest long-term benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

20

Heavy Duty Inc., a manufacturer of power tools, decides to offer a rebate of $100 on its 16-inch mid-range chain saw, which currently has a retail price of $470. Heavy Duty's marketers estimate that, as a result of the rebate, sales of this model will increase from 50 000 to 80 000 units next year. The profit margin for Heavy Duty before the rebate is $150. Based on the given information, is the decision to give the rebate a wise one?

A)Yes, since the benefits are $1.5 million more than the costs.

B)No, since costs are $5.0 million more than benefits.

C)Yes, since the benefits are $0.2 million more than the costs.

D)No, since costs are $3.5 million more than benefits.

A)Yes, since the benefits are $1.5 million more than the costs.

B)No, since costs are $5.0 million more than benefits.

C)Yes, since the benefits are $0.2 million more than the costs.

D)No, since costs are $3.5 million more than benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company that manufactures copper piping is offering to trade you 5 925 tonnes of low-grade copper ore for 4 000 tonnes of high-grade copper ore. Assuming you currently have 4 000 tonnes of high-grade ore, what are the total benefits and added benefits of taking the trade?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following best explains why market prices are useful to a financial manager when performing a cost-benefit analysis?

A)They can be evaluated to determine whether the market in which the manager exchanges goods and services offers true value.

B)They can be used to convert different services and commodities into equivalent cash values which can be compared.

C)They allow all commodities and services to be assigned a fixed and unchanging value.

D)They can be used to determine how much an asset can be sold for.

A)They can be evaluated to determine whether the market in which the manager exchanges goods and services offers true value.

B)They can be used to convert different services and commodities into equivalent cash values which can be compared.

C)They allow all commodities and services to be assigned a fixed and unchanging value.

D)They can be used to determine how much an asset can be sold for.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

23

Like other metals, uranium 308 is traded in competitive markets. Which of the following would most likely value a given weight of uranium 308 the most?

A)a metals trader who stockpiles and sells actual physical quantities of uranium 308

B)a power station that uses uranium 308 to produce electrical energy

C)a speculator who buys and sells uranium 308 on the market without ever using the metal

D)All buyers and sellers would have the same value for a given weight of uranium.

A)a metals trader who stockpiles and sells actual physical quantities of uranium 308

B)a power station that uses uranium 308 to produce electrical energy

C)a speculator who buys and sells uranium 308 on the market without ever using the metal

D)All buyers and sellers would have the same value for a given weight of uranium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

24

One of the main obstacles in cost-benefit analysis is that not all expected benefits can be stated in dollar terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

25

A manufacturer of breakfast cereals has the opportunity to purchase barley at $3.00 a kilo for 10 000 kilos, if it also buys 5 000 kilos of wheat at $16.00 per kilo. However, the manufacturer does not use any barley in its products, and currently needs 20 000 kilos of wheat. If the current market price of barley is $3.80 per kilo, and wheat is $15.80 per kilo, should this opportunity be taken, and why?

A)Because the value of the opportunity is negative, the opportunity should not be taken.

B)Because the opportunity does not meet the company's need for wheat, the opportunity should not be taken.

C)Because the company has no need of barley, the opportunity should not be taken.

D)Because the value of the opportunity is positive, the opportunity should be taken.

A)Because the value of the opportunity is negative, the opportunity should not be taken.

B)Because the opportunity does not meet the company's need for wheat, the opportunity should not be taken.

C)Because the company has no need of barley, the opportunity should not be taken.

D)Because the value of the opportunity is positive, the opportunity should be taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

26

What is a competitive market?

A)a market in which a good is bought for a lower price than that for which it can be sold

B)a market in which a good is sold at a lower price than that for which it can be bought

C)a market in which a good can be bought and sold at the same price

D)a market in which goods can be bought at the ask price and sold at bid price

A)a market in which a good is bought for a lower price than that for which it can be sold

B)a market in which a good is sold at a lower price than that for which it can be bought

C)a market in which a good can be bought and sold at the same price

D)a market in which goods can be bought at the ask price and sold at bid price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

27

Cost-benefit analysis cannot be performed in cases that are occurring in different currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

28

You have a used CD store. At an estate sale, you can purchase 250 compact discs for $500. You believe you could sell the CDs for an average of $2.50 each. What is the net benefit of buying the CDs at the estate sale and selling them in your store?

A)$125

B)$200

C)$625

D)$500

A)$125

B)$200

C)$625

D)$500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

29

A company intends to install new management software for its warehouse. The software will cost $50 000 to buy and will cost an additional $150 000 to install and implement. It is anticipated that it will save the company $45 000 through reductions in staff and $65 000 in general inventory costs in the first year after installation. What is the benefit to the company in the first year if they choose to install the software?

A)$180 000

B)$90 000

C)$110 000

D)$45 000

A)$180 000

B)$90 000

C)$110 000

D)$45 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company decides to close down its plastics division. It has on hand 20 tonnes of styrene monomer, a raw material that has a market price of $700 per tonne, which had been originally purchased at $650 per tonne. Given that the company has no use for the styrene monomer, and that it would cost the company $5 000 to store it, what is the value of the 20 tonnes of styrene monomer to the company?

A)$14 000

B)$13 000

C)$0

D)-$5 000

A)$14 000

B)$13 000

C)$0

D)-$5 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

31

Whenever a good trades in a competitive market, the price the good trades for determines the value of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is the best statement of the Valuation Principle?

A)It is not possible to compare costs and benefits that occur at different points in time, in different currencies, or with different risks.

B)If equivalent goods or securities trade simultaneously in different markets across the world, they will trade for the same price.

C)The value of a commodity or an asset to the firm or its investors is determined by its competitive market price. When the value of the benefits exceeds the value of the costs in terms of market prices, the decision will increase the market value of the firm.

D)The rate at which we can exchange money today for money in the future by borrowing or investing is the current market interest rate and is the same across all banks.

A)It is not possible to compare costs and benefits that occur at different points in time, in different currencies, or with different risks.

B)If equivalent goods or securities trade simultaneously in different markets across the world, they will trade for the same price.

C)The value of a commodity or an asset to the firm or its investors is determined by its competitive market price. When the value of the benefits exceeds the value of the costs in terms of market prices, the decision will increase the market value of the firm.

D)The rate at which we can exchange money today for money in the future by borrowing or investing is the current market interest rate and is the same across all banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following best explains why you cannot use the price of rolled oats at a local supermarket as the competitive market value of rolled oats?

A)You can buy the oats at the price posted by the store, but the store will not buy oats from you for the same price.

B)The posted prices of oats can vary widely between grocery stores, even within the same local area.

C)Grocery stores typically sell oats in different packaging, which results in different prices within the same store.

D)Grocery stores mark up the prices of their oats to make a profit.

A)You can buy the oats at the price posted by the store, but the store will not buy oats from you for the same price.

B)The posted prices of oats can vary widely between grocery stores, even within the same local area.

C)Grocery stores typically sell oats in different packaging, which results in different prices within the same store.

D)Grocery stores mark up the prices of their oats to make a profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Law of One Price states that if equivalent goods or securities are traded simultaneously in different competitive markets, they will trade for the same price in each market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

35

Whenever a good trades in a competitive market, the ________ determines the value of the good.

A)demand

B)cost

C)supply

D)price

A)demand

B)cost

C)supply

D)price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

36

If an arbitrage opportunity exists, an investor can act quickly in the hope of making a risk-free profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

37

You own 1 050 shares of Ausback Financial Group stock, currently trading for $56 per share. You are offered a deal where you can exchange these stocks for 925 shares of Newstar Energy stock, currently trading at $64 per share. What is the value of this trade, if you choose to make it?

A)-$480

B)-$400

C)$400

D)-$540

A)-$480

B)-$400

C)$400

D)-$540

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

38

A firm has contracted to supply 500 000 gallons of propane fuel for $1.49 million to the local council. The council wants to break the contract. What does the minimum current market price of propane need to be in order for the firm to benefit from breaking the contract?

A)greater than $2.98 per gallon

B)greater than $2.99 per gallon

C)greater than $3.00 per gallon

D)greater than $2.97 per gallon

A)greater than $2.98 per gallon

B)greater than $2.99 per gallon

C)greater than $3.00 per gallon

D)greater than $2.97 per gallon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

39

A mining company is offering to trade you 7 250 tonnes of low-grade copper ore for 5 000 tonnes of high-grade copper ore. Assuming you currently have 5 000 tonnes of high-grade ore, what should you do?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

40

An elderly relative offers to sell you their used 1 959 Jaguar Mark 9 saloon for $50 000. You note that very similar cars are selling on the open market for $90 000. You don't care for classic cars and would rather buy a new Subaru Outback available to you for $35 000. What is the net value of buying the Jaguar?

A)$50 000, since the Jaguar could be bought for this price.

B)$40 000, since this is the difference between purchase and resale price of the Jaguar.

C)$90 000, since the Jaguar could be sold for this price.

D)$35 000, since this is the value of the car that you really want to buy.

A)$50 000, since the Jaguar could be bought for this price.

B)$40 000, since this is the difference between purchase and resale price of the Jaguar.

C)$90 000, since the Jaguar could be sold for this price.

D)$35 000, since this is the value of the car that you really want to buy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the exchange rates, after fees, in Tokyo are ¥1 000 = €6 = $9 and the exchange rates in Paris are €1 = $1.5 = ¥171, which of the following would you expect to occur?

A)a surge in conversion of euros to yen in Paris

B)a surge in conversion of dollars to yen in Tokyo

C)a surge in conversion of euros to dollars in Paris

D)a surge in conversion of euros to yen in Tokyo

A)a surge in conversion of euros to yen in Paris

B)a surge in conversion of dollars to yen in Tokyo

C)a surge in conversion of euros to dollars in Paris

D)a surge in conversion of euros to yen in Tokyo

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

42

Dollar amounts received at different points in time cannot be compared in absolute terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

43

You are watching TV late one night and see an ad from ValuCo for the Dice-o-matic food slicer. You learn that the Dice-o-matic sells for $29.95. But wait, there's more! ValuCo is also including in this deal a set of Ginsu steak knives worth $10.95 and another free gift worth $7.95. Assuming that there is a competitive market for ValuCo items, at what price must ValuCo be selling this three-item Dice-o-matic deal to ensure the absence of an arbitrage opportunity and uphold the Law of One Price?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

44

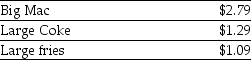

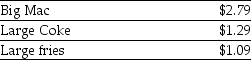

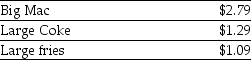

Use the table for the question(s)below.

Consider the following prices from a McDonald's Restaurant:

A McDonald's Big Mac value meal consists of a Big Mac, a large Coke and a large fries. Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.79. Does an arbitrage opportunity exists and, if so, how would you exploit it and how much would you make on one value meal?

A)No, no arbitrage opportunity exists.

B)Yes, buy a value meal and then sell the Big Mac, Coke and fries to make arbitrage profit of $0.38.

C)Yes, buy a Big Mac, Coke and fries, then sell a value meal to make arbitrage profit of $1.09.

D)Yes, buy a Big Mac, Coke and fries, then sell a value meal to make arbitrage profit of $0.68.

Consider the following prices from a McDonald's Restaurant:

A McDonald's Big Mac value meal consists of a Big Mac, a large Coke and a large fries. Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.79. Does an arbitrage opportunity exists and, if so, how would you exploit it and how much would you make on one value meal?

A)No, no arbitrage opportunity exists.

B)Yes, buy a value meal and then sell the Big Mac, Coke and fries to make arbitrage profit of $0.38.

C)Yes, buy a Big Mac, Coke and fries, then sell a value meal to make arbitrage profit of $1.09.

D)Yes, buy a Big Mac, Coke and fries, then sell a value meal to make arbitrage profit of $0.68.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

45

On Commodity Exchange A it is possible to buy and sell crude oil at $117 per barrel, while on Commodity Exchange B crude oil can be bought and sold at $119 per barrel. If there are transaction costs of 1% when buying or selling on either exchange, what is the net effect of buying a barrel of oil on Exchange A and selling it on Exchange B?

A)$1.01

B)-$0.36

C)-$0.47

D)$0.99

A)$1.01

B)-$0.36

C)-$0.47

D)$0.99

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

46

The 'one-year discount factor' is the discount at which we can purchase money in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

47

A backhoe can dig 175 metre of trench per hour and costs $525 per hour to hire and operate. A ditch digger can dig 5 metre of trench per hour. Based on this information, what is the most a ditch digger can charge per hour when digging ditches?

A)$13.33 per hour

B)$25 per hour

C)$15 per hour

D)$23.33 per hour

A)$13.33 per hour

B)$25 per hour

C)$15 per hour

D)$23.33 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the table for the question(s)below.

Consider the following prices from a McDonald's Restaurant:

A McDonald's Big Mac value meal consists of a Big Mac, a large Coke and a large fries. Assuming that there is a competitive market for McDonald's food items, at what price must a Big Mac value meal sell to insure the absence of an arbitrage opportunity and uphold the Law of One Price?

A)$5.47

B)$5.17

C)$5.37

D)$5.072

Consider the following prices from a McDonald's Restaurant:

A McDonald's Big Mac value meal consists of a Big Mac, a large Coke and a large fries. Assuming that there is a competitive market for McDonald's food items, at what price must a Big Mac value meal sell to insure the absence of an arbitrage opportunity and uphold the Law of One Price?

A)$5.47

B)$5.17

C)$5.37

D)$5.072

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements regarding the Law of One Price is INCORRECT?

A)An important property of the Law of One Price is that it holds even in markets where arbitrage is not possible.

B)At any point in time, the price of two equivalent goods trading in different competitive markets will be the same.

C)One useful consequence of the Law of One Price is that when evaluating costs and benefits to compute a net present value (NPV), we can use any competitive price to determine a cash value, without checking the price in all possible markets.

D)If equivalent goods or securities trade simultaneously in different competitive markets, then they will trade for the same price in both markets.

A)An important property of the Law of One Price is that it holds even in markets where arbitrage is not possible.

B)At any point in time, the price of two equivalent goods trading in different competitive markets will be the same.

C)One useful consequence of the Law of One Price is that when evaluating costs and benefits to compute a net present value (NPV), we can use any competitive price to determine a cash value, without checking the price in all possible markets.

D)If equivalent goods or securities trade simultaneously in different competitive markets, then they will trade for the same price in both markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

50

In order to distinguish between inflows and outflows, different colours are assigned to each of these cash flows when constructing a timeline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

51

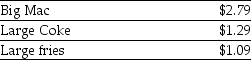

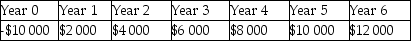

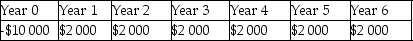

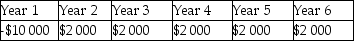

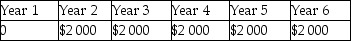

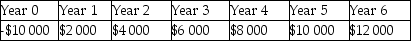

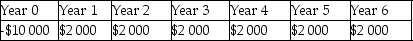

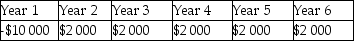

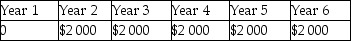

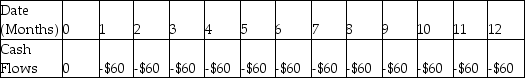

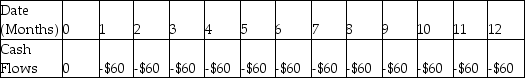

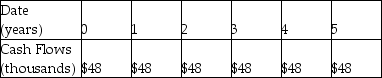

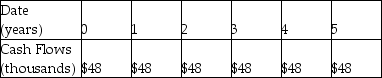

A lender lends $10 000, which is to be repaid in annual payments of $2 000 for 6 years. Which of the following shows the timeline of the loan from the lender's perspective?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements regarding arbitrage and security prices is INCORRECT?

A)When a bond is underpriced, the arbitrage strategy involves selling the bond and investing some of the proceeds.

B)We call the price of a security in a normal market the no-arbitrage price for the security.

C)The general formula for the no-arbitrage price of a security is Price (security)= PV (all cash flows paid by the security).

D)In financial markets it is possible to sell a security you do not own by doing a short sale.

A)When a bond is underpriced, the arbitrage strategy involves selling the bond and investing some of the proceeds.

B)We call the price of a security in a normal market the no-arbitrage price for the security.

C)The general formula for the no-arbitrage price of a security is Price (security)= PV (all cash flows paid by the security).

D)In financial markets it is possible to sell a security you do not own by doing a short sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

53

You see on eBay that a used Xbox 360 sells for $100 and a new Xbox 360 sells for $300. Is this an arbitrage opportunity?

A)Yes, because the market for a used Xbox 360 is not the same as the market for a new Xbox 360.

B)No, because the market for a used Xbox 360 is not the same as the market for a new Xbox 360.

C)No, because the market for a used Xbox 360 is a competitive market.

D)Yes, because the market for a used Xbox 360 is a competitive market.

A)Yes, because the market for a used Xbox 360 is not the same as the market for a new Xbox 360.

B)No, because the market for a used Xbox 360 is not the same as the market for a new Xbox 360.

C)No, because the market for a used Xbox 360 is a competitive market.

D)Yes, because the market for a used Xbox 360 is a competitive market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

54

'If equivalent investment opportunities trade simultaneously in different competitive markets, then they must trade for the same price in both markets.' What do we call the above statement?

A)the Net Present Value rule

B)the Valuation Principle

C)the Law of One Price

D)the time value of money

A)the Net Present Value rule

B)the Valuation Principle

C)the Law of One Price

D)the time value of money

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is an example of 'arbitrage'?

A)An investor, seeing that the price of palladium on the metals exchange in two different countries is slightly different, buys on one and sells on the other to make a profit.

B)An inventor of a new hydrocarbon cracking technology based on palladium buys this metal knowing that its price will rise when the technology is adopted.

C)A firm buys $250 000 of palladium today, with an option to sell it at $275 000 in one year if interest rates rise above 10%.

D)A metals merchant is offered $108 000 in one year for $100 000 of palladium today, when the interest rate is 10%.

A)An investor, seeing that the price of palladium on the metals exchange in two different countries is slightly different, buys on one and sells on the other to make a profit.

B)An inventor of a new hydrocarbon cracking technology based on palladium buys this metal knowing that its price will rise when the technology is adopted.

C)A firm buys $250 000 of palladium today, with an option to sell it at $275 000 in one year if interest rates rise above 10%.

D)A metals merchant is offered $108 000 in one year for $100 000 of palladium today, when the interest rate is 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

56

The State Bank offers an interest rate of 5.5% on savings and 6% on loans, while the Colonial Bank offers 6.5% on savings and 7% on loans. Which of the following is the LEAST likely outcome of such a situation?

A)The Colonial Bank would experience a surge in demand for loans.

B)The Colonial Bank would experience a surge in demand for deposits.

C)The State Bank would experience a surge in demand for loans.

D)The State Bank would experience a fall in demand for deposits.

A)The Colonial Bank would experience a surge in demand for loans.

B)The Colonial Bank would experience a surge in demand for deposits.

C)The State Bank would experience a surge in demand for loans.

D)The State Bank would experience a fall in demand for deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

57

Diwali Airlines has a contract that gives it the opportunity to purchase up to 10 000 000 gallons of jet fuel at $2.00 per gallon. The current market price of jet fuel is $2.26 per gallon. Diwali believes it will only need 6 000 000 gallons of jet fuel. What is the value of this opportunity?

A)$9 040 000

B)$2 600 000

C)$1 040 000

D)$1 560 000

A)$9 040 000

B)$2 600 000

C)$1 040 000

D)$1 560 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

58

Why are arbitrage opportunities short-lived?

A)Arbitrage opportunities need a lot of information processing, which is very slow to arrive.

B)Financial market regulations will kick in to restrict trade and effectively shut the opportunity down.

C)Prices will fluctuate up and down as traders take advantage of the opportunity, resulting in the net present value (NPV)fluctuating between positive and negative values.

D)Once investors take advantage of the opportunity, prices will respond so that the buying and selling price become equal.

A)Arbitrage opportunities need a lot of information processing, which is very slow to arrive.

B)Financial market regulations will kick in to restrict trade and effectively shut the opportunity down.

C)Prices will fluctuate up and down as traders take advantage of the opportunity, resulting in the net present value (NPV)fluctuating between positive and negative values.

D)Once investors take advantage of the opportunity, prices will respond so that the buying and selling price become equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is one of the prerequisite conditions for the Valuation Principle to work?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

60

Any arbitrage opportunity will exploit any mispricing to restore the Law of One Price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

61

How can we convert the value of money from one point in time to another?

A)using a cost-benefit analysis

B)using the current exchange rate

C)using the current interest rate

D)using the Valuation Principle

A)using a cost-benefit analysis

B)using the current exchange rate

C)using the current interest rate

D)using the Valuation Principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

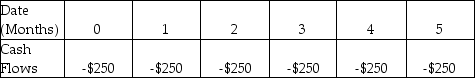

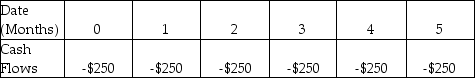

62

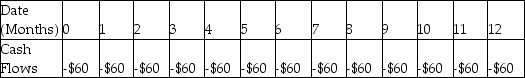

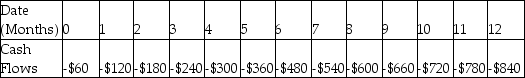

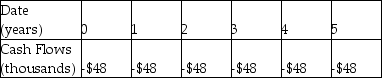

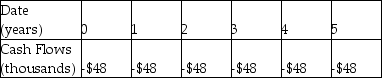

The timeline shown below best describes which of the following situations?

A)You make payments of $250 per month for six months.

B)You receive payments of $250 per month for five months.

C)You make payments of $250 per month for five months.

D)You receive payments of $250 per month for six months.

A)You make payments of $250 per month for six months.

B)You receive payments of $250 per month for five months.

C)You make payments of $250 per month for five months.

D)You receive payments of $250 per month for six months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

63

An investor has the opportunity to buy a $10 000 government bond which is guaranteed to yield 6.5% interest in one year's time. The investor decides to make the investment as there is a net difference between the cost and benefit. Which of the following is NOT a reason that the investor's decision may be flawed?

A)It does not consider the current market interest rate.

B)It ignores the fact that the costs are incurred today, but the benefits occur in one year's time.

C)It does not consider whether the $10 000 will be needed elsewhere.

D)It does not consider the value of the $10 000 in one year's time if invested elsewhere.

A)It does not consider the current market interest rate.

B)It ignores the fact that the costs are incurred today, but the benefits occur in one year's time.

C)It does not consider whether the $10 000 will be needed elsewhere.

D)It does not consider the value of the $10 000 in one year's time if invested elsewhere.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the risk-free rate of interest (rf)is 5%, then you should be indifferent between receiving $300 today or

A)$315.00 in one year.

B)$350.00 in one year.

C)$285.00 in one year.

D)none of the above.

A)$315.00 in one year.

B)$350.00 in one year.

C)$285.00 in one year.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

65

You are scheduled to receive $10 000 in one year. An increase in the interest rate will have what effect on the present value of this cash flow?

A)It will have no effect on the present value.

B)It will cause the present value to rise.

C)It will cause the present value to fall.

D)The effect cannot be determined with the information provided.

A)It will have no effect on the present value.

B)It will cause the present value to rise.

C)It will cause the present value to fall.

D)The effect cannot be determined with the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

66

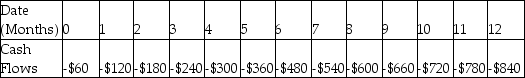

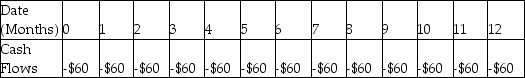

Samantha enters a rent-to-own agreement for living room furniture. She will pay $60 per month for one year. Which of the following shows the timeline for her payments if the first payment is one month from now?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

67

Stella deposits $5 000 in a savings account at a bank that offers interest of 5.5% on such accounts. What is the value of the money in her savings account in one year's time?

A)$5 275

B)$5 135

C)$4 739

D)$7 750

A)$5 275

B)$5 135

C)$4 739

D)$7 750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

68

A vintner is deciding when to release a vintage of sauvignon blanc. If it is bottled and released now, the wine will be worth $2.2 million. If it is barrel-aged for a further year, it will be worth 20% more, though there will be additional costs of $500 000. If the interest rate is 7%, what is the difference in the benefit the vintner will realise if he releases the wine after barrel-aging it for one year or if he releases the wine now?

A)He will earn $600 000 less if he releases the wine now.

B)He will earn $107 000 less if he releases the wine now.

C)He will earn $80 000 less if he releases the wine now.

D)He will earn $60 000 more if he releases the wine now.

A)He will earn $600 000 less if he releases the wine now.

B)He will earn $107 000 less if he releases the wine now.

C)He will earn $80 000 less if he releases the wine now.

D)He will earn $60 000 more if he releases the wine now.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

69

Samantha has holdings of 250 ounces of platinum, currently valued at $815 dollars per ounce. She estimates that the price of platinum will rise to $850 per ounce in the next year. If the interest rate is 8%, should she sell the platinum today?

A)Yes, as the difference between selling now and selling in one year is $6 991 today.

B)Yes, as the difference between selling now and selling in one year is $5 513 today.

C)Yes, as the difference between selling now and selling in one year is $7 550 today.

D)No, as the difference between selling now and selling in one year is -$6 988 today.

A)Yes, as the difference between selling now and selling in one year is $6 991 today.

B)Yes, as the difference between selling now and selling in one year is $5 513 today.

C)Yes, as the difference between selling now and selling in one year is $7 550 today.

D)No, as the difference between selling now and selling in one year is -$6 988 today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

70

You are scheduled to receive $10 000 in one year. An increase in the interest rate will have what effect on the future value of this cash flow?

A)It will cause the future value to rise.

B)It will cause the future value to fall.

C)It will have no effect on the future value.

D)The effect cannot be determined with the information provided.

A)It will cause the future value to rise.

B)It will cause the future value to fall.

C)It will have no effect on the future value.

D)The effect cannot be determined with the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

71

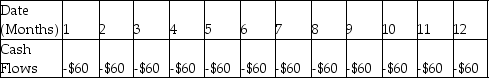

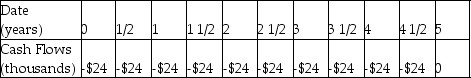

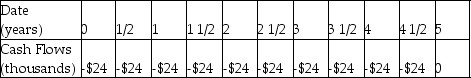

A tenant wants to lease a building for $48 000 per year. She signs a five-year rental agreement that states that she will pay $24 000 every six months for the next five years. Which of the following is the timeline for her rental payments, assuming she makes the first payment immediately?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

72

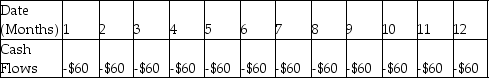

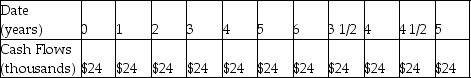

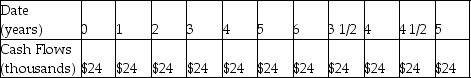

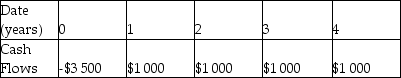

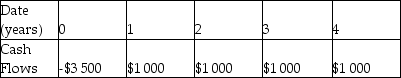

The timeline shown below best describes the cash flow of which of the following people?

A)Karen, who loans a friend $3 500, and whose friend pays back the loan in four annual instalments of $1 000

B)Joe, who puts down $3 500 to buy a car, and then makes annual payments of $1 000

C)Leo, who borrows $3 500, and then pays back the loan in four annual payments of $1 000

D)Harry, who borrows $3 500, and then receives an annual payment of $1 000

A)Karen, who loans a friend $3 500, and whose friend pays back the loan in four annual instalments of $1 000

B)Joe, who puts down $3 500 to buy a car, and then makes annual payments of $1 000

C)Leo, who borrows $3 500, and then pays back the loan in four annual payments of $1 000

D)Harry, who borrows $3 500, and then receives an annual payment of $1 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

73

If $476 invested today yields $500 in one year's time, what is the discount factor?

A)1.50

B)0.05

C)0.95

D)1.05

A)1.50

B)0.05

C)0.95

D)1.05

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

74

Why is it usually necessary to use the time value of money when performing a cost-benefit analysis?

A)In most investment projects costs are incurred up front, but benefits are provided in the future.

B)Although costs and benefits generally occur concurrently, the benefits will accrue value over time, due to interest.

C)For practical purposes, a dollar today may be considered to be equal to a dollar at some future time.

D)For an investment project to be considered, costs must have a higher dollar value from benefits.

A)In most investment projects costs are incurred up front, but benefits are provided in the future.

B)Although costs and benefits generally occur concurrently, the benefits will accrue value over time, due to interest.

C)For practical purposes, a dollar today may be considered to be equal to a dollar at some future time.

D)For an investment project to be considered, costs must have a higher dollar value from benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

75

Why should you approach every problem by drawing a timeline?

A)Timelines eliminate the majority of flawed financial decisions.

B)Timelines identify events in a transaction or investment which might otherwise be easily overlooked.

C)Timelines allow you to quickly sum cash flows over time.

D)Timelines can be used to schedule events which are yet to occur.

A)Timelines eliminate the majority of flawed financial decisions.

B)Timelines identify events in a transaction or investment which might otherwise be easily overlooked.

C)Timelines allow you to quickly sum cash flows over time.

D)Timelines can be used to schedule events which are yet to occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

76

If the interest rate is 5%, the one-year discount factor is equal to

A)1.045.

B)0.952.

C)0.050.

D)1.050.

A)1.045.

B)0.952.

C)0.050.

D)1.050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the risk-free rate of interest (rf)is 5%, then you should be indifferent between receiving $300 in one year or

A)$280.83 today.

B)$285.71 today.

C)$255.17 today.

D)none of the above

A)$280.83 today.

B)$285.71 today.

C)$255.17 today.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

78

Owen expects to receive $20 000 at the end of next year from a trust fund. If a bank loans money at an interest rate of 7.5%, how much money can he borrow from the bank on the basis of this information?

A)$11 428

B)$21 500

C)$15 000

D)$18 605

A)$11 428

B)$21 500

C)$15 000

D)$18 605

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

79

An investment will pay $205 000 in one year's time for an investment of $183 000 today. If the market interest rate is 8% over the same period, should this investment be made?

A)No, because the investment will yield $6 240 less than putting the money in a bank.

B)Yes, because the investment will yield $4 280 more than putting the money in a bank.

C)Yes, because the investment will yield $2 360 more than putting the money in a bank.

D)Yes, because the investment will yield $7 360 more than putting the money in a bank.

A)No, because the investment will yield $6 240 less than putting the money in a bank.

B)Yes, because the investment will yield $4 280 more than putting the money in a bank.

C)Yes, because the investment will yield $2 360 more than putting the money in a bank.

D)Yes, because the investment will yield $7 360 more than putting the money in a bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements is INCORRECT?

A)For most financial decisions, costs and benefits occur at different points in time.

B)We refer to (1 - rf)as the interest rate factor for risk-free cash flows.

C)We define the risk-free interest rate (rf)for a given period as the interest rate at which money can be borrowed or lent without risk over that period.

D)In general, money today is worth more than money in one year.

A)For most financial decisions, costs and benefits occur at different points in time.

B)We refer to (1 - rf)as the interest rate factor for risk-free cash flows.

C)We define the risk-free interest rate (rf)for a given period as the interest rate at which money can be borrowed or lent without risk over that period.

D)In general, money today is worth more than money in one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck